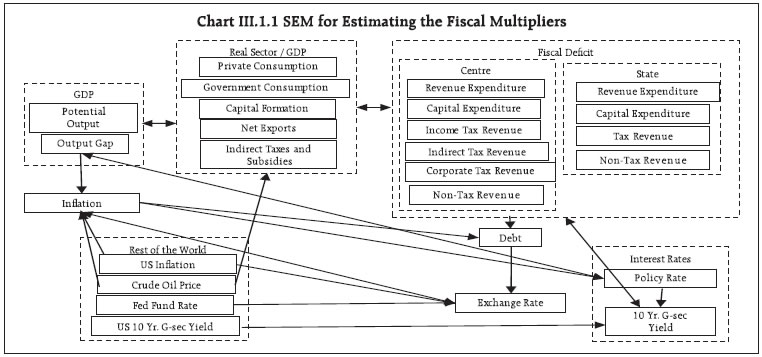

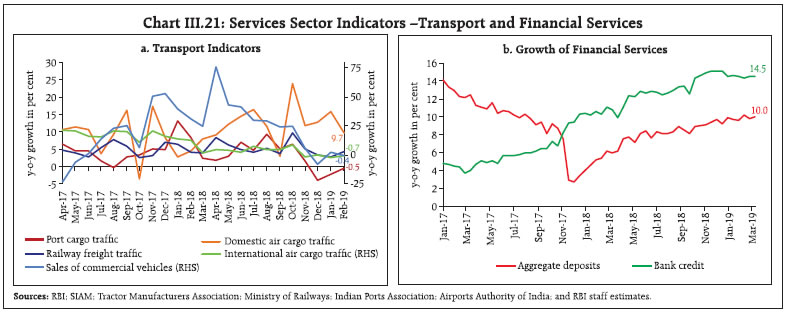

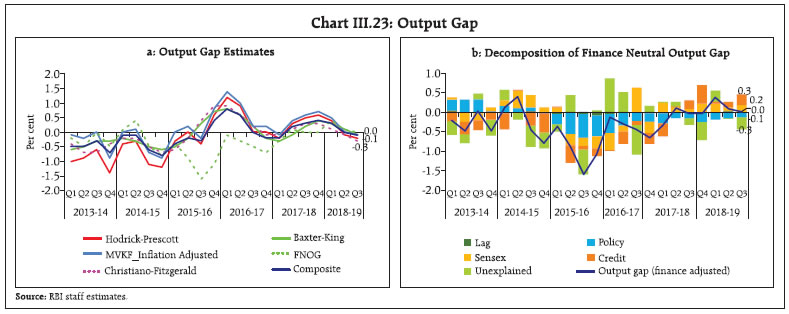

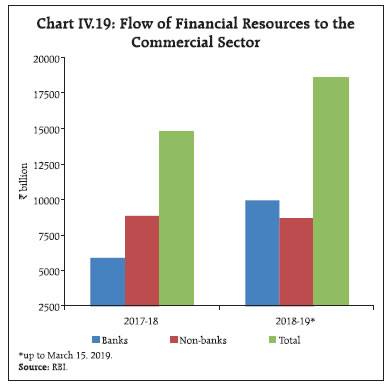

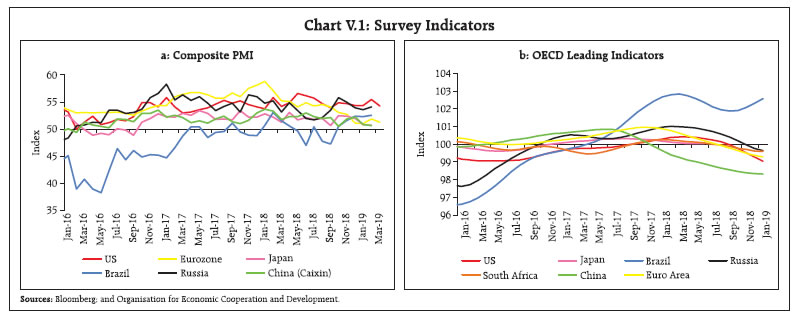

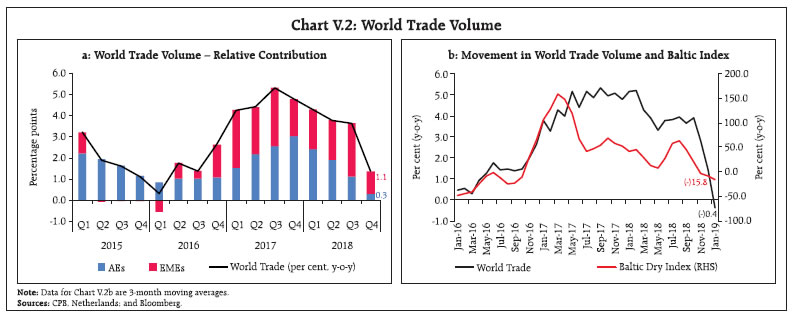

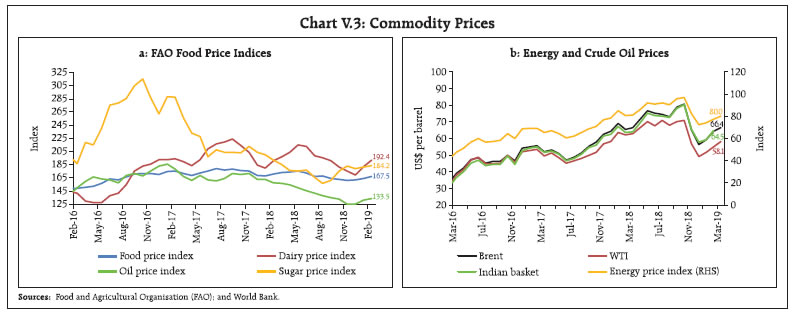

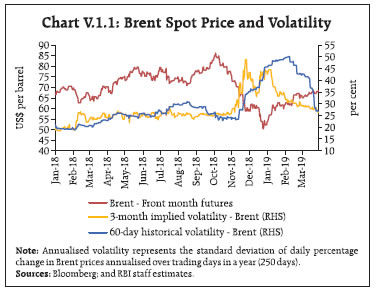

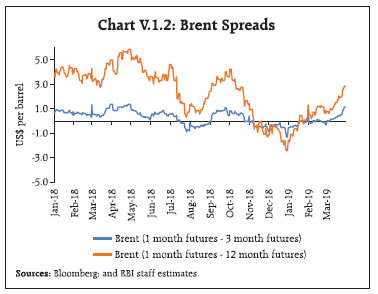

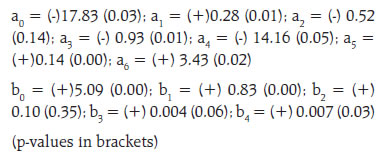

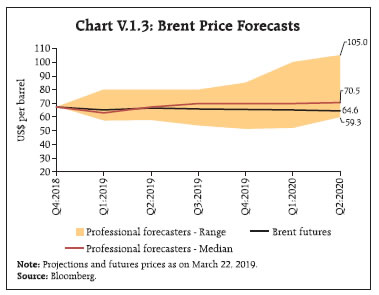

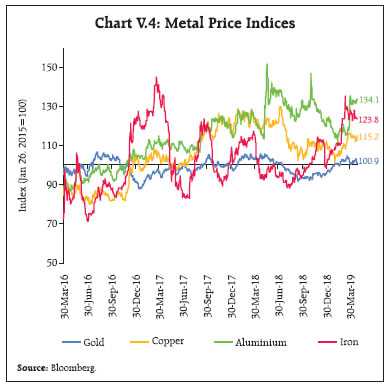

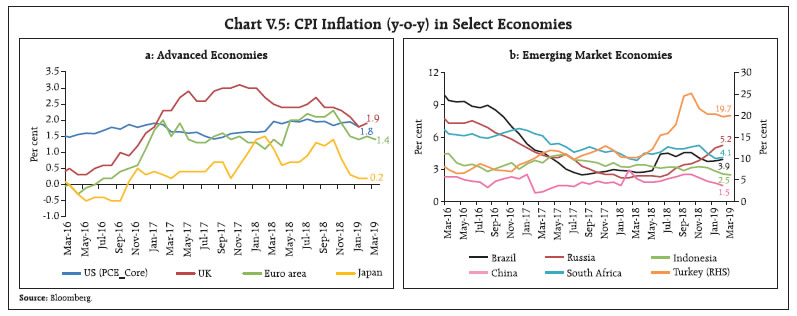

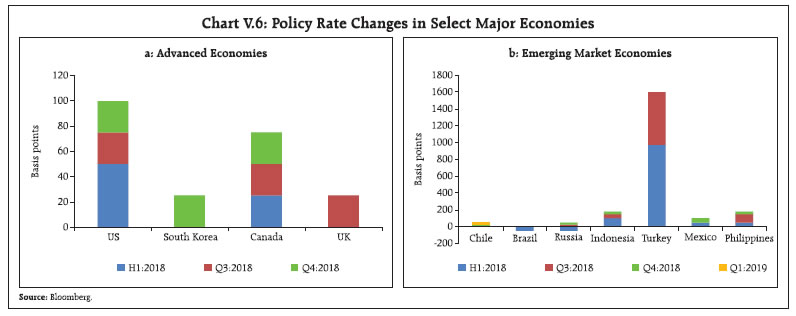

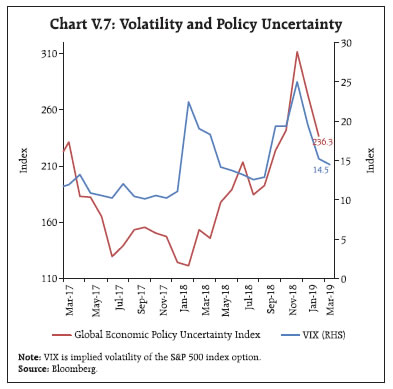

| I. Macroeconomic Outlook The macroeconomic setting for the conduct of monetary policy has undergone significant shifts as domestic activity lost speed in 2018-19 and inflation conditions turned unusually benign under the impact of deflationary food prices. Going forward, economic activity is expected to recover in 2019-20. Headline CPI inflation is projected to move up from its recent lows as the favourable base effects dissipate but remain below the target of 4 per cent in 2019-20. Global economic activity and trade have been shedding momentum and downside risks to the outlook have increased. I.1 Key Developments since October 2018 MPR Since the release of the Monetary Policy Report (MPR) of October 2018, the macroeconomic setting for the conduct of monetary policy has undergone significant shifts. After averaging close to 8 per cent through Q3:2017-18 to Q1:2018-19, domestic economic activity lost speed. The February 2019 release of the Central Statistics Office (CSO), read in conjunction with high frequency indicators, suggests that the economy could have encountered a soft patch. At the same time, some of the forward-looking surveys conducted by the Reserve Bank of India (RBI) indicate that consumer confidence has improved and business expectations remain optimistic. Moreover, aggregate flow of funds to the commercial sector from banks and non-banks remains robust, led by strong growth in bank credit. Inflation conditions have turned unusually benign under the impact of deflationary food prices. While total financial flows from banking and non-banking sources have improved, a durable strengthening of investment demand is yet to take hold. Turning to the international environment, global activity and trade have been shedding momentum and downside risks to the outlook have increased. Tracking other commodity prices, international crude oil prices have declined sharply from their October highs, though they continue to be volatile. Protracted trade tensions and concerns over Brexit have eroded business and consumer confidence in major countries/ regions. In response to these evolving developments, monetary policy authorities across the world have stepped back from further tightening/normalisation, and more recently a more accommodative stance is evident from some central banks. Monetary Policy Committee: October 2018-February 2019 During October 2018-February 2019, the Monetary Policy Committee (MPC) met thrice in accordance with its bi-monthly schedule. The MPC maintained status quo on the policy repo rate in its October 2018 meeting (with a majority of 5-1) but switched stance from neutral to calibrated tightening. The MPC’s decision was conditioned by risks to inflation from volatile crude oil prices; rising input costs; fiscal slippage concerns; uncertainty about the impact of minimum support prices (MSPs); the staggered impact of the likely increase in house rent allowances by the states; and, the virtual closing of the output gap. In its December 2018 meeting, the MPC left the policy rate unchanged and retained the stance of calibrated tightening, although inflation projections were revised downwards. In its February 2019 meeting, the MPC decided to reduce the policy repo rate by 25 basis points (bps) by a majority of 4-2 and was unanimous in voting for switching its stance to neutral from calibrated tightening. This decision was prompted by the continuous easing of headline inflation, a stable crude oil price outlook and some moderation in cost pressures. Headline inflation was projected to remain below the target of 4 per cent over the coming four quarters, which opened up space for easing. The diversity in the MPC’s voting pattern observed during October 2018-February 2019 was also seen in some other central banks (Table I.1), reflecting differences in individual members’ assessments and expectations, and policy preferences. | Table I.1: Monetary Policy Committees and Voting Pattern | | Country | Policy Meetings: October 2018 - March 2019 | | Total Meetings | Meetings With Full Consensus | Meetings With Dissents | | Brazil | 4 | 4 | 0 | | Chile | 4 | 4 | 0 | | Colombia | 4 | 4 | 0 | | Czech Republic | 4 | 0 | 4 | | Hungary | 5 | 5 | 0 | | Israel | 4 | 2 | 2 | | Japan | 4 | 0 | 4 | | South Africa | 3 | 2 | 1 | | Sweden | 3 | 1 | 2 | | Thailand | 4 | 1 | 3 | | UK | 4 | 4 | 0 | | US | 4 | 4 | 0 | | Sources: Central bank websites. | Macroeconomic Outlook Chapters II and III analyse macroeconomic developments during October 2018-March 2019 and explain the deviations of inflation and growth outcomes from staff’s projections. Turning to the outlook, the evolution of key macroeconomic and financial variables over the past six months warrants revisions in the baseline assumptions (Table I.2). First, international crude oil prices have declined sharply from their October 2018 level, even though they have rebounded in recent months. Crude oil prices (Indian basket) fell from their peak of around US$ 85 a barrel in early October 2018 to a low of around US$ 52 at end-December on the back of higher supplies and a slowdown in global demand. Prices edged higher to average around US$ 67 during March, after the Organisation of the Petroleum Exporting Countries (OPEC) and Russia cut production beginning January 2019, and production was disrupted in Venezuela. Given the current demand-supply assessment and signals extracted from the futures market, the baseline scenario assumes crude oil prices at an average of US$ 67 per barrel during 2019-20 (Chart I.1). | Table I.2: Baseline Assumptions for Near-Term Projections | | Indicator | October 2018 MPR | Current MPR (April 2019) | | Crude Oil (Indian basket) | US$ 80 per barrel during H2:2018-19 | US$ 67 per barrel during 2019-20 | | Exchange rate | ₹72.5/US$ | ₹69/US$ | | Monsoon | 9 per cent below LPA in 2018 | Normal for 2019 | | Global growth | 3.9 per cent in 2018 | 3.5 per cent in 2019 | | 3.9 per cent in 2019 | 3.6 per cent in 2020 | | Fiscal deficit (per cent of GDP) | To remain within BE 2018-19

Centre: 3.3

Combined: 5.9 | To remain within BE 2019-20

Centre: 3.4

Combined: 5.9 | | Domestic macroeconomic/ structural policies during the forecast period | No major change | No major change | Notes: 1. The Indian basket of crude oil represents a derived numeraire comprising sour grade (Oman and Dubai average) and sweet grade (Brent) crude oil.

2. The exchange rate path assumed here is for the purpose of generating staff’s baseline growth and inflation projections and does not indicate any ‘view’ on the level of the exchange rate. The Reserve Bank is guided by the objective of containing excess volatility in the foreign exchange market and not by any specific level of and/or band around the exchange rate.

3. Global growth projections are from the World Economic Outlook (July 2018 and January 2019 Updates), International Monetary Fund (IMF).

4. BE: Budget estimates.

5. LPA: Long period average.

6. Combined fiscal deficit refers to that of the Centre and States taken together. Combined fiscal deficit for 2019-20 is assumed to be the same as in 2018-19, as all state governments have not yet presented their budgets.

