Performance of the Indian banking sector during 2011-12 was influenced by the slowdown in the

domestic economy. Consequently, balance sheet expansion of banks was lower than the previous year.

Major profitability indicators, i.e., return on assets (RoA) and return on equity (RoE) dipped

marginally. However, cost to income ratio of banks improved during 2011-12, reflecting marginal

gains in efficiency. Though Indian banks remained well-capitalised, concerns about the growing

non-performing assets (NPAs) loomed large. Banks’ exposure to the stressed power and airline sectors

particularly added to deterioration in their asset quality. Though progress has been made in expanding

banking coverage, more efforts are needed to achieve meaningful financial inclusion. Customer

services of banks need to be strengthened to face the emerging challenges.

1. Introduction

4.1 Indian banking sector, which withstood the

turmoil of the global financial crisis during 2008-09, started showing some signs of stress during

the subsequent period. Performance of Indian

banks during the post-crisis period was conditioned

to a large extent by fragile recovery of the global

financial markets as well as a challenging

operational environment on the domestic front,

with high inflation and muted growth performance.

In addition, stressed financial condition of some

State Electricity Boards and airline companies

further added to the deterioration in the asset

quality of banks.

4.2 Against this backdrop, this chapter

analyses the operations and performance of Indian

banking sector (including regional rural banks

and local area banks) during 2011-12, based on

the audited balance sheets of banks and off-site

returns submitted to the Reserve Bank. Various

sections of this chapter focus on balance sheet

operations, profitability and efficiency indicators,

soundness position, overseas operations,

operations in the capital market, customer

services and technological developments. Progress

under financial inclusion plans is delineated in a

separate section. The concluding section highlights

major issues that emerge from the analysis.

2. Balance Sheet Operations of Scheduled

Commercial Banks

Balance sheet expansion slowed down led by

muted growth in deposits as well as loans

and advances

4.3 Consolidated balance sheet of SCBs grew

at a slower pace during 2011-12 as compared with

the previous year. On the liabilities side, the

deceleration in growth was broad-based with the

major items of liabilities, i.e., capital, deposits

and borrowings, registering moderation in growth.

On the assets side, the slowdown was mainly

attributed to deceleration in growth of loans and

advances, reflecting the slowdown in all key

segments of domestic macro-economy (Tables IV.1 and IV.2).

4.4 Reflecting the deceleration in the balance

sheet of public sector banks, their share in total

assets of the banking system dipped marginally

during 2011-12. Notwithstanding this, Indian

banking sector remained broadly public in nature

with public sector banks accounting for more than

two-thirds of total assets of all scheduled

commercial banks, as at end-March 2012

(Chart IV.1).

Table IV.1: Consolidated Balance Sheet of Scheduled Commercial Banks |

(Amount in ` billion) |

Item |

As at end-March 2012 |

Public

sector

banks |

SBI

group |

Nationalised

banks* |

Private

sector

banks |

Old

private

sector

banks |

New

private

sector

banks |

Foreign

banks |

All

scheduled

commercial

banks |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

1. Capital |

183 |

12 |

171 |

48 |

13 |

35 |

406 |

637 |

2. Reserves and Surplus |

3,373 |

1,061 |

2,312 |

1,545 |

266 |

1,279 |

531 |

5,449 |

3. Deposits |

50,020 |

14,050 |

35,970 |

11,746 |

3,159 |

8,587 |

2,771 |

64,537 |

3.1. Demand Deposits |

3,844 |

1,197 |

2,647 |

1,659 |

258 |

1,401 |

801 |

6,303 |

3.2. Savings Bank Deposits |

12,140 |

4,537 |

7,604 |

2,729 |

578 |

2,152 |

419 |

15,289 |

3.3. Term Deposits |

34,036 |

8,317 |

25,719 |

7,358 |

2,323 |

5,035 |

1,551 |

42,945 |

4. Borrowings |

4,618 |

1,588 |

3,030 |

2,584 |

198 |

2,386 |

1,199 |

8,401 |

5. Other Liabilities and Provisions |

2,186 |

1,002 |

1,184 |

855 |

114 |

741 |

929 |

3,970 |

Total Liabilities/Assets |

60,380 |

17,712 |

42,668 |

16,778 |

3,750 |

13,028 |

5,836 |

82,994 |

1. Cash and Balances with RBI |

2,800 |

791 |

2,009 |

706 |

167 |

538 |

232 |

3,737 |

2. Balances with Banks and Money at Call and Short Notice |

1,760 |

482 |

1,278 |

366 |

71 |

295 |

312 |

2,437 |

3. Investments |

15,041 |

4,173 |

10,868 |

5,260 |

1,093 |

4,166 |

2,005 |

22,305 |

3.1 Government Securities (a+b) |

12,580 |

3,513 |

9,067 |

3,474 |

785 |

2,688 |

1,376 |

17,429 |

a) In India |

12,494 |

3,494 |

9,000 |

3,468 |

785 |

2,683 |

1,376 |

17,338 |

b) Outside India |

85 |

19 |

67 |

5.6 |

- |

5.6 |

- |

91 |

3.2 Other Approved Securities |

10 |

0.2 |

9.7 |

0.2 |

0.2 |

0.01 |

- |

10 |

3.3 Non-Approved Securities |

2,451 |

660 |

1791 |

1,786 |

308 |

1,478 |

629 |

4,866 |

4. Loans and Advances |

38,783 |

11,520 |

27,263 |

9,664 |

2,301 |

7,363 |

2,298 |

50,746 |

4.1 Bills Purchased and Discounted |

2,307 |

888 |

1,419 |

357 |

113 |

244 |

257 |

2,922 |

4.2 Cash Credits, Overdrafts, etc. |

16,085 |

4,958 |

11,127 |

2,860 |

1,120 |

1,740 |

1,099 |

20,044 |

4.3 Term Loans |

20,391 |

5,674 |

14,717 |

6,447 |

1,068 |

5,380 |

942 |

27,780 |

5. Fixed Assets |

383 |

74 |

309 |

134 |

27 |

107 |

50 |

567 |

6. Other Assets |

1,613 |

672 |

941 |

649 |

91 |

558 |

939 |

3,201 |

Note: -: Nil/negligible. Components may not add up to their respective totals due to rounding off numbers to ` billion.

*: Includes IDBI Bank Ltd.

Source: Annual accounts of respective banks. |

Major Liabilities of SCBs

Deposits grew at a subdued pace

4.5 As at end-March 2012, deposits constituted

more than three-fourths of the total liabilities of

the banking sector. Deposits grew at a slower rate

than the previous year, which mainly emanated

from contraction of demand deposits as well as

slower growth of savings bank deposits. On the

other hand, growth in term deposits accelerated.

Going forward, the slowdown in demand and

savings banks deposit mobilisation, which are

the least cost sources of funds, could put

downward pressure on profitability of Indian

banks (Table IV.2).

Proportion of CASA deposits in total deposits

declined

4.6 The share of current and savings account

(CASA) deposits in total deposits declined during

2011-12 due to the decline in demand deposits

as well as slowdown in savings bank deposit

mobilisation. As at end-March 2012, CASA

deposits formed almost one-third of total deposits

of SCBs. Bank group-wise analysis of composition

of deposits revealed that foreign banks had the

highest proportion of CASA deposits followed by

new private sector banks. This could be partly

explained by the fact that number of private sector

banks revised their savings bank deposits rates upwards after the deregulation of savings bank

interest rate in October 2011 (Chart IV.2).

