| The Indian

economy continued to record robust growth in 2007-08, although marginally lower

than the last year. According to the revised estimates released by the Central

Statistical Organisation (CSO) in May 2008, the real GDP growth was placed at

9.0 per cent during 2007-08 as compared with 9.6 per cent in 2006-07. The deceleration

in growth was on account of industry and services, offset partially by recovery

in agriculture. The overall growth momentum moderated particularly during the

second half of the year (Table 1 and Chart 1).

Table

1: Growth Rates of Real GDP @ | (Per

cent) | Sector | 2000-01

to2007-08(Average) | 2005-06 | 2006-07

* | 2007-08

# | 2006-07 | 2007-08 |

Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 |

1 |

| 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 |

1. | Agriculture

and | 2.9 | 5.9 | 3.8 | 4.5 | 2.7 | 3.2 | 4.0 | 4.9 | 4.4 | 4.7 | 6.0 | 2.9 |

| Allied

Activities | (20.9) | (19.6) | (18.5) | (17.8) | | | | | | | | |

2. | Industry | 7.1 | 8.0 | 10.6 | 8.1 | 10.0 | 10.7 | 10.3 | 11.5 | 9.6 | 8.6 | 8.6 | 5.8 |

| | (19.6) | (19.4) | (19.5) | (19.4) | | | | | | | | |

| 2.1 | Mining

and Quarrying | 4.9 | 4.9 | 5.7 | 4.7 | 4.1 | 3.9 | 6.0 | 8.2 | 1.7 | 5.5 | 5.7 | 5.9 |

| 2.2 | Manufacturing | 7.8 | 9.0 | 12.0 | 8.8 | 11.7 | 12.2 | 11.3 | 12.8 | 10.9 | 9.2 | 9.6 | 5.8 |

| 2.3 | Electricity,

Gas and | | | | | | | | | | | | |

| | Water

Supply | 4.8 | 4.7 | 6.0 | 6.3 | 4.3 | 6.6 | 7.6 | 5.4 | 7.9 | 6.9 | 4.8 | 5.6 |

3. | Services | 9.0 | 11.0 | 11.2 | 10.7 | 11.7 | 11.6 | 11.1 | 10.5 | 10.6 | 10.7 | 10.0 | 11.4 |

| | | (59.6) | (61.1) | (61.9) | (62.9) | | | | | | | | |

| 3.1 | Trade,

Hotels, | | | | | | | | | | | | |

| | Restaurants,

Transport, | | | | | | | | | | | | |

| | Storage

and | | | | | | | | | | | | |

| | Communication | 10.3 | 11.5 | 11.8 | 12.0 | 10.9 | 12.7 | 12.1 | 11.6 | 13.1 | 11.0 | 11.5 | 12.4 |

| 3.2 | Financing,

Insurance, | | | | | | | | | | | | |

| | Real

Estate and | | | | | | | | | | | | |

| | Business

Services | 8.8 | 11.4 | 13.9 | 11.8 | 13.6 | 13.9 | 14.7 | 13.4 | 12.6 | 12.4 | 11.9 | 10.5 |

| 3.3 | Community,

Social | | | | | | | | | | | | |

| | and

Personal services | 5.8 | 7.2 | 6.9 | 7.3 | 10.3 | 7.2 | 5.6 | 5.1 | 5.2 | 7.7 | 6.2 | 9.5 |

| 3.4 | Construction | 10.6 | 16.5 | 12.0 | 9.8 | 13.1 | 12.0 | 10.8 | 12.2 | 7.7 | 11.8 | 7.1 | 12.6 |

4. | Real

GDP at Factor Cost | 7.3 | 9.4 | 9.6 | 9.0 | 9.6 | 10.1 | 9.3 | 9.7 | 9.2 | 9.3 | 8.8 | 8.8 |

| | | (100) | (100) | (100) | (100) | | | | | | | | |

Memo: | | | | | | | | | | (Amount

in Rupees crore) | a) | Real

GDP at Factor Cost | 26,12,847 | 28,64,310 | 31,22,862 | | | | | | | | |

b) | GDP

at Current Market Prices | 35,80,344 | 41,45,810 | 47,13,148 | | | | | | | | |

@ : At 1999-2000 prices. *

: Quick Estimates. # : Revised Estimates.

Note

:

Figures in parentheses indicate shares in real GDP.

Source

: Central Statistical Organisation. |

Agricultural

Situation

According to the revised forecast of the India Meteorological

Department (IMD) released in June 2008, the rainfall during the 2008 South-West

monsoon season (June to September) is likely to be 100 per cent of the long period

average (LPA) with a model error of (+/-) 4 per cent. Monsoon set in over Kerala

on May 31, 2008 coinciding almost with its normal date of arrival (June 1). It

advanced rapidly and covered parts of south peninsula and entire north-eastern

States by June 2, 2008. Northward advance of monsoon over east and central India

also has been near normal. Advance of this year’s monsoon has been smooth

and rapid, unlike last year when it was marked by a hiatus of about one week over

south peninsula. Rainfall during this year’s monsoon so far (up to July

23) has been less satisfactory, with rainfall over the entire country amounting

to 2 per cent below normal as against 4 per cent above normal during corresponding

period of the previous year (Table 2). Out of the 36 meteorological

sub-pisions, 21 have received excess/normal rainfall this year (up to July 23)

as compared with 29 last year. As on July 17, 2008, the total live water storage

of 81 important reservoirs accounting for around 72 per cent of the total reservoir

capacity of the country was 28 per cent of the full reservoir level (FRL) as compared

to 45 per cent recorded during the corresponding period of the previous year.

The average live water storage as per cent of FRL for the last ten years has been

much lower at 25 per cent. Kharif sowing is progressing with the

advent of the South-West monsoon in various States. Area coverage under kharif

crops up to July 18, 2008 was higher by 1.3 million hectares over the corresponding

period of the previous year. Among food crops, rice exhibited significant increase

in sown area along with coarse cereals and oilseeds (Table 3).

Table

2: Cumulative Rainfall | (Number

of Meteorological pisions) | Year | South-West

Monsoon | North-East

Monsoon | Cumulative

Rainfall:

Above(+)/

Below (-)

Normal

(per cent) | Spatial

Distribution | Cumulative

Rainfall:

Above(+)/

Below (-)

Normal

(per cent) | Spatial

Distribution | Excess

Rainfall | Normal

Rainfall | Deficient

Rainfall | Scanty/

No Rain | Excess

Rainfall | Normal

Rainfall | Deficient

Rainfall | Scanty/

No Rain | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

1998 | 6 | 12 | 21 | 3 | 0 | - | 28 | 6 | 1 | 1 |

1999 | -4 | 3 | 26 | 7 | 0 | - | 20 | 7 | 6 | 3 |

2000 | -8 | 5 | 23 | 8 | 0 | - | 0 | 4 | 13 | 19 |

2001 | -8 | 1 | 30 | 5 | 0 | - | 14 | 10 | 9 | 3 |

2002 | -19 | 1 | 14 | 19 | 2 | -33 | 3 | 7 | 12 | 14 |

2003 | 2 | 7 | 26 | 3 | 0 | 9 | 9 | 9 | 6 | 12 |

2004 | -13 | 0 | 23 | 13 | 0 | -11 | 8 | 10 | 17 | 1 |

2005 | -1 | 9 | 23 | 4 | 0 | 10 | 11 | 6 | 5 | 14 |

2006 | -1 | 6 | 20 | 10 | 0 | -21 | 3 | 6 | 14 | 13 |

2007 | 5 | 13 | 17 | 6 | 0 | -32 | 2 | 7 | 9 | 18 |

2008* | -2 | 9 | 12 | 14 | 1 | | | | | |

| (4) | (14) | (15) | (7) | (0) | | | | | |

* : up to July 23. Excess

: +20 per cent or more. Normal : +19 per cent to -19 per cent.

