Background and Rationale 1. Securitisation involves pooling of loans and selling them to a special purpose entity (SPE), which then issues securities backed by the loan pool. A well-developed securitisation market can inter alia provide a market-based mechanism for management of credit risk by financial institutions and can help in development of a secondary loan market. The Reserve Bank had issued the revised framework for Securitisation of Standard Assets vide the Master Direction dated September 24, 2021 (SSA). Aimed at development of a strong and robust securitisation market in India, while facilitating simpler securitisation structures, the revised framework aligned the regulatory framework for securitisation of standard assets with the Basel guidelines that came into force effective January 1, 2018. 2. Currently there is no corresponding mechanism for securitisation of non-performing assets (NPAs) through the SPE route. The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI) does provide for securitisation of NPAs but such securitisations have to be undertaken by Asset Reconstruction Companies (ARCs) licensed under the Act, in terms of the specifically laid down statutory/regulatory norms. Based on market feedback and stakeholder consultations, it was decided to enable securitisation of NPAs through the SPE route, on the lines of securitisation of standard assets. The Task Force on the Development of Secondary Market for Corporate Loans constituted by the Reserve Bank, which submitted its recommendations in September 2019, had also specifically recommended that securitisation of NPAs may be considered as an alternative investment route in stressed assets. 3. Accordingly, it was announced in the Statement on Developmental and Regulatory Policies released on September 30, 2022 that a Discussion Paper (DP) detailing relevant contours of the proposed framework on securitisation of stressed assets (SSAF) will be issued shortly. This DP delineates the broad features of the proposed framework, soliciting views/comments on critical issues of SSAF since securitisation of NPAs has features that distinguish it from the securitisation of standard assets. Specific questions on which comments are solicited are listed at Annex-1. 4. Comments may be submitted by February 28, 2023 to The Chief General Manager, Credit Risk Group, Department of Regulation, Central Office, Reserve Bank of India, 12th Floor, Central Office Building, Shahid Bhagat Singh Marg, Fort, Mumbai – 400001, or by e-mail with the subject line “Discussion Paper on Securitisation of Stressed Assets Framework (SSAF)”. Introduction 5. Securitisation of Stressed Assets is a financial structure whereby an originator of NPAs sells these to a SPE that funds such an acquisition by issuing securitisation notes. The SPE, in turn, appoints a servicing entity to manage the stressed assets, typically with a fee structure that incentivises them to maximise recoveries on the underlying loans. Investors are paid based on the recovery from underlying assets, as per the waterfall mechanism depending upon the seniority of the tranches. A flow chart, in this regard is presented below:  6. While de-recognition and bankruptcy remoteness remain the pillars of both types of securitisation structures, the main difference between the securitisation of stressed assets and the standard assets is related to the lower degree of certainty of cash flows from the underlying pool in case of stressed assets. In addition, the extent of involvement of third-party expert entities (‘Resolution Managers’) and their role in resolution of the underlying assets are differentiating features. 7. The underlying pool of assets in SSAF are different from pools of SSA in terms of the credit risk. While for SSA, the credit risk associated with the borrower is borne by the investors in securitisation notes, in SSAF the assets are already in default/NPA or deemed as non-performing. They are securitised at a discount to their nominal value, reflecting market’s valuation of these underlying assets after discounting portfolio losses and likelihood that resolution of underlying may generate sufficient recoveries to cover net value of non-performing exposures. Thus, the investors are exposed to the risk that workout of resolution exercise may not generate sufficient recoveries to cover net value of transferred underlying assets. International Experience 8. Securitisation of NPAs, though relatively new to global economy, is existent in developed economies in different forms. Basel Committee on Banking Supervision (BCBS) vide CRE-451 on ‘Securitisations of Non-Performing Loans’ dated November 26, 2020 has issued guidelines for calculation of capital and risk weights applicable to exposures to NPE Securitisations, to become effective on January 01, 2023. European Union (EU) has also released regulation for NPE Securitisation vide Regulation (EU) 2021/5572 effective from April 09, 2021. Further, Prudential Regulation Authority of UK has issued policy statement PS24/213 as part of Implementation of Basel Standards – Non-performing Loan Securitisations. Key Aspects of the Proposed Framework A. Definition of ‘Stressed Assets’ eligible for securitisation under SSAF 9. One of the key issues in SSAF relates to the universe of assets (in terms of asset classification) eligible to be covered under the framework. In terms of the extant instructions on SSA, eligible standard assets include those in the special mention account (SMA) category. However, the conditions for Simple, Transparent and Comparable (STC) securitisations explicitly exclude exposures in default. The question that needs to be addressed in respect of SSAF is whether the framework should be restricted only to NPAs, or expanded to include standard assets too, up to a ceiling. Securitisation involving only NPAs may have uncertain cash flows, mainly dependent on recoveries from underlying assets and issuance of securitisation notes on those underlying assets may not have regular servicing, which may be a limiting factor for the universe of investors. Internationally, a limited window is permitted for inclusion of non-NPA (standard) assets for structuring purposes. However, such transactions having combination of standard and NPA assets may lead to issues of regulatory arbitrage, complexity in valuation, etc. | Discussion Question 1: Should Securitisation of Stressed Assets Framework be limited only to NPAs, or should it include standard assets too, up to a certain threshold? The response may also elaborate pertinent implications viz. regulatory arbitrage, complexity, impact on resolution strategy and effectiveness, possible threshold etc. | B. Assets eligible for SSAF 10. Currently under SSA, the assets eligible for securitisation are restricted through specification of a negative list of assets4 which are ineligible to be part of underlying pool. However, given the unique nature of stressed assets relating to enforcement, pricing, resolvability etc., such an expansive approach may not be ideal at inception. The key factor is resolvability, and it may be pertinent to note that in other jurisdictions like Italy, Spain and USA, similar frameworks for securitisation of NPAs primarily cover residential/commercial mortgages, loans to small and medium enterprises and retail unsecured assets. 11. During preliminary interactions with a focused set of market participants, the views broadly mirrored the global experience in terms of asset selection viz. retail stressed assets – mortgages, unsecured personal loans and loans taken by MSMEs. In these categories of loans, where the borrower base is diversified, the cash flows are relatively predictable even where the assets are stressed, and borrowers often continue to make regular payments. With relatively predictable cash flows, the complexities involved in structuring such transaction are reduced. 12. An additional option is to permit stressed large corporate accounts. However, the downside is that these accounts may exhibit highly uncertain cash flows; delays in decision making by the Inter Creditor Agreement/Committee of Creditors leading to deterioration in value of underlying; and, representation by the resolution manager of only a part of the entire set of creditors. On the other hand, these assets have significant enterprise value backed by tangible security and potentially may attract wider investor base. Moreover since these accounts form major part of NPAs of financial sector, excluding them from SSAF will limit the universe of underlying pools. 13. Further, in order to have a portfolio approach towards recovery from varied pool of stressed assets, a floor on the value of underlying or number of loans in underlying assets can be considered. Discussion Question 2: Which type of assets should be eligible for Securitisation of Stressed Assets? Please support your answer with qualitative/quantitative rationale.

