Acknowledgements The Report of the ‘Working Group on Core Investment Companies’ was made possible with the support of a number of individuals and organisations. The Working Group would like to acknowledge the contribution of representatives of corporate groups who interacted with the Working Group and shared their inputs and suggestions. The Working Group greatly benefitted from the experience of Smt. Shyamala Gopinath, former Deputy Governor, Reserve Bank of India who shared her insights as a special invitee, on the genesis of the Core Investment Companies’ regulations and enriched the deliberations. Shri Manoranjan Mishra, Chief General Manager and Shri Ajay Kumar Sinha, Smt. Puspamitra Sahu and Shri Chandan Kumar, General Managers of Reserve Bank of India (RBI), made significant contributions to the deliberations of the Group and helped in arriving at the final recommendations. The Working Group would also like to commend the support provided by the Secretariat’s team led by Shri Amitava Ghosh, Deputy General Manager, RBI. We would also like to record appreciation for the technical inputs and meticulous organisation of meetings by Shri Rupesh Kanaujiya and Ms. Poorvi Shrivastava, Managers from Department of Non-Banking Supervision, RBI. Executive Summary A Core Investment Company (CIC) is a Non-Banking Financial Company (NBFC) which carries on the business of acquisition of shares and securities and holds not less than 90% of its net assets in the form of investment in equity shares, preference shares, bonds, debentures, debt or loans in group companies. Further investments in equity shares in group companies constitutes not less than 60% of its net assets. The Working Group (WG) examined the current regulatory and supervisory framework for CICs with a view to identify and suggest measures for limiting the risks posed by the CICs. In the process, the WG met representatives of CICs and banks to get a perspective from the stakeholders and undertook analysis of data presented by the Department of Non-Banking Supervision. The WG identified the following six major issues that are required to be addressed and suggested measures to mitigate the related risks for the CICs, their groups as well as for the system as a whole: I. Complex Group Structure The complexity of large conglomerates renders opacity to the groups in terms of ownership, controls and Related Party Transactions. In addition, as Section 186 (1) of Companies’ Act, 2013 (which restricts the Group Structure to a maximum of two layers) is not applicable to NBFCs, the scope of complexity gets exacerbated. The WG recommends that the number of layers of CICs in a group should be limited through regulation. II. Multiple Gearing and Excessive Leveraging The absence of restriction on the number of CICs that can exist in a group and non-deduction of capital of CICs for their exposures in group companies (including in step down CICs), creates scope for excessive leveraging. The WG recommends that step-down CICs may not be permitted to invest in any other CIC while allowing them to invest freely in other group companies. III. Build-up of high leverage and other risks at group level In order to articulate the risk appetite and identify the risks (including excessive leverage) at the Group level, the WG recommends that a Group Risk Management Committee (GRMC) be formed and also be entrusted with the responsibility to maintain oversight on the emerging risks of the entities in the Group, as well as of the Group as a whole. IV. Corporate Governance Currently, Corporate Governance guidelines are not explicitly made applicable to CICs. To strengthen the governance practices, the WG recommends constitution of Board level committees viz. Audit Committee, Nomination and Remuneration Committee and Group Risk Management Committee. Further, the WG advocates the need for inducting Independent Directors, conducting Internal Audit and preparing Consolidated Financial Statement and ring fencing the boards of CICs by excluding employees / Executive Directors of Group Companies from its Board, as elaborated in this Report. V. Review of Exempt Category and Registration The current threshold of ₹ 100 crore asset size and access to public funds for registration as CIC is recommended to be retained. CICs without access to public fund may not register with the Reserve Bank. Further, it is recommended to do away with the nomenclature of ‘exempted’ CIC to obviate the scope of its misrepresentation by any entity. VI. Enhancing off-site surveillance and on-site supervision over CICs Currently there is no prescription for submission of off-site returns or Statutory Auditors Certificate (SAC) for CICs. It is recommended that Offsite returns may be designed by the RBI and prescribed for CICs on the lines of other NBFCs. Annual SAC submission may also be stipulated. Onsite inspection of the CICs may be conducted periodically. Chapter I: Introduction and Terms of Reference I.1 Background The earliest reference to Core Investment Companies (CICs) can be traced back to the year 2002 when CICs were identified as investment companies whose only business was to invest in companies for the purpose of holding stake and were not trading in these securities. Further, at that time it was decided that CICs may not be mandated to register with the Bank as – -