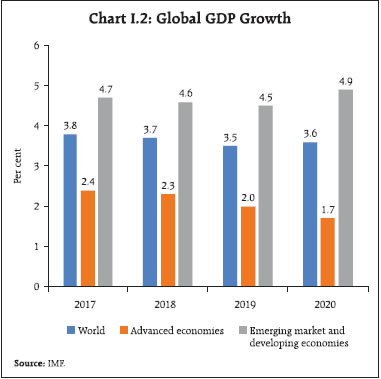

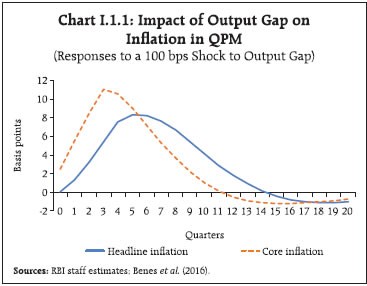

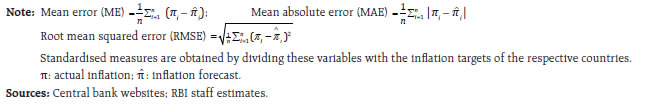

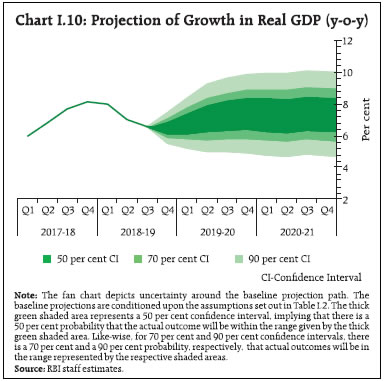

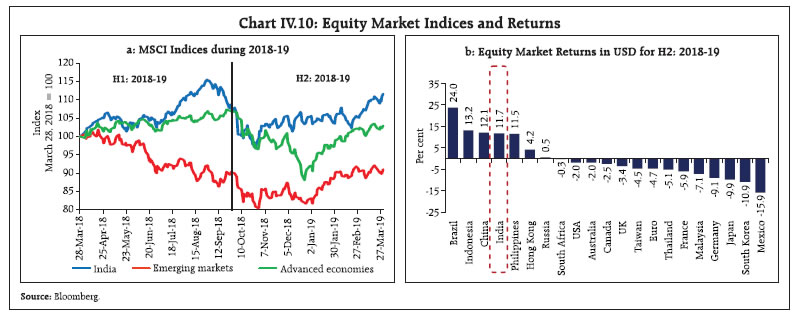

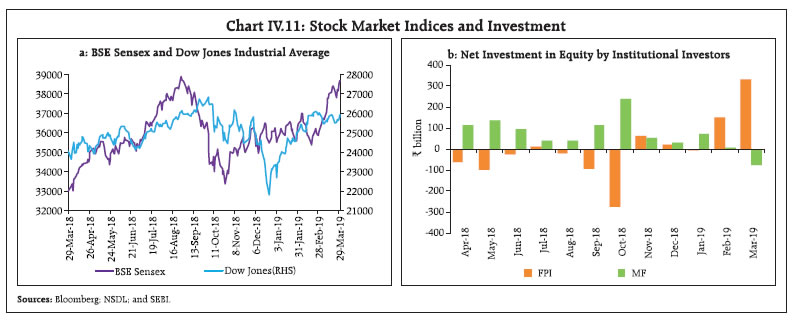

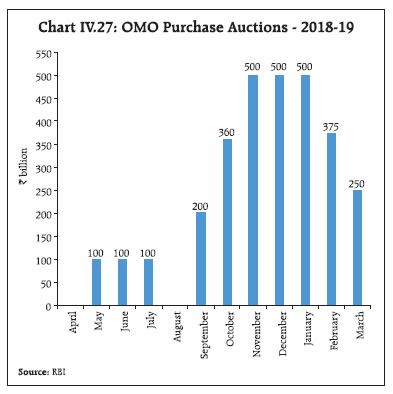

Sources: RBI staff estimates; Budget documents; and IMF. | Second, the nominal exchange rate (Indian rupee vis-à-vis the US dollar) has appreciated from its October 2018 level, buoyed by the steady revival of portfolio flows, softening of crude oil prices, lower domestic inflation prints, and dovish monetary policy stance in the US. Third, the pace of global economic activity and trade has turned out to be well below earlier expectations on account of elevated trade tensions, tighter financial conditions, uncertainty surrounding Brexit and slowdown in China. The global manufacturing purchasing managers’ index touched a 32-month low in February 2019 and remained weak in March. Global growth in 2019 is expected to be lower than that in the previous two years for both advanced economies (AEs) and emerging market and developing economies (EMDEs) (Chart I.2). I.2 The Outlook for Inflation Headline CPI inflation has declined sharply since mid-2018, driven by the sustained fall in food inflation (even turning into deflation during October 2018-February 2019), the waning away of the direct impact of house rent allowances for central government employees, and more recently, by a sharp fall in fuel inflation. CPI inflation excluding food and fuel has also moderated somewhat, though its level remains elevated. Overall, CPI inflation fell from 3.7 per cent in August-September 2018 to 2.6 per cent in February 2019 after touching a low of 2.0 per cent in January 2019 (Chapter II).  Turning to the outlook for inflation, inflation expectations of households and firms play an important role in shaping future inflation by influencing price and wage contracts. Inflation expectations of urban households surveyed by the Reserve Bank in its March 2019 round1 decreased by 40 bps each over the previous round (December 2018) for the three months ahead and one year ahead horizons to 7.8 per cent and 8.1 per cent, respectively. Three-month ahead inflation expectations in the March 2019 round were lower by 160 bps vis-à-vis the September 2018 round, but were unchanged from the March 2018 round. One-year ahead inflation expectations in the March 2019 round softened by 170 bps and 50 bps from the September 2018 and March 2018 rounds, respectively. The proportion of respondents expecting the general price level to increase by more than the current rate declined for both the three months ahead and one year ahead horizons (Chart I.3). Manufacturing firms polled in the January-March 2019 round of the Reserve Bank’s industrial outlook survey expected a reduction in pressures from the cost of raw materials in Q1:2019-20 (less negative values for cost of raw materials indicate less input price pressures) (Chart I.4).2 The outlook on selling prices remains robust. According to the Nikkei’s purchasing managers’ survey, firms in the manufacturing sector (March 2019) and services sector (February 2019) reported some moderation in pressures on both input and output prices. Professional forecasters surveyed by the Reserve Bank in March 2019 expected CPI inflation to increase from 2.6 per cent in February 2019 to 4.2 per cent by Q4:2019-20 (Chart I.5).3 Taking into account the initial conditions, signals from forward-looking surveys and estimates from structural and other models (Box I.1), CPI inflation is projected to pick up from 2.6 per cent during February 2019 to 2.9 per cent in Q1:2019-20, 3.0 per cent in Q2, 3.5 per cent in Q3, and 3.8 per cent in Q4, with risks broadly balanced (Chart I.6). The 50 per cent and the 70 per cent confidence intervals for headline inflation in Q4:2019-20 are 2.5-5.2 per cent and 1.7-5.9 per cent, respectively. For 2020-21, assuming a normal monsoon and no major exogenous or policy shocks, structural model estimates indicate that inflation will move in a range of 3.8-4.1 per cent. The 50 per cent and the 70 per cent confidence intervals for Q4:2020-21 are 2.6-5.7 per cent and 1.8-6.5 per cent, respectively. There are a number of upside and downside risks to the baseline inflation forecasts. The major upside risks include: geopolitical tensions and supply disruptions in the global crude oil market; volatility in international and domestic financial markets; the risk of a sudden reversal in the prices of volatile perishable food items; and, fiscal slippages. Among the downside risks are: a sharper than anticipated slowdown in global growth and its softening impact on crude oil and other commodity prices; and the persistence of a food supply glut keeping headline inflation below the baseline path. Box I.1: Output Gap and Core Inflation An accurate forward-looking assessment of inflation dynamics and their macroeconomic drivers is critical for the effective conduct of monetary policy in a flexible inflation targeting (FIT) regime. Inflation ultimately reflects demand-supply imbalances in the economy. The Phillips curve relates movements in inflation to the output gap4 as a proxy for demand-supply mismatches and suggests a trade-off between inflation and output in the short run, i.e., any attempt to boost economic activity (above its potential or capacity) can intensify inflationary pressures; similarly, any policy action intended to contain inflation will involve some temporary sacrifice of output. The Phillips curve relationship, which lies at the core of modern monetary theory and policy, has come under scrutiny over the past decade in view of inflation being largely impervious to large swings in economic activity and employment, especially in major advanced economies. These developments have lent credence to the argument that the curve has flattened or may even be dead reflecting, inter alia, the well-anchored inflation expectations, increased global integration, and uncertainty about the true output gap (Hooper et al., 2019). Another view is that the relationship may be non-linear (convex): inflation is less responsive to low or negative values of the output gap but could be highly sensitive to a large and increasing positive output gap. This could be due to the downward rigidity in wages and prices, which dampens the impact of low or negative output gaps on wages/prices and hence inflation. The non-linearity could also occur if there is a decline in trend inflation, as a result of which firms adjust prices less frequently implying a flatter Phillips curve, and a steeper curve for an increase in trend inflation (Ball et al., 1988). In emerging markets like India, the Phillips curve framework continues to be relevant for the conduct of monetary policy, despite recurrent and large supply shocks (Patra et al., 2017). The Phillips curve is a key pillar of the RBI’s workhorse Quarterly Projection Model (QPM)5 (Benes et al., 2016). In the QPM, core inflation (i.e., inflation excluding food and fuel) depends on: (a) the output gap; (b) expected inflation as well as its past values to capture both the forward-looking and the adaptive (backward-looking) components of the inflation process; (c) the real exchange rate: as depreciation raises the domestic cost of imported intermediate inputs and final goods, there is upward pressure on domestic prices; and, (d) domestic food and fuel prices. Taking various interactions, feedbacks and policy reactions within the QPM, a positive shock to the output gap increases core and headline inflation and the peak effect occurs with a lag of 3-5 quarters, the impact being stronger and faster for core inflation than for headline inflation (Chart I.1.1).  As noted earlier, the relationship between inflation and the output gap could be non-linear, with the impact of the output gap increasing more than proportionally as it turns positive. Accordingly, the following equation for core inflation is estimated using an exponential formulation for the output gap term: Note: Figures in parentheses are p-values. The results indicate that the Phillips curve is relatively flat for negative output gaps, but the impact increases rapidly with positive output gaps (Chart I.I.2). Such a relationship could occur if, for instance, the pricing power increases more than proportionally with the strengthening of economic activity. The results suggest the need for monetary policy to be vigilant in times of large positive output gaps. References: Ball, L., N.G. Mankiw, and D. Romer (1988), “The New Keynesian Economics and the Output-Inflation Trade-off”, Brookings Papers on Economic Activity, 1988(1), 1-82. Benes, J., K. Clinton, A. George, P. Gupta, J. John, O. Kamenik, D. Laxton, P. Mitra, G. Nadhanael, R. Portillo, H. Wang, and F. Zhang (2016), “Quarterly Projection Model for India: Key Elements and Properties”, RBI Working Paper Series No. 08. Hooper, P., F. Mishkin, and A. Sufi (2019), “Prospects for Inflation in a High Pressure Economy: Is the Phillips Curve Dead or is It Just Hibernating?”, US Monetary Policy Forum 2019. Patra, M. D., J.K. Khundrakpam, and S. Gangadaran (2017), “The Quest for Optimal Monetary