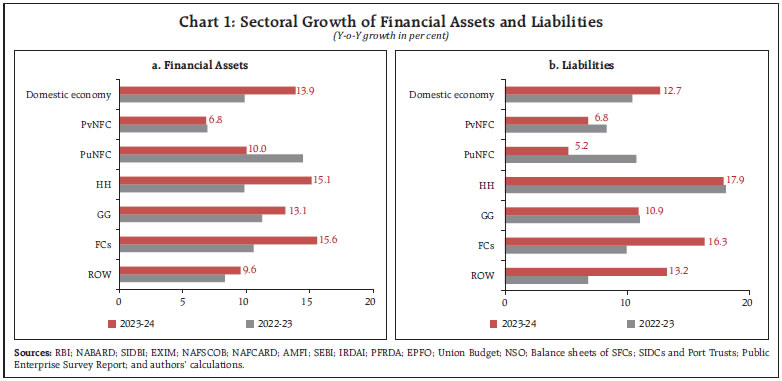

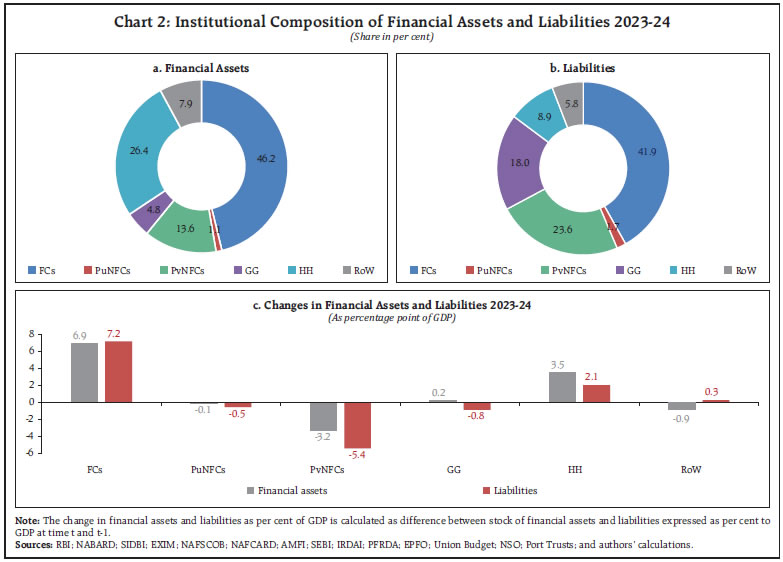

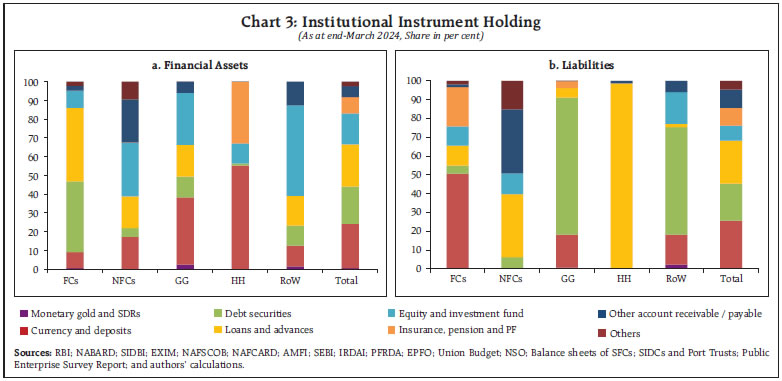

by Suraj S, Ishu Thakur, and Mousumi Priyadarshini^ The financial resource balance of the domestic economy improved by narrowing the deficit to 0.9 per cent of GDP in 2023-24 from 2.3 per cent in 2022-23. The strengthening of financial balance sheets of households, general government and non-financial corporations has driven the net financial wealth of domestic sectors to 28.6 per cent of GDP in 2023-24 from 24.8 per cent in 2022-23. The financial assets of the domestic economy expanded by 13.9 per cent, while liabilities grew by 12.7 per cent during the year. The government’s fiscal consolidation, coupled with improved corporate profitability and deleveraging, supported healthier financial net positions and rise in financial wealth. Introduction The flow of funds (FoF) refers to a comprehensive financial accounting framework to understand the fund flows across various institutional sectors of the economy.1, 2 It provides a consistent and homogenous information for analysing financial transactions and outstanding positions of financial assets and liabilities across institutional sectors of the economy. Copeland pioneered the FoF analysis in 1947. The FoF accounts have evolved globally and gained prominence as the critical tool for assessing financial interconnectedness and linkages among institutional sectors. It also helps to uncover the potential vulnerabilities consistent with the macroeconomic developments. The Global Financial Crisis (GFC) 2008 underscored the relevance of FoF analysis for assessing systemic risks and thus, became a crucial part of the G20 data gap initiative3. The FoF, which is currently structured on from-whom-to-whom (FWTW) basis across the instruments reveals inter-sectoral financial linkages, discloses the shifts in savings, investments, and indebtedness, and provides enhanced insights into the financing of economic growth, monetary policy transmission and financial intermediation.4 Following the System of National Accounts (SNA) 2008 framework and India’s G20 Data Gaps Initiative (DGI) commitments, the Reserve Bank of India’s financial accounts compilation framework known as the Financial Stocks and Flow of funds (FSF) presents a detailed view of sectoral and instrument-wise stocks and flows of financial resources. The current FSF mirrored the macroeconomic developments of 2023-24, which was characterised by robust economic growth of 12.0 per cent at current prices, largely driven by the private final consumption expenditure (PFCE) accelerating to 9.7 per cent. Favourable inflationary developments, prospect of inclusion of Indian bonds in major global bond indices, lower than expected market borrowings by the Union Government and domestic equity market capitalisation crossing the US$ 4 trillion-mark influenced the fund flows during the year. The overall capital flows remained robust with net capital inflows outpacing the current account deficit (CAD) enabling the accretion of foreign exchange reserves. The monetary policy committee (MPC) kept the policy repo rate unchanged at 6.50 per cent during 2023-24, while the stance focused on withdrawal of accommodation. The financial assets of the domestic economy expanded by 13.9 per cent in 2023-24, while liabilities grew by 12.7 per cent.5 The general government’s fiscal consolidation, coupled with improving corporate profitability and deleveraging, supported healthier sectoral net positions and the overall rise in financial wealth. The financial resource balance of the domestic economy remained in deficit at 0.9 per cent of gross domestic product (GDP) in 2023-24, as compared to that of 2.3 per cent in 2022-23.6 Net financial wealth (NFW) of domestic sectors rose to 28.6 per cent of GDP in 2023-24 from 24.8 per cent in 2022-23 signalling a broad-based strengthening of financial balance sheets of households, general government, and