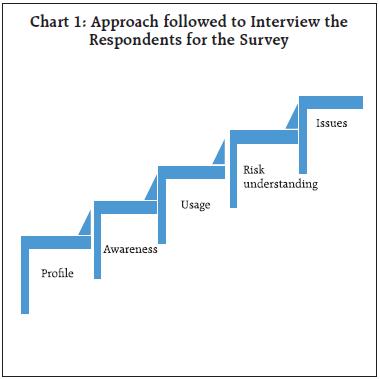

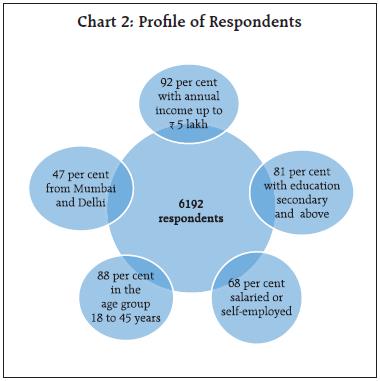

The Reserve Bank conducted a pilot survey on retail payment habits of individuals in six cities between December 2018 and January 2019 with a focus on the awareness and usage of digital payments. The survey results indicated a widespread awareness about digital payments among respondents, with the point in favour of digital payment being its convenience. The awareness was similar across men and women. The awareness was positively associated with ownership of bank accounts, levels of literacy and income of the users. However, there were concerns about a low level of awareness among respondents about the basic safety norms to be followed for digital payments. Introduction Retail payment system in India is undergoing radical transformation due to rapid technological changes and innovations in recent years. A proper understanding of payment behaviour and preference of consumers for various payment methods help in fine-tuning policies to maintain an apt regulatory framework. Against this backdrop, the Reserve Bank of India (RBI) conducted a pilot survey on retail payment habits of individuals in six cities viz., Delhi, Mumbai, Kolkata, Chennai, Bengaluru and Guwahati between December 2018 and January 2019. The objective of the survey was to gauge the retail payment habits of individuals with a focus on their awareness and usage of digital payments. This article presents the key findings from the pilot survey. The results presented should be treated as a case study and not be used to construct any population parameters. The article is organised as follows. The next section provides a review on the payment surveys conducted in a few advanced economies. Section III discusses the design and methodology adopted for the survey. Section IV discusses about the emerging importance of the retail digital payments in India in recent years and analyses the survey results. Conclusions are presented in Section V. II. Review of Payment Surveys Conducted in a few Advanced Economies The literature suggests that a broader adoption of digital payments significantly helps financial inclusion of the disadvantaged sections (World Bank Development Research Group et al., 2014). With the growing usage of digital payments, central banks in several advanced economies have resorted to surveys on consumer payments to ascertain payment habits, behaviour and attitudes (Table 1). Such surveys help in designing suitable policies that can enhance financial inclusion through digital modes while not compromising on financial stability. Certain interesting insights have emerged from the recent rounds of such surveys undertaken by various central banks. To illustrate, consumer payments survey conducted by the Reserve Bank of Australia in 2019 revealed continued decline in use of cash and increased preference for electronic payment modes by consumers (Caddy et al., 2020). Similarly, the methods-of-payment survey conducted by the Bank of Canada in 2017 indicated declining trend in cash usage in terms of volume and value (Henry et al., 2018). The Federal Reserve Bank of Atlanta in their survey of consumer payment choice conducted in 2019 found that three fourths of consumers make payments using electronic mode from bank account (Foster et al., 2020). The Reserve Bank of New Zealand in their public survey on cash use conducted in 2019 found preference for payment method other than cash (Reserve Bank of New Zealand, 2019). The results of the representative survey conducted by Oesterreichische Nationalbank (central bank of Austria) in 2018 revealed a “digital divide” with 58 per cent of Austrians (aged 14 or above) accessing online banking (Ritzberger-Grünwald and Stix, 2018). The Bundesbank in their survey in 2020 on use of payment instruments found growing use of cards during the covid 19 pandemic (Pietrowiak et al., 2021). The Swiss National Bank found use of cash as well as cashless methods in their household survey on payment methods conducted for the first time in 2017 (Swiss National Bank, 2018). III. Survey Design and Methodology The objective of this pilot survey was to gauge retail payment habits of individuals in India, with a specific focus on use of digital payments. The survey primarily focussed on four aspects of digital payments, viz., awareness, usage, risk perception and issues faced. Questions used for the interview of the respondents in the survey were organised as follows (Table 2). The pilot survey used quota sampling method to select the respondents from various categories. The survey adopted step up approach to interview the respondents (Chart 1). The pilot survey covered individuals of age 18 years or above across various socio-economic groups in six cities viz., Delhi, Mumbai, Kolkata, Chennai, Bengaluru and Guwahati. A total of 6,192 individuals participated in the survey. Chart 2 briefly presents the profile of the respondents. | Table 1: Payment Surveys by Central Banks in Select Advanced Economies | | Name of the Country | Name of the Central Bank | Payment Surveys relating to | | Australia | Reserve Bank of Australia | Consumer payments | | Austria | Oesterreichische National Bank | Use of financial innovations | | Canada | Bank of Canada | Methods-of-payment | | Germany | Deutsche Bundesbank | Use of payment instruments | | New Zealand | Reserve Bank of New Zealand | Cash use | | Switzerland | Swiss National Bank | Payment methods | | USA | Federal Reserve Banks of Atlanta | Consumer payment choice | | Note: The table is prepared based on the references cited in the Section, sourced from web sites of the respective central banks. |

