8.1 Integration of financial markets is a process of unifying markets and enabling convergence of risk-adjusted returns on the assets of similar maturity across the markets. The process of integration is facilitated by an unimpeded access of participants to various market segments. Financial markets all over the world have witnessed growing integration within as well as across boundaries, spurred by deregulation, globalisation and advances in information technology. Central banks in various parts of the world have made concerted efforts to develop financial markets, especially after the experience of several financial crises in the 1990s. As may be expected, financial markets tend to be better integrated in developed countries. At the same time, deregulation in emerging market economies (EMEs) has led to removal of restrictions on pricing of various financial assets, which is one of the pre-requisites for market integration. Capital has become more mobile across national boundaries as nations are increasingly relying on savings of other nations to supplement the domestic savings. Technological developments in electronic payment and communication systems have substantially reduced the arbitrage opportunities across financial centres, thereby aiding the cross border mobility of funds. Changes in the operating framework of monetary policy, with a shift in emphasis from quantitative controls to price-based instruments such as the short-term policy interest rate, brought about changes in the term structure of interest rates. This has contributed to the integration of various financial market segments. Harmonisation of prudential regulations in line with international best practices, by enabling competitive pricing of products, has also strengthened the market integration process.

8.2 Integrated financial markets assume vital importance for several reasons. First, integrated markets serve as a conduit for authorities to transmit important price signals (Reddy, 2003). Second, efficient and integrated financial markets constitute an important vehicle for promoting domestic savings, investment and consequently economic growth (Mohan, 2005). Third, financial market integration fosters the necessary condition for a country’s financial sector to emerge as an international or a regional financial centre (Reddy, 2003). Fourth, financial market integration, by enhancing competition and efficiency of intermediaries in their operations and allocation of resources, contributes to financial stability (Trichet, 2005). Fifth, integrated markets lead to innovations and cost effective intermediation, thereby improving access to financial services for members of the public, institutions and companies alike (Giannetti et al., 2002). Sixth, integrated financial markets induce market discipline and informational efficiency. Seventh, market integration promotes the adoption of modern technology and payment systems to achieve cost effective financial intermediation services.

8.3 An important objective of reforms in India has been to integrate the various segments of the financial market for bringing about a transformation in the structure of markets, reducing arbitrage opportunities, achieving higher level of efficiency in market operation of intermediaries and increasing efficacy of monetary policy in the economy (Reddy, 1999, 2005d). Efficient allocation of funds across the financial sector and uniformity in the pricing of various financial products through greater inter-linkages of financial markets has been the basic emphasis of monetary policy (Mohan, 2005). In the domestic sphere, integration of markets has been pursued through strengthening competition, financial deepening with innovative instruments, easing of restrictions on flows or transactions, lowering of transaction costs and enhancing liquidity. Financial markets in India have also increasingly integrated with the global financial system as a result of calibrated and gradual capital account liberalisation in keeping with the underlying macroeconomic developments, the state of readiness of the domestic financial system and the dynamics of international financial markets (Reddy, 2005a).

8.4 In the above backdrop, this chapter examines in detail the various aspects of integration of financial markets within the country as well as with international financial markets. The chapter is organised in six sections. Section I provides a brief review of the concept of financial integration along with a discussion on measurement issues. The policy measures enabling financial market integration in India are discussed in Section II. Empirical analysis of domestic financial market integration is presented in Section III. Integration of domestic financial markets with international as well as regional financial markets is set out in Section IV. Section V suggests some measures for further strengthening the integration process of the markets. Concluding observations are set out inSection VI.

I. CONCEPT AND DIMENSIONS OF FINANCIAL

MARKET INTEGRATION

8.5 Financial market integration encompasses a complex interplay of various factors such as policy initiatives, structure and growth of financial intermediaries/markets, organic linkages among market participants and the preference of savers and investors for financial instruments. While assessing the integration of financial markets, it may be useful to keep in view the heterogeneity of markets, dimensions of integration, measurement issues and perceived benefits and risks of integration.

Heterogeneity of Markets

8.6 Various financial market segments are not uniform as they trade in a variety of instruments, which differ in terms of risk and liquidity. First, some market segments are national, whereas others are international in nature, depending on where financial transactions occur among participants within a country’s geographic boundary or across the border. Generally, money and credit market segments involving participation of banks and other financial institutions operating within a country’s boundary are national in character. On the other hand, foreign exchange markets dealing with cross-border transactions and stock markets with cross-listings of securities and participation of foreign institutional investors are international in nature. Second, financial markets differ in terms of depth and liquidity. For instance, money market instruments are more liquid, while bonds in the capital markets are less liquid. Third, financial markets differ in terms of economic nature of instruments catering to various needs of economic agents. For instance, a distinction can be made between saving, investment, credit and derivative instruments. Fourth, financial markets are differentiated in terms of risk profile of instruments such as government bonds, which do not involve default and credit risks, and corporate bonds, which are relatively more risky in nature. Integration of market segments, thus, reflects an investor’s attitude towards risk and the trade-off between risk and return on assets. Fifth, market participants in different financial markets could be different such as banks, non-bank financial institutions, including mutual funds, insurance companies, mortgage institutions and specialised long-term financial institutions.

8.7 Financial market integration at the theoretical level has been postulated in several ways. The most popular economic principles of financial integration include the law of one price, term structure of interest rates, parity conditions such as purchasing power parity, covered and uncovered interest parity conditions, capital asset price model, arbitrage price theory and Black-Scholes’ principle of pricing derivatives (Box VIII.1).

Dimensions of Financial Market Integration

8.8 Broadly, financial market integration occurs in three dimensions, nationally, regionally and globally (Reddy, 2002 and BIS, 2006). From an alternative perspective, financial market integration could take place horizontally and vertically. In the horizontal integration, inter-linkages occur among domestic financial market segments, while vertical integration occurs between domestic markets and international/ regional financial markets (USAID, 1998).

8.9 Domestic financial market integration entails horizontal linkages of various segments, reflecting portfolio persification by savers, investors and intermediaries. Under horizontal integration, market interest rates typically revolve around a basic reference rate, which is defined as the price of a short-term low-risk financial instrument in a competitive and liquid market. It typically provides the basic liquidity for the formal financial system and central banks often use it to gauge the tightness of monetary policy. Domestic markets may be closely integrated because intermediaries operate simultaneously in various market segments; for instance, commercial banks operate in both the saving (deposit) and loan markets.

8.10 Global integration refers to the opening up of domestic markets and institutions to the free cross-border flow of capital and financial services by removing barriers such as capital controls and withholding taxes. A deeper dimension of global integration entails removing obstacles to movement of people, technology and market participants across border (BIS, 2006). Global integration is promoted through harmonisation of national standards and laws, either through the adoption of commonly agreed minimum standards or the mutual recognition of standards (Reddy, 2005c).

8.11 Regional financial integration occurs due to ties between a given region and the major financial centre serving that region. Economic integration might be easier to achieve at a regional level due to network externalities and the tendency of market makers to concentrate in certain geographical centres. Gravity models, which take into account the economic sizes and distance between two countries, explain bilateral trade and investment flows. Furthermore, regional financial integration can be an important means of developing local financial markets, for instance, through peer pressure to strengthen institutions and upgrade local practices (BIS, 2006).

