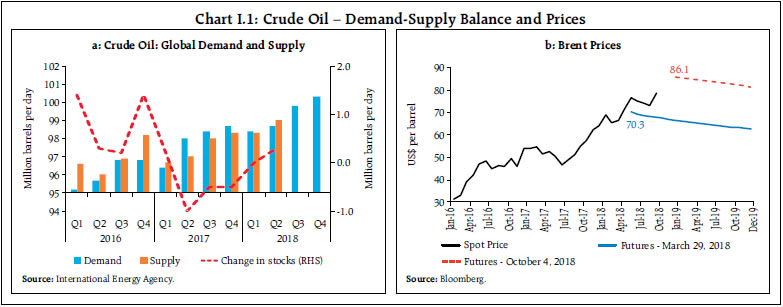

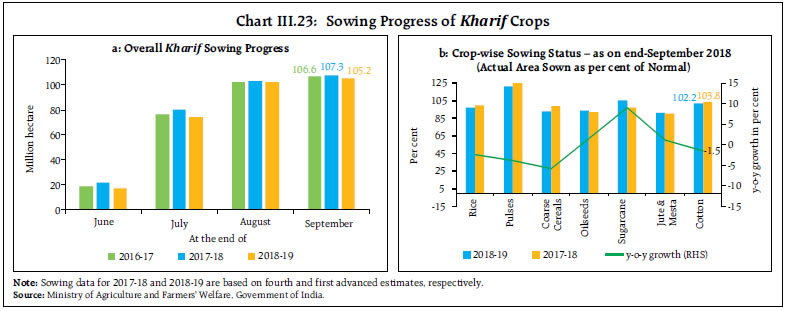

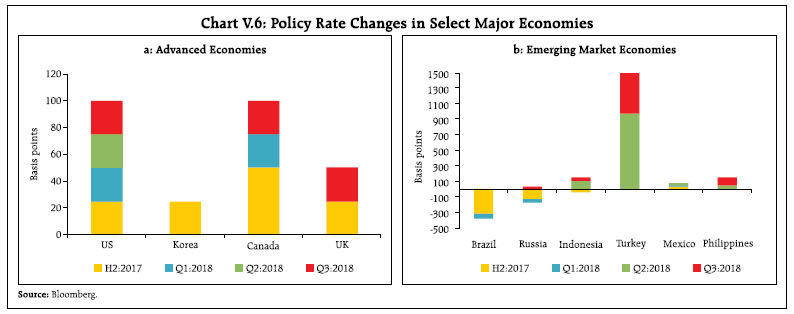

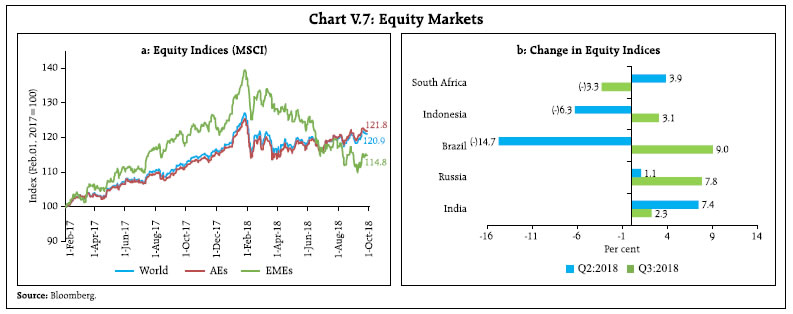

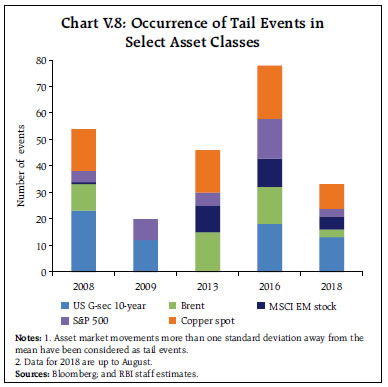

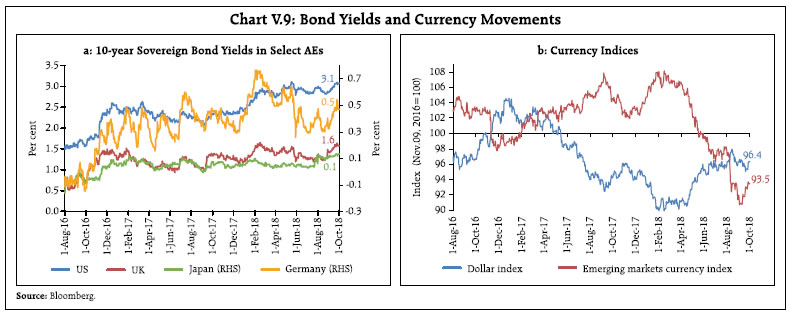

| I. Macroeconomic Outlook While domestic activity has continued to exhibit resilience and stability after the April 2018 Monetary Policy Report, the external environment has remained challenging and imparted downside risk to India’s growth prospects. The soft headline inflation readings for July and August 2018 relative to projections imply a largely benign food prices outlook in the near term even as upside risks to inflation over the 12-month ahead horizon appear to be rising modestly due to global financial market volatility and surging oil prices. I.1 Key Developments since April 2018 MPR In the period following the Monetary Policy Report (MPR) of April 2018, several risks it had flagged have been materialising on an ongoing basis. The global macroeconomic and financial environment has been roiled by bouts of financial market volatility, retaliatory trade protectionism among major economies of the world, elevated and volatile crude oil prices, and recurring jitters around the efficacy of managing monetary policy normalisation in the US amidst a late-in-the-cycle US fiscal stimulus, occurring all at once, lashing emerging market economies (EMEs) as an asset class with asset price shocks and capital outflows. More recently, vulnerabilities surfacing amongst specific EMEs have produced powerful contagion effects. Taken together, these global factors appear to be increasing risks around India’s growth prospects over the next 12-month horizon with a slant to the downside. Global growth itself is getting differentiated across economies and the cyclical upswing in global trade that had started in Q4:2017 is being stifled by rising trade tensions. Meanwhile, domestic economic activity has continued to exhibit resilience and stability in these highly unsettled global conditions. On the agricultural front, the spatial distribution of south-west monsoon was somewhat skewed, although most of the kharif crop growing states received normal rainfall. Industrial activity has gathered pace and the outlook for the services sector is gradually improving. Inward foreign direct investment remains buoyant. The slow firming up of private consumption and investment are expected to be sustained in H2:2018-19. The soft headline inflation readings for July and August 2018 relative to projections imply a largely benign food prices outlook in the near term; however, volatility in global financial markets and surging oil prices remain upside risks to inflation over the 12-month ahead horizon. These developments pose challenges for the setting of monetary policy in India. Monetary Policy Committee: April-August 2018 During April-August 2018, the Monetary Policy Committee (MPC) met thrice in accordance with its bi-monthly schedule. Maintaining status quo in its April 2018 meeting, the MPC increased the policy repo rate by 25 basis points (bps) successively in its June and August 2018 meetings. In its June 2018 meeting, the MPC’s vote was unanimous against the backdrop of rising inflation, upward revision in inflation projections, sharper than anticipated increase in crude oil prices, and hardening of households’ inflation expectations. In August, however, the MPC’s vote was by a majority of 5:1. The decision by majority was influenced by further hardening of inflation and inflation expectations amidst uncertainty around the impact of the minimum support price (MSP) hikes. The MPC’s voting pattern, which reflects differences in individual members’ assessments and expectations as well as relative weights on policy goals, is also observed in other central banks (Table I.1). Macroeconomic Outlook Chapters II and III analyse developments relating to prices and costs and demand and supply conditions during the first half of 2018-19, comparing outcomes versus forecasts and setting reasons underlying divergences. Turning to the outlook, developments in key macroeconomic variables over the past six months warrant revisions in the baseline assumptions (Table I.2). | Table I.1 Monetary Policy Committees and Voting Patterns | | Country | Policy Meetings: April - September 2018 | | Total Meetings | Meetings With Full Consensus | Meetings With Dissents | | Brazil | 4 | 4 | 0 | | Chile | 4 | 4 | 0 | | Colombia | 4 | 4 | 0 | | Czech Republic | 4 | 2 | 2 | | Hungary | 6 | 6 | 0 | | Israel | 4 | 0 | 4 | | Japan | 4 | 0 | 4 | | South Africa | 3 | 2 | 1 | | Sweden | 3 | 0 | 3 | | Thailand | 4 | 1 | 3 | | UK | 4 | 2 | 2 | | US | 4 | 4 | 0 | | Sources: Central bank websites; and Bloomberg. | First, international crude oil prices have firmed up by more than US$ 15 per barrel over the April 2018 MPR baseline assumption. Given the current demand-supply assessment and signals extracted from the futures market, the baseline scenario assumes crude oil prices (Indian basket) to average US$ 80 a barrel in the second half of 2018-19 (Chart I.1). Second, the exchange rate of the Indian rupee (INR) visà- vis the US dollar has depreciated from its end-March level, reflecting (i) the general strengthening of the US dollar across major currencies; (ii) higher crude oil prices widening the trade and current account deficits; (iii) portfolio outflows; and (iv) risk aversion among portfolio investors towards EMEs after the country-specific developments in Turkey and Argentina. As on October 4, the INR had depreciated by 11.8 per cent against the US dollar from its level at end-March 2018. | Table I.2: Baseline Assumptions for Near-Term Projections | | Indicator | April 2018 MPR | Current (October 2018) MPR | | Crude Oil (Indian Basket) | US$ 68 per barrel | US$ 80 per barrel during H2:2018-19 | | Exchange rate | ₹65.5/US$ | ₹72.5/US$ | | Monsoon | Normal for 2018 | 9 per cent below long period average | | Global growth | 3.9 per cent in 2018 | 3.9 per cent in 2018 | | 3.9 per cent in 2019 | 3.9 per cent in 2019 | | Fiscal deficit (per cent of GDP) | To remain within BE 2018-19

Centre: 3.3

Combined (Centre and States): 6.0 | To remain within BE 2018-19

Centre: 3.3

Combined (Centre and States): 5.9 | | Domestic macroeconomic/ structural policies during the forecast period | No major change | No major change | Notes: 1. The Indian basket of crude oil represents a derived numeraire comprising sour grade (Oman and Dubai average) and sweet grade (Brent) crude oil.

2. The exchange rate path assumed here is for the purpose of generating staff’s baseline growth and inflation projections and does not indicate any ‘view’ on the level of the exchange rate. The Reserve Bank is guided by the objective of containing excess volatility in the foreign exchange market and not by any specific level of and/or band around the exchange rate.

3. Global growth projections are from the World Economic Outlook (January 2018 and July 2018 Updates), International Monetary Fund (IMF).

