Issued for Discussion DRG Studies Series Development Research Group (DRG) has been constituted in Reserve Bank of India in its Department of Economic and Policy Research. Its objective is to undertake quick and effective policy-oriented research backed by strong analytical and empirical basis, on subjects of current interest. The DRG studies are the outcome of collaborative efforts between experts from outside Reserve Bank of India and the pool of research talent within the Bank. These studies are released for wider circulation with a view to generating constructive discussion among the professional economists and policy makers. Responsibility for the views expressed and for the accuracy of statements contained in the contributions rests with the author(s). There is no objection to the study published herein being reproduced, provided an acknowledgement for the source is made that the study was funded by the Reserve Bank of India under the DRG Study Series. The reproduced study should not contradict the findings of the original DRG study. Further, the reproduced study may be published with the same set of authors as the original DRG study. DRG Studies are published in RBI web site only and no printed copies will be made available. Director

Development Research Group |

Determinants of Financial Literacy and Financial

Inclusion in North-Eastern Region of India:

A Case Study of Mizoram by Bhartendu Singh1

Raj Rajesh

Ramesh Golait

K. Samuel L. Abstract The present study evaluates the determinants of the status of financial inclusion and financial literacy in the under-banked North-Eastern Region of India based on field survey-data in the State of Mizoram. The survey indicated that there was limited financial awareness in the study region, about 32 per cent of the respondents were not aware of any financial products except the savings bank account. About 20 per cent of the respondents reported lack of knowledge of the basic payment options and about 43 per cent of the respondents reported knowledge but lack of usage of these options. About half of the respondents were found to be unaware of the financial institutions other than banks, viz., non-banking financial companies, microfinance institutions and small finance banks. It was also found that use of life insurance products was low among respondents. The financial inclusion score and financial literacy score for the study region were generated using the OECD/INFE (Organisation for Economic Co-operation and Development/ International Network on Financial Education) Toolkit for measuring financial literacy and financial inclusion. The average financial literacy score estimated in the study was 14.37 on a scale of 0 to 21 (i.e., 68.43 per cent) and the average financial inclusion score was 3.35 on a scale of 0 to 7 (i.e., 47.86 per cent). Several factors based on the literature were identified and tested in terms of their effect on financial inclusion and financial literacy using suitable econometric techniques, including a logistic regression framework. Among the identified factors, the place of residence (block), employment type and nature of family (joint versus nuclear) of the respondents were seen to strongly influence their financial inclusion and financial literacy status. JEL Codes: G2, G18, G29, G21, G23 Keywords: Financial institutions and services, government policies and regulations, banks, financial institutions

Acknowledgement The authors are profoundly grateful to the Local Board for Eastern Area, RBI for conceptualisation of the study. The authors take this opportunity to extend their thanks to the participants of the Department of Economic and Policy Research (DEPR) Study Circle seminar of RBI for useful comments on an earlier draft of the study. Authors are also grateful to an anonymous external referee for very detailed suggestions and generous comments on the study. The authors would also like to thank Dr. Deba Prasad Rath, Principal Adviser, DEPR for insightful suggestions and encouragement. Authors would also like to thank Dr. Pallavi Chavan, Director, DRG, DEPR, and her team members for their comments and support throughout the study. Nonetheless, the views expressed in this study are those of the authors alone and not of the organisations they are attached to. The authors only are responsible for errors and omissions, if any. Bhartendu Singh

Raj Rajesh

Ramesh Golait

K. Samuel L.

Executive Summary Financial inclusion relates to the access to financial products and services. It is not limited to the basic access to deposits, but extends to the access to various financial services, including investments, credit, payments and insurance. Financial literacy provides basic knowledge and skills to analyse and understand financial products and services and assists in taking informed financial decisions. Financial inclusion without financial literacy may lead to exploitation as consumers may not be in a position to choose the right products and may end up taking uninformed decisions. On the other hand, financial literacy without financial inclusion is akin to providing skills without an opportunity to apply the same. In the long run, however, financial literacy takes people closer towards financial inclusion as there is a high likelihood that an aware person will seek access to finance and also achieve it. Against this backdrop, the present study was conceived to look into various factors impacting financial literacy and financial inclusion in the north-east taking Mizoram as the site of the study. The study is based on primary data collected through a structured questionnaire. Total 523 respondents were selected from eight blocks, covering four districts, of Mizoram. The factors2 identified for the study are based on extensive review of the literature and the existing financial situation in Mizoram. The survey indicated that there was a limited financial awareness in the study region. About 32 per cent of the respondents were not aware of any financial products except the savings bank account. About 20 per cent of the respondents reported lack of knowledge of the basic payment options and about 43 per cent of the respondents reported knowledge but lack of usage of these options. About half of the respondents were found to be unaware of the financial institutions other than banks, viz., non-banking financial companies, microfinance institutions and small finance banks. It was also found that use of life insurance was low among respondents. The financial inclusion score and financial literacy score for the study region was generated using the OECD/INFE (Organisation for Economic Co-operation and Development/ International Network on Financial Education) Toolkit for measuring financial literacy and financial inclusion. The average financial literacy score estimated in the study was 14.37 on a scale of 0 to 21 (i.e., 68.43 per cent). The average financial inclusion score was found to be 3.35 on a scale of 0 to 7 (i.e., 47.86 per cent). Out of 27 factors considered for the study as possible determinants of financial inclusion and financial literacy, the place of residence (block) was found to have large effect on both. Besides this, the type of employment and type of family (joint versus nuclear) also moderately influenced financial literacy. The subjects studied by the respondents as part of academic curriculum were also found to have moderate effect on financial inclusion. The financial literacy and financial inclusion were found to have a negligible effect on each other. The relatively lower level of economic development, particularly financial development in the north-eastern region (NER), as reflected in relatively lower credit intermediation, is a major concern from policy perspective. In this context, the study highlights the need to conduct a greater number of financial literacy workshops, especially for the people belonging to the vulnerable groups at regular intervals in the region. Moreover, the development and outcome of such workshops need to be closely monitored by the funding agencies.

Determinants of Financial Literacy and Financial Inclusion

in North-Eastern Region of India: A Case Study of Mizoram Introduction Financial literacy provides basic knowledge and skills to analyse and understand financial products and services and assists in taking informed financial decisions. Financial inclusion relates to the access to financial products and services. It is not limited to the basic access to deposits, but extends to the access to various financial services, including investments, credit, payments and insurance. Financial inclusion without financial literacy may lead to exploitation as consumers may not be in a position to choose the right products and end up taking uninformed decisions. On other hand, financial literacy without financial inclusion is akin to providing skills without an opportunity to apply the same. In the long run, however, financial literacy takes people closer towards financial inclusion as there is a high likelihood that a financially aware person will seek access to finance and also achieve it. The Organisation of Economic Cooperation and Development (OECD) defines financial literacy as a combination of financial awareness, knowledge, skills, attitude and behaviour necessary to make sound financial decisions and ultimately achieve individual financial well-being. People achieve financial literacy through a process of financial education. According to the Reserve Bank’s ‘Committee on Financial Inclusion’ (Chairman: Dr. C. Rangarajan) (RBI, 2008), financial inclusion is the process of ensuring access to financial services, timely and adequate credit for vulnerable groups such as weaker sections and low-income groups at an affordable cost. Financial literacy and financial inclusion are associated with each other. While there may be a positive correlation between the two, it is interesting to know if these two share a causal relation. It has been found in few studies that people who are financially included are not necessarily financially literate and many otherwise financially literate people are actually not financially included. Different studies in different places have arrived at contradictory findings, like there are studies which concluded that financial education results into higher savings for an individual in his/her lifespan later (Bernheim et al., 1997; Lusardi, 2003). However, some other studies could not find conclusive evidence that financial education improves personal financial decisions (Mandell, 2006; O’Connell, 2008). In the light of these contradictory results, it is interesting to know the other factors that have positive or negative impact on financial inclusion and financial literacy. The North Eastern Region (NER) of India, comprising eight States namely, Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Tripura and Sikkim, is characterised with a unique socio-cultural segment and predominantly semi-urban and rural areas encompassing hilly geographic terrain. The NER, home to 3.8 per cent of the national population, occupies about 8 per cent of India’s total geographical area, and is strategically important with over 5,300 km of international borders. Economic activity and banking parameters of the NER States, however, have remained unfavourable vis-à-vis all-India figures. At the same time, there remains a significant diversity in the level of development among the north-eastern States. The Government of India, Reserve Bank of India and the respective State governments have been making special efforts for an all-round development of the region. Recognising the critical role of financial sector in economic development, and to investigate the issues limiting the success in achieving financial inclusion in NER, the Reserve Bank constituted a committee on ‘Financial Sector Plan for NER’ (Chairperson: Smt. Usha Thorat, 2006). Further, to address the issues related to development of the Micro, Small and Medium Enterprises (MSMEs) sector in NER, a separate sub-group was constituted under the Prime Minister’s task force on MSMEs (Chairman: Shri T.K.A. Nair) in 2009. It was also emphasised in the literature that financial inclusion and development of NER holds the key to balanced regional economic prosperity (Rajan, 2016). The relatively low level of economic development, in general, and financial development in particular, of NER, as reflected in relatively lower credit intermediation, is a major concern from policy perspective. In this context, the rest of the study is organised as follows: Section 2 lays out the objectives and rationale for choosing the State of Mizoram for the study. Section 3 highlights the socio-economic profile of the State. Section 4 presents the literature review. Section 5 provides the banking landscape of Mizoram economy. Section 6 presents empirical results and Section 7 concludes the study. 2. Objectives and Rationale for Choosing Mizoram for the Study The objectives of this study are set out as follows: -

