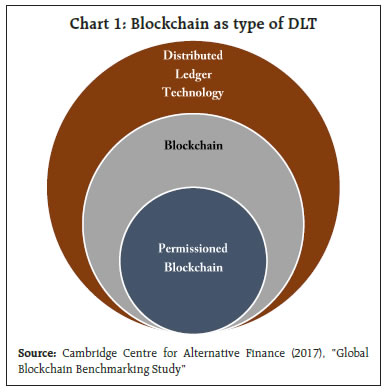

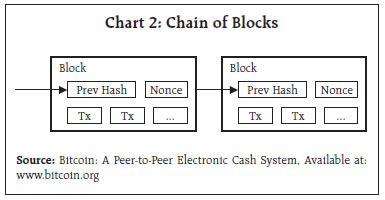

Distributed Ledger Technology (DLT) and blockchain have developed considerably in features and complexity to offer solutions to various industries including the financial sector. Some central banks have undertaken pilot projects to study and understand DLT and explore the potential benefits for their operations and the financial systems. So far most of these projects have been experimental in nature to explore the viability of conducting inter-bank settlements, settlement of digital assets and tokens and cross-border payments across DLT platforms with functionalities of the existing system. In the Indian context, increasing support from the Reserve Bank of India and the Government of India for innovations and emerging technologies through regulatory sandbox and various other schemes would pave the way for the new economy, enriched with technology-centric growth momentum. Introduction From the ashes of global financial crisis (GFC) emerged a white paper titled, ‘Bitcoin: A Peer-To-Peer Electronic Cash System’ (Nakamoto, 2008), providing a guide-path to revolutionise the financial system. Since then, the world has rapidly evolved from Bitcoin and initial designs of blockchain to customised blockchains to suit the demands of various industries. At present, there are more than 2,000 cryptocurrencies1 listed on major cryptocurrency exchanges, and numerous start-ups on blockchain across the world. Blockchain has become a catchword and no discussion on FinTech is complete without its reference. Such increase in popularity in the span of a decade reflects the innate revolutionary features that blockchain offers and its appeal to the technically proficient entrepreneurs. Despite several instances of bubble bursts involving cryptocurrencies, their valuation at present stands around $255 billion2. Blockchain and DLT have gained popularity in recent years, following the rally in the valuation of cryptocurrencies witnessed during late 2017, recovery in June 2019 and recent gains in the wake of the coronavirus outbreak. Due to the heightened interest in cryptocurrencies, even BigTech firms are increasingly occupying the space in FinTech, which had been primarily the domain of start-ups. The FinTech firms offering blockchain technology based solutions to remittances and international payments are rapidly disrupting and challenging market players. Central banks and other authorities are increasingly realising that they could reap benefits from this technology in terms of reducing risk, preventing fraud and executing monetary policy more effectively (De Meijer, 2018). Accordingly, some central banks have embarked on an ambitious journey to facilitate and guide the industry in a non-disruptive manner while preserving financial stability and ensuring the development of financial market infrastructure using DLT. Despite the huge interest among public in blockchain and DLT, there appears to be a gap in the information about these emerging technologies. Several central banks and other regulatory authorities have shown caution in embracing this technology due to various regulatory challenges associated with the complexity of this technology primarily arising from “the fast-moving vocabulary around blockchain technology and the challenges this unstable verbal terrain poses for regulators” (Walch, 2016). Here, it is useful to consider the proverbial statement of Charles Kettering, ‘a problem well stated is half resolved’. It is from this perspective that this study is motivated to provide a simplified understanding of DLT and blockchain and their applications by central banks; the learnings from the study may also be useful in the Indian context. The remainder of the article is organised in six sections comprising fundamentals of DLT and blockchain, recent developments and issues in DLT, the DLT projects implemented by various central banks, central bank digital currencies (CBDCs), the potential applications of DLT in Indian financial space and conclusion. II. Fundamentals of DLT and Blockchain – Key Concepts The terms DLT and blockchain are often used interchangeably. However, it is important to understand the distinction. Blockchain, a linearly connected chain of blocks, is a specific type of DLT, whereas DLT is a decentralised ledger, which may not be a linear chain, among various participants who agree on a common state of the ledger and validates the new information/transactions and updates the ledger. Thus, all blockchains are DLT; however, all DLT platforms are not blockchains (Chart 1). A DLT is not a blockchain if the distributed ledger is not in the form of linearly connected blocks. To illustrate, Hedera Hashgraph3 developed by Leemon Baird in 2016 is not a blockchain but comes under the DLT umbrella.  