a) Term loans only with the same asset universe as it is there in Securitisation of Standard Assets;

b) Big ticket loans above a certain aggregate threshold (e.g. Rs. 100 crores);

c) Small ticket loans such as commercial/residential mortgages, loans to MSMEs and unsecured retail assets with a floor on pool specifications such as minimum number of loans/ticket size/cumulative loan amount etc.

Please also share views on likelihood of resolvability under the selected option(s). | C. Minimum Risk Retention (MRR) 14. The requirement of MRR under SSA is intended to ensure retention of economic interest by the originators in the credit risk of the underlying assets, with the objective of aligning the interests of the originator with the interests of the investors. However, in case of SSAF, the objective of the originator is to transfer the NPAs from their books where they may no longer wish to be associated with the transferred assets in any way. As these assets have already defaulted, the origination standards may have limited role in determining chances of recovery, and hence economic interests of originator may not always align with that of investors. Further, resolvability of underlying assets is dependent upon the type of loans, quality of mortgages/hypothecated assets, which can be verified fairly by investors through due diligence. Therefore, it is the Resolution Manager (RM) whose economic interests ought to be closely aligned with interests of investors. RMs, who are usually employed on fee-based mechanism for recovery, should be incentivized for early resolution and higher recovery, rather than acting as cost centre through yearly fees and negligible output. To align the incentives for RMs, prudentially, it may be justifiable to stipulate that RMs retain a share of the risk by investing in securitisation notes. 15. The key issue, then, would be to determine as to who should bear the incidence of MRR – the originator or the RM, and in what manner. One option is to leave it to market to decide through the contractual terms of the structure. Another option is to distribute MRR between originator and RM through regulatory guidelines. A third option can be to specify recovery-based fee structure for RM and MRR with originator. Discussion Question 3: Whether form and quantum of Minimum Retention Ratio (MRR) is required to be prescribed regulatorily for SSAF? If so;

