Sharad Kumar and M. Sreeramulu* |

| |

| The study compares the employee productivity and employee cost ratios between the traditional banks and modern banks from 1997 to 2008. The study concludes that the performance of the modern banks (foreign and new private sector banks) was much superior than the traditional banks (public sector and old private sector banks). However, the gap between the performance of modern and traditional banks on all the five variables has shown a decreasing trend, which has significantly reduced during the period of 12 years under study, on account of the measures taken by the traditional banks during the period. |

| |

JEL Classification : G21 |

Keywords : Employees’ cost and Employees’ productivity, Traditional and Modern banks, Gap Index |

| |

Introduction |

| |

| Globalization, deregulation and advances in information technology during last 12 years have brought about significant changes in the operating environment for banks operating in India. During this period a slew of financial sector reform measures aiming at increasing operational efficiency of the banking sector as a whole, as well as of individual institutions are witnessed. Policy makers have clearly recognized that inefficiency is the main factor contributing to the high cost of banking services in India. In the process, a number of private sector banks (classified as new private sector banks) were allowed to operate with latest technology and fully automated systems akin to foreign banks. |

| |

| * Sharad Kumar is Director and M. Sreeramulu is Assistant Adviser in Department of Statistics and Information Management, Reserve Bank of India. The views expressed in this study are those of the authors and not the institution to which they belong. |

| |

The public sector and the existing private sector banks (old private sector banks) faced challenges in the form of competitive pressures and changing customer demands both from foreign banks and new private sector banks. Most of the public sector and old private sector banks (classified as traditional banks for the purpose of present study) had their existence for more than a century with a number of legacy issues to tackle. While the new private sector banks could adopt the best practices and implement latest technology in their operations, the foreign banks acquired the practices and technology akin to their host countries within the regulatory framework of India. Influenced by the varied practices and culture of host countries, this segment of banks operating in India was found to be quite heterogeneous in their operations and performance.

Faced with the threat of competition from the foreign and new private sector banks (classified as modern banks), the traditional banks employed a number of measures to improve the operational efficiency, meeting customer expectations and reduction of operating costs. These include going for fully automated systems (Core Banking Solution based operations) preceded with business process reengineering (BPR), offering VRS to its employees, training and retraining of staff, lateral recruitment of specialists, emphasis on marketing, advertising, customer relationship management and improving brand image, diversification of activities, introduction of electronic based multiple service delivery channels, setting up of back offices and data centers, business process outsourcing. Some of these banks have undergone restructuring exercise with the involvement of international consulting agencies to adopt best international practices and remove bottlenecks in their operations.

The paper is organized in five sections. Section I provides a survey of literature. Objective of the study is discussed in Section II. Section III presents the data and methodology. Analysis of data is discussed in section IV. Finally concluding observations of the study are presented in section V. |

| |

Section I |

Review of Literature |

| |

| A number of studies were conducted to compare different types of banks operating in India based on different performance/efficiency criteria/ parameters from time to time. After nationalization of banks, there was a growing concern on the deteriorating of banking sector’s efficiency in several spheres. The Reserve Bank of India constituted a number of committees, notably Tondon Committee (1975), Luther Committee (1977), Chakravarty Committee (1986) and Narsimham Committee (1991) which inter-alia examined various parameters of efficiency and given a number of suggestions to improve the efficiency of the banks in India. Nag and Shivaswamy (1990) compared the performance of Foreign Banks operating in India with the Indian scheduled commercial banks in terms of growth of deposits and loans and found that the performance of foreign banks stand out significantly higher. Sarkar and Das (1998) used 15 indicators in their study to compare public sector, private sector and foreign banks based on major criteria representing efficiency viz. profitability, productivity and financial management on which bank-wise/ bank group wise information was available. |

| |

Section II |

Objective of the Study |

| |

| For achieving the operational efficiency, meeting customer expectations and other parameters of banks’ performance, the role of employees and their efficient utilization cannot be undermined. The present study therefore compares the parameters of employees’ productivity viz. “business per employee” (BPE) and “profit per employee” (PPE) between the traditional banks and modern banks. It also compares the parameters measuring employees’ cost viz. “employee cost to operating expenses”, “employee cost to total business” and “employee cost to total assets”. These ratios are widely used in various studies to measure the employees’ productivity as well as employees’ cost. The time series data on these parameters during 12 year period from 1997 to 2008 have been analyzed to observe the trend and the impact of measures taken by traditional banks to face the challenges posed by the modern banks. |

| |

Section III |

Data and Methodology |

| |

The time series data on the selected variables/ratios viz. ‘business per employee’, ‘profit per employee’, ‘employee cost to operating expenses’, ‘employee cost to total business’, and ‘employee cost to total assets’ have been extracted from the publications ‘Statistical Tables relating to Banks’ and Trend and Progress of Banks in India published by Reserve Bank of India. Detailed definitions of employees’ productivity and employees’ Cost ratios are given in the Annex A.

