Letter of Transmittal Shri Sanjay Malhotra

Governor

Reserve Bank of India

Central Office

Mumbai – 400001 April 28, 2025 Dear Sir, Report of the Working Group on Comprehensive review of trading and settlement timings of markets regulated by the Reserve Bank We are pleased to submit the Report of the Working Group on Comprehensive review of trading and settlement timings of markets regulated by the Reserve Bank. The Working Group was tasked with reviewing existing timings, identifying operational challenges, examining global practices, and recommending the way forward. We thank you for entrusting this responsibility to the Working Group and hope that the recommendations will further aid market development, price discovery, and optimization of liquidity requirements. Yours faithfully, Sd/-

(Radha Shyam Ratho)

Chairperson | Sd/-

(Ravi Ranjan)

Member | Sd/-

(Lalit Tyagi)

Member | | | | | Sd/-

(Ashish Parthasarthy)

Member | Sd/-

(Parul Mittal Sinha)

Member | Sd/-

(Ashwani Sindhwani)

Member | | | | | Sd/-

(Ravindranath Gandrakota)

Member | Sd/-

(Shailendra Jhingan)

Member | Sd/-

(Dimple Bhandia)

Member-Secretary |

ACKNOWLEDGEMENTS The Working Group extends its heartfelt gratitude to Shri Sanjay Malhotra, Governor, Reserve Bank of India, for entrusting it with the responsibility of preparing this Report on comprehensive review of the trading and settlement timings of various markets regulated by the Reserve Bank of India. The Working Group would like to thank Shri T. Rabi Sankar, Deputy Governor, Reserve Bank, for his continuous encouragement and guidance. The Working Group immensely benefitted from the diverse expertise and insights of Shri H.K. Jena, MD & CEO, CCIL and Shri Vivek Aggarwal, MD & CEO, FBIL. The Working Group is also grateful to Shri Seshsayee G., CGM, FMOD and Shri Rakesh Tripathy, CGM, IDMD, for contributing their valuable insights. The Committee would like to place on record its deep appreciation for the excellent secretarial support provided by the team from the Financial Markets Regulation Department led by Shri Saswat Mahapatra. A special word of appreciation is in order for Shri Rajeev Kalra, Shri Rohit Kumar and Shri Abhishek Kumar. Meticulous organisation of meetings and other logistic support by Shri Anup Singh, Shri Pratik Yadav, Shri Karan Raibole and Shri Rahul Parmar from the Secretariat team is gratefully acknowledged.

LIST OF ABBREVIATIONS | API | Application Programming Interface | | ARCL | AMC Repo Clearing Limited | | CCIL | Clearing Corporation of India Limited | | CCP | Central Counterparty | | Clearcorp | Clearcorp Dealing Systems (India) Limited | | CLOB | Central Limit Order Book | | CD | Certificate of Deposit | | CP | Commercial Paper | | CROMS | Clearcorp Repo Order Matching System | | CRR | Cash Reserve Ratio | | DSB | Designated Settlement Bank | | DvP | Delivery versus Payment | | ETP | Electronic Trading Platform | | FAR | Fully Accessible Route | | FBIL | Financial Benchmarks India Limited | | FCY | Foreign Currency | | FCS-OIS | Foreign Currency Settled - Overnight Indexed Swap | | FEDAI | Foreign Exchange Dealers’ Association of India | | FIMMDA | Fixed Income Money Market and Derivatives Association of India | | FPI | Foreign Portfolio Investor | | FRA | Forward Rate Agreement | | IBU | IFSC Banking Unit | | IDL | Intra Day Liquidity | | INR | Indian Rupee | | IRD | Interest Rate Derivative | | IRS | Interest Rate Swap | | LAF | Liquidity Adjustment Facility | | LMF | Liquidity Management Framework | | MIBOR | Mumbai Interbank Outright Rate | | MIFOR | Mumbai Interbank Forward Outright Rate | | MOSPI | Ministry of Statistics and Programme Implementation | | MSF | Marginal Standing Facility | | NDF | Non-Deliverable Forward | | NDS-Call | Negotiated Dealing System – Call | | NDS-OM | Negotiated Dealing System – Order Matching | | OMO | Open Market Operation | | OIS | Overnight Indexed Swap | | OTC | Over-the-Counter | | PDAI | Primary Dealers’ Association of India | | PvP | Payment versus Payment | | RFQ | Request for Quote | | RTGS | Real Time Gross Settlement | | SDF | Standing Deposit Facility | | SGS | State Government Security | | SPD | Standalone Primary Dealer | | SLR | Statutory Liquidity Ratio | | T-Bill | Treasury Bill | | ToR | Terms of Reference | | TREP | Tri-Party Repo | | TREPS | Tri-party Repo Dealing System | | TRS | Total Return Swap | | WACR | Weighted Average Call Rate |

EXECUTIVE SUMMARY Market trading hours are critical for the efficient functioning of financial markets, as they influence liquidity, volatility, and facilitate price discovery by ensuring timely incorporation of information into asset prices. The last comprehensive review of market timings, for financial markets regulated by the Reserve Bank viz., the Government securities market, the money markets, the foreign exchange market and the markets for derivatives on interest rate, foreign exchange and credit, was undertaken in 2019. Over the last few years, there have been significant developments in these markets. For instance, the size of different domestic markets has increased significantly. The number of participants in different markets has also increased as has the diversity of products. Non-resident participation in Indian derivative markets has increased pursuant to regulatory changes facilitating such participation while such participation has also increased in the Government securities market post inclusion of Government securities in global bond indices. The participation of Indian entities in Non-Deliverable Forwards (NDFs) and Foreign Currency Settled - Overnight Indexed Swaps (FCS-OIS) has enabled greater integration of the onshore and offshore markets. Market infrastructure has also evolved with wider access to Electronic Trading Platforms (ETPs) and central counterparty (CCP) clearing services. Liquidity management dynamics have changed, amidst availability of 24x7 payment systems and evolution of the Reserve Bank’s Liquidity Management Framework (LMF). Against this backdrop, it was announced, in the Statement on Developmental and Regulatory Policies dated February 07, 2025, that a Working Group (hereinafter ‘the Group’) will be set up to review the current market trading and settlement timings and make recommendations in this regard. In accordance with the Terms of Reference (ToR), the Group has provided recommendations which are aimed at facilitating further market development, price discovery and optimization of liquidity requirements. The first chapter of the report outlines the current trading and settlement timings of the domestic markets and the Reserve Bank’s liquidity facilities. It also discusses the evolution of markets in terms of size, participation and infrastructure, along with changes in payment systems which have necessitated a review of the trading and settlement timings. The second chapter provides an overview of the recent developments in market microstructure. It observes that, in general, there has been an increase in turnover and open interest across the various market segments. This has been complemented by a rise in electronic trading and central clearing. The investor / participation base has also diversified with increased participation from both domestic and non-resident investors. The third chapter discusses the various perspectives – trade distribution, liquidity needs, sequencing of settlements and overlap with global markets – through which the Group reviewed the trading and settlement timings. It presents the Group’s assessment of the intraday market liquidity and trade distribution and discusses that trading activity, across markets, was relatively well distributed. It discusses that the evolving liquidity management dynamics for market participants, in light of the availability of 24x7 payment systems and non-guaranteed settlements occurring after the close of money markets, provide scope for extension in the timings of the money markets. It also highlights the need for effective sequencing of settlement cycles and netting of settlements, where possible, to avoid liquidity gridlocks and minimise liquidity risks. Deliberations on the increasing participation of non-resident investors in the markets and on the practices being followed globally for easing their access are also set out. The fourth chapter assesses the revision of trading and settlement timings for each market segment. It presents an assessment of the requests / feedback received from different stakeholders. The possibility of extending the timing for various segments of money market to optimize participants’ liquidity management has been discussed while noting that extending beyond an optimum level may lead to undue volatility in rates amidst thin liquidity in the evening hours and also have implications on the settlement infrastructure. The feasibility / desirability of extension / curtailment in market trading hours for Government securities has been debated, taking into account the requirements of post market hours operational processes such as portfolio valuation and aspects related to providing a sufficiently long trading day to enable assimilation of new information into prices. The feasibility of providing a post onshore market hours window for price quotation to non-resident investors in the Government securities market was also discussed. The optimal market hours for the foreign exchange market taking cognizance of the need to enable market participants to factor in developments and exchange rate movements in offshore market while recognising that facilities for undertaking foreign exchange transactions post onshore market hours is already available have also been discussed. The recommendations of the Group are summarised in the fifth chapter. The Group recommends that the market hours of the call money market be extended till 7:00 PM while the market hours for market repo and TREP be synchronised and extended till 4:00 PM. The Group also recommends unifying the TREP trading hours for members settling obligation through Designated Settlement Banks (DSBs) and through the Reserve Bank. The Group recommends preponing the timing of pre-announced LAF auction to 9:30 AM – 10:00 AM from 10:00 AM to 10:30 AM currently. With regard to the market hours for the Government securities market, the Group recommends that the current timings be continued with. However, post onshore market hours, transactions in Government securities with non-residents could be permitted during a time window between 5:00 PM and 11:30 PM. The Group recommends that such transactions, if permitted, be reported to NDS-OM on T+1 day before onshore market hours and settled on a T+2 basis. The Group does not recommend any changes in the trading hours for interest rate derivative and foreign exchange markets.