non-financial corporations.7 The rest of the article is structured as follows: Section II provides the sectoral and instrument-wise financial flows in the economy during 2023-24. An assessment of sectoral financial resource balance is presented in Section III. Section IV illustrates inter-linkages and sector specific financial trends. Section V concludes the article. II. Financial Flows: Sector and Instrument-wise Reflecting the uptick in economic growth, financial assets of the domestic sectors registered a growth of 13.9 per cent in 2023-24 as compared with 9.9 per cent previous year, while liabilities increased by 12.7 per cent as compared with 10.4 per cent. Households (HH) and financial corporations (FCs) including central bank, being the dominant sectors of the domestic economy, together accounted for around 73 per cent of the total financial assets in 2023-24. Both the sectors play a pivotal role in catering the financing needs of the general government (GG) and non-financial corporations (NFC). The financial asset growth was mostly broad-based across sectors barring the non-financial corporations (NFCs) including both public and private corporations. The FCs, constituting 46.2 per cent of total financial assets and 41.9 per cent of total liabilities, recorded growth in both assets and liabilities reflecting higher resource mobilisation and financial intermediation. In contrast, the assets and liabilities of NFCs declined reflecting slower expansion in business activity and continued deleveraging. The NFCs registered a significant moderation on the liabilities as compared with other domestic sectors. With the progress in fiscal consolidation, liabilities of the GG contracted marginally and its share in total liabilities reduced to 18.0 per cent in 2023-24 from 18.3 per cent in 2022-23. For households, both financial assets and liabilities rose, during 2023-24, reflecting steady financial balance sheet expansion. Despite global uncertainties, financial assets and liabilities of the rest of the world (RoW) increased in 2023-24 indicating the increasing openness in the external front (Charts 1 and 2). Instrument-wise preferences for financial assets and liabilities across sectors remained broadly stable during 2023-24. Currency and deposits, along with loans and advances, continued to be the major instruments used across sectors for holding both financial assets and liabilities. For financial corporations, loans and advances extended to households and private NFCs (PvNFCs), remained the predominant financial assets followed by debt securities issued by the general government. On the liabilities side, currency and deposits remained the major instruments of FCs. Debt securities held by financial corporations continued to be the major liability of the general government, while the assets were largely held in the form of deposits with other depository corporations (ODCs) and equity investments in public NFCs (PuNFCs).8 Among households, currency and deposits continued to remain the preferred financial assets. Nonetheless, the shares of insurance, pension, and equity investments in household financial assets have also been gradually increasing. Loans and borrowings from FCs continued to represent the major component of household liabilities. For RoW, equity investments in PvNFCs accounted for a significant portion of financial assets, while debt securities held by the central bank remained the main component of their liabilities (Chart 3).

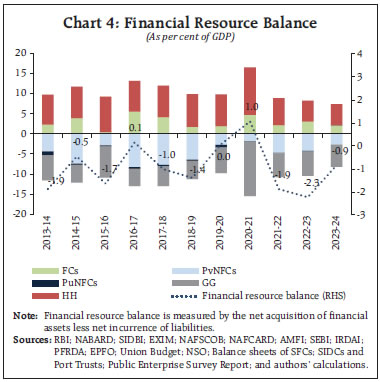

III. Financial Resource Balance The financial resource deficit of domestic sectors declined in 2023-24 driven by the higher growth of financial assets over the liabilities supported by strengthening financial balance sheets of NFCs, improved net financial positions of general government and households. The financial resource deficit of the domestic economy decreased to 0.9 per cent of GDP in 2023-24 from 2.3 per cent of GDP in 2022-23 (Chart 4).

