18th C. D. Deshmukh Memorial Lecture Reserve Bank of India Arvind Panagariya 15th December 2023 Arvind Panagariya* Introduction It is a great honor to be invited to deliver this 18th Chintaman Dwarakanath Deshmukh Memorial Lecture. Sir Chintaman was the first Indian to serve as the Governor of the Reserve Bank of India. His term, spanning 1943 to 1949, saw India transition from British rule to independence. During this period, the landmark Banking Companies Act of 1949, later renamed the Banking Regulation Act, came into force. Being a top central banker was only one of the many distinctions Sir Chintaman had earned during an illustrious career. As far back as 1931, when still only 35 years old, he served as the Secretary to the Second Roundtable Conference in London. Later, in 1944, he represented India as a member of the Indian delegation to the Bretton Woods Conference. After independence, he was the first Finance Minister to serve an uninterrupted six-year term. In this capacity, he played an important role alongside Prime Minister Jawaharlal Nehru in implementing the critical second five-year plan. He also made important contributions to the advancement of intellectual life in India. He served as the Vice Chancellor of Delhi University, President of the Indian Statistical Institute and the Institute of Economic Growth, and was a founding father of the National Council on Applied Economic Research. To honor this distinguished architect of many of modern India’s foundational institutions in financial, economic, and intellectual fields, I have chosen the subject of India’s economic ascendency worldwide in the next fifty years. As, no doubt, everyone in this distinguished audience is aware, for a staggering one and a half millenniums, India was the largest economy in the world. Subsequently, China overtook India, but the two economies remained the world’s largest until as recently as 1870. Today, with India becoming the world’s fifth-largest economy and well on its way to claiming the third spot, it is no longer unrealistic to pose the question of whether the global economy is poised to return to the old normal in which China and India would once again come to occupy the top two spots. What is a plausible transition to this old normal? What challenges does India face in its quest to get there? And what is the pathway to conquering those challenges? These are the questions I propose to explore in the lecture today. The Old Normal The brilliant and late economic historian Angus Maddison provided GDP estimates in constant dollars for the world's major economies going back to the first millennium. Though educated guesses at best, these estimates have broad acceptance among scholars. Even if doubts remain about the accuracy of the estimates in some analysts' minds, hardly anyone has questioned the broad picture they paint. Accordingly, I reproduce them in Table 1. According to the estimates, India was the world’s largest economy, accounting for nearly one-third of its GDP at the beginning of the first millennium CE. As the millennium ended, this share dropped to approximately 29 per cent, but India remained economically the largest in the world. By 1500 CE, India and China each accounted for a quarter of the global GDP. After 1500 CE, China acquired a clear lead over India, but India remained the second largest till 1870. | Table 1: GDP in million 1990 international Geary-Khamis dollars in selected countries and regions | | Year | India | China | Western Europe | Australia, New Zealand, Canada & USA | Other | | 1 | 32.9 | 26.1 | 10.8 | 0.5 | 29.7 | | 1000 | 28.9 | 22.7 | 8.7 | 0.7 | 39.0 | | 1500 | 24.4 | 24.9 | 17.8 | 0.5 | 32.4 | | 1600 | 22.4 | 29.0 | 19.8 | 0.3 | 28.5 | | 1700 | 24.4 | 22.3 | 21.9 | 0.2 | 31.2 | | 1820 | 16.0 | 32.9 | 23.0 | 1.9 | 26.2 | | 1870 | 12.1 | 17.1 | 33.0 | 10.0 | 27.8 | | 1913 | 7.5 | 8.8 | 33.0 | 21.3 | 29.4 | | 1950 | 4.2 | 4.5 | 26.2 | 30.7 | 34.4 | | 1973 | 3.1 | 4.6 | 25.6 | 25.3 | 41.4 | | 2001 | 5.4 | 12.3 | 20.3 | 24.6 | 37.4 | | Source: Maddison (2006). | Some skeptics have downplayed this commanding position of India in the global economy, arguing that this was an era in which everyone around the world had a subsistence-level existence, and India’s larger GDP represented its larger population. While it is true that prosperity as we define it today arrived in the world only after the Industrial Revolution, these skeptics overstate their case. Maddison provides his estimates in 1990 international Geary-Khamis dollars (GK$). He places India’s per-capita income in the first millennium at GK$450 relative to GK$400 in Eastern Europe, Latin America, Japan, and the region covering the former Soviet Union. Assuming that the per-capita income of KM$400 in these latter regions represented the subsistence level of income during the millennium, the excess KM$50 per-capita per year in India represented a 12.5 per cent premium over the subsistence level of income. Given India’s population of 75 million, this amount translated into a total of KM$3.75 billion premium each year. Over a thousand years, this annual excess income, in turn, translated into KM$3.75 trillion of wealth. These riches are reflected at least partially in the surviving monuments from that era, ranging from the Sanchi Stupa and Hampi to the Konark and Brihadishvara temples. They are also captured in the accounts left by the Greek and Chinese travelers visiting India at different times during, and