| ACKNOWLEDGEMENTS This project was made possible because of funding from the Reserve Bank of India, Mumbai, and we greatly appreciate the support received from the Reserve Bank. We also thank both the Bank officials and farmers covered in the study for their valuable time during our field visits. We are especially grateful to the Director, Institute for Social and Economic Change (ISEC), the Registrar and the Accounts Officer, ISEC, for their support. We are also thankful to Ms Suma from the accounts section of ISEC for handling the accounts of the project. We are also most grateful to Mr Devaraju and Mr Jaisimha at ISEC for their assistance in this project, without whose sincere efforts it would not have been completed. Mr Pranav Nagendran at ISEC helped revise and finalise the report and we are most grateful to him too. We also express our gratitude to the two anonymous referees and several RBI officials for their valuable comments. We thank the RBI and the Indian Council of Social Science Research for their support to ISEC. None of the organisations and people mentioned here, however, shares any responsibility for the views expressed or errors that remain. Executive Summary 1. Indian agricultural activity is predominantly carried out on small and marginal land holdings. Farmers in India, at large, have inadequate incomes and, consequently, low to no savings. However, in order to commence cropping, investments are required in the form of seeds, fertilisers, tools and other inputs, while returns on these investments are realised much later at the harvest stage. Insufficient savings lead to a shortage of funds to make these crucial investments; thereby forcing farmers to rely on credit. Previously, funds were predominantly borrowed from village-level moneylenders and other informal agents who charged hefty interest rates. This led to a multitude of travails for the farm sector, since high interest rates left little income for farmers and during periods of crop failure, farmers often found themselves unable to repay their dues. 2. In order to ameliorate the problem of farmer distress, the Government of India has made strides in expanding the formal banking network into rural areas following bank nationalisation (Rajeev and Mahesh, 2014). Additionally, in order to further attract farmers seeking short-term funds for cropping to the formal sector, the government introduced an Interest Subvention Scheme for short term crop loans in 2005 which was fine tuned in subsequent year. Under the scheme, short term credit is made available to farmers by commercial banks at an interest rate of 7 per cent at the ground level, thereby providing a subsidy of 2 percentage points out of the 9 per cent interest rate charged by banks on such loans. As a further incentive aimed at inculcating a habit of prompt repayment, banks have been directed to provide an additional interest subvention of 3 per cent per annum to farmers who have fully repaid their loans within the due date set by the banks, subject to a maximum period of one year. Thus, farmers repaying on time effectively bear only 4 per cent interest rate on credit. 3. The Interest Subvention Scheme for Short Term Crop Loans, which is aimed primarily at alleviating farmer distress and making affordable credit available to poor and vulnerable farmers, requires an assessment of its performance and an examination of its shortcomings, if any. In this respect, this study focuses on the state of Karnataka, which is a drought-prone region with low irrigation; more susceptible to farmer distress; and therefore, is in need of greater support in the form of credit and other inputs. 4. Utilising National Sample Survey Office (NSSO) data from the 70th Round (NSSO, 2013), the study found that more than 50 per cent credit comes from the informal sector in India. Small and marginal farmers face a high modal interest rate of 36 per cent, and most loans are taken for income-generating activities, thus indicating that there is a shortage of formal loans even for productive purposes. Landholding size was found to be directly related to the accessibility of credit from commercial banks such that while 83 per cent of large farmers’ loans came from institutional agencies, this figure was around 60 per cent for small and marginal farmers. Judging by the 70th Round data, 12 per cent of Scheduled Caste (SC) farmers had access to commercial bank credit in Karnataka, and 77 per cent of this was cornered by the top two quintiles of farmers classified by their assets. These observations point to an urgent need to improve access to formal financial services for marginalised and poorer farm communities. 5. Looking at the performance of the Interest Subvention Scheme for Short-term Crop Loans, we find that only 27 per cent of loanee farmers in Karnataka availed institutional loans at 7 per cent rate of interest or less, as opposed to 38 per cent at the all-India level, both of which appear to be low figures (NSSO, 2013). 6. For loans under interest subvention, as the rate of interest is subsidised, the possibility of an arbitrage opportunity arises by way of re-lending. While we cannot directly obtain information on arbitrage from NSSO data, the possibility of interest rate arbitrage can be indirectly estimated by the percentage of farmers who borrowed from both institutional sources as well as act as informal moneylenders. From our analysis of NSSO 70th Round Debt and Investment Survey data, it was found that such cases were negligible, at less than 1 per cent of cultivator households in the sample (NSSO, 2013). Insights from our field survey indirectly indicate that less than 2–3 per cent of households were possibly engaged in re-lending. 7. Using econometric analysis with a sample selection model to study repayment habits of farmer households, it was found that banks tend to lend to relatively better-off farmers with more assets and land, and those from majority social groups, however, these groups are relatively less likely to make prompt repayments. 8. To obtain a more contemporary understanding of agricultural credit in Karnataka, a field survey was conducted in four districts. The findings largely re-inforce what was indicated by the NSSO data. Only around 30 per cent of marginal and small farmers were found to have received subsidised credit, while this figure was around 70 per cent for large farmers. However, almost all farmer households were found to be financially included and 66 per cent were reported as regularly visiting banks. In 43 per cent of households, women members were reported as belonging to a self-help group (SHG) through which they obtained access to a commercial bank. 9. Financial literacy is a key element in improving the situation of agricultural credit. However, only 40 per cent of marginal and small farmers in Karnataka reported being even moderately aware of the Interest Subvention Scheme, and most farmers were unaware of the incentive for prompt repayment. 10. An emerging issue in agricultural credit, the rising prominence of jewel-based loans under the Interest Subvention Scheme, was revealed through a survey of banks in select districts in Karnataka. Due to mutations not occurring automatically, many farmers lacked the requisite land records. Even among farmers possessing adequate land records, hurdles were faced in obtaining a ‘no due certificate’ from all bank branches in the locality, certifying that the farmer does not have an outstanding short-term crop loan. The process also involves significant time (from lost working hours) and money (from transport and charges for certificates) costs. These bottlenecks have worked towards driving farmers to opt for jewel loans. 11. However, jewel loans were of smaller amounts (for a given land size) than the alternative loans (i.e. loans taken by providing a record of Rights, Tenancy, and Cropping or RTC). The size of a jewel loan is often insufficient to cover the full cost of cultivation. This has possibly led to an increased reliance on informal credit to cover the shortfall, especially for small and marginal farmers. Furthermore, in richer districts, where jewel loans are seen to be more prevalent, such loans appear to crowd out RTC-based loans. 12. Policy intervention is required to reduce reliance on gold/jewels for short-term crop loans. Observing the scenario on the ground, we propose that a fixed portion of loans (say 40–45 per cent) should be necessarily provided through the RTC route by any branch to ensure that small and marginal farmers (who lack gold) have access to formal finance for cultivation. 13. A different portal may be created so that information about outstanding loan of a loanee farmer in one bank branch can become readily available/ to other bank branches of the region through certain identification number (may be through his/her Kisan Credit Card (KCC) account). Additionally, alongside ‘no due certificates’, farmers are often asked to bring other documents such as an encumbrance certificate (EC) from the taluka office, and/or a legal opinion, all of which add to the cost and time to obtain a short-term crop loan. As farm activities are seasonal and timebound, it is necessary to set a definite timeline for processing crop loan applications. 14. Land records should be digitised and mutations should take place automatically so as to better enable formal financial access, and allowances should be made for landless/tenant farmers for accessing bank credit. 15. It is observed that tenant farmers’ access to credit is constrained by lack of land records or tenancy contracts (RTC). The study suggests that tenant farmers should be given short-term crop loans up to ₹1 lakh on a declaration basis. Banks can verify the credentials of randomly selected subset of applicants for authenticity. In Andhra Pradesh, revenue authorities issue credit eligibility certificates to tenant farmers who do not hold land records. Such a system can be adopted in other states as well. Further, tenant farmers often lack records of tenancy owing to stringencies in tenancy laws. Relaxation and amendments of these laws can help relieve some of the credit access woes among this group. 16. During our interactions, bank officials expressed their viewpoint that subsidised credit should also be extended to horticulture and dairy farmers especially to the poorest section. 17. Bank officials also indicated that several small farmers were unable to avail short-term crop loans owing to prior unpaid dues. Loan waiver drives often lead to bad repayment habits as farmers default on repayments in anticipation of such announcements. When asked about their outlook on loan waivers, farmers were favourable, but almost always expressed a preference for enhanced irrigation or similar productivity augmenting facilities over loan waivers. Thus, there is a strong policy suggestion to minimise loan waivers and instead concentrate on improving agricultural infrastructure and extension services (training programmes, marketing services, etc.). Direct cash benefits to compensate for crop losses during times of drought or proper implementation in terms of timely compensation and coverage of the existing crop insurance scheme will also help to alleviate agricultural distress. 18. There is a need to accelerate the formation of farmers’ Joint Liability Groups (JLGs) to improve credit access. Studies have found that SHGs among rural women in Karnataka have been successful in improving their access to formal financial services for establishing businesses and running business operations. By forming JLGs, farmers, too, can potentially have greater credit access. Such groups can be powerful catalysts for improving access to formal finance among marginalised groups such as SCs/STs and tenant farmers constrained by the absence of land or tenancy records. 19. In certain cases, farmers’ incomes are more dependent on the buyers of their crops, as is the case of sugarcane farmers. Here, the ability to repay loans depends on timely payments by sugar mills/factories, and hence, outside the control of farmers. Such loans should be rescheduled and also be made eligible, on a case-to-case basis, to receive the benefits of prompt repayment. 20. Low financial literacy is an important factor in determining the utilisation of the benefits of the Interest Subvention Scheme. Financial literacy may be improved through the printing of information brochures in local languages. Financial literacy may also lead to an improvement in payment habits when the advantages of prompt repayment become clear to a farmer. Announcing the names of farmers who repay loans in a timely manner in the gram sabha (with a token reward, if possible) can also help foster better repayment habits. 21. Farmers were also found to be withdrawing the entire eligible amount under the KCC scheme at once, which is not an optimal practice as credit is required at different stages of cultivation. The amount that can be withdrawn under KCC can be split into four instalments, as follows: 35 per cent at the time of sowing, 25 per cent during the weeding and irrigation phase, 20 per cent at the pest-fertiliser phase, and 20 per cent during harvest. 22. Overall, the Interest Subvention Scheme has functioned well in the state but requires attention in the aforementioned areas in order to ensure realisation of its true welfare generating potential among farmers in Karnataka. 23. Contextually, the Union Budget (Interim) presented on February 1, 2019 has announced to provide the benefits of interest subvention as well as prompt repayment to all farmers pursuing activities of animal husbandry. The Budget has also announced to extend the benefits of interest subvention and prompt payment for the rescheduled period of loans to farmers affected by natural calamities, where assistance is provided from National Disaster Relief Fund (NDRF). While these announcements will help the needy farmers, such benefits may also be extended to horticulture and to farmers whose payments get delayed due to non-receipt of proceeds from buyers of their produce. CHAPTER 1: Introduction The structural composition of India’s gross domestic product (GDP) has changed significantly, tilting away from the primary sector, even though more than half of its population still depends on agriculture. Among cultivator households, around 80 per cent belong to the small and marginal farmer group whose income levels are substantially low and do not allow for sufficient savings required for investments. In addition, the agricultural sector in the country is at the crossroads, often with conflicting forces working simultaneously. The vagaries of the weather create uncertainty, and the resultant high instability in production and productivity drags the development in the agricultural sector. In this context, it is to be noted that Karnataka is among the driest states in India. It has a low share of area under irrigation and, therefore, protective irrigation does not play a significant role here. Dominated by low-value and low-density crops, farmers’ income here is perennially low, and with the increase in prices of inputs (specifically of cash inputs), farmers’ net income is further reduced. As a result, farmers are unable to manage the probable risk or even working capital needs of the sector. One of the unpleasant outcomes of this scenario is the high indebtedness arising from institutional as well as non-institutional sources in the farm sector. Most of the recent studies on the farm sector have highlighted this as the dominant cause of farmer distress. Keeping the need for funds in mind, the Indian banking sector has been mandated to provide 18 per cent of their total credit to the agricultural sector at a reasonable rate of interest. The interest rate charged to the farmers is kept at a comparatively low rate of 7 per cent through government interest subvention, and to encourage prompt repayment, an additional 3 per cent subvention is provided for borrowers who repay on time. However, like numerous other welfare schemes of the government, the success of this scheme too depends on its proper implementation. As the Interest Subvention Scheme involves fiscal resources and is intended to benefit poor farmers, it is essential to examine how far the scheme has been successful in benefitting the neediest. It is also necessary to identify shortcomings, if any, in such initiatives by examining field-level operations, and look for remedies so that such initiatives can serve the objective. The state of Karnataka is an appropriate case study covering these aspects, given that this is a drought prone region with low irrigation facilities and, hence, in need of adequate support in terms of credit and other inputs than the states which are endowed with better land quality and weather conditions. 1.1 Subvention Schemes1 Given our focus on the subvention scheme and to place the discussion in perspective, it is worthwhile to discuss certain aspects of the scheme. • As directed by the Government of India (GoI) and in pursuance of the budget announcement made by the finance minister on February 28, 2006 relating to the Interest Subvention Scheme, an interest subvention of 2 per cent per annum is made available to the Public Sector Banks (PSBs) and the Private Sector Scheduled Commercial Banks with respect to loans given by their rural and semi-urban branches. The scheme is applicable to loans from banks’ own funds for short-term crop loans up to ₹3,00,000 per farmer, provided the banks make available short-term credit at the ground level at the rate of 7 per cent per annum to farmers. • An additional interest subvention of 3 per cent is made available to the farmers who repay the loan within one year from the date of disbursement of the crop loan or by the due date fixed by the bank for repayment, whichever is earlier, subject to a maximum period of one year from the date of disbursement. This also implies that the farmers who pay promptly would get short-term crop loans at 4 per cent per annum. This benefit would not accrue to those farmers who repay after one year of availing such loans. • Further, with regard to the Kisan Credit Card (KCC) scheme, the GoI has clarified that loans granted only for categories (i) and (ii) (given below), out of the following six categories, are covered under the Interest Subvention Scheme, which should be computed and segregated accordingly for claiming reimbursement of the interest subvention: -