Table IV.2 : Growth in Balance Sheet of Scheduled Commercial Banks |

(Per cent) |

Item |

Public sector

banks |

Private sector

banks |

Old private

sector banks |

New private

sector banks |

Foreign

banks |

All scheduled

commercial

banks |

2010-11 |

2011-12 |

2010-11 |

2011-12 |

2010-11 |

2011-12 |

2010-11 |

2011-12 |

2010-11 |

2011-12 |

2010-11 |

2011-12 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

1. Capital |

40.7 |

-4.2 |

5.1 |

- |

7.9 |

-4.2 |

4.1 |

1.7 |

15.1 |

15.6 |

21.3 |

8.0 |

2. Reserves and Surplus |

19.3 |

24.4 |

15.9 |

15.5 |

18.7 |

18.5 |

15.4 |

14.9 |

18.8 |

15.7 |

18.2 |

20.8 |

3. Deposits |

18.4 |

14.4 |

21.9 |

17.1 |

14.9 |

19.6 |

24.6 |

16.3 |

3.7 |

15.1 |

18.3 |

14.9 |

3.1. Demand Deposits |

11.3 |

-6.3 |

18.1 |

4.4 |

12.2 |

6.5 |

19.2 |

4.0 |

6.8 |

9.9 |

12.3 |

-1.8 |

3.2. Savings Bank Deposits |

22.1 |

12.1 |

23.0 |

19.1 |

14.0 |

16.3 |

25.8 |

19.9 |

8.8 |

5.6 |

21.8 |

13.1 |

3.3. Term Deposits |

18.2 |

18.2 |

22.5 |

19.7 |

15.5 |

22.1 |

25.8 |

18.6 |

0.6 |

21.0 |

18.2 |

18.6 |

4. Borrowings |

26.4 |

16.4 |

24.5 |

38.9 |

26.4 |

80.3 |

24.4 |

36.4 |

36.1 |

29.1 |

27.1 |

24.4 |

5. Other Liabilities and Provisions |

20.9 |

-6.8 |

21.0 |

20.6 |

-0.7 |

13.5 |

25.6 |

21.8 |

16.3 |

21.3 |

20.0 |

3.9 |

Total Liabilities/Assets |

19.2 |

14.1 |

21.5 |

20.0 |

14.9 |

21.4 |

23.5 |

19.6 |

12.8 |

18.8 |

19.2 |

15.5 |

1. Cash and Balances with RBI |

30.1 |

-20.5 |

13.5 |

-18.1 |

7.4 |

-7.9 |

15.2 |

-20.8 |

6.3 |

14.2 |

25.4 |

-18.5 |

2. Balances with Banks and Money at Call and Short Notice |

9.3 |

40.7 |

-18.2 |

15.6 |

-31.3 |

80.4 |

-16.0 |

6.5 |

33.2 |

13.8 |

6.0 |

32.4 |

3. Investments |

9.9 |

12.6 |

19.2 |

24.6 |

11.0 |

18.0 |

21.7 |

26.5 |

3.9 |

21.1 |

11.3 |

16.0 |

3.1 Government Securities |

7.4 |

16.2 |

9.1 |

32.0 |

6.3 |

21.5 |

10.1 |

35.4 |

-4.7 |

22.9 |

6.6 |

19.6 |

3.2 Other Approved Securities |

-43.4 |

-65.1 |

-71.4 |

-78.8 |

-82.2 |

-65.0 |

74.8 |

-97.6 |

-57.1 |

-100.0 |

-45.1 |

-65.6 |

3.3 Non-Approved Securities |

23.9 |

-2.2 |

41.0 |

12.5 |

24.9 |

10.0 |

45.0 |

13.0 |

28.1 |

17.5 |

29.8 |

5.1 |

4. Loans and Advances |

22.3 |

17.4 |

26.1 |

21.2 |

19.8 |

24.6 |

28.1 |

20.1 |

19.8 |

17.6 |

22.9 |

18.1 |

4.1 Bills Purchased and Discounted |

30.3 |

25.8 |

20.2 |

8.2 |

10.3 |

14.7 |

25.0 |

5.5 |

10.2 |

9.6 |

26.6 |

21.8 |

4.2 Cash Credits, Overdrafts, etc. |

24.0 |

17.9 |

41.2 |

27.6 |

23.4 |

33.3 |

54.6 |

24.2 |

27.1 |

18.4 |

26.2 |

19.2 |

4.3 Term Loans |

20.3 |

16.1 |

21.1 |

19.3 |

17.8 |

17.7 |

21.8 |

19.6 |

14.9 |

18.9 |

20.3 |

16.9 |

5. Fixed Assets |

4.9 |

5.9 |

26.8 |

3.0 |

6.5 |

6.9 |

32.8 |

2.1 |

2.0 |

1.2 |

9.1 |

4.8 |

6. Other Assets |

33.9 |

15.3 |

21.6 |

35.5 |

12.0 |

28.0 |

23.4 |

36.8 |

13.5 |

21.1 |

25.0 |

20.7 |

- : Negligible/Nil.

Source: Balance sheets of respective banks. |

Recourse to borrowings higher during 2011-12

4.7 As at end-March 2012, borrowings

constituted almost 10 per cent of the total

liabilities of the banking sector, which was

marginally higher than the previous year

(Table IV.1).

Major Assets of SCBs

Lower credit off-take led by both demand and

supply side factors

4.8 Total loans and advances witnessed

moderation in growth compared with the previous

year. The deceleration in bank credit was broad-based with credit off-take by all major sectors

slowing down during 2011-12. Credit to industry

and services sector, which together constituted

more than two-thirds of total bank credit,

recorded slower growth.

Risk aversion by banks was evident from

higher investment in government securities

4.9 In contrast with the overall slowdown

observed in the major balance sheet items of

banks, growth in investments accelerated during

2011-12 compared with the previous year. As

against deceleration in credit growth, banks’

investment in government securities increased

substantially. This trend partly reflected increase

in risk aversion by banks with a growing preference

to park funds in safer instruments, against the

backdrop of weak macro-economic outlook as

well as rising NPAs.

Investments in non-SLR instruments declined

4.10 As at end-March 2012, banks’ investments

in non-SLR instruments contracted compared

with the corresponding period of the previous year,

due to decline in investments in shares and mutual

funds. The decline in investments in mutual funds

could be partly attributed to the policy tightening

by the Reserve Bank in order to curb banks’

exposure to liquid/short term debt schemes of mutual funds. However, banks’ investments in

commercial papers increased sharply (Table IV.3).

Table IV.3: Non-SLR Investments of Scheduled Commercial Banks |

(Amount in ` billion) |

Instrument |

As on

March 23, 2012 |

Growth over

corresponding period of previous year |

As on

Sept 21, 2012 |

Growth over

corresponding period of previous year |

1 |

2 |

3 |

4 |

5 |

1 Commercial Paper |

196 |

59.2 |

357 |

90.6 |

|

(7.2) |

|

(10.9) |

|

2 Shares |

402 |

-12.0 |

426 |

-1.4 |

|

(14.8) |

|

(13.2) |

|

a) PSU |

72 |

|

76 |

|

b) Private corporate sector |

301 |

|

318 |

|

c) Public FIs |

23.8 |

|

25 |

|

d) Others |

5.2 |

|

7 |

|

3 Bonds/ Debentures |

1,861 |

11.5 |

2,002 |

15.5 |

|

(68.7) |

|

(61.2) |

|

a) PSU |

412 |

|

341 |

|

b) Private corporate sector |

741 |

|

884 |

|

c) Public FIs |

359 |

|

342 |

|

d) Others |

349 |

|

435 |

|

4 Units of UTI/ other MFs |

251 |

-47.2 |

485 |

-26.8 |

|

(9.3) |

|

(14.8) |

|

Total Investments (1 to 4) |

2,710 |

-0.6 |

3,270 |

8.4 |

|

(100.0) |

|

(100.0) |

|

Note: Percentage variation could be slightly different as absolute

numbers have been rounded off to ` billion.

Figures in

parentheses indicate share in respective totals.

Source: Section 42(2) returns submitted by SCBs. |

International Liabilities and Assets of Scheduled

Commercial Banks

While growth in total international liabilities

moderated, international assets registered

higher growth

4.11 During 2011-12, total international

liabilities of banks grew at a lower rate compared

with the previous year, mainly due to the

contraction in other liabilities owing to a decline

in ADRs/GDRs issued by the domestic banks.

However, inflows through NRE rupee deposits

increased which could be due to the increase in

interest rate under NRE term deposits following

the deregulation of interest rates on both savings deposit and term deposits under NRE accounts

(Table IV.4).

Table IV.4: International Liabilities of Banks - by Type |

(` billion) |

Liability Type |

Amount

Outstanding

(as at end-March) |

Percentage

Variation |

2011 |

2012 |

2010-11 |

2011-12 |

1 |

2 |

3 |

4 |

5 |

1. Deposits and Loans |

3,782 |

4,472 |

11.7 |

18.2 |

|

(72.5) |

(79.0) |

|

|

of which |

|

|

|

|

a) Foreign Currency Non Resident Bank [FCNR (B)] Scheme |

774 |

805 |

7.2 |

4.0 |

|

(14.8) |

(14.2) |

|

|

b) Foreign Currency |

954 |

1,100 |

28.3 |

15.3 |

Borrowings * |

(18.3) |

(19.4) |

|

|

c) Non-Resident |

1,212 |

1,626 |

-0.9 |

34.1 |

External Rupee (NRE) A/C |

(23.2) |

(28.7) |

|

|

d) Non-Resident |

411 |

532 |

33.2 |

29.6 |

Ordinary (NRO) Rupee Deposits |

(7.9) |

(9.4) |

|

|

2. Own Issues of Securities/Bonds |

46 |

56 |

-15.9 |

23.0 |

|

(0.9) |

(1.0) |

|

|

3. Other Liabilities |

1,387 |

1,133 |

28.2 |

-18.3 |

|

(26.6) |

(20.0) |

|

|

of which: |

|

|

|

|

a) ADRs/GDRs |

347 |

271 |

14.2 |

-21.8 |

|

(6.7) |

(4.8) |

|

|

b) Equities of banks |

732 |

536 |

45.4 |

-26.8 |

held by non-residents |

(14.0) |

(9.5) |

|

|

c) Capital/remittable |

308 |

326 |

12.2 |

5.8 |

profits of foreign

banks in India and

other unclassified

international

liabilities |

(5.9) |

(5.8) |

|

|

Total International |

5,215 |

5,661 |

15.3 |

8.6 |

Liabilities |

(100.0) |

(100.0) |

|

|

* Inter- bank borrowings in India and from abroad, external commercial

borrowings of banks.

