by Saksham Sood, Ipsita Padhi, Anoop K. Suresh, Bichitrananda Seth and Samir Ranjan Behera The Union Budget 2023-24 envisages capital expenditure as a key lever of growth and commits to credible fiscal consolidation for strengthening macro-stability. Public debt levels have moderated as the government resorted to prudent fiscal management notwithstanding the challenges induced by the pandemic. Budget proposals for infrastructure creation, digitisation, green transition and youth empowerment are expected to yield dividends beyond the near-term by lifting the economy’s growth potential. Introduction The Union Budget 2023-24 comes at a time when India is being viewed globally as a bright spot, in an otherwise uninspiring global economic landscape. It strikes the right chords through measures aimed at accelerating growth and job creation while promoting macroeconomic stability. The Budget adopts seven priorities that complement each other viz., inclusive development, infrastructure and investment, reaching the last mile, unleashing the potential, green growth, youth power and financial sector to guide its policy objectives. These initiatives would lift the economy’s potential, providing productivity benefits into the long-term. According due attention to fiscal prudence, the union government has managed to adhere to the budgeted fiscal deficit target of 6.4 per cent of GDP in 2022-23 (RE) despite the supply-side disruptions emanating largely from the war in Europe. In 2023-24, the gross fiscal deficit is budgeted to further consolidate to 5.9 per cent of GDP. The government has also reiterated its commitment to reduce the fiscal deficit to below 4.5 per cent of GDP by 2025-26, which was first announced in the Union Budget 2021-22. The Budget proposes measures to simplify the tax structure and widen the tax base through measures aimed at reducing the compliance burden of the taxpayers, formalisation of the supply chains and improvement in the ease of doing business. Redrawing of the personal income tax slabs will help boost consumption, especially at a time when global recessionary fears continue. On the expenditure front, revenue expenditure growth has been contained at 1.2 per cent, while capital expenditure is budgeted to increase to 3.3 per cent of GDP in 2023-24 (BE) as against an average of 1.7 per cent during 2010-20. Furthermore, to incentivise States to undertake capital expenditure, the scheme for providing financial assistance to the States for capital expenditure1 has been extended to 2023-24 (BE) with an enhanced allocation of ₹1.3 lakh crore.2 Against this backdrop, the rest of the article is divided into seven sections. Section II discusses the underlying dynamics of the fiscal deficit. Section III and IV make an assessment of the trends in receipts and expenditure of the union government. Section V delineates the outstanding liabilities of the union government. Section VI discusses the major sources of financing the fiscal deficit whereas Section VII dwells upon the transfer of resources to States. Section VIII sets out the concluding observations. II. Fiscal Deficit – The Underlying Dynamics The government adhered to the budgeted fiscal target of 6.4 per cent of GDP in 2022-23 (RE).3 In absolute terms, however, the gross fiscal deficit (GFD) surpassed budget estimates by ₹94,123 crore as the increase in revenue expenditure outweighed the higher receipts. Revenue expenditure surpassed the budget estimates by ₹2.6 lakh crore while capital expenditure fell short by ₹21,972 crore, resulting in a net increase in total expenditure by ₹2.4 lakh crore. On the receipts side, net tax revenue overshot the budgeted target by ₹1.5 lakh crore and non-debt capital receipts are estimated to exceed the budget estimates by ₹4,209 crore. This was partly offset by lower non-tax collections, which witnessed a shortfall of ₹7,900 crore (Chart 1). For 2023-24, the GFD is budgeted at 5.9 per cent of GDP4 - a consolidation of 51 basis points over 2022-23 (RE). Considering the underlying economic cycle, the cyclically-adjusted fiscal deficit for 2023-24 stands lower at 5.5 per cent (Chart 2).5 Further, the government remains committed to attain the medium-term target of achieving GFD of below 4.5 per cent by 2025-26. The consolidation in 2023-24 is sought to be achieved through containment of revenue expenditure to 11.6 per cent of GDP, even as capital expenditure is budgeted to rise to a high of 3.3 per cent of GDP (Table 1). Fiscal consolidation can free up productive resources for the private sector and contribute to lowering the cost of capital, thereby raising the growth rate of the economy in 2023-24.

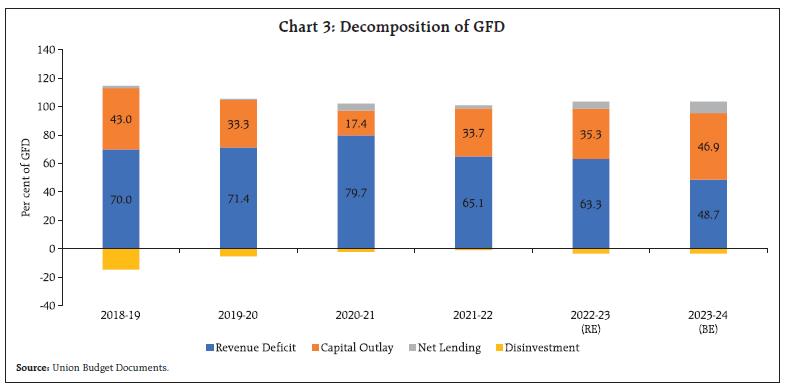

Decomposition of GFD The revenue deficit, which pre-empted around 70 per cent of the GFD during 2018-19 to 2020-21, is estimated to decline to 63.3 per cent in 2022-23 (RE) and further to 48.7 per cent in 2023-24 (BE). On the other hand, the contribution of growth-inducing capital outlay is budgeted to rise to 46.9 per cent in 2023-24 from an average of 36.5 per cent of GFD during 2010-11 to 2019-20 (Chart 3). | Table 1: Key Indicators6 | | (Per cent of GDP) | | | 2021-22 | 2022-23 | 2023-24 | | Actuals | BE | RE | BE | | 1 | 2 | 3 | 4 | 5 | | 1. Fiscal Deficit | 6.7 | 6.4 | 6.4 | 5.9 | | 2. Revenue Deficit | 4.4 | 3.8 | 4.1 | 2.9 | | 3. Primary Deficit | 3.3 | 2.8 | 3.0 | 2.3 | | 4. Gross Tax Revenue | 11.4 | 10.7 | 11.1 | 11.1 | | 5. Non-Tax Revenue | 1.5 | 1.0 | 1.0 | 1.0 | | 6. Revenue Expenditure | 13.5 | 12.4 | 12.7 | 11.6 | | 7. Capital Expenditure | 2.5 | 2.9 | 2.7 | 3.3 | | of which: | | | | | | Capital Outlay | 2.3 | 2.4 | 2.3 | 2.8 | | 8. Debt | 59.6 | 61.0 | 57.8 | 57.8 | | 9. Effective Revenue Deficit | 3.3 | 2.6 | 2.9 | 1.7 | Note: 1. Capital outlay is capital expenditure less loans and advances.

