by

A. Ganesh-Kumar1

Bipul K Ghosh

Khaijamang Mate

Prayag Singh Rawat

Issued for Discussion DRG Studies Series Development Research Group (DRG) has been constituted in Reserve Bank of India in its Department of Economic and Policy Research. Its objective is to undertake quick and effective policy-oriented research backed by strong analytical and empirical basis, on subjects of current interest. The DRG studies are the outcome of collaborative efforts between experts from outside Reserve Bank of India and the pool of research talent within the Bank. These studies are released for wider circulation with a view to generating constructive discussion among the professional economists and policy makers. Responsibility for the views expressed and for the accuracy of statements contained in the contributions rests with the author(s). There is no objection to the material published herein being reproduced, provided an acknowledgement for the source is made. DRG Studies are published in RBI web site only and no printed copies will be made available. Director

Development Research Group |

Acknowledgement The authors are deeply grateful to Dr. M.D. Patra, Executive Director, Reserve Bank of India for his constant support/encouragement to complete the study. We are also thankful to Dr. Rajiv Ranjan, Adviser, Department of Economic and Policy Research (DEPR) for his valuable guidance and support. We thank Dr. Satyananda Sahoo, Director, DEPR and his team members for their constant support and suggestions at each stages. The authors would also like to thank the participants at the various meetings held at the DEPR for their comments and suggestions, including on a set of preliminary results that were presented at the DEPR, which has helped shape the scope of this study and refine the analysis carried out here. The authors would also like to thank an anonymous referee for the insightful comments on an earlier draft, which have helped improve the report. Needless to say, the views expressed here are those of the authors alone and not of the Institutions to which they belong or of the FSU/DEPR/ RBI or the participants in the various meetings held at the DEPR or of the referee.

Executive Summary In this study, we examine the impacts of various types of government expenditure on the Indian economy. In particular, we examine the impacts of a rise in (a) Government consumption expenditure in general and the nature of the relation between government expenditure and GDP, (b) Government expenditure in Social Sectors and in Public Administration, (c) Government transfer payments to households, and (d) Public investment. Towards this, we have used a recursively dynamic computable general equilibrium (CGE) model of the Indian economy developed by Bhakta and Ganesh-Kumar (2016), which is built around a social accounting matrix (SAM) for the year 2011-12. The SAM and the model distinguish 9 commodities/ sectors, 9 factors of production, and 12 household types distinguished by their location and by the monthly per capita expenditure (MPCE) percentile. The model is solved annually over the period 2011-12 to 2025-26. As a first step, we develop a BASE scenario that captures a “Business As Usual” trajectory that the Indian economy is likely to take over the 10-year period 2016-17 to 2025-26 given the current structural characteristics of the economy, and the set of policies currently prevailing. We then develop five sets of counter-factual policy scenarios to study the economy-wide impacts of different types of public expenditure. Each of these sets consists of two or more simulations that are designed to address one main question and its sub-questions, if any. The impacts in each simulation are assessed by comparing the model outcomes in that simulation with the BASE scenario. Our results show that the impact of expansion in government expenditure across different types of expenditure depends crucially on the prevailing macroeconomic conditions, especially whether there is full employment/ unemployment of factors, and also on the complementary set of policies that are needed to generate the resources required to finance the additional expenditure. The main messages that emerge are as follows: -

Fiscal expansion in boom times is actually disastrous for the economy on all counts. -

However, it is not a foregone conclusion that fiscal expansion during recessionary conditions when unemployment prevails is always beneficial. It depends crucially on the type of government expenditure undertaken and the accompanying set of policies that determine how fiscal expansion is financed. -

Amongst alternative types of current expenditure, clearly expansion of government consumption scores over additional transfers to households in terms of impact on GDP. -

Between additional government current consumption and investment, the choice is not straightforward. -

Using additional taxes on households to finance expansion of public investment does not fare well compared to government consumption. -

Nor does shifting of government expenditure from current consumption to investment help if the exchange rate regime is neutral. -

Amongst all the policy options considered in this study, shifting of government expenditure from current consumption to investments accompanied by a slight depreciation of the Rupee turns out to be the best in terms of overall impacts on the GDP and various other macro indicators as well as household real income per capita.

