XV.The Reserve Bank's Accounts for 2003-04

|

THE RESERVE BANK’S ACCOUNTS FOR

2003-04 15.1 The key

financial results of the Reserve Bank’s operations during the year are presented

in this Section. INCOME AND EXPENDITURE 15.2

The gross income, expenditure, appropriations and net disposable income of the

Reserve Bank have been evolving over the last five years (Table 15.1).

|

Table 15.1: Trends in Gross Income,

Expenditure and Net Disposable Income | |

(Rupees crore) |

| | | | | | | |

| | Item |

2003-04 |

2002-03 |

2001-02 |

2000-01 |

1999-00 | | |

1 | 2 |

3 |

4 |

5 |

6 | |

Total Income (Gross) |

14,323.70 |

23,185.64 |

24,690.34 |

21,848.87 |

21,960.97 | |

Less transfer to: | | | | | |

| | (i) Contingency

Reserve | 969.47 |

6,733.92 |

6,996.04 |

6,202.57 |

6,554.50 | | |

(ii) Asset Development Reserve |

188.09 |

890.31 |

827.91 |

704.78 |

711.55 | | |

Total (i + ii) | 1,157.56 |

7,624.23 |

7,823.95 |

6,907.35 |

7,266.05 | |

Total Income (Net) |

13,166.14 |

15,561.41 |

16,866.39 |

14,941.52 |

14,694.92 | |

Total Expenditure | 7,762.14 |

6,723.41 |

6,542.39 |

5,587.52 |

5,340.92 | |

Net Disposable Income |

5,404.00 |

8,838.00 |

10,324.00 |

9,354.00 |

9,354.00 | | |

Less : Transfer to Funds * |

4.00 | 4.00 |

4.00 | 4.00 |

4.00 | |

Surplus transfer to the Government |

5,400.00 |

8,834.00 |

10,320.00 |

9,350.00 |

9,350.00 | | |

of which : | | | | | |

| | i) Normal

Transfer | 3,069.00 |

7,117.00 |

8,841.00 |

7,871.00 |

7,871.00 | | |

ii) Interest differential on account of conversion

of | | | | | |

| | special

securities into marketable securities | 2,331.00 |

1,717.00 |

1,479.00 |

1,479.00 |

1,479.00 | |

* : | An

amount of Rupees one crore each transferred to the National Industrial Credit

(Long Term Operations) Fund, National Rural Credit (Long Term |

| | Operations)

Fund, National Rural Credit (Stabilisation) Fund and National Housing Credit (Long

Term Operations) Fund during each of the five years. |

Surplus Transferable to the Government of India 15.3

The surplus transferable to the Central Government for the year 2003-04 amounted

to Rs.5,400.00 crore, inclusive of Rs.2,331.00 crore towards interest differential

on special securities converted into marketable securities.

The transfer on account of interest differential is intended to compensate the

Government for the difference in interest expenditure, which the Government had

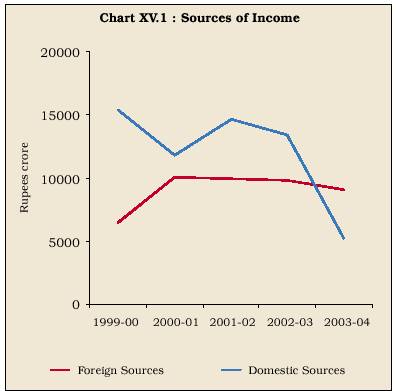

to bear consequent on the conversion. Income 15.4 The gross

income of the Reserve Bank for the year 2003-04 was Rs.14,323.70 crore which was

lower by Rs.8,861.94 crore (38.2 per cent) as compared with the previous year’s

total income of Rs.23,185.64 crore. There was a decline in income from both domestic

and foreign sources (Table 15.2 and Chart XV.1).