2. Effective revenue deficit is the difference between revenue deficit and grant-in-aid for creation of capital assets.

Source: Union Budget Documents. | III. Receipts Total receipts comprising net tax revenues, non-tax revenues and non-debt capital receipts, stood at 8.91 per cent of GDP in 2022-23 (RE), marginally exceeding the budgeted level of 8.85 per cent as tax revenues surpassed budget estimates, outweighing the shortfall in non-tax receipts. For 2023-24, total receipts are budgeted to rise to 9.0 per cent of GDP. Tax Revenues Gross tax revenues exhibited robust performance in 2022-23 (RE), despite the macroeconomic consequences of the war in Ukraine. Gross tax revenue exceeded the budget estimates by ₹2.9 lakh crore, on account of higher than budgeted collections in corporation tax, income tax and GST. In 2023-24, gross tax revenue is budgeted to increase by 10.4 per cent, with a budgeted buoyancy of 0.99 that is close to the trend level (proxied by the average for 2010-11 to 2018-19) [Table 2].

| Table 2: Tax Buoyancy | | | Average Tax Buoyancy (2010-11 to 2018-19) | 2021-22 | 2022-23 (BE) | 2022-23 (RE) | 2023-24 (BE) | | 1 | 2 | 3 | 4 | 5 | 6 | | 1. Gross Tax Revenue | 1.11 | 1.72 | 0.86 | 0.80 | 0.99 | | 2. Direct Taxes | 1.03 | 2.51 | 1.22 | 1.11 | 1.00 | | (i) Corporation Tax | 0.92 | 2.85 | 1.20 | 1.12 | 1.00 | | (ii) Income Tax | 1.27 | 2.21 | 1.28 | 1.13 | 1.00 | | 3. Indirect taxes | 1.25 | 1.04 | 0.51 | 0.46 | 0.99 | | (i) GST | - | 1.39 | 1.40 | 1.45 | 1.14 | | (ii) Customs Duty | 0.31 | 2.47 | 1.14 | 0.33 | 1.05 | | (iii) Excise Duty | 0.91 | 0.04 | -1.34 | -1.23 | 0.57 | Note: ‘-’: Not Applicable. Tax buoyancy is defined as the responsiveness of tax revenue to changes in nominal GDP and to discretionary changes in tax policies; calculations for 2022-23 (BE) are made over 2021-22 (RE).