Some Macroeconomic Impacts

of Different Types of Public Expenditure in India -

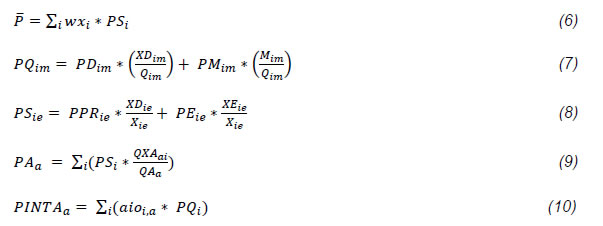

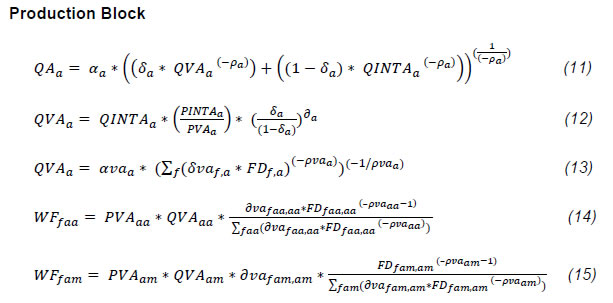

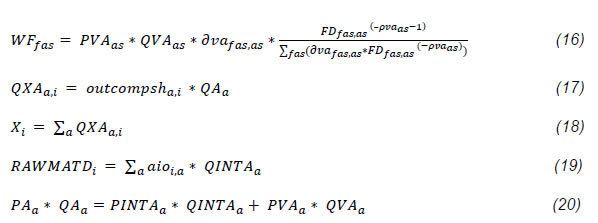

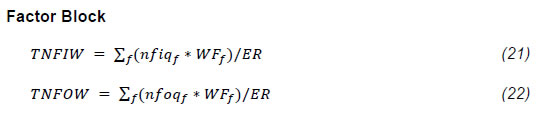

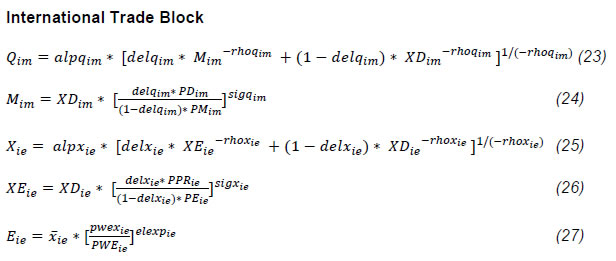

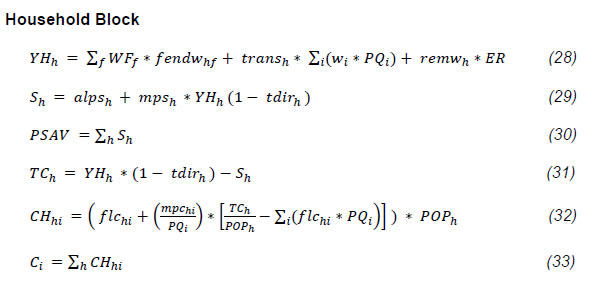

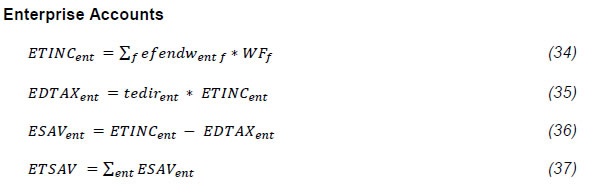

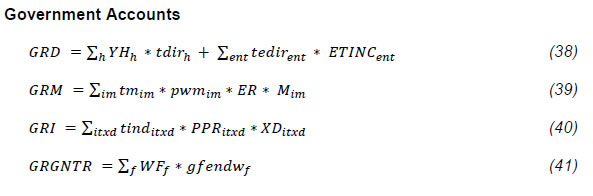

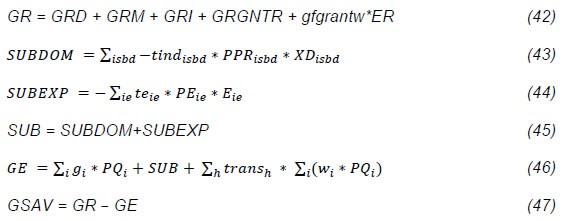

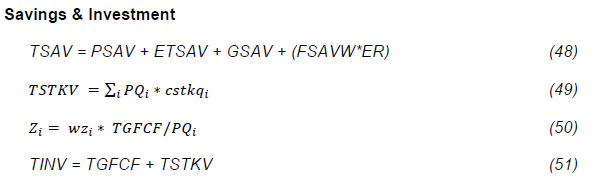

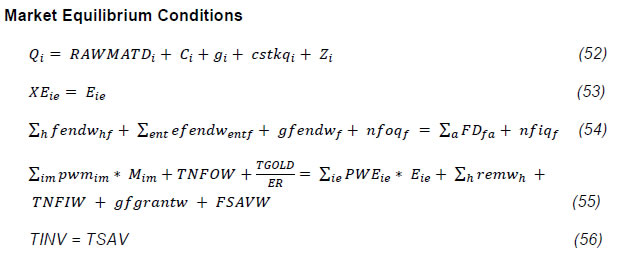

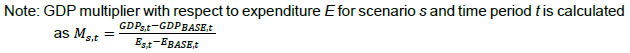

Analysis Using a Computable General Equilibrium Model Introduction High fiscal deficit, driven by a combination of large government expenditure towards current consumption, very high levels of subsidies, and low (direct) tax base have been an enduring feature of the fiscal situation in India, especially since the onset of the global economy crisis in 2008. In contrast, government investment, particularly in infrastructure and social sectors, has not kept pace with the demand for the services of these sectors. This has resulted in several and severe supply bottlenecks in key sectors such as electricity, transport, etc., with cascading impact on other sectors and the economy in general. In recent years, significant progress has been made to bring down the fiscal deficit and there are early signs that the process of fiscal consolidation is possibly having the desired effects on key macroeconomic variables such as GDP growth and inflation. Even as the government undertakes measures for fiscal consolidation, there is no denying that public current expenditure and public investments will continue to play a significant role in the evolution of the economy in the foreseeable future. Indeed, one prevailing view is that public expenditure, especially investments, in key sectors such as infrastructure (electricity, transport, etc.), social sectors (education and health), and agriculture are grossly inadequate to meet the needs of the economy/ society. Proponents of this view call for a massive ramping up of public expenditure in these sectors given the important role that they play in reducing poverty and improving living standards, food and nutritional security, and in overall human development. In recent years, voices in support for increasing public expenditure has also come about following the sharp slowdown in the growth performance of the country and the slow recovery witnessed thereafter. The general stance here is that public expenditure can expand aggregate demand, which in turn can help revive private investment sentiments, and thus facilitate the return of the economy to a high growth trajectory. Even as there is some merit in these arguments, one should recognise that public expenditure can also have some negative effects. Excessive public expenditure/ very high fiscal deficit can be inflationary, especially if accompanied by monetary accommodation. High fiscal deficit would mean that government would be competing for a larger portion of resources. And if the relative efficiency of public sector is lower than private sector, as is often the case, then it would imply that the overall efficiency of the economy in putting best use of its resources remains rather low. Given these two sides to the nature of public expenditure, in order to make informed policy decisions on public expenditure – how much, in which sector(s), should it be current or capital, should the government spend it by itself or transfer the resources to households – it is then critical to understand the effects of various types of public expenditure. Our objective in this study is to evaluate the impacts of various types of public expenditure in India. Specifically, we address the following questions in this study: (i) What are the impacts of a rise in government consumption expenditure, and what is the nature of the relationship between government expenditure and GDP? (ii) What are the impacts of a rise in government consumption expenditure in specific sectors? (iii) What are the impacts of a rise in government transfers to households? (iv) What are the impacts of a rise in government investment expenditure? An analysis of the impacts of public expenditure on sectors such as infrastructure, health, education, agriculture, general administration, etc., should recognise their cascading effects that go beyond the confines of these sectors per se, both in the short-run and in the long-run. In the short-run, public expenditure is a source of demand, the composition of which in terms of consumption and/or capital goods varies depending upon whether the expenditure is for current or capital purpose. In the long-run, public investments expand both human and physical capital in the economy that could help sustain high growth rates. Not recognising these inter-sectoral linkages can result in incomplete or partial understanding only. A study on the impacts of public expenditure would remain incomplete if it does not specify how the public expenditure is financed such as through taxation, reallocation of its expenditure pattern, borrowings (domestic/ foreign), etc. Each of these financing options implies alternative policy choices for the government. And those policy choices would in turn have their own effects on various economic agents/ sectors of the economy differently. For instance, additional direct taxes on (a certain class of) households affects their disposable income and hence consumption and savings, whose effect could run counter to the effects of an expansion in government expenditure. Similarly, if the government opts to rely on foreign capital to finance its expenditure, the additional foreign inflow would have its impact on the foreign exchange market, exports and imports, with attendant impacts on various sectors of production. The nature of the issues at hand requires an analytical framework that is equipped to handle inter-sectoral and inter-agent linkages. One such analytical framework that is strong on these aspects is the computable general equilibrium (CGE) modelling framework. CGE models are economy-wide models that include all sectors of the economy, and incorporate the behaviour of all economic agents (households, producing sectors, government, and rest-of-the world). These features make them particularly suited for analysing issues where the inter-sectoral and inter-agent linkages are very important. These models have been widely used to analyse macro-fiscal interactions in the context of trade and tax reforms, income distribution policies, etc., for India and other countries. In this study we use a recursively dynamic CGE model of the Indian economy developed by Bhakta and Ganesh-Kumar (2016). This model is built around a social accounting matrix (SAM) for the year 2011-12. The SAM and the model distinguish 9 commodities/ sectors, 9 factors of production, and 12 household types distinguished by their location and by the monthly per capita expenditure (MPCE) percentile. The model is solved annually over the period 2011-12 to 2025-26. As a first step, we develop a BASE scenario that captures a “Business As Usual” trajectory that the Indian economy is likely to take over the 10-year period 2016-17 to 2025-26 given the current structural characteristics of the economy, and the set of policies currently prevailing. We then develop five sets of counter-factual policy scenarios to study the economy-wide impacts of different types of public expenditure. Each of these sets consists of two or more simulations that are designed to address one main question and its sub-questions, if any. The impacts in each simulation are assessed by comparing the model outcomes in that simulation with the BASE scenario. The rest of this report is organised as follows: In section 2 we describe the CGE model and the data that we have used in this study. The BASE and various sets of policy scenarios that we develop are described in Section 3. The simulation results are discussed in detail in Section 4 and we provide some concluding remarks in the final section. 2. The CGE model and the data As mentioned earlier, in this study we use the recursively dynamic CGE model developed by Bhakta and Ganesh-Kumar (2016), which is itself based on the static CGE model developed by Ganesh-Kumar and Panda (2009). The model uses the social accounting matrix (SAM) for the year 2011-12 developed by Bhakta and Ganesh-Kumar (2016). This SAM distinguishes 9 commodities/ sectors, 9 factors of production, and 12 household types distinguished by their location and by the monthly per capita expenditure (MPCE) percentile (Table 1). | Table 1: Classification in Social Accounting Matrix/ CGE model | | 9 Commodities/ activities: Agriculture; Manufacturing-1 (mainly unskilled labour); Manufacturing-2 (mainly skilled labour); Electricity; Water supply; Services-1 (mainly unskilled labour); Education; Medical; Services-2 (mainly skilled labour); | | 9 Factors consisting of 3 labour types and 6 sectoral capital: Unskilled labour; Semiskilled labour; Skilled labour; Agriculture sector capital; Industries sector capital; Water Supply sector capital; Education sector capital; Medical sector capital; Services sector capital; | | 12 Household categories: 6 each in rural and urban areas, distinguished by MPCE percentile groups; < 10 per cent; 10 per cent to 30 per cent; 30 per cent to 50 per cent; 50 per cent to 70 per cent; 70 per cent to 90 per cent; > 90 per cent; | | Source: Authors | Starting from the base year 2011-12 (the same as in the SAM), we solve the recursive CGE model annually over the period 2011-12 to 2025-26. Conceptually, the recursive CGE model can be considered to have two modules, viz., a core static CGE module and an inter-temporal updating module. Here we briefly describe the main features of the core CGE model and the updation module. The Appendix 2 gives the full technical specification of the recursive CGE model. For further details see Bhakta and Ganesh-Kumar (2016). 