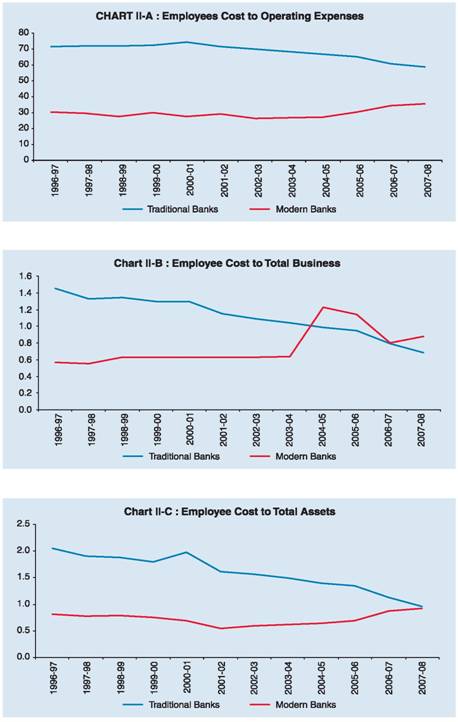

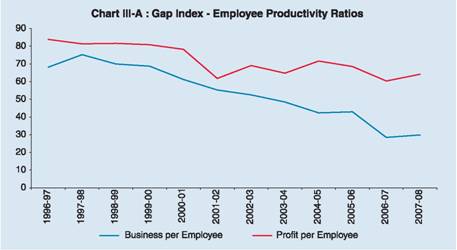

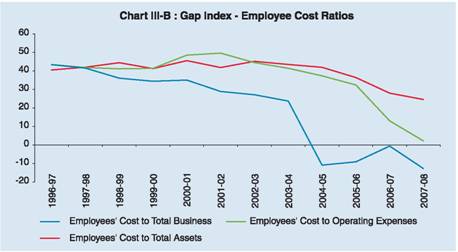

To compare the modern and traditional banks on the select parameters of employees’ productivity and employees’ cost the data has been presented in tabular and graphical forms. The gap indexes have been worked as the percentage of difference of the value of variables between modern banks (MB) and traditional banks (TB) as a ratio of their aggregate value. The purpose of Gap Index construction was to see whether or not the gap between modern and traditional Banks are reduced after several initiatives taken by the traditional banks to meet the challenges and competition from modern banks. The year-wise gaps were adequately displayed with the help of graphs to have an idea about the reduction of gaps. The use of statistical techniques was not considered appropriate at this stage, as the gaps between the two sets of banks on the variables studied were still quite large though they substantially reduced during the period of 12 years under study. |

| |

Section IV |

Analysis of Data |

| |

Employees’ Productivity: |

| |

| The productivity of employees is crucial for the overall efficiency of the banks. A number of measures have been taken by the banks to right size the employees for improving their productivity. The efforts have been ably supported by business process reengineering and technology implementation besides various measures taken for human resource development. |