The business model of CICs was such that they would have difficulty in complying with the NOF requirements; -

They were not accepting public deposits; and -

They were not trading in securities. I.2 However, it was later observed that it was impracticable to determine whether a CIC has invested in the shares of another company for the purpose of holding stake or for the purpose of trading. In certain companies, it was noted that though initial investment was made with an intent of holding stake in the investee company, later on, for various reasons, either the shares were sold or additional shares purchased. In order to extend a clearer stance in the matter in 2010 a new category of Systemically Important Core Investment Companies (CIC – Non - Deposit taking - Systemically Important) was created for companies having assets of ₹ 100 crore and above, which would be investing with the sole purpose of holding stakes in group concerns and not trading. The CICs were not allowed to receive bank funding in the form of loans and advances for on-lending to group entities. Banks, however, were not disallowed from investing in Commercial Papers (CPs) and Non-Convertible Debentures (NCDs) floated by the CICs. I.3 Origin of CICs In order to classify the CICs as a separate category of NBFC, its principal business was standardised by prescribing that CICs should hold a minimum of 90% of net assets in the form of exposure to group companies, of which 60% was to be in the form of investment in equity. A regulatory framework in the form of Adjusted Net Worth (ANW) and leverage limits (discussed below) was put in place for CIC-ND-SIs and they were given exemption from NOF requirement (₹ 2 crore), capital adequacy (15%) and intra-group exposure limits applicable to other NBFCs. NBFC - CIC was introduced as a new class of NBFC with light touch regulation as their exposure was restricted to their respective groups, hence it was considered that they would be taking limited risks. For the first time ‘Group’ for the purpose of CICs was defined vide notification dated January 05, 2011. Under this, the definition of Group as given in Company’s Act 19561 was expanded to include Subsidiaries, Joint ventures, Associates, Promoter-promotees, Related Parties, Common brand name, and investment in equity shares of 20% and above. This was at variance with the definition of Group given in the RBI Act Section 45IA which too was derived from the provisions of Companies Act 1956. Broad basing the definition of the Group for the CICs through the Master Direction, provided scope for inclusion of entities which would not have otherwise been considered as part of the Group. The regulation for CICs stipulated that there would not be any non-group loan or investments except in bank deposits or money market instruments. Growth of CICs I.4 Certain groups have more than one CIC, like one CIC for each vertical of business, so that the entire vertical becomes self-contained for financing purposes. Each CIC of a group would raise funds independently and use it to invest in the group companies including for setting up another CIC in the group. Over a period of time, certain business groups developed an element of multiple gearing as funds could be raised by the CICs and as well as by the step down CICs and the other group companies independently. At the Group level, it therefore led to over leveraging in certain cases. Since a few entities of a group may raise fund for a CIC and fall outside the ambit of any regulator, therefore the group level leverage is not apparent either to the CICs in the Group, or even to any sectoral regulator. Further, the level of control that the CICs have over their group entities is limited as they may not have the necessary knowledge and competence to exercise control over entities with varied businesses. The position of the board of CIC becomes more complex in mixed conglomerates which includes financial and non-financial entities in the group both in India and abroad. CICs have also been found to be providing loans to loss making entities within the group as at times their interests can be secondary to the Group’s requirements. Further, while on the Asset side, CICs have restriction of taking exposure only in their ‘Group’ companies, but on the liability side, there are minimal regulations and in addition to Bank borrowings, CICs could raise funds from markets, Mutual Funds, and other investors through CPs, NCDs and ICDs, etc. for investing and giving loans to group companies. I.5 Terms of Reference of Group Considering the size of the CICs and their group companies and their inter-connectedness, the need to review the structure and supervisory and regulatory regime was felt so as to take proactive measures, also from the point of view financial stability. Accordingly, it was announced in the Statement on Developmental and Regulatory Policies dated June 06, 2019 that the Bank has decided to constitute a Working Group to Review Regulatory and Supervisory Framework for Core Investment Companies (CICs) with a mandate: -

