CURRENCY

MANAGEMENT

12.1 The note issue and currency management

function vested in the Reserve Bank in terms of Section 22 of the Reserve Bank

of India Act, 1934 was guided during 2003-04 by the objectives of ensuring adequate

availability of notes and coins and improving the quality of notes in circulation.

Initiatives were taken to improve customer service and enhance security features

in currency notes with a strong drive towards computerisation of currency management

information system.

12.2 This Section

reviews currency operations during 2003-04 covering currency chest activity and

efforts undertaken to satisfy the buoyant demand for notes and coins in the face

of constraints on fresh supply. An update of efforts under the Clean Note Policy

shows progress in improving the quality of currency by efficient withdrawal of

soiled and mutilated notes from circulation and mechanisation of processing and

destruction. This Section also highlights the priority attached to enhancing the

security of the currency through stepped-up detection of counterfeit notes and

improved security features in currency notes. The heightened emphasis accorded

to customer service in 2003-04, the setting up of a Monetary Museum and a review

of the activities of the Bharatiya Reserve Bank Note Mudran Pvt. Ltd. are other

aspects covered in this Section. CURRENCY OPERATIONS 12.3

Currency operations are performed by the Reserve Bank through its 19 regional

offices/sub-offices and a wide network of currency chests and small coin depots

spread across the country. 12.4 The total number of currency

chests declined during the year consequent to implementation of the policy to

progressively convert and/or close currency chests held with the State Treasuries.

Commercial banks expanded their currency chest operations. Foreign banks were

permitted for the first time to operate currency chests. The State Bank Group

dominates the currency chest system by maintaining about 72.0 per cent of total

currency chests (Table 12.1).

Notes in Circulation 12.5

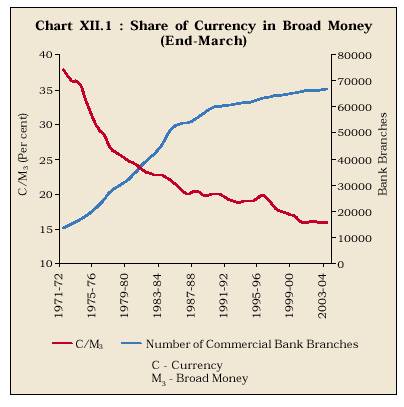

During the year, the total value of notes in circulation registered a growth of

15.8 per cent, reflecting the buoyancy in economic activity. The ratio of currency

to broad money (M3) remained unchanged at 15.8 per cent

at end-March 2004 (Chart XII.1).

| Table

12.1: Currency Chests | | | | | |

| Category |

No. of Currency |

Chests | | |

June 30, |

June 30, |

March 31, | | |

2004 |

2003 |

2003 | |

1 | 2 |

3 |

4 | |

Treasuries | 214 |

405 | 417 |

| State Bank of India |

2,173 |

2,116 |

2,117 | |

SBI Associate Banks |

1,004 |

1,002 |

1,002 | |

Nationalised | 943 |

903 | 897 |

| Private sector banks |

58 | 36 |

32 | |

Co-operative | 1 |

1 | 1 |

| Foreign banks |

4 | – |

– | |

Reserve Bank of India |

20 | 20 |

20 | |

Total | 4,417 |

4,483 |

4,486 |

12.6 The supply of notes was lower than the ‘indent’ made by

the Reserve Bank. The supply of coins was also less than the indent but the indent

itself was found to be slightly higher than the actual requirement due to decline

in demand for coins (Table 12.2).

12.7 Accordingly, efforts

to keep pace with the rising volume of currency demand took the form of judicious

distribution of available supplies, increase in the percentage of higher denomination

notes along with coinisation of lower denomination notes and ensuring the recirculation

of notes by use of machines for processing, verification and sorting.

|

Table 12.2: Fresh Notes and Coins

– 2003-04 | | Item | |

Notes | |

Coins | | |

Pieces |

Value |

Pieces |

Value | | |

(in Million) |

(Rupees crore) |

(in Million) |

(Rupees crore) |

| 1 |

2 |

3 |

4 |

5 | |

Indent |

15,800 |

1,76,250 |

3,460 |

720 | |

Supply |

13,166 |

1,37,278 |

2,828 |

509 |

12.8 A gradual compositional shift is underway in the form

of a gradual replacement of lower denomination notes by higher denomination notes.