Policy Rules in India”, Journal of Policy Modeling, 39(2), 349-370. | Inflation forecasts are critical for the conduct of forward-looking monetary policy and they play a special role in an inflation targeting framework by acting as an intermediate target. An analysis of cross-country forecast errors indicates that there is a positive correlation of the errors with the share of food in the CPI basket (Box I.2). I.3 The Outlook for Growth As noted earlier, economic activity weakened in the second half of 2018-19. Looking ahead, favourable factors such as an increase in financial flows to the commercial sector, stabilisation of crude oil and other commodity prices, consumption- and investment-enhancing proposals in the Union Budget 2019-20, and, the expectation of a normal monsoon are expected to boost economic activity. However, there could be headwinds from greater than expected moderation in global growth and global trade as well as unanticipated volatility in global financial markets. Turning to the forward-looking surveys, consumer confidence a year ahead has increased considerably in the March 2019 round of the Reserve Bank’s survey on positive sentiment pertaining to the general economic situation and the employment scenario (Chart I.7).8 Overall optimism in the manufacturing sector for the quarter ahead registered some moderation in the March 2019 round of the Reserve Bank’s industrial outlook survey due to some dip in prospects for production, order books, exports, and capacity utilisation (Chart I.8). Surveys by other agencies indicate a mixed picture on future business expectations (Table I.3). Firms in the manufacturing and services sectors polled in the Nikkei’s purchasing managers’ survey were optimistic about one-year ahead output prospects. In the March 2019 round of the Reserve Bank’s survey, professional forecasters expected real GDP growth to recover from 6.6 per cent in Q3:2018-19 to 7.5 per cent in Q4:2019-20 (Chart I.9). Taking into account the baseline assumptions, survey indicators, the cut in the policy repo rate in the February 2019 policy and model forecasts, real GDP growth is projected to improve from 7.0 per cent in 2018-19 to 7.2 per cent in 2019-20 – 6.8 per cent in Q1, 7.1 per cent in Q2, 7.3 per cent in Q3, and 7.4 per cent in Q4 – with risks evenly balanced around this baseline path (Table I.4). For 2020-21, the structural model estimates indicate real GDP growth at 7.4 per cent, with quarterly growth rates in the range of 7.3-7.5 per cent, assuming a normal monsoon, and no major exogenous or policy shocks. There are upside as well as downside risks to the baseline growth scenario (Chart I.10). The boost to private investment activity from faster resolution of stressed assets and increased as well as more broad-based credit offtake amidst rising capacity utilisation can raise the baseline growth projection. Conversely, further escalation of trade tensions and protectionist trends, increased volatility in global financial conditions over the uncertainty of the stance of monetary policy in the US and other advanced economies, uncertainty surrounding Brexit, a sharper slowdown in the Chinese economy and deviations of the south-west monsoon from the baseline assumption of a normal monsoon may pose downside risks to the baseline growth path. Box I.2: RBI Inflation Forecasts – An Evaluation RBI’s bi-monthly resolutions provide inflation forecasts for up to four quarters ahead. The Monetary Policy Report (MPR), released twice a year (April and October), provides inflation forecasts up to eight quarters ahead. Inflation forecasts for the period from April 2015 to September 2018 for up to four quarters ahead are benchmarked vis-à-vis those of some major central banks. Inflation in India eased significantly for a few months following demonetisation, which imparted a large upward bias to the forecasts made prior to November 2016 and for a few subsequent months. The analysis, therefore, presents results for the full sample period as well as for the period excluding demonetisation. The sample period also includes the introduction of the goods and services tax – a major structural reform measure – in July 2017 which, as the cross-country evidence suggests, adds uncertainty to the inflation outlook during the implementation stage. The mean forecast error for the sample excluding the demonetisation period is (-) 30 bps9 as compared with a range of 0 to (-) 40 bps for the other sample countries (Table I.2.1).10 The standardised mean error (i.e., the mean error divided by the respective inflation targets of the sample countries) is around 8 per cent for India vis-à-vis 0-13 per cent for the sample countries. Similarly, the mean absolute forecast error and the root mean squared error for RBI forecasts are within the ranges observed for the sample countries. | Table I.2.1 Inflation Forecast Errors | | (Percentage points) | | Item | India (full sample) | India (sample excluding October 2016-June 2017) | UK | Czech Republic | Sweden | Hungary | | Mean Error (ME) | -0.7 | -0.3 | 0.0 | 0.0 | 0.0 | -0.4 | | Standardised ME | -18.4 | -7.7 | -0.2 | 0.5 | 0.6 | -12.6 | | Mean Absolute Error (MAE) | 0.8 | 0.4 | 0.2 | 0.4 | 0.3 | 0.6 | | Standardised MAE | 20.7 | 10.7 | 11.6 | 19.3 | 14.6 | 19.6 | | Root Mean Squared Error (RMSE) | 1.1 | 0.6 | 0.3 | 0.5 | 0.4 | 0.8 | | Standardised RMSE | 27.6 | 13.8 | 14.2 | 24.3 | 17.6 | 27.2 |  | The share of food in the CPI basket varies widely across countries, which could have a significant bearing on forecast errors. Absolute measures of errors are found to be correlated with the share of food items in the CPI. There is a considerable flattening of the relationship once the forecast errors are standardised with respective inflation targets (Chart I.2.1). A desirable characteristic of a good forecast is that it should be unbiased, i.e., on average, the forecast error should be zero. Unbiasedness can be tested by regressing forecast errors on a constant by estimating the following equation:

| Table I.2.2: Unbiasedness Test | | Forecast horizon | India (full sample) | India (sample excluding October 2016-June 2017) | Czech Republic | Hungary | Sweden | UK | | 1 quarter ahead | -0.30** | -0.11 | 0.07 | -0.15 | -0.01 | -0.02 | | | (0.03) | (0.24) | (0.43) | (0.24) | (0.74) | (0.36) | | 2 quarters ahead | -0.64*** | -0.34** | 0.09 | -0.27 | 0.02 | -0.01 | | | (0.00) | (0.03) | (0.57) | (0.17) | (0.76) | (0.93) | | 3 quarters ahead | -0.88*** | -0.27 | -0.03 | -0.49 | 0.04 | -0.02 | | | (0.00) | (0.11) | (0.83) | (0.10) | (0.68) | (0.87) | | 4 quarters ahead | -1.13*** | -0.51*** | -0.09 | -0.60 | -0.00 | 0.03 | | | (0.00) | (0.01) | (0.63) | (0.10) | (0.99) | (0.86) | Notes: Figures in parentheses are p-values.

***,**,*: Significant at <1%, <5% and <10% levels, respectively.

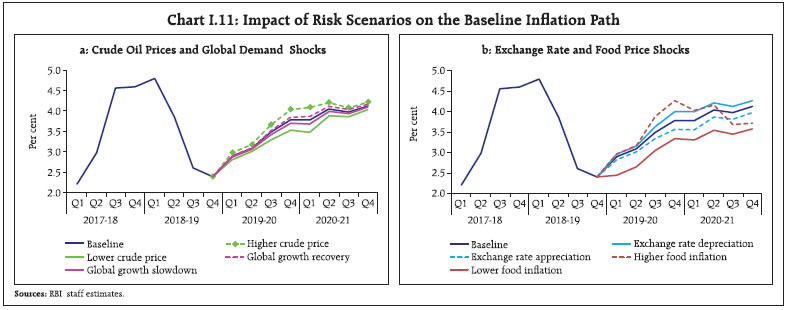

Sources: Central bank websites; RBI staff estimates. | Reference: Raj, J., M. Kapur, P. Das, A. George, G. Wahi and P. Kumar (2019), “Inflation Forecasts: Recent Experience in India and a Cross Country Assessment”, Reserve Bank of India (Mimeo). | I.4 Balance of Risks The baseline projections of growth and inflation presented in the previous sections are based on a set of assumptions explained in Table I.2. However, there are substantial uncertainties around these baseline assumptions which pose risks, both upside and downside, to the baseline projections. The projected paths of growth and inflation under various plausible alternative scenarios are discussed below: (i) Global Growth Uncertainties Global growth and trade have surprised on the downside in recent quarters. The baseline scenario in Table I.2, therefore, assumes some slowdown in global growth in 2019 vis-à-vis preceding years. However, global growth could turn out to be even lower on further escalation of trade tensions, volatility in global financial markets, more-than-envisaged slowdown in the Euro area and China, and limited monetary and fiscal policy space in major countries. In such circumstances, if global growth turns out to be 50 bps below the baseline, domestic GDP growth and inflation could be lower by around 15-20 bps and 10 bps, respectively, below the baseline. On the other hand, an orderly and quick resolution of trade issues between the US and China, and more accommodative monetary policies in the major advanced economies than currently anticipated on the back of a benign inflation outlook, could provide support to the global economy. Should global growth turn out to be 50 bps above the baseline scenario, domestic growth and inflation could be around 15-20 bps and 10 bps above the baseline (Charts I.11 and I.12).

| Table I.3: Business Expectations Surveys | | Item | NCAER Business Confidence Index (March 2019) | FICCI Overall Business Confidence Index (February 2019) | Dun and Bradstreet Composite Business Optimism Index (January 2019) | CII Business Confidence Index (March 2019) | | Current level of the index | 127.0 | 60.3 | 73.8 | 65.2 | | Index as per previous survey | 133.1 | 61.9 | 79.5 | 61.8 | | % change (q-o-q) sequential | -4.6 | -2.6 | -7.2 | 5.5 | | % change (y-o-y) | -1.8 | -15.8 | -18.9 | 8.7 | Notes: 1. NCAER: National Council of Applied Economic Research.

