The global banking sector remained financially sound in 2021 and 2022 so far on the back of implementation of various regulatory and macro-prudential reforms post-global financial crisis (GFC). The top 100 banks maintained healthy capital buffers while their profitability improved. The aggressive tightening of monetary policy in the recent period, however, has led to more austere financial conditions, posing risks to the global banking system. The medium-term challenges include effective regulation of technological innovations in the financial sector and risks emanating from climate change. 1. Introduction II.1 The prospects for sustaining the global recovery that characterised the year 2021 on the back of unprecedented policy stimulus and rapid pace of vaccinations have been dimmed by the war in Europe and synchronized and front-loaded monetary policy tightening in the face of surging global inflation. With persisting concerns about the near-term inflation outlook, amplified market volatility is raising financial stability risks. Higher capital and liquidity buffers have helped banks and financial institutions to remain resilient and stable. Nonetheless, fears of a hard landing have increased worldwide. For emerging market economies, these factors have translated into surges in capital outflows, sharp depreciation of exchange rates, loss of reserves and darkening macroeconomic prospects. II.2 The global banking sector weathered the pandemic shock well, gaining strength from capital buffers built since the global financial crisis (GFC) and supported by various regulatory concessions to mitigate the impact of the pandemic. In the fast-changing global macroeconomic environment, fraught with geopolitical and pandemic-related concerns, however, the banking sector faces new challenges emanating from rising interest rates and the likely increase in debt servicing burdens. Credit demand—which is largely procyclical— is likely to remain subdued in response to the weakening economic outlook, with depressed treasury income, the likelihood of increasing delinquencies and dents to profitability. II.3 Against this backdrop, this chapter is organised into five sections. An overview of global macro-financial conditions is presented in Section 2. In Section 3, recent global banking policy developments are tracked. Section 4 evaluates the financial performance of the global banking sector with Section 5 focusing on an analysis of the world’s largest banks. Section 6 concludes the chapter with the way forward. 2. Global Macroeconomic Conditions II.4 In its October update of the World Economic Outlook (WEO), the International Monetary Fund (IMF) kept the global GDP growth forecast for 2022 at 3.2 per cent after three successive downward revisions since January 2022. It highlighted growing risks to a darkening outlook and an increased divergence in the growth trajectories of advanced economies (AEs) and emerging market and developing economies (EMDEs) (Chart II.1a). II.5 The projection for global inflation has been revised upwards to 8.8 per cent in 2022 from 4.7 per cent in the previous year, led by a sharp increase in food and energy prices, lingering demand-supply imbalances and continuation of some supply chain disruptions (Chart II.1b). II.6 The growth in global goods and services trade is projected to moderate to 4.3 per cent in 2022 from 10.1 per cent a year ago. The current account deficits (CADs) of major AEs are likely to widen further, reaching the highest level after the GFC of 2008 (Chart II.1c). While government debt has moderated from a post-pandemic peak in 2020, it still remains elevated relative to historical averages (Chart II.1d). II.7 Central banks across the world have front loaded monetary policy tightening to restore price stability. Among the EMDEs, Brazil, Chile, Mexico and Russia have already raised policy rates several times through 2021. Other EME central banks have also started retracting accommodative stances by early 2022 (Chart II.2b).