To examine the current regulatory framework for CICs in terms of adequacy, efficacy and effectiveness of every component thereof and suggest changes therein. -

To assess the appropriateness of and suggest changes to the current approach of the Reserve Bank of India towards registration of CICs including the practice of multiple CICs being allowed within a group. -

To suggest measures to strengthen corporate governance and disclosure requirements for CICs. -

To assess the adequacy of supervisory returns submitted by CICs and suggest changes therein. -

To suggest appropriate measures to enhance RBI’s off-site surveillance and on-site supervision over CICs. I.6 Composition of the Working Group The composition of Working Group is as under: -

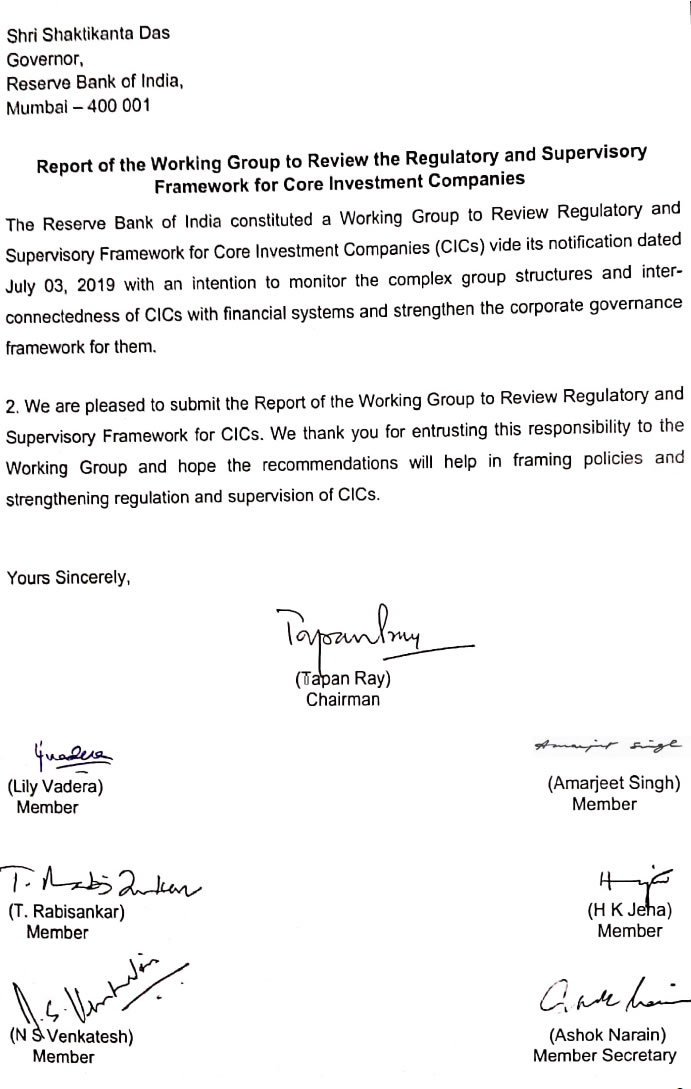

Shri Tapan Ray, Non-Executive Chairman, Central Bank of India and former Secretary, Ministry of Corporate Affairs, Govt. of India – Chairperson -

Smt. Lily Vadera, Executive Director, Reserve Bank of India - Member -

Shri Amarjeet Singh, Executive Director, Securities and Exchange Board of India - Member -

Shri T Rabi Sankar, Chief General Manager, Financial Markets Regulation Department, Reserve Bank of India - Member -

Shri H K Jena, Deputy Managing Director, State Bank of India - Member -

Shri N S Venkatesh, Chief Executive, Association of Mutual Funds in India – Member -

Shri Ashok Narain, Chief General Manager, Department of Non-Banking Supervision, Reserve Bank of India, Member, Secretary Chapter II Part A: Review of Current Supervisory and Regulatory Framework for CICs

