Global financial markets seem to have largely internalised tapering in the Federal Reserve’s bond purchase programme

and the focus has shifted to the likely path of policy interest rate in advanced economies (AEs), particularly the US.

In the recent period, emerging market and developing economies (EMDEs) experienced a significant spillover of

changes in the monetary policy stance in AEs. Against this backdrop, growth-inflation dynamics seem to have turned

less favourable for EMDEs increasing their vulnerability to spillovers from AEs.

Domestically, with political stability returning, the next level of reforms, better policy implementation and initiation

of steps to address supply side constraints will help revive the investment cycle and moderate inflation expectations.

External sector risks have receded because of timely policy interventions, although there is a need to work towards

reducing structural current account imbalances. Another concern is the dominance of stock market activity by

foreign institutional investors. Balancing fiscal restraint with a boost to capital spending, especially for developing

infrastructure will be a major challenge which can be partly addressed by creating a better environment for the

private sector.

In domestic financial markets, active management of liquidity by the Reserve Bank should ensure adequate flow

of credit to the productive sectors. The Securities and Exchange Board of India (SEBI) has taken several measures

to tackle volatility in the markets.

Global Backdrop

1.1. Volatility unleashed by the initial indications

of tapering of the Federal Reserve’s (Fed) bond

purchase programme about a year ago has subdued.

The adverse impact of increased volatility was

particularly severe in many emerging financial

markets including India. Consequently, tougher

monetary, fiscal and macro-prudential policy decisions

in emerging market and developing economies

(EMDEs) served to restore stability and confidence.

With tapering being largely internalised by the

financial markets, the focus has now shifted to the

path of policy interest rates in advanced economies

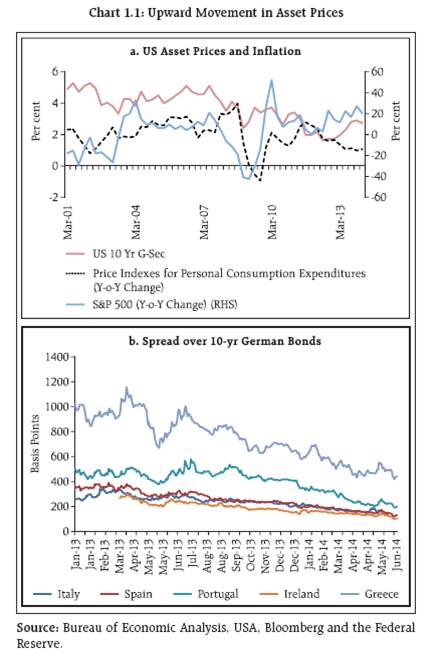

(AEs). In the US, inflation1 is below the policy goal

while the unemployment rate fell to below 6.5 per

cent in the recent period. However, declining labour

force participation rates suggest considerable slack in

labour markets. Further, US GDP contracted in Q1

2014 though it is expected to improve in subsequent quarters. The situation is no better in the Euro area

where fears of deflation have raised questions about

the monetary policy stance. Asset prices have risen

in these economies (Charts 1.1a and 1.1b). In a radical

move to avoid deflation, the European Central Bank

(ECB), cut its deposit rate from zero to -0.10 per cent

and its main refinancing rate to 0.15 per cent from

0.25 per cent recently. ECB’s policy move along with

the quantitative and qualitative easing (QQE) in Japan,

may reduce the impact of the Fed’s tapering on global

liquidity.

1.2. With regard to other risks, moderation in

China’s growth is evident as its economy seems to be

shifting from an investment led model to a more

sustainable growth path with a gradual transition to

a more market based economy. Geo-political risks

emanating in Iraq, Eastern Europe and in Asia Pacific

may have implications for global energy prices and

trade. Against this backdrop, EMDEs need to be more

alert to ward off possible spillovers.

The Case for Monetary Policy Coordination

1.3. With the eventual removal of policy

accommodation in the AEs, better global policy

coordination could reduce unexpected spillovers and

improve trust which may be essential for future

coordination. In the absence of global policy

coordination, cooperation and global safety nets,

EMDEs may have to resort to less than optimal policy

options such as strong macro-prudential measures

including capital controls and reserve accumulation.