DLT, as the name suggests, is distribution of a common ledger to all the participants of the network, and it is important to ensure that everybody has the same ledger with specific conditions and process for updating the ledger with information related to ownership of tokens. In other words, it is inherently a publicly shared ledger of who owns what. In contrast to centralised systems where a single entity maintains the database, DLT allows multiple entities to store a copy of the ledger and compete to update the ledger independently while following the rules of the system. A valid update to the ledger by a node becomes the new ledger for all other nodes of the system. Participants of the network agree to specific rules for changing the ledger and the process through which all participants validate transactions or modify the ledger is called consensus algorithm. Blockchain can be considered as a form of DLT where linearly connected information-containing blocks, secured by cryptography, are shared between participants. It is this fundamental difference that allows participants to engage in digital transactions without the need of a centralised trusted party that makes DLT a remarkable innovation. DLT is not a completely new technology but a combination of known technologies such as cryptography, peer-to-peer (P2P) networks, and consensus mechanisms/algorithms. II.1 Cryptographic hash functions As the most important building block of blockchain, a cryptographic hash function is a special type of function which takes input of any size and converts it to a small and fixed size output, called hash. The same input will always give the same hash, thus making it deterministic. It is practically irreversible in nature, implying that one cannot estimate the input data from a given hash value and most importantly it is collision free, i.e., no two inputs will give the same hash. Also, even a small change in the input generates a very different output, which makes cracking the output very difficult (Table 1). | Table 1: Different Hash Outputs of Similar Inputs | | Hash Function | Hash Value | | SHA256(‘India’) | abd149214539d9f222d25de6358735b9fa0efd3956f66102b2c119ae2d9f6348 | | SHA256(‘india’) | fb54e9062429a93785559529beda15c55f62c29be22267811c0e8346c14846d3 | | Source: Computed using sha256 function of hashlib library in Python. | II.2 Public-Private key cryptography In public key cryptography, every individual has own unique set of public-private key pair. To ensure transfer of messages without eavesdropping on the contents, one can encrypt the message using the public key of the intended recipient, who on receiving the encrypted message/document can decrypt it using own private key (public key is used for encryption and private key used for decryption, though it can work in reverse also). Public key cryptography is used to send the message to the right recipient in a secured manner, whereas private key cryptography can securely determine the source of the message/ transaction. II.3 Nodes Nodes are the points in a network through which an individual or an entity interacts with the network. In a DLT platform, nodes interact with each other to pass on information or conduct transactions. There can be different types of nodes with different functions in a DLT platform. For example, in blockchain based on Delegated Proof-of-Stake consensus protocol, there are two types of nodes, regular users and witnesses. In a permissionless system, anybody can join the network and become a node. However, in a permissioned system, one can become a node only after satisfying the predefined conditions. II.4 Tokens Tokens are units of objects, physical or virtual, which can also express ownership of an object. In principle, anything can be tokenised which results in different type of tokens such as payment and utility tokens, based on intended function. Tokenisation refers to the generation of tokens which is a digital representation of an object in DLT. Native token for a blockchain can be used as payment token. For example, Bitcoin blockchain has Bitcoin token as the native payment token, where the blockchain records the transactions of their Bitcoin tokens. An example of utility token is Filecoin which allows the token owners to store data on the network (Protocol Labs, 2017). II.5 Blocks in a blockchain The main purpose of blocks is to record transactions. Use of cryptographic hash functions ensures that the blocks are valid and tamper-proof. A block’s validity is defined by a blockchain protocol or consensus protocol/mechanism. In a blockchain, blocks are connected linearly like a chain using cryptographic hash functions, where contents of each block in the chain begins with the hash value of its previous block (Chart 2), thus forming a chain of blocks connected through hash value (Nakamoto, 2008). II.6 Proof-of-Work (PoW) It is a type of consensus mechanism for nodes to agree on validity of transactions in blockchain. Other categories of consensus algorithm are discussed subsequently. Under the PoW protocol, the process of creation of new blocks is referred to as mining and nodes which engage in mining as miners. It is one of the many consensus mechanisms and is being used in many blockchains such as Bitcoin and Ethereum4. It requires nodes to solve a mathematical puzzle (find hash value of the block which is less than a threshold value by changing nonce, a variable in the block) which can only be solved through trial and error basis and hence it requires significant computation power to create valid blocks in the blockchain. Bitcoin blockchain limits the number of blocks to be added in a given time which is one block per 10 minutes by adjusting the difficulty threshold. A major drawback with PoW is that with rising prices of Bitcoin, huge computation power is put to Bitcoin mining, thus resulting in substantial electricity consumption.  