II.1 The current regulatory and supervisory framework for CICs is given in the following paragraphs.

a. Regulations applicable to CICs (i) Principal Business Criteria and resultant ALM Mismatches: CICs are required to hold not less than 90% of their net assets in group companies and their investment in equity shares in group companies should not be less than 60% of their net assets. As 60% of “net assets”2 of CICs are required to be in equity which are not for trading, these are, in effect, long term in nature. While the structure of assets of CICs are stipulated as per the 90/60 principle, there is no guideline on the maturity pattern of its liabilities. As such at times, long terms investments by CICs in group companies are funded by short term liabilities, which leads to ALM mismatches for the CICs. (ii) Multiple CICs, gearing and interconnectedness: CICs are expected to take exposure only in group companies (as equity investment or loan / debt instrument) and such exposures are not deducted from the CICs capital, unlike in case of NBFCs/banks wherein intra-group exposures beyond 10% (of owned funds) gets deducted from their capital. The amounts received as capital by a CIC from the capital or borrowings of the Investing CIC can be leveraged by the recipient, which multiplies the borrowings against the investing CIC’s borrowings or capital, which the investing CIC had already leveraged. This enhances group level leverage and can increase the interconnectedness with the financial system. At present there is no restriction on the number of CICs in a single group, which permits scope for multiple gearing and over leveraging at the group level, while the regulatory capital requirement on stand-alone basis is still being met. Further as a result of the wider definition of ‘Group’ as indicated in para 1.4, the CICs can also invest in remotely connected companies. In case of problem in any one vertical of the group, because of crossholding and intra group borrowings, the risk of contagion across the verticals of the group became high. The CICs are exempt from the provisions of the Companies Act which restrict the layers of companies in a group. (iii) Corporate Governance Standards: Unlike NBFCs, which are required to constitute Committees of the Board like Audit Committee, Risk Management Committee, Nomination Committee and Asset Liability Management Committee etc., no such corporate governance standards are mandated for CICs. The same director could be part of boards of multiple companies in a group, including CICs. In a few cases, for instance, it has been observed that the CIC had lent funds to group companies at zero percent rate of interest with bullet repayment of 3-5 years and without any credit appraisal. Hence, the position of the Boards of CICs becomes difficult, particularly in mixed conglomerates, which include financial and non-financial entities, as the CIC’s board may not have the skill / capacity to monitor the diverse businesses of such large conglomerates spread across India and abroad. b. Registration of CICs and Exemption Prior to the advent of RBI’s regulations for CICs in the year 2010, companies that functioned like CICs (i.e., borrowed from the market to lend to group companies) could raise funds without any minimum capital requirement and could also lend without any reference to net-worth. Such uncontrolled borrowing and lending posed a systemic risk. Thus, CICs having asset size of ₹ 100 crore and above, were required to register with the Bank keeping in view their systemic significance. At the same time, CICs having asset size of less than ₹ 100 crore which access public funds and all CICs not accessing public funds (irrespective of their size), were exempted from registration and fell outside the regulatory and supervisory purview of the Bank. Exempt CICs gained credibility by virtue of being ‘exempted’ by the Bank which, inter alia, could facilitate fund raising. Since these exempted CICs are not monitored, there is no means to detect when a CIC has reached the threshold requiring registration. The WG deliberated that nomenclature of ‘exempt category CICs’, to an extent, lends certain unintended credibility to such entities. c. Prudential norms applicable to CICs: -

CICs are not subjected to CRAR of 15% and Net Owned Funds (NOF) of ₹ 2 crore requirements which other NBFC are subjected to. -

For CIC-ND-SI the Adjusted Net Worth shall at no point of time be less than 30% of its aggregate risk weighted assets on balance sheet and risk adjusted value of off-balance sheet items as on the date of the last audited balance sheet as at the end of the financial year. -

The outside liabilities of a CIC-ND-SI shall at no point of time exceed 2.5 times its Adjusted Net Worth as on the date of the last audited balance sheet as at the end of the financial year. Presently, there is no restriction on the aggregate group level leverage, as the entities in the group can borrow directly from banks and markets, in addition to borrowing from group CICs. -