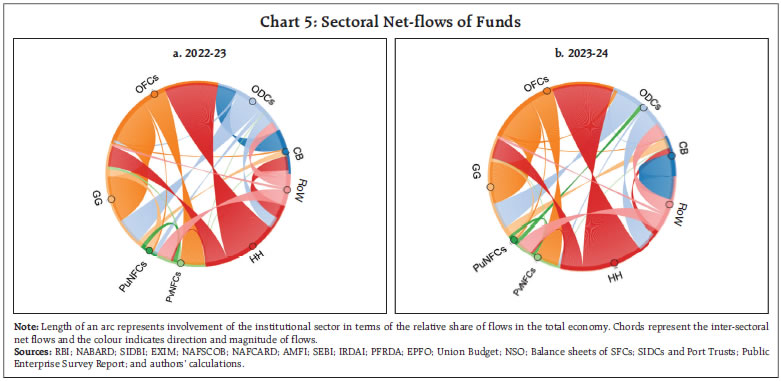

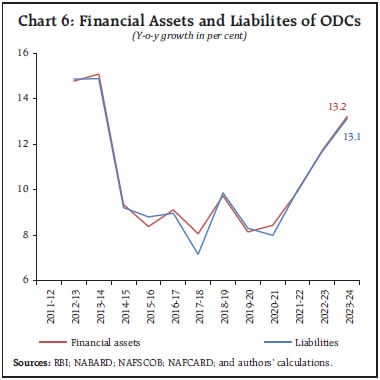

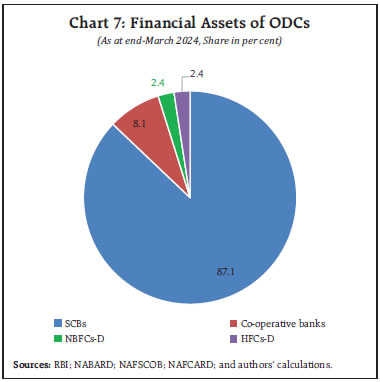

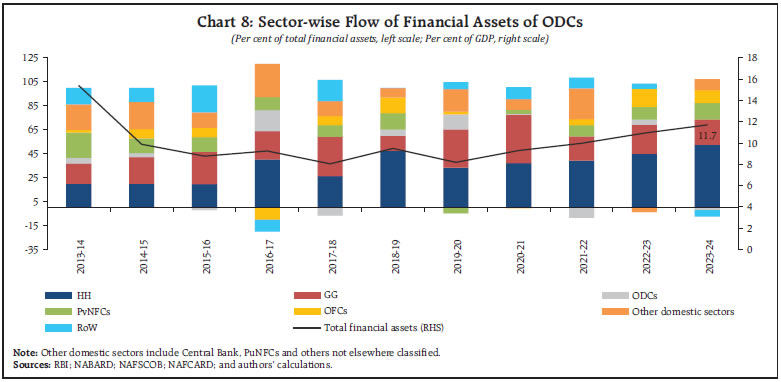

| Table 1: Sectoral Net Financial Wealth | | (As per cent of GDP at current prices) | | | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | | 1. FCs | 28.3 | 29.0 | 28.1 | 30.2 | 31.8 | 31.5 | 33.6 | 38.1 | 34.3 | 34.3 | 34.0 | | 2. NFCs | -21.6 | -26.7 | -26.1 | -30.2 | -35.1 | -37.6 | -38.4 | -34.8 | -34.9 | -34.4 | -32.8 | | 2.1. PuNFCs | -2.0 | -2.0 | -2.2 | -2.3 | -2.2 | -2.3 | -2.7 | -3.0 | -2.6 | -1.9 | -1.4 | | 2.2. PvNFCs | -19.6 | -24.7 | -23.9 | -27.9 | -32.8 | -35.4 | -35.7 | -31.8 | -32.3 | -32.5 | -31.4 | | 3. GG | -49.6 | -49.2 | -52.2 | -51.0 | -50.9 | -50.5 | -53.8 | -68.0 | -63.1 | -61.4 | -60.3 | | 4. HH | 73.1 | 75.5 | 77.0 | 78.4 | 79.9 | 81.2 | 82.4 | 99.8 | 92.5 | 86.4 | 87.8 | | 5. RoW | 24.3 | 23.9 | 23.1 | 21.4 | 20.8 | 21.0 | 19.6 | 19.0 | 17.5 | 17.3 | 16.1 | | Domestic sectors (1+2+3+4) | 30.2 | 28.5 | 26.8 | 27.4 | 25.7 | 24.6 | 23.9 | 35.1 | 28.8 | 24.8 | 28.6 | | Source: Authors’ calculations. | The NFW of the domestic sectors rose to 28.6 per cent of GDP at end-March 2024, up from 24.8 per cent in 2022-23 and the pre-COVID level of 23.9 per cent in 2019-20, indicating an overall strengthening of domestic sectoral financial balance sheets. The improvement was broad-based, with notable gains in the net financial wealth of NFCs, GG, and households (Table 1). IV. Sectoral Financial Linkages The mapping of sectoral financial flows offers a comprehensive view of the financial interlinkages and interconnectedness among domestic institutional sectors, as well as between residents and non-residents. Intersectoral financial flows also illustrate the direction of flows in FWTW basis alongside highlighting the magnitude of flows. The net financial flows (uses minus sources) across sectors are presented in the chord diagram (Chart 5). Households continued to remain prominent net lenders in 2023-24. Their net financial flows to OFCs and GG increased, while flows to the central bank moderated reflecting the currency withdrawal by the Bank on May 19, 2023.9 Amid rising credit demand, households continued to receive higher net inflows from ODCs during the year. The net flows between the GG and the central bank rose factoring the larger surplus transfers to the central government and redemption of debt securities held by the Bank. PuNFCs, supported by higher deposit accumulation, turned into net lenders to ODCs in 2023-24, reversing their net borrower position in 2022-23. PvNFCs