With their enormous clout, countries whose

currencies serve as reserve assets can induce negative

externalities on EMDEs through changes in their

monetary policies. While policy coordination has been

initiated in the context of global trade, Globally

Systemically Important Banks (G-SIBs) and other

regulatory areas to stem negative externalities, policy

cooperation/coordination is yet to be recognised in

the context of reducing spillovers from changes in

monetary policy especially with respect to AEs.

Domestic Scenario

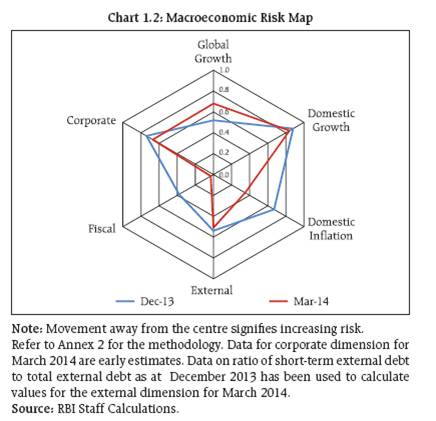

1.4. The risks being faced by the Indian economy

receded between December 2013 and March 2014

(Chart 1.2) following, among other developments, a

series of policy measures. In particular, India

tightened its monetary policy as an immediate

measure to shield against volatility emanating from

Fed’s intention to taper its bond purchase programme.

These measures were augmented by policies aimed

at attracting capital flows and overseas borrowings,

particularly the window for banks to swap their fresh

foreign currency non-resident (FCNR(B)) dollar funds

with Reserve Bank bolstered reserves. Policy measures

taken to curb gold imports helped in reducing the

current account deficit (CAD). Formation of a stable

government at the centre has ameliorated political

risk and has led to expectations of better policy

coordination and implementation which has had a

positive impact on the markets. Going forward, in

general the risks that the Indian economy is facing

are expected to fall. However, in comparison to the recent past, there could be some deterioration on the

current account and fiscal deficit fronts.

Low Growth-High Inflation

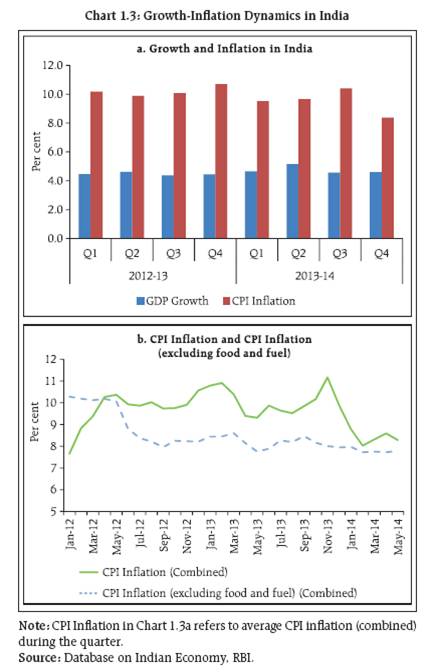

1.5. The growth-inflation setting in India was

adverse for seven of the last eight quarters with below

5 per cent GDP growth and high CPI inflation (Chart

1.3a). Persistent high inflation can alter inflation

expectations permanently and may lead to

disintermediation in the economy with resultant

adverse effects on financial savings, investment and

growth. High inflation can also interfere with the

financial sector’s ability to allocate resources

effectively as price uncertainty can alter inflation

expectations, which can significantly increase risk

premia in financial transactions. Formation of a stable

government and the expectation that the new

government will address supply side constraints will

have a positive impact on inflationary expectations.

Although CPI inflation (combined) moderated during

the last quarter of 2013-14, inflation in CPI excluding

the food and fuel segments was persistent at around

8 per cent (Chart 1.3b). In this context, the efforts to

stabilise the economy through monetary policy

interventions needs to be complimented by

appropriate fiscal policy measures.

1.6. GDP growth was marginally higher during

2013-14 than it was in 2012-13 though it continued

to be sub-5 per cent for the second consecutive year.

