Biswa

Swarup Misra*

Since their inception, regional rural banks

(RRBs) have taken deep roots and have become a sort of inseparable part of the

rural credit structure in India. The financial viability of the RRBs has, however,

been a matter of concern since the 1980s, just five years after their existence.

A number of committees have gone into the issue of their financial viability and

possible restructuring. This study follows a deductive approach. First the extent

of the problem of the loss making RRBs has been studied to analyse if the problem

is confined to some particular sponsor banks or States. Subsequently, an attempt

is made to enquire as to factors that influence the performance of the RRBs and

the role-played by the sponsor banks. The empirical analysis has been couched

in terms of profit and loss making RRBs for a reasonably long (10-year) period

to draw robust policy inferences.

JEL Classification : G21,

C23, R12

Keywords: RRBs, Restructuring Strategy, Panel

GMM

Introduction

Regional Rural Banks have

been in existence for around three decades in the Indian financial scene. Inception

of regional rural banks (RRBs) can be seen as a unique experiment as well as experience

in improving the efficacy of rural credit delivery mechanism in India. With joint

share holding by Central Government, the concerned State Government and the sponsoring

bank, an effort was made to integrate commercial banking within the broad policy

thrust towards social banking keeping in view the local peculiarities. The genesis

of the RRBs can be traced to the need for a stronger institutional arrangement

for providing rural credit. The Narsimham committee conceptualised the creation

of RRBs in 1975 as a new set of regionally oriented rural banks, which would combine

the local feel and familiarity of rural problems characteristic of cooperatives

with the professionalism and large resource base of commercial banks. Subsequently,

the RRBs were set up through the promulgation of RRB Act1 of 1976. Their equity

is held by the Central Government, concerned State Government and the Sponsor

Bank in the proportion of 50:15:35. RRBs were supposed to evolve as specialised

rural financial institutions for developing the rural economy by providing credit

to small and marginal farmers, agricultural labourers, artisans and small entrepreneurs.

Over the years, the RRBs, which are often viewed as the small man’s

bank, have taken deep roots and have become a sort of inseparable part of the

rural credit structure2 . They have played a key role in rural institutional

financing in terms of geographical coverage, clientele outreach and business volume

as also contribution to development of the rural economy3 . A remarkable feature

of their performance over the past three decades has been the massive expansion

of their retail network in rural areas. From a modest beginning of 6 RRBs with

17 branches covering 12 districts in December 1975, the numbers have grown into

196 RRBs with 14,446 branches working in 518 districts across the country in March

2004. RRBs have a large branch network in the rural area forming around 43 per

cent of the total rural branches of commercial banks. The rural orientation of

RRBs is formidable with rural and semi-urban branches constituting over 97 per

cent of their branch network. The growth in the branch network has enabled the

RRBs to expand banking activities in the unbanked areas and mobilise rural savings.

The mandate of promoting banking with a rural focus, however, would be an

enduring phenomenon only when the financial health of the RRBs is sound. With

built-in restrictions4 on their operations, it is common to expect that the financial

health of the RRBs itself would be a matter of concern. As regards their financial

status, during the year 2003-04, 163 RRBs earned profits amounting to Rs.953 crore

while 33 RRBs incurred losses to the tune of Rs.184 crore. Ninety RRBs had accumulated

losses as on March 31, 2004. Aggregate accumulated loss of RRBs amounted to Rs.

2,725 crore during the year 2003-04. Of the 90 RRBs having accumulated loss, 53

RRBs had eroded their entire owned funds as also a part of their deposits. Furthermore,

non-performing assets (NPAs) of the RRBs in absolute terms stood at Rs.3,299 crore

as on March 31,2004. The percentage of gross NPAs was 12.6 during the year ending

March 31, 2004. While 103 RRBs had gross NPAs less than the national average,

93 had NPAs more than it.

Given the multi agency share holding, this study

makes an attempt to enquire into such factors that influence the performance of

the RRBs and the role played by sponsor bank in a broader scenario. The problem

has been approached in a deductive pattern. First, an attempt is made to identify

the extent of the problem of loss making RRBs and see if they are confined to

some particular sponsor banks or States. If the problem banks and States could

be identified that would help in focussing the attention for an enduring solution.

Subsequently, a model-based approach has been pursued to identify the factors

that are responsible for the problems faced by the RRBs. This study contributes

to the literature on RRBs primarily in two ways. First, the issues concerning

RRBs are an area that is less visited empirically (econometrically) compared to

the vast literature on commercial banks. Whatever studies have emerged on the

topic, they have primarily relied on exploratory analysis done for a particular

year or on a group of RRBs to draw inferences. This kind of an approach has a

serious limitation in that the findings are guided by the choice of the year of

analysis or the particular RRB(s) in question. To overcome this problem, one needs

to consider, as attempted in this paper, a reasonably long period for analysis

where extreme observations would be evened out so that one gets results that are

more dependable. This study is an attempt in that direction. The present study

considers the entire population rather than a few RRBs and a ten-year period for

empirical analysis so that results are broad based and robust. Second, given the

attention at the policy level to restructure the RRBs, it is necessary that the

behaviour of RRBs be analysed separately for the profit and loss making ones,

than all RRBs bunched together so that it helps in policy formulation. Such an

approach has been followed in this study. The rest of the paper is organised

in six segments. Section I provides a brief review of the course for restructuring

and financial viability of RRBs suggested by different committees over the years.

Section II reviews briefly the different factors identified in the literature

that affects the financial performance of commercial banks and also the extant

literature on factors affecting performance of RRBs. A bird’s eye view of

the spatial distribution of the performance of RRBs across the States and sponsor

banks is given in section III. The methodology of the empirical analysis is discussed

in Section IV. Section V discusses the empirical results. Concluding observations

are set out in Section VI. Section

I Restructuring Strategies The financial viability

of RRBs has engaged the attention of the policy makers from time to time. In fact,

as early as 1981, the Committee to Review Arrangements for Institutional Credit

for Agriculture and Rural Development (CRAFICARD) addressed the

issue of financial viability of the RRBs. The CRAFICARD recommended that ‘the

loss incurred by a RRB should be made good annually by the shareholders in the

same proportion of their shareholdings’. Though this recommendation was

not accepted, under a scheme of recapitalisation, financial support was provided

by the shareholders in the proportion of their shareholdings. Subsequently, a

number of committees have come out with different suggestions to address the financial

non-viability of RRBs. For instance, the Working Group on RRBs

(Kelkar Committee) in 1984 recommended that small and uneconomic RRBs should be

merged in the interest of economic viability. Five years down the line, in a similar

vein, the Agricultural Credit Review Committee (Khusro Committee), 1989 pointed

out that ‘the weaknesses of RRBs are endemic to the system and non-viability

is built into it, and the only option was to merge the RRBs with the sponsor banks.

The objective of serving the weaker sections effectively could be achieved only

by self-sustaining credit institutions’. The Committee on Restructuring

of RRBs, 1994 (Bhandari Committee) identified 49 RRBs for comprehensive restructuring.

It recommended greater devolution of decision-making powers to the Boards of RRBs

in the matters of business development and staff matters. The option of liquidation

again was mooted by the Committee on Revamping of RRBs, 1996 (Basu Committee). The

Expert Group on RRBs in 1997 (Thingalaya Committee) held that very weak RRBs should

be viewed separately and possibility of their liquidation be recognised. They

might be merged with neighbouring RRBs. The Expert Committee on Rural Credit,

2001 (Vyas Committee I) was of the view that the sponsor bank should ensure necessary

autonomy for RRBs in their credit and other portfolio management system. Subsequently,

another committee under the Chairmanship of Chalapathy Rao in 2003 (Chalapathy

Rao Committee) recommended that the entire system of RRBs may be consolidated

while retaining the advantages of regional character of these institutions. As

part of the process, some sponsor banks may be eased out. The sponsoring institutions

may include other approved financial institutions as well, in addition to commercial

banks. The Group of CMDs of Select Public Sector Banks, 2004 (Purwar Committee)

recommended the amalgamation of RRBs on regional basis into six commercial banks

- one each for the Northern, Southern, Eastern, Western, Central and North-Eastern

Regions. Thus one finds that a host of options have been suggested starting with

vertical merger (with sponsor banks), horizontal merger (amongst RRBs operating

in a particular region) to liquidation by different committees that have gone

into the issue of financial viability and restructuring strategies for the RRBs. More

recently, a committee under the Chairmanship of A.V Sardesai revisited the issue

of restructuring the RRBs (Sardesai Committee, 2005). The Sardesai committee held

that ‘to improve the operational viability of RRBs and take advantage of

the economies of scale, the route of merger/amalgamation of RRBs may be considered

taking into account the views of the various stakeholders’. Merger of RRBs

with the sponsor bank is not provided in the RRB Act 1976. Mergers, even if allowed,

would not be a desirable way of restructuring. The Committee was of the view that

merging a RRB with its sponsor bank would go against the very spirit of setting

up of RRBs as local entities and for providing credit primarily to weaker sections.

