Policy actions, both domestic and global, augured well for the Indian financial markets in

Q3 of 2012-13. With aggressive monetary-easing measures by central banks of advanced

economies and some policy initiatives in distressed euro area economies, capital flows surged

into emerging economies. The Indian rupee and equity markets greatly benefitted from the

improved investor optimism. Despite the domestic macroeconomic stress, expectations of a

turnaround in the economy drove the rally in the Indian markets. Improved investor confidence

was also visible from the pick-up in the IPO market after a subdued year.

Global financial markets improve on

euro area policy action and fiscal cliff

agreement

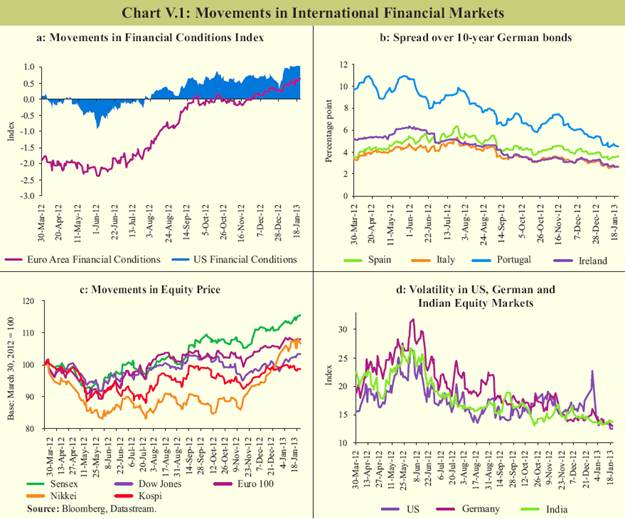

V.1 International financial market conditions

improved in Q3 of 2012-13 despite a fragile

global economic outlook. Recent financial

market developments indicate a perceived

reduction in some major downside risks to

the world economy. The easing of stress

can be seen in the positive streak shown by

Bloomberg’s Composite Financial Conditions

Index (BFCIUS Index) that tracks the overall

stress in money, bond, and equity markets,

thereby enabling assessment of the availability

and cost of credit (Chart V.1a).

V.2 The possibility of a near-term

worsening of the euro area crisis also

appears to have declined following new

policy announcements and the extension

of financial help to troubled periphery

economies. In December 2012, the euro area

finance ministers empowered the European

Central Bank (ECB) as the common bank

supervisor from 2014. They also approved

€39.5 billion aid to Spanish banks. International

leaders also agreed upon a deal to again

restructure Greece’s debt, with further large

hair cuts that paved the way for the release

of €34.4 billion in aid payment. Following

these developments, credit default swap

(CDS) spreads for European economies have

reduced.

V.3 With the improvement in borrowing

conditions in the financial markets, the 10-year

G-sec interest rate spread between distressed

euro area countries such as Spain, Italy, Ireland

and Portugal, and Germany declined (Chart

V.1b). The Italian and Spanish governments

were also able to raise longer-maturity debt

from the markets with improvements in

funding conditions.

V.4 Global equity prices showed major

gains in 2012, as investor preference to hold

risky assets increased following quantitative

stimuli announced by major central banks,

despite weak corporate earnings. The minifiscal

deal clinched by the US also aided the

rally in global markets in 2013 so far (Chart

V.1 c). Stock market uncertainty, as measured

by implied volatility, also decreased during the

period under review (Chart V.1d).

AE central banks’ unconventional policy

stimuli boost market sentiments

V.5 Unprecedented monetary stimuli by

central banks of advanced economies (AEs),

which include QE3 and recently announced

additional purchase of long-term treasury

securities to the tune of US$ 45 billion per month

by the US Federal Reserve (Fed), the outright

monetary transactions (OMT) programme by

the ECB and the asset purchase programme by

the Bank of Japan (BoJ), as well as measures

taken by the European Union to contain the euro area debt crisis, have helped revive global

financial market sentiments. Concomitantly,

the balance sheets of these central banks have

expanded significantly (Chart V.2).

V.6 Despite the positive impact of central

banks’ unconventional monetary policy actions, the future impact of such policy is of concern as

latter rounds of QE had a subdued effect (Chart

V.3a). Monetary policy stimuli in Q4 of 2012

did not necessarily have a dampening effect on

the long-term treasury yield in the US (Chart

V.3b). This could be because, in the absence

of a credible long-term fiscal consolidation

plan, yields may have become less responsive

to central bank actions. On the whole, the

evaluation of the success of QE would require

further research.