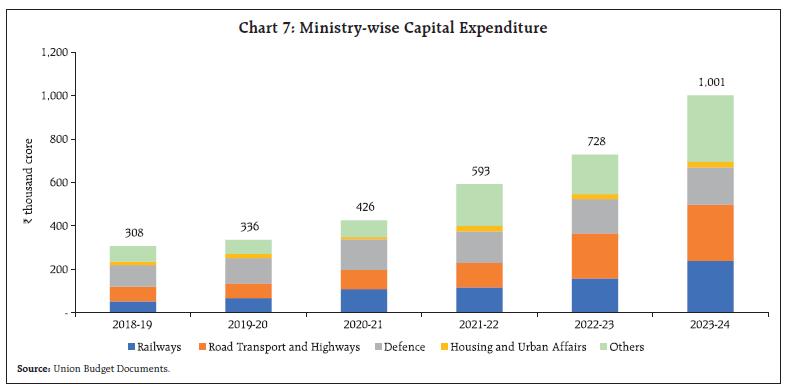

Source: RBI staff estimates based on Union Budget Documents. | Direct Taxes After registering a growth of 17.2 per cent in 2022-23 (RE), direct taxes are budgeted to grow by 10.5 per cent to reach 6.0 per cent of GDP in 2023-24 (Chart 4). Several direct tax changes have been proposed in the Budget to simplify and rationalise various provisions, to reduce the compliance burden and provide tax relief to citizens. Under personal income tax, the Budget proposes the following major changes to the new tax regime – (i) an increase in rebate limit to ₹7 lakh from ₹5 lakh, (ii) a reduction in the number of slabs to five from six and an increase in the tax exemption limit to ₹3 lakh from ₹2.5 lakh and (iii) extension of standard deduction benefit for salaried class and pensioners to the new tax regime. The highest surcharge rate was also brought down from 37 per cent to 25 per cent in the new tax regime, which would result in a reduction of the maximum tax rate to 39 per cent from the current rate at 42.74 per cent. Indirect Taxes Indirect tax collections in 2022-23 (RE) exceeded the BE by ₹55,247 crore, as GST collections exceeded budget estimates by ₹74,000 crore, offsetting the shortfall in customs (₹3,000 crore) and excise duty collections (₹15,000 crore). While the cut in excise duty on fuel in May 2022 contributed to lower excise duty collections in 2022-23 (RE), GST collections recorded a buoyancy of 1.45, reflecting the improvement in economic activity and the impact of efforts to increase the tax base and improve compliance. In 2023-24 (BE), indirect taxes are budgeted to grow by 10.4 per cent with GST, customs and excise budgeted to increase by 12.0 per cent, 11.0 per cent and 5.9 per cent, respectively. The tax changes (direct and indirect) proposed in the Budget are expected to increase disposable income by ₹35,000 crore. This is estimated to increase the real GDP growth by 15 basis points in 2023-24 by boosting personal consumption.7 Non-Tax Revenues Receipts from non-tax sources fell short of budgeted targets in 2022-23 (RE) by ₹7,900 crore as the lower than budgeted surplus transfer by the Reserve Bank was partly offset by higher interest receipts, dividends from public sector enterprises and spectrum revenues (Chart 5). In 2023-24, non-tax revenues are budgeted to increase by 15.2 per cent to ₹3.0 lakh crore. Non-debt Capital Receipts In 2022-23 (RE), disinvestment receipts8 are placed at ₹60,000 crore, as against the budgeted target of ₹65,000 crore of which only ₹38,671 crore has been garnered till end December 2022. In 2023-24 (BE), the disinvestment target has been pegged at ₹61,000 crore (Chart 6). Recoveries of loans and advances exceeded budget estimates in 2022-23 (RE) by ₹9,209 crore, outweighing the shortfall in disinvestment receipts. In 2023-24, recovery in loans is budgeted to decline by 2.1 per cent over 2022-23 (RE). IV. Expenditure Total expenditure is budgeted to grow by 7.5 per cent in 2023-24, lower than the 10.4 per cent growth recorded in 2022-23 (RE). In 2023-24, revenue expenditure is budgeted to grow by only 1.2 per cent as expenditure on major subsidies is budgeted to contract by 28.2 per cent due to the rationalisation of food subsidy and softening of urea prices. Noteworthy from the point of view of reviving investment and growth is the continued thrust provided to capital expenditure in the post pandemic period as the capital expenditure is budgeted to increase to 3.3 per cent of GDP in 2023-24 from an average of 1.7 per cent during 2010-20 (Table 3). In 2023-24, capital expenditure is budgeted at ₹10 lakh crore, which is close to three times the amount spent in 2019-20. Ministry-wise allocation of capital expenditure indicates that the Ministry of Railways and Road Transport and Highways account for almost half of the budgeted capital expenditure for 2023-24 (Chart 7). The increase in effective capital expenditure (capital expenditure plus grants-in-aid for creation of capital assets), through its multiplier effect, will generate additional output of ₹10.3 lakh crore during 2023-27 of which railways and loan assistance to States will contribute 43 per cent, while investment in logistics will contribute 19 per cent.9 Next, we decompose the total expenditure of the union government into committed expenditure, which includes establishment expenditure10, interest payments, grants recommended by the Finance Commission and GST compensation to States; and discretionary expenditure which includes central sector schemes, centrally sponsored schemes and transfers to States (excluding Finance Commission grants and GST compensation). Prior to the pandemic, the share of committed expenditure was higher than discretionary expenditure. However, with the end of GST compensation regime and introduction of interest free loans to States for capital expenditure, the share of committed expenditure stands reduced to 45.1 per cent of total expenditure in 2023-24 (BE) (Chart 8). | Table 3: Expenditure of Central Government | | | ₹ thousand crore | Growth Rate (per cent) | | | 2021-22 | 2022-23 (BE) | 2022-23 (RE) | 2023-24 (BE) | 2022-23 (BE) | 2022-23 (RE) | 2023-24 (BE) | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | | 1. Total Expenditure | 3,794 | 3,945 | 4,187 | 4,503 | 4.0 | 10.4 | 7.5 | | 2. Revenue Expenditure (of which) | 3,201 | 3,195 | 3,459 | 3,502 | -0.2 | 8.1 | 1.2 | | (i) Interest Payments | 805 | 941 | 941 | 1,080 | 16.8 | 16.8 | 14.8 | | (ii) Major Subsidies | 446 | 318 | 522 | 375 | -28.8 | 16.9 | -28.2 | | Food | 289 | 207 | 287 | 197 | -28.4 | -0.6 | -31.3 | | Fertilizer | 154 | 105 | 225 | 175 | -31.6 | 46.5 | -22.3 | | Petroleum | 3 | 6 | 9 | 2 | 69.8 | 167.9 | -75.4 | | (iii) MGNREGA | 98 | 73 | 89 | 60 | -25.9 | -9.2 | -32.9 | | (iv) PM-KISAN | 67 | 68 | 60 | 60 | 1.8 | -10.2 | 0.0 | | (v) Defence (Revenue) | 229 | 233 | 260 | 270 | 1.9 | 13.5 | 4.1 | | 3. Capital Expenditure | 593 | 750 | 728 | 1,001 | 26.5 | 22.8 | 37.4 | | (i) Capital Outlay | 534 | 610 | 620 | 837 | 14.2 | 16.0 | 35.0 | | 4. Effective Capital Expenditure | 836 | 1,068 | 1,054 | 1,371 | 27.8 | 26.1 | 30.1 | Note: Effective capital expenditure is the sum of capital expenditure and grants-in-aid for creation of capital assets.

Source: Union Budget Documents. |

V. Outstanding Debt After peaking at 62.8 per cent of GDP in 2020-21 due to the impact of the pandemic, the total outstanding debt of the Union government is budgeted to consolidate to 57.8 per cent of GDP in 2023-24 (BE). The ratio of interest payments to revenue receipts, however, is budgeted to increase to 41.0 per cent (Chart 9a). The interest rate growth differential (IRGD), an indicator of debt sustainability, continues to remain favourable, even though its magnitude has declined in the recent years (Chart 9b). However, as the union government debt still remains elevated vis-à-vis pre-pandemic trend, there is a need to stay on the path of fiscal consolidation.

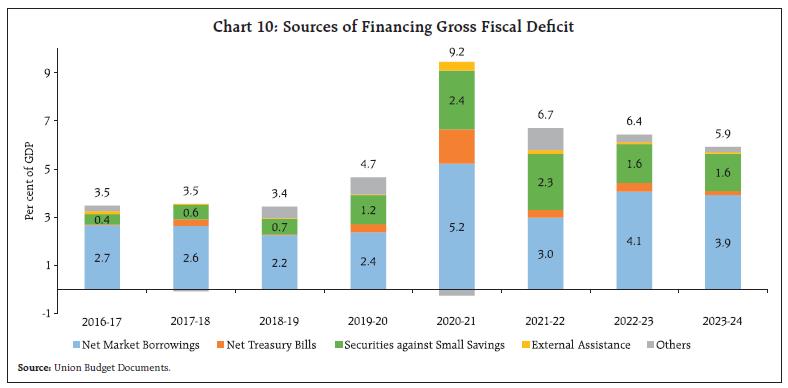

VI. Gross Fiscal Deficit Financing As per the revised estimates (RE) for 2022-23, the budgeted fiscal deficit target of 6.4 per cent of the GDP is likely to be met. In 2023-24 (BE) gross fiscal deficit (GFD) is budgeted at 5.9 per cent of GDP. Market borrowings are the main source of financing GFD for the union government, followed by securities issued against small savings (Chart 10). In 2023-24, gross and net market borrowings are budgeted at ₹15.4 lakh crore and ₹11.8 lakh crore, up from ₹14.2 lakh crore and ₹11.1 lakh crore, respectively in 2022-23 (RE) (Table 4). The gradual downscaling in the market borrowing requirements (as per cent of GDP) of the union government towards pre-pandemic level will open up space for private investment.

| Table 4: Market Borrowings of Union Government | | (₹ crore) | | | Gross Market Borrowings | Net Market Borrowings | | 2018-19 | 5,71,000

(3.0) | 4,22,735

(2.2) | | 2019-20 | 7,10,000

(3.5) | 4,73,968

(2.4) | | 2020-21 | 12,60,116

(6.4) | 10,32,907

(5.2) | | 2021-22 | 9,68,382

(4.1) | 7,04,097

(3.0) | | 2022-23 (RE) | 14,21,000

(5.2) | 11,08,183

(4.1) | | 2023-24 (BE) | 15,43,000

(5.1) | 11,80,911

(3.9) | Note: Figures in parentheses are as per cent of GDP.

