In an unsettling global environment following the war in Ukraine, the Indian banking system exhibited resilience with healthier balance sheets and a robust growth in flow of credit to the productive sectors of the economy. Several regulatory and supervisory measures of the Reserve Bank in line with global best practices preserved financial stability. Various measures for enhancing cyber security were undertaken during the year along with a greater focus on the usage of technology and examining the scope for use of Artificial Intelligence (AI) and Machine Learning (ML) tools for strengthening supervisory effectiveness. The Reserve Bank’s advanced supervisory monitoring system (DAKSH) was launched during the year. Consistency in enforcement actions was ensured, nudging the regulated entities to comply with the extant guidelines of the Reserve Bank. With an aim to enhance the consumers’ awareness of their rights and of the existence of alternate grievance redress mechanisms, a month-long intensive nation-wide public awareness programme was launched during the year. VI.1 The financial system in India remained sound and resilient during the year, despite persisting global headwinds that impacted domestic macroeconomic and financial conditions. The chapter discusses regulatory and supervisory measures undertaken during the year to strengthen the financial system and to preserve financial stability. As part of the overall objective of aligning the regulatory/supervisory framework with global best practices, important strides in the areas of risk management, regulatory compliance and enforcement, and consumer education and protection in banks were made during the year. Accordingly, several guidelines were issued during the year, pertaining to classification of Non-Banking Financial Companies (NBFCs) in the middle layer of scale-based regulation (SBR), digital lending, large exposure framework for the upper layer NBFCs under the SBR, review of regulatory framework for Asset Reconstruction Companies (ARCs), establishment of digital banking units (DBUs), and a revised regulatory framework for UCBs. The FinTech Department launched pilots of the digital rupee in phases for wholesale and retail segments. The Department of Supervision (DoS) also initiated a host of measures to further strengthen both onsite and off-site supervision, including developing dynamic supervisory dashboards/early warning indicator model, strengthening cross-border supervisory cooperation, monitoring of large borrower groups, enhancement of cyber security and the launch of advanced supervisory monitoring system (DAKSH), among others. VI.2 In other areas, Consumer Education and Protection Department (CEPD) continued its efforts during the year towards enhancing public awareness on financial literacy and frauds, using technology for strengthening customer protection and grievance redressal mechanisms, and also conducted a customer satisfaction survey on the Reserve Bank - Integrated Ombudsman Scheme (RB-IOS). The Deposit Insurance and Credit Guarantee Corporation (DICGC) launched new initiatives to strengthen the public awareness through the constitution of a Technical Advisory Committee (TAC) to guide the Corporation in its public outreach activities. VI.3 The rest of this chapter is divided into five sections. Section 2 deals with the mandate and functions of the Financial Stability Unit (FSU). Section 3 addresses regulatory measures undertaken by the Department of Regulation (DoR) along with activities of the FinTech Department during the year. Section 4 covers supervisory measures undertaken by the DoS and enforcement actions carried out by the Enforcement Department (EFD) during the year. Section 5 highlights the role played by CEPD and DICGC in protecting consumer interests, spreading awareness and upholding consumer confidence. These departments have also set out their agenda for 2023-24 in respective sections of this chapter. Concluding observations are set out in the last section. 2. FINANCIAL STABILITY UNIT (FSU) VI.4 The mandate of the Financial Stability Unit (FSU) is to monitor risks to financial stability while evaluating the resilience of the financial system by undertaking macroprudential surveillance through systemic stress tests, sensitivity analysis and financial network analysis. It also functions as the secretariat to the sub-committee of the Financial Stability and Development Council (FSDC), an institutional mechanism of regulators for preserving financial stability and monitoring macroprudential regulations for the financial system. The FSU publishes the bi-annual Financial Stability Report (FSR) covering an assessment of the possible risk scenarios and their ramifications for financial stability and an early warning analysis. Agenda for 2022-23 VI.5 The Department had set out the following goals for 2022-23: -

Implementation of the revised stress testing framework and publication of the results in FSR (Utkarsh) [Paragraph VI.6]; -

Carrying out sensitivity analyses covering the impact of house price movements on bank capital (Paragraph VI.7); -

Conduct of macroprudential surveillance (Paragraph VI.8); -

Publication of half-yearly FSRs (Paragraph VI.9); and -

Conduct meetings of the Financial Stability and Development Council – Sub Committee (FSDC-SC) [Paragraph VI.10]. Implementation Status VI.6 The stress testing framework for conducting multi-factor macroprudential stress tests has been revised, and results along with the revised methodology were published in the FSR of June, 2022. VI.7 In order to assess the impact of house prices on bank capital, a sensitivity analysis of the impact of the fall in house prices on the capital of banks was carried out, and results were published in the FSR of June 2022. Also, the methodology for banking stability indicator was revised and published. VI.8 In the FSR of December 2022, a financial system stress indicator was published to enhance macroprudential surveillance. Two rounds of the systemic risk survey were conducted to gather perceptions of experts, market participants and academicians, on major risks faced by the Indian financial system. VI.9 Two editions of the FSR, providing the collective assessment of the Sub-Committee of the FSDC on the balance of risks to financial stability, were released during the year. The 25th issue of the FSR, brought out on June 30, 2022, highlighted the challenges emanating from the unsettling global outlook caused by the war in Ukraine, front-loaded monetary policy normalisation by central banks in response to high inflation that turned out to be non-transitory and multiple waves of the COVID-19 pandemic. The 26th edition of the FSR was released on December 29, 2022 which highlighted concerns over intensification of macro-financial risks. Notwithstanding elevated risk off sentiments, strong macroeconomic fundamentals and healthy balance sheets provided resilience against global shocks. Improved asset quality of banks supported the revival in credit demand. The macro stress tests in both editions of the FSR reaffirmed the capability of scheduled commercial banks (SCBs) to withstand stress even under severe stress scenarios. VI.10 During 2022-23, the FSDC-SC held one meeting. The Sub-Committee discussed major developments in the global and domestic economy as well as in various segments of the financial system. It also deliberated upon various inter-regulatory issues and reviewed the activities of technical groups under its purview and the functioning of state level coordination committees (SLCCs). The members resolved to remain vigilant and proactive to ensure that financial markets and financial institutions remain resilient amidst amplified spillovers arising from the evolving global macroeconomic situation. Agenda for 2023-24 VI.11 In the year ahead, FSU will focus on the following: -

Peer review of stress testing framework; -

Conduct macroprudential surveillance; -

Publish half-yearly FSRs; and -

Conduct meetings of the FSDC-SC. 3. REGULATION OF FINANCIAL INTERMEDIARIES Department of Regulation (DoR) VI.12 The Department of Regulation (DoR) is the nodal Department for regulation of commercial banks, cooperative banks, NBFCs, Credit Information Companies (CICs) and All India Financial Institutions (AIFIs), which also aims at ensuring a healthy and competitive financial system, while promoting cost effective financial inclusion. The regulatory framework is fine-tuned as per the evolving requirements of the Indian economy while adapting to international best practices. Agenda for 2022-23 VI.13 The Department had set out the following goals for 2022-23: -

Convergence with Basel III standards and issuance of final guidelines for computation of capital charge for credit risk, market risk, and operational risk (Paragraph VI.14); -

Issue of a discussion paper on the expected loss approach for provisioning (Paragraph VI.15); -

Issuance of guidelines on securitisation of non-performing assets (Paragraph VI.16); -

Issue of a discussion paper on climate risk and sustainable finance (Paragraph VI.17); -

Issuance of guidelines on prudential and conduct issues associated with digital lending (Paragraph VI.18); -

Issuance of guidelines on financial statements - presentation and disclosure for rural cooperative banks (Paragraph VI.19); -

Issuance of part II of the guidelines on raising capital funds for primary (urban) cooperative banks (Paragraph VI.20); -

Guidance note on principles for sound management of operational risk and principles for operational resilience (Paragraph VI.21); and -