1. INTRODUCTION 1.1 Financial markets play a crucial role in economic development by allocating capital through efficient price discovery, facilitating risk management and by providing liquidity. Studies consistently link deep and liquid financial markets with macroeconomic stability and long-term economic prosperity1. Market trading hours are considered to be one of the major determining factors in the efficient functioning of financial markets. However, different theoretical frameworks for the study of financial markets have placed differing emphasis on the role of market timings. 1.2 The efficient market hypothesis, for example, assumes that markets reflect all available information. In this theoretical framework, it views trading times as a logistical necessity rather than an influencer of market efficiency. More recent theories, viz., those related to market microstructure consider market trading hours to be an important determining factor for market functioning. By establishing that market liquidity, volatility and information asymmetry play a crucial role in price formation of assets, and that time of the day has a crucial impact on these aspects, viz., market liquidity, volatility and information, the framework provides a theoretical construct for determining appropriate trading hours. Separately, sociological perspectives view financial markets as social constructs, where trading times influence and are influenced by factors such as the culture of a financial centre and its global interconnectedness. Operationally, trading hours are linked to human resource costs, settlement and other operational considerations. 1.3 More simply for market participants, market hours must facilitate two objectives. First, trading hours should be adequate for market participants to meet their trading requirements, while addressing ethical considerations related to market access like fairness, and the potential for manipulation. Second, market hours should facilitate adequate market liquidity and enable prices to adjust to evolving information and facilitate efficient price discovery, thereby, providing seamless trade executions. Market Timings in India 1.4 The market timings in the financial markets regulated by the Reserve Bank, viz., money market, Government securities market, foreign exchange market and markets for interest rate, foreign exchange and credit derivatives, have evolved over a period of time and have different underlying dynamics influencing their trading hours. Before the onset of the COVID-19 pandemic, financial markets in India broadly functioned from 9:00 AM till 5:00 PM (Table 1.1). During the pandemic, market trading hours were truncated with a view to minimise the risks arising from the outbreak. With the graded roll-back of the lockdown and easing of restrictions on movement of people and functioning of offices, market trading hours were restored to their earlier timings in a phased manner; with the exception of the foreign exchange market. Separately, market participants were permitted to undertake foreign exchange transactions and Foreign Currency Settled - Overnight Indexed Swap (FCS-OIS) transactions beyond onshore market hours. | Table 1.1: Market Trading Timings | | Market | Before April 7, 2020 | April 7, 2020 – November 8, 2020 | November 9, 2020 – April 17, 2022 | April 18, 2022 – December 11, 2022 | December 12, 2022 Onwards | | Call/notice/term money | 9:00 AM to 5:00 PM | 10:00 AM to 2:00 PM | 10:00 AM to 3:30 PM | 9:00 AM to 3:30 PM | 9:00 AM to 5:00 PM | | Market repo in Government securities^ | 9:00 AM to 2:30 PM | 10:00 AM to 2:00 PM | 10:00 AM to 2:30 PM | 9:00 AM to 2:30 PM | 9:00 AM to 2:30 PM | | Tri-party repo in Government securities | 9:00 AM to 3:00 PM | 10:00 AM to 2:00 PM | 10:00 AM to 3:00 PM | 9:00 AM to 3:00 PM | 9:00 AM to 3:00 PM | | Commercial paper and certificates of deposit | 9:00 AM to 5:00 PM | 10:00 AM to 2:00 PM | 10:00 AM to 3:30 PM | 9:00 AM to 3:30 PM | 9:00 AM to 5:00 PM | | Repo in corporate bonds# | 9:00 AM to 6:00 PM | 10:00 AM to 2:00 PM | 10:00 AM to 3:30 PM | 9:00 AM to 3:30 PM | 9:00 AM to 5:00 PM | | Government securities | 9:00 AM to 5:00 PM | 10:00 AM to 2:00 PM | 10:00 AM to 3:30 PM | 9:00 AM to 3:30 PM | 9:00 AM to 5:00 PM | | Foreign Currency (FCY) / Indian Rupee (INR) trades including forex derivatives* | 9:00 AM to 5:00 PM | 10:00 AM to 2:00 PM | 10:00 AM to 3:30 PM | 9:00 AM to 3:30 PM | 9:00 AM to 3:30 PM | | Rupee interest rate derivatives@ | 9:00 AM to 5:00 PM | 10:00 AM to 2:00 PM | 10:00 AM to 3:30 PM | 9:00 AM to 3:30 PM | 9:00 AM to 5:00 PM | ^ Trades for both settlement on T+0 and T+1 basis.

# Repo transactions in corporate bonds for settlement through AMC Repo Clearing Limited (ARCL) are required to be concluded by 1:00 PM for T+0 settlement, and by 5:00 PM for T+1 settlement.

* (a) Other than those traded on stock exchanges. (b) Authorised Dealers are permitted to undertake customer and interbank transactions beyond onshore market hours.