| |

Table 1: Employee Productivity Ratios |

(Rs. Lakhs) |

Year* |

Business Per Employee (Median) |

Profit Per Employee (Median) |

Traditional Banks |

Modern Banks |

Traditional Banks |

Modern Banks |

1 |

2 |

3 |

4 |

5 |

1997 |

75.28 |

397.50 |

0.57 |

6.50 |

1998 |

97.53 |

689.90 |

0.81 |

7.90 |

1999 |

112.93 |

638.66 |

0.57 |

5.66 |

2000 |

136.26 |

735.20 |

0.79 |

7.49 |

2001 |

166.23 |

690.83 |

0.71 |

5.84 |

2002 |

192.30 |

667.41 |

1.27 |

5.37 |

2003 |

223.36 |

717.00 |

1.68 |

9.17 |

2004 |

263.12 |

758.46 |

2.23 |

10.41 |

2005 |

302.02 |

745.56 |

1.29 |

7.82 |

2006 |

355.79 |

891.52 |

1.68 |

9.01 |

2007 |

439.96 |

790.44 |

2.84 |

11.48 |

2008 |

549.21 |

1216.76 |

3.87 |

17.74 |

* represents end of financial year |

|

| |

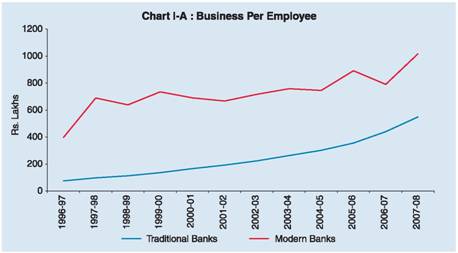

| The Employees’ Productivity Ratios represented by ‘business per employee’ and ‘profit per employee’ for the (12 year) period under study in respect of traditional and modern banks are presented in Table 1 above, Charts I-A and I-B below. (Detailed bank group-wise data on these parameters is also given in annex B). |

|

| |

|

| |

It may be observed from the above Table 1 and Chart I-A that the business per employee for traditional banks is continuously improving during the period of 12 years under study. It has increased 7.29 times (Rs. 75.28 lakhs to Rs. 549.21 lakhs) from 1997 to 2008. In case of modern banks the business per employee has increased only 3.06 times during the same period (less than half compared to the increase for traditional banks). It has, however, marginally declined during 1999, 2001, 2002, 2005 and 2007 compared to the previous years in respect of modern banks. The ratios of business per employee between modern and traditional banks have decreased drastically from 5.28 times in 1997 to 2.21 times in 2008 indicating that the gap in business per employee between modern banks and traditional banks is consistently reducing due to the efforts made by the traditional banks.

Table 1 and Graph IB reveal that the profit per employee has increased both for traditional and modern banks from 1997 to 2008. However, this increase has been significantly higher for traditional banks (6.79 times) compared to modern banks (2.73 times) during the period of 12 years under study. There has been decline of profit per employee during 1999, 2001and 2005 compared to the previous year both for traditional and modern banks indicating effect of some external factors impacting profitability of banks during these years. |

| |

Employee Cost Ratios |

| |

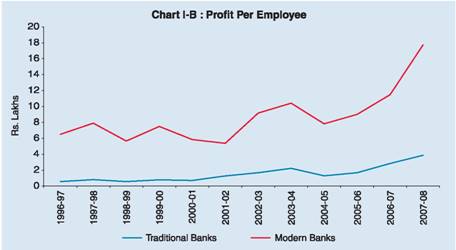

The Employees’ Cost Ratios which are represented by “employee cost to operating expenses”, “employee cost to total business’’ and “employee cost to total assets” are based on the wage bill data of individual banks. Banks have been treating them as critical factors for improving profitability and trying to minimize them in relation to operating expenses, total business and total assets. The employees’ cost in relation to these variables for the 12 years period under study in respect of traditional and modern banks is presented in Table 2 and Charts II-A, II-B and II-C below. (Detailed bank group-wise data on these parameters is also given in annex B)

From Table 2 and the Graph II-A it may be observed that the employee cost as a ratio of operating expenses in respect of traditional banks remained more or less constant from 1997 to 2002 and thereafter got reduced gradually. In case of modern banks, the ratio fluctuated within a narrow range and reduced marginally up to the year 2006 before showing upward trend during 2007 & 2008. The employee cost to operating expenses for traditional banks remained more than double of modern banks till 2006, however, this ratio decreased significantly during 2007 & 2008 (1.77 and 1.65 times respectively), indicating that efforts made by the traditional banks to reduce the wage bills in relation to operating cost made an impact during recent period. |

