VIII.1 The objective of the Reserve Bank’s currency management operations is to ensure an adequate supply of good quality banknotes and coins. Accordingly, the Reserve Bank continued to take various measures during 2007-08 to meet the increased public demand for banknotes and coins while simultaneously improving the quality of banknotes. The demand for banknotes was met in full during 2007-08. There was a marked improvement in the quality of Rs.10 denomination banknotes due to sustained efforts to increase the supply of fresh banknotes and mop up of the soiled banknotes. The number of soiled banknotes disposed off by the Reserve Bank during 2007-08 increased significantly, reflecting continued efforts towards weeding out soiled banknotes, increase in disposal capacity by resorting to second shift of currency verification and processing system (CVPS) operations, overhauling of existing machines and upgradation in their capacities. The mechanisation of note processing activities was achieved at all the 4,271 currency chests of commercial banks. Furthermore, all the currency chests held with banks were equipped with note sorting machines (NSMs). As a next logical step, the Bank has initiated exercise to procure and install desktop NSMs in select non-currency chest branches, based on the volume of cash handled, proximity to international border and quantum of detection of counterfeit notes.

VIII.2 In the above backdrop, this Chapter details the currency management operations of the Reserve Bank during 2007-08. The Reserve Bank continued with its initiatives under a multi-pronged approach to ensure regular supply of fresh banknotes, speedier disposal of soiled banknotes and extending mechanisation of cash processing activity to meet the public’s demand for good quality banknotes. The continued emphasis by the Reserve Bank on discontinuing the practice of stapling banknotes also contributed to the improvement in quality of banknotes. The indent for banknotes placed with the printing presses was met in full, both in terms of volume and value. The recent trend of the growth in the volume of banknotes being lower than that in value terms continued during 2007-08, reflecting the ongoing compositional shift in favour of higher denomination notes. The increased demand for coins, which began from October 2006 onwards, strengthened further during 2007-08. The Reserve Bank adequately met the increased demand for coins. The total number of currency chests and State Treasury Offices (STOs) declined further during 2007-08, reflecting the impact of the ongoing policy of rationalisation and consolidation of currency chests by public sector banks. Equipping all the currency chests with note sorting machines as well as the setting up of the Forged Note Vigilance Cells (FNVCs) at the banks helped in increasing the detection rates of counterfeit notes at the currency chest level itself.

BANKNOTES IN CIRCULATION

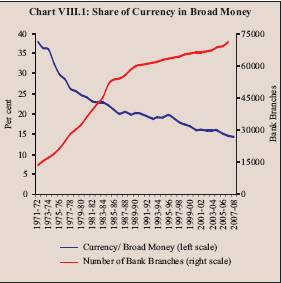

VIII.3 During 2007-08, the value of banknotes in circulation rose by 17.2 per cent (17.6 per cent during 2006-07) whereas the volume of banknotes rose by 11.0 per cent (5.2 per cent a year ago). Continuing its declining trajectory witnessed in the past few years, the ratio of currency with the public to broad money(M3) declined further to 14.2 per cent at end-March 2008 from 14.6 per cent a year ago (Chart VIII.1). The ratio of currency with the public to GDP continued to increase further to 12.0 per cent in 2007-08 from 11.6 per cent, a year ago.

VIII.4 The growth in the volume of banknotes, thus, continued to be lower than that in value terms, reflecting the gradual compositional shift towards higher denomination banknotes, particularly Rs.1,000 and Rs.500. While the volume of Rs.500 denomination banknotes increased by 16.7 per cent during 2007-08 (23.6 per cent a year ago), that of Rs.1,000 denomination banknotes rose by 50.7 per cent (45.7 per cent a year ago). The volume of Rs.10 denomination banknotes increased by 30.4 per cent due to sustained efforts to infuse a greater number of fresh banknotes into circulation to bring about an improvement in the quality of these banknotes. As a

result of sustained efforts to release the stock held with currency chests, the volume of banknotes in the denominations of Rs. 2 and Rs. 5 also increased by 23.2 per cent. However, the volumes of banknotes of denominations of Rs. 20, Rs. 50 and Rs. 100 decreased marginally as compared with those in 2006-07 (Table 8.1).