4. BE: Budget estimates. |

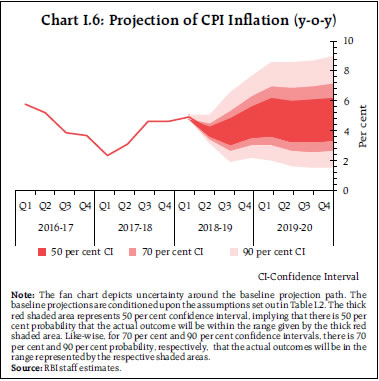

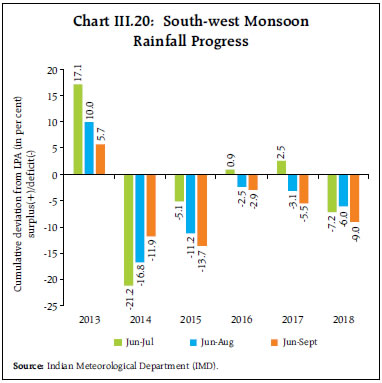

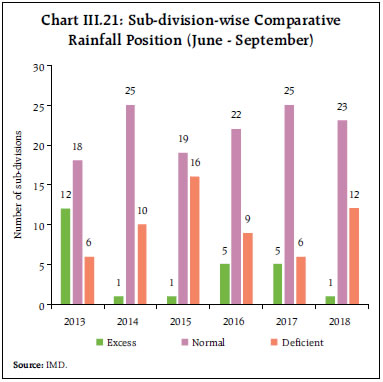

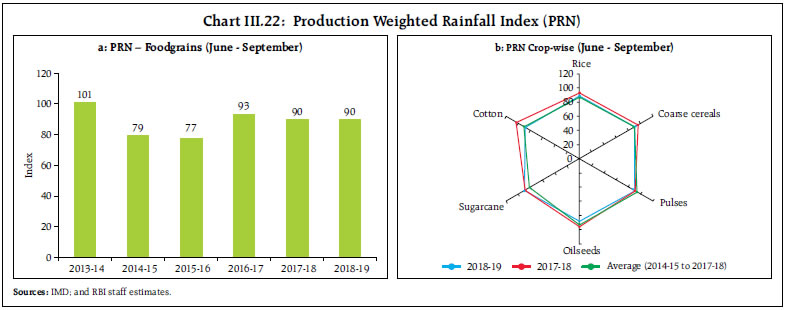

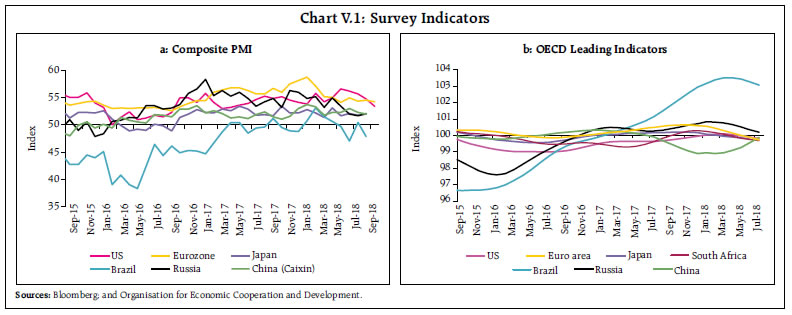

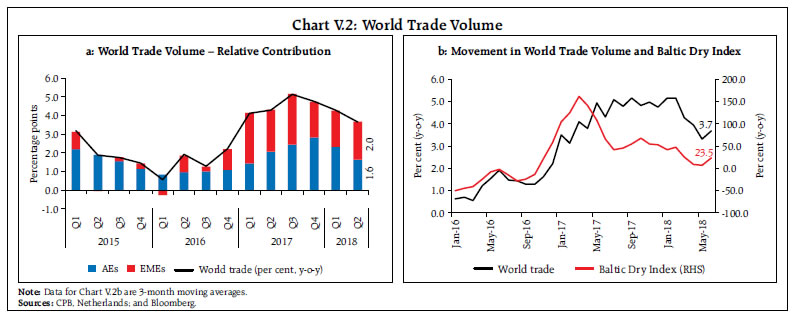

Third, global economic activity has expanded, broadly in line with the baseline projections given by the International Monetary Fund (IMF) in April (Chart I.2). However, it has become uneven and less synchronised across regions. Uncertainty has heightened on account of escalating protectionism and tariff wars, tightening of global financial conditions, and higher oil prices, all posing downside risks to global growth. The recovery in world trade is losing momentum.1 Finally, the south-west monsoon rainfall (June- September 2018) was 9 per cent below long period average, vis-à-vis the baseline assumption of normal monsoon made in April. I.2 The Outlook for Inflation Headline consumer price index (CPI) inflation averaged 4.4 per cent during 2018-19 up to August [4.1 per cent, excluding the estimated impact of house rent allowances (HRAs) for central government employees]. A broad-based uptick in inflation in respect of prices of fuel, transportation, personal care/effects, education and health services was largely offset by the unexpectedly and unseasonally benign food inflation (Chapter II). Looking ahead, it is useful to read into the signals emitted by inflation expectations of firms and households. By shaping price and wage setting behaviour, they influence future inflation. Inflation expectations also adapt to actual inflation outcomes of salient items such as food and fuel. Inflation expectations of urban households surveyed by the Reserve Bank exhibited a mixed picture in its September 2018 round2: they increased by 50 bps over the previous round for the three months ahead horizon and softened by 30 bps for the one year ahead horizon. The proportion of respondents expecting the general price level to increase by more than the current rate, however, declined marginally in the September round for the three months ahead horizon and was almost unchanged for the one year ahead horizon (Chart I.3). Manufacturing firms polled in the July-September 2018 round of the Reserve Bank’s industrial outlook survey expected higher cost of raw materials in Q3:2018-19 (Chart I.4).3 Consequently, respondents anticipated input prices to firm up further and muted profit margins in spite of higher selling prices. According to the Nikkei’s purchasing managers’ survey, firms in both the manufacturing and services sectors raised output prices in September 2018 in the face of input cost pressures. Professional forecasters surveyed by the Reserve Bank in September 2018 expected CPI inflation to fall from 4.8 per cent in Q1:2018-19 to 4.1 per cent in Q3 and then pick up to 5.1 per cent by Q2:2019-20 (Chart I.5).4 Taking into account the initial conditions, signals from forward-looking surveys and estimates from structural and other models5, CPI inflation is projected to pick up from 3.7 per cent in August 2018 to 3.9 per cent in Q3:2018-19 and 4.5 per cent in Q4:2018-19, with risks somewhat tilted to the upside (Chart I.6). The projected increase in inflation from current levels reflects the waning away of favourable base effects and anticipates the feeding through of the impact of the increase in MSPs into retail inflation. The direct impact of the increase in HRA by central government has started waning and will fade away completely by December 2018. Excluding the estimated impact of HRA for central government employees, CPI inflation is projected at 3.8 per cent in Q3:2018-19 and 4.5 per cent in Q4:2018-19. The 50 per cent and the 70 per cent confidence intervals for headline inflation in Q4:2018-19 are 3.6-5.7 per cent and 3.1-6.4 per cent, respectively.   For 2019-20, structural model estimates indicate that inflation will move in a range of 4.5-4.8 per cent, assuming a normal monsoon and no major exogenous/ policy shocks. The 50 per cent and the 70 per cent confidence intervals for Q4:2019-20 are 3.4-6.3 per cent and 2.7-7.2 per cent, respectively. There are upside and downside risks to the baseline inflation path. As stated earlier, the announced increase in MSPs for kharif crops has been much bigger than in the recent past, but there is considerable uncertainty about the exact impact of the scale and timing of government procurement operations. Other upside risks in the context of the baseline projection include supply disruptions in the global crude oil market, volatility in international financial markets and second round effects of the staggered HRA revisions by state governments. A major downside risk to the baseline could be decline in demand for oil due to global growth slowdown on account of rising trade tensions, which may help bring down oil prices. I.3 The Outlook for Growth The April 2018 MPR had projected an acceleration in real gross domestic product (GDP) growth in 2018-19 on the back of: (a) the goods and services tax (GST) stabilising; (b) improving credit offtake; (c) likely boost to investment from primary market resource mobilisation; (d) the process of recapitalisation of public sector banks and resolution of distressed assets under the Insolvency and Bankruptcy Code (IBC); (e) buoyant global trade; and (f) the thrust to the rural and infrastructure sectors in the Union Budget 2018- 19. Most of these have materialised, but to varying extent. However, global trade growth, as stated earlier, seems to be losing its synchronised momentum and this may hinder India’s export prospects. The uneven spatial distribution of the south-west monsoon is another factor that has also imparted some uncertainty to the agricultural outlook and inflation. Turning to forward-looking surveys, consumer confidence over the year ahead improved marginally in the September 2018 round of the Reserve Bank’s survey, reflecting an optimism on incomes and prices (Chart I.7).6 Optimism in the manufacturing sector for the quarter ahead improved in the September 2018 round of the Reserve Bank’s industrial outlook survey on account of higher order books and selling prices (Chart I.8).

| Table I.3: Business Expectations Surveys | | Item | NCAER Business Confidence Index (August 2018) | FICCI Overall Business Confidence Index (September 2018) | Dun and Bradstreet Composite Business Optimism Index (July 2018) | CII Business Confidence Index (September 2018) | | Current level of the index | 114.4 | 65.4 | 80.6 | 64.9 | | Index as per previous survey | 131.4 | 71.0 | 85.0 | 60.1 | | % change (q-o-q) sequential | -12.9 | -7.9 | -5.2 | 8.0 | | % change (y-o-y) | -15.9 | -1.1 | 11.7 | 11.3 | Notes: 1. NCAER: National Council of Applied Economic Research.

2. FICCI: Federation of Indian Chambers of Commerce & Industry.

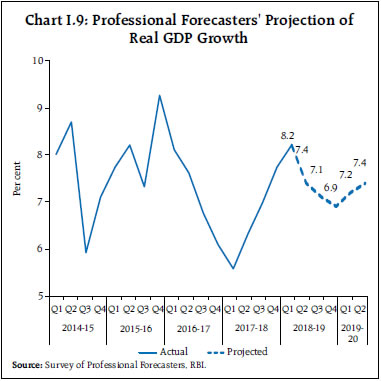

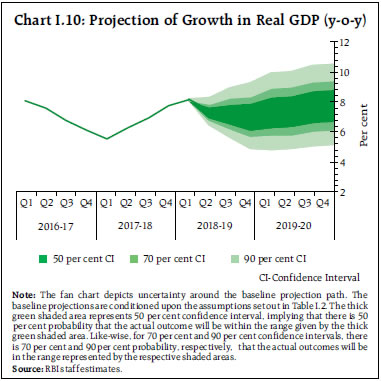

3. CII: Confederation of Indian Industry. | Surveys by other agencies indicate a mixed picture on future business expectations (Table I.3). Firms in the manufacturing and services sectors polled in the Nikkei’s purchasing managers’ surveys (September 2018) were optimistic about their output prospects a year ahead, driven by expected improvement in demand. In the September round of the Reserve Bank’s survey, professional forecasters expected real GDP growth to decelerate from 8.2 per cent in Q1:2018-19 to 6.9 per cent in Q4 and then recover to 7.4 per cent in Q2:2019- 20 (Chart I.9 and Table I.4). Taking into account the baseline assumptions, monetary policy tightening of 50 bps during June- August 2018, survey indicators and model forecasts, real GDP growth is projected to improve from 6.7 per cent in 2017-18 to 7.4 per cent in 2018-19 – 8.2 per cent in Q1, 7.4 per cent in Q2, 7.3 per cent in Q3 and 7.1 per cent in Q4 – with risks broadly balanced around this baseline path (Chart I.10). For 2019-20, structural model estimates indicate real GDP growth at 7.6 per cent, with quarterly growth rates in the range of 7.4-7.9 per cent, assuming a normal monsoon and no major exogenous or policy shocks. Strengthening investment activity and a further pick-up in credit growth impart an upside bias to the baseline growth projections. However, recent protectionist measures by major economies, threats of currency wars and the uncertainty associated with the pace of monetary policy normalisation in the US and other major advanced economies pose downside risks to the baseline growth path.

| Table I.4: Projections – Reserve Bank and Professional Forecasters | | (Per cent) | | | 2018-19 | 2019-20 | | Reserve Bank’s Baseline Projections | | | | Inflation, Q4 (y-o-y) | 4.5 | 4.6 | | Inflation excluding the estimated impact of HRA for central government employees, Q4 (y-o-y) | 4.5 | 4.6 | | Real GDP growth | 7.4 | 7.6 | | Median Projections of Professional Forecasters | | | | Inflation, Q4 (y-o-y) | 4.5 | 5.1# | | Real GDP growth | 7.4 | 7.5 | | Gross domestic saving (per cent of GNDI) | 29.8 | 30.0 | | Gross fixed capital formation (per cent of GDP) | 28.8 | 29.1 | | Credit growth of scheduled commercial banks | 12.0 | 12.3 | | Combined gross fiscal deficit (per cent of GDP) | 6.2 | 5.9 | | Central government gross fiscal deficit (per cent of GDP) | 3.3 | 3.1 | | Repo rate (end-period) | 7.00 | 7.00# | | Yield on 91-days treasury bills (end-period) | 7.2 | 7.2 | | Yield on 10-year central government securities (end-period) | 8.1 | 8.0 | | Overall balance of payments (US$ billion) | -20.7 | 0.3 | | Merchandise export growth | 10.4 | 9.7 | | Merchandise import growth | 14.3 | 8.4 | | Current account balance (per cent of GDP) | -2.7 | -2.5 | #: Forecast for Q2:2019-20; GNDI: Gross National Disposable Income.