| Table

15.2: Gross Income | | | | | | | |

(Rupees crore) | | |

Item | 2003-04 |

2002-03 |

2001-02 |

2000-01 |

1999-2000 | | |

1 | 2 |

3 | 4 |

5 | 6 |

| A. |

Foreign Sources | | | | | |

| | Interest,

Discount, Exchange | 9,103.50 |

9,826.65 |

9,986.46 |

10,086.08 |

6,514.73 | |

B. | Domestic

Sources | | | | | |

| | Interest |

4,872.41 |

13,064.77 |

14,492.14 |

11,314.12 |

14,928.38 | | |

Discount | 0.01 |

0.08 | 10.92 |

211.59 |

323.11 | | |

Exchange | 0.07 |

0.09 | 0.08 |

0.85 | 0.14 |

| | Commission |

335.05 |

279.42 |

189.51 |

210.37 |

185.62 | | |

Rent realised and others |

12.66 |

14.63 |

11.23 |

25.86 |

8.99 | | |

Total: Domestic | 5,220.20 |

13,358.99 |

14,703.88 |

11,762.79 |

15,446.24 | |

C. | Total

Income (Gross) (A+B) | 14,323.70 |

23,185.64 |

24,690.34 |

21,848.87 |

21,960.97 |

|

Table 15.3: Contingency and Asset

Development Reserves and Surplus Transfer to the Government |

| | | | | |

(Rupees crore) | |

Item | 2003-04 |

2002-03 |

2001-02 |

2000-01 |

1999-2000 | |

1 | 2 |

3 | 4 |

5 | 6 |

| Total Income (Gross) |

14,323.70 |

23,185.64 |

24,690.34 |

21,848.87 |

21,960.97 | |

Transfer to Contingency Reserve |

969.47 |

6,733.92 |

6,996.04 |

6,202.57 |

6,554.50 | | |

(6.8) |

(29.0) |

(28.3) |

(28.4) |

(29.9) | |

Asset Development Reserve |

188.09 |

890.31 |

827.91 |

704.78 |

711.55 | | |

(1.3) |

(3.8) |

(3.4) |

(3.2) |

(3.2) | |

Surplus transfer to the Government |

5,400.00 |

8,834.00 |

10,320.00 |

9,350.00 |

9,350.00 | | |

(37.7) |

(38.1) |

(41.8) |

(42.8) |

(42.6) | |

Note: Figures

in parentheses indicate proportion to total income. |

15.5

Transfer to Contingency Reserve, Asset Development Reserve and surplus transfer

to the Central Government witnessed some decline in 2003-04 as a proportion to

total income (Table 15.3).

Earnings from Foreign Sources 15.6

The Reserve Bank’s earnings from the deployment of foreign currency assets and

gold decreased by Rs.723.15 crore from Rs.9,826.65 crore in 2002-03 to Rs.9,103.50

crore in 2003-04 (Table 15.4). This was mainly on account of lower money market

interest rates in major countries, on the one hand, and a fall in prices of securities

due to rise in longer term yields, on the other. Before accounting for mark-to-market

depreciation in securities, the rate of earnings on foreign currency assets and

gold was 2.8 per cent in 2003-04 as against 3.2 per cent in 2002-03. The rate

of earnings on foreign currency assets and gold, after accounting for depreciation,

decreased from 3.1 per cent in 2002-03 to 2.1 per cent in 2003-04.

