SELECT ABBREVIATIONS | AA | - | Appellate Authority | NPCI | - | National Payment Corporation of India | | ATM | - | Automated Teller Machine | OBO | - | Office of the Banking Ombudsman | | BCSBI | - | Banking Codes and Standards Board of India | ODT | - | Ombudsman for Digital Transactions | | BO | - | Banking Ombudsman | OSDT | - | Ombudsman Scheme for Digital Transactions | | BOS | - | Banking Ombudsman Scheme | OTC | - | One Time Combination | | BSBDA | - | Basic Savings Bank Deposit Account | OVD | - | Officially Valid Document | | CCTV | - | Closed Circuit Television | PAN | - | Permanent Account Number | | CEPC | - | Consumer Education and Protection Cell | PNO | - | Principal Nodal Officer | | CEPD | - | Consumer Education and Protection Department | POS | - | Point of Sale | | CIC | - | Credit Information Company | PSU | - | Public Sector Undertaking | | CMS | - | Complaint Management System | RBI | - | Reserve Bank of India | | CPGRAMS | - | Centralized Public Grievance Redress and Monitoring System | RCA | - | Root Cause Analysis | | DG | - | Deputy Governor | RE | - | Regulated Entities | | DSA | - | Direct Sales Agent | RRB | - | Regional Rural Bank | | ED | - | Executive Director | RTGS | - | Real Time Gross Settlement | | FRC | - | First Resort Complaint | RTI | - | Right to Information | | IO | - | Internal Ombudsman | SBI | - | State Bank of India | | IVRS | - | Interactive Voice Response System | SMS | - | Short Message Service | | MD | - | Master Directions | UPI | - | Unified Payments Interface | | NBFC | - | Non-Banking Financial Company | UIDAI | - | Unique Identification Authority of India | | NEFT | - | National Electronic Fund Transfer | Y-o-Y | - | Year on Year |

FOREWORD  This Annual Report of the Ombudsman Schemes, issued in the silver jubilee year of Banking Ombudsman Scheme (BOS) has special relevance, since it is being released at the confluence of 150th birth anniversary of Mahatma Gandhi, the champion of customer rights. Over the years, the BOS has gained popularity and played an important part in aligning the alternate grievance redressal structure of RBI with the G-20 OECD High-Level Principles (HLPs) on Financial Consumer Protection (FCP) as the Scheme provides cost-free and expeditious grievance redressal mechanism. A third-party survey has shown overall satisfaction level of 73% among complainants under BOS, which RBI will strive to improve further. Another important aspect of the HLPs on FCP pertains to ‘financial awareness and education’. RBI strengthened this area by initiating campaigns through electronic media while continuing with print, SMS and Interactive Voice Response System (IVRS) messages to create financial awareness apart from Townhall / outreach programmes by Ombudsmen. In 2018-19, RBI extended the Ombudsman Scheme for Non-Banking Financial Companies (NBFCs) to non-deposit taking NBFCs, launched the Ombudsman Scheme for Digital Transactions, rolled out Complaint Management System, a ‘one-stop’ portal for lodgment of grievances and launched the Internal Ombudsman Scheme which mandated banks with more than ten branches to appoint an Internal Ombudsman to serve as an objective review mechanism to support their internal customer grievance redressal structure. The Annual Report carries analysis of receipt and resolution of complaints and the initiatives of RBI for strengthening consumer protection. It also lays down the plan of action for future while identifying areas for further action by Financial Service Providers as well as RBI. I hope this Report would be informative and useful for all stakeholders. (M K Jain)

Vision and Goals of the

Offices of RBI Ombudsman Schemes Vision - To act as a visible and credible dispute resolution agency for common persons utilizing services provided by entities regulated by RBI.

Goals -

To ensure grievance redressal of users of services provided by entities regulated by RBI in an inexpensive, expeditious and fair manner that provides impetus to improve customer services in the banking sector on a continuous basis. -

To provide policy feedback / suggestions to the Reserve Bank of India towards framing appropriate and timely guidelines for banks to improve the level of customer service and to strengthen their internal grievance redressal system. -

To enhance awareness of the Ombudsman Schemes of RBI. -

To facilitate quick and fair (non-discriminatory) redressal of grievances through use of IT systems, comprehensive and easily accessible database and enhanced capabilities of staff through capacity building.

EXECUTIVE SUMMARY Banking Ombudsman Scheme The Banking Ombudsman Scheme (BOS) was notified by the Reserve Bank of India (RBI) in 1995 under Section 35A of the Banking Regulation Act, 1949. As on date, Scheduled Commercial Banks, Scheduled Primary Urban Co-operative Banks, Regional Rural Banks (RRBs), Small Finance Banks and Payment Banks are covered under the Scheme. It is administered by RBI through 211 Offices of Banking Ombudsman (OBOs) covering all states and union territories. 2. A brief analysis of complaints handled by BOs during the year is as under: -

The complaints received at OBOs rose by 32,311 taking the total to 1,95,901 complaints in 2018-19 over the previous year (1,63,590), recording a year on year (Y-o-Y) increase of 19.75%. Of these, 72.19% were received electronically i.e., through the online portal and by emails as against 63.61% in the previous year; -

The disposal rate for this year (2018-19) was 94.03% as against 96.46% in 2017-18. This is largely due to rise in volume of complaints with resource remaining the same; -

While non-observance of fair practices code continued to remain the major ground of complaints during the year, its percentage came down from 22.10% in the previous year to 19.17% in the current year. ATM and debit card issues had increased from 15.08% in last year to 18.65% this year; -

Complaints received on grounds relating to pension, levy of charges without notice, credit card related issues and remittance have declined this year vis-à-vis previous year. The number of complaints pertaining to ‘mis-selling’ have gone up from 579 complaints in 2017-18 to 1,115 complaints this year, an increase of 92.57%; -

The number of complaints resolved by agreement i.e., through intervention of OBOs, mediation and conciliation, etc. rose from 65.82% during the previous year to 70.40% in 2018-19; -

The number of appeals received in 2018-19 stood at 78 as compared to 125 in 2017-18; -

The average cost of handling a complaint came down from ₹3,504/- in 2017-18 to ₹3,145/- in 2018-19 due to increased volume of disposal by the OBOs with the same resources as available in the previous year. There is thus an increased level of efficiency at the OBOs. Ombudsman Scheme for Non-Banking Financial Companies 3. The Ombudsman Scheme for Non-Banking Financial Companies (NBFC-O Scheme) was notified by RBI under Section 45L of the RBI Act, 1934 on February 23, 2018. The Scheme is applicable to Non-Banking Financial Companies (NBFCs) which (a) are authorized to accept deposits; or (b) have customer interface, with assets size of ₹100 crore or above, as on the date of the audited balance sheet of the previous financial year and is administered from the offices of the NBFC-Os in four metro centers viz. Chennai, Kolkata, Mumbai and New Delhi for handling complaints from the respective zones, so as to cover the entire country. 4. Brief analysis of complaints handled by NBFC-Os during the year is as under: i. The number of complaints received at NBFC-Os rose from 675 in four months operation during 2017-18 to 3,991 in 2018-19; ii. Non-adherence to fair practices code constituted 40.44% of complaints received, followed by non-observance of RBI directions (17.21%), levy of charges without notice (12.63%) and lack of transparency in contract / loan agreement (9.17%); iii. The disposal rate of NBFC-Os stood at 95.41% in 2017-18 and 99.10% in 2018-19; iv. One appeal has been received against the decision of NBFC-O during 2018-19, as compared to nil in the previous year. Developments during the Year 5. During the year, Consumer Education and Protection Department (CEPD) took a few initiatives for improving the accessibility of grievance redressal mechanism to the members of public. i. Ombudsman Scheme for Digital Transactions (OSDT) was introduced to provide grievance redressal forum for the consumers of the Payment System Participants (popularly known as Prepaid Payment Instrument providers); ii. The NBFC-O Scheme was extended to cover the regulated non-deposit taking NBFCs having asset size of ₹100.00 crore and above; iii. Internal Ombudsman (IO) Scheme was reviewed and extended to all Scheduled Commercial Banks having more than 10 outlets (excluding RRBs); iv. A third office of the Ombudsman at RBI, New Delhi was set up with effect from July 1, 2019 with a view to meet the growing demand for resolution of complaints; v. A state-of-art and user-friendly web-based online Application named Complaint Management System (CMS) was launched for filing complaints, which also allows the customers to track their complaints; vi. Education and awareness campaigns were undertaken through print and electronic media for the benefit of customers / members of public at large; vii. Annual conference of Banking Ombudsmen was held at Mumbai on June 21, 2019 on the theme of ‘Consumer Protection beyond Boundaries’. It witnessed wide-ranging discussions on issues related to emerging areas of complaints, safety in digital financial transactions and experience of other jurisdictions in redressal of customer grievances. Way Forward 6. In an endeavor to further strengthen the redressal mechanism and the preventive aspects of consumer protection framework, so that the confidence of the consumers of financial services is maintained, commitments in the form of Strategic Action Plans (SAPs) in the medium-term strategy framework for RBI, namely ‘UTKARSH – 2022’, have been delineated. For the year 2019-20, five SAPs will be taken up for implementation, viz., -