In addition to capital and free reserves, CICs are allowed to take 50% of unrealized appreciation of their investments in quoted scrips, for calculation of ANW which imparts volatility to their ANW that is presently reckoned on Balance Sheet date. This aspect of their capital calculation, while increasing their ability to access public funds in case of appreciation of their quoted investments, and in extreme cases, could make it difficult for the CIC to maintain capital requirement in the event of sharp decline in the value of such investments. -

Exposure to group companies are not deducted for capital calculation. -

Cannot borrow from banks for on-lending or making investment in group companies and are dependent on market borrowings for investing/lending to group companies. Part B: Approach adopted by the Working Group The WG adopted a three-pronged approach towards achieving the mandate assigned to it, viz. (i) Analysis of Regulatory and Supervisory framework (discussed in Part A above); (ii) Data Analysis (iii) Discussions and inputs from stakeholders, including representatives of CICs / banks; salient aspects of (ii) and (iii) above are delineated in the paragraphs below: II.2 Study of CICs: In August 2019, there were 63 CICs registered with Reserve Bank. As on March 31, 2019, the total asset size of the CICs aggregated to ₹ 2,63,864 crore and have approximately ₹ 87,048 crore of borrowings. The top five CICs consist of around 60% of the asset size and 69% borrowings of all the CICs taken together. The borrowing mix consists of debentures 55%, CPs 16%, FIs and other corporates 16% and bank borrowings 13%. The trend in growth of total asset size vis-a-vis the total borrowings of CICs for the past three Financial Years is illustrated below: Analysis of multiple gearing and exponential leverage due to CICs, under extant regulations is given in Annex-1 II.3 Inputs from Market Participants: The WG held discussions with representatives of a few CICs as well as banks and ex-Deputy Governor, RBI to take a comprehensive view of the Regulator as well as the regulated entities. Following suggestions were received during the interactions by the WG: (i) Registration threshold: One CIC representative suggested that the threshold for registration with the RBI (i.e., CICs having total assets of ₹ 100 Crore and accessing public funds) could be raised to ₹ 500 Crore & above, and those without public funds should also be required to be registered. This may be combined with tighter governance norms. It was stated that raising the threshold for registration may serve two purposes - facilitate ease of doing business for entities and focused supervision of bigger and systemically important CICs can be exercised by the Bank. (ii) Leverage Ratio: One representative of CIC suggested that a graded approach be adopted in respect of leverage, based on size and rating of the CICs instead of a ‘one size fits all’ restriction of 2.5 times of ANW. Another suggestion received was that along with individual leverage ratio, consolidated leverage ratio should be studied for assessing the risks in a holistic manner. (iii) Multiple Gearing/ Leverage: On the issue of allowing more than one CIC in a single group a suggestion was received that for large business houses multiple CICs for separate business verticals helped in attracting external investors and improved control of each vertical. However, CICs within a group should be restricted to a maximum of two levels, viz. one CIC at the top of the group (parent) which could hold investment in the step-down CICs and the step down CICs should be at the top of a logically explicable business vertical. The WG noted the complex structure of IL&FS, wherein it had four level of companies below the main CIC. Another suggestion was that there should be only one CIC in each group which may act as a holding company and raise funds for all group companies. It was argued that this will ensure a simplified structure and better control. (iv) Group Level Leverage and CRAR: One CIC representative suggested that prescription of leverage ratio for CICs should be restricted to 2 instead of present 2.5. Further, in order to restrict scope of build-up of high leverage at group level, a consolidated CRAR for CICs at 15% and core CRAR at 12% should be prescribed. (v) Related Party Transactions (RPT): Suggestions were made that the details of the operating entities (wherein the CICs have exposure) such as nature of business, net worth of the investee companies, their credit rating (if any) and such other critical information like any change in management during the period etc., may be disclosed. It was suggested that RPT between Financial and Non- Financial concerns of the group and sectoral exposures may also be disclosed. (vi) Asset Liability Management: The inflows of funds for a CIC is mainly dividend income from its group companies which is received annually after finalisation of Balance Sheet of the investee companies. Hence, monthly ALM statement shows mismatch. On this aspect, a suggestion was received that a simplified reporting requirement for CICs based on their size and interconnectedness could be designed. Further, investments in listed equity shares of the group entities may be classified as HQLA for meeting outflows in the pre-defined period. (vii) Background guidelines on CICs Discussions were also held with ex Deputy Governor and currently Chairperson of HDFC Bank Smt. Shyamala Gopinath who put forth the perspective and background to the guidelines for CICs issued in 2011-12. The extant framework was largely made with an intention to safeguard the asset side. Considering the growth in CICs both in terms of size and complex group structures, she suggested that the group may take a relook on prescribed Leverage ratio and the regulations on the liability side. Chapter III: Recommendations The issues relating to the structure and functioning of Core Investment Companies and the recommendations crystallized by the WG on the regulatory framework and the supervisory approach that could be considered for adoption by the Reserve Bank are discussed below. III.1 Issue: Multiple Gearing and Excessive Leveraging Currently, any number of CICs can exist in a group, and unlike other NBFCs, the CICs can invest in each other’s capital without deduction of their own capital. Consequently, a CIC can borrow (upto 2.5 times of its Adjusted Net Worth) to invest in the capital of other CICs in the group and the latter could further borrow against this capital. This leaves scope for multiple gearing on the same capital and cause excessive leverage at the Group level. As shown in the chart at Annex 1, a CIC’s capital of ₹ 100 can be leveraged upto 11.25 times if there are two CICs in a Group, which is considerably higher than the leverage of 7 permitted for NBFC- Non-ND-SI and 6.6 permitted for NBFC-ND-SIs (considering a prescribed CRAR of 15%). With the addition of more CICs, the scope of leverage at group level could increase exponentially. The operating companies and NBFCs, if any, in the group, are eligible to raise funds directly from banks and the markets, besides getting funding from the group CICs. In this scenario, the group level leverage can become excessive and also be difficult to monitor. Observation of Working Group: The members observed that the issue of excessive leverage could be addressed by any one or a combination of the following: (a) reducing the eligibility to borrow from 2.5 times of ANW to a lower level and / or (b) altering the method for calculation of ANW by: -