@ (a) Other than those traded on stock exchanges. (b) A market-maker is permitted to undertake transactions in FCS-OIS beyond onshore market hours. | 1.5 The Reserve Bank’s liquidity management operations, primarily conducted through the Liquidity Adjustment Facility (LAF) and Open Market Operation (OMO), seek to ensure adequate liquidity in the system. These operations have important implications for market trading and settlement timings, as do the conduct and settlement of primary auctions in Central Government dated securities, Treasury Bills (T-Bills) and State Government Securities (SGSs). The LAF operations, through auctions, are typically carried out in the first half of the day. The OMO auctions are conducted mostly between 9:30 AM and 10:30 AM. The Standing Deposit Facility (SDF) and Marginal Standing Facility (MSF) are available from 5:30 PM till 11:59 PM. The Standing Liquidity Facility (SLF) provided to standalone primary dealers (SPDs) is available from 9:00 AM till 2:00 PM (Table 1.2). Primary auctions are typically conducted between 10.30 AM and 11:30 AM. | Table 1.2: Timing of RBI Liquidity Facilities | | RBI Liquidity Operations /Facility | Timings | | Standing Liquidity Facility (SLF) | 9:00 AM to 2:00 PM | | Open Market Operation (OMO) Auction | 9:30 AM to 10:30 AM | | LAF Auction* | 10:00 AM to 10:30 AM | | 14-day LAF Auction | 11:00 AM to 11:30 AM | | Standing Deposit Facility (SDF) | 5:30 PM to 11:59 PM | | Marginal Standing Facility (MSF) | 5:30 PM to 11:59 PM | | *LAF fine-tuning auctions can be announced and conducted any time during the day. | Settlement Arrangements 1.6 Different markets have different settlement mechanisms and cycles. Call money transactions are bilaterally settled between participants, while outright trades and transactions in repo on Government securities are settled through Clearing Corporation of India Limited (CCIL) acting as a central counterparty (CCP) on delivery-versus-payment (DvP)-III basis. Commercial Papers (CPs) and Certificates of Deposit (CD) are settled bilaterally. Repo trades in corporate bonds are settled bilaterally or through AMC Repo Clearing Limited (ARCL) acting as a CCP. Interest Rate Derivative (IRD) transactions are settled by CCIL, either on a guaranteed or non-guaranteed basis, and also bilaterally between participants. Foreign exchange trades are also settled through CCIL as well as bilaterally. Liquidity operations of the Reserve Bank are gross settled bilaterally. 1.7 A typical business day starts with reversal of liquidity operations of the Reserve Bank before the markets open for trading. The settlement of primary auctions in the Government securities market takes place between 10:00 AM and 1:00 PM. Interest payments on / redemptions of dated securities, T-Bills and SGSs also take place in the morning. Outright trades in Government securities (executed on S-12 day) and transactions in repo on Government securities (executed on S day) are generally settled between 4:30 PM and 5:30 PM. The settlement of foreign exchange transactions through CCIL takes place, in multiple batches, during the window between 4:00 PM and 8:00 PM. After the markets close, the MSF and SDF of the Reserve Bank remain available till 11:59 PM (Table 1.3). Need for Review 1.8 The last comprehensive review of market timings was conducted by an internal working group of the Reserve Bank in 20193. The report of the internal group was published for seeking broader market feedback. Its recommendations were, however, kept in abeyance on account of the onset of the pandemic. Since then, significant changes have taken place in the regulatory framework for financial markets and in the market microstructure including trading volumes, market participants and trading infrastructure. 1.9 Turnover in different markets has grown rapidly in the last decade or so, in some cases, such as money markets and IRD market, by several multiples. The size of several markets viz., the Government securities market, foreign exchange market and different money markets are also much larger and with a larger number and variety of participants. 1.10 The market structure has also undergone noticeable changes driven by developments in the domestic and global economy and regulatory changes. Volumes in the overnight money markets have increasingly moved to the collateralised segments. This is in line with the developments in global markets. The development has been driven by several factors such as availability of higher collaterals with banks, greater participation of non-bank entities, availability of efficient trading and clearing systems, etc. The calibrated opening of the Indian debt markets to non-residents, especially the operationalisation of the Fully Accessible Route (FAR), and the inclusion of Government securities in global bond indices have led to a steady increase in Foreign Portfolio Investor (FPI) holdings of Government securities. Non-resident participation has also increased in the IRD segment after they were permitted to access the onshore IRD market in 2019. Non-resident participation in the onshore foreign exchange market has also increased. Separately, regulatory changes enabled the participation of onshore entities in offshore markets. Banks in India operating IFSC Banking Units (IBUs) have been permitted to participate in the Non-Deliverable Forward (NDF) market with effect from June 1, 2020. Further, banks and SPDs in India have been permitted to undertake transactions in the offshore FCS-OIS market with non-residents and other market makers from February 10, 2022, and August 08, 2022, respectively. These regulatory changes have reduced the price differential between onshore and offshore markets and led to the emergence of an onshore interbank market in non-deliverable derivatives wherein local banks transact with each other and with users. There is now a greater variety of derivative products available in the market, pursuant to regulatory changes facilitating product innovation, to enable non-retail clients to optimise their hedging costs and effectively manage their risks. Several structured foreign exchange derivatives are now being traded in the domestic market. In the IRD market, new instruments such as bond Forward Rate Agreements (FRAs) and Total Return Swaps (TRS) are being offered to users. Recently, forward contracts in government securities have also been permitted. 1.11 The financial market infrastructure has also evolved. Salient details covering the developments in trading as well as settlement mechanisms are outlined below. • While most of the trading in the Indian markets has been intermediated by Electronic Trading Platforms (ETPs), additional facilities have been added by several ETPs over the last few years to provide flexibility in trade execution. For instance, Application Programming Interface (API) support has become increasingly common on the ETPs today, and market participants are leveraging the same to optimise trade execution at their end. New dealing modes have been enabled on ETPs. For instance, while Negotiated Dealing System - Order Matching (NDS-OM) was traditionally a Central Limit Order Book (CLOB) venue, support for Request For Quote (RFQ) dealing mode has been introduced. ETPs have also been / are being introduced for instruments such as reference rate-based foreign exchange trades, where electronic trade execution was earlier not supported. • Settlement mechanisms have also evolved. Foreign exchange forwards with maturity up to thirty-six months are now being centrally cleared and settled. CCP-based clearing for modified MIFOR trades have been extended up to ten years. Tripartite repo settlements are now available for repos in corporate bonds through ARCL. Further, while the interbank trades in Government securities – outright and repo, foreign exchange spot and forwards and interest rate swaps on Mumbai Interbank Outright Rate (MIBOR) and Modified Mumbai Interbank Forward Outright Rate (MMIFOR) were centrally cleared, the support for clearing member structure has provided opportunities for users to also avail CCP services. 1.12 There have been other changes as well which have altered the dynamics of underlying participants’ trading needs. For instance, payment systems have transitioned to 24x7 operations leading to changes in the way banks manage their intraday funding needs, and access money markets along with the Reserve Bank’s liquidity facilities. The Reserve Bank’s liquidity operations have also evolved over the years in line with changes in the extant Liquidity Management Framework. 1.13 In recent years, there have been requests from market bodies and market participants to revisit existing market trading and settlement timings, with a view to ensure that they remain aligned with the evolving dynamics, global best practices as well as liquidity requirements and risk management considerations. Against this backdrop, it was announced in the Statement on Developmental and Regulatory Policies dated February 07, 2025, that: Synchronized and complementary market and settlement timings across various financial market segments can facilitate benefits of efficient price discovery and optimization of the liquidity requirements. Over the last few years, there have been several developments including increased electronification of trading, availability of forex and certain interest rate derivative markets on a 24X5 basis, increased participation of non-residents in domestic financial markets and availability of payment systems on a 24X7 basis. Accordingly, it has been decided to set up a working group with representation from various stakeholders to undertake a comprehensive review of trading and settlement timing of financial markets regulated by the Reserve Bank. 1.14 Accordingly, a Working Group (hereinafter ‘the Group’) with representation from various stakeholders was set up to undertake a comprehensive review of trading and settlement timings of markets regulated by the Reserve Bank with the following Terms of Reference (ToR): i. Review the current trading and settlement timings for various financial markets regulated by the Reserve Bank including functioning hours of market infrastructures for trading, clearing, settlement and reporting of transactions; ii. Identify the frictions, challenges and issues, if any, in overall functioning of markets on account of current trading and settlement timings in terms of transmission of prices/rates across markets, volatility and distribution of trades, liquidity requirements, netting efficiency, etc.; iii. To examine cross-country practices relating to market timings and their influence, if any, on market development in terms of participation, liquidity, volumes, etc.; iv. To examine the implications, including benefits, costs and challenges, if any, in revising the current timings for trading and settlement; and v. To make recommendations on trading and settlement timings. 1.15 The composition of the Group is as follows: i. Shri Radha Shyam Ratho, Executive Director, Reserve Bank of India (Chairperson) ii. Shri Ravi Ranjan, Deputy Managing Director, State Bank of India iii. Shri Lalit Tyagi, Executive Director, Bank of Baroda iv. Shri Ashish Parthasarthy, Group Head - Treasury, HDFC Bank v. Ms. Parul Mittal Sinha, Head of Financial Markets, Standard Chartered Bank vi. Shri Ashwani Sindhwani, CEO, Foreign Exchange Dealers’ Association of India vii. Shri Ravindranath Gandrakota, CEO, Fixed Income Money Market and Derivatives Association of India viii. Shri Shailendra Jhingan, Chairperson, Primary Dealers’ Association of India ix. Ms. Dimple Bhandia, Chief General Manager, Financial Markets Regulation Department, Reserve Bank of India (Member - Secretary) Approach of the Working Group 1.16 The Group held four meetings between February 2025 and April 2025. The details of the meetings are given in Annex I. The Group held detailed discussions with various stakeholder groups including insurance companies, mutual funds, co-operative banks, payment banks and small finance banks, to elicit suggestions and feedback related to trading and settlement timings of various markets. It also benefitted from suggestions and feedback from a larger group of market participants through the market associations, viz., FIMMDA, FEDAI and PDAI, represented in the Group. The Group also examined and drew lessons from the market trading and settlement timings followed in different jurisdictions globally. Structure of the Report 1.17 The introductory chapter has provided an overview of current trading and settlement timings of various markets regulated by the Reserve Bank and the key developments necessitating their review. Chapter 2 provides an overview of the financial market microstructure. Chapter 3 provides an assessment of various aspects pertaining to review of market trading and settlement timings such as market liquidity, transactions distribution, settlement cycles, etc., and also includes an assessment of some relevant international experiences with respect to market trading hours. Chapter 4 discusses the feedback received from different stakeholders and provides an assessment of the analysis undertaken by the Group to arrive at its recommendations. Chapter 5 presents the key recommendations of the Group for optimising trading and settlement timings across different markets. 2. MARKET STRUCTURE The Reserve Bank of India, under the statutory provisions of various legislations including, inter alia, the Reserve Bank of India Act, 1934, the Foreign Exchange Management Act, 2000, the Government Securities Act, 2006, and the Payment and Settlement Systems Act, 2007, regulates the Government securities market, the money markets, the foreign exchange market and markets for derivatives on interest rate, foreign exchange and credit. Money Market 2.1 The overnight money market in India is the most liquid segment of the market and comprises the uncollateralised (call money) and collateralised (market repo and TREP) segments. In India, as has been the case globally, the structure of money markets has witnessed a paradigm shift away from uncollateralised inter-bank market towards collateralised overnight markets comprising banks and non-bank entities. Between 2014-15 and 2024-25, the annual turnover in the overnight money market increased from ₹281.37 lakh crore to ₹1,324.05 lakh crore while the daily average turnover increased from ₹1.17 lakh crore to ₹5.52 lakh crore. This growth was largely driven by the expansion of the collateralised segment, where annual turnover rose from ₹245.27 lakh crore to ₹1,296.62 lakh crore even as the turnover in call money market declined from ₹36.10 lakh crore to ₹27.42 lakh crore (Chart 2.1). 2.2 The TREP segment accounts for the largest share in the overnight money market with 69 per cent of daily average volume in the market followed by market repo at 29 per cent. The share of call money has gradually come down from 13 per cent in 2014-15 to about 2 per cent in recent years (Chart 2.2).

2.3 The call money market is accessible exclusively to banks and SPDs - participants with access to the liquidity adjustment facilities of the Reserve Bank. Co-operative banks are the major lenders in the market while SPDs are the primary borrowers. The collateralised segment of the overnight money market has a diversified participant base, including non-bank entities such as mutual funds, insurance companies and corporates, in addition to banks and SPDs. In these markets, mutual funds are the major lenders, while SPDs and banks are the largest borrowers (Chart 2.3). 2.4 Transactions in the overnight money market are predominantly contracted over ETPs operated by Clearcorp Dealing Systems India Limited (Clearcorp), a subsidiary of CCIL. The Negotiated Dealing System – Call (NDS-Call) and the Clearcorp Repo Order Matching System (CROMS) platforms facilitate call money and market repo transactions respectively, while TREP transactions are executed on the Tri-party Repo Dealing System (TREPS) platform. Some call money and market repo transactions are also dealt bilaterally outside of ETPs and reported to CCIL. While all the three segments start trading at 9:00 AM, the market repo and TREP segments close at 2:30 PM and 3:00 PM respectively, whereas the call money market closes at 5:00 PM. 2.5 Call market trades are settled bilaterally using the Real-Time Gross Settlement (RTGS) system. Market repo and TREP transactions are settled along with outright transaction in Government securities on a DvP - III basis though CCIL, which acts as the CCP. This eliminates counterparty risks and, through multilateral netting, reduces liquidity requirements. The settlement of repo transactions normally takes place on a T+0 basis between 4:30 PM and 5:30 PM. Liquidity Adjustment Facility of the Reserve Bank 2.6 The Reserve Bank’s Liquidity Management Framework (LMF) is an important source of managing surplus / deficit in systemic liquidity. The LMF has evolved over the years keeping pace with the changes in different market segments as also with the growing needs of the participants. At present, the Reserve Bank conducts variable rate repos and reverse repos of tenors from overnight to 14 days for short-term liquidity adjustment while it also conducts long term repos and other operations such as OMOs and foreign exchange (FX) swaps to manage long term/ durable liquidity needs. 2.7 The repo/ reverse repo and OMO operations under the LMF are conducted over the Reserve Bank’s e-Kuber platform wherein the participants submit their bids/ offers electronically. The settlement of the first leg of all repos/ reverse repos happens on the same day within an hour of the announcement of auction result, while the settlement of the OMOs and the near leg of FX swaps is done on T+1 and spot (T+2) basis respectively. 2.8 In addition to the above operations, the Reserve Bank has also made available the standing facilities, viz., SDF and MSF which are available to eligible participants every day including on holidays to participants from 5:30 PM to 11:59 PM and the settlement of the same occurs in real-time. An optional automated sweep-in and sweep-out (ASISO) facility is also available in the e-Kuber system for eligible participants for the standing facilities. 2.9 Reversal of repos/ reverse repos as also the standing facilities is carried out at the beginning of the day of the second leg. Government Securities Market 2.10 Over the years, activities in the Government securities market have grown, with the annual turnover rising from ₹101.56 lakh crore in 2014-15 to ₹165.07 lakh crore during 2024-25 (Chart 2.4). Trading in dated securities account for about 85 per cent of turnover, followed by T-Bills and SGSs at 10 per cent and 5 per cent, respectively (Chart 2.5). Banks and SPDs are the major participants in the market (Charts 2.6 (a) and 2.6 (b)).

