Following the global financial crisis, the revamped bank capital regime globally appears to have increased systemic resilience. In the global financial markets, transition to a post LIBOR world remains a work in progress. On the domestic front, the Reserve Bank initiated several policy measures to deepen the G-Sec and Repo markets. In the capital market, higher investment through SIPs in mutual funds remains a bright spot. The Securities and Exchange Board of India (SEBI) has taken several steps to further strengthen the surveillance and integrity of the derivatives, mutual funds and commodity derivatives markets besides enhancing disclosure and transparency standards for credit rating agencies. The new insolvency and bankruptcy regime, which came into effect in 2016 has been providing a market driven, time-bound process for insolvency resolution of a corporate debtor, thereby helping financial institutions to clean up their balance sheets. Most importantly, it is aiding a paradigm shift in the extant credit culture and discipline. Pension Fund Regulatory and Development Authority (PFRDA) continues to bring more and more citizens under the pension net. The regulator changed the investment guidelines for the National Pension System (NPS) to limit exposure to Equity Mutual Funds. With the initiation of the process to identify Domestic Systemically Important Insurers (DSII), implementation of risk-based capital (RBC) & Operationalisation of CERT-Fin, Insurance Regulatory and Development Authority of India (IRDAI) is trying to strengthen the resilience of the Insurance sector. Engagement with Fintech and Suptech is increasing. The challenge for the regulator is to balance efficiency with prudential measures to mitigate risks to be able to harness the opportunities offered by Fintech. Section A International and domestic developments I. Banks a) International regulatory and market developments 3.1 The Bank for International Settlements (BIS), in its Annual Economic Report (AER) released in June 20181 noted that Basel III capital requirements fortify banks against the risks of failure. Its findings show that the likelihood of a bank suffering distress within a 2-year period falls as its Tier-1 risk-based capital ratio increases and goes down further if a high leverage-based Tier-1 capital ratio is also maintained. The report highlighted the complementary nature of Tier-1 Capital ratio and the leverage ratio-based regulations. 3.2 The AER, however, notes two areas where it feels that more action is needed to increase resilience. The first concerns the link between resilience and regulatory reporting requirements leading to increasing risk of regulatory arbitrage. One such example relates to banks’ ‘window-dressing’ around regulatory reporting dates. The second area of concern, relates to the ‘outlook for bank profitability’. While significant progress has been made in terms of balance sheet and business model adjustments for banks, market valuations for many of them point to continued investor scepticism about their profitability prospects. Such scepticism about the valuation depresses market-based resilience measure such as the market leverage ratio or credit default swap spreads; in other words, investors penalise banks for poor profitability outlook, prompting them not to undermine the importance of maintaining short-term profit projections even if such outcomes are beneficial in the long run. 3.3 The AER also argues that constraints on banks’ internal models are required to prevent the ‘gaming’ of capital requirements and to make risk-weighted asset (RWA) measures more comparable across the sector. A BCBS2 study referred to in the report finds that such ‘unwarranted’ variability can be material. The study, which assumes a benchmark capital ratio of 10 per cent shows that two banks with identical banking book assets might report capital ratios that show a difference of up to 4 percentage points (Chart 3.1). Additionally, the study also finds that in many cases, internally modelled risk weights were substantially lower than those under the standardised approach – for corporate exposures, by up to more than 60 per cent (Chart 3.2) and such an observed wedge and associated capital relief are difficult to justify. Such gaming of capital requirements may also have implications for model-based expected credit loss (ECL) estimation under the International Financial Reporting Standards (IFRS). 3.4 Central banks and financial market regulators have set in motion a drive to reform the interest rate benchmarks3. These benchmarks are referenced for a large volume and broad range of financial products and contracts including derivatives, loans and securities. The Financial Stability Board (FSB) has been monitoring progress on three work streams viz., (1) strengthening the inter-bank offer rates (IBORs) by fixing them to a greater number of transactions, (2) identifying appropriate alternative risk-free rates and encouraging derivatives to be referenced to them instead of the IBORs and, (3) having robust fall-back provisions for the contracts referenced to IBORs to reduce financial instability if an IBOR is discontinued.   3.5 About USD 350 trillion worth of contracts across the globe are pegged to LIBOR which is the key interest rate benchmark for several major currencies. Many of the current contracts would extend beyond 2021 (it has been proposed that LIBOR would cease to exist beyond this). The transition to alternative reference rates will involve considerable efforts for users of LIBOR for amending the contracts and updating the systems. Yet, when it comes to such a significant reform, the authorities concerned are not retreating in the matured financial markets. 3.6 On its part, the Federal Reserve (US FED) recently started disseminating three new benchmark rates. One of these, the Secured Overnight Financing Rate (SOFR) is endorsed by the Federal Reserve Bank of New York as an alternative to US Dollar LIBOR (USD-LIBOR). For the British pound, the reformed Sterling Overnight Index Average (SONIA) has been acknowledged as the alternative risk-free rate. Europe is seeking to replace the current euro benchmarks - the Euro Overnight Index Average (EONIA) and the Euro Interbank Offered Rate (EURIBOR) and has proposed a Euro Short-Term Rate (ESTER) as the new risk-free rate. One issue, however, is that while most of the chosen risk-free rates are overnight rates, the LIBOR includes credit risk and is a term rate. Thus, the key challenge is agreeing to a standard methodology for calculating credit and term spreads that can be added to the risk-free rate to construct a fall-back for LIBOR. While the predominant replacement for LIBOR benchmarks are seen to be overnight secured rates, some market participants might prefer term rates as replacements. In any case, a transition may disrupt interest rate swap (IRS) market and valuations. At the same time, the introduction of higher capital charges for illiquid trades as per the forthcoming Fundamental Review of the Trading Book (FRTB)4 makes the transition to alternative risk-free rates an expensive task for banks as well. 3.7 India’s position in priority as well as non-priority areas of Financial Stability Board (FSB) has improved compared to the last year as per the 2018 FSB Annual Report to G-20, due to the coordinated efforts of the government and financial sector regulators. The improvement in priority areas are particularly in “compensation”, “transfer/bridge/run-off power for insurers”, and “Over the Counter Derivatives - Trade Reporting and Platform Trading”. As per the latest status of “Implementation Monitoring Network Survey”, India is shown as “Implementation completed in 20 out of 22 recommendations” of non-priority areas of FSB. 3.8 In other major developments, the impending Brexit will limit the access of EU households and corporates to financial services provided in the UK which may have implications for market liquidity and risk premia. Taking into consideration a ‘No-deal Brexit’ scenario, EU financial institutions, counterparties and investors should be preparing for an appropriate action plan. b) Domestic regulatory and market developments 3.9 The recent developments with regard to IL&FS highlight the complexities that can be associated with financial conglomerate (FC) structures and their oversight (Box 3.1). 3.10 To manage the banking system’s liquidity more efficiently, banks have been allowed an enhanced incremental carve out of 2 per cent taking the total carve-out from Statutory Liquidity Ratio (SLR) holdings to 13 per cent of their net demand and time liabilities (NDTL) with effect from October 1, 2018 under Facility to Avail Liquidity for Liquidity Coverage Ratio (FALLCR). This along with the 2 per cent carve-out available for Marginal Standing Facility (MSF) takes the total carve-out available to 15 per cent of NDTL. Box 3.1 : Financial conglomerates - identification and oversight - A closer look A financial conglomerate (FC) is a group of entities whose activities are in the financial sector. While this definition typically covers a wide swathe of firms of varying sizes, regulatory jurisdictions typically impose additional conditions so as to specifically focus on financial conglomerates whose activities have significant externalities to the financial system at large. In Miller and Modigliani’s classical world of frictionless markets and no information asymmetry, the capital structure of a firm is irrelevant as investors can attain their desired risk level through diversification based on their risk appetite. In such a world a firm is thus only rewarded for that part of its risks that are not diversifiable (that is systemic risk). Firms, however, do care about their risk profiles because the reality is different from the frictionless world assumed by Miller and Modigliani. Information flow, taxes, bankruptcy costs, information and incentive imperfections, economies of scope and diversification benefits (including access to internal capital markets5) provide motivations for a conglomerate structure. As the IL&FS incident in the domestic financial markets illustrates, conglomerate structures also pose some clear risks: intra-group transactions create opportunities for regulatory arbitrage by bypassing regulations related to exposure norms and opportunities to mask leverage through double gearing and complex inter-group structures, leading to a possible spillover of risks to the financial system in times of business turmoil. The FC oversight structure as it is currently practiced in India is explained further and the underlying reasons that allowed some of the FCs to fall through the gaps in oversight mechanism are enumerated below. At present, the oversight of financial conglomerates is being carried out by an Inter Regulatory Forum for monitoring Financial Conglomerates (IRF-FC), which is one of the four working groups set up under the aegis of the FSDC Sub-Committee (FSDC-SC). The Working Group is modelled under the lead regulator principle. The rest of this box examines (a) current procedures for identifying FCs (b) oversight structure of FCs; and (c) action triggers. (a) Identification of FCs In India, the Inter Regulatory Forum (IRF) adopted the following definition for identifying an FC under IRF oversight in 2013: ‘A group would be identified as an FC on the basis of its significant presence in two or more market segments (Banking, Insurance, Securities, Non-Banking Finance and Pension Fund).’6 Accordingly, quantitative and objective criteria were laid out to identify significant presence in each of these market segments. Interestingly a group which has significant cross-sectoral activities but does not have a significant presence in at least two sectors as measured by the criteria is not covered by this definition. While significant presence in activities is a major contributor to an entity’s systemic risk, it is not the only contributor. Complex and camouflaged inter-group linkages through credit support and potency of spillover effects in times of turmoil (through banking sector linkages) are thus becoming important considerations for identifying FCs in the Indian context. In addition, it is also important to have an oversight of groups which are engaged in financial intermediation with significant spillover potential and yet have a significant part of their group revenue coming from non-financial businesses. (b) Oversight of FCs The Financial Conglomerate Returns (FINCON) submitted by the FCs on a quarterly basis capture the following information with respect to liquidity management: a) Intra-group transactions covering short term lending, placement of deposits, investments in bonds/debentures, Commercial Paper (CP), Certificate of Deposits (CDs), units of mutual funds, etc. within the group entities. This information is captured as an outstanding amount at the end of every quarter, as also the changes therein during the quarter. This helps in ascertaining the movement of funds within the group entities. b) A revised FINCON returns format due to be introduced aims to capture additional detailed information related to borrowings made by each group entity in an FC. Further, the bifurcation in terms of short-term borrowings (up to 1 year) and long-term borrowings (more than one year) will also be obtained. This will help in ascertaining the dependence of the FC’s group entities on banks and short-term borrowings. While the information set is fairly exhaustive, it is backward looking and may not capture emerging risks and vulnerabilities adequately. SEBI has recently overhauled the disclosures by Credit Rating Agencies (CRAs). The enhanced disclosures pertain to parent / group /government support, liquidity position (including forward looking measures for non-banks like unutilised credit lines and adequacy of cash flows for servicing maturing debt obligation). Incorporation of such disclosures in the analysis as also periodic discussions with the rating agencies will significantly enrich the quality of the quarterly analysis. (c) Action triggers A risk sensitive FC oversight regime where the intrusiveness of oversight of FCs is proportionate to a combination of (a) the size of the entity, and (b) the likelihood of an adverse event, (say, over a one-year horizon) may make possible remedial measures more timely. Some of the suggestive trigger events for conducting an FC’s assessment may be adverse rating action, unutilised credit lines falling below a certain threshold and bunching of maturing liabilities. To conclude, while the current FC oversight undertaken by IRF-FC generally satisfies all the relevant guidelines of BIS on financial conglomerate supervision, there is possibly some scope to further fine-tune them to Indian conditions to identify relevant FCs, incorporate market-based feedback in FC assessment and have proportionate triggers for timely action. References: Basel Committee on Banking Supervision (2012): “Principles for the supervision of financial conglomerates”, available at: https://www.bis.org/publ/joint29.htm. Institute of International Finance (2009): “Reform in the financial services industry”, available at:https://www.iif.com/system/files/iifreport_reformfinancialservicesindustry_1209.pdf. |