Review of the following guidelines: (a) prudential framework for resolution of stressed assets; (b) restructuring of projects under implementation by aligning it with prudential framework; (c) investment guidelines and financial statements’ formats for urban cooperative banks (UCBs); (d) dividend declaration policy of commercial banks; (e) liquidity management framework for commercial banks and UCBs; (f) capital adequacy framework for small finance banks (SFBs) and payments banks (PBs); (g) instructions on credit and debit cards; (h) instructions on inoperative accounts, centralised hosting of data on inoperative/unclaimed deposit accounts; and (i) recommendations of the Expert Committee on the primary (urban) cooperative banks and taking steps to issue regulatory instructions based on these recommendations (Paragraph VI.22). Implementation Status VI.14 Extensive internal and external consultations regarding convergence with Basel III standards and issuance of final guidelines for computation of capital charge for credit risk, market risk, and operational risk have been made. Draft guidelines on minimum capital requirements for operational risk and market risk under Basel III were issued on December 15, 2021 and February 17, 2023, respectively, for obtaining stakeholder comments thereon. The guidelines on minimum capital requirements for operational risk and market risk after taking into account the public comments along with draft guidelines on credit risk are being finalised. VI.15 As announced in the Statement on Developmental and Regulatory Policies (September 30, 2022), a discussion paper (DP) on Introduction of Expected Credit Loss Framework for Provisioning by Banks was released on January 16, 2023 inviting comments from the stakeholders. VI.16 As announced in the Statement on Developmental and Regulatory Policies (September 30, 2022), a discussion paper on Securitisation of Stressed Assets Framework was released on January 25, 2023 inviting comments from the stakeholders (Box VI.1). Box VI.1