To understand the architecture and ecosystem of Mizoram’s economy using secondary data; -

To estimate the financial inclusion score of the State; -

To analyse the factors, which determine financial inclusion in the State; -

To estimate the level of financial literacy in the State; -

To analyse the factors, which determine financial literacy in the State; -

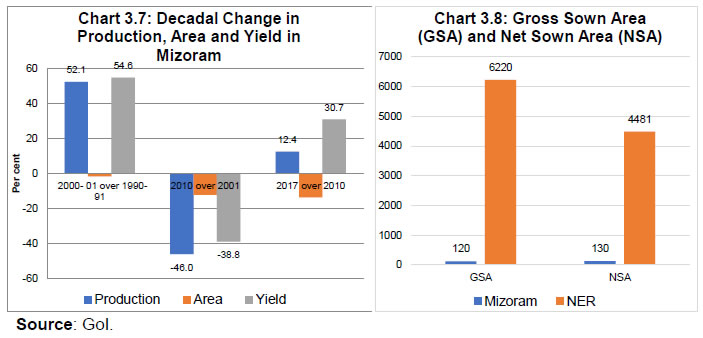

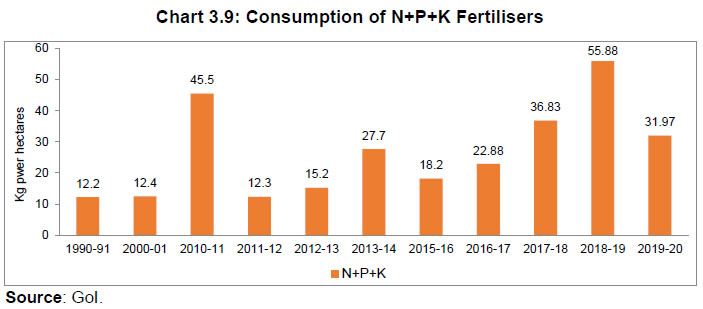

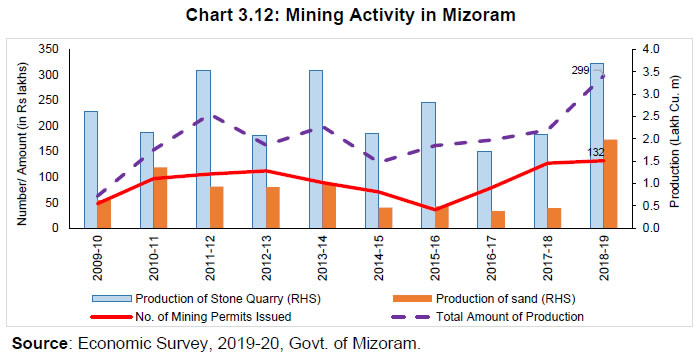

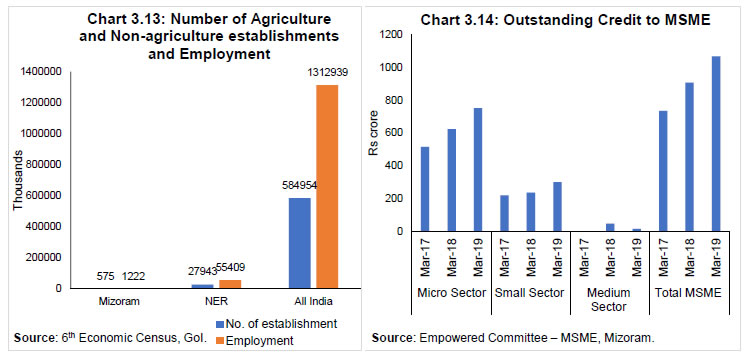

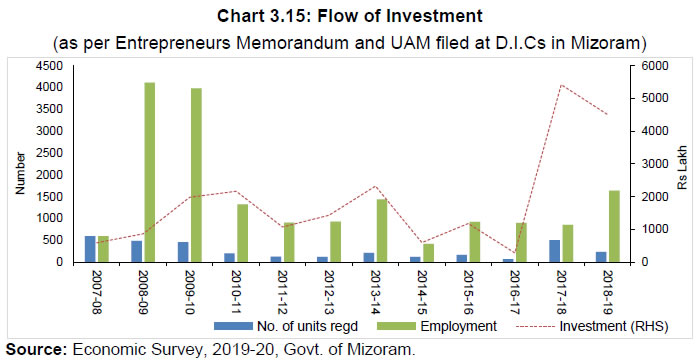

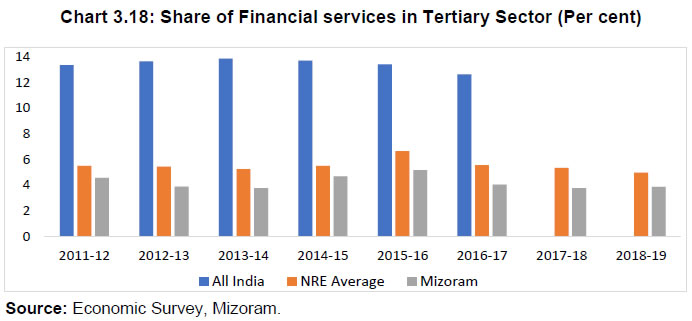

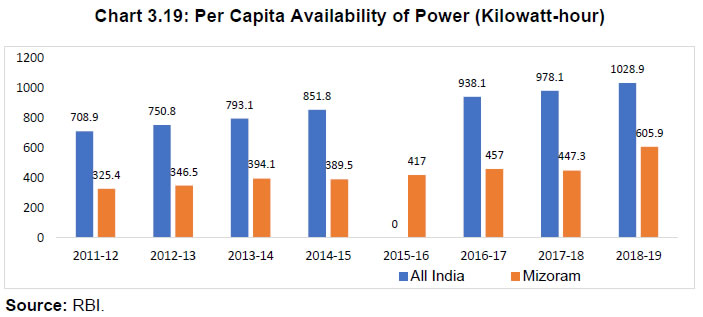

To assess public awareness about various government schemes (such as Direct Benefit Transfer (DBT), Pradhan Mantri Mudra Yojana (PMMY), PM Jan Dhan Yojna (PMJDY), etc.). As per CRISIL (2018) Inclusix Score, North East Region (NER) is the least financially included region of India. Mizoram stood 31st among all the States in India by CRISIL Inclusix Score, though it is one of the most urbanised States of India. At the time of the survey conducted by CRISIL, out of eight districts, seven were ranked below 440 among all the districts of India. The capital of the State, Aizawl, stood at 294th in rank. Interestingly, Mizoram is found to enjoy high branch penetration and above-average credit and deposit penetration as compared to other States. Further, as per the Census of India 2011, it is the second-most literate State in India whereas as second-least financially literate State as per National Centre for Financial Education Report, 2013. The banking development in NER, including Mizoram, is a phenomenon post-bank nationalisation in 1969. Prior to it, no bank branch of commercial bank existed in Mizoram. In the year 1972, when it was accorded the status of a Union Territory, the whole of the State was served by a single branch of State Bank of India (SBI). Even today, the banking penetration remains highly skewed in terms of location. Furthermore, unlike other States, only one regional rural bank (RRB) serves whole of the State. The studies focusing on financial inclusion and financial literacy in the State are less in number. All these aspects make the State an interesting case study to understand the factors influencing financial inclusion and financial literacy in a hilly State with a difficult geographical terrain. 3. Socio-Economic Profile of Mizoram The State is situated in the southern corner of NER. The word ‘Mizoram’ is a combination of two words of local language, viz., Mizo and Ram. The word “Mizo” means ‘native inhabitants’ while “Ram” means ‘land’, thus “Mizoram” means ‘land of the Mizos’. It was known as Lushai Hills District of Assam till 1954 and then was renamed as Mizo Hills District of Assam until 1972, when it was carved out and given the status of a Union Territory. It continued as a Union Territory until 1987, when it was declared as the 23rd State of India on February 20, 1987 by the 53rd Amendment of the Indian Constitution. 3.1 History and Geography of Mizoram Mizoram is a land-locked State sharing its borders with three Indian States, viz., Tripura (277 Kms) in the northwest, Assam (123 Kms) in the north and Manipur (95 Kms) in the northeast. It shares its boundary with two neighbouring countries, viz., Myanmar (404 Kms) in the east and south and Bangladesh (318 Kms) in the west. It had three districts when it was given the status of a State (1987), viz., Aizawl, Lunglei and Lawngtlai. In the year 1998, five new districts were created, viz., Kolasib, Mamit, Serchhip, Champhai (carved out of Aizawl) and Saiha (carved out of Lawngtlai). Recently on June 03, 2019, three new districts were added, viz., Hnahthial (carved out of Lunglei), Khawzawl (carved out of Champhai) and Saitual (carved out of Aizawl and Champhai). About 95 per cent of population in State is of diverse tribal origins, mostly from Southeast Asia, who were settled over waves of migration since 16th century but mainly in 18th century. It has the highest concentration of tribal people among all States in India, and they are currently protected under the Indian constitution as a Scheduled Tribe. The tribes adopted Christianity over the first half of 20th century. Now, it is one of the three States of India with a Christian majority (87 per cent). Its people belong to various denominations, mostly Presbyterian in north and Baptists in south. It is a highly literate agrarian economy; however, it suffers from slash-and-burn jhum or shifting cultivation, and poor crop yields. In recent years, the jhum farming practices are steadily being replaced with a significant horticulture and bamboo products industry. The State has about 871 kilometres of national highways, with NH-54 and NH-150 connecting it to Assam and Manipur respectively. It is also a growing transit point for trade with Myanmar and Bangladesh. It is a land of rolling hills, valleys, rivers and lakes. As many as 21 major hill ranges or peaks of different heights run through the length and breadth of the State. As per the State of Forest Report, Mizoram has the highest forest cover as a percentage of its geographical area, i.e., 84.5 per cent. The fabric of social life in the Mizo society has undergone tremendous changes over years. Before the British moved into the hills, the village and the clan formed units of Mizo society for all practical purposes. Mizos are giving up their old customs rapidly and adopting new modes of life, which is greatly influenced by the western culture. Many of their present customs are mixtures of their old traditions and western pattern of life. 3.2 Architecture of the Mizoram Economy: A Sectoral Analysis In line with the trend in structural shift in other States, the share of agriculture has declined and the share of industry and services sector in gross state value added (GSVA) has picked up (Chart 3.1). Within the agriculture sector, ‘forestry and logging’ (accounting for more than half of the agriculture and allied sector) dominates and its share has expanded in the last couple of years with a corresponding shrinkage in the share of crops, livestock and fishing and aquaculture (Chart 3.2). Mizoram is richly endowed with bamboo forests, which broadly cover half of the State’s land. It has the largest bamboo cover as a proportion of its geographical area in the country. It produces a variety of bamboo-based handicraft products and exports bamboo and teak wood to Bangladesh. The handloom production, estimated to be Rs.6 crore, generates several non-farm employment. It has great potential for export under the Look East Policy of the Government of India, given the similarity of fabrics being worn by the inhabitants of the South East Asian countries as produced by local weavers of the State. In line with the all-India trend, despite the decline in the share of agriculture in GSVA, the State economy is primarily agrarian with 60 per cent of the population depending, directly or indirectly, on agriculture. Rest of the working population is engaged in government jobs, small businesses and transport activities. Within the industrial sector, ‘electricity, gas, water supply and other utility services’ dominates with 56.4 per cent share in the industrial sector followed by ‘construction’ with 39.8 per cent share in 2019-20 (Chart 3.3). Manufacturing constitutes around 0.7 per cent of the GSVA, while mining constitutes around 0.3 per cent of GSVA. Within the industrial sector, the share of manufacturing, mining and construction has been shrinking in the last couple of years, while that of ‘electricity, gas, water supply and other utility services’ has been expanding. As per the sectoral composition, services sector activity dominates the State economy as it accounts for nearly half of the GSVA (Chart 3.4). The service sector is dominated by public administration, which constitutes around 30 per cent of the services sector followed by trade, repair, hotels and restaurants. The overall GSVA growth in the State has been highly volatile in line with the growth of the constituent sectors, which have exhibited marked year-to-year variation (Chart 3.5). Mizoram remains distinct from other north-eastern States in terms of economic development, the second highest per capita income followed by Sikkim in the NER. In line with its elevated level of per capita income, its poverty level is lower than the national average (Chart 3.6). 3.2.i Agriculture Agriculture is the mainstay of the people of Mizoram (Savant and Patnaik, 1998). About 90 per cent of the farmers in the State are small and marginal farmers3. The average size of land holding of the farmers is 1.25 hectares. Jhum or shifting cultivation is the main agricultural practice and it is carried out annually by a large number of people living in rural areas. The productivity of this type of agriculture is comparatively lesser than the national average. The performance of area, production and yield of major food-grains in the State suggests a mixed trend (Chart 3.7). Rice, coarse cereals and pulses are the main crops. Food grain production, at 76.9 thousand tonnes (in 2019-20), is the least amongst the NER States. It constituted merely one per cent of the total food grain production of the region. The State has total geographical area of 2,108,700 ha of which net sown area is 218,608 ha (10.4 per cent of total geographical area). The average of gross and net sown area for the last five years in Mizoram has changed in tandem with NER (Chart 3.8).  