3.11 To enable Non-Banking Financial Companies and Housing Finance Companies develop alternative funding channels, the Reserve Bank has allowed banks to provide partial credit enhancement (PCE) to bonds issued by the systemically important non-deposit taking non-banking financial companies (NBFC-ND-SIs) registered with the Reserve Bank and Housing Finance Companies (HFCs) registered with the National Housing Bank, subject to certain prudential conditions. 3.12 To encourage NBFCs to securitise/assign their eligible assets, it has been decided to relax the minimum holding period (MHP) requirement for originating NBFCs, with respect to loans of original maturity above 5 years, to receipt of repayment of six monthly instalments or two quarterly instalments (as applicable), subject to the NBFCs meeting the minimum retention requirement (MRR). II. Securities market Global 3.13 International Organisation of Securities Commissions (IOSCO) issued a final report7 on “Retail over-the-counter (OTC) Leveraged Products” which discusses policy measures designed to address the risks posed by retail investors trading in over-the-counter (OTC) leveraged products generally and binary options specifically. Retail investors typically use these products to speculate on short-term price movements in a given financial underlying. The report includes three complementary toolkits containing measures aimed at increasing the protection of retail investors who are offered OTC leveraged products, often on a cross-border basis. The report covers the marketing and sale of rolling-spot forex contracts, contracts for differences (CFDs) and binary options. The toolkits offer guidance on dealing with the risks posed by dealers selling these products, advice for educating investors about the risks of OTC leveraged products, and insight on approaches to enforcement, particularly against unlicensed firms offering these kinds of products. 3.14 FSB in its consultative document8 examined the effects of the G20 financial regulatory reforms on the incentives to centrally clear over-the-counter (OTC) derivatives. Centrally clearing standardised OTC derivatives is a pillar of the G20 Leaders’ commitment to reform OTC derivatives markets in response to the global financial crisis. The report infers that the reforms, particularly capital requirements, clearing mandates and margin requirements for non-centrally cleared derivatives are achieving their goals of promoting central clearing, especially for the most systemic market participants. Beyond the systemic core of the derivatives network of CCPs, dealers/clearing service providers and larger, more active clients, the incentives are less strong. Further, an analysis of quantitative and qualitative survey data and market outreach suggests that the treatment of initial margin in the leverage ratio can be a disincentive for banks to offer or expand client clearing services. The report identifies reform areas that are worth considering by the relevant standard-setting bodies (SSBs). Domestic 3.15 To deepen the corporate bond market, SEBI9 has mandated that all listed entities (other than scheduled commercial banks) with an outstanding rating of AA and above and with an outstanding long term borrowing of ₹1 billion or above shall raise not less than 25 per cent of their incremental borrowings by way of issuance of debt securities from FY 2019-20. III. Insurance market Domestic 3.16 The number of lives covered by the Individual Health Insurance Business went up from 21 million in FY 2011-12 to 33 million in FY 2017-18. However, the share of the lives covered under individual health insurance to the lives covered under the total Health Insurance Business (group business + government sponsored schemes + individual business) decreased from 10 per cent in FY 2011-12 to 7 per cent in FY 2017-18. On the other hand, the average premium per person has increased from ₹2,377 in FY 2010-11 to ₹4,595 in FY 2017-18 which could be attributed to: i. increase in average age of individuals covered under health insurance, ii. increase in premium owing to the innovative products offered by insurers having multiple benefits embedded in the products with relatively higher premium, and iii. increase in sum insured. 3.17 In terms of claims experience, there is an improvement in insurance claims loss ratio (ICR) at 71 per cent in FY 2017-18. The high ICR coupled with an increase in average premium per person gives an indication that there are ample business opportunities in the market for insurance companies. 3.18 The Insurance Regulatory and Development Authority of India (IRDAI) has started framing draft guidelines for identification of Systemically Important Insurers (SII) for the domestic insurance sector (Domestic Systemically Important Insurers or DSII). 3.19 As per the existing regulations, the required solvency capital to be held by Indian insurers is based on a simple factor-based approach expressed as a percentage of reserves and sum at risk. Insurers are expected to maintain a 150 per cent margin over the insured liabilities. The Risk Based Capital (RBC) approach links the level of required capital with the risks inherent in the underlying business. It represents an amount of capital that a company should hold based on an assessment of risks to protect stakeholders against adverse developments. However, shifting to RBC may require more technical expertise and its related costs. IRDAI has constituted a committee to examine in detail the RBC mechanism and its implementation in Indian insurance market. 3.20 IRDAI issued a comprehensive Information and Cyber Security guidelines for the insurance sector in April 2017 after completing a consultative process with all connected stakeholders. These guidelines are applicable to all insurers. IRDAI is also conducting independent reviews of insurers to assess the status of their compliance with cyber security guidelines. So far, reviews of 55 insures have been completed. Except seven non-life insurers and one life insurer, the rest complied with cyber security guidelines. These insurers have been advised to complete the pending tasks by end-December 2018. IRDAI is taking all necessary steps to ensure that these insurers fully comply with the cyber security guidelines. IV. Pension funds Domestic 3.21 The National Pension Scheme (NPS) and Atal Pension Yojana (APY) have both continued to progress in terms of total number of subscribers as well as assets under management (AUM) (Tables 3.1 and 3.2). PFRDA continues its work towards financial inclusion of the unorganised sector and the low income groups by expanding the coverage under APY. As on end-October 2018, 405 banks are registered under APY with the aim to bring more and more citizens under the pension net. | Table 3.1:Subscriber growth | | Sector | October 2017