2.11 Over the years, efforts have been made to diversify the investor base which has resulted in increased participation from both domestic and non-resident investors. For instance, over the last decade the share of holding of Central Government securities by insurance companies, mutual funds, corporates and FPIs has increased while the share of commercial banks has come down (Table 2.1). | Table 2.1: Ownership Pattern of Central Government Securities (Per cent) | | Quarter ended | Commercial Banks | Non-Bank PDs | Insurance Companies | Mutual Funds | Corporates | Foreign Portfolio Investors | Provident Funds | RBI | Others | Pension Funds | | Dec-24 | 38.0 | 0.7 | 26.1 | 3.1 | 1.5 | 2.8 | 4.3 | 10.6 | 8.0 | 5.1 | | Mar-14 | 44.5 | 0.1 | 19.5 | 0.8 | 0.8 | 1.7 | 7.2 | 16.1 | 9.4 | - | Note: Investment by pension funds were reckoned under ‘others’ category till December 2021.

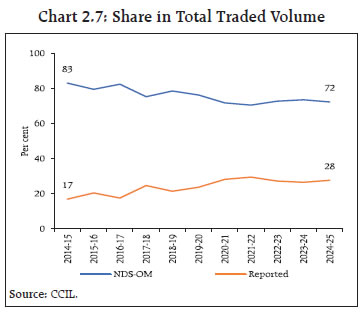

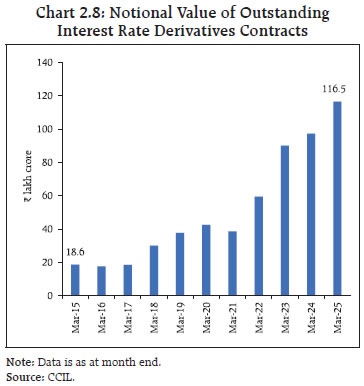

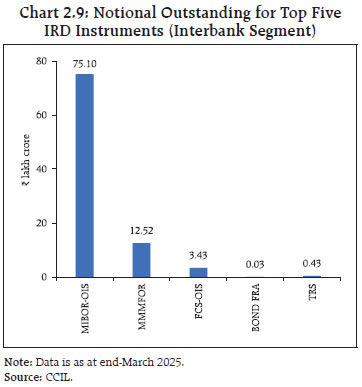

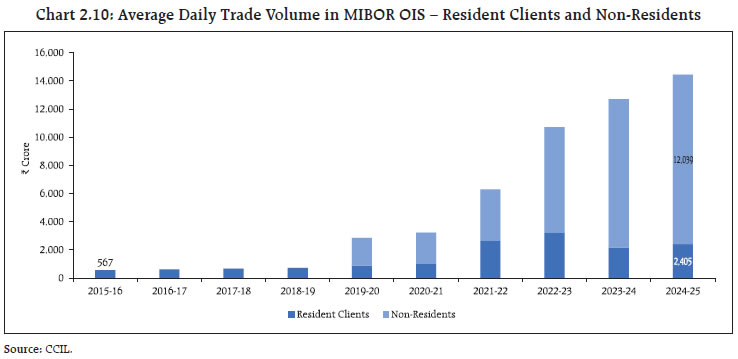

Source: Database on Indian Economy. | 2.12 Transactions in the over-the-counter (OTC) Government securities market are primarily conducted through the NDSOM platform, an ETP managed by Clearcorp. Trading on NDS-OM accounts for approximately 72 per cent of the total transaction value, while the remaining trades are reported to the platform after bilateral negotiation (Chart 2.7). The NDSOM platform offers both anonymous order matching and a RFQ segment, catering to diverse trading preferences.  2.13 The settlement of transactions in the Government securities market follows a structured timeline, along with the settlement of repo transactions in government securities as well as settlement of primary auctions and Reserve Bank’s liquidity operations. The settlement of primary auctions, coupon payments and redemptions takes place between 10:00 AM and 1:00 PM. The OMO auctions are settled between 12:00 noon and 4:00 PM. Outright transactions in Government securities are settled on a T+1 basis, along with T+0 transactions of collateralised money markets, through the guaranteed settlement mechanism provided by the CCIL4. The settlement starts after close of trading hours of the collateralised segment of the money market and is typically completed between 4:30 PM to 5:30 PM. Interest Rate Derivative Market 2.14 The IRD market has grown sharply over the last few years. This is reflected in the growth in the notional value of outstanding contracts, which surged from ₹19 lakh crore as at end-March 2015 to approximately ₹117 lakh crore as at end-March 2025 (Chart 2.8). The notional value of outstanding contracts would have been higher but for periodic portfolio compression exercises conducted by CCIL. The MIBOR-based overnight index swap (OIS) continues to dominate the market followed by MIFOR (now modified MIFOR) based IRS (Chart 2.9). Other IRD instruments have also evolved to cater to the diverse hedging needs of the market participants. Foreign banks, private sector banks and SPDs are the major participants in the market. Non-resident participation in the market has also increased in recent years (Chart 2.10).

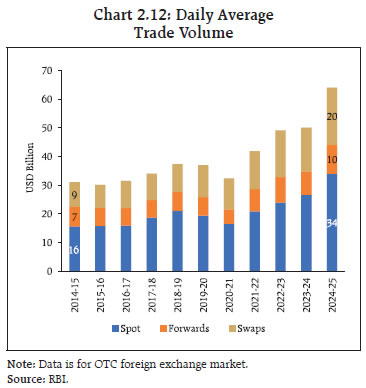

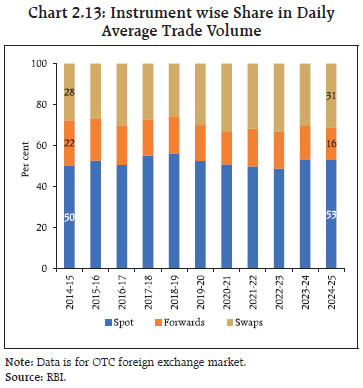

2.15 Transactions in the IRD market take place both on exchanges and in OTC market, though volumes on exchanges are low. Trades in the interbank MIBOR OIS market are primarily executed on ETPs. All OTC IRD transactions are mandatorily reported to a trade repository. CCIL provides CCP clearing and settlement for IRD transactions referenced to MIBOR and modified MIFOR. About 90 per cent of interbank MIBOR OIS and about 60 per cent of modified MIFOR IRS are CCP cleared (Chart 2.11). Foreign Exchange Market 2.16 The depth and breadth of the foreign exchange market in India have significantly improved over the years. Over the past decade, the daily turnover has increased from USD 32 billion in 2014-15 to USD 64.1 billion in 2024-25 (Chart 2.12). Spot, including cash and tom, constitute more than half of the average daily trading volume (Chart 2.13) with derivatives transactions, mainly forwards and swaps, accounting for the rest. Other foreign exchange instruments, such as options and structured derivatives, are also developing though they are relatively less liquid at present.