Having discussed various options for restructuring, the Committee was of the view

that ‘a change in sponsor banks may, in some cases help in improving

the performance of RRBs. A change in sponsorship may, inter alia; improve

the competitiveness, work culture, management and efficiency of the concerned

RRBs’. Against this backdrop, a number of issues need empirical probing.

Such as, which are the RRBs that need focus and whether for them the sponsor bank

has really to be made accountable. All these issues fall under the broader questions

of what factors drive the performance of RRBs? and do the sponsor banks have a

role to play? Section II reviews the literature on factors affecting performance

of a commercial bank in general and also in the context of RRBs. Section

II

Review of Literature RRBs though operate

with a rural focus are primarily scheduled commercial banks with a commercial

orientation. Beginning with the seminal contribution of Haslem (1968), the literature

probing into factors influencing performance of banks recognises two broad sets

of factors, i.e., internal factors and factors external to the bank.

The internal determinants originate from the balance sheets and/or profit and

loss accounts of the bank concerned and are often termed as micro or bank-specific

determinants of profitability. The external determinants are systemic forces that

reflect the economic environment which conditions the operation and performance

of financial institutions. A number of explanatory variables have been suggested

in the literature for both the internal and external determinants. The typical

internal determinants employed are variables, such as, size and capital [Akhavein

et al. (1997), Demirguc-Kunt and Maksimovic (1998) Short (1979) Haslem

(1968), Short (1979), Bourke (1989), Molyneux and Thornton (1992) Bikker and Hu

(2002) and Goddard et al. (2004)]. Given the nature of banking

business, the need for risk management is of crucial importance for a bank’s

financial health. Risk management is a reflection of the quality of the assets

with a bank and availability of liquidity with it. During periods of uncertainty

and economic slow down, banks may prefer a more diversified portfolio to avoid

adverse selection and may also raise their liquid holdings in order to reduce

risk. In this context, both credit and liquidity risk assume importance. The literature

provides mixed evidence on the impact of liquidity on profitability. While Molyneux

and Thornton (1992) found a negative and significant relationship between the

level of liquidity and profitability, Bourke (1989) in contrast, reports an opposite

result. One possible reason for the conflicting findings may be the different

elasticity of demand for loans in the samples used in the studies (Guru, Staunton

and Balashanmugam, 2004). Credit risk is found

to have a negative impact on profitability (Miller and Noulas,

1997standard microeconomic profit function. In this context, Bourke (1989) and

Molyneux and Thornton (1992) find that better-quality management and profitability

go hand in hand. As far as the external determinants of bank profitability

are concerned the literature distinguishes between control variables that describe

the macroeconomic environment, such as inflation, interest rates and cyclical

output, and variables that represent market characteristics. The latter refer

to market concentration, industry size and ownership status. Among the external

determinants which are empirically modeled are regulation [Jordan (1972); Edwards

(1977); Tucillo (1973)], bank size and economies of scale [Benston, Hanweck and

Humphrey (1982); Short (1979)], competition [Phillips (1964); Tschoegl (!982)],

concentration [Rhoades (1977); Schuster (1984)], growth in market [Short (1979)],

interest rates as a proxy for capital scarcity and government ownership (Short,

1979). The most frequently used macroeconomic control variables are the inflation

rate, the long-term interest rate and/or the growth rate of money supply. Revell

(1979) introduced the issue of the relationship between bank profitability and

inflation. He notes that the effect of inflation on bank profitability depends

on whether banks’ wages and other operating expenses increase at a faster

pace than inflation. Perry (1992) in a similar vein contends that the extent to

which inflation affects bank profitability depends on whether inflation expectations

are fully anticipated. The influence arising from ownership status of a bank on

its profitability is another much debated and frequently visited issue in the

literature. The proposition that privately owned institutions are more profitable,

however, has mixed empirical evidence in favour of it. For instance, while

Short (1979) provides cross-country evidence of a strong negative relationship

between government ownership and bank profitability, Barth et al. (2004)

claim that government ownership of banks is indeed negatively correlated with

bank efficiency. Furthermore, Bourke (1989) and Molyneux and Thornton (1992) find

ownership status is irrelevant in explaining profitability. While many of the

above factors would be relevant, it would be instructive to scan the literature

that has exclusively focussed on the RRBs.). This result may be explained by taking

into account the fact that more the financial institutions are exposed to high-risk

loans, the higher is the accumulation of unpaid loans implying that these loan

losses have produced lower returns to many commercial banks (Athanasoglou, Brissimis

and Delis, 2005). Some of the other internal determinants found in the literature

are funds source management and funds use management (Haslam, 1968), capital and

liquidity ratios, the credit-deposit ratio and loan loss expenses [Short (1979);

Bell and Murphy (1969); Kwast and Rose (1982)]. Expense management, a correlate

of efficient management is another very important determinant of bank’s

profitability. There has been an extensive literature based on the idea that an

expenses-related variable should be included in the cost part of a The literature

on RRBs recognises a host of reasons responsible for their poor financial health.

According to the Narasimham Committee, RRBs have low earning capacity. They have

not been able to earn much profit in view of their policy of restricting their

operations to target groups. The recovery position of RRBs is not satisfactory.

There are a large number of defaulters. Their cost of operation has been high

on account of the increase in the salary scales of the employees in line with

the salary structure of the employees of commercial banks. In

most cases, these banks followed the same methods of operation and procedures

as followed by commercial banks. Therefore, these procedures have not found favour

with the rural masses. In many cases, banks have not been located at the right

place. For instance, the sponsoring banks are also running their branches in the

same areas where RRBs are operating. The issue whether location matters for the

performance has been addressed in some detail by Malhotra (2002). Considering

22 different parameters that impact on the functioning of RRBs for the year 2000,

Malhotra asserts that geographical location of RRBs is not the limiting factor

for their performance. He further finds that ‘it is the specific nourishment

which each RRB receives from its sponsor bank, is cardinal to its performance’.

In other words, the umbilical cord had its effect on the performance of RRBs.

The limitation of the study is that the financial health of the sponsor bank was

not considered directly to infer about the umbilical cord hypothesis. Nitin and

Thorat (2004) on a different note provide a penetrating analysis as to how constraints

in the institutional dimension5 have seriously impaired the governance of the

RRBs. They have argued that perverse institutional arrangements that gave rise

to incompatible incentive structures for key stakeholders such as political leaders,

policy makers, bank staff and clients have acted as constraints on their performance.

The lacklustre performance of the RRBs during the last two decades, according

to the authors can be largely attributed to their lack of commercial orientation.

An appropriate restructuring strategy would require to identify the problems leading

to the non-satisfactory performance of the RRBs. The performance of the RRBs under

the aegis of their sponsor banks in the spatial dimension has been dealt in some

detail in Section III. Section III

Performance of RRBs in the Spatial Dimension: Some Stylised Facts The

RRBs, over the years have made impressive strides on various business indicators.

