Michael Debabrata Patra, Sitikantha Pattanaik,

Joice John and Harendra Kumar Behera* This paper employs a dynamic factor model to develop an Indicator of Global Spillovers (IGS) to examine the impact of unconventional monetary policies on transmission of monetary policy in India. Estimates from a Time-Varying Parameter Vector Autoregression (TVP-VAR) model indicate that monetary policy transmission through the money and credit markets is unaffected by global spillovers. In the debt market, however, transmission is impacted, producing occasional overshooting and over-corrections, but market microstructure seems to have a stronger influence and drives mean reversion. Heightened sensitivity of foreign exchange and equity markets to global spillovers notwithstanding, there is no statistically strong evidence of domestic monetary policy losing traction because of global spillovers. JEL Classification : C54, E52, E58 Keywords : Global spillovers, Monetary policy transmission, Dynamic factor model, M-GARCH, Time-varying parameter VAR Introduction In the aftermath of the global financial crisis (GFC), spillovers from the divergent courses for monetary policy set by systemic advanced economies (AEs) have posed a dilemma: will externalities from this transatlantic schism imprison interest rates in emerging market economies (EMEs) like India that are reasonably well-integrated into the global financial cycle? Will it be possible for these countries to conduct independent monetary policy as capital and asset prices are stirred up by the core financial centres? These questions form the theme of this paper. We ask them in the context of a rapidly proliferating strand in the empirical literature that is finding increasing evidence of significant spillovers, not just for fixed income markets and longer-term interest rates (Miyajima et al., 2014; Obstfeld, 2015; Sobrun and Turner, 2015; Turner, 2014), but for short-term interest rates and policy rates as well (Edwards, 2015; Gray, 2013; Hofman and Takáts, 2015; Takáts and Vela, 2014). Furthermore, as this evidence accumulates, the channel of propagation – global economic and financial integration – are becoming clearer and, as a consequence, more real and present for open EMEs (Hofman and Takáts, 2015), with investor arbitrage playing out through EME allocations in globally mobile funds and foreign participation in local markets (Barroso, Kohlscheen and Lima, 2014); and foreign currency denominated credit (He and McCauley, 2013). While considerable heterogeneity is found across EMEs (Chen et al., 2015), the constraining effects of spillovers on domestic monetary policy is observed irrespective of the exchange rate regime (Rey, 2015). The persuasiveness of this strand notwithstanding, there is a contrarian view too that seems to be standing up to the tests imposed by episodes of volatility, relative to the overwhelming effects of the taper caper.1 It is argued that the concept of monetary policy independence needs to distinguish between the ability to set monetary policy independently and the willingness to do so, the latter implying the extent to which external developments enter policy reaction functions of central banks in EMEs and the coefficients attached to them. The effects of spillovers or contagion, when appropriately measured, seem to be less severe for EMEs than generally assumed or observed in financial phenomena such as co-movements in interest rates across borders (Disyatat and Rungcharoenkitkul, 2015). First, in the taper caper and its aftermath, several EMEs allowed exchange rate adjustments, with some of them being large and apparently disruptive, but this enabled them to set domestic interest rates to domestic conditions. The exchange rate change was a measure of the importance of external developments in their reaction functions and their willingness to accommodate them rather than a loss of monetary policy independence. By the same logic, several EMEs are regarded as engaged in pursuing exchange rates that reflect domestic goals — competitive depreciations. Both interest rates and exchange rates can be regarded as instruments that serve domestic objectives. Secondly, some EMEs with large reserves actively intervened to stem turmoil in their foreign exchange markets. By all counts, they succeeded effectively in preventing the trilemma from breaking down to a dilemma a la Rey (2015), and set in motion what has been termed as quantitative tightening that supported domestic conditions. Also, many EMEs continue to retain both macro-prudential and administrative policies that can influence capital flows in both directions, and this is acknowledged to being effective in securing monetary policy autonomy. Thirdly, several EMEs, including India, have repaired and strengthened macroeconomic fundamentals and policies. As the events after the taper caper showed, these actions buffered their economies considerably, contrary to the view that in the face of spillovers, fundamentals do not matter (Eichengreen and Gupta, 2014).2 This view itself has been questioned by the evidence of investors differentiating among EMEs based on fundamentals, and especially in favour of economies having deeper markets and tighter macro-prudential policies (Mishra et al., 2014a). Moreover, differentiation was found to have set in early and persisting (Ahmed et al., 2017). In fact, this has led several central banks to urge the United States Federal Reserve (Fed, hereafter) to stop stoking speculation and to ‘just get on with it’ in normalising US monetary policy (Harrison, 2015; Parussini, 2015). This paper is an empirical exploration of these two sets of issues in the Indian context. The rest of the paper is organised into five sections. The next section presents stylised evidences on channels of contagion and their impact on financial markets in India. Section III develops a measure of global spillover. Section IV presents and discusses empirical results. Section V concludes the paper with implications for the conduct of monetary policy in open EMEs. Section II Living with Spillovers: The Indian Experience In a spillover-rich environment, the behaviour of the spectrum of domestic interest rates and asset prices alters in responce to global shocks, sometimes significantly and persistently. Perturbations in India’s domestic financial market segments during the period of study-which coincides with unconventional monetary policies (UMPs) of AEs, as well as high intensity global shocks such as the European sovereign debt crisis, the taper caper, the ‘bund tantrum’ and the Chinese devaluation-is the focus of this section. The discussion is arranged in terms of the stages in which each market segment transmits monetary policy impulses. Money Market In India, the money market provides the first leg of monetary policy transmission: policy rate changes impact the uncollateralised weighted average call money market rate (WACR) — the operating target — instantaneously and, in turn, all other money market rates evolve around the WACR with varying spreads. Typically, the money market is insulated from external shocks by active liquidity management by the RBI, which tend to offset fluctuations in market liquidity conditions brought on by domestic factors such as changes in government balances, currency demand and the like. The absence of prolonged disruptions in interbank overnight and money markets is largely corroborated in the country experience (Moreno and Villar, 2011). During the GFC and the taper caper, money market spreads widened significantly, dispelling the sense of insulation. Even though this was short-lived it provoked unconventional policy responses from the RBI, which lowered its policy repo rate by 425 bps cumulatively and injected liquidity/ opened up liquidity windows aggregating to 10 per cent of gross domestic product (GDP) to avert a liquidity freeze. In May-September 2013, as the taper caper hit EMEs, the RBI again responded unconventionally. It widened the policy corridor by raising the marginal standing facility rate by 200 bps while draining out liquidity by tightening reserve requirement maintenance and restricting access to liquidity under normal repos. These actions effectively raised the WACR by 300 bps, with a view to preventing a free fall of the rupee (Pattanaik and Kavediya, 2015). Significantly, the policy rate was kept unchanged to reflect the domestic focus of monetary policy through these troubled times. On both occasions, exceptional monetary measures were normalised quickly. Besides active liquidity management, money markets in India are also shielded from global spillovers by statutory liquidity ratio (SLR) requirements which entail that banks maintain a fixed proportion of liabilities in gilts. SLR maintenance in excess of the statutory requirement allows banks to get access to central bank liquidity as well as to secured markets, thus obviating a collateral constraint. Furthermore, banks largely fund themselves through retail deposits rather than wholesale funding, the latter identified elsewhere as a source of vulnerability to external contagion (Mesquita and Torós, 2010). Bond Market Much of the international debate in the empirical literature highlights co-movement of long-term yields as an example of possible loss of independence of domestic monetary policy. India’s 10-year government securities (G-sec) yield did, in fact, exhibit a high degree of co-movement with US and German government bond yields, but only during three episodes — the GFC, the taper caper and the bund tantrum. During the first two of these episodes, however, G-sec bond yields largely reflected the domestic monetary policy stance, which adjusted to insulate domestic macroeconomic conditions and quite successfully so. The Indian experience with regard to spillovers and G-sec yields is also borne out in the literature in which a broad consensus suggests that when markets are on edge, they pay greater attention to country-specific fiscal fundamentals rather than global correlations (Jaramillo and Weber, 2013a). In the short run, however, financial vulnerabilities may matter in spread formation (Bellas et al., 2010), but here too, it is important to recognise country specifics. Domestic prudential policies have also helped in insulating domestic bond markets. First, large non-resident holdings of locally-issued domestic government bonds, which expose domestic bond markets to cross-border co-movements and spillovers, are relatively small in India: the share of foreign portfolio investors in the stock of government bonds is less than 5 per cent. Secondly, the recent jump in direct issuances of US dollar denominated bonds by corporates in EMEs in international capital markets — which more than doubled since 2008 — has largely bypassed India which has accounted for only 5 per cent of this surge. Much of these issuances were driven by the lure of carry trade, i.e., financial risk-taking rather than real investment (Bruno and Shin, 2015). Thirdly, unlike in some EMEs such as Poland, Mexico, and Hungary (Moreno, 2010), changes in short-term domestic interest rates appear to be the lead driver of changes in nominal G-sec yields in India (Akram and Das, 2015). This is also found in broader surveys of country experiences, although stable inflation expectations tend to dampen the direct impact (Mohanty and Turner, 2008). Corporate bond yields in India essentially track the 10-year G-sec yield, with changing risk spreads over time. But for occasional deviations of risk spreads from normal levels, the evolution of bond yields is consistent with domestic monetary policy cycles. Corporate bond yields tend to follow G-sec yields in overshoots in response to global shocks and their speed of adjustment is also faster. Credit Market The recent literature also documents the credit channel of spillovers across EMEs in