Box VIII.1

Theory of Financial Market Integration

The law of one price (LOOP), pioneered by Augustin Cournot (1927) and Alfred Marshall (1930), constitutes the fundamental principle underlying financial market integration. According to the LOOP, in the absence of administrative and informational barriers, risk-adjusted returns on identical assets should be comparable across markets. While the LOOP provides a generalised framework for financial market integration, finance literature provides alternative principles, which establish operational linkages among different financial market segments. First, the term structure of interest rates, deriving from paradigms of unbiased expectations, liquidity preference, and market segmentation, establishes integration across the maturity spectrum, i.e., short, medium and long ends of the financial market (Blinder, 2004). Usually, the term structure is applied to a particular instrument such as the risk free government securities. In the monetary economics literature, it is recognised that the term structure of interest rate contains useful information about future paths of inflation and growth, which characterise the objective function of policy in most countries. Second, the capital asset pricing model (CAPM) of Nobel laureate, William Sharpe (1964) is used widely for valuing systematic risk to financial assets. The CAPM establishes linkage between market instruments and risk free instruments such as government securities. The CAPM envisages a simplified world with no taxes and transaction costs, and identical investors. In such a world, super-efficient portfolio must be the market portfolio (Tobin, 1958). All investors will hold the market portfolio; leveraging or de-leveraging would be driven by the risk-free asset in order to achieve a desired level of risk and return. Third, the Black-Scholes’ principle of option pricing postulates linkage between derivative products on the one hand, and cash/spot market of underlying assets on the other. The often quoted put-call parity principle in finance theory states that in the absence of arbitrage opportunities, a derivative instrument can be replicated in terms of spot price of an underlying asset, coupled with some borrowing or lending activity. The forward-spot parity relation is used widely for analysing linkages between foreign exchange forwards and the money market instruments.

Beyond economic and financial principles, financial markets integration could also occur due to information efficiency as economic agents form expectations about the future course of policy and real sector developments. For instance, even if transactions between residents and non-residents and between markets and intermediaries remain incomplete or limited due to regulatory barriers, participants could form expectation that such restrictions would not continue for long with a shift in policy regime towards greater opening and liberalisation of markets over time.

Measures of Financial Integration

8.12 The progress of domestic, global and regional financial integration could be measured using a number of approaches. Generally, these measures are pided into three categories: institutional/regulatory measures, quantity and price based measures. From a policy perspective, specific indicators of financial integration could be classified into de jure and de facto measures. The existence of legal restrictions on trade and capital flows across border as well as market segments is the most frequently used de jure indicators. However, these indicators have several shortcomings as restrictions may not be binding, or they are not respected because capital flows would not exist somehow. They may not cover a specific aspect of all possible impediments to financial integration (Prasad et al., 2006). Moreover, in practice, de jure indicators adopting a dichotomous scheme of the existence or absence of restrictions may not reveal actual degree of openness of countries to capital flows.

8.13 De facto indicators of financial integration are usually based either on prices or quantities. The commonly used price based measures for gauging price equalisation and convergence of market segments include cross-market spreads, correlation among various interest rates, tests of common trend in the term structure of interest rates and volatility transmission. From a policy perspective, interest rate spreads between the official short-term rate and a benchmark short-term market instrument on the one hand, and various other market interest rates on the other, are used for measuring price convergence and effectiveness of policy. Price-related measures also include covered and uncovered interest rate parity as well as asset price correlations between countries. There are, however, serious practical problems in using prices to measure global or regional financial integration, particularly in emerging markets. This is because prices may move together because of a common external factor or because of similar macroeconomic fundamentals and not because of market integration. Moreover, prices may be affected by differences in currency, credit and liquidity risks, implying different price movements even if there is a substantial degree of financial integration (Prasad et al., 2006).

8.14 Liquidity and turnover data are used as quantitative indicators for measuring inter-linkages among domestic financial market segments. For global integration, capital flows indicate whether a country is becoming more or less financially integrated over time. In this context, gross capital flows are a among various interest rates, tests of common trend in the term structure of interest rates and volatility transmission. From a policy perspective, interest rate spreads between the official short-term rate and a benchmark short-term market instrument on the one hand, and various other market interest rates on the other, are used for measuring price convergence and effectiveness of policy. Price-related measures also include covered and uncovered interest rate parity as well as asset price correlations between countries. There are, however, serious practical problems in using prices to measure global or regional financial integration, particularly in emerging markets. This is because prices may move together because of a common external factor or because of similar macroeconomic fundamentals and not because of market integration. Moreover, prices may be affected by differences in currency, credit and liquidity risks, implying different price movements even if there is a substantial degree of financial integration (Prasad et al., 2006).

Benefits and Risks of Financial Integration

8.15 Though financial integration provides several benefits, it also involves various risks. The benefits and costs of financial market integration depend on the degree of domestic financial market integration, international financial integration and financial development. Evaluating the benefits and risks of financial market integration is a complex issue, in particular, in an economy with open capital account (Box VIII.2).

Box VIII.2

Benefits and Risks of Financial Integration

The benefits of global integration depend on size, composition, and quality of capital flows. Global financial integration involves direct and indirect or collateral benefits (Prasad et al,. 2006). Analytical arguments supporting financial openness revolve around main considerations such as the benefits of international risk sharing for consumption smoothing, the positive impact of capital flows on domestic investment and growth, enhanced macroeconomic discipline and increased efficiency as well as greater stability of the domestic financial system associated with financial openness (Agenor, 2001). International financial integration could positively affect total factor productivity (Levine, 2001). Financial openness may increase the depth and breadth of domestic financial markets and lead to an increase in the degree of efficiency of the financial intermediation process by lowering costs and excessive profits associated with monopolistic and cartelised markets, thereby lowering the cost of investment and improving the resource allocation (Levine, 1996; Caprio and Honhan, 1999). Empirical studies on international integration offer mixed perspectives on the benefits of financial integration. The cumulative growth performance of emerging markets, excluding China and India, appears less spectacular than usually perceived under globalisation (Prasad et al., 2006). Financial market integration also poses some risks and entails costs. A major risk is that of contagion, which was evident in the case of East Asian crisis. There are two channels through which the contagion normally works. One, the real channel, which relates to potential for ‘domino effects’ through real exposures on participants operating in other segments. Two, the information channel which relates to contagious withdrawals due to lack of accurate and timely information. Increased domestic and international integration accentuates the risk of contagion as problems in one market segment are likely to be transmitted to other markets with the potential to cause systemic instability.

In the context of globalisation, potential costs include the high degree of concentration of capital flows, misallocation of flows, which may hamper their growth effects and exacerbate domestic distortions; the loss of macroeconomic stability; the pro-cyclical nature of short-term capital flows and the risk of abrupt reversals; a high degree of volatility of capital flows, which relates in part to herding and contagion effects; and risks associated with foreign bank penetration (Dadush, Dasgupta and Ratha; 2000). Most studies find that direct investment tends to be less volatile than other forms of capital flows (Chuhan et al., 1996; Brewer and Nollen, 2000; Sarno and Taylor, 1999). Volatility of capital flows translates into exchange rate instability (under flexible exchange rate) or large fluctuations in official reserves (under a pegged exchange rate regime) and sometimes currency crises as was observed in the East Asian crisis. For instance, nominal exchange rate volatility may hamper expansion of exports if appropriate hedging techniques are not available to exporters. Large capital inflows could also lead to rapid monetary expansion (due to the difficulty and cost of pursuing aggressive sterilisation policies), inflationary pressures (resulting from the effect of capital inflows on domestic spending), real exchange rate appreciation and widening of current account deficits.

8.16 In recent years, there appears to be some rethinking about financial globalisation based on the experience of various crises in the late 1990s and the current global imbalances (Reddy, 2005b). Owing to contagion effects, some economists have viewed increasing capital account liberalisation and unfettered capital flows as a serious impediment to global financial stability (Rodrik, 1998; Bhagwati, 1998; and Stiglitz, 2002). Others argue that increased capital account openness has largely proven essential for countries aiming to upgrade from lower to middle-income status (Prasad et al., 2006). In order to benefit from international capital inflows, host countries need to pursue sound macroeconomic policies, develop strong institutions and adopt an appropriate regulatory framework for the stability of financial systems and sustained economic progress (Reddy, 2003 and 2005).