To meet the short-term credit requirements for cultivation of crops; -

For post-harvest expenses; -

Produce marketing loan; -

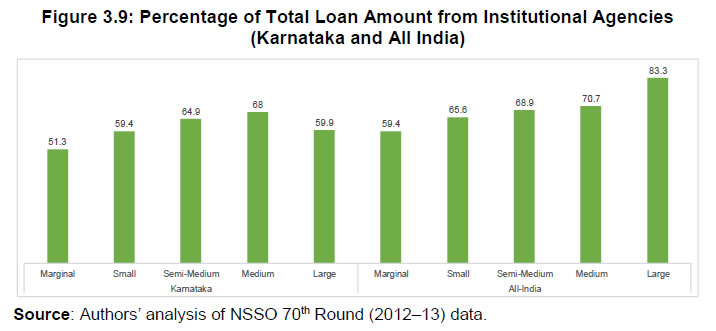

To meet the consumption requirements of farmer households; -

For working capital for maintenance of farm assets and activities allied to agriculture, like dairy animals, inland fishery, etc.; -

To meet investment credit requirements for agriculture and allied activities like pump sets, sprayers, dairy animals, etc. • The benefits of interest subvention are available to small and marginal farmers holding KCCs for an additional period of up to six months, post-harvest, against negotiable warehouse receipt for having kept their produce in warehouses. Before moving on to the findings with regard to the Interest Subvention Scheme, it is useful to look at the existing literature on the subject. 1.2 A Brief Review of the Literature and Research Gaps The literature on interest rate subvention schemes for crop loans, especially pertaining to India, is rather limited. Several studies, however, concentrate on the agrarian credit market in developing countries in general and the Indian agricultural credit market in particular (see Bardhan, 1989; Bell and Srinivasan, 1989). Although there has been a decline in the share of rural population in the total over time, 60 per cent of the population still lives in rural areas and depends mainly on agriculture, majority of which are small or marginal farmers. For this group of farmers, facing land and liquidity constraints in the risky and fluctuating production environment of Indian agriculture, credit remains a crucial input (Srinivasan, 1989). Amongst a few studies in the Indian context, Mitra et al. (1986) look at the causes of rural indebtedness in the state of Assam. As the nature of rural indebtedness largely depends on the state of the formal banking sector in rural areas, Ramachandran and Swaminathan (2001) examine the role of the rural banking sector in India. Historically, after the nationalisation of 14 major Indian banks on July 19, 1969, commercial banks were entrusted with the task of meeting the credit needs of the hitherto neglected rural masses (Rajeev and Mahesh, 2014). These banks were to provide credit to the neediest and reduce the role of informal lenders in the market. Formal banking institutions, thus, became an important source of credit to the agricultural sector, though it coexisted with the informal sector where interest rates were much higher (Stiglitz and Hoff, 1990). There are however a number of problems with the formal sector as noted by scholars. It is frequently observed that formal credit is not available at the beginning of a crop cycle when it is needed more (Gupta and Chauduri, 1997). Another serious problem in the formal credit market mentioned by some authors is that the officials of the formal credit institutions, who are in charge of disbursement of credit, often deliberately undertake dilatory tactics to seek bribes from farmers (ibid.; Benjamin, 1981; Lele, 1981). Because of these problems, in spite of the considerable expansion of the rural formal credit network, informal lenders still thrive in the agricultural credit market (NSSO, 2003). This is true not only in India but also in other developing nations including Pakistan (Aleem, 1990), Thailand (Siamwalla et al., 1990) and the African nations (Udry, 1990). The informal credit market has also undergone certain changes in the recent past. In the changing credit scenario, traditional landlords and moneylenders (Bhaduri, 1977 and Gangopadhyay and Sengupta, 1987) are fading away and a new class of lenders, who are the dealers of working capital have emerged (Rajeev and Deb, 2006). Due to their market power, they can charge a higher interest rate and their loan contracts are adverse towards comparatively smaller borrowers (ibid.). Exploitation by village moneylenders has been discussed by Basu (1989), who theoretically establishes that the rate of interest charged by an informal lender is lower if the loan size is greater, which in turn puts small borrowers are at a disadvantageous position. Unequal access to capital and hierarchies in an agrarian system are illustrated in the study by Eswaran and Katowal (1990) as well. Thus, one can see that while there are studies on Indian agricultural credit market, not many studies have dealt directly with the issue of effectiveness of the subvention scheme, and most of these studies are also dated. Additionally, while the incentives for prompt repayment are included to inculcate a habit of timely repayment, it would be of interest to study whether the formation of such a habit is negatively impacted by loan waiver schemes initiated by various state governments from time to time. Loan waivers create the problem of moral hazard among farmers for repayment, as it rewards those who have not repaid loans, providing incentives to farmers to avoid repayment until another loan waiver is initiated. A field-based survey is required to look at the ground level scenario concerning some of these pertinent issues. 1.3 Researchable Issues and Objectives Researchable issues on the subject at hand can be classified under three major headings. 1.3.1 Financial Accessibility First, it is important to note that in order to benefit from this facility, farmers need to access the formal banking sector, especially for obtaining credit. Secondly, she/he needs to repay the loan on time, failing which higher interest rates will be charged for the entire period (i.e. they will not be able to take benefit of the prompt repayment scheme). Given that such facilities are intended to benefit the poor, it is necessary to examine whether small and marginal farmers are able to access credit facilities from the formal sector and benefit from the subvention scheme. One of our earlier studies in Karnataka has revealed that financial accessibility in terms of credit is limited for small and marginal farmers primarily due to lack of land records (Rajeev et al., 2011). Thus, whether the intended beneficiaries have benefited from the programme or not needs to be ascertained. 1.3.2 Financial Literacy In any scheme for rural areas, ensuring proper flow of information to the ultimate beneficiary is a major challenge. This is seen in the case of the KCC scheme as well, where the intended beneficiaries of the scheme were unaware of its benefits (Rajeev and Vani, 2012). The success of the subvention scheme, thus, to a great extent, depends on information dissemination among the small and marginal farmers. As mentioned earlier, the subvention facility is further extended to prompt re-payers whereby those farmers can subsequently get the loan at 4 per cent interest rate. Given the fact that Indian farmers are used to loan waivers from time to time, the important question that arises is whether the scheme has been successful in conveying this information to the farmers and inculcating the habit of timely repayment in them. 1.3.3 Financial Integrity Given that the farmers are often cash starved, it is necessary to examine whether the credit under this scheme has been utilised for the stated purpose or diverted to other uses. Diversions can be for different purposes, including: -

For production/income generating purposes, other than for the purchase of intermediate goods for agriculture (as prescribed for a short-term crop loan). -

For essential consumption purposes such as education or health. -

There could be other diversion as well, given the linkages between formal and informal credit markets in the rural economy. There is a possibility that, one borrows from the formal sector to take advantage of arbitrage opportunity by lending it in the informal credit market at a higher interest rate. Thus, the major issues, in a nutshell, are: Is the credit with subsidised interest rate really being used for the stated purposes, i.e., for agricultural (short-term loan) activities? If not, what other activities are the credit being channelled to? 1.3.4 Objectives Access to Credit -

To examine how far small and marginal farmers are able to avail the benefits of the subvention scheme. -

To identify the major impediments to accessing credit by the needy. -

To evaluate the usage and utility of the prompt repayment scheme. Credit Sources and their Problems and Prospects Financial Literacy -

To critically analyse the aspect of financial literacy of small and marginal farmers with respect to the subvention scheme and prompt repayment scheme. -

To find whether there is a problem of information, and if so, how this problem can be addressed. Financial Integrity - To examine the aspects of proper utilisation of the funds and diversion of funds, if any. The reasons for diversion of funds are assessed wherever relevant.

Policy Suggestion - To suggest possible remedies for existing problems to make the policy more effective.

