RECENT PERFORMANCE OF CONSUMER GOODS SECTOR IN INDIA : SOME FACT FINDING

Raj Rajesh and Naveen Kumar*

The consumer goods sector is an important constituent of the index of industrial production (IIP) in India. During 2007-08, the sector witnessed sluggish growth causing moderation in IIP. Some have argued that slowdown in the consumer goods sector occurred due to hardening of the interest rates. The analysis, in the paper however, suggests that interest rate have had no impact on the consumer goods sector. Against this backdrop, the present study makes an in-depth analysis at a disaggregated level data to unravel the supply and demand side factors affecting the sector. On the demand side, it is empirically found that the changes in per capita income and consumption expenditure had a positive influence on consumer goods production. Further, investigating of the data suggests that the slowdown in the sector has not to do much with rise in interest rates. Rather, that is strong evidence to suggest that the present consumer goods IIP index (1993-94 base) has become too old to reflect the changing demand conditions in the country. It is also found that the present consumer goods IIP basket comprises some goods, which though might have outlived their utility but have a significant weight and this may, therefore, explain the extent of slowdown in the consumer goods industry.

JEL Classification : L6, L68

Key words : Industry, Consumer Goods, Interest Rate, India

I. INTRODUCTION

The trends in industrial production in India on a monthly basis are captured through the index of industrial production (IIP), which measures the general level of industrial activity in the economy. The IIP is a quick estimate and is used as a short-term indicator for gauging the industrial activity till the actual data based on detailed industrial survey becomes available with a lag of a year or so. Since the industrial value added (GDP) data an available only on a quarterly basis, the higher frequency of IIP data makes it a widely used leading indicator for monitoring the level of economic activity in India. The IIP, on a sectoral basis, is classified into three sectors, viz., mining, manufacturing and electricity. Besides, as per the use-based classification, the IIP is classified into four broader categories namely, basic goods, capital goods, intermediate goods, and consumer goods. The consumer goods sector constitutes about 5.0 per cent of India’s GDP and is an important constituent of the IIP with a weight of 28.7 per cent in the IIP (5.4 per cent for consumer durables and 23.3 per cent for consumer non-durables). The performance of the consumer goods sector is considered as a barometer for demand conditions in the economy as it deriver the demand for basic, intermediate and capital goods. It is no coincidence that the high growth phases of IIP were driven by the booming consumer goods sector both during 1993-96 and 2002-03 to 2006-07.

The consumer goods industry has done doing well during 2002-03 to 2006-07. During 2007-08, however, the sector showed signs of slowdown as the growth slackened from 10.1 per cent in 2006-07 to 6.1 per cent in 2007-08 to decline in the production of consumer durables and, with some moderation in non-durables. The fall in consumer durables has been attributed to a squeeze on bank loans and hardening of interest rates (GOI, 2007). In this backdrop, the present paper attempts to explain the factors that had to slowdown in the consumer goods industry by examining in detail the demand and supply-sides. Besides, it is also found that the present composition of IIP index has not kept pace with the structural changes (associated with changing demand conditions and preferences, etc) that have occurred in the economy in the last couple of years. And therefore, the present IIP index, especially in respect of consumer goods index might not have been able to capture the actual industrial activity.

The present Paper is organised in dix sections. Section II empirically examines the demand side influence on the consumer goods industry in India. The performance of consumer goods sector in the last couple of years and the slowdown in 2007-08 is disussed in Section III. Demand and supply side factors affecting the consumer durables sector and compositional issues of the IIP basket are examined in Section IV. Section V focuses on the performance of consumer non-durables sector. Section VI sum up the main findings.

Section II

THE DEMAND SIDE INFLUENCE ON CONSUMER GOODS INDUSTRY

The consumer goods sector is impacted by the changes in per capita income level (PCI) as well as private final consumption expenditure (PFCE) in the economy. As income levels rise, the proportion of households’ expenditure on various consumer items (both durables and non-durables) increases, though the proportion of expenditure on food products does not keep pace with the increase in income. In this way, a rise in per capita income is expected to boost the demand for various consumer items, which, in turn, leads to increased production. In the similar vein, a rise in consumption expenditure is also expected to influence the consumer goods production. In the last decade or so, growth in per capita income rose sharply, facilitating higher consumption expenditure in consonance with the growing consumerism in the country. Interestingly, it is observed that in the two phases of high industrial growth, viz. 1993-94 to 1995-96 and the current phase (since 2002-03 to 2006-07), pick-up in growth in per capita income coincided with the growth momentum of the consumer goods (Table 1).

Table 1: Trends in Consumer Goods Index, Per Capita Income and PFCE in India |

| |

Absolute Values |

Growth (%) |

Year |

CG Index |

PCI (Rs) |

PFCE (Rs Cr) |

CG Index |

PCI |

PFCE |

1993-94 |

100.0 |

12160.4 |

918944 |

4.0* |

3.5 |

4.5 |

1994-95 |

112.1 |

12692.6 |

961346 |

12.1 |

4.4 |

4.6 |

1995-96 |

126.5 |

13356.8 |

1018423 |

12.8 |

5.2 |

5.9 |

1996-97 |

134.3 |

14186.6 |

1097390 |

6.2 |

6.2 |

7.8 |

1997-98 |

141.7 |

14520.7 |

1122195 |

5.5 |

2.4 |

2.3 |

1998-99 |

144.8 |

15188.2 |

1190267 |

2.2 |

4.6 |

6.1 |

1999-00 |

153.0 |

15839.2 |

1253643 |

5.7 |

4.3 |

5.3 |

2000-01 |

165.2 |

16133.4 |

1286314 |

8.0 |

1.9 |

2.6 |

2001-02 |

175.1 |

16761.8 |

1363797 |

6.0 |

3.9 |

6.0 |

2002-03 |

187.5 |

17075.2 |

1393435 |

7.1 |

1.9 |

2.2 |

2003-04 |

200.9 |

18262.8 |

1489043 |

7.2 |

7.0 |

6.9 |

2004-05 |

224.4 |

19296.8 |

1569130 |

11.7 |

5.7 |

5.4 |

2005-06 |

251.4 |

20733.9 |

1675025 |

12.0 |

7.4 |

6.7 |

2006-07 |

276.8 |

22483.0 |

1778697 |

10.1 |

8.4 |

6.2 |

Note: CG- Consumer Goods, PCI – Per Capita Income, PFCE - Private Final Consumption Expenditure (at 1999-2000 prices).