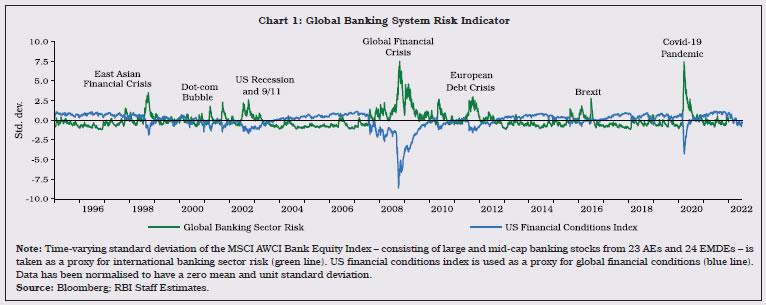

II.8 AEs, on the other hand, started policy normalisation more slowly, with a majority of central banks starting their rate hike cycle only in early 2022. In the United States, the Federal Reserve started policy tightening in March 2022 and has raised the federal funds rate to 4.25-4.50 per cent up to December 2022 (Chart II.2a). II.9 The outlook for 2023 remains uncertain, with little clarity on how quickly energy and food security could be restored globally. Consequently, the trajectory of inflation is expected to remain elevated going ahead, with diminishing confidence in the effectiveness of monetary policy to ensure a soft landing. The synchronised and aggressive tightening of monetary policy has led to more austere financial conditions, posing risks to the global banking system (Box II.1). Box II.1: Impact of Financial Conditions on Banking Sector Risk Historical data suggests that banking sector risk increases during periods of economic distress, such as the GFC and the COVID-19 pandemic (Chart 1). The following four-variable vector autoregression (VAR) model for G20 economies was estimated using quarterly aggregate data from 2000Q1 to 2022Q1 : In equation 1, Yt represents a vector of endogenous variables comprising of year-on-year growth (%) in consumer price index (CPI) and real gross domestic product (GDP) of G20 countries along with US financial conditions index (FCI)1,2. Yt also includes a proxy indicator of banking sector risk embodied in time-varying volatility of the MSCI AWCI Bank Index estimated from an Exponential Generalized Autoregressive Conditional Heteroskedasticity (EGARCH) model (Bollerslev, 1986; Nelson, 1991). The results suggest that one standard deviation increase in global inflation increases banking sector risk by 1.5 points over the medium term (Chart 2a).  On the other hand, an unanticipated increase in GDP growth lowers banking sector risk in the short-term, which may, however, increase over the medium term in response to a credit boom that often accompanies a post-crisis recovery in growth (Chart 2b). A shock to FCI, signifying a tightening of financial conditions, increases global banking sector risk by 1.1 points, which persists over the medium term (Chart 2c). References Bollerslev, T. (1986). Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 31(3), 307-327. Nelson, D. B. (1991). Conditional heteroskedasticity in asset returns: A new approach. Econometrica: Journal of the Econometric Society, 347-370. | 3. Global Banking Policy Developments II.10 Following the disruptions caused by the GFC in 2008, the G20 in coordination with the Financial Stability Board (FSB) launched a comprehensive programme of financial reforms with the aim of fixing the fault lines that led to the GFC. It has four core elements: (i) building resilient financial institutions; (ii) too-big-to-fail (TBTF) reforms; (iii) making derivatives markets safer; and (iv) enhancing the resilience of non-bank financial intermediation (NBFI). Recent policy developments in the areas of technological innovations and climate change risks also present opportunities as well as challenges. Building Resilient Financial Institutions3 II.11 As the deadline for adoption and implementation of the outstanding Basel III standards — set at January 20234 — draws closer, further progress is made in that direction. Since September 2021, six additional member jurisdictions have adopted the revised standardised approach for credit risk and four additional member jurisdictions each have adopted the revised internal ratings-based (IRB) approach, the revised operational risk framework and the output floor. Furthermore, three additional member jurisdictions have adopted the revised credit valuation adjustment (CVA) framework, the revised minimum requirements for market risk, the revised leverage ratio (2017 exposure definition) and the global systemically important banks (G-SIB) leverage ratio buffer. For standards that are past due, seven more capital standard implementations have been completed, including capital requirements for bank exposures to central counterparties (CCPs) and the total loss-absorption capacity (TLAC) holdings standard. For the disclosure standards, five more adoptions are observed, mainly for net stable funding ratio (NSFR) and interest rate risk in the banking book (IRRBB). One more adoption each in the implementation of the framework for domestic systemically important banks (D-SIBs) and the large exposures framework has happened during the period. Too-Big-To-Fail (TBTF) Reforms5 II.12 The focus of G-SIB resolution planning is shifting to fine-tuning and testing resolution preparedness. In 2022, unwinding of COVID-19 support measures by governments and central banks across countries, along with heightened geopolitical risks added to the macroeconomic and financial uncertainties. Some banks lost access to key services due to sanctions, while loss of market confidence led to a liquidity run in some others. Authorities had to step in to resolve or liquidate a few (non-systemic) banks. As four G-SIBs from EMEs are due to comply with the TLAC standard by January 2025, work is continuing to build up external TLAC. All other G-SIBs currently meet or exceed the final TLAC requirement, according to self-reporting. Making Derivatives Markets Safer II.13 The FSB6 has found that 18 out of 24 FSB member jurisdictions have implemented final higher capital requirements for non-centrally cleared derivatives (NCCDs). Margin requirements for NCCDs are in force in 16 jurisdictions; two jurisdictions have published final standards and three jurisdictions expect to implement the requirements in 2023. Trade reporting requirements for over-the-counter (OTC) derivatives transactions are in force in 23 FSB member jurisdictions and in the remaining jurisdiction7, preparations for authorising a trade repository (TR) and implementing the jurisdiction’s