(million) | October 2018

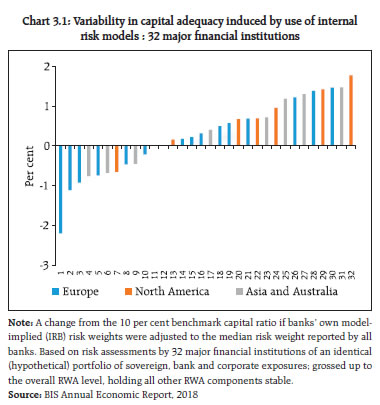

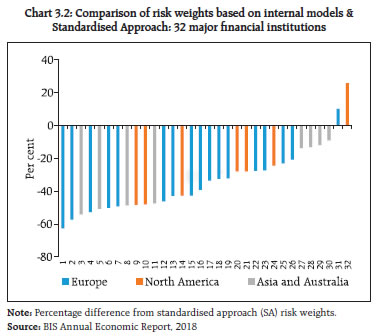

(million) | | Central Government | 1.88 | 1.98 | | State Government | 3.61 | 4.06 | | Corporate | 0.65 | 0.75 | | All Citizen Model | 0.53 | 0.76 | | NPS Lite | 4.41 | 4.38 | | APY | 6.97 | 12.13 | | Total | 18.05 | 24.06 | | Source: PFRDA. |

| Table 3.2: AUM growth | | Sector | October 2017

(₹ billion) | October 2018

(₹ billion) | | Central Government | 789.62 | 950.52 | | State Government | 1040.86 | 1335.36 | | Corporate | 187.99 | 252.94 | | All Citizen Model | 42.34 | 68.48 | | NPS Lite | 29.28 | 31.20 | | APY | 29.70 | 52.88 | | Total | 2119.79 | 2691.38 | | Source: PFRDA. |

| Table 3.3: The corporate insolvency resolution processes (CIRP) - No. of Corporate Debtors | | Quarter | Undergoing resolution at the beginning of the quarter | Admitted | Closure by | Undergoing resolution at the end of each quarter | | Appeal/ Review | Approval of resolution plan | Commencement of liquidation | | Jan-Mar, 2017 | 0 | 37 | 1 | - | - | 36 | | Apr-Jun, 2017 | 36 | 129 | 8 | - | - | 157 | | Jul-Sep, 2017 | 157 | 231 | 15 | 2 | 8 | 363 | | Oct-Dec, 2017 | 363 | 147 | 33 | 8 | 24 | 445 | | Jan-Mar, 2018 | 445 | 194 | 14 | 13 | 57 | 555 | | Apr-Jun, 2018 | 555 | 244 | 18 | 11 | 47 | 723 | | Jul-Sep, 2018 | 723 | 216 | 29 | 18 | 76 | 816 | | Total | NA | 1198 | 118 | 52 | 212 | 816 | Note : NA-Not applicable.