VIII.5 In volume terms, Rs.100 denomination banknotes had the largest share (30 per cent of the total pieces in circulation) at end-March 2008. In terms of value, Rs. 500 denomination banknotes had the largest share (45 per cent of the total value of banknotes in circulation) at end-March 2008 (Chart VIII.2). The consistent shift from lower denomination to higher denomination banknotes could be partly attributed to the technological advancements (growing network of ATMs) coupled with the rising income levels.

Coins in Circulation

VIII.6 The trend of increased demand for coins, which started from October 2006 onwards led by demand for Rs. 2 coins, continued during 2007-08. The total value of coins (including small coins in circulation) increased by 13.3 per cent during 2007-08 (11.2 per cent in 2006-07 and 2.2 per cent in 2005-06). In volume terms, the increase was 5.7 per cent in 2007-08 (6.5 per cent in 2006-07 and 1.4 per cent in 2005-06) (Table 8.2). The value of coins, relative to the value of the banknotes, declined from 1.71 per cent at end-March 2006 to 1.62 per cent at end-March 2007 and further to 1.56 per cent at end-March 2008. Amongst coins, while Re.1 coins had the largest share in terms of volume (25.9 per cent), Rs.5 coins had the largest share in value terms (35.8 per cent). In volume terms, Re.1, Rs.2 and Rs.5 coins increased by 8.1 per cent, 28.1 per cent and 12.8 per cent, respectively, during 2007-08. In value terms, Re.1, Rs.2 and Rs.5 coins increased by 8.0 per cent, 28.2 per cent and 12.8 per cent, respectively, during 2007-08.

Table 8.1:Banknotes in Circulation |

Denomination |

Volume (Million pieces) |

Value (Rupees crore) |

|

End-March |

End-March |

End-March |

End-March |

End-March |

End-March |

|

2006 |

2007 |

2008 |

2006 |

2007 |

2008 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Rs.2 and Rs.5 |

6,217 |

6,008 |

7,405 |

2,431 |

2,334 |

2,747 |

Rs.10 |

6,274 |

7,155 |

9,333 |

6,274 |

7,155 |

9,333 |

Rs.20 |

2,038 |

2,089 |

2,054 |

4,076 |

4,178 |

4,108 |

Rs.50 |

5,568 |

5,590 |

5,302 |

27,840 |

27,951 |

26,508 |

Rs.100 |

13,464 |

13,544 |

13,457 |

1,34,640 |

1,35,444 |

1,34,575 |

Rs.500 |

3,647 |

4,508 |

5,262 |

1,82,350 |

2,25,400 |

2,63,108 |

Rs.1000 |

643 |

937 |

1,412 |

64,300 |

93,676 |

1,41,219 |

Total |

37,851 |

39,831 |

44,225 |

4,21,911 |

4,96,138 |

5,81,598 |

CURRENCY OPERATIONS

VIII.7 In order to provide the public with good quality banknotes, the Reserve Bank continued with its initiatives under a multi-pronged approach involving regular supply of fresh banknotes, speedier disposal of soiled banknotes and extending mechanisation of cash processing activity. The discontinuance of the practice of stapling banknotes also contributed to the improvement in quality of banknotes. Banks were repeatedly advised to issue only clean banknotes to the public and to remit the soiled banknotes in unstapled condition to the Reserve Bank through currency chests. The Reserve Bank has been examining various options to increase the life of the banknotes as part of its clean note policy.

Currency Chests

VIII.8 The core central banking function of note issue and currency management is performed by the Reserve Bank through its 18 Issue Offices, the sub-office of the Issue Department at Lucknow, a currency chest at Kochi and a wide network of 4,271 currency chests and 4,033 small coin depots. The Reserve Bank has agency arrangements, mainly with scheduled commercial banks, under which a currency chest facility is granted to them. The total number of currency chests and State treasury offices (STOs) declined further during 2007-08, reflecting the impact of the on-going policy of rationalisation and consolidation of currency chests by public sector banks (Table 8.3). SBI and Associate banks carried out a detailed exercise with a view to rationalising and consolidating their currency chests. As a result, the number of chests at their branches in metros and major urban centres declined significantly. Two regional rural banks (Prathama Bank, Uttar Pradesh and Tripura Gramin Bank, Tripura) were granted ‘in principle’ approval for setting up currency chests. The number of currency chests at STOs declined to 17 and efforts are afoot to close them gradually. State Bank Group continued to have the largest share (71.8 per cent) of currency chests, followed by nationalised banks (25.0 per cent). The process of closing existing repositories or converting them into full-fledged currency chests initiated earlier was completed during the year and there were no repositories attached to currency chests as on March 31, 2008.

