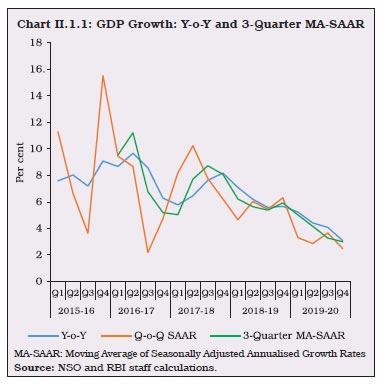

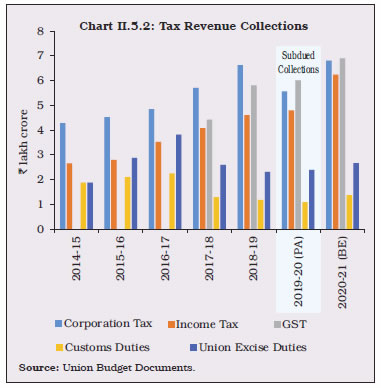

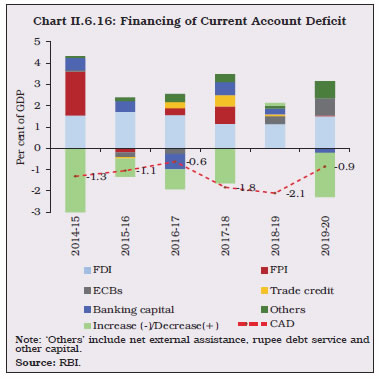

Economic activity in India slowed down in 2019-20 as a synchronised global downturn amplified by drags on aggregate demand took a costly toll. After remaining benign in the first half, headline inflation picked up subsequently on spikes in food price inflation. Monetary and credit conditions reflected deceleration in underlying activity in the economy. Financial markets turned volatile in the later part of the year in sync with global markets, reflecting the impact of the pandemic. Public finances recorded deviations from budgetary targets due to shortfalls in tax revenue and disinvestment collections. On the external front, the current account deficit narrowed with net capital flows remaining robust; foreign exchange reserves rose during the year. II.1 THE REAL ECONOMY II.1.1 Amidst a loss of momentum across geographies, escalation of trade tensions between China and the US, uncertainty over Brexit, and heightened geo-political risks, the global economy grew at its slowest pace in 2019 post global financial crisis. Just as these retarding forces appeared to be easing their grip towards the close of the year, the novel coronavirus (COVID-19) broke out and rapidly exploded into a pandemic, darkening global economic prospects and imparting extreme uncertainty about the outlook. II.1.2 As contagion was spreading to over 200 economies across the world, claiming over 59 lakh infections and 3,67,166 deaths worldwide by May 2020, the release of provisional estimates (PE) of national income by the National Statistical Office (NSO) at the end of the month revealed that the growth of India’s real gross domestic product (GDP) had slumped to 4.2 per cent in 2019-20 (6.1 per cent a year ago), the lowest since 2009-10. A downturn that set in during the last quarter of 2016-17, abstracting from ephemeral base effects in the second half of 2017-18, caused economic activity to lose speed over eight consecutive quarters to touch a low in Q4:2019-20 that has not been seen in the history of the 2011-12 base series. All components of domestic demand were driven down, except government final consumption expenditure (GFCE), which provided sustained support to aggregate demand. On the supply side, activity in manufacturing, construction and transportation was pulled down by sector-specific impediments1. Agriculture and allied activities provided a silver lining, on the back of record foodgrains and horticulture production, coupled with resilient allied activities and an outlook brightened by expectations of a normal south west monsoon (SWM) in 2020. II.1.3 Against this backdrop, this chapeau is followed by component-wise analysis of aggregate demand. Developments in aggregate supply conditions are analysed in sub-section 3. The last sub-section covers analysis of employment based on high frequency indicators and includes an assessment of the impact of the COVID-19 pandemic and major policy responses. Policy perspectives are set out in the concluding paragraph. 2. Unravelling the Demand Slowdown II.1.4 The May 2020 release of PE for 2019-20 offered a first glimpse at how the economy fared in Q4:2019-20 and, therefore, in the year as a whole; it also brought to bear revisions to estimates for the preceding quarters. The new release confirmed a 2.8 percentage points reduction in the growth of aggregate demand below its decennial trend rate of 7.0 per cent, and a sequential deceleration from a recent peak of 7.9 per cent in H2:2017-18. Real GDP growth in H2:2019-20 at 3.6 per cent was also the lowest registered in the 2011-12 base series (Appendix Table 1). The disruption caused by the imposed lockdown brought economic activity to a near standstill during the last week of Q4:2019-20 (Table II.1.1). II.1.5 The three-quarter moving average of seasonally adjusted annualised growth rates (MA-SAAR) corroborated the weakening of the momentum of demand (Chart II.1.1). Consequently, the negative output gap (i.e., deviation of actual output from its potential level) widened in 2019-20, pointing to the substantial slack in resource utilisation.

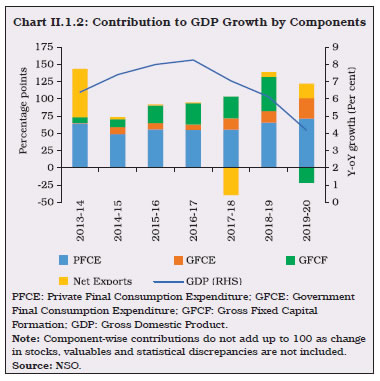

| Table II.1.1: Underlying Drivers of Growth | | Components | Growth (per cent) | Contribution to Growth (per cent) | | 2008-09 | 2009-11 | 2011-14 | 2014-18 | 2018-20 | 2008-09 | 2009-11 | 2011-14 | 2014-18 | 2018-20 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | | I. Total Consumption Expenditure | 5.5 | 6.5 | 6.1 | 7.5 | 7.0 | 118.2 | 53.5 | 71.5 | 64.6 | 91.8 | | Private | 4.5 | 5.9 | 6.7 | 7.4 | 6.2 | 81.9 | 40.4 | 66.2 | 53.8 | 68.5 | | Government | 11.4 | 9.7 | 2.6 | 8.2 | 10.9 | 36.3 | 13.1 | 5.3 | 10.8 | 23.3 | | II. Gross Capital Formation | -2.6 | 14.5 | 2.0 | 6.5 | 3.7 | -31.3 | 64.1 | 16.6 | 30.1 | 17.9 | | Fixed investment | 3.2 | 9.4 | 6.2 | 6.2 | 3.5 | 32.6 | 35.9 | 37.9 | 25.0 | 13.9 | | Change in stocks | -51.4 | 56.2 | -27.4 | 31.5 | 12.2 | -75.4 | 17.9 | -16.7 | 3.5 | 3.4 | | Valuables | 26.9 | 45.0 | -11.1 | 8.5 | 0.8 | 11.4 | 10.3 | -4.6 | 1.6 | 0.5 | | III. Net exports | | | | | | -72.4 | -4.1 | 8.9 | -8.5 | 14.0 | | Exports | 14.8 | 7.3 | 10.0 | 1.4 | 4.4 | 99.0 | 16.2 | 42.3 | 3.7 | 10.9 | | Imports | 22.4 | 6.9 | 6.1 | 4.2 | 0.9 | 171.4 | 20.3 | 33.4 | 12.3 | -3.0 | | IV. GDP | 3.1 | 8.2 | 5.7 | 7.7 | 5.2 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | | Source: NSO and RBI staff calculations. | II.1.6 Compositional shifts in demand conditions reflect the anatomy of the persistent slowdown extending into 2019-20 (Chart II.1.2 and Appendix Table 2). Consumption II.1.7 Private final consumption expenditure (PFCE), constituting 57.2 per cent of aggregate demand, recorded its lowest growth in a decade. Nonetheless, at 5.3 per cent in 2019-20, PFCE growth exhibited resilience in the face of the prolonged weakening of income and financial conditions. High frequency indicators of consumption demand either contracted or grew at a rate far below their long-run averages. Petroleum consumption remained flat, while non-oil non-gold imports remained in contraction all through the year. Among indicators of urban demand, passenger car sales contracted throughout 2019-20, exacerbated by idiosyncratic factors such as rising insurance costs and tighter emission norms. Other indicators of urban demand, viz., consumer durables and air passenger traffic also remained depressed during the year, with the latter bearing the brunt of an exogenous shock due to the grounding of a major airline.  II.1.8 Among indicators of rural demand, tractor sales had contracted until the beginning of the rabi sowing season, but record sowing along with improvement in terms of trade for the farm sector revived demand and catalysed a spurt in tractor sales between December 2019 and February 2020 and stayed robust even during the pandemic period. Motorcycle sales, however, have remained in the contraction zone starting from January 2019. The weakness in rural demand was also aggravated by moderation in rural wages and dwindling employment avenues, and the slowdown in alternative sources of livelihood such as manufacturing and construction. GFCE compensated for the slowdown in private consumption, registering double-digit growth for the third consecutive year in 2019-20. Excluding GFCE growth of 11.8 per cent, GDP growth for 2019-20 would have decelerated by 0.9 percentage points from the headline GDP growth estimated by the NSO. The COVID-19 pandemic delivered an unprecedented shock to the economy. It remains to be seen whether the recovery from the pandemic will be V-shaped or U-shaped (Box II.1.1). Investment and Saving II.1.9 The rate of gross domestic investment in the Indian economy, measured by the ratio of gross capital formation (GCF) to GDP at current prices, had declined to 32.2 per cent in 2018-19. Although data on GCF are not yet available for 2019-20, underlying indicators point to investment having weakened further. The ratio of real gross fixed capital formation (GFCF) to GDP declined to 29.8 per cent in 2019-20 from 31.9 per cent in 2018-19 on account of waning business confidence. The corporate tax regime reform of September 2019 has not yet gained traction in boosting capital expenditure. Box II.1.1