Net irrigated area in the State is 18,813 ha, which is just 8.6 per cent of total sown area. Major and medium irrigation is a challenge due to the hilly terrain. Although Mizoram receives sufficient rainfall during monsoon, only small areas of fertile land can be brought under cultivation during rabi season due to lack of enough water harvesting structures. Concerted efforts are required to increase soil moisture retention capacity, create irrigation facilities like tube wells, rainwater-harvesting structures and other water bodies for life saving irrigation during dry season. The State is blessed with an abundant rainfall, but its porous soil and inadequate irrigation infrastructure has affected its crop yield. The yield issue can be addressed by creating irrigation infrastructure and adoption of better crop technologies. Chart 3.9 shows that the State also has very low consumption of fertilisers and pesticides.  Farm mechanisation on an extensive scale is not feasible in the State due to hilly terrain, limited flat land, fragmented land holdings and poor road connectivity. Consequently, use of tractors and power tillers, adoption of new cropping pattern and efficient utilisation of available irrigation facilities are not being utilised at desired level for increasing the agricultural production in the State. Given the by and large subsistence nature of farming, the requirements of credit by agricultural households are meagre. As per the NSSO’s survey, agricultural households in Mizoram met about 86 per cent of their loan needs from institutional sources (Chart 3.10). This contrasts with some of the other NER States such as Manipur wherein the informal sources formed a significant chunk of credit (Chart 11). Integrated farming system is used mostly in the hilly farming system where resources are well managed through a combination of crop, livestock and fishery farming. Almost 60 per cent of households rear livestock mainly for nutritional, manure and additional income generation purpose. The production system in the villages is traditional, mainly based on indigenous breeds. The State has a great potential for the development of horticulture. More than 60 per cent of the population of Mizoram depends on land-based activities for their livelihood and horticulture plays a vital role covering 1.50 lakh Ha of plantation. The moderate slopes and geo-climatic situation offer excellent scope for growing wide variety of horticulture crops including fruits, vegetables, spices, plantation crops, medicinal and aromatic plants of high economic value. Recently, horticulture and floriculture has gained momentum and shown marked improvement in their productions. Major horticultural crops in the State are orange, banana, pineapple, passion fruit, areca nut, ginger, turmeric, bird’s eye chili, jackfruit, etc. which are marketed through various channels including sales in local markets, pre-harvest private contracts and sale to outside traders for marketing outside the State. Post-harvest handling, value addition through processing and market access are the major issues for development of this sector in the State. It holds the record of being the only State to successfully produce dragon fruit, a cactus like fruit imported from Thailand and Vietnam. It also exports anthurium, a decorative plant commonly known as lace leaf, to different States. The varied climatic conditions also facilitate sericulture viz., mulberry, eri, muga and tasar. The State is well-suited for organic farming, which is not only environment-friendly, but also beneficial for the farmers as it fetches higher price for the produce. Ipso facto, the government has promoted organic farming since the 1990s and it enacted the Mizoram Organic Farming Act, 2004 to boost organic farming in the State. Since 2015-16, the State promoted organic farming mainly under the Mission Organic Value Chain Development for North Eastern Region (MOVCD-NER)4 scheme, which aims at development of certified organic production in a value chain mode to link growers with consumers and to support development of entire value chain starting from inputs, seeds, certification, to the creation of facilities for collection, aggregation, processing marketing and brand building initiatives. The farm produce promoted under the scheme includes Mizo chilli, ginger turmeric and tea; of which the Mizo chilli received the coveted Geographical Indication (GI) tag in 2015. The State government harbours the goal of converting the State to Organic Farming and aims to set-up Bio Fertilizer Production Laboratories and Biocontrol Pesticide Laboratories in different parts. Mission Organic Mizoram has also tied-up with Mizden, an online marketing/logistic partner for online marketing of organic products in May 2020. The success of organic farming and its adoption by the farmers on a larger scale would inter alia hinge on government support for collection, transportation, storage and marketing of the produce as also minimising the cost of certification. Mizoram, possibly, may take a cue from Sikkim, which is a cent per cent organic State since 20165. In spite of having substantial growth potential in the agriculture and allied sectors, the State is yet to achieve the desired results. The reasons are manifold, including both supply as well as demand side. On supply side, the low volume of production surplus due to small holdings and traditional methods of cultivation practices results into low volume of marketable surplus, which is the major impediment for growth of desirable market dynamics in the region. On demand side, extremely low population density and the low purchasing power particularly in the rural areas constrained the expansion of demand for these high value commodities. High cost of transportation as well as lack of cold chain infrastructure (which is essential to transport these perishable commodities) force the producers to sell either at low prices or increases the extent of post-harvest losses which acts as disincentives for the producers. Foodgrains, vegetables, eggs, fish, etc. are sourced from the neighbouring States for meeting local consumption needs. Hence, warehousing facilities, including cold storage facilities, are a critical need for the State. The flagship government subsidised crop insurance scheme, Pradhan Mantri Fasal Bima Yojana (PMFBY), needs to be further operationalised in the State. Regulated agriculture markets and marketing infrastructure like market yards are further to be developed. The local surplus produce is generally sold in local markets only. Traders from neighbouring States like Assam also take up bulk purchasing of agriculture produce like squash (chow chow), ginger, pineapple, orange, hatkhora, etc. but such arrangements are rudimentary and do not necessarily ensure fair price to the farmers. Bamboo is an important and one of the fastest growing Non-Timber Forest Produce, which grows across the world. India, China and Myanmar together have 19.8 million hectares of bamboo reserves which is nearly 80 per cent of the world’s bamboo forests, out of which, the share of India is about 45 per cent (Nath, Pal and Banerjee, 2008). Approximately 60 per cent of the total growing stock of Bamboo in India is in the NER. A wide variety of products is made from bamboo in Mizoram, which include furniture, baskets, pipes, toys, hats, umbrella handle, fish baskets, mugs, weaving tools, traditional ornaments and even houses. The eco-friendly Bamboo crop, which represents a vast underused resource, has huge potential in improving not only rural economy but also industrial development and creating a sound economic base for the State (Northeast Window, 2017). Government of India increased import duty on bamboo from 10 per cent to 25 per cent, which will have a positive impact on farmers and entrepreneurs in the field. This step will invoke micro entrepreneurs to boost use of local bamboo in making ‘agarbatti’ and increase production. At present, India consumes about 1,490-ton agarbatti while only 760-ton agarbatti is being produced locally. This increase in import duty may produce thousands of new employment opportunities in a year, especially in rural area. 3.2.ii Industry Industrialisation in the State is slow due to absence of many prerequisite factors for industrial development (Laskar, 2009). Owing to the geo-tectonic features of the region, mining activity remains limited to mere sand mining and sandstone quarrying (GoM, 2020). There has been a significant year-to-year fluctuation in the production of sand and stone quarry, while the issuance of mining permits has increased significantly in the last couple of years (Chart 3.12).  