The demand for Rs.500 denomination notes increased sharply due to the growing

network of Automated Teller Machines (ATMs). In terms of value, the largest share

in circulation was of Rs.500 denomination. Notes of Rs.100 denomination had the

largest share in terms of volume. Notes of Rs.100 denomination and Rs.500 denomination

together accounted for 76.5 per cent of the total circulation in terms of value

(Table 12.3). Both Rs.500 and Rs.1000 denomination notes taken together have a

significant share in the value of notes issued over the last four years, although

there was a marginal rise in the volume of these notes (Chart XII.2).

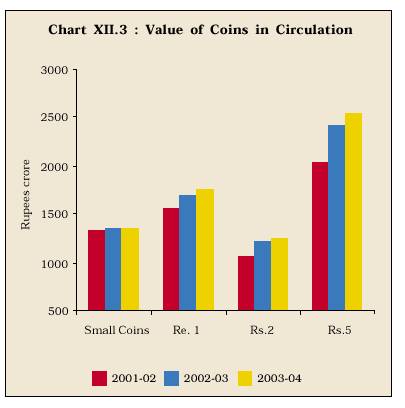

12.9

Notes of one rupee denomination have been withdrawn from issuance; however, 2,500

million pieces continued to be in circulation as on March 31, 2004. Value of Rs.5

coins in circulation increased at an average rate of 12.0 per cent over the last

two years. The total value of coins including small coins in circulation showed

an average growth of 7.0 per cent during the same period (Chart XII.3).

12.10

With adequate availability of coins from the mints, the Reserve Bank undertook

intensive efforts to ensure that the shortage of coins in the country in the recent

past was mitigated and that the supply of coins to the interior parts of the country

was sustained (Box XII.1).

| Table

12.3: Circulation of Notes and Coins | | | | |

(End-March 2004) |

| | Value | |

Volume | |

Denomination |

Rupees |

Share |

Million |

Share | | |

crore |

(per cent) |

Pieces |

(per cent) |

| 1 |

2 |

3 |

4 |

5 | |

Notes | | | | |

| Rs.2 and Rs.5 |

2,748 |

0.9 | 6,911 |

18.1 | |

Rs.10 | 7,750 |

2.4 | 7,750 |

20.2 | |

Rs.20 | 4,383 |

1.4 | 2,192 |

5.7 | |

Rs.50 | 33,027 |

10.3 |

6,605 |

17.2 | |

Rs.100 | 1,21,442 |

38.0 |

12,144 |

31.7 | |

Rs.500 | 1,22,938 |

38.4 |

2,459 |

6.4 | |

Rs.1,000 | 27,473 |

8.6 | 275 |

0.7 | |

Total | 3,19,761 |

100.0 |

38,336 |

100.0 | |

Coins | | | | |

| Small Coins |

1,353 |

18.8 |

54,102 |

62.9 | |

Rupee coins | 2,057 |

28.6 |

20,565 |

23.9 | |

Rs. 2 | 1,255 |

17.4 |

6,275 |

7.3 | |

Rs.5 | 2,536 |

35.2 |

5,071 |

5.9 | |

Total | 7,201 |

100.0 |

86,013 |

100.0 |

CLEAN NOTE POLICY 12.11 The Reserve Bank took

various measures to improve the quality of notes in circulation. These measures

included discontinuance of the practice of stapling of note packets, supply of

adequate quantity of fresh notes to banks and mopping up of soiled and mutilated

notes, particularly notes of lower denominations from circulation and acceleration

in mechanised processing of notes at the offices of the Reserve Bank. Disposal

of Soiled Notes 12.12 During 2003-04 (April-March),

12,445 million pieces of soiled notes were processed and disposed off. The denomination-wise

disposal of soiled notes indicates that Rs.10 constituted the largest share (40.2

per cent), followed by Rs.100 notes (31.8 per cent) and Rs.50 notes (21.0 per

cent) (Table 12.4).

Box

XII.1

Coins

– Shortage to Surplus

The Reserve Bank allowed its offices to engage private transport

operators for remittances of coins to the interior parts of the country. Coins

were distributed through mobile vans. Banks were persuaded to distribute coins

in marketplaces and to keep their branches at select places open on Sundays. Services

of postal authorities, Regional Rural Banks (RRBs), co-operative banks and State

Transport Undertakings were utilised for distribution of coins. A survey conducted

by the Administrative Staff College of India (ASCI), Hyderabad, revealed that

the availability of coins was 97 per cent of the demand even in rural areas. This

was achieved by overcoming the bottlenecks in the distribution system such as

non-availability of railway wagons/police security and the reluctance of banks

to handle the distribution work. The demand for coins,

particularly of lower denominations, has declined considerably. There has also

been a reverse flow of coins of 5 paise, 10 paise and 20 paise denominations.