turned as net borrower from ODCs in 2023-24 from their net lending position to ODCs in 2022-23. With robust capital inflows accruing to the foreign exchange reserves, central bank turned as net lender to the RoW. Contrastingly, the net flows from the central bank to ODCs declined consequent to the monetary policy stance of withdrawal of accommodation, marking a notable shift in the net lending position of central bank between the ODCs and RoW in 2023-24.  IV.1 Financial Corporations IV.1.1 Central Bank The growth in financial assets and liabilities of RBI increased to 11.1 per cent and 12.6 per cent in 2023-24, from 2.5 per cent and (-) 1.9 per cent, respectively in 2022-23. Increase on assets side was mainly on account of rise in foreign investments, gold, and loans and advances. The loans and advances by RBI to financial institutions outside India increased by 59.9 per cent due to increase in reverse repo transactions. Growth of currency liability of the RBI moderated to 3.9 per cent in 2023-24 from 7.8 per cent in 2022-23 amidst currency withdrawal and increasing preference for digital payments. The deposit liabilities increased by 27.1 per cent in 2023-24 reflecting the rise in deposits by ODCs and increase in reverse repo transactions amidst tightening of liquidity conditions in sync with the monetary policy stance. Liabilities under other accounts payable doubled due to increase in surplus payable to central government. IV.1.2 Other Depository Corporations Driven by the strong macroeconomic fundamentals and robust economic growth, the growth in financial assets of ODCs increased to 13.2 per cent in 2023-24, from 11.7 per cent in 2022-23. The scheduled commercial banks continued to dominate the segment with an increased share of 87.1 per cent, also reflecting the merger of an HFC with a scheduled commercial bank, with effect from July 1, 2023 (Charts 6 and 7). The Indian banking sector remained strong and resilient in 2023-24 propelled by robust credit growth, high profitability, improved asset quality. On the asset side, the Indian banking sector witnessed strong credit expansion in 2023-24. The loan-to-deposit ratio rose to 84.5 per cent in 2023-24 from 82.3 per cent in 2022-23. The growth rate in the holdings of central government securities increased to 13.8 per cent in 2023-24, supported by higher returns and its role in meeting regulatory and prudential liquidity requirements. In contrast, the flow of assets to the RoW declined in 2023-24, primarily due to a reduction in loans and advances extended by housing finance companies (Chart 8).