Deficient :

-20 per cent to -59 per cent. Scanty : -60 per cent to -99 per cent.

No Rain

: -100 per cent.

Note

: Figures in parentheses

indicate comparative position during the corresponding period of 2007.

Source: India Meteorological Department. |

Table

3: Progress of Area under Kharif Crops 2008-09 |

(Million

hectares) | Crop | Normal

Area | Area

Coverage (As on July 18, 2008) |

|

| 2007 | 2008 | Variation |

1 | 2 | 3 | 4 | 5 |

Rice | 39.1 | 12.1 | 14.9 | 2.8 |

Coarse Cereals | 22.7 | 9.6 | 9.9 | 0.3 |

of which: | | | | |

Bajra | 9.2 | 3.2 | 4.0 | 0.8 |

Jowar | 4.2 | 1.8 | 1.3 | -0.5 |

Maize | 6.4 | 4.3 | 4.1 | -0.2 |

Total Pulses | 10.9 | 4.2 | 4.2 | 0.0 |

Total Oilseeds | 15.9 | 9.9 | 10.1 | 0.2 |

of which: | | | | |

Groundnut | 5.4 | 3.0 | 2.7 | -0.3 |

Soyabean | 7.3 | 5.5 | 6.5 | 1.0 |

Sugarcane | 4.1 | 5.3 | 4.3 | -1.0 |

Cotton | 8.4 | 7.0 | 5.8 | -1.2 |

All Crops | 101.9 | 48.8 | 50.1 | 1.3 |

Source : Ministry

of Agriculture, Government of India. | According to the

Fourth Advance Estimates, the foodgrains production during 2007-08 was placed

at an all-time high of 230.7 million tonnes, indicating an increase of 6.2 per

cent over the previous year predominantly on account of kharif foodgrains

production. Barring sugarcane, all foodgrains and non-foodgrains are estimated

to reach an all-time record production during 2007-08 (Table 4).

Crops witnessing significant increase in production included coarse cereals (20.1

per cent) and oilseeds (18.6 per cent). Food Management

The procurement of foodgrains (rice and wheat) during 2008-09 (up to July

18, 2008) aggregated to 27.3 million tonnes, 78.6 per cent higher than that in

the corresponding period of the previous year (Table 5). This

was mainly on account of a more than two-fold increase in wheat procurement during

the current year as compared with the previous year. The offtake of foodgrains

(rice and wheat) during 2007-08 at 37.4 million tonnes was marginally higher by

1.8

Table

4: Agricultural Production | (Million

tonnes) | Crop | 2003-04 | 2004-05 | 2005-06 | 2006-07 | 2007-08 |

Target | Achievement

@ | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

Rice | 88.5 | 83.1 | 91.8 | 93.4 | 93.0 | 96.4 |

Kharif | 78.6 | 72.2 | 78.3 | 80.2 | 80.0 | 82.8 |

Rabi | 9.9 | 10.9 | 13.5 | 13.2 | 13.0 | 13.6 |

Wheat | 72.2 | 68.6 | 69.4 | 75.8 | 75.5 | 78.4 |

Coarse Cereals | 37.6 | 33.5 | 34.1 | 33.9 | 37.5 | 40.7 |

Kharif | 32.2 | 26.4 | 26.7 | 25.6 | 28.7 | 31.7 |

Rabi | 5.4 | 7.1 | 7.3 | 8.3 | 8.8 | 9.0 |

Pulses | 14.9 | 13.1 | 13.4 | 14.2 | 15.5 | 15.1 |

Kharif | 6.2 | 4.7 | 4.9 | 4.8 | 5.5 | 6.5 |

Rabi | 8.7 | 8.4 | 8.5 | 9.4 | 10.0 | 8.7 |

Total Foodgrains | 213.2 | 198.4 | 208.6 | 217.3 | 221.5 | 230.7 |

Kharif | 117.0 | 103.3 | 109.9 | 110.6 | 114.2 | 121.0 |

Rabi | 96.2 | 95.1 | 98.7 | 106.7 | 107.3 | 109.7 |

Total Oilseeds | 25.2 | 24.4 | 28.0 | 24.3 | 30.0 | 28.8 |

Kharif | 16.7 | 14.1 | 16.8 | 14.0 | 18.5 | 19.8 |

Rabi | 8.5 | 10.2 | 11.2 | 10.3 | 11.5 | 9.0 |

Sugarcane | 233.9 | 237.1 | 281.2 | 355.5 | 310.0 | 340.6 |

Cotton # | 13.7 | 16.4 | 18.5 | 22.6 | 22.0 | 25.8 |

Jute and Mesta ## | 11.2 | 10.3 | 10.8 | 11.3 | 11.0 | 11.2 |

@ : Fourth Advance Estimates

as on July 9, 2008.

# : Million bales of 170 kgs each.

## : Million bales

of 180 kgs each.

Source : Ministry of Agriculture, Government

of India. |

Table

5: Management of Food Stocks | (Million

tonnes) | Month | Opening

Stock of Foodgrains | Procurement

of Foodgrains | Foodgrains

Offtake | Closing

Stock | Norms |

Rice | Wheat | Total | Rice | Wheat | Total | PDS | OWS | OMS-

Domestic | Exports | Total |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 2004-05 | 13.1 | 6.9 | 20.7 | 24.0 | 16.8 | 40.8 | 29.7 | 10.6 | 0.2 | 1.0 | 41.5 | 18.0 | |

2005-06 | 13.3 | 4.1 | 18.0 | 26.7 | 14.8 | 41.5 | 31.4 | 9.8 | 1.1 | 0.0 | 42.3 | 16.6 | |

2006-07 | 13.7 | 2.0 | 16.6 | 26.3 | 9.2 | 35.5 | 31.6 | 5.1 | 0.0 | 0.0 | 36.8 | 17.9 | |

2007-08 | 13.2 | 4.7 | 17.9 | 26.4 | 11.1 | 37.5 | 33.5 | 3.9 | 0.0 | 0.0 | 37.4 | 19.8 | |

2008-09 @ | 13.8 | 5.8 | 19.8 | 4.7 | 22.5 | 27.3 | .. | .. | .. | .. | .. | .. | |

| | | | (4.2) | (11.1) | (15.3) | | | | | | | |

2007 | | | | | | | | | | | | | |

January | 12.0 | 5.4 | 17.5 | 4.3 | 0.0 | 4.3 | 2.7 | 0.4 | 0.0 | 0.0 | 3.1 | 18.1 | 20.0 |

February | 12.6 | 5.4 | 18.1 | 2.4 | 0.0 | 2.4 | 2.7 | 0.5 | 0.0 | 0.0 | 3.1 | 19.1 | |

March | 14.0 | 5.1 | 19.1 | 1.2 | 0.0 | 1.2 | 2.7 | 0.5 | 0.0 | 0.0 | 3.2 | 17.9 | |

April | 13.2 | 4.7 | 17.9 | 0.9 | 7.9 | 8.7 | 2.6 | 0.2 | 0.0 | 0.0 | 2.8 | 25.1 | 16.2 |

May | 13.5 | 11.6 | 25.1 | 1.5 | 2.6 | 4.0 | 2.8 | 0.2 | 0.0 | 0.0 | 3.0 | 25.9 | |

