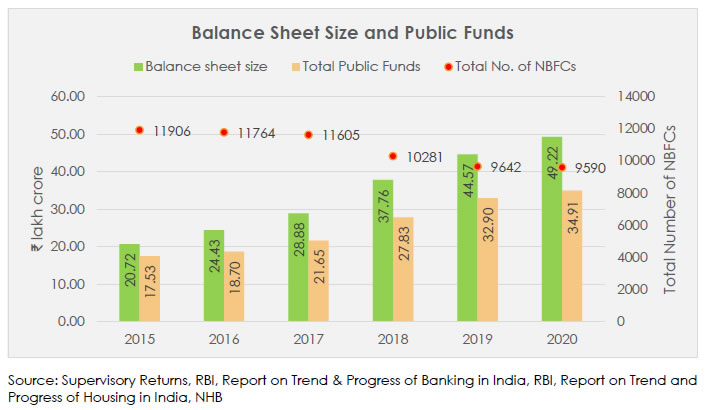

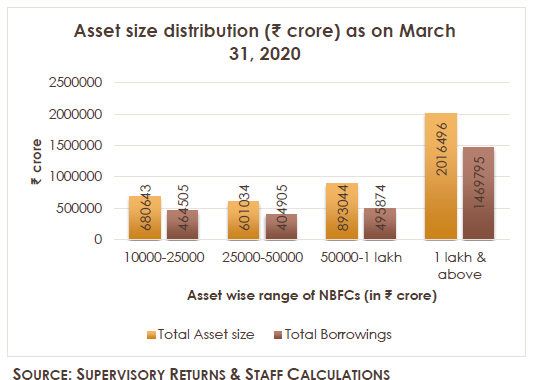

Chapter 1 - Introduction 1.1 Overview - The Non-Banking Financial Companies (NBFC) sector has, over the years, evolved considerably in terms of size, operations, technological sophistication and entry into newer areas of financial services and products. The number of NBFCs as well as the size of the sector have grown significantly. There is an increasingly complex web of inter-linkages of the sector with banks, capital market and other financial sector entities, on both sides of the balance sheet. The sector has also seen advent of many non-traditional players leveraging technology to adopt tech-based business models. Over the last decade, NBFCs have witnessed phenomenal growth. From being around twelve per cent of the balance sheet size of banks (2010), they are now more than a quarter of the size of banks. While the development of a robust non-bank intermediation channel provides a good ‘spare tyre’ to the economy, unbridled growth fueled by lighter regulatory framework can also lead to potential systemic risks. To regulate and supervise NBFCs, the Reserve Bank has implemented since 2006, differential regulation linked to size, in a limited manner. The fundamental premise has, however, been less rigorous regulation for the sector in general. Lighter and differential regulation has provided operational flexibility to NBFCs and helped them develop sectoral and geographical expertise, extending variety and ease of access of financial services. The extant regulatory arbitrage in favour of NBFCs has been well thought out and is conceptualised by design rather than by default. However, in view of the recent stress in the sector, it has become imperative to re-examine the suitability of this regulatory approach, especially when failure of an extremely large NBFC can precipitate systemic risks. The regulatory framework for NBFCs needs to be reoriented to keep pace with changing realities in the financial sector. The objective of this discussion paper is to revisit the broad principles which underpin the current regulatory framework and examine the need to develop a scale-based approach to regulation from a ‘systemic significance’ vantage point and recommend appropriate regulatory measures in support of a strong and resilient financial system. The primary focus of the discussion paper is examination of the principles and processes for identification of NBFCs that have significant systemic risk spill-overs and development of a conceptual framework on which regulations could be based. The Reserve Bank is conscious that NBFCs serve niche sectors/ geographies and their uniqueness must be preserved to ensure continued flexibility of their operations in the last mile of credit delivery. 1.2 Evolution of the Regulatory Framework for NBFCs – In 1964, RBI acquired regulatory and supervisory powers over NBFCs with the insertion of Chapter III-B in the Reserve Bank of India Act, 1934 (‘RBI Act’). In 1974, the RBI Act was amended to give the Reserve Bank more powers with respect to NBFCs, including the power to inspect NBFCs, enhanced penalties for contravention of RBI directions, obligations on statutory auditors, etc. Subsequently, various committees highlighted the need for an appropriate regulatory framework for the NBFC sector given its growing importance. Prudential norms were prescribed to NBFC sector in 1994 based on the recommendations of the Shah Working Group. In 1997, RBI Act, 1934 was further amended and regulation over NBFCs was made more comprehensive. A brief evolution of the regulatory framework for NBFCs since then is given below: 1.2.1 Regulatory Framework -1998 - In January 1998, the Reserve Bank issued a new regulatory framework for NBFCs building upon its newly acquired powers under the RBI Act. The salient features of this framework were: -

Categorisation of NBFCs into (i) public deposit accepting, (ii) non-public deposit accepting but engaged in loan, investment, hire-purchase and equipment leasing, and (iii) non-public deposit accepting core investment companies that acquire securities/ shares in their own group companies comprising not less than 90 per cent of their total assets but not trading in these securities/ shares; -

Clarifying the scope of the term ‘deposits’; -

Minimum credit rating and calibration of quantum of deposits linked to credit rating and net owned funds (NOF); -

Prohibition from grant of loan by an NBFC against the security of its own shares; -

Exemption to non-deposit taking NBFCs from application of prudential norms subject to Board resolution every year on non-acceptance of public deposits; -

Widening the scope of auditors’ certificate by including reporting on various supervisory concerns. 1.2.2 Classification of Systemically Important NBFCs – Based on Asset size In 2006, considering the increasing significance of the sector, the Reserve Bank introduced differential regulation and classified NBFCs with asset size of ₹ 100 crore and above as ‘Systematically Important NBFC-ND (NBFC-ND-SI)’. Prudential regulations such as capital adequacy requirements and exposure norms were made applicable to them. 1.2.3 Revised Regulatory Framework in 2014- The regulatory framework for the sector was reviewed in 2014 in view of the rapid strides made by NBFCs in terms of their size, nature of operations with entry into newer areas of financial services and products. The key changes in the revised regulatory framework were as follows: -

Requirement of minimum NOF of ₹ 2 crore for legacy NBFCs. -

Harmonisation of deposit acceptance requirements across NBFC categories. -

Revision of the threshold of systemic importance from ₹100 crore to ₹ 500 crore and inclusion of multiple NBFCs within the same group for reckoning systemic significance threshold. -

Differentiated regulatory approach based on customer interface and source of funds. At one end of the spectrum, entities with asset size less than ₹500 crore and not accessing public funds with no customer interface were exempted from prudential and business conduct regulations. At the other end, entities accessing public funds with customer interface were subjected to full slew of regulations. -

Harmonisation of asset classification norms for Deposit taking Non-Banking Financial Company (NBFC-D) and Systemically Important Non-Deposit taking Non-Banking Financial Company (NBFC-ND-SI) with banks. -

Review of corporate governance and disclosure norms leading to constitution of Board Committees (Audit Committee, Nomination Committee, and Risk Management Committee) and rotation of audit partners every three years applicable for NBFC-D and NBFC-ND-SI. 1.2.4 Summary of Extant Regulatory Framework of NBFC Sector 1.2.4.1 Minimum Capital Requirements - No company can carry out NBFC business without obtaining Certificate of Registration from RBI. Minimum Capital requirements for each type of NBFC are as under: | Type of NBFC | Minimum Net Owned Fund | | NBFCs other than mentioned below | ₹ 2 crore | | NBFC-MFI | ₹ 5 crore | | NBFC- MFI in NE Region | ₹ 2 crore | | NBFC- Factor | ₹ 5 crore | | NBFC-HFC | ₹ 20 crore | | NBFC-MGC | ₹ 100 crore | | IDF - NBFC | ₹ 300 crore | | NBFC- IFC | ₹ 300 crore | 1.2.4.2 Extant Regulatory Approach for NBFC-NDs1- The regulatory approach in respect of NBFCs-ND with an asset size of less than ₹ 500 crore (i.e. non-systemically important) is as under: -

Leverage ratio2 should not be more than 7; -

No CRAR/ exposure norms; -

180 days asset classification norm. For NBFC-NDs with assets of less than ₹ 500 crore and not accessing public funds – -