indeed even before, the first millennium CE. If not for its riches, for what did foreign invaders come pouring into India beginning as early as the 8th century CE? Was it not the wealth of India that led Columbus and Vasco de Gama to set sail in search of a sea route to India? Furthermore, archeological finds and the accounts of foreign travelers testify to the existence of thriving cities in India throughout the first one-and-a-half millenniums CE. These finds and contemporary accounts by travelers also bear witness to the existence of many centers of learning, scholarship, and culture, such as Takshashila, Nalanda, Vikramshila, and Valabhi, during the era. Such cities and centers of scholarship and culture could not have existed without a certain measure of prosperity. The countryside had to produce a surplus for the partial upkeep of these entities. That surplus was reflected in the land revenue that rulers collected from them. Finally, suppose we accept that subsistence income was everyone's fate before the Industrial Revolution. In that case, we must explain how per-capita income in West Europe fell from GK$450 in 1 CE to GK$400 in 1000 CE and climbed up to GK$771 in 1500 and GK$890 in 1600. No doubt, as already acknowledged, the Industrial Revolution was a turning point as far as economic prosperity was concerned. But that scarcely rules out the possibility that nations could go beyond subsistence incomes before its advent. India to Become the Third Largest by 2026 The starting point for assessing where India may be heading is its current standing in the global economy. Today, India is the world’s fifth-largest economy, preceded, in ascending order, by Germany, Japan, China, and the United States of America (USA). Figure 1 plots the GDP in current dollars, converted at the average annual exchange rate, in these countries from 2002 to 2022. In 2022, GDP in India, Germany, and Japan stood at $3.4 trillion, $4.1 trillion, and $4.2 trillion, respectively. The year had been unusual for Japan, as it experienced a steep fall in its GDP from $5 trillion in the preceding six years to just $4.2 trillion. The major cause of the fall in Japan’s GDP in dollar terms was a large appreciation of the dollar against the Japanese yen. Specifically, the dollar's value at the end of 2022 was 13.9 per cent higher than at the beginning of the year. How soon Japan can return to the $5 trillion mark will substantially depend on its currency recovering against the dollar. Nearly eight months into 2023, such recovery is nowhere in sight. On the contrary, the dollar has further appreciated in the double digits. If this appreciation holds up for the entire year, the Japanese GDP may end the year 2023 with yet another fall in current dollars. In sum, a return to the $5 trillion mark in current dollars in the near future is an uphill task for Japan.  Regarding Germany, its economy is currently struggling, with the IMF predicting negative growth in real terms in the euro. Its GDP in current dollars is expected to get help, however, from high inflation and appreciation of the euro in 2023. These two factors are predicted to pull up the German GDP in current dollars by a little more than 8 per cent to $4.4 trillion. But in the coming years, with inflation likely to decline sharply, GDP in current dollars will grow at most 4 per cent a year. Therefore, it is unlikely that GDP in current dollars in either Germany or Japan will cross $5 trillion mark in the coming three years. Japan will have to sustain a growth rate of 3.5 per cent in current dollars to reach $5.03 trillion in 2027 from its 2022 level of $4.2 trillion. At the 4 per cent annual growth rate, German GDP will rise from $4.4 trillion in 2023 to $4.9 trillion in 2026 and $5.1 trillion in 2027. Given these estimates, how soon can the Indian GDP cross the GDPs of these two countries? One way to answer this question is to assume that in the next four or five years, India will maintain the average growth rate in current dollars achieved during the last two decades. Recognizing that the first of these decades was rocked by the global financial crisis and the second by the pandemic, that there have been many reforms in the last decade, and that the problems afflicting China have led global investors to turn to India as an important destination, this is a conservative assumption. During the past two decades, India has grown at an annual average rate of 10.22 per cent in current dollars. At this rate, India’s GDP in current dollars will reach $5 trillion in 2026 and $5.5 trillion in 2027. This means that there are good prospects that India will become the world’s third economy by the end of 2026, sooner than nearly all current predictions. The USA-China Race How is the race among the USA, China, and India likely to evolve once India has become the world’s third-largest economy? With the GDP in the three countries in current dollars at $25.5, $18, and $3.4 trillion in 2022, pairwise gaps in GDPs are large, and any switches in rankings will take a considerable time. In the past, I have resisted speculating that far into the future, but I break that rule today principally because only such speculation will help us see how rare an opportunity knocks on our door. I hope that painting the contours of this opportunity in the sharpest possible manner would motivate our policymakers to take policy measures that would help us get to the destination with greater certainty and speed. The