requirements are ongoing. Central clearing requirements are in force in 17 FSB member jurisdictions and platform trading requirements are in force in 13 FSB member jurisdictions. Enhancing Resilience of Non-Bank Financial Intermediaries (NBFI) II.14 The FSB, together with standard setting bodies (SSBs) and other international organisations, has been working towards enhancing the resilience of the NBFI sector. It also focuses on reducing the systemic risks in the sector by strengthening their ongoing monitoring and, where appropriate, developing policies to address such risks. II.15 In November 2022, the FSB issued a progress report on enhancing resilience of Non- Bank Financial Intermediation8, which describes progress over the past year and planned work by the FSB, as well as by SSBs and other international organisations, to enhance the resilience of NBFI under the FSB’s NBFI work programme. The main focus of the NBFI work programme includes: policy work to enhance money market fund (MMF) resilience9; assessing liquidity risk and its management in open-ended funds (OEFs); examining the structure and drivers of liquidity in core government10 and corporate bond11 markets during stress; an examination of the frameworks and dynamics of margin calls12 in centrally and non-centrally cleared markets; an assessment of the fragilities in USD cross-border funding and their interaction with vulnerabilities in EMEs13. Climate-Related Financial Disclosures II.16 Increasingly, central banks and policymakers around the world are considering climate change as a potential source of systemic risk to the financial system. These risks, including physical, transition and liability risks14, may be transmitted across the financial system, including across borders and across sectors15. II.17 In recent years, efforts to address climate change risks have been growing across jurisdictions and a large and increasing number of central banks are either contemplating or have put in place plans for addressing financial sector risks from climate change. The lack of sufficiently consistent, comparable, granular and reliable climate data remains a major challenge in measuring exposures to climate-related risks. II.18 General sustainability- related disclosure requirements and climate-related disclosure requirements are the two areas where the International Sustainability Standards Board (ISSB) has recently proposed standards16. They are built on the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD) and industry-based disclosure standards. The objective is to develop a global baseline standard of sustainability disclosures with consistent, complete, comparable, and verifiable information. II.19 In June 2022, the BCBS issued 18 principles for effective management and supervision of climate-related financial risks17. These principles cover diverse areas such as corporate governance, internal controls, risk assessment, management and reporting. The objective of these principles is to achieve a balance in improving practices and providing a common baseline for internationally active banks and supervisors, while retaining sufficient flexibility, given the degree of heterogeneity and evolving practices in this area. These principles are designed in a manner that enables their adoption by a diverse range of banking systems in a proportional manner, depending on the size, complexity and risk profile of the bank or banking sector. II.20 In July 2022, the FSB, assessed the progress made by SSBs and other international organisations for addressing climate related financial risks18 for the first time. All the four blocks of the roadmap viz., firm-level disclosures, data, vulnerabilities analysis and regulatory and supervisory tools were assessed. The report highlighted the need to establish common metrics for climate-related financial risks, including forward-looking metrics and establish data repositories for open access to climate-risk related data in a consistent form. II.21 In the same month, the European Central Bank (ECB) announced that it will incorporate climate change considerations into the Eurosystem’s monetary policy framework19. The related measures include: (i) tilting ECB’s corporate bond holdings towards issuers with lower greenhouse gas emissions, more ambitious carbon reduction targets and better climate-related disclosures; (ii) limiting the share of assets issued by entities with a high carbon footprint that can be pledged as collateral by individual counterparties when borrowing from the Eurosystem; (iii) accepting marketable assets and credit claims from companies and debtors that comply with the Corporate Sustainability Reporting Directive (CSRD) as collateral in Eurosystem credit operations; and (iv) further enhancing the ECB’s risk assessment tools and capabilities to capture climate-related risks better. II.22 In November 2022, the FSB published a joint report20 with the Network for Greening the Financial System (NGFS) providing a synthesis of the findings of climate scenario analysis undertaken by various financial authorities. Enhancing Cross-Border Payments II.23 The major challenges in achieving the goal of faster and more efficient cross-border payments include high costs, low speed, limited access and inadequate transparency. In 2021, the FSB sought to address these issues by setting 11 global level quantitative targets for three segments – wholesale cross-border payments; retail cross-border payments; and remittances21. Furthermore, in July 2022, the FSB proposed key performance indicators (KPIs) to monitor progress toward the targets and identified existing and potential sources of data for calculating these KPIs22. A more detailed discussion of the KPIs and main data sources underlying their calculation, including material gaps, the approach to operationalising the monitoring exercise were discussed in the final report published in November 202223. II.24 In May 2022, the Committee