| Table 2: Purposes and the Related Survey Questions | | Purposes | Questions | | A. Awareness | i. whether the respondents were aware of digital payments. ii. which of the following method(s) the respondents were aware of: Debit or Credit Card, Net Banking, National Electronic Funds Transfer (NEFT)/ Real Time Gross Settlement (RTGS), Mobile Banking, Bharat Interface for Money Unified Payment Interface (BHIM UPI), Prepaid Cards, Mobile Wallets, Immediate Payment Service (IMPS), others. | | B. Usage | i. how do the respondents generally receive money for their regular expenses. ii. purposes of digital transactions done by the respondents. iii. preferred mode of the respondents for digital payments. | | C. Risk perception | i. whether the respondents share their passwords/Personal Identification Number (PIN)/One Time Password (OTP) for cards, bank accounts, etc. with others. ii. how often do the respondents change PIN for their prepaid/debit or credit cards/mobile banking. iii. opinion of the respondents about using PIN/OTP for small value transactions. | | D. Issues faced | i. hindrance faced by the respondents while making digital payments. |

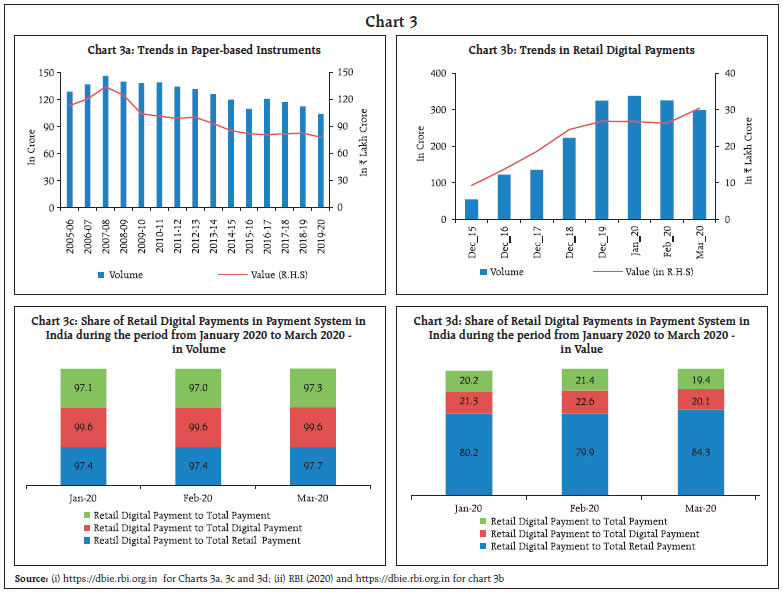

IV. Findings from the Survey IV.1 Stylised Facts on Retail Digital Payment in India Retail payment landscape in India has undergone several changes in recent decades. The use of paper-based instruments such as cheques and demand drafts has declined significantly in volume as well as in terms of value, while retail digital payments increased significantly on both these measures (Charts 3a and 3b). In terms of volume, retail digital payments accounted for over 99 per cent in total digital payments and 97 per cent or above in total payments as well as in total retail payments during the period from January 2020 to March 2020 (Chart 3c). In terms of value, share of retail digital payments accounted for around 80 per cent or more in total retail payments and around one-fifth in total payments as well as in total digital payments in the same period (Chart 3d).

