The Reserve Bank’s annual survey on Computer Software

and Information Technology Enabled Services Exports

(ITES) collects information on various dimensions of

exports of computer services and ITES exports, including

Business Process Outsourcing (BPO). Details on export of

software services are collected as per the type of activity/

services (on-site/off-site) and country of destination along

with the modes of supply. This article presents the aggregate

results of 2013-14 round of the survey and examines any

changes in the characteristics of software services exports.

It also analyses the trend in major aggregates based on

current and earlier round of survey results1.

I. Introduction

The annual survey on Software and Information

Technology Enabled Services Exports is conducted by

the Reserve Bank for estimation of various aspects of

Computer Services Exports as well as exports of ITES/

BPO. The Reserve Bank started to conduct the annual

survey on ‘Computer Software and Information

Technology Enabled Services Exports’ in 2002-03 as per

the recommendations of the National Statistical

Commission (2001) and subsequent guidance from the

Technical Group on Computer Services Exports (TGCSE)

(2008). The survey collects details of exports of

computer services following the Balance of Payments

and International Investment Position Manual (BPM6)

of the International Monetary Fund (IMF) and the

Manual on Statistics of International Trade in Services

(MSITS), which is joint work of seven international

agencies, as well as other select information on ITES/

BPO services exports. The survey also collects exports

data as per the four modes of supply (viz., cross-border

supply, consumption abroad, commercial presence and

presence of natural persons) as defined in MSITS. The

previous round of this survey was conducted for the

reference year 2012-13.

For the 2013-14 survey round, which was eighth

in the series, the schedule was canvassed among 6,700

companies. Responses were received from 873

companies, of which 128 cases were for Nil-return or

for closed companies. The remaining 745 companies

included most of the large IT companies as well as other

companies. The responding companies together

accounted for 74.7 per cent of the total software

services exports during the year. The detailed

methodology for estimation of software exports of the

non-responding companies is given in the Annex.

II. Software Services Exports from India – Recent

Trends

Software and IT-enabled services are considered

important activity in the Indian economy, including for

their role as net exports from the country. As per the

balance of payments (BoP) Statistics, the software

services exports (other than on-site exports), stood at

`4,206 billion in 2013-14 and constituted around 46

per cent of total services exports of India as well as 3.7

per cent of GDP. After growing at remarkable pace

during the period 2001-02 to 2007-08 (30.4 per cent in

US $ term), India’s software service exports reflected

some moderation following global financial crisis in

2008-09 but recovered in the subsequent period.

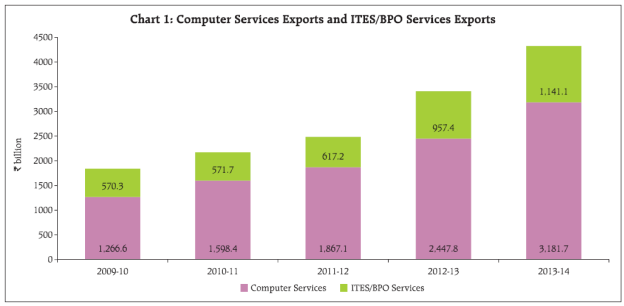

In this survey, software services exports have been

divided into two major categories: (i) Computer Services

exports which include IT services as well as Software

Product Development and (ii) ITES/ BPO services which

includes BPO services and engineering services. As per

the survey results, export of computer software services

and ITES/BPO services are estimated at `3,181.7 billion

(US$ 52.6 billion) and `1,141.1 billion (US$ 18.9 billion),

respectively, during 2013-14. India’s total export of

computer services and ITES/BPO services (excluding

commercial presence) is estimated at `4,322.8 billion

(US$ 71.4 billion), showing 14.1 per cent annual growth

in US $ terms.

Computer services remained the dominant

component (around 73.6 per cent share) in India’s total

software services exports during 2013-14 (Chart 1 and Table 1). ‘IT services’ was the major component in the

‘Computer Services’ category. The share of computer

services exports, in the total Computer software and

ITES/BPO services exports increased, whereas, the

share of ITES/BPO services exports declined.