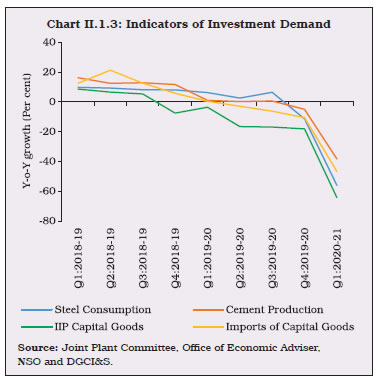

Macroeconomic Impact of COVID-19 COVID-19’s epidemiological dynamics are still rapidly evolving in India, rendering difficult an accurate assessment of its full macroeconomic effects. In this scenario, an approach employing a dynamic stochastic general equilibrium (DSGE) model built on New Keynesian foundations provides a tentative and proximate assessment of the likely impact of COVID-19 and the subsequent lockdown on the Indian economy. The model has three main economic agents, viz., households, firms and the government. COVID-19 and the lockdown can impact the economy through multiple channels (Eichenbaum et al., 2020; Faria-e-Castro, 2020; Yang et al., 2020). Because of lockdown, households have to stay at home and therefore, reduce labour supply to firms; consumption falls due to non-availability of non-essential items and fall in income; and restricted people-to-people contact stalls the momentum of the pandemic. The model is calibrated2 so that infections peak around the second half of August 2020 [based on the predictions of a generalised Susceptible-Exposed-Infectious-Recovered (SEIR) model for India] and the output gap widens to about (-) 12 per cent of potential output when the economy is worst hit. Two scenarios are envisaged: the first, i.e., lockdown I, impacts the supply side of the economy by decreasing the labour supply and its productivity. The second scenario, i.e., lockdown II, additionally considers the increase in marginal cost. Inflation falls under both scenarios mainly because of a fall in demand; under lockdown II, however, the decline in inflation is less steep and short-lived. Firms respond to the squeeze in profits, due to higher marginal costs, by curtailing production and labour demand. Wages see a lower rise and economy goes through a large contraction. However, the recovery from the pandemic is faster in this scenario on account of fewer opportunities for people-to-people interactions. Under scenario I by contrast, production retrenchment is less severe, but demand contraction is more pronounced due to a rise in infections. Thus, the economy undergoes a deeper contraction under lockdown II, but recovery from the pandemic is faster (Chart 1). In order to evaluate the macroeconomic implications of scenarios I and II, it is worthwhile to simulate a third scenario in which the government does not impose a lockdown (Chart 2). This results in a more widespread pandemic, which peaks in the second half of January 2021 with a very slow recovery. This causes a persistent labour shortage and the supply shock produces a lasting impact on inflation and the output gap, which corresponds to a permanent upward shift in inflation and a downward shift in potential output, respectively. In scenario II, which envisages a second lockdown, the decline in economic activity is expected to reach its trough in Q1:2020-21 and growth turns positive from Q4:2020-213 (Chart 3a). Inflation, which was high at 6.7 per cent in Q4:2019-20, is projected to ease till Q4:2020-21 (Chart 3b). In sum, COVID-19 without the associated lockdown acts like a supply shock which causes a persistent rise in inflation and a permanent loss of output. As per Scenario II, which looks closer to the reality, the decline in economic activity reaches its trough in Q1:2020-21 and recovers thereafter, albeit at a gradual pace, with growth turning positive from Q4:2020-21. References: 1. Eichenbaum, M. S., S. Rebelo, and M. Traband (2020), ‘The Macroeconomics of Epidemics’, National Bureau of Economic Research, Working Paper No. 26882. 2. Faria-e-Castro, M. (2020), ‘Fiscal Policy during a Pandemic’, Federal Reserve Bank of St. Louis, Working Paper Series No. 06. 3. Yang, Y., H. Zhang, and X. Chen (2020), ‘Coronavirus Pandemic and Tourism: Dynamic Stochastic General Equilibrium Modeling of Infectious Disease Outbreak’, Annals of Tourism Research. | II.1.10 Another constituent of GFCF, viz., construction activity remained subdued in 2019-20 as a large inventory overhang coupled with stressed liquidity conditions restrained new launches. This was also reflected in growth of steel consumption, which plunged to a decadal low of 0.9 per cent in 2019-20 and cement production which registered a contraction of 0.9 per cent (Chart II.1.3). Driving the contraction in GFCF during 2019-20 was the collapse in investment in machinery and equipment, as evident in both imports and production of capital goods. II.1.11 As per the Order Books, Inventories and Capacity Utilisation Survey (OBICUS) of the Reserve Bank, capacity utilisation (CU) in manufacturing sector picked up from 68.6 per cent in Q3:2019-20 to 69.9 per cent in Q4:2019-20. On a seasonally adjusted basis, CU remained stable at 68.3 per cent in Q4:2019-20 as against 68.4 per cent in Q3:2019-20. II.1.12 The rate of gross domestic saving, measured as a ratio of gross domestic saving to gross national disposable income (GNDI), which had moderated to 29.7 per cent in 2018-19, is expected to gather pace during 2019-20 on the back of an uptick in household financial savings (Appendix Table 3). As per the preliminary estimates, household financial saving has improved to 7.6 per cent of GNDI in 2019-20, after touching the 2011-12 series low of 6.4 per cent in 2018-19 (Table II.1.2). This improvement has occurred on account of sharper moderation in household financial liabilities than that in financial assets. COVID-19 related economic disruptions, however, caused a sharper decline in household financial assets in Q4:2019-20.

| Table II.1.2: Financial Saving of the Household Sector | | (Per cent of GNDI) | | Item | 2011-12 | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20# | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | | A. Gross financial saving | 10.4 | 10.5 | 10.4 | 9.9 | 10.7 | 10.4 | 11.9 | 10.4 | 10.5 | | of which: | | | | | | | | | | | 1. Currency | 1.2 | 1.1 | 0.9 | 1.0 | 1.4 | -2.1 | 2.8 | 1.5 | 1.4 | | 2. Deposits | 6.0 | 6.0 | 5.8 | 4.8 | 4.6 | 6.3 | 3.1 | 4.1 | 3.6 | | 3. Shares and Debentures | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 1.1 | 1.0 | 0.4 | 0.4 | | 4. Claims on Government | -0.2 | -0.1 | 0.2 | 0.0 | 0.5 | 0.7 | 0.9 | 1.0 | 0.0 | | 5. Insurance Funds | 2.2 | 1.8 | 1.8 | 2.4 | 1.9 | 2.3 | 2.0 | 1.3 | 1.7 | | 6. Provident and Pension funds | 1.1 | 1.5 | 1.5 | 1.5 | 2.1 | 2.1 | 2.1 | 2.1 | 2.1 | | B. Financial Liabilities | 3.2 | 3.2 | 3.1 | 3.0 | 2.7 | 3.0 | 4.3 | 4.0 | 2.9 | | C. Net Financial Saving (A-B) | 7.2 | 7.2 | 7.2 | 6.9 | 7.9 | 7.3 | 7.6 | 6.4 | 7.6 | GNDI: Gross National Disposable Income.

#: As per the preliminary estimate of the Reserve Bank. The NSO will release the financial saving of the household sector on January 29, 2021 based on the latest information, as part of the ‘First Revised Estimate of National Income, Consumption Expenditure, Saving and Capital Formation for 2019-20’.

Note: Figures may not add up to total due to rounding off.

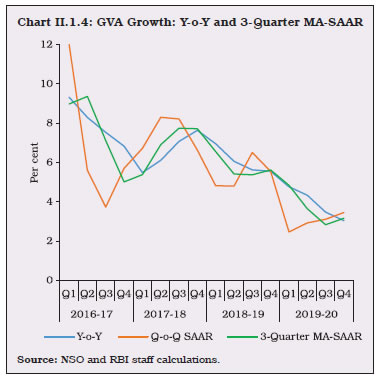

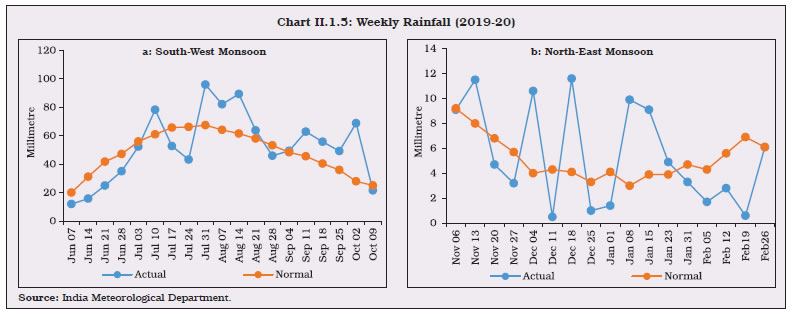

Source: NSO. | 3. Aggregate Supply II.1.13 Aggregate supply, measured by gross value added (GVA) at basic prices, slowed to 3.9 per cent in 2019-20, 2.1 percentage points lower than a year ago and 2.8 percentage points below its decennial rate of 6.7 per cent. GVA’s momentum measured by three quarter moving average (MA) of quarter-on-quarter (q-o-q) seasonally adjusted annualised growth rates (SAAR) appears to have troughed in Q3:2019-20 and a modest uptick seems to have commenced in Q4:2019-20 (Chart II.1.4). II.1.14 On the supply side, the main locomotive of growth – the services sector – has been severely affected by the lockdown, while industrial GVA went into an accentuated contraction in 2019-20 (Table II.1.3). These negative tendencies were cushioned by the agriculture sector, as discussed below.

| Table II.1.3: Real GVA Growth | | Sectors | Growth (per cent) | Contribution to Growth (per cent) | | 2008-09 | 2009-11 | 2011-14 | 2014-18 | 2018-20 | 2008-09 | 2009-11 | 2011-14 | 2014-18 | 2018-20 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | | I. Agriculture, Forestry and Fishing | -0.2 | 4.0 | 4.5 | 3.3 | 3.2 | -1.2 | 8.7 | 14.6 | 6.9 | 10.6 | | II. Industry | 3.4 | 9.1 | 2.9 | 8.8 | 2.6 | 18.6 | 29.2 | 11.8 | 26.8 | 11.1 | | 2. Mining and Quarrying | -2.5 | 9.7 | -5.6 | 8.7 | -1.4 | -2.4 | 5.0 | -4.4 | 3.4 | -0.4 | | 3. Manufacturing | 4.7 | 9.3 | 4.5 | 8.9 | 2.9 | 18.5 | 22.2 | 14.1 | 20.9 | 8.7 | | 4. Electricity, Gas, Water Supply and Other Utility Services | 4.9 | 6.5 | 5.1 | 8.3 | 6.2 | 2.5 | 2.0 | 2.1 | 2.5 | 2.8 | | III. Services | 6.4 | 8.0 | 7.0 | 8.1 | 6.3 | 82.6 | 62.1 | 73.6 | 66.3 | 78.3 | | 5. Construction | 5.6 | 6.4 | 5.4 | 4.7 | 3.7 | 11.6 | 7.9 | 9.0 | 5.3 | 5.3 | | 6. Trade, Hotels, Transport, Communication and Services related to Broadcasting | 2.4 | 9.0 | 7.5 | 8.7 | 5.7 | 9.6 | 19.8 | 24.0 | 22.0 | 21.3 | | 7. Financial, Real Estate and Professional Services | 5.2 | 5.6 | 8.5 | 8.7 | 5.7 | 23.5 | 15.0 | 28.8 | 24.9 | 25.1 | | 8. Public Administration, Defence and Other Services | 15.8 | 11.8 | 5.1 | 8.4 | 9.7 | 37.8 | 19.4 | 11.7 | 14.1 | 26.6 | | IV. GVA at basic prices | 4.3 | 7.4 | 5.6 | 7.4 | 5.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | | Source: NSO and RBI staff calculations. | II.1.15 Agriculture and allied activities, with a real GVA growth of 4.0 per cent in 2019-20 (PE), benefitted from record production of foodgrains as well as commercial and horticultural crops. The contribution of agriculture to overall economic growth (15.2 per cent) surpassed that of the industrial sector (4.7 per cent) for the first time since 2013-14. Although agriculture accounts for only 14.6 per cent share in overall GVA, the increased contribution in overall growth is expected to have positive impact on 48.3 per cent of total households who are employed in agriculture. II.1.16 The SWM started off on a sluggish note on June 8, 2019 with a delay of about one week from its normal onset. After a rainfall deficit of 33 per cent in June, the SWM gathered momentum from mid-July and cumulative rainfall at the end of the season (September 30, 2019) turned out to be 10 per cent above the long period average (LPA) [9 per cent below LPA during previous year]. Kharif sowing also gained momentum and ended the season with marginally higher acreage than in the previous year. Accordingly, kharif foodgrains production in 2019-20 is placed 1.3 per cent higher than the final estimates (FE) for 2018-19 (Table II.1.4). II.1.17 The incidence of cyclonic storms (mainly Vayu and Bulbul) and spells of unseasonal rains in October and mid-November (Chart II.1.5) resulted in damage to standing crops in many states. The maximum loss was in respect of urad, and production estimates were revised downward by 29.2 per cent (2nd AE over 1st AE) due to crop losses. | Table II.1.4: Agricultural Production 2019-20 | | (Lakh Tonnes) | | Crop | Season | 2018-19 | 2019-20 | 2019-20 Variation (Per cent) | | 4th AE | Final | Target | 4th AE | Over 2018-19 | Over 2019-20 | | 4th AE | Final | Target | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | Foodgrains | Kharif | 1,417.1 | 1415.2 | 1,479.0 | 1,433.8 | 1.2 | 1.3 | -3.1 | | | Rabi | 1,432.4 | 1437.0 | 1,432.0 | 1,532.7 | 7.0 | 6.7 | 7.0 | | | Total | 2,849.5 | 2852.1 | 2,911.0 | 2,966.5 | 4.1 | 4.0 | 1.9 | | Rice | Kharif | 1,021.3 | 1020.4 | 1,020.0 | 1,019.8 | -0.1 | -0.1 | 0.0 | | | Rabi | 142.9 | 144.4 | 140.0 | 164.5 | 15.1 | 13.9 | 17.5 | | | Total | 1,164.2 | 1164.8 | 1,160.0 | 1,184.3 | 1.7 | 1.7 | 2.1 | | Wheat | Rabi | 1,021.9 | 1036.0 | 1,005.0 | 1,075.9 | 5.3 | 3.9 | 7.1 | | Coarse Cereals | Kharif | 309.9 | 313.8 | 358.0 | 336.9 | 8.7 | 7.4 | -5.9 | | | Rabi | 119.6 | 116.7 | 125.0 | 137.9 | 15.3 | 18.2 | 10.3 | | | Total | 429.5 | 430.6 | 483.0 | 474.8 | 10.5 | 10.3 | -1.7 | | Pulses | Kharif | 85.9 | 80.9 | 101.0 | 77.2 | -10.1 | -4.6 | -23.6 | | | Rabi | 148.0 | 139.8 | 162.0 | 154.4 | 4.3 | 10.4 | -4.7 | | | Total | 234.0 | 220.8 | 263.0 | 231.5 | -1.1 | 4.8 | -12.0 | | Oilseeds | Kharif | 212.8 | 206.8 | 258.0 | 223.2 | 4.9 | 7.9 | -13.5 | | | Rabi | 109.8 | 108.5 | 103.0 | 111.1 | 1.2 | 2.4 | 7.8 | | | Total | 322.6 | 315.2 | 361.0 | 334.2 | 3.6 | 6.0 | -7.4 | | Sugarcane | Total | 4,001.6 | 4,054.2 | 3,855.0 | 3,557.0 | -11.1 | -12.3 | -7.7 | | Cotton # | Total | 287.1 | 280.4 | 358.0 | 354.9 | 23.6 | 26.6 | -0.8 | | Jute & Mesta ## | Total | 97.7 | 98.2 | 112.0 | 99.1 | 1.5 | 0.9 | -11.5 | #: Lakh bales of 170 kg each. ##: Lakh bales of 180 kg each. AE: Advance Estimate.

