The quality of expenditure is at centre-stage of the dynamics of subnational level fiscal consolidation in India. Empirical evaluation indicates that expenditure on public infrastructure, human capital, science and technology can be growth and welfare enhancing by improving capital and labour productivity. The quality of expenditure of most Indian states has modestly improved following the enactment of FRBM. States need to prioritize expenditure on physical and social infrastructure and economise on non-essential heads. 1. Introduction 2.1 Confronted with unsustainable levels of fiscal deficits and/or public debt and their adverse macroeconomic implications, governments across countries have embarked upon corrective strategies to adjust key fiscal parameters to levels that are sustainable in the context of the state of the economy. These efforts are typically driven by rules that limit deficits, debt, expenditure or a combination thereof. Fiscal adjustment strategies have been attempted in the form of revenue enhancement or expenditure compression or usually, a combination of both. The presence of nominal rigidities sets up trade-offs – a quantity-centric fiscal adjustment invariably involves compromises in terms of qualitative aspirations of fiscal authorities. In view of the committed nature of certain categories of expenditure, the imperative of achieving quantitative targets forces the curtailment of expenditures that are regarded as ‘productive’ since they provide positive externalities in terms of enhancing growth and efficiency. In recent years, however, prolonged periods of sluggish growth have brought these issues to the centre stage of the still unsettled debate on the optimal dynamics of fiscal consolidation. In this context, fiscal consolidation through quantity adjustments should not compromise on expenditure quality. 2.2 Fiscal consolidation at the sub-national level in India has been undertaken under a rule based framework through the enactment of fiscal responsibility and budget management (FRBM) legislations, although there are subtle variations in terms of design and features across states. Resource constraints have forced cutbacks in outlays on social and physical infrastructure in the wake of inflexibilities in committed expenditures and subsidies, with near-term as well as more drawn out implications for societal welfare. Consequently, careful assessment of the growth and efficiency enhancing effects of alternative mixes of government expenditure assumes critical importance if the best effects of fiscal rectitude have to be seized. In particular, it is imperative that states do not sacrifice growth inducing expenditures even as they put in place mechanisms for enhancing expenditure efficiency within the overall framework of fiscal consolidation. 2.3 Despite its importance from a ‘public good’ perspective, the quality of expenditure at the sub-national level has received less attention than it deserves. Analysis of the relationship between public expenditure and economic growth/ development has engaged economists since the late 19th century1. Diamond (1989) found empirical evidence that capital spending, particularly on health, housing and welfare has positive effect on growth. Endogenous growth theory turned attention to the macroeconomic effects of the quality of government spending, with investment in human capital, innovation, and knowledge being significant contributors to economic growth (Romer, 1986; Lucas, 1988; Rebelo, 1991). It is argued that in a knowledge-based economy, sustained investment in human capital would result in positive externalities which would perpetuate the growth process for a protracted period of time leading to overall economic development (Barro and Salai-Martin, 1992). Against this backdrop, this chapter analyses state finances with the specific objective of shedding light on its theme “Quality of Expenditure”. Section II draws out the lessons of the country experience. The quality of expenditure across Indian states and its impact on economic growth and equity are empirically explored through descriptive statistics and technical analysis in Section III. This section also dwells on the impact of FRBM implementation on expenditure quality at the state level. Section IV presents concluding observations. 