1.3.5 Methods The study utilises the 59th and 70th Rounds of NSSO debt and investment survey data to understand the macro-level scenario pertaining to access to credit and its utilisation. The sample size of NSSO being large, state-level parameters can be estimated by analysing the unit record data. However, NSSO data do not highlight the problems faced by the farmers and the possible remedial measures, for which a primary survey of limited size has been undertaken. For the primary survey, respondents include individuals from the following groups: The state of Karnataka has been selected for the study due to the reasons discussed above (and also as per the terms of reference of the study). A total of four districts consisting – one agriculturally backward; one forward; and two middle performing – have been chosen from the state for the survey (after discussion with the RBI during the project initiation seminar). From each district, one rural branch of a prominent bank of the district was visited and data on the borrowers were collected in the format available with the bank. A multi-stage sampling technique was used to select the farmers, first by selecting a district, then the villages within a district and, finally, households within a village. A total of 320 respondents were finally selected through a stratified random sampling technique with a view to incorporate different groups of farmers: small and marginal vis-à-vis medium and large (a more detailed discussion is presented in Chapter 6). The next chapter of the study presents a brief review of the existing literature. Chapter 3 provides a detailed analysis of NSSO data over time, for India as well as for the state of Karnataka, to understand credit accessibility at the macro level by different groups of farmers classified in terms of economic and social conditions. Terms and conditions of loans and re-lending possibilities are examined in Chapter 4. In Chapter 5, we present certain data collected from banks in our study areas to understand the scenario on the ground with regard to credit disbursement and gold loans. Chapters 6 and 7 are based on our field survey of farmer households. The last chapter offers conclusions and policy suggestions, again based on our survey of the various stakeholders. CHAPTER 2: Review of the Literature 2.1 Introduction Presently, there are only a few studies on the effectiveness of interest subsidies in the agricultural sector in India. However, some authors have studied the credit market in the agricultural sector in the country, including subsidies given for agriculture, especially through fertilizer and irrigation (electricity). Theoretically, while talking about the need for state intervention in the agricultural sector, Stiglitz (1987) argues that agricultural markets are characterised by high risks with regard to both output and prices. Hence, the interest rate for obtaining credit will be high (if left to the market), which per se is not a market failure, given that the probability of default is high (ibid.). At the same time, the existence of imperfect information on the kind of risks involved in credit – given that there are different individuals involved from different states and producing different kinds of crops (the adverse selection problem, where the farmer is likely to be better informed about the hazard) – and on the behaviour of the borrowing individuals cannot be ignored. This means that the market equilibrium is not, in general, pareto efficient (ibid.). Therefore, farmers’ access to credit remains limited in the absence of governmental intervention and state intervention is needed to make credit available to the farmers. 2.2 Development of the Indian Agricultural Sector: Investments versus Subsidies Subsidies and public investments have been an integral feature of the agricultural sector’s development in India. Fan et al. (2007), review the trends in subsidies and public investment in the agricultural sector in India and empirically estimate the relative impact that the various subsidy schemes and public investments have had on agricultural growth and poverty reduction in rural areas. By definition, government investments in agriculture are often equated with the public sector gross fixed capital formation (GFCF) in the agricultural sector. There is, however, a distinction between investments made in and for agriculture (Fan et al., 2007). Accordingly, investments made in agriculture primarily comprise irrigation projects alongside small-scale projects in horticulture and livestock and the development of state farms. On the other hand, government expenditure on agricultural related research and development (R&D), development of rural infrastructure like roads, education, etc. are considered as public investments made for agricultural growth, whether directly or indirectly (Dantwala, 1986). In this context, a declining trend is observed in the quantum of public investments which is rather disheartening because there is evidence to prove that it has had a positive effect on agricultural productivity. For instance, in the early 1980s the shares of public and private sectors in the creation of the Gross Capital Formation in agriculture were roughly equal. However, by the early 2000s the share of the public sector in the creation of GFCF had shrunk to nearly one-third the share of the private sector, at 1993–94 real prices (Gulati and Bathla, 2002). Owing to reductions in public expenditure for irrigation in the 1980s and 1990s, the growth in farmland irrigated through publicly funded schemes tapered down, resulting in a severe shortage of irrigation water and leaving in a large number of unfinished irrigation projects. Furthermore, even the investments in education, rural road infrastructure and electricity have continued to decline over the years (Fan et al., 2007). On the other hand, input and output subsidies in agriculture have seen an increasing trend over the years. The numerous input subsidies can be grouped into subsidies for fertilizer, credit, irrigation and power. For instance, in the total central government subsidy outlay, the share of fertilizer subsidy increased from 6.3 per cent to more than 50 per cent between 1976 and 2000, and the increased volume of fertilizer subsidy amounts to more than five times the government spending on agricultural R&D. Similarly, with the nationalisation of commercial banks and their entry into the agricultural credit, the share of credit disbursed by commercial banks increased from 3 per cent in 1967 to 15 per cent by the early 1990s (ibid.). Given this scenario, Fan et al. (2007), estimated the marginal impact of investments and subsidies on agricultural growth and poverty reduction, as shown in Table 2.1. | Table 2.1: Returns to Various Public Investments and Subsidies | | | 1960s | 1970s | 1980s | 1990s | | | Returns | Rank | Returns | Rank | Returns | Rank | Returns | Rank | | Rupee increase in agricultural GDP per rupee invested in each type of infrastructure/facility | | Road Investment | 8.79 | 1 | 3.8 | 3 | 3.03 | 5 | 3.17 | 2 | | Educational Investment | 5.97 | 2 | 7.88 | 1 | 3.88 | 3 | 1.53 | 3 | | Irrigation Investment | 2.65 | 5 | 2.1 | 5 | 3.61 | 4 | 1.41 | 4 | | Irrigation Subsidies | 2.24 | 7 | 1.22 | 7 | 2.28 | 6 | n.s | 8 | | Fertilizer Subsidies | 2.41 | 6 | 3.03 | 4 | 0.88 | 8 | 0.53 | 7 | | Power Subsidies | 1.18 | 8 | 0.95 | 8 | 1.66 | 7 | 0.58 | 6 | | Credit Subsidies | 3.86 | 3 | 1.68 | 6 | 5.2 | 2 | 0.89 | 5 | | Agricultural R&D | 3.12 | 4 | 5.9 | 2 | 6.95 | 1 | 6.93 | 1 | | Returns in Rural Poverty Reduction (Decrease in number of poor per million ₹ spent) | | Road Investment | 1272 | 1 | 1346 | 1 | 295 | 3 | 335 | 1 | | Educational Investment | 411 | 2 | 469 | 2 | 447 | 1 | 109 | 3 | | Irrigation Investment | 182 | 5 | 125 | 5 | 197 | 5 | 67 | 4 | | Irrigation Subsidies | 149 | 7 | 68 | 7 | 113 | 6 | n.a | 8 | | Fertilizer Subsidies | 166 | 6 | 181 | 4 | 48 | 8 | 24 | 7 | | Power Subsidies | 79 | 8 | 52 | 8 | 83 | 7 | 27 | 6 | | Credit Subsidies | 257 | 3 | 93 | 6 | 259 | 4 | 42 | 5 | | Agricultural R&D | 207 | 4 | 326 | 3 | 345 | 2 | 323 | 2 | | Source: Fan et al., 2007 | Their findings suggest that during the three decades prior to 1990s, all subsidies and investments yielded high returns and furthered the cause of poverty reduction. However, by the 1990s only agricultural R&D and rural road infrastructural investments continued to yield estimated returns of more than 300 per cent, while credit, power and fertilizer subsidies recorded negative net returns (concluded by Fan et al., 2007) and subsidies on irrigation had no significant impact on either agricultural production or rural poverty reduction. Hence, in the long run, public investments in agriculture can be most effective in promoting agricultural growth and poverty reduction. Therefore, they recommend that government subsidies, which constitute nearly 2 per cent of the national GDP, must be cut since subsidies have been unproductive, financially unsustainable and have crowded out more productive government investments in agricultural R&D, rural infrastructure and education. 