Source: Ministry of Agriculture and Farmers Welfare, GoI. |

II.1.18 Overall foodgrains production is estimated at 2,966.5 lakh tonnes in 2019-20 – a record for the third successive year. Foodgrains production is estimated to have grown by 4.0 per cent in 2019-20, driven mainly by record production of rice and wheat. Among commercial crops, oilseeds, cotton, and jute and mesta are estimated to have grown by 6.0 per cent, 26.6 per cent and 0.9 per cent, respectively, while sugarcane production contracted by 12.3 per cent over the previous year. II.1.19 As per the 2nd AE, the production of horticultural crops reached a record level of 3,204.8 lakh tonnes during 2019-20, driven mainly by production of vegetables and fruits (Table II.1.5). All the three key vegetables – onions, tomatoes and potatoes – registered increased production. | Table II.1.5: Horticulture Production | | (Lakh Tonnes) | | Crops | 2017-18 | 2018-19 | 2019-20 | Variation (Per cent) | | Final Estimate (FE) | 2nd AE | Final Estimate (FE) | 2nd AE | 2018-19 FE over 2017-18 FE | 2019-20 2nd AE over 2018-19 2nd AE | 2019-20 2nd AE over the 2018-19 FE | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | | Total Fruits | 973.6 | 973.8 | 979.7 | 990.7 | 0.6 | 1.7 | 1.1 | | Banana | 308.1 | 312.2 | 304.6 | 315.0 | -1.1 | 0.9 | 3.4 | | Citrus | 125.5 | 131.5 | 134.0 | 139.7 | 6.8 | 6.2 | 4.3 | | Mango | 218.2 | 209.6 | 213.8 | 204.4 | -2.0 | -2.5 | -4.4 | | Total Vegetables | 1,844.0 | 1,873.7 | 1,831.7 | 1,917.7 | -0.7 | 2.3 | 4.7 | | Onion | 232.6 | 232.8 | 228.2 | 267.4 | -1.9 | 14.8 | 17.2 | | Potato | 513.1 | 529.6 | 501.9 | 513.0 | -2.2 | -3.1 | 2.2 | | Tomato | 197.6 | 196.6 | 190.1 | 205.7 | -3.8 | 4.6 | 8.2 | | Plantation Crops | 180.8 | 176.6 | 163.5 | 162.4 | -9.6 | -8.0 | -0.7 | | Total Spices | 81.2 | 86.1 | 94.3 | 94.2 | 16.1 | 9.4 | -0.1 | | Aromatics and Medicinal | 8.7 | 8.5 | 8.0 | 8.0 | 3.9 | -6.6 | -0.4 | | Total Flowers | 27.9 | 28.9 | 29.1 | 30.6 | 4.1 | 5.8 | 5.5 | | Total | 3,117.4 | 3,148.7 | 3,107.4 | 3,204.8 | -0.3 | 1.8 | 3.1 | FE: Final Estimate. AE: Advance Estimate.

Source: Ministry of Agriculture and Farmers Welfare, GoI. | II.1.20 In recent years, the impact of climate change in terms of volatile rainfall intensity, increase in extreme events and rising temperature has implications for the outlook of agriculture (Box II.1.2). II.1.21 As in the previous two years, minimum support prices (MSPs) announced in 2019-20 for both rabi and kharif crops ensured a minimum return of 50 per cent over the cost of production. II.1.22 In the Union Budget 2020-21, the government had proposed to operationalise Kisan Rail for transporting perishable goods (including milk, meat and fish) to improve the efficiency of agricultural supply chains, reduce post-harvest losses and moderate price fluctuations. Further, Krishi Udaan scheme was proposed to help farmers to transport their produce by air on both national and international routes. The Budget has also given a major thrust to development of warehousing infrastructure as well as village level storage facilities in the country by involving various stakeholders such as NABARD, Warehouse Development and Regulatory Authority (WDRA), FCI, Central Warehousing Corporation (CWC) and self-help groups (SHGs). Pradhan Mantri Kisan Urja Suraksha evam Utthan Mahabhiyan scheme was launched enabling the farmers to set up solar power generation capacity on their fallow/ barren lands and to sell it to the grid. The government has proposed cluster-based 'One Product One District ' approach to tap the potential of horticulture sector in enhancing farmers’ income. Minimum support prices announced for kharif 2020-21 are higher by 2.9 per cent to 12.7 per cent vis-à-vis last year, ensuring a minimum return of 50 per cent over all India weighted average cost of production. Box II.1.2

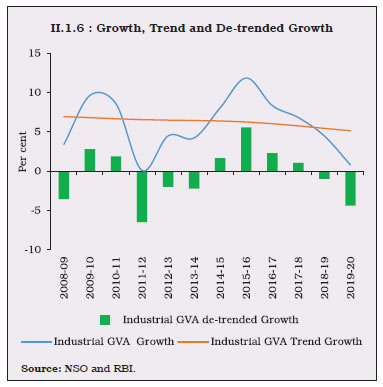

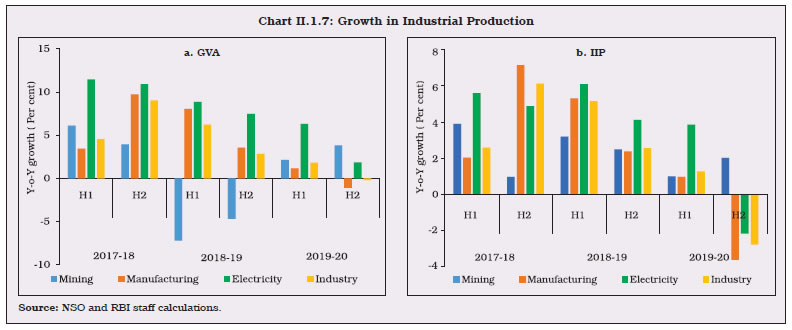

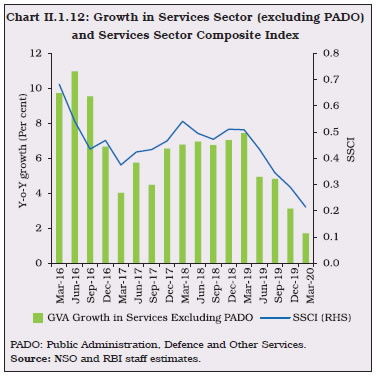

Climate Change - The Challenges for Indian Agriculture As in many parts of the world, drastic changes in climatic conditions have also been observed in India and these include impact on onset and withdrawal dates of monsoon and the incidence of extreme events (IPCC, 2019 and GoI, 2020). Consistent with models of climate change, the number of dry days as well as days with extremely high levels of rainfall have increased in India - more intense droughts; downward shifts in average rainfall by 59 mm since 2000 (Chart 1a); higher frequency of cyclones - India was hit by 8 cyclones in 2019 which is the highest since 1976 (Chart 1b); high variation in the number of subdivisions receiving excess/normal and deficient/scanty monsoon rains (Chart 1c); and an increase in the extent of crop area damaged due to unseasonal rains and heavy floods (Chart 1d). Global warming has also led to a sharp rise in the annual average temperature in India by 1.8°C between 1997 and 2019 as compared to a 0.5°C increase between 1901 and 2000 (Chart 2a). This has likely caused a decline in crop yields, undermining farm income (Chart 2b). Global warming has also led to a sharp rise in the annual average temperature in India by 1.8°C between 1997 and 2019 as compared to a 0.5°C increase between 1901 and 2000 (Chart 2a). This has likely caused a decline in crop yields, undermining farm income (Chart 2b). Water tables have depleted at an alarming rate, with around 52 per cent of the wells in India recording decline in water levels between the years 2008 and 2018 (Chart 3a). This imparts urgency to move from flood irrigation to micro irrigation methods like drip or hose reel, which can save up to 60 per cent of the water used and also help in preventing pest incidence. At present, the coverage of micro irrigation is much lower in states which have recorded higher declines in water tables (Chart 3b). Alongside, there is a need to adopt crop cycles, credit cycles and procurement patterns to monsoonal shifts. References: 1. Government of India, (2020), ‘Observed Monsoon Rainfall Variability and Changes during Recent 30 years (1989-2018)’, Climate Research and Services Division, Ministry of Earth Sciences, India Meteorological Department. 2. Intergovernmental Panel on Climate Change (IPCC) (2019), ‘Climate Change and Land’, World Meterological Organisation and United Nations Environment Programme. | II.1.23 Under Atmanirbhar Bharat Abhiyan Package, government has announced measures to strengthen infrastructure, logistics, capacity building, governance and administrative reforms for agriculture, animal husbandry, fisheries and food processing. These measures include eight development schemes4 with fund allocation of ₹1.6 lakh crore which is much higher as compared to funds allocated to the relevant schemes for the Union Budget 2020-21. In addition to the above schemes, the government has also announced three governance and administrative reforms to attract investments in agriculture sector and make it competitive, namely, delisting of various agricultural commodities from the Essential Commodities Act to develop seamless marketing and promote storage infrastructure in agriculture; ‘The Farmers’ Produce Trade and Commerce (Promotion and Facilitation) Ordinance 2020’ to ensure barrier free trade of agriculture produce; and ‘The Farmers (Empowerment and Protection) Agreement on Price Assurance and Farm Services Ordinance 2020’ to empower the farmers to engage with processors, aggregators, wholesalers, large retailers, and exporters in a fair and transparent manner (Annex II). Industrial Sector II.1.24 Industrial GVA decelerated sharply in 2019-20 to 0.8 per cent from 4.5 per cent last year. The print for 2019-20 was the lowest in the 2011-12 series, marking the fourth consecutive year of deceleration since 2015-16. The cyclical component5 of industrial GVA growth moved deeper into contraction (Chart II.1.6). II.1.25 The deceleration was broad-based with headwinds from subdued demand – both domestic and international. With dwindling confidence and imposition of lockdown, the demand for non-essential items plummeted. The index of industrial production (IIP) shrank by 0.8 per cent during 2019-20 from 3.8 per cent growth a year ago (Chart II.1.7a & 7b). II.1.26 In the manufacturing sector, which constitutes three-fourths of industry, 17 of 23 industry groups recorded contraction. The motor vehicles segment was the largest negative contributor to manufacturing IIP, while basic metals, largely comprising mild steel slabs, provided a positive impetus. II.1.27 The mining sector decelerated largely on account of disruptions caused by extended monsoon. Crude oil and natural gas production declined due to depletion in reserves, flood repairs and industrial strikes, in addition to sluggish demand. There was some recovery in mining activity during H2 as unfavourable weather conditions waned and economic activity picked up in January-February 2020. Electricity generation decelerated due to contraction in thermal power generation, lean industrial demand and the extended monsoon. IIP manufacturing and electricity closely co-moved, indicating that a pick-up in manufacturing activities is essential for electricity demand to improve. Hydro electricity generation registered double digit growth during the year even as the share of renewables increased in the total electricity generation mix.

II.1.28 In terms of use-based classification, much of the deceleration in IIP was caused by a sharp contraction in capital goods and consumer durables production (Table II.1.6). | Table II.1.6: Index of Industrial Production (2011-12 = 100) | | (Per cent) | | Industry Group | Weight in IIP | Growth Rate | | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2019-20

(April-June) | 2020-21

(April-June) | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | Overall IIP | 100 | 3.3 | 4.6 | 4.4 | 3.8 | -0.8 | 3.0 | -35.9 | | Mining | 14.4 | 4.3 | 5.3 | 2.3 | 2.9 | 1.6 | 3.0 | -22.4 | | Manufacturing | 77.6 | 2.8 | 4.4 | 4.6 | 3.9 | -1.4 | 2.4 | -40.7 | | Electricity | 8.0 | 5.7 | 5.8 | 5.4 | 5.2 | 1.0 | 7.3 | -15.8 | | Use-Based | | | | | | | | | | Primary goods | 34.0 | 5.0 | 4.9 | 3.7 | 3.5 | 0.7 | 2.6 | -20.3 | | Capital goods | 8.2 | 3.0 | 3.2 | 4.0 | 2.7 | -13.9 | -3.5 | -64.4 | | Intermediate goods | 17.2 | 1.5 | 3.3 | 2.3 | 0.9 | 9.1 | 9.2 | -43.0 | | Infrastructure/ construction goods | 12.3 | 2.8 | 3.9 | 5.6 | 7.3 | -3.6 | 0.4 | -48.3 | | Consumer durables | 12.8 | 3.4 | 2.9 | 0.8 | 5.5 | -8.7 | -2.7 | -67.6 | | Consumer non-durables | 15.3 | 2.6 | 7.9 | 10.6 | 4.0 | -0.1 | 7.0 | -15.3 | | Source: NSO. | II.1.29 In terms of weighted contributions to IIP, the shares of capital goods, construction/ infrastructure goods, consumer durables and consumer non-durables declined, while that of intermediate goods increased (Chart II.1.8). II.1.30 Even as the persisting weakness in capital goods production, and the decline in capacity utilisation have raised concerns in the context of investment slowdown, demand for consumer non-durables has also slumped, suggesting overall weakening of demand conditions (Chart II.1.9). II.1.31 The deceleration in manufacturing activity is aggravated by decline in trade due to trade disruptions with the onset of COVID-19 and declining demand. The import intensity of India’s manufacturing products6, on an average, stood at 35.6 per cent during the period 2015-17 (Table II.1.7).