thought that the moon is within our grasp can be a great motivator! To proceed, let us first consider the evolution of the race between the USA and China. The USA has grown at an annual average rate of 2.01 per cent in constant dollars during the past two decades. There are many reasons that this growth rate is the best the USA will do over the next two decades. They include an already high per-capita and total GDP, increasing complexity of the economy and the regulatory regime, growing consensus in favor of protectionism, and resistance to immigration that would lead to greater population aging. The future growth rate of China is more difficult to predict. However, the experiences of other fast-growing economies provide some guidance in this respect. In Table 2, I report decade-wise growth rates of GDP in constant local currency units in Taiwan, South Korea, Singapore, and China during their respective high-growth eras. In each case, the beginning point is the first year in which the growth rate shifted to a high-growth trajectory and is shown in parentheses following the country name in the first column. Observe that three decades of sustained growth between 8 and 10 per cent in all three of Taiwan, South Korea, and Singapore gave way to a fall in the growth rate to the 5 to 7 per cent range in the fourth decade. In the fifth decade, it fell to between 4 and 6 per cent; in the sixth decade, it fell further to 3.2 per cent or less. To be sure, there are some differences of nuances among the three countries. For example, Singapore grew slightly slower than Taiwan and South Korea in the first three decades but sustained slightly higher growth rates in the fourth and fifth. But beyond such differences, the pattern is quite similar. | Table 2: Growth rates of GDP in constant local currency units in fast-growing economies | | Decade after the shift to high-growth trajectory | Taiwan

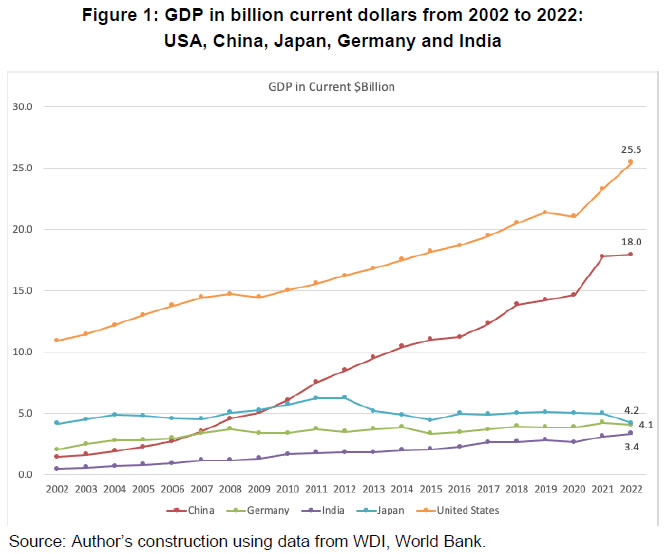

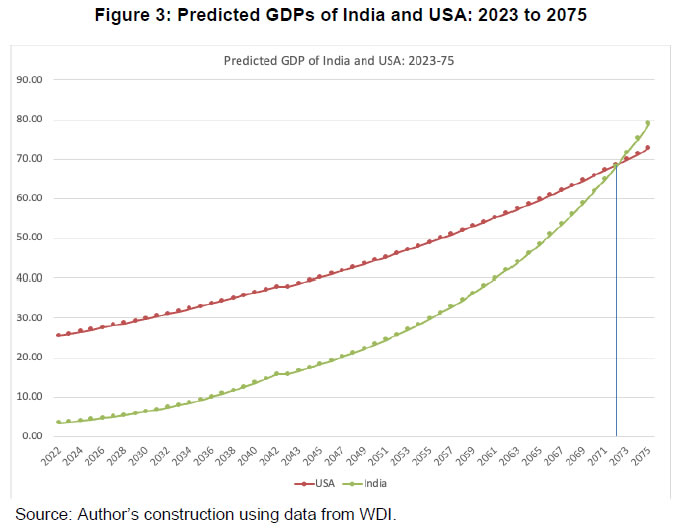

(1962 onwards) | South Korea

(1963 onwards) | Singapore

(1961 onwards) | China

(1982 onwards) | | 1st decade | 10.3 | 10.2 | 9.4 | 9.8 | | 2nd decade | 9.3 | 9.1 | 8.8 | 10.4 | | 3rd decade | 8.36 | 10.2 | 7.8 | 10.7 | | 4th decade | 5.72 | 6.8 | 7.1 | 6.7 | | 5th decade | 4.78 | 4.0 | 5.9 | | | 6th decade | 3.21 | 2.6 | 3.2 | | | Source: Author’s calculations using annual growth rates from WDI for South Korea, Singapore, and China. For Taiwan, Yu (1999) for years 1962-80 and National Statistics, Taiwan (https://eng.stat.gov.tw/cp.aspx?n=2334) subsequently. | Compared to Taiwan, South Korea, and Singapore, China has grown faster in the first three decades of its high-growth era. In this respect, it resembles Taiwan and South Korea more closely than Singapore. Given that Taiwan saw its growth rates in the 5th and 6th decades fall to 4.78 per cent and 3.21 per cent and South Korea to 4 per cent and 2.6 per cent, respectively, the most optimistic inference for China is that it would grow 5 per cent in the fifth decade and 3.5 per cent in the sixth. Indeed, keeping in view the numerous ongoing problems, including but not limited to a brewing crisis in the housing industry at the time of writing, super-high private and public debts, the specter of deflation, conflict with the USA, and domestic political challenges, each of these rates may turn out to be lower by up to a full percentage point. An important limitation of these growth rates from the viewpoint of the comparative evolution of the US and Chinese GDP is that they have been derived based on GDP in constant local currency. For comparability, what we need are the growth rates in constant dollars. To the extent that the proportionate change in the Chinese GDP deflator minus the proportionate change in the US GDP deflator exceeds the proportionate nominal depreciation of the Chinese currency, the growth rate of China’s GDP in constant local currency units underestimates the growth rate of its GDP in constant dollars and vice versa. In other words, to convert the GDP growth rate in constant local currency into that in constant dollars, we must add the proportionate real appreciation of the local currency to the GDP growth rate in constant local currency during the year. A more direct method of calculating the growth rates of Chinese GDP in constant dollars first applies the US GDP deflator to the Chinese GDP in current dollars and then uses the resulting constant-dollar GDP series to compute the growth rates. When this is done, China’s growth rates during the four successive “high-growth” decades are 3.5 per cent, 11.4 per cent, 16.6 per cent, and 7.0 per cent. The real depreciation of the yuan cuts the growth rate in the constant local currency units by 6.3 percentage points during the first of the four decades, while its real appreciation adds 1, 5.9, and 0.3 percentage points in the remaining three decades successively. Fluctuations in the real value of the Chinese currency vis-à-vis the dollar thus result in much greater variation in the decadal growth rates of GDP in constant dollars.1 Interestingly, in the last four decades, the GDP growth rate in constant dollars at 7 per cent exceeds that in the constant local currency units by only 0.3 percentage points. Considering the noise introduced by the numerous challenges facing China as mentioned earlier, we can justifiably maintain the assumption of 5 per cent growth in the next decade and 3.5 per cent in the following. Strictly