This largely reflected a contraction in the industrial

sector even as agricultural growth improved due to

the good monsoon while the services sector remained

unchanged (Table 1.1). Increase in growth of index

of industrial production (IIP) during April 2014 and

improvement in export performance during May 2014

point towards recovery in growth. Easing of domestic

supply bottlenecks and progress on the implementation

of stalled projects that have already been cleared

should further improve the growth outlook.

Table 1.1: Real GDP Growth-Supply Side (per cent) |

|

2012-13 |

2013-14 |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

Q4 |

I. Agriculture, forestry & fishing |

1.8 |

1.8 |

0.8 |

1.6 |

4.0 |

5.0 |

3.7 |

6.3 |

II. Industry |

-0.6 |

0.1 |

2.0 |

2.0 |

-0.9 |

1.8 |

-0.9 |

-0.5 |

(i) Mining & quarrying |

-1.1 |

-0.1 |

-2.0 |

-4.8 |

-3.9 |

0.0 |

-1.2 |

-0.4 |

(ii) Manufacturing |

-1.1 |

0.0 |

2.5 |

3.0 |

-1.2 |

1.3 |

-1.5 |

-1.4 |

(iii) Electricity, gas & water supply |

4.2 |

1.3 |

2.6 |

0.9 |

3.8 |

7.8 |

5.0 |

7.2 |

III. Services |

6.7 |

6.5 |

6.1 |

5.8 |

6.5 |

6.1 |

6.4 |

5.8 |

(i) Construction |

2.8 |

-1.9 |

1.0 |

2.4 |

1.1 |

4.4 |

0.6 |

0.7 |

(ii) Trade, hotels, transport & communication |

4.0 |

5.6 |

5.9 |

4.8 |

1.6 |

3.6 |

2.9 |

3.9 |

(iii) Financing, insurance, real estate and business services |

11.7 |

10.6 |

10.2 |

11.2 |

12.9 |

12.1 |

14.1 |

12.4 |

(iv) Community, social & personal services |

7.6 |

7.4 |

4.0 |

2.8 |

10.6 |

3.6 |

5.7 |

3.3 |

( IV) GDP at factor cost |

4.5 |

4.6 |

4.4 |

4.4 |

4.7 |

5.2 |

4.6 |

4.6 |

Source: Central Statistics Office. |

Savings and Investments

1.7. Low domestic growth and high inflation

continue to have an adverse effect on saving-investment

dynamics. While households’ financial

savings (which include bank deposits) as per cent of

GDP have been falling, expenditure on valuables2

(which includes gold) has risen over the last few years

though it declined in 2013-14 (Chart 1.4). This trend

reflects financial disintermediation with households

switching away from financial savings to valuables

mainly gold. High inflation and the consequent low

real rate of return on financial assets may force savers

to assume excessive risks in their search for yield.

1.8. Gross capital formation (GCF) declined for the

second consecutive year in 2012-13. This decline was

led by the private corporate sector adversely impacting

the growth prospects of the economy (Chart 1.5).

Efficient disintermediation through fund raising

activities in the Indian capital markets, particularly

via public issues, was low in recent years (Chart 1.6)

given the subdued investment climate. The Securities

and Exchange Board of India (SEBI) has proposed

significant measures to revitalise the primary market,

which include changes in minimum dilution norms

for initial public offers (IPOs), minimum public share

holding for public sector undertakings, investment bucket for anchor investors and eligibility criteria for

‘offer for sale’ in an IPO, among others. A number of issues have been hindering the development of the

corporate bond market in India (Box 1.1).

Box 1.1: The Corporate Bond Market in India

The corporate bond market in India saw a growth in

issuances during the last five years. However, the

development of the corporate bond market in India has

lagged behind in comparison with the G-Sec market owing

to many structural factors. While primary issuances have

been significant, most of these are accounted for by public

sector financial institutions and are usually issued on a

private placement basis to institutional investors. The

secondary market has not developed commensurately

and market liquidity has been very low. Dormancy in the

Indian corporate bond market is attributed to a range of

factors.