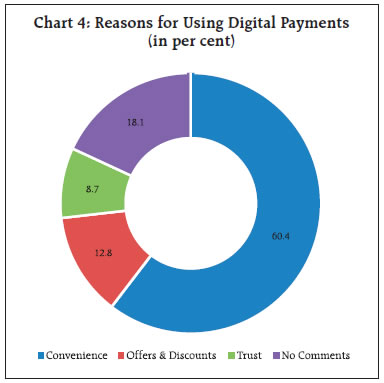

The findings of the pilot survey revealed that most of the respondents were aware of digital payments. Participants cited ‘convenience’ as the most important reason for use of digital payments (Chart 4). It indicated ‘debit or credit card’ as the most popular instrument for making digital payments followed by ‘net banking’, ‘mobile banking’ and ‘BHIM UPI’ (Chart 5). However, cash remained the most preferred mode of payment and for receiving money for regular expenses; it was followed by digital mode (Chart 6).

Participants also mentioned their use of cash for small value transactions (with amount up to ₹500) but indicated change of preference towards digital mode for payments involving higher amount of transactions (Chart 7). A substantial majority of the participants opined that the use of PIN/OTP for small value transactions for amount up to ₹2000 made transactions safe, although a few also found it inconvenient (Table 3).

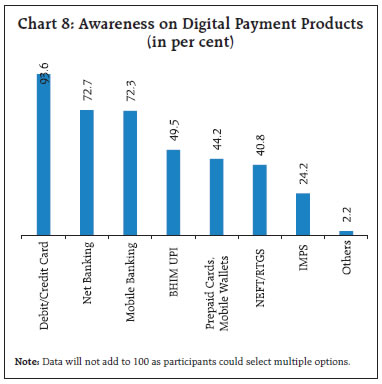

| Table 3: Opinions on using PIN/OTP for Small Value Transactions | | Types of Opinions | All Respondents | | i. It is an inconvenience | 11.6 | | ii. It makes transactions safe | 70.3 | | iii. No response | 18.1 | | Total | 100.0 | | Note: Data are as per cent to total number of respondents in the survey. | IV.2 Digital Payment Awareness from the Survey As per survey results, most of the respondents were aware about digital payments. Among various digital payment products, ‘debit or credit card’, ‘net banking’ and ‘mobile banking’ were the most well-known among all the respondents (Chart 8). The survey results also indicated that IMPS as a product was yet to receive wider acceptance.