| |

Table 2: Employee Cost Rates |

(Per cent) |

Year |

Employee Cost to Operating Expenses |

Employee Cost to Total Business |

Employee Cost to Total Assets |

Traditional Banks |

Modern Banks |

Traditional Banks |

Modern Banks |

Traditional Banks |

Modern Banks |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

1997 |

71.78 |

30.41 |

1.45 |

0.57 |

2.05 |

0.81 |

1998 |

72.20 |

29.52 |

1.33 |

0.55 |

1.90 |

0.78 |

1999 |

71.81 |

27.64 |

1.34 |

0.63 |

1.88 |

0.79 |

2000 |

72.28 |

30.07 |

1.30 |

0.63 |

1.80 |

0.75 |

2001 |

74.23 |

27.79 |

1.30 |

0.63 |

1.98 |

0.69 |

2002 |

71.52 |

29.36 |

1.15 |

0.63 |

1.62 |

0.55 |

2003 |

70.13 |

26.49 |

1.09 |

0.63 |

1.57 |

0.60 |

2004 |

68.42 |

26.96 |

1.04 |

0.64 |

1.49 |

0.62 |

2005 |

66.92 |

27.39 |

0.99 |

1.23 |

1.39 |

0.64 |

2006 |

65.26 |

30.43 |

0.95 |

1.14 |

1.35 |

0.69 |

2007 |

60.99 |

34.35 |

0.79 |

0.80 |

1.13 |

0.87 |

2008 |

58.63 |

35.53 |

0.68 |

0.88 |

0.96 |

0.92 |

|

| |

|

| |

As regards employee cost to total business, it has been consistently reducing for the traditional banks from 1.45 per cent in 1997 to 0.68 per cent in 2008. On the other hand, it has been increasing for modern banks in a very narrow range from 0.57 per cent to 0.64 per cent up to 2004, thereafter increased drastically to 1.23 per cent in 2005 and again reduced to 0.88 per cent in 2008. Employee cost to total business in respect of modern banks, which remained significantly lower compared to traditional banks up to 2004, overtook the traditional banks for last 4 years of the study period. This trend clearly indicates that the traditional banks have reached to the level where they can very well compete with the modern banks as regards to the marginal cost of expanding new business (deposits plus advances).

The employee cost to total assets in respect of traditional banks also consistently reduced from 1997 (2.05 per cent) to 2008 (0.96 per cent) with the exception of 2001, where it has marginally increased from the previous year. Employee cost to total assets in respect of modern banks also reduced marginally during the period of 12 years from 0.81 per cent in 1997 to 0.69 per cent in 2006 and increased thereafter to the level of 0.92 per cent in 2008. |

| |

Gap Index Analysis |

| |

The Gap Index has been defined as the percentage of difference of the value of variables between modern banks (MB) and traditional banks (TB) as a ratio of their aggregate value. For example the Gap Index of Business Per Employee (BPE) can be worked out as: |

| |

BPE(MB) - BPE(TB)

-------------------------------X 100

BPE(MB) + BPE(TB) |

| |

For cost related variables the cost of modern banks have been subtracted from the traditional banks to get the positive value as the value is expected to be lower for modern banks compared to the traditional banks. Table 3 below gives the gap indices of 5 variables under study. |