June | 12.6 | 13.3 | 25.9 | 1.3 | 0.7 | 2.0 | 2.7 | 0.4 | 0.0 | 0.0 | 3.0 | 23.9 | |

July | 11.0 | 12.9 | 23.9 | 0.8 | 0.0 | 0.8 | 2.9 | 0.4 | 0.0 | 0.0 | 3.2 | 21.2 | 26.9 |

August | 9.2 | 12.0 | 21.2 | 0.1 | 0.0 | 0.1 | 2.8 | 0.3 | 0.0 | 0.0 | 3.0 | 17.9 | |

September | 6.9 | 11.0 | 17.9 | 0.1 | 0.0 | 0.1 | 2.7 | 0.3 | 0.0 | 0.0 | 2.9 | 15.6 | |

October | 5.5 | 10.1 | 15.6 | 7.4 | 0.0 | 7.4 | 2.7 | 0.3 | 0.0 | 0.0 | 2.9 | 19.7 | 16.2 |

November | 10.7 | 9.0 | 19.7 | 1.8 | 0.0 | 1.8 | 2.7 | 0.3 | 0.0 | 0.0 | 2.9 | 18.5 | |

December | 10.1 | 8.4 | 18.5 | 3.5 | 0.0 | 3.5 | 2.7 | 0.3 | 0.0 | 0.0 | 3.0 | 19.2 | |

2008 | | | | | | | | | | | | | |

January | 11.5 | 7.7 | 19.2 | 4.5 | 0.0 | 4.5 | 2.9 | 0.3 | 0.0 | 0.0 | 3.2 | 21.4 | 20.0 |

February | 14.0 | 7.2 | 21.4 | 3.0 | 0.0 | 3.0 | 2.9 | 0.4 | 0.0 | 0.0 | 3.4 | 21.4 | |

March | 14.7 | 6.5 | 21.4 | 1.6 | 0.0 | 1.6 | 3.1 | 0.5 | 0.0 | 0.0 | 3.5 | 19.8 | |

April | 13.8 | 5.8 | 19.8 | 1.1 | 12.6 | 13.7 | .. | .. | .. | .. | .. | .. | 16.2 |

May | .. | .. | .. | 2.1 | 8.8 | 10.9 | .. | .. | .. | .. | .. | .. | |

June | .. | .. | .. | 1.2 | 0.9 | 2.2 | .. | .. | .. | .. | .. | .. | |

July @ | .. | .. | .. | 0.3 | 0.2 | 0.5 | .. | .. | .. | .. | .. | .. | 26.9 |

PDS : Public Distribution

System.

OWS : Other Welfare Schemes. OMS : Open Market Sales. .. : Not Available.

@ : Procurement up to July 18, 2008.

Note : 1. Closing stock

figures may differ from those arrived at by adding the opening stocks and procurement

and deducting offtake, as stocks include coarse grains also.

2. Figures in

parentheses indicate procurement of foodgrains during the corresponding period

of 2007-08.

3. Total minimum stocks are to be maintained, as on April 1, July

1, October 1, and January 1, by public agencies under the 'new buffer stocking

policy' with effect from March 29, 2005.

Source : Ministry

of Consumer Affairs, Food and Public Distribution, Government of India. |

per cent than that of the previous year. The total stocks of

foodgrains with the Food Corporation of India (FCI) and other Government agencies

were at around 19.8 million tonnes as on April 1, 2008, which was higher by 10.2

per cent than that a year ago. Both, the stocks of rice (13.8 million tonnes)

and of wheat (5.8 million tonnes) were higher than their buffer stock norms (12.2

million tonnes and 4.0 million tonnes, respectively).

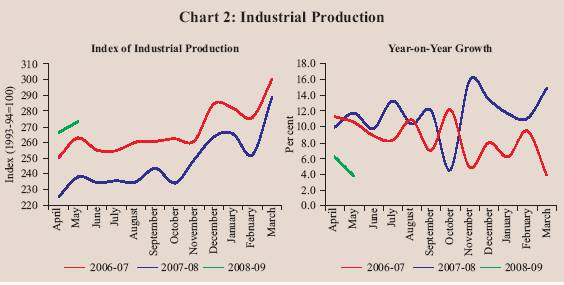

InIndustrial

Performance

Industrial production moderated during April-May

2008, recording year-on-year expansion of 5.0 per cent as against 10.9 per cent

in April-May 2007 (Chart 2 and Table 6). The

industrial deceleration was driven by both the manufacturing and electricity sectors.

Manufacturing recorded cumulative growth of 5.3 per cent during April-May 2008

as compared with 11.8 per cent during the corresponding period of the previous

year. Electricity sector at 1.7 per cent witnessed a sharp slowdown - the lowest

growth since 1994-95 for April-May period on account of decline in electricity

generation in all the three segments. The mining sector growth, however, accelerated.

The slowdown in manufacturing activity was driven by 13 industry groups (56.3

per cent weight in the IIP) that recorded decelerated/negative growth in April-May

2008 (Table 7). Industry groups such as 'metal products and

parts', 'other manufacturing industries', 'rubber, plastic, petroleum and coal

products', 'food products', 'jute and other vegetable fibre textiles' and 'wood

and wood products' recorded a decline in production; while 'leather and leather

and fur products', 'machinery and equipment', 'basic metal and alloy industries',

'wool, silk and manmade fibre textiles', 'textile products', 'cotton textiles'

and 'non-metallic mineral products' recorded decelerated growth. However, the

growth in 'chemicals and chemical products', a dominant segment of the manufacturing

industry, accelerated reflecting sharp expansion in nitrogenous fertilisers segment

and other pharmaceutical drugs.

Table

6: Index of Industrial Production: Sectoral and

Use-Based

Classification of Industries | (Per

cent) | Industry

Group | Weight

in the IIP | Growth

Rate | Weighted

Contribution# | 2007-08 | 2007-08 | 2008-09

P | 2007-08 | 2007-08 | 2008-09

P |

|

|

| April-May |

| April-May |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

Sectoral | | | | | | | |

Mining | 10.5 | 5.1 | 3.2 | 5.6 | 4.3 | 2.1 | 7.5 |

Manufacturing | 79.4 | 8.8 | 11.8 | 5.3 | 89.4 | 90.6 | 89.2 |

Electricity | 10.2 | 6.3 | 9.0 | 1.7 | 6.4 | 7.3 | 3.0 |

Use-Based | | | | | | | |

Basic Goods | 35.6 | 7.0 | 9.5 | 3.5 | 25.1 | 26.4 | 21.0 |

Capital Goods | 9.3 | 16.9 | 16.9 | 6.5 | 23.9 | 16.2 | 14.4 |

Intermediate Goods | 26.5 | 8.9 | 9.7 | 2.3 | 27.7 | 23.6 | 12.0 |

Consumer Goods (a+b) | 28.7 | 6.1 | 11.6 | 7.9 | 23.3 | 34.1 | 50.9 |

a) Consumer Durables | 5.4 | -1.0 | 0.8 | 4.8 | -1.0 | 0.6 | 7.3 |

b) Consumer Non-durables | 23.3 | 8.5 | 15.4 | 8.8 | 24.4 | 33.5 | 43.6 |

General | 100.0 | 8.3 | 10.9 | 5.0 | 100.0 | 100.0 | 100.0 |

P : Provisional.

# : Figures

may not add up to 100 due to rounding off.