Sources: RBI staff estimates; and Survey of Professional Forecasters (September 2018). |

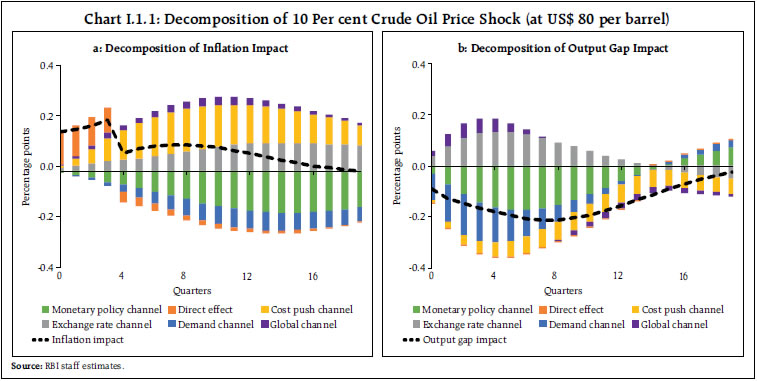

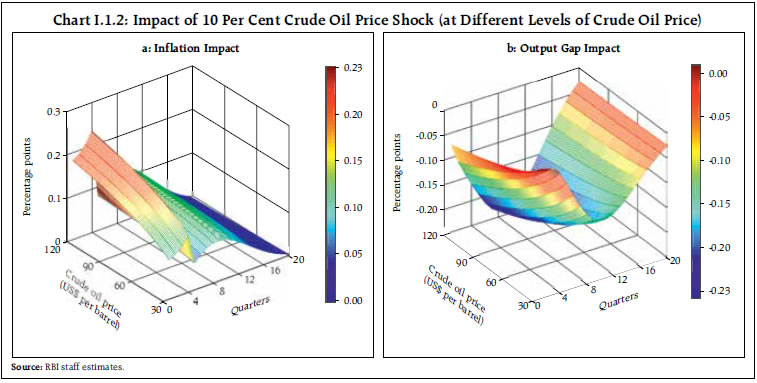

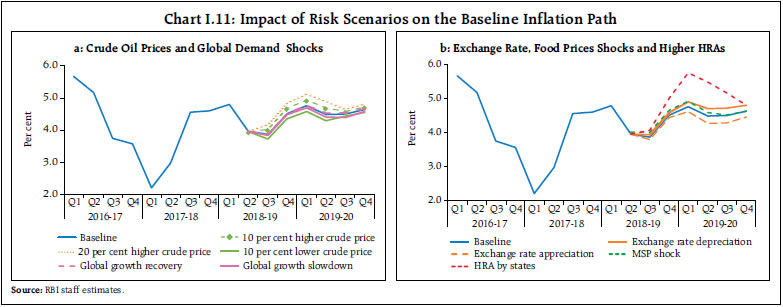

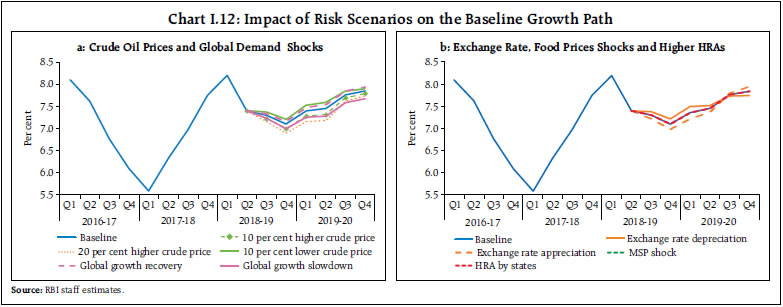

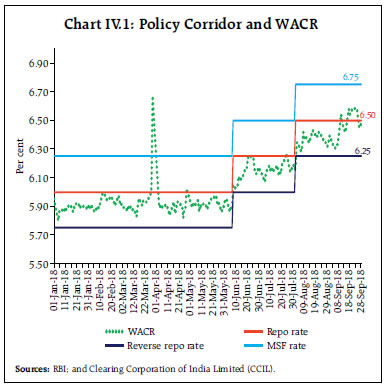

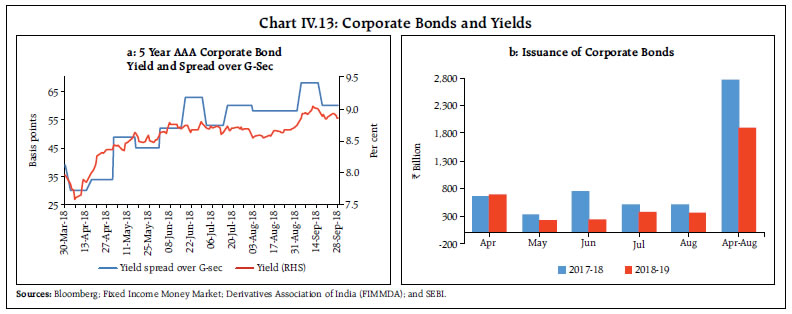

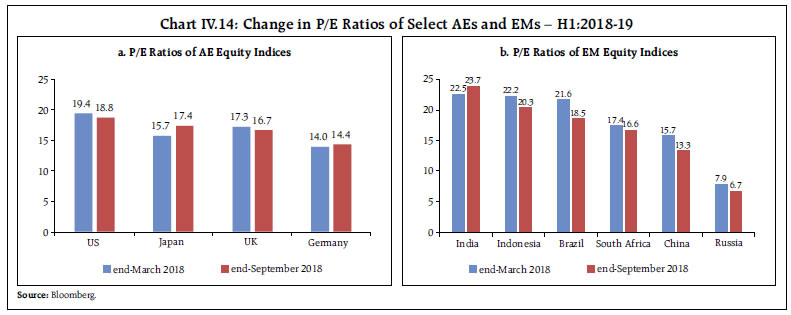

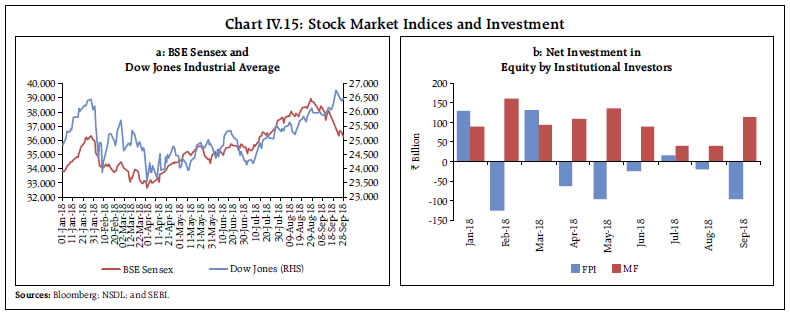

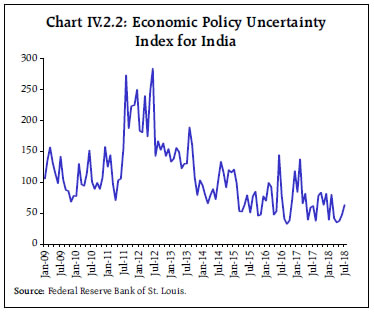

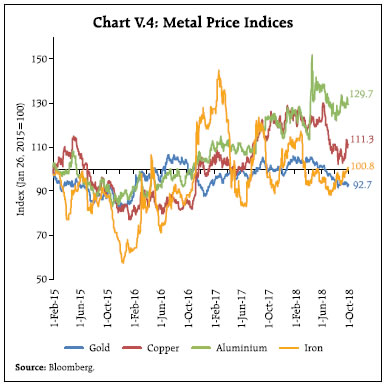

I.4 Balance of Risks The baseline projections of inflation and growth presented in the previous two sections are conditional on assumptions relating to key variables such as crude oil prices, external demand, exchange rate movements and fiscal stance (Table I.2) as well as the impact of higher MSPs. There are several uncertainties around the baseline assumptions, however, which could pose risks to baseline projections. The sensitivity of the baseline projections to plausible alternative scenarios is set out below. (i) International Crude Oil Prices Sharp swings in global crude prices over the past six months impart uncertainty to the outlook. The baseline scenario assumes crude oil prices (Indian basket) at US$ 80 per barrel in the second half of 2018-19. Upside risks to the baseline assumption can emanate from geo-political developments and supply disruptions. For a net energy importer like India, the dynamics of international crude price movements have significant macroeconomic implications. Box I.1 presents a scenario in which the Indian basket price increases by 10 per cent to US$ 88 per barrel, which is plausible under the current global crude oil price volatility. Under this scenario, inflation could increase by 20 bps and real GDP growth could be lower by around 15 bps in relation to their respective baselines given in Sections I.2 and I.3 (Charts I.11a and I.12a). Assuming that the Indian basket crude oil price increases by 20 per cent to US$ 96 a barrel, inflation and GDP growth could turn out to be 40 bps above and 30 bps below their respective baselines. Conversely, crude oil prices could soften below the baseline assumption if, for instance, there is a larger than expected shale gas supply and weaker than expected global demand due to growth slowing down on account of protectionist measures. As a result, if the price of the Indian basket of crude falls by 10 per cent to US$ 72 per barrel, inflation could ease by around 20 bps with a boost of 15 bps to growth. (ii) Global Growth In the baseline scenario, global growth is expected to be stronger in 2018 and 2019 relative to 2017. While the pace of global growth has been maintained in Q2:2018, it has turned uneven with new risks clouding the outlook. Escalating protectionism and rising geopolitical tensions could weigh on external demand. Tightening of financial conditions on the back of US monetary policy normalisation and expansionary US fiscal policy and uncertainty about the pace of further normalisation could also dampen global demand. If global growth slips by 50 bps, domestic growth and inflation could be around 20 bps and 10 bps below their respective baseline trajectories. However, if inflation remains benign in major advanced economies, a more gradual pace of monetary policy normalisation in these economies could boost global demand and global commodity prices. In this scenario, assuming that global growth surprises by 25 bps on the upside, domestic growth and inflation could edge higher by around 10 bps and 5 bps, respectively (Charts I.11a and I.12a). (iii) House Rent Allowances – Implementation by States Following the increase in pay and allowances by the central government for its employees based on the recommendations of the 7th central pay commission (CPC), some state governments have revised pay and allowances for their employees. If all state governments implement the increase in pay and allowances – especially HRAs – of an order similar to that of the central government, and if these get reflected in CPI, headline inflation could be around 100 bps above the baseline on account of the direct statistical effect on house rents (Chart I.11b). Additional indirect effects could also arise from higher demand and inflation expectations. As noted by the MPC in its recent resolutions, the direct statistical impact of HRA revisions will be looked through for policy purposes, while being watchful for any second-round effects. Box I.1: Macroeconomics of Crude Oil Prices Crude oil prices (Indian basket) increased from US$ 47 per barrel in June 2017 to US$ 78 in September 2018, an increase of 67 per cent in a span of 15 months. It is estimated that a US$ 10 increase in the price of international crude oil could reduce output in the OECD area by 20 bps after two years and raise inflation by 20 bps in the first year and by another 10 bps in the second year (OECD, 2011). For large net energy importers like India – 80 per cent of India’s crude oil requirement is met through imports – recent estimates suggest that real GDP growth could decline from its current trajectory, while inflation could rise significantly above target, rendering the current favourable macroeconomic conditions vulnerable. In addition, it is estimated that for every US$ 1 increase in the price of a barrel of crude, India’s current account deficit could widen by US$ 0.8 billion. Increases in crude oil prices impact economic activity through a variety of channels. Therefore, it is important to examine their effects in a general equilibrium context. The RBI’s workhorse Quarterly Projection Model (QPM) in its Forecasting and Policy Analysis System (FPAS), which draws its analytical underpinnings from new Keynesian foundations7, provides the flexibility to incorporate these various channels. There is the cost push channel that operates through the prices of non-administered fuel products i.e., petrol and diesel, whereby energy costs impact firms’ input costs, including transportation and other intermediate services. In addition, crude price increases are transmitted to the domestic economy through reduction in global demand, adverse price movements in respect of imports and exports, and undue volatility in the exchange rate. These diverse channels produce substitutions between energy and non-energy consumption, a reduction in output and an increase in inflation. The monetary policy response to these outcomes can, in turn, set off a chain of macroeconomic adjustments. The QPM depicts the various channels through which this transmission works (Chart I.1.1). A 10 per cent increase in international crude prices imparts a shock to petroleum product prices. Headline inflation goes up instantaneously by 13 bps, which takes up to a year to wear off. Furthermore, an increase in petroleum prices imparts cost push effects, which contribute about 15 bps to the increase in headline inflation. People react by spending less on non-oil items of consumption, reducing demand. To the extent that firms are not able to pass through the increase in oil prices to product prices, it reduces their profit margins, cash flows and investment. As a result, aggregate demand declines, leading to a negative contribution to inflation in the range of 5-10 bps. The crude oil price increase can also lead to a deterioration in the trade deficit, which can put downward pressure on the rupee, translating into an additional 10 bps increase in inflation. Consequently, monetary policy tightening is required to bring inflation back to target. The monetary policy reaction widens the output gap, compressing demand and thereby inflation. At its peak, the impact of the 10 per cent increase in crude oil price shock is expected to reduce growth by 15 bps and push up headline inflation by around 20 bps.   The effect of crude oil prices on domestic inflation and output depends upon not only on the extent of the change in crude oil prices but also on their initial level. This is because retail petroleum product prices contain several elements which are largely fixed – for example, excise duty and refining costs – while the base price moves in line with the movements in international crude oil prices and the exchange rate. The value added tax component moves in line with prices charged to dealers (inclusive of excise duty). The higher the level of crude oil prices, the smaller is the proportion of fixed elements and larger is the impact of a given increase in crude oil prices on domestic petrol and diesel inflation, and hence on overall inflation and output (Chart I.1.2). For instance, an increase of 10 per cent in crude oil prices from US$ 30 per barrel to US$ 33 per barrel is estimated to increase inflation by 13 bps, while a similar order of increase from US$ 100 a barrel to US$ 110 a barrel could pull up inflation by around 22 bps. References: Benes, Jaromir, et al. (2016), “Quarterly Projection Model for India: Key Elements and Properties”, RBI Working Paper Series, No. 08/2016. OECD (2011), “The Effects of Oil Price Hikes on Economic Activity and Inflation”, OECD Economics Department Policy Notes, No. 4. |