*: Based on old base 1980-81=100.

Source: Handbook of Statistics on Indian Economy 2006-07, RBI. |

The demand side influences of growing income and consumption on consumer goods production in India are captured empirically through regression analysis by disaggregating the consumer goods industry into durables and non-durables segments. The empirical analysis seeks to test the following hypothesis: whether at aggregated as well as disaggregated level, changes in PCI and PFCE significantly influences the production of consumer goods in India.

The following points emerge from our analysis. At aggregated level, changes in PCI and PFCE significantly influence the consumer goods production (Table 2). Further, the change in PCI had a positive influence both on the durables and non-durables industry. The change in PFCE was also found to significantly influence the consumer durables goods but not the non-durables segment despite the fact that the proportion of consumption expenditure on non-durables (food items) is large. This was possibly due to relatively inelastic demand in respect of non-durables, which, by and large, are in the nature of necessities. This might possibly also be on account of shifting of PFCE away from food items towards other durable items; and transport, communication, and medical services, which is consistent with the decline trend in the share of food items in PFCE.

Table 2: Estimation Results

(Estimation is for the period 1994-95 to 2006-07) |

| |

Dependent Variable |

Explanatory variables |

Diagnostics |

Intercept |

Other variable |

Model 1 |

LnCGt |

-10.4 |

1.6 LPCIt |

Adj R2 = 0.99; |

F-Stats= 1355.2; |

| |

|

(24.6) |

(36.8) |

DW=1.76. |

|

Model 2 |

LnCGt |

-14.1 |

1.4 LPFCEt |

Adj R2 = 0.98; |

F-Stats= 620.5; |

| |

|

(18.3) |

(24.9) |

DW=1.33. |

|

Model 3 |

LnCNDt |

- 9.1 |

1.5 LPCIt |

Adj R2 = 0.98; |

F-Stats= 663.9; |

| |

|

(16.5) |

(25.8) |

DW=1.33. |

|

Model 4 |

LnCNDt |

-12.1 |

1.2 LPFCEt |

Adj R2 = 0.96; |

F-Stats= 279.2; |

| |

|

(11.8) |

(16.7) |

DW=0.99. |

|

Model 5 |

LnCDt |

-14.8 |

2.1 LPCIt |

Adj R2 = 0.97; |

F-Stats= 384.7; |

| |

|

(14.3) |

(19.6) |

DW=1.29. |

|

Model 6 |

LnCDt |

-20.7 |

1.85 LPFCEt |

Adj R2 = 0.98; |

F-Stats= 483.4; |

| |

|

(17.5) |

(21.9) |

DW=2.01. |

|

Note: 1. LnCG – Log transformed consumer goods index; LnCND - Log transformed consumer non- durables goods index; LnPCI – Log transformed per capita net national Product.

2. Estimation with PFCE as independent variable for the period 1994-95 to 2005-06.

3. Parenthetic figures are the t-values.

4. Model 4 is a spurious regression. |

Section III

RECENT PERFORMANCE OF CONSUMER GOODS SECTOR

The consumer goods sector both due to its sheer weight in IIP and also being driver of demand for other sectors has been instrumental in leading the industrial growth in the country (Chart 1). In the earlier high growth phase (1993-96) of the industrial sector, consumer goods sector had played an instrumental role with a robust growth in consumer durables (Table 3). In the current high growth phase (2002-03 to 2007-08) also, IIP growth has been supported by the consumer goods sector (Chart 2). However, unlike the earlier high growth phase, which was of a shorter duration of three years (1993-96), the current phase of expansion in the consumer goods sector was sustained for a longer period (2002-03 to 2006-07) and appears more genuine and solid. This could be on account of following reasons. First, unlike the earlier phase (1993-96), which was based on optimistic expectations associated with the opening up of the economy, the response of Indian entrepreneurs at capacity creation in the current phase has been more matured. Their investment decisions have been guided more by stringent assessment of demand conditions in the market, and the recent capacity expansions have followed the exhaustions of existing capacities. Second, the demand for consumer goods seems to have been broad-based. Contrary to the earlier phase, the current phase is characterised by robust and widespread growth in services, with strong growth in new areas such as entertainment, logistics, business process outsourcing, besides the traditional areas such as construction, tourism, civil aviation, retailing, hospitality, etc. Such pervasive growth of the services sector has strong demand linkages with the consumer durables and non-durables goods, which makes it more enduring. Third, unlike the earlier phase when the cost of credit was not only high but the access to finance was also rostrained. Over the years, the ares to finance has improved rignificantly. Fourth, unlike the earlier phase, the current phase is characterised with increased competitiveness of the manufacturing sector.

Table 3: Growth Performance of Consumer Goods Sector and the IIP |

(Per cent) |

Year |

Consumer Durables |

Consumer Non-Durables |

Consumer Goods |

IIP |

1993-96 Phase |

|

|

|

|

1993-94* |

16.1 |

1.3 |

4.0 |

6.0 |

1994-95 |

16.2 |

11.2 |

12.1 |

9.1 |

1995-96 |

25.8 |

9.8 |

12.8 |

13.0 |

Current Phase |

|

|

|

|

2002-03 |

-6.3 |

12.0 |

7.1 |

5.8 |

2003-04 |

11.6 |

5.8 |

7.2 |

7.0 |

2004-05 |

14.3 |

10.8 |

11.7 |

8.4 |

2005-06 |

15.3 |

10.9 |

12.0 |

8.2 |

2006-07 |

9.2 |

10.4 |

10.1 |

11.5 |

2007-08 |

-1.0 |

8.5 |

6.1 |

8.3 |

2008-09

(Apr-May) |

4.8 |

8.8 |

7.9 |

5.0 |

*: Based on 1980-81 base; while for rest of the years, it is on 1993-94 base.