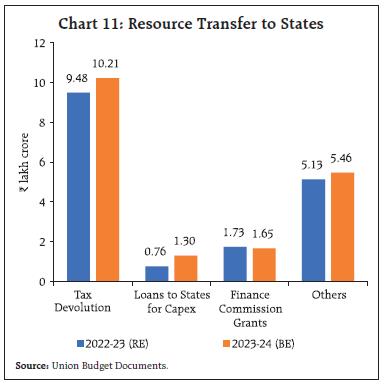

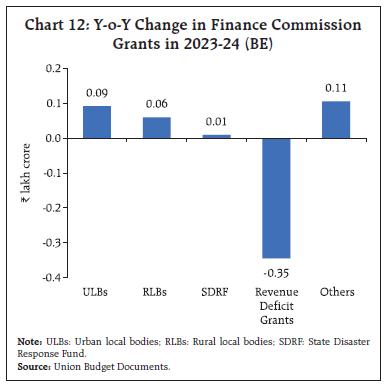

Source: Union Budget Documents. | VII. Resource Transfer from Centre to States The Centre has fixed States’ gross fiscal deficit at 3.5 per cent of the gross state domestic product (GSDP) for 2023-24, of which 0.5 per cent will be tied to power sector reforms. The gross transfer to the States is budgeted to increase in 2023-24 (BE), largely due to enhanced tax devolution and an increase in allocation for special assistance to States for capital expenditure (Chart 11, Annex 3). The Finance Commission Grants are expected to decline in 2023-24, primarily due to lower transfers under Post-Devolution Revenue Deficit Grants, while the transfers to the local bodies and health sector have seen a sharp rise (Chart 12). To spur States’ investment in infrastructure and incentivise them to undertake complementary policy actions, the Centre has decided to continue with the 50-year interest-free loan to States for one more year with an enhanced allocation of ₹1.3 lakh crore.11 The loan amount will have to be spent in 2023-24. While most of the loan will be at the discretion of the States, a part of it will be contingent on States increasing their actual capital expenditure. A part of the outlay will also be linked to, or allocated for, scrapping old government vehicles, urban planning reforms and actions, financing reforms in urban local bodies (to make them creditworthy for municipal bonds), housing for police personnel above or as part of police stations, constructing Unity Malls, children and adolescents’ libraries and digital infrastructure, and States’ share of capital expenditure of central schemes. The Union Budget also proposes to incentivise cities to improve their creditworthiness for municipal bonds through property tax governance reforms and ring-fencing user charges on urban infrastructure. Additionally, an Urban Infrastructure Development Fund (UIDF) is proposed to be established. It will be managed by the National Housing Bank and used by public agencies to create urban infrastructure in Tier 2 and Tier 3 cities.

VIII. Conclusion The Union Budget 2023-24 aims to strengthen growth momentum (through higher capital expenditure) and promote macroeconomic stability by strengthening the economic foundations with commitment to fiscal consolidation. While higher capital expenditure would generate multiplier effects and crowd-in private investment, fiscal consolidation would free up productive resources for the private sector. Further, infrastructure development, supported by integrated and coordinated planning, measures to promote digitisation and green economy, and skilling initiatives to harness the demographic dividend are expected to yield dividends beyond the near-term and raise the economy’s growth potential in the medium-run, as expounded in the accompanying article on “State of the Economy”.