2. FICCI: Federation of Indian Chambers of Commerce & Industry.

3. CII: Confederation of Indian Industry. |

| Table I.4: Projections - Reserve Bank and Professional Forecasters | | (Per cent) | | | 2018-19 | 2019-20 | 2020-21 | | Reserve Bank’s Baseline Projections | | | | | Inflation, Q4 (y-o-y) | 2.4 | 3.8 | 4.1 | | Real GDP growth | 7.0 | 7.2 | 7.4 | | Median Projections of Professional Forecasters | | | | | Inflation, Q4 (y-o-y) | 2.4 | 4.2 | | | Real GDP growth | 7.0 | 7.3 | | | Gross domestic saving (per cent of GNDI) | 29.9 | 30.2 | | | Gross fixed capital formation (per cent of GDP) | 29.0 | 29.4 | | | Credit growth of scheduled commercial banks | 13.8 | 13.3 | | | Combined gross fiscal deficit (per cent of GDP) | 6.4 | 6.3 | | | Central government gross fiscal deficit (per cent of GDP) | 3.4 | 3.4 | | | Repo rate (end-period) | 6.25 | 6.00 | | | Yield on 91-days treasury bills (end-period) | 6.3 | 6.1 | | | Yield on 10-year central government securities (end-period) | 7.4 | 7.3 | | | Overall balance of payments (US$ billion) | -13.6 | 11.4 | | | Merchandise export growth | 8.0 | 5.6 | | | Merchandise imports growth | 10.5 | 6.0 | | | Current account balance (per cent of GDP) | -2.4 | -2.3 | | GNDI: Gross National Disposable Income.

Source: RBI staff estimates; and Survey of Professional Forecasters (March 2019). |

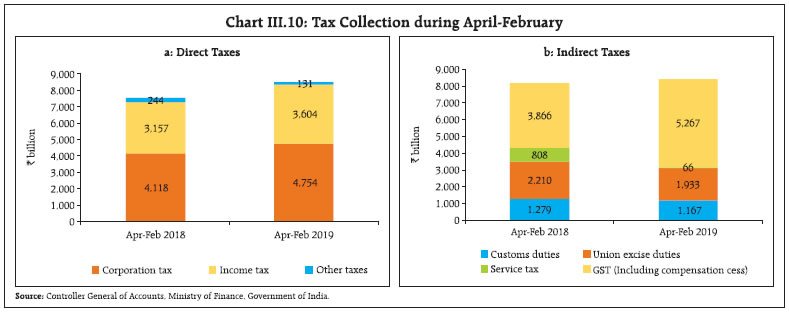

(ii) International Crude Oil Prices Global crude oil prices have declined sharply from their October 2018 levels; however, the short- and medium-term outlook remains uncertain. If oil supply becomes constricted due to geopolitical tensions and continuing OPEC production cuts, there could be a sudden and large upward pressure on oil prices. Assuming an increase in the Indian basket crude oil prices to around US$ 77 per barrel, inflation could be higher by 30 bps and growth could be weaker by around 20 bps. On the other hand, if global economic activity disappoints more than expected for the earlier noted reasons, crude oil demand could be lower. Moreover, the effectiveness of production cuts by the OPEC may be impaired if there is a compensating increase in shale output. If the Indian basket crude price were to fall to US$ 57 per barrel, inflation could ease by around 30 bps, with a boost of around 20 bps to growth. (iii) Exchange Rate The nominal exchange rate of the Indian rupee vis-à-vis the US dollar has appreciated from its October level, after coming under sustained pressure during August-September 2018. Higher crude oil prices and volatility in portfolio flows could put downward pressure on the Indian rupee. A depreciation of the Indian rupee by around 5 per cent relative to the baseline could increase inflation by around 20 bps, while providing a boost of 15 bps to growth. Conversely, India’s sound domestic fundamentals and increased capital inflows can lead to an appreciation of the domestic currency. An appreciation of the Indian rupee by 5 per cent could soften inflation by around 20 bps and lower growth by around 15 bps. (iv) Food Inflation Food inflation in India remained softer than expected in 2018-19, dipping into negative territory during October 2018-February 2019. Domestic food production is at historically high levels. The baseline path assumes food inflation to edge higher, with the dissipation of base effects. Going forward, adequate buffer stocks in cereals, a favourable demand-supply balance in many food items and continuing low global food prices could keep food inflation under check in 2019-20. Owing to these factors, should food inflation remain below the projected path by 100 bps, headline inflation may remain below the baseline by up to around 50 bps. On the other hand, given the unusually low food inflation, there is a risk of a sudden reversal in the prices of perishable food items. Should the monsoon be deficient, this may reduce agricultural production and exert upward pressure on food prices. In this scenario, GDP growth could be lower by around 30 bps in 2019-20, and higher food prices may push up headline inflation above the baseline by around 50 bps by the end of 2019-20. (v) Fiscal Slippages In 2018-19, the Centre’s indirect tax collections trailed budget estimates and contributed to the fiscal deficit turning out to be higher in the revised estimates. The baseline projections assume a fiscal stance as announced in the budgets for 2019-20. Going forward, alternative farm support schemes and farm loan waivers announced by some state governments, higher minimum support prices and food procurement, and lower direct tax collections could put upward pressure on the combined fiscal deficit. Should there be a fiscal slippage on account of such factors, this could crowd out private investment, impact potential output, and result in higher inflation. Conversely, with the stabilisation of the GST, indirect tax revenues could improve more than currently budgeted, which could help contain deficits, and provide higher resources for private investment, enhance potential output and reduce inflation. I.5 Conclusion To sum up, headline CPI inflation is expected to move up from its recent lows as the favourable base effects dissipate but is expected to remain below the target of 4 per cent. Higher crude oil prices, volatility in international financial markets, the risk of a sudden reversal in the prices of perishable food items, and fiscal slippages are, however, upside risks to the inflation trajectory. Softer crude oil and commodity prices on the back of a sharper slowdown in global growth, and the persistence of low food inflation pose downside risks to the headline inflation path. Real GDP growth is expected to recover in 2019-20. Private consumption is likely to remain its mainstay and investment activity is expected to remain strong. Recapitalisation of public sector banks and the ongoing improvement in their financials, and resolution of stressed assets under the insolvency and bankruptcy code are expected to improve bank credit offtake and support investment and aggregate demand. The policy repo rate cut in February 2019 and the demand-enhancing proposals in the Union Budget 2019-20 are also expected to boost aggregate demand. Deceleration in global trade and global GDP growth, however, poses downside risks to domestic economic activity. _________________________________________________________