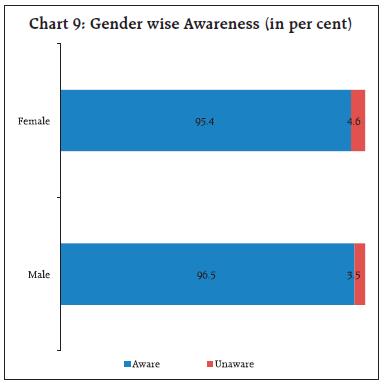

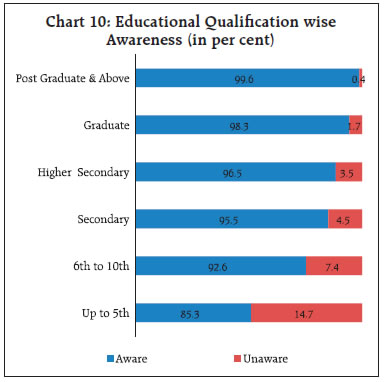

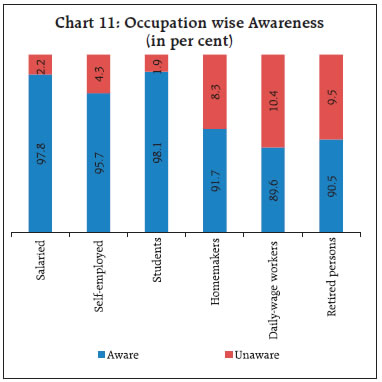

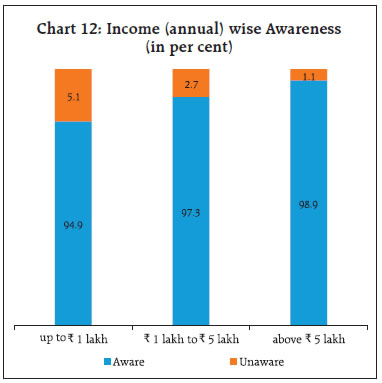

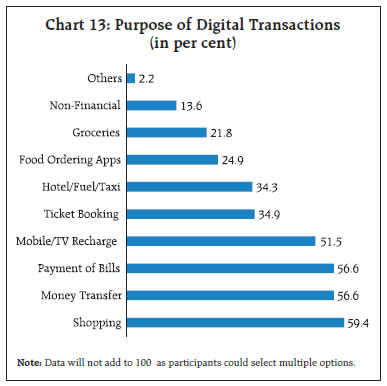

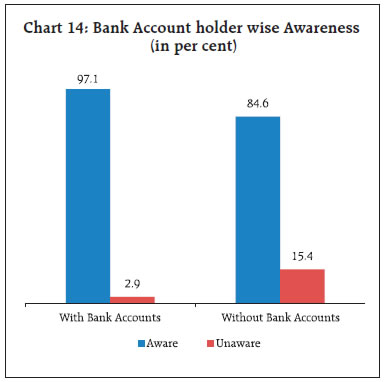

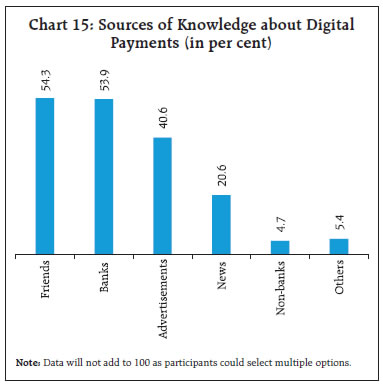

The level of awareness was almost similar across male and female respondents (Chart 9). The findings from the survey also indicated that awareness about digital payments increased with higher levels of literacy (Chart 10). Extent of awareness about digital payments was the highest among participants from the ‘student community’, while it was lower among ‘daily-wage workers’ and ‘retired persons’ (Chart 11). There was higher awareness among participants with higher annual income (Chart 12). The most important purpose for use of digital payments by the respondents were ‘shopping’, ‘money transfer’, ‘payment of bills’ and ‘mobile/ TV recharges’ (Chart 13). The results further revealed that most of the individuals having bank accounts were aware about digital payments (Chart 14). Respondents cited ‘friends’, ‘banks’ and ‘advertisement’ as the most important sources for their awareness about digital payments (Chart 15).