2. Cross-Country Experience 2.4 Empirical evaluation of the impact of different categories of expenditure on growth/ development has been largely inconclusive although a loose consensus has formed around the view that specific categories of government expenditure such as on public infrastructure, human capital, science and technology can be growth and welfare enhancing by improving capital and labour productivity (Tanzi and Zee, 1997). Moreover, public investment in social and physical infrastructure is observed to play a complementary role in crowding in private investment, particularly in the case of developing economies (Erden and Holcombe, 2005). It has also been pointed out that public expenditure needs to encompass both growth and equity considerations (Pattnaik et al., 2005; Daniel et al., 2006). 2.5 Country studies, both time series and panel, have reported growth enhancing effects of public expenditure on physical infrastructure such as transport, communications and defense (Baum and Lin, 1993; Devarajan, 1993; Ramirez, 2004). Similar results have been reported for South Africa, Chile (Albala-Bertrand and Mamatzakis, 2001) and Kenya (M’Amanja and Morrissey, 2005). 2.6 Fiscal multipliers are found to be sizable for productive capital spending in the countries constituting the Gulf Cooperation Council (GCC), despite important leakages through imports and remittances (Espinoza and Senhadji, 2011). Similarly, an increasing share of capital investment is found to have boosted per capita growth in thirty three small countries in Asia, Africa and the Pacific region – the impact being stronger in small states in the Asia and Pacific region, consistent with their larger development needs (Cabezon et al, 2015). On the other hand, Devarajan et al (1996) report the opposite for a sample of 43 developing countries over the period 1970-90 – while an increase in the share of current expenditure had positive effect on growth, capital expenditure had a negative impact – probably due to misallocation of expenditure. In the Brazilian context, capital expenditure is found to have a negligible impact on economic growth, possibly indicating that economies of scale are not being reaped (Busatto and Brunori, 2011). 2.7 Regarding the growth inducing effects of social sector expenditure such as health, education and water, positive effects have been reported (Nijkamp and Poot, 2004; Ramirez, 2004; Cullison, 1993; Devarajan, 1993). On the contrary, health care spending is found to be unfavourable to growth in Switzerland (Singh and Weber, 1997). In the Indian context, state-level data for the period 1990-2002 showed that higher government spending on public goods such as health and education had a positive impact on per capita GSDP growth and reduced poverty (Hong and Ahmed, 2009). 2.8 In the context of fiscal consolidation, expenditure reform can improve the efficiency of spending even without pruning the level of expenditure by freeing resources to help meet new needs and improve governance and transparency (Gupta et al., 2005). In this regard, reallocation of total spending in favour of infrastructure and education has a positive impact on long-run growth while a deficit financed increase in public expenditure has negative effects (Acosta- Ormaechea, 2013; Gemmell et al., 2014). In the Indian context, a qualitative shift in expenditure from revenue to capital without altering the level of fiscal deficit is found to lead to higher growth albeit with mild inflation pressures (Misra, 2012). Moreover, capital outlay is observed to have a prolonged multiplier effect which continues up to four years, underscoring the need to prioritize capital expenditure (Jain and Kumar, 2013; Bose and Bhanumurthy, 2013). 2.9 Based on the review of literature, it may be inferred that a shift in the composition of public expenditure towards human and physical capital would not only be growth enhancing but also welfare augmenting for the society as a whole, notwithstanding some evidence to the contrary. The channels through which this works are: (i) increase in capital and labour productivity; (ii) crowding in of private investment; (iii) higher fiscal multipliers; and (iv) direct/indirect impact on poverty and unemployment reduction. Given that the empirical evidence on quality of expenditure at the sub-national level is quite limited and somewhat ambivalent, especially in the Indian context, an attempt has been made to examine the gamut of issues around it at the state level in the ensuing section. 3. Government Expenditure – Empirical Analysis2 3.a The Backdrop 2.10 Limited space for garnering additional revenue notwithstanding, states’ aggregate expenditure3 (as proportion to GSDP) – both nonspecial category (NSC)4 and special category (SC)5 – accelerated during 2014-15 (RE) (Chart II.1-A). In particular, revenue expenditure of NSC states rose to 15.7 per cent of GSDP, with implications for the quality of expenditure (Chart II.I-B).  