Buoyant capital flows drive asset prices in

EMDEs

V.7 Excessive global liquidity arising from

the easy monetary policy pursued by central

banks in AEs, along with the lack of investment

opportunities, channelled funds into the

emerging market and developing economies (EMDEs) in search of higher returns. India and

other Asian countries, such as South Korea,

Philippines and Thailand, received higher FII

inflows in 2012 than in 2011 (Chart V.4).

V.8 Apart from the push factors discussed

above, various pull factors emanating from

domestic factors, such as the continued

dependence of the Indian economy on

domestic consumption unlike other exportdriven

economies and the relatively stable

earnings of listed companies, aided the surge

in flows into India. The domestic reform

measures announced by the government since

mid-September 2012 also boosted investor

sentiments. Indian equity markets showed

significant turnaround, while the rupee

remained range-bound.

Money markets remained stable despite

liquidity deficit

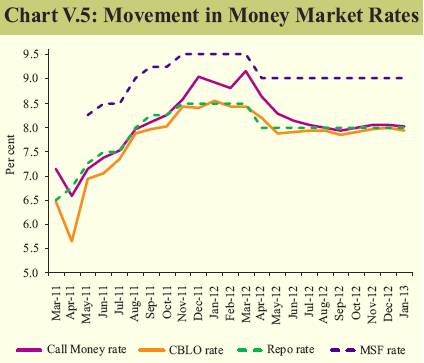

V.9 Notwithstanding tight liquidity

conditions due to advance tax payments,

high government cash balances and rise in

currency in circulation, the weighted average

call money rate generally remained around the

repo rate in Q3 of 2012-13. The rates in the

collateralised segments i.e., CBLO and market

repo, which constitute the predominant share

(around 80 per cent) of the overnight money

market, moved in tandem with the call money

rate (Chart V.5).

V.10 The amount of outstanding certificates

of deposits (CDs) witnessed a fall during 2012-

13. The weighted average effective interest rate (WAEIR) of aggregate CD issuances decreased

to 8.7 per cent at end-December 2012 from

11.1 per cent at end-March 2012 (Table V.1).

Table V.1: Average Daily Volume in Domestic Financial Markets |

(in ` billion) |

Month |

Money Market |

Bond Market |

Forex Market inter-bank (US$ bn) |

Stock

Market ## |

LAF |

Call Money |

Market Repo |

CBLO |

Commercial Paper* |

Certificates of Deposits* |

G-Sec** |

Corporate Bond# |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

Mar-12 |

–1574 |

175 |

112 |

380 |

912 |

4195 |

99 |

26 |

21 |

152 |

Jun-12 |

–913 |

152 |

180 |

376 |

1258 |

4252 |

258 |

30 |

19 |

117 |

Sep-12 |

–517 |

143 |

185 |

502 |

1706 |

3572 |

260 |

36 |

21 |

143 |

Oct-12 |

–671 |

150 |

218 |

436 |

1941 |

3531 |

230 |

39 |

20 |

139 |

Nov-12 |

–941 |

141 |

207 |

368 |

1994 |

3066 |

157 |

25 |

18 |

128 |

Dec-12 |

–1231 |

142 |

147 |

398 |

1818 |

3328 |

197 |

28 |

19 |

145 |

*: Outstanding position. ** : Average daily outright volume traded in central government dated securities.

# : Average daily trading in corporate bonds. ## : Average daily turnover in BSE and NSE.

Note: (–) ve figure under LAF indicates injection of liquidity into the system. |

V.11 Increased risk aversion by banks to lend

to the corporate sector, as evident from the

moderation in credit off-take, also manifested

in a significant uptick in the size of fortnightly

issuance of commercial paper (CP). The

weighted average discount rate (WADR) of

aggregate CP issuances decreased to 9.0 per

cent at end-December 2012 from 12.2 per cent

at end-March 2012.