emerging Europe (Brzoza-Brzezina et al., 2010) and Asia (He and McCauley, 2013): low interest rates on major currencies provide an incentive to substitute foreign currency credit-mostly dollar denominated-for local currency credit. In India, the share of non-resident participation in deposits and loans has been very low. Non-resident deposits (excluding rupee denominated deposits of non-residents) priced off a foreign interest rate constitute barely 3 per cent of banks’ total liabilities. On the assets side, 3 per cent of outstanding bank assets are externally sourced. Banks’ access to external finance is also governed by prudential regulations that limit it to 100 per cent of their Tier 1 capital. Moreover, open positions and gap limits attract capital charges. Several EMEs faced the compulsion of keeping their interest rates lower than what might have been warranted by Taylor-type rules on account of the accommodation of external developments in their policy reaction functions (BIS, 2014). By contrast, the RBI’s main instrument to smooth excessive exchange rate volatility has been active capital account management along with interventions in the foreign exchange market (Mohan and Kapur, 2009). Furthermore, the introduction of the Fed funds rate generates instability in the reaction function — the long-run coefficient on inflation falls below unity, while the coefficient on the output gap turns insignificant (Patra and Kapur, 2010). Section III Measuring Global Spillovers UMPs have produced strong co-movements in a host of economic and financial variables across borders. In order to examine spillovers in relation to a specific country, elements driving these co-movements can be identified and aggregated into an Indicator of Global Spillovers (IGS). It has been empirically shown that one or two common factors extracted from these innumerable variables may effectively capture a reasonably large part of the common information contained in them while maximising degrees of freedom (Breitung and Eickmeier, 2006). Accordingly, dynamic factor models (DFMs) have been favoured for extracting latent dynamic factors in co-movements and synchronisations represented in high dimensional vectors of time series variables. DFMs overcome the limitations of standard Vector Autoregression (VAR)/Global Vector Autoregression approaches — restrictive assumptions on the structure of the economy; which variables to include and, therefore, the number of shocks; difficulties in segregating global and country-specific factors; limitations on inclusion of number of countries and the like (Crucini et al. 2011; Giannone et al., 2004; Hirata, et al., 2013; Watson, 2004). Originating in seminal work on time series extensions of factor models developed for cross-sectional data (Geweke, 1977; Sargent and Sims, 1977), DFMs are able to simultaneously model data sets in which the number of variables can exceed the number of time series observations (Stock and Watson, 2011). Another advantage is that idiosyncratic movements from measurement errors or localised shocks can be eliminated, yielding more reliable policy signals (Breitung and Eickmeier, 2006). A similar parsimonious philosophy has driven the quest for financial conditions indices (Matheson, 2012; Osorio et al., 2011). A three-step procedure is adopted here. First, the extensive application of DFMs in the context of equity, bond and foreign exchange markets sheds light on the variables that are likely candidates for measuring global spillovers3: (i) VIX, as an indicator of risk perception or the confidence channel, exhibits strong co-movement with capital flows to EMEs in the role of a push factor (Nier et al., 2014); (ii) LIBOR-OIS spread as an indicator of the liquidity channel reflects US dollar liquidity stress (Ree and Choi, 2014) as well as risk of default associated with lending to other banks (Thornton, 2009); (iii) term spread, i.e., 10-year US treasury yield minus three-month US treasury yield, represents the portfolio balance channel (Bernanke, 2013)4; (iv) risk spread — US 10-year corporate yields minus US 10-year treasury yields (Bethke et al., 2015; Jaramillo and Weber, 2013b); and (v) DXY — the dollar index — represents the exchange rate channel of transmission of spillovers (Bergsten, 2013; Glick and Leduc, 2013). Hereafter, these variables are referred to as the spillover variables. In the second step, these variables are subjected to the Occam’s razor of being relevant to channels of transmission of monetary policy in India — the money market (spread between weighted average call rate and policy repo rate, with net injection/absorption of liquidity by the RBI as the control variable to capture market specific characteristics); the government bond market (10-year yield, with foreign portfolio investments (FPI) in debt securities as the control variable); the stock market (BSE Sensex returns, with foreign portfolio equity investment as the control variable); and the foreign exchange market (returns on or daily change in the INR-USD exchange rate, with net FPI investment, debt and equity together, as the control variable). For each domestic market segment, the relevant spillover variable is considered: LIBOR-OIS spread for the money market; the US term spread/risk spread for the bond market; the US VIX for the stock market; and LIBOR-OIS spread/DDXY (dollar index returns) for the foreign exchange market. These domestic market variables are hereafter referred to as domestic variables. Each postulated relationship is evaluated in a bivariate Baba, Engle, Kraft and Kroner (BEKK) - GARCH model5 which involves a system of conditional mean equations with exogenous regressors in VARX(p, q) form: For the conditional variance equation, we also use a BEKK framework augmented with the spillover variables in view of the associated advantages of estimating less number of parameters and ensuring positive semi-definiteness of the conditional variance matrix. The equation takes the following form: in which Ht is a linear function of its own lagged values, lagged squared innovations (εt-1) and their crossproduct, and exogenous spillover variables. Volatility transmission between domestic financial variables is represented by the off-diagonal parameters in matrices A and G while the diagonal parameters in those matrices capture the effects of their own past shocks and volatility. The parameters in matrix D measure international spillovers. Eq. (2) is estimated by the maximum likelihood method. Daily data for the period April 1, 2004 through October 15, 2015 are used, with estimations for the full sample period as well as for sub-samples covering the pre-crisis period (up to August 9, 2007) and the post-crisis period (from August 10, 2007 to October 15, 2015), as robustness checks. Impulse responses of the spillover variables on domestic variables in the unconditional VARX(p,q) models are found to be statistically significant though short-lived, with the impact persisting up to a maximum of one week6. When examined in a conditional VAR framework that allows for interactions of volatilities in variance equations, the mean spillover effects are found to be only marginally different (Appendix, Tables A.1 to A.4). Thus, even after controlling for interactions with volatility, there is evidence of spillover. Spillovers on to the call money market are found to be significant only in the post-crisis sample, essentially reflecting transient dollar liquidity shortages impacting the rupee leg. Of the two spillover variables relevant for the foreign exchange market, the impact of the LIBOR-OIS spread on the exchange rate of the rupee is found to be significant — though at 10 per cent level — in the post-crisis period and the full sample period, but it is insignificant in the pre-crisis sub-sample. Importantly, spillover is found to transmit through Foreign Institutional Investors (FII) investment flows, particularly in the post-crisis period. When the LIBOR-OIS spread is substituted with the DDXY, the impact is found to be significant in all sample periods, indicating that the rupee is directly influenced by movements of the US dollar vis-à-vis other major currencies. Mean spillovers on stock prices (daily returns) are found to be significant for the full sample as well as for the pre-crisis period; in the post-crisis period, spillovers are more evident in stock price volatility rather than in mean returns. The mean spillover on government bond yields is found to be insignificant in all sample periods, though FPI debt flows are influenced by both the term spread and the risk spread. Turning to volatility, shocks to the LIBOR-OIS spread and the DXYSQ (i.e., squared dollar index return) are found to increase volatility in the exchange rate of the rupee in a statistically significant manner. Similar results are also obtained in the case of stock market volatility in response to shocks to the VIX, with a significantly large impact in the post-crisis period. The impact on volatility of bond yields is also statistically significant, but the signs of coefficients reverse when the risk spread is considered, making the interpretation of the impact on mean and volatility difficult. An increase in the LIBOR-OIS spread is found to increase volatility in the call rate, despite the fact that net LAF liquidity — which should control both mean and volatility — is introduced in the model as a control variable. Overall, the five selected global spillover variables are found to influence volatility in domestic financial markets, and their effects on mean levels of variables are also found to be statistically significant but transitory.7 In the third stage, we estimate the IGS by applying a DFM to the selected spillover variables identified in the second stage.8 It is assumed that each variable (standardised) Yt can be decomposed into an unobserved common component, Ft, and a disturbance term εt. Ft is modelled as an autoregressive process and the disturbance term εt is assumed to be autocorrelated: Before estimation, all five spillover variables were converted to monthly frequency9 and standardised. The sample period for the analysis is from January 2002 to September 2015. The parameters are obtained by maximum likelihood estimation using the Kalman filter (Appendix, Table A.5), which produces substantial improvements in the estimates of factors relative to principal components when the common factor is persistent (Stock and Watson, 2011). The estimated factor loadings10 are provided in Table 1. The Portmanteau (Q) test suggests that all innovations are white noise, validating the goodness of fit of the DFM. Table 1 shows the IGS is significantly correlated with all five spillover variables, and especially with the VIX. This result is consistent with the central tendency in the empirical literature (Nier et al., 2014). IGS tracks global financial conditions nicely, particularly the GFC, the events relating to UMPs of the Fed, the sovereign debt crisis in Europe, the Chinese devaluation, the Bund Tantrum and the growing certainty around the Fed’s lift off (Chart 1). It does not, however, adequately capture the impact of the 2013 Taper Tantrum. Capital flows to EMEs reversed between May 2013 and January 2014, but recovered across all major EMEs by Q1 of 2014. This short-lived episode was also suffused with domestic policy responses in a number of countries, some dramatic and unconventional, which might be blurring the clear indications reflected, for instance, in US yield spreads (Section II). | Table 1: Factor Loadings for IGS and Correlation | | Variables | Factor Loadings | Correlation | | VIX | 0.44 (0.00) | 0.99 (0.00) | | LIBOR-OIS | 0.30 (0.00) | 0.74 (0.00) | | DXYSQ | 0.15 (0.00) | 0.34 (0.00) | | TMSPREAD | 0.01 (0.97) | 0.35 (0.00) | | RISKSPREAD | 0.16 (0.00) | 0.67 (0.00) | | Note: Figures in parentheses are p-values. |