For instance, deposits of RRBs have grown by 18 times and advances by 13 times

between 1980 and 1990. Between 1990 and 2004, deposits and advances grew by 14

times and 7 times, respectively (Table 1). Between the

year 2000 and 2004, loans disbursed by RRBs more than doubled reflecting the efforts

taken by the banks6 to improve credit flow to the rural sector. The average per

branch advances also increased from Rs.25 lakh in March 1990 to Rs.154 lakh in

March 2003. When one considers the deployment of credit relative to the mobilisation

of resources, the credit-deposit (C-D) ratio of RRBs were more than 100 per cent

during the first decade of their operations up to 1987. Though the C-D ratio subsequently

became lower, of late, it has shown an improvement and went up from around 39

per cent in March 2000 to 44.5 per cent in March 20047 .

Table

1:Evolution of RRBs: Select Indicators |

(Rs. Crore) |

Parameter | 1980 | 1985 | 1990 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 |

No. of RRBs | 85 | 188 | 196 | 196 | 196 | 196 | 196 | 196 | 196 | 196 | 196 | 196 | 196 |

Capital | 21 | 46 | 91 | 166 | 358 | 705 | 1,118 | 1,380 | 1,959 | 2,049 | 2,143 | 2,141 | 2,221 |

Deposits | 222 | 1,315 | 4,023 | 11,141 | 14,171 | 17,976 | 22,191 | 27,059 | 32,226 | 38,294 | 44,539 | 49,582 | 56,295 |

Investments | 20 | 164 | 60 | 1,348 | 2,879 | 3,891 | 5,280 | 6,680 | 7,760 | 8,800 | 9,471 | 17,138 | 21,286 |

Advances | 262 | 1,405 | 3,384 | 5,987 | 7,057 | 7,908 | 9,021 | 10,559 | 12,427 | 15,050 | 17,710 | 20,934 | 25,038 |

Total Assets | 426 | 2,320 | 6,081 | 14,886 | 18,969 | 24,376 | 29,468 | 35,820 | 42,236 | 49,596 | 56,802 | 62,500 | 70,195 |

Interest Earned | NA | NA | 480 | 1,158 | 1,421 | 2,033 | 2,624 | 3,281 | 3,938 | 4,619 | 5,191 | 5,391 | 5,535 |

Other income | NA | NA | 113 | 72 | 89 | 103 | 136 | 151 | 207 | 240 | 370 | 430 | 697 |

Total Income | NA | NA | 593 | 1,230 | 1,511 | 2,136 | 2,760 | 3,432 | 4,145 | 4,859 | 5,561 | 5,821 | 6,231 |

Interest expended | NA | NA | 326 | 851 | 1,065 | 1,462 | 1,773 | 2,131 | 2,565 | 2,966 | 3,329 | 3,440 | 3,363 |

Operating expenses | NA | NA | 254 | 657 | 726 | 804 | 845 | 982 | 1,056 | 1,165 | 1,459 | 1,667 | 1,825 |

Provisions and | | | | | | | | | | | | | |

contingencies | NA | NA | NA | 120 | 171 | 673 | 72 | 99 | 96 | 128 | 163 | 132 | 289 |

Total expenses | NA | NA | 581 | 1,509 | 1,791 | 2,265 | 2,617 | 3,113 | 3,621 | 4,130 | 4,787 | 5,107 | 5,187 |

Operating Profit | NA | NA | 12 | -279 | -280 | -129 | 143 | 319 | 524 | 729 | 774 | 714 | 1,044 |

Note :

Total expenses are excluding provisions and contingencies.

Source

: Reserve Bank of India. |

The presence of RRBs shows wide variation both across States and sponsor banks.

Although RRBs are spread over twenty-six States, they have most of their presence

in seven States, i.e., Andhra Pradesh, Bihar, Karnataka, Madhya Pradesh,

Maharastra, Rajasthan and Uttar Pradesh. Uttar Pradesh has the highest number

of RRBs, i.e., thirty-six and Kerala has got only two amongst the major

States of the country (Table 2). The north-eastern States

like Manipur, Meghalya, Mizoram and Nagaland have got only one RRB. Like-wise,

seven sponsor banks amongst twenty-eight, viz., Bank of Baroda, Bank

of India, Central Bank of India, Punjab National Bank, State Bank of India, United

Bank of India and UCO bankaccount for more than three fifths of the RRBs. More

than 160 RRBs earned profit in March 2004 while 150 RRBs were found to be earning

profits for three consecutive years beginning with the year 2000-01. More than

half of these loss-making RRBs are found to be operating in four States, i.e.,

Bihar, Madhya Pradesh, Maharastra and Orissa. Seen at the level of sponsor banks,

three banks, i.e., Bank of India, Central Bank of India and State Bank

of India accounted for more than half of the loss making RRBs.

As a

number of sponsor banks have promoted RRBs in more than one State, it becomes

natural to ask whether the presence of RRBs sponsored by a few banks whose area

of operation is confined to some specific States is camouflaging the performance

of better run RRBs. There can be three possibilities in such a situation. One,

irrespective of the State, the RRBs sponsored by some banks are incurring losses;

second, irrespective of sponsor banks, certain States are simply not conducive

to better performance for RRBs; and third, there is nothing inherent either with

a sponsor bank or a particular State in which the RRBs operate to contribute towards

the performance of RRBs and it is a combination of some other factors. To answer

these possibilities, one needs to assess the presence of RRBs sponsored by different

banks across the States and their performance. Such an attempt is made in Table

3 where performance of sponsor banks across regions is depicted.

Seen

from the perspective of the State in which they are operating, five out of the

eight-loss making RRBs in Bihar are

Table

2:State and Sponsor Bank-wise Distribution of RRBs |

Sr No | State | No.

| RRBs Profit Making

| Sr No | Sponsor

Bank | RRBs

No. | Profit

Making | f1 | Andhra

Pradesh | 16 | 15 | 1 | Allahabad

Bank | 7 | 7 |

2 | Arunachal

Pradesh | 1 | 0 | 2 | Andhra

Bank | 3 | 3 |

3 | Assam

| 5 | 4 | 3 | Bank

of Baroda | 19 | 15 |

4 | Bihar

| 16 | 8 | 4 | Bank

of India | 16 | 10 |

5 | Chhattisgarh | 5 | 3 | 5 | Bank

of Maharastra | 3 | 1 |

6 | Gujarat

| 9 | 8 | 6 | Bank

of Rajasthan | 1 | 0 |

7 | Haryana | 4 | 4 | 7 | Central

Bank of India | 23 | 15 |

8 | Himachal

Pradesh | 2 | 2 | 8 | Canara

Bank | 8 | 8 |

9 | Jammu

& Kashmir | 3 | 1 | 9 | Corporation

Bank | 1 | 0 |

10 | Jharkhand | 6 | 3 | 10 | Dena

Bank | 4 | 4 |

11 | Karnataka | 13 | 12 | 11 | Indian

Overseas Bank | 3 | 2 |

12 | Kerala | 2 | 2 | 12 | Indian

Bank | 4 | 4 |

13 | Madhya

Pradesh | 19 | 14 | 13 | J&K

Bank | 2 | 1 |

14 | Maharashtra

| 10 | 5 | 14 | Punjab

& Sind Bank | 1 | 1 |

15 | Manipur | 1 | 0 | 15 | Punjab

National Bank | 19 | 17 |

16 | Meghalaya | 1 | 1 | 16 | State

Bank of Bikaner and Jaipur | 3 | 2 |

17 | Mizoram | 1 | 1 | 17 | State

Bank of Hyderabad | 4 | 4 |

18 | Nagaland | 1 | 0 | 18 | State

Bank of India | 30 | 18 |

19 | Orissa | 9 | 3 | 19 | State

Bank of Indore | 1 | 1 |

20 | Punjab

| 5 | 5 | 20 | State

Bank of Mysore | 2 | 2 |

21 | Rajasthan | 14 | 10 | 21 | State

Bank of Patiala | 1 | 1 |

22 | Tamil

Nadu | 3 | 3 | 22 | State

Bank of Saurashtra | 3 | 3 |

23 | Tripura | 1 | 0 | 23 | Syndicate

Bank | 10 | 10 |

24 | Uttar

Pradesh | 36 | 34 | 24 | United

Bank of India | 11 | 9 |

25 | Uttaranchal | 4 | 4 | 25 | UCO

Bank | 11 | 7 |

26 | West

Bengal | 9 | 8 | 26 | Uttar

Pradesh State | | |

| | | | | Co-operative

(U.P.S.C.) | | |

| | | | | Bank | 1 | 0 |

| | | | 27 | Union

Bank of India | 4 | 4 |

| | | | 28 | Vijaya

Bank | 1 | 1 |

| Total | 196 | 150 | | Total | 196 | 150 |

Note :

