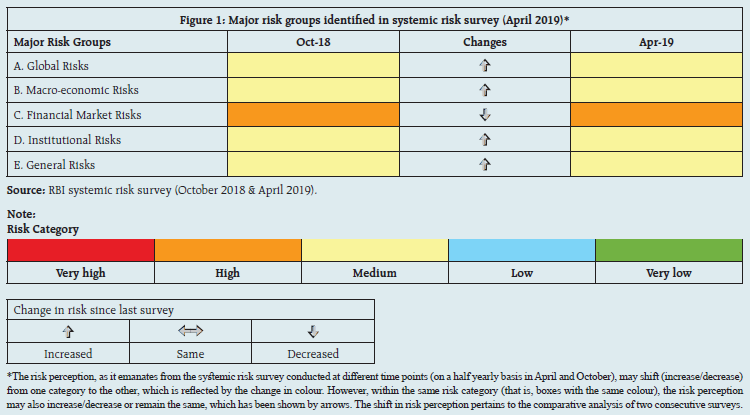

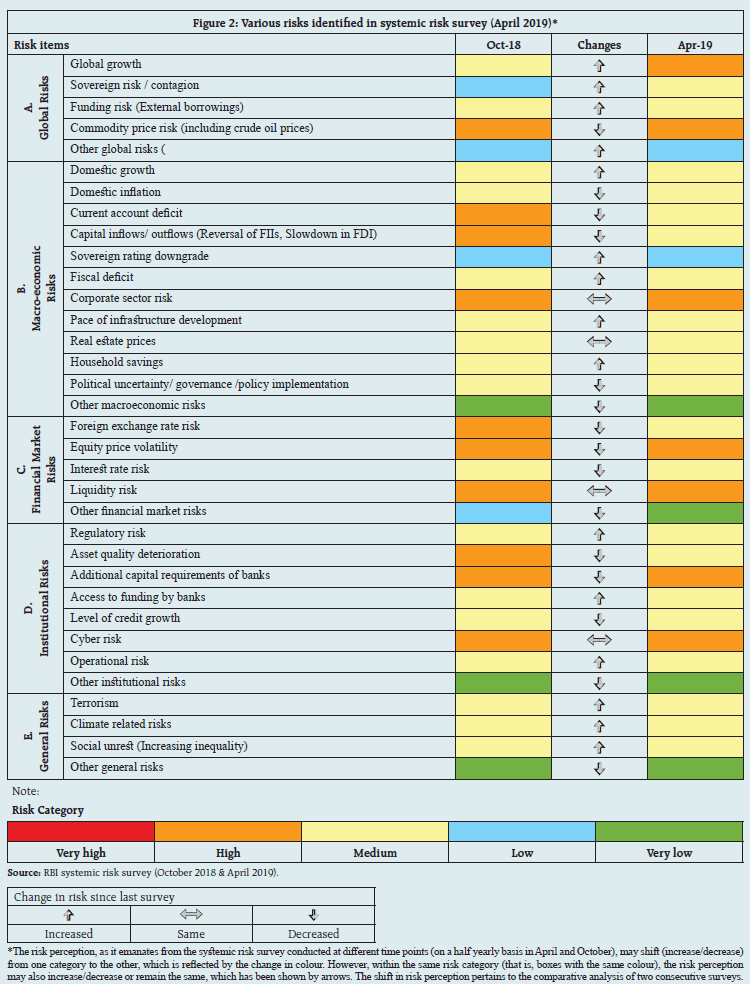

The systemic risk survey (SRS), the sixteenth in the series, was conducted during April-May 2019 to capture the perceptions of experts, including market participants, on the major risks presently faced by the financial system. According to the survey results financial market risks continue to be perceived as a high-risk category affecting the financial system while global risks, risk perception on macroeconomic conditions and institutional positions are perceived as medium risks affecting the financial system (Figure 1). Within global risks, the risk on account of global growth and commodity prices (including crude oil prices) were categorised as high risk. Within the macroeconomic risks group, risks on account of corporate sector vulnerabilities continue to be in the high-risk category. Risks to domestic growth, domestic inflation, fiscal and current account deficits, pace of infrastructure development, real estate prices and household savings continued to be in medium risk category in the current survey. In the financial market risks category, equity price volatility and liquidity risk continued in the high-risk category. Among the institutional risks, the risk on account of additional capital requirement of banks and cyber risk continued to be perceived as high-risk factors (Figure 2).

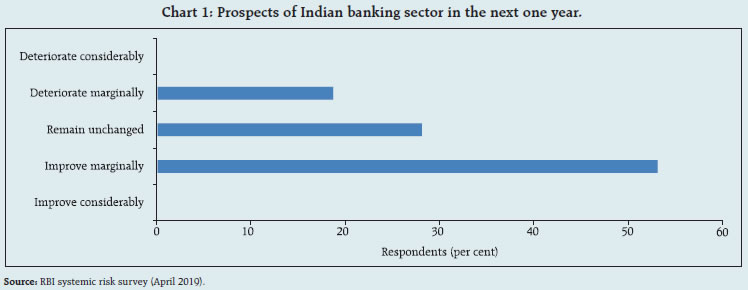

Participants opined that spillovers from a global trade war and the attendant geo-political tensions may impact domestic markets. Some opined that improvements in data quality and dissemination by themselves could buttress the cause of financial stability. Market participants posit that stock market correction and a possible deterioration in collateral values are important risks to financial market stability. About 50 per cent of the respondents feel that the prospects of Indian banking sector are going to improve marginally in the next one year aided by the stabilisation of the IBC process which will also play a key role in improving the confidence in the domestic financial system (Chart 1).  Majority of the participants in the current round of survey expect possibility of occurrence of a high impact event in the global financial system in the short term (upto 1 year) as medium. However, in the medium term (1 to 3 years) majority of the participants in the current round of survey assign a high probability to the occurrence of a high impact event in the global financial system. In the Indian financial system possibility of occurrence of a high impact event in the short-term as well as in the medium term has been assigned medium. There was a decrease in the share of respondents in the current survey who were fairly confident of the stability of the global financial system (Chart 2). Majority of the respondents were of the view that the demand for credit in the next three months would increase marginally. Average credit quality is also expected to improve marginally in the next three months (Chart 3). |