|

Table 15.4: Earnings from Foreign

Sources |

| | | | |

(Rupees crore) |

| | | | | |

| Item |

As on | |

Variation | | |

June 30, 2004 |

June 30, 2003 |

Absolute |

Per cent | |

1 |

2 |

3 |

4 |

5 | |

Foreign Currency Assets (FCA) |

5,24,865.01 |

3,65,000.98 |

1,59,864.03 |

43.8 | |

Gold | 18,655.48 |

17,182.40 |

1,473.08 |

8.6 | |

Special Drawing Rights (SDR) |

8.42 |

6.09 |

2.33 |

38.3 | |

Reserve Position in the IMF |

5,980.47 ** |

4,534.03 |

1,446.44 |

31.9 | |

Total Foreign Exchange Reserves (FER) |

5,49,509.38 |

3,86,723.50 |

1,62,785.88 |

42.1 | |

Average FCA |

4,38,958.40 |

3,17,297.00 |

1,21,661.40 |

38.3 | |

Earnings (Interest, Discount, Exchange gain/loss, | | | | |

| Capital gain /

loss on Securities) | 12,415.99 |

10,219.47 |

2,196.52 |

21.5 | |

Depreciation on Securities |

(-) 3,312.49 |

(-) 392.82 |

2,919.67 |

743.3 | |

Earnings Net of Depreciation |

9,103.50 |

9,826.65 |

(-) 723.15 |

(-) 7.4 | |

Memo Items: | | | | |

| Unrealised appreciation

on Securities | 330.31 |

1,888.12 |

(-) 1,557.81 |

(-) 82.5 | |

Earnings as percentage of Average FCA |

2.8 |

3.2 | | |

| Earnings (net of

depreciation) as percentage of Average FCA |

2.1 |

3.1 | | |

| ** : Reserve

Position in the International Monetary Fund (IMF), which was shown as a

memo item from May 23, 2003 to March 26, 2004 has been included in the reserves

from the week ended April 2, 2004. |

|

Table 15.5: Earnings from Domestic

Sources | | | | | |

(Rupees crore) |

| | | | | | |

| Item |

As on | |

Variation | | |

June 30, 2004 |

June 30, 2003 | |

Absolute |

Per cent | |

1 | 2 |

3 | |

4 |

5 | |

Domestic Assets |

84,872.74 |

1,54,812.91 |

(-) | 69,940.17 |

(-) 45.2 | |

Weekly average of Domestic Assets |

88,288.77 |

1,56,365.36 |

(-) | 68,076.59 |

(-) 43.5 | |

Earnings | 5,220.20 |

13,358.99 |

(-) | 8,138.79 |

(-) 60.9 | | |

(2,744.69) |

(642.81) | | | |

| of which: | | | | | |

| (i) |

Profit on Sale of Securities |

2,322.62 |

4,798.03 |

(-) | 2,475.41 |

(-) 51.6 | |

(ii) | Interest

on Securities | 1,938.28 |

7,100.29 |

(-) | 5,162.01 |

(-) 72.7 | |

(iii) | Interest

on Loans and Advances | 376.64 |

1,013.63 |

(-) | 636.99 |

(-) 62.8 | |

(iv) | Other

Earnings | 582.66 |

447.04 | |

135.62 |

30.3 | |

Memo Items: | | | | | |

| Earnings in percentage

terms (on average domestic assets) | 5.9 |

8.5 | | | |

| Earnings in percentage

terms (excluding profit on sale of securities) | 3.3 |

5.5 | | | |

| | | | | | |

| Note :

Figures in parentheses are depreciation on securities. |

Income from Domestic Sources 15.7 Domestic

income decreased by Rs.8,138.79 crore (60.9 per cent) from Rs.13,358.99 crore

in 2002-03 to Rs.5,220.20 crore in 2003-04. This decline in income was mainly

due to (a) reduction in profit from sale of rupee securities under open market

operations and booking of substantially higher depreciation in the value of rupee

securities, (b) substantial rise in cost of monetary operations under the Liquidity

Adjustment Facility (LAF), (c) reduction in interest income due to decline in

the size of the portfolio and (d) investment of Government of India surplus balances

in rupee securities held by the Reserve Bank (Table 15.5).

15.8

Profits booked on sale of securities amounted to Rs.2,322.62 crore in 2003-04,

representing a decrease of Rs.2,475.41 crore over the previous year. The interest

income on ways and means advances declined by Rs.241.98 crore from Rs.612.50 crore

in 2002-03 to Rs.370.52 crore in 2003-04, reflecting decreased recourse by the

Central Government to this facility and also the lower Bank Rate. Interest earnings

from loans and advances to banks/financial institutions declined by Rs.395.01

crore from Rs.401.13 crore in 2002-03 to Rs.6.12 crore in 2003-04 due to lower

utilisation of the refinance facility by primary dealers/scheduled commercial

banks combined with lower interest rates applicable on these advances.

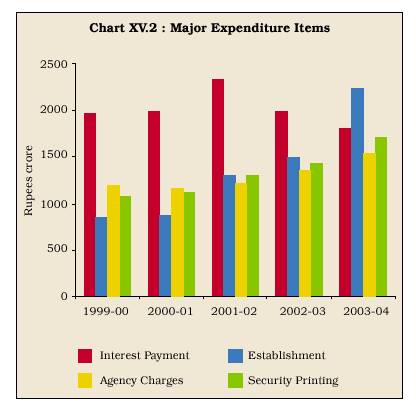

Expenditure 15.9

Total expenditure of the Reserve Bank increased by Rs.1,038.73 crore (15.5 per

cent) from Rs.6,723.41 crore in 2002-03 to Rs.7,762.14 crore in 2003-04 (Table

15.6 and Chart XV.2).