speaking, these growth rates are in constant local currency units. But with the Chinese price level now closer to the US price level than in the past, the scope for the real appreciation of the Chinese currency has considerably narrowed. Therefore, as a first approximation, we may also assume the same growth rates in constant dollars. Tweaking these rates up or down by a half to one percentage point would advance or delay the timing of the switch in the ranking between the two countries by a few years, but it will have no real impact on the central question of the timing of the restoration of the old normal. The answer to the latter depends on if and when the Indian GDP would cross the US GDP. Armed with these estimates of future GDP growth rates in constant dollars in China and the 2 per cent rate in the USA, we can now plot the paths of GDPs of the two countries in constant 2022 dollars. This is done in Figure 2. The paths will not be smooth since the growth rates will fluctuate annually, but this is not important for a longer-term exercise such as this one. My concern presently is with the evolution of the GDP trend, which is what Figure 2 depicts. Under the assumed growth rate, GDP in China will coincide with that in the USA in 2036, after which it will exceed the latter. Even if the Chinese growth rates are different so that this cross-over point shifts by five to ten years on either side, India will be competing with the USA to restore the old normal. India and the USA Though India achieved a marked acceleration of its growth rate beginning in 2003, its trajectory during the first two high-growth decades has not been as steep as those of the countries shown in Table 2. It grew at the annual average rate of 7.0 per cent during the first and 5.8 per cent during the second decade. The fact that the decline in the growth rate in the second decade has been principally on account of the COVID-19 shock can be gleaned from the fact that the average growth rate during the last three years of this decade was just 3.5 per cent. Correspondingly, the average annual growth rate during the first seven years of the decade stood at 6.7 per cent. These facts have two implications. First, India will likely remain on a lower growth trajectory during its first four decades of high growth than the countries shown in Table 2. Second, it will likely sustain its high but admittedly lower growth rates than those of the countries in Table 2 for longer. In other words, it will be several decades before its growth rate falls below 5 per cent. Before we can stipulate a plausible set of future growth rates for India, the last point to note is that the average annual growth rate of its GDP in constant dollars during high-growth but pre-COVID years, 2003-19, has been 8.8 per cent. Because the rupee saw a significant real appreciation during this period, the GDP growth rate in real dollars exceeded that in real rupees by 1.9 percentage points. Keeping this performance in view, a conservative assumption is that the Indian GDP in constant dollars will sustain a growth rate of 8 per cent in the next two decades. In addition, I shall assume that the country will maintain a 5 per cent growth rate for at least three additional decades. This latter assumption is justified because India is on a lower growth trajectory than the countries in Table 2 and, therefore, will be left with considerable room for catch-up at the end of its four high-growth decades. Continuing to assume the growth rate of 2 per cent for the USA, Figure 3 plots the paths of predicted GDPs of India and the USA during 2023-2075. At the assumed growth rates, India will catch up with the USA in 2072, precisely at the end of the 125th year of its independence and a mere two hundred years after the old normal was disturbed. While the timing of this event may be off by up to a decade, there remains a strong case that the world will return to the old normal within the current century.  How will the per-capita incomes of the two countries compare once their GDPs have converged? While it is hardly any surprise that given its much smaller population, the USA will continue to maintain a large lead over India in per-capita terms, it is of some significance that India will also achieve a high standard of living by that year. As per the medium scenario of the projections by the United Nations Population Division, the total populations of the USA and India in 2072 would be 387.925 million and 1685.415 million, respectively. At these populations, per-capita incomes of the USA and India in 2022 constant dollars work out to $176,671 and $40,459, respectively, in 2072. The latter figure exceeds the average per-capita GDP in the European Union in 2022. Why India is Likely to Catch up with the USA Restoring the old normal hinges on realizing India's assumed growth rates over the next five decades. Can we make a plausible case for such growth? To be sure, there is much going on for India in the coming decades for this scenario to fructify. Political stability is a necessary, though not sufficient, condition for sustained growth. The existence of border disputes with two neighboring countries notwithstanding, today, few analysts dispute that India will remain politically stable in the next half-century as long as the world does not descend into an all-around conflict. It was once suggested, with a great deal of conviction, that India would disintegrate in the face of its vast