Around 62 per cent of the respondents reported that they did not face any major problems while making digital payments. Participants who reported facing problems cited lack of proper infrastructure, more time taken, complexity, discomfort, non-familiarity as some of the hindrances in the use of digital payments (Table 4). There was a lack of awareness on the importance of basic safety norms to be followed for digital modes of payments among certain segments of participants. Around 8 per cent of the participants shared their passwords/PINs/OTPs used for digital payments (Chart 16). More importantly, majority of the participants either never changed passwords/ PINs for their prepaid/debit or credit cards/mobile banking or changed them only when prompted (Chart 17).

| Table 4: Hindrances Faced in Use of Digital Payments | | Hindrances | Responses | | i. Lack of point of sale machines/QR codes/internet connectivity | 9.6 | | ii. Digital transactions take more time/complex as compared to cash | 8.4 | | iii. Uncomfortable/unfamiliar with digital payments | 7.5 | | iv. Less trust in digital transaction (unsafe, risky, decline of transaction, etc.) | 5.2 | | v. Digital transactions costly as compared to cash | 3.1 | | vi. Do not have payment products (cards, wallets) or devices (mobile, laptop) | 1.6 | | Note: Data are as per cent to total number of respondents in the survey; participants could select multiple options. |

IV.3 Econometric Assessment of Digital Payment Awareness An econometric assessment of the factors determining these digital payments awareness is attempted in this sub-section in two steps. In the initial step, it is examined based on test of association method, i.e., whether the awareness about digital payments is associated with gender, levels of education, levels of income and possession of bank accounts. In the next step, logistic regression method is applied to look at the significance of association of these variables with the awareness on digital payments. IV.3.1 Chi-Square Test for Association with Awareness on Digital Payments Using this method, association of digital payment awareness is individually tested with the four variables under observation mentioned above.1 Null hypothesis tested along with the test results are presented in Table 5. The results suggested that awareness on digital payment was independent of gender but was associated with the levels of education, levels of income and possession of bank accounts by users at 1 per cent level of significance. IV.3.2 Logistic Regressions on Digital Payments Awareness The logistic or logit transformation is used when the outcome variable is dichotomous. The model used for analysing digital payments is as presented below: where, P is expected probability of awareness on digital payment, x1,x2, x3 and x4 respectively are independent categorical variables representing gender, levels of education, levels of income (annual), ownership of bank accounts, βi is the regression coefficient for xi (i = 1,2,3,4). All these variables along with their categories and values assigned to the categories are shown in Table 6. | Table 5: Chi-square Test for Association: Results | | Null Hypothesis (H0) | P-values | Remark on Acceptance or Rejection of H0 | | i. Gender and awareness on digital payments are not associated | 0.18 | Accepted | | ii. Education level and awareness on digital payments are not associated | 0.00 | Rejected | | iii. Income level and awareness on digital payments are not associated | 0.00 | Rejected | | iv. Having a bank account and awareness on digital payments are not associated | 0.00 | Rejected |