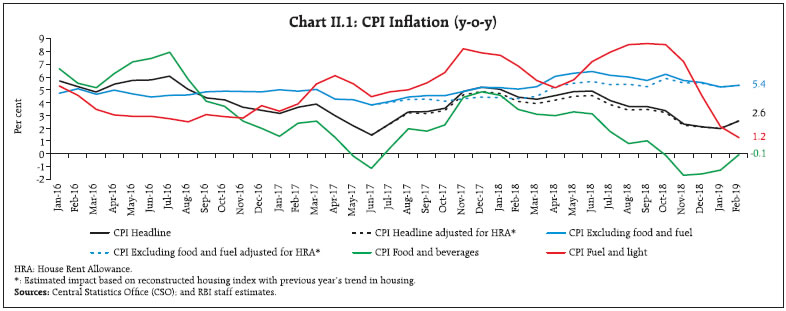

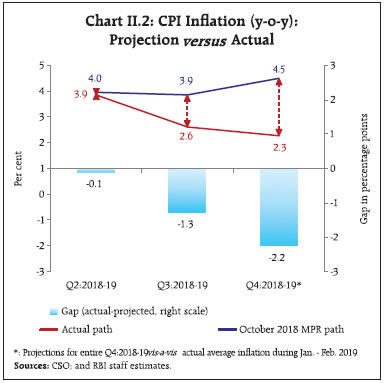

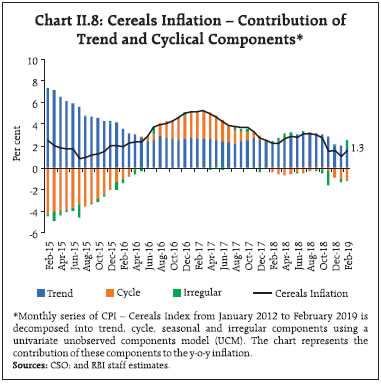

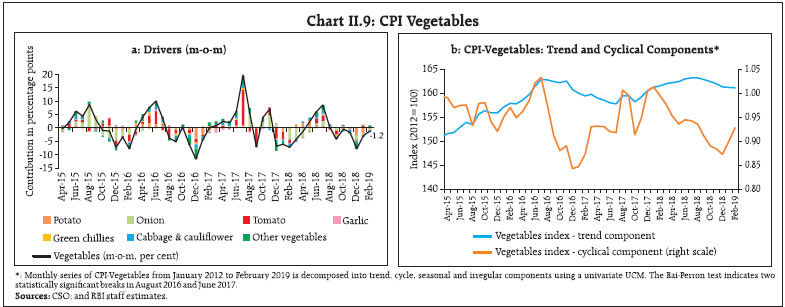

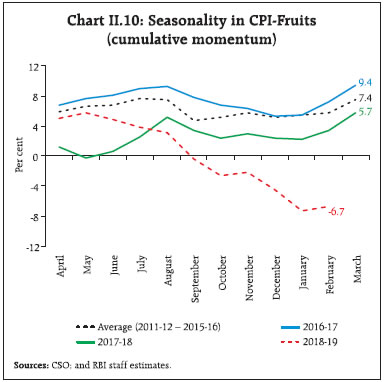

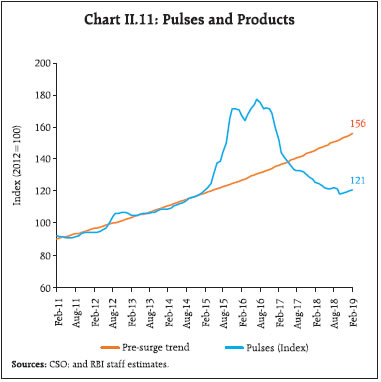

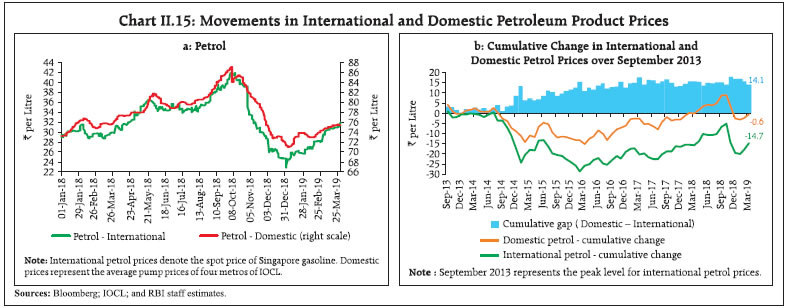

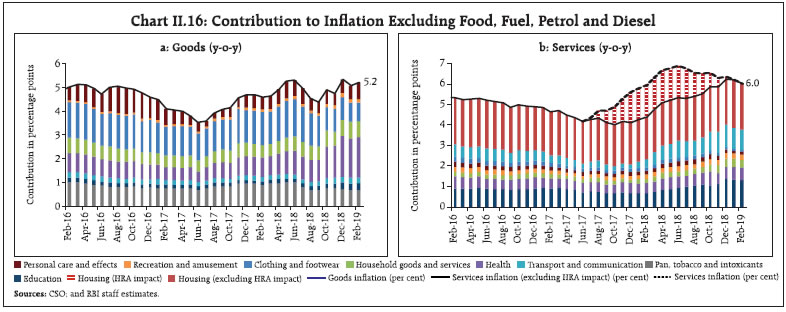

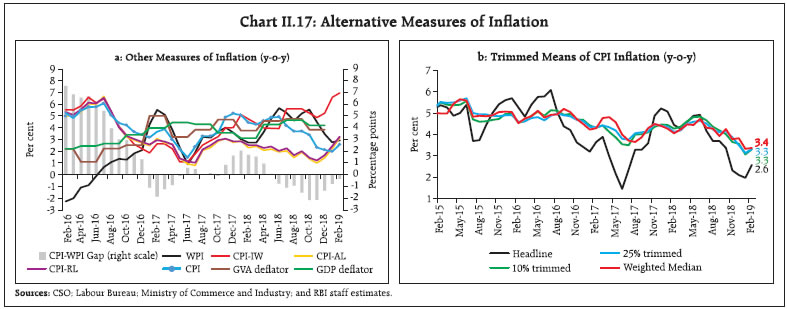

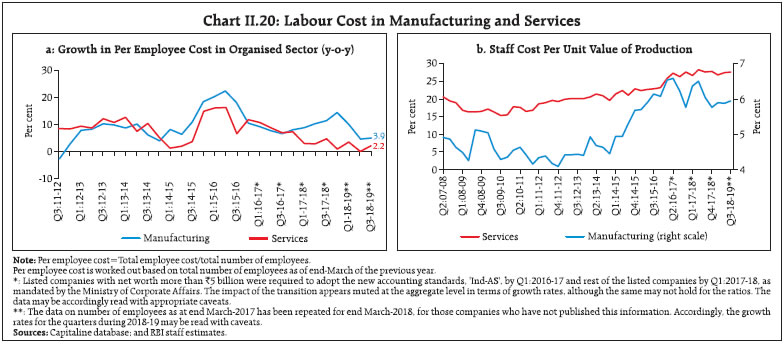

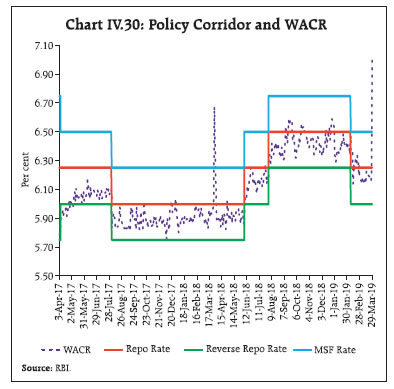

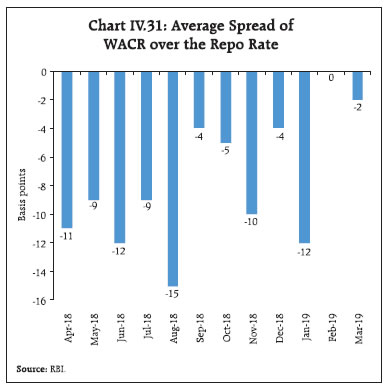

II. Prices and Costs Consumer price inflation has weakened in a broad-based manner with food prices contracting for five consecutive months since September 2018, fuel inflation collapsing and inflation excluding food and fuel softening even though it remains at an elevated level. Nominal growth in rural wages for both agricultural and non-agricultural labourers remained muted and pressure from staff costs in the organised sector was range-bound in Q3:2018-19. Industrial and farm input costs moderated considerably. Consumer price index (CPI) inflation surprised on the downside in Q4:2018-19, falling to 2.0 per cent in January 2019, the legislated floor for CPI inflation.1 It was the lowest reading since June 2017 when it briefly fell to 1.5 per cent. Although it edged up in February, its momentum remained weak relative to expectations. Prices of food and beverages contracted for five consecutive months since September 2018 leading to the longest deflationary spell in these prices in the CPI series so far. Fuel and light inflation collapsed from its recent peak in September tracking the softness in international energy prices and the unusual sharp decline in electricity prices. Inflation in CPI excluding food and fuel also softened since October with the statistical impact of the increase in house rent allowances (HRA) for central government employees on headline inflation dissipating completely by December (Chart II.1). Notwithstanding the softening, CPI inflation excluding food and fuel remained at an elevated level during 2018-19 (up to February), particularly with services inflation remaining sticky. Amendments to the RBI Act in 2016 enjoin it to set out deviations of inflation readings from projections, if any, and explain the underlying reasons thereof. The Monetary Policy Report (MPR) of October 2018 had projected CPI inflation at 3.9 per cent in Q3:2018-19, rising gradually to 4.5 per cent in Q4. Actual inflation outcomes undershot projections by a considerable margin, largely attributable to a significant change in initial conditions (assumptions) that were set out in the October 2018 MPR, particularly in respect of prices for international crude oil, exchange rate as also domestic electricity.  Food prices moved into deflation from October 2018, with a sustained fall in prices of vegetables, fruits and sugar due to robust supplies. In contrast to past trends, milk prices declined abruptly in October coming from high domestic availability. Furthermore, prices of cereals and pulses also saw declines during H2:2018-19 in spite of an increase in minimum support prices (MSPs). Crude oil prices, which were assumed to remain at US$ 80 per barrel at the time of the October MPR, fell sharply to touch a low of US$ 52 per barrel by end-December, before reverting to US$ 68 per barrel by end-March, pulling down inflation in CPI excluding food and fuel. Mirroring this downturn in crude oil prices, domestic LPG prices also collapsed from their recent peak in November. In addition, the trajectory of electricity inflation shifted dramatically downwards since November 2018, pulling down fuel inflation from 8.5 per cent in October to 1.2 per cent in February 2019. In the event, the path of inflation fell below projections by 1.3 percentage points in Q3 and by 2.2 percentage points in Q4 up to February (Chart II.2).  II.1 Consumer Prices The sustained softening in headline inflation during H2:2018-19 reflected initially the combined impact of favourable base effects (October-November) and thereafter a sharp decline in price momentum even when these base effects turned adverse (December-January).2 CPI food, driven down by favourable base effects and a decline in prices, moved into deflation in October 2018, which further deepened in November and persisted till Ferbuary 2019. It was only in February that contraction in food prices got arrested. In the fuel group, inflation moderated sharply on a sustained fall in price momentum. Price momentum in CPI excluding food and fuel, which registered a sharp pick-up in October, moderated thereafter during November-January, with tailwinds from favourable base effects resulting in a moderation of inflation. However, there was an upturn in price momentum in this category in February (Chart II.3). This, along with an upturn in food momentun caused CPI headline momentum to turn positive in February. The distribution of inflation across CPI groups in 2018-19 had striking commonalities with the preceding year, with similar median inflation rates and a persistent negative skewness in both the years emanating from food prices (Chart II.4). Diffusion indices of price changes in CPI items on a seasonally adjusted basis showed moderation during September-January. Much of it was reversed in February; however, more than four-fifths of the CPI basket, comprising both goods and services, experienced price increases, indicating a generalised pick-up in prices in that month (Chart II.5).3 II.2 Drivers of Inflation A historical decomposition of inflation shows that the moderation in inflation in H2:2018-19 was largely the result of favourable supply side shocks - particularly to prices of food and crude oil. Subdued demand pressures opened up a slightly negative output gap, which along with muted wage growth, produced a generalised decline in inflation (Chart II.6a).4 The break-up of overall inflation into goods and services components shows the predominant role of prices of goods in this broad-based downturn (Chart II.6b). These include perishable goods like vegetables and fruits (with a 7-day recall), non-perishable goods like cereals and pulses (with a 30-day recall) in Q3, and imported goods (gold, silver, petrol, diesel, LPG, kerosene, refined vegetables oils, electronic goods, chemical products, metal products, and clothing) in Q4 (up to February) (Chart II.6c).5 Services inflation remained sticky, even as the statistical effects of HRA increases for central government employees dissipated completely. CPI Food Group In terms of weighted contributions, the food and beverages group (weight: 45.9 per cent in CPI) contributed 9.5 per cent to overall inflation during April 2018 - February 2019 as compared with 28.9 per cent for the same period a year ago. Inflation in the food group moved into negative territory from October 2018 and was at (-) 0.1 per cent in February 2019 (Chart II.7a). Four food sub-groups – fruits, vegetables, pulses and sugar with a combined weight of 12.7 per cent in the CPI basket – remained in deflation in February 2019 (Charts II.7 a and b). Within the food group, inflation in respect of cereals (weight of 9.7 per cent in CPI and 21.1 per cent in the food and beverages group) picked up to 1.3 per cent in February 2019 from an intra-year low of 0.8 per cent in January, primarily driven by a modest recovery in rice inflation to (-) 1.9 per cent in February from (-) 2.1 per cent in January as a result of higher production and stocks much above buffer norms. As per the second advance estimates, production of rice was at 115.6 million tonnes in 2018-19, up from the record level of 112.9 million tonnes in 2017-18 (fourth advance estimates). A decomposition of CPI cereals inflation shows a negative contribution of cyclical factors in 2018-19 (Chart II.8). Prices of vegetables, which account for 6.0 per cent of CPI and 13.2 per cent of the food and beverages group, were the principal driver of the unusual food inflation dynamics witnessed during the year; the other key driver was fruits. A sharp fall in prices of vegetables and fruits, combined with a moderation/decline in prices of some protein-rich items (particularly, milk and products, and pulses), oils and fats, and sugar and confectionery kept overall food prices in deflationary zone from October 2018 to February 2019. The easing of food prices in early 2018-19 has, in fact, defied the historical pattern. Also, the rise in food prices during February was, in contrast to past trends, driven largely by a turnaround in fruits prices and recovery in prices of vegetables.  Within vegetables, inflation in respect of onion prices declined from a high of 40.6 per cent in July 2018 to (-) 57.1 per cent in January 2019, followed by some pick-up in February to (-) 49.5 per cent. Gains in kharif production, higher mandi arrivals as well as release of old stocks aided this fall. Tomato prices remained in deflation from March 2018 to January 2019, with negative momentum during August 2018 - February 2019 (barring January), again on account of healthy mandi arrivals and higher production. Anecdotal evidence suggests that the pick-up in tomato prices in January 2019 was largely due to delayed harvesting on account of acute cold conditions following rainfall in Nashik – a major tomato-growing district in Maharashtra, crop damage by fungus in Karnataka and adverse impact on the crop by cyclone Gaja in Tamil Nadu (particularly, in Dindigul, which is a major tomato supplier). However, inflation in respect of potatoes remained in double digits throughout 2018-19 (up to February), despite some moderation since October 2018. Price pressures were visible during March-July 2018 due to lower availability of stocks from cold storages, transport disruptions and protests organised by potato farmers (Chart II.9a). With fresh arrivals entering the market on the back of a bumper winter crop, prices declined during November-February. On the whole, a significantly lower build-up in the cumulative momentum of prices of vegetables in 2018-19 relative to the previous year helped in keeping food inflation low.  