The parallel issue of notes and coins of Rs.5 denomination has reduced the demand

for Rs.5 coins. Increasing stocks of coins with the public and reluctance to accept

coins by shops and banks have led to surplus of coins, especially in temple towns,

large cities as well as with agencies such as transport authorities and large

organisations. The Reserve Bank directed banks maintaining currency chests to

accept coins freely from the public either for exchange or for deposit. It also

decided to phase out from circulation all lower denomination coins such as 5 paise,

10 paise and 20 paise and cupro-nickel coins of 25 paise, 50 paise and one rupee.

Banks have been directed to accept and remit these coins to the Government mints. Offices

of the Reserve Bank have been accepting coins in bulk quantity by weight for the

sake of convenience of the public and bank branches. Banks have been directed

to implement this measure. Polythene pouches are being made available at some

of the bank branches to pack 100 coins for quick and smooth service.

12.13

During 2003-04 (April-March), the Issue Offices of the Reserve Bank received 21,933,212

mutilated notes. 21,908,135 notes, including the backlog from 2002-03, were adjudicated

under the Reserve Bank (Note Refund) Rules. Mechanisation 12.14

Mechanisation of processing and destruction of currency notes has been one of

the major thrust areas of the Reserve Bank in currency management.

|

Table 12.4: Denomination-wise Disposal of Soiled |

| | Notes

– 2003-04 | | | | |

(Million pieces) |

| Denomination |

2003-04 |

As percentage to total |

| | 2 |

3 | |

Rs. 1,000 | 13 |

0.1 | |

Rs. 500 | 247 |

2.0 | |

Rs. 100 | 3,954 |

31.8 | |

Rs. 50 | 2.617 |

21.0 | |

Rs. 20 | 306 |

2.5 | |

Rs. 10 | 5,004 |

40.2 | |

Up to Rs. 5 | 304 |

2.4 | |

Total | 12,445 |

100.0 |

The Reserve Bank has installed 48 Currency Verification and

Processing Systems (CVPS) at 18 offices. The notes processed on these machines

during 2003-04 aggregated 3,290 million pieces. Twenty-seven Shredding and Briquetting

Systems (SBSs) were installed at 18 Issue Offices of the Reserve Bank. These environment-friendly

machines provide shredding, granulation and briquetting of soiled currency notes

in a secure and eco-friendly manner. These machines have replaced the conventional

furnaces. As a result of mechanisation and certain special measures, 12.4 billion

pieces of bank notes were disposed off during 2003-04 as compared with 15.6 billion

pieces during the previous year. Counterfeit Notes 12.15

The Reserve Bank’s regional offices and branches of various banks detected counterfeit

notes valued at Rs. 2.76 crore during 2003-04 as against Rs. 3.50 crore during

2002-03. While there was a decline in the number of counterfeit notes detected

in Rs.500 denominations, there was increase in the number of notes detected in

Rs. 100 and Rs.1000 denominations (Table 12.5). Sustained public awareness campaigns

on security features of notes were conducted during the year through print and

electronic media. Necessary training for detection of counterfeit notes was also

imparted to the staff from banks as well as large public sector undertakings and

government departments such as Railways.

12.16 The Reserve

Bank and the Central Bureau of Investigation (CBI) jointly conducted a workshop

on counterfeiting, security features of notes and detection of counterfeit notes

with participants from senior level police officers from States/Union Territories,

National Crime Record Bureau (NCRB), Ministry of Home Affairs and Ministry of

Finance. |

Table 12.5: Counterfeit Notes Detected |

| | | (No.

of pieces) | | Denomination |

2003-04 |

2002-03 | |

1 | 2 |

3 | |

Rs. 1,000 | 248 |

39 | |

Rs. 500 | 17,783 |

35,398 | |

Rs. 100 | 1,82,361 |

1,72,597 | |

Rs. 50 | 4,701 |

3,488 | |

Rs. 20 | 56 |

34 | |

Rs. 10 | 77 |

198 | |

Total | 2,05,226 |

2,11,754 | | | | |

| Mahatma Gandhi

Series Notes | |

Mahatma Gandhi Series Notes 12.17 The Mahatma

Gandhi series of notes with enhanced security features were introduced from 1996.

With the advancement in reprographic techniques, earlier security features were

no longer considered sufficient to deter forgeries. Accordingly, new security

features have been progressively built into these notes over the period since

their introduction (Box XII.2).