| Table

15.6: Expenditure | | | | | | | | |

(Rupees crore) | | |

Item | 2003-04 |

2002-03 |

2001-02 |

2000-01 |

1999-2000 | | |

1 | |

2 |

3 |

4 |

5 |

6 | |

I. |

Interest Payment |

1,808.48 |

1,990.09 |

2,334.99 |

1,994.80 |

1,971.88 | | |

of which: | | | | | |

| | a) |

Scheduled Banks |

1,323.23 |

1,483.02 |

1,838.57 |

1,660.83 |

1,656.18 | | |

b) |

Payment in lieu of service charges on borrowings |

| | |

from IMF payable to Government of India |

– |

– |

– |

– |

7.82 | |

II. |

Establishment |

2,232.99 |

1,488.86 |

1,304.36 |

870.85 |

846.75 | |

III |

Non-Establishment |

3,720.67 |

3,244.46 |

2,903.04 |

2,721.87 |

2,522.29 | | |

of which: | | | | | |

| | a) |

Agency charges |

1,539.12 |

1,352.41 |

1,207.84 |

1,160.70 |

1,193.62 | | |

b) | Security

printing | 1,709.56 |

1,433.09 |

1,304.49 |

1,122.78 |

1,068.44 | |

Total [I+II+III] |

7,762.14 |

6,723.41 |

6,542.39 |

5,587.52 |

5,340.92 |

Interest

Payment 15.10 Interest payment decreased by Rs.181.61

crore (9.1 per cent) from Rs.1,990.09 crore in 2002-03 to Rs.1,808.48 crore in

2003-04 due to a reduction in the cash reserve ratio and lower interest rates

payable on eligible CRR balances. Establishment Expenditure 15.11

Establishment expenditure increased by Rs.744.13 crore (49.9 per cent) from Rs.1,488.86

crore in 2002-03 to Rs.2,232.99 crore in 2003-04 as a result of increased provisioning

in respect of gratuity and superannuation funds and payment of ex-gratia

of Rs.408.00 crore to staff who opted for Optional Early Retirement Scheme (OERS).

As per the actuarial valuation, the appropriation to the Gratuity and Superannuation

Fund was to the extent of Rs.1,010.00 crore during 2003-04 as against Rs.616.67

crore during the previous year. The establishment expenditure during 2003-04 comprised

of salary (14.5 per cent), allowances (25.7 per cent), funds (47.2 per cent) and

miscellaneous expenditures (12.6 per cent). Non-Establishment Expenditure 15.12

Expenditure on security printing comprising, inter alia, cost of printing

currency notes and cheque forms, increased by Rs.276.47 crore (19.3 per

cent) from Rs.1,433.09 crore in 2002-03 to Rs.1,709.56 crore in 2003-04 mainly

due to higher indent and supply of notes by more than 150 crore pieces.

BALANCE

SHEET Liabilities National Industrial

Credit (Long Term Operations) Fund 15.13 There were

no operations in the National Industrial Credit (Long Term Operations) Fund (established

under Section 46C of the Reserve Bank of India Act, 1934) during 2003-04 except

the credit of Rs.1.00 crore to the Fund out of the Reserve Bank’s income. National

Housing Credit (Long Term Operations) Fund 15.14 The

National Housing Credit (Long Term Operations) Fund was established by the Reserve

Bank in terms of Section 46 D(l) of the Reserve Bank of India Act, 1934 in January

1989. A token contribution of Rs.1.00 crore was made to the Fund out of the Reserve

Bank’s income during 2003-04. Deposits - Banks 15.15

‘Deposits - Banks’ represent balances maintained by banks in current accounts

with the Reserve Bank mainly for maintaining Cash Reserve Ratio (CRR) and as working

funds for clearing adjustments. Deposits - Others 15.16

‘Deposits - Others’ include deposits from financial institutions, employees’ provident

fund deposits, surplus earmarked pending transfer to the Government and sundry

deposits. Other Liabilities 15.17 ‘Other Liabilities’

include the internal reserves and provisions of the Reserve Bank and net credit

balance in the RBI General Account. These liabilities have increased by Rs.11,573.48

crore (9.8 per cent ) from Rs.1,18,356.01 crore as on June 30, 2003 to Rs.1,29,929.49

crore as on June 30, 2004 mainly on account of increase in the levels of the Currency