Indent and Supply of Fresh Banknotes

VIII.9 The indent for banknotes for the year was met in full (for the second year in succession) by the printing presses (Tables 8.4 and 8.5). This can be attributed to effective monitoring of supplies and efficient allocation and management of the capacities at the presses (depending on the denominations printed).

Table 8.2 : Coins in Circulation |

Denomination |

Volume (Million pieces) |

Value (Rupees crore) |

|

End-March |

End-March |

End-March |

End-March |

End-March |

End-March |

|

2006 |

2007 |

2008 |

2006 |

2007 |

2008 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Small coins |

54,115 |

54,277 |

54,735 |

1,357 |

1,364 |

1,455 |

Re. 1 coins |

18,730 |

22,878 |

24,721 |

1,873 |

2,288 |

2,472 |

Rs. 2 coins |

6,684 |

7,441 |

9,535 |

1,337 |

1,488 |

1,907 |

Rs. 5 coins |

5,289 |

5,761 |

6,500 |

2,645 |

2,881 |

3,250 |

Total |

84,818 |

90,357 |

95,491 |

7,212 |

8,021 |

9,084 |

Table 8.3: Currency Chests |

Category |

Number of Currency Chests |

|

June 30, |

June 30, |

June 30, |

Dec. 31, |

|

2005 |

2006 |

2007 |

2007 |

1 |

2 |

3 |

4 |

5 |

Treasuries |

149 |

116 |

23 |

17 |

State Bank of India |

2,198 |

2,182 |

2,127 |

2,097 |

SBI Associate Banks |

1,008 |

994 |

988 |

983 |

Nationalised Banks |

983 |

1,028 |

1,061 |

1,074 |

Private Sector Banks |

72 |

83 |

94 |

95 |

Co-operative Banks |

1 |

1 |

1 |

1 |

Foreign Banks Reserve Bank (offices and |

4 |

4 |

4 |

4 |

currency chests) |

20 |

20 |

20 |

20 |

Total |

4,435 |

4,428 |

4,318 |

4,291 |

Table 8.4: Volume of Banknotes Indented and Supplied |

(Million pieces) |

|

2005-06 |

2006-07 |

2007-08 |

2008-09 |

Denomination |

Indent |

Supply |

% of Supply to Indent |

Indent |

Supply |

% of Supply to Indent |

Indent |

Supply |

% of Supply to Indent |

Indent |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

Rs.5 |

— |

50 |

— |

— |

50 |

— |

— |

— |

— |

— |

Rs.10 |

3,300 |

1,183 |

36 |

3,500 |

3,480 |

99 |

4,200 |

4,193 |

100 |

5,000 |

Rs.20 |

1,200 |

706 |

59 |

500 |

438 |

88 |

600 |

636 |

106 |

500 |

Rs.50 |

2,700 |

1,063 |

39 |

1,400 |

1,458 |

104 |

1,200 |

1,213 |

101 |

1,000 |

Rs.100 |

5,550 |

3,208 |

58 |

4,000 |

4,034 |

101 |

4,200 |

4,199 |

100 |

4,200 |

Rs.500 |

1,800 |

661 |

37 |

1,500 |

1,473 |

98 |

1,800 |

1,805 |

100 |

3,500 |

Rs.1000 |

450 |

130 |

29 |

600 |

589 |

98 |

700 |

699 |

100 |

800 |

Total |

15,000 |

7,001 |

47 |

11,500 |

11,522 |

100.2 |

12,700 |

12,745 |

100.4 |

15,000 |

Printing Costs of Banknotes

VIII.10 As part of its ongoing efforts to reduce the expenditure on printing of banknotes, the Reserve Bank continued with the efforts to source banknotes from the lowest cost producer. Accordingly, the Reserve Bank has been sourcing banknotes from the two presses each of the Security Printing and Minting Corporation of India Ltd. (SPMCIL) and from Bharatiya Reserve Bank Note Mudran (Pvt.)

Ltd. (BRBNMPL). The amount charged for printing banknotes during 2007-08 was Rs. 2,026 crore, of which Rs. 908 crore was paid to the SPMCIL presses in respect of 5,442 million banknotes supplied by them and Rs.1,118 crore to BRBNMPL for 8,488 million notes procured from its presses (Table 8.6). It has been the Reserve Bank’s endeavour to consistently bring down the cost of banknotes and to encourage the note presses to bring about greater efficiencies in their operations while maintaining the quality of the printed banknotes.