II.7 Why use DLT? In real life, to provide for ownership of an object such as housing, cars, etc., there is a physical document issued by an authorised institution which is accepted by the public. Some of the major issues with this form of proof of ownership is the verification process and proliferation of counterfeit certificates. In DLT, every account has a digital public key and private key pair which is used to sign and encrypt blocks, using hash functions. This mechanism forms the backbone of the DLT structure. Here, the ownership is mentioned in a publicly shared electronic ledger which is made tamper-proof through cryptography. The authenticity of transactions is ensured through use of private key, which is used to sign transactions and thus providing proof that it came from the owner which can be verified easily by using its public key pair. III. Recent Developments and Issues in DLT Blockchain has come a long way from its conception with Satoshi Nakamoto’s paper of 2008. While cryptocurrency was the first of its applications, currently different applications have gained momentum. Initial shortcomings of first generation of blockchains include limited applications, slow transaction confirmations, limited throughput, no privacy and large energy consumption. These shortcomings are being resolved using new techniques such as sharding, alternative consensus mechanisms such as Proof-of-Stake, and permissioned blockchains for special applications, such as wholesale interbank settlements (Proof-of-Concept projects by Bank of Canada and Monetary Authority of Singapore). Interoperability between blockchains are being developed for cross-platform functionality. Increased demand for different solutions have led the development of other DLT platforms, such as Quorum, Corda, Hyperledger, etc. III.1 Proof-of-Stake (PoS) To overcome the limitations of ‘proof-of-work’, i.e., wastage of energy and slow confirmation of transactions, researchers have developed PoS-based consensus algorithms where anyone holding tokens can participate in the process of creation of new blocks. In PoS, blocks are not mined but forged. The influence of nodes on the blockchain is proportional to their amount of stake in the system. This is substantially efficient than the mining process in PoW (Buterin & Griffith, 2017). III.2 Permissioned versus Permissionless DLT Based on the ability to authenticate transactions, a DLT can be classified as permissioned (prior approval to participate necessary) or permissionless (anyone can participate). Most of the first generation blockchains are permissionless such as Bitcoin and Ethereum. Permissionless DLT systems are highly transparent, as everyone can see all the transaction on the ledger. However, they are also time consuming to operate, and not fit for solutions which require privacy of transactions. To overcome the limitations of permissionless systems and fulfil the specific needs of certain groups like banks and companies, permissioned DLT platforms were started. By its nature, the access to validate transaction are given to select agents. To solve for the requirements of privacy, DLT can be designed so that an agent can see only its own transactions and not of others. This is an important requirement by business and financial agents. III.3 Smart Contracts These contracts are basically lines of code or logic on DLT that execute themselves after the predetermined conditions are met. These can be interpreted as digital agreements where once the terms of the agreement are met, then the smart contract verifies it and transfers the tokens as per the terms (Buterin, 2013). A simple example of a smart contract is that once a payment is received it is automatically split and sent to the predetermined individuals. A smart contract can interact with other smart contracts and, thus, grow in terms of complexity. Smart contracts have been applied in various pilot projects of the central banks and other institutions in services like trade finance, settlement of securities, etc. III.4 Blockchain Interoperability There are many blockchains and DLT platforms operational in the world. These DLT platforms are made for specific use cases and can communicate with each other to deliver desired services. This feature of the DLT is often compared with Internet, which is a network of networks. Interoperability implies that based on a transaction occurring in a single DLT platform, another transaction will occur in a different DLT platform. Such interoperability is useful in cross-border payment transactions as demonstrated by Bank of Canada’s Project Jasper and Monetary Authority of Singapore’s Project Ubin (Bank of Canada et al, 2018) III.5 DLT and Blockchain Platforms DLT and blockchains should not be construed only as means to send cryptocurrencies but also as platforms to build larger applications. Each DLT platform is, by construct, unique with its own sets of features and associated advantages and disadvantages. Thus, it is important to select the right platform for the application in hand. Development of such platforms are depicted in the timeline starting from Bitcoin (Chart 3). IV. DLT in Central Banks Blockchain gained its popularity from Bitcoin, a cryptocurrency. Since it was infringing the domain of the central bank, which is the sole issuer of currency in an economy, by offering an alternative form of private currency, central banks across the world began to monitor the risks posed by cryptocurrencies. However, while monitoring these developments, central banks exhibited an optimism and interest in blockchain-based applications apart from cryptocurrencies. In August 2016, the World Economic Forum (WEF) published a report ‘The future of financial infrastructure’, which provided details of the possible ways in which blockchain can reshape financial services with applications ranging from payments to equities settlements (Chart 4). Central banks, entrusted with the responsibility of developing financial infrastructure, realised that they could facilitate innovations in a rapidly evolving digital landscape. Moreover, it was also acknowledged that the participation of central banks could bolster the security and stability of these platforms, while enhancing the resulting efficiencies for the financial sector.