Source : Central

Statistical Organisation. |

Table

7: Performance of Manufacturing Groups |

(Per

cent) | Industry

Group | Weigh

t

in the IIP | Growth

Rate | Weighted

Contribution # | 2007-08 | 2007-08

2008-09 P | 2007-08 | 2007-08 | 2008-09

P | April-May | April-May |

1 |

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

1. | Food

products | 9.08 | 7.1 | 39.3 | -7.9 | 6.4 | 21.9 | -12.3 |

2. | Beverages,

tobacco and | | | | | | | |

| related

products | 2.38 | 11.9 | 8.4 | 30.8 | 6.9 | 3.9 | 30.8 |

3. | Cotton

textiles | 5.52 | 4.3 | 7.4 | 1.5 | 2.0 | 2.7 | 1.2 |

4. | Wool,

silk and man-made | | | | | | | |

| fibre

textiles | 2.26 | 4.8 | 4.1 | 3.6 | 1.6 | 1.0 | 1.9 |

5. | Jute

and other vegetable | | | | | | | |

| fibre

textiles (except cotton) | 0.59 | 33.0 | 27.8 | -10.1 | 1.0 | 0.7 | -0.6 |

6. | Textile

products (including | | | | | | | |

| wearing

apparel) | 2.54 | 3.7 | 7.5 | 2.6 | 1.4 | 2.3 | 1.7 |

7. | Wood

and wood products, | | | | | | | |

| furniture

& fixtures | 2.70 | 39.6 | 87.9 | -17.4 | 5.3 | 6.9 | -5.1 |

8. | Paper

and paper products | | | | | | | |

| and

printing , publishing | | | | | | | |

| and

allied Industries | 2.65 | 2.7 | 0.8 | 2.5 | 1.0 | 0.2 | 1.4 |

9. | Leather

and leather & fur products | 1.14 | 11.5 | 8.9 | 8.5 | 1.1 | 0.6 | 1.3 |

10. | Chemicals

and chemical | | | | | | | |

| products

(except products of | | | | | | | |

| petroleum

& coal) | 14.00 | 10.6 | 6.6 | 12.2 | 22.8 | 11.6 | 45.9 |

11. | Rubber,

plastic, petroleum | | | | | | | |

| and

coal products | 5.73 | 8.9 | 13.2 | -5.2 | 6.2 | 7.1 | -6.4 |

12. | Non-metallic

mineral products | 4.40 | 5.7 | 8.1 | 1.4 | 4.2 | 4.6 | 1.7 |

13. | Basic

metal and alloy industries | 7.45 | 12.1 | 19.6 | 4.6 | 13.7 | 15.7 | 8.8 |

14. | Metal

products and parts | | | | | | | |

| (except

machinery and equipment) | 2.81 | -5.6 | 4.2 | -0.8 | -1.6 | 0.8 | -0.3 |

15. | Machinery

and equipment | | | | | | | |

| other

than transport equipment | 9.57 | 9.5 | 16.1 | 5.7 | 17.6 | 20.6 | 17.0 |

16. | Transport

equipment and parts | 3.98 | 2.9 | 1.8 | 11.6 | 2.3 | 1.1 | 14.0 |

17. | Other

manufacturing industries | 2.56 | 19.8 | -4.8 | -1.5 | 8.2 | -1.6 | -0.9 |

| Manufacturing

- Total | 79.36 | 8.8 | 11.8 | 5.3 | 100.0 | 100.0 | 100.0 |

P : Provisional. # : Figures

may not add up to 100 due to rounding off.

Source : Central

Statistical Organisation. | In terms of use-based

classification, the basic goods sector decelerated during April-May 2008, mainly

due to decline in production of certain petroleum and steel products. The intermediate

goods sector also witnessed deceleration, mainly on account of lower performance

of yarn, hessian, sacking and naptha segments. The capital goods sector that performed

well during 2007-08, decelerated to 6.5 per cent due to lacklustre performance

of printing machinery, material handling equipments, machine tools and computer

systems and peripherals during the period. The consumer goods sector recorded

decelerated growth due to moderated performance of non-durables. The consumer

durable goods industry, which declined in eight months of the last financial year,

posted 4.8 per cent growth during April-May 2008 led by the improved performance

of two wheeler tyres, window type air conditioners, washing/laundry machines,

motor cycles, passenger cars and T.V. receivers, among others. The consumer non-durables

segment moderated in April-May 2008 on account of base effect and decline in production

of sugar, wheat flour/maida, and certain edible oils.

Infrastructure

The core sector recorded lower growth at 3.5 per cent during April-May 2008

than 6.9 per cent during April-May 2007-08 (Chart 3). Sharp

deceleration in electricity and subdued performance of petroleum refinery products

impacted the growth of infrastructure during April-May 2008. The coal sector,

on the other hand, recovered and posted robust growth. The electricity sector

slowed down mainly on account of decline in nuclear and hydro electricity generation

along with lower plant load factor in thermal power plants. The cement sector

recorded decelerated growth due to base effect. The steel sector recorded moderate

growth on account of capacity constraints. Increased production in Oil and Natural

Gas Corporation (ONGC) Ltd. and Assam unit of Oil India Ltd. (OIL) contributed

to a turnaround in crude oil sector. The petroleum refinery sector decelerated

sharply on account of base effect and decline in production in some of the public

sector refineries.

Services

Sector

The services sector continued to record double digit

growth during 2007-08, although there was some moderation. Accelerated growth

in 'trade, hotels, transport, storage and communication' and 'community, social

and personal services' was more than offset by deceleration in 'financing, insurance,

real estate and business services' and 'construction'. Notwithstanding some moderation,

services sector remained the major contributor to the GDP growth (Table

8).

Table

8: Services Sectors – Contribution to Real GDP Growth |

(percentage

points) | Year/Quarter | Construction | Trade,

Hotels,

Transport and

Communication | Financing,

Insurance,

Real Estate

and Business

Services | Community,

Social

and

Personal

Services | Total

Services | 1 |

|

| 2 | 3 | 4 | 5 | 6 |

2000-01 | | | 0.4 | 1.6 | 0.5 | 0.7 | 3.2 |

2001-02 | | | 0.2 | 2.0 | 0.9 | 0.6 | 3.8 |

2002-03 | | | 0.5 | 2.2 | 1.1 | 0.6 | 4.3 |

2003-04 | | | 0.7 | 2.9 | 0.8 | 0.8 | 5.2 |

2004-05 | | | 1.0 | 2.7 | 1.2 | 1.0 | 5.8 |

2005-06 | | | 1.1 | 3.0 | 1.5 | 1.0 | 6.6 |

2006-07 | | | 0.8 | 3.1 | 1.9 | 1.0 | 6.8 |

2007-08 | | | 0.7 | 3.2 | 1.7 | 1.0 | 6.6 |

2006-07 | : | Q1 | 0.9 | 2.8 | 1.9 | 1.4 | 7.1 |

| : | Q2 | 0.9 | 3.4 | 2.0 | 1.1 | 7.4 |

| : | Q3 | 0.7 | 3.1 | 1.9 | 0.7 | 6.5 |

| : | Q4 | 0.8 | 3.1 | 1.8 | 0.7 | 6.5 |

2007-08 | : | Q1 | 0.6 | 3.4 | 1.8 | 0.7 | 6.5 |

| : | Q2 | 0.9 | 3.0 | 1.9 | 1.1 | 6.9 |

| : | Q3 | 0.5 | 3.0 | 1.6 | 0.8 | 5.9 |

| : | Q4 | 0.9 | 3.4 | 1.5 | 1.3 | 7.1 |

Source : Central

Statistical Organisation | The leading indicators of services

sector activity for 2008-09 so far suggest acceleration in growth in respect of

some indicators such as railway revenue earning freight traffic, tourist arrivals

and export cargo handled by civil aviation during April-May 2008 as compared with

April-May 2007. On the other hand, growth decelerated in respect of cargo handled

at major ports, various indicators of civil aviation excluding export cargo and

commercial vehicles production. Some deceleration was also observed in production

of cement and steel during April-May 2008, which are among the important indicators

of construction industry (Table 9).