on Payments and Market Infrastructures (CPMI) published best practices to self-assess the access arrangements of key payment systems, especially real time gross settlement (RTGS) systems24. The CPMI is also working towards extending the operating hours of RTGS systems across jurisdictions to increase the speed of cross-border payments while reducing liquidity costs and settlement risks25. II.25 In a paper published in August 202226, the ECB compared six27 potential avenues for cross-border payments systems that could pass the test of being immediate, cheap, universal and settled in a secure settlement medium. The report found that central bank digital currency (CBDC) and instant domestic payment systems, both interlinked through an FX conversion layer, could be the ‘holy grail’ of cross-border payments. Central Bank Digital Currency (CBDC) II.26 Globally, a consensus is emerging that CBDCs, if implemented correctly, can promote diversity in payment options, make cross-border payments faster and cheaper, increase financial inclusion and possibly facilitate crisis time –such as a pandemic – fiscal transfers to targeted beneficiaries. Many central banks and governments are stepping up their efforts towards exploring a digital version of fiat currency. The COVID-19 pandemic created conditions to support exponential growth in digital payments and the proliferation of private cryptocurrencies as an alternative to financial assets fetching low returns. This experience prompted central banks to accelerate work on CBDCs. The results of the 2021 Bank for International Settlements (BIS) survey on CBDCs28 revealed that 90 per cent of central banks were actively researching the potential for CBDCs, 62 per cent were experimenting with the technology and 26 per cent were deploying pilot projects. II.27 In October 202129, the ECB launched an investigation phase of the digital euro project with the aim of addressing key issues regarding design and distribution, based on users’ preferences and technical advice by merchants and intermediaries. The investigation phase will last for 24 months and would assess the possible impact of a digital euro on the market, identifying the design options to ensure privacy and avoid risks for euro area citizens, intermediaries and the overall economy. It will also define a business model for supervised intermediaries within the digital euro ecosystem. II.28 The BIS Innovation Hub (BISIH), along with the central banks of Australia, Malaysia, Singapore and South Africa, designed and developed a multi-CBDC (mCBDC) shared platform called “Project Dunbar” that could enable international settlements using digital currencies issued by multiple central banks. Unlike the correspondent banking model in which banks hold foreign currency accounts with each other, a multi-currency common settlement platform could enable transacting parties to pay each other in different currencies directly without the need for intermediaries and thus reduce the time, effort, cost and settlement risk for cross-border payments. The results of the initial phase of the project, published in March 2022, confirm the technical viability of mCBDCs based on two prototypes developed on blockchain based distributed ledger technology. II.29 The BISIH is also developing a prototype for retail CBDCs, based on a two-tier distribution model (central bank at the foundation of the retail CBDC system and customer-facing activities carried out by the private sector) that can enable a central bank ledger to interact with private sector service providers in a safe environment for retail payments30. Regulation of Crypto-Assets II.30 Following the aggressive tightening of monetary policy by the US Fed, crypto markets31 have witnessed high volatility. Even StableCoins32 were not spared. The crypto-sector’s market capitalisation fell from a peak of around $3 trillion in November 2021 to less than $1 trillion in December 202233. Some major crypto lending and trading platforms suspended withdrawals from their platforms or announced bankruptcy34. The crypto market faced another episode of turmoil in November 2022 following the collapse of a major crypto exchange35. These episodes have once again brought the issue of financial stability risks posed by these assets to the fore. Policy makers and SSBs across the world are working towards the development of risk-based and technology-neutral policies for effective regulation and supervision of crypto-assets, commensurate with risks that these assets pose. II.31 The FSB identified the following vulnerabilities related to the crypto-sector that may have financial stability implications: increasing linkages between crypto-asset markets and the regulated financial system; liquidity mismatch, credit and operational risks that make stablecoins susceptible to sudden and disruptive runs on their reserves, with the potential to spill over to short term funding markets; the increased use of leverage in investment strategies; concentration risk of trading platforms; opacity and lack of regulatory oversight of the sector; low levels of investor and consumer understanding of crypto-assets; money laundering; cyber-crime and ransomware36. II.32 The FSB also highlighted four transmission channels through which such vulnerabilities may have financial stability implications: (i) the financial sector’s direct exposures to crypto-assets, related financial products and entities that are financially impacted by these assets; (ii) wealth effects, i.e., the degree to which changes in the value of crypto-assets might impact their investors with subsequent knock-on effects on the financial system; (iii) confidence effects through which developments concerning crypto-assets could impact investor confidence in crypto-asset markets, and potentially the broader financial system; and (iv) extent of crypto-assets’ usage in payments and settlements. II.33 The BCBS divides crypto-assets into Group-1 