| Table 1: Software Services Exports from India with Components |

| (` billion) |

| Activity |

Software Services Exports |

Share in Total (%) |

| 2009-10 |

2010-11 |

2011-12 |

2012-13 |

2013-14 |

2009-10 |

2012-13 |

2013-14 |

| (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

| A) Computer Services |

1,266.6 |

1,598.4 |

1,867.1 |

2,447.8 |

3,181.7 |

69.0 |

71.9 |

73.6 |

| Of which: i) IT services |

1,115.8 |

1,492.2 |

1,661.8 |

2,256.7 |

2,936.7 |

60.8 |

66.3 |

67.9 |

| ii) Software Product Development |

150.8 |

106.2 |

205.3 |

191.1 |

245.0 |

8.2 |

5.6 |

5.7 |

| B) ITES/BPO Services |

570.3 |

571.7 |

617.2 |

957.4 |

1,141.1 |

31.0 |

28.1 |

26.4 |

| Of which: i) BPO Services |

431.3 |

468.7 |

523.0 |

789.6 |

934.1 |

23.5 |

23.2 |

21.6 |

| ii) Engineering Services |

139.0 |

103.0 |

94.2 |

167.8 |

206.9 |

7.5 |

4.9 |

4.8 |

| Total Export of Software Services (A+B) |

|

|

|

|

|

|

|

|

| in ` billion (A+B) |

1,836.9 |

2,170.1 |

2,484.3 |

3,405.2 |

4,322.8 |

100.0 |

100.0 |

100.0 |

| in US $ billion * |

38.7 |

47.6 |

51.8 |

62.6 |

71.4 |

|

|

|

| Annual Growth (in US $ terms) |

|

22.9 |

8.9 |

20.7 |

14.1 |

|

|

|

| * Using Average Exchange Rate for the year (applicable for all tables). |

| Table 2: Industry-wise Share of ITES/BPO Services Exports |

| (per cent) |

| Activity |

2009-10 |

2010-11 |

2011-12 |

2012-13 |

2013-14 |

| (1) |

(2) |

(3) |

(4) |

(5) |

| BPO Services |

75.6 |

82.0 |

84.7 |

82.5 |

81.9 |

| Customer interaction services |

18.0 |

12.2 |

14.4 |

10.9 |

8.4 |

| Finance and Accounting, auditing, book keeping and tax consulting services |

11.9 |

13.4 |

23.5 |

9.7 |

11.2 |

| HR Administration |

1.3 |

0.5 |

0.2 |

0.9 |

0.7 |

| Procurements and logistics |

0.3 |

0.5 |

0.0 |

0.4 |

0.3 |

| Medical transcription |

0.4 |

0.6 |

0.2 |

0.7 |

1.3 |

| Document Management |

0.3 |

0.6 |

0.4 |

0.5 |

0.9 |

| Content development and management and publishing |

1.0 |

0.8 |

0.7 |

1.4 |

0.9 |

| Other BPO service |

42.4 |

53.4 |

45.3 |

58.0 |

58.1 |

| Engineering Services |

24.4 |

18.0 |

15.3 |

17.5 |

18.1 |

| Embedded Solutions |

0.8 |

2.4 |

2.1 |

4.1 |

5.3 |

| Product Design Engineering (mechanical, electronics excluding software) |

7.5 |

8.6 |

7.0 |

5.9 |

5.5 |

| Industrial automation and enterprise asset management |

2.6 |

0.6 |

0.0 |

2.4 |

0.2 |

| Other Engineering service |

13.5 |

6.4 |

6.2 |

5.1 |

7.1 |

| Total BPO Services |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

III. Industry-wise Distribution of ITES/BPO Services

Exports

The classification given by the Department of

Information Technology (DIT-2003), Government of

India, was used for compilation of data on exports of

ITES/BPO services. Among the BPO services exports,

‘Finance and Accounting, auditing, book keeping and

tax consulting services’ and ‘Customer interaction

services’ were the major components.

During 2013-14, exports in BPO services and

Engineering services increased by `144.5 billion and

`39.1 billion, respectively, as compared with `266.6

billion and `73.6 billion increases in the previous year.

In the total ITES/BPO services exports, the Engineering

services recorded higher growth than BPO services.

Among BPO services, the share of ‘Finance and

Accounting, auditing, book keeping and tax consulting

services’ increased whereas the share of ‘Customer

interaction services’ declined (Table 2). However, ‘other

BPO services’ (i.e., Legal services, Animation, Gaming,

Pharmaceuticals and biotechnology services, etc.) as

well as combination of services constituted more than

half of the ITES/BPO services, and recorded an increase

of `107.4 billion in 2013-14.

Among Engineering services, the contribution of

‘Embedded Solutions’ increased, whereas the share of

‘Product Design Engineering’ (mechanical, electronics

excluding software) and ‘Industrial automation and

enterprise asset management’ declined in 2013-14

(Table 2).