2.3 Credit Subsidy in the Indian Agricultural Sector In India, credit subsidy in the agricultural sector consists of two components, i.e., interest subsidy and default subsidy. According to a study by Gulati (1989), the interest subsidy can be estimated easily by calculating the difference between interest rates being paid by farmers and retail traders. On the other hand, the default subsidy estimation is a difficult task due to the lack of data on eventual bad debts. Instead, the study makes an informed assumption that nearly 40 per cent of overdues with more than three years of default history usually gets written off (ibid.). Additionally, it was found that earlier the interest rates being charged from the agricultural sector on production credit were much higher than those on investment credit. The interest rates on production credit further varied with the size of the loan. The estimated weighted interest rate charged by commercial banks from farmers was about 12.7 per cent in 1981 (Morris, 1985). Subsequently, through government intervention, agricultural lending rates were decreased, which further would have led to the cross-subsidisation of other agricultural operations (Binswanger and Khandker, 1995). However, formal credit flows are often subject to delays, and this often leads to high interest rates in the informal credit markets on which the farmers rely (Chaudhuri and Gupta, 1996). Empirical evidence also shows that lack of access to government-subsidised formal credit is the underlying reason for the observed differences in farm productivity in rural India (Kochar, 1997). 2.4 Relation Between Credit and Agricultural Productivity: The Chinese Experience For the agriculture sector in China, too, credit is an important factor (Feder et al., 1990). It allows the farmers to fulfil the requirements of the agricultural production cycle, where income is received only after the harvest, while expenditure on inputs like fertilizer, seeds, etc., must be met in advance. Thus, the availability of credit allows for greater use of purchased inputs and consumption by farmers and helps in increasing their welfare (ibid.). However, Feder et al. (1990) emphasise that when the government intervenes in the agricultural credit market by fixing interest rate ceilings or by subsidising interest rates, it necessitates the rationing of credit available to the farmers. Credit rationing further results in some borrowers not being able to obtain the amount of credit they need at the prevailing interest rate, even when they are willing to pay a higher rate of interest to secure adequate credit. Therefore, cash shortages due to non-availability of credit become a binding constraint on the production capacity of farmers since the inputs used deviate from optimal levels and thereby decrease yield, because of the fixed nature of land in the production cycle (ibid.). This assumption is tested in this paper, taking note of the fact that the volume of liquidity obtained from informal sources was substantial in the case of China. The sample based on which credit constraint is ascertained in this study is illustrated in Table 2.2 which shows that amongst farmers who borrowed from a formal agency, 41 per cent felt that they are credit constrained. | Table 2.2: Credit Constraints faced by Households in a survey in China | | Category | Sample size

(No. of Households) | Credit constraint Household

(per cent of total Households) | | Borrowers | 145 | 41.3 | | Non-borrowers | 42 | 28.3 | | All | 187 | 37.4 | | Source: Feder et al., 1990. | Formal credit agencies dealing with agriculture sector face the problem of asymmetric information and moral hazard due to a large number of small and marginal farmers being present in the sector in most developing economies. This problem has been highlighted both theoretically and empirically in the literature. 2.5 Difficulties in Developing the Agricultural Credit Market Agricultural credit markets are imperfect because of asymmetric information, and due to the existence of moral hazard problems. Loan contracts are also difficult to enforce (Besley, 1994). Agriculture has important spatial and risk characteristics, and hence, the need for credit rationing arises for this sector (Stiglitz and Weiss, 1981). In order to develop effective policies for financing credit, one needs to understand how sensitive borrowers are to interest rates when compared to other factors affecting the demand for credit. However, it is difficult to determine the impact of interest rates on demand for agricultural credit subsidy because credit can be sought for a multitude of other reasons such as consumption smoothing, education and health expenditures. Another question that must be answered is whether the rate of return in agriculture justifies the high interest rates that banks demand in the absence of government intervention (Meyer, 2011). There have been multiple studies that have attempted to directly measure the sensitivity of credit demand to interest rates. Yet it is difficult to generalise the behaviour of the borrowing farmers since each study represents a unique situation, where there is every possibility of co-existence of farmers with very high and very low rates of agricultural return. Transaction costs of borrowing, the complex bureaucratic administrative procedures involved, access to other informal sources, credit rationing size, and repayment schedules may all have an impact on the sensitivity to interest rates as well (Meyer, 2011). A study by Turvey (2010) provides evidence to show that higher risk farms in rural China have lower credit demand elasticity, while farmers with better revenues have more elastic demand for credit. Furthermore, there are cases where households with higher savings rates had more inelastic demand than households with lower saving rates, this implies that high savings groups substitute investments through savings by taking loans, while low savings groups consider savings and credit as complementary financial instruments. Also, the elasticity of demand for credit, in some studies, was found to be higher for consumption goods than for agricultural investments, suggesting that interest rate policies have a greater impact on consumption than productive agricultural yield (ibid.). Hence, in this environment of diverse responses of the farmers to the interest rate, it is an impossible task to fix an interest rate that would discourage farmers not having genuine credit need for borrowing and support those who desperately need it for sustaining their productivity. The challenges of interest subvention policy are explored in the following section. 2.6 What is Interest Subvention? The literary meaning of subvention is a grant of financial support, and therefore, interest subvention becomes a form of a waiver of some percentage of interest, such that it promotes growth in a targeted sector on account of public interest. Interest subvention schemes are implemented with the help of funds allocated by the government. In the agricultural sector, such schemes are often floated in order to enhance the loan repayment ability of the farmers. The repayment amounts of the borrower are scaled down by the percentage of interest subvention granted by the government, and hence, the scheme supposedly benefits both the end consumer and the sector as a whole. In India, the Interest Subvention Scheme for short term crop loan offers short-term crop loans to farmers at 7 per cent rate of interest, with the government compensating the banks for the remaining 2 per cent of the applicable 9 per cent interest. On timely repayment of the loan, the farmer will be able to avail a further subvention of 3 per cent, thus bringing down the effective rate of interest for the borrower to 4 per cent (GoI, 2015). As a point of comparison, small- and medium-scale enterprises (manufacturing or services) paid interest at almost double the effective rate for farmers (nearly 13 to 14 per cent). However, there is a dearth of literature that tries to understand the extent to which the intended beneficiaries avail the scheme. What are the existing lacunas, if any, that need to be addressed? This study intends to fill this gap by analysing unit record household level data from NSSO as well as information collected from the field survey. CHAPTER 3: Farmers’ Indebtedness and Access to Credit in India and