crypto-assets, which fully meet a set of classification conditions, and Group-2 crypto-assets that do not meet such conditions. Group-1 assets were further divided into Group 1a assets, which include tokenised traditional assets and Group 1b assets, which include crypto-assets with effective stabilisation mechanisms. Group 1 crypto-assets are proposed to be subject to at least equivalent risk-based capital requirements, based on the risk weights on underlying exposures as set out in the existing Basel capital framework and Group 2 crypto-assets would be subject to further conservative capital treatment37. II.34 In June 2022, BCBS suggested some additions/changes to the framework which include: (i) development of standards text for inclusion in the Basel Framework; (ii) refinement of the classification conditions; (iii) introduction of an add-on to risk-weighted assets (RWA) to cover infrastructure risk for all Group 1 crypto-assets; (iv) recognition of hedging for certain Group 2 crypto-assets; and (v) introduction of an exposure limit, which will initially limit a bank’s total exposures to Group 2 crypto-assets to one per cent of Tier 1 capital38. II.35 In July 2022, the FSB prescribed the international stance on the way forward regarding the regulation and supervision of the crypto sector. Their recommendations include39: (i) crypto-assets and markets must be subject to effective regulation and oversight commensurate with the risks they pose both at the domestic and international level; (ii) crypto-asset service providers must at all times ensure compliance with existing legal obligations in the jurisdictions in which they operate; (iii) the recent turmoil in crypto-asset markets highlights the importance of progress in ongoing areas of work of the FSB and the international standard-setting bodies to address the potential financial stability risks posed by crypto-assets, including the so-called stablecoins; (iv) stablecoins should be subjected to robust regulations and supervision of relevant authorities if they are to play an important role in the financial system. The statement further declares that FSB members support the full and timely implementation of existing international standards and that the FSB is working to ensure that crypto-assets are subject to robust regulation and supervision. II.36 In October 2022, the FSB made recommendations for the regulation, supervision and oversight of crypto-asset activities and markets and reviewed previous recommendations for the regulation, supervision and oversight of ‘Global Stablecoin’ arrangements. These proposals seek to promote the comprehensiveness and international consistency of regulatory and supervisory approaches to crypto-asset activities and markets40, 41. 4. Performance of the Global Banking Sector II.37 The global banking sector was on a strong footing when the pandemic struck and has continued since then to remain financially sound throughout 2021 and 2022 so far, largely due to the implementation of various regulatory and macro-prudential reforms. Moreover, regulatory dispensations and extraordinary monetary and fiscal support helped banks to play a key role in ensuring availability of credit to the real sector. Bank Credit Growth II.38 At the onset of COVID-19 pandemic, credit growth slumped in the first half of 2020 on the back of contraction in global growth and restrictions on mobility. The revival of credit growth in the second half of 2020 proved short-lived—lasting only till the first half of 2021—and a sharp downturn has taken hold since then across AEs and EMDEs on weak demand drivers (Chart II.3a). While credit growth moderated in most of the AEs, USA and Australia have exhibited signs of recovery since the second half of 2021 (Chart II.3b). A similar revival is observed for most of the EMEs with the notable exception of China (Chart II.3c). In contrast, credit growth was dismal across the Euro area. Contraction in bank credit growth in Greece continued for the eleventh consecutive year in 2021 (Chart II.3d). Asset Quality II.39 Asset quality, as measured by the ratio of non-performing loans to total gross loans (NPL ratio), continued to improve across AEs (Chart II.4a). In the Euro area, government and institution-specific interventions in Greece led to significant improvement in its banks’ asset quality (Chart II.4b). Among the EMEs it has been improving since 2019, though the NPL ratio remained elevated in Russia and India vis-à-vis other countries (Chart II.4c). Provision Coverage Ratio II.40 The provision coverage ratio (PCR) has been high in some AEs like the USA and Norway, indicating greater resilience to stress in the banking book (Chart II.5a). The ratio has, however, remained low—in the range of 15 per cent to 35 per cent—in other economies like Australia, Canada and UK. PCR moderated slightly in few Euro area countries in 2021 (Chart II.5b). For the EMDEs, PCR remained stable, except for Brazil and Argentina where it declined but remained well above 100 per cent (Chart II.5c). Bank Profitability II.41 Despite lower interest rates, bank profitability, measured in terms of return on total assets (RoA), continued to improve for most AEs. In the USA and Denmark, however, profitability declined on account of higher loan loss provisioning (Chart II.6a). In the Euro area, RoA increased, except in Spain. Although profitability was in the negative territory for Greece, it improved from the second quarter of 2021 (Chart II.6b). Among EMDEs, RoA remained robust on account of lower provisioning requirements for non-performing loans (Chart II.6c). Capital Adequacy II.42 The capital to risk weighted assets ratio (CRAR) of banks remained well above the Basel III prescribed levels across jurisdictions, although marginal moderation is observed for AEs like Denmark and US in recent quarters. Among the Euro area countries and EMDEs, capital positions either remained stable or improved (Chart II.7).