Traditionally, the Indian financial system has been

dominated by banks with corporates relying more on loan

financing as compared to bond financing. Corporates

consider loan financing easier, less rigorous and

operationally more flexible, especially cash credits3. Banks

also find loan financing more convenient as they do not

need to mark-to-market (MTM) the loans vis-à-vis the

bonds. Further, banks prefer loan financing because it

provides them a greater degree of control and monitoring

over the performance of specific projects/activities of

corporate borrowers unlike bond financing where banks

have to rely on public disclosures of the financials by

corporates. Another major bottleneck in the growth of

secondary market liquidity is the large number of small

size bond issuances. Consolidation of corporate bond

issues through re-issuances may be needed to improve

market functioning. Internationally, insurance companies

are among the largest participants in the corporate bond

market. However, in India, institutional investors like

insurance companies, pension funds and the Employees’

Provident Fund Organisation (EPFO) which have large

assets under their management still have several

constraints in the nature of investment mandates

resulting in their limited participation in the corporate

bond market. Since pension funds and insurance

companies have to provide safe and guaranteed returns,

they prefer government securities. Further, unavailability

of the credit risk transfer mechanism in the corporate

bond market also works as a deterrent.

Though credit default swaps (CDS) have been introduced

in India, there is negligible activity in the market. One of the major constraints in this regard is the restriction on

the netting of the MTM position against the same

counterparty in the context of capital adequacy and

exposure norms. Without netting, trades in CDS have

become highly capital-intensive as banks and primary

dealers (PDs) have to provide higher capital charges on a

gross basis even if they act as market makers and have a

‘positive’ and ‘negative’ position against the same

counterparty. Netting has not been allowed by the Reserve

Bank due to lack of legal clarity. The absence of robust

bankruptcy laws is also reckoned as one of the major

reasons for low levels of investor interest in corporate

bonds. The current system of dissemination of

information in the corporate debt market is not robust.

There is no information on company-wise issuance data,

‘option’ availability, outstanding amount and rating,

among other relevant information, at one place. However,

of late, SEBI has mandated that both the depositories viz.

National Securities Depositary Limited (NSDL) and

Central Depository Services (India) Limited (CDSL) jointly

create, host, maintain and disseminate a centralised

database of corporate bonds/debentures. Other measures

taken by SEBI are aimed at according standardisation to

corporate bonds, improving transparency and bringing

them in line with dated government securities.

The success of order matching trading platform negotiated

dealing system-order matching (NDS-OM) in the G-Sec

market can act as a guide for setting up an order matching

trading platform for the corporate bond market. SEBI has

advised stock exchanges to start a separate anonymous

trading platform like NDS-OM. Though NSE has

introduced such a platform the trading volumes have

been negligible. Due to lack of central counterparty (CCP)

facility, market participants have not shown an interest

in routing transactions through the trading platform and

instead prefer to execute trades in the over the counter

(OTC) environment. Further, different state governments

charge different stamp duty on corporate bonds. Further,

there is a need for uniformity in stamp duty across all

states for bond issuance or re-issuances, debt assignment

and pass through certificates, for development of

corporate bond market.

Fiscal Constraints

1.9. The fiscal consolidation process, which had

resumed in 2012-13 through mid-year course

corrective measures, was continued in 2013-14 (PA).

With the growth slowdown affecting tax collections,

particularly indirect tax collections, and market

conditions not being conducive for meeting

disinvestment targets, the recent reduction in fiscal

defecit was mainly achieved through a sharp cutback

in ‘plan’ expenditure and higher receipts of non-tax

revenues that may not be recurring in nature. While

the need for fiscal consolidation cannot be over-emphasised,

it is important to ensure that its quality

is not compromised (Chart 1.7). It might be challenging,

but a fine balance needs to be struck between

containing the fiscal deficit on the one hand and

making investments in infrastructure to boost growth

on the other.

1.10. The net market borrowing of the central

government for 2014-15 has been budgeted at `4,573

billion, which is lower than the revised estimates at

`4,689 billion during the last fiscal year. Besides the

fiscal outlook, other factors including private credit

off-take, capital flows and the interest rate cycle

impact the government market borrowing programme.