Recently, Bank of Canada and Monetary Authority of Singapore in their projects tried cross-border payments across their respective blockchain network. The interest of central banks in DLT was heightened further in second half of 2019, as the proposed launch of Libra by Facebook was announced in a white paper in June 2019. In the last five years, several central banks have initiated projects (Annex) to study and use DLT technology so as to assess the potential applications of DLT in financial infrastructure. The objective of most of the projects is not to replace existing financial infrastructure, but an investigative one which is to study the viability of existing systems on a new decentralised platform. Such projects are primarily aimed at improving the understanding of DLT among central banks and explore the feasibility of implementing CBDC in financial infrastructure in a phased manner. IV.1 Bank of Canada (BoC): Project Jasper Bank of Canada started Project Jasper in March 2016 in collaboration with Payments Canada, R3 and canadian commercial Banks to study and understand DLT and its application in the financial ecosystem. It developed proof-of-concept (PoC)5 of DLT-based wholesale inter-bank payment system in phase 1 using Ethereum platform. Members of the network use digital depository receipts (DDRs) issued by Bank of Canada to transact and settle interbank payments, which would be settled finally against deposits of banks with the Bank of Canada. In phase 2, more functions were added such as Liquidity Saving Mechanism (LSM) on Corda platform, where privacy of transactions was ensured between financial institutions. In phase 3, the project extended the application of DLT to settlement of securities against DDRs on the distributed ledger. In phase 4, the project collaborated with other central banks to use DLT for cross-border and cross-currency settlement system. Overall, the project concludes that DLT-based applications may lead to efficiency gains and cost savings. However, to realise such benefits, it is important to expand the coverage of assets on distributed ledger along with participants in the network. IV.2 Monetary Authority of Singapore (MAS): Project Ubin Monetary Authority of Singapore (MAS) along with other financial institutions and R3 started Project Ubin in November 2016 to develop and produce a PoC to conduct inter-bank payments using DLT-based digital cash-on-ledger. This project leveraged the experience gained by R3 in Project Jasper and applied it to Project Ubin in the context of Singapore. In phase 1 of the project, a prototype for wholesale interbank payment was developed on Ethereum blockchain. In the second phase, based on the experience gained, advanced feature of LSM was added in the original PoC which was analysed and developed in other DLT platforms such as Hyperledger Fabric, Corda, and Quorum and was completed and published in November 2017. In phase 3, MAS and Singapore Exchange collaborated to develop Delivery versus Payment (DvP) functionalities for settlement of tokenised assets, such as of securities, on DLT platforms. In phase 4, MAS and BoC collaborated to enable cross-border interbank payments across different DLT platforms and published the Jasper-Ubin design paper in May 2019. Currently, phase 5 of the project is in progress, which would enable payments in different currencies on the same network. IV.3 Other Initiatives The interest of central banks in DLT rose substantially in recent years as they set up special units to monitor developments in this area and engaged in projects to improve the understanding of new technologies which can have a lasting impact on financial infrastructure. So far, the experimental studies of central banks with DLT projects have followed a similar pattern (Chart 5), starting with application in wholesale inter-bank payments, then testing with transactions in tokenised assets in Delivery-versus-Payment settlement and later moving to cross-border payments. Some of the central banks who have taken similar projects are European Central Bank in collaboration with Bank of Japan, Central Bank of Brazil, Bank of Thailand, etc. National Bank of Cambodia under its Project Bakong has developed a blockchain-based retail payment system, one of the first central banks to launch blockchain-based P2P system for public use. Apart from central banks, several private banks have also joined efforts in reaping benefits of blockchain and DLT. Illustratively, J.P Morgan has developed Quorum in 2017, a permissioned variant of Ethereum blockchain for enterprise solutions, which it uses to support the company’s Interbank Information Network (IIN). IIN aims to provide secure and fast exchange of information to facilitate cross-border payments in minimum time. The IIN has 365 banks globally on its network, including seven banks from India. V. Central Bank Digital