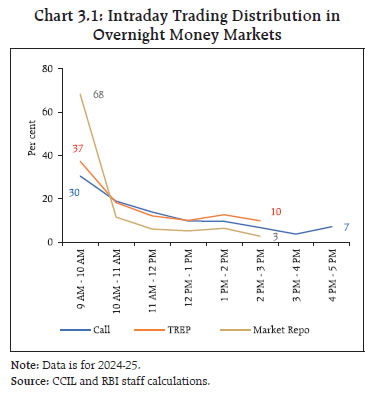

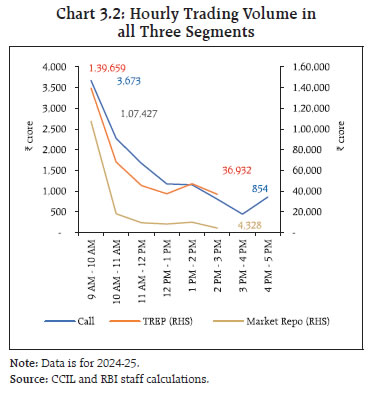

2.17 A significant portion of foreign exchange spot transactions in India is executed over ETPs. Several ETPs have been authorised for the purpose. Majority of derivative transactions (such as forwards and swaps) continue to be executed bilaterally through voice or intermediated through brokers. All foreign exchange derivative transactions are reported to the trade repository. The reporting of cash, tom and spot transactions to the trade repository has also commenced from February 2025. 2.18 Foreign exchange trades are settled through CCIL and also bilaterally between participants. Most interbank foreign exchange USD/INR spot and forward transactions are settled on a payment versus payment (PvP) basis by the CCIL. Transactions reported by participants are accepted by CCIL post exposure check and are settled on a multilateral net basis. The debit of INR payment takes place between 4:00 PM and 4:15 PM, followed by credit of foreign currency and INR on a PvP basis between 4:15 PM and 8:00 PM. CCIL also facilitates settlement of cross currency deals of banks in India through the CLS Bank. Other derivatives, including structured products, are settled bilaterally. 3. TRADING AND SETTLEMENT TIMINGS: ASSESSMENT 3.1 The Group reviewed the current trading and settlement timings for various financial markets regulated by the Reserve Bank recognising that optimal trading hours in financial markets are crucial for efficient market functioning and market development. As discussed in Chapter 1 of this Report, trading hours must be structured to facilitate efficient price discovery based on the flow of information, ensure adequate liquidity throughout the trading window, enable participants to fulfil their daily business requirements and support interbank participants in managing their positions after meeting client obligations. The Group also recognised that trading hours have implications for operating costs of market participants in terms of expenses related to human resources, market infrastructure, back-office operations for trade confirmation and settlement, liquidity provisioning, and regulatory compliance. Trading hours also need to be harmonised across different market segments and venues to enable the seamless transmission of price movements. Accordingly, the Group reviewed the trading and settlement timings from various diverse perspectives including market liquidity, transmission of prices, liquidity needs of participants, sequencing of settlements and alignment with global markets. The assessment is summarised below. Market Liquidity and Trade Distribution 3.2 Market liquidity plays a crucial role in price formation and efficiency. Higher liquidity enhances price discovery by reducing bid-ask spreads and allows traders to execute orders with minimal price impact. Deep and liquid markets absorb new information faster, improving price efficiency. Conversely, illiquidity can lead to price distortions, widening spreads, and increased 15 transaction costs. The Group assessed the liquidity distribution across markets in this context. 3.3 In the overnight money markets, the liquidity during the first hour of the trading day accounts for close to half the day’s total turnover (Chart 3.1). Market participants generally estimate their funding needs at the beginning of the day and attempt to meet the same from the overnight money markets during this time. Thereafter, the activity tapers off. A slight increase in trading activity is then evidenced between 1:00 PM to 2:00 PM. It is understood that this is the time window used by mutual funds to deploy their surplus funds in the collateralised money markets. The call money market also sees a slight uptick in the activity during the last hour of trading, as banks try to cover any unanticipated cash flows prior to market close. Though trading activity declines after the first hour, in absolute terms, there is reasonable liquidity in the collateralised money markets throughout the day (Chart 3.2).

3.4 Trading in the Government securities market is more evenly distributed, albeit with slightly higher volumes during the first and last hour of the trading session (Chart 3.3). Trading interest is higher during the first hour as information released post close of previous day’s trading session and overnight global developments are factored in. Market activity on account of allotments in primary auctions generally takes place towards the end of the trading session, leading to a slight uptick in volumes at that time. In recent months, this is also due to the release of key macroeconomic data towards the end of market hours pursuant to a change in time of release of the data by the Ministry of Statistics and Programme Implementation (MOSPI). 3.5 Similarly, trading volumes in the main IRD instruments – MIBOR OIS and modified MIFOR IRS, are also evenly distributed (Chart 3.4). While FCS-OIS can be traded beyond market hours, most of the trades are still concentrated during onshore trading hours (Chart 3.5).

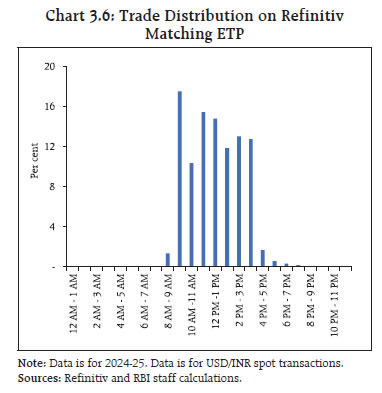

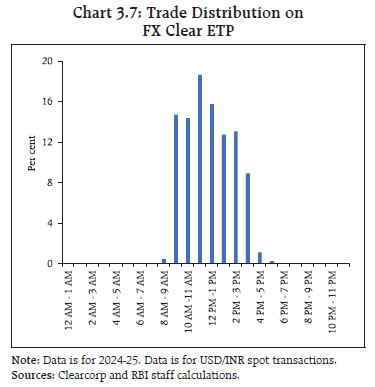

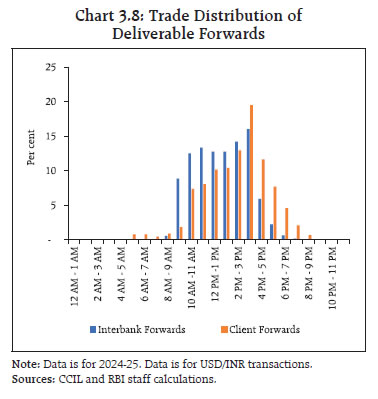

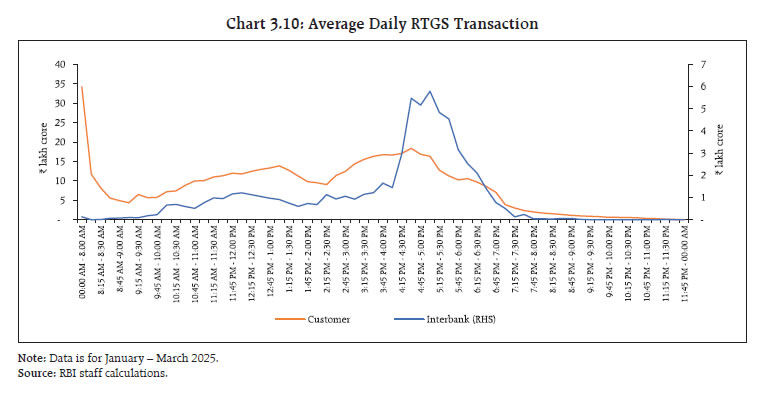

3.6 Liquidity in the inter-bank spot currency markets is also well distributed during the onshore market hours (9:00 AM till 3:30 PM). The trade distribution indicates that though trading is permitted beyond onshore market hours, inter-bank spot transactions are concentrated between 9:00 AM and 3.30 PM, with only a small share of transactions taking place before or after onshore market hours (Charts 3.6 and 3.7). Forward transactions (both deliverable and non-deliverable), however, trade in a wider time window with transactions being reported from 8:00 AM till 8:00 PM (Charts 3.8 and 3.9).