Yield curve gets inverted on economic slack

and as borrowing programme stays on track

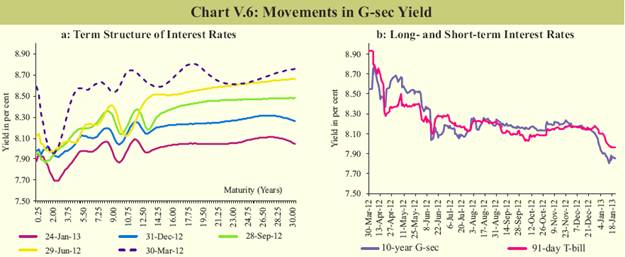

V.12 During Q3 of 2012-13, G-sec yields

firmed up in October, but declined markedly since December, with bonds rallying in

response to four major factors. First, the

market assessed that the year may pass

without additional market borrowing.

Second, expectations of a rate cut were built

on moderating inflation. Third, resumption

of OMO purchases by the Reserve Bank

also led to a rally in G-sec market. Fourth,

on review of the government’s cash position,

the auction of dated securities scheduled

for January 4, 2013 got postponed to late

February 2013, which also caused the

yields to soften. The 10-year generic yield

declined from 8.63 per cent at end-March

2012 to 7.99 per cent on January 1, 2013 and

further to 7.88 per cent as on January 24, 2013

(Chart V.6).

V.13 However, during Q3, the fall in short

term yields was not as significant, largely on

account of persistent tightness in liquidity

and the government’s decision to increase

the quantity of T-bill issuances during the last

quarter of the fiscal. With the spread between

the yield on the 10-year G-sec and 91-day

T-bill turning negative, the G-sec market

showed an inverted yield curve. During

the financial year, up to January 21, 2013,

the weighted average maturity of the dated

securities issued has increased to 13.5 years

from 12.5 years during the corresponding

period last year. The bid-cover ratio stood in

the range of 1.36-4.10 as against 1.39-5.12 in

the previous year (Table V.2).

V.14 In the same period, 27 states have

raised `1.3 trillion on a gross basis compared

with around `1.1 trillion raised during the

corresponding period of the previous year.

Rupee exchange rate remained range

bound in Q3 of 2012-13

V.15 Various reform measures, including

liberalised FDI limits for certain sectors and

the announcement of a fiscal consolidation

path, enhanced global investor confidence

in the Indian economy. This, along with

announcements of quantitative easing by the

US Fed and the BOJ, boosted capital inflows

to India and aided the recovery of the rupee.

Table V.2: Issuances of Central and State

Government Dated Securities |

Item |

2011-12 |

2012-13* |

1 |

2 |

3 |

Central Government |

|

|

Gross amount raised (` billion) |

5,100.0 |

5,220.0 |

Devolvement on primary dealer (` billion) |

121.1 |

18.3 |

Bid-cover ratio (range) |

1.39-5.12 |

1.36-4.10 |

Weighted average maturity (years) |

12.66 |

13.48 |

Weighted average yield (per cent) |

8.52 |

8.39 |

State government |

|

|

Gross amount raised (` billion) |

1,586.3 |

1,312.3 |

Cut-off yield range (per cent) |

8.36-9.49 |

8.58-9.31 |

Weighted average yield (per cent) |

8.79 |

8.92 |

* Up to January 21, 2013. |

Following the significant appreciation in

September 2012, the rupee movement turned

range bound with a weakening bias, reflecting

the wide trade deficit (Chart V.7).

V.16 As on January 23, 2013, the rupee

showed lower depreciation over end-March

2012 compared to other major EMDEs

like Brazil, South Africa and Argentina

(Table V.3).

Table V.3: Movement in Exchange Rates of Select EMDEs against the US dollar |

Appreciation (+)/Depreciation (-) in per cent |

Currency |

2010-11 |

2011-12 |

Jan 23, 2013

over end-

March 2012 |

1 |

2 |

3 |

4 |

|

Current Account Deficit Countries |

|

|

|

1. |

Brazilian Real |

9.7 |

-10.8 |

-10.4 |

2. |

Indian Rupee |

1.1 |

-12.7 |

-4.9 |

3. |

Mexican Peso |

4.3 |

-7.0 |

1.2 |

4. |

South African Rand |

8.0 |

-11.5 |

-14.3 |

5. |

Turkish Lira |

-4.8 |

-10.5 |

0.6 |

|

Current Account Surplus Countries |

|

|

|

1. |

Argentina |

-4.3 |

-7.5 |

-11.7 |

2. |

Indonesian Rupiah* |

4.7 |

-5.1 |

-4.7 |

3. |

Malaysian Ringgit |

8.2 |

-1.4 |

1.0 |

4. |

South Korea Won |

2.2 |

-2.7 |

6.9 |

5. |

Thai Baht |

6.7 |

-1.8 |

3.6 |

6. |

Russian Rouble |

3.4 |

-2.8 |

-3.0 |

7. |

Euro |

5.4 |

-6.0 |

-0.2 |

8. |

China |

4.1 |

4.2 |

0.3 |

*: Since Q4 of 2011 Indonesia has turned into a current account deficit country. |