Currency Central banks are not only exploring DLT for its application in improving financial market infrastructure but also considering it as a potential technological solution in implementing central bank digital currency (CBDC). Results from a recent survey of central banks conducted by Bank for International Settlements, conclude that some 80 per cent of the 66 responding central banks have started projects to explore the use of central bank-issued digital currency (CBDC) in some form (Boar et al, 2020). These central banks are contemplating and studying the potential benefits and implications of CBDC in the economy. We discuss below the efforts being made in central banks of China and Sweden in this regard. V.1 The People’s Bank of China (PBoC) PBoC has established Digital Currency Research Institute to study and undertake research in digital currency and explore technologies through which a central bank digital currency could be implemented. DLT and blockchain have been explored extensively by the PBoC as a possible technology for launching of CBDC (PBoC, 2016). Apart from CBDC, PBoC is supporting research on using blockchain for trade finance, especially after the support from the President of China for the blockchain technology, as an important breakthrough for innovations6. V.2 Sveriges Riksbank: E-Krona project With the declining usage of cash in Sweden, the Riksbank, the central bank of Sweden, has been researching on CBDC and analysing the implications of launching a digital currency, e-krona, from various perspectives such as monetary policy and financial stability. To implement e-krona, the Riksbank has explored various technical solutions including DLT. However, the bank has stated that, presently, DLT is not developed enough to provide the desired application of e-krona. Hence, e-krona would not be based on DLT in the short term. However, given the pace of technological development in DLT, it can become a relevant solution for CBDC in long term. Therefore, interaction with DLT applications is desirable for e-krona (Sveriges Riksbank, 2018). VI. DLT Applications in India Following Bitcoin, there have been various start-ups dealing with cryptocurrency in India such as Unocoin in 2013 and Zebpay in 2014 (Tracxn, 2019). However, the volatility in Bitcoin prices and the instances of frauds have brought to the fore regulatory concerns over the risks of cryptocurrencies. Both the Government of India and the Reserve Bank have indicated that they have not authorised or issued regulation for any entity to deal with cryptocurrencies and, hence, individuals have no legal protection in dealing with cryptocurrencies and would bear all the risks associated with it. In fact, the Reserve Bank has issued several press releases (Dec 24, 2013, Feb 01, 2017, Dec 05, 2017) warning against dealing in cryptocurrencies. Sensing the rising risks caused by speculative dealings in cryptocurrencies and to safeguard domestic depositors and financial institutions, the Reserve Bank in April 2018 prohibited its regulated entities from offering its services to companies dealing with cryptocurrencies or virtual currencies (VCs). However, the authorities have recognised the usefulness of blockchain and DLT (Table 2). Against this backdrop, it is critical for institutions in India to understand the potential benefits and risks associated with DLT to reap the benefits of digital innovation. In recent years, adoption of DLT and blockchain in India has progressed in both public and private sectors, although most of the projects are in the proof-of-concept phase. In fact, the public sector is emerging as a big user of blockchain-based solutions. Some state governments like Andhra Pradesh and Telangana have started blockchain-related solutions in the areas of land registry, digital certificates, electronic health records, etc., (Government of Andhra Pradesh, September 2018). In the private sector, banking and financial services sector is leading in adoption of blockchain-based solutions. Illustratively, these initiatives include: Yes Bank implementing issuance of commercial papers on blockchain (Yes Bank, July 2019); Axis Bank launching international payment service using Ripple’s enterprise blockchain technology (Axis Bank, November 2017); and HSBC India and Reliance Industries Ltd. executing blockchain-based trade finance transaction (HSBC India, November 2018). | Table 2: Major Developments related to DLT in India | | Report | Released | Select Takeaways related to DLT and Blockchain | | White Paper: Applications of Blockchain Technology to Banking and Financial Sector in India, IDBRT. | January 2017 | To explore the feasibility of blockchain technology in banking and financial sector, PoC of two use cases was developed: Domestic Trade Finance with a sight Letter of Credit and Enhanced Information Payments. | | RBI Inter-Regulatory Working