IV. Organisation-wise Distribution of Software

Services Exports

Public limited companies continued to have the

highest share of the total software services exports

though their share declined marginally from 64.6 per

cent in 2012-13 to 63.6 per cent in 2013-14 as the share

of Private limited companies increased (Table 3).

| Table 3: Organisation-wise Share of Software

Services Exports |

| (per cent) |

| Organisation |

2009-10 |

2010-11 |

2011-12 |

2012-13 |

2013-14 |

| (1) |

(2) |

(3) |

(4) |

(5) |

| Private Limited Companies |

39.3 |

38.5 |

41.2 |

35.3 |

36.0 |

| Public Limited Companies |

58.1 |

61.3 |

58.7 |

64.6 |

63.6 |

| Others |

2.6 |

0.2 |

0.1 |

0.1 |

0.4 |

| Total |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

V. Country-wise Distribution of Software Services

Exports

United States & Canada remained the top

destination (62.7 per cent) for software services exports

from India followed by Europe, which had nearly onefourth

share in 2013-14 (Chart 2). The shares of United

States & Canada in total software exports decreased,

whereas the share of Europe, Asia and Australia & New

Zealand increased as compared to 2012-13.

VI. Currency Composition of Software Services

Exports

US Dollar continued to remain the major currency

of invoicing software export accounting for nearly

three-fourth of total invoicing during 2013-14. The

shares of GBP, Euro and Indian rupee have increased

and the same of US dollar and Australian dollar have

decreased since 2012-13 (Chart 3).

VII. Modes of Software Services Exports

Software services are exported through both onsite

and off-site routes. The share of export of software

service through on-site mode, which recorded declining

trend since 2008-09, increased to 19.8 per cent in

2013-14 from 15.8 per cent in 2012-13.

As per the MSITS, international trade in services

can be conducted through four different modes, viz.,

(i) transactions between resident and non-resident

covering cross-border supply (Mode-1), (ii) consumption

abroad (Mode-2), (iii) presence of natural person

(Mode-4) and (iv) services provided locally by the

affiliates established abroad, i.e., commercial presence

(Mode-3). However, as per the BoP manual, foreign

affiliates established abroad are treated as the domestic

units in the host economy and hence the services

delivered by them are not considered as the exports of

the home country. To this extent, data on services

exports in BoP differs from those in the Foreign

Affiliates Trade in Services (FATS) statistics.

The survey collected the software services trade

data on all four modes of supply. The total international

trade in computer services by India by all four modes

of supply stood at `5,011.8 billion (US$ 82.8 billion) in

2013-14. The share of software services exports by

India through Mode-1 and Mode-2 declined, whereas

the share of software services through Mode-3 and

Mode-4 increased in 2013-14, reversing the trend

followed since 2009-10 (Table 5).

| Table 4: Share of On-site and Off-site Exports |

| (per cent) |

| Type of Services |

2009-10 |

2010-11 |

2011-12 |

2012-13 |

2013-14 |

| (1) |

(2) |

(3) |

(4) |

(5) |

| On-site (Mode 4) |

21.6 |

20.7 |

17.8 |

15.8 |

19.8 |

| Off-site (Mode 1 & Mode 2) |

78.4 |

79.3 |

82.2 |

84.2 |

80.2 |

| Total |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

| Table 5: Software Services Exports by Different Modes |

| (per cent) |

| Type of Mode |

2009-10 |

2010-11 |

2011-12 |

2012-13 |

2013-14 |

| (1) |

(2) |

(3) |

(4) |

(5) |

| Mode 1

(cross-border supply) |

64.6 |

67.4 |

69.0 |

74.7 |

69.0 |

| Mode 2

(consumption abroad) |

0.0 |

0.1 |

0.5 |

1.6 |

0.1 |

| Mode 3

(commercial presence) |

17.6 |

14.8 |

15.4 |

9.4 |

13.7 |

| Mode 4

(presence of natural person) |

17.8 |

17.7 |

15.1 |

14.3 |

17.1 |

VIII. Software Business of Subsidiaries/Associates

The survey also collects information on the

software business of foreign subsidiaries/ associates of

Indian companies (foreign affiliates), under the heads

of software business done in the host country, i.e.,

locally, to India and to other countries, for the purpose

of Foreign Affiliates Trade in Services (FATS). The total

software business of the Indian-owned foreign affiliates

(excluding the services provided to India) observed

slowdown following global crisis in 2008. However, in

2013-14, it increased significantly by `427.3 billion

(US$ 7.1 billion) as against a decline of `122.5 billion

(US$ 2.3 billion) in the previous year (Table 6). The

business of these subsidiaries to India increased by

`87.1 billion (US$ 1.4 billion) in 2013-14 on top of

increase of `173.2 billion (US$ 3.2 billion) in 2012-13.