Source: IBBI. | V. The insolvency and bankruptcy regime 3.22 The Insolvency and Bankruptcy Code (Code) 2016 provides for the reorganisation and insolvency resolution of corporate persons, among others, in a time bound manner for maximising the value of assets of such persons to promote entrepreneurship, credit availability and balancing the interests of all stakeholders. It separates the commercial aspects of insolvency resolution from its judicial aspects and empowers the stakeholders of the corporate debtor (CD) and the Adjudicating Authority (AA) to decide matters expeditiously within their respective domains. It provides an incentive-compliant, market driven and a time-bound process for insolvency resolution of a CD. The Code critically depends on financial creditors for its success. As at the end of September 2018, 816 corporate debtors were undergoing the resolution process (Table 3.3). 3.23 About 48 per cent of the admitted corporate insolvency resolution processes are triggered by operational creditors (OC) and about 38 per cent by financial creditors (FC), mostly banks (Table 3.4). | Table 3.4 Initiation of corporate insolvency resolution process (CIRP) | | Quarter | No. of Resolutions Processes Initiated by | Total | | Financial Creditor | Operational Creditor | Corporate Debtor | | Jan-Mar, 2017 | 8 | 7 | 22 | 37 | | Apr-Jun, 2017 | 37 | 58 | 34 | 129 | | Jul-Sep, 2017 | 92 | 100 | 39 | 231 | | Oct-Dec, 2017 | 64 | 69 | 14 | 147 | | Jan-Mar, 2018 | 84 | 88 | 22 | 194 | | Apr-Jun, 2018 | 98 | 128 | 18 | 244 | | Jul-Sep, 2018 | 77 | 126 | 13 | 216 | | Total | 460 | 576 | 162 | 1198 | | Source: IBBI. | 3.24 Of the 1,198 corporates in the resolution process up to September 2018, 112 were closed on appeal or review, 52 resulted in a resolution and 212 yielded liquidations; this is broadly consistent with expectations under the Code in its initial days of implementation. The distribution of 212 corporate debtors ending in liquidation is given in Table 3.5. | Table 3.5: Distribution of corporate debtors ending in liquidation | | State of Corporate Debtor at the Commencement of CIRP | No. of CIRPs initiated by | | FC | OC | CD | Total | | Either in BIFR or Non-functional or both | 49 | 61 | 53 | 163 | | Resolution Value ≤ Liquidation Value | 57 | 71 | 54 | 182 | | Resolution Value > Liquidation Value | 11 | 4 | 15 | 30 | | Source: IBBI. | 3.25 Till September 2018, NCLT 10 had resolved 50 cases involving admitted claims by FCs aggregating to ₹1249.77 billion. However, the median admitted claim was much lower at ₹0.85 billion and the third quartile of the admitted claim stood at ₹10.51 billion implying that so far significant efforts have been for resolving smaller claims. For claims beyond the third quartile threshold, the average recovery was at 46.66 per cent while the median recovery was 39.53 per cent implying higher recovery in some higher claim cases. For admitted claims by FCs below the third quartile, the average recovery was 36.37 per cent while the median recovery was higher at 53.88 per cent implying a somewhat lower recovery for the higher claims in this cohort. The frequency distribution of FCs recovery rates are given in Chart 3.3. VI. Recent regulatory initiatives and their rationale 3.26 Some of the recent regulatory initiatives, along with the rationale thereof, are given in Table 3.6. | Table 3.6: Important regulatory initiatives (June 2018 - November 2018) | | Date | Measure | Rationale/purpose | | 1. The Reserve Bank of India | | June 15, 2018 | Investment by Foreign Portfolio Investors (FPI) in Debt: FPIs were required to invest in Government bonds with a minimum residual maturity of three years. Henceforth, subject to certain conditions, FPIs are permitted to invest in specific categories of securities, without any minimum residual maturity requirement while investment in corporate bonds are being subjected to one-year residual maturity requirement. | To further facilitate FPIs’ investment process in debt instruments in India. | | July 25, 2018 | RBI has revised norms on short sale in the secondary market for government securities. The revised norms allow any other regulated entity which has the approval of the respective regulators to be considered an eligible entity to undertake short sales. The maximum amount of a security (face value) that can be short sold is: Liquid securities 2per cent of the total outstanding stock of each security, or, ₹5 billion, whichever is higher, and other securities 1 per cent of the total outstanding stock of each security, or, ₹2.5 billion, whichever is higher. | To deepen the G-sec and Repo markets. | | August 16, 2018 | It has been decided that with effect from August 20, 2018, LAF will also be extended to Scheduled State Co-operative Banks (StCBs) which are core banking solution (CBS) enabled and have CRAR of at least 9 per cent. Further, in order to provide an additional window for liquidity management over and above what is available under LAF, it has also been decided that (MSF) will be extended to Scheduled primary urban cooperative banks (UCBs) and Scheduled StCBs which are CBS enabled and have CRAR of at least 9 per cent. | To improve liquidity management in UCBs and StCBs. | | September 19, 2018 | RBI has relaxed external commercial borrowing (ECBs) norms. As per the revised norms, eligible ECB borrowers who are into manufacturing sector, will be able to raise ECB up to USD 50 million or its equivalent with minimum average maturity period of 1 year. It has also been decided to permit Indian banks to market Rupee denominated bonds (RDBs) overseas. Banks can participate as arrangers/underwriters/market makers/traders in RDBs issued overseas subject to applicable prudential norms. | To provide enhanced flexibility to corporates to choose their liability profile. | | September 21, 2018 | Co-origination of Loans by Banks and NBFCs for lending to Priority Sector: All scheduled commercial banks (excluding Regional Rural Banks and Small Finance Banks) may engage with Non-Banking Financial Companies - Non-Deposit taking - Systemically Important (NBFC-ND-Sis) to co-originate loans for the creation of priority sector assets. The bank can claim priority sector status without recourse to the NBFC. Minimum 20 per cent of the credit risk by way of direct exposure will be on NBFC’s books till maturity and the balance will be on the bank’s books. | To augment the flow of funds to Priority sector. | | September 27, 2018 | Basel III framework on Liquidity Standards: Banks have been allowed to use additional share of their Statutory Liquidity Reserves so as to meet Liquidity Coverage Ratio (LCR) requirement. Hence, the carve-out from SLR, under Facility to Avail Liquidity for Liquidity Coverage Ratio (FALLCR) will now be 13 per cent, taking the total carve out from SLR available to banks to 15 per cent of their NDTL. | To infuse more liquidity into the system. | | September 27, 2018 | UCBs with a good track record, minimum net worth of ₹500 million and maintaining Capital to Risk (Weighted) Assets Ratio of 9 per cent and above are eligible to apply for voluntary transition to small finance banks (SFB) under this scheme. Minimum net worth of the proposed SFB shall be ₹1 billion and minimum promoters’ contribution shall be 26 per cent of the paid-up equity capital. Under its on-tap scheme for voluntary transition, the promoters should submit applications along with requisite documents and information relating to the general body resolution by a two-thirds majority and authorising the board of directors to take steps for the transition. The general body resolution also has to identify and approve the promoters. The promoters shall furnish their business plans and project reports along with their applications. RBI would assess the ‘fit and proper’ status of the applicants to determine suitability. | To facilitate growth in the banking space. | | November 2, 2018 | Reserve Bank allowed banks to provide partial credit enhancement (PCE) to bonds issued by the systemically important non-deposit taking non-banking financial companies (NBFC-ND-SIs) registered with the Reserve Bank of India and Housing Finance Companies (HFCs) registered with National Housing Bank, subject to certain conditions. | To improve liquidity flow to NBFCs and HFCs. banks extending PCE to the bonds will enhance bonds’ credit rating, enabling the companies to access funds from the bond market on improved terms. | | November 26, 2018 | External Commercial Borrowing (ECBs) mandatory hedging provision was reduced to 70 per cent from 100 per cent by Reserve Bank for eligible borrowers raising ECBs under Track I, having an average maturity between 3 and 5 years. ECBs falling within the scope but raised earlier will be required to mandatorily roll over their existing hedge(s) only to the extent of 70 per cent of outstanding ECBs exposure. | To provide greater flixibility for managing exchange rate risks. | | November 29, 2018 | The Reserve Bank relaxed norms for non-banking financial companies (NBFCs) to securitise their loan books. NBFCs can now securitise loans of more than five-year maturity after holding those for six months on their books. Minimum Retention Requirement (MRR) for such securitisation transactions shall be 20 per cent of the book value of the loans being securitised. | To allow additional access to funding for the NBFC sector. | | 2. The Securities and Exchange Board of India (SEBI) | | June 11, 2018 | Disclosure by Exchanges related to Deliverable Supply and Position Limits Calculation for Agricultural Commodity Derivatives. | In order to provide necessary information to the stakeholders the Exchanges are directed to prominently disseminate on their websites the details of five year average deliverable supply, current year deliverable supply, source of data, categorisation of the commodity, position limits etc. for each of the commodity traded on their exchange, as per the given format. | | July 5, 2018 | Review of Adjustment of corporate actions for Stock Options. | Based on the recommendations of Secondary Market Advisory Committee (SMAC), the mechanism of dividend adjustment for stock options was revised. | | July 12, 2018 | Discontinuation of acceptance of cash by Stock Brokers. | In view of the various non-cash modes of electronic payments, Stock Brokers are directed not to accept cash from their clients either directly or by way of cash deposit to the bank account of stock broker. | | August 03, 2018 | Role of Sub-Broker (SB) vis-à-vis Authorised Person (AP). | There is no difference in the operative role of a Sub-Broker and that of an Authorised Person.SEBI Board in its meeting held on June 21, 2018 decided to discontinue with Sub-Broker as an intermediary to be registered with SEBI. | | August 10, 2018 | Enhanced monitoring of Qualified Registrars to an Issue and Share Transfer Agents: Qualified RTAs (QRTAs) are directed to comply with enhanced