Aggregate

Demand The Indian economy continued to be driven by domestic

demand with consumption accounting for more than two-thirds and investment little

less than one-third of real GDP. During 2007-08, the share of final consumption

expenditure declined to 67.8 per cent, while that of gross fixed capital formation

rose to 31.9 per cent (Table 10). Savings and

Investment

Gross Domestic Saving (GDS), as percentage of GDP

at current market prices, increased to 34.8 per cent in 2006-07 from 34.3 per

cent in 2005-06

Table

9: Indicators of Services Sector Activity |

(Growth

rates in per cent) | Sub-sector | 2006-07 | 2007-08 | 2007-08 | 2008-09 |

April-May

| 1 | | 2 | 3 | 4 | 5 |

1. | Tourist

arrivals | 13.0 | 11.3 | 8.2

* | 10.2 * |

2. | Commercial

vehicles production # | 11.2 | -0.2 | 10.6 | 4.6 |

3. | Railway

revenue earning freight traffic | 5.1 | 10.9 | 6.2 | 10.2 |

4. | New

cell phone connections | 85.4 | 38.3 | 50.4 | 42.9 |

5. | Cargo

handled at major ports | 22.1 | 14.7 | 17.7 | 10.3 |

6. | Civil

aviation | | | | |

| a)

Export cargo handled | 3.6 | 7.5 | 1.6 | 7.6 |

| b)

Import cargo handled | 19.4 | 19.7 | 21.7 | 9.3 |

| c)

Passengers handled at international terminals | 12.1 | 11.9 | 13.1 | 9.0 |

| d)

Passengers handled at domestic terminals | 34.0 | 20.6 | 24.4 | 5.9 |

7. | Cement

** | 5.8 | 6.9 | 7.8 | 5.4 |

8. | Steel

** | 2.7 | 4.0 | 5.5 | 4.5 |

9. | Aggregate

deposits of SCBs | 23.8 | 22.4 | 4.1

@ | 3.5 @ |

10.Non-food credit of SCBs | 28.5 | 23.0 | -0.7

@ | 1.7 @ |

* : April-June

# : Leading

Indicator for transportation.

** : Leading indicators for construction.

@ : Up to July 4.

SCBs : Scheduled Commercial Banks.

Source :

Ministry of Tourism; Ministry of Commerce and Industry;

Ministry

of Statistics and Programme Implementation;

Reserve Bank of India; and Centre

for Monitoring Indian Economy. |

Table

10: Expenditure Side of GDP (at 1999-2000 Prices) |

(Rates

as per cent of GDP) | Item | 2006-07* | 2007-08# | 2006-07 | 2007-08 |

Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 |

1 |

| 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

1. | Total

Final Consumption | | | | | | | | | | |

| Expenditure | 68.4 | 67.8 | 72.2 | 68.9 | 69.3 | 64.2 | 70.1 | 68.2 | 69.0 | 64.6 |

| (i)

Private Final | | | | | | | | | | |

| Consumption

Expenditure | 58.6 | 58.2 | 60.7 | 60.3 | 60.4 | 53.7 | 59.8 | 59.5 | 60.7 | 53.4 |

| (ii)

Government Final | | | | | | | | | | |

| Consumption

Expenditure | 9.8 | 9.6 | 11.5 | 8.6 | 8.9 | 10.5 | 10.3 | 8.7 | 8.3 | 11.2 |

2. | Gross

Fixed Capital | | | | | | | | | | |

| Formation | 30.6 | 31.9 | 30.8 | 31.2 | 29.6 | 30.9 | 32.0 | 33.4 | 31.0 | 31.6 |

3. | Change

in Stocks | 2.1 | 2.0 | 2.1 | 2.2 | 2.0 | 2.0 | 2.1 | 2.1 | 1.9 | 1.9 |

4. | Valuables | 1.2 | 1.3 | 1.3 | 1.3 | 1.2 | 1.1 | 1.2 | 1.3 | 1.4 | 1.1 |

5. | Exports | 20.6 | 20.3 | 24.5 | 18.8 | 17.9 | 21.4 | 23.8 | 16.8 | 19.0 | 21.6 |

6. | Less:

Imports | 24.7 | 24.4 | 25.6 | 27.0 | 24.2 | 22.6 | 24.9 | 24.8 | 25.4 | 22.8 |

7. | Discrepancies | 1.8 | 1.1 | -5.3 | 4.6 | 4.3 | 3.0 | -4.3 | 3.1 | 3.0 | 1.9 |

Memo: | | | | | | | | | (Rupees

crore) | Real GDP

at market prices | 31,17,372 | 33,98,767 | 7,04,841 | 7,22,355 | 8,25,401 | 8,64,774 | 7,69,871 | 7,88,514 | 8,99,098 | 9,41,283 |

* : Quick Estimates. # : Revised

Estimates. Source : Central Statistical Organisation. |

mainly due to improvement in the saving performance by the private

corporate and public sectors. On the other hand, the household saving rate declined

marginally in 2006-07 from the previous year on account of decline in the financial

saving rate (Table 11). The rate of gross domestic capital

formation (GDCF) was estimated to be marginally higher at 35.9 per cent of GDP

in 2006-07 than 35.5 per cent in 2005-06. During 2006-07, while the overall saving

rate increased by 0.5 percentage point in 2006-07, the overall investment rate

increased by 0.4 percentage point, reflecting a marginal narrowing down of current

account deficit.

Corporate Performance

The performance of non-government non-financial companies moderated during 2007-08

relative to the previous year (Table 12). Sales growth, which

slowed down in the first two quarters of the year, accelerated in the third and

fourth quarters. On the whole, sales growth during 2007-08 at 18.5 per cent was

lower than 26.2 per cent registered in the previous year. Growth in gross profits

and net profits also decelerated during 2007-08. The gross profits to sales ratio,

however, improved marginally over the same period. Growth in sales and net profits

in the fourth quarter of 2007-08 were at 20.6 per cent and 14.1 per cent, respectively,

as compared with 22.5 per cent and 39.6 per cent in the fourth quarter of 2006-07.