| Annex 1: Union Budget 2023-24: Key Fiscal Indicators | | | ₹ thousand crore | Per cent of GDP | Growth Rate | | 2020-21 | 2021-22 | 2022-23 (BE) | 2022-23 (RE) | 2023-24 (BE) | 2022-23 (RE) | 2023-24 (BE) | 2022-23 (RE) | 2023-24 (BE) | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | | 1. Direct Tax | 945 | 1,408 | 1,420 | 1,650 | 1,823 | 6.0 | 6.0 | 17.2 | 10.5 | | (i) Corporation | 458 | 712 | 720 | 835 | 923 | 3.1 | 3.1 | 17.3 | 10.5 | | (ii) Income | 470 | 673 | 680 | 790 | 873 | 2.9 | 2.9 | 17.4 | 10.5 | | 2. Indirect Tax | 1,082 | 1,301 | 1,338 | 1,393 | 1,538 | 5.1 | 5.1 | 7.1 | 10.4 | | (i) GST | 549 | 698 | 780 | 854 | 957 | 3.1 | 3.2 | 22.3 | 12.0 | | (ii) Customs | 135 | 200 | 213 | 210 | 233 | 0.8 | 0.8 | 5.1 | 11.0 | | (iii) Excise | 392 | 395 | 335 | 320 | 339 | 1.2 | 1.1 | -18.9 | 5.9 | | 3. Gross tax revenue (1+2) | 2,027 | 2,709 | 2,758 | 3,043 | 3,361 | 11.1 | 11.1 | 12.3 | 10.4 | | 4. Assignment to States | 595 | 898 | 817 | 948 | 1,021 | 3.5 | 3.4 | 5.6 | 7.7 | | 5. NCCD Transfers | 6 | 6 | 6 | 8 | 9 | 0.0 | 0.0 | 30.5 | 9.7 | | 6. Net tax Revenue (3-4-5) | 1,426 | 1,805 | 1,935 | 2,087 | 2,331 | 7.6 | 7.7 | 15.6 | 11.7 | | 7. Non-tax Revenue | 208 | 365 | 270 | 262 | 302 | 1.0 | 1.0 | -28.3 | 15.2 | | (i) Dividends and Profits | 97 | 161 | 114 | 84 | 91 | 0.3 | 0.3 | -47.7 | 8.4 | | (ii) Interest Receipts | 17 | 22 | 18 | 25 | 25 | 0.1 | 0.1 | 12.6 | 0.7 | | 8. Revenue Receipts (6+7) | 1,634 | 2,170 | 2,204 | 2,348 | 2,632 | 8.6 | 8.7 | 8.2 | 12.1 | | 9. Non-debt Capital Receipts | 58 | 39 | 79 | 84 | 84 | 0.3 | 0.3 | 112.1 | 0.6 | | (i) Disinvestment Receipts | 38 | 15 | 65 | 60 | 61 | 0.2 | 0.2 | 309.9 | 1.7 | | (ii) Recovery of Loans | 20 | 25 | 14 | 24 | 23 | 0.1 | 0.1 | -5.0 | -2.1 | | 10. Total Receipts (ex. borrowings) (8+9) | 1,692 | 2,209 | 2,284 | 2,432 | 2,716 | 8.9 | 9.0 | 10.1 | 11.7 | | 11. Revenue Expenditure | 3,084 | 3,201 | 3,195 | 3,459 | 3,502 | 12.7 | 11.6 | 8.1 | 1.2 | | (i) Interest Payments | 680 | 805 | 941 | 941 | 1,080 | 3.4 | 3.6 | 16.8 | 14.8 | | (ii) Major Subsidies | 708 | 446 | 318 | 522 | 375 | 1.9 | 1.2 | 16.9 | -28.2 | | Food | 541 | 289 | 207 | 287 | 197 | 1.1 | 0.7 | -0.6 | -31.3 | | Fertilizer | 128 | 154 | 105 | 225 | 175 | 0.8 | 0.6 | 46.5 | -22.3 | | Petroleum | 38 | 3 | 6 | 9 | 2 | 0.0 | 0.0 | 167.9 | -75.4 | | 12. Capital Expenditure (i + ii) | 426 | 593 | 750 | 728 | 1,001 | 2.7 | 3.3 | 22.8 | 37.4 | | (i) Capital Outlay | 316 | 534 | 610 | 620 | 837 | 2.3 | 2.8 | 16.0 | 35.0 | | (ii) Loans & Advances | 110 | 58 | 140 | 108 | 164 | 0.4 | 0.5 | 85.1 | 51.6 | | 13. Total Expenditure (11+12) | 3,510 | 3,794 | 3,945 | 4,187 | 4,503 | 15.3 | 14.9 | 10.4 | 7.5 | | 14. Fiscal Deficit (13-10) | 1,818 | 1,585 | 1,661 | 1,755 | 1,787 | 6.4 | 5.9 | 10.8 | 1.8 | | Source: Union Budget Documents. |

Annex 2: Highlights of the Union Budget 2023-24 The economic agenda presented in the Budget focuses on three things: first, facilitating ample opportunities for citizens, especially the youth, to fulfil their aspirations; second, providing strong impetus to growth and job creation; and third, strengthening macro-economic stability. Following four opportunities can be transformative to service the above-mentioned focus areas. 1. Economic Empowerment of Women: Facilitation of the women self-help groups (SHGs), mobilised by DAY-NRLM (Aajivika – National Rural Livelihood Mission) to attain next level of economic empowerment through formation of large producer enterprises or collectives. 2. PM VIshwakarma KAushal Samman (PM VIKAS): Scheme to integrate traditional artisans and craftspeople with micro, small and medium-scale enterprises (MSMEs) value chains. 3. Tourism: Promotion of tourism on mission mode with active participation of States, convergence of government programmes and public-private partnerships. 4. Green Growth: Implementation of programmes for green fuel, green energy, green farming and green mobility for efficient use of energy across various economic sectors. The Budget has announced seven priorities. The major policy actions proposed by the Budget under each priority are listed below. Priority 1: Inclusive Development Agriculture and Cooperation -

Establishment of an Agriculture Accelerator Fund to provide innovative and affordable solutions, promote use of modern technologies and encourage young entrepreneurs in rural areas. -

An open-source, open standard and interoperable public good digital infrastructure is proposed for agricultural sector which will enable inclusive, farmer centric solutions and support for growth of agri-tech industry and start-ups. -

Targeted agriculture credit of ₹20 lakh crore with focus on animal husbandry, dairy and fisheries. -

Set-up of Atmanirbhar Clean Plant Program to boost the availability of disease-free, quality planting material for high-value horticultural crops. -

Indian Institute of Millet Research, Hyderabad will be supported as the Centre of Excellence (CoE) to enable India to become Global hub for millets. -

Massive decentralization of storage capacity to help farmers realize remunerative prices through sale at appropriate times. Health, Education and Skilling -

157 new nursing colleges will be established. -

A Mission to eliminate Sickle Cell Anaemia by 2047 will be launched. -

Promotion of research and innovation in pharmaceuticals through Centers of Excellence (CoE) will be undertaken. -

Facilitation of joint public and private medical research through selected Indian Council of Medical Research (ICMR) labs. -

Re-envision of teachers’ training through innovative pedagogy and curriculum transaction. The District Institutes of Education and Training will be developed as vibrant institutes of excellence for this purpose. -

A National Digital Library for children and adolescents will be set-up for facilitating availability of quality books across geographies, languages, genres and levels, and device agnostic accessibility. States will be encouraged to set up physical libraries at Panchayat and ward levels. To inculcate financial literacy, financial sector regulators and organizations will be encouraged to provide age-appropriate reading material to these libraries. Priority 2: Reaching the Last Mile -

Launch of the Aspirational Blocks Programme covering 500 blocks for saturation of essential government services across multiple domains. -

Pradhan Mantri PVTG Development Mission will be launched to improve socio-economic conditions of the particularly vulnerable tribal groups (PVTGs). -

Recruitment of 38,800 teachers and support staff for the 740 Eklavya Model Residential Schools which serves tribal students. -

Financial assistance of ₹5,300 crores will be given for micro-irrigation under Upper Bhadra Project for drought-prone central area of Karnataka. -

Provision of free food grains to all Antyodaya and priority households for one year, under Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY). -

Enhancement of outlay for PM Aawas Yojana by 66 per cent. Priority 3: Infrastructure and Investment -