II.1.32 Import intensity differs across product groups, with the electronics industry having the highest import dependence, followed by machinery and equipment, reflecting disproportionate impact of trade restrictions on industries. Accordingly, an import disruption, ceteris paribus, would lead to non-availability of crucial components, resulting in contraction in manufacturing GVA by as much as 2.5 per cent (Table II.1.8). | Table II.1.7: Select Industry-wise Import Dependence (Average of 2015-2017) | | (Per cent) | | Industry | Import Intensity of Intermediate Inputs | Import Intensity of Output | Share in Manufacturing GVA | | 1 | 2 | 3 | 4 | | Electronics | 60.7 | 42.8 | 4.6 | | Machinery | 48.5 | 37.3 | 8.1 | | Transport Equipment | 5.3 | 3.4 | 11.5 | | Chemicals | 29.4 | 21.0 | 9.0 | | Pharmaceuticals | 2.7 | 1.3 | 6.5 | | Total Manufacturing | 35.6 | 25.1 | 100.0 | | Source: RBI staff estimates. | II.1.33 The impact due to factor income loss (capital and labour) of 68 days of lockdown on the manufacturing and mining sectors could be as high as ₹2.7 lakh crore (Table II.1.9). Services Sector II.1.34 In tandem with the slowdown in the industrial sector, services sector growth decelerated to 5.0 per cent in 2019-20 – the lowest in the last three decades. All sub-sectors except public administration, defence and other services (PADO) decelerated, the latter cushioning overall services sector growth, despite revenue shortfalls. Excluding PADO, services sector GVA growth decelerated to 3.7 per cent from 7.0 per cent in 2018-19 (Chart II.1.10). | Table II.1.8: Impact of Trade Disruption in India’s Manufacturing Sector | | (Per cent) | | India’s Main Imports | Global Import | | Scenario I: Import Freezes | Scenario II: Import < 50 per cent | Scenario III: Import < 25 per cent | | 1 | 2 | 3 | 4 | | Capital Goods (Machinery) | 0.84 | 0.42 | 0.21 | | Electronics and Electricals | 0.83 | 0.41 | 0.21 | | Pharmaceuticals | 0.05 | 0.01 | 0.01 | | Chemicals | 0.70 | 0.18 | 0.18 | | Transport Equipment | 0.16 | 0.02 | 0.04 | | Combined Effect on GVA of the Above Sectors | 2.58 | 1.04 | 0.64 | | Total Manufacturing GVA | 9.90 | 4.95 | 2.48 | Note: All values should be read as negative.

Source: RBI staff estimates |

| Table II.1.9: Impact on Manufacturing and Mining GVA - Alternate Scenarios | | Sectors | Disruptions | Factor Income Loss Estimated in Constant Prices (₹ lakh crore) | | Phase I & II: Lockdown (40 days) | Phase III & IV: Lockdown (28 days) | Cumulative Effect (68 days) | | 1 | 2 | 3 | 4 | 5 | | Mining & Quarrying | Partial | 0.389 | 0.109 | 0.498 | | Manufacturing | Partial | 1.664 | 0.576 | 2.240 | | Manufacturing & Mining GVA | | 2.053 | 0.685 | 2.738 | Note: 1. The sectoral proportion of labour income shares are taken from India KLEMS database.

2. All values to be read as negative.

3. The Q1:2020-21 impact on manufacturing GVA considers 33 days in Phase I & II, 28 days in Phase III & IV and 61 days in cumulative effect.

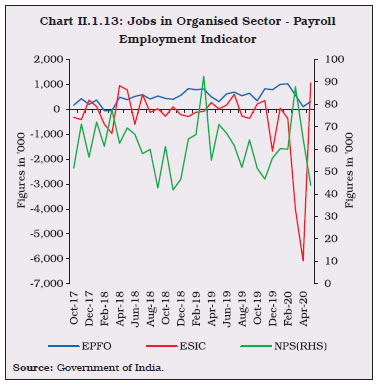

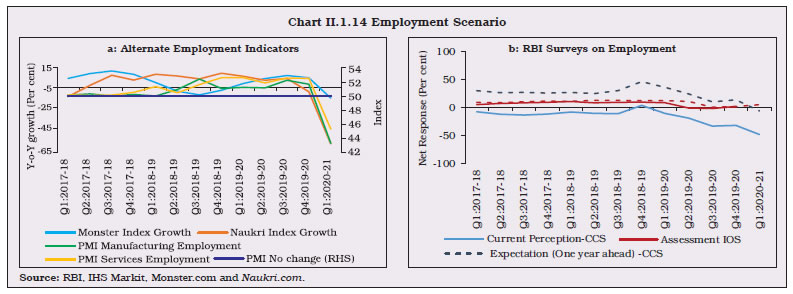

Source: RBI staff estimates. | II.1.35 Deceleration in construction and trade, hotels, transport, communication and services related to broadcasting drove the slowdown in overall services activity (Chart II.1.11). II.1.36 The sluggishness in the road transport sector was reflected in a contraction in commercial vehicle sales that began since H2:2018-19 and intensified through the year. The air transport segment remained stagnant, with contraction in both passenger and cargo traffic. Foreign tourist arrivals fell sharply from February 2020 pointing to difficult times ahead for the hospitality industry in the wake of COVID-19. The hospitality industry is likely to be the worst affected sector globally. Even rail transport decelerated during 2019-20. The construction sector registered its sharpest deceleration – from 6.1 per cent in 2018-19 to 1.3 per cent during 2019-20. Private sector estimates indicates that in the housing sector, new launches and sales declined in Q4:2019-20. II.1.37 The Reserve Bank’s services sector composite index (SSCI)7, which tracks activity in construction, trade, transport and finance and is a coincident indicator of GVA growth in the services excluding PADO, declined in 2019-20 (Chart II.1.12). 4. Employment II.1.38 In June 2020, the NSO released the Periodic Labour Force Survey (PLFS) of employment for 2018-19. The labour force participation rate was estimated at 37.5 per cent in 2018-19, an increase of 0.6 percentage points from 2017-18. The unemployment rate according to usual status declined to 5.8 per cent in 2018-19 (6.0 per cent for male and 5.2 per cent for female) from 6.1 per cent in 2017-18 (6.2 per cent for male and 5.7 per cent for female). Worker population rate, an indicator of employment, increased to 35.3 per cent in 2018-19 as compared to 34.7 per cent in 2017-18. In terms of distribution of workers by broad status in employment, the share of regular wage/salaried workers increased from 22.8 per cent in 2017-18 to 23.8 per cent in 2018-19, with a corresponding fall in the proportion of casual workers from 24.9 per cent to 24.1 per cent during the same period, indicating enhanced formalisation of the economy.  II.1.39 More updated organised sector employment, measured in terms of payroll8 data from the Employees’ Provident Fund Organisation (EPFO), Employees’ State Insurance Corporation (ESIC) and National Pension System (NPS), indicated a mixed picture with regard to job creation in 2019-20 (Chart II.1.13). Net subscribers added to EPFO per month averaged 6.5 lakh during April-March 2019-20, up from 5.6 lakh a year ago. On the other hand, the average number of members who paid their contribution to ESIC contracted by 4.1 lakh during 2019-20, in contrast to an addition of 0.6 lakh during 2018-19. New subscribers to NPS increased marginally during the same period. II.1.40 For Q4:2019-20, PMI employment index showed payroll hiring in manufacturing gained momentum whereas, for services, the rate of job creation moderated as compared to previous quarter. Hiring activity measured by online recruitment, showed a mixed pattern. While Naukri Job Speak Index contracted sharply, Monster Employment Index registered growth during Q4:2019-20 (Chart II.1.14a). Both the Industrial Outlook Survey (IOS) and Consumer Confidence Survey (CCS) pointed to the sentiments on employment conditions remaining pessimistic during Q4:2019-20 (Chart II.1.14b).