8.17 There is growing realisation that unlike trade integration, where benefits to all countries are demonstrable, in the case of financial integration, a ‘threshold’ in terms of preparedness and resilience of the economy is important for a country to get full benefits (Kose et al., 2006). A judgemental view needs to be taken whether and when a country has reached the ‘threshold’. The nature of optimal integration is highly country-specific and contextual. Financial integration needs to be approached cautiously, preferably within the framework of a plausible roadmap that is drawn up embodying the country-specific context and institutional features. On balance, there appears to be a greater advantage in well-managed and appropriate integration into the global process, which implies not large-scale but more effective interventions by the authorities. In fact, markets do not and cannot exist in a vacuum, i.e., without some externally imposed rules and such order is a result of public policy (Reddy, 2006b). Thus, with a view to enhancing financial sector efficiency, it is necessary not only to foster competition among institutions but also to develop a system that facilitates transparent and symmetric dissemination of maximum information to the markets.

II. POLICY MEASURES ENABLING MARKET

INTEGRATION IN INDIA

8.18 Until the early 1990s, India’s financial sector was tightly controlled. Interest rates in all market segments were administered. The flow of funds between various market segments was restricted by extensive micro-regulations. There were also restrictions on participants operating in different market segments. Banks remained captive subscribers to government securities under statutory arrangements. The secondary market of government securities was dormant. In the equity market, new equity issues were governed by several complex regulations and restrictions. The secondary market trading of such equities lacked transparency and depth. The foreign exchange market remained extremely shallow as most transactions were governed by inflexible and low limits under exchange regulation and prior approval requirements. The exchange rate was linked to a basket of currencies. Although the financial sector grew considerably in the regulated environment, it could not achieve the desired level of efficiency. Compartmentalisation of activities of different types of financial intermediaries eliminated the scope for competition among existing financial intermediaries (Mohan, 2004b).

8.19 Financial markets reform initiated in the early 1990s focused on removal of structural bottlenecks, introduction of new players/instruments, free pricing of financial assets, relaxation of quantitative restrictions, improvement in trading, clearing and settlement practices and greater transparency (Mohan, 2004b, 2006). Other policy initiatives in the money, the foreign exchange, the government securities and the equity markets were aimed at strengthening institutions, greater transparency, encouraging good market practices, effective payment and settlement mechanism, rationalised tax structures and enabling legislative framework. Dismantling of various price and non-price controls in the financial system has facilitated the integration of financial markets. While various measures initiated to develop the markets have been delineated in the respective chapters, some measures, in particular, facilitated the integration of markets (Box VIII.3).

III. DOMESTIC FINANCIAL MARKET

INTEGRATION IN INDIA

8.20 Broadly, India’s domestic financial market comprises the money market, the credit market, the government securities market, the equity market, the corporate debt market and the foreign exchange market, each of which has been addressed at length in the previous chapters. The channels of integration among various market segments differ. For instance, the Indian money and the foreign exchange markets are intrinsically linked in view of the presence of commercial banks’ and the short-term nature of both markets. The linkage is established through various channels such as banks borrowing in overseas

Box VIII.3

Measures Enabling Financial Market Integration in India

Broadly, integration of financial markets in India has been facilitated by various measures in the form of free pricing, widening of participation base in markets, introduction of new instruments and improvements in payment and settlement infrastructure.

Free Pricing

• Free pricing in financial markets was facilitated by various measures. These include, inter alia, freedom to banks to decide interest rate on deposits and credit; withdrawal of a ceiling of 10 per cent on call money rate imposed by the Indian Banks’ Association in 1989; replacement of administered interest rates on government securities by an auction system; abolition of the system of ad hoc Treasury Bills in April 1997 and replacement by the system of Ways and Means Advances (WMAs) with effect from April 1, 1997; shift in the exchange rate regime from a single-currency fixed-exchange rate system to a market-determined floating exchange rate regime; gradual liberalisation of the capital account in line with the recommendations of the Committee on Capital Account Convertibility (Chairman: Shri S. S. Tarapore) (see Chapter VI on Foreign Exchange Market); and freedom to banks to determine interest rates (subject to a ceiling) and maturity period of Foreign Currency Non-Resident (FCNR) deposits (not exceeding three years); and to use derivative products for hedging risk.

• In the capital market, the Capital Issues (Control) Act, 1947 was repealed. The introduction of the book-building process in the new issue market strengthened the price discovery process.

Widening Participation

• Enhanced presence of foreign banks, in line with India’s commitment to the World Trade Organisation under GATS, strengthened domestic and international markets inter-linkages, apart from increasing competition.

• Initially, the participation in the call market was gradually widened by including non-banks such as financial institutions, non-banking financial companies, primary/satellite dealers, mutual funds and corporates (through primary dealers). The process of transformation of the call money market into a pure inter-bank market, which commenced from May 2001, was completed in August 2005.

• Foreign Institutional Investors (FIIs) were allowed to participate in the Indian equity market and set up 100 per cent debt funds to invest in government (Central and State) dated securities in both the primary and secondary markets. This provided a major thrust to the integration of domestic markets with international markets.

• The linkage between the domestic foreign exchange market and the overseas market (vertical integration) was facilitated by allowing banks/authorised dealers (ADs) to borrow and invest funds abroad (subject to certain limits), and to lend in foreign currency to companies in India for any productive purpose, giving them the choice to economise on interest cost and exchange risk. Exporters also have the ability to substitute rupee credit for foreign currency credit.

• Indian companies were permitted to raise resources from abroad, through American/Global Depository Receipts (ADRs/ GDRs), foreign currency convertible bonds (FCCBs) and external commercial borrowings (ECBs), thus, facilitating integration of domestic capital market with international capital market. The Reserve Bank allowed two-way fungibility of ADRs/GDRs in February 2002.

• Corporates were allowed to undertake active hedging operations by resorting to cancellation and rebooking of forward contracts, booking forward contracts based on past performance, using foreign currency options and forwards, and accessing foreign currency-rupee swap to manage longer-term exposures arising out of external commercial borrowings.

•Integration of the credit market and the equity market was strengthened by application of capital adequacy norms and allowing public sector banks to raise capital from the equity market up to 49 per cent of their paid-up capital.

New Instruments

• Repurchase agreement (repo) was introduced as a tool of short-term liquidity adjustment. The liquidity adjustment facility (LAF) is open to banks and primary dealers. The LAF has emerged as a tool for both liquidity management and also signalling device for interest rates in the overnight market. Several new financial instruments such as inter-bank participation certificates (1988), certificates of deposit (June 1989), commercial paper (January 1990) and repos (December 1992) were introduced. Collateralised borrowing and lending obligation (CBLO) and market repos have also emerged as money market instruments.

• New auction-based instruments were introduced for 364-day, 182-day, 91-day and 14-day Treasury Bills, the zero coupon bond and government of India dated securities. In the long-term segment, Floating Rate Bonds (FRBs) benchmarked to the 364-day Treasury Bills yields and a 10-year loan with embedded call and put options exercisable on or after 5 years from the date of issue were introduced.

• Derivative products such as forward rate agreements and interest rate swaps were introduced in July 1999 to enable banks, FIs and PDs to hedge interest rate risks. A rupee-foreign currency swap market was developed. ADs in the foreign exchange market were permitted to use cross-currency options, interest rate and currency swaps, caps/collars and forward rate agreements (FRAs) in the international foreign exchange market, thereby facilitating the deepening of the market and enabling participants to persify their risk.