No Prudential Regulation; -

Conduct of business regulations, such as, KYC and FPC are not applicable to those NBFCs with no customer interface. 1.2.4.3 Extant Regulatory Approach for NBFC-ND-SI3 and NBFC-D A. Capital requirements - A minimum Capital of 15% of risk-weighted assets has to be maintained. Tier I capital shall be maintained at a minimum of 10% and Tier II shall not exceed Tier I capital. NBFCs primarily engaged in lending against gold jewellery (such loans comprising 50 percent or more of their financial assets) shall maintain a minimum Tier l capital of 12 percent. The risk weights assigned to the exposures held by NBFCs are determined on similar lines as Basel I standards, i.e., divided into 0%, 20%, 50% and 100%. Reserve Fund: As per section 45-IC of RBI Act 1934, every NBFC shall create a reserve fund and transfer thereto a sum not less than 20 per cent of its net profit every year as disclosed in the profit and loss account before declaring any dividend. B. Prudential regulations (applicable to NBFC-ND-SI and NBFC-D but not to NBFC-MFIs) Credit Concentration: (as a Percentage of Owned Funds) | Type of exposure | Single | Group | | Credit | 15% | 15% | | Investment | 25% | 25% | | Composite (Credit + Investment) | 25% | 40% | | Infrastructure related activities (Credit + Investment) | Additional 5% | Additional 10% | Credit concentration norms for NBFC-IFC: (as a Percentage of Owned Funds) | Type of exposure | Single | Group | | Credit | 15% and additional 10% | 25% and additional 15% | | Composite (Credit + Investment) | 25% and additional 5% | 40% and additional 10% | Note: Concentration norms not applicable to NBFCs which are not accessing public funds and not issuing guarantees Asset Classification: The default period for classifying assets as NPA is 90 days. Provisioning for loss/ doubtful/ sub-standard assets is as under: Provisioning Requirements: | Standard Assets | 0.40% for NBFC –ND- SI and

0.25% for NBFC-ND | | Sub-standard Assets | 10% of outstanding balance | | Doubtful Assets | 100% on un-secured portion and

20%, 30% and 50% on the secured portion depending on the age of doubtful assets | | Loss Assets | 100% of outstanding balance | C. Corporate governance and Disclosures – Every NBFC-ND-SI and NBFC-D is required to frame internal guidelines on corporate governance based on regulatory guidelines. The broad regulatory guidelines require NBFCs to -

constitute three Board-level committees, viz., Audit Committee, Nomination Committee and Risk Management Committee; -

ensure ‘fit and proper’ status of proposed/ existing directors; -

ensure rotation of partners of audit firms once in 3 years; -

make additional disclosures in balance sheets on the following: CRAR, investments, derivatives, ALM, direct and indirect exposure to real estate sector, penalties, concentration, customer complaints, etc.; -

disclose the internal guidelines on corporate governance on the company’s website. D. Fair Practices Code - FPC applicable to NBFCs covers the responsibility of the Board in ensuring fair practices, transparency in pricing, effective communication with borrowers on the relevant terms and conditions, appropriate recovery mechanism including manner of repossession of vehicles financed by the NBFC and guidelines to be followed for lending against gold jewellery. E. Grievance redressal mechanism - The Board of Directors is required to lay down an appropriate grievance redressal mechanism to ensure that all disputes arising out of the decisions of the NBFC’s functionaries are heard and disposed of at least at the next higher level. NBFCs are required to display the details of the grievance redressal officer at every branch and the process of escalation to the Reserve Bank/ Ombudsman in case a complainant is not resolved. Ombudsman scheme for NBFCs, 2018 covers deposit taking NBFCs and non-deposit taking NBFCs having customer interface with asset size ₹ 100 crore or above. However, NBFC-IFC, Core Investment Companies, IDF-NBFC and NBFC under liquidation are excluded from the ambit of the scheme. F. KYC Norms - All NBFCs with customer interface are required to follow the Know Your Customer Directions, 2016 as applicable to any other Regulated Entity. 1.2.4.4 Extant Regulatory Approach for deposit taking NBFCs (NBFC-D) - Besides regulations mentioned at para 1.2.4.3, other regulations applicable to NBFC-D are as under: A. Norms on Maintenance of Liquid Assets - Deposit accepting NBFCs have to invest 15% of their public deposits in statutory liquid assets; out of which 10% should be in unencumbered approved securities and the remaining 5% in term-deposits with Scheduled Commercial Banks. B. Restriction on acceptance of public deposit -

Public deposit can be accepted for a minimum period of 12 months and maximum period of 60 months (5 years). -

Only Deposit taking NBFCs with minimum investment grade or other specified credit rating are allowed to accept deposits. -

Public deposits can be raised to the tune of 1.5 times of NOF. -

Maximum interest rate payable on public deposits by NBFCs is 12.5 per cent per annum. -

They cannot accept deposits repayable on demand. Chapter 2 - Regulatory Arbitrage and Systemic Risk 2.1 Overview - The fundamental premise underlying the NBFC regulatory framework is ‘less rigorous’ regulation. It enables NBFCs to have operational flexibility and develop sectoral and geographical expertise, resulting in variety of financial services and ease of access. The extant regulatory arbitrage in favour of NBFCs is a deliberate policy choice. In this context existing arbitrage opportunities between banks and NBFCs are discussed below. 2.2 Regulatory Arbitrage between banks and NBFCs - The arbitrage between banks and NBFCs can be broadly categorised under a) structural arbitrage and b) prudential arbitrage. The major arbitrage opportunities in this regard are enumerated below: 2.2.1 Structural Arbitrage - Banks are regulated under Banking Regulation Act, 1949, whereas NBFCs are regulated under the RBI Act, 1934. In view of the differences in the legislative and licensing framework governing banks and NBFCs, there is an inherent structural arbitrage in favour of NBFCs. Important areas in which such structural arbitrage is manifested are in respect of i) maintenance of CRR/ SLR by banks against demand and time liabilities, ii) ceiling on voting rights of shareholders, iii) prohibition of buying, selling and bartering of goods, iv) prohibition in holding non-banking assets, v) mandatory Board expertise, vi) deposit insurance, vii) the requirement to hold a certain percentage of assets in India, and viii) restriction on investment in other companies. 2.2.2 Prudential Arbitrage – Prudential regulation of NBFCs is less rigorous than that applicable to banks. NBFCs enjoy greater flexibility in terms of capital adequacy, exposure framework, asset classification and provisioning norms, etc. Important details of regulatory arbitrage including prudential arbitrage are tabulated in Annex 1. 2.2.3 Corporate Governance and Disclosure norms - Currently, NBFC-ND-SI and NBFC-D are subject to guidelines on corporate governance with regard to ‘fit and proper’ criteria for directors; formation of Audit, Nomination and Risk Management Committees; rotation of partners of audit firm; disclosure requirements and appointment of Chief Risk Officer. However, coverage of corporate governance requirements for banks is wider in terms of instructions on compensation policy for WTD/ CEOs/ Risk Control Staff, ‘fit and proper’ criteria for promoters, prohibition on a person being a director in more than one bank, etc. Further, most public sector and private sector banks are listed and are, therefore, required to follow listing obligations having a bearing on corporate governance. 2.2.4 Other Areas of Regulatory Arbitrage - Apart from the aforementioned areas, there is also scope for regulatory arbitrage on account of regulatory restrictions imposed on banks with respect to lending against shares, dividend distribution4, etc. 2.3 Concerns on account of Arbitrage – Systemic Risk - Arbitrage induced by ‘less rigorous’ regulation is built on the premise that the NBFCs’ scale of operations is expected to be significantly low in comparison to banks and it may, therefor, not pose any significant systemic risk. However, NBFC sector has seen tremendous growth in recent years. In the last five years alone, the size of the balance sheet of NBFCs (including HFCs) has more than doubled from ₹20.72 lakh crore (2015) to ₹49.22 lakh crore (2020).  NBFCs are supposed to cater to niche sectors and geographies. Accordingly, a variety of categories of NBFCs have come up over the years. Prior to harmonization of categories in 2019, there were 12 different categories of NBFCs. In order to provide NBFCs with greater operational flexibility, harmonization of different categories of NBFCs into fewer ones was carried out. Accordingly, the three categories of NBFCs viz. Asset Finance Companies (AFC), Loan Companies (LCs) and Investment Companies (ICs) were merged into a new category called NBFC - Investment and Credit Company (NBFC-ICC). Apart from NBFC- ICC, which is primarily engaged in credit intermediation, there are NBFCs like Infrastructure Finance Company (IFC) and Infrastructure Debt Fund (IDF), focused on infrastructure financing; Factors, focused on factoring business; Housing Financing Companies, focused on housing finance & Micro Finance Institutions focused on micro finance.  The flexibility of operations of NBFCs has enabled it to assume a scale that would potentially impact systemic stability. The events unfolding in the latter half of 2018 also brought in new learnings. It may be noted that one of the largest Core Investment Companies (CIC) defaulted on its payment obligations towards market liabilities and a series of defaults followed. The liquidity stress arising out of this event impacted the fund raising ability of NBFCs, both big and small. There were concerns that the liquidity stress could translate in to solvency concerns in some instances. NBFCs have become more and more interconnected with the financial system. NBFCs were the largest net borrowers of funds from the financial system, with gross payables of ₹9.37 lakh crore and gross receivables of ₹ 0.93 lakh crore as at end-September 2020. They obtained more than half of their funding from SCBs, followed by AMC-MFs (Mutual Funds) and insurance companies. HFCs were the second largest borrowers of funds from the financial system, with gross payables of around ₹6.20 lakh crore and gross receivables of ₹0.53 lakh crore as at end-September 2020. As on March 31, 20205, the balance sheet sizes of the largest Urban Cooperative Bank and the largest Regional Rural Bank were ₹ 51,926.95 crore and ₹ 36,302.66 crore respectively. Further, the balance sheet sizes of the two recently licensed Private Sector banks were ₹ 1,49,200.39 crore and ₹ 91,717.79 crore respectively. In comparison, it may be noted that the largest NBFC-HFC had a balance sheet size of ₹ 5,24,093 crore. There were seven NBFCs (including HFCs) each with asset size exceeding ₹ 1 lakh crore and above. As can be seen from the chart below, even when the sector was performing reasonably well, one adverse incident in one of the large regulated entities having significant interconnectedness, impacted sentiments and threatened financial stability. Chapter 3 - Need for Review: Introducing Scale-Based Approach to Regulation 3.1 Overview - NBFCs are vital to the economy as they support real economic activity and complement the credit intermediation function of banks. They play a crucial role in widening access to financial services and enhance competition in the financial sector. Lower transaction costs, quick decision-making, customer orientation and prompt provision of services have typically differentiated NBFCs from banks. Over the years, the NBFC sector has undergone considerable evolution. Higher risk appetite of NBFCs has contributed to their size, complexity and interconnectedness making some of the entities systemically significant, posing potential threat to financial stability. While NBFCs are under regulation since 1964, the Reserve Bank introduced a comprehensive regulatory framework for the systemically important NBFCs in 2006 which were further refined in 2014 to keep pace with the changing financial dynamics. Since then, the Reserve Bank has been carrying out calibrated modifications and adjustments to mould the regulations to the changing environment and, accordingly, within the universe of systemically important NBFCs, an additional identifier has been placed at ₹ 5000 crore, wherein, additional regulations have been made applicable to such large NBFCs.  Unbridled growth aided by less rigorous regulatory framework within an interconnected financial system can sow the seeds of systemic risk. Failure of any large and deeply interconnected NBFC is capable of transmitting shocks in to the entire financial sector and cause disruption even to the operations of the small and mid-sized NBFCs. Under the circumstances, regulatory framework for NBFCs needs to be reoriented to keep pace with the changing realities. A calibrated and graded regulatory framework proportionate to the systemic significance of NBFCs may be best suited and thus there is a need to align the regulatory interventions with the objective of preserving financial stability and reducing systemic risks. Strong and well governed NBFCs can promote resilience in the financial system by providing a much-needed backup within the system. 3.2 Principle of proportionality in regulation -The principle of proportionality expounds that the degree of regulation of a financial entity should be commensurate with the perception of risk the entity poses to the financial system and the scale of its operation. This approach will lead to judicious use of regulatory and supervisory resources as entities posing systemic risks would be regulated and supervised more closely as compared to others. While international resemblance of adoption of scale based regulation can be seen in Global systemically important banks (G-SIBs), developed by the Basel Committee on Banking Supervision (BCBS), Global systemically important insurers (G-SIIs), developed by the International Association of Insurance Supervisors (IAIS), Non-bank non-insurer (NBNI) G-SIFIs, developed jointly by the FSB and the IOSCO and Designation process followed by Financial Stability Oversight Council in USA; domestic resemblance is seen in adoption of Domestic Systemically Important Banks (D-SIBs) framework for banks in India by the Reserve Bank. While embarking on the path of scale-based regulation, it is important to understand the fundamental factors that should trigger the rule of proportionality in regulation. Three such triggers are discussed below: -