Indent, Supply and Distribution of Coins

VIII.11 During 2007-08, there was a spurt in the indent placed by the Reserve Bank on the mints to meet the increased demand for coins (Table 8.7). The stock of 359 million pieces of Rs.5 cupro-nickel coins with the mints was also lifted by the Reserve Bank with the concurrence of the Government. The increased demand for coins was also met by issue of 127 million pieces of 50 paise coins. The measures initiated by the Reserve Bank to meet the increased demand for coins included: (i) arrangements for retail distribution through post offices, RRBs and UCBs, in addition to bank branches; (ii) identification of 2,000 bank branches across the country for distribution of coins; (iii) issuance of press releases informing the public of the same and putting the list of these bank branches on the Reserve Bank website; (iv) organisation of coin melas by several Issue Offices of the Bank at various prominent centres for disbursing coins directly to consumers; (v) bulk issuance of coins to registered associations of hotels, retail shops and chemists; and (vi) participation of the Reserve Bank offices in exhibitions/trade fairs and distribution of coins directly to the members of public.

Table 8.5: Value of Banknotes Indented and Supplied |

(Rupees crore) |

|

|

2005-06 |

|

|

2006-07 |

|

|

2007-08 |

|

2008-09 |

Denomination |

Indent |

Supply |

% of Supply to Indent |

Indent |

Supply |

% of Supply to Indent |

Indent |

Supply |

% of Supply to Indent |

Indent |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

Rs. 5 |

— |

25 |

— |

— |

25 |

— |

— |

— |

— |

— |

Rs. 10 |

3,300 |

1,183 |

36 |

3,500 |

3,480 |

99 |

4,200 |

4,193 |

100 |

5,000 |

Rs. 20 |

2,400 |

1,412 |

59 |

1,000 |

876 |

88 |

1,200 |

1,272 |

106 |

1,000 |

Rs. 50 |

13,500 |

5,316 |

39 |

7,000 |

7,292 |

104 |

6,000 |

6,065 |

101 |

5,000 |

Rs. 100 |

55,500 |

32,084 |

58 |

40,000 |

40,348 |

101 |

42,000 |

41,990 |

100 |

42,000 |

Rs. 500 |

90,000 |

33,065 |

37 |

75,000 |

73,655 |

98 |

90,000 |

90,250 |

100 |

1,75,000 |

Rs. 1,000 |

45,000 |

12,960 |

29 |

60,000 |

58,910 |

98 |

70,000 |

69,900 |

100 |

80,000 |

Total |

2,09,700 |

86,045 |

41.0 |

1,86,500 |

1,84,586 |

99.0 |

2,13,400 |

2,13,670 |

100.1 |

3,08,000 |

Table 8.6 : Supply and Cost of Banknotes |

Year |

SPMCIL |

BRBNMPL |

(July-June) |

Supply |

Cost |

Supply |

Cost |

|

(Million pieces) |

(Rupees crore) |

(Million pieces) |

(Rupees crore) |

1 |

2 |

3 |

4 |

5 |

2003-04 |

4,951 |

894.2 |

8,421 |

815.3 |

2004-05 |

4,160 |

783.3 |

7,391 |

660.3 |

2005-06 |

2,697 |

405.9 |

4,194 |

629.0 |

2006-07 |

5,136 |

1,041.9 |

7,348 |

978.3 |

2007-08 |

5,442 |

908.1 |

8,488 |

1,118.1 |

SPMCIL:Security Printing and Minting Corporation of India Ltd.

BRBNMPL:Bharatiya Reserve Bank Note Mudran (Pvt.) Ltd. |

Disposal of Soiled Banknotes

VIII.12 There was a marked improvement in the number of soiled banknotes disposed by the Reserve Bank during 2007-08. As many as 10,696 million pieces of soiled banknotes (24 per cent of banknotes in circulation) were processed and removed from circulation during the year. Within soiled banknotes, Rs.100 denomination notes constituted the largest share, followed by Rs.10 denomination notes (Table 8.8). As against total disposal of 10,696 million pieces during the year (7,325 million pieces a year ago), 13,742 million pieces of fresh banknotes were supplied to members of public and currency chests during the year (10,703 million pieces a year ago). The number of banknotes withdrawn from circulation and eventually disposed of at the Reserve Bank offices increased during the year as part of an ongoing effort towards lifting of soiled banknotes, increase in disposal capacity by resorting to second shift of currency verification and processing systems (CVPS) operations, overhauling of existing machines and upgradation in their capacities.