Institutional Measures

• Institutions such as Discount and Finance House of India (DFHI), Securities Trading Corporation of India (STCI) and PDs were allowed to participate in more than one market, thus strengthening the market inter-linkages.

• The Clearing Corporation of India Ltd. (CCIL) was set up to act as a central counter-party to all trades involving foreign exchange, government securities and other debt instruments routed through it and to guarantee their settlement.

Technology, Payment and Settlement Infrastructure

• The Delivery-versus-Payment system (DvP), the Negotiated Dealing System (NDS) and subsequently, the advanced Negotiated Dealing System – Order Matching (NDS-OM) trading module and the real time gross settlement system (RTGS) have brought about immense benefits in facilitating transactions and improving the settlement process, which have helped in the integration of markets.

• In the equity market, the floor-based open outcry trading system was replaced by electronic trading system in all the stock exchanges. markets, providing hedging facilities to corporates, accepting foreign currency deposits and acting as conduit for making payments for overseas merchant transactions. The linkage between the call money and the government securities markets exists, as at times, large positions in government securities are funded through short-term borrowings. The foreign exchange market and the equity markets are linked through the operations of foreign institutional investors. The emerging linkages among the money, the government securities and the foreign exchange markets have at times necessitated the use of short-term monetary measures by the Reserve Bank for meeting demand-supply mismatches to curb volatility.

Phases of Market Integration in India

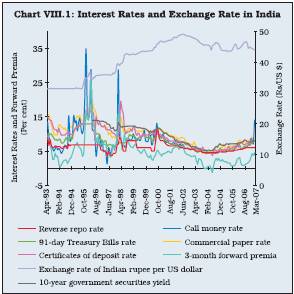

8.21 Various segments of financial markets have become better integrated in the reform period, especially from the mid-1990s (Chart VIII.1). As reforms in the financial markets progressed, linkages amongst various segments of market and between domestic and international markets improved. For the purpose of analysis, financial market linkages could be pided into two distinct phases. The first phase refers to the early transition period of the 1990s and the second phase is the period of relative stability in the financial markets from 2000 onwards.

8.22 In the first phase, domestic financial markets witnessed modest integration. Financial markets, in general, lacked depth as measured by the turnover in various market segments (Table 8.1). Domestic financial markets during this phase witnessed easing of various restrictions, which created enabling conditions for increased inter-linkages amongst market segments. The institution of a market-based exchange rate mechanism in March 1993 and transition to current account convertibility in August 1994 facilitated inter-linkages between the money and the foreign exchange markets. Since the beginning of second half of the 1990s, some episodes of volatility were witnessed in the money and the foreign exchange markets, which underscored the gradual integration of the domestic money market and the foreign exchange market.

Table 8.1: Depth of Financial Markets in India - Average Daily Turnover |

(Rupees crore) |

|

|

|

|

|

|

Year |

Money |

Government |

Foreign Exchange |

Equity Market** |

Equity Derivatives |

|

Market* |

Securities Market |

Market # |

(Cash Segment) |

at NSE |

1 |

2 |

3 |

4 |

5 |

6 |

1991-92*** |

6,579 |

391 |

– |

469 |

– |

2000-01 |

40,923 |

2,802 |

21,198 |

9,308 |

11 |

2001-02 |

65,500 |

6,252 |

23,173 |

3,310 |

410 |

2002-03 |

76,722 |

7,067 |

24,207 |

3,711 |

1,752 |

2003-04 |

28,146 |

8,445 |

30,714 |

6,309 |

8,388 |

2004-05 |

31,832 |

4,826 |

39,952 |

6,556 |

10,107 |

2005-06 |

39,997 |

3,643 |

56,391 |

9,504 |

19,220 |

2006-07 |

56,413 |

4,863 |

83,894 |

11,760 |

29,803 |

* : Including the call money, the notice money, the term money and the repo markets. The turnover in the CBLO segment was Rs.6,698 crore

in 2004-05, Rs. 20,040 crore in 2005-06 and Rs. 32,390 crore in 2006-07.

** : Includes both BSE and NSE turnover.

*** : Data for the government securities market and the equity market pertain to 1995-96.

# : Inter-bank turnover only.

– : Not available.

Source : Reserve Bank of India; Bombay Stock Exchange Limited; and National Stock Exchange of India Limited. |

8.23 Financial markets in India felt the initial impulses of the contagion from financial crises in the East Asian countries, which erupted in the second half of 1997-98. Pressures from contagion re-emerged in the mid-November 1997, following the weakening of the sentiment in response to financial crisis spreading to hit South Korea and far off Latin American markets. The East Asian crisis necessitated policy action by the Reserve Bank to mitigate excess demand conditions in the foreign exchange market. It also moved to siphon off excess liquidity from the system in order to reduce the scope for arbitrage between the easy money market and the volatile foreign exchange market. Foreign currency operations were undertaken in the third quarter of 1997-98 to curb volatility in the exchange rate. This helped in maintaining stability in the exchange rate of the rupee, but resulted in reduced money market support to the government borrowing, leading to an increase in the Centre’s monetised deficit. The Reserve Bank tightened its monetary policy stance by raising the CRR and the Bank Rate, thus, substituting cheap discretionary liquidity with expensive discretionary liquidity. A host of monetary policy actions were taken to tighten liquidity in November and December 1997 and January 1998.1 Monetary policy tightening measures in the wake of East Asian crisis led to hardening of domestic interest rates across various segments in the money market and the government securities market, especially at the short-end. Restoration of stability in the domestic financial markets in the second half of 1998, especially in the foreign exchange market, led the Reserve Bank to ease some of the monetary policy tightening measures undertaken earlier. Several banks reduced their lending and deposit rates in response to the Bank Rate cut as also in line with seasonal trends.

8.24 The second phase, beginning 2000 onwards, reflects the period of broad stability in financial markets with intermittent episodes of volatility. The process of financial market integration was more pronounced during this phase. A growing integration between the money, the gilt and the foreign exchange market segments was visible in the convergence of financial prices, within and among various segments and co-movement in interest rates. The capital market exhibited generally isolated behaviour from the other segments of domestic financial markets. However, there was a clear indication of growing cross-border integration as the domestic stock markets declined sharply in line with the sharp decline in international technology stock driven exchanges in 2001. On several other occasions also, the Indian equity markets tended to move in tandem with major international stock markets.

8.25 Growing integration of financial markets beginning 2000 could be gauged from cross correlation among various market interest rates. The correlation structure of interest rates reveals several notable features of integration of specific market segments (Table 8.2). First, in the money market segment, there is evidence of stronger correlation among interest rates in the more recent period 2000-06 than the earlier period 1993-2000, suggesting the impact of policy initiatives undertaken for financial deepening. The enhanced correlation among interest rates also indicates improvement in efficiency in the operations of financial intermediaries trading in different instruments. Second, the high correlation between risk free and liquid instruments such as Treasury Bills, which serve as benchmark instruments, and other market instruments such as certificates of deposit (CDs) and commercial papers (CPs) and forward exchange premia, underlines the efficiency of the price discovery process. Third, the sharp improvement in correlation between the reverse repo rate and money market rates in the recent period implies enhanced effectiveness of monetary policy transmission. Fourth, the high degree of correlation between long-term government bond yield and short-term Treasury Bills rate indicates the significance of term-structure of interest rates in financial markets. Fifth, the correlation between interest rates in money markets and three-month forward premia was significantly high, indicating relatively high horizontal integration. Integration of the foreign exchange market with the money market and the government securities market has facilitated closer co-ordination of monetary and exchange rate policies. The consequences of foreign exchange market intervention are kept in mind in monetary management which includes constant monitoring of the supply of banking system liquidity and an active use of open market operations to adjust liquidity conditions. Sixth, the equity market appears to be segmented with relatively low and negative correlation with money market segments.