Comprehensive risk perception: Once an NBFC crosses the thresholds for identified parameters (size, leverage, interconnectedness, complexity, and supervisory inputs), it should be subject to proportionately higher regulation. -

Size of operations: The size of any financial institution is of paramount importance. Irrespective of any other parameter, if the balance sheet size of an NBFC breaches a certain threshold, as identified by the Reserve Bank, it can be regulated at a higher pedestal, as it will have higher in-built degree of systemic significance. The size threshold can be reasonably high, as this is supposed to be an overriding factor. - Activity of NBFCs: Another trigger could be to subject NBFCs to differential regulations based on the activity carried out by them. Certain NBFCs are unlikely to pose any systemic risk on account of their activities and hence could be regulated relatively lightly. For instance, Type I6 NBFCs do not have either access to public funds or customer interface as they carry out business only from own funds, and as such, their ability to pose large-scale systemic disruption is limited. Similarly, NBFCs like NBFC-P2P lending platforms, NBFC-AA and NOFHC (bank holding company) do not, prima facie, pose systemic risk to credit intermediation. On the other hand, there are certain categories of NBFC whose business model involves at least some systemic impact. NBFC-HFC, IFC, IDF, SPD and CIC would fall in this category.

The principle of proportionality in regulation is proposed to be developed along the triggers discussed above. Issues for discussion (1)

A. Whether the triggers enumerated here adequately capture the basis for determining the degree of proportionality?

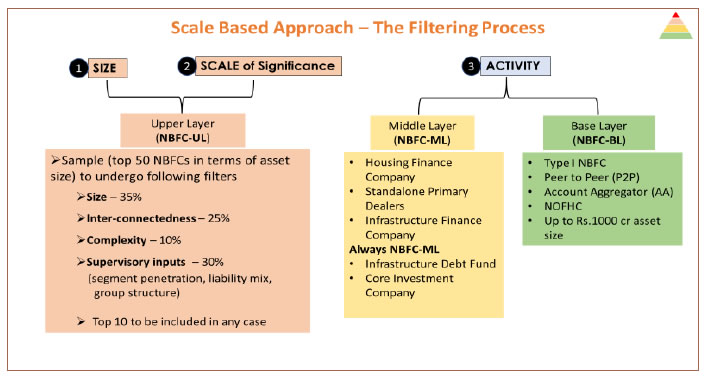

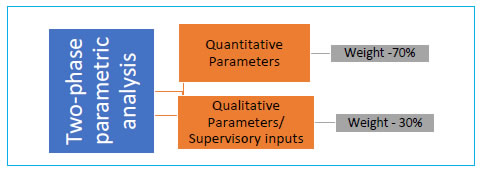

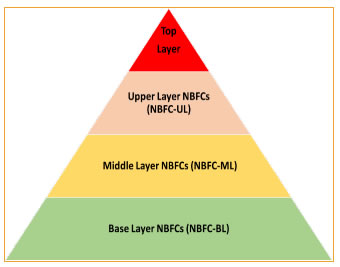

B. Whether there is a need to add any other or remove any of the triggers mentioned above? | 3.3 Introducing Scale-based Framework – Based on the discussion above, a regulatory framework anchored on proportionality can be introduced. If the framework is visualised as a pyramid, the bottom of the pyramid, where least regulatory intervention is warranted, can consist of NBFCs, currently classified as non-systemically important NBFCs (NBFC-ND), NBFC-P2P lending platforms, NBFC-AA, NOFHC and Type I NBFCs. As one moves up, the next layer can consist of NBFCs currently classified as systemically important NBFCs (NBFC-ND-SI), deposit taking NBFCs (NBFC-D), HFCs, IFCs, IDFs, SPDs and CICs. The regulatory regime for this layer shall be stricter compared to the base layer. Adverse regulatory arbitrage vis-à-vis banks can be addressed for NBFCs falling in this layer in order to reduce systemic risk spill-overs, where required. Going further, the next layer can consist of NBFCs which are identified as systemically significant among NBFCs (The parametric matrix for identifying such NBFCs is discussed in the next section). This layer will be populated by NBFCs which have large potential of systemic spill-over of risks and have the ability to impact financial stability. There is no parallel for this layer at present, as this will be a new layer for regulation. The regulatory framework for NBFCs falling in this layer will be bank-like, albeit with suitable and appropriate modifications. It is possible that considered supervisory judgment might push some NBFCs from out of the upper layer of the systemically significant NBFCs for higher regulation/ supervision. These NBFCs will occupy the top of the upper layer as a distinct set. Ideally, this top layer of the pyramid will remain empty unless supervisors take a view on specific NBFCs. In other words, if certain NBFCs lying in the upper layer are seen to pose extreme risks as per supervisory judgement, they can be put to significantly higher and bespoke regulatory/ supervisory requirements.  To sum up, regulatory and supervisory framework of NBFCs shall be based on a four-layered structure– Base Layer, Middle Layer, Upper Layer and a possible Top Layer. NBFCs in lower layer will be known as NBFC-Base Layer (NBFC-BL). NBFCs in middle layer will be known as NBFC-Middle Layer (NBFC-ML). An NBFC in the Upper Layer will be known as NBFC-Upper Layer (NBFC-UL) and will invite a new regulatory superstructure. There is also a Top Layer, which is ideally supposed to be empty. As such, no separate nomenclature is suggested. The regulatory framework for NBFCs is discussed in the next chapter. Issues for discussion (2)

A. Whether the layers in the regulatory pyramid capture the calibrated classification of NBFCs based on their likely systemic impact?