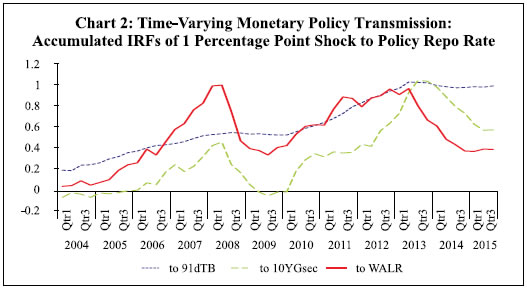

Section IV Impact of Spillovers on Monetary Policy Transmission Channels in India In this section, we set out to empirically evaluate the hypotheses proposed in the introductory section, armed with the lessons drawn from the available literature and the specifics of the Indian experience. With the failure of large macroeconometric models in predicting turning points of business cycles the world over, especially after the stagflation experience following the oil price shocks of the 1970s, economists turned to the use of VAR models, drawing on seminal work to capture the dynamics in multiple time series (Sims, 1980). While the VAR model has the advantage of being free of a priori strong commitment to structural restrictions, the imposition of constancy in parameters as well as error variances may produce misleading results, especially when policy reaction functions and transmission are changing either due to structural breaks/regime shifts and/or the changing nature of shocks. This is particularly relevant in the context of the period of study of this paper which covers a catastrophe of global dimensions and aftershocks as well as significant structural transformation in the Indian economy. These developments can and have forced changes in monetary policy transmission due to: (a) unconventional policy responses despite a stated objective function, leading to excessive accommodation/contraction, depending on the compulsion faced by central banks; and (b) exogenous non-policy factors influencing transmission such as asset quality concerns in the banking system and associated risk aversion, competition from non-banks/shadow banks, administered interventions in setting interest rates and macro-prudential and regulatory interventions impacting flow and pricing of credit. Accordingly, the methodology adopted here draws upon a recently growing strand in the literature which employs VAR models involving time-varying parameters (TVPs) with stochastic volatility in the tradition started by Primiceri (2005)11. The TVP-VAR also allows for the checking of impulse responses at different points of time. Following Imam (2015), the estimated cumulative impulse responses from the TVP-VAR — representing the impact of monetary policy shocks — are regressed on the IGS developed in Section III, while controlling for relevant domestic factors, in order to assess the impact of spillovers on monetary policy transmission in India. The interpretation of exogeneity in this context relates to non-policy factors, even though financial market variables included in the TVP-VAR reflect both policy and non-policy influences. The TVP-VAR Framework The measurement equation is specified as Results14 The accumulated time-varying impulse response functions (IRFs15) of monetary policy innovations for tbt' g-sect' walrt, exhibit sustained improvement in transmission over time, interrupted by spillover-induced disruptions which produce short-lived overreactions to global event shocks. Nevertheless, monetary policy transmission has always been positive around a rising trend (Chart 2). Transmission to 91-day TB yeild is almost complete and instantaneous in more recent years. Long-term rates, i.e. the 10-year G-sec yield and the WALR showed significant loss of traction to domestic monetary policy shocks during the financial crisis (2008–09), but transmission improved to pre-crisis levels and even strengthened till the taper caper of May 2013. Long-term rates overreacted to the exceptional monetary tightening in the second half of 2013, and corrected only gradually, showing up in a decline in the accumulated IRFs which still remained above pre-crisis levels. The estimated time-varying IRFs are presented in the appendix (Chart A.2).  There are several market-specific idiosyncratic factors in operation which explain the time variation in the IRFs. Accordingly, the cumulative IRFs are regressed individually on the IGS while controlling for domestic market-specific factors — the size of the G-sec market in terms of volumes (G-sec volume/GDP) and inflation expectations — in the case of the 91-day TB rates and the 10-year G-sec yield IRFs. The Newey–West regression estimator is used to overcome autocorrelation and heteroscedasticity in the error term that are commonly associated with time series data relating to financial markets. Given the need to identify the relative importance of each of the factors considered in the regression, standardised coefficients16 are reported in Tables 2 and 3. IGS has a statistically significant damping impact on monetary policy transmission to both g-sec and 91-day TB yields, but domestic factors such as volumes in the g-sec market and inflation expectations have a stronger influence.17 With regard to the bank lending rate, the IRF is regressed on IGS while controlling for financial development in the credit market measured by credit to GDP ratio (credit/GDP) and asset quality measured by gross non-performing assets to credit ratio (GNPA/credit).18 The standardised regression coefficients on IGS are not statistically significant. By contrast, credit/GDP and GNPA/credit ratios are statistically significant and together explain more than 50 per cent of variations in transmission over time. Thus, there is no statistically strong evidence of domestic monetary policy losing traction in respect of bank lending rates because of spillovers. | Table 2: Monetary Policy Transmission to G-sec Market | | Dependent | Monetary Policy Transmission to 91 day TB yield | Monetary Policy Transmission to g-sec 10 year yeild* | | Independent | Index of global

spillover (IGS) | -0.274 | -0.494 | | (0.002) | (0.013) | Market size

(G-sec volume/GDP) | 0.722 | 0.680 | | (0.000) | (0.023) | Long-term inflation

expectations | --- | 0.522 | | | (0.011) | | R-square | 0.548 | 0.422 | | F statistic | 28.40 | 7.06 | | | (0.000) | (0.001) | Notes: Figures in parentheses are p-values. Newey–West regression with autocorrelation and heteroscedasticity adjusted SEs.