monitoring requirements, through adoption and implementation of internal policy framework; and periodic reporting on key risk areas, data security measures, business continuity etc. | To further strengthen the risk management system for Market Infrastructure Institutions (MIIs). | | August 16, 2018 | In streamlining the process of public issue of Debt Securities, non-convertible redeemable preference shares(NCRPS), Debt Securities by Municipalities and securitised debt instruments (SDI), SEBI has cut the timeline for listing of such securities to six days, from 12 days at present. | To make issuance of debt securities NCRPS and SDI simpler and cost-effective. | | August 16, 2018 | E book mechanism (EBP) for issuance of securities on private placement basis: Additional facilities viz. closed bidding, multiple yield allotment, pay-in through escrow account bank account of issuer are provided by regulator. | To further rationalise and ease the process of issuance of securities on EBP platform. | | August 24, 2018 | Extension of Trading hours of Securities Lending and Borrowing (SLB) Segment. | With a view to facilitate physical settlement of equity derivatives contracts. | | September 1, 2018 | Additional Surveillance Measures (ASM). | Along with the existing pre-emptive Surveillance measures there are now Additional Surveillance Measures (ASM) on securities with surveillance concerns viz. price variation, volatility etc. to alert and advise investors to be extra cautious and advise market participants to act diligently while dealing in these securities. | | September 11, 2018 | Amendment to Securities and Exchange Board of India (Credit Rating Agencies) Regulations, 1999. | As per the amendment CRAs are not allowed to carry out any activity other than the rating of securities offered by way of public or rights issue. However, CRAs may undertake rating of financial instruments under the respective guidelines of a financial sector regulator or any authority as may be specified by the Board. | | September 19, 2018 | Amendment to SEBI (Credit Rating Agencies) Regulations, 1999 and modification to SEBI Circular dated May 30, 2018: It has been decided that cases of requests by an issuer for review of the rating(s) provided to its instrument(s) shall be reviewed by a rating committee of the CRA that shall consist of majority of members that are different from those in the Rating Committee of the CRA that assigned the earlier rating. Also, at least one-third of members of the Committee should be independent. | To enhance disclosure and transparency norms for credit rating agencies. | | September 19, 2018 | Interoperability among Clearing Corporations - Amendments to Securities Contracts (Regulation) (Stock Exchanges and Clearing Corporations) Regulations, 2012. | The proposal of ‘Interoperability’ seeks to address the current suboptimal utilisation of margin and capital resources in the securities market, by linking the Clearing Corporations (CCPs) and allowing market participants to consolidate their clearing and settlement function at a single CCP, irrespective of the stock exchange on which the trade is executed. | | September 19, 2018 | Know Your Client requirements for Foreign Portfolio Investors (FPIs). | FPIs are required to comply with the given Know Your Client (KYC) requirements viz. Identification and verification of Beneficial Owners – For Category II & III FPIs, Periodic KYC review, Exempted documents to be provided during investigations/ enquiry, Data security etc. | | October 09, 2018 | Participation of Eligible Foreign Entities (EFEs) in the commodity derivatives market. | To enable Foreign Entities having actual exposure to Indian commodity markets, to hedge their price risk in the Indian Commodity derivatives market. | | October 22, 2018 | Total Expense Ratio (TER) and Performance Disclosure for Mutual funds: It has been decided that asset management companies have to adopt full trail model of commission in all schemes without payment of any upfront commission. A framework for increased transparency in TER (total expense ratio) and a framework for performance disclosure of the schemes have also been implemented for MF schemes. Additionally, incentives for B-30 cities is modified and is to be based on inflows from retail investors. The slabs for base TER are also revised to achieve reduced cost for end investors. | To bring transparency in expenses, reduce portfolio churning and mis-selling in mutual fund (MF) schemes | | 3. The Pension Fund Regulatory and Development Authority (PFRDA) | | August 20, 2018 | Change in Investment Guidelines for NPS Schemes w.r.t investment in Equity Mutual Fund by Pension Funds: it has been decided to put a limit of 5 per cent on investment in Equity Mutual Funds in a manner that the aggregate portfolio invested in such mutual funds shall not be in excess of 5 per cent of the total portfolio of the fund at any point in time and the fresh investment in such mutual funds shall not be in excess of 5 per cent of the fresh accretions invested in the year. | In order to limit investments by Pension Funds into Equity Mutual Funds and promote active fund management practice. | | 4. The Insolvency and Bankruptcy Board of India (IBBI) | | July 4, 2018 | Amendments to the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations 2016.11 | The revised norms provide clarity on procedural requirements for various classes of creditors, details about timelines to be followed by resolution professionals and procedure for withdrawal of insolvency application. | | August 10, 2018 | Direction by circular to resolution professional to mention in the notice about representation in Committee of Creditors (CoC). | This relates to representation of Financial Creditors as members of the CoC, | | August 17, 2018 | The Insolvency and Bankruptcy Code (Second Amendment) Act, 2018. Some important provisions include: 1) providing relief to home buyers by recognising their status as financial creditors, 2) laying down a strict procedure for withdrawing a case after its admission under IBC 2016. It would be permissible only with the approval of the Committee of Creditors with 90 per cent of the voting share, permissible before publication of notice inviting Expressions of Interest (EoI). 3) voting threshold brought down to 66 per cent from 75 per cent for all major decisions such as approval of resolution plan, extension of CIRP period, etc. and 51% for routine decisions to ensure that the CD continues as going concern. 4) providing for a minimum one-year grace period for the successful resolution applicant to fulfill various statutory obligations required under different laws. | To balance the interests of various stakeholders, especially the home buyers and Micro, Small and Medium Enterprises (MSMEs), promoting resolution over liquidation of corporate debtor by lowering the voting threshold of CoC and streamlining provisions relating to eligibility of resolution applicants. | | October 5, 2018 | Amendments to the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations 2016. | The amendment now requires the resolution professional to circulate the minutes of the meeting by electronic means to authorised representative(s) also. The Regulations will enable a financial creditor in a class, who could not vote on a matter before the meeting, to vote after minutes of the meeting are circulated. | | October 11, 2018 | Amendment to (a) the Insolvency and Bankruptcy Board of India (Insolvency Professional Agencies) Regulations, 2016, (b) the Insolvency and Bankruptcy Board of India (Model Bye-Laws and Governing Board of Insolvency Professional Agencies) Regulations, 2016, and (c) the Insolvency and Bankruptcy Board of India (Information Utilities) Regulations, 2017. | The amendment relates to a few procedural issues with regards to insolvency proceedings. | | October 22, 2018 | Amendment to the IBBI (Liquidation Process) Regulations 2016. | The amendments, inter-alia, enable a liquidator to sell the business of the corporate debtor as a going concern. The amendments also provide that the valuation of the assets or business sold may be considered as that under the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2016 or the IBBI (Fast Track Insolvency Resolution Process for Corporate Persons) Regulations, 2017, as the case may be. | | October 22, 2018 | Insolvency and Bankruptcy Board of India (Mechanism for Issuing Regulations) Regulations, 2018. | The regulations provide for the manner in which regulations may be framed by IBBI providing, inter-alia, for effective engagement with the stakeholders, for making regulations. | Section B Other developments, market practices and supervisory concerns I. The Financial Stability and Development Council 3.27 Since the publication of the last FSR in June 2018, the Financial Stability and Development Council (FSDC) held one meeting on October 30, 2018 under the chairmanship of the Finance Minister where issues related to the state of the economy, strengthening cyber security in the financial sector including progress made in the setting up of a Computer Emergency Response Team in the Financial Sector (CERT-Fin), issues and challenges of crypto assets/currency, market developments and financial stability implications of the use of RegTech and SupTech by financial firms and regulatory and supervisory authorities, and implementing the recommendations of the Sumit Bose Committee Report on measures, such as, promoting an appropriate disclosure regime for financial distribution costs were discussed. The Council also discussed at length the issue of real interest rates and the current liquidity situation including segmental liquidity position. II. Fund flows: FPIs and Mutual Funds 3.28 The Mutual Fund (MF) industry is experiencing some volatility due to certain market developments. During April-September 2018, there was a net inflow of ₹458 billion as compared to a net inflow of ₹2,020 billion in April-September 2017. (Table 3.7). | Table 3.7: Trends in flow of funds | | (₹ billion) | | Month/Year | Apr-17 | May-17 | Jun-17 | Jul-17 | Aug-17 | Sep-17 | | Gross Mobilisation | 16372.2 | 16594.55 | 15523.72 | 18005.82 | 16252.21 | 18356.59 | | Redemption | 14865.17 | 17001.66 | 15689.64 | 17370.78 | 15635.2 | 18522.64 | | Assets at the end of the period | 19263.02 | 19039.75 | 18962.91 | 19969.05 | 20592.89 | 20403.01 | | Net Inflow/ Outflow | 1507.03 | -407.11 | -165.93 | 635.05 | 617.01 | -166.05 | | | | Month/Year | Apr-18 | May-18 | Jun-18 | Jul-18 | Aug-18 | Sep-18 | | Gross Mobilisation | 17183.28 | 19384.27 | 20684.5 | 22014.06 | 19797.79 | 16929.8 | | Redemption | 15809.00 | 19884.28 | 20219.75 | 22340.34 | 18051.3 | 19231.39 | | Assets at the end of the period | 23255.05 | 22595.78 | 22864.01 | 23055.38 | 25204.3 | 22044.23 | | Net Inflow/ Outflow | 1374.28 | -500.01 | 464.75 | -326.28 | 1746.49 | -2301.59 | | Source: SEBI. |