B. Is the activity-based classification of NBFC-AA, P2P, NOFHC in Lower Layer and NBFC-HFC, IFC, IDF, CIC and SPDs in Middle Layer justified? | 3.4 Scale and Activity - As regards nature of activity, it may be mentioned that NBFCs are generally meant to cater to niche sectors and geographies and accordingly specialised NBFCs have emerged; viz., P2P (Peer to Peer), Account Aggregator, gold loan NBFCs, NBFC-MFI, NBFC-Factor, NBFC-IDF, NBFC-IFC and NBFC-MGC. Owing to the specific set of financial activity performed by these NBFCs, the regulatory framework has evolved uniquely for each one of them. For example, in respect of gold loan NBFCs, there are specific regulations pertaining to maintenance of LTV ratio, verification of the ownership/ quality of gold, auction processes if gold jewellery has to be sold for recovery, branch expansion, etc. Similarly, for IFC and IDF there is a separate set of eligibility criteria and minimum capital requirement along with other generic regulations. As has been mentioned at para 3.2(iii), there are few categories of NBFC like Type I NBFCs, NBFC-P2P, NBFC-AA and NOFHC (bank holding company), whose risk perception is muted and their ability to have any large-scale systemic disruption is limited. These entities will always remain in the lower layer of the regulatory pyramid. On the other hand, there are certain categories of NBFC which would not be categorized in Base Layer as their business model involves a significant degree of systemic impact. NBFC-HFC, IFC, IDF, SPD and CIC would fall in this category. Though CICs and SPDs will fall in the Middle Layer of the regulatory pyramid, the existing regulations specifically applicable to them, will continue to apply. However, it may be emphasised that if SPDs based on the identified parameters (size, leverage, interconnectedness, complexity, etc.), reach the threshold for higher differential regulation, they will be subjected to stricter regulation as per the scale-based approach. To further illustrate, if an NBFC-IFC fulfils the criteria set for being identified as a NBFC-UL, then it will lie in the Upper Layer and the degree of regulation will match its risk perception. In case a HFC falls in the Upper Layer, the applicable regulatory tools will be determined keeping in view its overall transition to harmonization with NBFC regulation. 3.5 Identifying NBFCs in Upper Layer 3.5.1 The Principle - The intention is to identify a small set of NBFCs, which are significant from the point of view of systemic risk spill-overs and are therefore required to be subjected to tighter regulation. In order to identify such NBFCs in the Upper Layer, a range of parameters can be considered; viz., size, leverage, interconnectedness, substitutability, complexity, nature of activity of the NBFC, etc. The above factors are similar to those used in identifying domestic systemically important banks (D-SIBs). Some of the parameters may not, however, bear as much significance for NBFCs as for banks. For instance, the substitutability parameter is less important for NBFCs, as NBFCs play only a complementary role in credit intermediation. Besides the usual quantitative parameters, supervisory feedback can provide crucial inputs to evaluate possible risk spill-overs of NBFCs. As per the Reserve Bank’s circular on ‘Withdrawal of Exemptions Granted to Government Owned NBFCs’ dated May 31, 2018, the Government owned NBFCs are still in the transition period wherein they have to attain the minimum CRAR by March 31, 2022. It is, therefore, proposed not to subject these NBFCs to Upper Layer regulatory framework. Further, CIC, NOFHC, IDF, NBFC-AA, NBFC-P2P and NBFC-MGC will not be subjected to Upper Layer regulatory framework owing to their unique business models. 3.5.2 Methodology for Identification of NBFCs in Upper Layer - For identification of entities to be categorised as NBFC-UL, a parametric analysis will be carried out, comprising quantitative and qualitative parameters/ supervisory judgment. The quantitative parameters will have weightage of 70% whereas qualitative parameters/ supervisory inputs will have weightage of 30%.

| Components of the proposed parametric analysis | | Parameter | Sub-Parameters | Sub-Para Weights | Parameter Weights | | Quantitative Parameter (70%) | 1. Size & Leverage | Total exposure (on- and off-balance sheet) & Leverage - total debt to total equity | 20 + 15 | 35 | | 2. Inter-connectedness | (i) Intra-financial system assets

• Lending to financial institutions (including undrawn committed lines);

• Holdings of securities issued by other financial institutions;

• Net mark-to-market reverse repurchase agreements with other financial institutions;

• Net mark-to-market OTC derivatives with financial institutions. | 10 | 25 | (ii) Intra-financial system liabilities

• Borrowings from financial institutions (including undrawn committed lines)

• All marketable securities issued by the finance company to financial institutions;

• Net mark-to-market repurchase agreements with other financial institutions;

• Net mark-to-market OTC derivatives with financial institutions | 10 | | (iii) Securities outstanding with non-financial institutions (issued by the NBFC) | 5 | | 3. Complexity | (i) Notional Amount of Over-the-Counter (OTC) Derivatives

• OTC derivatives cleared through a central counterparty

• OTC derivatives settled bilaterally | 5 | 10 | (ii) Trading and Available-for-Sale Securities | 5 | | Qualitative Parameter / Supervisory inputs (30%) | 4. Nature and type of liabilities | • The amount and type of liabilities, including the degree of reliance on short-term funding

• Liquid asset ratios, which are intended to indicate a nonbank financial company’s ability to repay its short-term debt.

• The ratio of unencumbered and highly liquid assets to the net cash outflows that a nonbank financial company could encounter in a short-term stress scenario.

• Callable debt as a fraction of total debt, which provides one measure of a nonbank financial company’s ability to manage its funding position in response to changes in interest rates.

• Asset-backed funding versus other funding, to determine a nonbank financial company’s susceptibility to distress in particular credit markets.

• Asset-liability duration and gap analysis, which is intended to indicate how well a nonbank financial company is matching the re-pricing and maturity of the nonbank financial company’s assets and liabilities.

• A study on the borrowings split by type i.e. Secured debt securities; subordinated debt securities; preferred shares/CCPS; CPs; unsecured debt; securitisation and any other | 10 | 30 | | 5. Group Structure | • Total Number of entities

• Total number of layers

• Total Intra group exposure | 10 | | 6. Segment penetration | The importance of the NBFC as a source of credit to a specific segment or area | 10 | | | | Total Score | 100 |

Issues for Discussion (3)

A. Is the scoring methodology for the quantitative and qualitative parameters adequate to identify NBFCs which have systemic significance?

B. Are there any suggestions on weights assigned to different parameters? | 3.5.3 Selection of sample for identification of NBFCs in Upper Layer- The parameter-based measurement approach may be based on a sample of NBFCs, which will work as a proxy for the NBFC sector. The NBFCs fulfilling the following criteria can be included in the sample: -

The sample will exclude the top ten NBFCs (as per asset size), as they will automatically fall in the Upper Layer of regulation. -

The sample will consist of next 50 NBFCs based on the total exposure, including off-balance sheet exposure; -

NBFCs designated as NBFC-UL in the previous year (unless supervisors agree that there is a compelling reason to exclude any one of them); and -

NBFCs added to the sample by supervisors using their supervisory judgment. Issue for Discussion (4)

A. Whether the sample of the top 50 NBFCs is appropriate or NBFCs above a certain specified asset size threshold should constitute the sample? | 3.5.4 Scoring Methodology – Based on the data received from NBFCs in the sample on the above indicators, a composite score will be calculated for identification of NBFC-UL. For each NBFC, the score for a particular indicator will be calculated by dividing the individual NBFC’s amount by the aggregate amount for the indicator summed across all NBFCs in the sample. The score for each category will be converted into basis points and the overall systemic significance of an NBFC will be computed as weighted average scores of all indicators. Thus, the systemic significance score of an NBFC would represent its relative importance with respect to the other NBFCs in the sample. NBFCs having scores above a threshold (to be decided by the Reserve Bank) will be classified as NBFC-UL and lie in the Upper Layer of the regulatory pyramid. However, for calculating the score of leverage, the individual score of the NBFC is divided by the average leverage of the sample under study (i.e. 50 largest NBFCs in terms of exposure) and later multiplied with the assigned weight for arriving at the score. Further, the computation of the composite score for qualitative parameters, will be based on the indicators suggested in para 3.4.2 of this chapter. It may be noted that top ten NBFCs as per asset size will automatically be identified as NBFC-UL and lie in the upper layer, irrespective of the fact whether they fit in to the other parameters or not. 3.6 Implementation Plan- The process of identification of NBFC-UL based on parametric analysis discussed above shall be conducted as a yearly exercise based on the following processes - -

Once identified as NBFC-UL, the NBFC will be advised individually about its classification as a NBFC-UL and that it will be subjected to regulation akin to banks. -

In view of the enhanced regulatory requirement, a time-period of 8 weeks will be provided to the NBFC to enable it to chart out a plan for implementation. Within the allotted time-period, the NBFC would have to put in place a Board approved policy towards the adoption of the enhanced regulatory framework. -

The Board approved policy will detail out the roadmap towards adherence of the guidelines, such that it complies with all of them within a maximum time-period of 18 months from the date of its declaration as a NBFC-UL. During the period of transition, calibrated increment to business may be allowed through supervisory engagement. -