*: As the data on long-term inflation expectations are available from 2008, the sample period for this regression is from Q4:2007–08. |

| Table 3: Monetary Policy Transmission to Credit Market | | Dependent variable: Monetary Policy Transmission to WALR | Regression 1 | Regression 2 | Regression 3 | Regression 4 | Index of global spillover

(IGS) | -0.010 | -0.011 | -0.083 | -0.010 | | (0.912) | (0.921) | (0.473) | (0.911) | Financial development

(credit/GDP) | 0.849 | | | 0.775 | | (0.000) | | | (0.000) | Asset quality

(GNPA/credit) | | -0.732 | | -0.087 | | | (0.000) | | (0.674) | Financial development x

Asset quality | | | -0.512 | | | | | (0.000) | | | R-square | 0.694 | 0.527 | 0.247 | 0.697 | | F statistic | 52.94 | 27.74 | 8.30 | 34.81 | | | (0.000) | (0.000) | (0.000) | (0.000) | | Notes: Figures in parentheses are p-values. Newey–West regression with autocorrelation and heteroscedasticity adjusted SEs. | To summarise, the empirical results indicate that monetary policy transmission through the money market — the first leg of transmission — has improved substantially over time and is found to be almost complete even in the face of global spillovers. In the debt market, however, global spillovers affect transmission of monetary policy to yields and can even produce overshooting and over-corrections, but domestic factors such as market microstructure have a stronger influence. The latter may be influential in rendering the reactions to global perturbations short-lived and in ensuring mean reversions to normalcy. In the credit market, lending rates reflect low and incomplete transmission of monetary policy, even absent global spillovers. Spillovers have no significant influence, and asset quality and financial deepening play the more important role in determining policy transmission. These findings do not, however, negate the overwhelming effects that global spillovers can produce on global output and inflation gaps and, in turn, on domestic gaps. To that extent, spillovers do pose challenges to the successful conduct of monetary policy in pursuit of domestic goals. Section V Conclusion The mainstream view that global spillovers overwhelm monetary policy independence is being questioned by specific country experiences. The effects of UMPs on monetary policy transmission and goal variables is however, still an unsettled issue. Here, global real business cycles may be at work rather than financial forces. The arena shifts to the spectrum of financial markets which provide the transmission lines. In India, money market is largely sheltered from spillovers and so too is credit market, highlighting the shielding influence of the RBI’s active liquidity management, besides country-specific factors that impart a distinct home bias. In bond, forex and equity markets, in which foreign presence provides a conduit for contagion, capital flows management buffered by foreign exchange reserves has provided a buffer, but it will be tested for endurance in the period ahead by the exhaust fumes of Fed normalisation and the idling engines of monetary super accommodation. VAR and MGARCH estimates provide statistically significant evidence of spillovers transitorily affecting domestic financial markets. Extracting common elements in these spillovers through a dynamic factor model shows that global spillovers do dampen time-varying monetary policy transmission in the domestic bond market. The credit market is impervious. Thus, there is no statistically strong evidence of domestic monetary policy losing traction to global spillovers in India. Monetary policy does respond directly to volatility-driven stress in domestic financial market conditions, but this needs to be regarded as a policy choice with the ultimate objective of meeting domestic goals, rather than a loss of monetary policy independence. Global shocks in a globalised economy are unavoidable, but stabilising the domestic economy, irrespective of the nature and sources of shocks to domestic transmission channels, remains a key task for domestic monetary policy.

References Ahmed, S., B. Coulibaly, and A. Zlate (2017), “International Financial Spillovers to Emerging Market Economies: How Important are Economic Fundamentals?”, Journal of International Money and Finance, 76, 133-152. Akram, T. and A. Das (2015), “Does Keynesian Theory Explain Indian Government Bond Yields?”, Working Paper No. 834, March, Levy Economics Institute, Working Papers Series. Available at: http://www.levyinstitute.org/publications/does-keynesian-theory-explain-indian-government-bond-yields (last accessed 15 March 2018). Amengual, D. and M.W. Watson (2007), “Consistent Estimation of the Number of Dynamic Factors in a Large N and T Panel”, Journal of Business and Economic Statistics, 25(1), pp. 91–96. Bai, J. and S. Ng (2002), “Determining the Number of Factors in Approximate Factor Models”, Econometrica, 70(1), pp. 191–221. Bank for International Settlements (BIS) (2014), Annual Report 2013/14, 29 June. Barroso, J.B., E. Kohlscheen and E.J. Lima (2014), “What have Central Banks in EMEs Learned About the International Transmission of Monetary Policy in Recent Years? ”, BIS Papers No. 78, pp. 95–109. Bellas, D., M.G. Papaioannou and I. Petrova (2010), “Determinants of Emerging Market Sovereign Bond Spreads”, in A.P. Braga and C. Vincolette, Sovereign Debt and the Financial Crisis, Washington D.C., The World Bank, pp. 77–101. Bergsten, C.F. (2013), “Currency Wars, the Economy of the United States and Reform of the International Monetary System”, 12th Stavros Niarchos Foundation Lecture, Peterson Institute for International Economics, Washington D.C. Bernanke, Ben S. (2013), “Long-Term Interest Rates”, A Speech at the Annual Monetary/Macroeconomics Conference: The Past and Future of Monetary Policy, sponsored by Federal Reserve Bank of San Francisco, San Francisco, California. Bethke, S., M. Gehde-Trapp A. and Kempf (2015), “Investor Sentiment, Flight-to-Quality, and Corporate Bond Comovement”, CFR Working Papers 13-06, University of Cologne, Köln. Bollerslev, T. and R.F. Engle and J.M. Wooldridge (1988), “A Capital Asset Pricing Model with Time-Varying Covariance”, Journal of Political Economy, 96, pp. 116–31. Breitung, J. and S. Eickmeier (2006), “Dynamic Factor Models”, Allgemeines Statistisches Archiv, 90(1), pp. 27–42. Bruno, V. and H.S. Shin (2015), “Capital Flows and the Risk-taking Channel of Monetary Policy”, Journal of Monetary Economics, 71, pp. 119–32. Brzoza-Brzezina, M., T. Chmielewski and J. Niedźwiedzińska (2010), “Substitution Between Domestic and Foreign Currency Loans in Central Europe, Do Central Banks Matter? ”, ECB Working Paper Series, No 1187, May. Chen, Q., A. Filardo, D. He and F. Zhu (2015), “Financial Crisis, US Unconventional Monetary Policy and International Spillovers”, BIS Working Papers No. 494, Bank for International Settlements. Cogley, T., G.E. Primiceri and T.J. Sargent (2010), “Inflation-gap Persistence in the US”, American Economic Journal: Macroeconomics, 2(1), pp. 43–69. Crucini, M.J., M.A. Kose and C. Otrok (2011), “What are the Driving Forces of International Business Cycles?”, Review of Economic Dynamics, 14(1), pp. 156–75. Disyatat, P. and P. Rungcharoenkitkul (2015), “Monetary Policy and Financial Spillovers: Losing Traction?”, BIS Working Papers No. 518, Bank for International Settlements. Edwards, S. (2015), “Monetary Policy Independence under Flexible Exchange Rates: An Illusion?”, The World Economy, 38(5), pp. 773–87. Eichengreen, B. and P. Gupta (2014), “Tapering Talk: The Impact of Expectations of Reduced Federal Reserve Security Purchases on Emerging Markets”, World Bank Policy Research Working Paper No. 6754, World Bank, Washington D.C. Engle, R. and F.K. Kroner (1995), “Multivariate Simultaneous Generalized ARCH”, Econometric Theory, 11, pp. 122–50. Evans, C.L. and D.A. Marshall (1998), “Monetary Policy and the Term Structure of Nominal Interest Rates: Evidence and Theory”, in Carnegie-Rochester Conference Series on Public Policy, 49, North-Holland, pp. 53–111. Geweke, J. (1977), “The Dynamic Factor Analysis of Economic Time Series Models”, in D.J. Aigner and A.S. Goldberger (eds.), Latent Variables in Socio-Economic Models, Amsterdam, North-Holland. Giannone, D., L. Reichlin and L. Sala (2004), “Monetary Policy in Real Time”, in NBER Macroeconomics Annual 2004, Vol. 19, MIT Press, pp. 161–224. Glick, R. and S. Leduc (2013), “The Effects of Unconventional and Conventional US Monetary Policy on Dollar”, Working Paper 2013-11, Federal Reserve Bank of San Francisco. Gray, C (2013), “Responding to a Monetary Superpower: Investigating the Behavioural Spillovers of US Monetary Policy”, Atlantic Economic Journal, 41(2), pp. 173–84. Harrison, D. (2015), “Central Bankers Urge Fed to Get On With Interest-Rate Increase”, Wall Street Journal, 11 October. He, D. and R.N. McCauley (2013), “Transmitting Global Liquidity to East Asia: Policy Rates, Bond Yields, Currencies and Dollar Credit”, HKIMR Working Paper No. 15. Hirata, H., M.A. Kose and C. Otrok (2013), “Globalization vs. Regionalization”, IMF Working Paper 13:19. Hofmann, B. and E. Takáts (2015), “International Monetary Spillovers”, BIS Quarterly Review, September, pp. 105–118. Imam, P.A. (2015), “Shock from Graying: Is the Demographic Shift Weakening Monetary Policy Effectiveness”, International Journal of Finance and Economics, 20(2), 138–54. Jaramillo, L. and A. Weber (2013a), “Bond Yields in Emerging Economies: It Matters What State You Are In”, Emerging Markets Review, 17, pp. 169–85. — (2013b), “Global Spillovers into Domestic Bond Markets in Emerging Market Economies”, IMF Working Paper No. 13/264. John, J. (2015), “Has Inflation Persistence in India Changed over Time?”, The Singapore Economic Review, 60(4), 1550095. Matheson, T.D. (2012). “Financial Conditions Indexes for the United States and Euro Area”, Economics Letters, 115(3), pp. 441–46. Mesquita, M. and M. Torós (2010), “Brazil and the 2008 Panic”, BIS Papers No. 54, 113–20, Bank for International Settlements. Mishra, P., Moriyama, K., N’Diaye, P. and Nguyen, L. (2014). “Impact of Fed Tapering Announcements on Emerging Markets”, IMF Working Paper No. 14/109. Miyajima, K., M.S. Mohanty and J. Yetman (2014), “Spillovers of US Unconventional Monetary Policy to Asia: The Role of Long-term Interest Rates”, BIS Working Paper No. 478, Bank for International Settlements. Mohan, R. and M. Kapur (2009), “Managing the Impossible Trinity: Volatile Capital Flows and Indian Monetary Policy”, Working Paper No. 401, November, Stanford University. Mohanty, M.S. and P. Turner (2008), “Monetary Policy Transmission in Emerging Market Economies: What is New?”, BIS Papers No 35, pp. 1–59. Moreno, R. (2008), “Monetary Policy Transmission and the Long-term Interest Rate in Emerging Markets”, BIS Papers No. 35, pp. 61–80. — (2010). “Central Bank Instruments to Deal with the Effects of the Crisis on Emerging Market Economies”, BIS Papers No. 54, pp. 73–96. Moreno, R. and A. Villar (2011), “Impact of the Crisis on Local Money and Debt Markets in Emerging Market Economies”, BIS Papers No. 54, pp. 49–72. Mumtaz, H. and L. Sunder‐Plassmann (2013), “Time‐Varying Dynamics of the Real Exchange Rate: An Empirical Analysis”, Journal of Applied Econometrics, 28(3), pp. 498–525. Nakajima, J. (2011), “Time-varying Parameter VAR Model with Stochastic Volatility: An Overview of Methodology and Empirical Applications”, Monetary and Economic Studies, November, pp. 107–42. Nakajima, J., M. Kasuya and T. Watanabe (2011), “Bayesian Analysis of Time-varying Parameter Vector Autoregressive Model for the Japanese Economy and Monetary Policy”, Journal of the Japanese and International Economies, 25(3), pp. 225–45. Nier, E.W., T. Saadi-Sedik and T. Mondino (2014), “Gross Private Capital Flows to Emerging Markets: Can the Global Financial Cycle Be Tamed?” IMF Working Paper No. 14/196. Obstfeld, M. (2015), “Trilemmas and Trade-offs: Living with Financial Globalisation”, BIS Working Papers No. 480. Osario, C., Unsal, D. F. and Pongsaparn, R. (2011). “A Quantitative Assessment of Financial Conditions in Asia”, IMF Working Papers, No. 11/170, pp. 1-21. Patra, M.D. and M. Kapur (2010), “A Monetary Policy Model Without Money for India”, IMF Working Paper No. 10/183. Pattanaik, S. and R. Kavediya (2015), “Taper Talk and the Rupee–Preconditions for the Success of an Interest Rate Defence of the Exchange Rate”, Prajnan, 44(3), pp. 251–77. Pétursson, T.G. (2000), “The Representative Household’s Demand for Money in a Cointegrated VAR Model”, The Econometrics Journal, 3(2), pp. 162–76. Primiceri, G.E. (2005), “Time Varying Structural Vector Autoregressions and Monetary Policy”, The Review of Economic Studies, 72(3), pp. 821–52. Parussini, G. (2015), “India’s Central Bank Cuts Key Interest Rate More Than Expected”, Wall Street Journal, 29 September. Ree, J.J.K. and S. Choi (2014), “Safe-Haven Korea?: Spillover Effects from UMPs”, IMF Working Paper No. 14/53, Asia and Pacific Department, International Monetary Fund. Rey, H. (2015). “Dilemma not Trilemma: The Global Financial Cycle and Monetary Policy Independence”, NBER Working Paper No. 21162, May. Roley, V. V. and G.H. Sellon (1995), “Monetary Policy Actions and Long-term Interest Rates”, Federal Reserve Bank of Kansas City Economic Quarterly, 80(4), pp. 77–89. Saborowski, C. and S. Weber (2013). “Assessing the Determinants of Interest Rate Transmission Through Conditional Impulse Response Functions”, IMF Working Paper No. 13/23. Sargent, T.J. and C.A. Sims (1977), “Business Cycle Modeling Without Pretending to Have Too Much A Priori Economic Theory”, in C.A. Sims (ed.), New Methods in Business Cycle Research, 1, Federal Reserve Bank of Minneapolis, pp. 145–68. Sims, C.A. (1980), “Macroeconomics and Reality”, Econometrica, 48(1), pp. 1–48. Sobrun, J. and P. Turner (2015), “Bond Markets and Monetary Policy Dilemmas for the Emerging Markets”, BIS Working Papers No. 508. Stock, J.H. and M.W. Watson (2011), “Dynamic Factor Models”, Oxford Handbook of Economic Forecasting, vol. 1, pp. 35–59. Takáts, E. and A. Vela (2014), “International Monetary Policy Transmission”, BIS Papers No. 78, pp. 25–44. Thornton, D.L. (2009), “What the LIBOR-OIS Spread Says”, Economic Synopses, No. 24, Federal Reserve Bank of St. Louis. Turner, P. (2014), “The Global Long-term Interest Rate, Financial Risks and Policy Choices in EMEs”, BIS Working Papers No. 441. Watson, M.W. (2004). “Comment on Giannone, Reichlin, and Sala”, NBER Macroeconomics Annual 2004, Vol. 19, MIT Press, pp. 216–21.