Based

on three consecutive years performance beginning with the year 2000-01

Source

: Statistical Tables relating to banks in India (Various Issues) |

Table

3:Performance of Sponsor Banks Across Regions |

Sponsor Bank | No

of RRBs | State | Loss

Making | Allahabad

Bank | 7 | Uttar

Pradesh (6), Madhya Pradesh (1) | |

Andhra Bank | 3 | Andhra

Pradesh (2), Orissa (1) | |

Bank of Baroda | 19 | Uttar

Pradesh (9), Rajasthan (5), | Gujarat

(1), Madhya | | | Gujarat

(3), Madhya Pradesh (1), | Pradesh

(1), | | | Uttaranchal

(1) | Rajasthan (2) |

Bank of India | 16 | Uttar

Pradesh (3), Madhya Pradesh (4), | Jharkhand

(1), | | | Maharastra

(4), Jharkhand (4), Orissa (1) | Madhya

Pradesh (2) | | | | Maharastra

(3) | Bank

of Maharastra | 3 | Maharastra

(3) | Maharastra (2) |

Bank of Rajasthan | 1 | Rajasthan

(1) | Rajasthan (1) |

Central Bank

of India | 23 | Bihar

(8), Chattisgarh (1), Madhya Pradesh (7), | Bihar

(5) Madhya | | | Maharastra

(3), Rajasthan (1), Uttar Pradesh (2), | Pradesh

(1) | | | West

Bengal (1) | Uttar Pradesh

(1) | | | | West

Bengal (1) | Canara

Bank | 8 | Uttar

Pradesh (3), Karnataka (4), Kerala | |

Corporation

Bank | 1 | Karnataka

(1) | Karnataka (1) |

Dena Bank | 4 | Gujarat

(3), Chattisgarh (1) | |

Indian Overseas

Bank | 3 | Orissa

(2), Tamil Nadu (1) | Orissa

(1) | Indian

Bank | 4 | Andhra

Pradesh (2), Tamil Nadu (2) | |

J&K Bank | 2 | Jammu

& Kashmir (1) | Jammu

& Kashmir (1) | Punjab

& Sind Bank | 1 | Punjab

(1) | |

Punjab National Bank | 19 | Uttar

Pradesh (6), Punjab (3), Rajasthan (2) | Bihar

(1), | | | Bihar

(4), Himachal Pradesh (1), Haryana (3) | Uttar

Pradesh (1) | State

Bank of Bikaner and Jaipur | 3 | Rajasthan

(3) | Rajasthan (1) |

State Bank of

Hyderabad | 4 | Andhra

Pradesh (4) | |

State Bank of

India | 30 | Andhra

Pradesh (5), Arunachal Pradesh (1), | Andhra

Pradesh (1), | | | Assam

(1), Bihar (1), Chattisgarh (3), Himachal | Arunachal

(1), Assam | | | Pradesh

(1), Jammu & Kashmir (1), Jharkhand (2), | (1),

Uttar Pradesh (2), | | | Karnataka

(1), Madhya Pradesh (3), Meghalaya (1), | Uttaranchal

(3) Bihar | | | Mizoram

(1), Nagaland (1), Orissa (3), | (1),

Chattisgarh (1), | | | | Jammu

& Kashmir | | | | (1),

Jharkhand (2), | | | | Nagaland

(1), Orissa (3) | State

Bank of Indore | 1 | Madhya

Pradesh (1) | |

State Bank of

Mysore | 2 | Karnataka

(2) | |

State Bank of Patiala | 1 | Punjab

(1) | |

State Bank of Saurashtra | 3 | Gujarat

(3) | |

Syndicate Bank | 10 | Andhra

Pradesh (3), Haryana (1), Karnataka (4), | |

| | Kerala

(1), Uttar Pradesh (1) | |

United Bank

of India | 11 | West

Bengal (5), Assam (4), | Manipur

(1), | | | Manipur

(1), Tripura (1) | Tripura

(1) | UCO

Bank | 11 | West

Bengal (3), Bihar (3), Orissa (2), | Bihar

(1) Madhya | | | Rajasthan

(2), Madhya Pradesh (1) | Pradesh

(1), | | | Orissa

(2) | |

Uttar Pradesh State Co- | 1 | Uttar

Pradesh (1) | Uttar Pradesh

(1) | operative

(U.P.S.C.) Bank | | | |

Union Bank of

India | 4 | Uttar

Pradesh (3), Madhya Pradesh (1) | |

Vijaya Bank | 1 | Karnataka

(1) | |

Note : The figures

in parenthesis indicate the number of RRBs by the Sponsor banks. Performance relates

to the period 2000-01 to 2002-03

Source : Statistical Tables

Relating to Banks in India (Various Issues) and Annual Accounts of Scheduled Commercial

Banks in India 1989-2001, Reserve Bank of India | sponsored

by the Central Bank of India and one each by the Punjab National Bank, SBI and

the UCO bank. Of the five-loss making RRBs found in Madhya Pradesh, two are sponsored

by Bank of Baroda and one each by the Bank of India, the Central Bank of India

and the UCO Bank. Like wise, of the five-loss making RRBs found in Maharastra,

three are sponsored by Bank of India and two by Bank of Maharastra. From the sponsor

bank’s perspective one finds that the RRBs in which they have a stake and

which are not earning profits, are not confined to a single State. It is spread

across the States in which they have a presence. For instance, the eight loss

making RRBs for which the Central Bank of India is the sponsor bank, are spread

over Bihar, Madhya Pradesh, Uttar Pradesh and West Bengal. Similarly, the twelve

loss making RRBs sponsored by the SBI are spread across Andhra Pradesh, Arunachal

Pradesh, Assam, Bihar, Chhattisgarh, Jharkhand, Nagaland and Orissa. The same

is the case with the RRBs sponsored by Bank of India and UCO bank. Hence, one

finds no strong systematic pattern so as to infer whether or not the peculiarities

of any particular sponsor bank or a specific State in which they operate drives

the performance of RRBs. In such a situation, financial performance of the RRBs

has been modeled based on balance sheet information of the RRBs for a ten-year

period to decipher, what all factors that contribute to their financial health.

The modalities of the econometric estimation have been taken up in the next section.

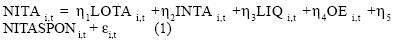

Section IV Data and Methodology

Net income as a percentage to total assets (NITA)8 is taken

to be the indicator of financial performance of the RRBs. NITA measures how profitably

and efficiently the RRB is making use of its total assets. Deflating the net income

by total assets also takes account of the variation in the absolute magnitude

of the profits, which may be size related. The performance of RRBs is postulated

to depend upon two broad sets of factors, internal to the RRBs as well as external

to them. The internal factors are represented through the balance sheet information

of the individual RRBs. RRBs are scheduled commercial banks whose source of income

arises primarily from lending and investment. Balance sheet management on

part of RRBs requires a judicious mix between lending and investment. As such,

loans and advances of each RRB as a percentage of total assets (LOTA) and investments

in securities of each RRB as a percentage of total assets (INTA) are included

as explanatory variables. In terms of liquidity management, since banks are involved

in the business of transforming short-term deposits into long-term credit, they

would be constantly faced with the risks associated with the maturity mismatch.

In order to hedge against liquidity deficits, which can lead to insolvency problems,

banks often hold liquid assets, which can be easily converted to cash. However,

liquid assets are often associated with lower rates of return. Hence, high liquidity

is expected to be associated with lower profitability (Molyneux and Thornton,

1992). The impact of liquidity on profitability is captured through the variable

LIQ, which is represented through Cash in Hand of the RRBs as a proportion of

their Assets. Another internal factor that can be expected to have a significant

effect on the financial health of the RRBs is their efficiency in expense management.

The ‘total expenses’ shown in profit & loss account of the RRBs

is the sum of ‘interest expenses’ and ‘operating expenses’.