The roadmap as approved by the Board towards implementation of the enhanced regulatory requirement will be submitted to the Reserve Bank and be subject to supervisory review at the time of annual inspection. Issue for Discussion (5)

A. Suitability of implementation plan, especially on maximum timeline suggested. | 3.7 Transition of NBFCs - Once an NBFC is identified as NBFC-UL, it will be subject to enhanced regulatory requirement at least for a period of four years from its last appearance in the category, even where it does not meet the parametric criteria in the subsequent year. Hence, if an identified NBFC-UL does not meet the criteria for classification for four consecutive years, it will move out of the enhanced regulatory framework. It may be noted that an NBFC-UL would be allowed to move out of the enhanced regulatory framework only if the movement is reflected as a voluntary strategic move as clearly laid out by its Board. However, if the reason to move down the regulatory layer is borne out of compulsion arising out of adverse market situations specific to the NBFC and deteriorating financials, it will not be allowed to move to a lower regulatory regime by the Reserve Bank till the entity attains sustainable financial health. Further, the identified NBFCs will also be informed about their status in the scale-based hierarchy well in advance so that they can initiate necessary remedial measures, in case they do not want to feature in the Upper Layer and get subjected to enhanced regulatory framework. They can utilise the window to scale down their operations and reduce interconnectedness and complexity to ensure that they continue to function as NBFC-ML rather than NBFC-UL. 3.8 Review of Assessment Methodology - The methodology for assessing the NBFC-UL will be reviewed on a regular basis i.e. at least once in four years. The review will take into consideration the functioning of the framework in the past years, theoretical developments internationally in the field of systemic risk measurement and methodologies adopted. The computation of systemic significance scores of all NBFCs in the sample will be performed annually based on the end-March data in the months of September-October every year. Chapter 4 - Proposed Scale-Based Framework 4.1 Overview - Regulatory framework of NBFCs shall be based on a four-layered structure– Base Layer (NBFC-BL), Middle Layer (NBFC-ML), Upper Layer (NBFC-UL) and Top Layer. Proposed regulatory framework for these layers is enumerated below. It may be noted that the regulatory framework envisages a progressive increase in the intensity of regulation. As has been discussed above, the extant regulatory framework for NBFC-NDs will now be applicable to Base Layer NBFCs while the extant regulatory framework applicable for NBFC-NDSI will be applicable to Middle Layer NBFCs. NBFCs residing in the Upper Layer will constitute a new category. The discussion paper is not a compilation of entire set of regulations applicable across different categories of NBFCs. In the following paras, only the revision proposed in the regulatory framework has been discussed. It may be important to note that the revisions applicable to lower layers of NBFCs will automatically be applicable to NBFCs residing in higher layers, unless there is a conflict or otherwise stated.  4.2 Structure and Regulatory Framework for NBFCs in Base Layer 4.2.1 Structure - The Base Layer will consist of NBFCs currently classified as non-systemically important NBFCs (NBFC-ND) besides Type I NBFCs, NOFHC NBFC-P2P and NBFC-AA. The current threshold for systemic importance is ₹ 500 crore. This threshold needs recalibration, taking into account increase in general price levels as well as increase in real GDP since 2014. Accordingly, the threshold is proposed to be revised to ₹1000 crore. Out of 9425 non-deposit taking NBFCs, 9133 NBFCs have asset size of less than ₹500 crore. If the current threshold of systemic significance is raised to ₹1000 crore, the number of NBFCs in this layer would go up by 76 to 9209. NBFCs featuring in this layer will be known as NBFC-Base Layer (NBFC-BL). 4.2.2 Raising the NOF – The minimum stipulated NOF for NBFCs was fixed at ₹2 crore by the Reserve Bank in April 1999. There has been a general increase in price levels and real GDP. Additionally, the risk perception in the sector has increased over the years. There is also a need to make necessary investments on IT enabled processes to ensure against risks of non-compliance with AML/KYC regulations and to address cyber security risks. Low entry point norms raise the chances of failure arising from poor governance of non-serious players. The ability of NBFCs to perform their role effectively and efficiently requires them to be adequately capitalised, financially resilient, and well-regulated so that they retain the confidence of their stakeholders including their lenders and borrowers. Reserve Bank’s regulatory architecture has been consistent with these objectives and it is now felt that there is a need for stronger entry point norms in the NBFC sector. Based on increase in prices, real GDP and regulatory judgement, the entry point norms will be revised from ₹2 crore to ₹20 crore. In order to ensure non-disruptive transition, a well-defined timeline will be prescribed for existing NBFCs, spanning over a period of, say, five years. For new registrations, the higher NOF norms will get implemented immediately on issue of instructions. 4.2.3 Regulatory Framework – NBFC-BL shall largely continue to be subjected to regulation as is currently applicable for NBFC-ND. However, as the threshold is being increased to ₹1000 crore, the regulatory framework can be supplemented by enhanced governance and disclosure standards. The specific changes in regulation will be: a) The extant NPA classification norm of 180 days will be harmonized to 90 days. It is usually argued that business cycle aspects of NBFC-clients often demand relaxed norms as their cash flows are uniquely different and often longer in frequency. However, such unique cash flow aspects of business should be factored by the NBFCs while fixing the due date for a customer. The NPA norm of 90 days overdue status would, therefore, not interfere with the business of the NBFC clientele. b) The overall role and responsibilities of the Risk Management Committee will be prescribed for these NBFCs. The decision on composition for the committee as a Board-level committee or executive-level committee will be left to be decided by the Board of the NBFC. c) It is proposed to prescribe that the Board will have adequate mix of experience and educational qualification among its members. At least one of the directors shall have experience in retail lending in a bank/ NBFC. The idea behind such changes is that less rigorous regulation should be supplemented by improved governance standards. d) Disclosure requirements will be widened by including disclosures on types of exposure, related party transactions, customer complaints, etc. Issues for Discussion (6)

A. Is the threshold of ₹ 1000 crore a correct identifier for NBFC-BL?

B. Are there any suggestions on the disclosure framework for NBFCs-BL?

C. Feedback on the proposed minimum NOF and the transition timelines.

D. Feedback on harmonization of NPA norms

E. Specific regulatory concessions to Type I NBFC | 4.3 Structure and Regulatory Framework for NBFCs in Middle Layer 4.3.1 Broad Structure - The Middle Layer shall consist of all non-deposit taking NBFCs classified currently as NBFC-ND-SI and all deposit taking NBFCs. This layer will exclude NBFCs which have been identified to be included in the Upper Layer. Further, NBFC-HFCs, IFCs, IDFs, SPDs and CICs, irrespective of their asset size, will be populated in this layer. NBFCs featuring in the Middle Layer will be known as NBFC-Middle Layer (NBFC-ML). NBFC-ML shall broadly be subjected to regulatory structure as applicable for NBFC-ND-SI and NBFC-D at present. However, adverse regulatory arbitrage posing systemic risk need to be addressed. These are discussed below. Further, regulations applicable to NBFC-BL will also become applicable to NBFC-ML, unless there is a conflict or otherwise stated. 4.3.2 Prudential Arbitrage 4.3.2.1 Capital Requirement – At present, NBFCs are on a Basel I type framework (i.e. uniform risk weights for counterparties, no capital for market risk or operational risk) and are required to maintain a minimum capital to risk weighted assets ratio (CRAR) of 15 per cent with minimum Tier I of 10 per cent (12 per cent for NBFCs lending predominantly against gold). For now, no changes are proposed in capital requirements for NBFC-ML. 4.3.2.2 Credit Concentration norms - At present, separate (but identical) limits are specified for lending and investment exposures on any single borrower (SBL) and a group of connected borrowers (GBL) linked to Owned Funds. In the case of banks, under the Large Exposure Framework (LEF), the limits are linked to Tier 1 capital. A comparison between the limits for NBFCs and banks is given in the table below: NBFC

(as a percentage of Owned Funds)* | Banks

(as a percentage of the Capital Base i.e. Tier I Capital) | | | Lending | Investment | Total | | Exposure | | Single borrower/ counterparty | 15 | 15 | 25 | Single Counterparty | 20# | | Group of borrowers/ parties | 25 | 25 | 40 | Groups of connected counterparties (using control and economic interdependence criteria) | 25 | * NBFC may exceed the concentration of credit / investment norms, by 5 per cent for any single party and by 10 per cent for a single group of parties, if the additional exposure is on account of infrastructure loan and / or investment. Further, concentration of credit / investment norms do not apply to NBFCs that do not issue guarantees and do not directly/ indirectly access public funds in India.