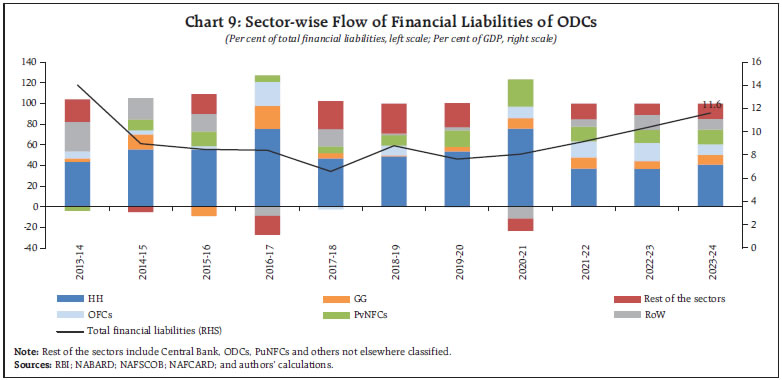

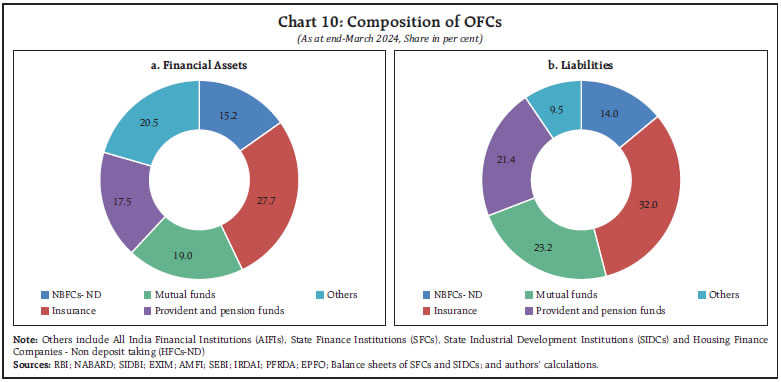

Flow of financial liabilities of ODCs increased to 11.6 per cent of GDP in 2023-24, driven largely by continued deposit mobilisation. The household sector remained the dominant contributor to bank deposits, reaffirming the preference in conventional savings, however, the deposits of other financial corporations (OFCs) with ODCs declined. Overall, the deposits expanded and accounted for 79.7 per cent of ODC liabilities, registering a 12.7 per cent increase during the year, aided by the rise in term deposit rates in a tightening interest rate environment (RBI, 2024b). This trend underscores the continued financial deepening of the banking sector and the shifting preference of savers toward higher-yielding term deposits in 2023-24 (Chart 9). IV.1.3 Other Financial Corporations Stock of financial assets and liabilities of OFCs registered a substantial expansion in 2023-24, rising to 93.1 per cent and 76.4 per cent of GDP, respectively, from 87.1 and 70.3 per cent each in 2022-23. The growth of financial assets of OFCs increased to 19.7 per cent in 2023-24 from 11.5 per cent in 2022-23. The growth of financial liabilities of OFCs increased to 21.7 per cent in 2023-24, from 10.8 per cent in 2022-23. Within the OFCs, the distribution of assets and liabilities continued to be dominated by insurance corporations, followed by mutual funds and pension and provident funds (Chart 10).

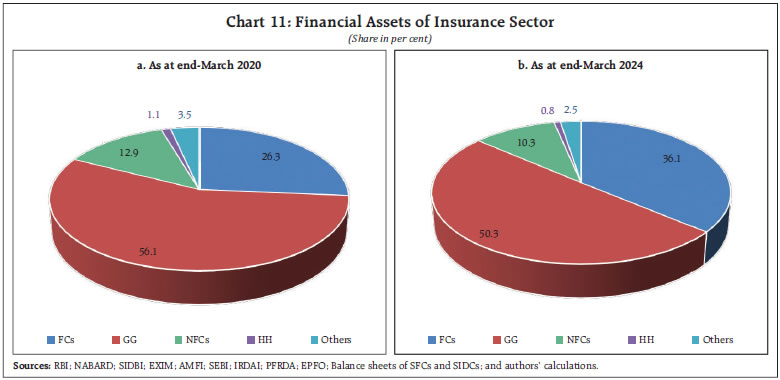

Financial assets and liabilities of insurance sector - the key driver of OFCs, accelerated sharply by 17.4 per cent and 16.8 per cent, respectively, compared with 8.6 per cent and 7.9 per cent in the previous year. This surge reflects post-pandemic portfolio rebalancing, strong premium growth, and increased participation in financial markets, underscoring the expanding role of the insurance industry in India’s financial intermediation and savings mobilisation. The share of financial assets in general government (GG) instruments declined from 56.1 per cent in 2019-20 to 50.3 per cent, while the share in FCs increased from 26.3 per cent to 36.1 per cent, following stronger capital positions and lower NPAs of banks. In contrast, share in NFCs declined from 12.9 per cent to 10.3 per cent, reflecting cautious credit exposure (Chart 11).

