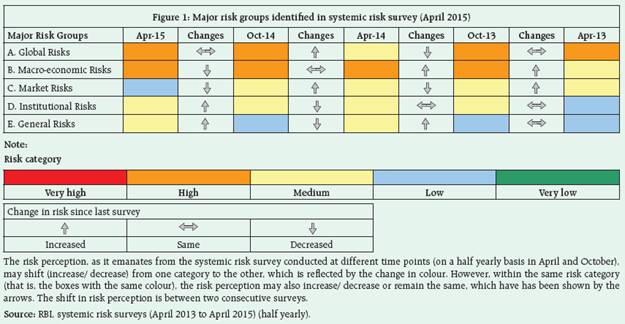

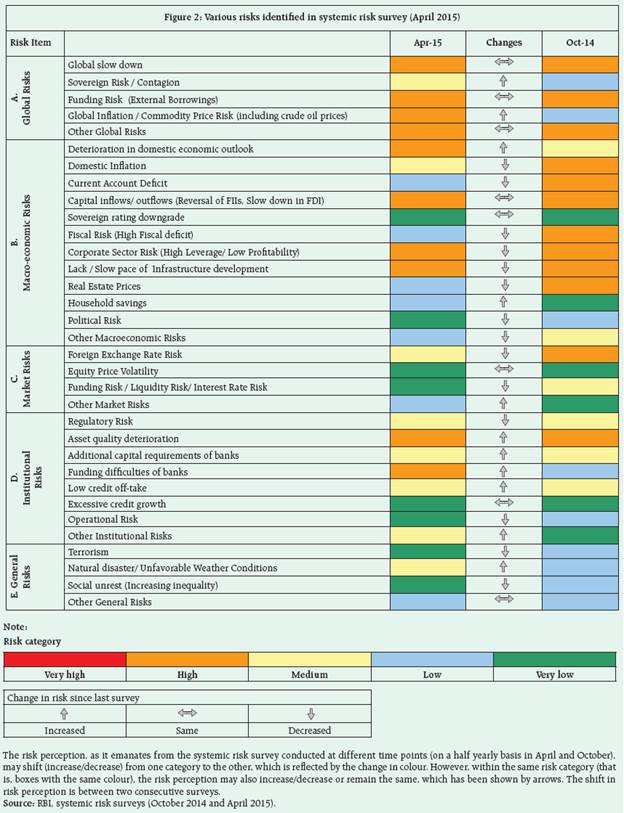

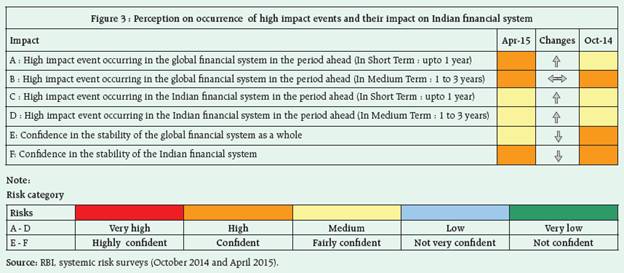

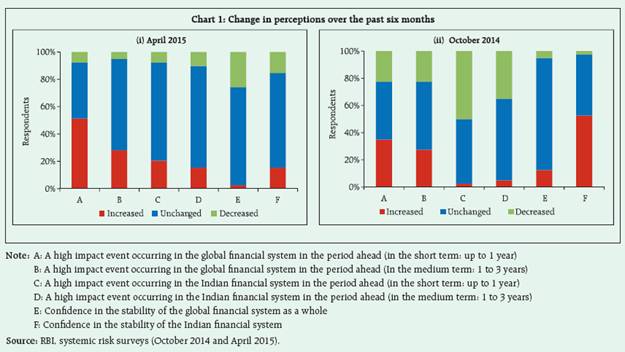

The systemic risk survey (SRS), the eighth in the series was conducted in April 20151 to capture the perceptions of experts, including market participants, on the major risks the financial system is facing. The results indicate that global risks and macroeconomic risks continued to be perceived as major risks affecting the financial system. The intensity of global risks, which had marginally increased in the last survey, remained at the same level. Macroeconomic risks though remained elevated at the high risk category in the current round of survey, its influence has reduced. Market risks have been perceived to be the low risk category in this survey, showing a cyclical nature with the rises & falls observed in an alternative round of survey. On the other hand, the Institutional risks, perceived to be in medium risk category, has increased from the previous survey. General risks which had decreased in the last survey, have again increased in the current round of the survey, mainly on account of perceived uncertainties about weather conditions (Figure 1). Within global risks, the risk of a global slowdown and global funding risks remained unchanged at an elevated mode in the current survey. While the sovereign risks increased to medium risk category in this survey, the global inflation risk indicated upward shift to high risk category among the global risk factors. Within the macroeconomic risk category, risks from deterioration in the domestic economic outlook increased into the high risk category in the current survey. The risks on account of domestic inflation, current account deficit and fiscal risks have declined considerably in the current survey. The risks emanating from slow pace of infrastructure development, capital inflows/outflows and corporate sector, though marginally receded, were still perceived to remain in the high risk category. Among the institutional risks, the asset quality of banks was still perceived as a high risk factor. While the regulatory and operational risks have reduced in the current survey, the risks on account of low credit off-take, additional capital requirements of banks and their funding difficulties have increased. Risk perceptions emanating from general risks due to natural disaster/ unfavorable weather conditions has increased, while general risks perception originating from terrorism and social unrest have receded during this round of survey (Figure 2).   Participants in the current survey felt that there is an increased possibility of a high impact event occurring in the global financial system in the period ahead (short term). They are not very confident about the global financial system, and more participants reflected that their confidence has marginally reduced during the past six months. However, according to participants, there is a medium possibility of an occurrence of a high impact event in the Indian financial system in the period ahead (short to medium term) as the experts have shown fair confidence in the Indian financial system (Figure 3 and Chart 1).   On the issue of likely changes in demand for credit in the next three months, the majority of the stakeholders are of the view that it may increase but marginally. A majority of the respondents had the impression that the average quality of credit may deteriorate marginally followed by a group of respondents who perceive that it is likely to remain unchanged in the next three months (Chart 2).

|