Box

XII.2

Security

Features of Mahatma Gandhi Note Series

Security features of bank notes of the Mahatma Gandhi Note Series are set out

below: Watermark: The Mahatma Gandhi Series of bank notes contain the Mahatma

Gandhi watermark with a light and shade effect and multi-directional lines in

the watermark window. Security Thread: Rs. 1000 notes

contain a readable, windowed security thread alternately visible on the obverse

with the inscriptions ‘Bharat’ (in Hindi), ‘1000’ and ‘RBI’, totally embedded

on the reverse. The Rs.500 and Rs.100 notes have a security thread with similar

visible features and inscription ‘Bharat’ (in Hindi), and ‘RBI’. When held against

the light, the security thread on Rs.1000, Rs.500 and Rs.100 notes can be seen

as one continuous line. The Rs.5, Rs.10, Rs.20 and Rs.50 notes contain a readable,

fully embedded windowed security thread with the inscription ‘Bharat’ (in Hindi)

and ‘RBI’. The security thread appears to the left of Mahatma Gandhi’s portrait. Latent

Image: On the obverse side of Rs.1000, Rs.500, Rs.100, Rs.50 and Rs.20 notes,

a vertical band on the right side of Mahatma Gandhi’s portrait contains a latent

image showing the respective denominational value in numeral. The latent image

is visible only when the note is held horizontally at eye level. Micro

lettering: This feature appears between the vertical band and Mahatma

Gandhi’s portrait. It contains the word ‘RBI’ in notes of Rs.5 and Rs.10. Notes

of Rs.20 and above also contain the denominational value in micro letters. This

feature can be seen better under a magnifying glass. Intaglio Printing:

The portrait of Mahatma Gandhi, the Reserve Bank’s seal, the guarantee and promise

clause, the Ashoka Pillar Emblem on the left and the Governor’s signature are

printed in intaglio, i.e., in raised prints,which can be felt by touch

in Rs.20, Rs.50, Rs.100, Rs.500 and Rs.1000 notes. Identification Mark:

A special feature in intaglio introduced on the left of the watermark window on

all notes except the Rs.10/- note assigns different shapes for various denominations

(Rs. 20-Vertical Rectangle, Rs.50-Square, Rs.100-Triangle, Rs.500-Circle and Rs.1000-Diamond)

to help the visually impaired to identify the denomination. Fluorescence:

Number panels of the notes are printed in fluorescent ink. The notes also

have optical fibres. Both can be seen when the notes are exposed to ultra-violet

lamp. Optically Variable Ink: A new security feature was incorporated in

the Rs.1000 and Rs.500 notes with revised colour scheme introduced in November

2000. The numerals 1000 and 500 on the obverse of Rs.1000 and Rs.500 notes, respectively,

are printed in optically variable ink, viz., a colour-shifting ink. The

colour of the numeral 1000/500 appears green when the note is held flat but would

change to blue when the note is tilted. See Through Register:

The small floral design printed both on the front (hollow) and back (filled

up) of the note in the middle of the vertical band next to the watermark has an

accurate back to back registration. The design will appear as one floral design

when seen against the light.

References

1. Balachandran, G. (1998), ‘The Reserve Bank of India, 1951-67 ’,

Oxford University Press. 2. Bazil Shaik and Sandhya Srinivasan,

(2001), ‘The Paper and the Promise: A Brief History of Currency and Bank Notes

in India’, Reserve Bank of India. 3. Reserve Bank of India (2001),

‘Functions and Working of the Reserve Bank of India’.

Computerisation of Currency Management 12.18 The

Reserve Bank is putting in place an Integrated Computerised Currency Operations

and Management System (ICCOMS) in the Issue Departments of the regional offices

of the Reserve Bank and in the Department of Currency Management at the Central

Office. The project includes computerisation and networking of the currency chests

with the Reserve Bank’s offices to facilitate prompt, efficient, error-free reporting

and accounting of currency chest transactions in a secure manner. The system will

provide a uniform computing platform across all the regional offices for transaction

processing, accounting and management information system relating to currency. Customer

Service

12.19 The Reserve Bank stepped up efforts to

improve customer services in the issue of coins, acceptance of coins from public

and exchange of soiled and mutilated notes. The Reserve Bank introduced a single

window customer service at its Issue Offices under which coins and notes of all

denominations are either issued or accepted at one counter. Similarly, mutilated

notes are accepted in a Drop Box (even beyond normal banking hours) without any

limit. A noteworthy development in this regard in 2003-04 was the constitution

of a Committee on Procedures and Performance Audit on Public Services (Chairman:

Shri S.S. Tarapore) to study, inter alia, services relating to individuals

(non-business) on currency management (Box XII.3).