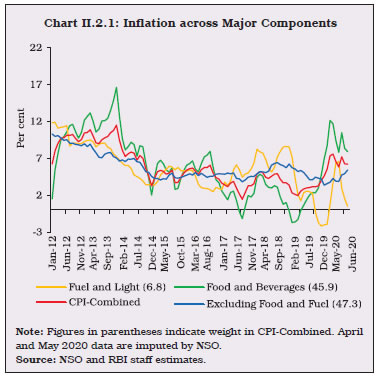

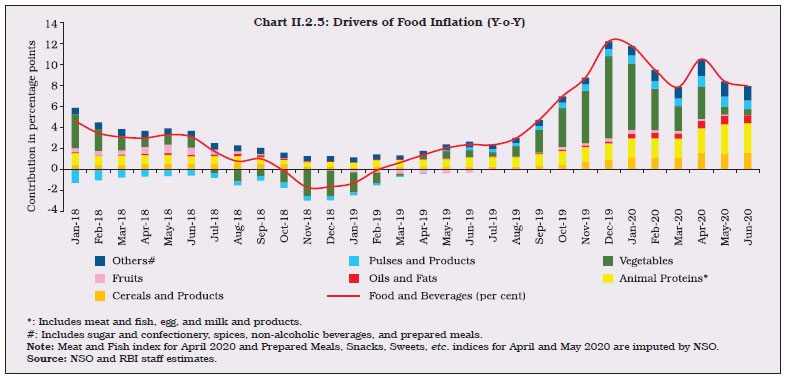

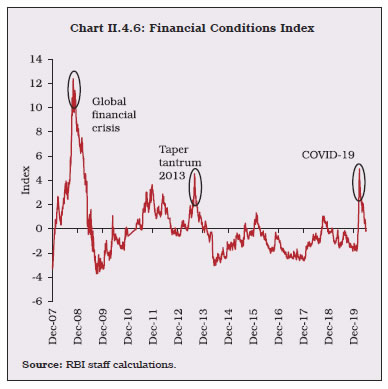

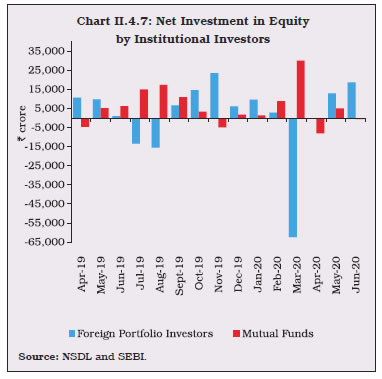

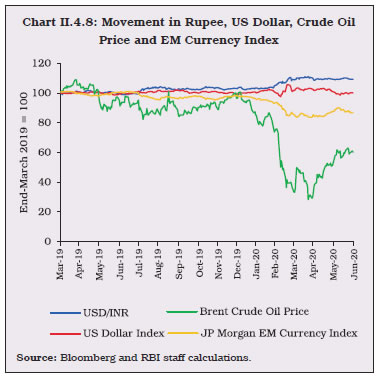

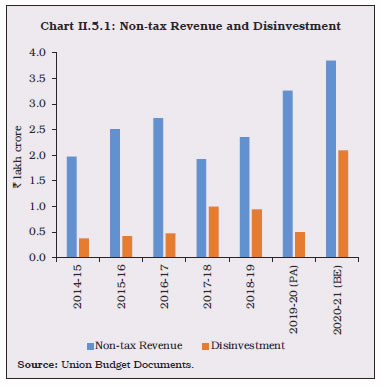

II.1.41 Considering the small farm size in India, the self-employed in agriculture can be assumed to be relatively unscathed by the pandemic. On the other hand, 40 per cent of casual labourers in rural areas are employed in the construction sector, which has come to a complete halt during the lockdown (Table II.1.10). Self-employed and casual labourers together account for 51.3 per cent of the urban workforce, and hence, the pandemic has disproportionate impact on urban areas. II.1.42 Several policy initiatives were undertaken by the government during the year for addressing structural bottlenecks in the economy. These policies are aimed at generating employment opportunities such as strategic promotion of labour-intensive manufacturing, increasing public expenditure on MGNREGA, Prime Minister’s Employment Generation Programme (PMEGP), Pandit Deen Dayal Upadhyaya Grameen Kaushalya Yojana (DDU-GKY) and Deen Dayal Antodaya Yojana – National Urban Livelihoods Mission (DAY-NULM). For skill development, a target to train over 69.03 lakh during 2016-17 to 2019-20 has been set to help them earn a livelihood through Pradhan Mantri Kaushal Vikas Yojana. As a part of legislative reforms, 44 labour laws have been simplified, amalgamated and rationalised into 4 labour codes in accordance with the recommendations of the 2nd National Commission on Labour. The Code on Wages, 2019, passed in both the Houses of Parliament, is expected to bring greater formalisation of the labour market and safeguard interests of workers, while facilitating employment creation and ease of doing business. | Table: II.1.10: Sector and Area-wise Type of Workforce | | (Percentage Share in respective Employment Category) | | Sectors | Rural | Urban | Rural+ Urban | | Self employed | Regular /Salaried | Casual | Self employed | Regular/ Salaried | Casual | Self employed | Regular/ Salaried | Casual | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | | Agriculture | 73.9 | 4.7 | 49.9 | 10.5 | 0.5 | 9.3 | 60.4 | 2.1 | 43.6 | | Mining & Quarrying | 0.1 | 1.1 | 0.8 | 0.1 | 0.8 | 0.4 | 0.1 | 0.9 | 0.6 | | Manufacturing | 6.5 | 20.0 | 4.7 | 22.8 | 23.6 | 17.1 | 10.0 | 22.2 | 6.7 | | Electricity & Water Supply | 0.1 | 1.8 | 0.1 | 0.7 | 1.7 | 0.2 | 0.2 | 1.9 | 0.1 | | Construction | 1.9 | 3.2 | 40.0 | 4.7 | 2.5 | 51.7 | 2.5 | 2.8 | 42.0 | | Trade, Hotel & Restaurant | 10.9 | 13.3 | 1.0 | 34.6 | 17.9 | 7.6 | 16.0 | 16.1 | 1.7 | | Transport, Storage & Communication | 3.0 | 12.7 | 2.3 | 12.3 | 9.8 | 8.1 | 4.9 | 10.7 | 3.3 | | Other Services | 3.5 | 43.3 | 1.2 | 14.3 | 43.2 | 5.6 | 5.8 | 43.3 | 1.9 | | Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | | Source: RBI staff calculations. | II.I.43 A package of measures was announced in May 2020 under Atmanirbhar Bharat Abhiyan in five tranches cover, among others, rural employment generation, infrastructure, MSMEs, NBFCs, migrant workers and ease of doing business. These measures aggregate around ₹20 lakh crore or 10 per cent of GDP and aim to address the difficulties faced by various categories including MSMEs, NBFCs, power distribution companies and infrastructure projects. The measures, both short-term and long-term in nature, also endeavour to make India self-reliant by boosting private participation in numerous sectors with global quality and competitiveness. The growth of India’s personal protective equipment (PPE) sector from scratch before March 2020 to making 1,50,000 pieces a day by beginning of May 2020 shows the potential of India in meeting the challenges. II.I.44 MSMEs which are badly hit by the pandemic are expected to benefit from various policies of the government such as collateral free loan of ₹3 lakh crore, subordinate debt provision of ₹20,000 crore and equity infusion via mother-fund-daughter fund model. Further, the change in definition of classification of MSMEs by including turnover as basis of definition will allow MSMEs to expand without losing benefits and also improve ease of doing business by aligning them with GST. The structural reforms introduced as part of fourth tranche of stimulus is expected to bring in private investments across eight critical sectors9. The proposed change in public sector enterprise policy, where all sectors will be opened to private sectors, and public-sector enterprises will operate only in notified strategic sectors, will bring in far-reaching changes in India’s industrial sector. The Atmanirbhar Bharat Abhiyan Package aims to provide immediate relief to sections of the economy most impacted by the pandemic and to revive economic activity along with creating new opportunities for employment and growth. In the manufacturing sector, 100 per cent FDI in contract manufacturing and commercial coal mining through the automatic route is expected to bring in more private investments. II.1.45 To sum up, consumption demand slumped during 2019-20. Gross fixed capital formation could not sustain its past momentum and contracted. On the supply side, agriculture and allied activities accelerated with record foodgrains and horticulture production supported by allied activities, which remained robust. Industrial sector activity plummeted during 2019-20, driven down mostly by the manufacturing sub-sector. With services sector growth also decelerating, the outlook for the economy is clouded by uncertainty and testing challenges, mainly the intensity, spread and duration of COVID-19. The priority is to revive growth as the Indian economy heals from the scars of COVID-19. II.2 PRICE SITUATION II.2.1 The global inflation environment remained benign through 2019 and the early part of 2020, engendered by soft commodity prices and massive monetary policy accommodation. In India too, headline inflation10 was benign in the first half of 2019-20, but firmed up in the second half due to a sharp spike in food inflation on a combination of adverse developments, i.e., the late withdrawal of the monsoon, unseasonal rains and supply disruptions. During December 2019-February 2020, headline inflation breached the upper tolerance band for inflation mandated for the monetary policy committee (MPC) [Chart II.2.1]. II.2.2 In the event, annual average inflation crossed 4 per cent for the first time since the adoption of flexible inflation targeting (FIT) framework in 2016, amidst accentuated volatility (Table II.2.1). The intra-year distribution of inflation also had a high positive skew, reflecting the spikes in food inflation during the second half of the year. Furthermore, kurtosis turned slightly less negative than it was a year ago, suggesting a few instances of large deviations from mean inflation, which was also reflected in the wide gap between maximum and minimum inflation during the year.

| Table II.2.1: Headline Inflation – Key Summary Statistics | | (Per cent) | | | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | Mean | 10.0 | 9.4 | 5.8 | 4.9 | 4.5 | 3.6 | 3.4 | 4.8 | | Standard Deviation | 0.5 | 1.3 | 1.5 | 0.7 | 1.0 | 1.2 | 1.1 | 1.8 | | Skewness | 0.2 | -0.2 | -0.1 | -0.9 | 0.2 | -0.2 | 0.1 | 0.5 | | Kurtosis | -0.2 | -0.5 | -1.0 | -0.1 | -1.6 | -1.0 | -1.5 | -1.4 | | Median | 10.1 | 9.5 | 5.5 | 5.0 | 4.3 | 3.4 | 3.5 | 4.3 | | Maximum | 10.9 | 11.5 | 7.9 | 5.7 | 6.1 | 5.2 | 4.9 | 7.6 | | Minimum | 9.3 | 7.3 | 3.3 | 3.7 | 3.2 | 1.5 | 2.0 | 3.0 | Note: Skewness and Kurtosis are unit-free.

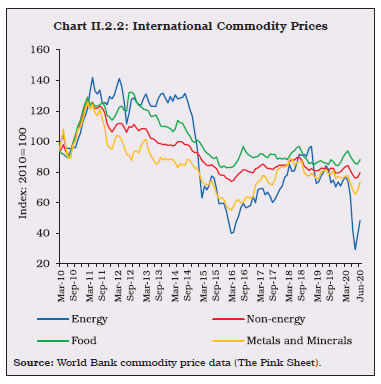

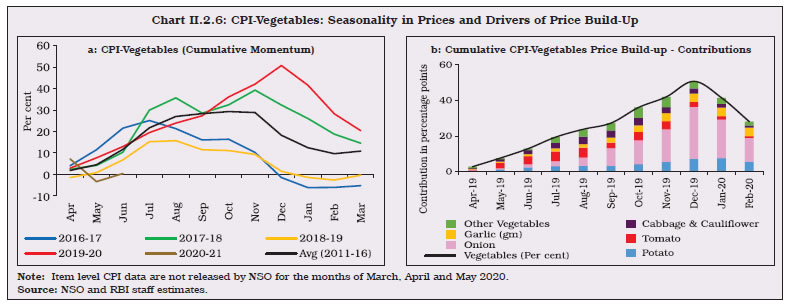

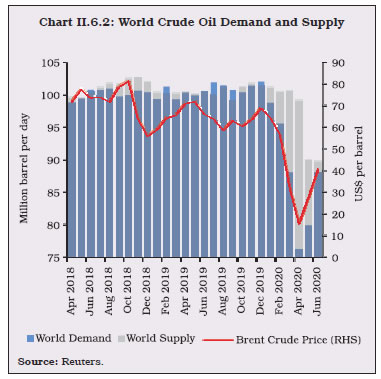

Source: NSO and RBI staff estimates. | II.2.3 Against this backdrop, sub-section 2 assesses developments in global commodity prices and inflation. Sub-section 3 discusses movements in headline inflation and major turning points, followed by a detailed analysis of the major constituents of inflation in sub-section 4. Sub-section 5 discusses other indicators of prices and costs, followed by concluding observations. 2. Global Inflation Developments II.2.4 International food prices were range-bound during H1:2019-20, but they firmed up from October 2019, primarily led by wheat (due to strong international demand), maize (supply uncertainty in the US and Argentina), palm oil (lower supply and rising demand for biodiesel in producing countries), meat (demand from China) and fish prices (Chart II.2.2). Beginning December 2019, prices of rice (drought conditions in Thailand), sugar (lower than expected world production) and other edible oils also hardened. In the non-food category, metal prices remained weak due to US-China trade tensions and subdued global demand. Prices of precious metals, however, registered a sharp increase on safe haven demand amidst global uncertainties. Crude oil prices generally declined during May-August 2019, despite production cuts by the organisation of the petroleum exporting countries (OPEC) and ongoing geopolitical tensions. A supply disruption in Saudi Arabia in September 2019 caused prices to increase temporarily before falling in October 2019. Prices picked up during November-December 2019 on hopes of positive US-China trade talks and deepening of production cuts by OPEC+ from 1.2 million barrels per day (mbpd) to 1.7 mbpd. In January 2020, however, the COVID-19 pandemic hit the transportation sector, which accounts for more than 60 per cent of oil demand. This led to a fall in crude oil prices during January-February 2020 to a level of US$ 5311 per barrel in February 2020. Subsequently, crude oil prices plunged even lower to US$ 32.2 per barrel in March 2020 as the OPEC+ failed to reach an agreement on production cuts. The price of the Indian basket of crude oil touched US$ 33.4 per barrel in March 2020, the lowest since February 2016. As the COVID-19 pandemic spread across the globe, all commodity prices dipped. The shutdown of industries in China in February 2020 and later in Europe and the US led to a fall in demand for metals, easing their prices. Prices of food items like palm oil, soy oil, sugar and corn also declined with retrenchment in demand for ethanol and bio-diesel as crude oil prices declined. Prices of some food items like rice and wheat were, however, supported by stockpiling by consumers in regions affected by COVID-19. Despite OPEC+ reaching an agreement to cut oil production by about 10 mbpd (about 10 per cent of global supply) in early April, crude oil prices continued to fall on COVID-19 induced slump in demand and exhaustion of storage capacity. Brent crude oil prices fell to a low of US$ 23.3 per barrel in April 2020. Subsequently, crude prices did recover to around US$ 42.8 per barrel in July 2020, but remained far below pre-COVID-19 levels.  II.2.5 Reflecting these global commodity price developments and weak demand conditions, consumer price inflation remained benign during 2019 and early 2020 in a number of economies. Core consumer price inflation was low in advanced economies (AEs), despite robust job growth. Many emerging market and developing economies (EMDEs) also experienced easing of inflation due to subdued economic activity, although some pressures from rising food prices were visible. With the outbreak of COVID-19 and consequential lockdown bringing global economic activity to near standstill, many economies resorted to monetary and fiscal measures to ward off recessionary tendencies and provide support to growth. 3. Inflation in India II.2.6 After trending below the target of 4 per cent during the first half of 2019-20, headline inflation spiked during the second half and reached a multi-year peak of 7.6 per cent in January 2020 (highest in 68 months) [Chart II.2.3]. An atypically prolonged south west monsoon (SWM) along with unseasonal rains during the kharif harvest period led to crop damages and supply disruptions which pushed up food prices, especially those of vegetables, from September to December 2019. Thereafter, with the fading of these pressures and encouraging prospects for the rabi crop, food inflation started easing from January 2020. II.2.7 Fuel prices recorded five consecutive months of deflation during July-November 2019, before bouncing back during December 2019-March 2020 on the pressures from international prices of LPG and kerosene. Inflation excluding food and fuel remained generally moderate during the year, with a historic low in October 2019, before gradually picking up again till January 2020. II.2.8 For the year as a whole, inflation picked up to average 4.8 per cent in 2019-20, 136 basis points (bps) higher than a year ago (Appendix Table 4). With the uptick in headline inflation from September 2019, households’ median inflation expectations hardened during the second half of 2019-20 by 103 bps three months ahead and by 133 bps a year ahead. This upturn in expectations is also corroborated by more forward-looking assessments of professional forecasters and by surveys of consumer confidence. 4. Constituents of CPI Inflation II.2.9 Constituents of CPI headline inflation exhibited distinct shifts during 2019-20 (Chart II.2.4). During the first half of the year, food inflation trailed below headline inflation, whereas inflation excluding food and fuel ruled above it. The dynamics reversed during the second half, with food inflation remaining significantly above the headline and inflation excluding food and fuel pacing below it. Inflation in fuel prices had eased below headline inflation from February 2019 to February 2020, but rose above it in March 2020. Food II.2.10 Inflation in prices of food and beverages (weight: 45.9 per cent in CPI) leaped from 1.4 per cent in April 2019 to 12.2 per cent in December 2019. Consequently, its contribution to overall inflation surged to 57.8 per cent in 2019-20 from 9.6 per cent a year ago. The delay in the onset of the southwest monsoon (SWM) by around a week, followed by a considerably longer delay in withdrawal (by 39 days), led to the persistence of high momentum in food prices. Additionally, cyclonic storms and unseasonal rains resulted in supply disruptions and damage to kharif crops, primarily vegetables and pulses, during December-January 2019-20 (Chart II.2.5). Price pressures soon became broad-based and were also observed across items such as cereals, milk, eggs, meat and fish, and spices. The delayed winter easing of vegetables prices brought some relief during January-March 2020. II.2.11 Drilling down into specific pressure points, prices of vegetables (weight: 13 per cent in CPI-Food and beverages) shaped the overall food inflation trajectory during 2019-20. Excluding vegetables, food inflation would have averaged 236 bps lower in 2019-20 (6.0 per cent including vegetables). The crop damage, mentioned earlier, resulted in a historically high build-up of momentum; consequently, vegetables price inflation rose to an all-time high of 60.5 per cent in December 2019 (Chart II.2.6a). II.2.12 Within vegetables, onion prices dominated the build-up in upside pressures (Chart II.2.6b) right from June 2019 in the wake of a slump in mandi arrivals due to reduced rabi onion acreage in Maharashtra in drought-like conditions. In addition, unseasonal rains during September-October 2019 damaged the kharif onion crop in major producing states of Maharashtra, Madhya Pradesh, Karnataka and Andhra Pradesh, escalating prices from September 2019.