Appendix | Table A.1: Spillover Impact in Money Market | | a. Mean Equation | | Dependent Variable: CALLSPREAD | Full Sample | Pre-Crisis | Post-Crisis | | Constant | -0.27 -(23.11)*** | -0.04 -(2.74)** | -0.13 -(6.78)*** | | CALLSPREADt-1 | 0.39 (18.96)*** | 0.55 (12.62)*** | 0.36 (13.06)*** | | CALLSPREADt-2 | 0.01 (0.28) | 0.12 (2.73)** | 0.06 (1.98)** | | CALLSPREADt-3 | 0.07 (3.10)*** | 0.03 (0.79) | 0.14 (5.16)*** | | CALLSPREADt-4 | 0.00 (0.00) | 0.06 (1.56) | 0.07 (2.43)** | | CALLSPREADt-5 | 0.08 (3.88)*** | 0.08 (2.66)** | 0.14 (5.83)*** | | LAFt-1 | 0.00 (9.41)*** | 0.00 (4.36)*** | 0.00 (5.99)*** | | LAFt-2 | 0.00 (1.93)** | 0.00 -(0.93) | 0.00 (1.36) | | LAFt-3 | 0.00 -(2.58)** | 0.00 (0.00) | 0.00 -(2.28)** | | LAFt-4 | 0.00 -(0.34) | 0.00 -(1.57) | 0.00 -(0.72) | | LAFt-5 | 0.00 -(0.69) | 0.00 -(0.34) | 0.00 (0.31) | | LIBOR_OISt-1 | 0.00 -(2.52)** | 0.00 -(2.17)** | 0.00 -(2.05)** | | Dependent Variable: LAF | | | | | Constant | 0.52 (0.21) | -5.18 -(1.78)* | 21.25 (3.40)*** | | CALLSPREADt-1 | 2.49 (2.63)** | 1.63 (1.65)* | -0.81 -(0.16) | | CALLSPREADt-2 | -0.36 -(0.36) | 0.02 (0.02) | 3.29 (0.59) | | CALLSPREADt-3 | -1.08 -(1.00) | -1.46 -(1.52) | -3.23 -(0.54) | | CALLSPREADt-4 | 0.57 (0.53) | 0.85 (0.88) | 9.62 (1.79)* | | CALLSPREADt-5 | -0.31 -(0.33) | -0.74 -(0.88) | 3.26 (0.67) | | LAFt-1 | 0.94 (48.90)*** | 0.97 (32.69)*** | 0.99 (41.70)*** | | LAFt-2 | -0.02 -(0.74) | -0.07 -(1.81)* | -0.04 -(1.22) | | LAFt-3 | -0.07 -(2.63)** | 0.00 (0.05) | -0.12 -(3.67)*** | | LAFt-4 | 0.02 (0.71) | -0.03 -(0.90) | 0.00 (0.11) | | LAFt-5 | 0.11 (5.94)*** | 0.09 (3.42)*** | 0.15 (6.57)*** | | LIBOR_OISt-1 | -0.06 -(0.80) | 0.09 (0.65) | -0.25 -(2.64)** | | b. Variance Equation | | | Full Sample | Pre-Crisis | Post-Crisis | | A{1}(1,1) | 0.56 (17.23)*** | 0.76 (11.06)*** | 0.70 (20.83)*** | | A{1}(1,2) | 0.49 (0.39) | 2.83 (2.12)** | -5.91 -(0.78) | | A{1}(2,1) | -0.00002 -(0.14) | -0.002 -(7.31)*** | 0.0004 (6.52)*** | | A{1}(2,2) | 0.27 (11.15)*** | 0.05 (1.00) | 0.20 (6.48)*** | | A{2}(1,1) | 0.69 (17.80)*** | 0.45 (5.60)*** | 0.50 (8.43)*** | | A{2}(1,2) | 3.18 (1.84)* | 1.22 (1.06) | 47.99 (4.45)*** | | A{2}(2,1) | -0.001 -(10.24)*** | -0.001 -(2.73)** | -0.001 -(7.59)*** | | A{2}(2,2) | 0.19 (5.14)*** | 0.13 (3.31)*** | 0.28 (6.27)*** | | B{1}(1,1) | 0.43 (6.59)*** | -0.06 -(0.33) | -0.31 -(3.86)*** | | B{1}(1,2) | 13.47 (5.86)*** | 0.81 (0.66) | 16.87 (1.90)* | | B{1}(2,1) | 0.00 -(5.36)*** | 0.00 -(0.30) | 0.00 -(2.01)** | | B{1}(2,2) | -0.91 -(17.07)*** | -0.23 -(1.40) | -0.60 -(7.27)*** | | B{2}(1,1) | 0.59 (16.16)*** | 0.59 (16.73)*** | 0.57 (11.54)*** | | B{2}(1,2) | 3.32 (1.79)* | -0.61 -(0.76) | 32.42 (2.79)** | | B{2}(2,1) | 0.00 -(1.34) | 0.00 (0.20) | 0.00 -(2.19)** | | B{2}(2,2) | 0.25 (1.49) | 0.85 (15.37)*** | -0.11 -(0.83) | | LIBOR_OISi, t-1 | 0.002 (4.29)*** | -0.01 -(8.59)*** | 0.002 (5.95)*** | | LIBOR_OISj, t-1 | 0.16 (4.67)*** | 0.59 (6.07)*** | -0.34 -(2.73)** | | Maximum eigenvalue | 0.78 | 0.77 | 0.74 | | MV-ARCH-Q(12) | 48.62 (0.45) | 59.32 (0.13) | 70.63 (0.18) | Notes: LIBOR_OISi, t-1 LIBOR_OISj, t-1 are the exogenous variables in variance equations of CALLSPREAD and LAF, respectively. Figures in parentheses are t-statistics when they are placed after coefficients and p-value, in case of ARCH tests. Constants in variance equation are not presented here to save space.