2.1 The core static CGE model The structure of the core static CGE module is similar to the static CGE model developed by Ganesh-Kumar and Panda (2009) and it differs only in terms of the underlying data and parameter values that are derived from the SAM for 2011-12. In this core CGE module, for any given year we solve for the level of output and prices of all commodities, returns to various factors of production, income, expenditure and savings of all households, government revenue, expenditure and savings, commodity exports, imports, the level of foreign flows that satisfies the balance of payments, and the national savings-investment balance. Domestic production and trade: This core CGE model is built along the approach developed by Dervis, de Melo and Robinson (1982). A distinguishing feature of this approach is that it treats the domestically produced goods and traded goods in a particular sector as imperfect but close substitutes using the Armington specification. The Armington approach helps avoid complete specialization that is implicit in models with perfectly substitutable commodities. It allows cross hauling wherein simultaneous imports and exports take place in a particular sector as observed in reality. An important consequence of this specification is that domestic market prices do not change by the same order as the change in world price. This imperfect substitutability between domestic and traded goods along with the government’s tariffs on imports, export subsidies and indirect taxes/ subsidies for domestic goods gives rise to wedge between import price, export price, domestic market price, and producer price in the model. The Armington specification determines commodity-wise imports and exports for a given set of import and export prices in foreign currency units, the exchange rate as determined in the forex market (see discussion below) and the set of endogenous domestic market prices that clear the commodity markets (see discussion below). Sectoral production in the core CGE model is characterised through nested production functions that determine sectoral output and value added, along with profit maximizing levels of demand for various factors of production and intermediate input requirements. The difference between the value of output and value added is the total cost of raw materials and other intermediate goods and services used in the production process. Demand for individual goods and services used as intermediates are based on Leontief type input-output coefficients. Sector-wise optimal demand for various factors of production depends upon both product and factor prices. Agent behaviour: The agents in the SAM and hence in the model are households, enterprises and government. Households derive their income from their endowment of various factors of production, and also the transfer payments that they receive from the government and from abroad (remittance). After paying direct taxes and setting aside a part of their disposable income as savings, households spend the rest of their budget on various goods and services. Commodity-wise household consumption is given by a Linear Expenditure System (LES) demand system, which is derived from maximizing a Stone-Geary utility function subject to budget constraint. Government receives its revenue from various taxes (direct taxes, tariffs, domestic indirect taxes), non-tax sources (its endowment of capital), and foreign inflows on government account. The various tax rates are typically fixed exogenously at their base year levels as derived from the SAM. Government expenditure is towards its current consumption, transfers to households, and subsidies for domestic goods and exports. The difference between government revenue and current expenditure is its savings. Private and public enterprises are the other domestic agents in the model. Their role in the model, however, is fairly rudimentary. They own factors of production (different types of capital) from which they derive income – akin to retained income of firms. While private enterprise pays tax on their retained income and save the rest, public enterprises contribute only to the national savings. This rudimentary characterisation of the role of enterprise is primarily conditioned by the data available in the SAM. Savings-investment: The core CGE model is a neo-classical savings driven model, wherein the total savings across all agents determines the aggregate investment in the economy. The sources of savings in the economy are the households, enterprises, government and capital flows from the rest of world. The amount of foreign savings in Rupee terms depends upon the volume of foreign capital flows in foreign currency units and the exchange rate. Part of the total savings is invested on fixed capital and the rest on inventory. The inventory requirements are specified for each sector exogenously and this is part of the total demand for each commodity. Given the fixed inventory requirement, it is the total fixed capital formation that ultimately varies with savings. In the core CGE model, for any given year, this total fixed capital investment generates demand for various goods and services. Markets and their closure: In all, there are three types of markets in the model, viz., for factors, commodities (goods and services) and foreign exchange. Supply of factors in the model is kept fixed for any given year. Demand for factors arise from the production sectors based on their profit maximising conditions. The default closure for the factor markets is that factor prices adjust to ensure that the aggregate demand for factors across all sectors clear the given supply. The model, however, has the flexibility to allow for unemployment of some/ all factors in which case the corresponding factor price(s) is kept fixed; i.e., by introducing factor price rigidity. In the commodity market, the sources of supply are domestic production and imports, while the sources of domestic demand are intermediates, household, government, inventory and fixed capital formation. For each commodity, domestic market price adjusts to ensure that total supply equals total demand. There is a separate market for exports, wherein export supply is determined by Armington type transformation function, while export demand is determined as a function of exogenously fixed reference world market price and endogenously determined export f.o.b. price. As with all CGE models, these market clearing prices are all relative prices – relative to the overall price index fixed exogenously as the numeraire. The foreign exchange market in the model reflects the main flows in the balance of payments wherein the difference between the total foreign exchange outgo (towards imports, factor payments and other current transfer to rest of world) and the total foreign exchange inflow (from exports, remittances, factor payments received) is bridged by a matching (inward/outward) capital flow2. In the model, all entries in the foreign exchange market are specified in foreign currency units, with the foreign exchange rate being the market clearing price variable. The model allows for two alternative closures for the foreign exchange market: (a) the amount of capital flows in foreign currency units can be kept fixed while allowing the exchange rate to vary to clear the foreign exchange market, or (b) keep the exchange rate fixed and allow the capital flows in foreign currency units to change to clear the foreign exchange market. As will be discussed later, in this study we use both these alternative closures in different scenarios. 2.2 Inter-temporal updating module While solving the core CGE model for any particular year, values of several other variables for that year are kept fixed at exogenously specified levels. Such exogenous variables include population, factor supplies and factor endowment distribution, government consumption, stocks, the levels of foreign remittances, etc. In the second module we update the values of these exogenous variables from one year to the next. Three types of equations are used in this updating module: (a) link equations that update the relation between investment in one year and the addition to supply of sectoral capital stock in next year and the endowment distribution of capital across various agents, (b) econometrically estimated relationships relating to total stock of labour in the economy and across household classes, and (c) exogenously specified growth rates to update other parameters such as foreign capital flows, tax rates, government expenditure, etc. Supply of capital stock: Being a neo-classical savings driven model, we do not have a detailed characterisation of investment by agents. All that the core CGE model solves is the total gross fixed capital formation across all types of capital and by all agents in any given year. A critical task here is to (i) disaggregate this total investment into that undertaken by each domestic agent in the economy (households, private and public enterprises, and government), (ii) work out their new levels of endowment of different types of capital (this would determine their factor incomes in the next year), and (iii) work out the total stock of each type of capital available for production activities in the next year. Towards