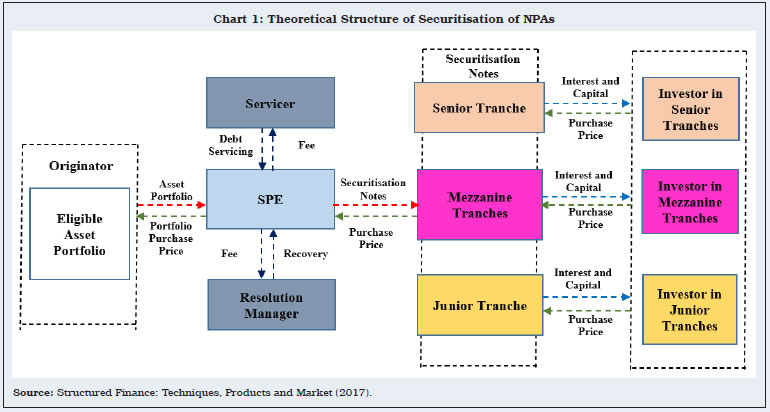

Securitisation of Stressed Assets Stressed assets (or more specifically, stressed loans) are exposures classified as non-performing assets (NPA), or as special mention accounts (SMA) with incipient stress in loan accounts1. The classification of SMA was introduced in the stressed asset category for identification of stress in accounts which have defaulted but not yet classified as NPAs. There is a technical difference between NPAs and SMAs based on aging criterion, but in terms of principles, both categories include assets which are not performing as required by the loan agreement. Therefore, for the sake of theoretical simplicity, ‘stressed assets’ and ‘NPAs’ are used interchangeably. Rising NPAs in an economy may have several adverse implications. First, it ties up the capital of lending institutions (e.g., provisioning) and hinders the capacity for additional credit creation; second, NPAs entail significant costs in terms of foregone income, provisioning, recovery efforts, etc. which impact the profitability of the financial intermediaries (FIs); third, it may create ‘adverse selection’ issues - because financial institutions facing high NPAs may end-up targeting riskier borrowers in search of higher interest income leading to inefficient allocation of resources; lastly, financial intermediation risk can arise because depositors may lose trust in lending institutions which have high NPAs. Therefore, putting in place necessary recognition and resolution measures for stressed assets becomes a critical policy imperative. Thematic Measures to Deal with NPAs Several policy initiatives have been taken in the recent past to enable the FIs to manage stressed assets better on their balance sheets. These measures were primarily aimed at: (i) resolution of long-standing stressed assets on the books of banks; (ii) timely identification and recognition of stress immediately upon default and initiation of corrective actions for mitigation of the same; (iii) strengthening the regulatory framework for asset reconstruction companies (ARCs); and (iv) enabling market mechanisms of credit risk transfer for lending institutions to better manage their portfolios. These measures provide the necessary tools and incentives for timely and more efficient resolution of stressed assets on their balance sheets. Such measures, combined with earnest efforts of the FIs, have improved the overall credit discipline in the country but there is scope to improve it further. Proposed Securitisation of Stressed Assets Framework Any mechanism offered to the concerned FIs for effectively dealing with rising NPAs or stressed assets should have two important components: timeliness of the measure taken, and the capacity to unlock the full value of the concerned loan/portfolio. Recovery in cases of NPAs is a time sensitive matter as their value erodes over time. Therefore, any mechanism which is time consuming may not be very effective in dealing with the issue of NPAs. Similarly, unlocking the true value of the NPAs may require a diverse set of potential investors with expertise in resolution, to make the acquisition bids more competitive. Securitisation of NPAs is a financial structure whereby an originator of non-performing assets sells these to a special purpose entity (SPE) that funds such an acquisition by issuing debt securities. The SPE will in turn appoint a servicing entity that will manage the stressed assets on a daily basis, typically with a fee structure that incentivises them to maximise recoveries on the underlying loans. Based on the recovery from underlying assets, investors will then be paid, in the waterfall mechanism depending upon the seniority of the tranches2 (Chart 1).  Securitisation of NPAs is different from that of standard assets, as for latter the credit risk associated with the borrower is borne by the investors in securitised notes, while in the former, the assets are already in default/NPA or deemed as non-performing. They are securitised at a discount on their nominal value, reflecting market’s valuation of these underlying assets after discounting portfolio losses and likelihood of resolution generating sufficient recoveries to cover the net value of non-performing exposures. Thus, the investors are exposed to the risk that the resolution exercise may not generate sufficient recoveries to cover fully the net value of transferred underlying assets. As mentioned above, securitisation can meet both the requirements of timeliness and unlocking fair realisable value, because it envisages a diverse set of agents with different expertise (e.g., servicer and resolution manager) to be a part of process ensuring a wide investors base having varying risk appetite. The involvement of resolution and recovery experts in the process may likely ensure marketability of the securitisation notes. It will also enable better distribution of credit/recovery risk in favour of agents who have the appetite and ability across the system leading to build-up of economic resilience against shocks. Further, the Task Force on the Development of Secondary Market for Corporate Loans (Chair: Shri T. N. Manoharan) constituted by the Reserve Bank which submitted its recommendations in September 2019, had specifically recommended that securitisation of NPAs may be considered as an alternative investment route in stressed assets. Therefore, after careful deliberation, collection of extensive market feedback, and stakeholder consultations, it was decided to enable securitisation of NPAs through the proposed structure, on the lines of securitisation of standard assets. Importantly, this mechanism is not intended to replace the existing resolution methods including the ARC route, but to co-exist as an alternative, and even provide additional avenues of engagement to ARCs as potential resolution managers. International Practices and Guidelines Securitisation of NPAs, though relatively new to the global economy, is in use in developed economies in different forms. The Basel Committee on Banking Supervision (BCBS) on ‘securitisations of non-performing loans’ has introduced instructions dated November 26, 2020 on non-performing exposures (NPE) securitisation for calculation of capital and risk weights applicable to exposures to NPE securitisations, which have become effective from January 1, 2023. The European Union (EU) has also released regulation for NPE securitisation, effective April 9, 2021. Further, the Prudential Regulation Authority of the United Kingdom has issued a policy statement as part of implementation of Basel standards - non-performing loan securitisations. The proposed framework by the Reserve Bank draws upon these frameworks, suitably modified to suit the domestic context. References: 1. Fabbri A. (2017), ‘Securitisation of Non-performing Loans’, in C. Stefano and S. Gatti (Eds), Structured Finance: Techniques, Products and Market (pp 153-207), Springer. 2. Basel Committee on Banking Supervision (2023), ‘Securitisation of Non-performing Loans’, CRE 45, BIS, Basel. 3. European Union (2021), ‘Regulation (EU) 2021/557 of the European Parliament and of the Council of March of 31, 2021’, Brussels. 4. Bank of England (2021), ‘Implementation of Basel Standards: Non-Performing Loan Securitisations’, Policy Statement 24/21, London. | VI.17 To prepare a strategy based on global best practices on mitigating the adverse impacts of climate change, a discussion paper on climate risk and sustainable finance was placed on the Reserve Bank website on July 27, 2022 for public comments and feedback. Based on analysis of the feedback received in this regard, it was announced in the Statement on Developmental and Regulatory Policies (February 8, 2023) that following guidelines for regulated entities (REs) would be issued in a phased manner: (i) broad framework for acceptance of green deposits; (ii) disclosure framework on climate-related financial risks; and (iii) guidance on climate scenario analysis and stress testing. Further, it was also announced as a part of the policy that the Reserve Bank would have a dedicated webpage on its website which would consolidate all instructions, press releases, publications, speeches and related Reserve Bank’s communication on climate risk and sustainable finance. VI.18 A press release was issued on August 10, 2022 specifying the Reserve Bank’s regulatory stance on the recommendations of the Working Group on Digital Lending (WGDL).3 This was followed by issuance of a circular on September 2, 2022 covering WGDL’s recommendations accepted for immediate implementation. Further, a set of Frequently Asked Questions (FAQs) was released on February 14, 2023 clarifying certain important aspects of the aforesaid circular. VI.19 The guidelines on presentation of financial statements and disclosures for rural cooperative banks were issued on February 20, 2023. VI.20 A Working Group, comprising various departments of the Reserve Bank as well as representatives from the Securities and Exchange Board of India (SEBI) and the Ministry of Cooperation, has been constituted to consider and provide recommendations on issues emanating from the new provisions of the Banking Regulation (Amendment) Act, 2020 and the recommendations of the Expert Committee for UCBs thereon, such as public issue/private placement of securities and issue of shares at premium by UCBs and concomitant issues of investor protection and grievance redressal. The Working Group has held a series of meetings, including engagement with various stakeholders from the sector on the operational/practical aspects pertaining to implementation of the provisions of the Banking Regulation (Amendment) Act, 2020. VI.21 The draft ‘Guidance Note on Operational Risk Management and Operational Resilience’ will be issued for public comments in due course. VI.22 The Department has reviewed and issued guidelines in following areas: (a) Master Direction - Credit Card and Debit Card - Issuance and Conduct Directions, 2022, issued on April 21, 2022; (b) Subsequent to issue of the revised regulatory framework for UCBs (July 19, 2022), circulars on housing loans limits, net worth and capital to risk-weighted assets ratio (CRAR) requirements, categorisation of UCBs for regulatory purposes and revised norms for classification of UCBs as financially sound and well managed (FSWM) were issued. Certain other recommendations of the Expert Committee on UCBs are under examination. The review of following guidelines is in progress: (a) prudential framework for resolution of stressed assets; (b) restructuring of projects under implementation by aligning it with prudential framework; (c) investment guidelines and financial statements’ formats for UCBs; (d) liquidity management framework guidelines for commercial banks and UCBs; (e) guidelines on inoperative accounts and development of a web portal for centralised search of unclaimed deposits across multiple banks; (f) framework for interest rate on advances; (g) framework for export credit; (h) dividend declaration policy of commercial banks; and (i) capital adequacy framework for small finance banks (SFBs). Major Developments Survey on Climate Risk and Sustainable Finance VI.23 On July 27, 2022, the results of a survey on climate risk and sustainable finance that was undertaken in January 2022 were released. The survey covered 12 public sector banks, 16 private sector banks and six foreign banks in India. The objective of the survey was to assess the approach, level of preparedness and progress made by leading scheduled commercial banks in managing climate-related financial risks. Establishment of Digital Banking Units (DBUs) VI.24 Based on the recommendations of the committee on establishment of digital banking units (DBUs), guidelines were issued on April 7, 2022 to all domestic SCBs (excluding regional rural banks, payments banks and local area banks). It encompasses the definitions of digital banking, DBU, digital banking products and digital banking segment and covers the infrastructure and resources required by DBUs and the products and services that could be offered by DBUs. The DBUs shall facilitate the customers in adopting digital modes/channels and