While rising operating costs to support increasing business activities is natural,

increasing operating costs relative to non operating expenses is a matter of concern

and reflects poor expense management. To judge the impact of expense management

on balance sheet health, the variable operating expenses as a percentage of total

expenditure (OE) has been taken as another independent variable.

Apart from

the internal factors, the literature recognises the influence of the sponsor bank

on a RRB’s health through what is termed as theumbilical

cord (Malhotra, 2002). According to the umbilical

cord hypothesis, given the very close relationship9 between the RRB and its sponsor

bank, the attitude of the sponsor bank would have a bearing on the performance

of the RRB. As it is quite complex to quantify the attitude of the sponsor bank

towards the concerned RRB, the impact of the sponsor bank has been subsumed under

a single indicator and it is the financial health of the sponsor bank. Financial

health of the sponsor bank reflected through its net income as a percentage of

its total assets (NITASPON) has been included as one of the regressors. Based

on the above discussion, to ascertain the impact of the internal and the external

factors on bank profitability, panel data regression models have been used. Equation

(1) describes the general specification of the model. Equation (1) can be estimated

either by least squares or through a procedure that accounts for fixed/ random

effects.

Where

The subscripts i and t refer to the year and cross section

(RRB); respectively. In addition to the above factors, an

environmental factor that may affect both the costs and revenue of the RRBs is

the inflationary conditions in the economy. The impact of inflation rates on bank

profitability depends on its effect on a bank’s costs and revenues. The

effect of inflation on bank performance depends on whether the inflation is anticipated

or unanticipated (Perry, 1992). If inflation is fully anticipated and interest

rates are adjusted accordingly resulting in revenues rising faster than costs,

then it would have a positive impact on profitability. However, if the inflation

is not anticipated and the banks are sluggish in adjusting their interest rates

then there is a possibility that bank costs may increase faster than bank revenues

and hence, adversely affect bank profitability. Interest rates in India were administered

for a long time till the onset of financial liberalization. In the post liberalisation

phase though banks have greater freedom to price their products, maneuverability

on part of banks in adjusting the interest rates are rather limited on account

of the preference for fixed rate deposits, administered savings, etc. Furthermore,

as all the variables in (1) are expressed as ratios, inflation is already accounted

for in the model. Hence, inflation as an additional variable has been excluded

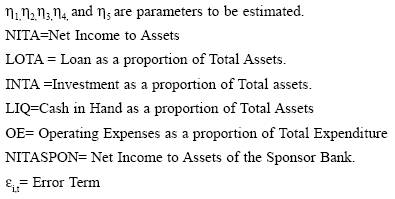

from the regression model. It is quite possible that past year’s performance

has a bearing on today’s performance and non-incorporation of the same in

the econometric estimation would blur the impact of other variables on NITA. To

account for the past year’s performance, lagged value of NITA has also been

considered in an extended model. The extended model assumes specification as laid

down in equation (2)

Where,

ηs are the parameters to be estimated. The extended

model (2) is a dynamic panel data model. A dynamic panel model poses a number

of econometric issues. The major problem that arises when lagged dependent variable

is introduced as an explanatory variable is that the error term and the lagged

dependent variable are correlated, with the lagged dependent variable being correlated

with the individual specific effects that are subsumed into the error term. This

implies that standard estimators are biased, and as such an alternative method

of estimating such models is required. The standard procedure to provide consistent

estimates is to adopt an instrumental variable procedure, with different lags

of the dependent variable used as instruments. Although a number of candidates

are possible, the Arellano and Bover (1995) approach is adopted as this

generates the most efficient estimates. While using lagged dependent variables

as instruments, overall instrument validity is examined using a Sargan test of

over identifying restrictions. The study covers the period

1994-2003. The choice of end points for the period of analysis is essentially

governed by two considerations. Based on the recommendations of the Narasimham

Committee Report (1992), reforms were initiated in 1993 to turn around the failing

RRBs. To enhance financial viability, a new set of prudential accounting norms

of income recognition, asset classification, provisioning, and capital adequacy

were implemented. Banks were also required to make full provisioning for bulk

of their non-performing assets. Furthermore, they were permitted to lend to non-target

group borrowers up to 60 per cent of new loans beginning in 1993-94. Permission

was also granted to introduce new services, such as loans for consumer durables.

As such, year 1993-94 has been taken as the initial year for estimation when the

RRBs were given the opportunity to operate in a more liberal framework. The choice

of the terminal year for the empirical study is guided by the availability of

balance sheet information on both RRBs as well as the sponsor bank from the various

issues of Statistical Tables Relating to Banks in India brought out by the Reserve

Bank of India. Balance sheet information was available till 2002-03 for RRBs when

the study was carried out. The study deals with all the 196 RRBs except one10

. To get a deeper insight into the factors contributing to the financial performance

of RRBs, the empirical analysis has been carried out separately for the profit

and the loss making RRBs apart from for all the RRBs taken together. Those RRBs

that earned profits consecutively for three years during 2000-01 till 2002-03

have been categorized as the profit making RRBs and the rest as loss making

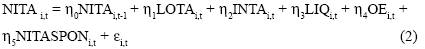

RRBs. Section V Empirical

Results To choose the appropriate model for estimating

specification (1), Hausman test is employed. The very low p-value obtained for

Hausman Statistics indicates a preference for fixed effects over random effect

model. The fixed effect estimation results indicate that investments contributed

positively to net income of both profit and loss making RRBs. On the other hand,

advances had a positive impact on the financial health of the profit making RRBs

only; the impact is found to be negative, although insignificant, for the loss

making

Table

4: Fixed Effects Estimation Results |

Independent Variables | Profit

Making RRBs | Loss

Making RRBs | All

RRBs | | Coefficient | P-Value | Coefficient | P-Value | Coefficient | P-Value |

LOTA | 0.013 | 0.02 | -0.01 | 0.36 | 0.003 | 0.56 |

INTA | 0.029 | 0.00 | 0.031 | 0.00 | 0.028 | 0.00 |

LIQ | 0.034 | 0.62 | -0.206 | 0.21 | -0.037 | 0.56 |

OETOTE | -0.232 | 0.00 | -0.217 | 0.00 | -0.226 | 0.00 |

NITASPON | 0.053 | 0.40 | 0.132 | 0.42 | 0.09 | 0.12 |

Adjusted R2 | 0.80 | | 0.75 | | 0.82 | |

RRBs. Liquidity also turned out to be insignificant

in the statistical sense to affect the net income of any category of RRBs. Operating

expenses have an across-the-board negative and significant impact on the RRBs’

financial performance. Furthermore, sponsor bank’s health turns out to be

insignificant in having an impact on the concerned RRBs irrespective of whether

it is making profits or incurring losses. Thus, going by the fixed effect estimation

results, the umbilical cord hypothesis appears to be on a weak footing. However,

estimation of the extended model (2), which employs more rigorous estimation procedures,

provides strikingly different results (Table 5). The dynamic

panel data estimation reveals that performance in the past years had a significant11

impact for the current year for both categories of RRBs. Advances contributed

negatively

Table

5: Dynamic Panel Data (GMM) Estimation Results |

Independent Variables | Profit

Making RRBs | Loss

Making RRBs | All

RRBs | | Coefficient | P-Value | Coefficient | P-Value | Coefficient | P-Value |

NITA(-1) | 0.454 | 0.00 | 0.490 | 0.00 | 0.410 | 0.00 |

NITA(-2) | 0.033 | 0.07 | 0.039 | 0.01 | 0.040 | 0.00 |

LOTA | -0.074 | 0.00 | 0.097 | 0.00 | -0.069 | 0.01 |

INTA | 0.016 | 0.01 | -0.002 | 0.82 | 0.020 | 0.00 |

LIQ | 0.064 | 0.82 | -1.682 | 0.00 | 0.51 | 0.12 |

OETOTE | -0.110 | 0.00 | -0.149 | 0.00 | -0.129 | 0.00 |

NITASPON | 0.304 | 0.00 | -0.747 | 0.00 | 0.200 | 0.0.04 |

P-Value of Sargan Test | 0.18 | | 0.10 | | 0.08 | |

to the health of the profit making RRBs.