Indian companies providing the combination of

four broad group of services (viz., IT services, Software

product development, BPO services and Engineering

services) were classified under ‘Other services’ category.

Under ‘Other Services’ category, foreign affiliates were

the major source for generating the software business

outside India. Software services provided by foreign

affiliates in all countries increased for ‘IT services’,

whereas it declined for ‘BPO services’ ‘Engineering

services’, and ‘Software product development’.

| Table 6: Software Business by Foreign Affiliates of Indian Companies |

| (` billion) |

| Activity |

2009-10 |

2010-11 |

2011-12 |

2012-13 |

2013-14 |

| Locally |

To India |

Other

Countries |

Locally |

To India |

Other

Countries |

Locally |

To India |

Other

Countries |

Locally |

To India |

Other

Countries |

Locally |

To India |

Other

Countries |

| (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

(9) |

(10) |

(11) |

(12) |

(13) |

(14) |

(15) |

| IT services |

6.4 |

0.0 |

0.4 |

17.9 |

0.2 |

1.6 |

27.5 |

10.7 |

5.4 |

23.9 |

1.8 |

0.4 |

37.4 |

2.0 |

3.0 |

| Software Product Development |

0.2 |

0.0 |

4.9 |

4.7 |

0 |

0.6 |

1.6 |

0.7 |

8.0 |

5.0 |

2.3 |

11.2 |

0.0 |

0.0 |

14.1 |

| BPO Services |

15.1 |

0.4 |

17.2 |

15.2 |

0.6 |

9.1 |

31.0 |

4.4 |

12.3 |

15.9 |

0.4 |

3.6 |

7.1 |

0.1 |

0.2 |

| Engineering Services |

0.6 |

0.1 |

0.0 |

1.7 |

0.3 |

0.0 |

1.5 |

0.3 |

20.6 |

1.6 |

0.5 |

0.0 |

0.1 |

0.0 |

0.0 |

| Other services |

370.1 |

7.1 |

22.3 |

338.2 |

4.4 |

26.7 |

391.8 |

0.4 |

20.8 |

307.4 |

184.6 |

28.9 |

644.3 |

274.6 |

118.9 |

| Total (` billion) |

392.3 |

7.7 |

44.9 |

377.7 |

5.4 |

38.1 |

453.4 |

16.4 |

67.0 |

353.8 |

189.6 |

44.1 |

689.0 |

276.7 |

136.2 |

| Total (US$ billion) |

8.3 |

0.2 |

0.9 |

8.3 |

0.1 |

0.8 |

9.5 |

0.3 |

1.4 |

6.5 |

3.5 |

0.8 |

11.4 |

4.6 |

2.3 |

USA had the maximum share of total software

business by foreign affiliates though its share declined

in 2013-14. It was followed by UK which recorded a

higher share. The share of Germany and Singapore in

the total software business of foreign affiliates also

increased during the year (Table 7).

| Table 7: Software Business by Foreign Affiliates of

Indian Companies – Country-wise Distribution |

| (per cent) |

| Country |

2009-10 |

2010-11 |

2011-12 |

2012-13 |

2013-14 |

| (1) |

(2) |

(3) |

(4) |

(5) |

| USA |

54.7 |

67.5 |

65.0 |

71.3 |

65.4 |

| United Kingdom |

6.1 |

6.8 |

5.3 |

6.6 |

7.9 |

| Canada |

4.0 |

2.7 |

3.6 |

4.1 |

4.1 |

| Germany |

3.1 |

2.5 |

2.9 |

3.0 |

3.5 |

| Singapore |

3.0 |

3.4 |

4.4 |

2.7 |

3.3 |

| Netherlands |

3.1 |

3.6 |

4.3 |

2.1 |

3.2 |

| Other Countries |

26.0 |

13.5 |

14.5 |

10.2 |

12.5 |

| Total |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

IX. Conclusion

During 2013-14, India’s export of computer

software services continued to have robust growth even

as the growth of ITES/BPO services moderated. Total

international trade in software services by India,

including the services delivered by foreign affiliates

established abroad, stood at `5,011.8 billion (US$ 82.8

billion) in 2013-14. Software exports by foreign affiliates

of Indian companies increased substantially in 2013-14.