Box XII.3

Committee on Procedures and Performance Audit on Public Services The

major recommendations of the Committee, which have been accepted by the Reserve

Bank, are: • Transparency in currency management; • Early introduction

of Rs.10 coin; • Phasing out of Rs.5 note totally; • Currency

Chest Agreement to be revised to incorporate a provision for monetary penalty

for non-compliance with the Reserve Bank’s instructions; • A

Systems Study of Banking Hall arrangements in the Mumbai Office of the Reserve

Bank to be commissioned with the help of a specialised agency to resolve the bottlenecks

in the smooth flow of transactions; • Suitable measures to separate location/time

for services to money changers and other individuals; • Citizens’

Charter for Currency Exchange Facilities be made available to customers visiting

the Banking Halls of the Reserve Bank offices and bank branches; • Authorised

bank branches to exhibit prominently a notice that soiled/mutilated currency notes

are freely exchanged at the bank branch; • The Reserve Bank Note Refund

Rules to be written in easily understandable language; • The

practice of pasting of mutilated notes at the time of tendering for exchange should

be reviewed by the Reserve Bank; and • Stringent action

to be taken against violation of instructions by banks on exchanging soiled/ mutilated

notes. Reference

1. Reserve Bank of India (2004), ‘Committee on Procedures and Performance

Audit on Public Services’, May. Reserve

Bank Monetary Museum 12.20 The Reserve Bank is setting

up a Monetary Museum in Mumbai to preserve the country’s monetary heritage. The

Museum is the first of its kind in the country and aims to depict the history

of currency and the evolution of money in India. The Museum would exhibit representative

collection of coinage, paper currency, financial instruments and curiosities across

the Indian history. The main exhibit sections of the Museum relate to concepts,

ideas and curiosities; coinage – from coins to bank notes – and advent of banking

in India. 12.21 The entire display has been divided into

self-contained thematic modules. The coinage section spans a period going back

from the early issues of punched marked coins in the sixth century B.C. to the

contemporary Republic of India coins. The notes on display date from the early

nineteenth century and consist of notes issued by private and semi-government

banks, the Government of India and the Reserve Bank. The section on Financial

Instruments depicts hundies, cheques and promissory notes, used in India. The

Museum also houses portraits of Governors of the Reserve Bank. The Bharatiya

Reserve Bank Note Mudran Pvt. Ltd 12.22 The total production

of notes by the two presses of the Bharatiya Reserve Bank Note Mudran Pvt. Ltd.

(BRBNMPL) at Mysore and Salboni increased by 34 per cent to 8,100 million pieces

during the year 2003-04 as compared with 6,049 million pieces in the previous

year. The sales turnover increased by 22.0 per cent to Rs. 813 crore during 2003-04

from Rs. 667 crore in the previous year. The company achieved a net profit of

Rs.135 crore during 2003-04 as compared with Rs.274 crore during the previous

year. The decline in profit was due to reduction in the sale price and certain

adjustments in booking of interest income in respect of loans extended to the

Government of India presses. The company repaid the outstanding balance of long-term

loans of Rs.1,300 crore and working capital of Rs.175 crore to the Reserve Bank

by switching over credit facilities to the State Bank of India (SBI). The company

was certified as 'ISO 14001-1996 Company' during the year. Outlook 12.23

The Reserve Bank would continue to pursue the objective of meeting the currency

demand of the economy and improving the quality of notes. Installation of additional

Currency Verification and Processing Systems would be undertaken to ease the pressure

of accumulation of soiled notes. Customer service would be upgraded further. A

sustained campaign against counterfeiting is being devised along with greater

emphasis on enhanced security features. The Reserve Bank would continue to facilitate

the circulation of clean notes in the economy. It intends to implement the Integrated

Computerised Currency Operations and Management System (ICCOMS) in all its offices

and major currency chests during 2004. The process of design and development of

software for the system is in progress. This will be followed by testing on a

pilot basis at currency chests and select offices of the Reserve Bank. In view

of the magnitude and spread, a process of dialogue with banks has been initiated

to work out the modalities for testing, training, trial run and implementation.

The Information Technology (IT) initiatives taken by banks for computerisation

of branch operations, coupled with advances in the communication facilities in

the country, would provide the necessary platform for successful implementation

of the ICCOMS across all banks throughout the country. These measures would provide

an enabling environment for smooth currency management.

|