| Table 6: Logistic Regression – Variables, Categories and Values | | Variables | Categories | Assigned Values | | i. Awareness on digital payments | Awareness | 1 | | Unawareness | 0 | | ii. Gender type | Male | 1 | | Female | 0 | | iii. Education level2 | Higher secondary and above | 3 | | Secondary | 2 | | 6th to 10th Standard | 1 | | Up to 5th Standard | 0 | | iv. Annual income level (in ₹ lakh) | Above 5 | 2 | | 1 to 5 | 1 | | Up to 1 | 0 | | v. Having a bank Account | Has a bank account | 1 | | Does not have a bank account | 0 | Gender was not found to be statistically significant in determining digital payments awareness (Table 7). Education level and ownership of bank accounts were significant at 1 per cent while income levels was significant at 5 per cent level. Values of the regression coefficients of all the significant variables were positive indicating their positive relationship with odds of awareness on digital payments (i.e. probability of awareness vis-à-vis probability on unawareness). | Table 7: Logistic Regression- Results | | Dependent Variable (Dep): Awareness on digital payment | | Independent variables | Coefficient | Std. Error | z- Statistic | P-values | | C | 0.66 | 0.21 | 3.17 | 0.00** | | Gender type | 0.05 | 0.17 | 0.27 | 0.79 | | Education level | 0.58 | 0.06 | 8.98 | 0.00** | | Income level | 0.27 | 0.13 | 2.04 | 0.04* | | Having a bank Account | 1.41 | 0.17 | 8.41 | 0.00** | | Total Observations | 6192 | | | | | Observations with Dep=0 | 229 | | | | | Observations with Dep=1 | 5963 | | | | | Note: * and ** indicate statistical significance at 5% and 1% levels respectively. | V. Conclusions The results of the pilot survey on retail payment habits of individuals conducted in six cities revealed that most of the respondents were aware about digital payments, and awareness was nearly equal among male and female participants. It found that levels of education, levels of income and having bank account play an important role on awareness about digital payments, as observed from the survey. Evaluation of the findings carried out based on Chi-square test and logistic regression methods reaffirmed these observations. The survey found there was a greater need for sensitisation among the public about basic safety norms while using digital modes of payment. The survey results also suggested that removal of certain infrastructure related bottlenecks would help in enhancing the use of digital payments. References Caddy James, Delaney Luc, Fisher Chay and Noone Clare (2020), “Consumer Payment Behaviour in Australia”, Bulletin, March, Reserve Bank of Australia, https://www.rba.gov.au/publications/bulletin/2020/mar/pdf/consumer-payment-behaviour-in-australia.pdf Foster Kevin, Greene Claire and Stavins Joanna (2020), “The 2019 Survey of Consumer Payment Choice: Summary Results”, https://www.frbatlanta.org/-/media/documents/banking/consumer-payments/survey-of-consumer-payment-choice/2019/2019-survey-of-consumer-payment-choice.pdf Henry Christopher, S., Huynh Kim, P. and Welte, Angelika (2018), “The Bank of Canada’s 2017 Methods-of-Payment Survey Report”, Research, Staff Discussion Paper, Bank of Canada, https://www.bankofcanada.ca/wp-content/uploads/2018/12/sdp2018-17.pdf Pietrowiak, Annett, Korella Lukas and Novotny Julien (2021), “Payment behaviour in Germany in 2020 – making payments in the year of the coronavirus pandemic, Survey on the use of payment instruments”, Deutsche Bundesbank, https://www.bundesbank.de/paymentbehaviour RBI (2020), “Assessment of the progress of digitisation from cash to electronic”, Department of Payment and Settlement Systems, RBI, https://www.rbi.org.in/Scripts/PublicationsView.aspx?id=19417 Reserve Bank of New Zealand (2019), “Cash Use in New Zealand - Public Survey 2019 High Level Findings”, https://www.rbnz.govt.nz Ritzberger-Grünwald, Doris and Stix, Helmut (2018), “How Austrians bank and pay in an increasingly digitalized world – results from an OeNB survey”, Monetary Policy & the Economy, Quarterly Review of Economic Policy, Oesterreichische Nationalbank Euro System, https://www.oenb.at/en/Publications/Economics/Monetary-Policy-and-the-Economy/2018/monetary-policy-and-the-economy-q3-18.html Swiss National Bank (2018), “Survey on payment methods 2017, Survey on payment behaviour and the use of cash in Switzerland”, https://www.snb.ch/en/mmr/reference/paytrans_survey_report_2017/source/paytrans_survey_report_2017.en.pdf World Bank Development Research Group, Better Than Cash Alliance, and Bill & Melinda Gates Foundation (2014), “The opportunities of digitizing payments”, a report to the G20 Global Partnership for Financial Inclusion; prepared for the G20 Australian Presidency August 28, 2014, http://documents.worldbank.org/curated/en/188451468336589650/pdf/903050WP0REPLACEMENT0Box385358B00PUBLIC0.pdf

|