#In exceptional cases, Board of banks may allow an additional 5 percent exposure of the bank’s available eligible capital base. | The extant credit concentration limits prescribed for NBFCs for their lending and investment can be merged into a single exposure limit of 25% for single borrower and 40% for group of borrowers anchored to the NBFC’s Tier 1 capital. In other words, exposure ceilings will apply to the overall exposure, whether lending or investment. Further, the denominator is proposed to be changed from Owned Funds to Tier I capital, as is currently applicable for banks. 4.3.2.3 Introduction of Internal Capital Adequacy Assessment Process (ICAAP) - As in banks, NBFCs shall be subject to the requirement of having a Board approved policy on Internal Capital Adequacy Assessment Process (ICAAP). Internal capital can be assessed based on it by factoring credit, market, operational, and all other residual risks. The objective of ICAAP is to ensure availability of adequate capital to support all risks in the business as also to encourage NBFC to develop and use better risk management techniques for monitoring and managing their risks. This will also include an active dialogue between the Reserve Bank and the NBFCs, wherein the supervisor will have the freedom to review and evaluate the NBFCs’ internal capital adequacy assessments and strategies, as well as their ability to monitor and ensure compliance with the regulatory capital ratios. Supervisors can take appropriate supervisory action if they are not satisfied with the result of this process, which may include prescription of additional capital to be maintained. This would be of significance as NBFCs have different business models and hence one-size-fits-all approach may not be feasible, and, here, supervisory judgment will play an important role. 4.3.3 Governance Arbitrage 4.3.3.1 Rotation of Auditors - A uniform tenure of three consecutive years (subject to the firms satisfying the eligibility norms each year can be made applicable for statutory auditors (SA) of the NBFC. The SA/firm after completion of continuous audit tenure of three years, shall not be eligible for re-appointment as SA of the same NBFC for a period of six years (two tenures). 4.3.3.2 Chief Compliance Officer - Compliance culture is one of the key elements in the NBFC’s corporate governance structure. The compliance function has to be adequately enabled and made sufficiently independent so that it can ensure strict observance of all statutory and regulatory provisions. As such, to ensure an effective compliance culture, independent corporate compliance function and a strong compliance risk management programme, a functionally independent Chief Compliance Officer should be appointed, who should be sufficiently senior in the organization hierarchy. The CCO shall have direct reporting lines to the MD & CEO and/or Board/Board Committee (ACB) of the NBFC. In case the CCO reports to the MD & CEO, the Audit Committee of the Board shall meet the CCO quarterly on one-to-one basis, without the presence of the senior management including MD & CEO. The CCO shall not have any reporting relationship with the business verticals of the NBFC and shall not be given any business targets. Further, the performance appraisal of the CCO shall be reviewed by the Board/ACB. 4.3.3.3 Compensation Guidelines – Compensation Guidelines for NBFCs along the lines of banks can be considered to address issues arising out of excessive risk taking caused by misaligned compensation packages. Further, the compensation policy may also give due consideration to the financial soundness and performance of the NBFC. The guidelines may be suitably calibrated for NBFCs in the Middle Layer by prescribing, at the minimum, a) constitution of a Remuneration Committee, b) principles for fixed/ variable pay structures, and c) malus/ claw back requirements. The Nomination and Remuneration Committee will ensure that there is no conflict of interest in appointment of directors and their independence is not subject to potential threats. 4.3.3.4 Key Managerial Personnel - Key managerial personnel (whole time employee in the nature of CEO, CFO, CS and WTD) will not hold any office (including directorships) in any other NBFC-ML or NBFC-UL. In order to ensure that there is no conflict arising out of independent directors being on the Board of various NBFCs at the same time, including those of competing NBFCs, it is proposed that an independent director shall not be on the board of more than two NBFCs (NBFC-ML and NBFC-UL) in total. The onus of ensuring that there is no conflict, will lie with the Board of the NBFC. 4.3.3.5 Corporate Governance and Disclosure Requirements - Banks are on Basel III framework that envisages market discipline through disclosures under Pillar III. In contrast, NBFCs are under Basel I like norms. However, with NBFCs transitioning to Indian Accounting Standards (Ind AS), disclosure requirements are expected to improve with detailed disclosures prescribed on Financial Instruments, Fair Value Measurement, Operating Segments, etc. These disclosures are more comprehensive than those under the previous Generally Accepted Accounting Principles (GAAP). Over and above the current disclosure requirements prescribed for NBFC-ND-SI, there are certain disclosures prescribed for banks, which would be equally relevant for NBFCs in this Layer. Making some of these disclosure requirements applicable to NBFCs would bring greater transparency and at the same time provide a better understanding of the entity to the stakeholders. Additional disclosures which are proposed to be made applicable to NBFC-ML are: -

Corporate Governance report like composition and category of directors, relationship between directors, shareholding of non-executive directors, etc. -

Disclosure on modified (i.e. non-clean) opinion expressed by auditors, its impact on various financial items and views of management on audit qualifications. -

Items of income and expenditure of exceptional nature. -

Breach in terms of covenants, incidence/s of default -

Divergence in asset classification and provisioning based on inspection findings Further, Governance requirements which are proposed to be made applicable to NBFC-ML are: -

Compliance certificates by Chief Executive Officer and Chief Financial Officer covering various aspects including financial statements, absence of fraudulent/ illegal transactions, submissions to auditors, etc. -

Requirements for Secretarial Audit. -

Obligations of independent directors, senior management, key management personnel, directors and promoters -

Limits on directorships/ membership of committees of listed entities -

Role of various committees (Audit Committee, Nomination and Remuneration Committee, Stakeholder’s relationship, Risk Management) and review of information by Audit Committee -

Vigil mechanism and requirements pertaining to related party transactions. -

Corporate Governance requirements for subsidiaries of listed entities. 4.3.4 Other Areas of Arbitrage 4.3.4.1 Sectoral Exposure – NBFCs cater to niche sectors and hence there is a need to extend commensurate flexibility for their operations. Sensitive Sectors (capital market and commercial real estate) are inherently risky but they need adequate institutional finance. Specifying hard coded sector-specific exposure limits may tantamount to altering the basic business model and risk appetite of certain NBFCs. On the other hand, concentration risk resulting from undiversified portfolios, particularly in sensitive sectors, could prove detrimental to NBFCs’ health. As such, it would be appropriate for the regulator to leave it to the NBFC’s Board to decide internal limits on sensitive sector exposures, but it should be supplemented by adequate disclosures. Further, NBFCs will be advised to conduct a dynamic vulnerability assessment of various sectors and consider the same, while conducting their business. These details should also be disclosed to all stakeholders and be subject to supervisory review. The SSE internal ceiling should separately represent capital market and commercial real estate exposures. Initial Public Offer (IPO) financing by Individual NBFCs has come under close scrutiny, more for their abuse of the system. While there is a limit of ₹ 10 lakh for banks for IPO financing, there is no such limit for NBFCs. Taking in to account the unique business model of NBFCs, it is proposed to fix a ceiling of ₹1 crore per individual for any NBFC. NBFCs are free to fix more conservative limits. Further, a sub-limit within the commercial real estate exposure ceiling should be fixed internally for financing land acquisition. Housing Finance Companies are subject to specific regulation on sensitive sector exposure. Regulatory approach in this regard for HFCs will be determined based on the harmonization process envisaged in the instructions issued to HFCs on October 22, 2020. 4.3.4.2 Regulatory Restrictions on lending - Regulatory restrictions on loans and advances imposed on banks may not necessarily be applicable/ desirable for NBFCs in all respects. However, few of the restrictions, which should be extended to NBFCs in this Layer, are enumerated below: -

To not allow NBFCs to provide loans to companies for buy-back of shares/securities. -

Restrictions placed on granting loans and advances to directors, their relatives and to entities where directors or their relatives have major shareholding (10% or more of the paid-up share capital). -

Restrictions placed on granting loans and advances to officers and relatives of senior officers. -

To not allow NBFCs to extend finance for setting up of new units consuming/producing the Ozone Depleting Substances7 (ODS). -

While appraising loan proposals involving real estate, NBFCs to ensure that the borrowers have obtained prior permission from government / local governments / other statutory authorities for the project, wherever required. 4.3.4.3 Guidelines for sale of stressed assets – At present, there are instructions on sale of stressed assets by banks to Asset Reconstruction Companies (ARCs). These guidelines applicable to banks since 2003 were further revised in September 2016. The guidelines lay out the broad principles that the banks should adopt while undertaking such a sale. However, there are no corresponding guidelines for sale of stressed assets by NBFCs. Incidentally, a report on the subject was put in public domain for comments, recommendations of which are being examined by the Reserve Bank. Guidelines on sale of stressed assets by NBFCs will be modified on similar lines as that for banks. 4.3.4.4 Core Banking Solution (CBS) for NBFCs – Information Technology continues to be the single largest facilitating force behind the ease of transactions and analytical processing. Banks have implemented Core Banking Solution (CBS) which has brought significant benefits, including transparency, efficiency, reducing the scope for fraudulent flow and enhanced customer service experiences. It is suggested that NBFCs with 10 and more branches shall mandatorily be required to adopt Core Banking Solution. The Reserve Bank will give broad guidance on the subject along with a time line to achieve this without any disruption. Issues for Discussion (7)

A. Capital Requirement (Para 4.3.2.1) - Are the proposed capital requirements adequate to take care of loss absorbency in the NBFCs?

B. ICAAP (Para 4.3.2.3) - The Reserve Bank would like to elicit views on pros and cons of the proposed ICAAP.

C. Chief Compliance Officer (Para 4.3.3.2) - Should the role and responsibilities of CCOs be on similar lines as that of banks?