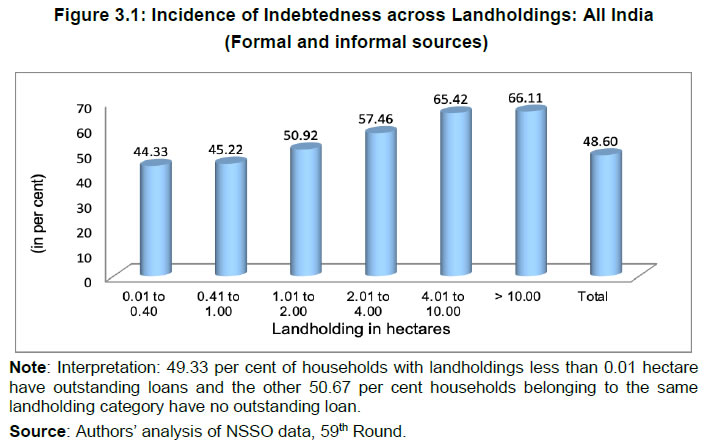

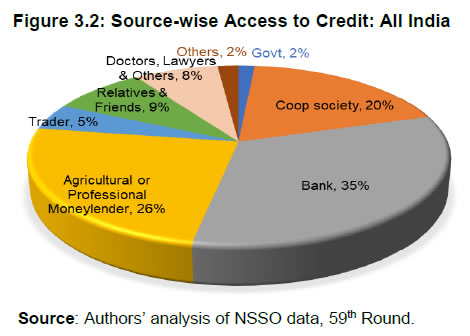

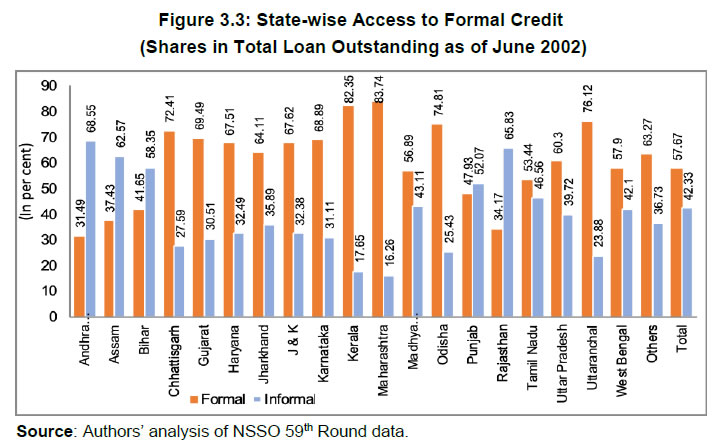

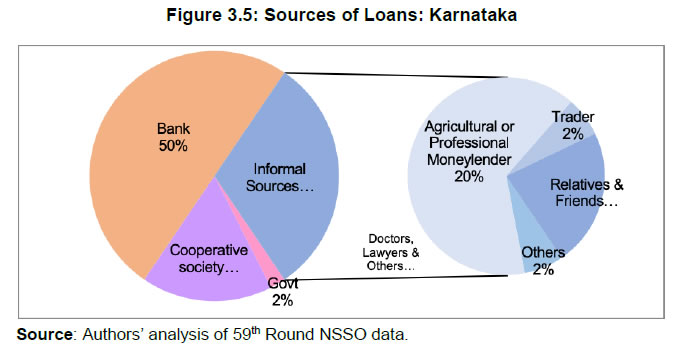

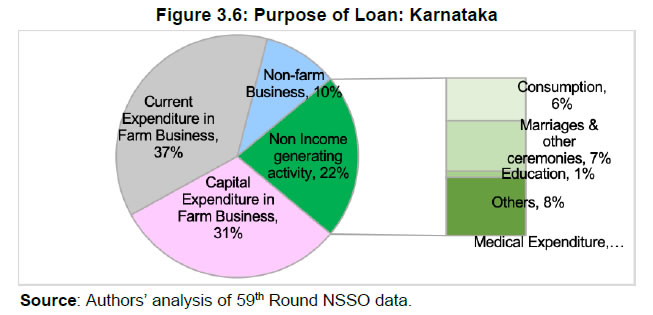

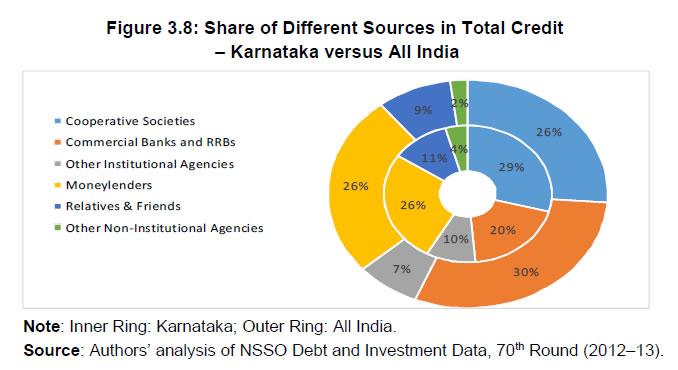

Karnataka: Evidence from NSSO Data 3.1 Introduction To have an understanding of access to credit at the macroeconomic level, this chapter presents the results of NSSO data analysis where the details of data sources are noted in Section 3.2. In order to examine accessibility of financial services, especially credit, by farmers of different economic classes, the indebtedness scenario is examined by classifying farmer households according to their landholding sizes. The analysis is further extended to incorporate various social classes to which the households belong, such as Scheduled Caste (SC) or Scheduled Tribe (ST) or households headed by a woman. The chapter presents an all-India scenario together with selected state-level analyses. Further the situation prevailing in the state of Karnataka has been highlighted. Finally, the chapter provides an econometric analysis based on recent data (NSSO 70th Round) to identify the factors that determine access to credit by the farmer households, thereby also establishing the statistical significance of some of the observations made previously through descriptive analyses. 3.2 Data Source The Ministry of Agriculture and Farmers’ Welfare conducted a comprehensive assessment of the economic situation of farmers in the country at the beginning of the millennium2. The motive was to understand various socioeconomic aspects relating to the farmers’ lives, including their standard of living, income and productive assets, farming practices and preferences, availability of resources, awareness of technical developments and access to modern technology in the field of agriculture, to mention a few. To provide the relevant information to the Ministry, the NSSO, as a part of the 59th Round, conducted the Situation Assessment Survey (SAS) of farmers from January to December 2003. The survey was conducted only in the rural areas of the country. Farmer households numbering 51,770 were surveyed in the central sample, while only seven states participated in the state sample which did not include Karnataka. Hence, strictly speaking, reliable estimates cannot be expected at the district level and, consequently, most of the analysis in this study is at the state level. Subsequently, NSSO’s 70th Round (2012–13) was completed and data from this survey has now become publicly available. It is, therefore, considered worthwhile to examine unit record data from this new source in order to understand the recent scenario. There are, however, certain differences in the way in which questions were asked in these two consecutive rounds. In particular, the 59th round analysis is primarily based on the SAS of farmer households. But in the new round, SAS of farmer households does not provide much information relevant to the current research work. Hence, data on farmer households has been culled out from the ‘Debt and Investment Survey’ of the 70th Round. The sample sizes of farmer households obtained from the Debt and Investment Survey were 43,254 and 1,483 for all-India and the state of Karnataka, respectively. The 70th Round titled ‘All-India Debt and Investment Survey (AIDIS)’ was carried out from January to December 2013. The information was collected from selected sample households by visiting each household twice. The survey period for the first visit was seven months, i.e., January to July 2013, and for the second visit was five months, i.e., from August to December 2013. In each visit, the assets and liabilities of the household were ascertained with a fixed reference date for all the households: 30th June 2012 for the first visit and 30th June 2013 for the second visit. Rural households were classified into farmer households and non-farmer households based on whether a household operated any land for agricultural activities during the last 365 days. 3.3 All India and Inter-State Analysis (59th Round) The NSSO provides information on the percentage of farmers who have outstanding credit on the date of survey, and this indicator is termed as the incidence of indebtedness (IOI). In addition, there is information on borrowings by farmers. A careful analysis of the data reveals that the richer states have higher levels of indebtedness, and similarly, richer farmers are more indebted. It is observed that socially backward classes or relatively weaker sections in terms of caste and gender also have lower indebtedness. From such evidence, it can be safely judged that IOI points more towards access to credit rather than a distress situation of inability to repay, even though the latter possibility cannot be fully ruled out. At the all-India level, according to the data from the 59th Round, the incidence of indebtedness was 48.6 per cent with an average outstanding debt per farmer household of ₹12,585. This figure rises to ₹25,891 if we consider only indebted households. As discussed earlier, if indebtedness can be taken as a proxy for access to credit, then it would imply that only around 49 per cent of the farmer households have accessed credit either from a formal or an informal source. IOI across different landholdings (for the 59th Round, see Figure 3.1) shows that access to credit increases with the size of landholdings. Further, one can broadly say that more than 50 per cent of marginal and small farmers do not have access to credit. This may not be only due to lack of creditworthiness, but also because of multiple factors such as financial literacy.  Though very small (less than 0.01 hectare group) farmers showed a little higher indebtedness, subsequent analysis revealed that this was primarily due to loans from the informal sector. They received 24 per cent of their credit from formal sources, while 76 per cent was from informal lenders (Table A3.1 in the Appendix). These two observations are somewhat disturbing as the objective of priority sector lending is somewhat diluted if it cannot provide financial services to the small and marginal farmers adequately. From such an aggregative picture moving to the regional level is necessary for a better understanding of the problems and policy implications. Inter-state analysis indicates a wide variation across states, making it clear that state-wise measures towards addressing the problems need to differ. All the four southern states and Punjab possess IOI greater than 60 per cent, while the north-eastern states show much lower figures. It should be noted that the southern states and Punjab have a good banking network, which possibly results in such high percentages (see Table A3.2 in the Appendix). Uttaranchal has the lowest IOI at 7.2 per cent. This observation also indicates that economic achievements of a state have considerable effects on the access to financial services and both may be impacting each other. The above analysis is based on the access to credit, both from formal and informal sources taken together. Though any source of finance may be useful for a farmer, access from formal sources is of considerably more importance given the adverse terms and conditions of the informal sources. It is, thus, necessary to have a disaggregated household level analysis based on sources of credit. Such an analysis reveals that, at an all-India level, around 58 per cent of credit supplied to the indebted households is sourced from formal sources and the rest, i.e., 42 per cent, is from informal sources, pointing to a large presence of informal lenders in the agrarian sector. As can be seen from Figure 3.2, commercial banks play a major role in the formal sector (35 per cent) and moneylenders are the largest suppliers of credit among the informal sources (26 per cent).  There are significant inter-state variations in the share of households accessing formal credit to IOI. Amongst the indebted farmers, Andhra Pradesh has the lowest (i.e. 31 per cent) and Kerala and Maharashtra the highest (i.e. around 83 per cent proportion of farmers accessing formal sources of credit (Figure 3.3). It is interesting to note that even though access to credit is quite high in Andhra Pradesh, most of it is from informal sources, revealing that an aggregative picture may conceal certain noteworthy variations. A further disaggregated analysis of sources within the formal sector shows that in the states of Maharashtra, Gujarat, Kerala, Haryana and Tamil Nadu, cooperative societies have played a major role in providing credit to the farmers.  The figures for usage of the credit availed by farmers for different purposes at the all-India level reveal that 65 per cent of the credit is used for income generating purposes and only 35 per cent is used for non-income generating purposes (Figure 3.4). Among the non-income generating category, expenditure on marriage and ceremonies tops the list. 3.3.1 Access to and Usage of Credit across Landholdings A further analysis of NSSO data revealed that there are wide variations across states in access to credit from formal sources. In most of the states, marginal and small farmers relied heavily on the informal sources for their credit needs, i.e. to the tune of 70 per cent. The share of usage of credit by marginal and small farmers in most states for income generating purposes is low, especially among economically backward states. Greater dependence on informal credit at a high- interest rate coupled with less use of it for income generating activities has a high probability of pushing farmers into a debt trap. Thus, formal credit institutions face a challenging task in reaching out to the economically backward regions and sections. 