this, first the total fixed capital investment undertaken by domestic agents in real terms is worked out by deducting the amount of foreign savings from the total gross fixed capital formation as determined by the core CGE model. Second, this real domestic gross fixed investment is divided into investments by private enterprises, public enterprise and government based on their actual shares in investment in the base year estimated from the National Accounts Statistics (NAS). Total investment by all households are then worked out residually and distributed across household types based on their shares in total household savings and their initial share in the total endowment of capital. Third, for each agent, their total investment is allocated across different types of capital. For private enterprise and households this is done based on the relative return of the different capital types as endogenously determined in the core CGE model. For public enterprise and government this allocation is done based on exogenously specified shares that reflect policy priorities of the government. Fourth, agent-wise the initial endowment of different capital types are updated based on their current period’s investment by capital type and agent-specific depreciation rates worked out from the NAS. Finally, for each capital type the total supply available for production activities in the next year is obtained as the sum total of corresponding agent-specific endowments. Labour supply: One of the salient features of the recursive CGE model by Bhakta and Ganesh-Kumar (2016) used here pertains to the way labour supply is updated between any two years in the updating module. As seen in Table 1 three types of labour are distinguished in the SAM and in the model based on their education levels, viz., unskilled (illiterate and up to primary school), semi-skilled (secondary and higher secondary school completed) and skilled (graduates and above). In the inter-temporal updation module the supply of labour by education level is worked out as follows: First, the total labour force is projected through annual growth rates implicit in the Planning Commission (2008) forecasts of labour force in the country between the years 2002 and 2022. To the best of our knowledge these are the only available forecasts of the growth in total labour force in the country. The Planning Commission forecasts the annual rate of growth in the labour force at five yearly intervals: 2.28 per cent between 2002 and 2007 1.92 per cent (2007-2012); 1.60 per cent (2012-2017); and 1.23 per cent (2017-2022). These estimates suggest a slowdown in the growth of the labour force between 2012 and 2017, and further between 2017 and 2022, for the intervening years we specify a linear reduction in the annual growth rate of labour force to the above levels. For the years beyond 2021-22, we use a linear reduction in the annual growth rate of labour force at the same rate as in 2017-2022. We use the above information to first project the total labour force in the country between 2011-12 and 2025-26. Second, the share of the three labour types are projected using a set of link equations that capture the relationship between progress in adult education outcomes and composition of labour supply by education levels. Specifically, the composition of total labour supply in a year projected above is made conditional on the progress in adult education outcomes in the previous year. Progress in the adult education outcomes measured in terms of three indicators of education attainment of adults, viz., literacy rate (LR), percentage of adults completed higher education (PAHE) and average years of schooling (AYS) are tracked in the model using the econometric relationships estimated by Bhakta (2015).3 We assume that the share of skilled and semi-skilled labour in total labour force change annually at the same rate as the annual progress in PAHE and AYS, respectively.4 With this assumption, the initial shares of these two labour types observed in the base year 2011-12 are updated first and the share of unskilled labour in the labour force is then obtained residually. Finally, the above projected shares of each labour type are then combined with the total labour force projected earlier to arrive at the supply of various types of labour by education level. Other exogenous variables and policy variables: The values of various other exogenous variables such as population (total, rural and urban), sectoral inventory requirements, the levels of foreign remittances, etc., are updated using growth rates derived from historical data. The updation rules for some other exogenous variables such as foreign capital flows in foreign currency units, government consumption, etc., are actually part of the scenario specification and these are described later. 2.3 Data As mentioned earlier, the CGE model makes use of the SAM developed by Bhakta and Ganesh-Kumar (2016). This SAM developed by Bhakta and Ganesh-Kumar (2016) is a modified version of the SAM for the year 2011-12 constructed by Ganesh-Kumar (2015). The SAM by Ganesh-Kumar (2015) reflects the various real and transfer flows in the economy for the year 2011-12 as per the old series of the National Accounts Statistics with base year 2004-05. The main data sources used by Ganesh-Kumar (2015) to construct the macro SAM are the National Accounts Statistics (NAS) and the Input-Output (IO) table for 2006-07 prepared by the Central Statistical Organisation (CSO), Government of India, and the Consumer Expenditure Survey and Employment and Unemployment Surveys of the National Sample Survey Organisation (NSSO) for the year 2011-12. These data sets are complemented by data from Pradhan et al. (2001) and Saluja and Yadav (2006) that have developed SAM for India. The SAM by Bhakta and Ganesh-Kumar (2016), which we use in this study, differs from the SAM by Ganesh-Kumar (2015) on two aspects. First and the most important difference is that the SAM by Bhakta and Ganesh-Kumar (2016) captures the structure of the economy in terms of the shares of agriculture, industry and services in total GDP as per the New Series of the NAS with Base Year 2011-12. Specifically, the shares of agriculture, industry and services in this SAM are 18 per cent, 33 per cent and 49 per cent, respectively, which are fairly close to their levels reported in the New Series for the year 2011-12. The other modification pertains to the sectoral disaggregation in the SAM – 9 in this SAM as described in (Table 1) while the SAM by Ganesh-Kumar (2015) considered the 23 sectors reported in the NAS. Appendix 1 reports the disaggregated SAM developed by Bhakta and Ganesh-Kumar (2016). The aggregate values of the various flows in the SAM are reported in the so-called macro-SAM (Table 2). The macro SAM shows that almost half of the demand for various goods and services (commodity account in the SAM) is for intermediate use by production activities themselves, with another 10 per cent being exported. Household demand accounts for about 22 per cent and investment demand (fixed capital and inventories) another 14 per cent. Of the total supply at market price, domestic production at producer prices accounts for 85 per cent, imports at c.i.f. prices 12 per cent and indirect taxes (including customs duty) another 3 per cent. Factor payments account for about 42 per cent of the total cost of production for the activities, the remaining being the cost of raw materials and intermediates. Households receive about 88 per cent of their income from factor payments, followed by transfer payments from government (8 per cent) and remittances from abroad (4 per cent). They spend about 68 per cent of their earnings on consumption, save 28 per cent and pay 3 per cent to government as direct taxes. For the government (aggregate of Union and States), taxes account for 79 per cent of its revenue and the remaining being non-tax revenue arising from its ownership of capital. The government spends nearly two-thirds on current consumption while its transfers to households and to the rest of world accounting for 40 per cent and 2 per cent, respectively, leaving it with a negative savings of 6 per cent. Households account for nearly two thirds of the total savings in the country followed by private and public enterprises (28 per cent) and rest of world (10 per cent). On the foreign account, nearly 97 per cent of the total outflow is on account of imports, while exports account for about 78 per cent of the foreign inflows, with remittances to households and foreign savings accounting for about 11 per cent each. | Table 2: Macro Social Accounting Matrix, 2011-12 | | (₹ crores) | | | Commodity | Activity | Factors | Households | Enterprises | Taxes | Govt | S-I | RoW | Total | | Commodity | 0 | 11,217,492 | 0 | 5,122,233 | 0 | 0 | 993,961 | 3,267,105 | 2,194,907 | 22,795,698 | | Activity | 19,412,967 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 19,412,967 | | Factors | 0 | 8,195,475 | 0 | 0 | 0 | 0 | 0 | 0 | 2,001 | 8,197,476 | | Households | 0 | 0 | 6,578,954 | 0 | 0 | 0 | 611,125 | 0 | 304,902 | 7,494,981 | | Enterprises | 0 | 0 | 1,232,227 | 0 | 0 | 0 | 0 | 0 | 0 | 1,232,227 | | Taxes | 664,195 | 0 | 0 | 240,280 | 314,517 | 0 | 0 | 0 | 0 | 1,218,992 | | Govt | 0 | 0 | 321,304 | 0 | 0 | 1,218,992 | 0 | 0 | 0 | 1,540,296 | | S-I | 0 | 0 | 0 | 2,132,468 | 917,710 | 0 | -97,415 | 0 | 314,341 | 3,267,105 | | RoW | 2,718,536 | 0 | 64,991 | 0 | 0 | 0 | 32,625 | 0 | 0 | 2,816,152 | | Total | 22,795,698 | 19,412,967 | 8,197,476 | 7,494,981 | 1,232,227 | 1,218,992 | 1,540,296 | 3,267,105 | 2,816,152 | | Source: Bhakta and Ganesh-Kumar (2016).