diversity of language, religion, and caste.2 Subsequent history has proven that argument wrong; few analysts would endorse it today. A closely related complementary factor in India’s favor is its democratic polity. On the one hand, policy changes within this structure are slow, as exemplified by the pace of economic reforms, which remain incomplete even three decades after they were launched. On the other hand, the changes once made are durable and not easily reversed. The practical implication of this fact is that whereas the transition out of the control regime of yesteryear into a market economy has been gradual, it is likely to endure. There may be setbacks here and there as we travel along this path—something we have experienced multiple times in the last three decades—but major deviations from this path or outright reversals, as seems to be happening in China, are unlikely. Indeed, as education expands and communication channels continue to improve, demands by the electorate for superior outcomes will only grow, with even state governments held to higher and higher delivery standards. The second factor favoring India is the low level of its current per-capita income. The per-capita GDP in current dollars in 2022 was $2,390 in India, $12,720 in China, and $33,645 in South Korea. The technology to achieve a significantly higher per-capita GDP than India’s current per-capita GDP already exists, as exemplified by its levels in China, South Korea, and other countries. Acquiring complementary skills and machines would permit India to achieve these higher levels of per-capita GDP. With the numerous reforms already in place and a few more, such acquisition is well within India’s reach. This, in turn, makes for good prospects for rapid growth as India catches up with its competitor countries. The third factor in India’s favor is rooted in its demography, as predicted to unfold over the next several decades. This factor is much discussed and has both a size and a composition aspect. Several points are worthy of note. -

India is now the largest country by population. This large size offers scale economies in the provision of public goods. For example, the per-unit cost of providing digital services of various kinds rapidly declines with the size of potential users. The large population also confers network economies in the use of digital services since it translates into a larger number of users with whom each user can transact. The same argument also applies to infrastructure: a larger population translates into a lower per-unit cost of provision of road, railway, and air connectivity. -

A large population translates into a large workforce, which paves the way for the emergence of large markets in various skills, making the country an attractive location for multinationals. One important factor bringing the multinationals to Indian shores as a part of their China+1 strategy is the large size of its labor market, which promises the availability of workers at relatively stable wages for several years. With the Western nations rapidly aging, services that can be digitized will progressively move to India, a process that is already underway on a substantial scale. -

In addition to being large, India’s population is also young. This factor translates into a larger workforce for a given population size and, hence, a higher per-capita output. Because the young save while the old dissave, a proportionately large young proportion also translates into higher savings and investment. This, too, contributes to a higher per-capita income. Finally, a younger population brings greater energy and innovation to a nation. The fourth factor favoring India is the global environment, which will likely unfold in the forthcoming decades. Two factors are of particular relevance in this context. The Chinese economy is now exhibiting all signs of fatigue and has either exited or will soon exit its high-growth phase. Moreover, geopolitically, India is emerging as a favored country by the United States and Europe. India also has friendly relations with Japan, South Korea, and Southeast Asian countries. These factors will likely lead the multinationals to prioritize India as the location of their future operations. They also open greater space for Indian goods and services worldwide. The fifth and final factor working to India’s advantage is the consensus favoring pro-market reforms forged over the past three decades. Many reforms are already in place, and those that are still outstanding have a good chance of being implemented in the coming years. Public pressure on the political leadership to provide good governance is high and is now operating at the level of the states as well. Governments that drag their feet and do not deliver, whether at the center or in the states, now risk being voted out in their next election. The Challenge of the Small Economic Units Let me note at the outset that challenges relating to maintaining macro-economic stability; continued freeing of labor, land, and capital markets; trade liberalization; privatization of public sector enterprises and banks; policies towards the digital economy; efficient delivery of benefits to the deprived; provision of roads, railways, waterways; building and administering of cities; and access and quality of education and health services will remain with the government in the years to come. The sooner we can correct past policy mistakes in these areas, the better