review of Internal Ombudsman Scheme, 2018 for extension to NBFCs; -

review of Consumer Education and Protection Cells (CEPCs) for empowering them on the lines of OBOs; -

review of the Ombudsman Schemes for updation and effective implementation including through convergence; -

formulation of policy to strengthen the system based on Root Cause Analysis (RCA) of major areas of complaint; -

introducing Interactive Voice Response System (IVRS) in CMS for online support to the customers. 7. The education and awareness initiative of CEPD has been two-pronged, i.e. physical and digital. Offices of Ombudsman will continue with the existing Town Hall, outreach / awareness and other innovative methods to sensitize the customers in their respective jurisdiction. CEPD will delve into the digital method in close association with Department of Communications. In the year 2019-20, the CEPD will generate awareness about the grievance redressal mechanisms of RBI and the Ombudsman Schemes as also undertake campaigns on safe digital banking and the regulatory stipulations on customer protection.

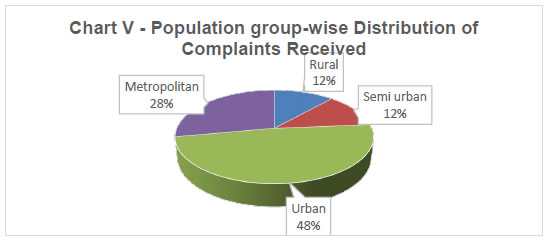

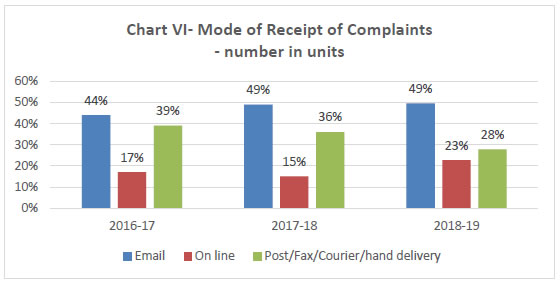

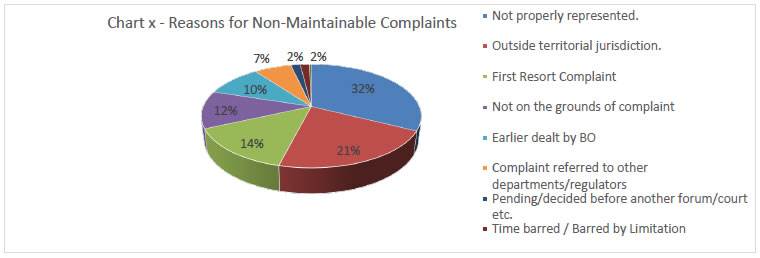

Chapter 1

The Banking Ombudsman Scheme Overview 1.1 The Banking Ombudsman Scheme was notified by the Reserve Bank of India (RBI) in 1995 under Section 35 A of the Banking Regulation Act, 1949. Over the years, it has undergone five2 revisions, the last being in July 2017. As on date, Scheduled Commercial Banks, Scheduled Primary Urban Co-operative Banks, Regional Rural Banks (RRBs), Small Finance Banks (SFBs) and Payment Banks (PBs) are covered under the Scheme. It is administered by the RBI through 213 OBOs covering all states and union territories of India. The cost of running the Scheme, which includes revenue and capital expenditures4, is borne by the RBI. 1.2 Over the years, the Scheme has gained wider acceptance and popularity as reflected by the Y-o-Y increase of 19.75% in the number of complaints received at the OBOs. The year-wise number of complaints received at OBOs in last three years is given at Appendix – I. 1.3 During the year, in line with the declining trend observed in the last three years, average cost of handling a complaint came down from ₹3,504/- to ₹3,145/-, evident from Chart I below. The decline is largely due to increase in volume of complaints while the human resources for handling these complaints remained the same. 1.4 A comparative position of cost of running the Scheme as well as the average cost per complaint during the last three years is given at Appendix II. 1.5 The BO-wise per complaint cost for the year 2018-19 is given at Appendix III. Considering the fixed costs involved, the offices having lesser inflow of complaints show higher cost per complaint. 1.6 A record 2,02,0835 complaints were handled by OBOs in 2018-19 as against 1,74,805 complaints in the previous year. While 6,182 complaints comprising 3.53% were pending at the end of the year 2017-18, the pendency for this year has gone up to 12,069 complaints, which worked out to 5.97% of the complaints handled. This is largely due to 19.75% increase in inflow of complaints attended to by the same available resources at the disposal of OBOs. The position of customer complaints handled by OBOs is given at Appendix IV. 1.7 The average Turn Around Time (TAT) for disposal of complaints of Offices of BOs has come down from 53 days in 2017-18 to 47 days in 2018-19, despite considerable increase in the complaints pertaining to digital transactions which require more time for investigation / and analysis documents for redressal. However, improvement in TAT is largely due to continuous follow up with the OBOs and banks and efficient handling by the BOs. 1.8 In addition to handling complaints, the BOs were also committed to the RBI’s agenda of spreading awareness about the grievance redressal system put in place by RBI at the level of banks as well as at the RBI. The BOs organised Town Hall events, awareness programmes / outreach activities besides participating in trade fairs, cultural events like Rath Yatra, etc. The awareness initiatives were targeted particularly in rural and semi-urban areas. In addition, awareness campaigns were also launched by CEPD for popularizing the Scheme. Receipt of Complaints 1.9 A comparison of the number complaints received by the OBOs during the last three years is given in Chart II. 1.10 In 2018-19, the number of complaints received by the BOs increased by 19.75% over 2017-18 (Appendix V). The upward trend could, inter alia, be attributed to the increase in the number of bank customers, increased usage of digital modes of transactions and the impact of initiatives for financial inclusion and spreading of awareness exercises undertaken by RBI, including through TV channels, FM Radio, SMS handle viz., “RBISay” as well as the outreach efforts made by OBOs at the regional levels. 1.11 Of the 1,95,901 complaints received by the OBOs, (Appendix I), in line with the last year’s trend, OBO New Delhi I received the maximum number of complaints (33,690), which accounted for 17.20% of the total complaints received by the OBOs. Together with OBO, New Delhi II, the total number of complaints handled by the OBOs at New Delhi stood at 44,932 representing 22.94% of total complaints received during the year. 1.12 With the launch of two new Schemes viz the NBFC-O Scheme and the OSDT, the same BOs handled complaints emanating from system participants and NBFCs require greater resources in terms of time and efort. Considering the need to improve the rate of disposal and the volume of complaints being received by offices at New Delhi, it was decided to open a third office of BO at New Delhi (OBO, New Delhi III) from July 1, 2019 by dividing the territorial jurisdiction of OBO, New Delhi I. 1.13 Complaints received at OBO Mumbai II, set up in February, 2018 by bifurcating the jurisdiction of OBO Mumbai I, rose to more than five times the previous year to 10,162 complaints (an increase of 439.38%) in 2018-19 from 1,884 complaints in 2017-18. Consequently, complaints received at OBO, Mumbai I witnessed a decline of 27.53% (from 18,085 complaints in 2017-18 to 13,106 complaints in the year 2018-19) during the year. A comparative position of complaints received by OBOs during the last three years is given in Chart III. Zone-wise Distribution of Complaints 1.14 Continuing the trend, and owing to huge volume of complaints received at offices at New Delhi, the North zone accounted for the maximum share of complaints (45.24%) in 2018-19. The East zone accounted the least i.e., 14.38% of total complaints received, highlighting the need for increased awareness initiatives in the zone. The zone-wise distribution of complaints received is depicted in Chart IV below. 1.15 Zone-wise receipt of complaints is given at Appendix VI. It may be observed therefrom that the maximum Y-o-Y growth in the number of complaints was also highest in North zone (23.41%), followed by South zone (18.65%), West zone (17.91%) and East zone (13.19%) respectively. Population Group-wise Distribution of Complaints 1.16 During the year, 48.36% of complaints were lodged by bank customers residing in urban areas. Complaints from metropolitan areas accounted for 27.90%, while semi-urban and rural areas accounted for 12.06% and 11.67% respectively. Recognizing that relatively lower share of complaints received from rural and semi-urban areas highlights the need to scale up the awareness campaigns in these areas in addition to taking initiatives to undertake such programmes in local languages, uniform guidelines have been issued to OBOs for selection of venue, conduct of programmes and evaluation of their impact so as to maximize their impact. Population group-wise distribution of complaints during the last year is given in Chart V below and at Appendix VII.  1.17 The percentages of complaints on each of the grounds follow similar pattern with the maximum being from metropolitan centers and least from rural centers as given at Appendix VIII. The complaints rise proportionately with the size of population, bank branches and awareness among the public. Modes of Receipt of Complaints 1.18 Complaints were received in the OBOs through various modes, including hand delivery, post, courier, fax, e-mails and online portal i.e. the RBI’s Complaint Tracking System, and with effect from June 24, 2019, through the CMS. A comparison of the various modes through which complaints were received during the last three years is given at Appendix IX and shown in Chart VI below:  1.19 The trend in the last three years indicates that complaints are increasingly being lodged through digital modes (email and online portal) than through physical modes (post/fax/courier/hand delivery). During the year, 72.19% of the complaints were filed using the digital mode of which 49.48% were through e-mails and 22.71% using the online portal. The share of complaints received using online portal stood at 14.98% in 2017-18 and rose to 22.71% in 2018-19 on the back of surge in receipt of complaints on CMS after its launch on June 24, 2019. By end June 2019, 5,813 complaints were received on CMS. The trend during the last three years is given in Chart VII below: 1.20 CMS provides a single platform for customers of regulated entities for lodging of complaints. With features like tracking of complaint and option of furnishing feedback, the percentage of complaints received through online mode is expected to increase markedly in the next year. Complainants: Group-wise Classification 1.21 Out of the total number of complaints lodged in the year 2018-19, 92.44% were by individuals. Of these, 0.68% complaints were lodged by senior citizens. The second category of complainants was ‘Individuals – Business’ with a share of 2.81% as shown at Appendix X. Bank Group-wise Classification 1.22 The bank-group wise classification of complaints received by OBOs during the last three years is indicated in Chart VIII. 1.23 Of the total number of complaints received in OBOs, nationalized banks and SBI taken together accounted for 61.91% during the last three years as detailed at Appendix XI. The share of Private Sector banks went up from 25.94% of total complaints received in last year to 28.04% during this year. The RRBs and Scheduled Primary Urban Cooperative banks together accounted for 1.87% of total number of complaints. The complaints against the new entities viz., PBs and SFBs went up from 0.30% during the last year to 0.90% during the current year, witnessing an Y-o-Y growth of 270.82%. Share of complaints against entities that are not covered under the Scheme went down from 7.11% in 2017-18 to 5.15% during the year under review. Nature of Complaints Handled 1.24 As specified under Clause 8 of the Scheme, there are 30 grounds for lodging complaints with the BO. Table 1 below broadly indicates the proportion of complaints received under the various grounds of complaints listed in the Scheme. | Table 1 - Category-wise Distribution of Complaints | | | No of complaints received | | 2016-17 | 2017-18 | 2018-19 | | Non-observance of Fair Practice Code | 31,769