and Gold Revaluation Account (CGRA). 15.18 The reserves,

viz. Contingency Reserve, Asset Development Reserve, Currency and Gold

Revaluation Account and Exchange Equalisation Account reflected in ‘Other Liabilities’

are in addition to the ‘Reserve Fund’ of Rs.6,500.00 crore held by the Reserve

Bank as a distinct balance sheet head. Currency and Gold Revaluation

Account (CGRA) and Exchange Equalisation Account 15.19

Gains/losses on valuation of foreign currency assets and gold due to movements

in the exchange rates and/or prices of gold are not taken to the Profit and Loss

Account but instead booked under a balance sheet head named as CGRA. The balance

represents accumulated net gain on valuation of foreign currency assets and gold.

During 2003-04, there was an accretion of Rs 11,006.63 crore to the CGRA, thus

increasing its balance from Rs.51,276.41 crore as on June 30, 2003 to Rs.62,283.04

crore as on June 30, 2004. The balance in the CGRA at the end of June 2004 was

equivalent to 11.5 per cent of foreign currency assets and gold holdings of the

Reserve Bank, as compared with 13.4 per cent at the end of June 2003. The decline

was mainly on account of increase in the level of foreign currency assets on the

one hand, and appreciation of the rupee against the US dollar during 2003-04,

on the other. The balance in the Exchange Equalisation Account (EEA) represents

provision made for exchange losses arising out of forward commitments. The balance

in the EEA as on June 30, 2004 stood at Rs 5.65 crore. The balances in the CGRA

and the EEA are grouped under ‘Other Liabilities’ in the balance sheet (Table

15.7).

Contingency Reserve and Asset Development Reserve 15.20

The Reserve Bank maintains a Contingency Reserve (CR) to enable it to absorb unexpected

and unforeseen contingencies. The Reserve Bank has set an indicative target for

the CR at 12 per cent of the Reserve Bank’s total assets to be achieved in phases

by the year 2005, subject to review if considered necessary. The balance in the

CR has increased from Rs.55,249.29 crore as on June 30, 2003 to Rs.56,218.76 crore

as on June 30, 2004. A transfer

| Table

15.7: Balances in Currency and Gold

Revaluation Account and

Exchange

Equalisation Account

| | | |

(Rupees crore) |

| | | |

| As on |

Currency and |

Exchange | |

June 30 |

Gold Revaluation |

Equalisation |

| | Account |

Account | |

1 |

2 |

3 | |

2000 | 27,608.43 |

791.27 | |

2001 | 29,124.44 |

49.46 | |

2002 | 51,010.77 |

51.50 | |

2003 | 51,276.41 |

567.25 | |

2004 | 62,283.04 |

5.65 |

of Rs.969.47 crore was made to the CR during 2003-04 from the

Reserve Bank’s income. The balance in the CR is sufficient to meet contingent

liabilities. 15.21 In order to meet the internal capital

expenditure and make investments in its subsidiaries and associate institutions,

the Reserve Bank had created a separate Asset Development Reserve (ADR) in 1997-98,

with the aim of reaching one per cent of the Reserve Bank’s total assets within

the overall target of 12 per cent set for the CR. In the year 2003-04, an amount

of Rs.188.09 crore was transferred from income to the ADR raising its level from

Rs.5,590.85 crore as on June 30, 2003 to Rs.5,778.94 crore as on June 30, 2004.

The CR and ADR together constituted 10.2 per cent of total assets of the Reserve

Bank as on June 30, 2004 (Table 15.8).

| Table 15.8: Balances

in Contingency Reserve and | | |

Asset Development Reserve | |

| (Rupees

crore) | | | | | | |

| As on |

Balance in |

Balance in |

Total |

Percentage |

| June 30 |

CR |

ADR | |

to total | | | | | |

assets | |

1 |

2 |

3 |

4 |

5 | |

2000 | 29,911.56 |

3,167.85 |

33,079.41 |

9.2 | |

2001 | 36,514.13 |

3,872.63 |

40,386.76 |

9.9 | |

2002 | 48,434.17 |

4,700.54 |

53,134.71 |

11.7 | |

2003 | 55,249.29 |

5,590.85 |

60,840.14 |

11.7 | |

2004 | 56,218.76 |

5,778.94 |

61,997.70 |

10.2 | | | | | | |

| CR :