*,*,***: indicates significant at 10%, 5% and 1% levels, respectively. |

| Table A.2a: Spillover Impact in G-sec Market | | a. Mean Equation | | Dependent Variable: IN10YGS | Full Sample | Pre-Crisis | Post-Crisis | | Constant | 0.05 (4.42)*** | 0.04 (2.32)** | 0.06 (3.31)*** | | IN10YGSt-1 | 1.04 (55.40)*** | 1.08 (31.52)*** | 0.99 (38.17)*** | | IN10YGSt-2 | -0.05 -(2.46)** | -0.09 -(2.49)** | -0.001 -(0.04) | | NFIIDRt-1 | -0.00001 -(0.11) | 0.00003 (0.06) | 0.00002 (0.23) | | NFIIDRt-2 | 0.00004 (0.40) | 0.00036 (0.73) | -0.00008 -(0.71) | | TMSPREADt-1 | 0.00124 (1.59) | -0.00031 -(0.17) | 0.00224 (1.34) | | Dependent Variable: NFIIDR | | | | | Constant | 1.26 (3.73)*** | 0.45 (1.43) | -2.16 -(1.00) | | IN10YGSt-1 | 1.02 (1.38) | -1.36 -(2.10)** | -1.04 -(0.45) | | IN10YGSt-2 | -1.17 -(1.58) | 1.31 (2.03)** | 1.45 (0.62) | | NFIIDRt-1 | 0.27 (11.41)*** | 0.18 (4.07)*** | 0.30 (9.91)*** | | NFIIDRt-2 | 0.02 (0.71) | -0.01 -(0.48) | 0.23 (7.89)*** | | TMSPREADt-1 | -0.19 -(5.70)*** | -0.12 -(3.62)*** | -0.14 -(0.50) | | b. Variance Equation | | A{1}(1,1) | 0.17 (5.59)*** | 0.31 (12.52)*** | 0.28 (14.77)*** | | A{1}(1,2) | -8.12 -(9.10)*** | -0.54 -(0.29) | -3.04 -(0.87) | | A{1}(2,1) | -0.0001 -(0.73) | 0.00 (3.70)*** | -0.0002 -(1.46) | | A{1}(2,2) | 0.81 (29.97)*** | 0.93 (18.92)*** | 0.63 (16.48)*** | | A{2}(1,1) | -0.40 -(17.90)*** | | | | A{2}(1,2) | 2.02 (1.63)* | | | | A{2}(2,1) | 0.00002 (0.13) | | | | A{2}(2,2) | 0.10 (1.31) | | | | B{1}(1,1) | -0.13 -(1.72)* | -0.91 -(89.38)*** | 0.95 (172.86)*** | | B{1}(1,2) | 0.29 (0.40) | 1.88 (1.65)* | -3.46 -(1.88)* | | B{1}(2,1) | -0.0001 -(1.39) | 0.004 (5.82)*** | 0.00004 (0.38) | | B{1}(2,2) | 0.53 (9.73)*** | 0.20 (1.64)* | 0.64 (12.12)*** | | B{2}(1,1) | -0.88 -(62.09)*** | | | | B{2}(1,2) | 0.46 (0.39) | | | | B{2}(2,1) | -0.0003 -(1.90)* | | | | B{2}(2,2) | 0.59 (14.27)*** | | | | TMSPREADi, t-1 | -0.002 -(6.52)*** | 0.01 (11.29)*** | 0.003 (5.36)*** | | TMSPREADj, t-1 | 0.000 (0.00) | -0.18 -(5.50)*** | 0.08 (0.32) | | Maximum eigenvalue | 0.66 | 0.93 0.99 | | | MV-ARCH-Q(12) | 32.17 (0.96) | 21.21 (0.99) | 19.74 (0.99) | Notes: TMSPREADi, t-1 TMSPREADj, t-1 are the exogenous variables in variance equations of IN10YGS and NFIIDR, respectively.

Figures in parentheses are t-statistics when they are placed after coefficients and p-value, in case of ARCH tests.

Constants in variance equation are not presented here to save space.