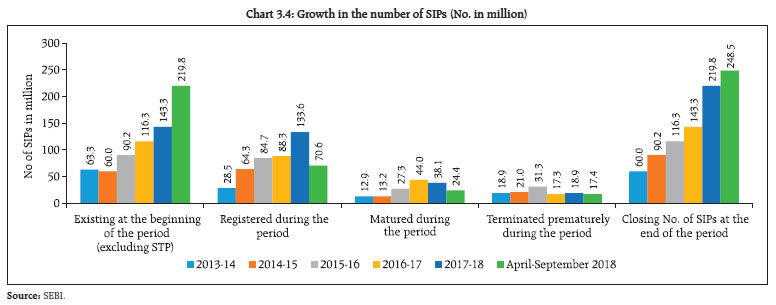

3.29 Notwithstanding the ebbs and flows in aggregate mobilisation of MFs, the Systematic Investment Plans (SIPs) remain a favoured choice for the investors (Chart 3.4). The net folio increase during April-September 2018 over 2017-18 was 2.88 million. Investments through SIPs in mutual funds appear to be relatively more stable from the point of view of sustainability of fund inflows. 3.30 Given the significant churn in MF flows, management of liquidity by MFs assume importance (Box 3.2). Box. 3.2 Framework for Liquidity Risk Management by MFs Mutual funds are redeemable on daily basis, which, under normal circumstances see orderly redemptions. However, under stressed market conditions, a fund must be ready to meet the redemption obligations to its unit-holders. In this context, liquidity management is very important for mutual funds and there must be adequate policies and procedures to meet investor redemption requests. SEBI has put in place various policy tools to mitigate / resolve liquidity issues in MF schemes: 1. Exit load: A fee calculated as a percentage of net asset value (NAV) is charged from an investor when units are redeemed within the period specified in the scheme’s offer document. This measure reduces the likelihood of withdrawals by investors from the mutual fund schemes within the specified period. 2. For better asset-liability match: Close ended debt schemes can invest only in such securities which mature on or before the date of the maturity of the scheme. Further, Liquid funds can invest only in instruments of up to 91-day maturity and Money Market Mutual Fund (MMMF) schemes can invest only in money market instruments with maturity less than one year. 3. Listing of close ended / interval schemes: To provide investors with an exit option and to give fund managers certainty in managing funds till the closing date, the regulatory framework was amended by mandating the listing of close ended and interval schemes. 4. Portfolio diversification norms: Investment limits are being placed on securities issued by a single issuer, sector exposure limit, group level limit and also limits on investments in listed securities issued by associate / group companies. 5. 20-25 rule: To reduce investors’ concentration, SEBI guidelines mandate that each scheme needs to have a minimum of 20 investors and no single investor shall account for more than 25 per cent of the corpus of the scheme. This reduces the likelihood of huge redemptions of a scheme’s units by a single/ few investors holding a substantial proportion of the scheme’s asset. 6. Adopting the principles of Fair Valuation: To ensure fair treatment to all investors, the overarching and overriding principles of fair valuation have been adopted as per which the valuation of investments shall be reflective of the realisable value of the securities/assets. Adopting such principal of fair valuation takes away the incentive from investors to redeem prior to other investors, thereby reducing the redemption pressure and ‘run’ on the scheme. 7. Mutual funds have also been provided with a period of 10 days, from date of redemption request, to provide redemption proceeds to investors. 8. Stress testing by AMCs: To evaluate potential vulnerabilities and take corrective actions thereof, stress testing has been made mandatory for all Liquid Fund and MMMF Schemes. The stress test is required to be carried out by the AMC at least on a monthly basis and should test the impact of interest rate risk, credit risk and liquidity and redemption risk, among others deemed necessary, on the NAV of the concerned schemes. 9. Limits on investment in illiquid assets: To limit investments in illiquid assets, aggregate value of any scheme’s investments in ‘illiquid securities’, which are defined as non-traded, thinly traded and unlisted equity shares, should not exceed 15 per cent of the total assets of the scheme and any illiquid securities held above 15 per cent of the total assets will be assigned zero value. 10. Borrowing by MFs: To meet temporary liquidity requirements of the Mutual Funds for the purpose of repurchase, redemption of units or payment of interest or dividend to the unit-holders, MFs have been permitted to borrow to the extent of 20 per cent of the net asset of the scheme and the duration of such a borrowing shall not exceed a period of 6 months. 11. Restrictions on redemptions: In order to protect the interest of the investors, SEBI vide its circular dated May 31, 2016 has provided guidelines on restrictions on redemptions. The following should be observed before imposing restrictions on redemptions: a. Restrictions may be imposed when there are circumstances leading to a systemic crisis or event that severely constricts market liquidity or the efficient functioning of markets such as: i. Liquidity issues - when the market at large becomes illiquid affecting almost all securities rather than any issuer specific security. Further, restriction on redemption due to illiquidity of a specific security in the portfolio of a scheme due to a poor investment decision, is not allowed. ii. Market failures, exchange closures - when markets are affected by unexpected events which impact the functioning of exchanges or the regular course of transactions. iii. Operational issues – when exceptional circumstances are caused by force majeure, unpredictable operational problems and technical failures (for example a black out). b. Restrictions on redemptions can be imposed for a specified period of time not exceeding 10 working days in any 90 days period. c. Any imposition of restrictions requires specific approval of board of AMCs and Trustees and SEBI should be informed immediately about this. d. When restrictions on redemptions are imposed, the following procedure shall be applied: i. All redemption requests up to ₹0.20 million will not be subject to such restriction. ii. Where redemption requests are above ₹0.20 million, AMCs shall redeem the first ₹0.20 million without such restriction and remaining part over and above ₹0.20 million shall be subject to such restriction. This information should be disclosed prominently and extensively in the scheme related documents. |