Group on FinTech and Digital Banking (Chariman: Sudarshan Sen). | February 2018 | “There is a need to develop a deeper understanding of various FinTech products and their interaction with the financial sector and thereby their implications on the financial system, before actively regulating this space.” | | Finance Minister’s speech in Budget 2018-19. | February 2018 | “The Government will explore use of block chain technology proactively for ushering in digital economy.” | | Blueprint of Blockchain Platform for Banking Sector and beyond, IDBRT. | January 2019 | The report discusses how to build a useful blockchain that can serve as a platform to launch varied applications. | | Report of the Committee to propose specific actions to be taken in relation to Virtual Currencies (Chairman: Subhash Chandra Garg). | July 2019 | “The Committee recommends that the RBI examine the utility of using DLT based systems for enabling faster and more secure payment infrastructure, especially for cross-border payments.” | | Report of the Steering Committee on FinTech Related Issues (Chairman: Subhash Chandra Garg). | September 2019 | In the context of public sector blockchain-based trade finance, “the Committee accordingly recommends that the Ministry of MSME should work with DFS and RBI for testing and implementing block-chain solutions in trade finance for MSMEs in public sector banks as well.” | | Enabling Framework for Regulatory Sandbox, RBI. | August 2019 | Innovative products/technologies such as Smart contracts and applications under Blockchain technology could be considered for testing under the regulatory sandbox cohorts. RBI invited applications with the theme of ‘Retail Payments’ in its first cohort of Regulatory Sandbox on November 04, 2019. | Start-ups are also leveraging blockchain to provide solutions across different industries such as healthcare, retail, government services and human resource. Investment in blockchain-based startups in India through venture capitalists is estimated to be around US$ 8.5 million (NASSCOM, 2019). However, as per this report, compared to the rise in venture capital investments in blockchain start-ups globally, Indian start-ups were able to capture only about 0.2 per cent of those investments. The Reserve Bank of India has been pro-active in providing guidance for development of blockchain-based application through its new regulatory sandbox environment. Start-ups and financial institutions using blockchain-based application can be included in the cohorts of regulatory sandbox for testing their products for a stipulated period. Recently, the Government of India in the Union Budget 2020-21 proposed various measures, emphasising on the new economy based on emerging technologies such as artificial intelligence, machine learning, internet of things, etc. It proposed to bring out a policy to enable private sector to build Data Centre parks throughout the country and allocated ₹ 6,000 crore for improving digital connectivity at grassroot level by connecting 1 lakh Gram Panchayats under Bharatnet programme and ₹ 8,000 crore over the five-year period for the National Mission on Quantum Technologies and Applications. Furthermore, it was proposed to defer the tax payment on shares allotted by the start-ups to their employees under the employee stock option plans (ESOPs). Thus, these measures would not only provide new avenues for start-ups to grow and flourish but also generate new investment and employment opportunities. Going forward, as regulatory environment around DLT and blockchain technology matures with the implementation of regulatory sandbox, more start-ups and investments are expected. VII. Conclusion In the span of a decade, DLT and blockchain have developed considerably in features and complexity to offer solutions to various industries including the financial sector. Initially, the understanding of DLT was confined to computer scientists and few other curious individuals due to their complexity. However, with applications in finance and other areas, there is widespread interest in DLT. Some central banks, in collaboration with other institutions, have undertaken pilot projects to study and understand DLT and explore the potential benefits to their operations and the financial systems. So far, most of these projects have been experimental in nature to explore the viability of conducting inter-bank settlements, settlement of digital assets and tokens and cross-border payments across DLT platforms with functionalities of the existing system. It is important to note that most of these central banks have not yet expressed the intent to deploy the DLT-based applications into production. Even in the case of CBDC, the Riksbank, inter alia, has stated that DLT in its present forms is immature to be used for implementation of e-krona. Nevertheless, such projects with their consequential benefits