the prospects of higher growth and a faster return to the old normal. Rather than elaborate on each of these issues, which I have done in detail in my 2019 book India Unlimited, in this last substantive section of the lecture, I want to discuss a problem that, to my mind, requires greater attention from the policymakers.3 Explicit recognition of this problem would help design the policies in many areas I have just mentioned. The problem I refer to is the phenomenon of the small economic units in nearly all spheres of life that we had encouraged in the past and, to some degree, continue to do today. Lest I am misunderstood, I state at the outset that it is not my case that we must replace the small economic units with medium and large ones in the entirety. Instead, my case is for a rebalancing in favor of medium and large economic units. Without policies encouraging such rebalancing, growth will falter, and the return to the old normal will be delayed by multiple decades. Small Habitations First and foremost, the population of India remains highly dispersed in small habitations. Because the last census was conducted in 2011, the available data are dated. Nevertheless, they are adequate to give us some sense of the magnitude of our challenge. In 2011, 834.7 million, or 68.9 per cent of all Indians, lived in rural areas. However, rural India is not a uniform entity. Sizes of rural habitations vary widely. As many as three-quarters of rural Indians, or a little more than half of all Indians, lived in habitations smaller than 5,000 in 2011. In absolute terms, this was a population of 637.5 million. South Korea offers a dramatic contrast to India in this respect. In the first half of the 1960s, its urban population was less than 30 per cent.4 By 2018, 83 per cent of its population came to live in cities of 50,000 or more. In the same year, as much as 76 per cent of the population lived in cities of 500,000 or more, compared to only 55 per cent in the OECD.5 Even in the United States, sometimes described as a nation of small towns, 54.5 per cent of the population lived in incorporated habitations of 10,000 or more residents.6 Table 3, which reports the distribution of the rural population by village size, offers some insight into this phenomenon. | Table 3: Distribution of rural population by village size, 2011 | | Rural Habitation Size | As per cent of total rural population | As per cent of total Indian population | Cumulative

(as per cent of rural) | Cumulative

(as per cent of total Indian population) | | <200 | 1.0 | 0.7 | 1.0 | 0.7 | | 200-499 | 4.8 | 3.3 | 5.7 | 4.0 | | 500-999 | 12.4 | 8.5 | 18.1 | 12.5 | | 1000-1999 | 23.7 | 16.3 | 41.8 | 28.8 | | 2000-4999 | 34.6 | 23.8 | 76.5 | 52.6 | | 5000-9999 | 14.9 | 10.2 | 91.3 | 62.9 | | 10000 or more | 8.7 | 6.0 | 100.0 | 68.9 | | Source: Author’s calculations using Census 2011 data. | In some states of India, such as Rajasthan, Chhattisgarh, Madhya Pradesh, Odisha, Andhra Pradesh, and Gujarat, the villages are highly dispersed. Small habitations in distant locations turn the delivery of even what may be considered basic public services such as piped water, electricity, roads, digital connectivity, education, and health into a serious challenge. When our young journalists go to remote villages, bring images of deprivation from them, and complain that even after 75 years of independence, the people of these villages are waiting for development to reach them, they do not stop to think how big a challenge this is for a nation with a per-capita income of just $2,400 per annum. How far can any government push redistribution to bring genuine prosperity to these villages before it begins killing the incentive to create wealth? Indeed, even if a draconian government were to redistribute the income entirely equally—a feat no government in the known history of mankind has accomplished—the resulting income would fail to give each citizen a prosperous existence. The bottom line is that redistribution has limits, and beyond bringing the basic amenities to them, no government can bring true prosperity to the small, distant habitations. People must move to larger habitations with enough population concentration to make various modern economic activities viable. Village-level self-sufficiency, which many of our leaders sought and promoted at independence, is incompatible with modern-day aspirations of owning a car, refrigerator, air-conditioned housing, and access to decent education and health services. Small Farms In addition to living in highly dispersed and small villages, Indian farmers operate tiny agricultural holdings. This remains the case, notwithstanding that agricultural land as a proportion of the total land area in India is among the highest worldwide. In 2020, the proportion stood at 44.4 per cent in the USA, 56.1 per cent in China, 36.5 per cent worldwide, and 60.2 per cent in India.7 Figure 4 provides the size distribution of agricultural holdings in India as per the 2015-16 agricultural census, the latest available. Almost half (48 per cent, to be more precise) of the holdings that year were smaller than half a hectare. Holdings smaller than 2 hectares accounted for 86 per cent of all holdings. At the other extreme, only 1 per cent of the holdings were 10 hectares or larger. To further appreciate these holdings' smallness, it is instructive to consider the average size of the holdings within each category shown in Figure 4. Figure 5 presents