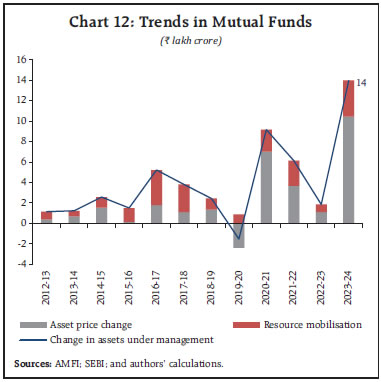

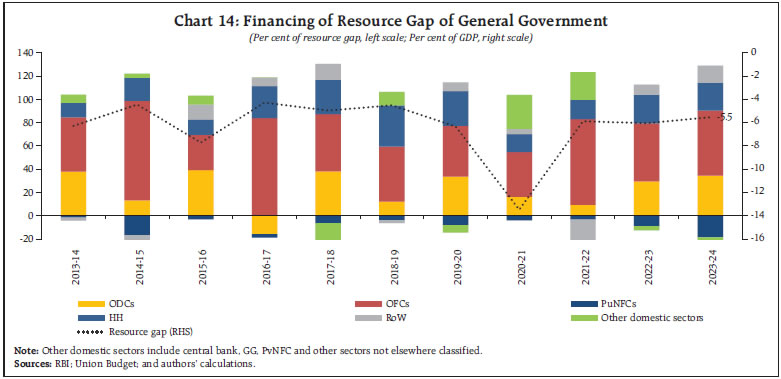

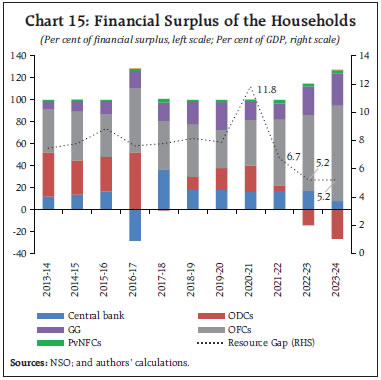

As domestic equity market capitalisation crossed the US$ 4 trillion-mark in 2023-24, the mutual funds industry witnessed strong gains in assets supported both by the asset appreciations and the growth of investors (RBI, 2024a). Stocks of financial assets and liabilities of mutual funds increased by 35.5 per cent in 2023-24 as compared to 4.9 per cent in 2022-23. This growth was enabled by deeper penetration, digital integration, improved financial literacy led retail participation, and evolving investor mind-set. AUM to GDP ratio reaching an all-time high of 17.7 per cent as of March 2024, driven by valuation changes along with increase in resource mobilisation on account of rising retail participation, portfolio counts, robust growth in systematic investment plans and ease of access and investment provided by various platforms (Chart 12). The financial assets and liabilities of pension and provident funds (accounting for 16.3 per cent of GDP) rose by 27.0 per cent in 2023-24 on top of 16.4 per cent rise in 2022-23. The government securities continued to remain the dominant asset class, accounting for 59.4 per cent of the total. IV.2 Non-financial Corporations The growth of financial assets of NFCs moderated marginally to 7.1 per cent in 2023-24 from 7.4 per cent in 2022-23 while liabilities recorded a fall of 6.7 per cent in 2023-24 from 8.5 per cent in 2022-23. Notably, the debt-to-equity ratio of PuNFCs moderated to 4.1 in 2023-24 (4.8 in 2022-23) and the same of PvNFCs increased to 3.5 from 3.3 in the previous year. The corporate resilience in terms of cash-to-debt ratio of PuNFCs increased to 20.9 in 2023-24 from 18.5 previous year showing improved liquidity and financial resilience supported by higher profits and capital infusion in select public enterprises (especially energy and transport) by the central government.  On the liability side, the corporate debt effect (Prakash et al., 2023) increased marginally, but not enough to offset the rise in cash holdings. As a result, PuNFCs became net lenders in 2023-24, pointing profitability, controlled leverage, and cautious financial management amidst a high interest rate environment (Chart 13a).10 Though the cash-to-debt ratio of PvNFCs increased from 34.6 to 35.8 in 2023-24, the net changes in the ratio marginally declined due to the debt effect. The debt effect expanded as firms ramped up borrowing to finance capacity expansion, inventory accumulation, and working capital requirements driven by robust economic growth (Chart 13b). IV.3 General Government Post-pandemic fiscal consolidation by the union government brought the gross fiscal deficit down to 5.5 per cent of GDP in 2023-24 from 6.5 per cent in 2022-23, and 6.7 per cent in 2021-22 (GoI 2025). The state governments’ combined gross fiscal deficit (GFD) was 2.9 per cent of GDP in 2023-24 as compared with 2.7 per cent in 2022-23 (RBI, 2024c). Reflecting the fiscal prudent measures, the financial resource gap of general government in 2023-24 narrowed down to 5.5 per cent of GDP, as compared with 6.0 per cent previous year (Chart 14). General government debt reduced to 83.7 per cent of GDP from 84.5 per cent in 2022-23 with the continued commitment to fiscal consolidation. Growth of equity investments in statutory corporations and joint stock companies, comprising the bulk of financial assets of central government, accelerated to 17.1 per cent during 2023-24 (15.5 per cent in 2022-23) with increased capital infusion by the central government in PuNFCs. Total loans and advances extended by the general government moderated to 7.7 per cent in 2023-24, vis-à-vis, 9.4 per cent in 2022-23. On the liabilities side, debt securities issued by central government, accounting for 73.5 per cent of its total liabilities as at end-March 2024, rose by 10.8 per cent over the previous year.  IV.4 Households The financial surplus of households remained unchanged at 5.2 per cent of GDP between 2022-23 and 2023-24. It moderated to 6.7 per cent of GDP in 2021-22 from 11.8 per cent of GDP in 2020-21. The moderations reflect the continued drawdown of excess savings accumulated during the pandemic (Chart 15). The flow of financial assets mainly in the form of bank deposits, provident and pension funds, life insurance funds, and small savings recorded a marginal uptick to 11.4 per cent of GDP (11.1 per cent in 2022-23). Concurrently, the flow of liabilities rose to 6.2 per cent of GDP (from 5.9 per cent a year earlier), indicating higher borrowings, both from banks and non-banking financial companies (NBFCs). The rise in households’ share in credit coupled with a decline in their share of deposits, has been a major factor behind the post pandemic moderation in net household financial savings. However, the growth momentum in unsecured personal loans and credit card outstanding, started slowing down following the central bank’s decision to increase the risk weights on these exposures.11