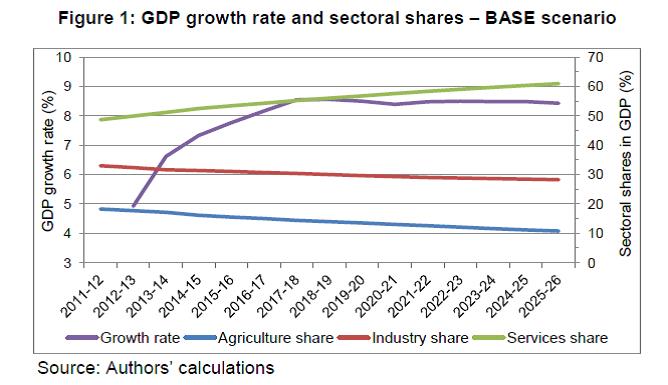

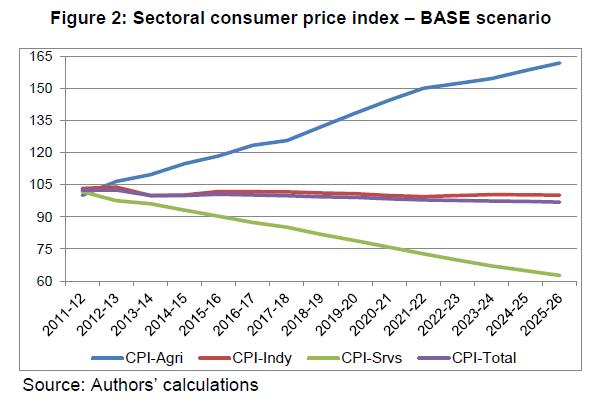

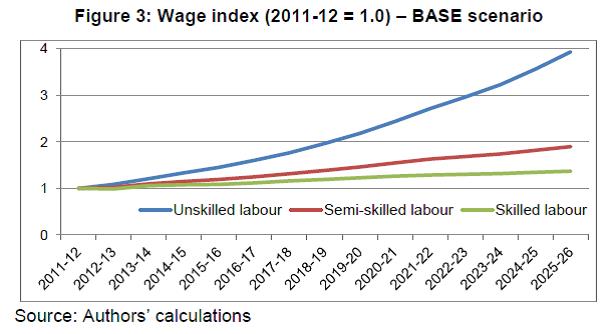

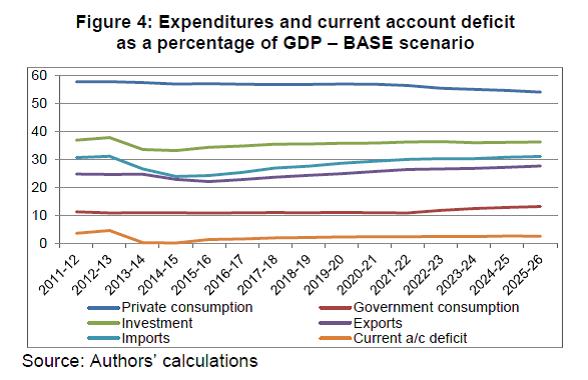

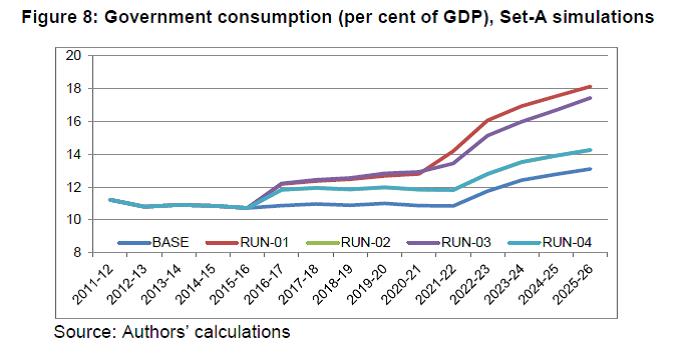

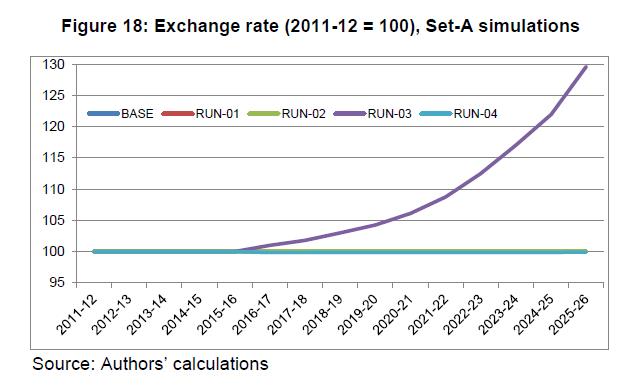

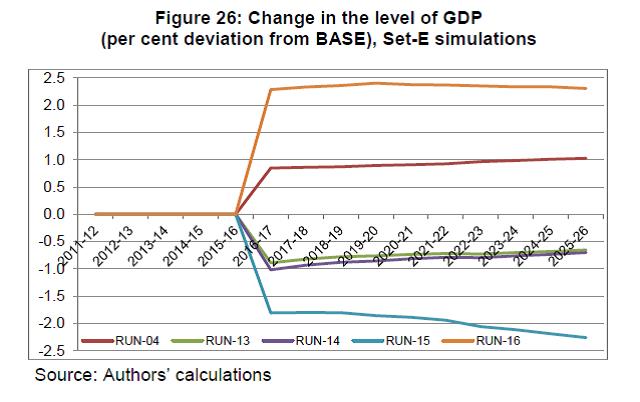

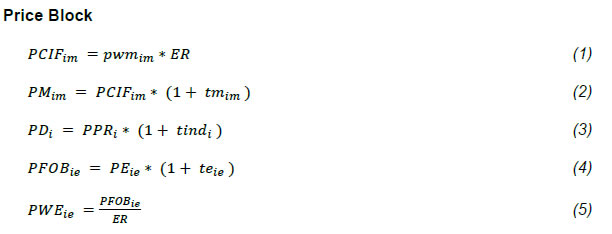

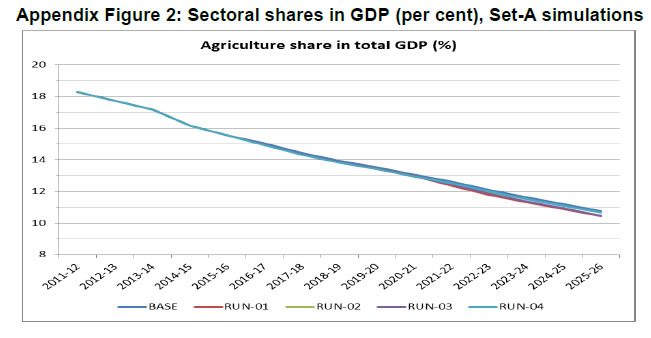

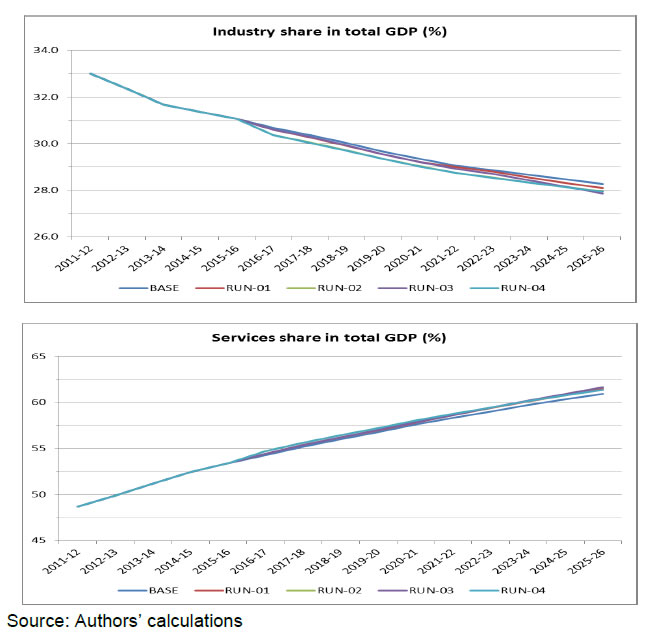

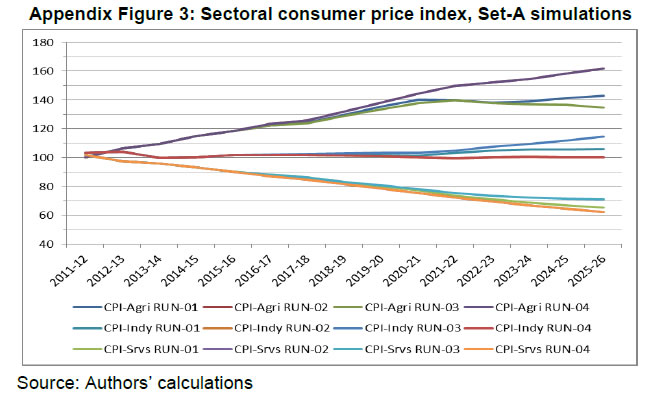

Notes: S-I refers to Savings-Investment flows in the economy; RoW refers to Rest of World. | 3. Scenario specification Simulation period: As mentioned earlier, the model is simulated over the period 2011-12 to 2025-26. This 15-year time period can be categorised into (a) the historic period covering the 5 years 2011-12 to 2015-16, and (b) the future 10-year period from 2016-17 to 2025-26. As mentioned earlier, the CGE model is built around the SAM for 2011-12, which is the base year for the model as well. Various parameters of the model are calibrated from the SAM such that the model solution for the base year replicates the SAM values. Over time, the model is solved sequentially from one year to another by updating the values of various exogenous variables (population, factor supplies and factor endowment distribution, government consumption, stocks, and the levels of foreign remittances and foreign capital inflows) using growth rates specified exogenously. For the historic period 2011-12 to 2015-16, the actual observed growth rate of these exogenous variables are used to run the model sequentially over these years. Some of the model parameters (especially the total factor productivity parameters, and household savings function parameters) are tweaked further so that the model solution for this period replicates as closely as possible the actual observed values of key macroeconomic variables. In particular we track (a) the annual growth in aggregate and sectoral GDPs, exports and imports, (b) the shares of the three broad sectors (agriculture, manufacturing and services) in total GDP, and (c) the share of exports, imports and trade deficit in GDP. While carrying out our analysis the specification of the parameters and exogenous variables for the historic period is kept constant. The alternative scenarios differ from one another only in their specification for the future period starting from 2016-17 onwards. BASE scenario: The first step towards analysing the impacts of alternative types of government expenditure is to construct a BASE scenario that captures a “Business As Usual” trajectory that the Indian economy is likely to take over the 10-year period 2016-17 to 2025-26 given the current structural characteristics of the economy, and the set of policies currently prevailing. The key questions in this context are: What is the rate at which the economy is most likely to grow over this period? What are the likely changes in the structure of the economy over this period – in terms of the relative importance of agriculture, industry and services, the extent of openness of the economy, the distribution of income, consumption and savings across domestic agents (households, enterprises, and government), etc.? These are questions on which there are hardly any studies that can provide (at least partial) guidance, especially for the 10-year period that we are interested. Some projections of the future growth of the economy are available from diverse sources such as the Government of India, Reserve Bank of India, the IMF, the UN and the World Bank. For most part, these growth forecasts are available only for the short-term (next 2-3 years at most). The range of forecast values across these sources does not vary drastically. Based on these estimates and after considering the recent improvements in ease of doing business, we feel it is reasonable to expect that the growth rate of the economy would improve steadily during the next couple of years and reach a steady state growth rate of 8.5 per cent per annum (p.a.) under BASE scenario from 2017-18 onwards. While a higher growth rate may be desirable for the country’s long-term developmental objectives, we believe a steady growth of 8.5 per cent p.a. is feasible within the current context of tepid global economic growth. In terms of the structure of the economy, we expect the current sectoral growth pattern to continue in the future as well. Accordingly, the share of services in total GDP is expected to rise further, while agriculture and industry would lose their shares.5 In case of exports and imports, we have assumed that the current policies prevail in the future and the share of exports and imports in total GDP would grow very slowly reflecting the global economic conditions. We have maintained the trade deficit in both goods and services at around 3.3 per cent to 3.8 per cent of GDP. In the BASE scenario, for the future period we have kept the exchange rate fixed at levels prevailing in 2015-16 and allowed the capital flows to adjust to clear the foreign exchange market. Assuming that remittances grow at 1 per cent p.a., and other invisibles in the balance of payments grow at current rates, we have tried to maintain the current account deficit at about 2 per cent to 2.5 per cent of GDP. In the BASE scenario, we assume that the government maintains strict fiscal discipline even as its policies with regard to taxation, public expenditure and transfers to households prevailing in 2011-12 are assumed to continue.6 On the expenditure side, government consumption and transfers to households are assumed to grow at around 9 per cent to 12 per cent p.a. in real terms (Table 3). Further, existing public policies in key social sectors such as health, education, water and sanitation, public spending in particular, are assumed to be same as those prevailing in the historical time period. | Table 3: Specification of growth rates (per cent) of exogenous variables in the BASE scenario | | Year | Population | Total labour force | Govt consump-tion | Transfer to house-holds | Govt foreign borrowings | Remittances to households | Factor income | | Total | Rural | Urban | Inflows | Outflows | | 2011-12 | 1.3 | 0.8 | 2.5 | 1.9 | 4.0 | 26.1 | -1.0 | 1.4 | 5.0 | 50.0 | | 2012-13 | 1.3 | 0.7 | 2.4 | 1.9 | 13.0 | 10.0 | -0.3 | 1.8 | -10.0 | 10.0 | | 2013-14 | 1.2 | 0.7 | 2.4 | 1.8 | 10.0 | 24.0 | 10.0 | 1.2 | 5.0 | 70.0 | | 2014-15 | 1.2 | 0.7 | 2.4 | 1.7 | 8.0 | 10.0 | 10.0 | 1.0 | 5.0 | 5.0 | | 2015-16 | 1.2 | 0.6 | 2.5 | 1.7 | 12.0 | 10.0 | -1.0 | 1.0 | 5.0 | -20.0 | | 2016-17 | 1.2 | 0.6 | 2.4 | 1.6 | 12.0 | 10.0 | -1.0 | 1.0 | 5.0 | -10.0 | | 2017-18 | 1.2 | 0.5 | 2.4 | 1.5 | 10.0 | 10.0 | -1.0 | 1.0 | 5.0 | 5.0 | | 2018-19 | 1.1 | 0.5 | 2.4 | 1.5 | 12.0 | 10.0 | 0.1 | 1.0 | 5.0 | 5.0 | | 2019-20 | 1.1 | 0.5 | 2.3 | 1.4 | 10.0 | 10.0 | 0.1 | 1.0 | 5.0 | 5.0 | | 2020-21 | 1.1 | 0.4 | 2.4 | 1.3 | 10.0 | 10.0 | 0.1 | 1.0 | 5.0 | 5.0 | | 2021-22 | 1.1 | 0.4 | 2.4 | 1.2 | 12.0 | 10.0 | 0.1 | 1.0 | 5.0 | 5.0 | | 2022-23 | 1.0 | 0.3 | 2.3 | 1.2 | 9.0 | 10.0 | 0.1 | 1.0 | 5.0 | 5.0 | | 2023-24 | 1.0 | 0.3 | 2.3 | 1.1 | 10.0 | 10.0 | 0.1 | 1.0 | 5.0 | 5.0 | | 2024-25 | 1.0 | 0.3 | 2.2 | 1.0 | 9.0 | 10.0 | 0.1 | 1.0 | 5.0 | 5.0 | | Source: Authors | The population growth rate and its composition across rural and urban areas are taken from the UN population projections (UN-DESA-PD 2014). The total supply of labour is projected using the growth rates reported in Planning Commission (2008) and the composition of the labour force by skill level is endogenously determined based on education attainment as explained earlier. On the saving-investment side, both household and enterprise savings are assumed to grow marginally over the period and government savings remain stable to maintain fiscal discipline while foreign savings is determined through the BOP equilibrium. Then total investment of the economy is determined by total savings which combines private, government and foreign savings. Total investment in each sector is determined endogenously in the model as explained earlier. Finally, with regard to the macroeconomic closure, in the BASE scenario we specify that (i) there is full employment of all factors of production and hence factor prices adjust to clear the factor markets, (ii) the foreign exchange rate is fixed and capital flows in foreign currency units adjust to clear the foreign exchange market, and (iii) the model is savings driven (neo-classical) implying that total fixed capital formation in the economy depends upon the total