Domestic equity markets firmed up as

market liquidity improved with FII flows

V.17 As on January 24, 2013, the domestic

equity markets witnessed a y-o-y gain of 17.2

per cent with a 6.2 per cent gain over end-

September 2012. Following the global equity

market rally driven by a spate of generally

better international economic data and policy

actions, the Indian bourses also picked up. The

BSE Sensex and S&P CNX Nifty crossed the

20,000 and 6,000 mark, respectively after two

years. The BSE Sensex closed at 19,924 on

January 24, 2013.

V.18 Various factors, including recent reform

measures such as the diesel price hike, cap on

subsidised LPG, permission for FDI in retail

and aviation and the passing of the Banking

Laws (Amendment) Bill, 2011 in Parliament,

along with hopes of a cut in the policy rate by the

Reserve Bank in January 2013, and sustained

FII inflows helped revive the domestic equity

market.

V.19 Market indicators, such as market

capitalisation and daily turnover, have shown

an increasing trend in 2012, reflecting the

positive sentiment in the Indian stock market.

Further, the PE ratio of the BSE Sensex

increased in 2012, indicating a rise in the

valuation of Indian stock over the year.

V.20 During 2012-13 (up to January 23,

2013), FIIs made net investments of `1,190

billion in the capital market (both equity and

debt) compared with that of `520 billion during

the corresponding period in the previous year.

FIIs made net investments of `1,011 billion in

the equity markets compared with `27 billion

last year.

V.21 Domestic institutional investors

(DIIs) (comprising banks, domestic financial

institutions, insurance companies, new

pension fund and mutual funds) made net

sales during 2012-13 (up to January 23, 2013)

(Chart V.8).

Bankex outperformed Sensex

V.22 As at end-December 2012, the BSE

Bankex, which represents major banks in

India, recorded much higher y-o-y gains

of 57 per cent than the BSE Sensex (26

per cent), despite concerns about modest

loan growth, deterioration in asset quality

and alleviated risks. The factors that

influenced the BSE Bankex favourably

are the strong balance sheet performance

by some private sector banks, stable net

interest margin owing to a reduction in

the CRR by 175 basis points of NDTL and

expectation of treasury profit as bonds rallied.

The Bankex also benefitted from the positive

sentiments in the overall Indian equity

markets.