Notes: 1. Figures in parentheses are percentages to total.

2. Based on Locational Banking Statistics (LBS) statements.

3. Percentage variation could be slightly different as absolute

numbers have been rounded off to ` billion. |

4.12 In contrast, international assets of the

banking sector registered higher growth in 2011-

12 compared with the previous year, mainly led

by foreign currency loans to residents, and Nostro

balances (Table IV.5).

Table IV.5: International Assets of Banks Classified by Type |

(` billion) |

Asset Type |

Amount

Outstanding |

Percentage

Variation |

March

2011 |

March

2012 |

2010-11 |

2011-12 |

1. Loans and Deposits |

2,787 |

3,410 |

17.5 |

22.3 |

|

(96.8) |

(97.3) |

|

|

of which |

|

|

|

|

a) Loans to Non-Residents* |

144 |

156 |

41.4 |

8.1 |

|

(5.0) |

(4.4) |

|

|

b) Foreign Currency Loans to Residents ** |

1,401 |

1,652 |

13.4 |

17.9 |

|

(48.6) |

(47.2) |

|

|

c) Outstanding Export Bills |

613 |

725 |

21.4 |

18.3 |

drawn on Non-Resident by Residents |

(21.3) |

(20.7) |

|

|

d) Nostro Balances@ |

624 |

865 |

19.6 |

38.7 |

|

(21.7) |

(24.7) |

|

|

2. Holdings of Debt Securities |

2.0 |

- |

351.3 |

- |

|

(0.1) |

(0.0) |

|

|

3. Other Assets @@ |

91 |

94 |

0.1 |

2.9 |

|

(3.2) |

(2.7) |

|

|

Total International Assets |

2,881 |

3,504 |

16.9 |

21.6 |

|

(100.0) |

(100.0) |

|

|

* Includes rupee loans and foreign currency (FC) loans out of non-residents

deposits.

** Includes loans out of FCNR(B) deposits, Packing Credit in Foreign

Currency (PCFC’s), FC lending to and FC deposits with banks in

India etc.

@ Includes placements made abroad and balances in term deposits

with non-resident banks.

@@ Capital supplied to and receivable profits from foreign branches/

subsidiaries of Indian banks and other unclassified international

assets.

Notes: 1. Figures in parentheses are percentages to total.

2. Based on Locational Banking Statistics (LBS) statements.

3. Percentage variation could be slightly different as absolute

numbers have been rounded off to ` billion.

4. -: Nil/Negligible. |

Consolidated international claims registered

higher growth

4.13 Continuing the trend observed during the

previous year, total consolidated international

claims registered accelerated growth during 2011-

12. However, no significant change was discernible

in the maturity (residual)-wise as well as sector-wise

composition of total international claims

(Table IV.6). The growth in the consolidated

international claims of banks on countries other than India was mainly led by claims of banks on

the UAE, Hong Kong, the US, Singapore and the

UK (Table IV.7).

Table IV.6: Maturity (Residual) and Sectoral

Classification of Consolidated International

Claims of Banks |

(` billion) |

Residual Maturity/Sector |

Amount

Outstanding |

Percentage

Variation |

March

2011 |

March

2012 |

2010-11 |

2011-12 |

1 |

2 |

3 |

4 |

5 |

Total Consolidated International claims |

2,464 |

2,809 |

5.9 |

14.0 |

|

(100.0) |

(100.0) |

|

|

a) Maturity-wise |

|

|

|

|

1. Short-term (residual |

1,539 |

1,832 |

6.6 |

19.0 |

maturity of less than one year) |

(62.5) |

(65.2) |

|

|

2. Long-term (residual |

872 |

924 |

6.5 |

5.9 |

maturity of one year and above) |

(35.4) |

(32.9) |

|

|

3. Unallocated |

53 |

54 |

-18.8 |

1.7 |

|

(2.1) |

(1.9) |

|

|

b) Setor-wise |

|

|

|

|

1. Bank |

1,091 |

1,286 |

11.5 |

17.8 |

|

(44.3) |

(45.8) |

|

|

2. Non-Bank Public |

9 |

19 |

-39.7 |

114.1 |

|

(0.4) |

(0.7) |

|

|

3. Non-Bank Private |

1,364 |

1,505 |

2.2 |

10.3 |

|

(55.4) |

(53.6) |

|

|

Notes:

1. Figures in parentheses are percentages to total.

2. Unallocated residual maturity comprises maturity not applicable (e.g., for equities) and maturity information not available from reporting bank branches.

3. Bank sector includes official monetary institutions (e.g., IFC, ECB, etc.) and central banks.

4. Prior to the quarter ended March 2005, non-bank public sector comprised of companies/institutions other than banks in which shareholding of State/Central governments was at least 51 per cent, including State/Central government and its departments. From March 2005 quarter, ‘Non-bank public’ sector comprises only State/ Central government and its departments and, accordingly, all other

entities excluding banks are classified under ‘Non-bank private sector.

5. Based on CBS (Consolidated Banking Statistics) statements - Immediate Country Risk Basis.

6. Percentage variation could be slightly different as absolute numbers have been rounded off to ` billion. |

Table IV.7: Consolidated International Claims of Banks on Countries other than India |

(` billion) |

Country |

Amount Outstanding |

Percentage Variation |

March 2011 |

March 2012 |

2010-11 |

2011-12 |

1 |

2 |

3 |

4 |

5 |

Total Consolidated International Claims |

2,464 |

2,809 |

5.9 |

14.0 |

|

(100.0) |

(100.0) |

|

|

Of Which |

|

|

|

|

1. United States of America |

548 |

643 |

3.2 |

17.2 |

|

(22.2) |

(22.9) |

|

|

2. United Kingdom |

344 |

364 |

-4.9 |

6.0 |

|

(13.9) |

(13.0) |

|

|

3. Hong Kong |

184 |

220 |

-3.2 |

19.5 |

|

(7.5) |

(7.8) |

|

|

4. Singapore |

185 |

216 |

0.6 |

16.3 |

|

(7.5) |

(7.7) |

|

|

5. United Arab Emirates |

155 |

221 |

14.5 |

42.8 |

|

(6.3) |

(7.9) |

|

|

6. Germany |

142 |

118 |

16.3 |

-16.6 |

|

(5.7) |

(4.2) |

|

|

Notes: 1. Percentage variation could be slightly different as absolute numbers have been rounded off to ` billion.

2. Figures in parentheses are percentages to total. |

Credit-Deposit (C-D) and Investment-Deposit

(I-D) Ratios

Incremental C-D ratio remained well above

incremental I-D ratio

4.14 The incremental C-D ratio declined during

the first three quarters of 2011-12, partly reflecting

the slowdown in bank credit. There was a sharp

rise in the ratio during the fourth quarter of 2011-12 as deposits growth decelerated sharply

even as growth in credit remained stable.

Incremental C-D ratio was highest for new private

sector banks while foreign banks recorded the

highest incremental investment-deposit (I-D) ratio

(Charts IV.3 and IV.4)1.

Maturity Profile of Assets and Liabilities

Maturity mismatch continued to persist with

proportion of short-term liabilities registering

an increase

4.15 The persistent mismatch in the average

maturity profile of assets with that of liabilities

has been a concern for Indian banking sector in

recent years. The proportion of short-term

liabilities registered an increase from 2008

onwards. On the other hand, the proportion of

short-term assets in total assets exhibited a

declining trend from 2008 onwards (Chart IV.5 and Table IV.8).