Source: Ministry of Statistics and Programme Implementation (MOSPI), Government of India (GOI) |

The year 2007-08, however, witnessed subdued performance of the sector as the growth slowed down to 6.1 per cent from 10.1 per cent (2006-07). In four months of 2007-08, the consumer goods sector recorded negative/zero growth led by poor performance of the durables segment, which registered eight months of negative growth during the year. The loss in growth momentum of the sector in 2007-08 resulted in a sharp drop in its relative contribution to IIP growth to 23.3 per cent2 (Table 4). The loss in relative contribution of consumer goods in the IIP growth was made good mostly by acceleration in the relative contribution of the capital goods sector during 2007-08. The disaggregated data revealed that non-durables segment decelerated to 8.5 per cent during 2007-08 as against 10.4 per cent during 2006-07 (Table 5). There has been a marked decline in consumer durables sector production during 2007-08. Thus, more than the non-durables, it is the durables, which have triggered a slowdown in the consumer goods industry during 2007-08.

Table 4: Relative contribution of Consumer Goods Sector to IIP growth |

(Per cent) |

| |

Consumer Goods |

Consumer Durables |

Consumer Non- urables |

1993-96 Phase |

|

|

|

1993-94* |

14.1 |

10.0 |

3.9 |

1994-95 |

38.1 |

9.6 |

28.7 |

1995-96 |

28.9 |

11.3 |

17.9 |

Current Phase |

|

|

|

2002-03 |

36.8 |

-8.8 |

45.6 |

2003-04 |

31.2 |

12.0 |

19.2 |

2004-05 |

42.6 |

12.9 |

29.6 |

2005-06 |

46.3 |

14.9 |

31.4 |

2006-07 |

28.5 |

6.7 |

21.8 |

2007-08 |

23.3 |

-1.0 |

24.4 |

*: Pertains to base 1980-81.

Source: Ministry of Statistics and Programme Implementation (MOSPI), Government of India (GOI). |

Table 5: Trends in Growth of Consumer Goods and its Constituents |

(Per cent) |

Month/ Year |

Consumer Goods

(28.7%) |

Consumer Durables (5.4%) |

Consumer Non-Durables (23.3%) |

| |

2005-06 |

2006-07 |

2007-08 |

2005-06 |

2006-07 |

2007-08 |

2005-06 |

2006-07 |

2007-08 |

April |

13.5 |

8.9 |

14.7 |

18.7 |

7.4 |

2.4 |

11.9 |

9.4 |

18.7 |

May |

18.4 |

10.5 |

8.7 |

17.7 |

17.5 |

-0.7 |

18.6 |

8.2 |

12.1 |

June |

23.7 |

6.1 |

3.6 |

12.8 |

19.9 |

-3.6 |

27.5 |

1.8 |

6.3 |

July |

4.5 |

16.8 |

7.1 |

3.8 |

16.1 |

-2.7 |

4.7 |

17.1 |

10.5 |

August |

9.3 |

15.0 |

0.0 |

13.0 |

19.0 |

-6.2 |

8.0 |

13.6 |

2.4 |

September |

11.9 |

12.1 |

-0.2 |

15.2 |

11.8 |

-7.3 |

10.5 |

12.2 |

2.6 |

October |

14.6 |

-2.8 |

13.7 |

16.4 |

0.2 |

9.0 |

14.0 |

-4.1 |

15.8 |

November |

11.1 |

13.5 |

-2.9 |

16.2 |

10.1 |

-5.5 |

9.3 |

14.8 |

-2.0 |

December |

7.3 |

10.7 |

8.7 |

12.0 |

1.8 |

2.8 |

6.0 |

13.5 |

10.3 |

January |

8.0 |

8.2 |

8.4 |

15.9 |

5.3 |

-0.5 |

5.7 |

9.1 |

11.1 |

February |

12.5 |

7.4 |

11.7 |

20.3 |

1.8 |

3.0 |

10.1 |

9.3 |

14.3 |

March |

12.4 |

15.8 |

0.9 |

21.0 |

3.8 |

-1.8 |

9.5 |

20.2 |

1.8 |

Apr-March |

12.0 |

10.1 |

6.1 |

15.3 |

9.2 |

-1.0 |

10.9 |

10.4 |

8.5 |

Note : Figures in parenthesis represent respective weights in the IIP.

Source: Ministry of Statistics and Programme Implementation (MOSPI), Government of India (GOI). |

Section IV

EXAMINING CONSUMER DURABLES SECTOR

During 2007-08, the consumer durables sector recorded a decline of 1.0 per cent in production as against 9.2 per cent growth during 2006-07. Further, the growth was negative in eight months during 2007-08. Both supply side and demand side sector contributed to the decelerated.

Demand and Supply Analysis

The demand for consumer durables, by its very nature, is income elastic and some of

its items exhibit sensitivity to interest rates3. The regrestion analysis rechers ......... that interest

rates have risen significantly in recent times. The availability of consumer loans and a rise in per capita income, have a significant influence on the consumer durables industry (Table 6).

On the demand side, credit demand for consumer loans, ( declined during 2007-08) (Table 7). Thus, superficially it appears that both higher cost (interest rates) and reduced availability of credit to the consumer durable sector has effect of its performance. However, on a detailed item-wise analysis, it is found that most of the interest sensitive and credit dependent segments such as passenger cars, refrigerators, air-conditioners (ACs), washing machines, scooters and mopeds, etc. except motorcycles recorded robust growth (Chart 3). This suggests the fact that despite the hardening of interest rates, demand for several durables, which are largely interest sensitive, has not abated. This is also in line with the findings in earlier analysis in Section I, which highlighted that with the growing prosperity of the Indian middle class, the incremental expenditure on consumer durables increases.

| Table 6: Estimation Result |

| |

Dependent Variable |

Explanatory variables |

Diagnostics |

Intercept |

Variable 1 |

Variable 2 |

Model |

LnCDt |

-7.87 |

1.09 LPCIt |

0.21 LCDLOANt |

Adj R2 = 0.99; |

| |

|

(4.06) |

(4.10) |

(3.83) |

F-Stats= 438.61; |

| |

|

|

|

|

DW=2.38. |

Note: 1. LnCD – Log transformed consumer durables goods index; LnPCI – Log transformed per capita net national Product; LnPFCE - Log transformed private final consumption expenditure; LCDLOAN – Log transformed banking loan for consumer durables.