2.11 Interest payments, administrative services and pensions, which are in the nature of committed expenditure, account for a dominant portion of non-development revenue expenditure of states. With a noteworthy decline in interest payments on loans due to the debt swap scheme (DSS) and the debt consolidation and relief facility (DCRF), the ratio of interest payments to revenue receipts (IPRR) has been broadly contained below 15.0 per cent - the level prescribed by the twelfth finance commission (FCXII). Nevertheless, the rising trend in the committed expenditure-GSDP ratio in recent years is a cause for concern (Chart II.2-A). It is set to rise even further as the implementation of the recommendations of the seventh central pay commission (CPC-VII) may have a cascading impact on salary and pension burdens across states. 2.12 In 2012-13, when the Sixth Pay Commission (CPC VI) award was implemented, the share of expenditure on pay and allowances of all employees in revenue expenditure (net of interest payments and pensions) ranged from 28.9 per cent to 79.1 per cent across states (FC-XIV, 2014). While CPC V had a cumulative impact of 1.0 per cent of GSDP for states over a two year period (Mohan, 2008), the total impact of CPC VI on state finances was about 1.4 per cent of GSDP over a two year period (Kumar and Krishna, 2015). CPC VII may have an average impact of 0.9 per cent of GDP on revenue and fiscal deficit of combined government finances over the duration of FC XIV, premised on the assumption of a growth of 15 per cent in other revenue expenditure for 2016-17- the year of implementation of CPC VII (Bhanumurthy et al., 2015). 2.13 Besides salary expenditure, growing pension liabilities could be another major source of fiscal strain for states in the future. Illustratively, the pension liabilities of states at an aggregate level have almost doubled between 1997-98 and 2014- 15 RE (Chart II.2-B). With CPC VII recommending one rank one pension for all central government employees, demonstration effects on states may exacerbate fiscal strain. 2.14 Aggregate capital expenditure (capital outlay plus loans and advances) of states has remained almost stagnant over the years as a proportion to GSDP. There has been a moderate increase in expenditure on physical infrastructure in housing, roads and bridges between 2009-10 and 2015-16. 2.15 Expenditure on the social sector is associated with large positive externalities. A major portion of social sector expenditure has been in the form of revenue expenditure rather than capital outlay. While social sector expenditure is usually vulnerable to austerity measures, aggregate social sector expenditure of states has increased as a proportion to GSDP, even after the enactment of fiscal responsibility legislation by the states. 3.b Some Stylised Evidence6 2.16 Given the positive externalities associated with expenditure on social and physical infrastructure, it is expected that the expenditure pattern on these heads would converge across states over a period of time. There is, however, significant variation in expenditure on social and physical infrastructure among states in terms of both composition and the level of spending (Chart II.3). Expenditure on physical infrastructure shows greater variability, with energy being the most volatile component. By contrast, states’ spending on the social sector exhibits stability and is dominated by outlays on education.  2.17 Majority of the NSC states incurred expenditure on social and physical infrastructure (as proportion to aggregate expenditure) below the group average; indicative of the presence of sharp outliers (Chart II.4). Two features are noteworthy: (a) states’ spending on medical and public health has tended to exhibit a central tendency, with a greater degree of cluster around the average (NSC states) relative to expenditure on energy7 which is at the other end of the spectrum in terms of dispersion from the average.  2.18 At a disaggregated level, average social sector expenditure on education and health8 is higher among Group ‘A’9 states than the remaining two groups, indicative of the impact of income levels on the quality of expenditure (Table II.1). In respect of physical infrastructure, expenditure on roads and bridges is highest for Group ‘C’ states, pointing to a greater focus on deepening basic developmental requirements. For Group ‘B’ states, however, committed expenditure is, on average, higher than other income groups which somewhat constrains the fiscal space for expenditure on social and physical infrastructure (Table II.1). 