Table IV.8: Bank Group-wise Maturity Profile of Select Liabilities/Assets |

(As at end -March) |

(Per cent to total under each item) |

Liabilities/assets |

Public sector banks |

Private sector banks |

Old private sector banks |

New private sector banks |

Foreign banks |

All SCBs |

|

2011 |

2012 |

2011 |

2012 |

2011 |

2012 |

2011 |

2012 |

2011 |

2012 |

2011 |

2012 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

I. Deposits |

|

|

|

|

|

|

|

|

|

|

|

|

a) |

Up to 1 year |

48.2 |

49.6 |

46.1 |

48.7 |

45.3 |

48.1 |

46.4 |

48.9 |

63.7 |

61.8 |

48.5 |

50.0 |

b) |

Over 1 year and up to 3 years |

28.6 |

25.3 |

38.6 |

30.0 |

40.6 |

39.2 |

37.9 |

26.6 |

27.3 |

29.8 |

30.4 |

26.3 |

c) |

Over 3 years and upto 5 years |

8.1 |

8.5 |

6.1 |

5.7 |

8.5 |

6.9 |

5.2 |

5.2 |

8.9 |

8.3 |

7.8 |

8.0 |

d) |

Over 5 years |

15.1 |

16.6 |

9.1 |

15.7 |

5.6 |

5.8 |

10.4 |

19.3 |

- |

0.1 |

13.4 |

15.7 |

II. Borrowings |

|

|

|

|

|

|

|

|

|

|

|

|

a) |

Up to 1 year |

39.9 |

45.4 |

42.4 |

50.3 |

54.5 |

63.7 |

41.7 |

49.2 |

78.8 |

84.5 |

46.1 |

52.6 |

b) |

Over 1 year and up to 3 years |

12.5 |

12.2 |

16.2 |

11.8 |

12.5 |

13.4 |

16.4 |

11.7 |

14.7 |

9.2 |

13.8 |

11.7 |

c) |

Over 3 years and upto 5 years |

12.3 |

15.2 |

9.8 |

12.5 |

11.4 |

7.8 |

9.7 |

12.9 |

2.1 |

2.7 |

10.2 |

12.5 |

d) |

Over 5 years |

35.3 |

27.2 |

31.6 |

25.4 |

21.6 |

15.1 |

32.2 |

26.2 |

4.4 |

3.5 |

29.9 |

23.2 |

III Loans and Advances |

|

|

|

|

|

|

|

|

|

|

|

|

a) |

Up to 1 year |

36.0 |

34.3 |

37.6 |

35.2 |

41.9 |

44.0 |

36.3 |

32.4 |

68.1 |

67.4 |

37.8 |

35.9 |

b) |

Over 1 year and up to 3 years |

36.3 |

37.4 |

36.4 |

37.1 |

38.4 |

36.1 |

35.8 |

37.4 |

17.0 |

15.5 |

35.4 |

36.3 |

c) |

Over 3 years and upto 5 years |

10.9 |

11.0 |

11.4 |

11.3 |

9.9 |

9.1 |

11.9 |

12.0 |

4.2 |

4.5 |

10.7 |

10.8 |

d) |

Over 5 years |

16.8 |

17.3 |

14.5 |

16.4 |

9.8 |

10.8 |

16.0 |

18.2 |

10.7 |

12.5 |

16.1 |

17.0 |

IV. Investments |

|

|

|

|

|

|

|

|

|

|

|

|

a) |

Up to 1 year |

18.1 |

20.1 |

36.6 |

42.5 |

28.7 |

30.3 |

38.8 |

45.7 |

79.9 |

76.6 |

27.5 |

30.4 |

b) |

Over 1 year and up to 3 years |

12.7 |

12.6 |

22.7 |

17.3 |

12.2 |

12.2 |

25.6 |

18.6 |

14.2 |

12.9 |

15.0 |

13.7 |

c) |

Over 3 years and upto 5 years |

14.4 |

14.2 |

10.0 |

9.2 |

11.7 |

13.0 |

9.5 |

8.2 |

3.4 |

5.2 |

12.4 |

12.2 |

d) |

Over 5 years |

54.8 |

53.1 |

30.7 |

31.0 |

47.3 |

44.4 |

26.1 |

27.5 |

2.5 |

5.3 |

45.0 |

43.7 |

Note: - Nil/negligible

Source: Balance sheets of respective banks. |

Off-Balance Sheet Operations of SCBs

Off-balance sheet exposures continued to

increase, albeit, at a slower pace

4.16 In recent years, off-balance sheet activities

of banks have come under the scrutiny of the

Reserve Bank, especially given the fact that the

excessive growth in off-balance sheet exposure of

banks in advanced economies has been one of the

factors behind the global financial turmoil. During

2011-12, total off-balance sheet liabilities (notional)

of banks registered lower growth than the previous

year. Bank group-wise analysis of off-balance sheet

exposure revealed that, off-balance sheet exposure (notional) as percentage of on-balance sheet

liabilities was significantly higher for foreign banks

as compared with other bank groups, due to their

higher exposure in forward contracts, guarantees

and acceptance/endorsements (Chart IV.6 and

Appendix Table IV.2).

3. Financial Performance of Scheduled

Commercial Banks

4.17 Financial performance of banks came

under pressure during 2011-12, mainly due to

the increased cost of deposits in the backdrop of

an elevated interest rate environment. However,

on a positive note, the efficiency of banks

improved. The two main indicators of profitability,

i.e., RoE and RoA declined marginally during

2011-12, reflecting deceleration in the net profit

of banks.

Profitability

Growth in consolidated net profit slowed

down due to spurt in interest expenditure

4.18 Despite accelerated growth in total income,

the consolidated net profit of the banking sector

increased at a slower rate compared with the

previous year, mainly due to the steep increase in

interest expended.

4.19 Interest expended on deposits accounted

for more than three-fourths of the total interest

expenditure of banks. This, along with an increase in the proportion of relatively high-cost term

deposits, led to an acceleration in the interest cost

of banks. In addition, retail deposits became more

costly in the backdrop of a high interest rate

environment.

Net interest margin dipped slightly

4.20 During 2011-12, the net interest margin

(NIM) of banks dipped marginally compared with

the previous year, mainly reflecting the steep rise

in interest expended (Table IV.9).

Table IV.9: Trends in Income and Expenditure of Scheduled Commercial Banks |

(Amount in ` billion) |

| Item |

2010-11 |

2011-12 |

Amount |

Percentage Variation |

Amount |

Percentage Variation |

1 |

2 |

3 |

4 |

5 |

1. Income |

5,712 |

15.5 |

7,408 |

29.7 |

a) Interest Income |

4,913 |

18.3 |

6,551 |

33.3 |

b) Other Income |

799 |

0.7 |

857 |

7.3 |

2. Expenditure |

5,009 |

14.5 |

6,591 |

31.6 |

a) Interest Expended |

2,989 |

9.9 |

4,305 |

44.0 |

b) Operating Expenses |

1,231 |

23.1 |

1,371 |

11.3 |

of which : Wage Bill |

727 |

31.6 |

780 |

7.3 |

c) Provisions and Contingencies |

788 |

20.8 |

915 |

16.1 |

3. Operating Profit |

1,491 |

22.0 |

1,732 |

16.1 |

4. Net Profit |

703 |

23.2 |

817 |

16.1 |

5. Net Interest Income (1a-2a) |

1,924 |

34.5 |

2,245 |

16.7 |

Memo Item: |

Net Interest Margin (NII as percentage of average assets) |

2.91 |

|

2.90 |

|

Note: Percentage variation could be slightly different as absolute numbers have been rounded off to ` billion.

Source: Annual accounts of respective banks. |

Consequent to the slowdown in net profit, RoA

and RoE dipped marginally

4.21 During 2011-12, two major indicators of

profitability, RoA and RoE dipped marginally

compared with the previous year, mainly reflecting

the slowdown in net profit caused by increased

interest expenditure (Table IV.10). A more detailed analysis of RoA and RoE of bank groups is

provided in Box IV.1.

Table IV.10: Return on Assets and Return on Equity of SCBs – Bank Group-wise |

(Per cent) |

Bank group/year |

Return on

Assets |

Return on

Equity |

2010-

11 |

2011-

12 |

2010-

11 |

2011-

12 |

1 |

2 |

3 |

4 |

5 |

1 |

Public sector banks |

0.96 |

0.88 |

16.90 |

15.33 |

|

1.1 Nationalised banks* |

1.03 |

0.88 |

18.19 |

15.05 |

|

1.2 SBI Group |

0.79 |

0.89 |

14.11 |

16.00 |

2 |

Private sector banks |

1.43 |

1.53 |

13.70 |

15.25 |

|

2.1 Old private sector banks |

1.12 |

1.20 |

14.11 |

15.18 |

|

2.2 New private sector banks |

1.51 |

1.63 |

13.62 |

15.27 |

3 |

Foreign banks |

1.75 |

1.76 |

10.28 |

10.79 |

|

All SCBs |

1.10 |

1.08 |

14.96 |

14.60 |

Notes: 1. Return on Assets for a group is obtained as weighted average

of return on assets of individual banks in the group, being the

proportion of total assets of the bank as percentage to total

assets of the group.