D. Independent Directors (Para 4.3.3.4) - The Reserve Bank would like to elicit views on the proposal to restrict independent directors to be on the Board of not more than two NBFCs in the Middle and Upper Layers.

E. Disclosure Requirements (Para 4.3.3.5) - Whether any other measures are suggested to strengthen governance and disclosure requirements?

F. Sensitive Sector Exposure (Para 4.3.4.1) - Are the suggested changes adequate to contain risks from SSE?

G. Core Banking Solutions (Para 4.3.4.4) - Is the threshold of 10 branches optimal? | 4.4 Structure and Regulatory Framework for NBFCs in Upper Layer – 4.4.1 Structure - The Upper Layer of the scale based regulatory framework shall consist of only those NBFCs which are specifically identified as systemically significant among NBFCs, based on a set of parameters mentioned in Chapter 3. Number for NBFCs which will reside in this layer would be dependent upon the composite score thrown by the parametric analysis. It may, however, be recalled that the top ten NBFCs (in terms of their asset size) will anyway reside in this layer, irrespective of any other factor. It is expected that a total of not more than 25 to 30 NBFCs will occupy this layer. The nomenclature of NBFCs identified in this layer shall be termed as NBFC-Upper Layer (NBFC-UL). 4.4.2 Regulatory Framework - In addition to the regulations applicable to NBFC-ML, a set of additional regulations will apply to NBFC-UL. In view of their large systemic significance and scale of operations, the regulation of NBFC-UL will be tuned on similar lines as those for banks, though providing for the unique business model of the NBFCs as also preserving flexibility of their operations. The suggested additional regulatory tools are mentioned below. 4.4.2.1 Capital Regulation -

Capital Requirements: Scheduled commercial banks are on a Basel III framework which provides for minimum requirements for Common Equity Tier 1 (CET 1) capital. It is felt that CET 1 could be introduced for NBFC-UL to enhance the quality of regulatory capital. It is proposed that CET 1 may be prescribed at 9% within the Tier I capital. -

Leverage: In addition to the CRAR requirements, NBFCs will also be subjected to a leverage requirement to ensure that the growth of the NBFC is supported by adequate capital. A suitable ceiling for leverage will be prescribed for these entities, which would act as a backstop for further growth of the NBFCs to a desired level. -

Standard asset provisioning: Systemically important NBFCs are currently subject to a flat rate of 0.40% as standard asset provision whereas, banks are subjected to differential rate of standard asset provisioning. (for example: farm credit and SME@ 0.25%, CRE @ 1.00%, CRE-RH @ 0.75%, and all other loans 0.40 %). In order to tune the regulatory framework for NBFC-UL to greater sensitivity, it is suggested that NBFCs falling in Upper Layer are prescribed differential standard asset provisioning on lines of banks. These NBFCs are already under Ind AS and the accounting standards demand allowances based on 12-month expected credit losses in place of standard asset provisioning. However, NBFCs must reckon differential standard asset provisioning to arrive at the prudential floor envisaged under regulatory guidelines for implementation of Indian accounting Standards. 4.4.2.2 Credit concentration norms and applicability of Large Exposure Framework - As per the extant norms, banks are permitted to take a single counterparty exposure to the extent of 20% of eligible capital base while the Board may allow additional 5%, whereas a limit of 25% is applicable for a group of connected counterparties, subject to the LEF framework. In case of NBFCs, there are separate limits for lending, investment and for both lending and investment put together. As suggested for NBFC-ML, the proposal is to merge the two limits while retaining the overall ceiling. Further, in view of the higher systemic risk posed by NBFC-UL, the LEF as applicable to banks, can be extended with suitable adaptation (to take care of heterogeneity and flexibility of operations of the NBFCs) along with a transition time for implementation. 4.4.2.3 Listing and Corporate Governance- NBFCs deemed to pose higher systemic risk need to maintain highest corporate governance standards and a diffused ownership structure to minimise the possibility of abuse of dominance. Since NBFCs lying in the Upper Layer have ability to cause adverse systemic risks, the regulatory tools can be calibrated on the lines of the private banks; that is, such NBFCs should be subject to mandatory listing requirement and should follow the consequent Listing Obligations and Disclosures Requirements. It may however be noted that the disclosure requirements have to be put in place before the actual listing of the NBFC, as per the provisions of the board approved implementation plan mentioned at Para 3.5 of Chapter 3. In order to ensure a non-disruptive transition, adequate phase-in time will be provided in the implementation plan. Additionally, following governance regulations are also suggested for these NBFCs- -

Qualification of Board members – Board members shall be qualified for their positions. They should understand their oversight and corporate governance role and be able to exercise sound, objective judgment about the affairs of the NBFC. The composition of the Board should ensure mix of educational qualification and experience within the Board. Specific expertise of Board members will be a prerequisite depending on the type of business pursued by the NBFC. -

Removal of Independent Directors before completion of their normal tenure will be subject to approval by the supervisors. -

Group Structure – It will be ensured that the group structure is not complex and opaque. The same may be based on the supervisory judgement and based on factors indicated in the qualitative parametric analysis proposed in Chapter 3. NBFCs will provide detailed disclosure on group companies including consolidated financial position and details of related party transactions. -

Remuneration policies - Guidelines on compensation for Whole Time Directors / Chief Executive Officers / Other Risk Takers will be framed on the lines as applicable to Private Sector Banks. The Remuneration Committee will be vested with greater responsibility in this regard. 4.4.2.4 Other Areas of Arbitrage Sectoral Exposure - The extant regulatory framework for banks specifies limits on capital market exposure linked to net worth as at March 31 of the previous year. While no limits are in place for real estate, there is a requirement for a Board-approved policy coupled with disclosure requirements and differential risk weights. In comparison, there are no specific sectoral restrictions for NBFCs’ exposures to capital market or real estate sector. NBFC-UL, on account of their large size and interconnectedness, may be particularly vulnerable to concentration risks arising from Sensitive Sector Exposures (SSEs). NBFCs may fix SSE ceilings based on internal board approved policy. HFCs will continue to be guided by the extant prescriptions applicable to them as far as CRE is concerned. Apart from proposed framework for SSE suggested for NBFCs in this Layer, the question considered is whether limits should be placed also on exposure to other specific sectors of the economy. Considering the unique nature of NBFCs, it will be incumbent upon the Board of NBFCs to determine internal exposure limits on other important sectors. Further, these NBFCs shall also have an internal Board approved limit for exposure to the NBFC sector. Issues for Discussion (8)

A. Capital Regulation (Para 4.4.2.1) - In addition to leverage and differential standard asset provisioning, should any other tool be prescribed?

B. Credit Concentration (Para 4.4.2.2)- The Reserve Bank would like to elicit views on extending LEF to NBFCs in this Layer and specific adaptions needed.

C. Listing Requirements (Para 4.4.2.3)- The Reserve Bank would like to elicit views on the requirement of mandatory listing and the timeline to adhere to this requirement.

D. Disclosure Requirements – (Para 4.4.2.3 (iii))- Feedback on additional disclosure requirements to depict that the group structure is not complex and opaque. | 4.5 Structure and Regulatory Framework for NBFCs in Top Layer - The Top Layer is supposed to remain empty. The layer can get populated in case the Reserve Bank takes a view that there has been unsustainable increase in the systemic risk spill-overs from specific NBFCs in the Upper Layer. Such NBFCs judged to be extreme in supervisory risk perception would be pushed to the Top Layer from the Upper Layer. NBFCs in this Layer will be subject to higher capital charge, including Capital Conservation Buffers. There will be enhanced and more intensive supervisory engagement with these NBFCs. This will offer a framework for any NBFC to grow in size and complexity, provided it is able to build up capital commensurate with the additional risks and subject itself to intense supervisory scrutiny. 4.6 Structural Arbitrage – Given the fact that legislative foundation of regulation of NBFCs is established on a different footing compared with banks the resultant structural arbitrage will continue to exist. The proposed scale-based approach to regulation is not based on any recommended legislative change. However, going forward, a comprehensive legislative solution would be required to address the issue of resolution of failing NBFCs8 to take care of the unique nature of resolution of financial institutions including the need to protect depositors’ interest, avoiding moral hazard, ensuring continuity of critical financial services, etc. Issue for Discussion (9)

Whether the extant structural arbitrage arising out of legislative foundation needs to be addressed in any specific area? | Summary chart of the suggested regulatory changes across different layers of the regulatory pyramid for NBFCs is attached as Annex 2 to this discussion paper.

Annex –1 Comparative Chart on Regulatory Features | Regulation | NBFC-ND-SI | HFCs | Banks | | Structural Arbitrage | | Entry Point Norms and Listing Requirements | Minimum net owned fund (NOF) required is ₹2 crore.

No mandatory listing requirements. | Minimum net owned fund required is ₹20 crore.

No mandatory listing requirements. | Minimum required initial paid up voting equity capital

(i) on-tap licensing of universal banks in the private sector - ₹500 crore.