An analysis of prices of vegetables based on sectoral CPI indices suggests that even as month-on-month volatility was higher in urban markets than their rural counterparts, the difference in monthly changes in prices between rural and urban areas was not found to be statistically significant, suggesting that rural-urban price changes were broadly in the same direction.6 A decomposition of CPI-vegetables into trend and cyclical components reveals that a large cyclical downturn till December 2018 was the key mover as the trend component remained more or less flat (Chart II.9b). Some upturn observed since January 2019 in the cyclical component of prices has contributed to a lower rate of decline in prices of vegetables in Q4 (January-February). Prices of fruits (weight of 2.9 per cent in the CPI and 6.3 per cent within the food and beverages group) were another downside surprise during 2018-19. Fruit prices fell in June-July 2018, contrary to past patterns. Strong domestic arrivals of mangoes and bananas, together with higher imports of some fruits (particularly apples and citrus fruits) pulled down domestic prices. Overall, prices of fruits witnessed a sustained decline during June 2018 - January 2019 (except November 2018), contrary to the usual pattern (Chart II.10). While deflation in fruits prices persisted during December 2018 - February 2019, their momentum underwent a sharp upturn in February 2019 in contrast to the average negative momentum of (-) 2.6 per cent in the previous two months. In the case of prices of pulses, deflation persisted on the back of oversupply, although this trend is reversing gradually. Pulses account for 2.4 per cent of the CPI and 5.2 per cent of the food and beverages group. The contribution of pulses to overall inflation was (-) 6.0 per cent during April-February 2018-19 as against (-) 18.9 per cent during April-February 2017-18. With production and procurement of pulses in 2018-19 remaining broadly at the previous year’s level, mandi level prices of some varieties such as arhar and urad have recovered and moved up towards their MSPs in some of the major producing states. Pulses prices have been ruling well below their historical trend for 10 months now (Chart II.11).  The deflation in prices of the sugar and confectionery sub-group since February 2018 because of excess domestic production, increased open market sales and deflationary movements in global sugar prices, contributed to the subdued food inflation. The increase in the minimum selling prices of sugar by ₹ 2 per kg. to ₹ 31 per kg. by the central government in February 2019 has not yet been reflected in domestic retail prices. Prices of oils and fats remained subdued since September 2018 in line with international edible oils prices. As per the second advance estimates of the Ministry of Agriculture and Farmers’ Welfare, oilseeds production is likely to go up marginally by 0.6 per cent in 2018-19 (over the fourth advance estimates of 2017-18) as the decline in groundnut seeds production is offset by higher production in soybean and mustard seeds. The Government of India has also reduced the import duty on crude palm oil and refined, bleached and deodorised (RBD) palm oil imports from Malaysia and Indonesia, effective January 1, 2019.  Prices of protein-rich items such as eggs, meat and fish witnessed upside pressure. In the case of eggs, inflation after remaning in negative territory during November 2018 - January 2019, turned positive in February. Meat and fish prices also experienced upside pressures that are typical during the winter months. Inflation in respect of meat and fish was at 5.9 per cent in February, the highest since October 2016, due to higher input prices relating to maize and soybean that constitute animals and poultry feed stock. After reaching an intra-year high of 3.0 per cent in November, inflation in spices eased to 1.8 per cent in February on account of a broad-based decline in prices, reflecting higher expected production of turmeric, dried chillies, dhania and jeera. CPI Fuel Group Fuel and light inflation, which was at 8.5 per cent in October 2018, moderated to 4.5 per cent in December and further to 1.2 per cent in February on account of a fall in prices of LPG along with sustained moderation in electricity, and firewood and chips prices (Chart II.12a). After registering significant price increases between June and November, domestic LPG prices declined abruptly since December, following a collapse in prices in the international market. After the migration of subsidy payments on LPG to bank accounts under the direct benefit transfer scheme, LPG prices in CPI mirror open market prices, which, in turn, track international prices closely (Chart II.12b).  Inflation in electricity, which constitute around one-third of the fuel and light sub-group, moderated to an average of 0.6 per cent in H2:2018-19 (up to February), after hovering around 3 per cent during H1:2018-19. Energy deficit continues to decline despite the stagnation in generation of electricity in January-February 2019 (0.7 per cent y-o-y growth) indicating subdued demand, which is also reflected in low spot prices at the Indian Energy Exchange during this period. Inflation in respect of items of rural consumption such as firewood and chips, which remained sticky and elevated till October, since then declined by 5.4 percentage points to touch 0.6 per cent in February, accentuating the fall in the fuel group inflation. However, administered kerosene prices registered sustained increases as oil marketing companies (OMCs) raised prices in a calibrated manner to phase out subsidy. CPI Excluding Food and Fuel CPI inflation excluding food and fuel saw an uptick in October 2018 which was, however, short-lived as it softened sequentially from 6.2 per cent in October to 5.2 per cent in January 2019 before edging up marginally to 5.4 per cent in February. It is noteworthy though that CPI inflation excluding food and fuel has remained above 5 per cent since December 2017. Excluding volatile items such as petrol, diesel, gold and silver, CPI inflation remained between 5.5-5.8 per cent since October (Chart II.13). Housing, having a weight of 21.3 per cent in CPI excluding food and fuel, was the largest contributor (22 per cent) to inflation in this group, even as the statistical impact of HRA increases of central government employees waned completely by December. The health sub-group, with a weight of 12.5 per cent, contributed around 18 per cent to CPI inflation excluding food and fuel during October-February (Chart II.14). The transport and communication sub-group contributed around 14 per cent – the third highest – to inflation in CPI excluding food and fuel, with its contribution much below its weight of 18.2 per cent due to a sharp decline in petrol and diesel prices since November (Chart II.15a). The wedge between international and domestic prices remains considerable due to the asymmetric pass-through of international crude oil prices to domestic prices since 2014 (Chart II.15b). Among other sub-groups, education (weight of 9.4 per cent in CPI excluding food and fuel) contributed around 13 per cent to CPI inflation excluding food and fuel in H2 (up to February) due to a pick-up in inflation in tuition fee, books and journals. In contrast, a sharp moderation in clothing and footwear inflation from October 2018 pulled down its contribution to inflation in CPI excluding food and fuel to 8 per cent, well below its weight of 13.8 per cent in the group (Chart II.14). Disaggregation of CPI inflation excluding food, fuel, petrol and diesel into goods and services shows that goods inflation moved in a narrow range of 4.9-5.1 per cent during H2:2018-19 (up to February), while services inflation persisted at elevated levels – 6.0-6.5 per cent. Goods inflation picked up in Q3 across commodity groups – particularly medicines, household goods, and items of personal care and effects – offset somewhat by a sharp moderation in clothing and footwear sub-group inflation (Chart II.16a). Sticky and elevated services inflation in Q3 was primarily on account of a rise in transportation fares, education expenses and household services, which more than offset the significant moderation in housing inflation on waning HRA effects. During January-February 2019, services inflation moderated somewhat from 6.2 per cent to 6.0 per cent as transportation services inflation eased, reflecting the lagged impact of lower fuel prices and also on account of some moderation in inflation in respect of housing, education and ‘personal care and effects’ services (Chart II.16b).  Other Measures of Inflation Measures of inflation other than the CPI showed mixed movements since the October MPR. Inflation measured by sectoral CPIs – for industrial workers (CPI-IW), agricultural labourers (CPI-AL) and rural labourers (CPI-RL) – edged up during November to February 2019. First, food inflation in all the three sectoral CPIs was higher relative to all India CPI. Second, fuel inflation remained range bound and did not collapse in sectoral CPIs. The housing index in the CPI-IW is revised once in six months, i.e., in January and July every year. Following the increase in HRA under the 7th central pay commission (CPC), the housing index in the CPI-IW increased by 8.8 per cent and 15.9 per cent in January and July 2018, respectively, and further by 8.8 per cent in January 2019. CPI-IW inflation shot up to 7.0 per cent in February from 5.2 per cent in December, pulled up by the January 2019 increase in its housing index.   In contrast, wholesale price index (WPI) inflation fell from its October 2018 peak of 5.5 per cent to 2.8-2.9 per cent in January-February. The sequential decline in WPI inflation was led by a significant fall in inflation in respect of crude petroleum, mineral oils and basic metals, tracking international commodity prices. GDP and GVA deflators also edged down in Q3 in line with WPI inflation (Chart II.17a). Volatile prices of items such as food, fuel and precious metals impart high dispersion, asymmetry and non-normality to the distribution of inflation. To gauge underlying inflation dynamics, one way is to remove high positive as well as negative skewness and chronic fat tails in the inflation distribution by trimming the tails. In addition to exclusion based measures discussed earlier, trimmed means of CPI have softened sequentially over the last six months (Chart II.17b). Inflation measures, which remove the volatile components and represent the durable component of inflation, can be evaluated against desirable properties of 'core' inflation. An analysis of eleven inflation measures suggests that none of the exclusion-based measures satisfied all the properties of 'core' inflation. However, two statistical measures, viz., trimmed means (5 per cent and 10 per cent) satisfied all the properties of a core measure, other than the ease of communication (Box II.1). II.3 Costs Underlying cost conditions have largely co-moved with WPI inflation. Industrial and farm costs captured under the WPI picked up in Q1:2018-19 and remained elevated till November 2018, after which they moderated considerably (Chart II.18). Global crude oil prices declined sharply during November-December 2018 from their peak levels in October 2018 before edging up in January and February 2019. This decline got passed on to prices of inputs such as high-speed diesel, aviation turbine fuel, naphtha, bitumen, furnace oil and petroleum coke, pulling down domestic farm and non-farm input costs. Though some of the petroleum product prices