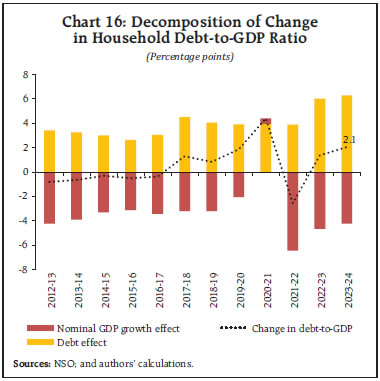

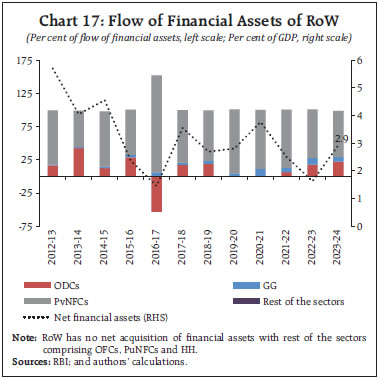

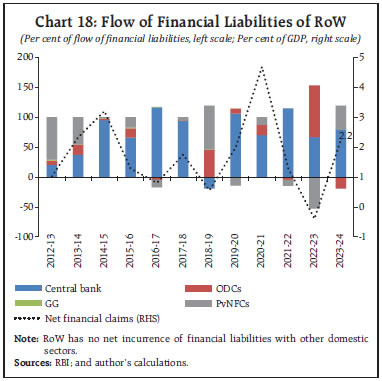

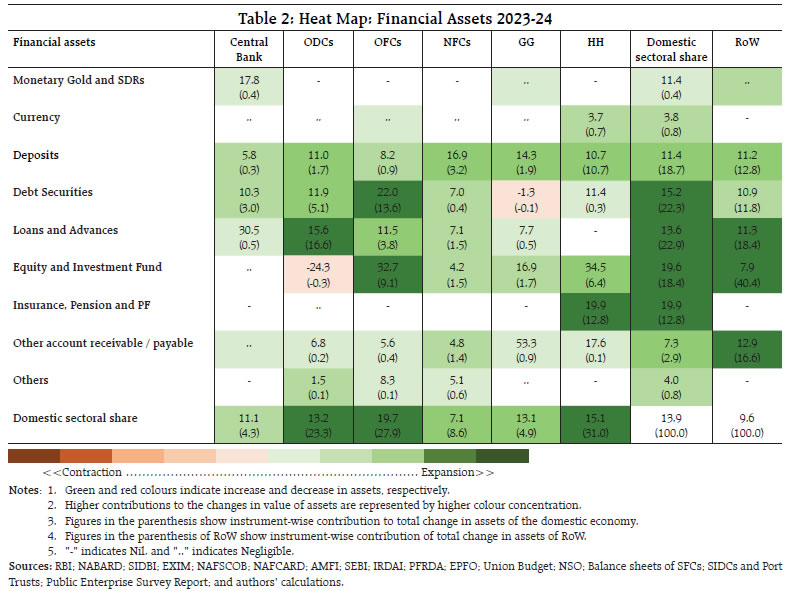

The household debt-to-GDP ratio increased to 41.5 per cent in 2023-24 from 39.4 per cent in the previous year, offsetting the GDP growth effect (Chart 16).12 The stock of HH financial assets increased to 129.3 per cent of GDP at end-March 2024 from 125.8 per cent a year ago. Accordingly, their net financial wealth increased to 87.8 per cent of GDP from 86.4 per cent over the same period. IV.5 Rest of the World The financial linkages with Rest of the World (RoW) strengthened in 2023-24, amidst multiple global headwinds, supported by robust capital inflows and a narrowing current account deficit (CAD). India remained net borrower in 2023-24 as the net acquisition of assets by RoW remained positive with higher portfolio and direct investments indicating a buildup of India’s external liabilities. The flow of financial assets of RoW increased to 2.9 per cent of GDP in 2023-24 (from 1.6 per cent in the previous year) driven by higher equity investments in private corporate businesses, increased deposits with ODCs and loans to the central government (Chart 17).  Notwithstanding the above trends, the flow of financial liabilities of the RoW increased to 2.2 per cent of GDP, a sharp turnaround from (-) 0.4 per cent in the previous year. This rise was driven primarily by an increase in foreign investments by the RBI, reflecting higher accretion to foreign exchange reserves and active foreign asset management in response to sustained capital inflows. At the same time, foreign deposits held in India exceeded Indian banks’ deposits placed abroad by about ₹1,287 billion, which partially offset the overall rise in RoW liabilities (Chart 18). Despite India being a net borrower, these trends together highlight a resilient external sector in 2023-24, marked by robust capital flows, strengthened reserves, and prudent external asset liability management by the RBI and the banking system. IV.6 Sector and Instrument-wise Heat Maps A snapshot of sectoral contribution to the total increase in financial assets and liabilities of the domestic sector is presented in Table 2 and 3, respectively. Stock of financial assets of the domestic sector expanded by 13.9 per cent during 2023-24, with households making the largest contribution, followed by OFCs and ODCs. Instrument-wise, loans and advances accounted for the largest share of the asset growth, followed by debt securities and deposits. The rise in loans and advances was driven primarily by ODCs and OFCs, reflecting stronger financial intermediation during the year. Deposits grew across all sectors, with household sector contributing the most to this expansion. The increase in debt securities was mainly attributable to OFCs, while equity investment growth was led by OFCs and households. In the RoW, financial assets rose by 9.6 per cent during the year, primarily due to higher equity investments, followed by an increase in other accounts receivable, reflecting the expansion of trade credit and advances extended to PvNFCs (Table 2).