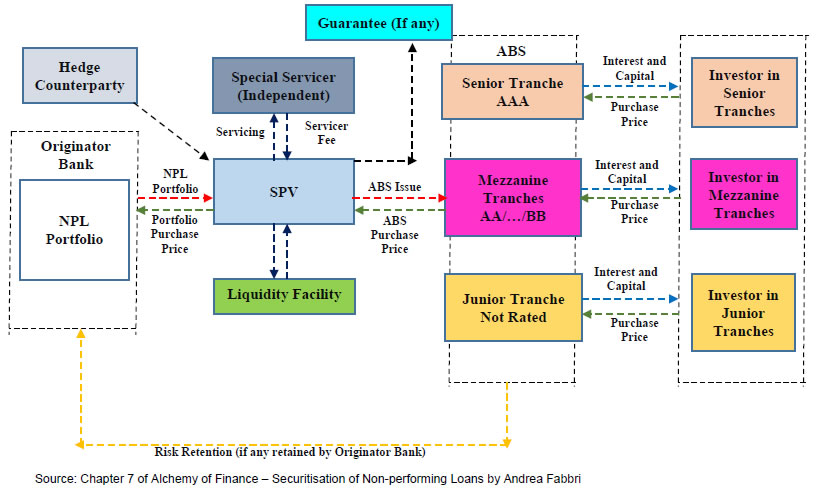

a) Should the MRR stipulation be same as for SSA or different in terms of quantum/form?

b) Who shall fulfil MRR requirement - Resolution Manager, originator, both or other parties too?

Please support your answer with rationale. | D. Regulatory Framework with respect to Special Purpose Entity (SPE), Resolution Manager and Other Stakeholders 16. Under SSAF, the role of SPEs and the RM is of paramount importance because of their involvement with resolution/recovery exercise of the underlying exposures and reporting requirements to financial regulators. The role of the RM is related inter alia to the following factors: experience in working-out the NPAs including due diligence; effectiveness of the business plan; recovery strategies; loan management; legal network; reporting and IT (also for data quality purposes). While there are various options (as elucidated below) to consider for organisational structure of the RM, it is imperative the RM is an entity independent from the originator. 17. While originator may have some insights to share regarding the conduct and performance of the accounts, it may be transient in nature and investors may prefer an independent RM. In order to enable the market to have the freedom of choice over RM, an enabling mechanism for independent RM seems warranted while at the same time, fulfilling the prudential expectations of the role. Having an independent RM under SSAF is perceived as a strong point for the investors compared to the case where originator manages the assets via their specialized servicing unit. RMs who are independent from the originator can bring up-to date recovery mechanism and would be able to treat all portfolios in a similar manner. However, there may be merit in facilitating engagement of originator for a brief period, post transfer of assets to ensure due diligence and smooth sharing of information. 18. Further, since the role of SPE and RM is central to the SSAF wherein they are directly responsible for resolution and recovery of underlying stressed pool, it is desirable that they should be within the regulatory purview of Reserve Bank. However, the mechanism/route to regulate them needs to be explored, keeping in view the set of activities they will be required to undertake in SSAF. Discussion Question 4: Does the idea of independent Resolution Manager lead to any prudential, economic or any other conflict/arbitrage?

Discussion Question 5: Should the framework completely prohibit any kind of relationship of originator with the Resolution Manager post transfer of stressed assets or an arm’s length relationship may be permitted for a certain period (say, 3 months post transfer) to ensure smooth transition and information exchange?

Discussion Question 6: What would be the ideal regulatory framework for the SPE and the Resolution Manager under SSAF, considering inter alia the imperative of regulatory reporting?