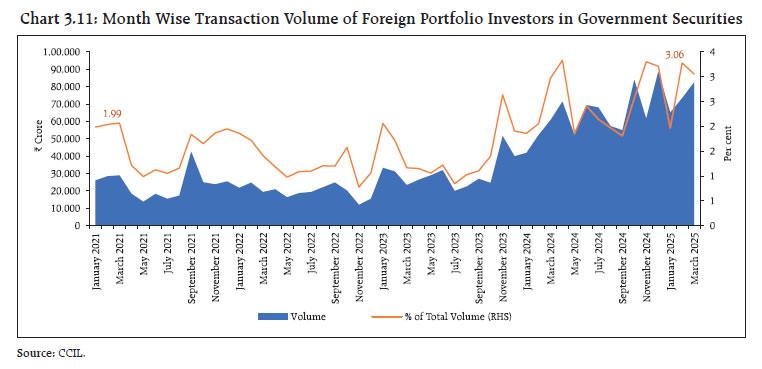

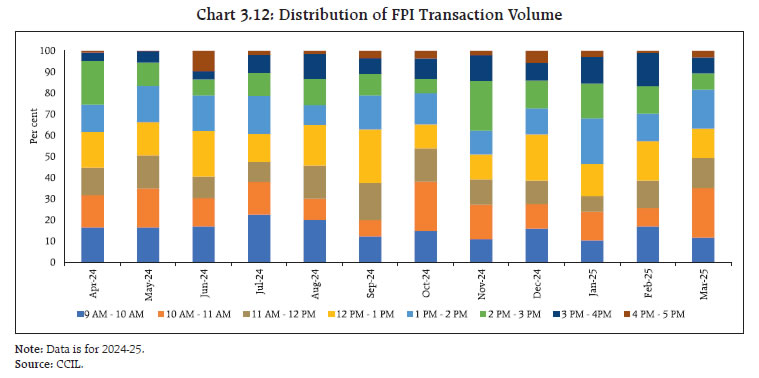

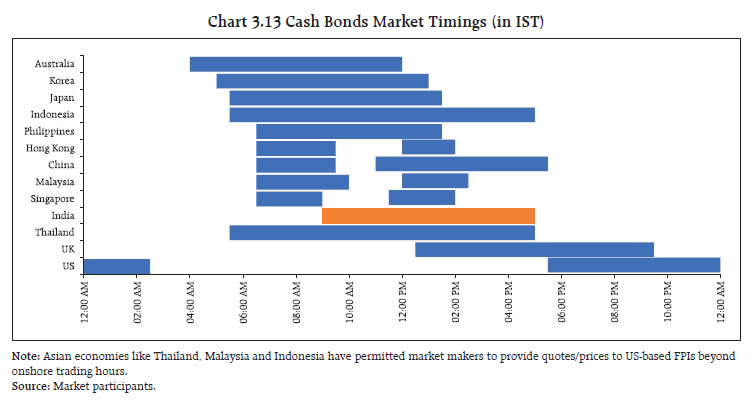

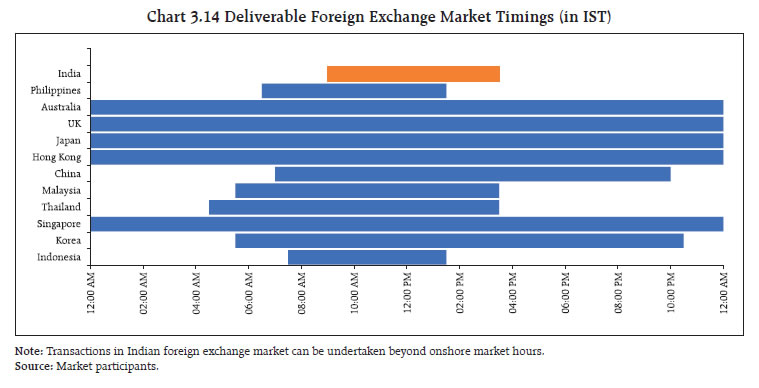

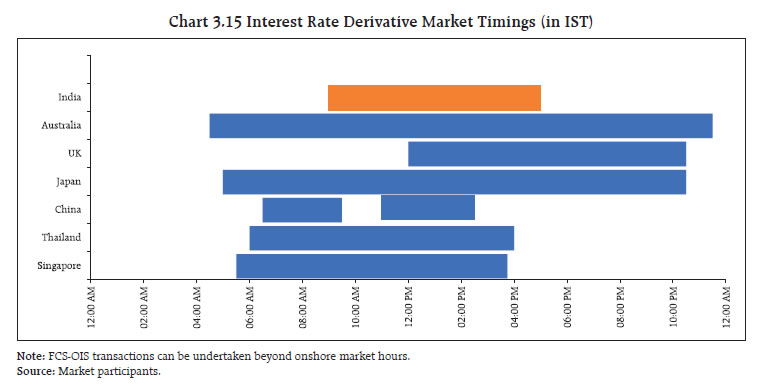

3.7 The Group thus noted that except for money markets, which tend to trade primarily in the early part of the trading session based on funding considerations of market participants, liquidity in Government securities, IRDs and foreign exchange markets are relatively well distributed during the trading hours. Even in the case of the foreign exchange market and FCS-OIS where trading is permitted on a 24x5 basis, trading tends to be concentrated during the onshore market trading hours. Assessment of Liquidity Requirements 3.8 Effective liquidity management is critical for market participants. It enables them to meet payment obligations promptly, mitigating the risk of settlement failures and potential market disruptions, thereby supporting operational efficiency and financial stability. Market participants typically manage their short-term liquidity requirements through intraday credit lines from banks, money market instruments, and liquidity operations of the Reserve Bank. The Group noted that the trading hours of funding markets should adequately support these needs. 3.9 The Group deliberated that with payment systems now operating on a 24x7 basis, liquidity management dynamics for market participants have changed. Banks, in particular, need to anticipate and maintain adequate liquidity buffers to handle unexpected outflows especially for the period after the closure of the overnight money markets. At present, the call money segment, the last available interbank funding market of the day, closes at 5:00 PM. The distribution of interbank and customer RTGS transactions indicates that transactions are undertaken in sizeable quantum up to 7:00 PM (Chart 3.10).  3.10 The Group noted that there are non-guaranteed settlements occurring after the close of funding market. Any failure or delay in such settlements may create liquidity constraints for market participants. To illustrate, the reporting of RFQ trades in corporate bonds are now permitted till 4:00 PM, with the settlement window extending till 5:45 PM. There is no defined time window for the bilateral settlement of call money transactions. While interbank foreign exchange transactions are accepted by CCIL for guaranteed settlement, the INR leg of client transactions are settled bilaterally using RTGS. Handling any such delay or failure after close of money market can, at present, only be met through the Reserve Bank’s liquidity window. This increases dependence on the liquidity facilities offered by the Reserve Bank. For market participants not having access to the Reserve Bank’s liquidity window, no funding avenues are available. 3.11 Feedback from mutual funds suggests that debt mutual funds, one of the largest participants in the market repo and TREP markets, often receive cash flow reports after 3:00 PM. With the collateralised money market segment closing by 3:00 PM, a part of their funds may remain undeployed. The Group also discussed that with T+0 cash settlement available on exchanges, corporates also have better visibility of their cash position by 3:30 PM. 3.12 The Group noted that while the current market timings of overnight money markets are largely adequate to meet the funding needs of most market participants, there remains scope for extension in the timings of the money market. Assessment of Settlement Sequence and Timings 3.13 The Group recognised that effective sequencing of settlement cycles and netting of settlements, where possible, are crucial to avoid liquidity gridlocks and minimise liquidity risks. Amidst the diverse settlement modes for different markets, the Group discussed a few potential changes in the extant settlement arrangements. 3.14 The Group noted that the settlement of Government securities primary auctions occurs in the first half of the trading day, while the guaranteed settlement of secondary market transactions through CCIL (both outright and repo) takes place after the close of market. Due to this market participants may need to arrange for intraday liquidity or use the intraday credit line even if their net obligations in both the markets taken together are low / zero. Similarly, the settlement of Reserve Bank’s liquidity operations is not netted with the settlement of the primary auctions of Government securities and secondary market transactions, creating intraday liquidity requirements. The Group also noted that as the reversal of the Reserve Bank’s liquidity operations are carried out at the start of the day, before the opening of the money markets, market participants need to use overnight funds or intraday liquidity facilities from the Reserve Bank or intraday credit lines from banks to meet their obligations. 3.15 The Group discussed the possibility of streamlining the settlement of call money transactions which are currently executed on or reported to the NDS-Call platform but are settled bilaterally. To this end, the Group deliberated on the possibility of the NDS-Call platform being enabled to automatically trigger an RTGS settlement upon the execution of call transactions on the NDS-Call platform. The Group, however, felt that while this may benefit the call money borrowers by providing immediate liquidity, there could be operational concerns for lenders to ensure the availability of funds at the time of call transactions. Facilitating Non-Resident Participation in the Indian Financial Market 3.16 The Indian financial markets, especially the Government securities, foreign exchange markets and related derivatives market, are increasingly integrated with global markets. As discussed in Chapter 2 of this Report, the Government securities market has witnessed sustained interest from non-resident investors following the introduction of the FAR in 2020 and the inclusion of Indian Government securities in global bond indices. The share of FPIs in trading volumes in the Government securities market has been steadily rising in the recent period (Chart 3.11). Of this, about 60-70 per cent of FPI transactions currently occur during the first half of the trading session (by 1:00 PM) possibly as most FPIs investing in India have operational offices in Asia (Chart 3.12).  3.17 The Group discussed if an overlap of domestic market trading timings with major financial hubs such as London, New York, Singapore, etc., could help in effective assimilation of international developments by domestic market participants and also ease the participation of non-resident investors. The Group noted that the domestic trading hours overlap with those of major Asian and European markets, but not with US market hours (Charts 3.13 to 3.15). It also noted that some Asian economies allow market makers to provide quotes/prices to US-based FPIs beyond onshore trading hours. The Group deliberated on the possibility of putting in place a similar arrangement to permit post-market quoting of Government securities for FPIs.

3.18 The Group noted that trading and settlement timings of financial markets across countries have evolved in response to a combination of market structure, regulatory requirements, technological capabilities and global integration needs. Besides operational considerations including staffing and cost implications, geographic location and time zone considerations also impact trading timings decisions. It was observed that flexibilities in market hours tend to be adopted more by countries located in the eastern-most and western-most geographies. In particular, countries in the eastern part of Asia have tended to adapt their market timings to address the disconnect with the global financial hubs in Europe and North America. Different models have been followed by different countries. For example, Japan and Hong Kong have extended market hours to enhance the overlap with trading hours of major financial hubs in the West. In July 2024, the trading hours of the Korean (KRW/USD) foreign exchange market were extended until 2:00 AM local time the next day (from 09:00 AM to 03:30 PM earlier) to cover the trading hours of the financial markets in London. Other Asian economies like Thailand, Malaysia and Indonesia have permitted market makers to provide quotes/prices to US-based FPIs beyond onshore trading hours. In most East Asian nations, government bonds are permitted to be traded beyond onshore market hours for offshore investors. In many cases, however, the average volumes of trades in post onshore market trading hours are not very substantial. The average daily volumes of Indonesian, Thai and Malay bonds is about USD 25 million during US hours. The Group felt that such a model may be more relevant for jurisdictions, wherein, there is demand (although limited) from foreign investors after close of onshore markets. The Group also noted that several Asian jurisdictions have included lunch breaks of varying duration during their respective trading hours. In addition to providing a respite from intense trading activity for the traders, the lunch breaks also allow markets to delay their closing, thereby increasing the overlap with markets operating in later time zones. Illustratively, the market timings for the cash bond markets across jurisdictions in local time is placed in Table 3.1.