Table

11: Rates of Gross Domestic Saving and Investment |

(Per

cent of GDP at current market prices) | Item | 2001-02 | 2002-03 | 2003-04 | 2004-05 | 2005-06

PE | 2006-07

QE | 10th

Plan

Average | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

1. Household Saving | 22.1 | 23.2 | 24.4 | 23.0 | 24.2 | 23.8 | 23.7 |

of which : | | | | | | | |

a) Financial assets | 10.9 | 10.3 | 11.4 | 10.1 | 11.8 | 11.3 | 11.0 |

b) Physical assets | 11.3 | 12.9 | 13.0 | 12.9 | 12.5 | 12.5 | 12.7 |

2. Private Corporate Saving | 3.4 | 3.9 | 4.4 | 6.6 | 7.5 | 7.8 | 6.0 |

3. Public Sector Saving | -2.0 | -0.6 | 1.1 | 2.2 | 2.6 | 3.2 | 1.7 |

4. Gross Domestic Saving | 23.5 | 26.4 | 29.8 | 31.8 | 34.3 | 34.8 | 31.4 |

5. Net capital inflow | -0.6 | -1.2 | -1.6 | 0.4 | 1.2 | 1.1 | 0.0 |

6. Gross Domestic Capital Formation # | 22.8 | 25.2 | 28.2 | 32.2 | 35.5 | 35.9 | 31.4 |

7. Gross Capital Formation | 24.2 | 25.2 | 26.8 | 31.6 | 34.5 | 36.0 | 30.8 |

of which : | | | | | | | |

a) Public sector | 6.9 | 6.1 | 6.3 | 6.9 | 7.6 | 7.8 | 6.9 |

b) Private corporate sector | 5.4 | 5.7 | 6.6 | 10.5 | 13.3 | 14.5 | 10.1 |

c) Household sector | 11.3 | 12.9 | 13.0 | 12.9 | 12.5 | 12.5 | 12.8 |

d) Valuables | 0.6 | 0.6 | 0.9 | 1.3 | 1.2 | 1.2 | 1.0 |

8. Total Consumption Expenditure (a+b) | 76.7 | 75.1 | 73.0 | 69.2 | 67.8 | 66.1 | 70.2 |

a) Private Final Consumption | | | | | | | |

Expenditure | 64.4 | 63.2 | 61.7 | 58.4 | 57.4 | 55.8 | 59.3 |

b) Government Final Consumption | | | | | | | |

Expenditure | 12.4 | 11.9 | 11.3 | 10.7 | 10.4 | 10.3 | 10.9 |

Memo: | | | | | | | |

Saving-Investment Balance (4-6) | 0.7 | 1.2 | 1.6 | -0.4 | -1.2 | -1.1 | 0.0 |

Public Sector Balance | -8.9 | -6.7 | -5.3 | -4.7 | -5.0 | -4.5 | -5.3 |

Private Sector Balance | 8.8 | 8.5 | 9.2 | 6.1 | 5.9 | 4.5 | 6.8 |

a) Private Corporate Sector | -2.1 | -1.9 | -2.2 | -4.0 | -5.8 | -6.8 | -4.1 |

b) Household Sector | 10.9 | 10.3 | 11.4 | 10.1 | 11.8 | 11.3 | 10.9 |

PE : Provisional Estimates.

QE : Quick Estimates.

# : Adjusted for errors and omissions.

Note

: Figures may not add up to the total due to rounding off.

Source

: Central Statistical Organisation. | Business

Expectation Survey

According to the quarterly business expectations

survey of the National Council of Applied Economic Research (NCAER) released in

April 2008, the overall business confidence index (BCI) for the next six months

declined both over the previous round and the previous year (Table

13). A component-wise analysis shows that three out of four components, viz.,

overall economic conditions, investment climate and financial position of firms

declined over the previous round, while the capacity utilisation did not show

any variation. The BCI in respect of consumer durables, services and intermediates

sectors declined, while modest gains were observed in respect of capital goods

and consumer non-durables.

Table

12: Corporate Financial Performance |

(Growth rates

in per cent) | Item | 2005-06 | 2006-07 | 2007-08P | 2006-07 | 2007-08 |

| Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

Sales | 16.3 | 26.2 | 18.5 | 25.6 | 29.2 | 30.3 | 22.5 | 19.2 | 16.0 | 18.0 | 20.6 |

Other Income | 17.3 | 7.1 | 47.0 | 21.6 | 15.5 | 9.2 | 0.4 | 106.7 | 45.2 | 70.2 | 28.5 |

Expenditure | 16.7 | 23.4 | 18.6 | 24.0 | 27.7 | 25.7 | 20.0 | 18.0 | 15.3 | 18.9 | 23.3 |

Depreciation | 8.1 | 15.4 | 14.8 | 14.9 | 16.4 | 16.8 | 18.1 | 18.1 | 15.8 | 17.9 | 15.4 |

Gross Profits | 24.6 | 41.9 | 23.3 | 32.7 | 46.0 | 52.9 | 35.5 | 31.9 | 22.5 | 20.4 | 16.8 |

Interest Payments | -2.0 | 17.4 | 28.8 | 19.9 | 18.0 | 11.9 | 32.3 | 4.4 | 18.4 | 45.7 | 35.8 |

Profits After Tax | 32.8 | 45.2 | 27.0 | 34.7 | 49.4 | 59.5 | 39.6 | 33.9 | 22.7 | 29.4 | 14.1 |

| Select

Ratios | (Per

cent) |

Gross Profits to Sales | 12.2 | 15.5 | 16.3 | 15.2 | 15.6 | 15.8 | 15.4 | 16.7 | 16.3 | 16.2 | 15.0 |

Profits After Tax to Sales | 8.2 | 10.7 | 11.8 | 10.6 | 11.0 | 11.0 | 10.6 | 11.6 | 11.5 | 12.2 | 10.3 |

Interest to Sales | 2.2 | 2.1 | 2.3 | 2.2 | 2.0 | 2.0 | 2.0 | 2.0 | 2.1 | 2.5 | 2.2 |

Interest to Gross Profits | 18.1 | 13.4 | 13.9 | 14.2 | 13.1 | 12.6 | 12.9 | 11.8 | 12.8 | 15.3 | 14.6 |

Interest Coverage (Times) | 5.5 | 7.5 | 7.2 | 7.0 | 7.6 | 7.9 | 7.7 | 8.5 | 7.8 | 6.5 | 6.8 |

Memo: | (Amount

in Rupees crore) | No of Companies | 2,730 | 2,388 | 2,219 | 2,228 | 2,263 | 2,258 | 2,356 | 2,342 | 2,228 | 2,329 | 2,357 |

Sales | 7,35,216 | 10,41,894 | 10,88,203 | 2,34,610 | 2,51,125 | 2,60,064 | 2,94,223 | 2,80,814 | 2,97,110 | 3,06,238 | 3,50,917 |

Other Income * | 17,088 | 23,895 | 28,798 | 4,304 | 5,282 | 4,927 | 8,466 | 9,151 | 8,057 | 9,221 | 10,082 |

Expenditure # | 6,43,826 | 8,78,645 | 9,12,834 | 2,00,120 | 2,11,043 | 2,17,472 | 2,49,133 | 2,37,698 | 2,49,194 | 2,57,472 | 3,02,105 |

Depreciation | 28,961 | 37,095 | 38,528 | 8,449 | 8,892 | 9,172 | 10,338 | 10,173 | 10,576 | 10,961 | 11,805 |

Gross Profits | 90,179 | 1,61,006 | 1,76,845 | 35,761 | 39,055 | 40,995 | 45,424 | 46,780 | 48,296 | 49,717 | 52,583 |

Interest Payments | 16,302 | 21,500 | 24,551 | 5,083 | 5,121 | 5,162 | 5,862 | 5,504 | 6,194 | 7,609 | 7,703 |

Profits After Tax | 60,236 | 1,11,107 | 1,27,968 | 24,845 | 27,710 | 28,698 | 31,251 | 32,699 | 34,266 | 37,470 | 36,109 |

P : Provisional; data pertain

to 2,219 companies available so far.

* : Other income excludes extraordinary

income/expenditure if reported explicitly.

# : The increase or decrease in

stock in trade is accounted under total income instead of total expenditure as

was hitherto done.

Notes : 1. Data for 2005-06 are based

on audited annual accounts, while those for 2006-07 and 2007-08 are based on abridged

financial results of the select non-Government non-financial public limited companies.

2. Growth rates are percentage changes in the level for the period under reference

over the corresponding period of the previous year for common set of companies.