2.19 As noted above, states in lower income brackets need to improve social sector spending, given the correlation of around 0.5 between expenditure on health and education and the human development index (HDI) of NSC states. These adjustments would enhance labour productivity and enable states to reap the benefits of the “demographic dividend”. | Table II.1: Expenditure on Select Indicators as percentage of aggregate expenditure (2013-14) | | States | Social Sector | Physical Infrastructure | Committed Expenditure | | Education | Health | Roads & Bridges | Energy | Int. Pay. | Pension | Admin. Exp. | | Group A | | | | | | | | | Goa | 16.4 | 5.8 | 4.7 | 16.9 | 11.4 | 7.2 | 5.8 | | Maharashtra | 21.7 | 3.8 | 4.8 | 4.8 | 12.0 | 7.3 | 7.9 | | Haryana | 16.2 | 3.5 | 5.6 | 12.0 | 12.6 | 8.9 | 5.9 | | Gujarat | 15.9 | 4.6 | 5.8 | 5.8 | 13.5 | 8.4 | 4.0 | | Tamil Nadu | 16.7 | 3.8 | 4.2 | 3.9 | 9.6 | 11.5 | 4.8 | | Mean | 17.4 | 4.3 | 5.0 | 8.7 | 11.8 | 8.7 | 5.7 | | CV | 12.6 | 19.4 | 12.0 | 57.6 | 11.1 | 13.5 | 23.3 | | Group B | | | | | | | | | Kerala | 18.0 | 5.0 | 4.6 | 0.3 | 12.5 | 15.1 | 5.0 | | Punjab | 15.4 | 4.1 | 1.7 | 11.0 | 17.8 | 14.3 | 11.7 | | Karnataka | 15.5 | 3.8 | 6.6 | 6.0 | 7.3 | 8.6 | 4.7 | | Andhra Pradesh | 14.5 | 3.9 | 3.4 | 5.9 | 10.0 | 10.6 | 5.7 | | West Bengal | 18.8 | 4.3 | 2.1 | 2.0 | 20.9 | 11.7 | 5.7 | | Mean | 16.4 | 4.2 | 3.7 | 5.0 | 13.7 | 12.0 | 6.6 | | CV | 10.2 | 9.9 | 48.5 | 73.2 | 36.4 | 20.3 | 39.6 | | Group C | | | | | | | | | Rajasthan | 17.1 | 4.2 | 4.1 | 12.4 | 10.1 | 8.7 | 4.6 | | Jharkhand | 14.3 | 3.8 | 7.4 | 6.0 | 9.2 | 12.3 | 11.5 | | Chhattisgarh | 18.3 | 3.6 | 7.2 | 1.3 | 3.5 | 7.1 | 7.0 | | Madhya Pradesh | 16.1 | 3.6 | 4.3 | 9.7 | 7.5 | 6.9 | 5.6 | | Odisha | 15.7 | 3.3 | 7.0 | 2.1 | 5.4 | 11.0 | 7.1 | | Uttar Pradesh | 16.7 | 3.5 | 6.8 | 6.2 | 9.0 | 10.1 | 6.4 | | Bihar | 19.5 | 2.9 | 7.1 | 7.6 | 7.1 | 12.3 | 6.7 | | Mean | 16.8 | 3.6 | 6.3 | 6.5 | 7.4 | 9.8 | 7.0 | | CV | 9.4 | 10.9 | 21.2 | 56.5 | 29.3 | 21.4 | 28.9 | | All NSC States | | | | | | | | | Mean | 16.9 | 4.0 | 5.1 | 6.7 | 10.5 | 10.1 | 6.5 | | CV | 10.9 | 16.6 | 33.3 | 64.8 | 39.4 | 24.0 | 32.6 | 3.c Assessing the Quality of Expenditure 2.20 In order to assess expenditure quality, the methodology of cardinal scores employed in the literature (Morris and McAlpin, 1982; Bhide and Panda, 2002; Dholakia, 2005) is applied to data on states’ finances for the period 2003-04 to 2013-14 broken into three sub-periods – pre-crisis years (2003-04 to 2007-08); the global financial crisis (2008-09 to 2009-10); and post-crisis years (2010-11 to 2013-14) – to assess the impact of structural breaks and also as a robustness check. During the crisis, a few state governments announced dedicated fiscal stimulus packages in order to boost demand, while many other states announced sector specific tax reductions in order to deal with the resulting slowdown (RBI, 2010).10 Minimum and maximum values of four indicators representing expenditure on health, education, roads and bridges, and energy as a proportion to the state’s own tax revenue are identified. For each indicator, the score of each state is mapped to a scale of 0 to 100 where 0 represents minimum performance and 100 represents maximum performance.11 2.21 During the global financial crisis, expenditure on education, health and roads and bridges increased for all three income categories of states (Table II.2). As the emphasis on fiscal consolidation was renewed in the post-crisis years, expenditure scores have moderated and so has expenditure quality.12 Scores on energy expenditure, however, do not show any increase during the crisis period since such expenditures are usually huge and often met through borrowed funds. 