The capital investment outlay has been increased by 33 per cent to ₹10 lakh crore, which will account for 3.3 per cent of the GDP. The direct capital investment by the Centre is complemented by the provision made for creation of capital assets through Grants-in- Aid to States.; taking the ‘Effective Capital Expenditure’ of the Centre to 4.5 per cent of GDP. -

The special assistance to the States for capital expenditure in the form of 50-year interest free loan will be continued for one more year with enhanced outlay of ₹1.3 lakh crore. -

Infrastructure Finance Secretariat will assist all stakeholders for more private investment in infrastructure. -

One hundred critical transport infrastructure projects, for end-to-end connectivity, last and first mile connectivity for ports, coal, steel, fertilizer, and food grains sectors will be taken up on priority basis. -

Fifty additional airports, heliports, water aerodromes and advance landing grounds will be revived for improving regional air connectivity. Urban Development -

Cities will be incentivized to improve their credit worthiness for municipal bonds. through property tax governance reforms and ring-fencing user charges on urban infrastructure -

An Urban Infrastructure Development Fund (UIDF) will be established through use of priority sector lending shortfall which will be managed by the National Housing Bank and will be used by public agencies to create urban infrastructure in Tier 2 and Tier 3 cities. -

All cities and towns will be enabled for 100 per cent mechanical desludging of septic tanks and sewers for transition from manhole to machine-hole mode. Priority 4: Unleashing the Potential -

Under Mission Karmayogi, the government has also launched an integrated online training platform, iGOT Karmayogi, to provide continuous learning opportunities for lakhs of government employees to upgrade their skills. -

For realizing the vision of ‘Make AI in India and Make AI work for India’, three centres of excellence for Artificial Intelligence will be set-up in top educational institutions. -

To unleash innovation and research by start-ups and academia, a National Data Governance Policy will be brought out. This will enable access to anonymized data. -

The know your customer (KYC) process will be simplified adopting a ‘risk-based’ instead of ‘one size fits all’ approach. The financial sector regulators will also be encouraged to have a KYC system fully amenable to meet the needs of Digital India. -

A one stop solution for reconciliation and updation of identity and address of individuals maintained by various government agencies, regulators and regulated entities will be established using DigiLocker service and Aadhaar as foundational identity. -

For the business establishments required to have a Permanent Account Number (PAN), the PAN will be used as the common identifier for all digital systems of specified government agencies. This will bring ease of doing business; and it will be facilitated through a legal mandate. -

For obviating the need for separate submission of same information to different government agencies, a system of ‘Unified Filing Process’ will be set-up. -

Vivad se Vishwas I scheme is aimed at less stringent contract execution for MSMEs. -

Vivad se Vishwas II scheme is aimed at easier settlement of contractual disputes of government and government undertakings for MSMEs. -

To better allocate scarce resources for competing development needs, the financing of select schemes will be changed, on a pilot basis, from ‘input-based’ to ‘result-based’. -

For efficient administration of justice, Phase-3 of the E-Courts project will be launched with an outlay of ₹7,000 crore. -

Fintech services in India have been facilitated by our digital public infrastructure including Aadhaar, PM Jan Dhan Yojana, Video KYC, India Stack and unified payment interface (UPI). To enable more Fintech innovative services, the scope of documents available in DigiLocker for individuals will be expanded. -

An Entity DigiLocker will be set up for use by MSMEs, large business and charitable trusts. This will be towards storing and sharing documents online securely, whenever needed, with various authorities, regulators, banks and other business entities. -

One hundred labs for developing applications using 5G services will be set up in engineering institutions to realise a new range of opportunities, business models, and employment potential. Priority 5: Green Growth -

To facilitate transition of the economy to low carbon intensity and reduce dependence on fossil fuel imports, National Green Hydrogen Mission was recently launched with an outlay of ₹19,700 crore. -

The budget provides ₹35,000 crore for priority capital investments towards energy transition and net zero objectives, and energy security by Ministry of Petroleum and Natural Gas. Battery Energy Storage Systems with capacity of 4,000 MWH will be supported with Viability Gap Funding. -

The Inter-state transmission system for evacuation and grid integration of 13 GW renewable energy from Ladakh will be constructed with investment of ₹20,700 crore including central support of ₹8,300 crore. -

To incentivize environmentally sustainable and responsive actions by companies, individuals and local bodies, a Green Credit Programme will be notified under the Environment (Protection) Act. -

PM Programme for Restoration, Awareness, Nourishment and Amelioration of Mother Earth (PM-PRANAM) will be launched to incentivize States and Union Territories to promote alternative fertilizers and balanced use of chemical fertilizers. -

With a total investment of ₹10,000 crore, 500 new ‘waste to wealth’ plants under GOBARdhan (Galvanizing Organic Bio-Agro Resources Dhan) scheme will be established for promoting circular economy. -

10,000 Bio-Input Resource Centres will be set-up to facilitate 1 crore farmers to adopt natural farming over the next 3 years. -

Afforestation initiative for mangrove forests will be launched titled ‘Mangrove Initiative for Shoreline Habitats & Tangible Incomes’(MISHTI). -

A new scheme, Amrit Dharohar, will be implemented over the next three years to encourage optimal use of wetlands, and enhance bio-diversity, carbon stock, eco-tourism opportunities and income generation for local communities. -

Coastal shipping will be promoted for both freight and passengers through PPP mode with viability gap funding. Priority 6: Youth Power Skilling -

Pradhan Mantri Kaushal Vikas Yojana 4.0 will be launched to skill lakhs of youth within next three years. The scheme will also cover new age courses for Industry 4.0 like coding, artificial intelligence (AI), robotics, mechatronics, internet of things (IoT), 3D printing, drones, and soft skills. To skill youth for international opportunities, 30 Skill India International Centres will be set up. -

A unified Skill India Digital platform to further strengthen the digital skilling ecosystem will be launched. -

Direct Benefit Transfer under a pan-India National Apprenticeship Promotion Scheme will be rolled out to benefit 47 lakh youth in next 3 years. Tourism -

States will be encouraged to set up a Unity Mall for promotion and sale of their own ODOPs (One District One Product), geographical indications (GI) products and other handicraft products. -