2. Return on Equity = Net profit/average of capital and reserves

and surplus for current and previous year.

3. * Nationalised banks include IDBI Bank Ltd. |

Efficiency

Operating efficiency, as captured by cost to

income ratio witnessed improvement

4.22 During 2011-12, operating efficiency of

banks in terms of cost-to-income ratio2 witnessed

an improvement. The other efficiency indicator,

NIM, dipped marginally, which implied reduction

in cost of financial intermediation (Chart IV.7).

Cost/Return on funds

Spread of banks narrowed due to increased

cost of funds

4.23 During 2011-12, both cost as well as return

on funds increased for the banks. However, the

spreads narrowed due to the higher increase in

cost of funds. At the bank group level, cost of funds

was lower in the case of foreign banks, partly because low cost CASA deposits formed a higher

proportion of total deposits for foreign banks

(Table IV.11 and Chart IV.8).

Table IV.11: Cost of Funds and Returns on Funds - Bank Group-wise |

(Per cent) |

Sr.

no. |

Bank group/year |

Cost of

Deposits |

Cost of

Borrowings |

Cost of

Funds |

Return on

Advances |

Return on

Investments |

Return on

Funds |

Spread |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9= (8-5) |

1 |

Public sector banks |

|

|

|

|

|

|

|

|

2010-11 |

5.12 |

2.28 |

4.89 |

9.09 |

6.80 |

8.41 |

3.52 |

|

2011-12 |

6.36 |

2.81 |

6.06 |

10.30 |

7.54 |

9.52 |

3.46 |

1.1 |

Nationalised banks* |

|

|

|

|

|

|

|

|

2010-11 |

5.13 |

2.36 |

4.93 |

9.21 |

6.83 |

8.49 |

3.56 |

|

2011-12 |

6.51 |

2.78 |

6.22 |

10.32 |

7.44 |

9.49 |

3.27 |

1.2 |

SBI Group |

|

|

|

|

|

|

|

|

2010-11 |

5.09 |

2.14 |

4.79 |

8.84 |

6.72 |

8.22 |

3.43 |

|

2011-12 |

5.97 |

2.85 |

5.66 |

10.26 |

7.78 |

9.59 |

3.93 |

2 |

Private sector banks |

|

|

|

|

|

|

|

|

2010-11 |

4.97 |

2.33 |

4.56 |

9.65 |

6.53 |

8.55 |

3.99 |

|

2011-12 |

6.43 |

2.92 |

5.84 |

10.99 |

7.26 |

9.69 |

3.85 |

2.1 |

Old private sector banks |

|

|

|

|

|

|

|

|

2010-11 |

5.63 |

2.24 |

5.50 |

10.42 |

6.20 |

8.98 |

3.48 |

|

2011-12 |

7.24 |

4.34 |

7.10 |

11.98 |

7.37 |

10.47 |

3.37 |

2.2 |

New private sector banks |

|

|

|

|

|

|

|

|

2010-11 |

4.73 |

2.33 |

4.27 |

9.41 |

6.62 |

8.42 |

4.15 |

|

2011-12 |

6.14 |

2.81 |

5.45 |

10.69 |

7.23 |

9.46 |

4.01 |

3 |

Foreign banks |

|

|

|

|

|

|

|

|

2010-11 |

3.30 |

2.56 |

3.11 |

8.75 |

7.39 |

8.11 |

5.00 |

|

2011-12 |

4.34 |

2.60 |

3.83 |

9.61 |

8.10 |

8.91 |

5.08 |

4 |

All SCBs |

|

|

|

|

|

|

|

|

2010-11 |

5.01 |

2.33 |

4.73 |

9.18 |

6.79 |

8.42 |

3.69 |

|

2011-12 |

6.28 |

2.81 |

5.90 |

10.40 |

7.53 |

9.52 |

3.62 |

Notes : 1. Cost of Deposits = Interest paid on deposits/Average of current and previous year’s deposits.

2. Cost of Borrowings = Interest paid on borrowings/Average of current and previous year’s borrowings.

3. Cost of Funds = (Interest paid on deposits + Interest paid on borrowings)/(Average of current and previous year’s deposits plus borrowings).

4. Return on Advances = Interest earned on advances /Average of current and previous year’s advances.

5. Return on Investments = Interest earned on investments /Average of current and previous year’s investments.

6. Return on Funds = (Interest earned on advances + interest earned on investments) / (Average of current and previous year’s advances plus investments).

7. *: Includes IDBI Bank Ltd.

Source: Calculated from balance sheets of respective banks. |

4. Soundness Indicators

4.24 All scheduled commercial banks in India

have become Basel II compliant as per the

standardised approach with effect from April 1,

2009. For migrating to advanced approaches of

Basel II, the Reserve Bank issued separate set of

guidelines and the applications received from

banks for migration to advanced approaches of

Basel II are at various stages of examination with

the Reserve Bank. Parallel to this process, the

Reserve Bank came out with the final guidelines

for implementation of Basel III in May 2012. The

guidelines issued by the Reserve Bank will become

effective from January 1, 2013. Against this

backdrop, it is important to examine the existing

capital position and other soundness indicators

of Indian banks in order to assess banks’

preparedness to migrate to the more advanced

regulatory approaches.

Box IV.1: What Drives the Profitability of Indian Banks?: A Du Pont Analysis for Bank Groups

Profitability of banks facilitates many aspects, which includes,

inter alia, enhancing the ability of banks to mobilise resources

from the capital market, as well as better management of nonperforming

assets. In addition, sound profitability of banks

enhances their ability to augment the financial inclusion

process. During the pre-liberalisation period, banks in India

were operating in a rather tight regulatory environment. After

liberalisation, Indian banks operated in a less regulated

environment in terms of interest rate liberalisation, reduction

in reserve requirements, and entry deregulation. In addition,

with the advent of complex financial products, banks’ business

has expanded in recent years beyond the traditional financial

intermediation process. Also, off-balance sheet exposure of

banks has witnessed a significant increase in recent years.

Against this backdrop, it is important to analyse the main

sources of profitability of Indian banks.

In recent years, significant variation in profitability has been

observed among bank groups. It was observed that, generally

profitability of foreign banks was higher than that of other

bank groups. Some past studies on profitability of Indian

banks concluded that higher profitability of foreign banks

could be attributed to their access to low cost CASA deposits,

diversification of income as well as higher “other income”.

During 2011-12, foreign banks accounted for close to 12 per

cent of the total net profit of SCBs. As against this, their share

in total assets of Indian banking sector stood at 7 per cent

(Charts 1.A and 1.B).

In order to understand the sources of profitability across

bank groups, RoE analysis and Du Pont analysis have been

carried out taking the bank group-wise data for 2011-12. The

RoE analysis decomposes the profitability of banks into two

components, i.e., profitability of bank assets, as captured by RoA and leverage, captured by the ratio of total average assets

to total average equity. Further, decomposition of RoE suggests

that banks’ profitability can be associated with higher return

from assets or higher leverage or both. There are some studies

which focused on the possibility of getting a higher RoE by

substitution of equity capital with lower cost long-term debt.

While higher return on assets is always considered good, a

higher leverage ratio exposes bank to the risk of insolvency.

Table 1.1: RoE Analyis of Profitability: 2011-12 |

Bank Group |

Return on

Equity |

Profitability of Assets |

Leverage |

Capital to Assets

Ratio |

1 |

2 |

3 |

4 |

5 |

SBI group |

16 |

0.91 |

17.58 |

0.07 |

Nationalised banks |

15.05 |

0.87 |

17.37 |

0.4 |

Old private sector banks |

15.18 |

1.15 |

13.23 |

0.35 |

New private sector banks |

15.27 |

1.57 |

9.72 |

0.27 |

Foreign banks |

10.79 |

1.75 |

6.15 |

6.95 |

It follows from the empirical result presented in Table 1.1,

that the higher RoE for the SBI group and nationalised banks

was associated with a higher leverage ratio, while for new

private sector banks, the higher RoE was attributable to higher

profitability of assets and lower leverage. Among the bank

groups, foreign banks had the highest return from assets as

well as the lowest leverage ratio. The capital to assets ratio, as

calculated for various bank groups using balance sheet data,

further corroborates the findings of RoE analysis. As at end-

March 2012, this ratio was highest for foreign banks, indicating

their better capital position vis-à-vis other bank groups.