savings available from all sources (domestic agents and foreign). Policy scenarios: We study the economy-wide impacts of different types of public expenditure by developing five sets of counter-factual policy scenarios. In each of these sets we develop various alternative simulations wherein one or more model parameters are shocked to represent a certain policy change. Each of these sets of policy scenarios are designed to address one main question and its sub-questions, if any. Table 4 summarises the alternative sets of scenarios that we carry out here. Set-A: In the first set of scenarios we analyse the impact of a 10 per cent rise in general government consumption expenditure under alternative macroeconomic conditions. Starting from 2016-17, in each year the government consumption in real terms is increased by 10 per cent over the corresponding level in the BASE scenario. We study the impact of this rise in government expenditure under alternative macroeconomic conditions. It is well known that the impact of fiscal expansion would differ depending upon whether the economy has idle resources or not at that time; i.e., whether there is full employment of factors or if there are unemployed factors. By simulating the policy shock under two alternative closures for the factor markets, viz., full employment/ unemployment, one can understand the impacts of fiscal expansion under different states of the economy. Similarly, how the fiscal expansion is financed, viz., through domestic or foreign resources, can also affect the outcomes. At a macroeconomic level, this manifests as whether or not foreign capital is available to augment the total resources in the economy to support fiscal expansion. It is quite likely that foreign capital is not supportive of fiscal expansion that is directed towards current consumption, but may be more accommodative of an expansion in government investment. The situation with foreign capital flow would affect not just the overall availability of resources but also the exchange rate as well. In a situation where foreign capital is easily available the exchange rate is likely to remain fairly stable even though the exchange rate regime per se is not fixed. As opposed to this, when foreign capital flow is relatively tight the exchange rate is likely to be volatile in order to clear the foreign exchange market. These are indeed alternative characterisation of the foreign exchange market and can be captured through its closure specification. By varying the closure specification for the foreign exchange market one can understand how alternative ways of financing fiscal expansion (with foreign resources or through a combination of domestic resources plus exchange rate changes) affect the economy. | Table 4: Specification of policy scenarios | | Scenario | Description | Closure | | Set A: Impact of a general rise in government consumption expenditure under alternative macroeconomic conditions | | RUN-01 | 10% rise in general government consumption expenditure | Full Emp; Fix ER; Savings driven; | | RUN-02 | 10% rise in general government consumption expenditure | Un-Emp; Fix ER; Savings driven; | | RUN-03 | 10% rise in general government consumption expenditure | Full Emp; Fix CapFlow; Savings driven; | | RUN-04 | 10% rise in general government consumption expenditure | Un-Emp; Fix CapFlow; Savings driven; | | Set B: Nature of relationship between government expenditure and GDP | | RUN-05 | 5% rise in general government consumption expenditure | Un-Emp; Fix CapFlow; Savings driven; | | RUN-06 | 15% rise in general government consumption expenditure | Un-Emp; Fix CapFlow; Savings driven; | | RUN-07 | 20% rise in general government consumption expenditure | Un-Emp; Fix CapFlow; Savings driven; | | RUN-08 | 25% rise in general government consumption expenditure | Un-Emp; Fix CapFlow; Savings driven; | | Set C: Impact of a rise in government expenditure in specific sectors | | RUN-09 | Equivalent (to RUN-04) rise in government expenditure in social sectors (Water supply, Education, Medical) | Un-Emp; Fix CapFlow; Savings driven; | | RUN-10 | Equivalent (to RUN-04) rise in government expenditure in public administration (Services-2) | Un-Emp; Fix CapFlow; Savings driven; | | Set D: Impact of rise in government transfers to households | | RUN-11 | Equivalent (to RUN-04) rise in government transfers to all households | Un-Emp; Fix CapFlow; Savings driven; | | RUN-12 | Equivalent (to RUN-04) rise in government transfers to bottom 70% of households | Un-Emp; Fix CapFlow; Savings driven; | | Set E: Impact of rise in government investment expenditure | | RUN-13 | Equivalent (to RUN-04) rise in government investment + additional direct tax on top 30% of households | Un-Emp; Fix CapFlow; Fixed investment; | | RUN-14 | Equivalent (to RUN-04) rise in government investment + additional direct tax on top 30% of households + capital flow | Un-Emp; Fix ER; Fixed investment; | | RUN-15 | Equivalent (to RUN-04) rise in government investment + cut in govt. cons + capital flow | Un-Emp; Fix ER; Fixed investment; | | RUN-16 | Equivalent (to RUN-04) rise in government investment + cut in govt. cons + capital flow + exchange rate depreciation | Un-Emp; Fix ER; Fixed investment; | | Source: Authors. | Hence, in the first set, we carry out four simulations RUN-01 to RUN-04 (Table 4). In each of these simulations, we keep the magnitude of shock in government consumption constant, but vary the macroeconomic closure. In RUN-01, we keep the same macroeconomic closure as in the BASE scenario. In RUN-02, we allow for unemployment in the factor market, while keeping the foreign capital flow easy. In RUN-03, we change the closure only for the foreign exchange market by keeping the foreign capital flow at the BASE level. Finally, in RUN-04, we allow for both unemployment and fixed foreign capital flow.7 Set-B: In the second set of scenarios we are concerned with question whether the impact of fiscal expansion depends upon the quantum of expansion. In the event that the impact on, say the GDP, depends upon the quantum of fiscal expansion then it would imply that the relationship is non-linear, and in such a case the nature of non-linearity itself would of interest to understand. If, however, the impact on GDP does not depend upon the magnitude of fiscal expansion, then the relationship is linear and in this case the question of interest is the slope of this linear relation. Towards answering this question we carry out 4 simulations in this set, viz., RUN-05 to RUN-08, all of which have the same specification as RUN-04 of Set-A including the macroeconomic closure except for the magnitude of rise in government expenditure. In RUN-05, the quantum of fiscal expansion is 5 per cent over BASE level, while in RUN-06, RUN-07 and RUN-08 it is 15 per cent, 20 per cent and 25 per cent, respectively. Set-C: In this set, our concern is on the question whether there is a difference in the impact of fiscal expansion if the additional expenditure is directed at specific sectors rather than spread across all sectors as in Set-A scenarios. Specifically, in RUN-09 we examine the impacts of a rise in government expenditure in the social sectors (water supply, education and medical services) while in RUN-10 we study expansion in expenditure on public administration (part of Services-2 sector). In both these simulations, we increase the public expenditure by an equivalent amount as in the Set-A simulations. Further, we keep the macroeconomic closure in both these simulations as in RUN-04 of Set-A. That is, we allow for unemployment and keep the foreign capital flow fixed at the BASE levels. Set-D: Here we focus on the impacts of an increase in government transfers to households. In RUN-11 and RUN-12 we increase government expenditure by the same amount as before. This amount is transferred to all households in RUN-11 in proportion to the transfers that they received in the base SAM for 2011-12. In RUN-12, the additional transfer is restricted to the bottom 70 per cent of the households in rural and urban areas. We keep the unemployment and fixed foreign capital flow closure as in RUN-04 of Set-A. While the quantum of fiscal expansion and macroeconomic closure are same as before, qualitatively these two simulations differ from the previous ones. In the previous sets of simulations, the source of additional demand due to fiscal expansion is the government itself. Here, however, the additional transfers add to household income first. Given household