create awareness on digital banking. Regulatory Framework for Branches of Indian Banks Operating in GIFT-IFSC - Acting as Professional Clearing Member (PCM) of India International Bullion Exchange IFSC Limited (IIBX) VI.25 The Reserve Bank has laid down the regulatory framework for the participation of Indian banks’ branches in Gujarat International Finance Tec-City (GIFT) - International Financial Services Centre (IFSC) [GIFT-IFSC] to provide clearing and settlement services on IIBX. The instructions are applicable to domestic SCBs (including foreign banks operating through a wholly-owned subsidiary incorporated in India) which are authorised to deal in foreign exchange and have a branch in GIFT-IFSC. Relaxation in the Eligibility Criteria for Offering Internet Banking Facility by Regional Rural Banks (RRBs) VI.26 RRBs are allowed to provide internet banking (INB) facility to their customers with either view rights only or with both transaction and view rights, with the latter being subject to prior approval of the Reserve Bank. Considering the small proportion of RRBs having approval for INB with transaction facility and to promote the spread of digital banking in rural areas, instructions have been revised providing various relaxations in the financial criteria. Updates on Reserve Bank’s Financial Statements - Presentation and Disclosure Directions, 2021 VI.27 Reporting of Reverse Repos with the Reserve Bank on the Bank’s Balance Sheet: In order to bring more clarity on the presentation of reverse repo in the balance sheet, all type of reverse repos with the Reserve Bank, including those under the liquidity adjustment facility (LAF) shall be presented under sub-item (ii) ‘In Other Accounts’ of item (II) ‘Balances with the Reserve Bank of India’ under Schedule 6 ‘Cash and Balances with Reserve Bank of India’. VI.28 Disclosure of Divergence in Asset Classification and Provisioning: Thresholds for disclosing details of divergence in asset classification and provisioning have been revised for all commercial banks as under: (i) for additional gross NPAs, if it exceeds five per cent of the reported incremental NPAs for the reference period; and (ii) for additional provisioning for NPAs, if it is five per cent of the reported profit before provisions and contingencies for the reference period. Also, disclosure requirements for UCBs for the divergence have also been made applicable for the annual financial statements for the year ending March 31, 2024 and onwards. VI.29 Disclosure of Material Items: In order to ensure greater transparency, banks shall also disclose the particulars of all such items in the notes to accounts wherever any item under the Schedule 5(IV) - Other Liabilities and Provisions – ‘Others (including provisions)’ or Schedule 11(VI)- Other Assets – ‘Others’ exceeds one per cent of the total assets. Further, payments banks shall also disclose particulars of all such items in the notes to accounts, wherever any item under the Schedule 14(I) - Other Income – ‘Commission, Exchange and Brokerage’ exceeds one per cent of the total income. Review of Statutory Liquidity Ratio (SLR) Holdings in Held-to-Maturity (HTM) Category VI.30 With the onset of COVID-19 pandemic, banks were allowed to exceed the ceiling for SLR securities in HTM category from 19.5 per cent of net demand and time liabilities (NDTL), up to an overall limit of 22 per cent of NDTL, in respect of SLR securities acquired between September 1, 2020 and March 31, 2022. The banks have since been allowed to include SLR securities acquired between September 1, 2020 and March 31, 2024 under HTM within the enhanced overall limit of 23 per cent of NDTL. Bilateral Netting of Qualified Financial Contracts - Amendments to Prudential Guidelines VI.31 Regulated Entities (REs) have been allowed to compute their counterparty credit risk on net basis under the bilateral netting framework for qualified financial contracts [over the counter (OTC) derivatives and repo contracts]. Consequently, based on references received, it was clarified that (i) the exemption for foreign exchange (except gold) contracts which have an original maturity of 14 calendar days or less from capital requirements in lieu of counterparty credit risk shall henceforth be applicable only to RRBs, local area banks (LABs) and cooperative banks, where the bank has not adopted the bilateral netting framework; (ii) sold options can be exempted provided they are outside the netting and margin agreements; and (iii) the exposure of a credit default swap (CDS) seller to its buyer may be capped at the amount of premium unpaid, provided the CDS are outside the legal netting and margin agreements. Reserve Bank of India Unhedged Foreign Currency Exposure (UFCE) Directions, 2022 VI.32 A review of the extant guidelines on the subject was undertaken and all the existing instructions on the subject (starting October 1999), including the revisions/clarifications, were consolidated in the directions. Some of the key changes to provide clarity/reduce compliance burden, inter alia, encompassed exclusion of ‘factoring transactions’ from UFCE for certain entities; and raising of threshold for smaller entities based on total exposure from banking system to ₹50 crore (up from ₹25 crore). For such smaller entities having foreign currency exposure, banks would not be required to periodically obtain hedging information. An explanatory note providing the background for these directions was also issued. Maintenance of Statutory Liquidity Ratio (SLR) - Section 24 and Section 56 of the Banking Regulation Act, 1949 VI.33 In 2018, the amended Section 17 of the Reserve Bank of India (RBI) Act empowered the Reserve Bank to introduce the standing deposit facility (SDF) - an additional tool for absorbing liquidity without any collateral. It has been decided that the balances held by banks with the Reserve Bank under the SDF are an eligible statutory liquidity ratio (SLR) asset. Exemption from Maintenance of Cash Reserve Ratio (CRR)/SLR- Foreign Currency Non-Resident [(FCNR(B)/Non-Resident External (NRE)] Term Deposits - Section 42 of the Reserve Bank of India Act, 1934 and Section 18 and 24 of the Banking Regulation Act, 1949 VI.34 As a part of the foreign exchange market measures announced on July 6, 2022, banks were advised that with effect from the reporting fortnight beginning July 30, 2022, incremental FCNR (B) deposits as also NRE term deposits with reference to base date of July 1, 2022, mobilised by banks till November 4, 2022 will be exempted from maintenance of CRR and SLR. The exemption on reserves maintenance will be available for the original deposit amounts till such time the deposits are held in the bank books. As a result of this, there was a marginal net increase in percentage terms (approximately 2 per cent) in FCNR(B) and NRE term deposits mobilised by scheduled commercial banks (SCBs) as on November 4, 2022 vis-à-vis July 1, 2022. Further, the interest rate ceiling applicable to FCNR(B) deposits, was temporarily withdrawn for incremental FCNR(B) deposits mobilised by banks. The extant restriction with respect to interest rates offered on incremental NRE deposits mobilised by banks was also temporarily withdrawn. The above concessions were granted with effect from July 7, 2022 until October 31, 2022. Discussion Paper on Introduction of Expected Credit Loss Framework for Provisioning by Banks Released VI.35 In line with the announcement made in the Statement on Developmental and Regulatory Policies (September 30, 2022), a discussion paper on Introduction of Expected Credit Loss Framework for Provisioning by banks was released on January 16, 2023, for stakeholders’ comments. The proposed approach is to formulate principle-based guidelines supplemented by regulatory backstops, wherever necessary. The key requirement under the proposed framework shall be for the banks to classify financial assets into one of the three categories - stage 1, stage 2, and stage 3, depending upon the assessed credit losses on them, at the time of initial recognition as well as on each subsequent reporting date and to make necessary provisions. Further, RRBs and smaller cooperative banks (threshold to be decided based on comments) are proposed to be kept out of the above framework. Circular on Board approved Loan Policy - Management of Advances - UCBs VI.36 In order to ensure that the loan policies of UCBs have a comprehensive coverage, are in alignment with the extant regulations and reflect their approved internal risk appetite, UCBs were advised4 that the loan policy of the bank shall be reviewed by their Board at least once in a financial year. Revised Regulatory Framework - Categorisation of UCBs for Regulatory Purposes VI.37 Based on the recommendations of the Expert Committee on UCBs (Chairman: Shri N. S. Vishwanathan, Former Deputy Governor, RBI), it was decided to adopt a 4-tiered regulatory framework, with the categorisation of UCBs, based on their deposit size for differentiated regulatory prescriptions aimed at strengthening the financial soundness of the UCBs. Accordingly, under the revised regulatory framework for UCBs, which was issued on July 19, 2022, UCBs have been categorised into the following four tiers for regulatory purposes: (a) Tier 1 - All unit UCBs and salary earners’ UCBs (irrespective of deposit size) and all other UCBs having deposits up to ₹100 crore; (b) Tier 2 - UCBs with deposits more than ₹100 crore and up to ₹1,000 crore; (c) Tier 3 - UCBs with deposits more than ₹1,000 crore and up to ₹10,000 crore; and (d) Tier 4 - UCBs with deposits more than ₹10,000 crore. Individual Housing Loans - Enhancement in Limits for UCBs and RCBs VI.38 Considering the increase in housing prices and consumer needs, the limits on housing loans sanctioned by primary (urban) cooperative banks [UCBs] and rural cooperative banks (RCBs), viz., state cooperative banks (StCBs) and district central cooperative banks (DCCBs), for individual borrowers were enhanced.5 The limits per individual borrower were increased to ₹50 lakh (earlier ₹20 lakh) for RCBs with assessed net worth less than ₹100 crore; and ₹75 lakh (earlier ₹30 lakh) for other RCBs. The limits for tier I and tier II UCBs were placed at ₹60 lakh (earlier ₹30 lakh) and ₹140 lakh (earlier ₹70 lakh) per individual borrower, respectively, subject to extant prudential exposure limits. As recommended by the Expert Committee on UCBs, a four-tiered regulatory framework was adopted for categorisation of UCBs, which was notified vide circular dated December 1, 2022. Consequently, the limits on housing loans sanctioned by UCBs to an individual borrower were reclassified6 as ₹60 lakh for tier-1 UCBs and ₹140 lakh for UCBs categorised in tiers 2 to 4. Permission to Rural Cooperative Banks (StCBs/DCCBs) to lend to Commercial Real Estate - Residential Housing (CRE-RH) VI.39 Rural cooperative banks (RCBs), viz., StCBs and DCCBs were not allowed to finance commercial real estate (CRE). However, considering the growing need for affordable housing and to realise their potential in providing credit facilities to the housing sector, RCBs were permitted7 to extend finance to Commercial Real Estate - Residential Housing (CRE-RH) sector within the existing aggregate housing finance limit of five per cent of their total assets as per their board-approved policy, with periodic performance monitoring. Circular on Housing Finance – Loans for Repairs/Additions/Alterations - Enhancement of Limits for UCBs VI.40 The ceiling on loans extended by UCBs to individuals for carrying out repairs/additions/alterations to their dwelling units was revised8 upwards to ₹10 lakh in metropolitan centres (those centres with population of 10 lakh and above) and ₹6 lakh in other centres, in alignment with the limits prescribed under the priority sector guidelines. Issue and Regulation of Share Capital and Securities of Rural Cooperative Banks (RCBs) VI.41 The instructions applicable for RCBs on issue and regulation of capital funds were reviewed by the Reserve Bank vide circular dated April 19, 2022 to ensure congruity with the provisions of the Banking Regulation (Amendment) Act, 2020. The revised guidelines prescribe terms for issuance of capital