3.d Impact of Public Expenditure on Growth13 2.22 The impact of different types of government spending on per capita GSDP growth is explored at the state level. In order to examine the growth-expenditure relationship, it is hypothesised that higher share of capital outlay and developmental expenditure in total government spending have a positive impact on per capita GSDP growth of states. To test this hypothesis empirically, a dynamic panel model is estimated in the tradition of Cabezon et.al, (2015) comprising NSC states over the period 2001-02 to 2013-14 (221 observations). Per capita GSDP growth is regressed on the gross fiscal deficit (GFD) as a proportion to GSDP (GFD/GSDP), the ratio of public debt to GSDP (as in Baldacci et al., 2004) and on the share of four important expenditure categories – capital outlay, revenue expenditure, development and non-development expenditure in total expenditure (following Devarajan et al., 1996). | Table II.2: Scores of select expenditure items of NSC States | | State Category | Social Sector | Physical Infrastructure | | Education | Health | Roads and Bridges | Energy | | Pre- crisis | Crisis | Post- crisis | Pre- crisis | Crisis | Post- crisis | Pre- crisis | Crisis | Post- crisis | Pre- crisis | Crisis | Post- crisis | | Group A | 6.5 | 9.8 | 8.8 | 8.3 | 11.3 | 11 | 9 | 15.5 | 10.7 | 9.6 | 8 | 7 | | Group B | 10.3 | 10.8 | 11.3 | 18.3 | 20.7 | 19.7 | 9.8 | 11.4 | 9.8 | 9.9 | 9.7 | 6.6 | | Group C | 25.8 | 29.1 | 26.4 | 38 | 37.2 | 28.8 | 25 | 32.1 | 25.8 | 24.1 | 14.2 | 14.3 | | NSC States | 12.8 | 15.4 | 14.5 | 19.4 | 21.5 | 18.7 | 13.4 | 18.7 | 14.6 | 13.5 | 10.3 | 8.9 | 2.23 Panel data unit root tests developed by Levin et al. (2002) and Im et al. (2003) reject the null of a unit root for all the variables in the data. The impact of various government expenditure categories on per capita GSDP growth of states is estimated using dynamic panel Generalised Method of Moments (GMM) estimation (Arellano and Bond, 1991), which allows to correct for state-specific individual effects and the endogeneity of the explanatory variables by instrumenting with lagged explanatory variables.14 2.24 Four different models have been estimated: model 1 studies the impact of capital outlay on per capita GSDP growth while models 2, 3 and 4 examine the effects of revenue, development and non-development expenditure, respectively. Estimation results presented in Annex 1 are intuitively appealing: (i) a higher deficit has a negative impact on growth; (ii) a non-linear impact of the debt-GSDP ratio on per capita growth is consistent with the literature (IMF, 2012) – while low levels of debt are found to be conducive for growth, higher levels are growth-retarding; (iii) enhancing the share of capital outlay and development expenditure in total spending stimulates per-capita GSDP growth while revenue and non-development expenditures are found to have negative consequences.15 Overall, the results are in conformity with earlier studies (Misra, 2012; Bose and Bhanumurthy, 2013). These empirical findings suggest that switching the composition of expenditure of the states in favour of capital outlay, while containing the fiscal deficit, has positive implications for growth. 3.e Impact of Public Expenditure on Efficiency - A Case Study of the Education Sector 2.25 In gauging the efficiency of government spending, there is a need to go beyond a strictly accounting view of public expenditure and instead adopt a social welfare maximisation approach (Gupta and Verhoeven, 2001; Herrera and Pang, 2005). Alternative techniques such as Stochastic Frontier Analysis (SFA), Data Envelopment Analysis (DEA) and Free Disposable Hull (FDH) have been developed to assess the efficiency and effectiveness of government expenditure. Among them, the FDH makes fewer assumptions in contrast to the DEA and the SFA. Moreover, it lends practical utility for policy analysis as it is a non-parametric technique unlike the SFA and does not assume convexity of the production frontier as assumed under the DEA (Muhabir, 2011). 2.26 The FDH efficiency scores of education attainment are computed for the period 2005-06 to 2012-13 in respect of income group A, B, C for NSC states and separately for SC states.16 These average efficiency scores are measured using two inputs (public expenditure and teacher-student ratio) and two outputs (gross primary and upper primary school enrolment)17. 2.27 The average efficiency scores vary across Groups and year (Table II.3). In recent years (2011- 12 and 2012-13), the efficiency frontiers in both input-oriented and output oriented methods are essentially defined by Group ‘A’ states.18 These states have also managed to improve and attain full efficiency in both measures (in a relative sense) over the years. Interestingly, Group ‘C’ states seem to outperform Group ‘B’ states as indicated by their average efficiency scores, although the difference is not large. In terms of input oriented scores, the ‘SC’ states have generally lower scores compared to all other groups. 