Contingency Reserve. | ADR

: Asset Development Reserve. |

Assets Foreign Currency Assets 15.22

The foreign currency assets comprise foreign securities held in the Issue Department

and balances held abroad and investments in foreign securities held in the Banking

Department. Such assets rose from Rs.3,65,000.98 crore as on June 30, 2003 to

Rs.5,24,865.01 crore as on June 30, 2004. The increase in the level of foreign

currency assets was mainly on account of net purchases of US dollars from the

market, interest and discount received and revaluation gains. Investment

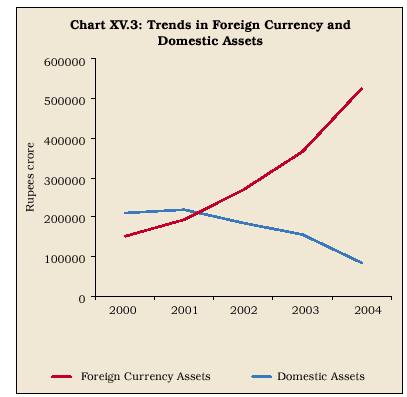

in Government of India Rupee Securities 15.23 Investment

in Government of India Rupee Securities which stood at Rs.1,05,144.04 crore as

on June 30, 2003 decreased by Rs.64,964.30 crore (61.8 per cent) to Rs.40,179.74

crore as on June 30, 2004 (Table 15.9 and Chart XV.3).

| Table 15.9: Outstanding

Foreign Currency and | | |

Domestic Assets | |

| | |

(Rupees crore) | | | | |

| As on |

Foreign |

Domestic | |

June 30 |

Currency |

Assets | | |

Assets | |

| 1 |

2 |

3 | |

2000 | 1,50,901.13 |

2,09,065.64 | |

2001 | 1,91,226.06 |

2,16,246.37 | |

2002 | 2,67,333.18 |

1,86,226.62 | |

2003 | 3,65,000.98 |

1,54,812.91 | |

2004 | 5,24,865.01 |

84,872.74 |

Investments in Shares of Subsidiaries and Associate Institutions 15.24

There was no change in the Reserve Bank’s investments in the shares of its subsidiaries

and associate institutions during 2003-04 (Table 15.10).

Other Assets 15.25

‘Other Assets’ comprise mainly fixed assets, gold holdings in the Banking Department,

amounts

|

Table 15.10: Investments in Shares of |

| Subsidiaries/Associate

Institutions | | | |

(Rupees crore) |

| | Institution |

Book value of shares held |

| | |

as on | |

| | |

June |

June | | | |

30, 2004 |

30, 2003 | | |

1 |

2 |

3 | | | | | |

| 1. |

Deposit Insurance and Credit | | |

| | Guarantee

Corporation | 50.00 |

50.00 | | | | | |

| 2. |

National Bank for Agriculture | | |

| | and

Rural Development | 1,450.00 |

1,450.00 | | | | | |

| 3. |

State Bank of India |

1,222.73 |

1,222.73 | | | | | |

| 4. |

National Housing Bank |

450.00 |

450.00 | | | | | |

| 5. |

Bharatiya Reserve Bank Note | | |

| | Mudran

(Pvt.) Ltd. | 800.00 |

800.00 | | | | | |

| 6. |

Infrastructure Development | | |

| | Finance

Co. Ltd. | 150.00 |

150.00 | | | | | |

| | Total |

4,122.73 |

4,122.73 |

spent on projects pending completion and staff advances. The

level of ‘Other Assets’ increased by Rs.2,035.21 crore (16.4 per cent) from Rs.12,424.56

crore as on June 30, 2003 to Rs.14,459.77 crore as on June 30, 2004. Financial

Sector Reforms and the Reserve Bank’s Balance Sheet 15.26

The process of financial sector reforms has impacted the Reserve Bank’s balance

sheet in terms of size, composition and sources of income (Box XV.1).

Auditors 15.27

The accounts of the Reserve Bank for the year 2003-04 were audited by M/s. P.B.Vijayaraghavan

& Co., Chennai, M/s. Khimji Kunverji & Co., Mumbai, M/s. J.L. Sengupta

& Co., Kolkata, M/s. S.N. Nanda & Co., New Delhi, M/s Rajendra K. Goel

& Co., New Delhi and M/s. Ford, Rhodes, Parks & Co., Mumbai appointed

by the Central Government.