2. Estimation is for the period 1994-95 to 2006-07.

3. Parenthetic figures are the t-values. |

Table 7 : Growth in Non-Food Bank Credit |

(Per cent) |

End-March |

Consumer Durables Loan |

Personal Loan |

Non-Food Gross Bank Credit |

2002 |

26.0 |

21.9 |

12.5 |

2003 |

2.9 |

31.4 |

28.4 |

2004 |

14.6 |

27.7 |

17.5 |

2005 |

8.5 |

33.2 |

37.9 |

2006 |

-20.9 |

40.5 |

39.6 |

2007 |

28.9 |

26.5 |

27.9 |

February 15, 2008 |

5.9 |

30.2 |

22.0 |

May 23, 2008 |

-6.0 |

15.9 |

24.1 |

Source: Report on Trends and Progress of Banking in India, Various Issues and Macro Economic and

Monetary Developments in 2007-08, RBI. |

On the whole, it is found that during 2007-08, out of 26 items that comprise consumer durables production index in IIP, ten items accounting for 2.3 weight of consumer durables in its total weight of 5.4 per cent weight in IIP recorded a decline in production (Table 8). It may be observed that except for motorcycles, other items being less costlier, do not depend much on credit finance. The decline in production of telephone instruments, T.V. receivers, tape recorders and typewriters may be attributed to product obsolescence and their replacement by newer products like DVD players, LCDs, computer keyboards, mobiles phones, etc. Further, the emergence of multi-use products hastened this process of replacement. For instance, if one buys a mobile phone with additional in-built features like alarm clock, time display, camera and FM, one may not need to buy radio receivers, camera or photo films, wrist watches, and alarm clocks. Similarly, a computer with additional TV tuning card and FM software (which come at much lower cost than buying a radio set and TV) could also substitute radio sets and televisions. Many other products such as typewriters have become obsolete with the advent of computers, which provide higher degree of flexibility in typing related works.

Further, the demand for the existing production basket of durables seems to have been impacted by cheaper imports owing to appreciation of the Indian Rupee. To add to the present woes, in the last couple of years, India has entered into free trade agreement with some Asian countries, which have comparative advantage in various durable items vis-a-vis India, which might have impacted some segments of durables industry.

The production of two-wheelers, especially motorcycles (accounting for 83 per cent market share in two-wheeler industry during 2006-07) has been on a slide since March 2007 (Chart 4). The trend could be attributable to hardening of interest rates in the vehicle loans segment.

On the supply side, it is found that in recent years, the corporate are using more of their internal accruals and raising cheaper loans abroad rather than relying on domestic bank loans for their expansion plans (Table 9). With the hardening of domestic interest rates, and the liberal government norms allowing greater access to foreign borrowings, more and more Indian corporates are raising capital at cheaper rates from the overseas markets through external commercial borrowings (ECBs).

Table 8: Items in Consumer Durables Recording Decline in Production in 2007-08 |

(Per cent) |

| |

Weight |

2006-07 |

2007-08 |

1 |

T.V. receivers |

4.97 |

-3.4 |

-1.2 |

2 |

Alarm time pieces |

2.73 |

-5.4 |

-4.0 |

3 |

Metalic utencils excl. pressure cookers |

1.88 |

0.3 |

-4.0 |

4 |

Typewriters |

0.28 |

14.5 |

-6.0 |

5 |

A.C. single phase house service meters |

1.14 |

92.3 |

-8.3 |

6 |

Motor cycles |

3.80 |

14.7 |

-8.6 |

7 |

Tractor tyres/ a.d.v. tyres |

0.61 |

15.5 |

-8.6 |

8 |

Telephone instruments |

6.21 |

16.5 |

-22.6 |

9 |

A.C. poly phase house service meters |

0.96 |

92.9 |

-40.6 |

10 |

Tape recorders |

0.35 |

-59.3 |

-72.8 |

Source: Ministry of Statistics and Programme Implementation (MOSPI), Government of India (GOI). |

Table 9: Pattern of Sources of Funds for Indian Corporates |

(Per cent) |

Sources of funds |

2000-01 |

2001-02 |

2002-03 |

2003-04 |

2004-05 |

2005-06 |

Average

(2000-01 to

2005-06) |

I. |

Internal sources |

30.6 |

46.0 |

76.3 |

49.7 |

42.9 |

47.1 |

40.2 |

II. |

External sources |

69.4 |

54.0 |

23.7 |

50.3 |

57.1 |

52.9 |

59.8 |

| |

A. Paid-up capital |

36.7 |

38.1 |

9.4 |

4.2 |

16.1 |

10.8 |

21.2 |

| |

B. Borrowings |

20.4 |

-13.2 |

2.4 |

19.1 |

16.5 |

18.5 |

18.5 |

| |

Of which, |

|

|

|

|

|

|

|

| |

(i) From Banks |

.. |

.. |

15.2 |

17.5 |

25.0 |

23.5 |

24.3 |

| |

(ii) From Indian |

|

|

|

|

|

|

|

| |

financial institutions |

.. |

.. |

-10.9 |

-2.5 |

1.0 |

-0.6 |

0.2 |

| |

C. Trade dues and other current liabilities |

11.4 |

28.6 |

11.5 |

26.8 |

24.3 |

23.0 |

19.6 |

| |

D. Others |

0.8 |

0.4 |

0.4 |

0.1 |

0.2 |

0.6 |

0.5 |

Total |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

.. Not Available.