Discussion Question 7: What could be the possible corporate structures for the Resolution Manager within the ambit of regulatory power of the RBI? Are there any foreseeable concerns if the Resolution Manager is required to be an NBFC/ARC registered with RBI?

Please elaborate on your response covering the legal and functional perspectives of the envisaged structure | E. Access of Finance to Resolution manager 19. Under SSAF, resolution/recovery of stressed assets is envisaged to be carried out by an independent RM. The resolution effort may require additional/interim finance to meet administrative, operational, and other expenses required to kick-off the resolution/recovery plans. RMs can either finance the same through funding raised from investors, borrowings from lending institutions, or a combination of the two. In case of financing by lending institutions to RM, there is a possible risk of over valuation of underlying assets at the time of transfer by originator to SPE where the originator could end up extending finance to RM in exchange of over valuation of stressed assets. Prudentially, it may be necessary to discourage such practice of artificially levering up books by originator without any real value addition. -

One option is for the RM to finance administrative, operational and other expenses from own funds only. However, any such restrictions on borrowing by RM may be restrictive as the same will not only affect the capabilities of the resolution manager to resolve assets but also limit the size of stressed assets that can be resolved under SSAF. -

Another option could be to allow additional finance from lending institutions other than originator and originator group. This will check the incentive for originator to artificially prop up the valuation and enhance the capabilities of RMs in resolving even bigger accounts or pools. But there is likely to be little skin-in-the-game for the RM with no own funds at stake in resolution of underlying assets. -

Another option can be i) pro-rata contribution by RM with respect to funding obtained from lending institutions other than from the originator, and ii) any borrowing from lending institutions needs to be performing/standard during the resolution period along with super charge over any cash flow/recovery from underlying assets. This arrangement can balance out the two extremes and be in line with extant regulatory guidelines on additional finance under RBI’s Prudential Framework for Resolution of Stressed Assets dated June 7, 2019. | Discussion Question 8: Should the Resolution Managers be permitted to borrow from other lending institutions towards additional funding for resolution of underlying assets? If so, what safeguards may be necessary? | F. Capital Treatment 20. Under SSA, lenders are required to apply the Securitisation -External Ratings-based Approach (SEC-ERBA) for calculation of risk weighted assets for credit risk of securitisation exposures. However, as the underlying pool of assets in SSAF have the distinctive pre-eminent risk of incorrect valuation of the NPAs and information asymmetry at the time of transfer from originator to SPE, the capital requirement for securitisation notes in SSAF needs to be markedly different from SSA, which is underpinned by the assumption that the assets are performing at the time they are securitised, credit risk being the main regulatory driver. 21. Globally, for NPA securitisation, standard setting bodies (SSBs) such as the Basel Committee on Banking Supervision and regulatory bodies like Prudential Regulatory Authority, UK and the European Banking Authority have notified all the three approaches viz. internal ratings-based approach (SEC-IRBA), the standardised approach (SEC-SA) and the external rating-based approach (SEC-ERBA). However, no differential treatment vis-à-vis securitisation of standard assets is envisaged as far as SEC-ERBA approach is concerned, implying that the same risk weights table based on external ratings (which is expected to take into account the nature of transaction under SSAF), as applicable to securitisation of standard assets shall apply in case of stressed assets well. 22. However, the concept of non-refundable purchase price discount (NRPPD) has been introduced under the Basel guidelines as part of SEC-IRBA or SEC-SA to regulate the discount applied to the nominal or outstanding value of the stressed assets when they are securitised. NRPPD is the difference between the outstanding balance of the exposures in the underlying pool and the aggregate consideration at which securitisation notes on these underlying exposures are sold to third party investors. It has been stipulated under the Basel guidelines that where the NRPPD is equal to or higher than 50 per cent of the outstanding balance of the pool of exposures, the REs may apply a risk weight of 100 per cent to the senior tranche of NPA securitisation. This discount is “non-refundable” i.e. it is not intended to flow back to the seller of the asset in any way. 23. Under SSAF, it is proposed to retain the Securitisation External Ratings-based Approach (SEC-ERBA) for calculation of risk weighted assets, as under SSA, subject to the requirement of minimum NRPPD, with the risk weight of 100 per cent as a floor. NRPPD of 50 per cent may be justifiable in view of various costs to be incurred in the process viz. collateral costs, adjustment to collateral value, judicial costs, NPA management costs, investor costs of capital, etc., and which need to be provided for in the price discovery at the time of sale to SPE. However, given the practical realities where the immediate provisioning costs weigh much more than an overall economic cost, a 50 per cent NRPPD will effectively preclude fresh NPAs from being considered by the banks under SSAF. The other option may, therefore, be a graded NRPPD, starting with say, 30 percent for NPAs less than a year to 50 per cent for NPAs of longer vintage. Discussion Question 9: Is the capital regime based on External Ratings Based Approach (ERBA), subject to a minimum NRPPD and RW floor of 100 per cent, robust enough to capture the risks associated with the NPA securitisation exposures? How should the NRPPD be structured to balance the considerations – a uniform NRPPD of, say, 50 per cent, or a graded NRPPD?