1 See Chapter VI for details.

Table 8.2: Correlation Among Major Financial Markets |

(April 1993 to March 2000) |

Instrument |

RREPO |

Call |

TB91 |

TB364 |

Yield10 |

CDs |

CPs |

FR1 |

FR3 |

FR6 |

EXCH |

LBSES |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

RREPO |

1.00 |

|

|

|

|

|

|

|

|

|

|

|

|

Call |

0.35 |

1.00 |

|

|

|

|

|

|

|

|

|

|

|

TB91 |

0.44 |

0.61 |

1.00 |

|

|

|

|

|

|

|

|

|

|

TB364 |

0.32 |

0.40 |

0.90 |

1.00 |

|

|

|

|

|

|

|

|

|

Yield10 |

0.04 |

0.46 |

0.57 |

0.49 |

1.00 |

|

|

|

|

|

|

|

|

CDs |

0.30 |

0.32 |

0.45 |

0.41 |

0.38 |

1.00 |

|

|

|

|

|

|

|

CPs |

0.39 |

0.54 |

0.81 |

0.75 |

0.57 |

0.71 |

1.00 |

|

|

|

|

|

FR1 |

0.27 |

0.80 |

0.45 |

0.33 |

0.46 |

0.47 |

0.63 |

1.00 |

|

|

|

|

FR3 |

0.28 |

0.68 |

0.47 |

0.32 |

0.56 |

0.58 |

0.65 |

0.97 |

1.00 |

|

|

|

FR6 |

0.30 |

0.61 |

0.48 |

0.36 |

0.60 |

0.62 |

0.68 |

0.91 |

0.98 |

1.00 |

|

|

EXCH |

0.03 |

-0.04 |

-0.23 |

-0.38 |

-0.06 |

-0.19 |

-0.31 |

-0.25 |

0.12 |

0.13 |

1.00 |

|

LBSES |

-0.37 |

-0.10 |

-0.24 |

-0.34 |

-0.05 |

-0.40 |

-0.28 |

-0.32 |

-0.28 |

-0.30 |

0.35 |

1.00 |

(April 2000 to March 2007) |

RREPO |

1.00 |

|

|

|

|

|

|

|

|

|

|

|

|

Call |

0.77 |

1.00 |

|

|

|

|

|

|

|

|

|

|

|

TB91 |

0.85 |

0.88 |

1.00 |

|

|

|

|

|

|

|

|

|

|

TB364 |

0.83 |

0.85 |

0.99 |

1.00 |

|

|

|

|

|

|

|

|

|

Yield10 |

0.79 |

0.79 |

0.96 |

0.98 |

1.00 |

|

|

|

|

|

|

|

|

CDs |

0.75 |

0.88 |

0.93 |

0.92 |

0.89 |

1.00 |

|

|

|

|

|

|

|

CPs |

0.80 |

0.85 |

0.96 |

0.94 |

0.92 |

0.95 |

1.00 |

|

|

|

|

|

FR1 |

0.57 |

0.64 |

0.58 |

0.52 |

0.51 |

0.61 |

0.66 |

1.00 |

|

|

|

|

FR3 |

0.59 |

0.58 |

0.60 |

0.54 |

0.54 |

0.62 |

0.70 |

0.97 |

1.00 |

|

|

|

FR6 |

0.60 |

0.56 |

0.60 |

0.55 |

0.56 |

0.63 |

0.71 |

0.93 |

0.99 |

1.00 |

|

|

EXCH |

0.27 |

0.06 |

0.08 |

0.04 |

0.06 |

0.14 |

0.21 |

0.51 |

0.61 |

0.66 |

1.00 |

|

LBSES |

-0.19 |

0.01 |

-0.07 |

-0.05 |

-0.11 |

-0.06 |

-0.13 |

-0.39 |

-0.50 |

-0.56 |

-0.69 |

1.00 |

TB91 |

: 91-day Treasury Bills rate. |

|

|

|

RREPO : |

Reverse repo rate. |

|

|

|

Yield10 |

: 10-year government securities yield. |

|

|

Call |

: |

Inter-bank call money rate (weighted average). |

|

CPs |

: Commercial paper rate. |

|

|

|

TB364 |

: |

364-day Treasury Bills rate. |

|

|

|

FR1 |

: 1-month forward exchange premia. |

|

|

CDs |

: |

Certificates of deposit rate. |

|

|

|

FR6 |

: 6-month forward exchange premia. |

|

|

FR3 |

: |

3-month forward premia. |

|

|

|

LBSES |

: Natural logarithm of BSE Sensex. |

|

|

EXCH |

: |

Exchange rate of Indian rupee per US dollar. |

|

Note

: Based on monthly data. |

Segment-wise Integration

Integration of the Government Securities Market

8.26 The existence of a well-developed government securities market is a pre-requisite for a market-based monetary policy and for facilitating financial market integration. The government securities market is also required to develop a domestic rupee yield curve, which could provide a credible benchmark for pricing of securities in other markets. The government securities market is increasingly getting integrated with other market segments as is reflected in the close co-movement of interest rates. As alluded to earlier, a high degree of correlation between long-term government bond yields and short-term Treasury Bills rates in recent years demonstrates the significance of the term-structure of interest rates in the financial market. Furthermore, the movement of 3-month rupee interest rate implied from the forward premia has also moved largely in tandem with the 91-day Treasury Bills rate, barring the redemption phase of Resurgent India Bond when the forward premia turned negative, implying a reasonable level of integration of the government securities market with the foreign exchange market (Chart VIII.2).

8.27 As indicated earlier, the efficiency of monetary policy also hinges on how effectively impulses are transmitted across various financial markets, which in turn, is incidental upon the level of market integration. An improvement in the transmission of impulses was reflected in the sharp moderation in the of the term-structure of interest rates in the financial market. Furthermore, the movement of 3-month rupee interest rate implied from the forward premia has also moved largely in tandem with the 91-day Treasury Bills rate, barring the redemption phase of Resurgent India Bond when the forward premia turned negative, implying a reasonable level of integration of the government securities market with the foreign exchange market (Chart VIII.2).

8.27 As indicated earlier, the efficiency of monetary policy also hinges on how effectively impulses are transmitted across various financial markets, which in turn, is incidental upon the level of market integration. An improvement in the transmission of impulses was reflected in the sharp moderation in the term premium in the government securities market, especially the narrowing down of the spread on 10-year government bond yield and Treasury Bills instruments in the recent period (Chart VIII.3). Since long-term interest rates account for a premium charge on liquidity risk and various uncertainties relating to macroeconomic fundamentals such as inflation and growth, the flattening of the yield curve or narrowing of spread between long-term and short-term interest rates points towards a stronger economy and stable financial environment.

8.28 For effective market integration, it is essential that there exists a deep secondary market for government securities, which provides a benchmark for valuation of other market instruments, and the turnover of the instruments in both primary and secondary markets is fairly large. The turnover in the secondary segment of government securities market, indicating the depth of this market segment, inter alia, is influenced by some key factors such as monetary policy stance, banks’ SLR holding and credit demand by the private sector. This was evident in the rise in turnover in the secondary market for government securities, fuelled by banks’ excess SLR holding during the period of softening interest rates. In the recent period, following the tightening of policy stance and rise in credit demand, banks have reduced SLR holdings close to the prescribed limit. Reduction in volumes in the secondary segment of government securities in the second half of 2006 was mostly due to rise in interest rates apart from demand side factors. The secondary market turnover has, thus, declined in the recent period (Chart VIII.4). This trend, if persists for long, could affect the depth and yield in this segment and consequently pose some challenges for effective market integration. International evidence suggests that banks tend to rebalance their portfolio and reduce their holding of government securities when interest rates rise. For instance, in the US, the proportion of government securities held by commercial banks in total US government securities declined to 1.6 per cent in 2005 from 5.3 per cent in 2003 when the interest rates rose following increase in the Federal Funds Rate from 1.25 per cent in 2003 to 5.0 per cent in 20052 .