increased in February 2019, reflecting the increase in crude oil prices, industrial input costs continued to decelerate due to a sharp decline in mineral prices. Among other industrial raw materials, domestic coal inflation eased during January-February 2019 largely due to favourable base effects. Inflation in paper and pulp prices edged up in Q3:2018-19 due to rising production costs and global prices. Inflation in fibres picked up in Q2 and Q3 after being in negative territory in Q1. However, it has moderated since December 2018 due to softening prices of raw cotton on account of weak demand from domestic yarn mills and excess stocks in overseas markets. Box II.1: Core Inflation Measures in India – An Empirical Evaluation Movements in headline inflation are influenced by its trend and by changes of a temporary nature. While the transitory elements largely reflect supply shocks, the trend component responds to changes in aggregate demand conditions and expectations. This persistent component of inflation, often referred to as core or underlying inflation, provides an important guide to the future path of headline inflation. Hence, a core inflation measure is often used by monetary authorities as an input for the conduct of monetary policy. Two commonly used approaches to measure core inflation are (i) exclusion-based measures i.e., excluding some highly volatile elements from the headline such as food and fuel; and (ii) statistical measures such as median or trimmed mean. There are some properties that a core inflation measure should satisfy: credibility: a measure of core inflation should be timely, credible (verifiable by agents independent of the central bank) and easily understood by the public. mean and standard deviation: a core inflation measure should have the same mean as the headline, but lower standard deviation. reversion: an appropriate measure of core inflation is the one to which headline reverts; hence, core inflation measure can be a good predictor of future inflation. core inflation causes headline, but headline does not cause core: core and headline need to be cointegrated with a unitary coefficient (termed as unbiasedness). In other words, core is strongly exogenous (with respect to headline), but headline is not. correlation with past monetary policy: monetary policy over a longer horizon is more likely to be correlated with durable or core CPI inflation. A total of eleven CPI core measures for India were considered out of which six were exclusion-based measures, viz.: (i) excluding food and fuel; (ii) excluding food, petrol and diesel; (iii) excluding food, fuel, petrol and diesel; (iv) excluding food, petrol, diesel, gold and silver; (v) excluding food, fuel, petrol, diesel, gold and silver; and (vi) excluding food, fuel, petrol, diesel, gold, silver and housing. Five statistical measures considered are: (i) trimmed mean (5 per cent); (ii) trimmed mean (10 per cent); (iii) trimmed mean (20 per cent); (iv) median; and (v) reweighting the index based on historical standard deviation. Based on data from January 2012 to February 2019, headline inflation is treading below the lower range of the band constructed by using all the eleven core measures (Chart II.1.1). For the full period, all exclusion-based measures satisfied all the properties other than (i) being a robust future inflation predictor; and (ii) correlation with past monetary policy (Table II.1.1). However, if the sample period is truncated to mid-July 2018, the property of being an efficient future inflation predictor is also satisfied. This suggests that the recent unusual period of low and persistent food inflation has impaired the predictive properties of exclusion-based measures. Also, the property of correlation with the past monetary policy was not satisfied by any exclusion-based measure. This was possibly due to the reason that it was only in January 2014 that the RBI adopted CPI as the headline inflation measure. It is also significant that often inflation in WPI and sectoral CPIs registered wide divergence. The trimmed mean measures (5 per cent and 10 per cent) satisfied all the desirable properties in the full sample. However, statistical measures of core inflation are not easy to communicate. | Table II.1.1: Properties of CPI Core Inflation Measures | | | Properties → | Ease of Communication | Equality of means | Less variance | Future inflation predictor | Co integrated | Unbiasedness | Attraction condition | Correlation with past monetary policy | | Measures↓ | | | | (1) | (2a) | (2b) | (3) | (4a) | (4b) | (4c) | (5) | | 1. | Excluding Food and Fuel | √ | √ | √ | x | √ | √ | √ | x | | 2. | Excluding Food, Petrol and Diesel | √ | √ | √ | x | √ | √ | √ | x | | 3. | Excluding Food, Fuel, Petrol and Diesel | √ | √ | √ | x | √ | √ | √ | x | | 4. | Excluding Food, Petrol, Diesel, Gold and Silver | √ | √ | √ | x | √ | √ | √ | x | | 5. | Excluding Food, Fuel, Petrol, Diesel, Gold and Silver | √ | √ | √ | x | √ | √ | √ | x | | 6. | Excluding Food, Fuel, Petrol, Diesel, Gold, Silver and Housing | √ | √ | √ | x | √ | √ | √ | x | | 7. | Trimmed Mean (5 per cent) | x | √ | √ | √ | √ | √ | √ | √ | | 8. | Trimmed Mean (10 per cent) | x | √ | √ | √ | √ | √ | √ | √ | | 9. | Trimmed Mean (20 per cent) | x | √ | √ | √ | √ | x | x | x | | 10. | Median | x | √ | √ | x | √ | √ | x | x | | 11. | Historical Standard Deviation | x | √ | √ | √ | √ | √ | √ | √ | | Note: √: property satisfied; x: property not satisfied. | References: Das, A., J. John and S. Singh (2009), “Measuring Core Inflation in India”, Indian Economic Review, July December. Das, P. and A.T. George (2017), “Comparison of Consumer and Wholesale Prices Indices in India: An Analysis of Properties and Sources of Divergence”, RBI Working Paper Number 5/2017, May. Raj, J. and S. Misra (2011), “Measures of Core Inflation in India – An Empirical Evaluation”, Reserve Bank of India Occasional Papers, Vol. 32, No. 3, Winter, pp 37-66. Raj, J., S. Misra, A. T. George, and J. John (2019) “Measures of Core Inflation in India – An Empirical Evaluation using CPI data”, mimeo. | In the case of farm sector inputs, inflation in respect of fertilisers and pesticides increased in Q2:2018-19 and Q3, while fodder inflation turned positive in January 2019 and edged up further in February, after remaining negative for 16 consecutive months. Fertiliser prices rose in line with the increase in global prices of phosphate and potash, while prices of pesticides were impacted by an uptick in global crude oil prices. Inflation in respect of agricultural machinery and implements prices picked up in Q2 and Q3, but eased marginally in Q4 (up to February). Inflation in electricity, which carries a high weight in both industrial and farm inputs, remained elevated and volatile during 2018-19. Nominal growth in rural wages for both agricultural and non-agricultural labourers remained muted in Q3:2018-19, reflecting the lagged impact of moderate rural inflation and low food prices (Chart II.19). Pressures from staff costs in the organised sector have been range-bound. Per employee staff costs in the manufacturing sector, which declined in the first two quarters of 2018-19, edged up in Q3:2018-19. In the services sector, per employee staff cost growth increased by 2.2 per cent in Q3:2018-19 as compared with 0.1 per cent in the previous quarter (Chart II.20a). Unit labour costs for companies in the manufacturing sector ticked up in Q3:2018-19.7 In the services sector, unit labour costs flattened in Q1:2018-19 but edged up in the next two quarters. The growth in staff costs outpaced the growth in value of production in both the manufacturing and services sectors in Q3 (Chart II.20b). Easing of commodity prices, particularly of crude petroleum, mineral oils and metals, was also reflected in the moderation in input costs of manufacturing firms covered in the Reserve Bank’s industrial outlook survey. Fewer firms assessed an increase in cost of raw materials in Q4:2018-19 than in the last two quarters and the decline is expected to continue in Q1:2019-20. Firms passed the cost benefit on to their selling prices in Q4 and expected moderation in selling prices in the first quarter of 2019-20. Firms polled in the manufacturing purchasing managers’ index (PMI) also reported a decline in input costs and selling prices for the second consecutive quarter in Q4:2018-19. However, the rate of decline in selling prices was lower than that of input costs. In contrast, input cost inflation reported by firms in the services sector in the PMI was marginally higher in Q4:2018-19 than in the previous quarter. The increase in prices charged by these firms remained subdued in Q3 and Q4. II.4 Conclusion Headline CPI inflation movements were characterised by unprecedented and, to a large extent, unanticipated collapse in inflation in food and fuel, which together constitute around 53 per cent of the CPI basket. Inflation in the remaining 47 per cent of the CPI basket, comprising items excluding food and fuel, also moderated somewhat in Q4:2018-19, notwithstanding the fact that the levels were still elevated. Inflation outcomes going forward will largely be shaped by movements in food inflation. Record agricultural production, high stocks of food grains and effective supply management measures by the government have kept food inflation in check in recent years. Should the monsoon turn out to be normal, food inflation is likely to remain contained in 2019-20.  The fuel inflation trajectory is also likely to be shaped by movements in international energy prices. Should the domestic economic activity slow down further, it will reduce the risk of sudden demand side pressures impinging on CPI inflation excluding food and fuel. Inflation expectations of both households and producers have softened, and professional forecasters also expect inflationary pressures to remain contained. There are also some upside risks to inflation, which emanate largely from oil – from a further tightening of crude supplies due to continuing production cuts by the Organisation of the Petroleum Exporting Countries (OPEC), Iran sanctions and Venezuela turmoil, as also from the demand side if trade tensions are resolved suitably. Fiscal slippage at the centre and/or state levels, if any, represents another medium-term risk to the inflation trajectory through higher aggregate demand pressures and crowding out of private investment. Given its past volatility, food inflation reversal poses another significant upside risk, especially in view of reports of some probability of El Niño this year and its implications for monsoon. On the whole, though inflation is likely to edge up from current levels, it is projected to remain within the Reserve Bank’s target of 4 per cent during 2019-20. _____________________________________________________________________________