VIII.13 During 2007-08, 6,287 million pieces of banknotes were processed through CVPS operations (as compared with 4,532 million pieces, a year ago). The remaining banknotes were disposed of under the Dynamic Working Model, which is a statistical method in which a representative sample of a lot (i.e., soiled banknotes considered for processing) is taken for checking of discrepancies, i.e., for shortages and

counterfeits. If the shortages and counterfeits detected in the representative sample are within the ‘tolerance limit’, then the remaining lot is shredded, otherwise it is subjected to 100 per cent checking on CVPS. This ‘tolerance’ is based on the past data on denomination specific shortages and counterfeits of notes detected at each Reserve Bank’s office. Disposal of lower denomination notes increased by 28 per cent during 2007-08.

Table 8.7: Indent and Supply of Coins |

(Million pieces) |

|

2005-06 |

2006-07 |

2007-08 |

2008-09 |

Denomination |

Indent |

Supply |

Indent |

Supply |

Indent |

Supply |

Indent |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

25 paise |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

50 paise |

0 |

0 |

0 |

0 |

185 |

127 |

400 |

Re. 1 |

0 |

13 |

0 |

45 |

1,500 |

1,294 |

2,500 |

Rs. 2 |

0 |

22 |

700 |

686 # |

1,500 |

1,562 |

1,800 |

Rs. 5 |

0 |

7 |

0 |

11 |

300 |

173 |

800 |

Total |

0 |

42* |

700 |

742 |

3,485 |

3,156 |

5,500 |

* : Includes mainly commemorative coins.

# : New ferritic stainless steel coins, for which an indent of 700 million pieces was placed

in December 2006 in view of the rise in

international prices of copper and nickel. |

Mechanisation

VIII.14 Mechanisation of cash processing activity and disposal of soiled banknotes continued to be one of the major thrust areas of the Reserve Bank in currency management. With all the currency chests currently equipped with at least one note sorting machine, banks have been advised to install desktop note sorting machines (NSMs) in non-currency chest branches also based on the volume of cash handled. The Reserve Bank has also initiated the process for procurement of NSMs for installation at its Issue offices and select bank branches across the country (Box VIII.1).

Counterfeit Banknotes

VIII.15 During 2007-08, the number of counterfeit banknotes detected at the Reserve Bank’s offices and bank branches increased by 86.9 per cent. In value terms, the counterfeit notes increased by 137.1 per cent on account of rise in detections in the notes of higher denominations, viz., Rs.100 and above (Table 8.9).

Table 8.8: Disposal of Soiled Notes and Supply of Fresh Banknotes |

Denomination |

Volume in million pieces |

|

2005-06 |

2006-07 |

2007-08 |

|

Disposal |

Supply |

Disposal |

Supply |

Disposal |

Supply |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Rs. 1,000 |

5 |

279 |

7 |

405 |

17 |

663 |

Rs. 500 |

242 |

996 |

276 |

1,427 |

444 |

1756 |

Rs. 100 |

3,250 |

3,223 |

2,360 |

3716 |

3,727 |

4,015 |

Rs. 50 |

2,160 |

1,221 |

1,456 |

1,438 |

2,172 |

1,522 |

Rs. 20 |

532 |

730 |

489 |

739 |

834 |

728 |

Rs. 10 |

2,593 |

2,392 |

2,243 |

2,719 |

3,030 |

4,580 |

Up to Rs. 5 |

522 |

64 |

494 |

259 |

472 |

478 |

Total |

9,304 |

8,905 |

7,325 |

10,703 |

10,696 |

13,742 |

Memo: |

|

|

|

|

|

|

Total Banknotes in Circulation |

37,851 |

|

39,831 |

|

44,225 |

Note: Supply figures are notes issued to public by issue offices plus remittances sent to currency chests and therefore differ from the figures in Table 8.4 which gives notes supplied by presses to the Reserve Bank. |

Box VIII.1 Note Sorting Systems

As a part of the plan to effectively control the circulation of counterfeit notes at the entry point itself as also to ensure furtherance of ‘Clean Note Policy’, that is only non-issuable banknotes are sent to the Reserve Bank and only good quality re-issuable banknotes are issued to the public, banks were advised to mechanise the currency chest operations, in a time bound manner. Accordingly, banks were required to provide note sorting machines of appropriate capacity at all their chest branches. All the currency chest branches in the banking network have since installed note sorting machines. In order to further strengthen the detection and anti-counterfeiting systems, the Reserve Bank will be installing NSMs at select non-chest branches all over the country based on their proximity to international borders, higher counterfeit detection and those having high cash handling requirements.