Leverage Ratio II.43 The leverage ratio i.e., regulatory Tier I capital as a proportion to total assets, remained well above the minimum of 3 per cent under Basel III norms. Within the AEs, the USA, Switzerland and Australia maintained a leverage ratio of more than twice the prescribed levels, although marginal decline was observed in recent quarters. Germany, France and Portugal lead the Euro Area banks in maintaining high leverage ratios. Among the EMDEs, Argentina and Indonesia maintained healthy leverage ratios (Chart II.8).

Financial Market Indicators II.44 Banking stocks plummeted globally in 2020 but recovered during 2021 on liquidity infusions by central banks, turnaround in economic activity and a positive growth outlook. This reversed in early March 2022 as the war in Europe ushered in a new wave of uncertainty. Since then, the equity prices of Indian banks have revived, mainly reflecting their robust capital positions and improvement in profitability and asset quality. Equity prices in other AEs and EMEs have also recovered in recent months, but are still trading below previous highs (Chart II.9a). II.45 After declining from their peaks in March 2020, credit default swap (CDS) spreads of banks have increased significantly from the beginning of 2022. Global sanctions and rating downgrades following the Russia-Ukraine war have led to a dramatic rise in CDS spreads in Russia. The CDS spreads of banks in other markets also followed suit; however, spreads have moderated in recent months (Chart II.9b). 5. World’s Largest Banks II.46 The country-wise distribution of the top 100 banks ranked by Tier-1 capital remained largely similar in 2021 to that a year ago42 (Chart II.10a). Moreover, out of 20 Chinese banks in the list, the ranking of 18 banks either improved or remained same as previous year on higher accumulation of Tier-1 capital relative to other banks. Consequently, the share of total assets held by China-based banks increased year-on-year in 2021 while that of banks in AEs declined during the same period (Chart II.10b). II.47 In terms of asset quality, the share of Chinese banks in non-performing loans (NPLs) of top 100 banks increased in 2021 while the share of AE banks declined (Chart II.11a). However, the provision coverage ratio (PCR) was more than 100 per cent for all the Chinese banks in the list, indicating higher loss absorbing capacity in case of distress. In contrast, roughly half of banks in AEs and EMDEs (excluding China) had PCRs greater than 100 per cent (Chart II.11b). II.48 Banks further shored up their capital in 2021, with all banks maintaining capital to risk weighted assets ratio (CRAR) at or greater than 12 per cent and 64 banks with CRAR higher than 16 per cent (Chart II.12a). The distribution of banks as per their leverage ratios (capital to assets ratio) remained similar in 2021 as in 2020 and only two banks had leverage ratio at or below three per cent. 64 banks had leverage ratio greater than 6 per cent indicating their comfortable capital position (Chart II.12b). The profitability of banks improved, with higher number of banks registering RoA in the range of 1 to 2 per cent and greater than 3 per cent as compared with the previous year (Chart II.12c).

6. Conclusion II.49 With global growth set to deteriorate in 2022 and with rising prospects of a recession in 2023, credit growth, could procyclically decelerate across major economies which, in turn, could shrink bank profitability. While banks weathered the pandemic with high capital buffers and improved asset quality, going forward, they face a highly uncertain outlook, with the possibility of continuing geopolitical tensions, tighter monetary and liquidity conditions and potential adverse spillover effects on profitability and asset quality. Moreover, wider adoption of technology in the financial system amidst a new wave of innovations and climate change risks pose new challenges for financial stability that would require risk mitigating regulatory and supervisory actions.

|