Du Pont analysis decomposes profitability of banks into two

components, viz., asset utilisation and cost management.

Asset utilisation is captured by the total income net of interest

expenditure and provisions/contingencies as percentages of

average total assets. The ratio of operating expenses to average

total assets indicates how efficiently a bank is using its resources

and is thus termed as a parameter to understand the efficiency

of cost management by banks. Better profit of banks can be

attributed to better asset utilisation or better cost management

or both simultaneously. Table 1.2 summarises the result of Du

Pont analysis carried out on banks, for 2011-12.

According to the results of Du Pont analysis, foreign banks

registered the highest RoA among bank groups, mainly on

account of better asset utilisation, though their operating

expenses to assets ratio was also higher when compared to

other bank groups. This result corroborates the findings of past

literature according to which foreign banks’ higher profitability

could be attributed to better fund management practices.

Table 1.2: Du Pont Analysis of Profitability: 2011-12 |

Bank Group |

Asset Utilisation |

Cost Management |

1 |

2 |

3 |

SBI group |

2.85 |

1.94 |

Nationalised banks |

2.35 |

1.48 |

Old private sector banks |

3.06 |

1.91 |

New private sector banks |

3.81 |

2.24 |

Foreign banks |

4.27 |

2.52 |

Capital Adequacy

CRAR under both Basel I and II remained well

above the stipulated norm

4.25 The capital to risk-weighted assets ratio

(CRAR) remained well above the stipulated 9 per

cent for the system as a whole as well as for all

bank groups during 2011-12, indicating that

Indian banks remained well-capitalised. Also, the

CRAR (Basel II) at the system-level improved

marginally compared with the previous year

(Table IV.12).

Table IV.12: Capital to Risk-Weighted Assets Ratio under Basel I and II – Bank Group-wise |

(As at end-March) |

(Per cent) |

Bank Group |

Basel I |

Basel II |

2011 |

2012 |

2011 |

2012 |

1 |

2 |

3 |

4 |

5 |

Public sector banks |

11.78 |

11.88 |

13.08 |

13.23 |

Nationalised banks* |

12.15 |

11.84 |

13.47 |

13.03 |

SBI group |

11.01 |

11.97 |

12.25 |

13.70 |

Private sector banks |

15.15 |

14.47 |

16.46 |

16.21 |

Old private sector banks |

13.29 |

12.47 |

14.55 |

14.12 |

New private sector banks |

15.55 |

14.90 |

16.87 |

16.66 |

Foreign banks |

17.71 |

17.31 |

16.97 |

16.74 |

Scheduled commercial banks |

13.02 |

12.94 |

14.19 |

14.24 |

Note: *: Includes IDBI Bank Ltd.

Source: Based on off-site returns submitted by banks. |

Tier I capital constituted more than 70 per

cent of capital funds of banks

4.26 The component-wise breakup of capital

funds indicated that Tier I capital accounted for more than 70 per cent of the total capital of Indian

banks both under Basel I and II, reflecting the

sound capital position of banks. As at end-March

2012, the core CRAR stood well above the

stipulated minimum of 6 per cent (Table IV.13).

4.27 As at end-March 2012, the majority of

public sector banks had Tier I capital adequacy

ratio within the range of 8 to 12 per cent

(Chart IV.9).

Table IV.13: Component-wise Capital Adequacy of SCBs |

(As at end-March) |

(Amount in ` billion) |

Item |

Basel I |

Basel II |

2011 |

2012 |

2011 |

2012 |

1. Capital funds (i+ii) |

6,745 |

7,810 |

6,703 |

7,780 |

i) Tier I capital |

4,765 |

5,685 |

4,745 |

5,672 |

ii) Tier II capital |

1,980 |

2,124 |

1,958 |

2,109 |

2. Risk-weighted assets |

51,807 |

60,375 |

47,249 |

54,623 |

3. CRAR (A as % of B) |

13.0 |

12.9 |

14.2 |

14.2 |

of which: Tier I |

9.2 |

9.4 |

10.0 |

10.4 |

Tier II |

3.8 |

3.5 |

4.1 |

3.9 |

Source: Based on off-site returns submitted by banks. |

Leverage Ratio

Leverage ratio remained well above 4.5

per cent

4.28 In 2011-12, the leverage ratio, calculated

as Tier I capital (under Basel II) as percentage of

total assets increased compared with the previous

year and remained above 4.5 per cent3. This was

in sync with the increase in CRAR (under

Basel II) (Chart IV.10).

Non-Performing Assets

Gross NPA ratio at system-level increased,

mainly on account of the deterioration in

asset quality of public sector banks

4.29 During 2011-12, the deteriorating asset

quality of the banking sector emerged as a major

concern, with gross NPAs of banks registering a

sharp increase. The spurt in NPAs could be

attributed to the slowdown prevailing in the domestic economy as well as inadequate

appraisal and monitoring of credit proposals

(Chart IV.11)4.

4.30 The deterioration in asset quality was more

pronounced in the case of public sector banks.

During 2011-12, the gross NPAs of public sector

banks increased at a higher rate as compared with

the growth rate of NPAs at a system-level (Table

IV.14 and Chart IV.12).

Table IV.14: Trends in Non-performing Assets - Bank Group-wise |

(Amount in ` billion) |

Item |

Public sector banks |

Nationalised banks* |

SBI Group |

Private sector banks |

Old private sector

banks |

New private sector

banks |

Foreign banks |

Scheduled commercial banks |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

Gross NPAs |

|

|

|

|

|

|

|

|

Closing balance for 2010-11 |

746 |

442 |

303 |

182 |

36 |

145 |

50 |

979 |

Opening balance for 2011-12 |

746 |

442 |

303 |

182 |

36 |

145 |

50 |

979 |

Addition during 2011-12 |

928 |

586 |

341 |

98 |

27 |

71 |

45 |

1,071 |

Recovered during 2011-12 |

478 |

325 |

152 |

73 |

20 |

52 |

32 |

585 |

Written off during 2011-12 |

23 |

13 |

10 |

19 |

1 |

18 |

- |

43 |

Closing balance for 2011-12 |

1,172 |

690 |

482 |

187 |

42 |

145 |

62 |

1,423 |

Gross NPAs as per cent of Gross Advances** |

|

|

|

|

|

|

|

|

2010-11 |

2.4 |

2.1 |

3.4 |

2.5 |

1.9 |

2.7 |

2.5 |

2.5 |

2011-12 |

3.3 |

2.8 |

4.6 |

2.1 |

1.8 |

2.2 |

2.6 |

3.1 |

Net NPAs |

|

|

|

|

|

|

|

|

Closing balance for 2010-11 |

360 |

212 |

147 |

44 |

9 |

34 |

12 |

417 |

Closing balance for 2011-12 |

591 |

389 |

202 |

44 |

13 |

30 |

14 |

649 |

Net NPAs as per cent of Net Advances*** |

|

|

|

|

|

|

|

|

2010-11 |

1.2 |

1.0 |

1.7 |

0.6 |

0.5 |

0.6 |

0.6 |

1.1 |

2011-12 |

1.7 |

1.6 |

2.0 |

0.5 |

0.6 |

0.5 |

0.6 |

1.4 |

Notes: 1. *: Includes IDBI Bank Ltd.

2. **: Calculated taking gross NPAs from annual accounts of respective banks and gross advances from off-site returns.

3. ***: Calculated taking net NPAs from annual accounts of respective banks and net advances from off-site returns.

4. -: Nil/negligible.

Source: Balance sheets of respective banks. |

Slippage ratio deteriorated, though recovery

ratio witnessed an improvement

4.31 In addition to an increase in gross NPAs at

the system-level, fresh accretion of NPAs, as

captured by the slippage ratio5 also increased

during 2011-12 compared with the previous year.

However, on a positive note, the recovery ratio6 of

the banking sector witnessed an improvement

during the year. During 2011-12, the written-off

ratio7 was significantly lower as compared with

the previous year (Chart IV.13).

4.32 At the bank group level, the accretion to

NPAs as captured by the slippage ratio was higher

in the case of public sector banks and foreign

banks. However, their recovery performance was

also better than private sector banks. Among various bank groups, new private sector banks

relied more on writing off NPAs as a measure to

contain their NPAs level (Chart IV.14).