2.28 From an input-oriented point of view, Group ‘A’ states has an efficiency score of 0.86 in 2005-06, implying that these states could reduce 14 per cent (i.e. 100 minus 86) of their resources to achieve given levels of output, i.e., these states on an average were employing excess resources of nearly 14 percent. Similarly, the output oriented results, which show an efficiency score of 0.81 in the same year for Group ‘A’ states, means that output quantities could be increased by 19 per cent with the same level of inputs. Over the period of analysis, the average scores for both input and output efficiency of Group ‘A’ states have gradually increased whereas no such tendency is evident for the other groups. Therefore, the other Groups need to follow the best practices of Group A so that they can move towards the frontier over time. 3.f. Impact of FRBM 2.29 A well-designed fiscal responsibility legislation (FRL) helps in containing fiscal deficits and rationalizing expenditure biases, while addressing the problem of time inconsistency and enhancing transparency and accountability (Corbacho and Schwartz, 2007). In India, FRBM legislations were passed by states at different points of time and consequently, the number of years considered for the analysis of the impact of FRBM on state finances is not uniform across states. To maintain consistency in the analysis, however, equal number of years are taken before and after implementation of FRBM by each state to calculate the average for the period 1991-92 to 2013-14. The five broad fiscal indicators considered are total expenditure, revenue expenditure, capital outlay, developmental and non-developmental expenditure. All the indicators are normalised in terms of gross state domestic product (GSDP) of respective states at current prices. States are grouped into A, B and C categories in terms of their real per capita incomes in 2013-14. | Table II.3: Free Disposable Hull (FDH) efficiency scores, by groups of states | | Year | Input orientated | Output orientated | | A | B | C | SC | A | B | C | SC | | 2005-06 | 0.86 | 0.90 | 0.98 | 0.84 | 0.81 | 0.82 | 0.97 | 0.92 | | 2006-07 | 0.83 | 0.88 | 0.97 | 0.76 | 0.88 | 0.91 | 0.93 | 0.95 | | 2007-08 | 0.73 | 0.85 | 0.91 | 0.79 | 0.77 | 0.91 | 0.96 | 0.95 | | 2008-09 | 0.74 | 0.86 | 0.90 | 0.77 | 0.79 | 0.90 | 0.96 | 0.97 | | 2009-10 | 0.96 | 0.94 | 0.91 | 0.83 | 0.87 | 0.92 | 0.94 | 0.96 | | 2010-11 | 0.94 | 0.92 | 0.95 | 0.8 | 0.96 | 0.91 | 0.98 | 0.96 | | 2011-12 | 1.00 | 0.86 | 0.92 | 0.81 | 1.00 | 0.95 | 0.97 | 0.97 | | 2012-13 | 1.00 | 0.94 | 0.95 | 0.82 | 1.00 | 0.95 | 0.96 | 0.95 | 2.30 Significantly, 13 out of the 17 NSC states have been successful in reducing the proportion of their total expenditure to GSDP after implementation of FRBM (Table II.4). Interestingly, five states (three in group ‘A’ and two in group ‘C’) have experienced an expenditure reduction of two percentage points and above, which is noteworthy since the overall average expenditure-GSDP ratio of the 17 states underwent a reduction of about one percentage point between the two periods. | Table II.4: Total Expenditure | | (per cent) | | State Category | Total Expenditure/GSDP | | Pre-FRBM | Post-FRBM | | Group A | | | | Goa | 22.9 | 17.0 | | Maharashtra | 14.0 | 12.2 | | Haryana | 15.5 | 13.4 | | Gujarat | 16.8 | 13.1 | | Tamil Nadu | 14.7 | 15.2 | | Group B | | | | Kerala | 15.6 | 15.4 | | Punjab | 16.7 | 15.9 | | Karnataka | 16.1 | 17.7 | | Andhra Pradesh | 17.1 | 16.8 | | West Bengal | 15.4 | 14.4 | | Group C | | | | Rajasthan | 18.0 | 16.8 | | Jharkhand | 20.3 | 19.4 | | Chhattisgarh | 15.6 | 19.2 | | Madhya Pradesh | 20.3 | 21.1 | | Odisha | 19.9 | 17.6 | | Uttar Pradesh | 17.4 | 21.2 | | Bihar | 26.2 | 24.1 | | Average | 17.8 | 17.1 | 2.31 In terms of expenditure composition, 12 states (including all in group ‘A’) have been able to curtail their revenue expenditure-GSDP ratio in the post-FRBM period (Table II.5). While the overall average has reduced by 1.0 percentage point in the post-FRBM period, four states have been successful in reducing their revenue expenditure-GSDP ratio by two percentage points or more. No state from the middle-income category figures in this list. 2.32 States, in general, have raised the average capital outlay-GSDP ratio by 0.6 percentage point post-FRBM. Six states outperformed the average by improving this ratio by more than 1 percentage point (Table II.5). Overall, 13 states, including all those in group ‘A’ and six in group ‘C’ have improved their capital outlay-GSDP ratios. | Table II.5: Revenue and Capital Outlay | | (per cent) | | State Category | Rev.Exp./GSDP | Capital Outlay/GSDP | | Pre- FRBM | Post- FRBM | Pre- FRBM | Post- FRBM | | Group A | | | | | | Goa | 20.0 | 