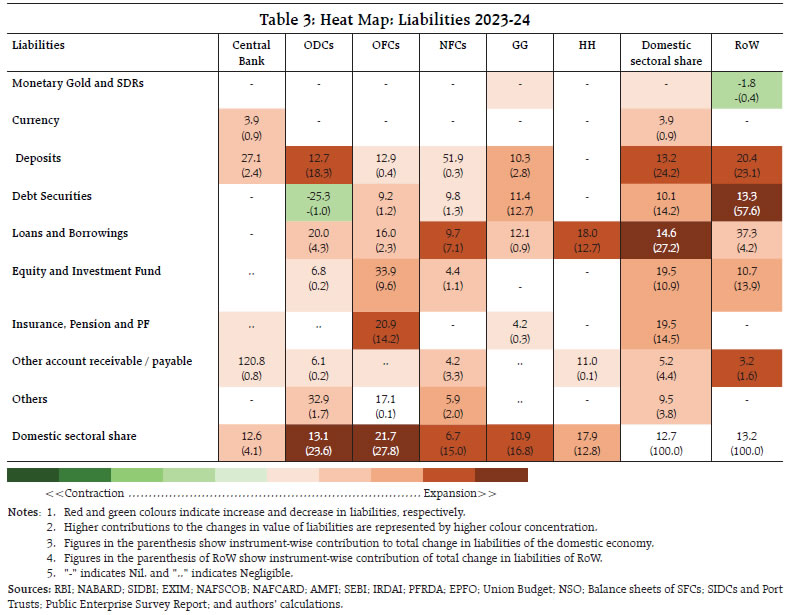

The domestic sector stock of liabilities increased by 12.7 per cent in 2023-24 with largest contribution from OFCs followed by ODCs and GG. Instrument-wise loans and borrowings led by HH and NFCs accounted for the major share followed by deposit liability steered by ODCs. The central bank’s deposit liabilities also expanded, reflecting the balance sheet expansion of ODCs, and increased reverse repo transactions following the monetary stance of withdrawal of accommodation. Liability of RoW grew by 13.2 per cent during the year mainly due to a rise in debt securities held by the RBI and deposits held by FCs. However, liabilities in the form of monetary gold and SDRs declined marginally, owing to a reduction in India’s reserve position with the International Monetary Fund (Table 3). V. Conclusion The sectoral financial landscape in 2023-24, largely reflected a balanced assets and liabilities expansion and improved financial health. Both financial assets and liabilities of the domestic sectors registered strong growth of 13.9 per cent and 12.7 per cent, respectively over 2022-23, reflecting robust economic growth, high financial intermediation, and deepening linkages among institutional sectors. FCs and households being in surplus continued to remain as the net lending sectors to the rest of the economy. Households expanded their asset base through deposits, insurance, and equity investments. Financial corporations continued to play a pivotal role in mobilising and allocating resources, with notable growth in loans and advances, and debt securities, reaffirming their central role in financing the growth of the domestic economy. The general government’s fiscal consolidation, alongside improving corporate financial balance sheets, contributed to healthier sectoral net positions and an overall rise in net financial wealth to 28.6 per cent of GDP. India’s financial interactions with the rest of the world strengthened during the year driven by both inflows and outflows despite multiple global uncertainties. Overall, the financial accounts of 2023-24 highlights a robust and resilient financial balance sheet of domestic sectors supported by strong macroeconomic fundamentals and deepened financial intermediation. References: Copeland, Morris A. (1947). “Tracing Money Flows through the United States Economy,” American Economic Review, 37 (2), 31-49. Government of India. (2025). Union Budget 2025-26. Ministry of Finance, Government of India. National Statistical Office. (2025). National Accounts Statistics 2025. Ministry of Statistics and Programme Implementation, Government of India. Organisation for Economic Co-operation and Development. (2017). Understanding Financial Accounts. Edited by Peter van de Ven, P. and D. Fano (eds.), OECD. Retrieved from https://www.oecd.org/content/dam/oecd/en/publications/reports/2017/11/understanding-financial-accounts_g1g8072a/9789264281288-en.pdf Prakash, A., Sarkar, K.K., Thakur, I., Goel, S. (2023). Financial Stocks and Flow of Funds of the Indian Economy 2020-21. RBI Bulletin, March 2023. RBI (2024a). Annual Report 2023-24. Reserve Bank of India. RBI (2024b). Report on Trends and Progress of Banking in India 2023-24. Reserve Bank of India. RBI (2024c). State Finances A Study of Budgets of 2024-25. Reserve Bank of India.

|