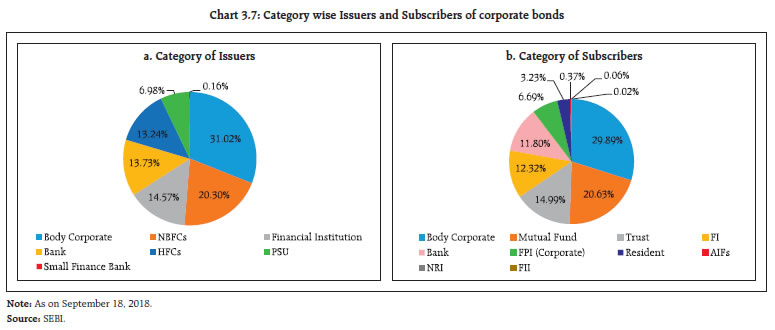

III. Trends in capital raised – debt and equity – emerging issues a. Credit ratings and framework for their role and accountability A. Trend in rating movements 3.31 An analysis of the credit ratings of debt issues of listed companies by major Credit Rating Agencies (CRAs) in India shows that there was a surge in the share of downgraded/ suspended companies of two rating agencies during the June and September 2018 quarters (Chart 3.5). B. Further strengthening of the CRA framework 3.32 In order to further strengthen the rating framework, SEBI, in May 2018, issued guidelines with respect to the process for review of ratings. Pursuant to the circular, based on the representations received from the market participants, further modifications were made to the framework. It was decided that requests by an issuer for review of the rating(s) provided to its instrument(s) will be reviewed by a rating committee of the CRA that will consist of majority of whose members are different from those in the Rating Committee that assigned the earlier rating, and at least one-third of the members will be independent. Further, to make the disclosures more relevant, CRAs were directed to disclose all the ratings which were not accepted by an issuer, on their website, for a period of 12 months from the date of such ratings being disclosed as a non-accepted rating. 3.33 In June 2018 SEBI directed that CRAs may withdraw a rating subject to CRA having (i) rated the instrument continuously for 5 years or 50 per cent of the tenure of the instrument, whichever is higher and (ii) received an undertaking from the issuer that a rating is available on that instrument. Further, at the time of withdrawal, the CRA shall assign a rating to such instrument and issue a press release regarding the rating. Vide SEBI (Credit Rating Agencies) (Amendment) Regulations, 2018, notified on May 30, 2018, SEBI put in place various criteria on enhanced net worth of the CRA, minimum shareholding of the promoter with lock-in requirement, restrictions on cross-holdings among CRAs and restrictions on carrying out any activity other than the rating of securities offered by way of public or rights issue with certain carve-outs. 3.34 SEBI also overhauled the disclosures by CRAs recently. The enhanced disclosures pertain to parent / group/government support, liquidity position (including forward looking measures for non-banks like unutilised credit lines and adequacy of cash flows for servicing maturing debt obligation, etc.). The enhanced disclosure regime significantly enhances the information content of the rating. C. Primary market issuance trends in FY 2018-19 3.35 During April-September 2018, ₹274.45 billion was raised through 12 public issues in bond market. More than ₹2 trillion was also raised through private placement of corporate bonds during the same period (Chart 3.6). The major issuers of corporate bonds were body corporates and NBFCs accounting for more than 50 per cent of the outstanding corporate bonds as on September 2018 (Chart 3.7a) whereas body corporates and mutual funds were the major subscribers of the same (Chart 3.7b). With regard to equity capital ₹149.70 billion has been raised during April-October 2018 (Chart 3.6). IV. Commodity Derivatives (a) Risk Management and Surveillance of Commodity Derivative Markets 3.36 SEBI took over the regulation of commodity derivatives market from September 28, 2015. To streamline and ensure the smooth functioning of commodities futures markets, SEBI has put in place a comprehensive risk management and surveillance framework for National Commodity Derivative Exchanges in October 2015 and prescribed additional risk management norms for commodity National Exchanges in September 2016. 3.37 In 2014, SEBI had issued norms related to the Core Settlement Guarantee Fund, default waterfall, stress testing, back testing etc. for recognised Clearing Corporations. These norms have been made applicable to Clearing Corporations clearing commodity derivatives transactions as well. Inter-alia, Minimum Required Corpus of Core Settlement Guarantee Fund (MRC) for the commodity derivatives segment of any stock exchange has been stipulated at ₹100 million and modified standardised stress testing scenarios and methodology has been prescribed for carrying out daily stress testing for credit risk for commodity derivatives. Risk management framework and product design guidelines were issued for trading in options on commodity futures. At present, Multi Commodity Exchange of India Ltd. (MCX) is offering Options trading in Gold Futures, Crude oil futures, Copper futures, Silver Futures and Zinc futures. The National Commodity & Derivatives Exchange Ltd. (NCDEX) is offering Options trading in Guar Seed futures, Guar Gum futures, Chana futures, Soybean futures and Refined Soy Oil futures.  3.38 In addition, SEBI has been taking various measures to further strengthen the surveillance and integrity of commodity derivatives markets. Some of the important measures taken by SEBI during 2018-19 (up to October 24, 2018) includes: monthly surveillance meetings with commodity exchanges, surprise warehouse visits, visits to physical markets of commodities traded at the exchange, meeting various traders and value chain participants to take their feedback and collect surveillance inputs for further policy measures, inspections of commodity derivatives exchanges, imposition of special margins, Self-Trades Prevention check at permanent account number level by exchanges to restrict wash/ self-trades at exchanges platform, increased penalty (up to 100 per cent of the profit/loss booked) in case of reversal of trades, etc. (b) Market developments 3.39 As on October 31, 2018, the benchmark indices, MCX COMDEX increased by 6.8 per cent and NCDEX Dhaanya increased by 10.3 per cent over March 31, 2018. During the same period, while the S&P World Commodity Index increased by 5.1 per cent, Thomson Reuters CRB Index decreased by 2.3 per cent (Chart 3.8). 3.40 The total turnover at all the commodity derivative exchanges (futures and options combined) saw a growth of 14.0 per cent during April 2018 - September 2018 as compared to previous six months i.e. October 2017 - March 2018 period. During the period, metal had a share of 38.7 per cent followed by Bullion (including diamond) which had a share of 31.6 per cent. Energy and Agriculture experienced a growth of 20.3 per cent and 9.4 per cent respectively. The total share in turnover of the non-agricultural derivatives was 90.6 per cent during the period while agri-derivatives contributed a share of 9.4 per cent (Chart 3.9). (c) Unified Stock Exchanges 3.41 The Union budget for FY 2017-18, proposed that the commodities and securities derivatives markets will be further integrated by integrating the participants, brokers, and operational frameworks. This budget announcement was implemented by SEBI in two phases. In Phase-I, integration at the intermediary level and in Phase II a single exchange to operate various segments such as equity, equity derivatives, commodity derivatives, currency derivatives, interest rate futures and debt were enabled. This integration of exchanges with universal trading facilities across securities and commodity derivatives aims at bringing synergy in the functioning of securities and commodities market. 3.42 This is beneficial from the point of view of investors, market participants and the regulator as there are many commonalities between the two markets in terms of trading and settlement mechanism, risk management and redressal of investor grievances. Brokers will also benefit as transaction costs are expected to come down due to competition between exchanges. Further, having a single firm/company for both the markets will result in a single margin account. 3.43 Investors have to pay less and can trade in both equity and commodities through one trading account. In the current scenario traders who are active in both equity and commodity markets have to transfer money to two broker firms/companies, one for equity trading and other for commodities trading. This is a constraint as money transfers between the two markets may be time consuming, requires more working capital and are costly (transfer charges). This may also result in a loss of opportunity especially in a volatile market. The new move will help in expanding the commodity derivatives market while availing the benefits of already developed equity markets. V. Fintech 3.44 The recent EBA (European Banking Authority) Report13 on FinTech strives to provide a balanced analysis of potential prudential risks and opportunities that may arise due to FinTech. It analyses this on the basis of seven major FinTech use cases : biometric authentication using fingerprint recognition, robo-advisory as a way of investment advice, big data and machine learning in credit scoring, use of a distributed ledger technology and smart contracts for trade finance, distributed ledger technology as a means to streamline customer due diligence processes, mobile wallet with the use of near-field communication and outsourcing the core banking/payment system to the public cloud. The EBA report acknowledges the increased operational risk on the part of incumbent institutions because of lack of adequate expertise and cyber-security issues among others. However, it also emphasises a number of opportunities in terms of efficiency gains, cost reduction and improved customer experience. 3.45 BIS in its report14 analysed the early user experience of Suptech (supervisory technology) (Box 3.3). Box 3.3: Riding on Suptech Suptech is the use of innovative technology by supervisory agencies to support supervision. Presently data collection method used by supervisors includes periodic data templates which might have missing data points or overlapping data. The reporting template offers less flexibility to supervisors for differentiated analysis. Suptech helps to digitise reporting and regulatory processes, resulting in efficient and proactive monitoring of risk and compliance by financial institutions. It could facilitate risk and compliance monitoring to evolve into a predictive process from a backward-looking process. A number of supervisory agencies are already using innovative ways to effectively implement a risk-based approach to supervision. The most common initiative taking root in various countries is regulatory ‘sandbox’ which is a controlled environment created by financial authority for regulated or unregulated institutions to test innovations for certain period and according to certain rules. Some of the potential and actual applications of Suptech adapted from FSI Insights report is summarised below: Suptech applications for real-time monitoring: Real-time monitoring of the Australian primary and secondary capital markets is done by the Australian Securities and Investments Commission (ASIC). The system provides real-time data feeds from all equity and equity derivative transactions and generates real-time alerts, enabling identification of anomalies within markets. Data analytics: Many supervisory agencies use Suptech for data validation, data-cleaning and data checks. For example, the Bank of Italy (BoI) uses structured and unstructured data for detecting anti-money laundering (AML). The Netherlands Bank (DNB) transforms data output into logical indicators, for example traffic lights and dashboards. Mexico’s National Banking and Securities Commission uses cloud computing to process large volumes of data. Several supervisory agencies use chatbots to provide virtual assistance to supervised entities and for answering consumer complaints. Market surveillance and supervision: The Financial Conduct Authority of UK (FCA) uses supervised machine learning (ML) tools to analyse millions of equity market transactions and detect signals of market manipulation. Suptech applications in misconduct analysis emphasises on AML, financing of terrorism, fraud detection and mis-selling. Suptech application in macroprudential supervision can be found for credit risk evaluation, liquidity risk detection, identification of macro-financial risks, and policy evaluations. Supervisory agencies have started using ML algorithms which merge different data sources to produce forecasts of loan defaults. The DNB is working on a neural network framework to detect anomalies, that is unusual liquidity flows, in payment data derived from a real-time gross settlement system. Identification of macro-financial risks: DNB uses transactions processed in TARGET215 and other financial market infrastructures (FMIs) for forecasting risk indicators. Challenges in developing Suptech applications: Increased operational risk, computational and human resource constraints and lack of transparency in some of the data analytics applications are some of the critical issues that have been observed. Hence, human intervention through supervisory expertise is still crucial in the supervisory process, mainly in investigating the results of the analyses and deciding on a course of action. References: Bank for International Settlements (2018): “Innovative technology in financial supervision (suptech) - the experience of early users”, available at: https://www.bis.org/fsi/publ/insights9.htm. Reserve Bank of India (2017): “Report of the Working Group on FinTech and Digital Banking”, available at https://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/WGFR68AA1890D7334D8F8F72CC2399A27F4A.PDF |