*,*,***: indicates significant at 10%, 5% and 1% levels, respectively. |

| Table A.2b: Spillover Impact in G-sec Market | | a. Mean Equation | | Dependent Variable: IN10YGS | Full Sample | Pre-Crisis | Post-Crisis | | Constant | 0.05 (4.16)*** | 0.04 (2.72)*** | 0.08 (3.23)*** | | IN10YGSt-1 | 1.06 (54.89)*** | 1.10 (35.48)*** | 1.01 (46.06)*** | | IN10YGSt-2 | -0.07 -(3.39)*** | -0.10 -(3.35)*** | -0.018 -(0.81) | | NFIIDRt-1 | -0.00007 -(0.62) | 0.0004 (0.72) | -0.00005 -(0.46) | | NFIIDRt-2 | 0.00007 (0.69) | 0.0007 (1.08) | -0.00006 -(0.56) | | RISKSPREADt-1 | 0.00376 (1.91)* | -0.0006 -(0.12) | 0.00062 (0.11) | | Dependent Variable: NFIIDR | | | | | Constant | -0.70 -(1.58) | 0.09 (0.34) | 5.37 (1.79)* | | IN10YGSt-1 | 0.58 (0.63) | -1.36 -(2.25)** | -2.96 -(1.40) | | IN10YGSt-2 | -0.48 -(0.52) | 1.40 (2.31)** | 2.86 (1.37) | | NFIIDRt-1 | 0.21 (8.82)*** | 0.23 (5.24)*** | 0.30 (10.30)*** | | NFIIDRt-2 | 0.06 (2.40)** | -0.05 -(1.56) | 0.22 (8.54)*** | | RISKSPREADt-1 | -0.103 -(0.82) | -0.386 -(3.95)*** | -2.03 -(3.12)*** | | b. Variance Equation | | A{1}(1,1) | -0.19 -(9.33)*** | 0.24 (7.96)*** | 0.16 (5.71)*** | | A{1}(1,2) | -1.62 -(1.25) | 1.64 (0.89) | -1.30 -(0.47) | | A{1}(2,1) | -0.0001 -(0.93) | 0.001 (0.94) | -0.001 -(4.14)*** | | A{1}(2,2) | 0.68 (19.25)*** | 0.91 (16.21)*** | 0.67 (16.36)*** | | A{2}(1,1) | 0.37 (16.73)*** | 0.49 (13.63)*** | 0.29 (13.62)*** | | A{2}(1,2) | 2.96 (3.03)*** | -0.89 -(0.77) | 1.33 (0.38) | | A{2}(2,1) | -0.0001 -(0.46) | -0.001 -(0.90) | 0.0001 (0.42) | | A{2}(2,2) | 0.20 (1.85)* | -0.10 -(0.70) | -0.15 -(1.05) | | B{1}(1,1) | 0.05 (0.61) | -0.01 -(0.11) | 0.05 (0.56) | | B{1}(1,2) | 2.59 (2.66)*** | 0.88 (1.05) | -18.19 -(5.61)*** | | B{1}(2,1) | -0.0003 -(2.14)** | 0.0002 (0.20) | -0.0001 -(0.53) | | B{1}(2,2) | 0.77 (44.84)*** | 0.40 (4.33)*** | 0.45 (4.05)*** | | B{2}(1,1) | 0.90 (93.50)*** | 0.84 (53.46)*** | -0.94 -(131.65)*** | | B{2}(1,2) | -3.02 -(3.22)*** | -2.39 -(1.44) | 3.61 (1.32) | | B{2}(2,1) | 0.0003 (1.80)* | -0.002 -(1.08) | -0.001 -(4.47)*** | | B{2}(2,2) | 0.03 (0.28) | -0.23 -(2.81)*** | -0.36 -(5.01)*** | | TMSPREADi, t-1 | -0.004 -(4.38)*** | 0.01 (3.60)*** | -0.03 -(7.48)*** | | TMSPREADj, t-1 | -2.89 -(14.51)*** | -0.39 -(0.96) | -4.43 -(5.80)*** | | Maximum eigenvalue | 0.49 | 0.99 | 0.99 | | MV-ARCH-Q(12) | 15.23 (1.00) | 61.57 (0.10) | 24.66 (0.99) | Notes: RISKSPREADi, t-1 RISKSPREADj, t-1 are the exogenous variables in variance equations of IN10YGS and NFIIDR, respectively.

Figures in parentheses are t-statistics when they are placed after coefficients and p-value, in case of ARCH tests.

Constants in variance equation are not presented here to save space.

*,*,***: indicates significant at 10%, 5% and 1% levels, respectively. |

| Table A.3a: Spillover Impact in Foreign Exchange Market | | a. Mean Equation | | Dependent Variable: DINR | Full Sample | Pre-Crisis | Post-Crisis | | Constant | 0.00 -(0.39) | 0.00 (0.21) | 0.00 (0.34) | | DINRt-1 | 0.01 (0.29) | -0.01 -(0.18) | 0.01 (0.48) | | DINRt-2 | -0.01 -(0.72) | 0.02 (0.73) | -0.04 -(1.83)* | | DINRt-3 | -0.02 -(1.32) | -0.06 -(2.14)** | -0.01 -(0.55) | | DINRt-4 | 0.00 (0.20) | -0.06 -(1.88)* | 0.02 (0.89) | | NFIIt-1 | -0.01 -(0.42) | -0.02 -(0.45) | -0.01 -(0.35) | | NFIIt-2 | -0.07 -(2.36)** | -0.10 -(1.90)* | -0.01 -(0.30) | | NFIIt-3 | -0.04 -(1.40) | -0.08 -(1.46) | -0.03 -(0.89) | | NFIIt-4 | 0.03 (0.98) | 0.09 (1.84)* | -0.03 -(0.70) | | LIBOR_OISt-1 | 0.00 (1.65)* | 0.00 -(0.16) | 0.00 (1.71)* | | Dependent Variable: NFII | | | | | Constant | 0.03 (6.39)*** | 0.02 (4.38)*** | 0.07 (9.50)*** | | DINRt-1 | -0.06 -(8.39)*** | -0.04 -(2.96)*** | -0.07 -(7.14)*** | | DINRt-2 | -0.02 -(2.52)** | -0.02 -(1.33) | -0.03 -(3.49)*** | | DINRt-3 | 0.00 (0.08) | -0.01 -(0.61) | -0.02 -(2.01)** | | DINRt-4 | -0.01 -(0.97) | 0.00 (0.29) | -0.02 -(2.39)** | | NFIIt-1 | 0.25 (10.53)*** | 0.33 (10.21)*** | 0.29 (10.31)*** | | NFIIt-2 | 0.14 (6.32)*** | 0.02 (0.53) | 0.14 (5.45)*** | | NFIIt-3 | 0.09 (4.25)*** | 0.12 (3.52)*** | 0.09 (3.93)*** | | NFIIt-4 | 0.09 (4.87)*** | 0.08 (2.48)** | 0.06 (2.96)*** | | LIBOR_OISt-1 | 0.00 -(2.09)** | 0.00 -(1.72)* | 0.00 -(3.56)*** | | b. Variance Equation | | A(1,1) | 0.29 (16.93)*** | 0.47 (11.84)*** | 0.22 (12.17)*** | | A(1,2) | 0.00 -(0.30) | -0.01 -(0.76) | 0.01 (0.46) | | A(2,1) | -0.04 -(2.22)** | 0.00 (0.01) | -0.08 -(1.60) | | A(2,2) | 0.25 (18.51)*** | 0.31 (13.75)*** | 0.50 (10.80)*** | | B(1,1) | 0.96 (192.97)*** | -0.87 -(34.35)*** | 0.97 (165.32)*** | | B(1,2) | 0.00 (0.61) | 0.09 (3.82)*** | -0.02 -(1.76)* | | B(2,1) | 0.01 (1.30) | -0.50 -(4.98)*** | 0.08 (1.24) | | B(2,2) | 0.97 (398.46)*** | 0.98 (131.86)*** | 0.55 (9.37)*** | | LIBOR_OISi, t-1 | 0.00 (2.41)** | 0.00 (3.38)*** | 0.00 (2.68)*** | | LIBOR_OISj, t-1 | 0.00 (1.75)* | 0.00 (0.00) | 0.00 -(1.85)* | | Maximum eigenvalue | 0.99 | 0.93 | 0.98 | | MV-ARCH-Q(12) | 41.44 (0.74) | 39.49 (0.80) | 33.61 (0.94) | Notes: LIBOR_OISi, t-1 LIBOR_OISj, t-1 are the exogenous variables in variance equations of DINR and NFII, respectively.

Figures in parentheses are t-statistics when they are placed after coefficients and p-value, in case of ARCH tests.

Constants in variance equation are not presented here to save space.

