Himanshu Joshi* |

| |

| As the capital account of the balance of payments (BoP) is not separately represented in the national account identity, its contribution to capital formation remains generally unexamined. Taking various components of domestic savings and the capital account, the existence of a long-term steady state relationship between capital formation and various savings components and capital account balance to GDP. A notable result is that the short-term dynamics of capital formation are guided significantly by the capital account such that disturbances in the steady state equilibrium are corrected over time by means of changes in the desired amounts of capital flows in the balance of payments. The implication of this finding is that a calibrated approach to easing external capital constraints would serve to smoothen and foster the capital acquisition cycle for productive activities and help in achieving higher levels of capital formation and economic growth. |

| |

JEL Classification : E21, E22

Keywords : Co-integration, Eigenvector, weak exogeneity, Steady State. |

| |

Introduction |

| |

| Savings form the backbone for investments viz., higher savings lead to higher investments and vice versa in accordance with the general perception about the macroeconomic balance in national accounts. An economy can have different forms of savings of which household financial savings generally constitute the largest share in aggregate domestic savings. Other forms of savings comprise physical savings by households, savings by the private corporate sector and the public sector and foreign savings as measured by the |

| |

| * The author is Director in the Monetary Policy Department. The views expressed in the paper are strictly personal and not that of the Reserve Bank of India. The author is extremely thankful to Dr. Kumarjit Mandal for his valuable suggestions for improving the paper. However, the author is solely responsible for errors and omissions, if any. |

| |

| magnitude of the current account balance. Generally, while the current account is considered as foreign savings in the national accounts identity, an attempt has been made in this paper to examine whether, apart from other forms of domestic savings, capital account of the BoP can be considered as an explanatory variable for capital formation in India. Though the capital account of the BoP is not separately represented in the national income identity, it may have a significant role in explaining capital formation. |

| |

| The capital account balance of the BoP is a useful yardstick to measure the contribution of capital flows to domestic capital formation as it comprises flows such as external commercial borrowings, foreign direct investments and forms of external assistance that may generally be earmarked for specific capital expenditure purposes. On the other hand, while NRI deposits and portfolio flows may not directly contribute to capital formation, they may have indirect effect on domestic capital accumulation rate owing to improvement in market liquidity and sentiments, and by serving to equilibrate the receipt–expenditure imbalance in the current account. Another reason to use the capital account balance than the current account balance stems from the nature of transactions in these accounts. All capital account proceeds in foreign currency are converted in domestic currency, and the foreign exchange so received is partially or fully utilised to cover the deficit in the current account. Eventually, any remaining surplus shows up as addition to country’s foreign exchange reserves. The domestic currency denominated proceeds received by resident corporate/other entities in lieu of sale of foreign exchange may be subsequently utilised for capital acquisition though, and figure partly as some portion of the current account expenditure, but would not fully capture the actual expenditure on capital formation as would be if the entire capital account was taken into account. Further, as a large part of current account expenditure is made on intermediate inputs and consumables such as crude oil and other commodities, the current account deficit may not serve as an adequate measure for actual capital formation which essentially comprises acquisition of tangible goods such as machinery, equipment and new construction and change in stocks.

The scenario above would remain much the same even if the current account were in surplus, say, owing to large inflows of remittances. In this case all foreign exchange receipts received by residents (households and corporates) would either show up as household financial savings or as other corporate deposits. The household deposits would be measured as a part of household financial savings while corporate deposits would, in any case, be outside the standard enumeration of aggregate domestic savings.

Considering the above characterisation, this paper presents an empirical examination of the savings and investment behavior in the Indian economy over the period from 1950-51 to 2005-06, in particular, attempting to elicit economic aggregates that might be important for the purpose of capital formation in India. The empirical analysis is based on long time series data on the various components of gross savings and capital formation, accessed from the National Accounts Statistics (NAS), and the balance of payment statistics issued by the Reserve Bank. The paper is schematised in three sections. Section I describes the data. Section II includes explanation of empirical methodology and results and Section III offers some concluding observations. |

| |

| |

Section I

Data Employed |

| |

| Data on different components of savings viz., financial and physical savings of the households, savings by the private corporate sector and the public sector, and foreign capital as reflected by the magnitude of capital account balance were considered along with gross domestic capital formation as the dependent variable. The capital account balance measures the inflow of foreign capital of various types including those that directly or indirectly contribute to capital formation in the economy. The data series on savings components chosen for the empirical analysis are in terms of current prices but converted into respective ratios to GDP at current market prices. |

|

| |

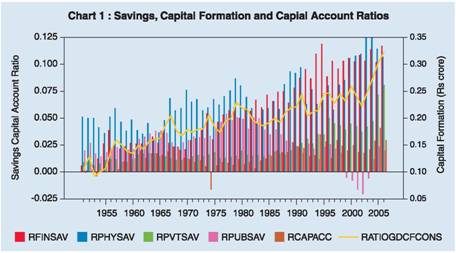

Chart 1 presents different components of savings alongside gross domestic capital formation as ratios to GDP at current market prices.

where,

(i) RFINSAV = ratio of household financial savings to GDP at current market prices

(ii) RPHYSAV = ratio of household physical savings to GDP at current market prices.