This is in contrast to the fixed effects estimation result where advances had

a positive impact for the profit making RRBs. For the loss making RRBs, the negative

and insignificant coefficient for advances in the fixed effects estimations turns

out to be positive and significant in the dynamic model. For all RRBs taken together,

advances are found to adversely affect the bottom line. As far as investments

are concerned, they contributed positively and significantly to the performance

of the profit making RRBs. Again in sharp contrast to the fixed effects results,

investments seem to be inconsequential in influencing the bottom line of loss

making RRBs. For all RRBs taken together, impact of investments turns out to be

positive and significant. The relative importance attached to investment vis-a-vis

advances in their portfolio management by the profit and loss making RRBs, can

be seen from Chart 1, which depicts yearly average figures. As can be seen from

Chart 1, investments over the years have assumed increasing importance in the

asset portfolio of profit making RRBs. Income from investments relative to advances

has also contributed a higher proportion to income for profit making RRBs in the

recent years compared to the loss making ones (Chart 1).

For instance, investment income in total income while increased from 6 per cent

to 9 per cent for the loss making RRBs, it increased from 2 per cent to 14 per

cent for the profit making RRBs between the period 1994-99 and 2000-

03.

Compared to the period 1994-99, there has been a relative shift towards investments

in the portfolio management of both profit and loss making RRBs during the period

2000-03. The shifting away from advances, however, has been sharper for the profit

making RRBs. While the proportion of loans to assets declined from 41.5 percent

to 35 per cent for the loss making RRBs, the decline was more pronounced from

59 per cent to 48 per cent for the profit making RRBs over the sub periods 1994-99

and 2000-03.

Operating expenses had a negative impact on the profitability

of both profit and loss making RRBs. A more interesting finding from the panel

GMM estimations in contrast to the fixed effect estimations concerns to the umbilical

cord hypothesis. One would be tempted to say that the umbilical cord hypothesis

does not hold good going by the fixed effect estimation results. The GMM estimation12

results, however, indicate that while the sponsor bank acted as a positive force

for the profit making RRBs, the impact was negative for the loss making RRBs.

For all RRBs taken together, the impact of the sponsor bank’s health on

the financial health of the concerned RRB turns out to be positive and statistically

significant. The profit making RRBs are able to reap the synergy from their association

with the sponsor bank. The sponsor bank, on the other hand, is found to act, as

a drag on the financial health of the loss making RRBs. The literature (Malhotra,

2002 etc.) recognises a host of reasons for the drag. It could be due to competition

for business rather than co-operation between the RRB and the sponsor bank, which

are co-present in a particular geographical area. Else, it could simply be, because

of the apathetic attitude of the sponsor bank towards the RRBs when it requires

a supporting hand. Support could be in the form of advice on financial decisions,

or meeting skill requirements of the RRBs or management of the affairs of the

RRB. This finding is significant in the present milieu where a number of options

are being considered to restructure the RRBs. The results indicate that different

strategies need to be thought of keeping in view whether the RRB under consideration

is making profits or incurring losses. While going into the details of the modalities

of the restructuring process of RRBs is beyond the scope of this study, it can

be held that a one size fits all prescription (be it for horizontal or vertical

merger of the RRBs) for the restructuring of the RRBs needs to be revisited. Very

recently, 28 RRBs sponsored by nine banks1 in six States have been amalgamated

into nine new RRBs, bringing down the number of RRBs to 177. The consolidation

exercise mostly involved merger of profit making RRBs of the same sponsor bank

within a State. It is much easier (as they are in any case financially viable)

to decide about the course of restructuring of the RRBs that are making profits.

The approach to the restructuring of the loss making RRBs is an area, which would

require deeper analysis. Merger of loss making RRBs operating in a contiguous

area has the possibility of bringing some rewards in terms of house keeping, better

administrative control, etc. The other possibility is that by merging two RRBs

that are financially unviable, the inefficiencies are compounded and the merged

entity falls under its own dead weight. With the umbilical cord hypothesis operational,

it may be suggested that for the loss making RRBs, the sponsor banks need to play

a more proactive role. Section VI Conclusion The

study made an attempt to examine whether the problems associated with the RRBs

are specific to certain sponsor banks or States in which they operate. To get

a deeper insight, all the RRBs were categorised either as profit making or loss

making ones. RRB earning profits consecutively for the past three years from the

terminal year of the study have been classified as profit making and the rest

as loss making. Such a classification led to 150 RRBs falling in the profit making

category and rest 46 as loss making. The exploratory analysis revealed that the

problem of the loss making RRBs is neither confined to some specific States nor

to a group of sponsor banks. In the absence of any strong systematic pattern so

as to suggest that the performance of RRBs is driven by the peculiarities of any

particular sponsor Bank or a specific State in which they operate, econometric

estimation was employed so as to decipher the factors that contribute to their

financial health. Based on the balance sheet information on individual RRBs for

the past ten years, this study has approached the issue primarily form the asset

side of the RRBs balance sheet. Given the linkage between the RRBs and their sponsor

bank, an attempt was also made to infer whether or not the umbilical cord hypothesis

is operational. Both fixed effect and panel GMM estimations were carried out.

The more appropriate GMM estimation results indicated that the loan portfolio

management for the profit making RRBs is an area of concern. Investments

contribute positively to the financial performance of the profit making RRBs.

Advances while had a positive impact, investments, however, turned out to be inconsequential

for the performance of loss making RRBs. The results further indicated that the

umbilical cord hypothesis is operational. The sponsor bank contributes positively

to the financial health of the profit making RRBs. For the loss making RRBs, the

sponsor bank acts as a drag on their performance. The income from investments

coupled with synergy from the sponsor bank’s association could mitigate

the negative impact flowing from the loan portfolio for the profit making RRBs.

The loss making RRBs on the other hand, could have done better had the sponsor

banks played a proactive role, especially in their investment portfolio management.

The loss making RRBs need focused attention of the all the stake holders, in general,

and of the sponsor bank, in particular, so as to transform them into profitable

ventures. In view of the intricacies involved, some critical thinking is called

for at the policy level in restructuring the loss making RRBs are concerned. The

sponsor bank for the loss making RRBs could be given a time frame and if within

this period, significant improvement is not made, the possibility of changing

the sponsor bank as suggested by the Sardesai Committee may be a worthwhile option.

Notes 1. RRBs were

established “with a view to developing the rural economy by providing, for

the purpose of development of agriculture, trade, commerce, industry and other

productive activities in the rural areas, credit and other facilities, particularly

to small and marginal farmers, agricultural labourers, artisans and small entrepreneurs,

and for matters connected therewith and incidental thereto”(RRBs Act, 1976).

2. Debate in the XV Lok Sabha on Regional Rural Bank (Amendment Bill,

2004).

3. RRBs alone have organised roughly 12 lakh self-help

groups, 45 per cent of the total self-help groups in the country. RRBs have also

issued over 40 lakh Kisan Credit Cards to the farmers and organised over 5,000

out of 11,000 farmers’ clubs under NABARD scheme.

4.

Following the recommendations of the Narasimham Committee (1991), there have been

gradual relaxations in their choice of clientele and area of operations.

5. Lack of a single owner with clear ownership and control, and no

prospects for profits, diffused accountability and weakened oversight of the RRBs.

6. Though the growth in credit when seen in isolation gives an impression

of the impressive strides made by RRBs in disbursing credit, they account for

a very small proportion (around 3 per cent) of the total assets of the Indian

banking sector, despite their significant branch network.

7.

While C-D ratio for 50 RRBs was more than 60 per cent that for 87 banks was less

than 40 per cent in March 2004.

8. Net Income has been defined

as the excess of total income over total expenditure.

9. Specifically,

the sponsor bank contributes thirty-five per cent of issued capital of a RRB,

appoints its chairman, advises on decisions regarding investments, monitor its

progress and suggest corrective measures to be taken by the RRB. More on the relationship

between the sponsor bank and their RRBs is discussed in Annex 2.

10. The

left out RRB is the Kshetryia Kisan Gramin Bank due to lack of information on

the Sponsor Bank for the entire period of 1994-2003.