add to the ability of central banks and regulators in guiding development of DLT-based financial market infrastructure. This also enables the central banks in providing productive guidance to start-ups and institutions as they embark on adoption of new technologies for providing effective and efficient solutions to business problems. In the Indian context, increasing support from the Reserve Bank of India and the Government of India to innovations and emerging technologies through regulatory sandbox and various other schemes would pave the way for the new economy enriched with technology-centric growth momentum. References Axis Bank (2017), “Axis Bank launches Ripple-powered instant payment service for retail and corporate customers”. Press Release, November 22. Banco Central Do Brazil (2017), “Distributed ledger technical research in Central Bank of Brazil”. Bank of Canada (2017-19), “Fintech Experiments and Project”, Available at: https://www.bankofcanada.ca/research/digital-currencies-and-fintech/fintech-experiments-and-projects/ Bank of Canada, the Monetary Authority of Singapore, Accenture and J.P. Morgan (2019), "Jasper-Ubin Design Paper: Enabling Cross-Border High Value Transfer Using Distributed Ledger Technologies". Bank of England (2018), “FinTech Accelerator Proof of Concept”, Available at: https://www.bankofengland.co.uk/research/fintech/proof-of-concept Bank of Thailand (2018-19), “Project Inthanon Phase 2: Enhancing Bond Lifecycle Functionalities & Programmable Compliance Using Distributed Ledger Technology”, Available at: https://www.bot.or.th/English/PressandSpeeches/Press/2019/Pages/n3962.aspx Boar, C., Holden, H., and Wadswoth, A. (2020), “Impending arrival – a sequal to the survey on central bank digital currency”, BIS Papers No.107, January. Buterin, V. (2013), “A Next-Generation Smart Contract and Decentralized Application Platform.” Ethereum White Paper, Available at https://github.com/ethereum/wiki/wiki/White-Paper. Buterin, V., & Griffith, V. (2017), “Casper the Friendly Finality Gadget”, ArXiv, abs/1710.09437. De Meijer, C.R.W. (2018), “Central Banks apathy for blockchain is waning”, Finextra, August 21, Available at: https://www.finextra.com/blogposting/15678/central-banks-apathy-for-blockchain-is-waning?utm_medium=rss&utm_source=finextrafeed European Central Bank and Bank of Japan (2017-19), “STELLA - a joint research project of the European Central Bank and the Bank of Japan”. Government of Andhra Pradesh, APCRDA (2018), “Securing Land Records through Blockchain”. Available at: https://www.esri.in/~/media/esri-india/files/pdfs/events/2018/UC/experience-the-uc/presentations/apcrda-land-records-on-blockchain-urban-transformation-summit.pdf HSBC (2018), “HSBC and Reliance Industries execute first of its kind blockchain trade finance transaction”, News Release, November 04. Monetary Authority of Singapore (2017-19), “Project Ubin: Central Bank Digital Money using Distributed Ledger Technology”, Available at: https://www.mas.gov.sg/schemes-and-initiatives/Project-Ubin Nakamoto, S. (2008), “Bitcoin: A Peer-to-Peer Electronic Cash System”, Available at https://bitcoin.org/bitcoin.pdf. NASSCOM (2019), NASSCOM Avasant India Blockchain Report. People’s Bank of China (2016), Transcript of Governor Zhou Xiaochuan’s Exclusive Interview with Caixin Weekly, Press Release. Protocol Labs (2017), “Filecoin: A Decentralized Storage Network.” Filecoin White Paper, Available at: https://filecoin.io/filecoin.pdf Reserve Bank of India (2013), “RBI cautions users of Virtual Currencies against Risks”, Press Releases, December 24. Reserve Bank of India (2017), “RBI cautions users of Virtual Currencies”, Press Releases, February 01. Reserve Bank of India (2017), “Reserve Bank cautions regarding risk of virtual currencies including Bitcoins”, Press Releases, December 05. Reserve Bank of India (2018), “Prohibition on dealing in Virtual Currencies (VCs)”, Notifications, April 06. South African Reserve Bank (2018), “Project Khokha: Exploring the use of distributed ledger technology for interbank payments settlement in South Africa”. Sveriges Riksbank (2018), “The Riksbank’s e-krona project : Report 2”, Available at : https://www.riksbank.se/en-gb/payments--cash/e-krona/e-krona-reports/e-krona-project-report-2 Tracxn (2019), “Blokchain Startups in India”. Available at: https://tracxn.com/explore/Blockchain-Startups-in-India Walch, A. (2016), “The Path of the Blockchain Lexicon (and the Law)”, Review of Banking & Financial Law, Vol.36. World Economic Forum (2016), “The Future of Financial Infrastructure: An Ambitious Look at How Blockchain Can Reshape Financial Services", Future of Financial Services Series, August. Available at: http://www3.weforum.org/docs/WEF_The_future_of_financial_infrastructure.pdf. Yes Bank (2019), “Yes Bank Implements Asia’s First Commercial Paper Issuance On Blockchain”, Press Release, July 11.