(ii) For Small Finance Banks - ₹200 crore.

Listing requirements

(i) For a new universal bank - required to get its shares listed on a stock exchange within six years of commencement of operations.

(ii) For Small Finance Bank - to be mandatorily listed within three years of reaching a net worth of ₹500 crore for the first time. | | Resolution of stressed assets | The resolution mechanism as applicable to banks is made largely applicable to NBFC-ND-SI and NBFC-D. | No resolution mechanism except as available in NHB directions. | Resolution mechanism issued in June 2019 | | Unquoted/ Unlisted Investment | Only for deposit taking NBFCs with a cap of 20% of Owned Fund. | No limits | Investment in unlisted non-SLR securities should not exceed 10 per cent of total investment in non-SLR securities as on March 31. | | Branch Licensing | No guidelines (except for gold loan NBFCs wherein a need to take prior approval to open branches if it exceeds 1000 branches) | Prior information to be submitted to the supervisor. | Have a branch authorization policy which details out the manner in which they can open the branches. | | Prudential Arbitrage | | CRAR | (i) 15 percent of aggregate RWAs.

(ii) Based only on credit risk capital charge

(iii) Min Tier I – 10%

No bifurcation as CET 1 or Additional Tier I (AT 1) | (i) 15% of aggregate RWAs by March, 2022.

(ii) Based only on credit risk capital charge

(iii) Min Tier I – 10%

No bifurcation as CET 1 or Additional Tier I (AT 1) | (i) 9% (11.5% including CCB)

(ii) Based on credit, market and operational risk capital charges

(ii) Min. Tier I – 7% | | Leverage | No prescribed Leverage | 14 times of NOF to come down to 12 times by March 31, 2022 | Minimum of 4% for DSIBs and 3.5% for other banks | | Classification as NPA | Interest and / or installment has remained overdue for a period of 3 months or more. | Interest and / or installment has remained overdue for a period of more than 90 days. | Interest and / or instalment of principal remain overdue for a period of more than 90 days. | | Substandard assets | NPA for a period not exceeding 12 months | NPA for a period not exceeding 12 months | NPA for a period less than or equal to 12 months | | Doubtful assets | Substandard for a period exceeding 12 months | Substandard for a period exceeding 12 months | Substandard for a period of 12 months | | Provisioning for standard assets | 0.40% | Individual housing- 0.25%

CRE - 1.00%

CRE-RH - 0.75%

Teaser rate Housing loans - 2.00%

All other loans - 0.40% | Farm credit and SME 0.25%

CRE 1.00%

CRE-RH 0.75%

All other loans 0.40% | | Target under priority sector lending | Not mandated. | Not mandated. | 40 per cent of Adjusted Net Bank Credit or credit equivalent amount of off-balance sheet exposure, whichever is higher; 75% for SFBs | | Risk weights under capital adequacy | Risk weights fall in the range of

(i) 0% - sovereign exposures, sovereign guaranteed exposures, cash & bank balances, TDS, advance tax, etc.

(ii) 20% - bonds of public sector banks, State Govt. guaranteed claims which have not remained in default for a period not more than 90 days

(iii) 50% - All assets covering PPP and post COD infra projects with one year of successful completion

(iv) 100% - for all other assets | Risk weights fall in the range of

(i) 0% - sovereign exposures, sovereign guaranteed exposures, cash & bank balances, advance taxes, etc.

(ii) 20% - bonds of public sector banks, State Govt. guaranteed claims which have not remained in default for a period not more than 90 days

(iii) 35% to 100% - for various housing loans based on LTV, amount of exposure, asset classification, etc. (restructured housing loans will attract additional 25% risk weight)

(iv) 50% - MBS issued by HFCs, banks, etc.

(v) 75% - CRE (RH)

(vi) 100% - CRE and all other assets

(vii) 100% - for all other assets

(viii) 125% - MBS and securitized exposures backed by CRE | (i) Claims on NBFCs, corporates other than those specified are as per the ratings assigned.

(ii) Fund based and non-fund based claims on Venture Capital Funds – 150%

(iii) Claim identified as a high-risk exposure by the Bank – 150%

(iv) Credit card receivables, capital market exposures – 125%

(v) Capital instruments issued by financial entities (other than banks and NBFCs) -125%

(vi) Equity instruments (not deducted) issued by financial entities (other than banks and NBFCs) – 250%

(vii) Loans and advances to bank’s own staff which are fully covered - 20%

(viii) Regulatory retail loans - 75% | | Credit Concentration norms | As a % of Owned Funds

(i) Lend to / Invest in:

Single party – 15% each; Group – 25%

(ii) Lend to and invest in (taken together) Single party - 25%;

Group 40%

These are not applicable to NBFCs not accessing public funds in India | As a % of Owned Funds

(i) Lend to / Invest in:

Single party – 15% each; Group – 25%

(ii) Lend to and invest in (taken together) Single party - 25%;

Group 40%

Norms not linked to access of public funds | As a % of bank's available eligible capital base at all times

(i) Single counterparty - 20%, Board may allow additional 5%

(ii) Group of connected counterparties – 25% (increased to 30% till June 30, 2021) | | Liquidity Guidelines | (i) 10 maturity buckets,

(ii) net cumulative negative mismatches in the maturity buckets of 1-7 days, 8-14 days, and 15-30 days shall not exceed 10%, 10% and 20% of the cumulative cash outflows in the respective time buckets;

(iii) conduct stress tests on a regular basis for a variety of short-term and protracted NBFC-specific and market-wide stress scenarios;

(iv) For NBFC-ND-SI with asset size more than ₹ 5000 crore and all deposit taking NBFCs irrespective of their size, LCR is made applicable in a phased manner so as to achieve 100% by December 2024. | (i) 10 maturity buckets,

(ii) net cumulative negative mismatches in the maturity buckets of 1-7 days, 8-14 days, and 15-30 days shall not exceed 10%, 10% and 20% of the cumulative cash outflows in the respective time buckets;

(iii) conduct stress tests on a regular basis for a variety of short-term and protracted NBFC-specific and market-wide stress scenarios;

(iv) All non-deposit taking HFCs with asset size of ₹5,000 crore & above, and all deposit taking HFCs irrespective of their size, LCR is made applicable in a phased manner so as to achieve 100% by December 2025. | (i) 10 maturity buckets with greater granularity,

(ii) Net cumulative negative mismatches during the next day, 2-7 days, 8-14 days and 15-28 days buckets should not exceed 5 %, 10%, 15 % and 20 % of the cumulative cash outflows in the respective time buckets,

(iii) Stress testing guidelines require banks to hold additional capital and liquidity buffers under Pillar 2 of Basel II and Basel III framework.

(iv) LCR to be maintained at 100%

(v) NSFR made applicable in a phased manner. | | Corporate Governance | | Corporate Governance | (i) Constitution of Committees of the Board – Audit Committee, Nomination Committee, Risk Management Committee.

(ii) IS Audit to be conducted at least once a year;

(iii) Policy in place for fit and proper criteria;

(iv) Rotation of partners of the Statutory Auditors.

(v) Fit and proper criteria for directors | (i) Constitution of Committees of the Board – Audit Committee, Nomination Committee, Risk Management Committee.

(ii) IS Audit similar as for NBFCs;

(iii) Policy in place for fit and proper criteria;

(iv) Rotation of partners of the audit firm | For commercial banks listed in stock exchanges the corporate governance guidelines to be followed are in line with those prescribed by SEBI Listing Obligations and Disclosure Requirements (LODR) Regulations | | Other Areas | | Sectoral Exposures | Not applicable | Exposure to capital market – ceiling of 40% of Net Worth (solo basis); 20% of NW in direct exposure. | Large Exposure Framework for different categories.

(i) Exposures to a single NBFC is restricted to 15 percent of the eligible capital base and group of NBFCs to 25%.

(ii) Exposure to capital market in all forms – 40% of Net Worth (solo basis); 20% of NW in direct exposure.

On Consolidated basis 40% of consolidated NW and within it 20% of consolidated NW as direct exposure

(iii) internal limits for CRE

(iv) limit on exposure to hold shares in a company; lower of 30% of its own paid up capital and reserves or 30% of paid-up equity of that company | | Lending Against shares (LAS) | Applicable to NBFC with asset size of ₹ 100 crore and above

(i) LTV of 50%

(ii) lending for investment in capital market against Group 1 securities – no limit

(iii) other than Group I security – limits ₹ 5 lakhs

(iii) Report on-line to stock exchanges on a quarterly basis, information on the shares pledged in their favour, by borrowers for availing loans | (i) LTV of 50%

(ii) lending for investment in capital market against Group 1 securities – no limit

(iii) other than Group I security – limits ₹ 5 lakhs

(iii) Report on-line to stock exchanges on a quarterly basis, information on the shares pledged in their favour, by borrowers for availing loans | (i) LAS to not exceed ₹10 lakh if held in physical form and ₹20 lakh if in dematerialized form.

(ii) minimum margin of 50 percent of the market value