(24.25%) | 36,146

(22.10%) | 37,557

(19.17%) | | ATM/ Debit Cards | 16,434

(12.55%) | 24,672

(15.08%) | 36,539

(18.65%) | | Mobile / Electronic Banking | - | 8,487

(5.19%) | 14,794

(7.55%) | | Failure to Meet Commitments | 8,911

(6.80%) | 11,044

(6.75%) | 13,332

(6.81%) | | Credit Cards | 8,297

(6.33%) | 12,647

(7.73%) | 13,274

(6.78%) | | Deposit Accounts | 7,190

(5.49%) | 6,719

(4.11%) | 10,844

(5.54%) | | Levy of Charges without Prior Notice | 7,273

(5.55%) | 8,209

(5.02%) | 8,391

(4.28%) | | Loans and Advances | 5,559

(4.24%) | 6,226

(3.81%) | 7,610

(3.88%) | | Pension Payments | 8,506

(6.49%) | 7,833

(4.79%) | 7,066

(3.61%) | | Non-adherence to BCSBI Codes | 3,699

(2.82%) | 3,962

(2.42%) | 5,981

(3.05%) | | Remittances | 3,287

(2.51%) | 3,330

(2.04%) | 3,451

(1.76%) | | Para-Banking | - | 579

(0.35%) | 1,115

(0.57%) | | DSAs and Recovery Agents | 330

(0.25%) | 554

(0.34%) | 629

(0.32%) | | Notes and Coins | 333

(0.25%) | 1,282

(0.78%) | 480

(0.25%) | | Others | 23,169

(17.69%) | 26,219

(16.03%) | 28,330

(14.46%) | | Out of Purview of BO Scheme | 6,230

(4.76%) | 5,681

(3.47%) | 6,508

(3.32%) | | Total | 130,987 | 163,590 | 1,95,901 | | (Figures in bracket indicate % age to total complaints of respective years.) | 1.25 While non-observance of fair practices code at 19.17% continued to remain major ground for complaints during the year, its percentage came down from 22.10% in the previous year. Complaints received on grounds relating to pension, levy of charges without notice, credit cards and remittance have declined this year vis-a-vis previous year. However, number of complaints pertaining to ‘mis-selling’ have gone up from 579 complaints in 2017-18 to 1,115 complaints during this year, showing an increase of 92.57%. 1.26 Complaints relating to ATM / Debit Cards comprised 18.65% of total complaints, up from 15.08% in the previous year. Of the total number of ATM / Debit Cards complaints, a major sub-category was ‘Account debited but cash not dispensed by ATMs’ which accounted for almost 53.00% of the ATM related complaints (Table 2). | Table 2 - Breakup of ATM / Debit Card Complaints | | Sub Category | No of Complaints | | 2016-17 | 2017-18 | 2018-19 | | Non-Payment of Cash / Account Debited but Cash not Dispensed by ATMs* | 9,656

(7.37%) | 14,691

(8.98%) | 19,366

(9.89%) | | Use of Stolen / Cloned Cards | - | 2117

(1.29%) | 4,961

(2.53%) | | *Debit in account without use of the card or details of the card | - | 2,356

(1.4%) | 4,481

(2.3%) | | *Account Debited More than Once for One Withdrawal in ATMs or for POS Transaction | - | 965

(0.59%) | 1,288

(0.66%) | | Short Payment of Cash / *Less or Excess amount of Cash Dispensed by ATMs | 1,222

(0.93%) | 1,166

(0.71%) | 1,186

(0.61%) | | Others | 5,556

(4.24%) | 3,377

(2.06%) | 5,257

(2.68%) | | Sub-Total | 16,434

(12.55%) | 24,672

(15.08%) | 36,539

(18.65%) | | Total No. of Complaints Received | 130,987 | 163,590 | 1,95,901 | *Introduced with effect from July 1, 2017

(Figures in bracket indicate %age to total number of complaints of respective years.) | 1.27 The complaints on the ground relating to digital transactions (mobile, internet, ATM and credit cards) rose by 18,801 to 64,607 complaints and accounted for 32.984.98% of total complaints, a 6.48% increase in share of complaints over the previous year. This, however, did not include the digital related complaints falling under other grounds under the Scheme. The rise in complaints reflects rising popularity of digital modes of transactions. 1.28 The rising complaints relating to digital transactions led to the launch of OSDT (please refer para 4.2), extension of limited liability circular to the PPIs in January 2019 and introduction of tokenization of card transactions for facilitating transactions without disclosing the 16 digit Primary Account Numbers. 1.29 During the year, 3.61% of the complaints related to ‘Pension Payments’ as compared to 4.79% in the previous year. The number of complaints in this category has come down both in absolute and in percentage terms, inter alia, due to the continued efforts of RBI to improve the services received by this class of customers. However, the number at 7,000 plus is still high. The Department will continue to strive to bring this number further down by closely working and following up with the banks. 1.30 Complaints on ‘deposit accounts’ constituted 5.54% of the total complaints received, witnessing an increase of 61.39% on Y-o-Y basis. The complaints were mainly on grounds of delay in credit, non-credit of proceeds to party’s account, non-payment of deposit or non-observance of the RBI directives and wrong application of rate of interest on deposits in savings or other accounts, etc. 1.31 Complaints relating to ‘Loans and Advances’ constituted 3.88% of the total complaints received and generally pertained to delay in sanction, disbursement, non-observance of prescribed time schedule for disposal of loan applications, non-acceptance of application without valid reason, etc. 1.32 In 2018-19, 1.76% of the complaints received related to ‘Remittances’ such as non-payment/ inordinate delay in the payment or in the collections of cheques, drafts, bills etc. 1.33 OBOs also received 3.32% of the complaints which were ‘Out of Purview’ of the Scheme and were closed as non-maintainable, which were marginally less than those in the previous year (3.47%). 1.34 Complaints under ‘Others’ category at 14.46% related to complaints on ‘Non-adherence to Prescribed Working Hours’, delay in providing banking facilities, etc. as detailed in Table 3. | Table 3 - Breakup of Complaints in ‘Others’ Category | | Sub Category | 2016-17 | 2017-18 | 2018-19 | | i. Non-adherence to RBI directives on: | | | | | I. Banking or other services | 5,202