3. The quarterly data may not add up to annual data due to differences in the

number and composition of companies covered in each

period. |

The CII business confidence index (CII-BCI) for April-September 2008

declined by 5.3 per cent as compared with the past six months and 2.9 per cent

as compared with the corresponding period a year ago (Table 13).

The decline was on account of uncertain global economic outlook and concerns about

high interest rates. The composite business optimism index for July-September

2008 compiled by Dun and Bradstreet (D&B) declined by 11.2 per cent as compared

with the previous quarter and by 18.0 per cent as compared with the previous year.

All the six optimism indices - volumes of sales, net profits, selling prices,

new orders, inventory levels and employee levels declined as compared with the

previous quarter. Optimism was particularly low among respondents in the consumer

durables and basic goods sectors.

Table

13: Business Expectations Surveys |

(Per

cent) | Organisation | Business

Expectations | Growth

over a

year ago | Growth

over

previous round | Period | Index |

|

|

1 | 2 | 3 | 4 | 5 |

NCAER | April-September

2008 | Business Confidence

Index | -1.7 | -3.4 |

CII | April-September

2008 | Business Confidence

Index | -2.9 | -5.3 |

Reserve Bank of India | July-September

2008 | Business Expectations

Index | 0.8 | -0.9 |

Dun & Bradstreet | July-September

2008 | Business Optimism Index | -18.0 | -11.2 |

According to the Reserve Bank’s Industrial Outlook Survey

of manufacturing companies in the private sector for April-June 2008, the business

expectations indices based on assessment for April-June 2008 and on expectations

for July-September 2008 declined by 5.4 per cent and 0.9 per cent, respectively,

over the corresponding previous quarters. The indices, however, increased by 0.3

per cent and 0.8 per cent, respectively, over the corresponding quarters of the

previous year (Chart 4).

The decline in expectations

index for July-September 2008 over the previous quarter was due to lower net responses

for major parameters of the survey such as overall business situation, overall

financial situation, production, order books, cost of raw materials, capacity

utilisation, employment, imports and profit margins than in the previous quarter

(Table 14). Most of the corporates expect increase in raw material

prices and the increased production cost is expected to be adjusted by keeping

inventory levels (both raw material and finished goods) at ‘below average’

and by increasing selling prices.

Table

14: Reserve Bank’s Industrial Outlook Survey - Net Response on

'A Quarter Ahead' Expectations About the Industrial Performance |

(Per

cent) | Parameter | Response | Apr-June

2007 | July-Sept

2007 | Oct-Dec

2007 | Jan-Mar

2008 | April-June

2008 | July-Sept

2008 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

1. | Overall

business situation | Better | 51.7 | 49.5 | 50.2 | 47.7 | 46.0 | 41.8 |

| | | (43.3) | (41.2) | (42.1) | (42.9) | (42.7) | (42.6) |

2. | Financial

situation | Better | 43.8 | 41.3 | 40.1 | 40.3 | 36.6 | 32.7 |

| | | (49.8) | (49.8) | (51.3) | (50.3) | (51.6) | (53.0) |

3. | Working

capital finance requirement | Increase | 35.3 | 34.5 | 32.2 | 34.7 | 36.6 | 33.6 |

| | | (59.2) | (59.2) | (62.6) | (60.3) | (56.5) | (57.3) |

4. | Availability

of finance | Improve | 35.2 | 32.1 | 33.8 | 31.1 | 32.3 | 30.2 |

| | | (57.2) | (58.6) | (58.8) | (59.5) | (58.3) | (57.9) |

5. | Production | Increase | 47.8 | 46.6 | 49.0 | 43.9 | 45.2 | 43.5 |

| | | (41.6) | (41.1) | (40.9) | (42.3) | (41.0) | (36.6) |

6. | Order

books | Increase | 45.7 | 43.6 | 44.1 | 37.1 | 41.5 | 38.5 |

| | | (45.4) | (46.1) | (46.0) | (48.6) | (44.3) | (43.5) |

7. | Pending

orders, if applicable | Below normal | -2.2 | -2.2 | -3.5 | 0.4 | -4.3 | 2.2 |

| | | (82.8) | (82.6) | (82.4) | (80.2) | (81.3) | (80.9) |

8. | Cost

of raw material | Decrease | -42.1 | -46.0 | -42.4 | -44.1 | -48.2 | -54.7 |

| | | (52.0) | (49.7) | (51.0) | (49.2) | (46.0) | (39.1) |

9. | Inventory

of raw material | Below average | -7.3 | -5.4 | -6.3 | -7.3 | -7.0 | -3.8 |

| | | (85.0) | (85.0) | (85.0) | (84.8) | (83.2) | (81.8) |

10. | Inventory

of finished goods | Below average | -4.4 | -2.7 | -3.5 | -4.5 | -5.8 | -1.5 |

| | | (85.2) | (87.1) | (86.4) | (86.1) | (84.5) | (84.5) |

11. | Capacity

utilisation (Main product) | Increase | 29.4 | 27.0 | 28.4 | 24.2 | 25.6 | 22.2 |

| | | (60.4) | (61.4) | (61.5) | (62.3) | (59.9) | (58.8) |

12. | Level

of capacity

utilisation | Above normal | 11.5 | 9.4 | 10.7 | 6.4 | 9.4 | 3.6 |

| (Compared

to the average in the | | (77.1) | (76.5) | (77.2) | (78.3) | (77.0) | (74.9) |

| preceding

four quarters) | | | | | | | |

13. | Assessment

of the production capacity | More than | 4.0 | 3.0 | 4.2 | 4.7 | 8.0 | 4.6 |

| (With

regard to expected demand in the | adequate | (82.2) | (82.2) | (83.0) | (83.8) | (81.2) | (81.3) |

| next

six months) | | | | | | | |

14. | Employment

in the company | Increase | 18.3 | 17.4 | 16.7 | 14.6 | 20.8 | 15.8 |

| | | (73.3) | (73.5) | (74.1) | (75.6) | (68.2) | (71.5) |

15. | Exports,

if applicable | Increase | 33.4 | 32.6 | 31.4 | 24.3 | 27.7 | 27.7 |

| | | (56.8) | (55.6) | (55.9) | (58.3) | (53.3) | (54.9) |

16. | Imports,

if any | Increase | 21.6 | 23.7 | 20.8 | 20.1 | 25.3 | 21.3 |

| | | (68.4) | (68.2) | (68.6) | (70.5) | (65.6) | (66.5) |

17. | Selling

prices are expected to | Increase | 15.5 | 19.0 | 13.0 | 14.9 | 19.1 | 21.0 |

| | | (68.9) | (67.1) | (68.5) | (67.1) | (66.0) | (61.5) |

18. | If

increase expected in selling prices | Increase

at | 12.1 | 10.4 | 3.7 | 13.3 | 9.0 | 3.0 |

| | lower

rate | (66.7) | (65.0) | (58.9) | (66.7) | (64.0) | (61.3) |

19. | Profit

margin | Increase | 9.9 | 7.5 | 9.6 | 5.4 | 7.2 | 3.8 |

| | | (62.5) | (62.6) | (59.6) | (60.0) | (61.0) | (59.8) |

Notes :

1. 'Net response' is measured as the percentage share differential between the

companies reporting 'optimistic'

(positive) and 'pessimistic' (negative) responses;

responses indicating status quo (no change) are not reckoned.

Higher

'net response' indicates higher level of confidence and vice versa.