VIII.16 The significant increase in detection was attributable to installation of NSMs by all the banks at their currency chest branches (to facilitate examination and detection of counterfeit notes at the currency chest level itself), and the setting up of the Forged Note Vigilance Cells (FNVCs) at the banks (to ensure stringent levels of anti-counterfeit management in the banking system). The share of the counterfeit notes detected at the Reserve Bank’s offices declined from 96.1 per cent in 2005-06 to 56.4 per cent in 2006-07 and further to 31.7 per cent in 2007-08 indicating increased effective use of NSMs at currency chest branches (Table 8.10).

VIII.17 The FNVCs constituted at the head offices of the banks perform several important functions such as (i) dissemination of the Reserve Bank’s instructions on counterfeit notes to their branches;(ii) monitoring implementation of these instructions; (iii) consolidation of data on detection of counterfeit notes and follow-up of counterfeit note cases with the police; (iv)stepping up of surveillance at currency chests where detection of shortages/defective/ counterfeit notes was higher; and (v) ensuring installation of NSMs at currency chests and monitoring the detection of counterfeit notes at currency chests /other branches.

Computerisation of Currency Management

VIII.18 The Reserve Bank had taken up the task of putting in place an Integrated Computerised Currency Operations and Management System (ICCOMS) comprising 3 components, viz., Currency Chest Reporting System (CCRS), ICCOMS-Issue Department (ICCOMS-ID) and Currency Management Information System (CMIS) in the central office, Issue Departments in regional offices and currency chests maintained by various banks. The project includes computerisation and networking of the currency chests with the Reserve Bank’s Issue offices to facilitate prompt, efficient and error-free reporting and accounting of the currency chest transactions and seamless flow of information between the Issue Departments and the Central Office in a secure manner with proactive monitoring. The ‘live-run’ of CCRS component under ICCOMS, which commenced last year, has since stabilised and enabled the Reserve Bank to account for currency transfer transactions efficiently. Under the second component, viz., ICCOMS-ID, transactions are put through by all the 19 offices of the Reserve Bank on a ‘straight through put’ process. As part of CMIS, which became operational during the year, the data replicated from all the Issue Offices has enabled the Reserve Bank to identify stock of banknotes and coins, accumulation and disposal of soiled notes, consumption of fresh notes and reissuables and coins at all the Issue Offices and monitor notes in circulation at any point of time on an all-India basis.

Table 8.9: Counterfeit Notes Detected |

|

Number of pieces |

Value (Rupees) |

Denomination |

2005-06 |

2006-07 |

2007-08 |

2005-06 |

2006-07 |

2007-08 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Rs.10 |

80 |

110 |

107 |

800 |

1,100 |

1,070 |

Rs. 20 |

340 |

305 |

343 |

6,800 |

6,100 |

6,860 |

Rs. 50 |

5,991 |

6,800 |

8,119 |

2,99,550 |

3,40,000 |

4,05,950 |

Rs. 100 |

104,590 |

68,741 |

110,273 |

1,04,59,000 |

68,74,100 |

1,10,27,300 |

Rs. 500 |

12,014 |

25,636 |

66,838 |

60,07,000 |

1,28,18,000 |

3,34,19,000 |

Rs. 1000 |

902 |

3,151 |

10,131 |

9,02,000 |

31,51,000 |

1,01,31,000 |

Total |

123,917 |

104,743 |

195,811 |

1,76,75,150 |

2,31,90,300 |

5,49,91,180 |

Note: Data are exclusive of the counterfeit notes seized by police and other enforcement agencies. |