Excluding the unrealised appreciation (allowed upto 50%) in the quoted investments of the CIC; -

Deducting the capital contribution of one CIC in other CICs / NBFCs of the Group from ANW of the investing CIC; With regard to (a) and (b)(i) above, it was felt that for a standalone CIC, the leverage of 2.5 times of ANW was lower than that allowed for NBFCs which was about 7 times of its capital. As such, there was no need to change either 2.5 times or the definition of ANW. In view of the above, the WG recommends the following: Recommendation 1 For ANW calculation, any capital contribution of the CIC to another step-down CIC (directly or indirectly) shall be deducted over and above the 10% of owned funds as applicable to other NBFCs. Further, step-down CICs may not be permitted to invest in any other CIC. Existing CICs may be given a glide path of 2 years to comply with this recommendation. III. 2. Issue: Complex Group Structures CICs are often part of large business conglomerates having multiple companies and business lines spread across India and abroad. A few such group structures were found to be complex due to multiple layers and cross holdings. Observation of Working Group: The complexity of large conglomerates was a matter of concern as it rendered opacity to the group in terms of ownership, controls and Related Party Transactions. The Companies’ Act 2013 restricts the Group Structure to a maximum of three layers (including the top layer) which while simplifying group structures also controls excessive leverage. However, the NBFCs are exempted from this provision of the Companies’ Act, which has facilitated the proliferation of multiple layers of CICs in a Group (with cross holdings). Recommendation 2 The number of layers of CICs in a group should not exceed two, as in case of other companies under the Companies Act, which, inter alia, would facilitate simplification and transparency of group structures. As such, any CIC within a group shall not make investment through more than a total of two layers of CICs, including itself. For complying with this recommendation, RBI may give adequate time of say, two years, to the existing groups having CICs at multiple levels. III.3 Issue: Build-up of high leverage and other risks at group level The WG deliberated on the issues pertaining to the aggregate leverage i.e. amount of borrowings raised by both financial and non-financial entities. It was observed by a member that the standalone leverage of IL&FS (a CIC) was within the regulatory limit. However, when calculated at consolidated level it was considerably high as on March 2018. Observation of Working Group: The WG acknowledged that, except for listed CICs which are required to prepare consolidated financial statements, it was difficult to calculate and monitor the leverage of a conglomerate at the group level, considering that several entities of the group, below the CIC may be unregulated. The WG also observed that while presently, leverage appears to be one of the main risks with respect to a CIC, monitoring of other internal and external risks arising at the group level is also important. There is, therefore, a need for a strong and effective group governance policy which should cover among other things, build-up of leverage at group level. Recommendation 3 Every conglomerate having a CIC should have a Group Risk Management Committee (GRMC) which, inter alia, should be entrusted with the responsibilities of (a) identifying, monitoring and mitigating risks at the group level (b) periodically reviewing the risk management frameworks within the group and (c) articulating the leverage of the Group and monitoring the same. Requirements with respect to constitution of the Committee (minimum number of independent directors, Chairperson to be independent director etc.), minimum number of meetings, quorum, etc. may be specified by the Reserve Bank through appropriate regulation. III. 4 Issue: Corporate Governance Guidelines The WG deliberated on the fact that over the years, large groups with multiple business lines and complex structures have set up more than one CIC in a group which reduces the transparency and at times the CICs take exposures without requisite due diligence or application of commercial judgment. Presence of common directors in the recipient company and those of the CIC, may deprive the CIC of a system of independent checks and balances. The lack of regulations on Corporate Governance for the CICs raises the scope for intra-group transactions wherein the commercial interest of the RBI Regulated Entity (RRE) becoming subservient to the