| Table 3.1: Market Timings (in local time) | | Country | Cash Bonds | | Indonesia | 07:00 AM - 06:30 PM | | Korea | 08:30 AM - 04:30 PM | | Singapore | 09:00 AM - 11:30 AM and 02:00 PM - 04:30 PM | | Thailand | 07:00 AM - 06:30 PM | | Malaysia | 09:00 AM - 12:30 PM and 02:30 PM - 05:00 PM | | China | 09:00 AM - 12:00 PM and 01:30 PM - 08:00 PM | | Hong Kong | 09:00 AM - 12:00 PM and 02:00 PM - 04:00 PM | | Japan | 09:00 AM - 05:00 PM | | US | 08:00 AM - 05:00 PM | | UK | 08:00 AM - 05:00 PM | | Australia | 08:30 AM - 04:30 PM | | Philippines | 09:00 AM - 04:00 PM | | India | 09:00 AM - 05:00 PM | | Source: Market Participants. | 3.19 It was also noted that countries have also adopted other measures to tap into the global investors’ appetite and enhance access to their onshore markets. China implemented the China Bond Connect in July 2017, an investment channel that gives overseas investors access to fixed income markets in Mainland China via trading infrastructure in Hong Kong. This allows overseas investors to settle and hold bonds via nominee account structures instead of opening onshore accounts. The China Bond Connect is the fourth official channel for international investors to invest in China’s onshore fixed income market, the other channels being the China Interbank Bond Market (CIBM) Direct, the Qualified Foreign Institutional Investor (QFII) Scheme, and RMB Qualified Foreign Institutional Investor (RQFII) Scheme. 3.20 The Group observed that there is no one-size-fits-all approach. Various jurisdictions have adopted bespoke models to cater to the global investors’ demand and establish connectivity with the global financial markets. The operational and the risk management challenges associated with these initiatives have also influenced choices. Also, the different models have evolved in line with the overall regulatory and the capital account convertibility framework of the countries, in addition to the market conditions and the level of sophistication of participants involved. 4. FEEDBACK AND ASSESSMENTS 4.1 The Group systematically analysed the perspectives outlined in the previous chapter for each market segment, integrating stakeholder feedback to refine its assessment of optimal trading and settlement timings. Money Market 4.2 The Group noted the lack of availability of interbank funding avenues post 5:00 PM even though payment systems are operational. The daily balances held by banks at the close of business on each day (close to midnight) are considered for computation of Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR). Interbank and customer foreign exchange transactions by banks undertaken beyond onshore trading hours also have implications for liquidity management. Settlement timings in the corporate bond market and cash flow patterns of mutual funds also call for availability of money markets beyond the currently available window. The limitations imposed by the trading timings of the money market increases the reliance on liquidity facilities provided by the Reserve Bank while posing challenges for participants not having access to such facilities. Different stakeholders suggested the Group to consider extending the timing of call money market till 7:30 PM or 8:00 PM to provide an interbank funding avenue after 5:00 PM. The Group also received unanimous feedback from different stakeholders, that the market repo and TREP trading windows should be extended to better accommodate funding requirements of market participants, especially the non-bank entities. While most stakeholders requested extension in market hours till 4:00 PM, some stakeholders also requested extension till 5:00 PM. One of the members suggested that the market hours be extended till 3:30 PM as most of the market participants crystalise their fund flows by 3:00 PM and would be in a position to deploy their funds by 3:30 PM. The Group also discussed the possibility of unifying the market repo and TREP trading hours and unifying the TREP trading hours for participants settling directly with the Reserve Bank and participants settling through Designated Settlement Banks (DSBs) (at present, the market hours for participants settling through DSBs closes 30 minutes ahead of other participants). 4.3 The Group noted that the bilateral settlement of call money transactions is dependent only on the availability of payment systems, and any extension would neither impact other settlements nor require any changes in the settlement infrastructure. However, extending beyond an optimum level may lead to undue volatility in rates amidst thin liquidity and impact the weighted average call rate (WACR) calculation. Further, most RTGS transactions are completed by 7:00 PM (para 3.9). Therefore, on balance, the Group felt that the availability of call money market till 7:00 PM may provide banks with adequate flexibility to cover requirements related to unanticipated flows. The Group also noted that any extension in market timings of call money market must be accompanied by similar extension in reporting of cancellation of call money transactions – the window for which presently closes at 5:30 PM. 4.4 The Group noted that the settlement of collateralised money market transactions is intertwined with the settlement of secondary market transactions in Government securities. Therefore, any extension in the trading timings for collateralised money market segments will also impact the settlement of Government securities transactions as well as settlement activities of the market participants. On balance, the Group suggested to extend the trading timings of market repo and TREP till 4:00 PM. 4.5 Within the collateralised segment, the trading timings of market repo and TREP are different. As the participant base for both market repo and TREP segments remains the same, maintaining different trading hours for these segments offers no significant advantage as both are settled together. The Group felt that uniformity in the trading hours would help mitigate the additional pressure on the TREP segment during the final half-hour of trading and provide market participants with greater flexibility in selecting a segment to meet their funding requirements. The Group recognised that extending the trading hours of market repo and TREP would result in the settlement of the segments being extended to 5:30 PM – 6:30 PM. The general feedback which the Group received from its various stakeholders was that the associated operational challenges were manageable. 4.6 Currently, the trading window for the TREP segment closes at 3:00 PM. However, for participants settling their funds through DSBs, the trading window closes earlier at 2:30 PM. With recent improvements in fund settlement mechanisms through DSBs, CCIL has indicated that the need for differential trading hours no longer exists. Accordingly, the Group felt that with the operational constraint removed, uniformity in trading timings for all participants of TREP segment could be considered. 4.7 Currently, the outright and repo transactions in Government securities are settled by CCIL on a DvP III basis. This provides significant netting efficiency to participants especially as outright trades in Government securities, repo transactions and reversal of the previous day’s repo transactions are all settled together. However, this also means that the reversal of repo trades happens towards the end of a business day. The Group received feedback that the reversal of market repo trades at the end of the day resulted in lenders in the market being forced to avail intraday liquidity. The reversal of repo trades in the morning, on the other hand, will ensure availability of funds for market participants – especially lenders – to manage their intraday liquidity requirements. The Group, however, noted that an early settlement of the reversals of repo trades could reduce the netting efficiency of current settlements and also require borrowers to arrange for funds at the beginning of the day. It felt that this may lead to additional liquidity pressures on market participants and was, therefore, not in favour of any change. 4.8 The Group assessed the difficulties posed by the early reversal of the Reserve Bank’s liquidity operations (typically between 5:00 AM and 7:00 AM) and discussed the feasibility of shifting the time to around 9:30 AM -10:00 AM. It was felt that this would enable market participants to utilise the funds for settlement of primary auctions and reduce dependence on available credit lines. At the same time, the Group felt that it would need to be ensured that the reversal of the liquidity operations take place before the liquidity auctions for the day. Postponing the timing of reversal of the liquidity operations would entail a concomitant postponement of the auction timings for the current day’s operations. This could have its own implications for the overall functioning of the markets. The Group also discussed the benefits of preponing the daily liquidity operations of the Reserve Bank from the current window of 10:00 AM - 10:30 AM to 9:30 AM -10:00 AM. On balance, the group felt that postponing the reversal of the Reserve Bank’s liquidity operations may pose its own set of challenges but felt that there are benefits associated with preponing the daily auction to an earlier time window. Government Securities Market 4.9 The Group assessed the adequacy of trading and settlement timings of the Government securities market in the context of evolving market dynamics, including the needs of domestic participants and the growing interest of non-resident investors. It noted that the trading activity in the Government securities market is fairly well distributed throughout the trading hours and adequately factors the information released during and post trading hours. While most stakeholders suggested retention of current market timings, the Group received feedback both for shortening of the trading timings as well as extension of trading timings. 4.10 The curtailment of trading timings of the Government securities market to 3:30 PM was suggested by certain market participants to align the same with the timings of the equity market. This adjustment, they suggested, would bring uniformity in trading timings across asset classes and may facilitate the timely completion of post-market activities such as valuations of portfolios at the end of the working day. The stakeholders added that the experience with truncated trading hours during the COVID-19 period made a case for shorter trading hours as the market was able to meet its trading requirements within a shorter trading window. 4.11 The Group deliberated on this feedback. The Group noted that the revision in timing for release of key economic data, from 5:30 PM to 4:00 PM5, could potentially lead to increased short-term volatility in the Government securities market during those periods. Thus, there may be merit in reducing the current market trading timings. The Group also discussed curtailment in trading hours to align the timings of Government securities and equity markets. 4.12 The Group, however, felt that the trading dynamics of these markets differ. Equity prices fluctuate with company performance, investor sentiment, and market news, whereas the value of debt instruments hinges on prevailing interest rates, time to maturity, inflation expectations and macroeconomic shifts. Equities attract a broader mix of retail and institutional traders; by contrast, bond markets are dominated by institutional investors seeking predictable income and capital preservation. Further, while some of the markets close at 3:30 PM, the debt markets including secondary markets for CPs, CDs and corporate bonds have longer market hours till 5:00 PM. The present trading hours for Government securities market also facilitate primary dealers to manage the allotments during the primary auctions as well as OMOs in an optimal manner. 4.13 The Group discussed the possible impact of any curtailment in timings for Government securities market on non-resident participation, particularly in light of the growing interest of non-residents in the Indian markets. The Group noted that non-resident participation is reasonably high in the Indian equity markets, even though they operate till 3:30 PM. The Group, however, felt that the dynamics of non-resident participation in the equity and the debt markets may be different. It was noted that based on the feedback from the non-resident investors that extant matching, reporting and margining requirements for trading in Government securities effectively curtails available market hours, the Reserve Bank has permitted non-residents additional three hours from close of market to report their trade. Curtailing the market hours further could affect ability of non-resident investors to participate in the market optimally. While a section of market participants had indicated being comfortable with shorter market trading hours, the feedback was not unanimous. On a review, the Group felt that each market’s trading hours should be set according to its own liquidity patterns and price‑discovery needs and was of the view that the extant trading hours for Government securities markets be retained. 