This

RRB is sponsored by U.P.S.C.B., a Cooperative Bank.

11. This in a way

testifies the appropriateness of employing the extended dynamic model for estimation.

Guided by statistical significance, two lags of the dependent variable have been

used in the GMM estimation.

12. The p-values for the Sargan test are 0.18,

0.10 and 0.08 for the profit making, loss making and all RRBs, respectively.

13. The Government of India (Ministry of Finance), issued nine notifications

on September 12, 2005 for amalgamation of 28 RRBs into nine new RRBs sponsored

by nine banks in six States. These amalgamations have become effective from September

12, 2005.

References

Akhavein,

J.D., Berger, A.N., Humphrey, D.B. (1997): “The Effects of Megamergers on

Efficiency and Prices: Evidence from a Bank Profit Function”, Finance

and Economic Discussion Series 9, Board of Governors of the Federal Reserve

System.

Arellano, M., and Bover, O. (1995): “Another

Look at the Instrumental Variables Estimation of Error Components Models,”

Journal of Econometrics, 68, pp.29–51.

Athanasoglou

Panayiotis P., Brissimis Sophocles N. and Delis Matthaios D. (2005): “Bank-

Specific, Industry-Specific and Macroeconomic Determinants of Bank Profitability”,

Bank of Greece Working Paper No. 25.

Balachandher

K G, John Staunton and Balashanmugam (2004): “Determinants of Commercial

Bank Profitability in Malaysia” Papers presented at the 12th Annual

Australian Conference on Finance and Banking.

Barth, J.R., Caprio, G.,

Levine, R. (2004): “Bank supervision and regulation: What Works Best?”

Journal of Financial Intermediation, 13 (2), pp.205-248.

Benston,

George J., Gerald A. Hanweck and David B. Humphrey (1982): “Scale Economies

in Banking”, Journal of Money, Credit, and Banking, Vol.XIV, No.

4, part 1, November.

Bikker, J.A., Hu, H. (2002): “Cyclical

Patterns in Profits, Provisioning and Lending of Banks and Procyclicality of the

New Basel Capital Requirements”, BNL Quarterly Review, 221, pp.143-175.

Bell Frederick W. and Nell Mushy (1969): “Impact of

Market Structure on the Price of a Commercial Banking Service”, The

Review of Economics and Statistics, May.

Bose, Sukanya

(2005): “Regional Rural Banks: The Past and the Present Debate”, Macro

Scan, URL: http://www.macroscan.com/fet/jul05/ fet200705RRB_Debate.htm.

Bourke, P. (1989): “Concentration and other Determinants

of Bank Profitability in Europe, North America and Australia”, Journal

of Banking and Finance, Vol.13, pp. 65-79.

Consideration

of the Regional Rural Banks (Amendment) Bill, 2004,

Proceedings Other

Than Questions and Answers, XIV Lok Sabh.

Das

Prasant (2000): “Sustainability Through Outreach - The Malbar Lighthouse

Shows the Way.” National Seminar on Best Practices in RRBs,BIRD,

Lucknow.

Demirguc-Kunt, A., Huizinga, H. (2000): “Financial

Structure and Bank Profitability”, World Bank, Mimeo.

Demirguc-Kunt,

A., Maksimovic, V. (1998): “Law, Finance and Firm Growth”, Journal

of Finance, 53(6), pp.2107-2137.

Edwards. Franklin

R. (1977): “Managerial Objectives in Regulated Industries: Expense Preference

Behavior inBanking”, Journal of Political Economy, February.

Goddard, J., Molyneux, P., Wilson, J.O.S. (2004): “The

Profitability of European Banks: A Cross-Sectional and Dynamic Panel Analysis”,

Manchester School 72 (3), pp.363- 381.

Haslem,

John (1968): “A Statistical Analysis of the Relative Profitability of Commercial

Banks”, Journal of Finance, Vol. 23, pp.167-176.

Hausman,

Jerry A. (1978): “Specification Tests in Econometrics,” Econometrica,

46, pp.1251–1272.

Joshi V.C. and Joshi V.V. (2002):

“Managing Indian Banks”, Response Books, New Delhi.

Kannan,

R (2004), ”Regional Rural Banks”, URL: http:// www.geocities.com/learning/banking2/rrb.html

Kwast, Myron L. and John T. Rose (1982), “ Pricing,

Operating Efficiency and Profitability Among Large Commercial Banks”,

Journal of Banking and Finance,Vol.6.

Malhotra, Rakesh

(2002): “Performance of India’s Regional Rural Banks (RRBs): Effect

of the Umbilical Cord”. URL: http://www.alternative-finance.org.uk/rtf/rrbsmalhotra.rtf.

Miller, S.M., Noulas, A.G. (1997): “Portfolio Mix and

Large-bank Profitability in the USA”, Applied Economics, 29 (4),

pp.505-512.

Mohan Jagan (2004): “Regional Rural

Banks Need a Shot in the Arm”, Financial Daily from The Hindu Group

of Publications. March 19th Edition.

Molyneux, P.,

Thornton, J. (1992): “Determinants of European Bank profitability: A Note”,

Journal of Banking and Finance, Vol.16, pp.1173-1178.

Nitin

Bhatt and Thorat Y. S. P. (2004): “India’s Regional Rural Banks: The

Institutional Dimension of Reforms”, National Bank News Review, NABARD,

April-September.

Neely, M.C., Wheelock, D.C. (1997),

“Why Does Bank Performance Vary Across States? Review”, Federal

Reserve Bank of St. Louis, Vol 79, No. 2, pp. 27-40.

Perry,

P., (1992): “Do Banks Gain or Lose from Inflation”, Journal of

Retail Banking, 14(2), pp.25-30.

Reddy, Y.V. (2000): “Future of

Rural Banking” Address at Prof. G. Rama Reddy’s Third Endowment Lecture,

Hyderabad, Reserve Bank of India Bulletin, January.

Reddy,

Y.V. (2000): “Rural Credit: Status and Agenda”, Reserve Bank of

India Bulletin, November.

Report on Trends and Progress of Banking in

India (Various Issues), Reserve Bank of India, Mumbai. URL: (www.rbi.org.in).

Reserve Bank of India (2004): “Report of the Advisory

Committee on Flow of Credit to Agriculture and Related Activities From the Banking

System”. URL: (www.rbi.org.in).

Reserve

Bank of India (2005): “Report of the Internal Working Group on

RRBs”, Chairman: A.V. Sardesai, Mumbai. URL: (www.rbi.org.in).

Reserve Bank of India (2002): “Annual Accounts of

Scheduled Commercial Banks in India (1989-2001)”,Mumbai. URL: (www.rbi.org.in).

Revell, J., (1979): “Inflation and Financial Institutions”,

Financial Times, London.

Rhoades, Stephen A.1977):

“Structure and Performance Studies in Banking: A Summary and Evaluation”,

Staff Economics Studies 92, Federal Reserve Board, Washington, DC.

Schuster, Leo (1984): “Profitability and Market Share

of Banks”, Journal of Bank Research, Spring.

Shaffer,

S. (1994): “Bank Competition in Concentrated Markets”, Federal

Reserve Bank of Philadelphia Business Review, March/April, pp.3-16.

Shaffer, S. (2004): “Comment on “What Drives Bank

Competition? Some International Evidence” by Stijn Claessens and Luc Laeven,

Journal of Money, Credit, and Banking, Vol.36, pp.585-592.

Sharma

K.C; Josh P.; Mishra J.C.; Kumar Sanjay; Amalorpavanathan R.and Bhaskran R. (2001):

“Recovery Management in Rural Credit”, Occasional Paper,

No. 21, NABARD, Mumbai.

Short, Brock (1977): “Bank

Concentration, Market Size and Performance: Some Evidence From Outside the United

States”, Mimeo, IMF, Washington, DC.

Short, B.K.

(1979): “The Relation Between Commercial Bank Profit Rates and Banking Concentration

in Canada, Western Europe and Japan”, Journal of Banking and Finance,

Vol.3, pp.209-219.