(3.97%) | 5,669

(3.47%) | 6,571

(3.35%) | | II. Interest rates (loans and advances) | 1,051

(0.80%) | 1,226

(0.75%) | 1,193

(0.61%) | | III. Any other direction or instruction as may be specified by the RBI on loans and advances and other matters | 13,986

(10.68%) | 17,061

(10.43%) | 16,246

(8.29%) | | ii. Non-adherence to prescribed working hours | 387

(0.30%) | 258

(0.16%) | 465

(0.24%) | | iii. Refusal to accept or delay in accepting payment towards taxes as required by RBI/Govt. | 183

(0.14%) | 213

(0.13%) | 419

(0.21%) | | iv. Refusal to issue or delay in issuing or Failure to Service or Delay in Servicing or Redemption of Government Securities | 210

(0.16%) | 169

(0.10%) | 233

(0.12%) | | v. Other Matters Specified by RBI | 2,150

(1.64%) | 1,623

(0.99%) | 3,203

(1.64%) | | Sub-Total | 23,169

(17.69%) | 26,219

(16.03%) | 28,330

(14.46%) | | Total No. of Complaints Received | 130,987 | 163,590 | 195,901 | | (Figures in bracket indicate percent to total complaints of respective years.) | Complaints on Grounds added in 2017-18 1.35 Two grounds namely (i) ‘Non-adherence to RBI instructions on Mobile / Electronic Banking’ and ‘Non-adherence to Reserve Bank guidelines on para-banking activities like sale of insurance / mutual fund / other third-party investment products by banks’ (misselling) were included in the BO Scheme with effect from July 2017. The new grounds together accounted for 9,066 (5.54% of total complaints) and 15,909 (8.12%) complaints during the last two years as shown in Chart IX. 1.36 Table 4 below indicates a comparative position of disposal of complaints by OBOs. | Table 4- Comparative Position of Disposal of Complaints by OBOs | | Number of Complaints | Year | | 2016-17 | 2017-18 | 2018-19 | | Received during the Year | 1,30,987 | 1,63,590 | 1,95,901 | | Brought forward from Previous Year | 5,524 | 11,215 | 6,182 | | Handled during the Year | 1,36,511 | 1,74,805 | 2,02,083 | | Disposed during the Year | 1,25,296 | 1,68,623 | 1,90,014 | | Rate of Disposal (%) | 91.78% | 96.46% | 94.03% | | Carried forward to the Next Year | 11,215 | 6,182 | 12,069 | 1.37 The table above indicates that the OBOs have disposed of 21,391 more complaints during this year with the same resources available with them. The OBO-wise position of complaints disposed during the year 2018-19 is given at Appendix XII. 1.38 The share of Non-Maintainable6 complaints received during 2018-19 stood at 52.90% as compared to 48.94% during 2017-18 and 52.26% in 2016-17. The details of the grounds under which the complaints have been disposed of as non-maintainable are given in the Chart X below. It could be observed therefrom that the complaints have been disposed of as non-maintainable largely due to i) incomplete information given in the complaint, ii) complaints falling outside the territorial jurisdiction of the BOs, iii) First Resort complaints (FRCs) and iv) not falling under the grounds listed under Clause 8 of BOS. The satisfaction survey conducted by M/s Karvy Data Management Ltd. revealed that some respondents admitted to having lodged complaints with the Ombudsmen even when they knew that it fell outside the purview of BOS and also having approached BOs as a first resort because, in their experience, the banks normally resolve the complaints expeditiously once the same had been forwarded to them by the BOs. Going forward, while CMS will filter FRCs and the non-maintainable complaints arising out of jurisdictional reasons, there is a need for creating greater awareness on the BOS and for improving the grievance redressal mechanisms in the banks.  1.39 OBO and bank- wise distribution of maintainable complaints is given at Appendix XIII and XIV respectively. Mode of Disposal of Maintainable Complaints 1.40 The Scheme promotes settlement of complaints by agreement through conciliation and/or mediation by BOs. If the parties fail to arrive at an acceptable agreement, the BO gives a decision or passes an Award. There has been a marked increase in the number of complaints resolved by agreement in the last two years. As detailed in Table 5 below 69.88% of the maintainable complaints were resolved through agreement as compared to 65.82% during 2017-18 and 42.43% during 2016-17, indicating mediation is being used as an effective tool in complaint resolution. | Table 5 - Mode of Disposal of Maintainable Complaints | | Disposal of Maintainable Complaints | 2016-17 | 2017-18 | 2018-19 | | By Mutual Settlement/Agreement | 26,535

(42.43%) | 54,987

(65.82%) | 64,470

(69.88%) | | Disposal by Award | 31

(0.05%) | 133

(0.16%) | 98

(0.11%) | | Maintainable Complaints Rejected | 35,792

(57.23%) | 28,259

(33.82%) | 26,905

(29.16%) | | Maintainable Complaints Withdrawn | 181

(0.29%) | 153

(0.18%) | 791

(0.86%) | | Total | 62,539 | 83,532 | 92,264 | | (Figures in brackets indicate percentage to Maintainable Complaints) | Turn Around Time for Disposal of Complaints 1.41 The time taken by BOs to dispose a complaint stood at 47 days during the year 2018-19 as compared to 53 days a year ago. The most remarkable improvement was marked with regard to complaints against recovery agents, which witnessed a reduction by 18 days, i.e., from 61 days to 43 days. The ground-wise Turn Around Time is given at Appendix XV. Grounds for Rejection of Maintainable complaints 1.42 The grounds for rejection of maintainable complaints and their proportion to total complaints received during the year are indicated in Table 6. | Table 6 - Grounds for Rejection of Maintainable Complaints | | Ground for Rejection | No of Complaints Rejected | | 2016-17 | 2017-18 | 2018-19 | | Not on grounds of complaint (Clause 8) or not in accordance with provisions of Clause 9 (3) | 31,162

(87.06%) | 25,114

(89.00%) | 26,447

(98.30%) | | Beyond Pecuniary Jurisdiction of BO - Clause 12 (5) & (6) | 152

(0.42%) | 115

(0.41%) | 137

(0.51%) | | Requiring elaborate documentary and oral evidence - Clause 13 (c/d) | 3,883