Unfavourable location and topography, lack of better road transport connectivity, paucity of mineral resources, low level of entrepreneurship and skills are some of the major factors hindering industrial growth in the State. Industries in the State are mainly cottage industries, handloom and handicrafts, bamboo products, forest products and horticulture products. Handloom is one of the major industry sectors in the State employing thousands of weavers (Deccan Chronicle, 2019). The weavers produce traditional Mizo products like puan, shawls, bags, etc. The availability of raw material, designs and marketing are the major issues affecting the growth of the sector. Khadi and Village Industries Board (KVIB) was set up in the State in March 1986. The Board provides financial assistance to registered individuals, institutions, co-operatives and departmental units. It also provides technical guidance and training. The agro-climatic conditions of the State are conducive to agricultural and horticultural crops and thereby a strong and effective food-processing sector could play a significant supportive role in the economy. Food processing industry has been a key focus of the State government and hence the Mizoram Food and Allied Industries Corporation (MIFCO) was established in 1989 in order to promote the rapid development and promotion of food processing industries. As per the 6th Economic Census (March 2016), the NER accounts for mere 4.8 per cent and 4.2 per cent of the total number of agriculture and non-agriculture establishments and the number of people employed in such establishments, respectively (Chart 3.13). Within the NER, Mizoram has lesser number of establishments and accordingly it accounts for barely 2.1 per cent of the total establishments in the NER. It ranks sixth6 amongst the eight NER States, both in terms of number of establishments and employment. In the last few years, many micro and small enterprises have been set up under Stand-Up India Scheme, Prime Minister's Employment Generation Programme (PMEGP) and Pradhan Mantri Mudra Yojana (PMMY). During 2018-19, the banks financed 149 units under Stand-Up India, 1,175 units under PMEGP and 9,176 units under PMMY respectively. Outstanding credit to MSMEs of the State has increased from Rs.907.7 crore as on March 31, 2018 to Rs.1067.6 crore as on March 31, 2019 (Chart 3.14). There are 26 MSME clusters recognised in the State - 3 MSME clusters recognised under MSE-MDP programme and 23 handloom clusters under the National Handloom Development Programme (NHDP) as on March 31, 2019.  For promoting entrepreneurship, the State government has initiated Entrepreneurship Development Scheme (EDS) to educate the youth of the State on various opportunities beyond the public sector and impart skills necessary to prepare them to start their own venture and be successfully self-employed. In order to implement the EDS, the State has constituted the “Mizoram State Entrepreneurship Development and Monitoring Committee” or MEDMOC, which organises skill development programmes, etc. The government also runs various other schemes. The State government provides 50 per cent of the start-up capital (maximum Rs.5 lakh) as grant for starting the business to an entrepreneur selected through a competition. The government also runs a scheme to create community asset in each district through public participation wherein the State government allocates a budget of Rs.1 crore per project. The State government has also set up Zoram Industrial Development Corporation (ZIDCO) for the purpose of Industrial Development of the State. Another government unit, Zoram Electronics Development Corporation (ZEDCO) had also been set up to promote electronic industry. There is a potential for setting up fruit juice plants based on locally produced fruits. A number of cottage and household industries are functioning under the KVIB fold. The flow of investment and employment generated in the industrial sector as per the Entrepreneurs Memorandum and Udyog Aadhaar Memorandum (UAM) filed at district industrial centres (DICs) during 2007-08 to 2018-19 is as below (Chart 3.15).  Lower level of industrialisation does not enthuse sufficient demand for bank credit and hence the share of credit to industry stands low at 14 per cent, which is less than half the all-India level (Charts 3.16 and 3.17). Personal credit constitutes 55 per cent in total credit, which is about 2.5 times that of the all-India level. Popular activities like tailoring, furniture making, automobile repairs, bakery, handloom weaving and black smithy account for more than 80 per cent of the total number of enterprises/units in the State. Most of these units are in and around Aizawl, followed by Lunglei district. There is a scope for development of plywood and paper industry with abundance of timber and bamboo, apart from handicrafts, village and cottage industries, agro-based industries and agro-processing units in the State. Development of handloom industry and agro-based industries has brought about migration of workforce from agriculture to non-agriculture sector to some extent. 3.2.iii Services Sector Tertiary sector transacts with the production of intangible goods like transportation, hotel restaurants, real estate, arts, entertainment health insurance services, education and telecom services etc. Services sector is the largest sector of India. Gross Value Added (GVA) at current prices for services sector is estimated at Rs.92.26 lakh crore in 2018-19. Services sector accounts for 54.40 per cent of India's total GVA of 169.61 lakh crore Indian rupees. With GVA of Rs.50.43 lakh crore, Industry sector contributes 29.73 per cent, while agriculture and allied sector has a share of 15.87 per cent (Ministry of Statistics and Programme Implementation, 2018-19). In the NER, services sector contributes between 40 per cent and 65 per cent except the State of Sikkim where services contribute less than 28 per cent of the GVA. Among the States in the NER of India, Manipur reports the highest contribution from the services sector. The share of this sector in Mizoram is more than 45 per cent. At the all-India level, financial services contribute between 12 per cent and 14 per cent in recent years, while in the NER, this sector contributes between 5 per cent and 6.6 per cent. The contribution of financial services in Mizoram largely remained less than 5 per cent (Chart 3.18). Contribution of financial services in Manipur is the lowest in the NER (3.14 per cent in 2018-19), while for Mizoram, it was the second lowest.  The share of real estate, ownership of dwelling and professional services is another important sub-sector of services sector. At all-India level, this sub-sector holds a substantial share which is more than 25 per cent of the whole and it has shown an increasing trend over the period. On the contrary, this sub-sector could contribute on an average only 7.8 per cent of the total services in Mizoram. Moreover, this sector has shown a decreasing trend during the last decade. Nevertheless, the small share of this sector opens up a positive opportunity for future growth of the sector. The contribution (in percentage terms) of sub-sector, viz., trade, repair, hotels and restaurants in the State is at par with the all-India figures, while a difference of approximately 5 per cent (on an average) is found in the sub-sector, viz., transport, storage, communication and services related to broadcasting. The contribution of other services moves between 25-30 per cent, while at all-India level, it is found moving between 13 per cent and 14 per cent. 3.3 Infrastructure Availability Availability of Infrastructure is primary requirement to the development of economy. On one hand, it provides basic services to general public and on the other hand, it is the enabler, facilitator and accelerator of the economic growth. It is a well-accepted fact that there exists a strong positive correlation between investment in infrastructure and GDP growth. 3.3.i Power Position Power generation is far below its own requirement in Mizoram. It is only 15 MW as against a peak power demand of more than 102 MW. Though the State has huge hydroelectric power potential (estimated at around 4500 MW), only a fraction of the potential is harnessed at present through Small and Mini Hydel Projects. The State is also endowed with abundant potential for solar energy estimated at 9.09 GW as per the National Institute of Solar Energy (NISE) with an average capacity of 250 sunny days in a year, receiving an average hourly radiation of 200 MW per sq.km. (Chart 3.19).  In line with the all-India trend, over the years, per capita availability of power has been improving in the NER as also in Mizoram (Chart 3.20), though in terms of per capita power availability, it significantly lagged behind with about half of the national average. As per the requirement and availability, State’s power position has improved significantly in the last five years and remains better than the NER, though it lags behind the national average (Chart 3.21).