(iv) Exchange Rate The INR depreciated vis-à-vis the US dollar during April-September, reflecting both domestic and global developments. Looking ahead, a faster pace of monetary policy normalisation by the US Fed than currently factored in by financial markets, rising trade protectionism, threat of currency wars, and higher international crude oil prices are some of the factors that could exert downward pressure on the Indian rupee. Assuming a depreciation of the Indian rupee by around 5 per cent relative to the baseline, inflation could increase by around 20 bps, while the likely boost to net exports could push up growth by around 15 bps. On the other hand, India could also attract large inflows with its reasonably sound domestic fundamentals relative to its peers and the various initiatives taken by the government to boost investment. An appreciation of the Indian rupee by 5 per cent in this scenario could soften inflation by around 20 bps and GDP growth by around 15 bps in 2018-19 (Charts I.11b and I.12b).  (v) Food Inflation The large increase in MSPs for kharif crops announced by the government in July 2018 can have a direct impact on food inflation and second round effects on headline inflation through relative price adjustments, higher demand on the back of higher rural incomes and increase in inflation expectations. The baseline projections incorporate the likely effect of the increase in MSPs on inflation, assuming normal procurement by the government in line with past trends (Box II.1). However, if procurement operations turn out to be larger than assumed, headline inflation could increase by around 20 bps above the baseline. (vi) Fiscal Slippage The baseline projections assume a fiscal stance as announced in the Union and State budgets for 2018-19. Higher MSPs combined with stepped-up food procurement operations and unbudgeted farm loan waivers by states pose upside risks to the fiscal outlook. Should there be fiscal slippage at the centre and/or state levels, it could result in greater market volatility, crowding out of private investment and higher inflation. Quantitative estimates of these risks will, however, be reliant on incoming data right up to the April 2019 MPR. I.5 Conclusion To sum up, real GDP growth is expected to accelerate in 2018-19 vis-à-vis 2017-18, with the pace of growth easing in H2 relative to H1. Stabilisation of the goods and services tax, progress on resolution of distressed assets under the insolvency and bankruptcy code and initiatives towards strengthening of bank balance sheets are supporting economic and investment activity. However, the uncertain global environment poses an important downside risk to the domestic growth outlook. Inflation is expected to pick up from its current levels as the MSPs for kharif crops feed into domestic food inflation and favourable base effects dissipate. Volatile crude oil prices and the volatility in international financial markets pose the primary upside risks to the inflation outlook. ________________________________________________________________________

