Today, the Reserve Bank released the web publication ‘Quarterly Basic Statistical Return (BSR)-2 on Deposits with Scheduled Commercial Banks1 – September 20252’ on its ‘Database on Indian Economy’ portal3 (https://data.rbi.org.in Homepage > Publications). Scheduled commercial banks (SCBs), excluding regional rural banks, report quarterly branch-wise data on type of deposits (current, savings and term), its institutional sector wise ownership, age wise distribution of deposits pertaining to individuals, maturity pattern, size, and interest rate range wise distribution of term deposits as well as number of employees in the ‘Basic Statistical Return’ (BSR) - 2. These data are released at disaggregated level across population groups4, bank groups, states, districts, and centres. Highlights:  -

Metropolitan branches, having larger share of deposits, exhibited moderation in deposit growth (y-o-y) to 9.6 per cent in September 2025 from 12.7 per cent a year ago. The rural, semi-urban and urban branches registered 11.7 per cent, 10.7 per cent and 9.5 per cent deposit growth, respectively, during the same period. -

Public sector banks recorded 9.6 per cent of deposit growth (y-o-y) with an improvement in share of deposits to 57.6 per cent in September 2025 from 57.3 per cent a quarter ago. Deposit growth of private sector banks declined to 10.0 per cent in September 2025 from 15.1 per cent a year ago. -

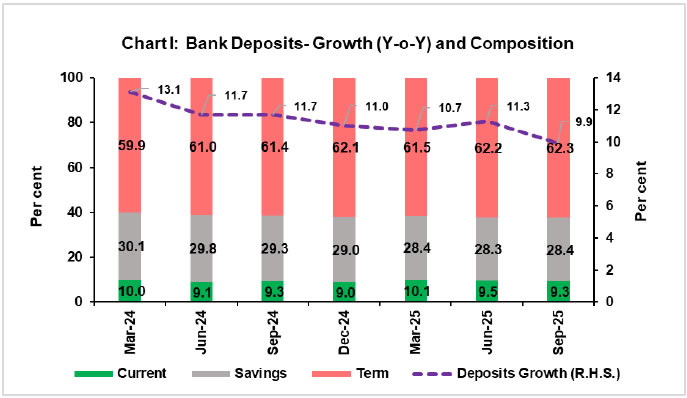

Though there is a declining trend in term deposit growth (11.6 per cent), it remained higher than that of current (9.3 per cent) and savings deposit (6.7 per cent) in September 2025. -

As at end-September 2025, 69.8 per cent of term deposits were held under the original maturity bucket of ‘one to three years’ vis-à-vis 66.8 per cent a year ago and 20.0 per cent of term deposits were held under maturity period up to one year. -

The share of term deposits bearing interest rate ‘less than 7 per cent’ surged to 46.0 per cent in September 2025 from 31.2 per cent a year ago (Chart II).  -

Term deposits of size ‘one crore and above’ grew (y-o-y) by 12.3 per cent in September 2025 and their share stood at 45.6 per cent as compared to 45.3 per cent a year ago. -

The household sector remained the largest contributor of deposits with nearly three-fifths share in deposits in September 2025. Within household sector, individuals (including HUF) and females owned 85.6 per cent and 34.5 per cent of deposits, respectively, in September 2025. -

Contribution of senior citizens in total SCB’s deposits rose to 20.6 per cent as of end-September 2025 (20.1 per cent a year ago). -

Top six states / union territories (viz., Maharashtra, Uttar Pradesh, Karnataka, NCT of Delhi, Tamil Nadu and West Bengal) collectively accounted for 54.2 per cent of household deposits in September 2025. Maharashtra alone contributed to 16.5 per cent of households’ deposits. Ajit Prasad

Deputy General Manager

(Communications) Press Release: 2025-2026/1582

|

|