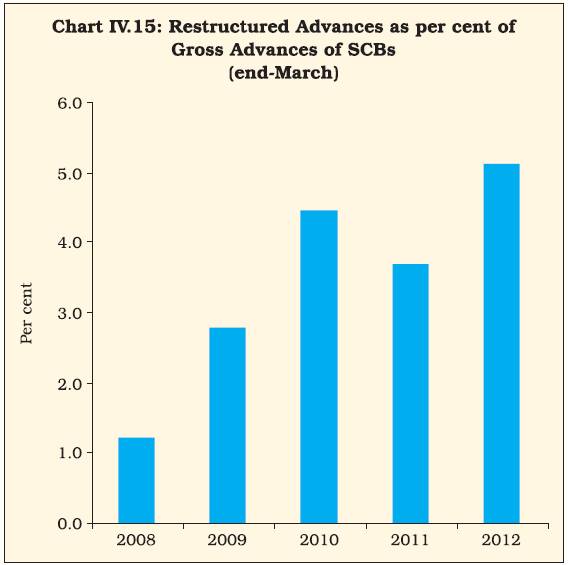

Restructured standard advances increased

significantly

4.33 In recent years, restructuring of advances

has been one of the important channels used by

banks to contain the deterioration in asset quality caused by burgeoning NPAs. Consequent to the

slowdown in domestic economy, banks, especially

public sector banks actively resorted to

restructuring their advances under the special

dispensation scheme of the Reserve Bank

announced during 2008. The scheme enabled

banks to retain the status of standard accounts

even after restructuring. The steep increase in

gross NPAs during 2011-12 was accompanied by

a considerable pick-up in the growth of restructured

advances. This was mainly due to the steep

increase in restructured advances by public sector

banks, particularly nationalised banks (Charts

IV.15 and IV.16).

4.34 During 2011-12, total amount of NPAs

recovered through the Securitisation and

Reconstruction of Financial Assets and

Enforcement of Security Interest Act (SARFAESI

Act), Debt Recovery Tribunals (DRTs) and Lok

Adalats registered a decline compared with the

previous year. Of the total amount recovered

through these channels, recoveries under the

SARFAESI Act constituted almost 70 per cent.

4.35 Banks approach the DRTs in case they fail

to recover total amount of their bad loans through

the SARFAESI Act. At present, there are 33 DRTs and five Debt Recovery Appellate Tribunals across

the country. NPAs recovered through DRTs

constituted almost 28 per cent of total NPAs

recovered through these three channels (Table

IV.15).

Table IV.15: NPAs of SCBs Recovered through Various Channels |

(Amount in ` billion) |

Recovery channel |

2010-11 |

2011-12 |

No. of cases

referred |

Amount

involved |

Amount

recovered* |

Col. (4) as %

of Col. (3) |

No. of cases

referred |

Amount

involved |

Amount

recovered* |

Col.(8) as %

of Col.(7) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

i) Lok Adalats |

6,16,018 |

53 |

2 |

3.7 |

4,76,073 |

17 |

2 |

11.8 |

ii) DRTs |

12,872 |

141 |

39 |

27.6 |

13,365 |

241 |

41 |

17.0 |

iii) SARFAESI Act |

1,18,642# |

306 |

116 |

37.9 |

1,40,991# |

353 |

101 |

28.6 |

Total |

7,47,532 |

500 |

157 |

31.4 |

6,30,429 |

611 |

144 |

23.6 |

Notes: 1. *: Refers to amount recovered during the given year, which could be with reference to cases referred during the given year as well as during

the earlier years.

2. #: Number of notices issued. |

4.36 As at end-June 2012, banks subscribed to

almost 70 per cent of total security receipts issued

by 14 securitisation/reconstruction companies.

These companies, which function under the

SARFAESI Act, acquire NPAs from banks, which

helps the banking sector to improve the quality of

their balance sheets (Table IV.16).

Table IV.16: Details of Financial Assets

Securitised by SCs/RCs |

(Amount in ` billion) |

Item |

End-March

2012 |

End-June

2012 |

1 |

2 |

3 |

1 |

Book value of assets acquired |

769 |

805 |

2 |

Security Receipts issued by SCs/RCs |

165 |

167 |

3 |

Security Receipts subscribed by |

|

|

|

(a) Banks |

115 |

116 |

|

(b) SCs/RCs |

35 |

36 |

|

(c) FIIs |

1 |

1 |

|

(d) Others (Qualified Institutional Buyers) |

14 |

15 |

4 |

Amount of Security Receipts completely redeemed |

79 |

82 |

Source: Quarterly Statement submitted by Securitisation Companies/

Reconstruction Companies (SCs/RCs). |

Provisioning coverage ratio declined

4.37 Though total provisioning increased at a

higher rate, in sync with the higher growth of NPAs,

the provisioning coverage ratio (PCR) dipped

compared with the previous year. This was mainly

due to the decline in the PCR of public sector

banks (Table IV.17).

Table IV.17: Trends in Provisions for Non-performing Assets – Bank Group-wise |

(Amount in ` billion) |

Item |

Public

sector

banks |

Nationalised

banks* |

SBI

group |

Private

sector

banks |

Old

private

sector

banks |

New

private

sector

banks |

Foreign

banks |

Scheduled

commercial

banks |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

Provisions for NPAs |

|

|

|

|

|

|

|

|

As at end-March 2011 |

366 |

212 |

154 |

135 |

24 |

110 |

38 |

540 |

Add : Provisions made during the year |

381 |

219 |

161 |

56 |

8 |

47 |

34 |

472 |

Less : Write-off, write- back of excess during the year |

190 |

152 |

38 |

51 |

7 |

43 |

23 |

264 |

As at end-March 2012 |

558 |

279 |

278 |

140 |

25 |

114 |

49 |

747 |

Memo: Provisioning Coverage Ratio (Ratio of outstanding provisions to gross NPAs (per cent)) |

End-March 2011 |

49.0 |

47.9 |

50.7 |

74.0 |

64.9 |

75.6 |

75.0 |

55.1 |

End-March 2012 |

47.6 |

40.4 |

57.7 |

74.9 |

61.0 |

78.6 |

79.0 |

52.5 |

Note: *: Includes IDBI Bank Ltd.

Source: Balance sheets of respective banks. |

Net NPAs increased significantly

4.38 In sync with the acceleration in growth of

gross NPAs as well as a lower provisioning

coverage, net NPAs registered higher growth. Net

NPA ratio was on a higher side for public sector

banks, as compared with private sector and

foreign banks (Also see Table IV.14).

NPAs became stickier, with proportion of substandard

as well as doubtful assets in gross

advances registering an increase

4.39 Apart from an increase in NPAs, the

deterioration in asset quality was also evident in the form of rising sub-standard/doubtful assets

as a percentage of gross advances. Increase in

these two categories of NPAs as percentage of gross

advances indicated that NPAs became stickier

(Table IV.18).

Table IV.18: Classification of Loan Assets - Bank Group-wise |

(As at end-March) |

(Amount in ` billion) |

Sr.

No. |

Bank group |

Year |

Standard assets |

Sub-standard assets |

Doubtful assets |

Loss assets |

Amount |

Per cent* |

Amount |

Per cent* |

Amount |

Per cent* |

Amount |

Per cent* |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

1 |

Public sector banks |

2011 |

32,718 |

97.8 |

350 |

1.0 |

332 |

1.0 |

65 |

0.2 |

|

|

2012 |

38,255 |

97.0 |

623 |

1.6 |

490 |

1.2 |

60 |

0.2 |

1.1 |

Nationalised banks** |

2011 |

22,900 |

98.1 |

218 |

0.9 |

193 |

0.8 |

32 |

0.1 |

|

|

2012 |

26,910 |

97.5 |

402 |

1.5 |

268 |

1.0 |

21 |

0.1 |

1.2 |

SBI Group |

2011 |

9,818 |

97.0 |

132 |

1.3 |

139 |

1.4 |

33 |

0.3 |

|

|

2012 |

11,345 |

95.9 |

221 |

1.9 |

222 |

1.9 |

39 |

0.3 |

2 |

Private sector banks |

2011 |

7,936 |

97.8 |

45 |

0.6 |

108 |

1.3 |

29 |

0.4 |

|

|

2012 |

9,629 |

98.1 |

52 |

0.5 |

104 |

1.1 |

29 |

0.3 |

2.1 |

Old private sector banks |

2011 |

1,836 |

98.0 |

13 |

0.7 |

18 |

1.0 |

6 |

0.3 |

|

|

2012 |

2,287 |

98.2 |

18 |

0.8 |

17 |

0.7 |

7 |

0.3 |

2.2 |

New private sector banks |

2011 |

6,100 |

97.7 |

33 |

0.5 |

90 |

1.4 |

22 |

0.4 |

|

|

2012 |

7,342 |

98.1 |

34 |

0.4 |

87 |

1.2 |

22 |

0.3 |

| 3 |

Foreign banks |

2011 |

1,943 |

97.5 |

19 |

0.9 |

21 |

1.1 |

11 |

0.5 |

|

|

2012 |

2,284 |

97.3 |

21 |

0.9 |

22 |

0.9 |

20 |

0.8 |

| 4. |

Scheduled commercial banks |

2011 |

42,596 |

97.8 |

414 |

0.9 |

461 |

1.1 |

104 |

0.2 |

|

|

2012 |

50,168 |

97.2 |

695 |

1.3 |

617 |

1.2 |

109 |

0.2 |

Notes: 1. Constituent items may not add up to the total due to rounding off.