4.14 Certain participants also suggested an extension in trading hours so that there is an overlap with the US markets to cater to non-resident investors. Suggestions were also received to extend the trading timings with breaks in between, similar to the structure followed in a few Asian countries. The Group noted that the trading hours in the Indian markets overlap with that of other major Asian and European economies and that the only major market without an overlap in trading timing is the US market. It was observed that, any extension in market trading timings has two major challenges. First, extension of trading timings may lead to a distribution of existing liquidity in the market over a longer period, in the absence of any significant incremental trading demand, and could adversely influence the price transmission and market efficiency. Second, the extended trading timings may pose challenges in terms of operational overheads, especially with respect to settlement processing and back-office functions. Therefore, the Group was not in favour of extension in the current market timings of the Government securities market. 4.15 As an alternative to extending market hours, the Group received suggestions to permit market makers to offer quotes to non-residents post onshore market hours. Stakeholders cited similar practice adopted in some of the other Asian jurisdictions (para 3.18) and indicated that transactions beyond onshore market hours are already permitted in the Indian foreign exchange and interest rate derivative markets. The Group, however, observed that the underlying dynamics of the foreign exchange market and debt market are different. Foreign exchange markets are primarily driven by currency conversion needs and are globally more liquid than debt markets, which meet financing and investment needs. The Group also noted that while most FPIs investing in India have an Asian office and are able to meet their requirements during the onshore trading hours, there are also US-based investors without presence in Asia who face difficulties in investing in Government securities. On a balance, the Group felt that permitting market-makers to offer quotes to non-residents post onshore trading hours, would be a better alternative. 4.16 The Group deliberated on two potential models for post onshore market price quoting to non-resident investors: In both cases, transactions post onshore market hours will be undertaken on a T+2 settlement basis (as is already allowed for FPIs) and will be reported to NDS-OM for settlement during a window between 7:00 AM and 8:30 AM on T+1 date. 4.17 After reviewing operational feasibility of each option, the Group felt that a window till 11:30 PM to provide quotes to non-residents would adequately meet the requirement of overlap with the US market. The Group noted that if trades post onshore market hours are permitted, CCIL would be required to make appropriate arrangements at their end to facilitate reporting of such trades on T+1 date. The Group also felt that the quantum of trades post onshore market hours was not expected to be large (as has been the experience of peer Asian economies). This mechanism may be reviewed at a later period based on the experience and trends in trading volume. 4.18 The Group also received multiple suggestions from varying stakeholders related to settlement of primary auction of Government securities, OMO and secondary market transactions in Government securities. The Group deliberated on suggestions by a few stakeholders to shift the settlement of primary market auctions to a later part of the day as this could provide participants with more time to arrange for funds. The Group noted that while shifting the primary auction settlement to the second half of the day is operationally viable, some participants use securities allotted in the primary auction as collateral for borrowing in market repo and TREP. It, therefore, felt that settlement timing of primary auction should not be changed. 4.19 The Group also discussed the possibility of merging the primary auction settlement with settlement of secondary market transactions noting that the merger of primary and secondary market settlements could significantly enhance netting efficiencies and reduce liquidity requirements. However, the Group acknowledged the legal and operational challenges associated with merging of the settlement of primary auctions, which are not guaranteed by the CCIL, and secondary market transactions which are guaranteed. Similar challenges would also arise in case of any proposal to merge the settlement of the Reserve Bank’s liquidity operations with the settlement of Government securities secondary market transactions. 4.20 As the settlement of Government securities transactions starts after the close of collateralised money market segment, the settlement of outright Government securities transactions would be shifted to 5:30 PM - 6:30 PM, basis the proposal for extension in trading timings of collateralised segment to 4:00 PM. 4.21 The Group also discussed the feasibility of permitting T+0 transactions in Government securities to enhance liquidity management. Similar feedback was also received from nonresident investors who do not have access to the repo market. However, the Group felt that alternative instruments for liquidity management are available for most market participants and that permitting T+0 transactions in Government securities could fragment liquidity in the market and compromise price discovery by dispersing trading activity across multiple settlement cycles. Interest Rate Derivative Market 4.22 The Group did not receive any feedback for change in the trading and settlement timings of the IRD market, both OTC and exchange traded. The Group noted that any incremental FPI needs, due to proposed post onshore market trading in Government securities, may be met by post market hours trading in FCS-OIS. Foreign Exchange Market 4.23 The Group noted that currency markets are essentially hedging markets and trade from 9:00 AM till 3:30 PM with after-market hours trading permitted, effectively making them a 24x5 market. They are also influenced by information related to domestic and global developments such as changes in crude oil prices or release of major economic data globally. A significant portion of INR-based currency derivatives in the form of NDFs, are also traded offshore. 4.24 The Group received mixed suggestions regarding timing of the foreign exchange market. One view was that the current market timings be retained as: (a) the current trading hours are sufficient to meet the needs of the market participants; (b) post market hours trading is permitted for both residents and non-residents, if required; and (c) the uniform timing of equity and foreign exchange market may be retained. Another view supported the extension in current trading timing of foreign exchange market till 5:00 PM suggesting that the curtailed timing of foreign exchange market during COVID-19 pandemic has not been restored. Also, while larger participants were able to trade post market hours, the facility may not be uniformly available to all clients. Further, extension of market hours till 5:00 PM will be in alignment with other markets such as Government securities, IRD, etc. The Group did not receive any suggestion on timings of exchange traded currency derivatives market. 4.25 In view of the mixed feedback received by the Group about the market timings for the foreign exchange market, FEDAI was requested to undertake a member consultation on the issue. Based on the consultation, FEDAI submitted to the Group that the current trading timing of the foreign exchange market is adequate to meet the regular business requirements of the participants (both banks and clients) especially as the option of transacting beyond onshore market hours was also available. FEDAI also submitted that the extant timings provided sufficient overlap with Asian as well as European markets. 4.26 Taking all of the above into account, the Group felt that the needs of the market participants are adequately met by the current market timings in conjunction with post market trading being permitted. It noted that while the foreign exchange market and FCS-OIS market are permitted to function on a 24x5 basis, most of the transactions are concentrated in the onshore market hours. On balance, the Group felt that the existing market trading timings for foreign exchange market and related derivatives market should remain unchanged. 4.27 The Group deliberated on a suggestion to split the settlement of OTC foreign exchange transactions accepted by the CCIL for guaranteed settlement into two parts -one in the morning and one in the evening - to improve liquidity management. The Group felt that the splitting of settlement while providing flexibility to participants in arranging for funds, may minimise the netting benefits achieved through single-stage settlement while adding to operational challenges. The Group felt that the single daily settlement of OTC foreign exchange transactions by CCIL should be retained. 5. SUMMARY OF RECOMMENDATIONS The Group reviewed the existing trading and settlement timing of various markets regulated by the Reserve Bank in the light of the developments in the financial markets over the last decade or so, as set out in Chapter 2 of this Report, taking cognisance of the various considerations impacting and being impacted by market timings, as set out in Chapter 3 of this Report, as well as the various feedback gathered by the Group during its interactions with different sets of market participants, as set out in Chapter 4. The Group aimed to assess whether the current trading and settlement timings continue to support market efficiency and to make recommendations on where changes in the timings can foster greater efficiencies. While making its recommendations, the Group remained mindful of associated operational feasibilities and infrastructure capabilities of market participants and market infrastructure providers. Based on these aspects, the Group makes the following recommendations: Money Market 5.1 Extend the call money market timings to 7:00 PM. Concomitantly, the reporting window for NDS-Call transactions, including for cancellations, should also be extended to 7:30 PM. 5.2 Unify and extend the timings of market repo and TREP trading hours till 4:00 PM. 5.3 Unify the TREP trading hours for members settling obligations through DSBs and through the Reserve Bank. 5.4 The settlement timings for repo transactions to be shifted to 5:30 PM – 6:30 PM in consonance with the shift in trading hours. 5.5 Prepone the pre-announced LAF auction timing to 9:30 AM – 10:00 AM. Fine-tuning auctions may continue to be held at any time during the day based on evolving liquidity needs. Government Securities Market 5.6 Maintain the existing market trading timings of 9:00 AM to 5:00 PM. 5.7 Permit post onshore market hours transactions in Government securities with nonresidents during a time window of 5:00 PM to 11:30 PM. Such transactions must be reported to NDS-OM on T+1 day between 7:00 AM – 8:30 AM, with settlement on a T+2 basis. 5.8 The settlement timings for Government securities will shift to 5:30 PM – 6:30 PM in line with the settlement of TREP and market repo. Interest Rate Derivative Market 5.9 Retain the existing market hours for interest rate derivatives (OTC and exchange-traded). Foreign Exchange Market 5.10 Retain the current market hours for the foreign exchange markets (OTC and exchange-traded). 5.11 Maintain the settlement mechanism of a single guaranteed settlement of OTC foreign exchange transactions by CCIL each day. Going forward, the Group acknowledged that market dynamics and trends are continuously changing, and the dynamics will continue to evolve with increasing integration of onshore and offshore markets, diversification of participant base, broadening of product suite and advances in trading technologies. Accordingly, the Group noted the need for a periodic review of market trading and settlement timings to ensure that they remained relevant given the evolving market microstructure.