Discussion Question 10: Should the framework propose a lower NRPPD (e.g. 30 per cent) for it to be ‘qualifying’ under the framework provided the assets are sold promptly (thereby improving their recoverability prospects)? What should be the pre-requisite/safeguard for such dispensation?

Please support your arguments with the recoverability experience in the Indian context. Are there any other pragmatic alternatives for Indian markets that may be considered? | G. Due Diligence 24. Due diligence is essential for the investors to satisfy themselves regarding the quality of the underlying pool based on the loan-level information. With proper due diligence, the information asymmetry between the originator and potential investors is expected to be minimized. Under SSA, due diligence is primarily with respect to credit granting standards applicable at the origination of the underlying assets and reputation of the originator in terms of observance of credit appraisal and credit monitoring standards and adherence to regulatory guidelines (MHP and MRR specifically). 25. However, in SSAF, due diligence requires to be closely related to recoverable value of the collateral/security and origination standards, which is somewhat different from SSA. The application of sound standards in the selection and pricing of the exposures are also major concerns to be scrutinized by the investors as part of due diligence exercise. While this may not require major divergence from existing due diligence requirements under SSA, certain modifications may be necessary. | Discussion Question 11: For the due diligence to be conducted by the investors/resolution manager, will the framework under SSA broadly suffice or is there a need for major modification in the SSAF framework? | H. Credit Enhancement 26. Credit enhancement is an arrangement between the market participants wherein they take varied internal and external measures to improve creditworthiness of securitisation notes as per risk appetite of investors. Such arrangements assist in structuring and broaden the pool of investors with potential inclusion of even those investors with slightly lower risk appetite and would break the ground for initial take-off of SSAF. Credit enhancement facilities include all arrangements that could result in a facility provider absorbing losses of the investors in a securitisation transaction, which need not be contingent upon the default status of the underlying exposures. As such, there may not be any economic rationale to not permit credit enhancement for SSAF. Discussion Question 12: Which of the following options may be considered for permitting credit enhancement:

a) Credit Enhancements may be permitted for all tranches; the capital requirement will be based on external credit rating framework for all REs extending Credit Enhancement (CE)

b) Credit Enhancement may only be permitted for senior tranches. In either of the options, originator cannot provide CE

c) Credit Enhancements are not allowed.

Further, regarding reset of credit enhancement, is there any specific aspect which should be considered while following a regime similar to the CE reset regime prescribed for SSA? | I. Valuation of Securitisation Notes under SSAF 27. Under the SSA, the valuation of securitisation notes has been left to be determined as per the board approved policies. A similar approach may be adopted for NPA securitisation notes but given the inherent risks involved in the resolution of stressed assets in India, it is desirable that a graded form of risk-sensitive write-down can be provided in order to avoid the cliff-effect at the maturity of the securitisation notes. Hence, a minimum 20% write-down of the outstanding value of unamortised notes (netted for repayments) each year, may be considered, corresponding to a full write-down over a maximum five-year period. The five year-period is in sync with the resolution period prescribed for asset reconstruction companies, and also takes into account the gradual deterioration in values of collateral with delays in resolution. 28. This regime is envisaged to be risk-sensitive so that the write-down is also a function of seniority class of the notes. The waterfall mechanism should be reflected in the write-down, with the equity tranche bearing the maximum risk, followed by mezzanine and then senior tranches. To achieve this objective, the exposure-weighted risk-weight of the tranches can be used as a proxy to distribute the write-down requirements across unamortised and unprovided tranches. An indicative illustration explaining valuation treatment for first two years is furnished in Annex - II with appropriate explanation. | Discussion Question 13: Does the proposed valuation regime capture the risk, associated with the securitisation notes with stressed assets as underlying, sufficiently? Does the proposed arrangement present any challenges from operational, accounting or any other perspective? If yes, what could be the alternative to the proposed regime. |