3.3.2 Access and Usage of Credit across Social Groups In addition to economic status, an analysis in terms of social category and gender assumes considerable importance as inequality in access with respect to these classes, if any, needs to be identified so as to be curtailed. In this regard, an analysis based on formal versus informal sources in access to credit is quite revealing. In particular, access to formal credit is seen to be quite high for the general category (66 per cent) and the lowest for the SC category at 46 per cent. Among women-headed farmer households, access to formal credit was similarly low and only 46 per cent had access to formal sources (see Tables A3.3a and A3.3b in the Appendix). Both SC and women-headed farmer households categories have used a relatively lesser share of credit for income generating activities. Even though, at the all-India level, the share of credit from formal sources is quite low for SC category farmer households, a wide variation is seen in credit off-take across states. An analysis of state-level data reveals that in the states such as Maharashtra, Kerala, Odisha, Chhattisgarh and others indebted SC households have obtained more than 70 per cent of their credit from formal sources. 3.4 The Indebtedness Scenario in Karnataka The state-level analysis discussed above reveals that households in Karnataka have a satisfactory level of access to credit, and the state can, therefore, be considered as a ‘middle performing’ state. However, there exist variations in access to credit, and its terms and conditions, across various social groups and weaker sections. 3.4.1 Sources of Borrowing The sources of borrowing are classified into two broad groups, viz. formal and informal. The government, cooperative societies and banks come under the category of formal sources, while moneylenders, traders, relatives and friends, doctors, lawyers and others come under the informal category. The outstanding debt in many states including Karnataka is financed more by formal sources than by informal sources (see Figures 3.5 and 3.3). Commercial banks have played a major role by financing 50 per cent of the outstanding loans (in forms of amount), while 17 per cent have been provided by cooperative banks, and a small portion, i.e. 2 per cent, by government sources. The remaining 31 per cent of outstanding loans were provided by informal sources within which moneylenders are the major players – they financed 20 per cent of the total debt. The modal interest rate is 36 per cent for moneylenders and roughly 1/4th of the loans taken from them are at an interest rate of 60 per cent.  Even in terms of the number of loans (see Table A3.4 in the Appendix), it was found that 52 per cent of loans are from formal sources (21 per cent from cooperatives and 29 per cent from commercial banks) and the rest are from various informal sources. The median amount of outstanding loan per borrower from the formal sector is around ₹15,000, while it is only ₹8,000 per borrower from informal sources (Table A3.4). Our analysis of access to formal credit amongst the indebted households shows that farmers with low land holdings (up to 0.4 hectare) and low per capita consumption expenditure (up to ₹420) have relatively lower share (Table A3.5 and Table A3.6 in the Appendix to Chapter 3). 3.4.2 Purpose of Borrowing Coming to activity-wise usage of loans, it is observed that the share of loans taken for income generating activities is as high as 78 per cent (Fig. 3.6). Within income generating activities, current expenditure in farm business forms the major category and nearly 3/4th of the loans for this category are financed by formal agencies, and the modal interest rate faced by the borrowers is 12 per cent. The next important category is capital expenditure in the farm business, and here too more than 3/4th of the loan is from formal agencies. Among income generating activities, non-farm business accounts form the lowest category, accounting for only 10 per cent of the outstanding loan. This category, however, has the highest average or the median sum of the outstanding loan. The formal sector plays a major role in financing too, and borrowers face a (modal) 16 per cent rate of interest.  Within the category of non-income generating activities, loans for marriages and ceremonies and consumption account for a major part as in the case of All India. The sources for these loans are mostly informal agencies and the borrowers face high-interest rates with a modal value of 36 per cent. The average amount borrowed for marriages and ceremonies is also quite high. The borrowers under these categories not only face a high rate of interest, but the fact that these categories do not generate any income can also be a cause for farmers’ distress. 3.4.3 Region-wise Debt In order to understand regional variations, a district-level analysis was deemed useful even though the data available was limited. Across districts, a wide variation was noticed in the incidence of indebtedness. IOI ranged from 93.7 per cent, in Chamarajanagar, to 24.9 per cent in Bangalore. It was also seen that most districts where IOI is above 70 per cent are agriculturally well developed, either with plantation crops (e.g. districts of Kodagu, Shimoga and Chikmagalur, etc.), or with highly irrigated areas growing input-intensive food grain crops (e.g. districts of Mysore, Mandya, Hassan, etc.). On the other hand, districts like Chamarajanagar, Haveri and Uttara Kannada are not very developed agriculturally, but still have high IOI. Here, it is worth noting that poverty ratios are also quite high in Haveri and Uttara Kannada districts (Figure 3.7). Most of the districts with high IOI are also better banked districts and the average loan per household in some of these districts is quite high. Thus, it can be said that either IOI or average amount of borrowing could be taken as an indication of backwardness or distress if it is coupled with high poverty and low development. The districts with very low IOI and a high poverty ratio are the ones where the absorption capacity is low. An analysis at the disaggregated level, done either in terms of the economic status of the households, i.e. landholding or per capita consumption expenditure, or at the social level, i.e. in terms of backward castes (SCs/STs/OBCS), may throw more light on the distress picture. However, data limitations preclude an exercise of this nature. 3.4.4 Debt Pattern across Economic Classes: According to Land Holdings In Karnataka, 53.0 per cent of farmer households belong to the category of marginal landholders, another 21.2 per cent are small farmers and the remaining 25.8 per cent are medium and large farmers. It is observed that the incidence of indebtedness increases with the size of the landholding. Out of the total number of outstanding loans, marginal farmers hold only 34 per cent and small farmers hold 18 per cent. As can be seen from Table A3.5 in the Appendix, the share of formal financial institutions in the loans availed by marginal farmers of low land holdings (up to landholding of 0.4 hectares) is quite low and they also face a high rate of interest. The modal interest rate faced by marginal farmers is 36 per cent, whereas for the larger landholding categories it is around 12 to 14 per cent. According to Expenditure Class A reclassification of households on the basis of monthly per capita consumption expenditure (MPCE) into three groups, i.e., per capita expenditure class of less than ₹300 (people with abject poverty), ₹300 to ₹420 (in and around the poverty line), and above ₹420 (the relatively better off class), shows that farmers who are the poorest MPCE class, i.e., below ₹300, have low access to formal credit. In particular, 71 per cent of their borrowings are from informal sources (Table A3.6 in the Appendix) and thus they end up paying a high interest rate of around 36 per cent. The average outstanding loan for this class is also quite low amounting to about one-third of the average loan outstanding for the better off farmers. Further, 35 per cent of the farmers are in and around the poverty line (falling in the MPCE class of ₹300 to ₹420) (Table A3.6) and their share in the total outstanding debt is 22 per cent. 3.5 Analysis of NSSO 70th Round Data Moving on to the more recent scenario, we analyse the incidence of indebtedness of farmer households having outstanding credit as on the date of the survey and the share of institutional and non-institutional sources in providing this credit (Table A3.7 and A3.12 in the Appendix). Also presented in Table A3.7 are the percentages of households that have borrowed since the year 2000. Though figures of borrowings are available for several years, the study considers borrowings since the year 2000 (figures for years prior to 2000 are a negligible number, and hence not considered). It is, however, to be noted that most of the outstanding credit (more than 80 percent) refers to borrowings that took place during 2011–13. Thus, the analysis presented in table A3.7 displays to a large extent the situation during 2011–13. The data reveals that as of June 30, 2012 (that is the reference period), 34 million out of 97 million farmer households were observed to be indebted, i.e. have outstanding credit, and, consequently, the IOI is 35 per cent at the all-India level. As far as borrowing is concerned, 54 per cent of farmer households have borrowed either from an institutional agency or a non-institutional agency. Average loan outstanding per household is ₹77,089, and per indebted household is ₹2,20,280. One noteworthy feature between the NSSO 59th and 70th Rounds is that the amount of loan outstanding per borrower has increased substantially, i.e. from ₹25,891 to ₹2,20,280. A state-level comparison indicates that the incidence of indebtedness is the highest in Telangana, followed by Andhra Pradesh (Table A3.7). These results also corroborate what we had noticed from the 59th Round (2003) NSSO survey. All the southern states have IOI greater than 50 per cent and have also witnessed a high prevalence of borrowing. The incidence of borrowing figures is higher than IOI, as loans fully repaid will not be included in IOI (but will be captured under borrowing); however, as expected, there is a strong correlation between the two. The correlation coefficient between the incidence of indebtedness and incidence of borrowing was 0.96. The southern states not only have high IOI but also witness high average debt. Kerala tops the list with an average outstanding loan per farmer household of ₹3.4 lakh and an average debt per indebted household of ₹6.4 lakh (Table A3.7). Punjab has the second highest average debt per household. The majority of economically backward states showed a low incidence of borrowing and IOI, as well as low average debt per household. 