this information. Holdings smaller than half a hectare were only 0.23 hectare on average. When all holdings were considered, the average size was 1.08 hectares. Even the larger holdings were, on average, only 16.96 hectares. The preponderance of such small holdings undermines efficiency in a big way. Farmers cultivating these holdings cannot be expected to compete in the global marketplace against farmers cultivating farms going into hundreds of hectares using highly mechanized techniques. The farms also hold a large proportion of the farmer’s time hostage to a small total value added. Undoubtedly, many of these farmers engage in non-farm activities, but the alternative income-generation opportunities their small villages offer are limited. Small Enterprises Agriculture is not alone in being stuck in small economic units. Given our history of encouragement to cottage and village enterprises during the Nehru era, an ever-expanding list of small-scale-industries (SSI) reservations from 1967 until 1991, and continuing preoccupation with micro and small enterprises even in the post-liberalization era, industry and services sectors in India also suffer from this fate. This is graphically brought out by Table 4. | Table 4: Firm-size distribution of workforce in industry and services | | Firm Size | Percentage of Workforce in Industry and Services | Percentage of the total workforce | | 1-5 workers | 59.2 | 32.29 | | 6-9 workers | 12.8 | 6.98 | | 10-19 workers | 7.1 | 3.87 | | 20 or more workers | 18.3 | 9.98 | | Not known | 2.6 | 1.42 | | Total | 100 | 54.54 | | Source: Author’s construction from estimates in GoI 2023a, Appendix Tables 26 and 41. | Based on the Periodic Labor Force Survey (PLFS) 2021-22, 72 per cent of the workforce in industry and services was employed in enterprises with nine or fewer workers. A large part of these 72 per cent of workers is self-employed in the proprietor and partnership enterprises, many of which employ no full-time workers other than family members. Seen differently, 45.46 per cent of all workers in India are employed in agriculture; another 39.27 per cent are employed in enterprises with nine or fewer workers; and only 10 per cent are employed in enterprises with 20 or more workers. Notably, by the most commonly used definition, enterprises with fewer than 50 workers are considered small, those with 49 to 199 workers medium, and only those with 200 workers large. Because the PLFS aggregates all enterprises with 20 or more workers into a single category, we lack workforce distribution according to this classification. However, the evidence from it does allow us to conclude that the proportion of all workers in the large enterprises is in the single digits. While small enterprises will always remain home to half or a little more of the workforce in industry and services, their current dominance and the relative absence of medium and large enterprises as employers impede the creation of high-productivity and high-wage jobs on a large scale. The current employment pattern translates into low productivity for most workers. It is not merely the case that large enterprises exhibit significantly higher worker productivity than small ones, but their significant presence also helps drive productivity up in the latter. Large enterprises generally operate in the global marketplace and must compete against the best in the world. This forces them to struggle harder to be efficient. They can also better exploit scale economies and superior technology embedded in machines. They are constantly exposed to new technologies and management techniques through contact with their global counterparts. Their preponderance forces greater efficiency among smaller enterprises, which must either serve as their ancillaries or compete with them. The gap between worker productivity in small and large enterprises is narrower when the latter are ubiquitous. A graphical comparison of India and China regarding employment and worker productivity by firm size illustrates this point. Figure 6 shows employment distribution across small, medium, and large manufacturing enterprises in India and China in 2005, the latest year for which I can obtain such comparative estimates. The striking feature of this graph is that only 16 per cent of the manufacturing workforce in India is employed in medium and large enterprises. In China, this proportion is 75 per cent.  Next, consider the relative levels of worker productivity across enterprises of different sizes. Figure 7 offers this comparison between India and China, also for the year 2005. This figure normalizes worker productivity in large enterprises at 100 for India and China, though it is significantly higher in the latter. The key takeaway from this figure is that worker productivity in small enterprises is much lower than in large and medium enterprises in India relative to that in China. With 75 per cent of the workforce in China in large or medium enterprises, these enterprises define the ecosystem in the labor market. Small enterprises must compete with them for labor. The high wages they must pay as a result also force them to achieve high efficiency. In contrast, with 84 per cent of the workforce in small enterprises, these latter define the ecosystem in the labor market. With the resulting slack in the labor market, the incentive to enforce high efficiency does not exist. Only as medium and large enterprises begin to bid for workers on a