At least 50 destinations to be selected and developed as a complete package for domestic and foreign tourists. Priority 7: Financial Sector • Expanded corpus of ₹9,000 crore under a revamped credit guarantee scheme for MSMEs is proposed to enable additional collateral-free guarantee credit of ₹2 lakh crore. • A national financial information registry will be set up to serve as the central repository of financial and ancillary information. This will facilitate efficient flow of credit, promote financial inclusion, and foster financial stability. A new legislative framework will govern this credit public infrastructure, and it will be designed in consultation with the Reserve Bank. • To meet the needs of Amrit Kaal and to facilitate optimum regulation in the financial sector, public consultation, as necessary and feasible, will be brought to the process of regulation-making and issuing subsidiary directions. • To simplify, ease and reduce cost of compliance, financial sector regulators will be requested to carry out a comprehensive review of existing regulations. For this, they will consider suggestions from public and regulated entities. Time limits to decide the applications under various regulations will also be laid down. • Gujarat International Finance Tec-City (GIFT) International Financial Services Centre (IFSC): To enhance business activities in GIFT IFSC, the following measures will be taken: -

Delegating powers under the special economic zone (SEZ) Act to International Financial Services Centres Authority (IFSCA) to avoid dual regulation. -

Setting up a single window information technology (IT) system for registration and approval from International Financial Services Centre Authority (IFSCA), SEZ authorities, Goods and Services Tax Network (GSTN), Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI) and Insurance Regulatory Development Authority of India (IRDAI). -

Permitting acquisition financing by IFSC Banking Units of foreign banks. -

Establishing a subsidiary of Export Import (EXIM) Bank for trade re-financing. -

Amending IFSCA Act for statutory provisions for arbitration, ancillary services, and avoiding dual regulation under SEZ Act. -

Recognizing offshore derivative instruments as valid contracts. • To improve bank governance and to enhance investors’ protection, certain amendments to the Banking Regulation Act, the Banking Companies Act and the Reserve Bank of India Act are proposed. • To build capacity of functionaries and professionals in the securities market, SEBI will be empowered to maintain standards for education in the National Institute of Securities Markets. • A Central Data Processing Centre will be setup for faster handling of administrative work under the Companies Act. • An integrated IT portal will be established for investors to reclaim unclaimed shares and unpaid dividends from the Investor Education and Protection Fund Authority. • Digital payments continue to find wide acceptance. In 2022, they recorded an increase of 76 per cent in transactions and 91 per cent in value. Fiscal support for this digital public infrastructure will be continued in 2023-24. • A one-time new small savings scheme, Mahila Samman Savings Certificate, will be made available for a two-year period up to March 2025. This will offer deposit facility up to ₹2 lakh in the name of women or girls for a tenor of 2 years at fixed interest rate of 7.5 per cent with partial withdrawal option. • The maximum deposit limit for Senior Citizen Savings Scheme will be enhanced from ₹15 lakh to ₹30 lakh. The maximum deposit limit for Monthly Income Account Scheme will be enhanced from ₹4.5 lakh to ₹9 lakh for single account and from ₹9 lakh to ₹15 lakh for joint account. Fiscal Management • Fifty-year interest free loan to States: The entire fifty-year loan to States has to be spent on capital expenditure within 2023-24. Most of this will be at the discretion of States, but a part will be conditional on States increasing their actual capital expenditure. Parts of the outlay will also be linked to, or allocated for, the following purposes: -

Scrapping old government vehicles. -

Urban planning reforms and actions. -

Financing reforms in urban local bodies to make them creditworthy for municipal bonds. -

Housing for police personnel above or as part of police stations. -

Constructing Unity Malls. -

Children and adolescents’ libraries and digital infrastructure. -

State share of capital expenditure of central schemes. • States will be allowed a fiscal deficit of 3.5 per cent of gross state domestic product (GSDP) of which 0.5 per cent will be tied to power sector reforms. Tax Proposals Indirect Tax Proposals - The Union Budget proposes to reduce the number of basic customs duty rates on goods, other than textiles and agriculture, from 21 to 13. As a result, there are minor changes in the basic custom duties, cesses and surcharges on some items including toys, bicycles, automobiles and naphtha.

Sector Specific Indirect Tax Proposals -

Green mobility: The Budget proposes to exempt excise duty on GST-paid compressed biogas contained in blended compressed natural gas. Customs duty exemption is being extended to import of capital goods and machinery required for manufacture of lithium-ion cells for batteries used in electric vehicles. -

Electronics: The Budget proposes to provide relief in customs duty on import of certain parts and inputs like camera lens and continue the concessional duty on lithium-ion cells for batteries for another year. The basic customs duty on parts of open cells of television panels is reduced by 2.5 per cent. -

Electrical: The basic customs duty on electric kitchen chimney is being increased from 7.5 per cent to 15 per cent and that on heat coils is proposed to be reduced from 20 per cent to 15 per cent. -

Chemicals and Petrochemicals: To facilitate energy transition and support the Ethanol Blending Programme, basic customs duty exemption is given to Denatured ethyl alcohol. Basic customs duty is also being reduced on acid grade fluorspar and crude glycerin. -

Marine Products: To enhance the export competitiveness of marine products, reduction in duties on key inputs for domestic manufacture of shrimp feed is proposed. -

Lab Grown Diamonds: To sustain India’s global leadership in cutting and polishing of diamonds, the Budget has proposed to reduce basic customs duty on seeds used to manufacture Lab Grown Diamonds (LGDs). -

Precious Metals: The Budget proposes to increase the duties on articles made from gold and platinum. The import duty on silver dore, bars and articles are also increased. -

Compounded Rubber: The basic customs duty rate on compounded rubber is being increased from 10 per cent to ‘25 per cent or ₹30/kg’ whichever is lower. -

Cigarettes: National Calamity Contingent Duty (NCCD) on specified cigarettes is proposed to be revised upwards by about 16 per cent. Direct Tax Proposals -

MSMEs and Professionals: The Budget proposes to enhance the limits of presumptive taxation to ₹3 crore for Micro Enterprises and ₹75 lakh for professionals with cash payments less than 5 per cent. -

Cooperatives: In line with the new manufacturing companies, the new co-operatives that commence manufacturing activities shall also benefit from a lower tax rate of 15 per cent. The threshold limit for cooperatives to withdraw cash without tax deducted at source (TDS) increased to ₹3 crore. -