3.5.1 Borrowing during Kharif Season Table A3.8 in the Appendix provides figures for the incidence of borrowing (IOB and IOI), as collected by NSSO for the period July to December 2012. IOB for the six months defined above was about half of the IOI, with some interstate variations. It can also be observed that Telangana, Andhra Pradesh, Kerala, Tamil Nadu and Puducherry had a high incidence of borrowing during the kharif season. Punjab’s IOB during this season was low, which may be attributed to wheat being grown mainly during the rabi season and possibly all loans taken by the farmers are not captured here. However, some rice-growing states like Tripura, West Bengal or Assam with a rather low IOB is a matter of concern. The state of West Bengal, for example, has a large share of small and marginal farmers who possibly hardly have any savings. 3.5.2 IOI and Borrowings across Different Landholdings Appendix Table A3.9 provides a comparison of data pertaining to IOI across different landholdings in Karnataka along with all-India figures. The percentage difference across different landholdings is clearly visible from the table. While 31 per cent of marginal farmers in case of India could access credit (both formal plus informal), this percentage was 53 for medium farmers. For large farmers, the corresponding figure is low possibly due to lower demand for credit, especially from informal sources. Thus, an inverted ‘U’ shape of indebtedness versus landholding size is clear for India, which was also seen during the 59th Round. In the case of Karnataka, however, the scenario is not so clear. While marginal farmers’ access (IOI) is lower than small, medium and large farmers, small farmers’ access is found to be at par with those in larger landholding groups. A comparison of borrowing trends across different social groups shows that at the all-India level, ST households have lower access than others with an IOI of 20 per cent, while OBC households have the highest IOI of 39 per cent (Table A3.10). Even in terms of the amount of credit that could be accessed, ST households have the lowest average loans of ₹117,063 while general caste households have an average loan amount of ₹294,477. In Karnataka, OBC households have the highest IOI figure of 59 per cent, followed by ST households with 54 per cent, general and other caste households with 45 per cent, and SC households with the lowest figure of 41 per cent. 3.5.3 Sources of Credit: Formal versus Informal Formal sources of credit include cooperative/ commercial banks, the government and SHGs, while non-institutional sources primarily comprises of friends and relatives, and moneylenders among other non-institutional lenders. It can be observed that at the all-India level, institutional and non-institutional sources have almost identical shares (viz. 49 per cent and 51 per cent) and the state of Karnataka closely mirrors this, while Kerala has a high share of institutional credit amounting to 72 per cent. On the other extreme is the state of Jammu and Kashmir (J&K) with nearly 70 per cent of loans received from non-institutional agencies (Table A3.11). Regarding the role of different entities/banks within the institutional sources category, cooperatives are found to have played a relatively more important role in states like Maharashtra, Gujarat, Kerala, and Punjab in providing loans to farmers. More than one-third of loans in these states come from cooperative societies. In most southern states, commercial banks and Regional Rural Banks have played a major role in providing credit to farmer households. Close to one-fourth of the loans in these states come from banks directly and indirectly through SHGs which are bank linked. On the other hand, moneylenders play a major role in most backward regions. On an average, at the all-India level, more than a quarter of borrowings comes from moneylenders (Table A3.12 in the Appendix), which is a rather large number. In terms of the amount of money lent (Figure 3.8), out of the ₹5100 billion, ₹1300 billion (26 per cent) is loaned by cooperative societies, ₹1500 billion (30 per cent) by commercial banks and another ₹1300 billion (26 per cent) by moneylenders at the all-India level. Other institutional agencies (7 per cent, 400 billion), relatives & friends (9 per cent, 500 billion) and other non-institutional agencies (2 per cent, 100 billion) constitute the rest of the sources of credit.  According to land-size disaggregation of borrowers (Figure 3.9 and Table A3.12 in the Appendix), one can see that commercial banks are more inclined to large farmers in providing loans while cooperative banks are relatively more unbiased in this regard. As already noted in the Indian case, amongst farmers who have accessed credit, 83 per cent of the total loans taken by large farmers are from institutional agencies, while around 60 per cent of marginal farmers’ loans are from institutional agencies. Farmers in general, and small and marginal farmers in particular, depend quite substantially on moneylenders. In Karnataka, too, access to institutional agencies for marginal farmers is relatively lower. Access is also low for large farmers, perhaps due to lack of demand.  The purpose-wise utilisation pattern of credit from institutional sources reveals that, at the all-India level, 31 per cent of credit is used for short-term crops, about 20 per cent is used for capital expenditure, and another 11 per cent for non-farm business (Table A3.15). However, it is also important to note that about 20 per cent of the non-institutional loans are used for farm activities. Thus, non-institutional sources play a prominent role in agricultural credit. The scenario is similar for the state of Karnataka (Table A3.16 in the Appendix). 3.6 Understanding the Determinants of Access to Credit: An Econometric Analysis for India While the preceding analysis shed light on the various aspects of access to credit by farmer households, it is descriptive in nature and the statistical significance of such results has not been established. To understand the factors that may be responsible for enhancing accessibility to credit, an econometric analysis has been carried out. Households which have cultivated land at least once in the year before the date of the survey are classified as farmer households and are culled out from the larger data set of the Debt and Investment Survey, NSSO, 2013. For this analysis, we have considered all farmer households that borrowed from formal sources after June 30, 2012 till the date of the survey. Loans which were taken before June 30, 2012 have been omitted from the analysis because there is only information on loans which were outstanding or not repaid as on June 30, 2012. Farmers who may have availed a loan and already repaid it before June 30, 2012 are not captured by this data. By considering farmer households that borrowed after June 30, 2012, we obtain complete information regarding all borrower farmers (irrespective of whether repayment has been made or not) from this date to the date of the survey (that begins from January 2013). Explanatory variables included the economic status of households in terms of their landholdings and assets. Social classes and educational qualifications are incorporated into the analysis as well. In addition, access to credit from alternative sources is taken into account. 3.6.1 Methodology In order to explore the factors that determine access to credit, we have used a probit model which is applied in cases where the observed dependent variable y is dichotomous, i.e. it assumes either the value 0 or 1. The model presumes the existence of a continuous latent variable Y* which is a linear function of the explanatory variables. In terms of notation, Y* assumes the following form: And the observed dependent variable y assumes the value 0 and 1 according to the rules given below: The probit model parameters are estimated by the maximum likelihood method where the likelihood function is given below. The log likelihood function is obtained by taking a log of the above function. In the above formulation, it is assumed that there are m outcomes with Y = 1 and the remaining n-m outcomes Y = 0 One can even obtain the predicted probabilities using the maximum likelihood form. 3.6.2 Explanatory Variables and Results We first describe the variables considered for the exercise in Table 3.1. The rationale for using these variables becomes clear from explanations provided while discussing our results. Table 3.2 provides descriptive statistics of variables used, and Table 3.3 presents the results. | Table 3.1: Descriptions of the Variables under Study | | Variable | Description | | Availing a short-term crop loan or KCC loan (dependent variable) | Dummy Variable: = 1 if the farmer household has availed a short-term crop loan or KCC loan between June 30, 2012 and the date of the survey, = 0 if otherwise | | Prompt repayment of a short-term crop loan or KCC loan (excluding those from cooperative banks) | = 1 if the household has received a short-term crop loan or KCC loan at 4 per cent rate of interest or below (excluding those from cooperative banks), = 0 otherwise | | Secondary education or higher in household | = 1 if at least one member of the household has been educated up to the secondary level or higher, = 0 otherwise | | Age of household head | Age of the head of the household in years | | Household size | Number of members | | Area of land under cultivation | Measured in acres | | Average regional asset value | Average asset value of cultivator households, region-wise | | Household asset value (excluding rural land value) | The value of household assets, excluding the value of owned rural land | | Debt asset ratio | Debt asset ratio of the household | | Indebted to moneylenders | If the household had outstanding debt from informal lenders as on June 30, 2012 | | Indebted to relatives | If the household had outstanding debt from relatives and friends as on June 30, 2012 | | Hindu | Hindu = 1, Others = 0 | | SC/ST | SC/ST = 1, Others = 0 | | Household member has bank account | Having bank account = 1, Others = 0 | | Labour is principal income source | Principal income of the household is labour activities = 1, Others = 0 | | Non-agricultural activities are the principal income source | Principal activity regular salaried or non-farm self-employment | | Source: Authors’ computation based on NSSO 70th Round Debt & Investment Survey data. |