Source: Finances of Private Limited Companies; RBI Bulletin, Various Issues. |

Structural changes in the Economy and need for revision of IIP index

In the course of development, as the structure of the industrial sector changes over time, there is a need to revise the IIP periodically by shifting the base year to a more recent period. Most of the advanced countries follow United Nation’s Statistical Office (UNSO) recommendation of quinquennial revision of the industrial production index basket to capture the actual production trends in the economy. However, in India, the revision of IIP base has been done with a lag of decade or more since the 1960s4.

Post-reforms, there have been marked structural changes in the demand pattern of consumer durables in the Indian economy since the IIP basket was last revised during 1997-98. In tune with technological revolution, newer variants of durables have flooded the market in response to changing demand and lifestyle patterns. Such changes, however, might not be well captured by the current IIP index with the base year 1993-94. The current index of production for consumer durables in India is based on the production of 26 items5 belonging broadly to rubber, plastic, petroleum & coal products; metal utensils products and parts; electronic equipments, transport equipments, and other manufacturing industries (Appendix Table A). It may be recalled that the consumer goods accounted for a weight of 23.7 per cent (2.6 per cent durables, and 21.1 per cent non-durables) in the IIP in 1980-81 series (Table 10 and Appendix Table C). In the 1993-94 series, the weight of consumer goods was revised up by 5.0 percentage points to 28.7 per cent, of which more than half the incremental weight was on account of consumer durables, thereby increasing their weight in IIP from 2.6 per cent (1980-81 series) to 5.4 per cent (1993-94 series). The revision reflected the changing demand patterns in favour of durable luxury items such as washing/laundry machines6 (also micro-electronic equipments). Importantly, it may be noted that the IIP revision in 1997-98 (which chose the 1993-94 as the base year) saw an increase in the number of consumer goods, wherein the number of durables in the IIP basket increased from 22 (1980-81 series) to 26 (1993-94 series), while in the case of non-durables, it increased from 50 to 58. On the contrary, the number of items representing basic, intermediate and capital goods sectors in the IIP basket declined. The last revision of IIP index, thus, reflected the growing consumerist culture with a growing preponderance of consumer goods in industrial production.

Table 10: Comparison of number of items, weights in the use-based categories for

1980-81 and 1993-94 series of IIP |

Sr. No. |

Use-based Category |

No. of items |

Weight |

1980-81 |

1993-94 |

1980-81 |

1993-94 |

1. |

Basic goods |

65 |

63 |

39.4 |

35.6 |

2. |

Capital goods |

55 |

50 |

16.4 |

9.3 |

3. |

Intermediate goods |

96 |

90 |

20.5 |

26.5 |

4. |

Consumer durables |

22 |

26 |

2.6 |

5.1 |

5. |

Consumer non-durables |

50 |

58 |

21.1 |

23.3 |

| |

Total |

288 |

287 |

100.0 |

100.0 |

Source : Ministry of Statistics and Programme Implementation (MOSPI). Government of India (GOI). |

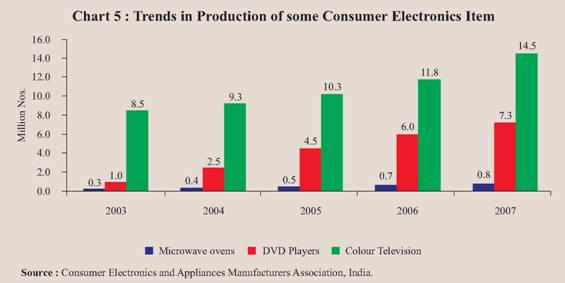

On the supply side, while the technology has enabled a surge in superior options of consumer durables on the supply side, on the demand side, growing prosperity of the middle-class households and rising consumerism has seen emergence of a large market for a variety of sophisticated, semi-luxury and luxury durables. The altering demand conditions in the economy have turned the luxuries of the yesteryears into necessities as evidenced in the case of mobile phones. Furthermore, in recent years, there has been high volumes of production and consumption of high-end electronic products such as LCD TVs, microwave ovens, MP3 and DVD players, ipods, digital cameras, etc (Chart 5). These items, however, are not captured in the present IIP basket (1993-94 base). Further, many of these electronic items are now being imported in large numbers, and, therefore, the domestic production data may not be truly reflective of demand conditions in the market.

It can be argued that the slowdown in consumer durables (based on the available data), thus, depicts only half the truth as the current series of the Index of Industrial Production based on the product basket and weights assigned in 1993-94 has serious limitations7 in fully capturing the post-reform dynamics of the economy. Further, in the present durables IIP basket, some of durables items (such as telephone instruments, alarm time pieces and typewriters), which have outlived their utility, may be over-emphasising the extent of slowdown in consumer durables industry. Hence, there is a need for revision of the IIP basket in consonance with the switch in demand preferences. Furthermore, there is a need to recast the basket through a broader coverage of items and industries, revising their respective weights and an improved technique of construction of the index with a view to reflect adequately the industrial growth and structure.

To sum up, demand side impact emanating from hardening of interest rates on the consumer durables appears to be limited. There is a need to revise the durables segment IIP index to take into account several other factors such as shifting demand pattern, products obsolescence, etc, and thereby truly capture the performance of the sector in proper perspective.