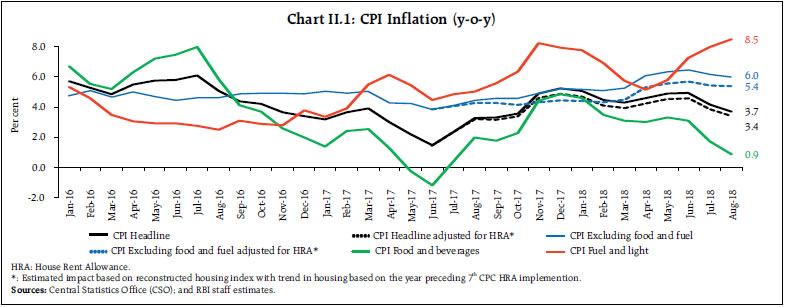

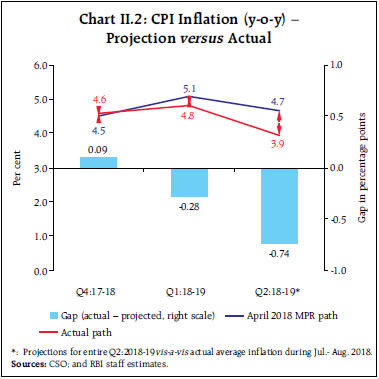

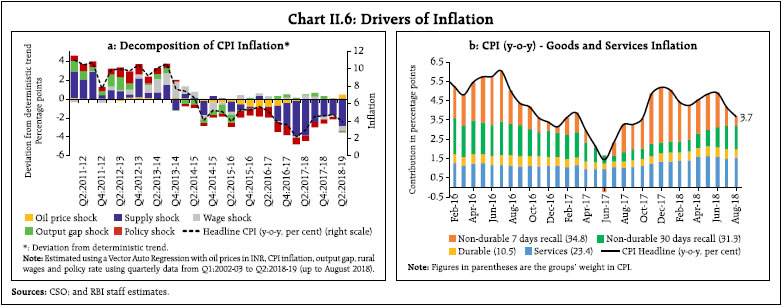

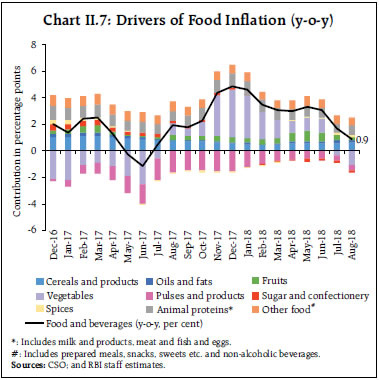

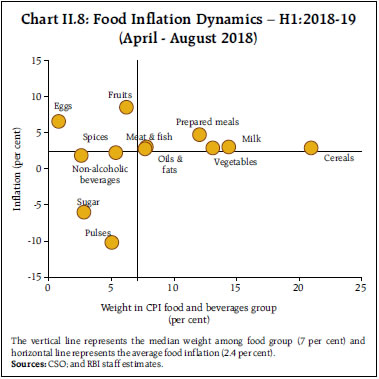

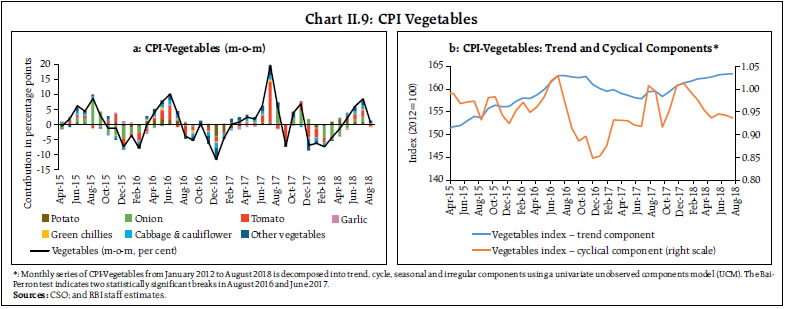

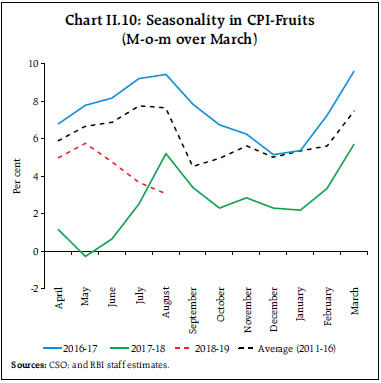

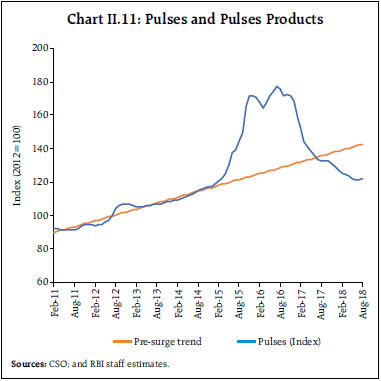

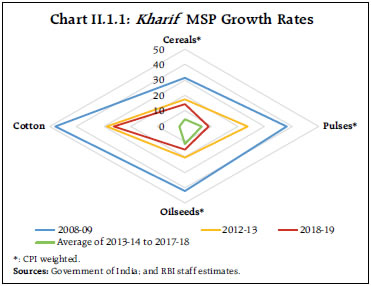

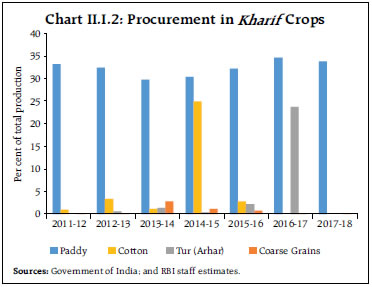

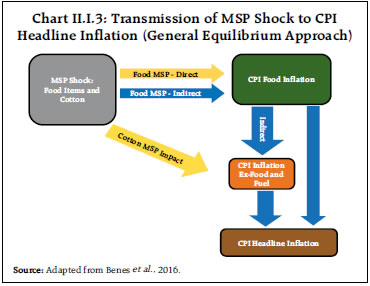

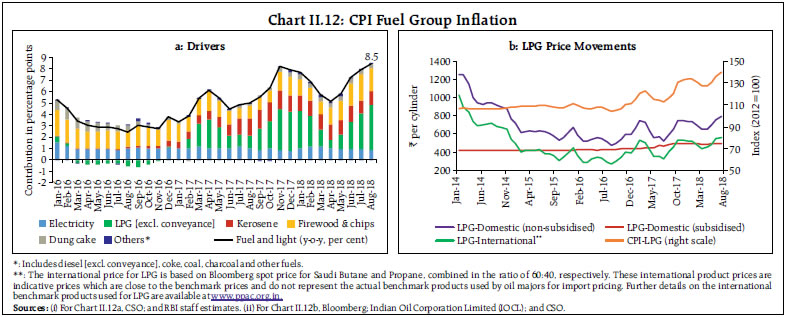

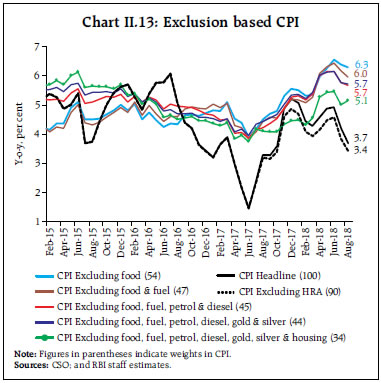

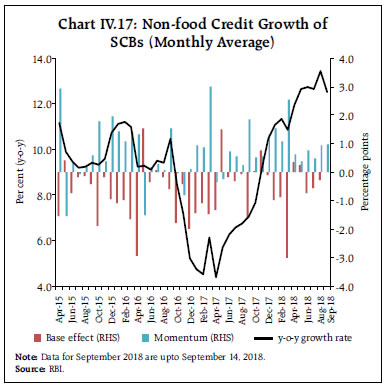

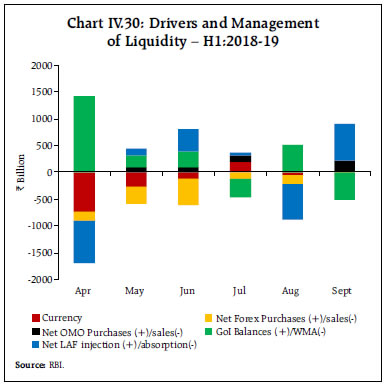

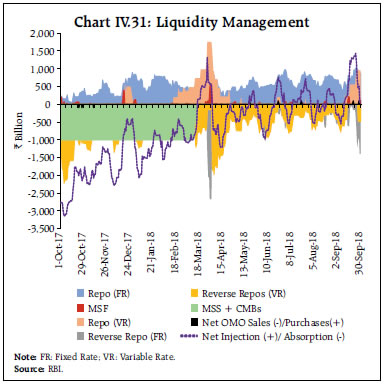

II. Prices and Costs Inflation has eased in Q2:2018-19 on an unusual ebbing in the momentum of food prices, after rising strongly in Q1 on the back of surging prices of non-food items (including the impact of 7th CPC’s HRA increase) across categories. Input costs rose sharply in Q1 and remained firm in Q2, largely due to increase in fuel prices. Wage pressures remained contained in both rural and organised sectors. Over the first half of 2018-19, the course of consumer price index (CPI) inflation has been shaped by diverse pulls. Within major groups, while food inflation remained soft in Q1:2018-19, and declined sharply in July and August 2018, fuel and light inflation rose noticeably, tracking international prices. Inflation in CPI excluding food and fuel also firmed up in Q1:2018-19 and remained elevated through July- August, notwithstanding some softening. The impact of the increase in house rent allowances (HRA) for central government employees on headline inflation has started to ebb from July.1 Adjusting for the HRA impact, headline inflation in August was estimated at 3.4 per cent as against the print of 3.7 per cent and inflation in CPI excluding food and fuel was estimated at 5.4 per cent against the reading of 6.0 percent (Chart II.1).2 The MPR of April 2018 had projected CPI inflation to increase from 4.6 per cent observed in Q4:2017-18 to 5.1 per cent in Q1:2018-19 and then moderate to 4.7 per cent in Q2. Excluding the estimated impact of HRA, CPI inflation was projected at 4.7 per cent in Q1 and then moderate to 4.4 per cent in Q2. Actual inflation outcomes have tracked these projections directionally; in terms of magnitude, however, inflation undershot projections by a considerable margin – 28 basis points (bps) in Q1 and 74 bps in Q2 up to August (Chart II.2) – entirely on account of a surprising persistence in the softening of prices of fruits, particularly in Q2, and lower than usual hardening in prices of vegetables in the summer months. Food inflation fell from 3.7 per cent in Q4:2017-18 to 3.1 per cent in Q1:2018-19. This is a significant development because it occurred on a base which reflected the after effects of demonetisation in depressing prices of fruits and vegetables in Q1 a year ago. Subsequently, food inflation plunged further to 1.3 per cent in July-August as strong favourable base effects coincided with inexplicable weak momentum of food prices. In fact, ebbing food inflation more than offset the impact of higher than projected crude oil prices – US$ 73.5 per barrel, on an average, during H1:2018-19 vis-à-vis the baseline assumption of US$ 68 per barrel in April 2018.   II.1 Consumer Prices As stated earlier, headline inflation dynamics in H1:2018-19 have reflected divergent movements among constituents which are revealed when momentum and base effects are disentangled. In the case of food items, there has been an unusually low momentum in prices of vegetables and an unexpected decline in prices of fruits in H1. In Q2, base effects turned favourable and along with unseasonally low momentum pulled down food inflation to just 1.3 per cent (up to August 2018) well below its quarterly trend level of six years (7.1 per cent). In the case of items excluding food and fuel, momentum in prices remained strong during April-May in Q1. Thereafter, in Q2 so far, momentum effects have been offset by favourable base effects. As a result, the monotonic hardening of headline inflation from 4.3 per cent in March 2018 to 4.9 per cent by June reversed and inflation fell to 3.7 per cent in August (Chart II.3). On an average, the distribution of inflation across CPI groups in 2018 so far had striking similarities with the outcomes in 2017, a period that also saw soft inflation readings coming from moderation in food inflation in the post-demonetisation period. Median inflation rates were in the range of 4.3-4.8 per cent in both the years and inflation exhibited considerable negative skew on account of deflation in pulses and sugar prices (Chart II.4). Diffusion indices of price changes in CPI items suggest that on a seasonally adjusted basis, a broadening swathe of goods and almost all services have experienced price increases since July, implying that soft headline inflation reading is occurring alongside generalised price increases across goods and services (Chart II.5).3 II.2 Drivers of Inflation A historical decomposition of inflation shows that large and sequential supply side shocks, emanating essentially from food group, have defined the overall change in headline inflation trajectory since Q3:2016- 17. In H1:2018-19, several factors impacted inflation – a favourable food supply shock; an adverse oil price shock; and soft rural wage growth in spite of the quickening of agricultural activity and indications of firming up of rural demand (Chart II.6a).4 The pick-up in services inflation was led by elevated house rentals on the back of increase in HRA for central government employees. Inflation in other items of services – education, transport and medical – also firmed up. From July, however, goods inflation – especially in respect of perishables – pulled down overall inflation, helped by subdued month-on-month changes and favourable base effects (Chart II.6b). CPI Food Group In terms of weighted contributions, the food group contributed 25.2 per cent to overall inflation during April-August 2018 in contrast to 8.9 per cent a year ago. The average contribution of food inflation to overall inflation in the last five years has been 47 per cent. Within food, inflation in cereals, which has a weight of 9.7 per cent in the CPI and 21.1 per cent in the food and beverages group, remained benign at sub- 3 per cent level during H1:2018-19, with production boosted by two consecutive years of record harvests, and stocks being well above buffer norms. The food inflation trajectory was largely shaped by vegetables, fruits, pulses and sugar during H1:2018-19, with its unexpected slump defying the usual seasonal uptick, especially in prices of vegetables during July-August (Charts II.7 and II.8).   Vegetables account for 6 per cent of the CPI and 13.2 per cent of the food and beverages group. A delayed winter easing of price pressures in vegetables commenced from December 2017 and extended well up to April 2018, as mandi arrivals, specifically of onions and tomatoes, surged muting the usual summer upturn (Chart II.9a). Onion inflation declined from a high of 159 per cent in December 2017 to 23 per cent in May 2018, pulled down by bumper mandi arrivals, imports, and implementation of a minimum export price (MEP) that deterred exports, together creating persistent surplus supply conditions. Onion prices, however, picked up in July with the country-wide transporters’ strike, which affected the supplies of essential food items. After remaining low during April-May, prices of tomatoes recorded an upsurge during June-July due to widespread farmers’ agitations. By contrast, price pressures have been more pronounced in respect of potatoes since March 2018 due to lower availability of stocks from cold storages, transport disruptions and protests organised by potato farmers against not receiving remunerative prices for their crops. Prices of vegetables, however, witnessed some easing in August 2018 led by a contraction in prices of tomatoes and moderation in onion price pressures as arrivals surged, which played a key role in moderating food inflation during the month.   An analysis of prices of vegetables based on sectoral CPI indices suggests that there is no statistically significant difference in month-on-month changes in prices of vegetables between rural and urban areas.5 A decomposition of the CPI-vegetables into its trend and cyclical components reveals a rising trend since H1:2017-18, indicating that the recent softening in vegetable prices may not be structural in nature (Chart II.9b). Fruits prices also declined during June-August, contrary to the usual seasonal pattern. Fruits have a weight of 2.9 per cent in the CPI and 6.3 per cent within the food and beverages sub-component. Healthy domestic production of major fruits like mangoes and bananas, together with imports of some fruits (particularly apples and citrus fruits) pulled down fruits prices in contrast to the usual pattern in June and July every year when they rise (Chart II.10).  Deflation in the prices of pulses persisted on the back of over-supply, though the pace of deflation moderated during H1. Pulses account for 2.4 per cent of the CPI and 5.2 per cent of the food and beverages sub-component. Mandi level prices of some pulses such as arhar and urad remained below their minimum support prices (MSPs) in major producing states such as Maharashtra, Madhya Pradesh, Uttar Pradesh and Karnataka. In response, several measures that had been undertaken by the government in the previous year were extended into 2018-19 such as (i) removal of the export ban on all pulses; and (ii) imposition of import duty of 60 per cent on gram and 30 per cent on masoor to provide some relief to farmers. Nonetheless, pulses prices continued to rule well below their historical trend during H1:2018-19 (Chart II.11). Prices of sugar and confectionery also remained in deflation zone from February 2018 on account of surplus production during the sugarcane season of 2017-18 (Charts II.7 and II.8). Domestic sugar prices have closely tracked global price movements which have also been in deflation due to excess global supply. In view of the sharp decline in sugar prices, the government raised the import duty on sugar to 100 per cent, besides re-imposing stockholding limits on sugar sales and fixing the ex-mill sugar prices to ₹29 per kg in June 2018. Moreover, the customs duty on export of sugar was withdrawn to encourage the sugar industry. These measures, along with supply disruptions in July following the transporters’ strike, drove up sugar prices during June-August, though y-o-y inflation continued to be in the negative zone.  In the case of protein-rich items such as eggs, price pressures were visible during June-July 2018, reflecting the combined impact of the usual lower egg production during summer months and higher consumption during early monsoon months in several parts of the country. Furthermore, the country-wide truckers’ strike in July also affected the supply of eggs in several states, adding to upside pressures on prices. However, prices of eggs softened in August. Among other protein-rich items, meat and fish prices experienced the usual upside pressures during May-June, followed by easing during July-August. In the case of milk and products, price pressures were subdued due to robust growth in milk production. Among other food components, edible oil inflation recorded a pick-up in August 2018 after remaining in the range of one to three per cent since May 2017. After an increase in import duties on all major varieties of oils in November 2017, duties were hiked further during March and June 2018 in order to curb cheap imports. Inflation in spices started rising beginning April 2018 after remaining in deflation for 10 successive months since June 2017. While pressures on black pepper prices have remained muted so far, prices of other spices like dry chillies, turmeric, jeera, dhania and tamarind have firmed up, thereby driving up overall inflation in this group (Charts II.7 and II.8). On July 4, 2018 the central government announced minimum support prices (MSPs) for all kharif crops of a minimum of 150 per cent of the cost of production. Increases in MSPs generally get transmitted to headline inflation through direct and second round effects and, it is in the context of the upside risks to the near-term inflation outlook that the size and span of the impact of the MSP need to be carefully evaluated (Box II.1). CPI Fuel Group Fuel and light inflation increased sequentially every month from a trough of 5.2 per cent in April 2018 to 7.2 per cent by June 2018 and further to 8.5 per cent by August 2018 (Chart II.12a). Domestic prices of liquefied petroleum gas (LPG) tracked rising international product prices. Since the migration of subsidy payments on LPG to bank accounts under the direct benefit transfer scheme, LPG prices in CPI mirror open market prices. As such, they now reflect international prices closely (Chart II.12b). Inflation in respect of items of rural consumption such as firewood and chips continued to be sticky and elevated. Administered kerosene prices also registered sustained increases as oil marketing companies (OMCs) raised prices regularly in a calibrated manner. Box II.1: Assessing the Impact of MSPs on CPI Inflation Fulfilling the announcement made in the Union Budget 2018-19, MSPs for 14 crops for the 2018-19 kharif season were raised to at least 1.5 times of production (A2+FL) costs.6 This implies a nominal MSP increase in the range of 3.7 to 52.5 per cent for different crops over their levels a year ago, an area weighted increase of 17.3 per cent, a production weighted increase of 14.0 per cent, and a CPI weighted increase of 13.3 per cent (excluding cotton, as it does not appear directly in the CPI basket). In a historical perspective, the current increase in MSPs is significantly higher than the average of the last five years, but well below the upward revisions effected in 2008-09 and 2012-13 (Chart II.1.1). Empirically, it is observed that procurement is the channel through which higher MSPs pass through into inflation (RBI, 2018). For kharif crops, procurement has been the highest in respect of paddy at 32.4 per cent of production (average of last seven years), whereas it is negligible or absent in the case of other crops; an outlier was arhar for which procurement increased from insignificant levels to 23.7 per cent of production in 2016-17 as a part of the government’s food management strategy (Chart II.1.2).   Estimates of the impact of the July 2018 MSP announcements on CPI inflation that are available in the public domain range from 20 bps to 110 bps. For operational purposes, however, precision in these estimates is the key since it conditions the monetary policy response to the likely deviations of inflation from its target. Illustratively, a straight-line approach of imputing the full increase in MSPs on to headline CPI inflation by using CPI weights for the crops in consideration, but without factoring in the scale of procurement operations, may overestimate the MSP impact. The total impact of MSPs on inflation comprises a first round (direct) effect and subsequent second (indirect) round effects. The first round effect – the quantum by which individual commodities respond to MSP shock – is estimated econometrically. The second-round effects are estimated using a two-stage process: (1) A static approach that mimics time-invariant economy-wide effects, is first employed to estimate the commodity level producer price effect through a series of iterations using input-output (IO) tables for 2012-13 and mapping those effects to the wholesale price index (WPI) using WPI weights; (2) The pass-through of the wholesale price increases to CPI food inflation components is then worked out by using elasticities derived from an Autoregressive Distributed Lag (ARDL) model. The second-round effects are also examined using RBI’s quarterly projection model, which is a new Keynesian open economy gap model. It attempts to capture several inter-twined effects dynamically. A hike in MSP could trigger relative price adjustments between MSP and non-MSP food items. Higher MSPs could also lead to a rise in rural incomes which would boost food demand. Furthermore, higher labour demand could lead to overall wage increases in the rural sector as labourers migrate from sowing/cropping of non-MSP to MSP crops. This increase in prices of food items, coupled with rising rural wages and incomes, could affect prices of non-food goods and services via second round effects (Ghate et al., 2018). The increase in the cotton MSP could directly affect inflation through retail clothing (Chart II.1.3).  A first approximation of the inflationary impact of MSP increase from these methodologies yields 29-35 bps increase in headline CPI inflation. These estimates are highly tentative in the absence of robust information on the actual size and scale of procurement operations or more broadly on the combined effectiveness of procurement, price support/deficiency schemes and private sector participation as envisaged under the Pradhan Mantri Annadata Aay SanraksHan Abhiyan (PM AASHA) programme. Accordingly, these initial estimates need to be read with appropriate caveats and revisited once further details are released on actual MSP implementation. References: Benes, M. J., K. Clinton, A. T. George, P. Gupta, J. John, O. Kamenik, D. Laxton, P. Mitra, G. V. Nadhanael, R. Portillo, H. Wang and F. Zhang (2016). “Quarterly Projection Model for India: Key Elements and Properties”, RBI Working Paper, November. Ghate, C., S. Gupta, and D Mallick (2018). “Terms of Trade Shocks and Monetary Policy in India”, Computational Economics , Volume 51, Issue 1, pp 75–121, January. Reserve Bank of India (2018). “MSPs - Do They Influence Inflation Trajectory?”, Box II.2.2, RBI Annual Report 2017-18. |