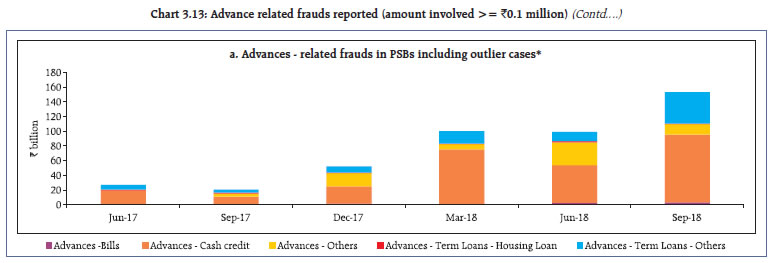

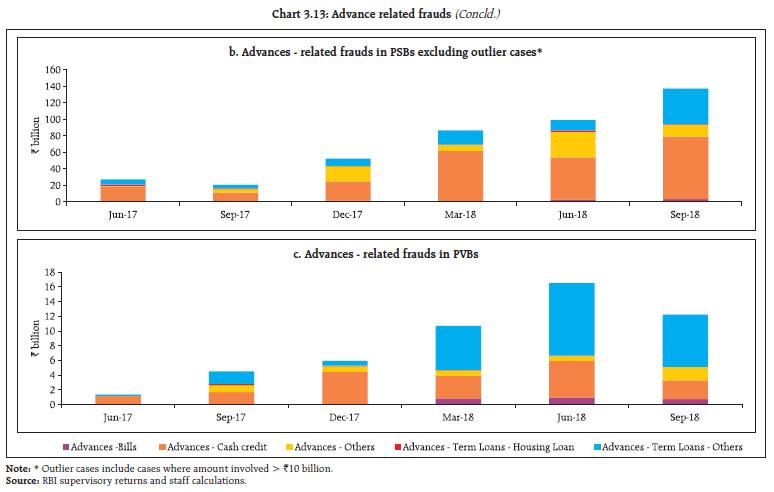

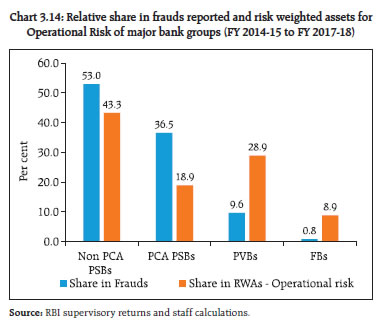

VI. Cyber security and data protection (A) Cyber security preparedness in banks – The Indian scenario 3.46 Over the years, resilience to cyber threats has emerged as a major area of concern in the Indian financial sector, more specifically in the context of banking operations involving critical payment system infrastructure. Over the past few years, several foundational milestones have been accomplished in the area of cyber security in banks ensuring that, the odd attack notwithstanding, the Indian banking system is adequately prepared to deal with a significant majority of cyber threats. Some of the measures taken and the safeguards implemented are: i. Bank boards (or board-level committees as the case may be) have been encouraged to assign due importance and demonstrate their commitment to cyber security by suitably equipping themselves with sufficient expertise to provide strategic directions; deliberating on cyber security in discussions related to design and implementation of new systems/major changes in existing systems; strengthening the CISO’s office both in terms of a cyber security budget, resources and by periodically reviewing the status of the bank’s cyber security posture. ii. The baseline expectations from banks in the area of cyber security were outlined in a comprehensive cyber security framework circulated by the Reserve Bank in June 2016. The banks are required to, inter alia, strictly enforce cyber hygiene in their environments (including in third-parties wherever applicable) with respect to password controls; port opening/ closing; network access controls; inventorying of IT assets and ensuring that these are updated with latest patches; instituting appropriate metrics and measures to assess the effectiveness of cyber security-related controls including the functioning of Security Operations Centres; ensuring application and database integrity and confidentiality of sensitive data; and periodically verifying the robustness of the banks’ IT infrastructure by conducting Vulnerability Assessment/Penetration Testing, code reviews, etc. The progress made by banks in the implementation of the measures outlined in the Cyber Security Framework and other regulatory instructions/ advisories is periodically assessed by the CSITE Cell through on-site examinations – both comprehensive and thematic/focused - and through offsite submissions by banks, communicating compliance with specific control measures. iii. Based on inputs received from market intelligence and government agencies, advisories and alerts are issued to banks, to avoid exploitation of the same vulnerabilities. This ensures that detection and response efforts of one entity feed into the prevention and detection efforts of the others thereby raising the security level of the entire banking system. Further, periodic returns are collected and reviewed to assess the cyber hygiene of the banks on an ongoing basis. iv. The Reserve Bank and other agencies (like CERT-In and IDRBT) conduct periodic cyber drills for banks to evaluate their detection, response and recovery policies and procedures; and to ensure that they are adequate to contain and remediate breaches and get back to normal operations at the earliest. 3.47 The banking industry as a target of choice for cyber-attacks in India is and will be vulnerable to novel and evolving threats. Recent cyber-attacks have, through their sophistication, necessitated banks to undertake extensive surveillance of their systems and networks on a continuous basis for effective timely threat intelligence. The sheer diversity and increasing complexity of cyber threats has brought about a realisation that a determined, focused and coordinated effort from multiple stakeholders will lead the way to a cyber-threat-resilient banking system. 3.48 The regulators are consistently engaged in supervising their relevant intermediaries on the progress of implementation and robustness of cyber security frameworks. Cyber Security/System audits of the intermediaries are being conducted regularly by competent auditors and the same is being reported to the concerned regulators. Some salient features of the general guidelines issued by various regulators include: i. Identification of Critical Information Infrastructure (CIIs) and getting them notified in coordination with National Critical Information Infrastructure Protection Centre (NCIIPC). ii. Adoption of Board approved cyber security policy. iii. Identification by intermediaries of critical IT assets and documentation of risks associated with such assets. iv. Reporting of all the cyber incidents to the Indian Computer Emergency Response Team (CERT-In) v. Periodic reassessment of Information & Cyber Security status. vi. Conducting the Vulnerability Assessment and Penetration Test (VA/PT) for all public-accessible applications. vii. Appointment of Chief Information Security Officer (CISO) who will be responsible for designing and enforcing information security (IS) policy. 3.49 SEBI issued detailed guidelines to Market Infrastructure Institutions (MIIs) to set-up their respective Cyber Security Operation Centre (C-SOC) and oversee their operations round the clock by dedicated security analysts. The Cyber Resilience framework has also been extended to Stock Brokers/ Depository Participants. Smaller intermediaries can utilise the services of the Market SOC which is proposed to be set up by MIIs for dedicated cyber security solutions. IRDAI has mandated insurers to establish the SOC at the insurer level for monitoring of network security. (B) Banking frauds 3.50 Operational risks in the banking sector have assumed significance of late, calling for reforms in governance and Board oversight structures and overhaul of the extant risk culture in banks (see box 3.4). Table 3.8 provides the number and the amount involved in frauds of ₹ 0.1 million and above reported by the banks and FIs during last 5 financial years and in the first half of the FY 2018-19. | Table 3.8: Frauds reported during the last 5 FYs and H1:2018-19 | | (amount involved >= ₹0.1 million) | | FY | Frauds of ₹ 0.1 million and above (A) | Out of A, Credit related frauds (B) | Per cent of B in A | | No of Frauds | Amount Involved

(₹ million) | No of Frauds | Amount Involved

(₹ million) | No of Frauds | Amount Involved | | 2013-14 | 4306 | 101708 | 1990 | 84121 | 46.21 | 82.71 | | 2014-15 | 4639 | 194551 | 2251 | 171222 | 48.52 | 88.01 | | 2015-16 | 4693 | 186988 | 2125 | 173681 | 45.28 | 92.88 | | 2016-17 | 5076 | 239339 | 2322 | 205614 | 45.74 | 85.91 | | 2017-18 | 5917 | 411677 | 2526 | 225590 | 42.69 | 54.8 | | H1:2018-19 | 3416 | 304202 | 1792 | 287505 | 52.5 | 94.51 |