The share of on-site exports increased in 2013-14,

for the first time after 2008-09 even as Mode-1 (cross-border

supply) continued to be the major mode of

software services exports. The share of software

services exports through Mode-1 and Mode-2 declined,

whereas, the share of software services through Mode-

3 and Mode-4 has increased in 2013-14. USA continued

to remain the major destination for software exports

and US dollar remained the major invoice currency for

software exports during 2013-14.

Box: Comparison of survey results with NASSCOM and BoP data

The Reserve Bank publishes the software exports

data in BoP using data reporting by Authorised

Dealers (ADs), STPI and also the software exports

data released by the NASSCOM. This accounts for

only non-physical offsite software exports. As per

the BoP data released by the RBI, non-physical (offsite)

software exports stood at `4,206.0 billion in

2013-14 which does not include on-site software

exports. Adding the on-site software exports of

`857.3 billion(US$ 14.2 billion), as reported in

the survey, the total software services exports in

2013-14 worked out to `5,063.3 billion (US$ 83.7

billion).

NASSCOM publishes exports of IT-BPO industry

which is based on the global software business of the

Indian software companies, i.e., software exports of

Indian companies together with the software business

of their overseas subsidiaries. Accordingly, in order

to make the data generated through the RBI’s survey

on Software & ITES/BPO Services Exports comparable

with NASSCOM data, the software business of

overseas subsidiaries of Indian companies have been

added to the estimated software services exports of

India, based on the survey.

Based on the survey, export of software services

from India in 2013-14 was estimated at `4,322.8

billion (US$ 71.4 billion) and the software business

done by the Indian subsidiaries abroad in 2013-14

was estimated at `689.0 billion (US$ 11.4 billion).

Thus, the global software export of India based on

the survey was `5,011.8 billion (US$ 82.8 billion) as

against `5,228.9 billion (US$ 86.4 billion) published

by the NASSCOM. The software business done by the

overseas subsidiaries of Indian companies accounted

for 13.7 per cent of the global software business,

estimated through the survey.

The survey results are quite comparable with the

software exports data released by NASSCOM and

also with the software service exports data of BoP.

| Reconciliation of Software Services Exports of India during 2013-14 |

| (` billion) |

| Software exports

as per NASSCOM

(Global business) |

Software Exports based on annual Survey |

Software Exports based on Balance of Payment Statistics |

| Indian companies

(Mode 1, Mode 2 &

Mode 4) |

Subsidiaries

abroad (Mode

3 & export of

Subsidiaries other

than India) |

Global Business |

Software Exports

based on BoP data |

On-site software

exports based on

survey (Mode 4) |

Total Software

Exports of India |

| (1) |

(2) |

(3) |

(4)=(2)+(3) |

(5) |

(6) |

(7)=(5)+(6) |

| 5,228.9 |

4,322.8 |

689.0 |

5,011.8 |

4,206.0 |

857.3 |

5,063.3 |

Annex:

Methodology for estimation of Software Services Exports of Non-responding companies

Annual survey on Software and IT enabled Services

Exports for the period 2013-14 was launched among

nearly 6,700 Software and ITES/BPO companies. Of

these, 873 companies responded to the survey which

included 128 NIL and closed companies. The non-respondent

companies were generally the smaller

companies, as the 745 active companies that supplied

data included all major companies in the sector.

Using the observed proportion, number of companies

with NIL exports was estimated from 5,827

non-respondent companies and software exports

have been estimated for the remaining 4,973 non-responded

companies, using the following method:

-

Based on the ITES/BPO reported activity,

companies have been classified in four groups,

viz.; IT Services, ITES/BPO Services, Engineering

Services and Software Product Development

Services (having 100 per cent business under

respective group).

-

For classifying the other companies having

combination of these as their business activity,

reported proportions of their exports done in

IT, BPO, Engineering and Software Product

Development services have been used.

-

Based on the reported data, it was observed

that ‘On-site’ software export was primarily

reported by the major companies. Therefore,

only offshore software exports component was

used for estimating software export of non-responded

companies.

-

As the observed distribution of exports was

highly positively skewed in each of these

groups, median was used for estimating

software exports in each group.

Estimated software exports for ith group of non-responding

companies

The total software export of India has been compiled

as the sum of reported software exports and the

estimated software export for non-responded

companies in each of the four groups.

Using the methodology given above, the software

services exports of non-respondent companies was

estimated to the tune of `1,093.4 billion (around

25.3 per cent of total software services exports).

* P

|