*,*,***: indicates significant at 10%, 5% and 1% levels, respectively. |

| Table A.3b: Spillover Impact in Foreign Exchange Market | | a. Mean Equation | | Dependent Variable: DINR | Full Sample | Pre-Crisis | Post-Crisis | | Constant | 0.01 (0.97) | 0.00 (0.09) | 0.02 (1.81)* | | DINRt-1 | -0.02 -(1.15) | -0.03 -(0.90) | -0.01 -(0.29) | | DINRt-2 | -0.01 -(0.59) | 0.03 (1.13) | -0.04 -(1.56) | | DINRt-3 | -0.02 -(0.98) | -0.05 -(1.85)* | -0.01 -(0.45) | | DINRt-4 | 0.01 (0.70) | -0.05 -(1.70)* | 0.02 (0.85) | | NFIIt-1 | 0.00 -(0.49) | 0.00 -(0.59) | 0.00 -(0.96) | | NFIIt-2 | 0.00 -(2.75)*** | 0.00 -(1.99) | 0.00 -(0.28) | | NFIIt-3 | 0.00 -(0.75) | 0.00 -(2.17)** | 0.00 -(1.06) | | NFIIt-4 | 0.00 (1.51) | 0.00 (1.91)* | 0.00 -(0.86) | | DDXYt-1 | 0.09 (7.94)*** | 0.08 (5.15)*** | 0.07 (3.11)*** | | Dependent Variable: NFII | | | | | Constant | 23.50 (7.45)*** | 13.40 (4.04)*** | 51.79 (8.75)*** | | DINRt-1 | -50.86 -(7.21)*** | -29.88 -(2.89)*** | -64.88 -(6.54)*** | | DINRt-2 | -17.72 -(2.50)** | -7.93 -(0.71) | -29.42 -(2.81)*** | | DINRt-3 | -6.05 -(1.00) | -1.82 -(0.19) | -21.84 -(2.09)** | | DINRt-4 | -5.13 -(0.82) | -0.17 -(0.02) | -19.46 -(1.90)* | | NFIIt-1 | 0.26 (11.55)*** | 0.33 (9.97)*** | 0.30 (10.27)*** | | NFIIt-2 | 0.18 (8.89)*** | 0.03 (0.73) | 0.14 (5.63)*** | | NFIIt-3 | 0.06 (3.02)*** | 0.13 (3.94)*** | 0.10 (5.37)*** | | NFIIt-4 | 0.07 (3.48)*** | 0.07 (2.48)** | 0.06 (3.34)*** | | DDXYt-1 | -19.55 -(3.40)*** | -4.29 -(0.75) | -12.19 -(1.16) | | b. Variance Equation | | A(1,1) | 0.24 (20.74)*** | 0.50 (11.88)*** | 0.22 (11.71)*** | | A(1,2) | -42.79 -(5.19)*** | 7.47 (0.69) | 17.11 (0.70) | | A(2,1) | 0.00 (0.70) | 0.00 (0.46) | 0.00 -(2.09)** | | A(2,2) | 0.44 (18.66)*** | 0.30 (13.46)*** | 0.54 (11.85)*** | | B(1,1) | 0.97 (343.97)*** | 0.84 (36.74)*** | 0.97 (166.98)*** | | B(1,2) | 11.12 (4.71)*** | -1.25 -(0.29) | -19.63 -(1.79)* | | B(2,1) | 0.00 -(2.16)** | 0.00 -(2.73)*** | 0.00 (2.21)** | | B(2,2) | 0.91 (98.95)*** | 0.96 (169.98)*** | 0.52 (9.03)*** | | DXYSQi, t-1 | 0.04 (3.98)*** | -0.13 -(4.67)*** | 0.04 (3.03)*** | | DXYSQj, t-1 | -19.84 -(2.87)*** | -17.14 -(2.98)*** | -11.60 -(1.07) | | Maximum eigenvalue | 0.99 | 0.95 | 0.98 | | MV-ARCH-Q(12) | 46.96 (0.52) | 28.16 (0.99) | (0.93) | Notes: DXYSQi, t-1 DXYSQj, t-1 are the exogenous variables in variance equations of DINR and NFII, respectively.

Figures in parentheses are t-statistics when they are placed after coefficients and p-value, in case of ARCH tests.

Constants in variance equation are not presented here to save space.

*,*,***: indicates significant at 10%, 5% and 1% levels, respectively. |

| Table A.4: Spillover Impact in Stock Market | | a. Mean Equation | | Dependent Variable: DLSENX | Full Sample | Pre-Crisis | Post-Crisis | | Constant | 0.23 (3.55)*** | 0.79 (5.17)*** | 0.13 (1.90)* | | DLSENXt-1 | 0.05 (2.45)** | 0.04 (1.18) | 0.03 (1.53) | | DLSENXt-2 | -0.01 -(0.65) | -0.08 -(2.23)** | -0.03 -(1.11) | | DLSENXt-3 | 0.00 -(0.11) | 0.01 (0.21) | -0.03 -(1.17) | | DLSENXt-4 | 0.02 (0.91) | 0.01 (0.26) | 0.006 (0.26) | | NFIIEQt-1 | 0.00 -(0.58) | 0.00 (0.58) | -0.0005 -(0.20) | | NFIIEQt-2 | 0.00 (0.44) | 0.00 (0.65) | -0.0023 -(1.04) | | NFIIEQt-3 | 0.00 -(1.04) | -0.01 -(1.22) | -0.0015 -(0.65) | | NFIIEQt-4 | 0.00 -(1.12) | -0.01 -(1.88)* | -0.0036 -(1.51) | | VIXt-1 | -0.01 -(2.44)** | -0.04 -(4.15)*** | -0.0033 -(0.89) | | Dependent Variable: NFIIEQ | | Constant | 2.40 (8.80)*** | 3.45 (4.97)*** | 3.53 (10.20)*** | | DLSENXt-1 | 0.59 (6.59)*** | 0.27 (3.10)*** | 0.60 (6.24)*** | | DLSENXt-2 | 0.03 (0.34) | -0.09 -(1.08) | 0.15 (1.69)* | | DLSENXt-3 | 0.02 (0.28) | 0.06 (0.74) | -0.14 -(1.58) | | DLSENXt-4 | -0.09 -(1.05) | -0.08 -(0.99) | 0.07 (0.75) | | NFIIEQt-1 | 0.30 (12.57)*** | 0.29 (7.31)*** | 0.36 (12.03)*** | | NFIIEQt-2 | 0.13 (4.90)*** | 0.03 (0.78) | 0.04 (1.25) | | NFIIEQt-3 | 0.07 (2.89)*** | 0.12 (3.28)*** | 0.09 (4.43)*** | | NFIIEQt-4 | 0.11 (5.22)*** | 0.07 (2.13)** | 0.07 (3.86)*** | | VIXt-1 | -0.06 -(5.81)*** | -0.19 -(4.25)*** | -0.08 -(8.12)*** | | b. Variance Equation | | A(1,1) | 0.25 (18.12)*** | 0.38 (11.24)*** | -0.02 -(0.99) | | A(1,2) | -0.19 -(1.60) | -0.22 -(2.58)** | -0.06 -(0.54) | | A(2,1) | -0.01 -(4.20)*** | 0.00 (0.17) | -0.01 -(1.75)* | | A(2,2) | 0.70 (18.31)*** | 0.48 (14.69)*** | 0.75 (17.35)*** | | B(1,1) | 0.94 (138.82)*** | 0.86 (31.51)*** | -0.16 -(0.52) | | B(1,2) | 0.41 (4.54)*** | 0.07 (1.70)* | 0.10 (0.28) | | B(2,1) | 0.01 (4.81)*** | 0.01 (1.74)* | 0.00 -(0.07) | | B(2,2) | 0.60 (11.20)*** | 0.88 (75.45)*** | 0.39 (8.86)*** | | VIXi, t-1 | 0.02 (8.19)*** | 0.03 (3.68)*** | 0.05 (15.07)*** | | VIXj, t-1 | -0.04 -(3.93)*** | -0.39 -(13.24)*** | -0.18 -(16.26)*** | | Maximum eigenvalue | 0.98 | 0.99 | 0.72 | | MV-ARCH-Q(12) | 56.02 (0.20) | 39.51 (0.80) | 63.22 (0.21) | Notes: VIXi, t-1 VIXj, t-1 are the exogenous variables in variance equations of DLSENX and NFIIEQ, respectively.

Figures in parentheses are t-statistics when they are placed after coefficients and p-value, in case of ARCH tests.

Constants in variance equation are not presented here to save space.

*,*,***: indicates significant at 10%, 5% and 1% levels, respectively. |

| Table A.5: Estimated Coefficients – Dynamic Factor Model | | | Coef. | SE | z | p-value | 95%CI | | Autocorrelated Factor | | Factor Lag 1 | 0.890 | 0.036 | 24.700 | 0.000 | 0.819 | 0.960 | | Factor Loadings | | VIX Factor | 0.444 | 0.042 | 10.450 | 0.000 | 0.361 | 0.527 | | LIBOR-OIS Factor | 0.301 | 0.040 | 7.520 | 0.000 | 0.223 | 0.379 | | DXYSQ Factor | 0.151 | 0.034 | 4.470 | 0.000 | 0.085 | 0.217 | | TMSPREAD Factor | 0.001 | 0.017 | 0.040 | 0.972 | -0.032 | 0.034 | | RISKSPREAD Factor | 0.160 | 0.029 | 5.550 | 0.000 | 0.103 | 0.217 | | Autocorrelated Residuals | | VIX Residual Lag1 | 0.720 | 0.403 | 1.790 | 0.074 | -0.070 | 1.511 | | LIBOR-OIS Residual Lag1 | 0.786 | 0.049 | 16.140 | 0.000 | 0.690 | 0.881 | | DXYSQ Residual Lag1 | -0.020 | 0.079 | -0.260 | 0.796 | -0.174 | 0.134 | | TMSPREAD Residual Lag 1 | 0.975 | 0.015 | 63.850 | 0.000 | 0.945 | 1.004 | | RISKSPREAD Residual Lag 1 | 0.913 | 0.031 | 29.830 | 0.000 | 0.853 | 0.974 |

|