behaviour with regard to savings and consumption, not all of the additional transfer is consumed. A part it is saved and eventually manifests as investment demand. Thus, the nature and source of additional demand varies significantly in these simulations. Between RUN-11 and RUN-12 also there would be differences due to variations in the behaviour of different classes of households. Set-E: In this fifth and final set of simulations, we study the impacts of increase in government investment instead of current consumption. In the 4 simulations that we carry out here, we increase government investment by the same amount as in the previous simulations and allow for unemployed factors of production. One critical aspect of this set of simulations needs to be noted first. As mentioned earlier, in the SAM and in the model, we do not maintain any distinction between public and private investments, and only the total investments in the economy are captured. Further, in the BASE and in all the previous simulations, we have specified the model to be savings driven in the sense that total fixed capital formation is determined by the level of savings that the economy generates. This is the so-called ‘neo-classical closure’. An implication of the neo-classical closure is that neither the level of total fixed investment nor any of its components can be exogenously set to reflect a particular policy. Hence, in order to study increase in government investment, we change the saving-investment closure in this set of simulations. We fix the level of total investment in the economy at the elevated level to mimic the increase in government investment. Given this ‘investment target’ the issue then is one of generating the requisite amount of savings. The 4 simulations that we carry out here vary in the way the requisite savings is generated to meet the investment target. Here it must be noted that as a class CGE models, including ours, characterise the functioning of the real side of the economy only in the sense that there is no money or any other financial asset. Consequently, it is not possible to specify deficit financing (or money creation to put it loosely) as a policy option for raising the requisite savings to meet the investment target. The necessary resources have to come through some combination of private/ government/ foreign savings, which can come about through alternative policy specifications. One way is to impose additional taxes on households so that government is able to raise its revenue and hence savings. This is the so-called ‘Johansen closure’ named after Leif Johansen who first introduced this specification (Johansen 1960). In RUN-13 and RUN-14 we introduce a variable rate of direct tax applicable on the top 30 per cent of the households in both rural and urban areas. These two simulations differ in the specification of the way the foreign exchange market is cleared. In RUN-13 we keep the level of foreign capital flows at the BASE levels and allow exchange rate to adjust to clear the foreign exchange market. Hence in this simulation, the additional tax is the only policy instrument used to raise the requisite savings to meet the investment target. In RUN-14 we allow for the possibility that foreign capital could be accommodative of fiscal expansion directed towards investment. Accordingly, in RUN-14 we change the foreign exchange market closure, wherein the exchange rate is kept fixed at BASE level and allow the foreign capital flows to adjust to clear this market. A comparison of RUN-13 and RUN-14 would reveal how additional foreign capital flows to support enhanced public investment helps relieve the tax burden on households. As opposed to imposing additional taxes to raise government revenue and hence government savings, in RUN-15 and RUN-16 we consider the case of government cutting down its current expenditure in order to raise its savings. Government current consumption in these two simulations is endogenously determined depending upon the amount of savings that has to be generated to meet the target level of investment. With regard to the foreign exchange market, in both these simulations we keep the exchange rate fixed and allow foreign capital flows to be determined endogenously. The difference between these two simulations is that in RUN-15 the exchange rate is kept fixed at BASE levels, while in RUN-16 we allow the Rupee to depreciate somewhat in order to raise the requisite Rupee savings to meet the investment target. We specify that the government allows the Rupee to depreciate by 5 per cent over BASE levels in year 2016-17 (first year of shock) and thereafter the Rupee is allowed to depreciate further gradually by 0.25 per cent annually. This is expected to increase the Rupee value of foreign savings and to that extent it can help moderate the cut in government current expenditure required to meet the savings-investment target. 4. Simulation results 4.1 BASE scenario We begin by presenting some of the key results for the BASE scenario as obtained from the model. The results are shown graphically from the base year 2011-12. As mentioned earlier, the model specification and hence the outcomes for the historic period 2011-12 to 2015-16 is same across all the scenarios. Later, while discussing the results for policy simulations we focus only for the period starting from 2016-17 onwards. Figure 1 shows the projected growth rate of GDP and the evolution of the sectoral shares in GDP in the BASE scenario. For the historical period, the model projected growth rate tracks closely the actual observed growth rate. With regard to the sectoral shares, for the base year 2011-12, the model outcomes show that the three broad sectors agriculture, industry and services have a share of about 18.3 per cent, 33.0 per cent and 48.7 per cent, respectively. Again, these shares are pretty close to the actual observed values for that year as per the New Series of the NAS with base 2011-12. In terms of the projections for the future, it is seen that agriculture and industry lose share by about 7.5 and 4.7 percentage points, respectively, over the 15 years starting from 2011-12, while the share of services increases by 12.3 percentage points over an already large base. By 2025-26, the shares of agriculture, industry and services in GDP are projected to be 10.8 per cent, 28.3 per cent and 61.0 per cent, respectively.  Sectoral prices, however, show the converse trend. Agricultural prices rise sharply compared to both industrial and services prices (Figure 2). In the base year 2011-12, the CPI for all three sectors is nearly same. By 2025-26, however, agricultural products become relatively more expensive – about 2.6 times the price of services and about 1.6 times that of industrial products. The CPI for agricultural products rises by over 60 percentage points over the period 2011-12 to 2025-26. In contrast, the CPI for services fall by about 40 percentage points while CPI of industrial products show a very mild decline during this period.  The movements in sectoral price are closely linked to their cost structure, which in turn depends upon their factor use patterns and factor prices. As mentioned earlier, the model distinguishes three types of labour, viz., unskilled, semi-skilled and skilled. While all sectors use all these three labour types, the share of each labour type varies across the sectors, and follows from the usage pattern as captured in the SAM for the base year 2011-12.8 Table 5 shows the total supply of the three types of labour and their usage pattern across sectors. The supply of unskilled labour force is projected to fall over time from about 228 million in 2011-12 to 186 million in 2025-26. In contrast, the supply of both semi-skilled and skilled labour is expected to rise over this period by 75 million and 26 million, respectively, reflecting the progress in education attainment in the country. As a consequence of the change in the supply patterns of the three labour types, the wage structure undergoes a drastic transformation. Real wages of unskilled labour rises dramatically by 3.9 times over the period 2011-12 to 2025-26 (Figure 3) reflecting the shrinking supply of this type of labour. In contrast, the rise in real wages of semi-skilled and skilled labour is quite modest – 1.9 times in the case of semi-skilled labour and just 1.4 times in the case of skilled labour – due to the expansion in their supply which somewhat offsets the positive impact of the overall rise in productivity on their wages.