13.9 | 2.8 | 3.1 | | Maharashtra | 12.0 | 10.3 | 1.5 | 1.7 | | Haryana | 13.2 | 11.3 | 1.5 | 1.9 | | Gujarat | 14.3 | 10.5 | 1.9 | 2.5 | | Tamil Nadu | 13.2 | 12.7 | 0.9 | 2.0 | | Group B | | | | | | Kerala | 14.0 | 14.1 | 1.0 | 0.9 | | Punjab | 14.9 | 14.7 | 1.2 | 1.1 | | Karnataka | 13.7 | 14.3 | 1.9 | 3.1 | | Andhra Pradesh | 14.2 | 13.7 | 1.7 | 2.5 | | West Bengal | 14.2 | 13.5 | 0.9 | 0.8 | | Group C | | | | | | Rajasthan | 15.3 | 14.2 | 2.3 | 2.4 | | Jharkhand | 15.6 | 15.9 | 3.5 | 3.2 | | Chhattisgarh | 13.3 | 15.5 | 1.9 | 3.0 | | Madhya Pradesh | 17.3 | 16.2 | 2.2 | 3.3 | | Odisha | 17.2 | 15.2 | 1.8 | 2.2 | | Uttar Pradesh | 15.1 | 17.3 | 1.3 | 3.7 | | Bihar | 22.4 | 19.3 | 2.4 | 4.3 | | Average | 15.3 | 14.3 | 1.8 | 2.4 | 2.33 At the overall level, there has been only a marginal improvement in the average development expenditure-GSDP ratio (Table II.6). Although no state from the high income category recorded an improvement in the post- FRBM period, seven states – mostly from the low income group – appear in this list. In contrast, there has been an appreciable decline in the average non-developmental expenditure-GSDP ratio post-FRBM, with a majority of states achieving a reduction in the range of 0.4 -3.9 percentage points (Table II.6). Thus, fiscal consolidation at the state level has been accompanied by improvement in the quality of expenditure after the implementation of FRBM. | Table II.6: Developmental and Non- developmental Expenditure | | (per cent) | | State Category | Dev.Exp./GSDP | Non-dev.Exp./GSDP | | Pre- FRBM | Post- FRBM | Pre- FRBM | Post- FRBM | | Group A | | | | | | Goa | 14.2 | 12.2 | 8.7 | 4.8 | | Maharashtra | 8.7 | 8.3 | 5.1 | 3.8 | | Haryana | 9.7 | 9.7 | 5.8 | 3.6 | | Gujarat | 11.8 | 9.1 | 4.9 | 3.9 | | Tamil Nadu | 9.6 | 9.6 | 4.6 | 4.7 | | Group B | | | | | | Kerala | 9.5 | 8.0 | 5.9 | 6.5 | | Punjab | 8.5 | 7.6 | 8.1 | 8.1 | | Karnataka | 11.4 | 12.4 | 4.4 | 4.6 | | Andhra Pradesh | 11.5 | 12.1 | 5.5 | 4.6 | | West Bengal | 8.9 | 8.3 | 6.4 | 5.9 | | Group C | | | | | | Rajasthan | 11.3 | 11.5 | 6.7 | 5.3 | | Jharkhand | 14.6 | 13.4 | 5.7 | 6.1 | | Chhattisgarh | 10.6 | 14.6 | 4.5 | 4.2 | | Madhya Pradesh | 13.5 | 14.8 | 6.2 | 5.4 | | Odisha | 11.8 | 11.7 | 7.9 | 5.6 | | Uttar Pradesh | 10.0 | 12.7 | 7.0 | 7.7 | | Bihar | 15.4 | 16.6 | 10.8 | 7.5 | | Average | 11.2 | 11.3 | 6.4 | 5.4 | | Note: Details of developmental and non-developmental expenditure can be seen in Appendix 2 and Appendix 4. | 2.34 For sustainable long-term growth, the revenue account needs to be balanced while borrowed funds should only be used for capital expenditure in order to maintain inter-generational equity (Emmerson et al., 2006). Moreover, lower deficits will lead to reduced borrowings which, in turn, would ease interest burdens. After the implementation of FRBM, there has been an increase in the number of occasions on which various states have recorded revenue balance/ surplus (Annex 2). 4. Conclusion 2.35 States’ spending has been marked by the dominance of revenue expenditure. As the empirical analysis presented in this chapter shows, it is an increase in the share of capital outlay and development expenditure in total expenditure that stimulates higher growth in per capita GSDP. Over the last decade, there has been some improvement in the quality of expenditure but with considerable dispersion across states. 2.36 A disconcerting feature is the stagnation in expenditure on education and health. Larger investment in education and health is a prerequisite for harnessing the benefits of a rapidly increasing young work force for gainful and productive allocation of human capital. In this context, the revenue balance/surplus which many states have recorded in recent years may provide the necessary fiscal space to increase investments in social and physical infrastructure. Furthermore, with the FC-XIV recommending higher tax devolution from the Centre to the states from 2015-16, the states will have greater autonomy in prioritizing their expenditure on social and physical infrastructure through untied funds. 2.37 The quality of expenditure of most Indian states has modestly improved following the enactment of FRBM. Rule-based frameworks have imparted greater responsibility to states on their fiscal positions by enabling them to benchmark themselves vis-à-vis their peers. In order to garner additional fiscal space, states need to redouble their efforts in revenue mobilisation along with prioritizing expenditure on physical and social expenditure while economizing on non-essential heads.