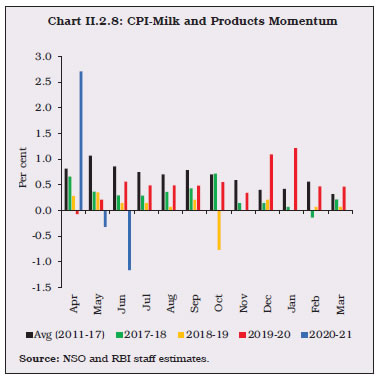

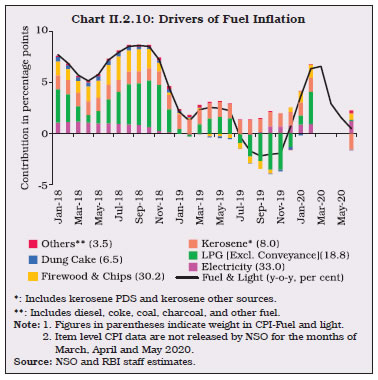

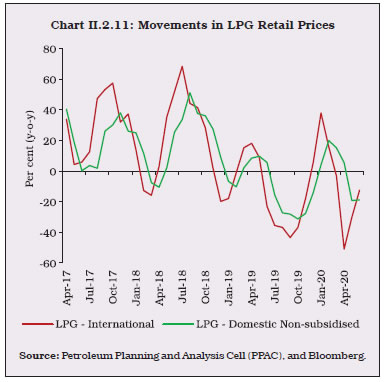

Furthermore, the rains also impacted the transplantation of the late kharif onion crop. Onion price inflation skyrocketed to 327.4 per cent in December 2019. Supply side measures, including imposing a minimum export price (MEP) of US$ 850 per tonne, banning export of onions, imposing stock holding limits on wholesale traders and retailers in September 2019, and announcement of import of 1.2 lakh tonnes of onions from Turkey, Afghanistan and Egypt during November-December 2019 did not, however, fully alleviate price pressures. With the arrival of the delayed kharif crop and on the back of a better rabi crop, which boosted the production of onions, as per the 2nd Advance Estimates (AE) of the Ministry of Agriculture, onion prices started easing from January 2020. II.2.13 Potato prices also picked up throughout the year (barring September 2019 and February 2020), primarily due to untimely and excess rains, which damaged crops ready for harvest and disrupted supplies to mandis. Consequently, potato price inflation reached an all-time high of 63 per cent in January 2020, after emerging out of 7 months of continuous deflation in November 2019. In the case of tomato prices, inflation peaked at 70 per cent in May 2019 and remained in high double digits till December 2019, due to delayed harvesting in Maharashtra and fungus-damaged crops in Karnataka, coupled with the supply disruptions referred to earlier in key supplier states – Karnataka, Maharashtra and Himachal Pradesh. Tomato prices, however, moderated during November 2019 - February 2020, in line with the usual seasonal pattern. II.2.14 Prices of cereals and products (weight of 21 per cent in the CPI-Food and beverages) also witnessed a build-up in upside pressures during 2019-20 (Chart II.2.7), rising almost continuously from 1.2 per cent in April 2019 to around 5.3 per cent during January-March 2020. In the case of wheat, inflation averaged around 6.5 per cent during the year, capped by higher procurement which also economised on imports (31.4 per cent lower in 2019-20). Non-PDS rice prices emerged out of 11 months of deflation in October 2019 on account of positive price pressures and unfavourable base effects to reach an inflation level of 4.2 per cent in January 2020, in the wake of higher procurement and damages to the kharif crop, but they moderated to 3.9 per cent in February 2020.  II.2.15 Milk and products prices (weight of 14.4 per cent in the CPI-Food and beverages) were another pressure point during the year (Chart II.2.8). Increase in procurement prices of milk led to major milk co-operatives like Amul and Mother Dairy raising retail milk prices by ₹2-3 per litre twice – during May and again in December 2019. This was followed by similar hikes by milk co-operatives in other states, elevating the momentum of milk and products prices during the year. Increases in the cost of production because of reduced availability of fodder also contributed to an upward revision in procurement prices and, subsequently, in retail prices. Higher global prices for skimmed milk products also supported milk prices. Milk price inflation peaked during the year at 6.5 per cent in March 2020.  II.2.16 In the case of pulses (weight: 5.2 per cent in CPI-Food and beverages), 2019-20 began with the end of a prolonged deflation of 29 months in May 2019. Ahead of this development, a substantial fall (by 54 per cent) in imports during 2018-19 had helped in rebalancing the demand-supply situation. Additionally, a decline in kharif pulses production (by 4.6 per cent as per 4th Advance Estimates for 2019-20 over 2018-19 Final Estimates), especially urad production (by 44.9 per cent), added to inflation persistence (Chart II.2.9), despite imports being higher by around 14.6 per cent during 2019-20. II.2.17 Inflation in protein-rich items such as eggs and meat and fish (weight: 8.8 per cent in CPI-Food and beverages) averaged 4.5 per cent and 9.3 per cent, respectively – the highest in the last six years – and together, they contributed 13.7 per cent of overall food inflation during the year. Meat and fish prices reflected higher feed prices, especially of maize and soybean. Along similar lines, egg prices witnessed heightened prices during September-January 2019-20. With the outbreak and spread of COVID-19, however, the consumption of poultry slumped and prices moderated during February-March 2020. II.2.18 Among other major food items, sugar and confectionery, and oils and fats also contributed positively to overall food inflation, reflecting a decline in domestic production in the case of the former and higher international prices in respect of the latter. II.2.19 Prices of fruits (weight of 6.3 per cent in the CPI-food and beverages group) emerged out of nine months of deflation in September 2019 but prices generally remained soft in the rest of the year. Prices of spices, especially of dry chillies and turmeric, registered significant pressures due to a reduction in the area under production. Fuel II.2.20 The contribution of the fuel group (weight of 6.8 per cent in CPI) to headline inflation decreased to 1.9 per cent in 2019-20 from 11.3 per cent in the previous year. Fuel inflation eased sequentially from April to June 2019 and moved into deflation during July-November 2019, pulled down by favourable base effects and muted price pressures in major fuel items (Chart II.2.10). Domestic LPG prices, which rose during April-June 2019, sank into deflation in July 2019, tracking the collapse in international LPG prices with a lag (Chart II.2.11). Firewood and chips inflation picked up during December 2019 to February 2020 on the back of strong price pressures on winter demand. Domestic LPG prices also moved out of deflation in January 2020, in line with the upward movement in international LPG prices. Administered kerosene prices continued to rise throughout 2019-20 as oil marketing companies (OMCs) raised prices in a calibrated manner to eventually phase out the kerosene subsidy. Electricity inflation, which had largely remained in negative territory during April-August 2019, also recorded an uptick in H2:2019-20. Reflecting these developments and strong unfavourable base effects, fuel inflation turned positive in December 2019 and reached an intra-year peak of 6.6 per cent in March 2020.

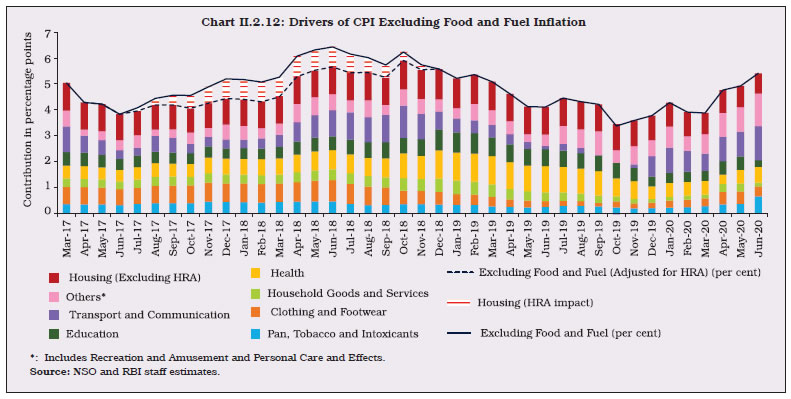

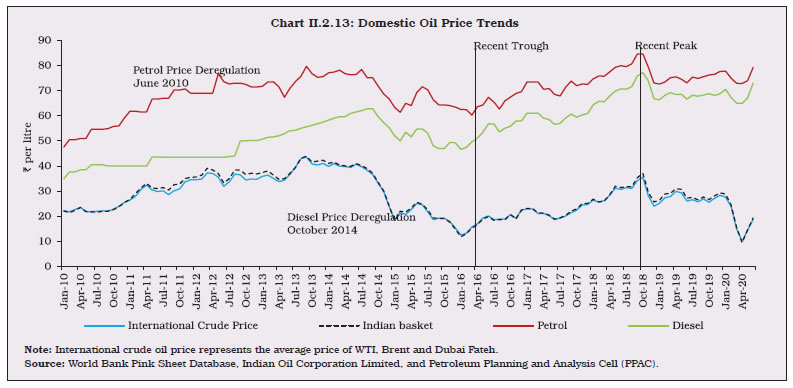

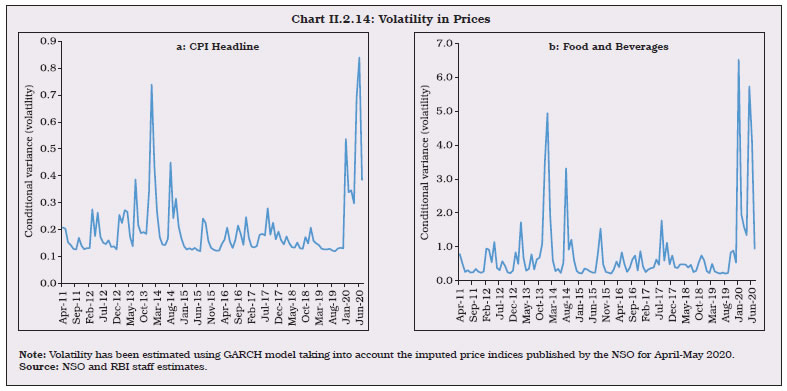

Inflation Excluding Food and Fuel II.2.21 Inflation excluding food and fuel moderated from 2018-19 levels to an average of 4.0 per cent in 2019-20 (Appendix Table 4) with a historic low of 3.4 per cent in October 2019 (Chart II.2.12). Some hardening occurred during November 2019-January 2020 due to prices of personal care and effects and transport and communication sub-groups, reflecting increase in gold prices, hikes in mobile telecom tariffs, and the rise in petrol and diesel prices (Chart II.2.13). Subsequently, a sharp fall in transport and communication prices in February and March 2020 on the back of easing international crude oil prices and falling domestic air passenger traffic led to moderation during February-March 2020. II.2.22 Among the major constituents of this group, inflation in prices of the miscellaneous category moderated during April-October 2019 reaching 3.4 per cent in October 2019 (lowest since July 2017) and again during February-March 2020. Within the miscellaneous group, price pressures remained generally contained in respect of household goods and services, health, recreation and amusement, and education. II.2.23 Housing inflation moderated to 4.5 per cent in 2019-20 (6.7 per cent in 2018-19), reflecting the waning of the impact of the increase in house rent allowance (HRA) for central government employees under the 7th Pay Commission award. A historic low of 3.7 per cent was recorded in March 2020. Net of housing, inflation excluding food and fuel averaged 3.9 per cent in 2019-20, down from 5.6 per cent a year ago. II.2.24 Clothing and footwear inflation eased to a trough of 1.0 per cent in September 2019, largely reflecting muted input costs. International prices of cotton, a major input into clothing production, as measured by the Cotton A Index, fell during May to August 2019, followed by a recovery during September 2019-January 2020. The outbreak of COVID-19 also rattled international cotton markets, with the Cotton A Index registering a fall in February and March 2020.