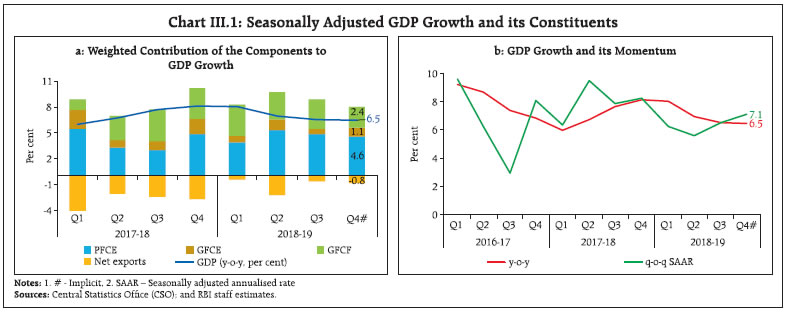

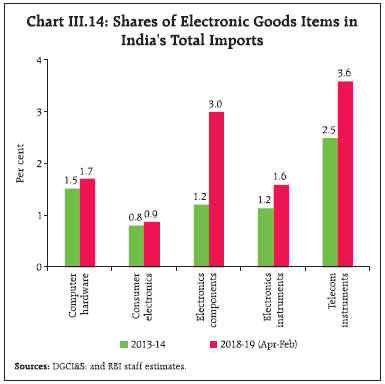

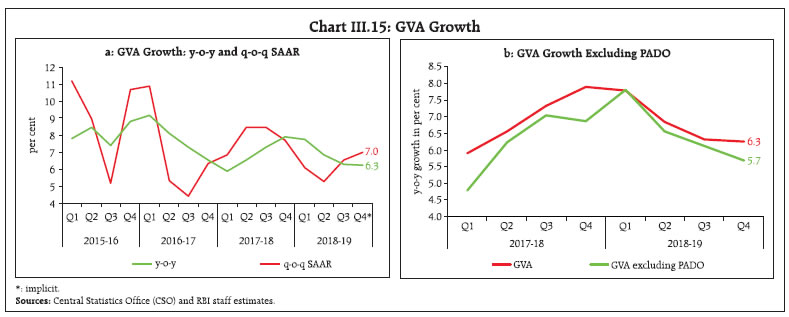

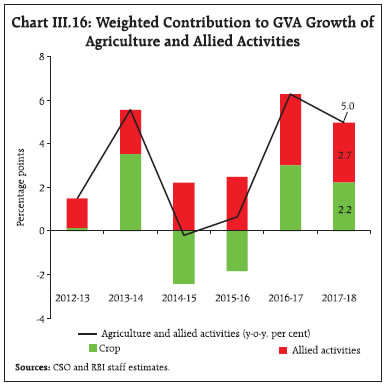

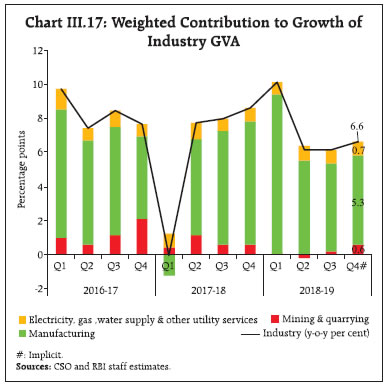

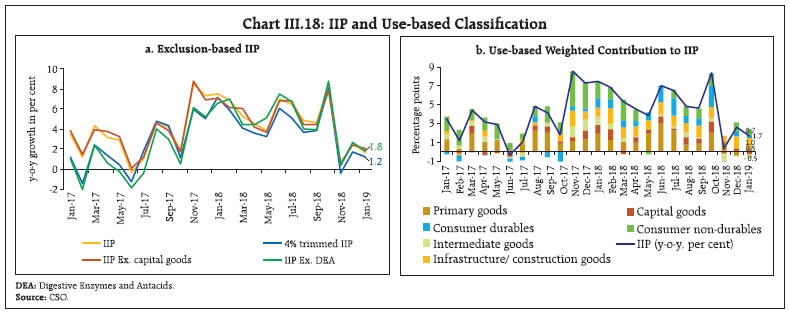

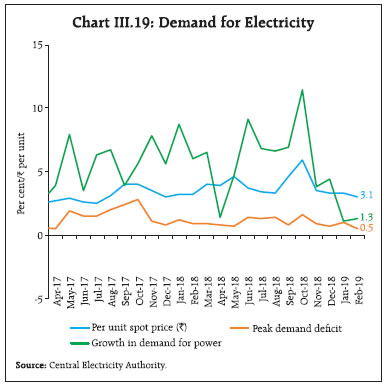

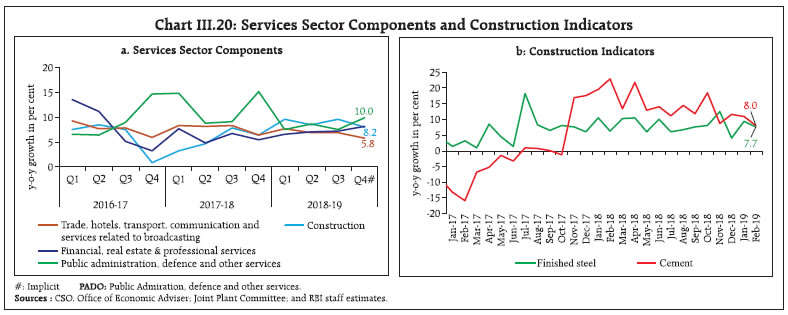

III. Demand and Output Economic activity slowed down in Q2 led mainly by a large drag from net exports, which became entrenched in Q3 due to deceleration in public spending and private consumption. On the supply side, agriculture and allied activities moderated characterised by a modest growth in kharif and horticulture production. Industrial growth also decelerated led by a slowdown in manufacturing activity. However, services sector activity remained resilient, supported primarily by construction, financial services, and public administration and defence. Domestic economic activity lost pace in Q2 and Q3, with coincident indicators suggesting a sharper deceleration in Q4. Aggregate demand weakened in Q2 by a large drag from net exports, followed by a slowdown in consumption, both private and government, in Q3. By contrast, gross fixed capital formation (GFCF) growth remained in double digits for the fifth consecutive quarter in Q3. On the supply side, agriculture and allied activities slowed down in Q2 and Q3, with increases in kharif and horticulture production turning out to be modest relative to last year’s record. Higher input costs, particularly stemming from crude oil prices, and weaker pricing power, impacted profit margins of firms and restrained manufacturing. In the services sector, activity picked up on the back of growth of financial services and construction activity which was supported by public infrastructure spending. However, trade, hotels, transport, and communication services lost momentum in Q2 and remained flat in Q3. III.1 Aggregate Demand The growth in aggregate demand, measured by y-o-y changes in real GDP at market prices, moderated to 6.5 per cent in H2:2018-19 from 7.5 per cent in H1 and 7.9 per cent a year ago. The slowdown was caused by lower though still healthy growth of 9.1 per cent in GFCF in H2 as compared with 10.9 per cent in H1. Private consumption was sustained by higher spending on durable goods and services, while government spending accelerated in H2 on account of higher spending by states. These disparate movements were reflected in shifts in weighted contributions of the components to GDP growth (Chart III.1a and Table III.1). Overall, however, the moderation in GDP growth in H2 can be attributed to adverse base effects even as momentum, measured by the q-o-q seasonally adjusted annualised growth rate (SAAR), accelerated during the same period (Chart III.1b).  | Table III.1: Real GDP Growth | | (y-o-y, per cent) | | Item | 2017-18 (FRE) | 2018-19 (SAE) | Weighted Contribution* | 2017-18 (FRE) | 2018-19 (SAE) | | 2017-18 | 2018-19 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4# | | Private final consumption expenditure | 7.4 | 8.3 | 4.2 | 4.7 | 10.1 | 6.0 | 5.0 | 8.8 | 6.9 | 9.8 | 8.4 | 8.1 | | Government final consumption expenditure | 15.0 | 8.9 | 1.5 | 0.9 | 21.9 | 7.6 | 10.8 | 21.1 | 6.5 | 10.8 | 6.5 | 11.6 | | Gross fixed capital formation | 9.3 | 10.0 | 2.9 | 3.1 | 3.9 | 9.3 | 12.2 | 11.8 | 11.7 | 10.2 | 10.6 | 7.7 | | Exports | 4.7 | 13.4 | 1.0 | 2.7 | 4.9 | 5.8 | 5.3 | 2.8 | 11.2 | 13.9 | 14.6 | 14.0 | | Imports | 17.6 | 15.7 | 3.8 | 3.7 | 23.9 | 15.0 | 15.8 | 16.2 | 10.8 | 21.4 | 14.7 | 16.1 | | GDP at market prices | 7.2 | 7.0 | 7.2 | 7.0 | 6.0 | 6.8 | 7.7 | 8.1 | 8.0 | 7.0 | 6.6 | 6.5 | FRE: First Revised Estimates; SAE: Second Advance Estimates; #: Implicit growth

*: Component-wise contributions to growth do not add up to GDP growth in the table because change in stocks, valuables and statistical discrepancies are not included.

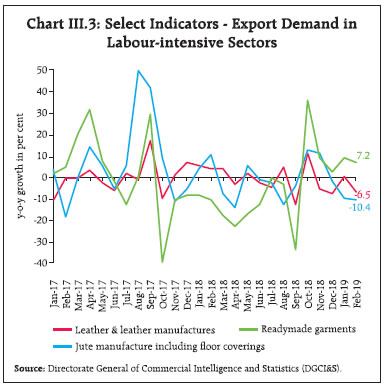

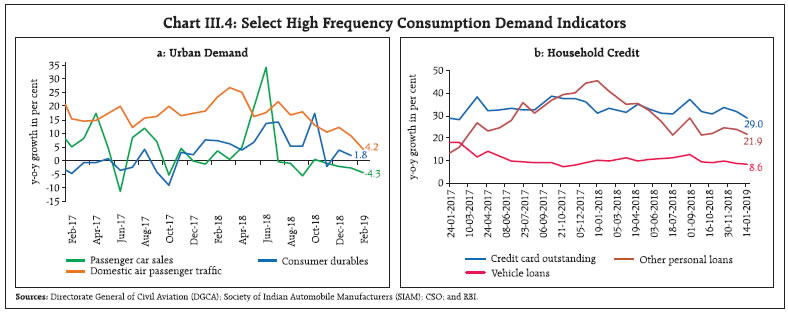

Source: CSO. | GDP Projections versus Actual Outcomes The October 2018 Monetary Policy Report (MPR) projected GDP growth at 7.4 per cent in Q2, 7.3 per cent in Q3 and 7.1 per cent in Q4 of 2018-19, with risks evenly balanced around this baseline path (Chart III.2). Actual outcomes in terms of the second advance estimates (SAE) of the CSO released on February 28, 2019 undershot these projections by 40 and 70 basis points in Q2 and Q3, respectively. The downward surprise in Q2 stemmed from a stronger than anticipated drag from net exports, mainly due to a sharp acceleration in the import bill on the back of a surge in international crude prices. In Q3, projection errors emanated mainly from a sharper than expected slowdown in government consumption as revenue expenditure growth of central government nosedived. In the event, overall GDP growth for 2018-19 at 7.0 per cent in the SAE (February 28, 2019) turned out to be lower than the projection of 7.4 per cent in the October MPR. III.1.1 Private Final Consumption Expenditure Private final consumption expenditure (PFCE) remained the mainstay of aggregate demand, with its share rising to 57.9 per cent in H2:2018-19 from 57.0 per cent a year ago. Its resilience drew on a combination of factors, viz., low retail inflation that expanded disposable incomes, the significant softening of global crude oil prices and resulting economies in energy outgoes, expansion of public spending in rural areas, and strong growth in personal and consumer loans, notwithstanding a slowdown in agriculture and labour-intensive exports, which could have adversely impacted rural consumption (Chart III.3). High frequency indicators of urban consumption have, however, moderated significantly in Q4:2018-19. Growth in domestic air passenger traffic continued to decelerate (Chart III.4.a). Passenger car sales have been contracting since July 2018, inter alia, due to volatility in fuel prices and mandated long-term upfront insurance premium payments. Going forward into 2019-20, urban consumption may get some support from the spending uptick associated with general elections, increase in disposable incomes due to a relaxation in income tax, and prospects of sustained growth in personal bank loans (Chart III.4b).

Among the indicators of rural demand, sales of motorcycles remained in contraction zone. Tractor sales also sharply decelerated in recent months possibly due to weak rabi sowing and subdued farm prices. The production of consumer non-durables remained lacklustre (Chart III.5). Robust growth in construction activity in H2:2018-19 – an employment-intensive sector – should augur well for rural incomes and demand. Rural demand may also get some support from policy measures announced recently, viz., implementation of PM Kisan Samman Yojana (PMKSY), direct income transfer schemes, farm loan waivers by many states, and the government’s continued thrust on rural infrastructure spending. III.1.2 Gross Fixed Capital Formation Growth in gross fixed capital formation (GFCF) has remained in double digits since Q3:2017-18, though it is likely to slow down in Q4 as some of the key indicators of investment demand, viz., capital goods production and imports have decelerated. The share of GFCF in GDP improved to 32.3 per cent in 2018-19 from 31.4 per cent a year ago, indicating an incipient strengthening of investment demand. The pick-up in fixed investment was supported by higher construction activity, led by the government’s drive to boost spending on the road sector and affordable housing. The performance of software firms – a proxy for investment in intellectual property products – has also been healthy as reflected in their latest financial results. The ongoing resolution of distressed assets of non-financial corporates under the Insolvency and Bankruptcy Code (IBC) process is expected to unlock resources for investment activity. However, growth of capital goods imports – another proxy for investment demand – contracted in February 2019 (Chart III.6a). Production of capital goods also either contracted or remained tepid from November 2018 to January 2019. Seasonally adjusted capacity utilisation (CU-SA), however, crossed its long-term average in Q3:2018-19, which could encourage fresh capacity addition and capex (Chart III.6b). Sustained growth in housing loans disbursed by scheduled commercial banks (SCBs) also bodes well for investment in dwellings. The pick-up in investment demand was financed by non-food bank credit and inflows of foreign direct investment (FDI) (see Chart III.7; and Chapter IV for details). Overall, there has been an improvement in the flow of resources from the financial sector to the non-financial corporate sector, which should support the private capex cycle.

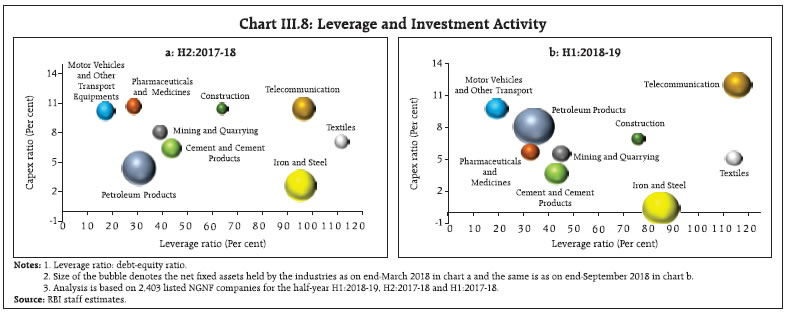

Half-yearly financial statements of listed non-government non-financial (NGNF) companies suggest a decline in the capex ratio in H1:2018-19 over H2:2017-18 across manufacturing industries, and notably, in cement and cement products, iron and steel, pharmaceuticals and medicines, and textiles (Chart III.8).1 The decline in the capex ratio for iron and steel was on account of overall deleveraging that was underway in the sector; on the other hand, the ratio for petroleum product firms improved significantly. With debt levels declining in some sectors and the resolution of stressed assets under the IBC, the capex ratio could improve, going forward.  Notwithstanding recent improvements, the investment rate has declined significantly since 2012-13, mirroring the decline in the saving rate over these years (Chart III.9a). The savings rate of the household sector, which is a net supplier of funds to the economy, declined from 23.6 per cent of GDP in 2011-12 to 17.2 per cent in 2017-18. While the private corporate sector financed its investment predominantly through its own saving, the public sector continues to rely heavily on households for resources (Chart III.9b). III.1.3 Government Expenditure Government final consumption expenditure (GFCE) supported aggregate demand in H2:2018-19, especially in Q4. GFCE is likely to augment aggregate demand in 2019-20 too, in view of higher outgoes in the Interim Union Budget on agriculture and various income support schemes. Revenue expenditure growth budgeted for 2019-20 is also higher than in 2018-19 (RE) (Table III.2). | Table III.2: Key Fiscal Indicators – Central Government Finances | | Indicator | Per cent to GDP | | 2018-19 (BE) | 2018-19 (RE) | 2019-20 (BE) | | 1. Revenue Receipts | 9.1 | 9.1 | 9.4 | | a. Tax Revenue (Net) | 7.8 | 7.8 | 8.1 | | b. Non-Tax Revenue | 1.3 | 1.3 | 1.3 | | 2. Non-Debt Capital Receipts | 0.5 | 0.5 | 0.5 | | 3. Revenue Expenditure | 11.2 | 11.2 | 11.7 | | 4. Capital Expenditure | 1.6 | 1.7 | 1.6 | | 5. Total Expenditure | 12.8 | 12.9 | 13.3 | | 6. Gross Fiscal Deficit | 3.3 | 3.4 | 3.4 | | 7. Revenue Deficit | 2.2 | 2.2 | 2.2 | | 8. Primary Deficit | 0.3 | 0.2 | 0.2 | Note: BE: Budget Estimates. RE: Revised Estimates.