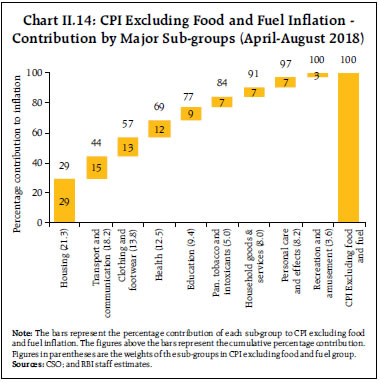

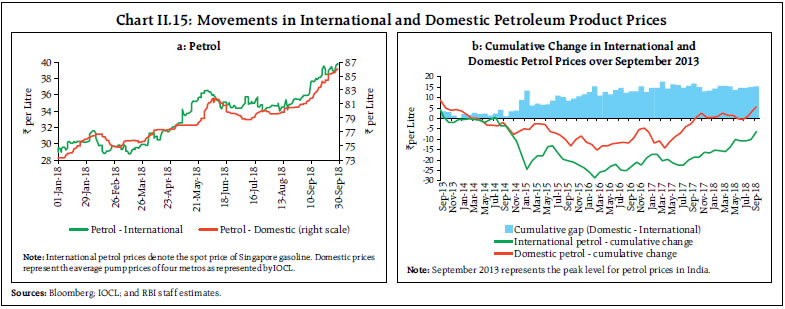

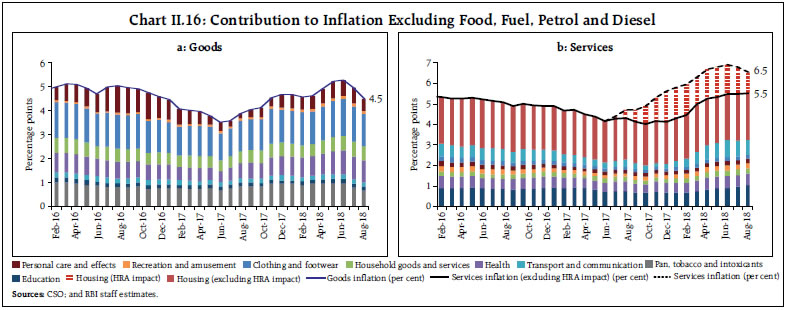

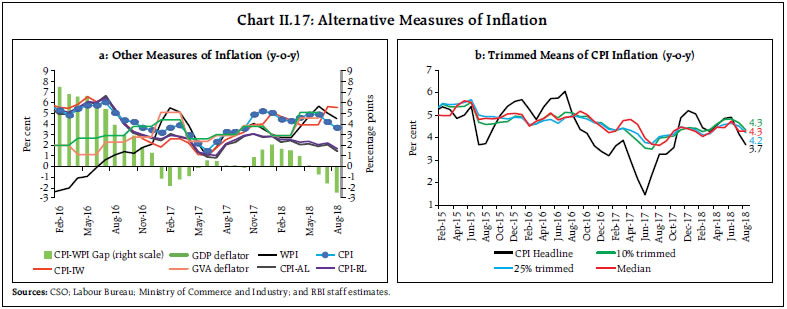

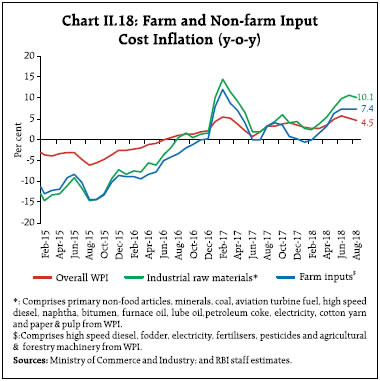

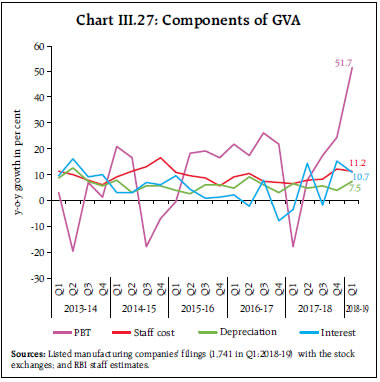

CPI Excluding Food and Fuel A sustained rise in CPI inflation excluding food and fuel started in H2:2017-18 and continued into H1:2018-19 – it rose from 5.1 per cent in February to 6.4 per cent in June, before moderating to 6.2 per cent in July and further to 6.0 per cent in August (Chart II.13). Adjusted for the estimated HRA impact, CPI inflation excluding food and fuel was 5.5 per cent in H1:2018-19 (up to August) – 70 bps lower than the actual outcome. Housing inflation contributed close to 30 per cent of the increase in CPI inflation excluding food and fuel in H1:2018-19 (up to August), largely reflecting the HRA increases of central government employees (Chart II.14). Adjusted for HRA, the housing group still contributed a fifth of overall increase in CPI inflation excluding food and fuel. The second largest contributor in this category was the transport and communication sub-group, largely reflecting increases in petrol and diesel pump prices and second-round effects on transport fares. Petrol (and diesel) pump prices during H1:2018-19 increased sharply by about ₹10 per litre, as international prices surged (Chart II.15). As a result, the contribution of petrol and diesel (with a weight of 2.3 per cent) to CPI excluding food and fuel inflation rose from 1.7 per cent in March 2018 to 8.6 per cent in August. Accentuating the impact of petrol and diesel on inflation in the recent period has been the asymmetric pass-through of international crude oil prices to domestic prices since 2014 (Chart II.15).   Excluding food, fuel, petrol and diesel, CPI inflation increased from 5.2 per cent in February to peak at 6.2 per cent in June, before moderating to 5.8 per cent in July and to 5.7 per cent in August. Excluding the four volatile items – petrol, diesel, gold and silver – as well as housing, CPI inflation increased by 120 bps from February to 5.5 per cent in June, before moderating to 5.0–5.1 per cent in July–August (Chart II.13). The edging down of inflation in July and August was due to lower inflation prints in pan, tobacco and intoxicants, clothing and footwear, and miscellaneous groups. Inflation in respect of both goods and services in the CPI excluding food, fuel, petrol and diesel edged up during Q1:2018-19 (Chart II.16). For goods, inflation picked up across commodity groups, particularly medicines, clothing and footwear, bedding, utensils and washing powder. However, during July-August 2018, goods inflation moderated sharply by 80 bps, driven primarily by a fall in inflation in pan, tobacco and intoxicants group and personal care and effects sub-group (Chart II.16a). Services inflation rose in H1:2018-19 to reach a peak of 6.9 per cent in June, driven up largely by the HRA increases and an increase in tuition fees and prices of transportation services, as alluded to earlier. As the HRA effects started to wane, services inflation moderated to 6.5 per cent in August (Chart II.16b). Excluding the HRA impact, services inflation rose from 5.0 per cent in March and remained steady at 5.5 per cent during June-August. Communication services inflation, however, remained muted due to subdued prices in respect of cellular services.  Other Measures of Inflation Measures of inflation other than the CPI have shown mixed movements since the April MPR. After the HRA-linked spike in January 2018, inflation in terms of CPI for industrial workers (CPI-IW) declined in line with inflation in CPI for agricultural labourers (AL) and rural labourers (RL), reflecting inter alia soft food inflation readings. CPI-IW reflects changes in its housing index once in six months – in January and July every year. The revision in CPI-IW housing index – from 3.0 per cent in December 2017 to 10.2 per cent in January 2018 and further to 26.1 per cent in July – created sizeable upside impulses pushing CPI-IW inflation significantly above headline CPI inflation in July.7 Accordingly, as the impact of the HRA increase intensified, CPI-IW inflation shot up to 5.6 per cent in August from 3.9 per cent in June. In contrast, wholesale price index (WPI) inflation firmed up significantly in Q1, driven up by international prices of crude petroleum and high speed diesel. Inflation in respect of electricity, naphtha, furnace oil, manufacture of plastic products, manufactured vegetable and animal oils and fats also fuelled WPI inflation. GDP and GVA deflators also ticked up in Q1 in line with WPI inflation (Chart II.17a) which moderated somewhat in July and August with the collapse in food inflation. Volatile prices of items such as transport fuel, vegetables, pulses and precious metals impart high dispersion, asymmetry and non-normality to the distribution of inflation. High positive as well as negative skew and chronic fat tails in the inflation distribution could be removed by trimming the outliers. Trimmed means of CPI, including its weighted median, rose sharply in Q1:2018-19 before softening in July and August (Chart II.17b). II.3 Costs Measures of inflation have largely tracked underlying cost conditions. In the case of industrial and farm costs in the WPI and remained elevated in Q2 so far (Chart II.18). The rise in global crude oil prices impacted domestic prices of inputs such as high speed diesel, aviation turbine fuel, naptha, bitumen, furnace oil and petroleum coke, pushing up domestic farm and nonfarm costs. Input cost pressures weakened slightly in July 2018, reflecting soft metal prices and transient easing of global crude oil prices.   Among other industrial raw materials, domestic coal inflation slowed down significantly as compared with the previous year’s level. Inflation in respect of paper and paper products has also remained moderate so far, reflecting inter alia cheap imports of paper under free trade agreements with the Association of Southeast Asian Nations (ASEAN) and South Korea. Inflation in prices of fibres (specifically cotton, jute and mesta) after remaining in negative territory during February to May 2018, picked up subsequently due to elevated international prices and lower production estimates for 2018-19 season. Among farm sector inputs, inflation in respect of agricultural input prices such as fertilisers increased gradually in line with international prices. Despite rising demand, prices of tractors remained stable on the back of increased competition as tractor firms aspired to expand their market shares. Inflation in respect of pesticides and other agrochemical products was driven by uptick in inflation in insecticide and pesticide even as deflation in fungicide prices continued. Prices of fodder remained in deflation due to increased production on the back of good monsoons during the last two years. Inflation in respect of electricity, which has a high weight in both industrial and farm inputs, rose significantly during May-August, reflecting mainly the price surge on account of supply disruptions in the summer following severe dust storms in northern India and adverse base effect in August. Additionally, the distribution companies (DISCOMS) raised their tariffs, following the diversion of coal supplies by the government away from captive power producers to thermal power plants with low stocks. Growth in rural wages, both for agricultural and non-agricultural labourers, has remained subdued since August 2017, reflecting the lagged impact of low inflation in the previous few months (Chart II.19). Pressure from staff costs in the organised sector has broadly been contained. The uptick in staff costs growth in the manufacturing sector in Q4 was short-lived and it slid back in Q1:2018-19. The annual growth in per employee cost for the manufacturing sector stood at 11.4 per cent in Q1:2018-19. For the services sector, the sequential deceleration since Q4:2015-16 in staff cost growth was interrupted by an uptick in Q1:2018-19 when it rose by 9.8 per cent (Chart II.20a). Unit labour costs for companies in the manufacturing sector have been volatile and remained muted in Q1:2018-19.8 Unit labour costs in the services sector edged down in Q1, with the growth in value of production outpacing the growth of staff cost (Chart II.20b). Pressure from rising commodity prices was also reflected in an increase in input costs of manufacturing firms covered in the Reserve Bank’s industrial outlook survey. These firms reported a rise in the cost of raw materials in Q2:2018-19 and expected it to increase further in Q3. However, they are not expecting to pass the entire cost burden to selling prices, reflecting still subdued pricing power. The manufacturing purchasing managers’ index (PMI) as well as the services PMI point to an increase in the cost of raw materials in Q1 and Q2 so far. Firms covered in these indices also reported an increase in their selling prices, indicating that some pass-through of higher costs to clients may already be occurring. II.4 Conclusion Going forward, inflation outcomes will be influenced by several factors. The government has announced measures aimed at ensuring remunerative prices to the farmers for their produce. The magnitude of the impact of these measures on CPI inflation will be contingent upon the manner and effectiveness with which these measures are implemented. Risks to inflation could emanate from rising geopolitical and trade tensions, with attendant implications for global commodity prices and financial markets. The impact of the 7th CPC HRA award on headline inflation has started waning and the effect of increases in HRA by states is not yet visible. As and when HRA awards by states start showing up in the CPI, it will impact headline inflation. As in the case of the centre’s HRA, second round effects will warrant vigilance. The near-term inflation expectations of households and those of businesses polled in the forward-looking surveys of the Reserve Bank of India have firmed up over successive rounds, with the potential to feed into wages and input costs. While low food inflation prints and the positive outlook on food – on account of supply management measures by government and a normal monsoon – provide comfort, it is necessary to be watchful as several upside risks to inflation persist, notably from surging oil prices and volatile financial markets.