Annex - I Issues for Discussion Discussion Question 1: Should Securitisation of Stressed Assets Framework be limited only to NPAs, or should it include standard assets too, up to a certain threshold? The response may also elaborate pertinent implications viz. regulatory arbitrage, complexity, impact on resolution strategy and effectiveness, possible threshold etc. Discussion Question 2: Which type of assets should be eligible for Securitisation of Stressed Assets? Please support your answer with qualitative/quantitative rationale. a) Term loans only with the same asset universe as it is there in Securitisation of Standard Assets; b) Big ticket loans above a certain aggregate threshold (e.g. Rs. 100 crores); c) Small ticket loans such as commercial/residential mortgages, loans to MSMEs and unsecured retail assets with a floor on pool specifications such as minimum number of loans/ticket size/cumulative loan amount etc. Please also share views on likelihood of resolvability under the selected option(s). Discussion Question 3: Whether form and quantum of Minimum Retention Ratio (MRR) is required to be prescribed regulatorily for SSAF? If so; a) Should the MRR stipulation be same as for SSA or different in terms of quantum/form? b) Who shall fulfil MRR requirement - Resolution Manager, originator, both or other parties too? Please support your answer with rationale. Discussion Question 4: Does the idea of independent Resolution Manager lead to any prudential, economic or any other conflict/arbitrage? Discussion Question 5: Should the framework completely prohibit any kind of relationship of originator with the Resolution Manager post transfer of stressed assets or an arm’s length relationship may be permitted for a certain period (say, 3 months post transfer) to ensure smooth transition and information exchange? Discussion Question 6: What would be the ideal regulatory framework for the SPE and the Resolution Manager under SSAF, considering inter alia the imperative of regulatory reporting? Discussion Question 7: What could be the possible corporate structures for the Resolution Manager within the ambit of regulatory power of the RBI? Are there any foreseeable concerns if the Resolution Manager is required to be an NBFC/ARC registered with RBI? Please elaborate on your response covering the legal and functional perspectives of the envisaged structure Discussion Question 8: Should the Resolution Managers be permitted to borrow from other lending institutions towards additional funding for resolution of underlying assets? If so, what safeguards may be necessary? Discussion Question 9: Is the capital regime based on External Ratings Based Approach (ERBA), subject to a minimum NRPPD and RW floor of 100 per cent, robust enough to capture the risks associated with the NPA securitisation exposures? How should the NRPPD be structured to balance the considerations – a uniform NRPPD of, say, 50 per cent, or a graded NRPPD? Discussion Question 10: Should the framework propose a lower NRPPD (e.g. 30 per cent) for it to be ‘qualifying’ under the framework provided the assets are sold promptly (thereby improving their recoverability prospects)? What should be the pre-requisite/safeguard for such dispensation? Please support your arguments with the recoverability experience in the Indian context. Are there any other pragmatic alternatives for Indian markets that may be considered? Discussion Question 11: For the due diligence to be conducted by the investors/resolution manager, will the framework under SSA broadly suffice or is there a need for major modification in the SSAF framework? Discussion Question 12: Which of the following options may be considered for permitting credit enhancement: a) Credit Enhancements may be permitted for all tranches; the capital requirement will be based on external credit rating framework for all REs extending Credit Enhancement (CE) b) Credit Enhancement may only be permitted for senior tranches. In either of the options, originator cannot provide CE c) Credit Enhancements are not allowed. Further, regarding reset of credit enhancement, is there any specific aspect which should be considered while following a regime similar to the CE reset regime prescribed for SSA? Discussion Question 13: Does the proposed valuation regime capture the risk, associated with the securitisation notes with stressed assets as underlying, sufficiently? Does the proposed arrangement present any challenges from operational, accounting or any other perspective? If yes, what could be the alternative to the proposed regime.

|