Integration of the Credit Market

8.29 The integration of the credit market with other money market segments has become more pronounced in recent years. Sustained credit demand has led to higher demand for funds, exerting some pressure on liquidity. This was reflected in the decline in banks’ investment in government securities and higher activity in all the money market segments such as inter-bank call money, collateralised borrowing and lending obligation (CBLO) and market repo rates. Total volume in these three markets increased from Rs.16,132 crore in March 2005 to Rs.35,024 crore in March 2006 and further to Rs.38,484 crore in February 2007. Banks also resorted to increased issuances in the CDs market to meet their liquidity requirements. Outstanding CDs increased from Rs.12,078 crore in March 2005 to Rs.43,568 crore in March 2006 and further to Rs.77,971 crore by March 2, 2007.

8.30 In the context of credit market integration with other markets, particularly, the benchmark government securities, there is evidence of high correlation between the commercial paper rate and the Treasury Bills rate. Also, the AAA rated 5-year corporate bond yield and government securities yield of corresponding maturity show high co-movement (Chart VIII.5). However, the spread of the AAA rated 5-year corporate bond yield over government securities yield of corresponding maturity has increased in the recent period. Under competitive market condition, the market rate should be equal to risk free rate plus a risk premium3 . Though a simple regression model confirmed the unitary elasticity response of the corporate bond rate to government securities yield, the model was subject to auto-correlated errors, implying some imperfection in the corporate debt market. Furthermore, in an alternative specification using weekly data, it was found that the AAA rated 5-year corporate bond spread over the risk free 91-day Treasury Bills rate could be significantly determined by the term spread, i.e., the spread of 5-year government securities yield over 91-day Treasury Bills rate, and default premia (AAA rated 5-year corporate bond yield less AB rated 5-year corporate bond yield), besides the persistence in corporate bond spread (its own lagged terms). Thus, a rising spread between the corporate bond yield and the benchmark risk free government bond yield suggests that the corporate debt market continues to lack adequate depth and liquidity. As indicated by the High Level Expert Committee on Corporate Bonds and Securitisation, 2005 (Chairman: Dr. R. H. Patil), the corporate debt market, which is at a nascent stage of development, needs to be strengthened, inter alia, in terms of investor base and enhanced liquidity through consolidation of the issuance process by creating large floating stocks.

Integration of the Foreign Exchange Market

8.31 The degree of integration of the foreign exchange market with other markets is largely determined by the degree of openness. At the cornerstone of the international finance, integration through foreign exchange market is characterised with the Purchasing Power Parity (PPP) doctrine and the three international interest parity conditions, viz., the Covered Interest Parity (CIP), the Uncovered Interest Parity (UIP) and the Real Interest Parity (RIP). According to the PPP, in the absence of restrictions on cross border movements of goods and services and assuming no transactions costs, commodity prices expressed in any single currency should be the same all over the world. In other words, the path of the nominal exchange rate should be guided by the developments in the domestic prices of goods and services vis-à-vis prices of the major trading partners. The behaviour of the Real Effective Exchange Rate (REER) could, therefore, indicate whether the nominal exchange rate moves as per the principle of PPP. The simplest approach to test PPP is just a test of stationarity of the REER, i.e., to see whether deviations from the PPP are temporary and whether over time the REER reverts to some mean or equilibrium, usually the benchmark level at 100, subject to a base year. In India, the 36-currency REER did not show any sustained appreciation or depreciation over longer horizon during the April 1993-December 2006 (Chart VIII.6). During this period, it hovered around the mean at 99.2, which was close to the benchmark level. A formal unit root test also suggests that the broad-based REER is stationary, thus, supporting the purchasing power parity in the long-run.

2 Source: Federal Reserve Bank of New York, the US. Also, www.bondmarkets.com

3 For a sample period of April 2003 to February 2007, applying a regression of AAA rated 5-year corporate bond yield upon 5-year government securities yield, the following estimates were found: Corporate Bond Yield = 0.40 + 1.05 G-sec Yield (1.50) (25.50) R –2= 0.94, DW = 0.34.

Figures in parentheses are estimated t-values. The unity restriction on the coefficient of G-sec yield could not be rejected.

8.32 According to the Covered Interest Parity (CIP), the rates of return on homogenous financial instruments that are denominated in same currency, but traded domestically or offshore must be equal under efficient market conditions, provided exchange controls do not exist and country risk premium is similar in two markets. The CIP implies that yield on foreign investment that is covered in forward markets equals the yield on domestic investment. The interest differential is offset by premium or discount on the forward rate. The absence of covered interest differential indicates that there are some impediments to financial integration, attributable to some element of market imperfection, transaction costs, market liquidity conditions, margin requirements, taxation and market entry-exit conditions. In the Indian context, the forward price of the rupee is not essentially determined by the interest rate differentials, but it is also significantly influenced by: (a) supply and demand of forward US dollars; (b) interest rate differentials and expectations of future interest rates; and (c) expectations of future US dollar-rupee exchange rate. Empirical evidence supports this view, as three month forward premia has less than perfect co-movement with interest rate differential (between 91-day treasury bill rate and three-month LIBOR), indicative of the time varying nature of the risk premium. Inter-linkage becomes stronger when the interest rate differential is based on the monthly average call money rate and one-month LIBOR (Chart VIII.7). The relationship improves still further, when the difference between commercial paper (CP) rate in India and the 3-month US dollar LIBOR rate is considered for interest parity assessments. The deviation of the forward premium from the interest parity condition appears to increase during volatile conditions in the spot segment of the foreign exchange market.

8.33 The Uncovered Interest Rate Parity (UIP) implies that ex-ante, expected home currency returns on foreign bonds or deposits in excess of domestic deposits of equal maturity and default risk should be zero. The currency composition of the asset holdings is, therefore, irrelevant in determining relative returns. The prevalence of UIP also implies that the cost of financing for domestic firms in domestic and foreign markets would be the same. Operating through rational expectations, the UIP suggests that expected changes in the nominal exchange rates should approximate the interest rate differentials. In the Indian context, though empirical studies confirm the existence of CIP, they dispute the existence of UIP. Usually, if CIP holds, UIP will also hold if investors are risk-neutral and form their expectations rationally, so that expected depreciation of home currency equals the forward discount (Box VIII.4).

Stock Market Integration

8.34 As alluded to earlier, the equity market has relatively low and negative correlation with other market segments (Table 8.2). The low correlation of the equity market with risk free instruments is indicative of greater volatility of stock returns and the existence of large equity risk premium. The large risk premium occurs when equity price movements cannot be rationalised with standard inter-temporal optimisation models of macroeconomic fundamentals such as consumption and savings (Mehra and Prescott, 1985). This could be on account of different participants in the equity and other financial markets. For instance, the common participation by banks in the money, the government, the foreign exchange and the credit markets ensures fairly high correlation among these segments. The exposure of banks to the capital market remains limited on account of restrictions due to prudential regulation. A major reason for the surge in equity prices could be due to demand-supply mismatches for equity securities. In fact, a large proportion of equities is held by promoters and institutional investors as detailed in Chapter VII. The supply of securities for retail investors could possibly be lagging behind their demand. Equity prices, however, have relatively higher correlation with the forward exchange rate than other market interest rates. This is because portfolio investors, mainly, the FIIs, are allowed to hedge their exposure in the foreign exchange market through the forward market.