2. * : As per cent to gross advances.

3. **: Includes IDBI Bank Ltd.

Source: Off-site Returns. |

Sector-wise Analysis of Non-performing Assets8

Deterioration in asset quality of public sector

banks was spread across priority and non-priority

sectors

4.40 Bank group-wise analysis of the ratio of

gross NPAs to gross advances indicated that for

public sector banks, this ratio increased for both

the priority and non-priority sectors. In addition,

the gross NPAs to gross advances ratio (priority

sector) was significantly higher for public sector

banks than other bank groups (Chart IV.17).

Nearly half of the total NPAs were attributed

to priority sectors

4.41 During 2011-12, total priority sector NPAs

increased at a significantly higher rate than the

growth rate of credit to the priority sector.

However, the share of the priority sector in total

NPAs declined compared with the previous year.

Among bank groups, proportion of priority sector

in total NPAs was higher for public sector banks.

Share of agricultural sector in total NPAs

registered an increase

4.42 The sectoral classification of NPAs revealed

that, during 2011-12, the share of agriculture in

total NPAs increased marginally. However, despite

the subdued industrial performance, the share of micro and small enterprises in total NPAs of the

banking sector came down as compared with the

previous year (Chart IV.18 and Table IV.19).

Table IV.19: Sector-wise NPAs of Domestic Banks* |

(Amount in ` billion) |

Bank group |

Priority sector |

Of which |

Non-Priority

sector |

Of which |

Total NPAs |

Agriculture |

Micro and Small

Enterprises |

Others |

Public Sector |

Amt. |

Per cent |

Amt. |

Per cent |

Amt. |

Per cent |

Amt. |

Per cent |

Amt. |

Per cent |

Amt. |

Per cent |

Amt. |

Per cent |

Public sector banks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011 |

413 |

58.1 |

145 |

20.4 |

144 |

20.2 |

124 |

17.5 |

298 |

41.9 |

3 |

0.4 |

711 |

100.0 |

2012 |

562 |

50.0 |

227 |

20.1 |

178 |

15.9 |

157 |

14.0 |

563 |

50.0 |

32 |

2.9 |

1,125 |

100.0 |

Nationalised banks** |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011 |

257 |

59.9 |

92 |

21.5 |

105 |

24.4 |

60 |

14.0 |

172 |

40.1 |

3 |

0.6 |

430 |

100.0 |

2012 |

323 |

48.3 |

129 |

19.3 |

134 |

20.0 |

61 |

9.1 |

345 |

51.7 |

10 |

1.5 |

668 |

100.0 |

SBI group |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011 |

156 |

55.3 |

53 |

18.7 |

39 |

13.9 |

64 |

22.7 |

126 |

44.7 |

- |

0 |

281 |

100.0 |

2012 |

239 |

52.3 |

98 |

21.4 |

45 |

9.8 |

97 |

21.1 |

218 |

47.7 |

22 |

4.9 |

457 |

100.0 |

Private sector banks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011 |

48 |

26.8 |

22 |

12.1 |

13 |

7.2 |

14 |

7.5 |

132 |

73.2 |

2 |

0.8 |

180 |

100.0 |

2012 |

51 |

27.9 |

22 |

11.8 |

17 |

9.4 |

12 |

6.7 |

132 |

72.1 |

0 |

0 |

183 |

100.0 |

Old private sector banks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011 |

16 |

43.3 |

4 |

11.3 |

6 |

14.9 |

6 |

17.1 |

21 |

56.7 |

2 |

4.1 |

37 |

100.0 |

2012 |

18 |

42.9 |

6 |

13.4 |

7 |

16.8 |

5 |

12.8 |

24 |

57.1 |

0 |

0 |

42 |

100.0 |

New private sector banks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011 |

32 |

22.6 |

18 |

12.3 |

8 |

5.2 |

7 |

5.1 |

111 |

77.4 |

0 |

0 |

143 |

100.0 |

2012 |

33 |

23.4 |

16 |

11.3 |

10 |

7.1 |

7 |

4.9 |

108 |

76.6 |

0 |

0 |

141 |

100.0 |

All SCBs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011 |

461 |

51.8 |

167 |

18.7 |

157 |

17.6 |

138 |

15.5 |

430 |

48.2 |

4 |

0.5 |

891 |

100.0 |

2012 |

613 |

46.9 |

248 |

19.0 |

195 |

14.9 |

169 |

13.0 |

695 |

53.1 |

32 |

2.5 |

1,308 |

100.0 |

Notes: 1. * : Excluding foreign banks.

2. - : Nil/negligible

3. Amt. – Amount; Per cent – Per cent of total NPAs.

4. **- Includes IDBI Bank Ltd.

Source: Based on off-site returns (domestic) submitted by banks. |

Liquidity

Liquidity ratio exhibited marginal decline

4.43 During 2011-12, the liquidity of banks was

adversely affected by many structural and

frictional factors, which include, inter alia,

deceleration in deposits growth rate, growing

mismatch in maturity profile of assets and liabilities as well as exposure to long-run

infrastructure projects. The percentage of liquid

assets (cash and balances with the Reserve Bank

in excess of CRR requirements, and investments

and advances with maturity up to one year) in total

assets can be taken as a rough measure of banks’

liquidity condition. This ratio deteriorated

marginally during 2011-12.

5. Sectoral Deployment of Bank Credit

Deceleration evident in the growth of aggregate

non-food bank credit

4.44 The growth in aggregate non-food bank

credit decelerated in 2011-12. This trend is in

consonance with the overall slowdown observed

in the growth of loans and advances in banks’

consolidated balance sheet. Sluggish growth

performance of the domestic economy due to cyclical and structural factors partly explains the

slowdown in credit off-take. The overall slowdown

in non-food bank credit during 2011-12 mainly

emanated from slower growth in credit to industry,

services and personal loans.

4.45 Given that majority of the personal loans

are long-term in nature, growth in personal loans

assumes special significance, especially in the

backdrop of increase in NPAs during 2011-12. On

a year-on-year basis, the growth in personal loans

decelerated during 2011-12 compared with the

previous year. Within the personal loans segment,

housing credit slowed down (Table IV.20).

Table IV.20: Sectoral Deployment of Gross Bank Credit |

(Amount in ` billion) |

Sr

No. |

Sector |

Outstanding as on |

Percentage Variation |

Mar-11 |

Mar-12 |

2010-11 |

2011-12 |

1 |

Agriculture and Allied Activities |

4,603 |

5,226 |

10.6 |

13.5 |

2 |

Industry, of which |

16,208 |

19,659 |

23.6 |

21.3 |

|

2.1 Infrastructure |

5,266 |

6,191 |

38.6 |

17.6 |

|

2.2 Micro and Small Industries |

2,291 |

2,592 |

11.0 |

13.1 |

3 |

Services |

9,008 |

10,330 |

23.9 |

14.7 |

|

3.1 Trade |

1,863 |

2,209 |

13.2 |

18.6 |

|

3.2 Commercial Real Estate |

1,118 |

1,205 |

21.4 |

7.8 |

|

3.3 Tourism, Hotels & Restaurants |

277 |

313 |

42.9 |

12.9 |

|

3.4 Computer Software |

151 |

154 |

20.3 |

2.1 |

|

3.5 Non-Banking Financial Companies (NBFCs) |

1,756 |

2,218 |

54.8 |

26.3 |

4 |

Personal Loans |

6,854 |

7,683 |

17.0 |

12.1 |

|

4.1 Credit Card Outstanding |

181 |

204 |

-10.2 |

12.9 |

|

4.2 Education |

437 |

502 |

18.6 |