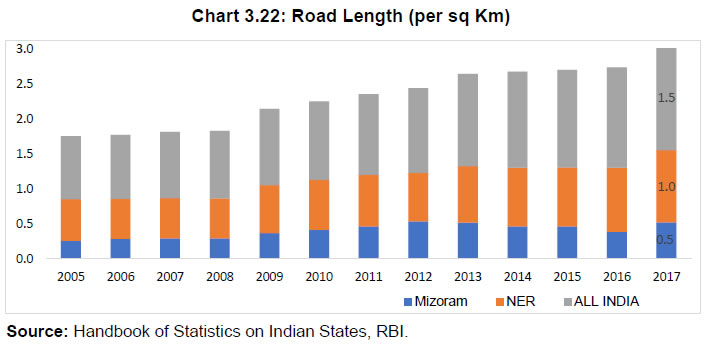

3.3.ii Road and Railways Transport The road density is much lower than the national average as also the NER in Mizoram (Chart 3.22). The State is connected with the rest of India by National Highway (NH-54), which runs through Assam and Meghalaya. Also, roads are narrow and winding through hilly terrains, thereby lengthening journey period. The need for strengthening the road infrastructure cannot be over-emphasised since road transport remains the sole mode of transport owing to the absence of railways and waterways in the State (GoM, 2020).  Due to the near absence of other means of transport, particularly railways and waterways, roads are the primary means of communication, and the importance and dependence of the whole State on the road infrastructure cannot be over-emphasised. In this context, recently, the Indian Railways is implementing various projects to improve its network across North-East India. One of the major railway projects, Bairabi-Sairang new rail line project is all set to give a massive boost to the rail connectivity in the region, as it will connect Mizoram to Indian Railways network up to Bairabi railway station, which is the gateway to the State. The challenges in the construction of this project are immense due to difficult geography, deep gorges, high hills and prolonged rainfall leaving less working period. Slope stabilisation is another challenge due to alternate band of very weak strata of sandstone, silt and shale. Also, construction material such as coarse and fine aggregates as well as other quarry products are not available locally. So, it is transported from other States, as far as from Pakur in Jharkhand. The project is expected to get completed by end-2022. The economy of Mizoram is primarily agrarian with 60 per cent of the population depending, directly or indirectly, on agriculture. Rest of the working population is engaged in government jobs, small businesses and transport activities. Sectoral composition of GSVA suggests the dominance of forestry and logging (coupled with the practice of traditional subsistence level farming) in the primary sector, ‘electricity, gas and water supply services’ in the industrial sector and ‘public administration in the tertiary sector. This composition coupled with lower level of industrialisation, and inadequate availability of infrastructure facilities possibly does not generate sufficient demand for credit in the State. Development of physical infrastructure, particularly in the rural areas, is equally important for generation of demand for financial services. Improvement in availability of electricity, roads and telecommunications, warehouses in rural areas would lead to better supply chain management, enhanced productivity and greater value addition. There is a significant potential for organic farming and the State government has taken a number of initiatives to promote it. The unique socio-economic condition of the State also warrants apposite financial innovations to suit local needs. In view of its long international border with Bangladesh, Mizoram is well-positioned to reap benefits from exporting quarry stones and stone chips, which are in great demand in Bangladesh. It can also boost the export of handloom products under Look East policy, given the similarity of fabrics worn by people of South-east Asian countries and that produced by local weavers. 4. Literature Review While financial inclusion is addressed by improving the financial infrastructure, many studies find that high financial literacy also has a clear beneficial effect on financial inclusion. Volpe, Joseph and Haiyang (2002) studies investment literacy among 530 investors and found that the level of investment literacy varied with people’s age. The study concluded that older investors performed better than their counterparts did. Almenberg and Soderbergh (2011) found that older people possess lower financial literacy. Bhushan and Medury (2013) conducted a study to measure the level of financial literacy among salaried individuals and identify the socio-economic-demographic factors affecting the level of the financial literacy. Various studies suggest that the literacy level, in general, varies with gender. The studies have found that general literacy level among male population is higher than their counterparts. Volpe, Joseph and Haiyang (2002) studied investment literacy among 530 investors and found that the male investors and older investors performed better than their counterparts. Agarwalla et al. (2013) studied the influence of socio-demographic variables on the three-response variables viz., financial knowledge, financial behaviour and financial attitude among working youth in urban India. The study considered a sample of 754 respondents and employed the methodology used by OECD-INFE study. The study also found that the influence of gender is similar to what has been reported in other studies. Bashir et al. (2013) tried to identify and analyse the psychosocial factors that may have influence over financial literacy in Pakistan by administrating a questionnaire among 120 respondents. Study concluded that males were more financially literate. Another attempt was made by Bhushan and Medury (2013) to measure the level of financial literacy among salaried individuals by selecting a sample of 516 respondents from Himanchal Pradesh. The study found that the overall financial literacy level (58.30 per cent) is not very encouraging. Moreover, the level of financial literacy among females were even worse. Firli (2017) and Almenberg and Soderbergh (2011) found a similar result about gender. Danes and Hira (1987) surveyed 323 college students from Iowa State University using a questionnaire of 51 items to measure their knowledge of credit cards, insurance, personal loans, record keeping, and overall financial management. Their findings indicate that males know more than females in most areas, married students know more than unmarried students, and senior students know more than junior students. Their overall finding was that college students have low financial knowledge. Literacy and education, in general terms, are positively correlated. Some of the researchers took an attempt to study the relation between level of education and financial literacy. Volpe, Joseph and Haiyang (2002) found that the level of investment literacy varied with people’s education. A study was conducted by Agarwalla et al. (2012) to study level of financial literacy among students, young employees and the retired employees in India, by taking a sample of approximately 3,000 respondents spread across the country and by employing OECD approach. They arrived at a conclusion that the overall financial literacy score is on par with the poor global standards. The study concluded that the financial knowledge is positively correlated with education, but education has no influence on the financial attitude. Another study conducted by Agarwalla et al. in the following year, i.e., 2013 highlighted that the respondents in the sample had high educational levels but did not have adequate financial literacy. This may be due to absence of inputs relevant to financial literacy in the Indian education system. Bhushan and Medury (2013) and Firli (2017) found that financial literacy is positively associated with education and income. The State has established Financial Literacy and Credit Counselling Centres (FLCCs) operationalised by the banks in each district. Traditionally, India is known for its joint family system. Higher number of families living together provides greater opportunity for interaction. Such situation gives an opportunity for psychological and moral support from the elders, and at the same time, older people get helping hands of the younger. This mutual support creates a synergy that helps members learn from each other. In recent years, due to migration for employment, joint families converted into nuclear families in most of the places. A landmark study conducted by Agarwalla et al. (2013) highlighted that there are few factors specific to India, such as joint-family and consultative decision-making process which tend to influence financial literacy significantly. Das and Mahapatra (2019) in their study of financial literacy in Assam concluded that the level of financial literacy among Assamese people is satisfactory when compared to the national average. They found a weak relationship between financial literacy and financial attitude. Another study conducted by Bora (2020) reveals that among the eight States of NER, Tripura is the most financially inclusive State with an intermediate level of financial inclusion followed by Assam, Sikkim, Mizoram, and Meghalaya. However, the financial inclusion index score was low in the States of Arunachal Pradesh, Manipur, and Nagaland. The purpose of financial inclusion is to ensure easy availability of formal financial sources to every citizen of a country, so that the common people do not fall prey to the gimmicks and trick of financial frauds. Zinsa and Weill (2016) conducted a study to examine the factors that determines financial inclusion in Africa. The study was based on World Bank’s Global Findex database on 37 African countries and applied Probit model. The study identified that male, rich, educated and older were more financially included. The study found no significant difference between factors that determined traditional banking or mobile banking. On the contrary, the study concluded that determinants of informal finance differ from those of formal finance. Mohapatra (2014) on the issue of financial inclusion commented that RRBs are playing a vital role in this regard. Age is an important demographic factor that needs to be studied in connection with financial inclusion. An attempt is made by Tuesta et al. (2015) to study the three dimensions (i.e., access, use and barriers) determining financial inclusion in Argentina. They considered variables like use of financial products (like account, debit card, credit card, e-payments, formal credit), perceived barriers (like distance, costs, documents required, distrust of financial institutions, other family member, lack of money) and demographic factors (like gender, age, income, and level of education). The study concluded that age was one of the major factors of financial inclusion on the demand-side. Abel, Mutandwa and Roux (2018) conducted a study with an objective to assess determinants of financial inclusion in Zimbabwe by a nationally representative sample of 4,000 Zimbabweans of age older than 18 years. The study employed the Logit Model to investigate the determinants of financial inclusion and concluded that age was positively related to financial Inclusion. Another study conducted in India by Singh (2019) found similar results. A study conducted in the NER by Bhanot, Bapat and Bera (2012) pointed out that proximity to a bank branch or post office increases the chances of financial inclusion, but these do not facilitate inclusion. The complicated and lengthy procedure involved in the system discourages the stakeholders to avail formal financial services. Tuesta et al. (2015) and Zulfiqar et al. (2016) highlighted that lengthy and multiple documentations is perceived by prospective users as a major barrier to financial inclusion by various demographic groups. The world is going techno-savvy day by day. The information which were not accessible easily by the common people earlier are now accessible over mobile phone or on computer, at the convenience. Access to information is not perceived as a big barrier to financial inclusion. Smart mobile phones have made the access to information even easier. Although, smart mobiles are getting cheaper, but still it has not reached the rural masses. Furthermore, internet connectivity (Wi-Fi/GPRS etc.) is still a barrier to access, especially in the rural and remote areas. Many studies have been conducted to collect the perception of the stake holders on this respect. A study conducted by Bhuvana and Vasantha (2016) concluded that financial literacy, high cost, technology, trust, income level, distance and inappropriate products were deciding factors for the level of financial inclusion in rural areas. Singh (2011) investigated into the inclusive growth and regional disparity in banking services. The secondary data centred study found disparity in distribution of bank offices across six banking regions in India and within north-eastern region as well. The study concluded that the NER suffers from weak infrastructural facilities like connectivity, geographical inconvenience like difficult terrain, thinly populated States, and other reasons like lower business for commercial banks. The study also pointed out that the region was suffering with lower credit-deposit (C-D) ratio, low recovery of loans and higher NPA. Atkinson and Messy (2012) and OECD (2013) highlighted that women possess lower level of financial knowledge as compared to men and women were less likely to be active financial consumers as compared to men. Improved financial knowledge may help women to become financially included. In India, a study was conducted by Ghosh (2019) using district-level secondary data to estimate the impact of Financial Literacy Centres (FLC) on financial inclusion or financial knowledge. The study used household level data from the Financial Inclusion Insights (FII) survey, operated by the global research group InterMedia. A study conducted by Lalhmingsangi (2019) found that less than 20 per cent self-employed individuals in Aizawl prepare monthly budget. Surprisingly, only 1 per cent of the respondents were regularly saving the surplus money while 45 per cent used to keep money in cash while 39 per cent keep in savings bank account. Out of 157 respondents, 35 per cent respondents do not discuss financial matters openly. The study concluded that the level of financial literacy in Mizoram is very low. Lalrinmawii (2019) in a study on Financial Inclusion in Aizawl concluded that the availability of a bank in a person's vicinity is the most important factor in influencing financial inclusion. The finding of the study also showed that since every credit was disbursed through banks, and even MGNREGS money was transferred through bank accounts, most of the women had bank accounts. Another study conducted by Lalremruati and Fanai (2018) on financial inclusion of food and grocery shop owners in Aizawl found that over 97 per cent of the respondents were financially included. The preference for doing transactions in cash, low income and assets, lack of financial knowledge, attitude of bank branch officials, limited number of banks in the local area, and cumbersome banking procedures are the main problems faced by the food and grocery store owners in availing/accessing banking services. Vanlalmuana and Gupta (2015) in their study of financial inclusion among private schools’ teachers in Aizawl district highlighted that school-teachers did not go beyond a basic savings account despite the fact they are better educated and well-equipped with financial resources. 15 per cent of the private school teachers did not have a basic savings account. Similarly, another study by Sailo and Singh (2019) found that financial literacy is relatively low among college teachers in Aizawl. The respondents were familiar with the low-risk investment avenues, but the knowledge decreases with the increase in the risk involved. Boro (2015) in a study found that the customers in their younger age availed more technological mediums for banking transactions. Further, consumers were highly aware of ATMs and used it more as compared to other technological mediums such as credit cards, net-banking, mobile banking, NEFT, RTGS and mobile wallets. Another study found that Assam is less financially included as compared to all-India average. The study mentioned that bank branches in Assam had grown at a higher rate than rest of India, but there were significant differences in geographic/ demographic penetration and usage ratio between Assam and aggregate India. Thus, banks should think of spreading technology-driven products and services to the excluded areas and population, e.g., business correspondents (Maity and Sahu, 2021). Chakraborty and Barman (2013) conducted a study about financial inclusion in Tripura. In the study, they pointed out that it was somewhat difficult to recover the amount disbursed by financial institutions to poor people. Another study conducted in the NER observed that Indian financial system has experienced considerable widening and deepening in recent years, especially banking services, still financial exclusion of underprivileged section remains a major concern. The researcher stressed the need for financial inclusion by delivery of basic banking services to all the sections of the society at affordable rate (Goyal, 2008). Kodan, Garg and Kaidan (2011) evaluated the level of financial inclusion in the NER and highlighted the indications and implications on future course of action that can be initiated by the Reserve Bank. The review of the literature suggests that a good number of studies have been conducted in India to assess the level of financial literacy and financial inclusion. There are some studies also for NER, but the studies extensively in the State of Mizoram have been fewer. 5. Banking Landscape in Mizoram 5.1 Access and Usage of Banking Services in NER Like many other socio-economic indicators, banking indicators are not uniform across regions in India. It is observed that the banking density7 is significantly higher in the Southern, Northern and Western Region as compared with North-Eastern, Eastern and Central Regions (Table 5.1). | Table 5.1: Region-wise Banking Density | | (Population per Office (‘000)) | | Region | 2003-04 | 2016-17 | Change | | Northern Region | 12.5 | 6.8 | -5.7 | | North-Eastern Region | 21.0 | 13.1 | -7.9 | | Eastern Region | 19.7 | 13.0 | -6.6 | | Central Region | 19.5 | 12.1 | -7.4 | | Western Region | 14.5 | 8.9 | -5.6 | | Southern Region | 12.2 | 6.8 | -5.4 | | All- India | 15.6 | 9.3 | - 6.4 | | Source: Authors estimates based on BSR, RBI and National Accounts Statistics, Govt of India (NAS) (various issues). | Within the NER, Mizoram appears to be well covered by banking network in terms of the number of people served per bank branch. This, however, overlooks the sparse population distributed across difficult hilly terrains. In terms of demographic penetration, population served per bank branch is higher than the all-India figure, though it is lower than the NER (Chart 5.1). Mizoram is better placed than NER, it lags behind all-India figure and has higher pressure of population on bank branches. In terms of geographical area served by each bank branch, it lags far behind all-India and even within the NER. The area served by each bank branch is roughly five times that of the corresponding all-India figure, and almost twice as much as the corresponding NER figure (Chart 5.2). 5.2 ATMs (per 1000 population) ATM density in the State is lower than the national average, though it has a better ATM penetration than the NER (Chart 5.3). ATM penetration in the State can be attributed to public sector banks, which account for around 80 per cent of the ATM network.