| |

Table 3: Gap Index |

Year |

Business per Employee (Rs. Lakhs) |

Profit per Employee (Rs. Lakhs) |

Employee Cost to Total Business (per cent) |

Employee Cost to Operating Expenses (per cent) |

Employee Cost to Total Assets (per cent) |

1 |

2 |

3 |

4 |

5 |

6 |

1997 |

68.15 |

83.84 |

43.34 |

40.48 |

43.41 |

1998 |

75.23 |

81.35 |

41.48 |

41.96 |

41.83 |

1999 |

69.95 |

81.63 |

36.04 |

44.42 |

41.08 |

2000 |

68.73 |

80.86 |

34.40 |

41.24 |

41.38 |

2001 |

61.21 |

78.24 |

35.02 |

45.52 |

48.51 |

2002 |

55.26 |

61.79 |

28.86 |

41.80 |

49.58 |

2003 |

52.50 |

69.08 |

27.10 |

45.16 |

44.46 |

2004 |

48.49 |

64.77 |

23.70 |

43.47 |

41.41 |

2005 |

42.34 |

71.62 |

-10.93 |

41.92 |

37.32 |

2006 |

42.95 |

68.53 |

-9.17 |

36.39 |

32.40 |

2007 |

28.49 |

60.34 |

-0.63 |

27.94 |

13.00 |

2008 |

29.86 |

64.18 |

-12.82 |

24.53 |

2.13 |

Percentage Reduction from 1997 to 2008 (per cent) |

56.18 |

23.45 |

129.58 |

39.4 |

95.09 |

|

| |

|

| |

It may be observed from Table 3 above and the Charts III-A and Graph III-B that the gaps between modern and traditional banks on all employee cost ratios have been coming down consistently from 1997 to 2008. The percentage reduction was highest (129 per cent) in case of employee cost to total business, which has drastically come down and assumed negative value from 2005 to 2008. The gap between traditional and modern banks in respect of employee cost to total assets reduced significantly from 43.41 in 1997 to 2.13 in 2008 (95.09 per cent reduction). In the case of employee productivity ratios, business per employee, the gap between traditional and modern banks reduced significantly from 68.15 in 1997 to 29.86 in 2008 (56.18 per cent). The gap in respect of profit per employee between traditional and modern banks was reduced from 83.84 to 64.18 (23.45 per cent) during the same period. However, the gap in absolute terms as at end March 2008 is still high in respect of business per employee (29.86), profit per employee (64.18) and employee cost to operating expenses (24.53). Thus, the traditional banks have to continue to take further steps to improve their productivity and cost reduction efforts for competing with the modern banks. It will be interesting to monitor the trend of gap indices by the banks in future to get an idea about the existing gaps between modern and traditional banks. |

| |

Section V |

Concluding Observations |

| |

While comparing the 12 year’s data from 1997 to 2008 on productivity factors viz. ‘Business per Employee’ (BPE) and ‘Profit per Employee’ (PPE) and employee cost factors viz. ‘Employee Cost to total Business’, ‘Employee Cost to total Assets’ and ‘Employee Cost to Operating Expenses’ it was observed that the performance of the modern banks (foreign and new private sector banks) was much superior than the traditional banks (public sector and old private sector banks). However, the gap between the performance of modern and traditional banks on all the five variables has shown a decreasing trend, which has significantly reduced during the period of 12 years under study.

The impact of measures taken by traditional banks to meet the challenges from modern banks to improve operational efficiency has resulted in improved performance of traditional banks on all the factors studied. However, the performance of the traditional banks is still quite below compared to the modern banks on these variables except on ‘Employee Cost to total Business’ in which the traditional banks have surpassed the modern banks during recent period i.e from 2005 to 2008.

The traditional banks are still to resolve a number of legacy issues related to people and processes for improving the productivity and reducing cost in order to compete with the modern banks.

It is interesting to observe the reduction in the gap due to improved performance of traditional banks. This gap is likely to be further reduced in future due to certain measures taken by the traditional banks recently. However, the trend has to be closely monitored to come to a firm conclusion. |

| |

| |

References |

| |

● Nag. A. K and Shivaswamy. K (1990), Foreign Banks in India – Recent Performance, Reserve Bank of India Occasional Papers, Vol. 11, No. 4, December, pp 297-328

● Rakesh Mohan (2005), Reforms, Productivity and Efficiency in Banking, The Indian Experience, Address Delivered at the 21st Annual General Meeting and Conference of the Pakistan Society of Development Economists at Islamabad in December 2005.

● Reserve Bank of India (1975), Report of the Study Group to Frame Guidelines to Banks for the Follow-up Credit, (Tandon Committee).

● Reserve Bank of India (1977), Report of the Productivity, Efficiency and Profitability Committee on Banking, (Luther Committee).

● Reserve Bank of India (1986), Report of the Committee to Review the Working of the Monetary System, (Chakravarty Committee).

● Reserve Bank of India (1991), Report of the Committee on the Financial System, (Narasimham Committee)

● Reserve Bank of India, Trend and Progress of Banks in India, various Issues (1997 to 2008).

● Reserve Bank of India, Statistical Tables Relating to Banks in India, CDs.

● Sarkar, P.C. & Das, Abhiman (1997), “Development of Composite Index of Banking Efficiency: The Indian Case”, Reserve Bank of India Occasional Papers, Vol.18, No.4, December, pp.679-709.