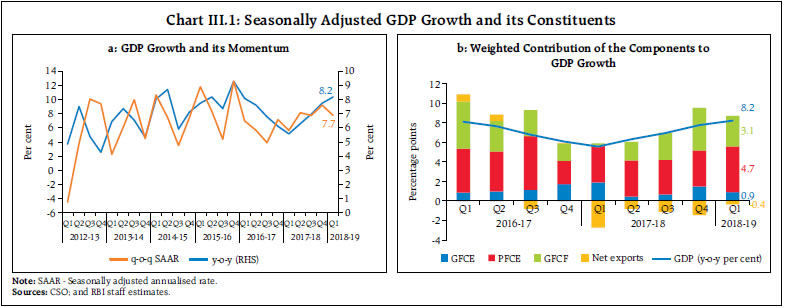

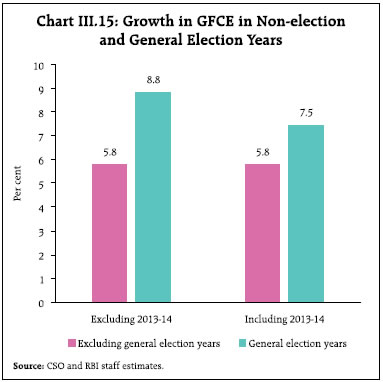

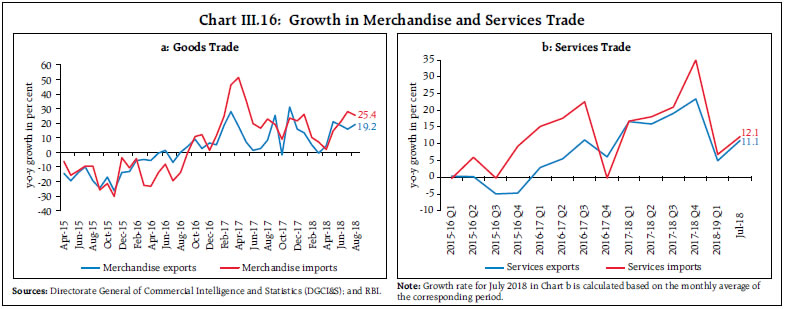

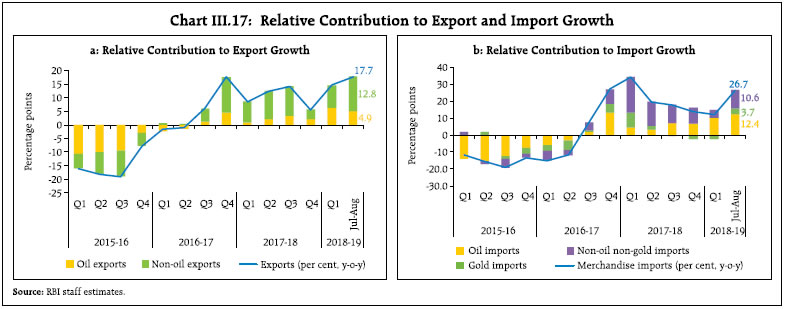

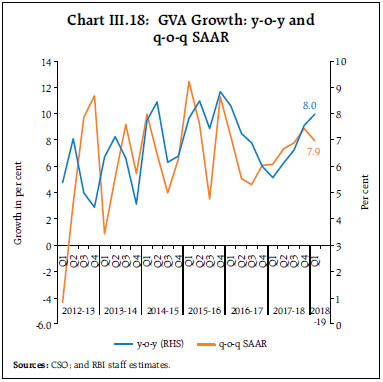

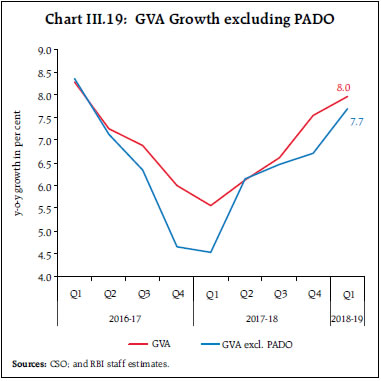

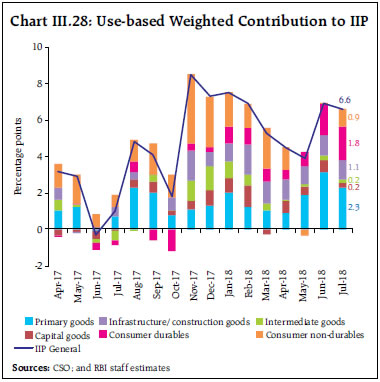

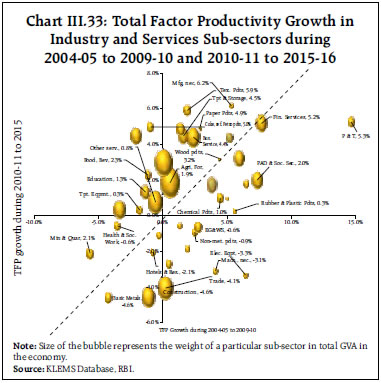

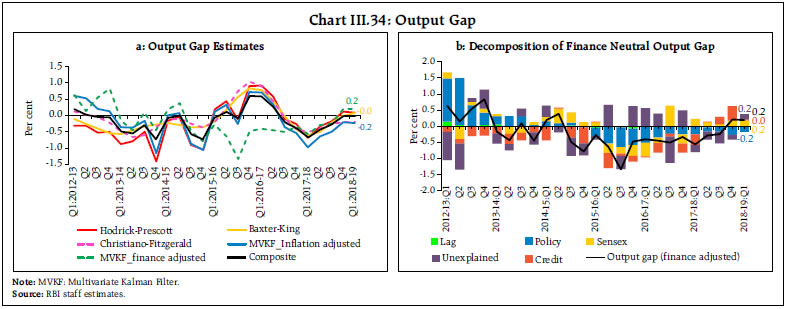

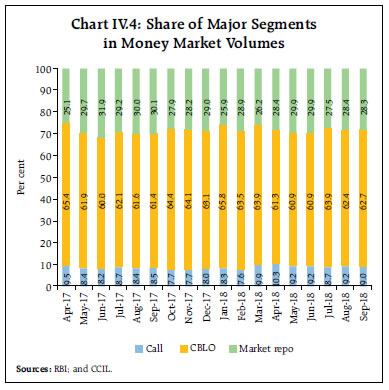

III. Demand and Output Aggregate demand has been underpinned by the strengthening of private consumption and investment demand. The drag from external demand has reduced with a robust pick-up in non-oil merchandise exports. Aggregate supply conditions improved with a sharp acceleration in manufacturing and the resilience in agriculture and allied activities. Raising real investment activity on a durable basis holds the key to sustaining the growth momentum, going forward. Since the start of 2018, i.e., from the January-March 2018 quarter, economic activity in India appears to be charting a step-up in its trajectory. Quarterly estimates of the Central Statistics Office (CSO) for Q1:2018- 19 (April-June) confirm that gross domestic product (GDP) growth averaged 8 per cent in the January-June 2018 period, up from 6.6 per cent in the period July- December 2017. High frequency and survey-based indicators suggest that aggregate demand is fast catching up with aggregate supply. Sales growth, pick-up in capacity utilisation and the acceleration in the fast-moving consumer goods (FMCGs) space attest that the output gap has virtually closed. Meanwhile, another engine of aggregate demand has started to pick-up with the bounce-back in merchandise exports. On the supply side, the rapid catch-up in sowing activity, backed by ample reservoir storage, brightens the outlook for agriculture and allied activities on top of the record production in 2017-18. Industrial activity has strengthened and become more broad-based, buoyed by manufacturing. The services sector remains resilient, supported by strong growth in construction activity as well as public administration, defence and other services (PADO). III.1 Aggregate Demand Measured by year-on-year (y-o-y) changes in real GDP at market prices, aggregate demand strengthened to 7.7 per cent in Q4:2017-18 and surged to a nine-quarter high of 8.2 per cent in Q1:2018-19 (Table III.1). This extended its sequential acceleration to four successive quarters, beginning in Q2:2017-18. Momentum, measured by q-o-q seasonally adjusted annualised rate (SAAR), however, moderated in Q1:2018-19 (Chart III.1a). Among its components, consumption expanded on the back of growth in private final consumption expenditure (PFCE), which reached a six-quarter high of 8.6 per cent in Q1:2018-19. Government final consumption expenditure (GFCE) decelerated to 7.6 per cent, albeit from a high of 16.9 per cent in Q4:2017-18. Investment demand embodied in the growth of gross fixed capital formation (GFCF) decelerated sequentially in Q1:2018-19; however, it remained reasonably strong at 10 per cent, given the government’s thrust on national highways and low-cost housing. Despite a hostile and unpredictable international trading environment, growth of exports of goods and services jumped to a 16-quarter high of 12.7 per cent in Q1:2018-19, mitigating the negative contribution of net exports to aggregate demand caused by the unrelenting surge in imports (Chart III.1b). | Table III.1: Real GDP Growth | | (Per cent) | | Item | 2016-17 | 2017-18 (PE) | Weighted Contribution* | 2016-17 | 2017-18 (PE) | 2018-19 | | 2016-17 | 2017-18 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | | Private final consumption expenditure | 7.3 | 6.6 | 4.1 | 3.7 | 8.3 | 7.5 | 9.3 | 4.2 | 6.9 | 6.8 | 5.9 | 6.7 | 8.6 | | Government final consumption expenditure | 12.2 | 10.9 | 1.2 | 1.1 | 8.3 | 8.2 | 12.3 | 22.5 | 17.6 | 3.8 | 6.8 | 16.9 | 7.6 | | Gross fixed capital formation | 10.1 | 7.6 | 3.1 | 2.4 | 15.9 | 10.5 | 8.7 | 6.0 | 0.8 | 6.1 | 9.1 | 14.4 | 10.0 | | Exports | 5.0 | 5.6 | 1.0 | 1.1 | 3.6 | 2.4 | 6.7 | 7.0 | 5.9 | 6.8 | 6.2 | 3.6 | 12.7 | | Imports | 4.0 | 12.4 | 0.9 | 2.7 | 0.1 | -0.4 | 10.1 | 6.6 | 18.5 | 10.0 | 10.5 | 10.9 | 12.5 | | GDP at market prices | 7.1 | 6.7 | 7.1 | 6.7 | 8.1 | 7.6 | 6.8 | 6.1 | 5.6 | 6.3 | 7.0 | 7.7 | 8.2 | PE: Provisional Estimates.

*: Component-wise contributions do not add up to GDP growth in the table because changes in stocks, valuables and discrepancies are not included.