(10.85%) | 2,337

(8.27%) | 193

(0.72%) | | Complaints without sufficient cause - Clause 13(e) | 132

(0.37%) | 298

(1.05%) | 42

(0.16%) | | Not pursued by the complainants - Clause 13(f) | 440

(1.23%) | 272

(0.96%) | 71

(0.26%) | | No loss/damage/inconvenience to the complainant- Clause 13 (g) | 23

(0.06%) | 123

(0.44%) | 15

(0.06%) | | Total | 35,792 | 28,259 | 26,905 | | (Figures in brackets indicate percentage to Maintainable Complaints.) | 1.43 As may be seen from the Table 6 above, the number of maintainable complaints rejected has come down in absolute number from 28,259 in 2017-18 to 26,905 in 2018-19. The maximum number of rejections were on the ground that the complaint was ‘not on grounds of complaint (Clause 8) or not filed in accordance with required provisions of Clause 9 (3). More rejections on this ground calls for creating greater awareness among complainants about BOS. The launch of CMS for lodgement of complaints is expected to address this issue. 1.44 The BO Scheme envisages summary disposal of complaints. As such, complaints requiring elaborate documentary and oral evidence are rejected by the BOs. Such rejections were made appealable with effect from July 1, 2017 with an objective to review these decisions at Appellate Authority level. Consequently, the number of such disposal declined from 3,883 in 2016-17 to 2,337 in 2017 –18 and 193 in 2018-19. 1.45 ‘First Resort Complaints7 (FRCs) are returned to the complainants advising them to follow the laid down procedure with a copy to the concerned bank for suitable redressal. During the year, 5.13% of the non-maintainable complaints were FRCs. Age–wise Classification of Pending Complaints 1.46 Although the Scheme specifies no time limit for resolution of complaints by OBOs, efforts are made to resolve the same within two months. However, due to reasons such as non-submission and / or delay in submission of complete information by complainants/banks, the time taken for resolution may get extended in some cases. Of the total complaints do not remain pending as on June 30, 2019, around 12.73% were over two months old. The BOs and the PNOs of banks have been continuously advised/sensitized to ensure that complaints are not pending for more than two months. The age-wise classification of number of pending complaints is detailed at Appendix XVI. Chart XI below indicates age-wise classification of pending complaints. Awards Issued 1.47 During the year, 98 Awards were issued by BOs. The OBO-wise position of Awards issued and implemented is indicated in Table 7. | Table 7- OBO-wise Position of Awards issued during 2018-19 | | OBO | Awards Issued | Implemented | | Ahmedabad | 0 | 0 | | Bangalore | 2 | 1 | | Bhopal | 2 | 2 | | Bhubaneswar | 0 | 0 | | Chandigarh | 5 | 0 | | Chennai | 0 | 0 | | Dehradun | 2 | 2 | | Guwahati | 0 | 0 | | Hyderabad | 0 | 0 | | Jaipur | 0 | 0 | | Jammu | 2 | 1 | | Kanpur | 6 | 28 | | Kolkata | 4 | 0 | | Mumbai-I | 0 | 0 | | Mumbai-II | 0 | 0 | | New Delhi-I | 31 | 5 | | New Delhi-II | 2 | 3 | | Patna | 1 | 1 | | Raipur | 1 | 0 | | Ranchi | 29 | 26 | | Thiruvananthapuram | 11 | 14 | | Total | 98 | 838 | Satisfaction Survey of Complainants 1.48 On the direction of the Central Board, the Department undertook an All India Survey through a vendor M/s Karvy Data Management Limited to gauge the level of satisfaction of complainants who approached the Banking Ombudsman for redressal of their grievance. The Survey was based on five parameters to measure the level of customer satisfaction on a scale of five, viz., (i) ease of lodging a complaint, (ii) resolving complaint in reasonable time, (iii) promoting settlement of the complaint by mediation and conciliation, (iv) escalating complaint to the Ombudsman drives the service provider to redress the complaint immediately (v) overall satisfaction with redressal. As per the findings of the survey, more than 70% of complainants were satisfied with the redressal provided by the BO. The findings of the Survey are placed at Appendix XVII. Appeals against the Decisions of the BOs 1.49 The Deputy Governor-in-Charge of the CEPD, RBI is the designated as the Appellate Authority9 (AA) as per the provisions of the BO Scheme. CEPD provides the Secretariat to the AA. During the year, 78 appeals were received as compared to 125 appeals during the last year. Of these, 57 appeals were received from complainants who were aggrieved by the decision of the respective BOs whereas 21 were filed by the banks. With 95 appeals pending from the previous year, the AA handled 173 appeals during the year. The number of appeals disposed during the year went up substantially by 173% to 101 from 37 during 2017-18. 1.50 The position of appeals handled by the AA during the last three years and the OBO-wise position of appeals received during the year 2018-19 is given in Tables 8 and 9 respectively. | Table 8 - Position of Appeals | | Particulars | 2016-17 | 2017-18 | 2018-19 | | Appeals pending at the beginning | 3 | 7 | 95 | | Appeals received during the year from complainants | 7 | 115 | 57 | | Appeals received during the year from banks | 8 | 10 | 21 | | Total appeals handled during the year | 18 | 132 | 173 | | Appeal disposed during the year | 11 | 37 | 101 | | Pending at the end of the year | 7 | 95 | 72 | | Mode of Disposal | | Appeals remanded to the BO | 2 | 19 | 11 | | Appeals withdrawn / settled/ infructuous | 3 | 7 | 21 | | Particulars | 2016-17 | 2017-18 | 2018-19 | | Appeals rejected | - | 6 | 38 | | Appeals allowed | 6 | 5 | 31 | | Appeals Disposed | | i. In favour of complainant appellant | 5 | 7 | 26 | | ii. In favour of banks | 1 | 17 | 41 | | iii. Neither in favour of complainant appellant nor in favour of banks (Remanded back to BO / infructuous) | 5 | 13 | 34 |

| Table 9 – OBO-wise Position of Appeals Received during the Year 2018-19 | | OBO | No of Appeals | | Ahmedabad | 6 | | Bangalore | 2 | | Bhopal | 1 | | Bhubaneswar | 1 | | Chandigarh | 4 | | Chennai | 6 | | Dehradun | 0 | | Guwahati | 2 | | Hyderabad | 0 | | Jaipur | 3 | | Jammu | 0 | | Kanpur | 7 | | Kolkata | 1 | | Mumbai-I | 3 | | Mumbai-II | 0 | | New Delhi-I | 18 | | New Delhi-II | 12 | | Patna | 0 | | Raipur | 1 | | Ranchi | 1 | | Thiruvananthapuram | 10 | | Total | 78 |

Chapter 2

THE OMBUDSMAN SCHEME FOR NON-BANKING FINANCIAL COMPANIES, 2018 2.1 RBI, in exercise of the powers under Section 45L of the RBI Act, 1934, introduced the Ombudsman Scheme for Non-Banking Financial Companies (NBFC-O Scheme) on February 23, 2018. The objective of the Scheme is to provide a system of Ombudsman for redressal of complaints of customers of Non-Banking Financial Companies (NBFC) pertaining to deficiency in service by the NBFCs. The Scheme is applicable to NBFCs10 which (a) are authorized to accept deposits; or (b) have customer interface, with assets size of ₹100 crore or above, as on the date of the audited balance sheet of the previous financial year, or with any such asset size as the RBI may prescribe. 2.2 The Scheme was initially operationalized for all deposit taking NBFCs in the country. Upon review, it was decided to extend its coverage to Non-Deposit Taking NBFCs having customer interface, with assets size of ₹100 crore or above with effect from April 26, 2019. 2.3 The Non-Banking Financial Company - Infrastructure Finance Company (NBFC-IFC), Core Investment Company (CIC), Infrastructure Debt Fund-Non-Banking Financial Company (IDF-NBFC) and NBFCs under liquidation, are excluded from the ambit of the Scheme. The Scheme is being administered from the offices of the NBFC-Os in four metro centers viz. Chennai, Kolkata, Mumbai and New Delhi for handling complaints from the respective zones, so as to cover the entire country. Number of NBFCs and complaints received by NBFC-Os 2.4 The position of complaints received by four offices of NBFC-Os is given in Table 10 below. Annualizing the 675 complaints received in the four months of 2017-18, it could be observed that the complaints against NBFCs have nearly doubled this year vis-à-vis last year. | Table 10 - Complaints Received by NBFC-Os | | NBFC-O | No of Deposit Taking NBFCs | 2017-18 | 2018-19 | Y-o-Y Growth% | | Chennai | 42

| 139 | 1124 | 708.63 | | (23.33) | (20.59) | (28.16) | | Kolkata | 5

| 70 | 513 | 632.86 | | (2.78) | (10.37) | (12.85) | | Mumbai | 13

| 343 | 995 | 190.09 | | (7.22) | (50.81) | (24.93) | | New Delhi | 120

| 123 | 1359 | 1004.88 | | (66.67) | (18.22) | (34.05) | | Total | 180 | 675 | 3991 | 491.26 | | (Figures in brackets show % share to total) | 2.5 NBFC-O New Delhi accounted for 34.05% of the complaints received followed by Chennai (28.16%), Mumbai (24.93%) and Kolkata (12.85%). Ground-wise distribution of complaints 2.6 Complaints are classified into broad categories based on the grounds of complaints specified under Clause 8 of the Scheme. The ground-wise distribution of complaints received by NBFC-Os is given in the Table 11 below: | Table 11 - Ground wise distribution of Complaints | | Complaint Category | 2017-18 | 2018-19 | | Non-Adherence to Fair Practices Code | 338 | 1,614 | | Not Covered under the Clause 8 of the Scheme | 73 | 380 | | Non-Observance RBI directions to NBFC | 58 | 687 | | Levying of Charges without Notice | 26 | 504 | | Delay in Repayment of Deposits | 18 | 131 | | No Transparency in Contract/Loan | 16 | 366 | | Delay in release of securities/documents | 7 | 72 | | No Communication about Loan Sanctioned | 5 | 107 | | Non-understandable or No Adequate Notice on terms and conditions | 4 | 57 | | Non-understandable or Sanction Letter/Terms | 3 | 45 | | Delay in Payment of Interest | 2 | 20 | | Other Categories | 125 | 8 | | Total | 675 | 3,991 | 2.7 With 40.44% of the total complaints received, non-adherence to the fair practices code was the major category of complaints received in the offices of NBFC-Os followed by non-Observance RBI directions to NBFCs at 17.21%, levying of charges without notice (12.63%), lack of transparency in contract/loan (9.17%). Disposal of Complaints 2.8 NBFC-Os handled 4,022 complaints during the year disposing 99.10% of the complaints by the end of June 2019. The detailed position of complaints disposed is given below at Table 12. | Table 12 - Disposal of Complaints by NBFC-O | | | 2017-18 | 2018-19 | | Pending at the Beginning | 0 | 31 | | Complaints Received | 675 | 3,991 | | Complaints Handled | 675 | 4,022 | | Disposed of during the year | 644 | 3,986 | | Rate of Disposal (%) | 95.41% | 99.10% | | Complaints Pending as on June 30, 2018/2019 | 31 | 36 | | Age-wise Pendency | | | Complaints Pending for less than one month | 26 | 25 | | Complaints Pending for one to two months | 3 | 10 | | Complaints Pending for two to three months | 2 | 1 | Mode of Disposal of Maintainable Complaints 2.9 The complaints which pertain to any of the grounds of complaints specified under Clause 8 of the Scheme or categorized as maintainable complaints and their mode of disposal is indicated in Table 13 below: | Table 13 - Mode of disposal of maintainable complaints by NBFC-O | | | 2017-18 | 2018-19 | | Maintainable Complaints | 118 | 939 | | Mode of Disposal | | Mutual Settlement/agreement | 93