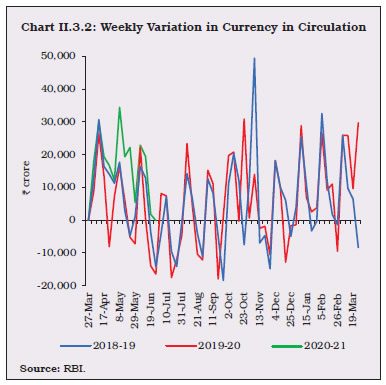

II.2.25 Overall, headline inflation was subjected to higher volatility in 2019-20 relative to the previous four years, underpinned by high flux in food prices (Charts II.2.14a & b). Within the food group, price spikes for different items occurred at different time points. Empirical analysis for the period January 2011 and February 2020 suggests that seasonal behaviour has changed in the case of prices of many food items such as, onions, ginger, brinjals, cauliflowers, okras and green peas. Interestingly, despite being the most volatile item, seasonality in onion prices has declined significantly over the years, partly reflecting improvement in cold storage facilities. Volatility estimated from asymmetric GARCH12 models suggest volatility in onion prices is likely to persist in the near term, while tomato price volatility may be short-lived. Inflation is persistent in the case of protein items and dry fruits, more than that for prices of vegetables. There is no evidence of persistence of volatility in prices of items such as petrol, diesel and precious metals, although these items also contribute to volatility in headline inflation.  5. Other Indicators of Inflation II.2.26 During 2019-20, sectoral CPI inflation based on the consumer price index of industrial workers (CPI-IW) remained elevated and reached 9.6 per cent in December 2019 (highest in 73 months), primarily due to housing and food prices. With the impact of HRA revision of the 7th central pay commission (CPC) completely waning in January 2020 and food prices easing along with favourable base effects, CPI-IW inflation softened to 5.5 per cent in March 2020. Inflation based on the consumer price index of agricultural labourers (CPI-AL) and the consumer price index of rural labourers (CPI-RL), which do not have housing components, also increased during the year and reached 11.1 per cent and 10.6 per cent, respectively, in December 2019 (highest in 72 months) before easing thereafter, on softening of food prices and favourable base effects. II.2.27 Inflation, measured by the wholesale price index (WPI), remained subdued during 2019-20. It reached an intra-year low of zero per cent in October 2019 (lowest in 40 months) due to deflation in prices of non-food manufactured products and fuel and power. It picked up during November 2019-January 2020, however, driven by a sharp uptick in prices of primary articles and unfavourable base effects, before moderating to 0.4 per cent in March 2020 due to softening in the prices of all three major groups, i.e., primary articles, fuel & power and manufactured products. On an annual average basis, WPI inflation softened to 1.7 per cent in 2019-20 from 4.3 per cent in 2018-19. A similar easing was also visible in the GDP deflator to 2.9 per cent in 2019-20 from 4.6 per cent in 2018-19. II.2.28 After major increases in minimum support prices (MSPs) during 2018-19 for kharif and rabi crops, MSPs witnessed a moderate hike in 2019-20. The extent of MSP increases varied across crops, ranging from 1.1 per cent in the case of moong and nigerseed to 9.1 per cent for yellow soybean. MSPs of rice and wheat were increased by 3.7 per cent and 4.6 per cent, respectively. II.2.29 Wage growth for agricultural and non-agricultural labourers generally remained subdued during the year, averaging around 3.4 per cent, and reflecting the slowdown in the construction sector. In the corporate sector, pressures from staff costs remained moderate during the year. II.2.30 In sum, headline inflation picked up strongly during the closing months of 2019-20 and the short-term outlook for food inflation has turned uncertain. Global crude oil prices have started firming modestly in more recent weeks. Disruptions in food and manufactured items’ supply chains could amplify sectoral price pressures, thus posing an upside risk to headline inflation. Heightened volatility in financial markets could also have a bearing on inflation. All of these may influence inflation expectations of households, which are adaptive in nature, and show significant sensitivity to shocks to food and fuel prices. Monetary policy, therefore, has to keep a constant vigil on price movements, especially as they can translate into generalised inflation. II.3 MONEY AND CREDIT II.3.1 Monetary and credit conditions moderated through 2019-20 reflecting the weakening of underlying economic activity, with inflation remaining benign in the first half of the year before spiking on food price pressures in the later months. The rate of money supply (M3) slackened as deposit growth moderated. Towards the close of the year, the slowing of deposit growth became accentuated as COVID-19 impelled a flight to cash. In terms of the sources of money supply, credit growth slumped to half its rate a year ago, reflecting weak demand and risk aversion among banks. Contra-cyclically, reserve money (RM) expansion, adjusted for first round effects of cash reserve ratio (CRR) changes, was broadly maintained at the preceding year’s rate, bolstered by a build-up of net foreign assets (NFA) of the Reserve Bank and its monetary policy operations in consonance with the accommodative policy stance adopted since June 2019 – open market purchases; reduction in the CRR; special market operations (in the form of long-term repo operations and targeted long-term repo operations); and USD/INR swaps. These developments engendered abundant liquidity in the system which eased liquidity premia in the midst of strong discrimination by financial markets on credit risk concerns. II.3.2 Against this backdrop, sub-section 2 delves into the dynamics underlying movements in RM and, thereby, into the role of the Reserve Bank’s balance sheet in the larger context of the state of the economy. This section also analyses the impact of COVID-19 on currency in circulation. Sub-section 3 examines developments in money supply in terms of its components and sources, throwing light on the behaviour of assets and liabilities of the banking sector. The underpinnings of bank credit evolution during the year have been covered in sub-section 4. This is followed by concluding observations and some policy perspectives. 2. Reserve Money II.3.3 Reserve money – a stylised depiction of the Reserve Bank’s balance sheet that focuses on its ‘moneyness’13 comprising currency in circulation, bankers’ deposits and other deposits with the Reserve Bank – increased by 9.4 per cent in 2019-20, lower than 14.5 per cent a year ago as well as its decennial trend rate of 11.4 per cent (2010-19) [Chart II.3.1; Appendix Table 4]. Adjusted for the reduction in the CRR by 100 basis points (bps), effective March 28, 2020 – which reduced RM statistically by around ₹1,37,000 crore – RM grew by 13.7 per cent during the year, as against 13.9 per cent in 2018-19. II.3.4 Drilling into the unravelling of reserve money changes during the year reveals interesting behavioural shifts. Among components, the expansion in RM was driven by currency in circulation (CiC) – 120 per cent of the RM expansion during the year. At the end of March 2020, CiC constituted around 81 per cent of RM. II.3.5 The demand for CiC normally follows a defined intra-month pattern – expansion during the first fortnight due to transactions by households, followed by a contraction in the second fortnight due to flow back of currency from households to the banking system (Chart II.3.2). II.3.6 CiC also exhibits seasonality across months/quarters – expanding in Q1, followed by contraction in Q2, with more than three-fourths of its annual variation occurring during Q3 and Q4. The year 2019-20 began with the usual seasonal spurt in currency demand in Q1 associated with summer holidays, weddings, rabi procurement and kharif sowing. In the following quarter, CiC contracted due to seasonal slack of economic activity in cash-intensive sectors such as construction and agriculture. Thereafter, CiC expanded, reflecting rise in currency demand for kharif harvest and festivals in Q3 and the harvest of rabi crops during Q4. The year ended with a surge in pandemic-related rush to cash. Overall, CiC growth of 14.5 per cent was slightly lower vis-a-vis 16.8 per cent a year ago (Chart II.3.3); however, the currency-GDP ratio increased to its pre-demonetisation level of 12.0 per cent in 2019-20 from 11.3 per cent a year ago, indicating the rise in cash-intensity in the economy in response to the pandemic (Chart II.3.4).  II.3.7 There was an unusual rise in month-over-month (M-o-M) CiC variation during March-June 2020 vis-à-vis the corresponding period in previous years14 (Chart II.3.5 and Chart II.3.6).

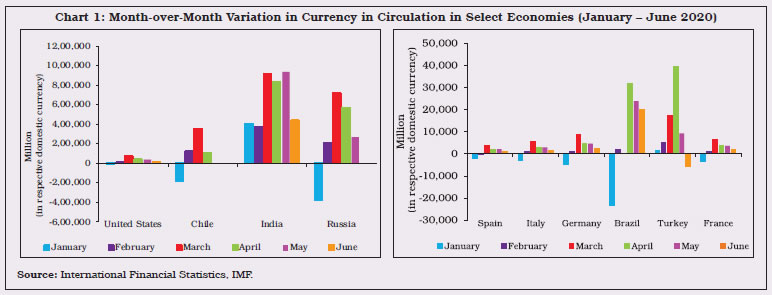

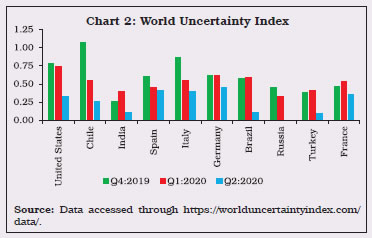

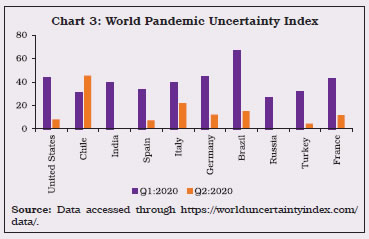

II.3.8 Bankers’ deposits with the Reserve Bank decreased by 9.6 per cent in 2019-20 as against an increase of 6.4 per cent in the previous year, mirroring subdued deposit mobilisation and the reduction in CRR to 3.0 per cent for a period of a year, effective March 28, 2020 (Chart II.3.7).