Box

XV. 1

Financial Sector Reforms and the Reserve Bank’s Balance Sheet The

financial sector reforms initiated in the early 1990s have influenced the Reserve

Bank’s Annual Financial Statements and accounting policies in terms of size and

composition of assets and sources of income and expenditure. The last 14 years

have also witnessed a shift in the Reserve Bank’s policy towards transparency

and disclosure in accounting. The Committee on Financial Sector Reforms (Chairman

: Shri M. Narasimham) gave a further impetus to the reform process. Liberalisation

in trade and foreign investment policies, exchange control liberalisation and

other reforms have strengthened the country’s balance of payments. Foreign exchange

reserves have accordingly increased substantially over this period, which have

had a significant impact on the nature of the Reserve Bank’s balance sheet. The

salient features of financial sector reforms and their impact on the Reserve Bank’s

Balance Sheet are as under:

• Since 1990 ‘Interest Income’ and ‘Interest Expenditure’

are being furnished in the Profit and Loss Account as against ‘Net Income’ reported

earlier. The break-up of ‘Income’ into ‘Income from Domestic Sources’ and ‘Income

from Foreign Sources’ is being provided since 1994. Allocation to statutory funds

is being disclosed as an item of appropriation of surplus funds. A detailed break-up

of major items of Annual Financial Statements is now available in the Annual Report. • The

‘Significant Accounting Policies’ and ‘Notes to the Accounts’ are disclosed every

year from 1992 onwards. • Several Accounting Standards,

both Indian and international, were adopted with suitable modifications during

the last decade. The RBI General Regulation 23 was amended in 1996 to carry out

the valuation of rupee securities and foreign securities at monthly intervals

and foreign currency assets at weekly intervals. Section 33(4) of the RBI Act,

1934 was amended in 1991 to provide for valuation of gold at rates not exceeding

international market rates at the end of every month. • A

substantial part of income was earmarked every year to meet exchange losses /

exchange guarantee on account of schemes such as the FCNRA scheme and India Development

Bonds. It was decided that the exchange risk liability on account of these

schemes would be met by the Central Government which resulted in easing of pressure

on the Exchange Equalisation Account. • The practice of transferring

large sums to the Statutory Developmental Funds out of surplus income was discontinued

from 1993; instead a token amount of Rupees one crore each is being contributed

to the funds. • It was decided that no further loans

and advances would be made from the Development Funds to development finance institutions

and the repayments made by them will not be redeployed for fresh lending to them.

The balance in statutory funds consequently increased substantially and it was

decided in 1998 to transfer these unutilised balances to the Contingency Reserve,

resulting in the strengthening of the Reserve Bank’s internal reserves. • The

outstanding loan balances of development finance institutions with the Reserve

Bank were transferred to the Central Government in March 2002 in exchange for

Government securities of an equal amount. While the loans and advances on the

asset side of the balance sheet were, thus, replaced by Government securities,

the balances in the Statutory Funds on the liability side were transferred to

the Contingency Reserve. • In the recent past, the composition

of assets of the Reserve Bank has undergone a major change. Foreign currency assets

and gold which stood at 41.9 per cent of total assets as on June 1997 increased

to 89.1 per cent as on June 30, 2004. Over the same period, the share of domestic

assets in total assets declined from 58.1 per cent as on June 30, 1997 to 10.9

per cent as on June 30, 2004. The substantial change in the asset composition

was mainly on account of the absorption of external inflows into foreign exchange

reserves and sterilisation of the incremental liquidity through sale of domestic

securities. • Corresponding to the changes in the asset

composition of the balance sheet, the Reserve Bank’s income profile has also undergone

changes. The gross income increased from Rs.11,931.7 crore during the year 1995-96

to Rs. 24,690.3 crore during 2001-02, mainly due to factors such as reduced interest

expense on CRR balances of banks, discontinuance of issuance of exchange guarantees,

shifting of exchange loss of FCNRA deposits to the Government and increase in

the domestic interest rates during the period. The gross income, however, has

been showing a decline since 2001-02, which could be attributed to high-yielding

Government securities getting replaced by low-yielding foreign currency assets,

fall in both domestic and international interest rates, lower demand for refinance

from the Reserve Bank due to adequate liquidity in the market and reduction in

the Bank Rate.

|