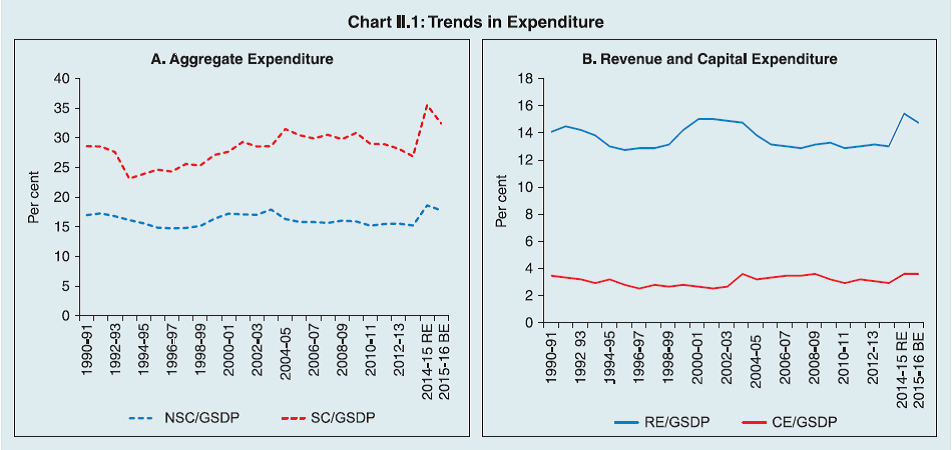

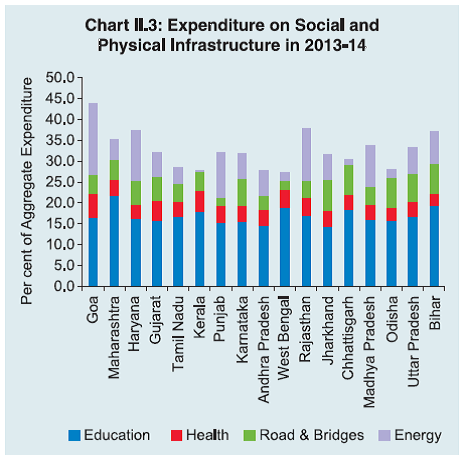

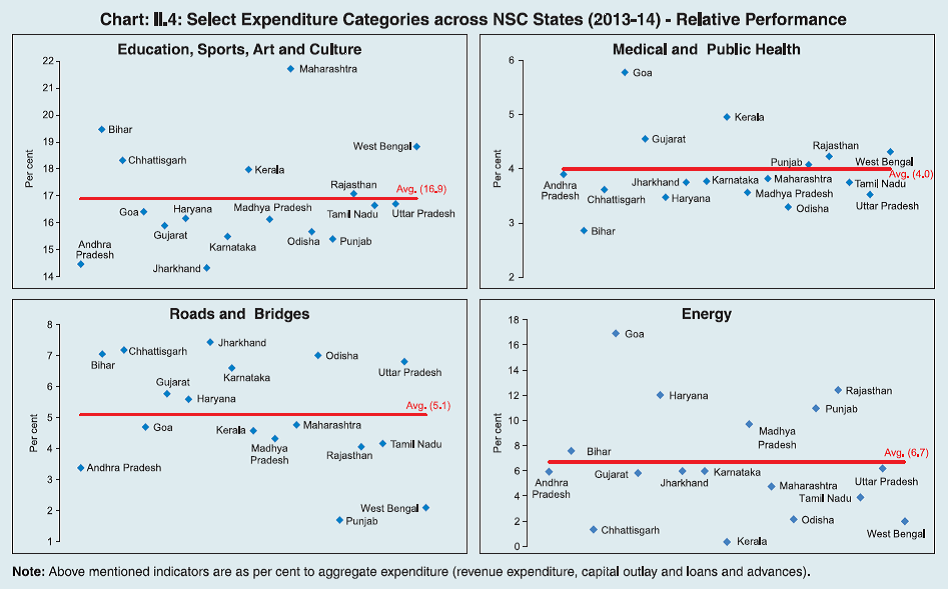

|