requirements of the group. In this context, CICs by virtue of their good external ratings can raise funds even for poorly performing group companies at competitive rates. It is observed that at times CICs extend loans to group companies at a zero percent rate of interest with provision for bullet repayment. As a corollary, CICs based on their standing, also extend guarantees to enable the group companies raise funds at lower costs. Observation of Working Group: The WG felt that it was crucial that the Boards of CICs function keeping in perspective good corporate governance standards. Accordingly, CICs may be encouraged to get themselves listed on stock exchanges, which attracts transparency and best governance standards along with market discipline. However, as a step in that direction, drawing from the Companies’ Act and Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 the Reserve Bank may consider implementing certain standards of governance for unlisted CICs, as indicated below: Recommendation 4 i. At least one third of the Board should comprise of independent members if chairperson of the CIC is non-executive, otherwise at least half of the Board should comprise of independent members, in line with the stipulations in respect of listed entities. Further, to ensure independence of such directors, RBI may articulate appropriate requirements like fixing the tenure, non-beneficial relationship prior to appointment, during the period of engagement and after completion of tenure, making removal of independent directors subject to approval of RBI etc. ii. There should be an Audit Committee of the Board (ACB) to be chaired by an Independent Director (ID). The ACB should meet at least once a quarter. The ACB should inter-alia be mandated to have an oversight of CIC’s financial reporting process, policies and the disclosure of its financial information including the annual financial statements, review of all related party transactions which are materially significant (5% or more of its total assets), evaluation of internal financial controls and risk management systems, all aspects relating to internal and statutory auditors, whistle-blower mechanism etc. In addition, the audit committee of the CIC may also be required to review (i) the financial statements of subsidiaries, in particular, the investments made by such subsidiaries and (ii) the utilization of loans and/ or advances from/investment by CIC in any group entity exceeding rupees 100 crore or 10% of the asset size of the group entity whichever is lower. iii. A Nomination and Remuneration Committee (NRC) at the Board level should be constituted which would be responsible for policies relating to nomination (including fit and proper criteria) and remuneration of all Directors and Key Management Personnel (KMP) including formulation of detailed criteria for independence of a director, appointment and removal of director etc. iv. All CICs should prepare consolidated financial statements (CFS) of all group companies3 (in which CICs have investment exposure). CIC may be provided with a glide path of two years for preparing CFS. In order to strengthen governance at group level, if the auditor of the CIC is not the same as that of its group entities, the statutory auditor of CIC may be required to undertake a limited review of the audit of all the entities/ companies whose accounts are to be consolidated with the listed entity. v. All CICs registered with RBI should be subjected to internal audit. vi. While there is a need for the CIC’s representative to be on the boards of its subsidiaries / associates etc., as necessary, there is also a scope of conflict of interest in such situations. It is therefore recommended that a nominee of the CIC who is not an employee / executive director of the CIC may be appointed in the Board of the downstream unlisted entities by the respective CIC, where required. III.5 Issue: Review of Exempt Category and Registration The members expressed the view that at present CICs with assets below the qualifying threshold (₹ 100 crore asset size) or CICs without public funds do not require RBI registration and hence are called “exempted” CICs. Observation of Working Group: The WG observed that this nomenclature, though not formally conveyed, was occasionally referred to in correspondence etc., which provided unintended credibility to such CICs, as ‘exempted’ by the RBI, and created scope for misrepresentation. A need was felt by the WG to ensure that such entities should not take advantage of the existing regulations. It was observed that this needed to be tackled. Recommendation 5 -