As per the usage of banking services, in terms of both number of deposit accounts and credit accounts per ‘000 persons, Mizoram significantly lags behind all-India average, though it is comparable with the NER average (Charts 5.4 and 5.5).

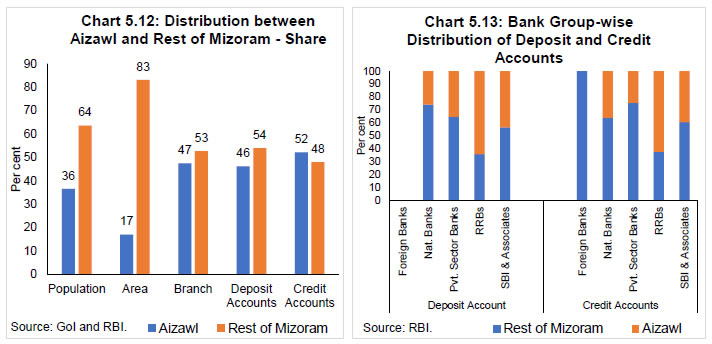

Mizoram lags behind both the NER and the all-India average in terms of deposit-GSDP and credit-GSDP ratio (Charts 5.6 and 5.7) with around 30 per cent of the all-India average. The C-D ratio of the State is much lower than that of all-India average (Chart 5.8). The prevalence of traditional, less capital-intensive and non-commercial agricultural practices and absence of large capital-intensive industries in the State possibly does not generate adequate demand for credit, which could be keeping the credit-GSDP ratio very low in the State. There has also been lower achievement of targeted annual credit in the State in the last couple of years (Chart 5.9). 5.3 Banking/ Financial Ecosystem in Mizoram There are 28 banks operating in the State, which includes 16 public sector banks, eight private banks, one payments bank, one regional rural bank and two co-operative banks. In all, there are 224 bank branches, of which, only 67 (33 per cent) cater to rural areas. Mizoram Rural Bank (MRB), a RRB, is the largest bank in terms of branch network but SBI has the largest share in deposits and advances. The bank branches are complemented by a network of 183 ATMs, of which, more than half (97 ATMs) belong to SBI. Banking business in the State constituted merely 4.1 per cent of the entire business of NER; as such, it remained the lowest amongst the NER States (Chart 5.10). In addition, public sector banks account for bulk of the banking business followed by RRBs, private sector banks, and the small finance banks (Chart 5.11). The banking services remains skewed, as it is mainly concentrated in Aizawl. Even though accounting for 37 per cent of the population and just 17 per cent of the geographical area of Mizoram; Aizawl accounts for 47 per cent of Mizoram’s bank branches, 46 per cent of its deposit accounts and 52 per cent of its credit accounts as on March 2018 (Chart 5.12). Bank-group wise branch presence and banking activities in State also remains lop-sided. Out of total 208 branches of different banks functioning in the State, at the end-June 2021, Mizoram Rural Bank (an RRB) has the largest number of bank branches network (42 per cent per cent) (Table 5.2). Among the bank groups, it has the widest reach in rural areas. Private Banks and nationalised banks are mainly located in Aizawl and have negligible presence in rural areas (Chart 5.13). It is pertinent to note here that the existing branch authorisation policy8 has rural (Tier 5 and Tier 6) banking outlet opening quotas set for individual banks at national level but not at the State level. Moreover, the opening of any banking outlet (part/full time) in Tier 3 to Tier 6 centres in NER and Left-Wing Extremist (LWE) affected districts also counts towards fulfilling this quota. The current policy consequently allows banks to ignore opening of banking outlets in the unbanked rural centres of relatively challenging States like Mizoram. In other words, at present, there is no regulatory compliance requirement compelling banks to extend coverage in banking deficient areas within States as long as they fulfil the national target. | Table 5.2: Bank-Group-wise Offices/Branches of banks in Mizoram (June 2021) | | Bank group | Total no. of Offices/ Branches | Percentage Share of Offices/Branches | | Rural | Semi-Urban | Urban | Total | | Nationalised Banks | 32 | 0.92 | 5.07 | 8.76 | 14.75 | | Private Sector Banks | 36 | 0.46 | 6.45 | 9.68 | 16.59 | | Regional Rural Banks | 92 | 24.42 | 8.29 | 9.68 | 42.4 | | SBI and its Associates | 47 | 6.91 | 5.53 | 9.22 | 21.66 | | Payments Bank | 6 | 0 | 2.3 | 0.46 | 2.76 | | Small Finance Bank | 4 | 0 | 1.38 | 0.46 | 1.84 | | Total | 217 | 32.72 | 29.03 | 38.25 | 100 | | Source: RBI. |