instruments as well as conditions for withdrawal of share capital for RCBs, and also permit them to raise capital by issuance of preference shares. Revised Regulatory Framework for Urban Co-operative Banks (UCBs) – Net Worth and Capital Adequacy VI.42 A circular dated December 1, 2022 was issued on ‘Revised Regulatory Framework for Urban Co-operative Banks (UCBs) – Net Worth and Capital Adequacy’. As indicated therein, a minimum net worth stipulation of ₹2 crore for Tier-1 UCBs operating in a single district and ₹5 crore for all other UCBs has been prescribed. Further, the minimum CRAR requirement for Tier-1 banks has been retained at the present prescription of 9 per cent, while for Tier-2 to 4 UCBs, the CRAR requirement has been revised to 12 per cent. UCBs which do not meet the revised net worth and/or the CRAR requirement, have been provided a suitable glide path, with stipulation of an intermediate target as well. Further, revaluation reserves have now been allowed to be reckoned as Tier-I capital, subject to terms and conditions. Punjab and Maharashtra Cooperative Bank Limited (Amalgamation with Unity Small Finance Bank Limited) Scheme, 2022 - Provisioning on Interbank Exposure and Valuation of Perpetual Non-Cumulative Preference Shares (PNCPS) and Equity Warrants VI.43 The provisioning requirement for UCBs’ investment in perpetual non-cumulative preference shares (PNCPS) and equity warrants, resulting from Punjab and Maharashtra Cooperative Bank Limited (Amalgamation with Unity Small Finance Bank Limited) Scheme, 2022 was clarified. Accordingly, UCBs, were allowed to spread the resulting provisions equally over two financial years. Further, investment in PNCPS and equity warrants were exempted from the prudential limits applicable on investment in non-SLR securities. Doorstep Banking Services by UCBs VI.44 ln order to attain harmonisation of regulatory framework across REs and to provide convenience of banking services to the customers at their doorstep, UCBs which satisfy ‘Financially Sound and Well Managed (FSWM)’ criteria have been permitted to provide doorstep banking services to their customers without seeking prior approval of the Reserve Bank vide circular dated June 8, 2022. However, non-FSWM UCBs would have to seek prior approval of the Reserve Bank to provide doorstep banking services. Opening of New Place of Business by DCCBs VI.45 Pursuant to the amendment to the Banking Regulation Act on September 29, 2020, DCCBs are permitted to open new place of business, install automated teller machines (ATMs), or shift the location of such offices only after obtaining prior approval of the Reserve Bank. Accordingly, a circular dated August 11, 2022 was issued for opening new place of business or installation of ATMs, prescribing criteria and procedure for submission of application by DCCBs. DCCBs satisfying the criteria are allowed to open a new place of business with prior approval of the Reserve Bank. DCCBs are also allowed to install off-site/mobile ATMs, without prior permission from the Reserve Bank, subject to satisfying the criteria, which should be reported to the Reserve Bank immediately after operationalisation of the off-site/mobile ATMs. Review of Norms for Classification of UCBs as Financially Sound and Well Managed (FSWM) VI.46 Pursuant to the revised regulatory framework for UCBs released by the Reserve Bank based on the recommendation of the Expert Committee, a circular on revised norms for classification of UCBs as FSWM was issued on December 1, 2022 as per which such UCBs, inter alia, are required to maintain one per cent higher CRAR than the minimum CRAR required to be maintained by them as on the reference date. Further, the UCBs are now permitted to classify themselves as FSWM based on this revised FSWM criteria on the basis of assessed financials and findings of the Reserve Bank inspection report or audited financial statements, whichever is latest. Scale-Based Regulation for Non-Banking Financial Companies (NBFCs) VI.47 An integrated and scale-based regulatory framework for NBFCs was issued on October 22, 2021 in terms of which NBFCs categorised in the upper layer (NBFC-UL) are required to, inter alia, maintain common equity Tier-I (CET-1) capital of at least 9 per cent of risk weighted assets (RWA). As a follow-up to framework provisions, guidelines providing detailed instructions on components of, as well as regulatory adjustments from, CET-1 capital, applicable to all NBFC-UL (except core investment companies), were issued on April 19, 2022. Identification of NBFCs in the Upper Layer VI.48 Considering the evolution of NBFCs in terms of size, complexity, and interconnectedness within the financial sector, the Reserve Bank had put in place a scale-based regulation for NBFCs in October 2021 to align the regulations for NBFCs with their changing risk profile. This framework categorises NBFCs in base layer (NBFC-BL), middle layer (NBFC-ML), upper layer (NBFC-UL) and top layer (NBFC-TL) and states that the upper layer shall comprise those NBFCs which are specifically identified by the Reserve Bank based on a set of parameters and scoring methodology as provided in the framework and envisaged that the top ten NBFCs in terms of their asset size shall always reside in the upper layer. For this purpose, a list of 16 NBFCs-UL, identified as per methodology specified in scale-based regulation for NBFCs, was released on September 30, 2022. Circular on Multiple NBFCs in a Group-Classification in Middle Layer under Scale-Based Regulation VI.49 As per the instructions contained in Master Direction on Systemically Important Non-Deposit Taking NBFCs (NBFC-ND-SI), if the consolidated asset size of all NBFCs within the same group was ₹500 crore and above, all non-deposit taking NBFCs in the group were categorised as NBFC-ND-SI, irrespective of their individual asset sizes. On similar lines, under the scale-based regulatory (SBR) framework (applicable from October 1, 2022), it was advised9 that total assets of all the NBFCs in a ‘Group’ shall be consolidated to determine the threshold for classification of NBFCs in the Middle Layer. This threshold currently stands at ₹1,000 crore as per the SBR Framework. Large Exposures Framework for Non-Banking Financial Company - Upper Layer (NBFC-UL) VI.50 Large Exposures Framework (LEF) for NBFCs in the Upper Layer was introduced10 as part of the scale-based regulation for NBFCs. A summary of the LEF prescribed for NBFC-UL is given in Table VI.1. | Table VI.1 Large Exposure Framework for NBFC - Upper Layer | | Sum of All Exposure Value to | Large Exposure Limit as per cent of Eligible Capital Base | | Other than Infrastructure Finance Companies | Infrastructure Finance Companies | | 1 | 2 | 3 | Single Counterparty | | | Group of Connected Counterparties | | | | Source: RBI. | Instructions on Loans and Advances – Regulatory Restrictions – NBFCs VI.51 To improve governance in NBFCs in the middle and upper layers, instructions were issued11 authorising the Board of NBFC/Committee of Directors to sanction loans aggregating ₹5 crore and above to directors, their relatives, and associated entities. Loans to senior officers are required to be reported to the Board. For NBFCs in the base layer, it has been mandated that they shall have a Board approved policy for granting such loans. In respect of loans to real estate sector, the regulations of NBFCs in the middle and upper layers have been harmonised with those applicable to banks, and it has been mandated that NBFCs must ensure that the borrowers have obtained necessary prior permission from government/local government/other statutory authorities for the project, wherever required. Guidelines on Compensation of Key Managerial Personnel (KMP) and Senior Management in NBFCs dated April 29, 2022 VI.52 On April 29, 2022, the Reserve Bank issued a set of principles for fixing compensation of key managerial personnel (KMP) and senior management of NBFCs. As per the guidelines, NBFCs are required to constitute a nomination and remuneration committee (NRC), which will be responsible for framing, reviewing and implementing the compensation policy. The guidelines, inter alia, prescribe that the compensation package comprising fixed and variable pay may be adjusted for all types of risks. A certain portion of variable pay may have a deferral arrangement and the deferral pay may be subjected to malus/clawback arrangement. Voluntary Surrender of Certificate of Registration (CoR) by NBFCs VI.53 In order to streamline the process of voluntary cancellation of CoR of NBFCs [including housing finance companies (HFCs)], a press release along with the application form and checklist of indicative documents was issued on the Reserve Bank’s website on December 1, 2022 to spread awareness amongst NBFCs/HFCs desirous of surrendering CoR voluntarily. The concerned NBFCs can now approach the regional office of the Reserve Bank under whose jurisdiction the NBFC is registered with the duly filled application form and requisite documents for voluntary cancellation while the HFCs can furnish the application along with documents through the National Housing Bank, New Delhi. Disclosures in Financial Statements - Notes to Accounts of NBFCs VI.54 After the introduction of scale-based regulation framework for NBFCs, instructions were issued on specific disclosure requirements to specific NBFC layers on areas like exposure (capital market, sectoral and real estate), related party transactions, complaints, divergence in asset classification and provisioning, corporate governance, etc. Also, disclosure requirements applicable to lower layers of NBFCs will be applicable to NBFCs in higher layers. Guidelines on Digital Lending VI.55 In order to address concerns arising out of unbridled engagement of third parties, mis-selling, breach of data privacy, unfair business conduct, charging of exorbitant interest rates, and unethical recovery practices, the ‘guidelines on digital lending’ were issued on September 2, 2022. The guidelines are based on the principle that lending business can be carried out only by entities that are either regulated by the Reserve Bank or are permitted to do so under any other law. The guidelines aim to make the lending process transparent and fair by, inter alia, (i) mandating flow of funds between lenders and borrowers only through their bank accounts without any pass-through account/pool account of any third party; (ii) ensuring that lending service providers do not collect any fee/charges directly from the customer; (iii) transparent disclosure of the key facts of the borrowing arrangement, including the all-inclusive cost to a borrower; (iv) ensuring need-based collection of data with audit trails backed by explicit customer consent; and (v) putting in place an appropriate privacy policy with regard to customer data. Extension of Guidelines on Legal Entity Identifier (LEI) for Borrowers of NBFCs and UCBs VI.56 The LEI guidelines were extended12 to UCBs and NBFCs. Further, the threshold above which all non-individual borrowers were required to obtain LEI was reduced from ₹50 crore to ₹5 crore. Accordingly, all non-individual borrowers of scheduled commercial banks (SCBs), All India Financial Institutions (AIFIs), local area banks (LABs), small finance banks (SFBs), UCBs and NBFCs (including HFCs) having total exposure of ₹5 crore and above are now mandated to obtain LEI in a phased manner. Issuance of Consolidated Circular on Opening of Current Accounts and Cash Credit (CC)/Overdraft (OD) Accounts by Banks VI.57 To enforce credit discipline amongst the borrowers and to facilitate better monitoring by the lenders, a circular dated August 6, 2020 was issued on ‘opening of current accounts by banks - need for discipline’. Considering the feedback received from various stakeholders, subsequent circulars on the subject were issued on November 2, 2020; December 14, 2020; August 4, 2021 and October 29, 2021. To provide clarity on the instructions and put all instructions in one place, a self-contained circular on the subject consolidating all the extant instructions was issued.13 Review of Limit of Total Carve out of Government Securities under Facility to Avail Liquidity