A planned reduction in deficits and in the government’s

market borrowing will leave more resources for the

private sector.

Liquidity Conditions

1.11. The Reserve Bank capped borrowings by banks

from the liquidity adjustment facility (LAF) window

in July 2013 (Chart 1.8a). One of the objectives of

capping borrowings from LAF and of introducing term

repos was to reduce banks’ reliance on Reserve Bank’s

overnight liquidity facilities and to shift the remaining

eligible liquidity support to term segments with a

view to promoting the development of the term

money market and providing greater flexibility to

banks in managing their reserve requirements. Money

market activity (excluding Reserve Bank’s participation)

is captured in Chart 1.8b. Liquidity stress increased between mid July 2013-end October 2013 after banks’

borrowings from the overnight LAF were capped by

the Reserve Bank leading them to borrow from the

marginal standing facility (MSF) window. With the

introduction of RBI’s term repo window, the liquidity

stress fell and call rates have more or less remained

within the policy rate corridor (Chart 1.8c).

External Sector

1.12. India’s CAD at 4.7 per cent of GDP in 2012-13

deteriorated substantially mainly because of an

increase in trade deficit due to a slowdown in major

trade partner economies, inadequate pass-through of

higher global oil prices and a sharp rise in demand

for precious metals like gold and silver. Modest

recovery in key partner economies and the depreciation

of the rupee helped India boost its exports in 2013-14

and robust demand for software exports also

improved earnings from invisibles. With a fall in gold

imports mainly due to restrictions, the trade balance

improved during 2013-14 (Chart 1.9a). Thus, the

current account which had been under stress since

2011-12 was brought to a sustainable level during

2013-14 and CAD fell from 4.7 per cent during 2012-

13 to 1.7 per cent during 2013-14. This along with

strong capital inflows, particularly NRI deposits

(Chart 1.9b), brought stability to the external front.

Reduction in CAD, improvement in capital inflows,

accretion to foreign exchanges reserves and stability

of the exchange rate improved the external sector’s

resilience.

1.13. Recent bullish sentiments in domestic stock

markets seem to have been largely supported by

foreign institutional investors (FIIs) (Charts 1.10a

and 1.10b).

Corporate Sector Performance

1.14. There has been some improvement in the

performance of the corporate sector in the half year

ending March 2014 when compared to the previous

half year (Chart 1.11)4. Improvement is witnessed

in the profitability, leverage, sustainability and

turnover dimensions.

1.15. ‘Construction’, ‘electricity generation and

supply’ and ‘iron & steel’ are the major industries

burdened with interest expenses along with high

leverage (Chart 1.12). Further, ‘textiles’, ‘transport,

storage & telecommunications’ also show relatively

high burden of interest payments and leverage5.

Sector/Industry Analysis – Select Indicators

1.16. Leverage of Indian corporates increased across

major sectors/industries during 2010-11 and 2012-13

(Chart 1.13 i.a)6. Within manufacturing sector, ‘iron & steel’ and ‘textiles’ had relatively higher leverage.

In the services sector, ‘transportation’ was burdened

with higher leverage mainly on account of air

transport companies (Chart 1.13 i.b).

1.17. The interest coverage ratio9, which

reflects the ability of corporates to service borrowings

with the present level of profits fell across sectors

(Chart 1.13 ii.a) with mining & quarrying experiencing

the sharpest decline. Within the manufacturing

sector, ‘motor vehicles & transport equipment’, ‘nonelectrical

equipments’ and ‘electrical equipments’

industries witnessed a considerable fall in the interest

coverage ratio (Chart 1.13 ii.b).

1.18. Stress was also visible in the declining

operating profit margins10 of Indian corporates. All

sectors witnessed declining operating profit margins

(Chart 1.13 iii.a), with mining & quarrying experiencing

relatively larger decline. Industries such as ‘real

estate’ and ‘non-electrical equipments’ experienced

sizeable fall in their operating profit margins

(Chart 1.13 iii.b).

|