An opportunity would be provided to sugar co-operatives to claim payments made to sugarcane farmers for the period prior to the assessment year 2016-17 as an expenditure. This is expected to provide them with a relief of almost ₹10,000 crores. -

The proposal has been made for a higher limit of ₹2 lakh per member for penalty exemption of cash deposits to and loans in cash by Primary Agricultural Co-operative Societies (PACS) and Primary Co-operative Agriculture and Rural Development Banks (PCARDBs). -

Start-Ups: The date of incorporation for income tax benefits to start-ups has been extended till March 31, 2024. It is also proposed to provide the benefit of carry forward of losses on change of shareholding of start-ups from seven year of incorporation to ten years. -

Appeals: To reduce the pendency of appeals, it is proposed to deploy about 100 Joint Commissioners for disposal of small appeals. -

Better targeting of Tax Concessions: The budget proposed to cap deduction from capital gains on investment in residential house under sections 54 and 54F to ₹10 crore. -

Rationalisation: Income of Authorities, Boards and Commissions set up by statutes of the Union or State for the purpose of housing, development of cities, towns and villages, and regulating and developing an activity is proposed to be exempted from income tax. Personal Income Tax | Income | Tax rate | | ₹ 0-3 lakh | Nil | | ₹ 3-6 lakh | 5 per cent | | ₹ 6-9 lakh | 10 per cent | | ₹ 9-12 lakh | 15 per cent | | ₹ 12-15 lakh | 20 per cent | | Above ₹ 15 lakh | 30 per cent | -

The standard deduction of ₹50,000 to salaried people and deduction up to ₹15,000 for pensioners under the new tax regime. -

It is also proposed to reduce the highest surcharge rate from 37 per cent to 25 per cent in the new tax regime. This would result in reduction of the maximum tax rate from 42.74 per cent to 39 per cent. -

The limit for tax exemption on leave encashment on retirement of non-government salaried employees is proposed to be increased from the current ₹3 lakh to ₹25 lakh. -

The new income tax regime will be made as the default tax regime. However, citizens will continue to have the option to avail the benefit of the old tax regime.

| Annex 3: Resource Transfers from Centre to States and UTs with Legislature | | | 2021-2022 | 2022-2023 (RE) | 2023-2024 (BE) | 2021-2022 | 2022-2023 (RE) | 2023-2024 (BE) | 2021-2022 | 2022-2023 (RE) | 2023-2024 (BE) | | | ₹ crore | As per cent of Gross Transfers | Y-o-Y Growth (Per cent) | | I Devolution of States Share in Taxes | 898,392 | 948,406 | 1,021,448 | 52.7 | 55.4 | 54.8 | 51.0 | 5.6 | 7.7 | | II Some Important Items of Transfer | 202,808 | 125,177 | 183,613 | 11.9 | 7.3 | 9.9 | 23.0 | -38.3 | 46.7 | | of which: | | | | | | | | | | | 1. Back-to-Back Loans to States in lieu of GST Compensation Shortfall | 147,866 | - | - | 8.7 | 0.0 | 0.0 | 34.2 | - | - | | 2. Externally Aided Projects-Loan | 23,083 | 29,580 | 24,550 | 1.4 | 1.7 | 1.3 | -13.8 | 28.1 | -17.0 | | 3. Special Assistance as Loan to States for Capital Expenditure | 14,186 | 76,000 | 130,000 | 0.8 | 4.4 | 7.0 | 19.9 | 435.7 | 71.1 | | III Finance Commission Grants | 207,435 | 173,257 | 165,480 | 12.2 | 10.1 | 8.9 | 12.7 | -16.5 | -4.5 | | of which: | | | | | | | | | | | 1. Grant for local bodies - Urban Bodies | 16,147 | 15,026 | 24,222 | 0.9 | 0.9 | 1.3 | -39.5 | -6.9 | 61.2 | | 2. Grant for local bodies - Rural Bodies | 40,312 | 41,000 | 47,018 | 2.4 | 2.4 | 2.5 | -33.6 | 1.7 | 14.7 | | 3. Grants-in-Aid for SDRF | 17,747 | 18,635 | 19,573 | 1.0 | 1.1 | 1.1 | -20.3 | 5.0 | 5.0 | | 4. Post Devolution Revenue Deficit Grants | 118,452 | 86,201 | 51,673 | 6.9 | 5.0 | 2.8 | 59.3 | -27.2 | -40.1 | | IV Total Transfer to States [other than I+II+III] | 345,847 | 395,334 | 426,996 | 20.3 | 23.1 | 22.9 | 6.3 | 14.3 | 8.0 | | 1. Under Centrally Sponsored Schemes (Revenue) | 334,581 | 346,992 | 364,270 | 19.6 | 20.3 | 19.6 | 8.5 | 3.7 | 5.0 | | 2. Under Central Sector Schemes (Revenue) | 9,994 | 46,687 | 60,942 | 0.6 | 2.7 | 3.3 | -38.1 | 367.2 | 30.5 | | 3. Under Other Categories of Expenditure (Revenue) | 1,270 | 1,552 | 1,681 | 0.1 | 0.1 | 0.1 | 26.6 | 22.2 | 8.3 | | 4. Capital Transfers | 2 | 102 | 103 | 0.0 | 0.0 | 0.0 | -5.0 | 5268.4 | 1.0 | | V Transfer to Delhi, Puducherry and Jammu and Kashmir | 51,128 | 68,654 | 65,337 | 3.0 | 4.0 | 3.5 | 0.9 | 34.3 | -4.8 | | VI Gross Transfers to States/UTs (I+II+III+IV+V) | 1,705,610 | 1,710,828 | 1,862,874 | 100.0 | 100.0 | 100.0 | 29.2 | 0.3 | 8.9 | | VII Less Recovery of Loans and Advances | 17,569 | 9,105 | 8,296 | 1.0 | 0.5 | 0.4 | 9.1 | -48.2 | -8.9 | | VIII Net Transfers (VI-VII) | 1,688,041 | 1,701,723 | 1,854,578 | 99.0 | 99.5 | 99.6 | 29.5 | 0.8 | 9.0 | | IX Gross Transfers / GDP (per cent) | 7.2 | 6.3 | 6.2 | - | - | - | - | - | - | | X Net Transfers / GDP (per cent) | 7.1 | 6.2 | 6.1 | - | - | - | - | - | - | | Source: Union Budget Documents. |

|