significantly larger scale will greater efficiency in the small enterprises be achieved. When we consider Figures 6 and 7 together, we see that most workers in India are stuck in low-productivity jobs. Not only is the productivity in small enterprises extremely low relative to that in large enterprises, but the bulk of the workforce is stuck in those enterprises. The phenomenon of too many workers producing too little output is present not just in agriculture but in manufacturing as well. Just as transformation requires the movement of a large proportion of agricultural workers to gainful employment in industry and services, it requires the movement of a large proportion of manufacturing workers from small to medium and large enterprises. Small Schools and Colleges The phenomenon of small economic units has also come to penetrate India’s education sector and manifests itself in the ubiquity of small schools and colleges. Geeta Gandhi Kingdon has studied this phenomenon extensively in the case of public elementary schools.8 She defines an elementary school as small if it has 50 or fewer students. If the school has only grades 1 to 5, this figure translates in classes of size ten on average when student attendance is 100 per cent. If it has grades 1 to 8, the average size drops to 6.25. She further defines the school as tiny if it has 20 or fewer students. In this case, the average class size drops to four in a school with five grades and 2.5 in one with eight grades. In 2010-11, small public schools accounted for 30.24 per cent of all public primary and elementary schools and had just 30.4 students per school on average. The proportion of small schools rose to 40 per cent, and per school enrolment on average fell to 28.4 in 2016-17. As regards tiny schools, their proportion rose from 6.9 per cent to 11.1 per cent, and enrolment per school fell from 12.9 to 12.6 on average over the same period. Tiny schools with average sizes of 28 and 13, respectively, impose high per-pupil costs. Kingdon estimates that per-pupil annual cost in teacher salary alone was Rs.93,285 in small schools and Rs.192,539 in tiny schools in 2016-17. Tragically, with just 28.4 students on average in 2016-17, class sizes of 5.6 pupils in small schools with grades 1 to 5 and 3.5 pupils in those with grades 1 to 8 are even pedagogically unviable. The phenomenon observed by Kingdon in elementary schools also afflicts India’s colleges. All India Survey on Higher Education 2020-21 (AISHE-2020-21) reveals that as many as 3,215 colleges in India, accounting for 7.9 per cent of all colleges, have 50 or fewer students. As many as 26,529, or 65.1 per cent of all colleges, have less than 500 students.9 As in elementary schools, small colleges are costly and pedagogically too small to impart good education to students. Students are offered courses in an extremely limited number of areas. Concluding Thoughts To realize its full potential, India must take the steps necessary to help its economic units grow larger. Small habitations, small farms, and small enterprises are intimately linked. Reforms that will help the enterprises in industry and services grow larger will create job opportunities for the masses, which will, in turn, pave the way for workers to migrate from rural to urban areas. Such migration will automatically increase land per worker in farming while also bringing more and more of the population to where development is. With the population becoming progressively concentrated in urban agglomerations, we will also see larger economic units replace some smaller ones in areas such as schools and colleges. I am confident we are on the cusp of a new chapter in India’s history. While the next two decades will see the fastest transformation in the country’s history, given the large economic base already established and a high expected growth rate, the following three will witness unsurpassed and steadily rising prosperity. Sacrifices made by my father’s generation to free India from the British yoke and those by my generation to build and strengthen the Indian democracy would now bear fruit for the generations represented by my children and theirs. The coming decades will also witness a confident India play a central role in building a prosperous global economy and peaceful world order. References Government of India, 2019. Agricultural Census: 2015-16, New Delhi: Ministry of Agriculture and Farmers Welfare. Government of India, 2023a. Periodic Labor Force Survey 2021-22, New Delhi: National Sample Survey Office, Ministry of Statistics and Program Implementation. Government of India, 2023b. All India Survey on Higher Education 2020-21, New Delhi: Department of Higher Education, Ministry of Education. Harrison, Selig S., 1960. India: The Most Dangerous Decades, Princeton, NJ: Princeton University Press. Kingdon, Geeta, 2020. “The Private Schooling Phenomenon in India: A Review,” The Journal of Development Studies 56(10), 1795-1817. Maddison, Angus, 2006. The World Economy: 1-2001 A.D., Volume 2, Paris: OECD. Panagariya, Arvind, 2020. India Unlimited: Reclaiming the Lost Glory, New Delhi: Harper Collins. Yu, Tzong-Shian, 1999. “A Balanced Budget, Stable Prices, and Full Employment: The Macroeconomic Environment for Taiwan’s Growth.” In Erik Thorbecke and Henry Wan, eds., Taiwan’s Development Experience: Lessons on Roles of Government and Market, Boston: Kluwer Academic Publishers, pp. 141-55.

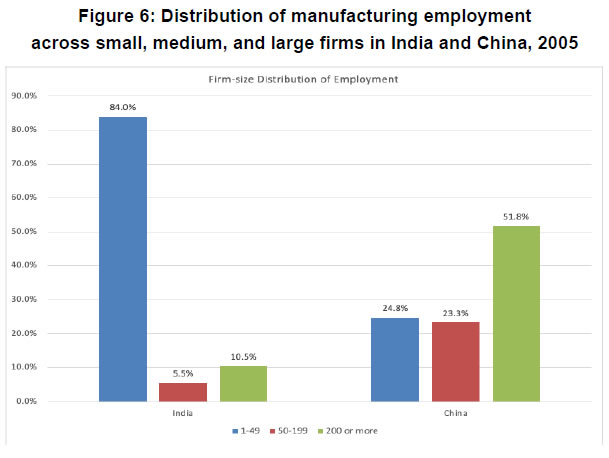

|