Section V

CONSUMER NON-DURABLES

The demand for consumer non-durables remains, by and large, inelastic with only limited influence of interest rates. During 2007-08, the growth in consumer non-durables industry moderated to 8.5 per cent as against 10.4 per cent during 2006-07. In an item-wise analysis, it is found that during 2007-08, out of 63 non-durable items (with a weight of 23.3 per cent IIP), 22 items accounting for 7.5 per cent weight in the IIP recorded a decline in production (Table 11 and Appendix Table B). This along with the moderation in production of sugar, with a high weight of 2.24 per cent in the IIP, and other non-durables such as chocolate and confectionery, coffee, beer, etc., also led to moderation in non-durables. During 2007-08, as opposed to durables, which recorded a decline in eight months of the fiscal, consumer non-durables recorded negative growth only in one month (in November 2007). The decline in consumer non-durables sector in November 2007 was led by a huge decline in food products by 15.3 per cent with wheat flour/maida, and some edible oils recording decline in production. On the whole, during 2007-08, the moderation in non-durables was attributable to supply side problems, resulting in decline in production of milk powder, wheat flour/maida, edible oils (especially mustard oil), and moderation in production in respect of sugar and cotton clothes. On the demand side, appreciation of Indian rupee has affected the external demand for some non-durables such as textile products. During 2007-08, the production of cotton clothes moderated to 3.4 per cent from 12.4 per cent during 2006-07. Similarly, the production of cotton hosiery clothes also moderated on account of base-effect, while the production of leather garments declined during the period. The apparels segment was severely hit due to appreciation of rupee against the US dollar.

Table 11: De-growth Trends in Certain Non-Durables during 2007-08 |

(Per cent) |

Items |

Weight |

2006-07 |

2007-08 |

1 |

Wheat flour/maida |

21.41 |

-9.3 |

-0.1 |

2 |

Vitamin A |

10.73 |

8.5 |

-5.6 |

3 |

Tea |

7.63 |

6.3 |

-0.1 |

4 |

Vitamin C |

5.91 |

-64.4 |

-8.2 |

5 |

Ampicillin |

5.78 |

38.4 |

-21.6 |

6 |

Mustard oil/ rape seed oil |

5.21 |

120.2 |

-9.9 |

7 |

Writing instruments |

4.49 |

4.8 |

-11.3 |

8 |

Soap all kinds (IPP) |

2.90 |

-3.1 |

-14.4 |

9 |

Biscuits (IPP) |

2.70 |

17.3 |

-2.8 |

10 |

Cotton seed oil |

1.89 |

-3.6 |

-6.1 |

11 |

Razor blades |

1.57 |

13.5 |

-7.4 |

12 |

Leather garments |

0.82 |

12.7 |

-54.9 |

13 |

G.L.S. lamps |

0.77 |

-2.4 |

-8.4 |

14 |

Deoiled rice bran |

0.74 |

-4.5 |

-2.7 |

15 |

Matches (IPP) |

0.68 |

0.4 |

-26.6 |

16 |

Contraceptives |

0.53 |

25.4 |

-16.3 |

17 |

Dry cells |

0.38 |

-4.7 |

-1.0 |

18 |

Til seed oil |

0.38 |

-0.3 |

-44.1 |

19 |

Auto lamps |

0.32 |

6.4 |

-1.4 |

20 |

Toothpowder |

0.27 |

-9.1 |

-6.7 |

21 |

Deoiled mustard cake |

0.14 |

93.7 |

-0.2 |

22 |

Sun flower oil |

0.10 |

25.7 |

-25.0 |

Source: Ministry of Statistics and Programme Implementation (MOSPI), Government of India (GOI). |

Sugar production which recorded a robust, growth in the initial months of 2007-08, moderated thereafter. Delays in sugarcane crushing in a number of states owing to the issues in sugarcane pricing led to a steep decline in production in the largest producing state of Uttar Pradesh (Chart 6). Given the high weight of sugar in the consumer non-durables, the decline in production has significantly moderated the consumer non-durables sector.

The edible oils production moderated primarily on account of lower mustard crop during 2007-08 as the higher minimum support prices (MSP) for wheat and barley resulted in decline in the area under mustard/rapeseed during Rabi 2008. Further, lower than required temperatures in Rajasthan and Madhya Pradesh adversely affected the production of edible oils.

Similar to our preceding analysis of the durables IIP basket, it is found that the present basket of non-durables IIP might not be reflecting the accurate production trends in the economy. In the last couple of years, within the non-durables, there has been a phenomenal growth in the production of the cosmetics including shampoos, face creams, as a large number of multi-national corporation (MNCs) set up their production bases in India. Similarly, in the case of processed foods, there has been a tremendous growth in the production of potato wafers, namkeens, fruit juices and soft drinks, etc in the last decade or so. It can be argued that if ‘chocolates and sugar confectionery’ and ‘malted foods’ can find a place in the current IIP basket, why should these emerging products be left out, especially in the backdrop of changing taste preferences and habits of the consumers. Furthermore, in the last couple of years, exceptional growth in organised retailing with mushrooming of shopping malls, multiplexes and the rise in the consumerist culture (with the growing prosperity of the Indian middle class) has given fillip to the consumption of these items. Non-inclusion of these items in the non-durables IIP of provides incomplete trends in industrial production, which calls for revision of the non-durables IIP, both items and weight, to correspond to the changing times.

Section VI

CONCLUDING REMARKS

To conclude, the analysis in the paper corroborates that both the changes in per capita income and consumption expenditure had a positive influence on consumer goods production. The much perceived demand side impact due to hardening of interest rates appears to be limited to certain interest sensitive items in consumer durables. An investigation of the data related issues reveals strong evidence to suggest that the current IIP index (1993-94 base) dose not to reflect the changing demand pattern of consumer goods in the country and hence fails to capture the actual production trends. Besides, it is also found that the present consumer durables goods IIP basket comprises some goods, which though might have outlived their utility but have a significant weight and this may, therefore, be over-emphasising the extent of slowdown in consumer durables industry. This calls for a change in product basket and redistribution of weight in accordance with the present to fully capture the post-reform dynamics. As regard to the performance of consumer non-durables, it is found that supply-side factors have had a major impact on deceleration of the sector. As in consumer durables sector, there has been emergence of many new products, which currently do not find place in the IIP basket or are weighted disproportionately. The issue of recasting the IIP basket, especially for the consumer goods sector, thus emerges as an essential solution in order to truly mirror the industrial growth performance.