(iii) RPVTSAV = ratio of private corporate savings to GDP at current market prices.

(iv) PUBSAV = ratio of public sector savings to GDP at current market prices.

(v) RCAPACC = ratio of capital account balance of BoP to GDP at current market prices.

(vi) RATIOGDCFCONS = ratio of nominal gross domestic capital formation to GDP at current market prices

|

| |

| The Chart 1 suggests considerable differences in the data generating processes with frequent peaks and troughs requiring appropriate empirical investigation. |

| |

| |

Section II

Empirical Methodology and Results |

| |

The empirical methodology is based on multivariate cointegration analysis proposed by Johansen (1988) which permits the estimation of the long-run steady state relationship among the system variables and offers a means to conduct robust test of Granger causality. As the methodology is now commonly known in academic domain - for the sake of brevity, the technical description of method is not provided. Readers may like to refer Johansen (op.cit).

Table 1 reports the results of the tests of unit roots conducted for different data series included in the model.

According to Table 1, all variables qualify for inclusion in the cointegrating space as each one of them is integrated of order one viz., I(1).

As required by the Johansen (op.cit) procedure the estimates reported in Table 2 are based on all system variables which are non-stationary or I(1) and can exhibit a long-term steady state relationship. |

| |

Table 1 : Augmented Dickey Fuller Tests of Unit Root |

Variable( Ratios) |

Without trend |

With trend |

1 |

2 |

3 |

Household financial savings to nominal GDP at market prices. |

-0.57 |

-2.40 |

Household physical savings to nominal GDP at market prices. |

-1.20 |

-3.18 |

Private corporate sector savings to nominal GDP at market prices. |

1.36 |

-0.05 |

Public sector savings to nominal GDP at market prices. |

-1.88 |

-2.28 |

Capital account balance to nominal GDP at market prices. |

-1.70 |

-2.33 |

Gross domestic capital formation at current prices to nominal GDP at market prices. |

0.15 |

-3.64 |

Note : All variables are integrated of order one at the customary 5 percent significance level compared to the tabulated critical values. |

|

| |

| |

Table 2 : The Long Term Equilibrium- Savings and Capital Formation (1950-51-2005-06) |

(Normalized Eigenvector) |

Explanatory Variable |

Long Run Steady State Coefficients |

1 |

2 |

Financial savings rate of households |

0.252 |

Physical savings rate of households |

0.952 |

Private corporate savings rate |

1.924 |

Public savings rate |

1.614 |

Capital account to GDP ratio |

1.761 |

Constant |

0.017 |

Note : * The coefficients are based on the normalization of the second co-integrating eigenvector

corresponding to significant Trace statistic at 127.25 compared to the 5 percent critical value at

103.67. A similar relationship using current account rather than capital account balance is not found cointegrated |

|

| |

These estimates are based on the second cointegrating vector chosen against the significance of the Trace statistic with reference to the tabulated critical value at 5 per cent.

Results in Table 2 provide estimates of long-run steady state relationship between various components of savings, capital account balance and the gross domestic capital formation as ratios of GDP at current market prices. It may be noted that specification chosen here may not be mistaken as an estimation of national accounts identity in the way that the estimates are arrived using the Johansen’s vector error correction model (VECM) and also owing to the choice of capital account balance which is not represented in the national income identity. According to Table 2, while a single per cent increase in the household financial savings rate increases the capital formation rate in the long term by just 0.25 per cent, a similar increase in household physical savings rate increases capital accumulation rate by 0.952 per cent. On the other hand a single per cent increase each in the private and public sector savings rate increases the long term capital acquisition rate by 1.924 per cent and 1.614 per cent, respectively. The impact on capital formation on account of capital account balance is also relatively large at 1.761 per cent which is almost as good as the impact made by the private or public sector savings rate. Of the results reported in Table 2, it is surprising to note that the long-term impact of the financial savings rate of households is much lower than that generally expected despite its larger share in aggregate savings rate, perhaps, owing to the subventions that continue to hinder the accessibility of the private corporate sector to banking resources. The high elasticity of capital formation to private and public savings rate savings indicate the important role played by these components – and emphasizes the need to maintain the tempo of corporate efficiency and fiscal consolidation as suggested in Mohan (2008) as a way forward to ensuring the continuation of the growth momentum of the Indian economy.

Of the above empirical estimates, it is particularly noteworthy that among the various domestic savings components, the highest impact on long term capital formation is made by the private corporate savings. The evidence seems to be gaining ground as pointed out by Acharya (2008) noting that, in the recent five years, the significant acceleration in the investment rate from 24 per cent to 36 per cent occurred simultaneously with higher incremental savings made by the private sector. In addition, a recent International Monetary Fund (IMF) paper (Oura, 2008) also underscores the importance of internally accrued savings for corporate growth in India in suggesting that there could likely be a negative correlation between external financial dependence and corporate growth. In other words, corporates with lower financial dependence (or higher internal savings) have greater potential to grow compared to those more dependent on borrowed/external financial resources.