for Liquidity Coverage Ratio (FALLCR) for Liquidity Coverage Ratio (LCR) VI.58 Due to the reduction in permissible drawdown under the marginal standing facility (MSF) from 3 per cent to 2 per cent of net demand and time liabilities (NDTL), banks were permitted to reckon government securities as level-1 high quality liquid assets (HQLA) under FALLCR within the mandatory statutory liquidity ratio (SLR) requirement up to 16 per cent of their NDTL from existing limit of 15 per cent so as to maintain the total HQLA carve out from the mandatory SLR for meeting LCR requirement at 18 per cent of NDTL (2 per cent MSF and 16 per cent FALLCR). Treatment of Overnight Deposit of Banks with Reserve Bank under Standing Deposit Facility (SDF) for LCR VI.59 SDF was operationalised in April 2022 as per which eligible participants can place deposits with the Reserve Bank on an overnight basis and such balances are reckoned as an eligible asset for computation of SLR. It was clarified that the overnight balances held by banks with the Reserve Bank under SDF shall be eligible as level-1 HQLA for computation of LCR. Outsourcing of Financial Services - Responsibilities of Regulated Entities (REs) Employing Recovery Agents VI.60 The Reserve Bank has been addressing the issues relating to recovery agents (RAs) engaged by the regulated entities (REs). Given the growing incidence of unacceptable practices followed by RAs, the Reserve Bank issued additional instructions to REs, inter alia, extending the scope of the guidelines to cover more REs and specifying permissible hours of calling borrowers (not before 8:00 A.M. and after 7:00 P.M.) for recovery of overdue loans. The REs were also advised to strictly ensure that they or their RAs do not resort to intimidation or harassment of any kind, either verbal or physical, against any person in their debt collection efforts, including acts intended to humiliate publicly or intrude upon the privacy of the debtors’ family members, referees and friends, sending inappropriate messages either on mobile or through social media. These instructions were made applicable to all commercial banks (excluding payments banks), AIFIs, NBFCs, UCBs, StCBs, DCCBs, and ARCs. However, these instructions are not applicable to micro-finance loans covered under ‘Master Direction - Reserve Bank of India (Regulatory Framework for Microfinance Loans) Directions, 2022’ released on March 14, 2022. Review of the Regulatory Framework for Asset Reconstruction Companies (ARCs) VI.61 Against the backdrop of a significant build-up of non-performing assets (NPAs) in the financial system and concerns over the performance of ARCs, an external committee was set up by the Reserve Bank to review, inter alia, the existing legal and regulatory framework applicable to ARCs and recommend measures to enhance their efficacy. Based on the committee’s recommendations and feedback from the stakeholders, extant regulatory framework for ARCs has been reviewed vide circular dated October 11, 2022. The revised guidelines are intended to enable ARCs to play a more meaningful role in resolution of stressed assets by addressing some of the structural issues in the ARC sector. The measures introduced in the revised regulatory framework for ARCs are broadly driven by the following objectives: (i) introducing a comprehensive corporate governance framework for ARCs, thus strengthening their prudent functioning, (ii) enhancing the transparency of ARCs, thus making them more attractive to investors, (iii) strengthening the prudential guidelines for ARCs, thus improving their financial soundness, and (iv) furthering their role in resolution of stressed assets by way of suitable regulatory enablement. Diversification of Activities by Standalone Primary Dealers (SPDs) VI.62 With a view to strengthening the role of SPDs as market makers at par with banks operating as primary dealers, SPDs have been permitted to offer all foreign exchange market-making facilities as currently permitted to category-I authorised dealers vide instructions dated October 11, 2022. This would provide a broader spectrum of market-makers to forex customers for managing their currency risk and the wider market presence would improve the ability of SPDs to provide support to their primary dealer activities. Inclusion of Goods and Services Tax Network (GSTN) as a Financial Information Provider (FIP) under Account Aggregator (AA) Framework VI.63 With a view to facilitating cash flow-based lending to MSMEs, GSTN has been included as an FIP under the AA framework vide circular dated November 23, 2022. The Department of Revenue, Government of India, shall be the regulator of GSTN for this specific purpose and two GST returns (GSTR), viz., form GSTR-1 and form GSTR-3B, have been included as financial information. Revised Regulatory Framework for Issuance and Conduct of Credit Cards and Debit Cards VI.64 Master Circular on credit card, debit card and rupee denominated co-branded and pre-paid card operations of banks and credit card issuing NBFCs dated July 1, 2015 consolidated the instructions on credit card, debit card and rupee denominated co-branded prepaid cards. These instructions have been updated and issued in the form of Master Direction - Credit Card and Debit Card - Issuance and Conduct. The Reserve Bank has made an endeavour to strengthen the areas that needed attention, viz., issuance of unsolicited cards, closure of a credit card account, introduction of credit cards for business purposes, billing issues, adjustment of credit transactions, new form factors, issues relating to co-branded arrangement and mis-selling. Many of these aspects were being flagged in complaints, RTI queries, media reports, suggestions from public and consumer body representations. Operations of Subsidiaries and Branches of Indian Banks and All India Financial Institutions in Foreign Jurisdictions and in International Financial Services Centres (IFSCs) - Compliance with Statutory/Regulatory Norms VI.65 A framework has been put in place for Indian banks/AIFIs dealing in financial derivatives, including structured derivative products, through their branches/subsidiaries operating in foreign jurisdictions and in International Financial Services Centres (IFSCs). Claims Received from the National Credit Guarantee Trustee Company Limited (NCGTC) - Classification for the Purpose of Maintenance of CRR/SLR VI.66 The claims received, in the event of invocation of guarantee from the National Credit Guarantee Trustee Company Limited (NCGTC) on account of any relative credit extended by a bank, held pending adjustment, is reckoned as ‘liability’ for the computation of NDTL for CRR/SLR. It has been decided that the amounts received by a bank from the NCGTC towards claims in respect of guarantees invoked and held by them pending adjustment of the same towards the relative advances, need not be treated as outside liabilities for the purpose of computation of NDTL for CRR and SLR. Master Direction – Reserve Bank of India (Acquisition and Holding of Shares or Voting Rights in Banking Companies) Directions, 2023 VI.67 A Press Release was published on November 26, 2021 communicating the acceptance of 21 of (some with partial modifications, where considered necessary) 33 recommendations made by an Internal Working Group (IWG) to review the extant guidelines on ownership and corporate structure for Indian private sector banks along with notification that the consequential amendments in instructions/ circulars/ master directions/ licensing guidelines will follow in due course. Accordingly, on January 16, 2023 a Master Direction (MD) and Guidelines for major shareholders (Acquisition and Holding of Shares or Voting Rights in Banking Companies) were issued consolidating three Master Directions (MDs)14 pertaining to shareholding and voting rights in banking companies. The major changes made in the MD/Guidelines, inter alia, include updates in the limits on permissible shareholding by different categories of shareholders, introduction of reporting requirements for encumbrance of shares by promoter, and strengthening of arrangements for continuous monitoring of the ‘fit & proper’ status of major shareholder of a banking company. Discussion Paper on Securitisation of Stressed Assets Framework (SSAF) VI.68 As a part of the Statement on Developmental and Regulatory Policies (September 30, 2022), the Reserve Bank had proposed to introduce a framework for securitisation of stressed assets in addition to the ARC route. Accordingly, a discussion paper (DP) on securitisation of stressed assets framework (SSAF) was released on January 25, 2023, inviting comments from stakeholders. The DP broadly covers nine relevant areas of the framework including asset universe, asset eligibility, minimum risk retention, regulatory framework for special purpose entity and resolution manager, access to finance for resolution manager, capital treatment, due diligence, credit enhancement and valuation. It draws upon similar frameworks introduced in other jurisdictions, while trying to keep it structurally aligned with the framework for securitisation of standard assets. Circular on Governance, Measurement and Management of Interest Rate Risk in Banking Book VI.69 Interest rate risk in banking book (IRRBB) refers to the current or prospective risk to banks’ capital and earnings arising from adverse movements in interest rates that affect the banks’ banking book positions. Excessive IRRBB can pose a significant risk to banks’ current capital base and/or future earnings. Accordingly, final guidelines on IRRBB, in alignment with the revised framework of BCBS were issued on February 17, 2023 to enable the banks to measure, monitor and disclose their exposure to IRRBB. The date for implementation would be decided in due course. Draft Guidelines on Minimum Capital Requirements for Market Risk – under Basel III VI.70 As part of convergence of the Reserve Bank’s regulations for banks with Basel III standards, the draft guidelines on minimum capital requirements for market risk - Basel III were issued on February 17, 2023, for public comments. The guidelines shall be applicable to all commercial banks (excluding local area banks, payments banks, regional rural banks and small finance banks) and shall come into effect from April 1, 2024. Reserve Bank of India (Financial Statements - Presentation and Disclosures) Directions, 2021 (Master Direction) - Applicability to State and Central Cooperative Banks VI.71 The Master Direction (MD) was earlier applicable to all commercial banks and Primary (Urban) cooperative banks, which, inter alia, harmonised disclosure related instructions for the annual financial statements across banking sector. In consultation with the National Bank for Agriculture and Rural Development (NABARD), the MD was updated making it applicable to state and central cooperative banks, mutatis mutandis. Some disclosure requirements of the Master Direction, as stated in Annex III A of the said Direction shall be applicable to state and central cooperative banks, from the financial year ending March 31, 2024. Implementation of Indian Accounting Standards (Ind AS) VI.72 To address the prudential concerns related to continued recognition of unrealised management fees even though the said fee had not been realised for more than 180 days, Ind AS implementing ARCs, shall reduce following amount from the net owned funds for calculation of capital adequacy ratio and amount available for dividend: (a) management fee recognised during the planning period that remains unrealised beyond 180 days from the date of expiry of the planning period, (b) management fee recognised after the expiry of the planning period that remains unrealised beyond 180 days of such recognition, and (c) any unrealised management fees, notwithstanding the period for which it has remained unrealised, where the net asset value of the security receipts has fallen below 50 per cent of the face value. ARCs shall also disclose information related to ageing of unrealised management fees in the prescribed format in their notes to accounts. Agenda for 2023-24 VI.73 During 2023-24, the Department will focus on the following key deliverables: -