| Table 3.2: Descriptive Statistics Relating to the Variables under Consideration | | Variable | Observations | Mean | Standard Deviation | Minimum | Maximum | | Short-term crop loan access | 50,618 | 0.0666759 | 0.2494623 | 0 | 1 | | Prompt repayment | 50,618 | 0.0147971 | 0.1207412 | 0 | 1 | | Secondary education or better in household | 50,618 | 0.527125 | 0.499269 | 0 | 1 | | Age of household head | 50,618 | 48.95417 | 13.05511 | 13 | 102 | | Household size | 50,618 | 5.138152 | 2.402801 | 1 | 36 | | Area of land under cultivation | 50,618 | 0.967544 | 1.597746 | 0.001 | 42.67 | | Average regional asset value | 50,618 | 2028348 | 1908319 | 320647.8 | 2.27 x 107 | | Household asset value (excluding rural land value) | 50,618 | 845162.9 | 7151997 | 0 | 1.43 x 109 | | Debt asset ratio | 50,618 | 0.057800 | 0.363773 | 0 | 53.66296 | | Indebted to moneylenders | 50,618 | 0.237998 | 0.425862 | 0 | 1 | | Indebted to relatives | 50,618 | 0.184263 | 0.387702 | 0 | 1 | | Hindu | 50,618 | 0.786380 | 0.409865 | 0 | 1 | | SC/ST | 50,618 | 0.343870 | 0.475003 | 0 | 1 | | Household member has bank account | 50,618 | 0.794579 | 0.404013 | 0 | 1 | | Labour is principal income source | 50,618 | 0.133865 | 0.340511 | 0 | 1 | | Non-agricultural activities are the principal income source | 50,618 | 0.213422 | 0.409727 | 0 | 1 | | Source: Authors’ computation based on NSSO 70th (2013) Round Debt & Investment Survey data. |

| Table 3.3: Regression Results | | Short Term Crop loan or Kisan Credit Card Loans | Coefficient | Standard Error (Robust) | z | P>z | Marginal Effects | | Secondary education or better in household | -0.014 | 0.020 | -0.690 | 0.490 | -0.001 | | Age of household head* | 0.001* | 0.001 | 1.800 | 0.072 | 0.000 | | Household size** | 0.009** | 0.004 | 2.280 | 0.023 | 0.001 | | Area of land under cultivation*** | 0.088*** | 0.005 | 16.470 | 0.000 | 0.009 | | Average regional asset value*** | 0.000** | 0.000 | 3.160 | 0.002 | 0.000 | | Debt asset ratio*** | -0.614** | 0.215 | -2.860 | 0.004 | -0.060 | | Indebted to moneylenders | -0.003 | 0.025 | -0.120 | 0.903 | 0.000 | | Indebted to relatives*** | -0.337*** | 0.029 | -11.730 | 0.000 | -0.028 | | Hindu*** | 0.277*** | 0.026 | 10.450 | 0.000 | 0.024 | | SC/ST*** | -0.174*** | 0.021 | -8.100 | 0.000 | -0.016 | | Household member has bank account*** | 0.777*** | 0.038 | 20.720 | 0.000 | 0.054 | | Labour is principal income source*** | -0.320*** | 0.035 | -9.250 | 0.000 | -0.026 | | Non-agricultural activities are the principal income source*** | -0.460*** | 0.028 | -16.160 | 0.000 | -0.036 | | Constant*** | -2.429*** | 0.058 | -41.960 | 0.000 | | No. of observations: 50,618; Wald Chi2: 1791.21; Prob > Chi2: 0.000.

Note: 1. Figures in parentheses are robust standard errors. *, **, and *** indicate that a coefficient in a particular regression is significant at the 10 per cent, 5 per cent, and 1 per cent levels of a two-tailed test for significance, respectively.

2. Based on Probit model, Dependent Variable: Access to Short-term Crop Loan or KCC Loan between July 1, 2012 and the Survey Date (up to June 30, 2013).