Integration and Stability of Markets

8.35 Financial markets integration process could be smooth or volatile depending on the risks associated with different instruments. When financial integration occurs in a smooth manner, it promotes efficiency in allocation of resources and stability of the financial system. On the contrary, volatility induced integration fuels speculation and undermines competitive price discovery process, with adverse consequences for resource allocation. In the Indian context, empirical evidence shows that growing integration among financial market segments has been accompanied by lower volatility in interest rates (Table 8.3). Barring the stock market, various segments of financial markets, in general, witnessed significantly lower volatility (measured by standard deviation) during April 2000 to March 2007 than the earlier period April 1993 to March 2000. The cross-section volatility of market interest rates has also declined, suggesting the convergence of interest rates due to effective management of liquidity and increasing depth of financial markets.

8.36 The reduction in volatility in the money market segment, in particular, coincided with the introduction of the full-fledged liquidity adjustment facility (LAF) in 2000-01. The operation of the LAF has generally managed to keep the overnight rate, i.e., the call money rate in the corridor of reverse repo rate and repo rate (Chart VIII.8). The gradual phasing out of non-banks from the call money market has led to development of collateralised markets such as the repo market and the CBLO. The migration to the collateralised segments has also reduced the volatility in the overnight money market rates as availability of alternative avenues for mobilising short-term funds has enabled market rates to align with the informal interest rate corridor of repo and reverse repo rate under the LAF.

Financial Market Integration and Monetary Policy

8.37 Developed and integrated financial markets are pre-requisites for effective and credible transmission of monetary policy impulses. The success of a monetary policy transmission framework that relies on indirect instruments of monetary management such as interest rates is contingent upon the extent and speed with which changes in the central bank’s policy rate are transmitted to the spectrum of market interest rates and exchange rate in the economy and onward to the real sector (Mohan, 2007). Deviations between money market rates and the policy interest rate, in particular, have at least two adverse effects. First, they weaken the monetary policy transmission mechanism and introduce an element of uncertainty. Greater the influence the central bank has over interest rate levels, the easier it is for it to manage demand in the economy and attain its objective of low inflation and sustained growth (Petursson, 2001). Second, a large spread entailing a mismatch between inter-bank rates and the central bank’s policy rate could lead to inefficiencies in the financial intermediation process. In the Indian context, there has been convergence among market segments, with a significant decline in the spread of market interest rates over the reverse repo rate (Table 8.4). The spread was the lowest for the inter-bank call money rate followed by rates on Treasury Bills, certificates of deposit, commercial paper and 10-year government bond yield. The benefit of financial markets development percolating to the private sector was also evident from the moderation in spread of commercial paper over the policy rate. The narrowing of the spread between the policy rate and other market rates suggests the increasing efficiency of the transmission mechanism of monetary policy.

8.38 Besides correlation measure, more formal and robust approach to market integration analysis entails an investigation of causal relationship among various interest rates. The causal relationship between reverse repo rate and market interest rates, in particular, highlights the importance of monetary transmission in influencing the term structure of interest rates. Empirical analysis of Granger causality reveals certain important features of transmission mechanism in the Indian context5. First, lags associated with the transmission of policy impulses to market rates are aligned with the term structure of instruments; short-term rates exhibit relatively lower lags than medium and longer maturity instruments to the changes in policy rates. Second, the reverse repo rate has uni-directional causal effect on short-end of the financial market, including call money rate and 91-day Treasury Bills rate. In the medium-to-longer term horizon, 10-year Government bond yield has a bi-directional causal association with the reverse repo rate. This could be attributed to the feedback between policies and markets, since at the longer end, financial markets contain useful information about investment activity and economic agents’ expectations about inflation and growth prospects.

Box VIII.4

Foreign Exchange Market Efficiency

In the context of a country’s international financial integration, an important issue is the degree of foreign exchange market efficiency, which can be examined through empirical evaluation of ‘covered interest parity (CIP)’ and ‘uncovered parity (UIP)’ hypotheses. The interest parity hypothesis is important from a policy perspective (Blinder, 2004). First, the CIP reflects information efficiency of the foreign exchange market. Deviations from CIP can arise because of imperfect integration with overseas markets. Second, the UIP could be attributed to effectiveness of sterilised foreign exchange market intervention by central banks as well as that of interest rate defence of the exchange rate. To the extent that UIP is valid, official intervention cannot successfully change the prevailing spot exchange rate relative to the expected future spot rate, unless the authorities allow interest rates to change (Isard, 1995). It may, however, be added that there are other channels (for instance, the signalling channel) through which sterilised intervention may still be effective. Similarly, the interest rate defence of the exchange rate rests on possible deviations from UIP; otherwise, any attempts by the monetary authority to increase interest rates to defend the exchange rate would be offset exactly by expected currency depreciation. Policy-exploitable deviations from UIP are, therefore, a necessary condition for an interest rate defence (Flood and Rose, 2002).

From a cross-country perspective, empirical literature generally supports the CIP. As regards the UIP, the literature in general does not support it, though results could vary across currency, time horizon and countries (Isard, 1995; Fama, 1984; Froot and Thaler, 1990; Wadhwani, 1999; Chinn and Meredith, 2002; Bekaert et al., 2002; and Flood and Rose, 2002). The failure of UIP is attributable, inter alia, to time-varying risk premium, deviations from rational expectations (since tests of UIP involve a joint test of efficient market hypothesis and rational expectations), transaction costs, and endogenous monetary policy (Wadhwani, 1999; Kim and Roubini, 2000; and Meredith and Ma, 2002).

In the Indian context, empirical evidence covering the period April 1993 to early 1998 finds some support for CIP but not for UIP (Bhoi and Dhal, 1998; and Joshi and Saggar, 1998). Deriving from theoretical and empirical insights from cross-country studies, Pattnaik, Kapur and Dhal (2003) adopted a rigorous empirical analysis of parity conditions in the Indian context during April 1993 to March 2002. The study reiterated that the overall evidence in favour of market efficiency appears to be inconclusive. While CIP appears to hold on an average, the evidence for UIP comes from the absence of any predictable significant excess foreign exchange market returns. In view of significant ongoing liberalisation of the capital account in the subsequent period, it was attempted to examine afresh the interest parity conditions for India. Accordingly, interest parity conditions for the rupee vis-à-vis the US dollar using monthly data over the period April 1993 to September 2006 with regard to 3-month forward premia were examined. For interest rate differential, two alternative measures of domestic interest rate (call money rate and 91-day Treasury Bills rate) have been used; for the foreign interest rate, 1-month and 3-month LIBOR were used. The results were more or less in line with previous studies4 . Deviations from UIP could not only be due to presence of time varying risk premium but also due to surges in private capital flows (RBI, 2001). Although non-residents have been increasingly permitted to invest in the Indian markets, restrictions on borrowing and investing by residents in the overseas markets remained for most of the sample period of this study. Moreover, even with regard to non-residents, the major players, viz., the foreign institutional investors (FIIs) are more focused on the equity markets. Furthermore, central bank intervention in the market and administrative measures can also affect market behaviour. All these factors can cause deviations from UIP in the short-horizon, but over time there remains a tendency for the exchange rate movements to be consistent with UIP and stable real exchange rate. The average level of interest rate differentials points the right way in forecasting long-run currency changes, even though the short-run correlation usually points the wrong way in forecasting near-term exchange rate changes (Froot and Thaler, 1990).