A unique and interesting feature of the banking ecosystem in Mizoram is the lead role played by the single RRB (with SBI as its sponsor bank) functioning in the State viz., Mizoram Rural Bank (MRB). MRB has been playing a pivotal role in promoting financial inclusion in the State. 40 out of the 44 brick and mortar branches of commercial banks present in the villages with population below 5,000 belongs to MRB. In addition, 37 of the 55 BCs present in villages with population below 2000 are also sponsored by MRB (Table 5.3). MRB accounts for 33 per cent of the deposits and 39 per cent of credit in the State as on March 2021 (Charts 5.14 and 5.15), while the corresponding all-India share of deposits and credit by RRBs is 3.4 per cent and 2.9 per cent, respectively. Only Tripura, among the other NER States has a comparable deposit share accounted for by RRBs. MRB also boasts of being a RRB in the entire NER States having highest level of deposit and credit accounts per lakh person (Charts 5.16 and 5.17). No other State/UT/region in India has such a prolific role being played within it by RRB(s). | Table 5.3: Banking Facilities in Villages in Mizoram (December 2019) | | Particulars | Total | RRB | SBI | Other CBs | Payments Banks | | Bank Branches in Villages with population below 5000 (703 villages) | 44 | 40 | 4 | 0 | 0 | | Business Correspondents/Access Points in Villages with population below 2000 (660 villages) | 196 | 37 | 7 | 11 | 141 | | Source: SLBC Mizoram. |

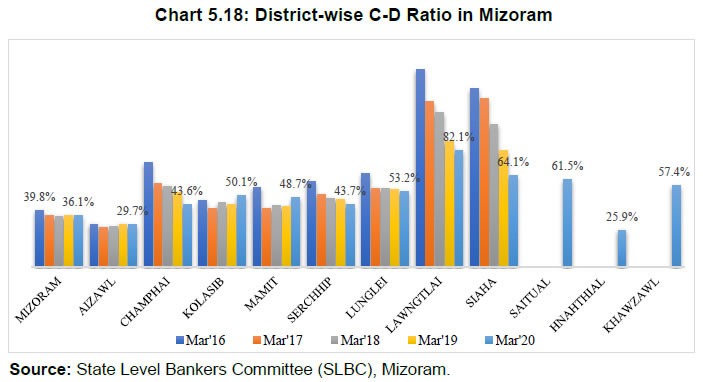

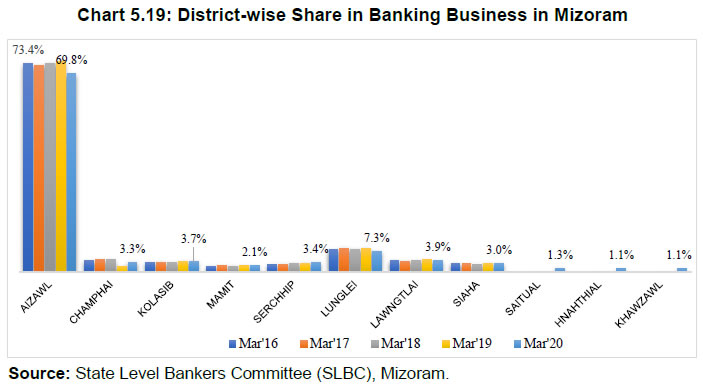

In many parts of the remote hinterlands of Mizoram, MRB branches are often supported by their business correspondents (BCs), which are the sole or primary banking service provider to the populace. Out of the 66 rural bank branches in the State, as on December 2019, 49 belong to MRB. This may offer an interesting opportunity for study as this unique level of dependence of a section of the populace on an RRB for their banking needs. This may have certain contrasts in terms of levels of engagement and trust, customer service and satisfaction, etc. when compared to areas served by multiple types of banks or traditional commercial banks. Unlike some of the RRBs of the region, the MRB remains well-capitalised and has been making profits in the last couple of years (Table 5.4). Given its wider outreach in rural areas, the MRB can potentially be a game changer in promoting financial inclusion in the State which can be further strengthened by infusion of fresh capital, strengthening governance, designing unique bouquets of product suites, training of staff and improvement in technical capability and infusing professionalism in management. | Table 5.4: Performance of Mizoram Rural Bank | | (Amount in Rs. lakhs) | | S. No. | Particulars | 2019 | 2018 | 2017 | | 1. | Capital | 3,103.82 | 3,103.82 | 3,103.82 | | 2. | Reserve and surplus | 12,301.66 | 11,459.47 | 9,249.57 | | 3. | Capital Adequacy Ratio (per cent) | 10.95 | 11.63 | 11.55 | | 4. | % of Gross NPA to total advances | 5.22 | 5.94 | 5.97 | | 5. | % of Net NPA to total advances | 2.05 | 3.94 | 3.97 | | 6. | Net loss (-)/Profit | 842.2 | 2,209.89 | 2,007.15 | | Source: Mizoram Rural Bank’s Website. | Mizoram has a two-tier Short-term Cooperative Credit structure with Mizoram Cooperative Apex Bank Ltd. as the apex bank (with 17 branches) and 135 Primary Agricultural Credit Societies (PACS). An Urban Co-operative Bank viz., Mizoram Urban Co-operative Bank, is also functioning in the State with a single branch located in Aizawl. The branches of co-operative banks are limited to urban/semi-urban centres whereas their network of PACS, though serving a wide swathe of rural areas, are limited in their capacity to cater to the requirements of the villages. Moreover, many of the primary agricultural credit societies (PACS) have also become unviable. There is a need to widen the reach of the branches of co-operative banks and strengthen the network of PACS operating under the State Co-operative bank. 5.4 District-wise C-D Ratio9 Analysis The C-D ratio in Mizoram has declined from 39.8 per cent in March 2016 to 36.1 per cent in March 2020 (Chart 5.18). The district with the highest share in banking business (deposit + credit) is Aizawl (ranging from 73.4 per cent – 69.8 per cent during 2016-20) (Chart 5.19). The C-D ratio in Aizawl is among the lowest, at below 30 per cent on an average during the last five years. The main reason cited for this during discussions in State-Level Bankers’ Committee (SLBC)/District Coordination Committee (DCC) forum is the concentration of government deposits in the State capital. In the two southern districts i.e., Lawngtlai and Saiha with relatively high C-D ratios historically, there was a significant decline in C-D ratio during this period.