Table V.4: House Price and Transaction Volume Indices (Base Q4:2008-09 = 100) |

Quarter |

Mumbai |

Delhi |

Bengaluru |

Ahmedabad |

Lucknow |

Kolkata |

Chennai* |

Jaipur |

Kanpur |

All India |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

House Price Index |

|

|

|

|

|

|

|

|

|

|

Q1:2011-12 |

191.6 |

152.8 |

116.9 |

152.3 |

149.3 |

157.0 |

106.3 |

161.1 |

135.4 |

152.0 |

Q2:2011-12 |

206.1 |

153.0 |

116.0 |

162.8 |

159.2 |

159.0 |

113.9 |

165.1 |

138.3 |

157.8 |

Q3:2011-12 |

191.7 |

168.6 |

146.1 |

171.8 |

172.3 |

155.0 |

120.3 |

163.5 |

140.0 |

164.1 |

Q4:2011-12 |

224.7 |

195.3 |

140.6 |

177.2 |

169.7 |

158.4 |

117.0 |

164.4 |

148.7 |

176.9 |

Q1:2012-13 |

231.8 |

217.3 |

140.2 |

176.6 |

179.4 |

204.2 |

133.9 |

171.9 |

144.9 |

188.6 |

Q2:2012-13 |

232.4 |

225.2 |

143.0 |

183.4 |

208.9 |

226.9 |

129.5 |

177.7 |

135.8 |

194.3 |

Growth in per cent |

|

|

|

|

|

|

|

|

|

|

y-o-y |

12.8 |

47.2 |

23.2 |

12.7 |

31.3 |

42.7 |

13.7 |

7.6 |

–1.8 |

23.1 |

q-o-q |

0.3 |

3.6 |

2.0 |

3.9 |

16.4 |

11.1 |

–3.3 |

3.4 |

–6.3 |

3.0 |

House Transactions Volume Index |

|

|

|

|

|

|

|

|

|

|

Q1:2011-12 |

89.5 |

149.4 |

100.8 |

134.3 |

93.9 |

107.9 |

80.3 |

243.1 |

208.4 |

123.2 |

Q2:2011-12 |

79.0 |

165.5 |

123.5 |

154.1 |

106.7 |

139.2 |

85.5 |

239.1 |

131.1 |

129.1 |

Q3:2011-12 |

75.9 |

195.9 |

84.6 |

131.2 |

165.1 |

108.9 |

130.9 |

222.0 |

120.6 |

128.9 |

Q4:2011-12 |

108.6 |

149.8 |

70.8 |

122.2 |

153.0 |

128.5 |

99.0 |

247.5 |

172.1 |

126.5 |

Q1:2012-13 |

153.2 |

133.6 |

81.6 |

140.1 |

151.9 |

98.2 |

80.9 |

296.7 |

154.9 |

134.6 |

Q2:2012-13 |

100.4 |

142.6 |

112.6 |

130.5 |

233.7 |

96.9 |

68.2 |

322.6 |

409.2 |

145.4 |

Growth in per cent |

|

|

|

|

|

|

|

|

|

|

y-o-y |

27.1 |

–13.8 |

–8.8 |

–15.3 |

119.1 |

–30.4 |

–20.2 |

34.9 |

212.1 |

12.6 |

q-o-q |

–34.5 |

6.7 |

38.0 |

–6.9 |

53.9 |

–1.3 |

–15.7 |

8.7 |

164.1 |

8.0 |

Note: *Chennai index is based on both residential and commercial properties.

All-India index is a weighted average of city indices, weights based on population proportion. |

Signs of IPO market revival in December

2012 after a subdued period

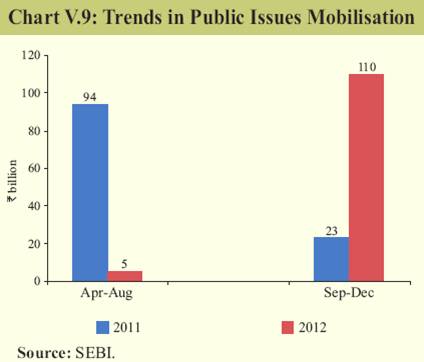

V.23 During September–December 2012,

`110 billion was mobilised through 18 issues

compared to `23 billion mobilised through

11 issues during the corresponding period

last year (Chart V.9). Various measures taken

by SEBI, such as allowing qualified foreign

investors (QFIs) to invest in the primary as

well as secondary markets, electronic initial

public offers (e-IPOs), requiring companies to

attain the minimum public shareholding of 25

per cent by June 2013, introduction of the Rajiv

Gandhi Equity Savings Scheme, 2012 and the

disinvestment programme by the government

may also enhance primary market activity.

House prices show slight moderation, but

with increasing volumes

V.24 The annual growth in the Reserve

Bank’s quarterly House Price Index at the all-

India level remains strong at 23 per cent in

Q2 of 2012-13. The q-o-q increase, however,

moderated to 3 per cent, the lowest in the past

seven quarters. Transaction volumes have picked up and showed an annual growth of

over 12 per cent in Q2 (Table V.4).

Markets improve, but uncertainty still

significant for 2013

V.25 Reduced fiscal space in several AEs and

limited scope for monetary policy actions due to

the enlarged balance sheets of central banks are

expected to keep sentiments and markets range

bound. The stress in the global financial markets

has eased in view of reduced uncertainties in

the euro area and the temporary resolution of

the fiscal cliff in the U.S. However, a credible

fiscal consolidation by the US can generate a

more significant impact. Quantitative easing

by the AEs has translated into higher capital

flows to EMDEs, including India, which may

witness some moderation going forward, but

is nevertheless, likely to remain positive in the

near term.

V.26 Looking at domestic factors, commitment

to reforms and efforts for sustainable fiscal

consolidation would provide a positive impetus

to the markets. Stronger signs of global and

domestic recovery are crucial to support

investor optimism. |