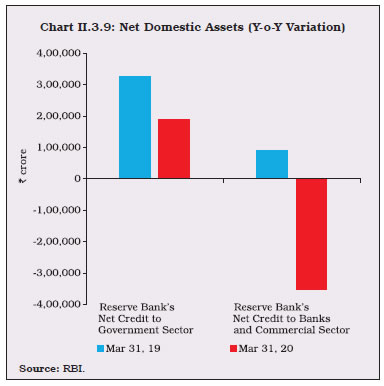

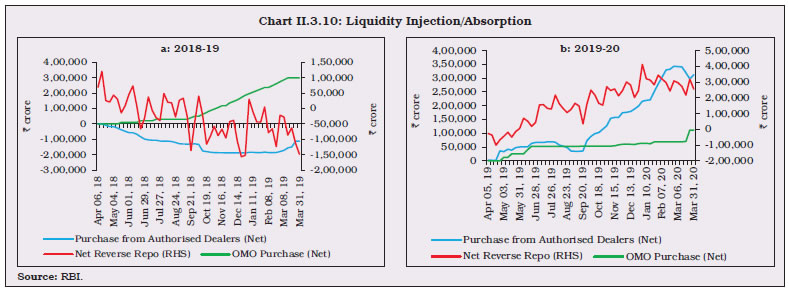

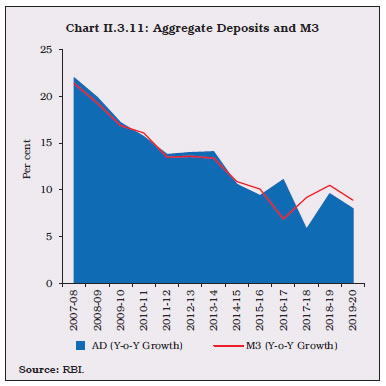

II.3.9 Amongst sources of RM, net domestic assets (NDA) and NFA have alternated in determining RM growth (Chart II.3.8). During 2019-20, the main driver was NFA, with net purchases from Authorised Dealers at ₹3,12,005 crore vis-à-vis net sales at ₹1,11,945 crore in the previous year. Consistent with the accommodative stance of monetary policy set out in June 2019, the Reserve Bank ensured comfortable liquidity conditions, augmenting its liquidity management toolkit with unconventional instruments. II.3.10 Net open market purchases of ₹1.1 lakh crore resulted in an increase in net Reserve Bank credit to the government by ₹1.9 lakh crore, which became the main driver of NDA in 2019-20. Among other constituents of NDA, net claims on banks15 and the commercial sector (mainly PDs), reflected mainly net LAF absorption aimed at sterilising forex operations and managing the large overhang of liquidity in the system (Chart II.3.9). II.3.11 The net LAF position was in repo mode during April-May 2019, but turned into reverse repo mode for the remainder of the financial year (Chart II.3.10a and Chart II.3.10b). 3. Money Supply II.3.12 M3, comprising currency with the public (CwP), aggregate deposits (AD) and other deposits with the Reserve Bank, averaged 10.2 per cent for the first three quarters of 2019-20 (10.1 per cent a year ago), before dropping off sharply in February and March 2020 to end the year at 8.9 per cent (Chart II.3.11). II.3.13 From the components side, M3 expansion was contributed by AD, its largest constituent (86 per cent), led mainly by time deposits – AD accounted for 78 per cent of the increase in M3 during the year. On a year-on-year basis, however, there was a moderation in time deposit growth due to the decline in interest rates and the general slowdown in economic activity (Chart II.3.12). As usual, demand deposits remained volatile, mirroring largely the variations in CwP (Chart II.3.13), which grew at a lower rate of 14.5 per cent vis-à-vis 16.6 per cent in the previous year. The flight towards cash and a concomitant drawdown on demand deposits was particularly visible in the last quarter of 2019-20, in the wake of uncertainities related to COVID-19 pandemic.

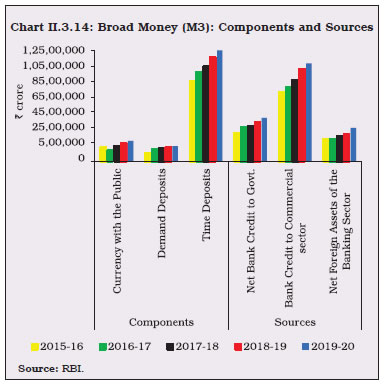

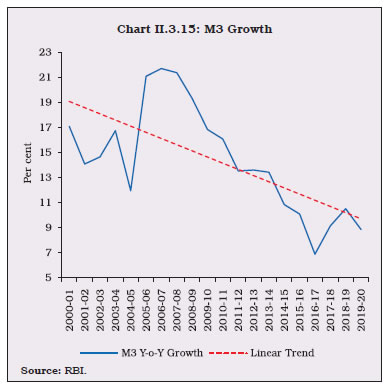

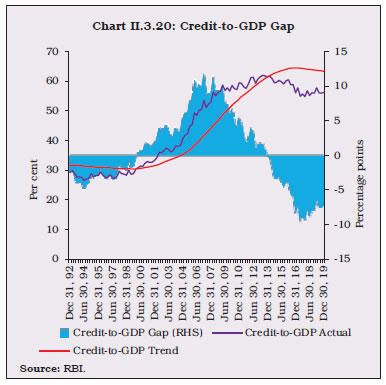

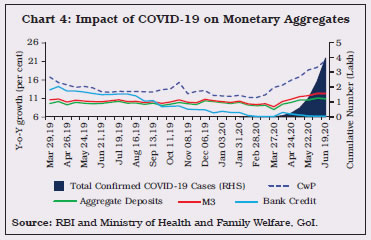

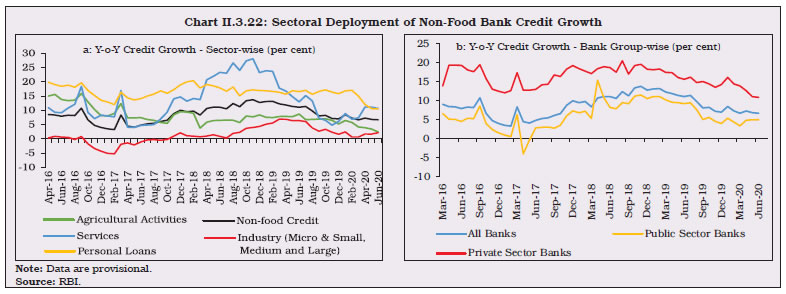

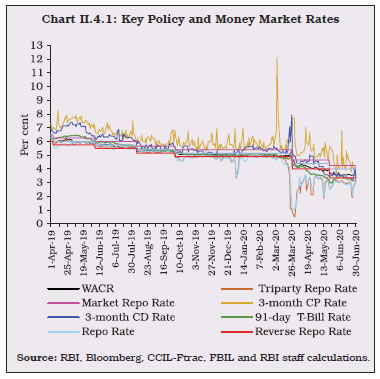

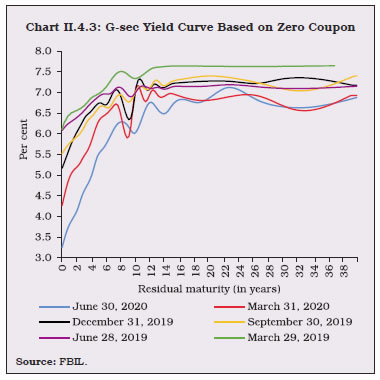

II.3.14 Bank credit to the commercial sector, followed by net bank credit to the government and net foreign exchange assets of the banking sector, led the expansion in M3. Nonetheless, bank credit to the commercial sector grew at a lower rate than a year ago, reflecting lower bank credit offtake in the economy (Chart II.3.14 and Table II.3.1). With non-SLR investments of banks also decelerating, commercial banks augmented their SLR portfolios, which was reflected in net bank credit to government increasing by 11.8 per cent as compared with 9.7 per cent a year ago. Growth of NFA of the banking sector mirrored NFA in RM.

Key Monetary Ratios II.3.15 The money multiplier declined to 5.5 by end-March 2020 from 5.6 a year ago, converging towards its decennial average level (2010-19) of 5.5. Adjusted for reverse repo, however, analytically akin to banks’ deposits with the central bank – the money multiplier turned out to be lower at 4.8 by end-March 2020, reflecting the deceleration in the rate of money supply below its secular trend (Chart II.3.15).

| Table II.3.1: Monetary Aggregates | | Item | Outstanding as on March 31, 2020

(₹ Crore) | Year-on-year growth rate

(in per cent) | | 2018-19 | 2019-20 | 2020-21

(as on June 19, 2020) | | 1 | 2 | 3 | 4 | 5 | | I. Reserve Money (RM) | 30,29,674 | 14.5 | 9.4 | 11.8 | | II. Money Supply (M3) | 167,99,930 | 10.5 | 8.9 | 12.3 | | III. Major Components of M3 | | | | | | III.1. Currency with the Public | 23,49,715 | 16.6 | 14.5 | 21.3 | | III.2. Aggregate Deposits | 144,11,708 | 9.6 | 8.0 | 10.9 | | IV. Major Sources of M3 | | | | | | IV.1. Net Bank Credit to Government | 49,06,583 | 9.7 | 11.8 | 19.8 | | IV.2. Bank credit to Commercial Sector | 110,38,644 | 12.7 | 6.3 | 6.3 | | IV.3. Net Foreign Assets of the Banking Sector | 38,01,036 | 5.1 | 23.8 | 27.4 | | V. M3 net of FCNR(B) | 166,18,480 | 10.5 | 8.8 | 12.5 | | VI. Money Multiplier | 5.5 | | | | Note: 1. Data are provisional.

2. The data for RM pertain to June 26, 2020.

Source: RBI. |

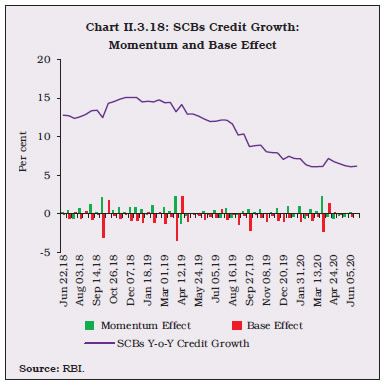

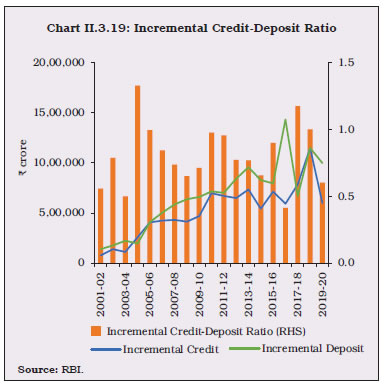

II.3.16 Linking this phenomenon of money creation process to the dynamics of economic activity, empirical analysis16 considering data from Q1:2010 to Q4:2019 suggests that the money multiplier adjusted for reverse repo could be a lead indicator for gauging the movement of economic activity. Also, the money multiplier adjusted for reverse repo appears to be a better indicator, capturing the recent dynamics of economic activity more closely than the unadjusted money multiplier. II.3.17 The currency-deposit ratio at 16.3 per cent at end-March 2020 moved above its decennial average (2010-19) of 15.1 per cent. During the year, the pace of expansion in currency and a rise of the currency-deposit ratio pointed to a shift in public’s preference towards holding cash in response to the uncertainty caused by the pandemic. As at end-March 2020, the reserve-deposit ratio was 3.8 per cent (4.5 per cent last year), reflecting the impact of the CRR reduction (Chart II.3.16). II.3.18 With the statutory requirements for CRR and statutory liquidity ratio (SLR), at 3 per cent and 18 per cent, respectively, around 79 per cent of deposits were available with the banking system as on end-March 2020 for credit expansion. The moderation in the credit-deposit ratio to 76.4 per cent as at end-March 2020 from 77.7 per cent a year ago was largely a reflection of subdued demand conditions in the economy due to several factors examined subsequently. II.3.19 The credit-deposit ratio, which measures the demand for credit relative to funding available in the banking system, underwent four distinct phases since independence. It varied with the evolution of the economy – from the pre-nationalisation phase to the post-nationalisation phase, and subsequently, the reform phase starting from early 1990s followed by movements dictated by upturns and downturns in growth cycles. These movements also reflected changes in statutory requirements for CRR and SLR. The average credit-deposit ratio of 72 per cent during the first two post-independence decades fell to 69 per cent during the next two decades as deposit growth gained momentum with the geographic spread of banking services, and further to 55 per cent during 1990-2004 due to phases of subdued credit demand. Subsequently, the average credit-deposit ratio increased to 75 per cent during 2005-20 on the back of a credit boom (2005-14), and supportive economic growth conditions (Chart II.3.17). 4. Credit II.3.20 Credit offtake from SCBs was muted during 2019-20, growing at 6.1 per cent y-o-y in a sharp loss of pace from 13.3 per cent a year ago and from a recent peak of 15.0 per cent in December 2018. II.3.21 Credit demand has been ebbing away across all sectors, despite the post-IL&FS shift among large borrowers, including non-banking financial companies (NBFCs) and housing finance companies (HFCs), away from non-bank sources and towards the banking system for meeting funding requirements. The unabated weakening of economic activity, coupled with deleveraging of corporate balance sheets and risk aversion by banks due to asset quality concerns, was accentuated towards the close of the year by the pandemic woes (Chart II.3.18), producing a reduction in the incremental credit-deposit ratio (Chart II.3.19). The credit-to-GDP gap remained wide during 2019, reflecting the slack in credit demand (Chart II.3.20). II.3.22 The COVID-19 outbreak has affected more than 200 countries across the globe, bringing global economic activity to a near standstill, through lockdown and social distancing norms necessary for the safety and health concerns of the human beings. Several fiscal and monetary policy measures were also undertaken in India in sync with other countries to mitigate the macroeconomic impact caused by the pandemic (Annex II). With a nation-wide lockdown and people mostly remaining indoors, amidst fear and uncertainty, the usage of cash witnessed an abnormal rise (Chart II.3.21). The Reserve Bank undertook expansionary monetary policy measures to ensure the availability of adequate liquidity in the system. COVID-19 has imparted scars on monetary and credit aggregates towards the end of the year (Box II.3.1).