The current threshold of ₹ 100 crore asset size for registration as CIC may be retained. All CICs with public funds and asset size of ₹ 100 crore and above may continue to be registered with RBI. CICs without access to public fund need not register with the Reserve Bank. -

The nomenclature of ‘exempted’ CIC in all future communications / FAQs etc. published / issued by the Reserve Bank should be discontinued. III.6 Issue: Enhancing off-site surveillance and on-site supervision over CICs Observation of Working Group: No off-site reporting requirement is prescribed for CICs. Also, submission of Statutory Auditors Certificate is not mandated in respect of CICs, unlike other NBFCs. Till recently on-site inspection of CICs was also not being conducted. In addition to financials statements data and regulatory ratios, the WG is of view that the off-site return must capture the details of group structure and shareholding pattern of the CICs. The details must be captured at the time of issuing a Certificate of Registration (CoR) to a new CIC or at the time of processing other approvals like change of management etc., and any change should be updated through off site returns. The group structure will help in developing a database on the structures of the conglomerates, of which, the CIC/NBFCs is/ are a part. This will result in in early assessment of the impact of the difficulties of other / unregulated entities in the group on the regulated NBFCs. Recommendation 6 Offsite returns may be designed by the RBI and prescribed for the CICs on the lines of other NBFCs. These returns may inter alia include periodic reporting (e.g. six monthly) of disclosures relating to leverage at the CIC and group level. A CIC may also be required to disclose to RBI all events or information with respect to its subsidiaries which are material for the CIC. Annual submission of Statutory Auditors Certificates may also be mandated. Onsite inspection of the CICs may be conducted periodically.

Annex-1 | Table – Potential leverage in case of two layers of CIC | | | 1st Layer | 2nd Layer | Total Leverage | | Scenario | Permissible Leverage Ratio | Capital | Borrowed Funds | Total Assets | Capital | Borrowed Funds | Total Assets | | 1 | 2.5 | 100 | 250 | 350 | 350 | 875 | 1225 | 11.25 | | 2 | 2.25 | 100 | 225 | 325 | 325 | 731 | 1056 | 9.56 | | 3 | 2 | 100 | 200 | 300 | 300 | 600 | 900 | 8.00 | | 4 | 1.75 | 100 | 175 | 275 | 275 | 481 | 756 | 6.56 | | 5 | 1.5 | 100 | 150 | 250 | 250 | 375 | 625 | 5.25 | | 6 | 1.25 | 100 | 125 | 225 | 225 | 281 | 506 | 4.06 | | 7 | 1 | 100 | 100 | 200 | 200 | 200 | 400 | 3.00 | | Note- Total Leverage is calculated as (total borrowed funds)/(Original Capital) |

|