Table 8.10: Counterfeit Notes Detected at the

Reserve Bank and Bank Branches |

(In pieces) |

Year |

Detection at Reserve Bank |

Detection at Other Banks |

Total |

1 |

2 |

3 |

4 |

2005-06 |

119,068 |

4,849 |

123,917 |

|

(96.1) |

(3.9) |

|

2006-07 |

59,048 |

45,695 |

104,743 |

|

(56.4) |

(43.6) |

|

2007-08 |

62,134 |

133,677 |

195,811 |

|

(31.7) |

(68.3) |

|

Note :Figures in parentheses in columns (2) and (3) represent the shares in total. |

Customer Service

VIII.19 The Reserve Bank continued with its efforts to improve customer service in matters relating to issue/acceptance of coins from public and exchange of soiled and mutilated banknotes. In this regard, the Reserve Bank reiterated its directions to all scheduled commercial banks to issue/accept coins and soiled banknotes in transactions or for exchange without any restriction. Those offices, where demand for coins picked up, were advised to arrange for organisation of coin camps at identified locations in consultation with the banks. Efforts were continued to provide timely and efficient customer service not only at the Reserve Bank’s offices but also at the chest and the bank branches.

VIII.20 For improved customer service towards exchange of mutilated banknotes, the Reserve Bank has proposed simplification of the existing Note Refund Rules and the same would be put in place after notification by the Government.

VIII.21 As a part of awareness campaign, the Reserve Bank in association with the National Film Development Corporation (NFDC) has developed a film to create awareness on security features of banknotes and on ‘do’s and don’ts’ for handling of banknotes. This, being in electronic media, will serve as an important tool for building awareness amongst public cutting across all strata of society through the length and breadth of the country.

VIII.22 Against the backdrop of significant changes in currency management operations in the last few years, a Working Group on Currency Management (Chairman: Shri U. S. Paliwal) was set up to look into the existing systems and procedures and suggest ways for further improvement and rationalisation in the area of cash handling, processing and distribution. The Group, in its Interim Report submitted to the Reserve Bank recommended, inter alia, the introduction of non-sequential numbering of banknotes in the denominations of Rs.500 and Rs.1,000 at the presses as also a system of incentives/disincentives for proper/improper handling of cash and better/bad customer service (Box VIII.2).

Bharatiya Reserve Bank Note Mudran Pvt. Ltd.

VIII.23 The Bharatiya Reserve Bank Note Mudran Pvt. Ltd. (BRBNMPL), incorporated as a wholly owned subsidiary of the Reserve Bank, was set up in 1996 to take over the work of the New Note Press project. The BRBNMPL prints bank notes at its two note presses viz., Mysore (Karnataka) and Salboni (West Bengal). The total supply of banknotes by BRBNMPL during 2007-08 (July-June) was 8,488 million pieces (7,348 million pieces during 2006-07).

Box VIII.2 Non-sequential Numbering of Banknotes

The Reserve Bank introduced the ‘star series’ numbered banknotes in the denomination of Rs. 10, Rs. 20 and Rs. 50 in April 2006. Star series is a special series of numbering which is different from normal numbering method. The star series of numbering is basically used for replacing the defective notes (single/packet) with star series notes. One complete prefix series with “*’’ is exclusively reserved for numbering in star series. Star series may have the following sequence of numbering 0AA*000001 up to OAA*1000000. After successful introduction of star series banknotes in the denominations of Rs. 10, Rs. 20 and Rs. 50, the Reserve Bank will now be introducing non-sequential numbering for Rs. 500 and Rs. 1,000 denominations notes. With this system in place, a fresh banknote packet will have 100 pieces that may not be serially numbered banknotes from 1 to 100. In other words, the packet will contain 100 pieces but some of the banknotes in the sequence will not be there. The system will result in cost and manpower rationalisation at the presses.

As it is, serially numbered banknote packets are available only in the fresh note packets issued over the counter and through ATMs. Majority of the public/users of cash receive re-issuables banknotes, which are not serially numbered. With the increase in the demand for banknotes of Rs. 500 and Rs. 1,000 denominations, especially for ATMs, it is essential to meet the demand for fresh banknotes by bringing greater efficiency at the presses.

Outlook

VIII.24 The currency management operations of the Reserve Bank would continue to be conducted with the objective of ensuring an adequate supply of good quality banknotes and coins in the country in an efficient manner. Various options would be explored for increasing the circulation life of banknotes. Rationalisation of the systems and procedures would be pursued with a view to increasing the efficiency of operations. Efforts would also be made to strive towards setting international benchmarks in currency management.

|