2. Figures in parentheses are the percentages of respondents with 'no change over

the preceding quarter' as

responses. |

The recent

projections for growth rate of industrial production in 2008-09 by the Centre

for Monitoring Indian Economy (CMIE) present an optimistic view in the light of

large capital investments scheduled for commissioning during the year. The CMIE

expects the industrial growth to accelerate from the estimated 8.5 per cent in

2007-08 to 11.4 per cent in 2008-09. Growth rates in the manufacturing, mining

and electricity sectors are projected at 10.8 per cent, 8.0 per cent and 6.3 per

cent, respectively. As per CMIE, the industrial rebound is expected to be well

spread across all the sectors and would be fuelled by robust growth in capital

goods in the wake of large capital goods imports and investments, healthy order-book

position and a pick-up in the growth of consumer goods.

The ABN-AMRO Purchasing

Managers' Index (PMI)1 for June 2008 rose to its highest reading in four months

at 58.6 (57.4 in May 2008), supported by increase in the rate of growth of both

output and new orders, indicating strong growth in the manufacturing sector. Manufacturing

firms attributed higher new order levels to improvement in market conditions and

robust underlying demand. However, on the down side, input price inflation accelerated

to its sharpest for nineteen months in June, on account of higher raw material

costs.

Survey of Professional Forecasters2

The results of professional forecasters' survey conducted by the Reserve

Bank in June 2008 suggested moderation in economic activity for each of the three

forthcoming quarters and for 2008-09 on the whole (Table 15).

Between the third round of survey conducted in March 2008 and fourth round survey

in June 2008 forecast of real GDP growth for 2008-09 was revised downward to 7.9

per cent from 8.1 per cent. The sectoral growth rate forecasts for industry and

services sector were also revised downwards. On the other hand,

Table

15: Median Forecasts of Select Macroeconomic Indicators by

Professional

Forecasters 2008-09 | Indicators | Actual

2007-08 | 2008-09 |

Annual | Q1 | Q2 | Q3 | Q4 |

| E | L | E | L | E | L | E | L | L |

1 |

| 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

1 | Real

GDP growth rate at | | | | | | | | | | |

| factor

cost (in per cent) | 9.0 | 8.1 | 7.9 | 8.1 | 8.0 | 8.3 | 7.7 | 8.1 | 7.6 | 7.5 |

| a.

Agriculture & Allied | | | | | | | | | | |

| Activities | 4.5 | 3.0 | 3.0 | 3.0 | 3.1 | 3.0 | 3.4 | 2.9 | 3.1 | 3.8 |

| b.

Industry | 8.1 | 8.1 | 7.5 | 8.4 | 7.1 | 8.5 | 7.0 | 8.6 | 7.4 | 7.3 |

| c.

Services | 10.7 | 9.7 | 9.5 | 10.0 | 9.9 | 9.6 | 9.6 | 9.8 | 9.6 | 9.5 |

2 | Gross

Domestic Saving | 34.8 * | 35.0 | 35.0 | - | - | - | - | - | - | - |

| (per

cent of GDP | | | | | | | | | | |

| at

current market prices) | | | | | | | | | | |

3 | Gross

Domestic Capital | | | | | | | | | | |

| Formation | 35.9

* | 36.0 | 36.3 | 36.2 | 36.6 | 36.0 | 36.0 | 36.0 | 35.8 | 36.1 |

| (per

cent of GDP at | | | | | | | | | | |

| current

market prices) | | | | | | | | | | |

4 | Corporate

profit after tax | 27.0 | 24.7 | 16.0 | 21.3 | 20.3 | 22.6 | 17.4 | 23.1 | 16.0 | 19.5 |

| (growth

rate in per cent) | | | | | | | | | | |

5 | 91-day

Treasury Bill Yield | 7.2 | 6.8 | 8.2 | - | - | - | - | - | - | - |

| (per

cent-end period) | | | | | | | | | | |

| 6 | 10-year

Government Securities | | | | | | | | | | |

| Yield | 7.9 | 7.8 | 8.8 | - | - | - | - | - | - | - |

| (per

cent-end period) | | | | | | | | | | |

7 | Export | 23.7 | 15.8 | 20.0 | - | - | - | - | - | - | - |

| (growth

rate in per cent) | | | | | | | | | | |

8 | Import | 29.9 | 20.0 | 29.5 | - | - | - | - | - | - | - |

| (Growth

rate in per cent) | | | | | | | | | | |

9 | Trade

Balance | -90.1 | -115.5 | -126.2 | -28.4 | -31.1 | -27.5 | -32.1 | -28.1 | -31.1 | -29.0 |

| (US

$ billion) | | | | | | | | | | |

E : Earlier Projection. L

: Latest Projection. * : Pertains to 2006-07.

- : Not Available.

Note

: The latest round refers to the fourth round for the quarter ended June

2008,

while earlier round refers to third round for the quarter ended March

2008.

Source : Survey of Professional Forecasters, First

Quarter 2008-09. | growth rates in export and import were

revised upwards to 20 per cent and 30 per cent, respectively. The trade deficit

is expected to increase in 2008-09.

Forecasts by various agencies for

real GDP growth in 2008-09 are set out in Table 16.

Table

16: Projections of Real GDP for India by Various Agencies - 2008-09 |

(per

cent) | Agency | Overall

Growth | Agriculture | Industry | Services | Month

of

Projection | 1 | 2 | 3 | 4 | 5 | 6 |

ASSOCHAM # | 7.9 | 2.6 | 7.6 | 9.7 | Apr-08 |

Confederation of Indian Industries (CII) | 8.0

-8.5 | - | - | - | Mar-08 |

Citigroup | 7.7 | 3.0 | 7.5 | 9.2 | Mar-08 |

| 8.3 | - | - | - | Feb-08 |

Merrill Lynch | 7.9 | 2.5 | 7.4 | 9.6 | June-08 |

| 8.2 | 3.0 | 7.6 | 9.9 | Mar-08 |

JP Morgan | 7.0 | - | - | - | Mar-08 |

| 7.5 | - | - | - | Dec-07 |

Centre for Monitoring Indian Economy (CMIE) | 9.5 | 3.2 | 11.4 | 10.6 | July-08 |

| 9.1 | - | - | - | Feb-08 |

NCAER @ | 8.5-8.8 | 2.5 | 8.9-9.4 | 10.2-10.5 | May-08 |

Standard & Poor’s, CRISIL | 7.8 | 3.0 | 7.5 | 9.5 | June-08 |

| 8.1 | 3.0 | 8.3 | 10.3 | Apr-08 |

| 8.5 | - | - | - | Feb-08 |

Asian Development Bank | 8.0 | - | - | - | Apr-08 |

| 8.5 | - | - | - | Sep-07 |

International Monetary Fund * | 8.0 | - | - | - | July-08 |

| 7.9 | - | - | - | Apr-08 |

| 8.4 | - | - | - | Oct-07 |

United Nations Organisation | 8.2 | - | - | - | Jan-08 |

Economic Advisory

Council to Prime

Minister | 8.5 | - | - | - | Jan-08 |

Reserve Bank of India | 8.0-8.5 | - | - | - | Apr-08 |

- : Not Available. : Calendar

year. : The Associated Chambers of Commerce and Industry of India.

@ : National

Council of Applied Economic Research. |

1

The PMI is a composite indicator designed to provide an overall view of activity

in the manufacturing sector. A PMI of 50.0 indicates no change while values above

or below this level indicate an expansion or a contraction of manufacturing activity.2

Introduced by the Reserve Bank from the quarter ended September 2007. The

forecasts made in the section are that of professional forecasters and not that

of the Reserve Bank. |