|

| |

Annex - A |

S.No |

Ratio |

Definition of Ratio |

A. Employee Productivity Ratios |

1. |

Business per Employee (Rs. Lakhs) |

Total Business* / Number of employees |

2. |

Profit per Employee (Rs. Lakhs) |

Net Profit / Number of Employees |

B. Employee Cost Ratios |

3. |

Employee Cost to Operating Expenses |

Payments to and Provisions for employees as a percentage of Operating Expenses |

4. |

Employee Cost to Total Business |

Payments to and Provisions for employees as a percentage of Total Business |

5. |

Employee Cost to Total Assets |

Payments to and Provisions for employees as a percentage of Total Assets |

* * Total Business = Deposits + Advances |

|

| |

Annex - B |

a) Business Per Employee |

(Rs. Lakhs) |

Bank Group |

1997 |

1998 |

1999 |

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

Nationalized Banks |

69.9 |

87.7 |

96.2 |

114.8 |

153.6 |

181.7 |

204.4 |

249.4 |

312.4 |

364.0 |

464.0 |

586.0 |

SBI Group Banks |

67.5 |

76.4 |

93.2 |

111.2 |

131.3 |

168.5 |

204.2 |

220.7 |

271.7 |

342.6 |

435.8 |

526.8 |

Public sector banks(mean) |

68.7 |

82.1 |

94.7 |

113.0 |

142.5 |

175.1 |

204.3 |

235.0 |

291.1 |

353.3 |

449.9 |

556.4 |

Old Private Sector Banks |

81.9 |

113.0 |

131.2 |

159.5 |

190.0 |

209.5 |

242.4 |

291.2 |

313.0 |

358.3 |

430.0 |

542.0 |

Traditional Banks |

75.3 |

97.5 |

112.9 |

136.3 |

166.2 |

192.3 |

223.4 |

263.1 |

302.0 |

355.8 |

440.0 |

549.2 |

New Private Sector Banks |

374.0 |

797.7 |

690.0 |

889.0 |

749.9 |

699.5 |

712.8 |

716.5 |

687.9 |

803.0 |

569.0 |

594.6 |

Foreign Banks |

421.0 |

582.1 |

587.3 |

581.4 |

631.7 |

635.3 |

721.2 |

800.5 |

803.2 |

980.0 |

1211.9 |

1439.0 |

Modern Banks |

397.5 |

689.9 |

638.7 |

735.2 |

690.8 |

667.4 |

717.0 |

758.5 |

745.6 |

891.5 |

790.4 |

1216.8 |

|

| |

b) Profit Per Employee |

(Rs. Lakhs) |

Bank Group |

1997 |

1998 |

1999 |

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

Nationalized Banks |

0.30 |

0.50 |

0.47 |

0.45 |

0.54 |

0.97 |

1.70 |

2.23 |

1.87 |

2.13 |

2.76 |

3.94 |

SBI Group Banks |

0.39 |

1.11 |

0.77 |

0.99 |

0.81 |

1.24 |

1.57 |

2.42 |

2.07 |

2.20 |

2.76 |

3.55 |

Public sector banks(mean) |

0.34 |

0.81 |

0.62 |

0.72 |

0.68 |

1.12 |

1.64 |

2.33 |

1.97 |

2.16 |

2.76 |

3.75 |

Old Private Sector Banks |

0.80 |

0.82 |

0.53 |

0.87 |

0.75 |

1.44 |

1.72 |

2.13 |

0.62 |

1.20 |

2.92 |

4.00 |

Traditional Banks |

0.57 |

0.81 |

0.57 |

0.79 |

0.71 |

1.27 |

1.68 |

2.23 |

1.29 |

1.68 |

2.84 |

3.87 |

New Private Sector Banks |

8.00 |

8.33 |

7.11 |

9.37 |

7.02 |

4.84 |

8.22 |

8.14 |

5.37 |

5.77 |

3.57 |

4.39 |

Foreign Banks |

5.00 |

7.48 |

4.21 |

5.61 |

4.66 |

5.91 |

12.13 |

12.68 |

12.27 |

12.24 |

19.39 |

31.09 |

Modern Banks |

6.50 |

7.90 |

5.66 |

7.49 |

5.84 |

5.37 |

9.17 |

12.41 |

7.82 |

9.01 |

11.48 |

17.74 |

|

| |

c) Employee Cost to Total Business |

(Per cent) |

Bank Group |

1997 |

1998 |

1999 |

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

Nationalized Banks |

1.66 |

1.53 |

1.54 |

1.48 |