4 The estimated CIP equations are as follows: FR3 = 1.70 + 0.45 ID1 + 0.25 ID1(-1) + 0.17 ID1(-2)

(4.8) (6.4) (3.2) (2.5) DW = 0.3 R –2= 0.47 FR3 = 1.08 + 1.08 ID2 (1.7) (6.7) DW = 0.3 R –2 = 0.22 where FR3 is 3-month forward premia, ID1 is interest rate differential between the call money rate and the 1-month LIBOR and ID2 is the interest rate differential between the 91-day Treasury Bills rate and the 3-month LIBOR. Figures in parentheses are estimated t-values.

The estimated UIP equation is as follows:

DEPX = -0.06 - 0.04 FR3 (t-3) 2 (0.4) (1.5) DW = 1.5 R – = 0.01 where DEPX is actual exchange rate depreciation under the assumption of rational expectations. Figures in parentheses are estimated t-values.

Table 8.3: Financial Market Volatility |

Rate Apr-1993 |

Apr-1993 |

Apr-2000 |

|

to |

to |

to |

Mar-2007 |

Mar-2000 |

Mar-2007 |

1 |

2 |

3 |

4 |

Call money rate |

4.30 |

5.38 |

1.90 |

Reverse repo rate |

1.27 |

1.14 |

1.32 |

Treasury Bills rate (91 days) |

2.29 |

1.93 |

1.46 |

Treasury Bills rate (364 days) |

2.57 |

1.56 |

1.66 |

Certificates of deposit rate |

3.17 |

2.36 |

1.66 |

Commercial paper rate |

3.30 |

2.50 |

1.99 |

Yield on 10-year government |

|

|

|

securities |

2.77 |

0.99 |

1.78 |

Exchange rate (Rs./US$) |

5.96 |

4.62 |

1.61 |

Forward exchange premium |

4.69 |

5.99 |

1.91 |

(1 month) |

|

|

|

Forward exchange premium |

3.93 |

4.51 |

1.86 |

(3 month) |

|

|

|

Forward exchange premium |

3.73 |

4.00 |

1.84 |

(6 month) |

|

|

|

BSE SENSEX (index volatility) |

2582 |

685 |

3194 |

(annualised index |

(32.94) |

(32.44) |

(33.36) |

return volatility) |

|

|

|

Cross-section volatility* |

3.88 |

4.08 |

2.53 |

Note : 1. Volatility is measured in terms of standard deviation.

2. Data for 10-year government securities yield are available

since April 1996, while data for 1-month forward exchange

premia are available from June 1995.

* :Standard deviation of all of the above interest rates and forward premia. |

8.39 As alluded to earlier, market integration could be attributable to liquidity, term structure, credit market conditions, exchange rate and macroeconomic fundamentals. Empirical results reveal that the market integration process is influenced by liquidity, safety and risk, external market developments, private sector growth, credit requirements and macroeconomic developments such as growth and inflation outlook implied by the long-term bond yield6. First, short-term liquidity impact on the inter-bank call money rate is mainly influenced by foreign exchange market developments reflected in the movement of forward exchange rate and fiscal policy induced effect at the short-end of the market through changes in the benchmark 91-day Treasury Bills rate. Second, the rate on 91-day Treasury Bills is influenced by the 10-year government securities yield and private sector credit condition through changes in the commercial paper rate, while foreign exchange market development and liquidity exert some influence in the short-run. Third, forward exchange premia is driven by arbitrage condition, with the inter-bank call money market being the key driver, though some modest impact was due to developments in the private sector (commercial paper) and long-term fundamentals (10-year government bond yield). Fourth, for the private sector, commercial paper is driven by long-term government securities yield in the medium to longer term horizon, while liquidity, risk premium and foreign exchange market condition have modest impact in the shor t-run. Fifth, the commercial paper representing developments in productive activities and credit requirements by the private sector has a substantially larger impact than liquidity, foreign exchange market and risk premium. Moreover, an extension of the above multivariate vector auto-regression(VAR) model to a structural representation reveals that financial market integration in the medium to longer term horizon is induced by the long-term yield on government securities and the commercial paper rate, attributable to macroeconomic developments such as medium-term inflation outlook and real sector developments in the private sector.

Table 8.4: Interest Rate Spread over the |

Reverse Repo Rate |

(Percentage point) |

|

|

|

|

Interest Rate |

Apr-1993 |

Apr-1993 |

Apr-2000 |

|

to |

to |

to |

|

Mar-2007 |

Mar-2000 |

Mar-2007 |

1 |

2 |

3 |

4 |

Call Money Rate |

1.78 |

2.98 |

0.58 |

Certificates of Deposit Rate |

3.31 |

5.43 |

1.19 |

Commercial Paper Rate |

3.99 |

6.09 |

1.89 |

91-day Treasury Bills Rate |

1.69 |

2.90 |

0.48 |

364-day Treasury Bills Rate |

2.48 |

4.18 |

0.79 |

10-year Yield on Government |

|

|

Securities |

3.42 |

6.21 |

1.83 |

Dynamics of Market Inter-linkages

8.39 As alluded to earlier, market integration could be attributable to liquidity, term structure, credit market conditions, exchange rate and macroeconomic fundamentals. Empirical results reveal that the market integration process is influenced by liquidity, safety and risk, external market developments, private sector growth, credit requirements and macroeconomic developments such as growth and inflation outlook implied by the long-term bond yield6. First, short-term liquidity impact on the inter-bank call money rate is mainly influenced by foreign exchange market developments reflected in the movement of forward exchange rate and fiscal policy induced effect at the short-end of the market through changes in the benchmark 91-day Treasury Bills rate. Second, the rate on 91-day Treasury Bills is influenced by the 10-year government securities yield and private sector credit condition through changes in the commercial paper rate, while foreign exchange market development and liquidity exert some influence in the short-run. Third, forward exchange premia is driven by arbitrage condition, with the inter-bank call money market being the ke driver, though some modest impact was due to developments in the private sector (commercial paper) and long-term fundamentals (10-year government bond yield). Fourth, for the private sector, commercial paper is driven by long-term government securities yield in the medium to longer term horizon, while liquidity, risk premium and foreign exchange market condition have modest impact in the shor t-run. Fifth, the commercial paper representing developments in productive activities and credit requirements by the private sector has a substantially larger impact than liquidity, foreign exchange market and risk premium. Moreover, an extension of the above multivariate vector auto-regression(VAR) model to a structural representation reveals that financial market integration in the medium to longer term horizon is induced by the long-term yield on government securities and the commercial paper rate, attributable to macroeconomic developments such as medium-term inflation outlook and real sector developments in the private sector.

8.40 To sum up, integration among various market segments has grown, especially in the recent period. This was reflected in an increase in the depth of the markets and higher correlation among interest rates in various market segments. Growing integration among various financial market segments was accompanied by lower volatility of interest rates. The narrowing of the interest rate spread over the reverse repo rate reflects an improvement in the monetary policy transmission channel and greater financial market integration. Financial market integration reflects a dynamic interaction among various parameters such as liquidity, safety and risk, foreign exchange market development, private sector activity, and macroeconomic fundamentals. Alternatively, financial integration exhibits interaction among financial intermediaries, the Government, the private sector and the external sector. In respect of specific market segments, it was found that the reverse repo rate has one-way causal effect with the short-end of the financial markets, i.e., money market, while with the 10-year government bond yield, a two-way causal relation exists, implying a feedback between policy and markets at the longer end. In the foreign exchange market, the PPP doctrine has been held in the absence of any sustained appreciation/depreciation of the REER. The equity market has a relatively low interaction with other market segments, which is reflected in the existence of a large equity risk premium.

5 Granger causality tests were conducted for the period April 1993 to September 2006 by estimating a vector error correction model (VEC) by taking the following variables: reverse repo rate, 91-day Treasury Bills rate, 364-day Treasury Bills rate and 10-year Government securities yield. The order of the VAR model was chosen to be two months lag based on the Schwarz Criterion.