The Systemic Risk Survey (SRS), the tenth in the series, was conducted in April-May 20161 to capture the perceptions of experts, including market participants, on the major risks presently faced by the financial system. The results indicate that global risks continued to be perceived as major risks affecting the financial system. The risk perception on macroeconomic conditions have relatively increased in the current survey though remained in the medium risk category. Market risks have been perceived to be moderated. On the other hand, the Institutional risks moved to the high risk category (Figure 1). Within global risks, the risk of a global slowdown, though marginally receded, remained in high risk category, whereas the global inflation risks indicated a downward shift within the medium risk category. Within the macroeconomic risk category, risk of domestic inflation increased to the medium risk category, while risk on account of capital flows declined. The corporate sector risks remained elevated in the high risk category. The respondents have felt that the equity price volatility and funding risk have increased, while the foreign exchange risk has moderated. Among the institutional risks, the asset quality of banks was still perceived as a high risk factor, with the risk on account of capital requirement increased (Figure 2).

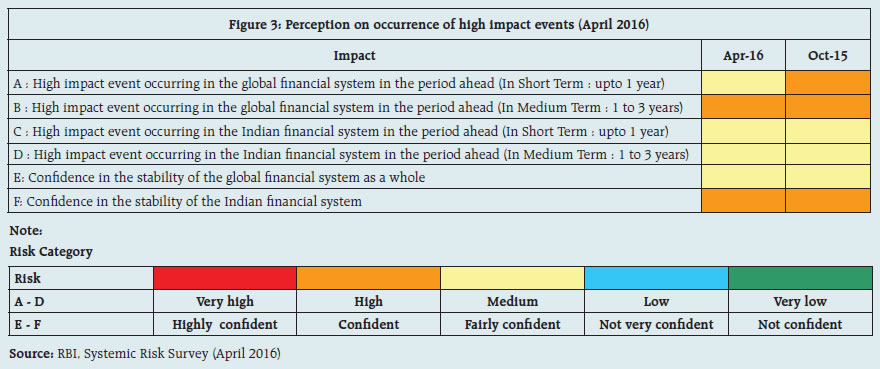

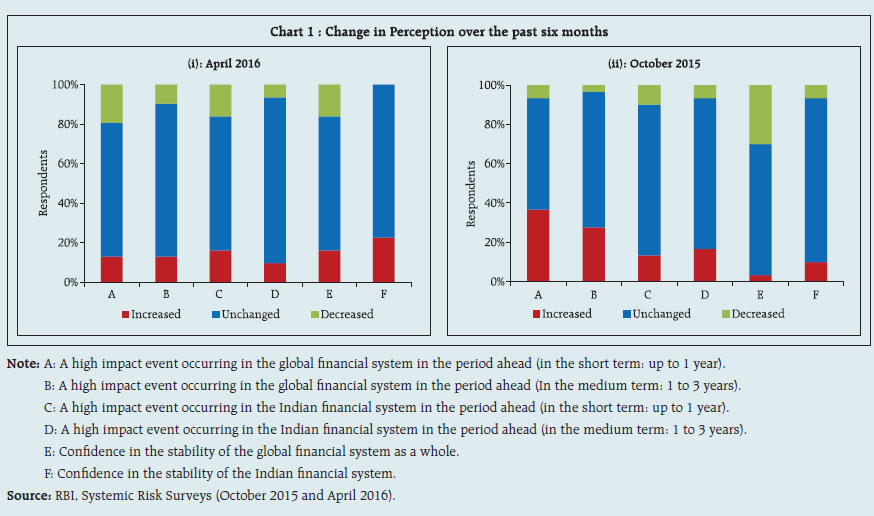

Participants in the current round of survey felt that the possibility of a high impact event occurring in the global financial system in the short term period is medium, however, such a possibility could be high in the medium term. Their confidence in the global financial system was moderate, although a greater number respondents indicated that their confidence has marginally increased during the past six months. It was further felt that there is ‘medium’ possibility of an occurrence of a high impact event in the Indian financial system in the period ahead (short to medium term) even as the respondents continued to show their high confidence in the Indian financial system (Figure 3 and Chart 1).

On the issue of likely changes in demand for credit in the next three months, the majority of the respondents were of the view that it might increase marginally, while others felt it may remain unchanged. A majority of the respondents indicated that the average quality of credit would remain unchanged in the next three months, though, a large group of respondents also perceived that it is likely to deteriorate further (Chart 2).

|