| Annex: Central Banks’ DLT Projects | | Phase | Project Objectives | DLT Platforms | Published/Completed | | 1. Bank of Canada – Project Jasper | | Phase 1 | Create a wholesale interbank payment proof-of-concept (PoC) on DLT | Ethereum | February 2017 | | Phase 2 | Build additional functionalities such as Liquidity Saving Mechanism (LSM) | Corda | September 2017 | | Phase 3 | Examine Delivery versus Payment (DvP) solutions for security settlement | Corda | October 2018 | | Phase 4 | Collaborate with other central banks to use DLT for cross-border and cross-currency settlement system | Quorum and Corda | May 2019 | | 2. Monetary Authority of Singapore – Project Ubin | | Phase 1 | Proof-of-concept project to conduct inter-bank payments using Blockchain technology | Ethereum | March 2017 | | Phase 2 | Three different models for decentralised inter-bank payment and settlements with liquidity saving mechanisms. | Quorum, Hyperledger Fabric, Corda | November 2017 | | Phase 3 | Delivery versus Payment (DvP) capabilities for settlement of tokenised assets across DLT platforms. | Ethereum, Quorum, Hyperledger Fabric, Chain, Anquan | November 2018 | | Phase 4 | Cross-border payment versus payment across different DLT platforms. | Quorum and Corda | May 2019 | | Phase 5 | Enabling broad system collaboration for different currencies in the same network | - | In Progress | | 3. European Central Bank and Bank of Japan – Project Stella | | Phase 1 | Payment systems: liquidity saving mechanisms in a distributed ledger environment, | Hyperledger Fabric | September 2017 | | Phase 2 | Securities settlement systems: delivery-versus-payment in a distributed ledger environment, | Hyperledger Fabric, Corda, Elements | March 2018 | | Phase 3 | Synchronised cross border payments | Hyperledger Fabric | June 2019 | | 4. Bank of Thailand – Project Inthanon | | Phase 1 | Building the Fundamental: Decentralised RTGS for interbank settlement | Corda | January 2019 | | Phase 2 | Lifecycle of bond tokens, Bond DvP, inter-bank repurchase agreement | Corda | July 2019 | | Phase 3 | Cross border payment with DLT interoperability, collaboration with HKMA’s project Lionrock | Corda | December 2019 |

| Annex: Central Banks’ DLT Projects (Concld.) | | Phase | Project Objectives | DLT Platforms | Published/Completed | | 5. Central Bank of Brazil | | Phase 1 | Identified four use cases and among them, selected Alternative System for Transactions Settlement for protyping the proof of concept using it; | Ethereum | November 2016 | | Phase 2 | Improved on the features of inter-bank settlement prototype and analysed this with competing blockchain platforms | Hyperledger Fabric, Corda, Quorum, | March 2017 | | 6. South Africa Reserve Bank – Project Khokha | | Single Phase | Built an RTGS PoC on DLT, expanding on privacy and scalability in a ‘realistic’ environment | Quorum | June 2018 | | 7. Bank of England in collaboration with | | PwC | Assess the potential of DLT, gain in-house capabilities and knowledge in PoC use case of transfer of ownership of a fictional asset among several participants. | Ethereum | 2016 | | Ripple | PoC to explore the synchronised movement of two different currencies in two different simulated Real Time Gross Settlement (RTGS) systems. | Interledger Protocol | July 2017 | | Baton Systems, Clearmatics Technologies Ltd, R3 and Token | PoC to understand how a renewed RTGS service could be capable of supporting settlement in systems operating on innovative payment technologies, such as DLT | Corda | July 2018 |

|