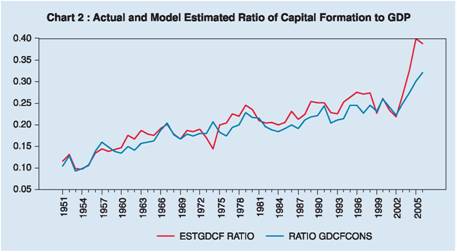

The model performance in terms of the long term co-integrating relationship between capital formation and various savings components and capital account balance as ratios of GDP at current market prices can be gauged from the plot of actual versus the estimated gross capital formation in Chart 2.

While the results in Table 2 are mostly intuitive from the standpoint of macroeconomic understanding, it may be worthwhile to dwell a little more on some standard tests of causality to ascertain the roles of various savings components in causing capital formation. Towards this purpose, a robust test of weak exogeneity within the framework of multivariate co-integration analysis was conducted. Table 3 reports the results. |

|

| The results reported in Table 3 are revealing from the point of view of the significant causation effect that capital account flows have on aggregate capital formation even as other variables do not have any short-run influence on the parameters of the cointegrating space. Thus, in the short-term, any disturbance in long term capital formation process is likely to be corrected by flows through the capital account with the potential to steer the system back to its steady state trajectory. The restoration of the original equilibrium occurs over time as the desired external capital is acquired by domestic agents by means of capital account transactions to maintain their preferred long-term time path of capital formation. The implication of this finding is that calibrated liberalisation of external capital intake would ease and foster the process of capital formation and growth whereas discretionary controls may tend to retard the economy’s objective to achieving desired level of capital formation. It may be, hence, not be too far fetched to assume that progressive relaxation of capital controls in the post-reform years have been quite helpful in sustaining the tempo of investment and growth. |

| |

Table 3 : Testing of Causality (Weak Exogeneity) (1950-51-2005-06) |

Gross Domestic Capital Formation Caused by |

Chi-Square statistic |

1 |

2 |

Financial Savings rate of Households |

2.718 |

| |

(0.099) |

Physical Savings rate of Households |

0.010 |

| |

(0.920) |

Private Corporate Savings rate |

1.184 |

| |

(0.178) |

Public Savings rate |

0.274 |

| |

(0.601) |

Capital account to GDP ratio |

12.490 ** |

| |

(0.000) |

Note : ** Test of weak exogeneity (causality) as reflected by the Chi-square

statistic pertaining to the test against the null hypothesis no exogeneity. |

|

| |

Section III

Conclusions |

| |

The role of savings in capital formation in India brings forth the finding that whilst the long-run steady state relationship between capital formation and various components of savings and the capital account balance has remained stable, the role of capital account in maintaining the momentum of capital acquisition by restoring the balance between savings and capital investment has been notably significant. In fact, the capital account has played an important role as an equilibrating mechanism by addressing short-term disturbances in the steady state equilibrium thereby avoiding sudden disruptions in the process of capital formation cycles. By this token, it may not be incorrect to state that capital flows have the potential to influence growth positively both in the short and the long-term by helping to maintain the aggregate balance between savings and investment and providing support for long term capital formation. Needless, to mention in terms of the long-term impact, both public and private savings are also crucial for sustaining capital formation as they have highly positive long term impact on capital formation. As should be the case, the impact of household physical saving runs pari-passu with capital formation.

An appropriate mix of fiscal and monetary policies besides improved fiscal performance and consolidation under the FRBM Act, 2003 and calibrated liberalisation of the capital account would go a long way in sustaining the pace of capital formation as observed in the recent years. As for the private sector, while the profitability (savings) of Indian industry particularly since 2004-05 has been substantially supported by a significant softening of the interest burden due to sustained reduction in inflation and domestic and foreign interest rates, further improvements in the return on assets (hence savings) could be achieved by improving operational/ managerial and financial efficiency. Finally, mention may be made of the relatively small impact of household financial savings on capital formation (which though has a significant share in the aggregate domestic savings) on account of the subventions on banking resources that continue to hinder the accessibility of the private sector to such resources. |

| |

References |

| |

Acharya, S. (2008), ‘The Savings-Investment Miracle’, Business Standard, March 27, 2008.

Johansen, S (1988). ‘Statistical Analysis of Cointegrating Vector’, Journal of Economic Dynamics and Control, vol 12, 231-254.

Mohan, Rakesh (2008), ‘The Growth Record of the Indian Economy, 1950-2008: A Story of Sustained Savings and Investment’ Reserve Bank of India Bulletin, March .

Oura, H (2008), ‘ Financial Development and Growth in India’ IMF Working Paper No: 08/79, International Monetary Fund, March. |

|