Source: Central Statistics Office (CSO), Government of India. |

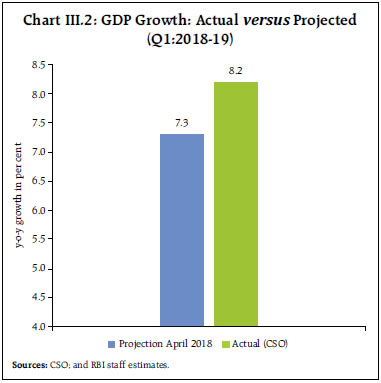

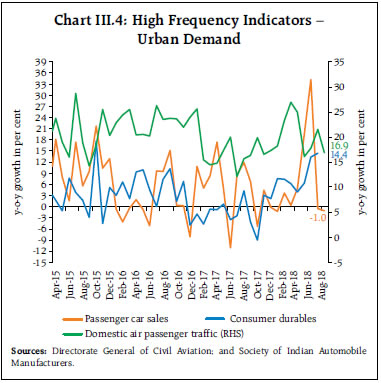

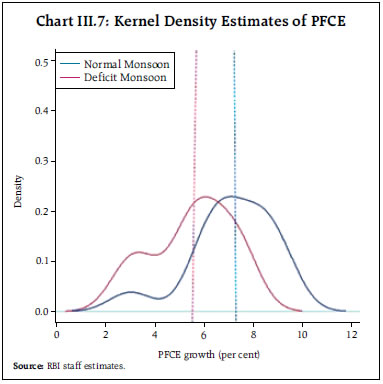

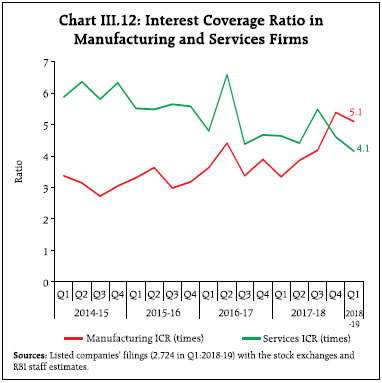

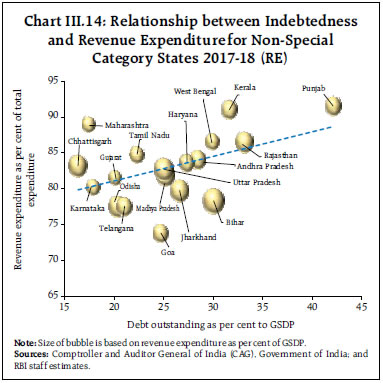

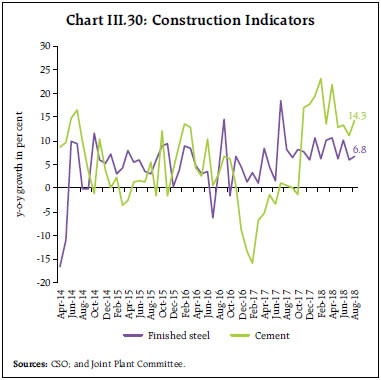

The April 2018 MPR had projected real GDP growth of 7.3 per cent for Q1:2018-19, with risks evenly balanced around the baseline path (Chart III.2).  The actual outcome for the quarter overshot the projection by 90 basis points, reflecting larger than expected gains in most of the constituents of aggregate demand. First, private consumption demand surprised on the upside in Q1:2018-19 and touched a six-quarter peak. The April 2018 projection had assumed that lingering effects of the goods and services tax (GST) implementation would have an adverse impact on consumption demand – especially in urban areas – through loss of output and employment in unorganised activities. Furthermore, a sharp acceleration in allied activities in the agricultural sector posted a growth of 8.1 per cent in Q1:2018-19, which was significantly above trend. This is likely to have boosted rural consumption. Second, GFCF growth overshot the projection on account of stronger than expected capital goods production and the robust recovery in the construction sector. III.1.1 Private Final Consumption Expenditure PFCE remained the mainstay of aggregate demand running ahead in Q1:2018-19 on the strength of rising rural and urban demand and undeterred by the surge in domestic prices of petroleum products. After rising since the beginning of 2017-18, wage (staff cost per employee) growth in the organised manufacturing and services sectors has remained range bound (see Chart II.20, Chapter II). However, in the information technology (IT) sector, growth in staff cost was robust in Q1:2018-19, which could have added to the purchasing power. In contrast, anecdotal evidence suggests that following a decline in exports and moderation in domestic production, growth in wage incomes could have moderated in some of the labour-intensive segments such as readymade garments, and jute manufactures, which, in turn, might have impacted consumption demand (Chart III.3).   High frequency indicators of urban consumption present a mixed picture. While domestic air passenger traffic and production of consumer durables expanded during Q1 and Q2:2018-19 so far, sales of passenger cars contracted during July-August, after peaking in June, possibly as a response to the sharp rise in fuel prices (Chart III.4). Household credit demand in the form of personal loans and leasing of vehicles by commercial banks maintained a robust tempo (Chart III.5). Going forward, urban consumption is expected to strengthen further on the implementation of the 7th Central Pay Commission (CPC) awards by states and the recent reduction in GST rates. High frequency indicators of rural demand seem to be indicating a slight loss of momentum in Q2:2018- 19 (Chart III.6). Sales of motorcycles and tractors, which grew robustly during Q1:2018-19, decelerated in Q2 (July-August). Nevertheless, construction activity in rural areas has been buoyant since Q2:2017-18, supported by the government’s thrust on rural housing and roads. Strong topline growth of FMCG companies, a sizeable part of which emanates from rural areas, also corroborates the improving dynamics of rural consumption. The latter should also benefit from the tailwinds of normal rains in large parts of the country, given the empirical evidence of a positive association of normal monsoon with growth in private consumption (Chart III.7).1 The sizeable increase in MSP of kharif crops announced in July 2018 is expected to augment incomes of rural households if it is implemented effectively. III.1.2 Gross Fixed Capital Formation Growth in gross fixed capital formation (GFCF), which had accelerated to a seven-quarter high of 14.4 per cent in Q4:2017-18, retained double-digit growth in Q1:2018-19 with some moderation in pace relative to the previous quarter. The share of GFCF in aggregate demand in Q1:2018-19 at 31.6 per cent was higher than 31.0 per cent a year ago, indicating improving investment demand. Robust investment activity was also reflected in several high frequency indicators such as steel consumption, cement production, and import of capital goods (Chart III.8). Strong growth in housing loans disbursed by scheduled commercial banks (SCBs) and especially housing finance companies also suggests rising investment in the construction sector.  Capacity utilisation (seasonally adjusted) gained momentum and improved to 74.9 per cent in Q1:2018- 19, higher than the level recorded in the first quarter of the past year (Chart III.9). The number of stalled projects, though reported some improvement in both the private and government sectors in Q4:2017-18 and Q1:2018-19, there was a slight deterioration in government sector in Q2:2018-19 (Chart III.10). Since 2011-12, capital formation has decelerated due to the slowdown in investment in the private sector, weighed down, inter alia, by overhang of corporate debt (Chart III.11). Empirical analysis suggests that higher leverage constrains firms’ ability to invest, resulting in slowdown in fresh investment (Box III.1). Since H2:2017-18, however, the corporate sector has been deleveraging, especially in the manufacturing sector, which is reflected in an improvement in their interest coverage ratios (ICRs) (Chart III.12). Recent data on investment activity and several lead/coincident indicators of investment, viz., sales growth, capacity utilisation, inventory drawdown, and gradually returning pricing power suggest that the investment cycle has turned.2

Box III.1: Leverage and Investment Empirical evidence on firm-level capital investment points to sales growth, leverage, growth of debt and repaying capacity of firms being its key determinants (Krznar and Matheson, 2018; Li, Magud and Valencia, 2015; Magud and Sosa, 2015). Leverage, which affects investment behaviour in multiple ways, constrains a firm’s capacity to mobilise external resources for financing new and risky projects. In a scenario of high leverage, major gains from investment accrue to debt-holders, thereby discouraging promoters from undertaking further investment. In the aftermath of the global financial crisis, leverage of Indian non-financial firms, measured as the ratio of debt to equity, rose across sectors, eroding debt servicing capacity and undermining investment decisions. In order to formally examine the impact of leverage on investment activity, firm-level data of both listed and non-listed non-financial companies for the period of 2004 to 2017 drawn from the CMIE’s Prowess database were modelled in a dynamic Arellano-Bond panel regression framework that addresses the problem of potential endogeneity of regressors: The results confirm the dominant negative influence of leverage in determining fixed investment while sales growth, operating profit and market price to book value positively affect investment (Table III.1.1). One percentage point increase in leverage was found to reduce fixed investment by 40 basis points. The specification was also tested at sectoral level, viz., manufacturing, construction and metals. The sectoral results also corroborate the aggregate findings. The growth of outstanding debt is found to have a positive impact on capital expenditure as firms finance long-term investment by incurring new debt. Sales growth, an indicator of current and future demand, also leads to further investment, supporting that the investment accelerator is at work. | Table III.1.1: Regression Results – Impact of Leverage over Firms’ Capital Expenditure (2004-2017) Dependent Variable: Investment-Fixed Asset Ratio | | | Overall | Manufacturing Firms | Construction Sector Firms | Metal Sector Firms | | | (1) | (2) | (3) | (4) | | Investment ratio (lag) | 0.133*** | 0.138*** | 0.043 | 0.112*** | | | (0.010) | (0.015) | (0.038) | (0.020) | | Debt to equity ratio | -0.399*** | -0.197** | -1.924*** | -0.241 | | | (0.093) | (0.095) | (0.581) | (0.198) | | Interest coverage ratio | 0.005 | -0.005 | 0.027* | 0.001 | | | (0.003) | (0.004) | (0.015) | (0.008) | | Sales growth rate (y-o-y) | 0.020*** | 0.020* | 0.016*** | 0.032*** | | | (0.002) | (0.010) | (0.005) | (0.012) | | Growth of operating profit (y-o-y) | -0.000 | -0.002 | 0.004 | -0.001 | | | (0.001) | (0.001) | (0.006) | (0.002) | | Growth of outstanding debt (y-o-y) | 0.011*** | 0.012*** | 0.005 | 0.015*** | | | (0.001) | (0.002) | (0.005) | (0.004) | | Market price to book value ratio (annual average) | 0.249** | -0.015 | 1.182*** | -0.189 | | | (0.103) | (0.114) | (0.391) | (0.252) | | Constant | 5.553*** | 7.077*** | 3.392*** | 8.453*** | | | (0.299) | (0.310) | (0.992) | (0.561) | | Observations | 20,726 | 13,885 | 1,421 | 4,673 | | Number of firms | 2,693 | 1,669 | 191 | 558 | Note: *** p<0.01, ** p<0.05, * p<0.1.

Source: RBI staff estimates. | To conclude, high leverage among non-financial firms leads to a slowdown of investment in the economy. Recent concerted efforts to strengthen balance sheets of both firms and banks are expected to lead to pick-up in capital formation in the medium to long term. References: Krznar, I., and T. Matheson (2018), Investment in Brazil: From Crisis to Recovery, IMF Working Paper, WP/18/6. Li, D., N. Magud and F. Valencia (2015), Corporate Investment in Emerging Markets: Financing vs. Real Options Channel, IMF Working Paper, WPIEA2015285. N. Magud and S. Sosa (2015), Investment in Emerging Markets: We Are Not in Kansas Anymore…Or Are We?, IMF Working Paper, WP/15/77. | III.1.3 Government Expenditure GFCE continued to support aggregate demand in Q1. The fiscal position of the central government showed an improvement in terms of key deficit indicators, as per cent of budget estimates (BE), during April-August 2018-19 as growth in revenue receipts exceeded that of expenditure (Table III.2). Tax revenues grew by 7.5 per cent, supported by higher income tax collections (Charts III.13a and b). Notwithstanding month-over-month fluctuations, the overall indirect tax base has expanded. Ongoing simplification of procedures and rationalisation of GST rates have encouraged voluntary compliance, especially in the business-to-business segment and small enterprises. Many registrants under the GST network (GSTN) were those who fell below the GST threshold but nevertheless chose to be a part of the GST. Similarly, more than 50 percent of those who could have chosen to opt for the simpler composition scheme chose to register under the regular GST scheme.3 States’ own tax revenues, comprising mainly their collection under the state goods and services tax (SGST), have stabilised in recent months, though there is some uncertainty relating to the sharing of revenues from the integrated goods and services tax (IGST) between the centre and states and the transfer under GST compensation cess.4 Furthermore, non-tax revenues have shown a marked improvement for centre. | Table III.2: Key Fiscal Indicators – Central Government Finances (April-August) | | (Per cent) | | Indicator | As a per cent of BE | y-o-y Growth | | 2017-18 | 2018-19 | 2018-19 | | 1. Revenue receipts | 27.0 | 26.9 | 13.3 | | a. Tax revenue (Net) | 27.8 | 24.7 | 7.5 | | b. Non-tax revenue | 24.0 | 40.1 | 42.0 | | 2. Total non-debt receipts | 26.6 | 26.4 | 12.7 | | 3. Revenue expenditure | 45.8 | 43.8 | 11.6 | | 4. Capital expenditure | 35.4 | 44.0 | 20.6 | | 5. Total expenditure | 44.3 | 43.8 | 12.7 | | 6. Gross fiscal deficit | 96.1 | 94.7 | 12.6 | | 7. Revenue deficit | 134.2 | 114.0 | 10.0 | | 8. Primary deficit | 1401.3 | 767.7 | 13.2 | BE: Budget Estimates.

Source: Controller General of Accounts, Ministry of Finance, Government of India and Union Budget Document, 2018-19. | On the expenditure front, accounts for April-August 2018-19 reveal a marked moderation in revenue expenditure mainly due to lower subsidy outgo. The quality of expenditure improved, with growth in capital expenditure – at 20.6 per cent – outpacing revenue expenditure. As regards states, the share of revenue expenditure in their total expenditure was estimated slightly lower at 83 per cent in their BE for 2018-19, though still higher than in 2015-16 and 2016-17 (Table III.3).