Comprehensive review of instructions on statutory and other restrictions in credit management (Utkarsh 2.0); -

Review of miscellaneous non-banking companies (MNBCs) regulations (Utkarsh 2.0); -

Recognition of self-regulatory organisations (SROs) for NBFCs; -

Review of liquidity management framework of UCBs (Utkarsh 2.0); -

Issue of harmonised regulations on ‘Income Recognition, Asset Classification and Provisioning Pertaining to Advances’ to regulated entities (Utkarsh 2.0); -

Comprehensive review of all non-fund based contingent facilities issued by lending institutions (Utkarsh 2.0); -

Review of policy on conduct of activities by banks and NBFCs; -

Review of regulation on agency business and referral service; -

Comprehensive review of guidelines on area of operations of UCBs; -

Review of instructions on various regulatory approvals of UCBs; and -

Regulatory initiatives on climate risk and sustainable finance. FinTech Department VI.74 The FinTech Department, set up on January 4, 2022, is entrusted with the responsibility to give a further boost to the FinTech sector by fostering innovation, while remaining vigilant and addressing the risks associated with the FinTech ecosystem under the adequacy framework. VI.75 The Department undertook several measures in pursuance of this mandate to fulfil the objectives set out for 2022-23. Agenda for 2022-23 VI.76 The Department had set out the following goals for 2022-23: -

Phased introduction of Central Bank Digital Currency (CBDC) [Utkarsh] (Paragraph VI.77-VI.80); -

Implementation of the roadmap laid down by ‘Vision and Strategy Document on FinTech (Utkarsh), and policy framework for FinTechs and BigTechs (Paragraph VI.81); -

Facilitating setting up of 75 digital banking units in 75 districts of the country (Paragraph VI.82); and -

Ensuring execution of key projects of importance through the Reserve Bank Innovation Hub (Paragraph VI.83). Implementation Status Phased Introduction of CBDC VI.77 During the year, the Reserve Bank issued a ‘Concept Note’ on CBDC to create awareness about CBDCs in general and the planned features of the Digital Rupee (e₹), in particular. It explained the objectives, choices, and benefits of issuing a CBDC in India. The concept note also sought to explain the Reserve Bank’s approach towards introduction of the CBDC. Subsequently, the Reserve Bank launched pilots of e₹ for specific use cases. VI.78 The first pilot in the Digital Rupee - Wholesale Segment (e₹-W) commenced on November 1, 2022. The use case for this pilot is settlement of secondary market transactions in government securities (G-secs). Use of e₹-W is expected to make the inter-bank market more efficient. Settlement in central bank money would reduce transaction costs by pre-empting the need for settlement guarantee infrastructure or for collateral to mitigate settlement risk. Nine banks (viz., State Bank of India, Bank of Baroda, Union Bank of India, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Yes Bank, IDFC First Bank and HSBC) are participating in the pilot. VI.79 The first pilot for Retail Digital Rupee (e₹-R) was announced on December 1, 2022. e₹-R offers features of physical cash like trust, safety and settlement finality in digital mode. It can be held or used to carry out transactions, similar to the manner in which currency notes can be used in physical form. The pilot was launched in Mumbai, New Delhi, Bengaluru and Bhubaneswar, comprising participating customers and merchants in a closed user group (CUG). Other locations including Ahmedabad, Chandigarh, Gangtok, Guwahati, Hyderabad, Indore, Kochi, Lucknow, Patna and Shimla are also being added to the pilot in phases. The pilot began with four banks (viz., State Bank of India, ICICI Bank, Yes Bank and IDFC First Bank) while four other banks (viz., Bank of Baroda, Union Bank of India, HDFC Bank and Kotak Mahindra Bank) have joined subsequently. Five more banks (viz., Punjab National Bank, Canara Bank, Federal Bank, Axis Bank and IndusInd Bank) are in the process of joining the pilot. The scope of pilot is being expanded gradually to include more banks, users and locations as needed. VI.80 The results of both the pilots so far have been satisfactory and in line with expectations. Implementation of the Roadmap Laid Down by ‘Vision and Strategy Document on FinTech and Policy Framework for FinTechs and BigTechs VI.81 A working group (WG) has been constituted, under the Chairmanship of Executive Director, in charge of the FinTech Department to formulate a framework for the sustainable development of FinTech sector including BigTechs. The WG comprises representatives from various internal departments, viz., Department of Economic and Policy Research (DEPR), FinTech Department, Department of Regulation (DoR), Department of Supervision (DoS), Financial Inclusion and Development Department (FIDD) and Department of Payment and Settlement Systems (DPSS) along with representations from the FinTech Industry, a legal firm, and Reserve Bank Innovation Hub (RBIH). The WG has been engaging with various stakeholders of the FinTech eco-system, which includes banks and FinTechs/BigTechs. The WG is in the process of finalising its recommendations which, inter alia, will include vision and strategy for the development of FinTech ecosystem in India and a framework for FinTechs and BigTechs. Establishment of Digital Banking Units (DBUs) VI.82 The Hon’ble Finance Minister in her budget speech on February 1, 2022 announced the setting up of the 75 Digital Banking Units (DBUs) in 75 districts of the country to commemorate the 75 years of independence of the country (Azadi Ka Amrit Mahotsav). These 75 DBUs have been dedicated to the service of the nation by the Hon’ble Prime Minister on October 16, 2022. At present, 84 DBUs are in operation in various parts of the country. However, banks are free to set up DBUs in accordance with regulatory guidance and policy. The DBUs enable customers to have cost effective/convenient access and enhanced digital experience to/of various products and services in an efficient, paperless, secured and connected environment, in self-service as well as assisted mode. Although the Reserve Bank has provided a standardisation in terms of the minimum number of products and services which can be offered across all the DBUs vide its circular dated April 7, 2022 on ‘Establishment of DBUs’, banks have the freedom to offer any digital products and services in addition to the prescribed minimum. DBUs are organising financial literacy events to create awareness on cyber security and other relevant IT areas relating to digital financial services, with district as the catchment area. DBUs will catalyse adoption of digital banking by providing digital financial services and products to the public in a seamless and efficient manner. Projects Undertaken through Reserve Bank Innovation Hub (RBIH) VI.83 During 2022-23, the RBIH has undertaken multiple innovative projects of key importance to the financial sector. A pilot project for end-to-end digitalisation of Kisan Credit Card (KCC) lending, conceptualised and developed by the RBIH in consultation with the Reserve Bank, was operationalised in Madhya Pradesh, Karnataka and Tamil Nadu (Box VI.2). Further, RBIH conducted a Swanari TechSprint, that aimed to encourage the financial services ecosystem partners to create and produce smart, creative, and sustainable solutions for the underserved, low-and middle-income (LMI) women and women-owned enterprises. Additionally, to provide incubation and mentoring support to start-ups, it entered into MoUs with the IIT Madras Research Park; the Society for Innovation and Entrepreneurship (SINE), IIT Bombay and the Centre for Innovation Incubation and Entrepreneurship (CIIE), IIM Ahmedabad. Major Initiatives Account Aggregator Framework VI.84 The Account Aggregator (AA) eco-system is witnessing increased traction as major public sector banks have joined the framework and other financial sector regulators (FSRs), viz., the Securities and Exchange Board of India (SEBI), Pension Fund Regulatory and Development Authority (PFRDA) and Insurance Regulatory and Development Authority of India (IRDAI), have advised their respective regulated entities to join the framework as financial information provider (FIP). Further, with a view to facilitating cash flow-based lending to micro, small and medium enterprises (MSMEs), goods and services tax network (GSTN) has been included as a FIP under the AA framework. The Department of Revenue, GoI, shall be the regulator of GSTN for this specific purpose. As a result, the number of registered non-banking financial companies (NBFCs) AA, FIPs and financial information users (FIU) are expected to increase substantially. In view of the growing number of participants in the ecosystem, the Reserve Bank is taking well considered and nuanced approach, in consultation with the Reserve Bank Information Technology Private Limited (ReBIT) and other stakeholders, to make the ecosystem more robust, address the technical issues of the growing ecosystem and facilitate further growth of the same. Box VI.2