(78.81) | 742

(79.02) | | Awards Issued | 0 | 0 | | Rejected | 25

(21.19) | 197

(20.97) | | (Figures in brackets indicate percentage to Maintainable Complaints.) | 2.10 Conforming to the inherent objective laid down in Clause 11 of the Scheme, 79.02% of the Maintainable complaints were resolved by conciliation and mediation. No Award was passed by the NBFC Ombudsman during the year. NBFC-O wise position of complaints disposed (2018-19) 2.11 The status of complaints received in the offices of NBFC-O is given in Table 14 below: | Table 14 - Office-wise Position of NBFC-O Complaints | | NBFC-O | Pending at the end of the year | Complaints Received | Complaints Handled | Complaints Disposed | Pending at the end of the year | Rate of Disposal | | Chennai | 0 | 1,124 | 1,124 | 1,121 | 3 | 99.73% | | Kolkata | 1 | 513 | 514 | 514 | 0 | 100.00% | | Mumbai | 25 | 995 | 1,020 | 1,008 | 12 | 98.82% | | New Delhi | 5 | 1,359 | 1,364 | 1,343 | 21 | 98.46% | | Total | 31 | 3,991 | 4,022 | 3,986 | 36 | 99.10% | NBFC- wise list of complaints received is given in the Annex V. Appeals 2.12 The Scheme provides the appellate mechanism under which both, the complainant as well as the NBFC, can appeal against the decision or Award of the BO to the Appellate Authority designated under the Scheme, provided the complaint is closed under the appealable clauses of the Scheme, i.e. against Award under Clause 12 allowing the complaint or rejecting the complaint for the reasons referred to in Sub Clauses (c) to (f) of Clause 13. The Deputy Governor-in-Charge of the CEPD is the designated Appellate Authority. The secretarial assistance to the Appellate Authority is provided by CEPD. Only one appeal against the decision of the Ombudsman has been received which is being processed.

Chapter 3

Complaints received in RBI through other sources Centralised Public Grievance Redress and Monitoring System 3.1 Centralised Public Grievance Redress and Monitoring System (CPGRAMS) is an initiative of Government of India which provides an alternate channel to public to lodge their complaints with regulators. The CPGRAMS portal has been developed by the Department of Administrative Reforms and Public Grievances of Government of India. Government Departments and banks are subordinate offices in this portal, to receive and redress complaints. CEPD is the Nodal Office for RBI and OBOs are subordinate offices. 3.2 A comparative position of the complaints received through this portal and handled by OBOs during the last three years is given at Appendix XVIII. During 2018-19, the complaints received through this portal went up by 115.44% from 149 in the previous year to 321. Applications Received under Right to Information Act, 2005 3.3 The BOs are the Central Public Information Officers under the Right to Information Act, 2005 (RTI Act) to receive applications and furnish information relating to complaints handled by the OBOs. During the year, 829 RTI applications were received by all OBOs. The OBO-wise position of such applications received during the last three years is detailed at Appendix XIX.