Appendix Table A : List of Consumer Durables Goods included in the IIP

(1993-94 base) |

Sr. No. |

Item |

Industrial Code (NIC-87) |

Weight in IIP |

Weight in

Consumer

Durables |

1 |

Bicycle tubes |

3100 |

0.06 |

1.11 |

2 |

Bicycle tyres |

3100 |

0.05 |

1.07 |

3 |

Giant tubes |

3100 |

0.02 |

0.43 |

4 |

Giant Tyres |

3100 |

0.39 |

7.76 |

5 |

Tractor tyres/ a.d.v. tyres |

3100 |

0.06 |

1.20 |

6 |

Two wheeler tyres |

3100 |

0.11 |

2.09 |

7 |

Metalic utencils excl. pressure cookers |

3469 |

0.19 |

3.70 |

8 |

Pressure cookers |

3469 |

0.04 |

0.77 |

9 |

Window type air conditioners |

3552 |

0.01 |

0.25 |

10 |

Refrigerators (domestic) |

3553 |

0.15 |

2.92 |

11 |

Typewriters |

3581 |

0.03 |

0.56 |

12 |

Sewing machines |

3591 |

0.08 |

1.64 |

13 |

Washing/ laundry machines, etc. |

3593 |

0.19 |

3.79 |

14 |

Electric fans all kinds (IPP) |

3641 |

0.21 |

4.19 |

15 |

Electric fans all kinds (SSI) |

3641 |

0.00 |

0.02 |

16 |

Telephone instruments |

3655 |

0.62 |

12.17 |

17 |

T.V. receivers |

3661 |

0.50 |

9.75 |

18 |

Tape recorders |

3664 |

0.03 |

0.68 |

19 |

Passenger cars |

3741 |

0.36 |

7.04 |

20 |

Motor cycles |

3751 |

0.32 |

6.29 |

21 |

Scooter and mopeds |

3751 |

0.49 |

9.64 |

22 |

Bicycles, all kinds |

3760 |

0.30 |

5.82 |

23 |

A.C. poly phase house service meters |

3804 |

0.10 |

1.89 |

24 |

A.C. single phase house service meters |

3804 |

0.11 |

2.25 |

25 |

Alarm time pieces |

3820 |

0.27 |

5.37 |

26 |

Wrist watches |

3820 |

0.39 |

7.61 |

| |

Total |

|

5.08 |

100.00 |

IIP :

SSI : Small Scale Industries.

Source: Ministry of Statistics and Programme Implementation (MOSPI), Government of India. |