Pilot on Digitalisation of Kisan Credit Card (KCC) Lending The Kisan Credit Card (KCC) scheme has been one of the predominant modes of financing farmers in India. The major challenges associated with the scheme are high turn-around time (TAT), multiple branch visits, paper-based credit delivery and high transaction costs. Considering these challenges associated with the rural finance, digitalisation of agrifinance in India was ideated between the Reserve Bank and the Reserve Bank Innovation Hub (RBIH). The idea is to enable frictionless delivery of Kisan Credit Card (KCC) loans in a paperless and hassle-free manner and reduce the turn-around time and avoid multiple visits to bank branches. The pilot is being carried out in three states, viz., Madhya Pradesh, Karnataka (with the Union Bank of India) and Tamil Nadu (with the Federal Bank and Indian Bank). The pilot enabled successful disbursal of loans up to ₹ 1.6 lakh not requiring any collateral, within a few minutes to farmers. The pilot is being scaled up to other districts of these three states as well as in other states. This pilot requires bespoke technical integration of banks’ system with different states’ digital land records. Addressing these issues in digital KCC may help banks to bring in the much-needed efficiency by eliminating the manual process involved in procedures like verification of land documents, integration with banks’ Business Rule Engine (BRE), assessment of the scale of finance, approval, paper-based know your customer (KYC), and processing wet signatures of loan applicants. The pilot project of lending based on milk pouring data to dairy farmers has also commenced in Gujarat in association with HDFC Bank. Various testings under the pilots have been found successful and the results of these pilots have been encouraging. All the learnings from the pilots are being used towards development of an Integrated Public Tech Platform for Finance (IPTPF),which would be an enabler for delivery of the frictionless credit by facilitating seamless flow of required digital information to lenders. Source: RBI. | Regulatory Sandbox (RS) – Cohorts and Inter-Operable Regulatory Sandbox (IoRS) VI.85 Under the second cohort of the RS on theme ‘Cross-Border Payments’, eight entities tested a range of products, including, inter alia, blockchain-based cross-border payment system, and digitisation of cross-border payment process. Four out of the eight products were found acceptable within the boundary conditions defined during testing. Under the third cohort with the theme ‘MSME Lending’, the shortlisted eight entities have completed their testing of products which, among others, include end-to-end straight through processing for digital lending to MSMEs, use of proprietary business finance variables to underwrite real time cash flow-based credit for MSMEs, innovative use of blockchain technology in MSME lending and straight through process journey for MSME Mudra loan from lead to disbursal. The test results are currently under evaluation. This cohort on MSME lending is expected to spur innovations that can help to fill the credit gap for MSMEs through the use of technology and data analytics. Under the fourth cohort with the theme ‘Prevention and Mitigation of Financial Frauds’, six entities have been selected for the testing and the entities commenced testing of their products from February 2023. The entities are testing various products, including risk-based authentication solution, early warning system for credit monitoring and fraud identification using both internal and external data, Artificial Intelligence (AI)/Machine Learning (ML) based closed user group model for preventing card frauds and fraud filter system to lock login in sleep mode. This cohort is envisaged to prevent occurrence of fraud, strengthen fraud governance, reduce the response time to frauds and the lag between occurrence and detection of financial frauds. The fifth cohort under RS has been announced to be ‘Theme Neutral’ wherein innovative products/ services/ technologies cutting across various functions in the Reserve Bank’s regulatory domain would be eligible to apply. The ‘On Tap’ application facility under RS is currently open for themes ‘Retail Payments’ and ‘Cross-border Payments’. Two entities have been selected for the test phase under the on-tap application facility for the theme ‘Retail Payments’ and the testing of the products has been started by one entity while the other one is in the process of partnering with commercial bank/s to start the testing. Further, in order to facilitate testing of hybrid products/ services falling within the regulatory ambit of more than one financial regulator, viz., the Reserve Bank, SEBI, IRDAI, International Financial Services Centres Authority (IFSCA) and PFRDA, a Standard Operating Procedure (SOP) for Interoperable Regulatory Sandbox (IoRS) has been prepared and operationalised by the Inter- Regulatory Technical Group on FinTech (IRTG on FinTech) constituted under the aegis of Financial Stability Development Council-Standing Committee (FSDC-SC). Applications have been received under the IoRS framework, which are being processed as per the provisions of the SOP. HARBINGER 2021 VI.86 The Reserve Bank launched its first global hackathon HARBINGER 2021 on November 9, 2021 with four problem statements under the broad theme of ‘Smarter Digital Payments’. The Hackathon witnessed a very good participation of 363 teams from proposals submitted by teams from within India and from 22 other countries, including the US, the UK, Sweden, Singapore, Philippines, and Israel. The final evaluation of solutions to problem statements was conducted in May 2022 wherein a jury of external experts evaluated and selected the winners and runners-up based on parameters like innovation, technology, demonstration, user experience, security and ease of implementation. These innovative products are expected to bring additional benefits in the payment ecosystem, viz., inclusion of the underprivileged and prevention of digital payment frauds. While the regulatory sandbox initiative is focused on fostering innovation by the Indian entities within the regulatory domain of the Reserve Bank, IoRS is inter-regulatory in approach and global hackathon ‘HARBINGER’ is targeted towards the global innovator community for providing solutions to specific statement of problems. The second edition of Reserve Bank’s global hackathon – ‘HARBINGER 2023’ has also been launched with the theme ‘Inclusive Digital Services’ wherein innovative ideas have been invited for the four problem statements, viz., innovative, easy-to-use, digital banking services for differently abled (Divyaang), RegTech solutions to facilitate more efficient compliance for Regulated Entities (REs), exploring use cases/solutions for CBDC-retail transactions; including transactions in offline mode and increasing transactions per second (TPS)/ throughput and scalability of blockchains. Agenda for 2023-24 VI.87 In 2023-24, the Department will focus on the following goals: -

Conducting further pilots with various use cases in both CBDC-Retail and CBDC-Wholesale (Utkarsh 2.0); -

Developing an appropriate framework for managing FinTech ecosystem in the country (Utkarsh 2.0); -

To create an open, inter-operable integrated public tech platform for finance that can act as a single unified public platform which would facilitate integration of data in a seamless manner for all lenders, which would enable the delivery of frictionless credit; -

Conduct of global hackathons ‘HARBINGER’ series; -

Bringing improvements to the account aggregator technological ecosystem to achieve efficiency and facilitate further growth of the same; and -

Facilitation in development of RegTech tools for adoption by regulated entities and exploring identification of emerging SupTech tools. One of the cohorts under the RS/Hackathon would include themes relating to RegTech (Utkarsh 2.0). 4. SUPERVISION OF FINANCIAL INTERMEDIARIES Department of Supervision (DoS) VI.88 The Department of Supervision (DoS) is entrusted with the responsibility of supervising all Scheduled Commercial Banks (SCBs) [excluding Regional Rural Banks (RRBs)], Local Area Banks (LABs), Payments Banks (PBs), Small Finance Banks (SFBs), Credit Information Companies (CICs), All India Financial Institutions (AIFIs), Urban Co-operative Banks (UCBs), Non-Banking Financial Companies (NBFCs) [excluding Housing Finance Companies (HFCs)] and Asset Reconstruction Companies (ARCs). Commercial Banks VI.89 The Department took several measures to further strengthen both onsite and off-site supervision of the SCBs, LABs, PBs, SFBs, CICs and AIFIs during the year. Agenda for 2022-23 VI.90 The Department had set the following goals for 2022-23: -

Generate supervisory dashboards for senior management of the Reserve Bank (Utkarsh) [Paragraph VI.91]; -

Back-testing of Early Warning Indicator (EWI) model to assess its predictive power/ creating a new EWI framework for SCBs (Paragraph VI.92); and -