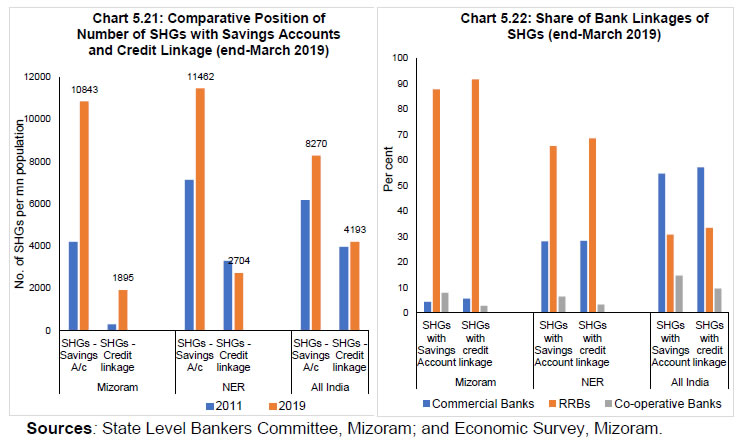

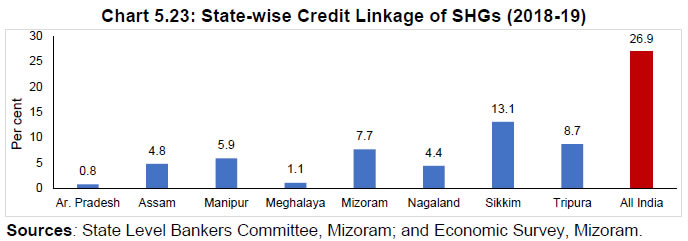

Aizawl contributes the most as far as the share in banking business is concerned, but surprisingly has the second lowest Credit – Deposit Ratio. On contrary to this, southern-most district, viz., Lawngtlai, shares less than 4 per cent in the total banking business but enjoys more than 80 per cent C-D Ratio (Chart 5.20). 5.5 Strategy for Fostering Financial Inclusion in Mizoram The brick-and-mortar branches of commercial banks in varying degrees now cover urban and semi-urban areas, access to banking facilities continues to be an issue for the villages. Mizoram has 703 villages with population below 5000. In these villages, only 44 brick and mortar branches of commercial banks have been opened as on December 2019. The dispersed nature of villages with relatively small number of households in hilly terrains makes traditional branch banking unviable. Due to the limitations of branches of commercial banks, the solution to the problem of ensuring access to banking facilities will have to come from other modes. The business correspondents (BCs) have a greater role in fostering financial inclusion in Mizoram. Two major developments since 2018 have led to a marked improvement in coverage of unbanked areas with banking facilities. First, an increase in the number of BCs commissioned by the banks due to the continued push from the government and Reserve Bank. Secondly, the entry of differentiated banks in 2019, within which there is immense role of India Post Payments Bank, which has opened six branches in the State (Table 5.5). As at end-March 2019, there are 116 BCs appointed by seven banks and the majority of them belonged to MRB (65) and SBI (19). The entry of India Post Payments Banks with its access points has also provided a great boost to the access of banking facilities for villages in the State. | Table 5.5: BCs and Differentiated Banks in Mizoram | | S. No. | Particulars | Dec 2017 | Dec 2019 | | 1 | Business Correspondents | 46 | 95 | | 2 | Payments Banks – Branches/ Access Points | Nil | 6 / 225 | | 3 | Small Finance Banks – Branches | Nil | 2 | | Source: State Level Bankers Committee, Mizoram. | There is also a need for strengthening the self-help groups (SHG)-bank linkage programme (SBLP) programme in the State. In recent years, there has been a significant growth of SHGs with bank linkage (i.e., having savings accounts in banks) and their number per million population in the State is almost at par with NER and even higher than that of the corresponding all-India level (Chart 5.21). However, the number of SHGs which have been credit-linked continues to remain significantly low in comparison to NER and all-India level, despite significant growth (Chart 5.22). As opposed to the all-India trend, where commercial banks have been the major driver of SHGs, in NER and Mizoram, RRBs have been the game changers. The current performance of SHG-bank linkage programme in the State is attributed mainly to the Mizoram Rural Bank, which accounted for 87.7 per cent of savings-linked SHGs and 91.7 per cent of credit-linked SHGs (Chart 5.23). This share for an RRB is much higher compared to the comparable NER and all-India figures for RRBs. Tepid performance of SHGs in Mizoram and in NER may inter alia be attributed to poor banking penetration and absence of mentors. Both the State government and banks are making concerted efforts to step up SHG-Bank Linkage programme. Mizoram State Rural Livelihood Mission (MzSRLM) and North East Rural Livelihood Project (NERLP) are anchoring the SHG-Bank Linkage efforts in the State. Aizawl and Lunglei districts are covered under the World Bank funded NERLP while MzSRLM covers the remaining six districts.

An important factor influencing the delivery of credit to farmers in Mizoram is the non-acceptability of certain types of land holding in the State as equitable mortgage for bank loans. The land is collectively owned by the village council in north eastern States. The farmers do not have a legal title of their land. The village council gives the farmers Village Council (VC) passes, which are not always accepted by the banks. This makes it difficult for the banks to provide credit to the farmers. Hence, there is also a need for digitisation of land records and adoption of agricultural land leasing legislation. To sum up, banking business in Mizoram remains relatively low within the NER states. Public sector banks dominate the banking business in the State. However, the MRB, unlike other NER States plays a lead role. Bank-group wise branch presence and banking activities also remains lop-sided. The dispersed nature of villages with relatively small number of households in hilly terrains makes traditional branch banking unviable in many areas of the State. Due to the lesser number of branches of commercial banks, the solution to the problem of ensuring access to banking facilities will have to come from other modes. In view of poor banking outreach of banks in rural areas, there is a need to revisit the existing branch authorisation policy, which sets banking outlet opening quotas for individual banks at national level but not at the State level. There is also a need to expand the role of Mizoram Rural Bank in promoting financial inclusion in the State. The SHG-bank linkage programme also needs to be fostered as it can achieve desired outcome, especially in rural areas. While the limited banking outreach may not have been able to fully meet the credit demand of the State from the formal banking channel, poor industrial base and traditional farm practices and inadequate infrastructure facilities may be keeping the credit absorption tepid in the State. This also is duly reflected in lower C-D ratio and credit-GSDP ratio. Against this backdrop, there is a greater need for strengthening the infrastructure in the State, promote industrialisation, foster commercial cropping and food-processing industry and also develop sectoral forward and backward inter-linkages to allow the financial sector to play its due role in fostering growth. 6. Data and Empirical Estimates To assess the status of financial literacy and extent of financial inclusion in Mizoram, we used data from both secondary and primary sources. The primary data is collected through a structured questionnaire10 based on purposive sampling method. The secondary data is collected from various publications of the Reserve Bank, Census of India, Directorate of Economics and Statistics, Mizoram, Central Statistics Office (CSO), post offices, etc. Considering the impact of COVID-19 (working hours and maintenance of social distancing), it was not possible to cover whole of the State. Hence, eight blocks from four districts were covered. The selection of four districts was based on various socio-economic and demographic indicators in the State. The literacy rate is highest in Aizawl (97.9 per cent), while it is the lowest in Lawngtlai (65.9 per cent). Lawngtlai is the only district, which has literacy rate lower than national average. Mamit (17 per cent), Lawngtlai (18 per cent) and Champhai (39 per cent) are the three districts with the lowest urban population, while Aizawl (79 per cent) has the highest urban population. Density of population is lowest in Mamit and the highest in Aizawl. The per capita average deposit and credit accounts per 1000 population is the highest in Aizawl and lowest in Mamit and Lawngtlai. Aizawl has the highest population as well as density in the State, while Champhai, Lawngtlai and Mamit are placed 3rd, 4th and 5th as far as population is concerned. Out of total 196 bank branches functional in Mizoram, 97 (49.5 per cent) branches are in Aizawl. Remaining half are spread over rest of the State. Surprisingly, the State capital maintains the lowest C-D ratio of only 29.1 per cent, while Lawngtlai (83.10 per cent) enjoys second highest C-D ratio in the State. Mamit and Champhai maintain 52.8 per cent and 67.6 per cent C-D ratio, respectively (Table 6.1). These four districts cover nearly 60 per cent of the geographical area of the State. Moreover, Mamit district is also among the 117 Aspirational Districts identified by NITI Aayog. Champhai and Lawngtlai districts are located remotely on the east and south extremities and have extensive international borders with Myanmar and Bangladesh. Total 523 respondents spread across eight blocks11 were recorded (Table 6.2). | Table 6.1: Basis of Selection of Centres for Conducting Survey12 | | Banking Data as on March 2018/ Other data from Census 2011 | Aizawl | Mamit | Lawngtlai | Champhai | Kolasib | Lunglei | Saiha | Serchhip | | Area (Sq. km) | 3,575 | 3,025 | 2,556 | 3,185 | 1,382 | 4,537 | 1,399 | 1,421 | | Population-2011 census | 4,00,309 | 86,364 | 1,17,894 | 1,25,745 | 83,955 | 1,61,428 | 56,574 | 64,937 | | Population Density | 112 | 29 | 46 | 39 | 61 | 36 | 40 | 46 | | No. of RD Blocks | 5 | 3 | 4 | 4 | 2 | 4 | 2 | 2 | | No. of Villages | 94 | 86 | 159 | 83 | 34 | 161 | 52 | 35 | | Sex Ratio | 1009 | 927 | 945 | 984 | 956 | 947 | 979 | 977 | | Urban Population (%) | 79 | 17 | 18 | 39 | 56 | 43 | 44 | 49 | | Literacy (Per cent) | 97.89 | 87.03 | 65.88 | 95.15 | 77.96 | 88.86 | 90.43 | 97.91 | | No. of Bank Branches | 97 | 9 | 11 | 21 | 17 | 21 | 6 | 14 | | C-D Ratio (Utilisation) (%) | 29.1 | 52.8 | 83.1 | 67.6 | 29.7 | 78.9 | 140.8 | 48.6 | | Population per branch | 4,127 | 9,596 | 10,718 | 5,988 | 4,939 | 7,687 | 9,429 | 4,638 | | Area (sq.km.) per branch | 37 | 336 | 232 | 152 | 81 | 216 | 233 | 102 | | Deposit A/Cs per 1000 population - Number | 1,582 | 792 | 948 | 1,093 | 1,168 | 1,118 | 1,180 | 1,198 | | Credit A/Cs per 1000 population - Number | 179 | 61 | 64 | 101 | 80 | 120 | 137 | 104 | | Average deposits per population (Rs.) | 1,64,613 | 18,255 | 17,738 | 24,122 | 29,847 | 36,214 | 26,330 | 34,509 | | Average credit per population (Rs.) | 47,907 | 9,642 | 14,734 | 16,298 | 8,858 | 28,575 | 37,063 | 16,754 | | Sources: RBI; and the Census of India, Government of India. |