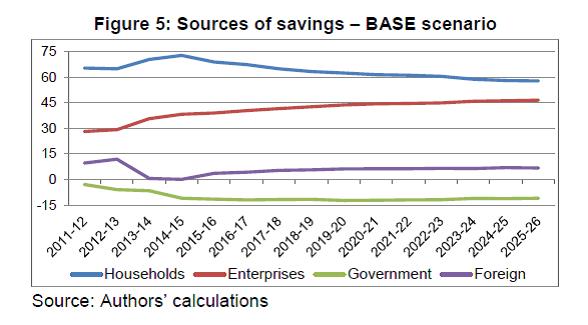

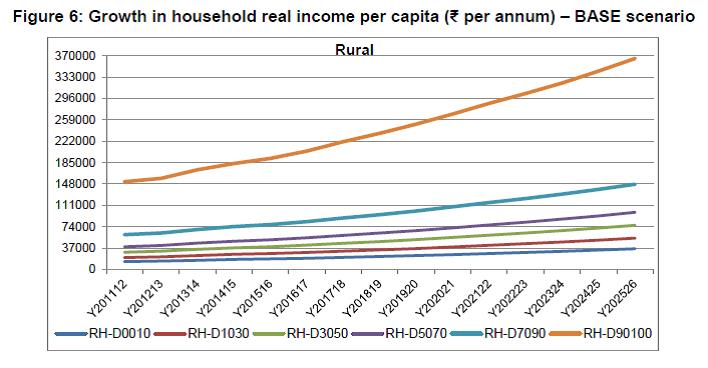

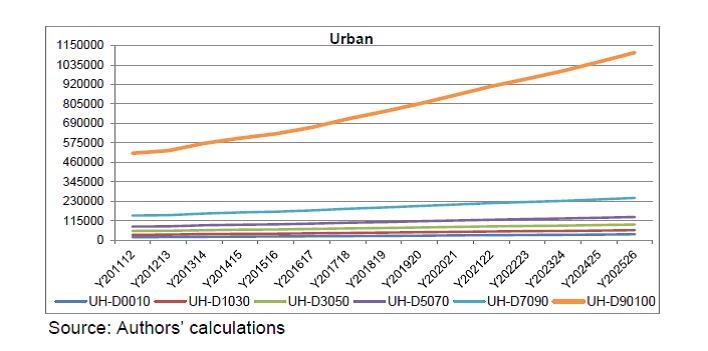

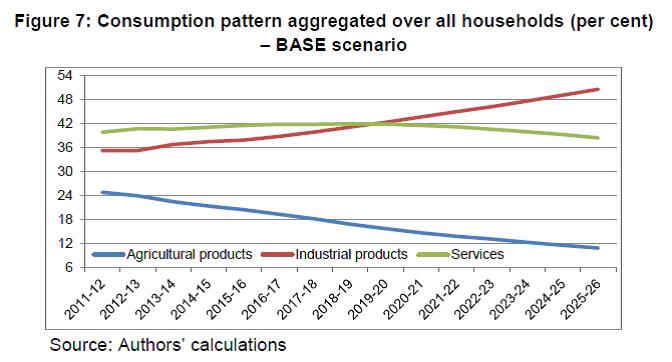

| Table 5: Labour supply and sectoral use pattern (million persons) – BASE scenario | | Year | Unskilled labour | Semi-skilled labour | Skilled labour | | Agri | Ind | Services | Total supply | Agri | Ind | Services | Total supply | Agri | Ind | Services | Total supply | | 2011-12 | 129.6 | 67.3 | 31.5 | 228.3 | 59.1 | 30.8 | 56.2 | 146.1 | 5.1 | 3.5 | 34.4 | 43.0 | | 2012-13 | 131.5 | 66.0 | 29.5 | 227.0 | 63.5 | 32.0 | 55.8 | 151.3 | 5.7 | 3.8 | 35.4 | 44.8 | | 2013-14 | 131.2 | 65.0 | 29.4 | 225.6 | 66.0 | 32.9 | 57.8 | 156.6 | 5.9 | 3.9 | 36.9 | 46.7 | | 2014-15 | 130.8 | 65.0 | 28.0 | 223.8 | 69.3 | 34.6 | 58.0 | 162.0 | 6.4 | 4.2 | 37.9 | 48.5 | | 2015-16 | 129.7 | 65.3 | 26.8 | 221.8 | 72.3 | 36.6 | 58.5 | 167.4 | 6.8 | 4.6 | 39.0 | 50.4 | | 2016-17 | 129.2 | 64.6 | 25.8 | 219.6 | 75.8 | 38.1 | 59.0 | 172.8 | 7.3 | 4.9 | 40.1 | 52.3 | | 2017-18 | 127.1 | 64.8 | 25.1 | 217.0 | 78.1 | 40.0 | 60.2 | 178.3 | 7.6 | 5.1 | 41.4 | 54.2 | | 2018-19 | 126.6 | 63.7 | 23.8 | 214.2 | 82.1 | 41.4 | 60.2 | 183.7 | 8.2 | 5.5 | 42.4 | 56.1 | | 2019-20 | 126.0 | 62.5 | 22.6 | 211.0 | 86.1 | 42.8 | 60.1 | 189.1 | 8.8 | 5.8 | 43.4 | 58.0 | | 2020-21 | 125.1 | 61.3 | 21.2 | 207.6 | 90.4 | 44.4 | 59.7 | 194.5 | 9.5 | 6.1 | 44.2 | 59.9 | | 2021-22 | 123.7 | 60.2 | 19.9 | 203.9 | 94.6 | 46.2 | 59.1 | 199.9 | 10.3 | 6.6 | 44.9 | 61.8 | | 2022-23 | 121.1 | 59.4 | 19.4 | 199.9 | 97.6 | 48.0 | 59.5 | 205.2 | 10.8 | 7.0 | 45.8 | 63.7 | | 2023-24 | 118.3 | 58.4 | 19.0 | 195.7 | 100.6 | 49.8 | 60.0 | 210.5 | 11.4 | 7.4 | 46.7 | 65.5 | | 2024-25 | 115.7 | 57.3 | 18.2 | 191.2 | 104.1 | 51.6 | 60.0 | 215.7 | 12.1 | 7.8 | 47.5 | 67.4 | | 2025-26 | 113.0 | 56.1 | 17.4 | 186.4 | 107.6 | 53.5 | 59.9 | 220.9 | 12.8 | 8.3 | 48.2 | 69.3 | | Source: Authors’ calculations | The use of the three types of labour across sectors is driven by profitability considerations and the production function parameters, which are kept constant in the simulations here. Under this assumption on the technology, it is seen that the use of unskilled (skilled) labour declines (rises) across the board in all sectors. The use of semi-skilled labour rises mainly in agriculture and industry while in services it rises initially up to 2016-17 and stays more or less constant thereafter (Table 5). In terms of deployment across sectors, agriculture’s share in the total demand for unskilled labour actually rises from about 57 per cent in 2011-12 to about 61 per cent in 2025-26, even though the sector’s use of this labour type declines in absolute numbers. In contrast, industry’s share in total demand for unskilled labour remains more or less constant at around 30 per cent while that of services declines from about 14 per cent to 9 per cent. With regard to both semi-skilled and skilled labour, the share of both agriculture and industry in the total demand rises over time while that of services declines commensurately. This demand pattern for the three labour types and the changes in the wage structure seen earlier affects sectoral costs. Agriculture being the largest user of unskilled labour, which witnesses the highest rise in wages, sees a sharp rise in its costs resulting in the sharp rise in its output prices seen earlier (Figure 2). Similarly, industry being another major user of unskilled labour also witnesses a rise in its costs and hence price, though to a much lesser degree than agriculture. In contrast, services sector that uses the least amount of unskilled labour witnesses a decline in its cost and hence its prices relative to the other two sectors. The composition of GDP in terms of various types of expenditure is shown in Figure 4. Private consumption as a percentage of GDP declines rather steadily by about 4 percentage points over the 15-year period. In contrast, government consumption as a percentage of GDP is 2 percentage points higher in the terminal year compared to its initial value. Investments, exports and imports witness some kind of turbulence during the years 2012-13 to 2014-15, when all three of them witness sharp reduction in their shares. Thereafter all three of them witness a steady recovery. By 2025-26, exports is higher by 3 percentage points over its initial value, while investments is only 1 percentage point lower and imports is at the same level as in 2011-12. The current account deficit (CAD) as a percentage of GDP shows much greater movement over this period. In 2011-12 and 2012-13, CAD was about 3.5 per cent and 4.5 per cent of GDP, respectively. Thereafter, it shows a sharp correction to almost 0 per cent in 2014-15. Subsequently, the CAD rises somewhat and fluctuates at around 2 per cent to 2.5 per cent of GDP between 2018-19 and 2025-26.  The source of total savings in the economy by institution type is shown in Figure 5. Households account for well over half the total savings in the economy, though their share is projected to come down by about 7.5 percentage points from the 2011-12 level of 65.3 per cent. The share of enterprises (private and public) in total is expected to rise dramatically to about 47 per cent in 2025-26 from 28 per cent in 2011-12. Government is expected to remain a dis-saver and this is expected to worsen over time. Government’s share in total savings deteriorates to -11 per cent in 2025-26 from -3 per cent in 2011-12. Finally, the share of foreign savings shows fluctuations in the initial years, but stabilises later on at around 6 per cent to 7 per cent from 2019-20 onwards.  The growth in real income per capita for rural and urban households is shown in Figure 6. In the model, household specific CPI based on their respective consumption pattern is used to compute the real income. Thus, we capture the growth in nominal income and also the changes in relative prices that matter for the each household type. The figure brings out clearly rural-urban divide at each MPCE percentile groups. Indeed, on an absolute basis, the difference is starker for the top 10 per cent MPCE group – the income of the richest rural household is only 30 per cent (33 per cent) of the richest urban household in the year 2011-12 (2025-26). In contrast, the poorest rural household’s income was 75 per cent (102 per cent) of the poorest urban household in the year 2011-12 (2025-26). Over the 15 years, real income per capita doubles for all rural households with the increase being higher for the poorer rural households than for the richer rural households. In contrast, the rise in real income per capita is less than double for all but the richest urban households. In other words, within rural inequality is projected to come down while within urban inequality is expected to rise even as rural-urban inequality is expected to decline, especially for the lower income groups. The distribution of savings across various household classes is shown in Table 6. In 2011-12, 84 per cent of household savings were accounted for by the top 30 per cent of households in rural and urban areas, with about 37 per cent coming from the rural top 30 per cent and the balance 47 per cent from the urban top 30 per cent. Over time, with real incomes growing across all households, the share of the top 30 per cent of the households is projected to come down by 7 percentage points to about 77 per cent in the terminal year. Interestingly, the gap in the shares of rural and urban top 30 per cent of households is projected to narrow down over time 38 per cent for the rural top 30 per cent versus 39 per cent for their urban counterparts. Another interesting aspect of these projections is that in the terminal year the bottom 70 per cent of rural population is projected to account for 15 per cent of total household savings while their urban counterparts are expected to contribute only 8 per cent.