1.62 |

1.32 |

1.25 |

1.17 |

1.08 |

0.92 |

0.77 |

0.66 |

SBI Group Banks |

1.89 |

1.72 |

1.68 |

1.54 |

1.69 |

1.31 |

1.28 |

1.28 |

1.39 |

1.38 |

0.94 |

0.75 |

Public sector banks(mean) |

1.74 |

1.60 |

1.59 |

1.50 |

1.65 |

1.32 |

1.26 |

1.21 |

1.18 |

1.08 |

0.85 |

0.70 |

Old Private Sector Banks |

1.16 |

1.07 |

1.09 |

1.12 |

0.95 |

0.98 |

0.93 |

0.87 |

0.79 |

0.83 |

0.73 |

0.65 |

Traditional Banks |

1.45 |

1.33 |

1.34 |

1.30 |

1.30 |

1.15 |

1.09 |

1.04 |

0.99 |

0.95 |

0.79 |

0.68 |

New Private Sector Banks |

0.22 |

0.24 |

0.26 |

0.26 |

0.28 |

0.28 |

0.40 |

0.42 |

0.42 |

0.44 |

0.49 |

0.58 |

Foreign Banks |

0.92 |

0.86 |

1.00 |

1.01 |

0.97 |

0.99 |

0.85 |

0.86 |

2.03 |

1.85 |

1.11 |

1.17 |

Modern Banks |

0.57 |

0.55 |

0.63 |

0.63 |

0.63 |

0.63 |

0.63 |

0.64 |

1.23 |

1.14 |

0.80 |

0.88 |

|

| |

d) Employee Cost to Operating Expenses |

(Per cent) |

Bank Group |

1997 |

1998 |

1999 |

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

Nationalized Banks |

72.53 |

72.07 |

73.42 |

73.57 |

76.04 |

72.73 |

70.74 |

69.53 |

68.25 |

64.88 |

64.36 |

62.43 |

SBI Group Banks |

72.55 |

74.98 |

71.16 |

71.59 |

72.99 |

71.26 |

71.12 |

68.86 |

67.43 |

67.63 |

65.49 |

60.58 |

Public sector banks(mean) |

72.54 |

73.12 |

72.57 |

72.84 |

74.87 |

72.20 |

70.87 |

69.28 |

67.95 |

65.92 |

64.93 |

61.50 |

Old Private Sector Banks |

60.80 |

59.73 |

61.31 |

64.58 |

63.00 |

61.84 |

60.29 |

57.30 |

53.22 |

56.45 |

57.05 |

55.75 |

Traditional Banks |

71.78 |

72.20 |

71.81 |

72.28 |

74.23 |

71.52 |

70.13 |

68.42 |

66.92 |

65.26 |

60.99 |

58.63 |

New Private Sector Banks |

18.01 |

19.04 |

19.13 |

19.20 |

19.13 |

23.12 |

21.73 |

23.11 |

24.75 |

27.30 |

28.91 |

31.17 |

Foreign Banks |

35.15 |

32.00 |

29.84 |

33.31 |

31.82 |

33.12 |

31.94 |

31.98 |

30.89 |

35.15 |

39.78 |

39.89 |

Modern Banks |

30.41 |

29.52 |

27.64 |

30.07 |

27.79 |

29.36 |

26.49 |

26.96 |

27.39 |

30.43 |

34.35 |

35.53 |

|

| |

e) Employee Cost to Assets |

(Per cent) |

Bank Group |

1997 |

1998 |

1999 |

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

Nationalized Banks |

2.07 |

1.91 |

1.93 |

1.88 |

2.12 |

1.74 |

1.65 |

1.53 |

1.41 |

1.26 |

1.11 |

0.95 |

SBI Group Banks |

2.13 |

2.01 |

1.92 |

1.76 |

1.94 |

1.50 |

1.50 |

1.52 |

1.44 |

1.54 |

1.30 |

1.02 |

Public Sector Banks(mean) |

2.09 |

1.95 |

1.93 |

1.84 |

2.04 |

1.65 |

1.59 |

1.52 |

1.42 |

1.36 |

1.21 |

0.98 |

Old Private Sector Banks |

1.50 |

1.36 |

1.36 |

1.42 |

1.26 |

1.28 |

1.23 |

1.14 |

1.07 |

1.18 |

1.05 |

0.93 |

Traditional Banks |

2.05 |

1.90 |

1.88 |

1.80 |

1.98 |

1.62 |

1.57 |

1.49 |

1.39 |

1.35 |

1.13 |

0.96 |

New Private Sector Banks |

0.37 |

0.34 |

0.34 |

0.28 |

0.33 |

0.26 |

0.42 |

0.47 |

0.50 |

0.55 |

0.61 |

0.71 |

Foreign Banks |

1.06 |

0.95 |

1.00 |

1.04 |

0.97 |

1.00 |

0.89 |

0.88 |

0.89 |

0.98 |

1.12 |

1.13 |

Modern Banks |

0.81 |

0.78 |

0.79 |

0.75 |

0.69 |

0.55 |

0.60 |

0.62 |

0.64 |

0.69 |

0.87 |

0.92 |

|