Smirlock, M. (1985): “Evidence

on the (non) Relationship Between Concentration and Profitability in Banking”,

Journal of Money, Credit, and Banking, Vol. 17, pp. 69-83.

Staikouras,

C., Steliaros, M. (1999): “Factors That Determine the Profitability of the

Greek Financial Institutions”. Hellenic Bank Association, 19, pp.61-66.

Statistical Tables Relating to Banks in India (Various

Issues), Reserve Bank of India, Mumbai. URL: (www.rbi.org.in)

Thingalaya N.K. (2000): “The Other Side of the Rural Banking”, BIRD,

Lucknow.

Velayudham, T. K., and Sankaranarayanan, V.

(1990): “Regional Rural Banks and Rural Credit: Some Issues”, Economic

and Political Weekly, September 22, pp.2157-2164.

Tschoegl, Adrian E.

(1982): “Concentration Among International Banks -A Note”, Journal

of Banking and Finance, Vol.6.

Tschoegi, Adrian

E. (1983): “Size, Growth and Transnationality Among the World’s Largest

Banks”, Journal of Business, 56, No. 2. Annex-1

The Basis for the Umbilical Cord Hypothesis

1. Section 3 of Chapter II of RRB Act, 1976 stipulates that only on

request of a Sponsor Bank, Central Government would consider establishment

of a RRB.

2. Duties of the Sponsor Bank have been spelled out in Section

3 (3) of RRB act as: a. Subscribing to the share capital of RRB, b. Training the

personnel of RRB, c. Providing such managerial and financial assistance during

the first five years as mutually agreed upon.

3. Under Section 4 of

RRB Act, 1976, the RRB will have its Head Office at such place as decided by the

Central Government in consultation with NABARD and the Sponsor Bank.

4.

Section 6(2) of RRB Act stipulates that the Sponsor Bank will contribute thirty-five

per cent of issued capital of its RRB.

5. Under Section 9(d) of RRB

Act, two directors, who are officers of the Sponsor Bank, shall be nominated on

the Board of RRB.

6. Under Section 11 of Act, the Sponsor Bank shall

appoint the Chairman of a RRB and specify the period of appointment. The appointment,

however, would not exceed a period of five years.7. The Sponsor Bank

has the right to remove the Chairman at any time (Section 11(4)).

8.

The Sponsor Bank shall depute officers or other employees to RRB as may be necessary

or desirable (Section 17 of RRB Act, 1976).

9. Amalgamation of RRBs

under Section 23-A can be done by Central Government in consultation with NABARD,

State Government and the Sponsor Bank.

10. Section 24-A of RRB Act stipulates

that the Sponsor Bank are required to monitor the progress of RRBs and carry out

inspection, internal audit and scrutiny and suggest corrective measures to be

taken by the RRB. 11. Interest rate on SLR deposits of all maturity held by RRB

with the sponsor bank would be at 0.5 per cent over the maximum term deposit rate

of the sponsor bank.

12. Governments of India and Reserve Bank of India have

further issued the directives that, ‘for overall management of the RRB it

would be the responsibility of the Sponsor Bank to guide the RRB in various matters

on human resource management, computerization, business development, branch expansion,

etc.’

13. Many RRBs have an agency arrangement with their Sponsor Bank

for issue of Demand Drafts.

14. Sponsor Bank also directly helps RRB in matters

of daily cash remittances, over draft facility, decisions on investments, etc.

The relationship between the sponsor bank and its RRBs as evolved over the years

can further be assessed in terms of summary and descriptive statistics as laid

out below:

Summary

Characteristics of the Determinants of RRB Profitability |

(Per

cent) | Year | Net

Income

to Assets

(NITA) | Loans

to

Assets

(LOTA) | Investment

To Assets

(INTA) | Liquidity

(LIQ) | Operating

Expenses

to Total

Expenses

(OETOTE) | Net

Income

to Assets

of Sponsor

Bank

(NITASPON) | Inflation |

| Profit | Loss | Profit | Loss | Profit | Loss | Profit | Loss

Profit | Loss | Profit | Loss | Inf |

1994 | -4.22 | -6.98 | 61 | 36.5 | 0.3 | 0 | 0.89 | 1.22 | 49.3 | 43.8 | 0.36 | 2.71 | 8.4 |

1995 | -2.89 | -3.97 | 59.9 | 34.2 | 0.2 | 0 | 1.14 | 1.49 | 46.6 | 44.1 | 0.48 | 2.49 | 12.5 |

1996 | -0.07 | -5.46 | 63.8 | 39.3 | 1.9 | 4.1 | 0.89 | 1.39 | 36.1 | 39.8 | -1.26 | 2.55 | 8.1 |

1997 | 1.84 | -5.95 | 57.7 | 51.1 | 2.1 | 5.2 | 1.19 | 1.49 | 30.7 | 34.4 | -0.81 | 2.06 | 4.6 |

1998 | 3.4 | -3.85 | 58 | 49.9 | 4.3 | 7.1 | 0.95 | 1.32 | 35 | 31.2 | -1.08 | 1.76 | 4.4 |

1999 | 4.33 | -2.23 | 51.5 | 37.9 | 8.9 | 10.6 | 1.07 | 1.34 | 34.4 | 30.6 | -0.76 | 1.81 | 5.9 |

2000 | 3.26 | -2.04 | 51.8 | 35.2 | 10.8 | 7 | 1.54 | 1.27 | 32.8 | 28.2 | 0.1 | 1.79 | 3.3 |

2001 | 2.89 | -2.45 | 46.2 | 33.1 | 12.6 | 5.3 | 1.77 | 1.17 | 30 | 27.4 | 0.23 | 1.64 | 7.2 |

2002 | 2.95 | -0.22 | 46.4 | 34.1 | 14 | 4.9 | 1.22 | 1.14 | 28.1 | 29.6 | 1.01 | 1.85 | 3.6 |

2003 | 2.78 | 0.04 | 46.1 | 38.8 | 25.7 | 15.4 | 0.65 | 1.11 | 30.1 | 31.2 | 1.67 | 2.25 | 3.5 |

Source:

Statistical Tables Relating to India (Various Issues). |

Descriptive

Statistics of Variables Employed | (Per

cent) | Bank | Measure | NITA | INTA | LOTA | LIQ | OETOTE | NITASPON | Inflation |

Category |

| |

| |

| |

| | Profit | Mean | 0.2 | 15.9 | 33.9 | 1.3 | 34.0 | 1.4 | 6.1 |

| Median | 0.9 | 13.4 | 32.2 | 1.1 | 32.9 | 1.5 | 5.9 |

| SD | 2.5 | 13.5 | 13.6 | 0.7 | 8.9 | 0.9 | 2.8 |

| Skewness | -1.3 | 1.0 | 0.5 | 1.3 | 0.6 | -0.8 | 1.0 |

| Kurtosis | 5.3 | 4.0 | 2.5 | 5.1 | 3.5 | 3.9 | 3.1 |

| CV | 1227.2 | 85.1 | 40.0 | 56.5 | 26.0 | 62.1 | 45.3 |

Loss | Mean | -2.6 | 31.5 | 9.3 | 1.3 | 34.0 | 1.4 | 6.1 |

|

| |

| |

| |

| |

| Median | -2.1 | 30.9 | 5.5 | 1.3 | 31.2 | 1.5 | 5.9 |

| SD. | 3.2 | 12.3 | 11.3 | 0.1 | 6.0 | 0.8 | 2.8 |

| Skewness | -0.7 | 0.5 | 1.6 | 0.2 | 0.7 | -0.9 | 1.0 |

| Kurtosis | 3.2 | 2.8 | 5.3 | 1.8 | 1.9 | 4.2 | 3.1 |

* Research Officer in the Department of

Economic Analysis and Policy, Reserve Bank of India and presently working from

the Patna office of the Bank. The views expressed here are of the author and not

necessarily of the institution to which he belongs. Discussions with Shri S.S.Mishra

have been enlightening for the author. The author would like to thank an anonymous

referee for valuable suggestions. The author gratefully acknowledges the encouragement

and inspirations of Dr. Narendra Jadhav, Dr. R.K.Pattnaik and Shri S. Ganesh. |