|

Appendix Table B : List of Consumer Non-Durables Goods included in the IIP

(1993-94 base) |

Sr. No. |

Item |

Industrial Code (NIC-87) |

Weight in IIP |

Weight in

Consumer

Durables |

1 |

Milk powder of all kinds |

2010 |

1.01 |

4.35 |

2 |

Wheat flour/maida |

2041 |

2.14 |

9.22 |

3 |

Biscuits (IPP) |

2050 |

0.27 |

1.16 |

4 |

Biscuits (SSI) |

2050 |

0.18 |

0.76 |

5 |

Sugar |

2060 |

2.24 |

9.66 |

6 |

Chocolate & sugar confectionary |

2090 |

0.37 |

1.59 |

7 |

Deoiled mustard cake |

2100 |

0.01 |

0.06 |

8 |

Edible hydrogenated oil |

2100 |

0.22 |

0.97 |

9 |

Soyabeen oil |

2100 |

0.01 |

0.04 |

10 |

Sun flower oil |

2100 |

0.01 |

0.04 |

11 |

Coconut oil |

2113 |

0.19 |

0.80 |

12 |

Cotton seed oil |

2113 |

0.19 |

0.81 |

13 |

Deoiled rice bran |

2113 |

0.07 |

0.32 |

14 |

Ground nut oil |

2113 |

0.20 |

0.86 |

15 |

Mustard oil/ rape seed oil |

2113 |

0.52 |

2.24 |

16 |

Rice bran oil |

2113 |

0.23 |

1.00 |

17 |

Til seed oil |

2113 |

0.04 |

0.16 |

18 |

Tea |

2130 |

0.76 |

3.29 |

19 |

Coffee |

2140 |

0.10 |

0.43 |

20 |

Malted food |

2191 |

0.26 |

1.12 |

21 |

Rectified spirit |

2200 |

0.36 |

1.53 |

22 |

Beer |

2200 |

0.11 |

0.47 |

23 |

Indian made foreign liquor |

2220 |

0.46 |

1.98 |

24 |

Country liquor |

2230 |

0.26 |

1.10 |

25 |

Soft drink & soda |

2240 |

0.37 |

1.59 |

26 |

Cigarettes |

2271 |

0.83 |

3.59 |

27 |

Cotton cloth (excluding hosiery) |

2360 |

0.99 |

4.25 |

28 |

100% Non-cotton cloth |

2471 |

1.20 |

5.18 |

29 |

Blended cloth |

2471 |

0.32 |

1.37 |

30 |

Cotton hosiery cloth |

2600 |

2.54 |

10.93 |

31 |

Paper & paper board (IPP) |

2802 |

1.38 |

5.95 |

32 |

Paper & paper board (SSI) |

2802 |

0.00 |

0.01 |

33 |

Leather footwear Indian type (IPP) |

2900 |

0.03 |

0.14 |

Appendix Table B : List of Consumer Non-Durables Goods included in the IIP

(1993-94 base) |

Sr. No. |

Item |

Industrial Code (NIC-87) |

Weight in IIP |

Weight in

Consumer

Durables |

34 |

Leather footwear Indian type (SSI) |

2900 |

0.01 |

0.02 |

35 |

Leather footwear western type |

2900 |

0.15 |

0.63 |

36 |

Leather garments |

2920 |

0.08 |

0.35 |

37 |

Leather goods |

2920 |

0.02 |

0.11 |

38 |

Sulpha drugs |

3041 |

0.18 |

0.78 |

39 |

Trimethoprim |

3041 |

0.12 |

0.51 |

40 |

Ampicillin |

3042 |

0.57 |

2.46 |

41 |

Pencillin |

3042 |

0.17 |

0.73 |

42 |

Vitamin A |

3042 |

1.06 |

4.56 |

43 |

Vitamin C |

3042 |

0.58 |

2.51 |

44 |

Hair oil/ ayurvedic hair oil |

3043 |

0.25 |

1.08 |

45 |

Detergent all kinds |

3051 |

0.19 |

0.82 |

46 |

Soap all kinds (IPP) |

3051 |

0.29 |

1.23 |

47 |

Soap all kinds (SSI) |

3051 |

0.05 |

0.21 |

48 |

Agarbatti |

3059 |

0.04 |

0.16 |

49 |

Toothpaste |

3059 |

0.12 |

0.51 |

50 |

Toothpowder |

3059 |

0.03 |

0.11 |

51 |

Matches (IPP) |

3070 |

0.07 |

0.29 |

52 |

Matches (SSI) |

3070 |

0.03 |

0.11 |

53 |

Fire works |

3080 |

0.04 |

0.19 |

54 |

Rubber footwear |

3113 |

0.10 |

0.43 |

55 |

Contraceptives |

3124 |

0.05 |

0.23 |

56 |

Razor blades |

3490 |

0.16 |

0.68 |

57 |

Dry cells |

3622 |

0.04 |

0.16 |

58 |

Auto lamps |

3631 |

0.03 |

0.14 |

59 |

G.L.S. lamps |

3631 |

0.08 |

0.33 |

60 |

Fluorescent tubes |

3633 |

0.05 |

0.23 |

61 |

Syringes all types |

3801 |

0.28 |

1.21 |

62 |

Writing instruments |

3871 |

0.45 |

1.94 |

63 |

Pencils (SSI) |

3872 |

0.07 |

0.31 |

| |

Total |

|

23.21 |

100.00 |

Source: Ministry of Statistics and Programme Implementation (MOSPI), Government of India. |

Appendix Table C: Use-based Classification: Weight in IIP |

(Per cent) |

Categories |

Base year |

1956 |

1960 |

1970 |

1980-81 |

1993-94 |

1. |

Basic Goods Industries |

22.3 |

25.1 |

32.3 |

39.4 |

35.5 |

2. |

Capital Goods Industries |

4.7 |

11.8 |

15.3 |

16.4 |

9.3 |

3. |

Intermediate Goods Industries |

24.6 |

25.9 |

21.0 |

20.5 |

26.5 |

4. |

Consumer Goods Industries (a+b) |

48.3 |

37.3 |

31.5 |

23.7 |

28.7 |

| |

a. Consumer Durables |

2.2 |

5.7 |

3.4 |

2.6 |

5.4 |

| |

b. Consumer Non-durables |

46.2 |

31.6 |

28.1 |

21.1 |

23.3 |

Total (1+2+3+4) |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

Source: Database on ASI, Economic and Political Weekly. |

Select References

Centre for Monitoring Indian Economy.

Database on the Annual Survey of Industries (ASI), 1973-74 to 2003-04, EPW Research Foundation (EPWRF), Second Edition, CD ROM.

Government of India, Ministry of Statistics and Programme Implementation.

______ , National Accounts Statistics, Various Issues.

______(2007), Mid-Year Review of the Indian Economy 2007-08, Ministry of Finance.

Nagaraj R. (2008), ‘India’s Recent Economic Growth: A Closer Look’, Economic and Political Weekly, Vol XLIII, No. 15, April 12-18.

National Council for Applied Economic Research (2008), NCAER Business Expectations Survey, May.

Reserve Bank of India, Report on Currency and Finance, Various issues.

______ (2007), Annual Report 2006-07.

______ (2007), Handbook of Statistics on the Indian Economy, 2006-07.

______ (2007), Report on Trend and Progress of Banking in India, 2006-07.

______ Banking Statistical Returns, Various Issues.

Society for Indian Automobiles Manufacturers’ Association. http://www.siamindia.com

* Authors are Research Officers in the Department of Economic Analysis and Policy of the Reserve Bank of India. The authors are thankful to Shri K.U.B Rao, Adviser, for encouragement and support. Our special thanks go to Smt. Gunjeet Kaur, Director, for her able guidance and suggestions, which actually helped in improving the content of the paper. Thanks are also due to Shri L Lakshmanan, Assistant Adviser and Shri A.N. Yadav, Research Officer, for their valuable suggestions on an earlier version of the draft. Data assistance and support rendered by Shri K.M. Kesarkar, Assistant Manager and Smt. S.S. Walavalkar, Senior Assistant, is kindly acknowledged. Views expressed in this Paper are those of the authors’ alone and not of the institution to which they belong.

1 In India, expenditure on consumption goods forms a bulk portion of private final consumption expenditure. The share of food products and beverages constitutes for a major share in PFCE. It accounted for 51.5 per cent of PFCE in 1999-2000, which though declined to 40.5 per cent in 2005-06, but, it still accounts for a major share in PFCE. Added to it other expenditures on clothing & footwear, furniture, furnishing, utensils, refrigerator, cooking, washing appliances, etc., the expenditure on consumer items would account for nearly half of the PFCE.

2 The performance of the consumer goods sector in the recent past had been upbeat and its relative contribution to the IIP growth increased from 36.8 per cent in 2002-03 to 46.3 per cent in 2005-06.

3 Of the 26 items constituting the consumer durables, by and large, the demand for six items viz., ACs, refrigerators, washing machines, passenger cars, motorcycles, and scooter & mopeds, are found to be sensitive to interest rate.

4 It may be noted that the IIP base was revised in 1960 within a span of four years from the 1956 base. Since then the

revision of base is done with lag of more than decade or so.

5 Radio receivers’ as an item of consumer durables goods in 1980-81 series has been dropped in the 1993-94 series.

6 Two more items viz. ‘pressure cookers’ and ‘metallic utensils excluding pressure cookers’ were also included.

7 Limitations of the IIP data inter alia include old base year, non-response of production units in reporting data, inadequate or no coverage of new units and latest products. |