Chapter 4

Important Developments and Way Forward 4.1 During the year under review, in order to provide platform of grievance redressal to the customers of Payment System Participants, the RBI launched a new Scheme christened as Ombudsman Scheme for Digital Transactions (OSDT). Further, the existing NBFC Ombudsman Scheme was reviewed and its coverage was extended to include those Non-Deposit Taking NBFCs who have an asset size of Rs.100.00 crore or more. The ease of filing complaints was enhanced significantly by the launch of CMS. The thrust on awareness was also enhanced. The Annual Conference of Ombudsman was organized on the theme of ‘Consumer Protection beyond Boundaries’. Launch of the Ombudsman Scheme for Digital Transactions (OSDT) 4.2 The OSDT, announced in the Monetary Policy Statement of December 5, 2018, was launched on January 31, 2019. The Scheme has been launched in exercise of the powers conferred under Section 18 of the Payment and Settlement Systems Act, 2007. It provides a cost-free and expeditious complaint redressal mechanism for redressal of complaints pertaining to deficiency in service related to digital transactions provided by the System Participants defined under the Scheme. Complaints relating to digital transactions undertaken through banks continue to be handled under the Banking Ombudsman Scheme. The offices of Ombudsman for Digital Transactions (ODT) are functioning from all the existing OBOs. The Scheme also provides for an Appellate mechanism under which the complainant / System Participant has the option to appeal against the decision of the ODT before the Appellate Authority, which is vested with the Deputy Governor in charge of CEPD. Extension of the NBFC-O Scheme to Non-Deposit Taking NBFCs 4.3 RBI had launched the NBFC-O Scheme on February 23, 2018 for deposit-taking NBFCs registered with RBI. The Scheme was to be extended to remaining identified categories of NBFCs based on experience gained. Upon review, it was decided to extend the coverage of NBFC-O Scheme to Non-Deposit Taking NBFCs having customer interface, with assets size of ₹100 crore or above with effect from April 26, 2019.The Non-Banking Financial Company - Infrastructure Finance Company (NBFC-IFC), Core Investment Company (CIC), Infrastructure Debt Fund-Non-Banking Financial Company (IDF-NBFC) and NBFCs under liquidation, are excluded from the ambit of the Scheme. The Scheme is being administered from the offices of the NBFC-Os in four metro centers viz. Chennai, Kolkata, Mumbai and New Delhi for handling complaints from the respective zones, so as to cover the entire country. Launch of Complaint Management System (CMS) 4.4 CMS, which is a web-based software for consumers, RBI users at Ombudsman offices, CEPCs, CEPD and regulated entity users for enabling end-to-end complaints management was launched by Governor, RBI on June 24, 2019. This system provides a single platform available on web and mobile for lodging and monitoring complaints against entities regulated by RBI. It has replaced the Complaint Tracking System which was launched in the year 2006 and was limited only to BOS as the other Schemes were launched recently. CMS application features workflow and integration amongst Ombudsman verticals, CEPCs, CEPD and regulated entities, as well as communication channels (e-mail and SMS) to digitize end-to-end complaint management process. It provides real time status of complaints at pan-India level and has advance management information dashboards which will improve the operational efficiency of offices by enabling online handling and monitoring of complaints, thereby reducing the turnaround time. It also has a comprehensive e-learning based consumer education material to enhance awareness related to financial services and consumer rights. Awareness Initiatives 4.5 During 2018-19, the Reserve Bank conducted country-wide awareness campaigns through print and electronic media on various topics such as fictitious offers, BSBD Accounts, banking facilities for senior citizens and differently-abled persons and safe digital banking. The Reserve Bank’s SMS handle ‘RBISAY’ was also extensively used for sending text messages on such topics across India. An IVRS was made available to the public for obtaining information on these and other awareness initiatives of the Reserve Bank. During the year, the offices of BO also conducted 259 Town Hall/ awareness/ outreach programs, mainly in Tier II cities. Opening of third Ombudsman Office at New Delhi 4.6 The Reserve Bank has set up a third office of the BO and ODT at RBI, New Delhi (New Delhi-III) with a view to meet the growing demand for resolution under the BOS and the OSDT. This office became operational with effect from July 1, 2019. With addition of this Office, the RBI has now 22 Ombudsman Offices in the country. Annual Conference of Banking Ombudsmen (BOs) 4.7 Annual conference of RBI Ombudsmen was held at Mumbai on June 21, 2019. The theme of the Conference was ‘Consumer Protection beyond Boundaries’. It was inaugurated by Shri M.K. Jain, Deputy Governor (DG), RBI. Smt. Surekha Marandi, the then Executive Director (ED), RBI, Smt. Malavika Sinha, ED, RBI, MDs / CEOs of major public, private and foreign banks, heads of regulatory and supervisory departments, Legal Department of RBI attended the Conference. 4.8 Smt. Surekha Marandi, ED in her address complemented the Ombudsmen on achieving a high rate of disposal of 96.46% during 2017-18. She counselled all stakeholders to be prepared to meet the challenges of rising consumer expectation in the era of technology driven faceless banking. 4.9 In his inaugural address, DG, while highlighting the achievements in grievance redressal and consumer protection spelled out his expectations from the Ombudsmen and impressed upon the need for creating greater awareness. He also exhorted the banks to ensure that their internal grievance redressal mechanisms were strengthened. 4.10 Shri D Sethy, Chief General Manager (CGM), CEPD read out the keynote address of Shri Shaktikanta Das, Governor, RBI. The message outlined five areas of priority for further strengthening consumer protection viz. (i) Approach to grievance redressal to be simple, accessible, through dynamic channels, with periodic updation (ii) Consumer protection to be discussed in international fora of ombudsmen and Central Banks (iii) higher investment on financial education (iv) periodic review of system and procedures in ombudsman offices with training and capacity building of staff and (v) near real time fraud mitigation and complaint resolution to enhance customers’ trust in digital transactions. Governor, through the message, reiterated that consumer must find a place in the business policies of banks and FSPs and urged them to own their customers. 4.11 The conference deliberated on (i) best practices in consumer protection with perspectives across geographies and (ii) digital innovation in a financial space - need for a robust consumer protection framework. Dignitaries from overseas ombudsman offices like United Kingdom and South Africa and Head, Consumer Protection, Organization for Economic Protection and Development also participated and shared their perspective. The action points of the Conference have been taken up for implementation. Review of Internal Ombudsman Mechanism in Banks 4.12 The RBI had, in May 2015, advised all public-sector and select private and foreign banks to appoint Internal Ombudsman (IO) as an independent authority to review complaints that were partially or wholly rejected by the banks. RBI revisited this arrangement and in September 2018, issued revised directions under Section 35 A of the Banking Regulation Act, 1949 in the form of an ‘Internal Ombudsman Scheme, 2018’. The Scheme covers, inter-alia, appointment / tenure, roles and responsibilities, procedural guidelines and oversight mechanism for the IOs. All Scheduled Commercial Banks in India having more than ten banking outlets (excluding Regional Rural Banks), are required to appoint one or more IO. The IO is required to examine all customer complaints, which are in the nature of deficiency in customer service and are partly or wholly rejected by the bank. As the banks are required to internally escalate all complaints which are not fully redressed to their IOs before conveying the final decision to the complainant, the customers of banks need not approach the IO directly. The implementation of IO Scheme is to be monitored through the bank’s internal audit mechanism apart from supervisory oversight by RBI. Way Forward 4.13 The way forward for CEPD is delineated in RBI’s medium-term strategy framework – ‘Utkarsh 2022’ – announced by the Governor, RBI on July 23, 2019. 4.14 Formulate policy to strengthen the system based on Root Cause Analysis (RCA) of major areas of complaint: Offices of Ombudsman and CEPC had undertaken RCA of the major areas of complaint. The study revealed that the major reasons for complaints arise from lack of customer awareness regarding RBI instructions and safe banking practices, lack of sensitization regarding customer protection among front desk staff of banks, instances of non-implementation of RBI instructions and variation in practices adopted by banks in areas where detailed guidance is not listed in the extant regulations. The findings of the RCA are being examined for necessary regulatory and supervisory action with an objective of strengthening consumer protection among the entities regulated by RBI. 4.15 Conduct review of CEPCs for empowering them on the lines of Banking Ombudsman: The CEPCs redress complaints that do not fall under the ambit of Ombudsman Schemes of RBI. However, unlike the case of Ombudsmen, there is no explicit ground, pecuniary jurisdiction or power to issue Award by CEPCs. The feasibility of empowering the CEPCs is being examined. 4.16 Review Internal Ombudsman Scheme for extension to NBFCs: It is proposed to strengthen the internal grievance redressal mechanism of the NBFCs on the basis of experience gained in implementing the Ombudsman Scheme for NBFCs. The review for extending the IO Scheme to NBFCs will be undertaken in due course. 4.17 Review of the Ombudsman Scheme for effective implementation, including through convergence: With the launch of the Ombudsman Scheme for Digital Transactions, RBI is administering three different Ombudsman Schemes. Since there is a need to converge the three schemes into one, the CEPD will undertake a review during the coming year. 4.18 Operationalizing IVRS: The IVRS will be integrated to CMS to provide online voice support to the customers. The work will be completed during 2019-20. 4.19 Creating consumer awareness through multi-pronged strategy: The education initiative of CEPD will be two-pronged, i.e. physical and digital. With the CEPCs and OBOs continuing with the existing Town Hall, Outreach / awareness and other innovative methods to sensitize the customers in their respective jurisdiction, CEPD will undertake multimedia publicity campaign during the year 2019-20.

Annex - I Important Notifications Relating to Customer Service issued by the RBI in 2018-19 | July 2, 2018 | Master Circular – Facility for Exchange of Notes and Coins (RBI/2018-19/3 DCM (NE) No. G-2/08.07.18/2018-19): The Master Circular has inter alia mandated banks to issue fresh / good quality notes and coins of all denominations on demand, exchange soiled / mutilated / defective notes, and accept coins and notes either for transactions or exchange. All branches should provide the facilities to members of public without any discrimination on all working days. None of the bank branches should refuse to accept small denomination notes and / or coins tendered at their counters. | | July 3, 2018 | Master Circular – Scheme of Penalties for bank branches based on performance in rendering customer service to the members of public (RBI/2018-19/11DCM (CC) No. G-4/03.44.01/2018–19): The Scheme of Penalties for bank branches including currency chests has been formulated in order to ensure that all bank branches provide better customer service to members of public with regard to exchange of notes and coins, in keeping with the objectives of Clean Note Policy. Penalties may be imposed on banks for deficiencies in exchange of notes and coins / remittances sent to RBI / operations of currency chests etc. | | July 12, 2018 | Incorporation of Name of the Purchaser on the Face of the Demand Draft (RBI/2018-19/14 DBR.AML.BC. No.210/ 14.01.001/ 2018-19): In order to address the concerns arising out of the anonymity provided by payments through demand drafts and its possible misuse for money laundering, it has been decided that the name of the purchaser be incorporated on the face of the demand draft, pay order, banker’s cheque, etc., by the issuing bank. | | October 16, 2018 | Prepaid Payment Instruments (PPIs) – Guidelines for Interoperability (RBI/2018-19/61 DPSS.CO.PD.No.808/02.14.006/ 2018-19): In order to prepare better for implementation of interoperability, consolidated guidelines for enabling all phases are enclosed in the circular. Participating PPI issuers, who choose to adopt interoperability shall ensure adherence to the enclosed guidelines, in addition to the instructions on KYC, security for transactions and application life cycle, cyber security, fraud prevention and risk management as laid down in the Master Direction. Further, all participating PPI issuers shall be guided by the technical specifications / standards / requirements for achieving interoperability through Unified Payments Interface (UPI) and card networks as per the requirements of National Payments Corporation of India (NPCI) and the respective card networks. NPCI and card networks shall facilitate participation by PPI issuers in UPI and card networks. | | November 15, 2018 | Real Time Gross Settlement (RTGS) System - Implementation of Positive Confirmation (RBI/2018-19/76DPSS(CO) RTGS No.1049/ 04.04.016/2018-19): The National Electronic Funds Transfer (NEFT) system provides for sending a positive confirmation to the remitter of the funds regarding completion of the funds transfer, thus giving an assurance to the remitter that the funds have been successfully credited to the beneficiary account. Banks have been advised to provide the same facility to the remitter of funds under the RTGS system as well. | | January 4, 2019 | Customer Protection – Limiting Liability of Customers in Unauthorised Electronic Payment Transactions in Prepaid Payment Instruments (PPIs) issued by Authorised Non-banks (RBI/2018-19/101DPSS.CO.PD.No.1417/02.14.006/2018-19): With a view to further strengthen customer protection for the PPIs which are issued by entities other than banks, the criteria for determining the customers’ liability in unauthorised electronic payment transactions resulting in debit to their PPIs have been reviewed. A customer’s liability arising out of an unauthorised payment transaction will be limited as below:

| Customer liability in case of unauthorised electronic payment transactions through a PPI | | S.No. | Particulars | Maximum Liability of Customer | | (a) | Contributory fraud / negligence / deficiency on the part of the PPI issuer, including PPI-MTS issuer (irrespective of whether or not the transaction is reported by the customer) | Zero | | (b) | Third party breach where the deficiency lies neither with the PPI issuer nor with the customer but lies elsewhere in the system, and the customer notifies the PPI issuer regarding the unauthorised payment transaction. The per transaction customer liability in such cases will depend on the number of days lapsed between the receipt of transaction communication by the customer from the PPI issuer and the reporting of unauthorised transaction by the customer to the PPI issuer - | | | | i. Within three days# | Zero | | | ii. Within four to seven days# | Transaction value or ₹ 10,000/- per transaction, whichever is lower | | | iii. Beyond seven days# | As per the Board approved policy of the PPI issuer | | (c) | In cases where the loss is due to negligence by a customer, such as where he / she has shared the payment credentials, the customer will bear the entire loss until he / she reports the unauthorised transaction to the PPI issuer. Any loss occurring after the reporting of the unauthorised transaction shall be borne by the PPI issuer. | | (d) | PPI issuers may also, at their discretion, decide to waive off any customer liability in case of unauthorised electronic payment transactions even in cases of customer negligence. | | # The number of days mentioned above shall be counted excluding the date of receiving the communication from the PPI issuer. | | | May 28, 2019 | Real Time Gross Settlement (RTGS) System – Extension of Timings for Customer Transactions (RBI/2018-19/189 DPSS (CO) RTGS No. 2488/04.04.016/2018-19): The timings for customer transactions (initial cut-off) in RTGS was extended from 4:30 pm to 6:00 pm. Accordingly, the RTGS time window with effect from June 01, 2019 is as under:

| Sr. No. | Event | Time | | 1. | Open for Business | 08:00 hours | | 2. | Customer transactions (Initial Cut-off) | 18:00 hours | | 3. | Inter-bank transactions (Final Cut-off) | 19:45 hours | | 4. | IDL Reversal | 19:45 hours - 20:00 hours | | 5. | End of Day | 20:00 hours |

The time-varying charges for transactions in RTGS from 13:00 hours to 18:00 hours shall be ₹ 5 per outward transaction. The time varying charges structure is as under:

| Sr. No. | Time of Settlement at the Reserve Bank of India | Time varying charge per outward transaction (in addition to flat processing charge) (exclusive of tax, if any) | | From | To | | 1 | 08:00 hours | 11:00 hours | Nil | | 2 | After 11:00 hours | 13:00 hours | ₹ 2.00 | | 3 | After 13:00 hours | 18:00 hours | ₹ 5.00 | | 4 | After 18:00 hours | | ₹ 10.00 | | | May 29, 2019 | Amendment to Master Direction (MD) on KYC (RBI/2018- 19/190 DBR.AML.BC. No.39/14.01.001/2018-19): Important changes carried out in the Master Direction in accordance with the amendments are listed hereunder:

a) Banks have been allowed to carry out Aadhaar authentication/ offline-verification of an individual who voluntarily uses his Aadhaar number for identification purpose. (Section 16 of the amended MD on KYC)

b) ‘Proof of possession of Aadhaar number’ has been added to the list of Officially Valid Documents (OVD) with a proviso that where the customer submits ‘Proof of possession of Aadhaar number’ as OVD, he may submit it in such form as are issued by the Unique Identification Authority of India (UIDAI). (Section 3 of the amended MD)

c) For customer identification of “individuals”:

i) For individual desirous of receiving any benefit or subsidy under any scheme notified under Section 7 of the Aadhaar Act, 2016, the bank shall obtain the customer’s Aadhaar and may carry out its e-KYC authentication based on his declaration that he is desirous of receiving benefit / subsidy under the Aadhaar Act, 2016. (Section 16 of the amended MD)

ii) For non-DBT beneficiary customers, the Regulated Entities (REs) shall obtain a certified copy of any OVD containing details of his identity and address along with one recent photograph. (Section 16 of the amended MD)

d) REs shall ensure that the customers (non-DBT beneficiaries) while submitting Aadhaar for Customer Due Diligence, redact or blackout their Aadhaar number in terms of Sub-Rule 16 of Rule 9 of the amended PML Rules, 2005. (Section 16 of the amended MD)

e) REs other than banks may identify a customer through offline verification under the Aadhaar Act with his/her consent. (Section 16 of the amended MD)

f) In case OVD furnished by the client does not contain updated address, certain deemed OVDs for the limited purpose of proof of address can be submitted provided that the OVD updated with current address is submitted within 3 months. (Section 3(a) ix of the amended MD)

g) For non-individual customers, PAN/Form No. 60 of the entity (for companies and Partnership firms – only PAN) shall be obtained apart from other entity related documents. The PAN/Form No. 60 of the authorised signatories shall also be obtained. (Section 30-33)

h) For existing bank account holders, PAN or Form No. 60 is to be submitted within such timelines as may be notified by the Government, failing which account shall be subject to temporary ceasing till PAN or Form No. 60 is submitted. However, before temporarily ceasing operations for an account RE shall give the customer an accessible notice and a reasonable opportunity to be heard. (Section 39 of the amended MD) | | June 10, 2019 | Financial Inclusion- Access to Banking Services – Basic Savings Bank Deposit Account (BSBDA) (RBI/2018-19/206 DBR.LEG.BC.No.47/ 09.07.005/ 2018-19): Banks advised to offer the following basic minimum facilities in the BSBD Account, free of charge, without any requirement of minimum balance:

i) The deposit of cash at bank branch as well as ATMs/CDMs;

ii) Receipt/ credit of money through any electronic channel or by means of deposit /collection of cheques drawn by Central / State Government agencies and departments;

iii) No limit on number and value of deposits that can be made in a month;

iv) Minimum of four withdrawals in a month, including ATM withdrawals;

v) ATM Card or ATM-cum-Debit Card;

Further, Banks are free to provide additional value-added services, including issue of cheque book, beyond the above minimum facilities, which may/may not be priced (in non-discriminatory manner) subject to disclosure. | | June 11, 2019 | National Electronic Funds Transfer (NEFT) and Real Time Gross Settlement (RTGS) systems – Waiver of charges (RBI/2018-2019/208 DPSS (CO) RPPD No.2557/04.03.01/2018-19): The RBI reviewed the various charges levied by it on the member banks for transactions processed in the RTGS and NEFT systems. In order to provide an impetus to digital funds movement, it was decided that with effect from July 1, 2019, processing charges and time varying charges levied on banks by RBI for outward transactions undertaken using the RTGS system, as also the processing charges levied by RBI for transactions processed in NEFT system will be waived by the Reserve Bank. The banks were advised to pass on the benefits to their customers for undertaking transactions using the RTGS and NEFT systems with effect from July 1, 2019. | | June 14, 2019 | Security Measures for ATMs (RBI/ 2018-19/214 DCM (Plg.) No. 2968/ 10.25.007/ 2018-19): Certain measures aimed at mitigating risks in ATM operations and enhancing security, are listed below were introduced:

i) All ATMs shall be operated for cash replenishment only with digital One Time Combination (OTC) locks.

ii) All ATMs shall be grouted to a structure (wall, pillar, floor, etc.) by September 30, 2019, except for ATMs installed in highly secured premises such as airports, etc. which have adequate CCTV coverage and are guarded by state / central security personnel.

iii) Banks may also consider rolling out a comprehensive e-surveillance mechanism at the ATMs to ensure timely alerts and quick response.

The above measures shall be implemented in addition to the existing instructions, practices and guidance issued by RBI and law enforcement agencies. Non-adherence of timelines / non-observance shall attract regulatory action including levy of penalty. | | June 26, 2019 | Acceptance of coins (RBI/2018-19/223 DCM (NE) No.3057/ 08.07.18/ 2018-19): The RBI continues to receive complaints about non-acceptance of coins by bank branches, causing considerable inconvenience to the public at large. Therefore, once again all the banks were advised to immediately direct all branches to accept coins of all denominations tendered at their counters for transactions or exchange and ensure strict compliance in the matter. |

ANNEX II-STATEMENT OF COMPLAINTS RECEIVED BY THE OFFICES OF THE BANKING OMBUDSMAN (2018-19) | Bank Name | Total Num ber of Com plai nts

Rece ived | Other

than Cre dit / Debit Card Comp laint per

1000 acco unts | Credit / Debit Card Comp laint s per 1000 Credit / Debit Card

Acco unts | Comp laint per Bra nch | Dep osit Acc ount | Remi tta nce | Loa ns And Adv ance | Loans And Adva nce- Hou sing | Loans And Adva nce- Gen eral | Atm/ Debit Card | Credit Card | Mo bile Ban king

/ Elec tronic

Ban king | Levy of Cha rges Wit hout Prior No tice | Pens ion | Para- Ban king | Fail ure of Com mit ment to BCSBI

Code | Non- Obs erva nce of Fair Pra ctices | Fail ure On Com mit ments | Notes And Coins | DSA